Is tickmill legit

Features of this classic account:

- A minimum balance requirement of 50,000

- Spreads from 0.0 pips

- Leverage of 1:500

- Minimum lots of 0.01

- Commissions of 1.6 each aspect for every 100,000 traded

Top forex bonuses

Tickmill review – is tickmill scam or legit broker?

Tickmill

Rating

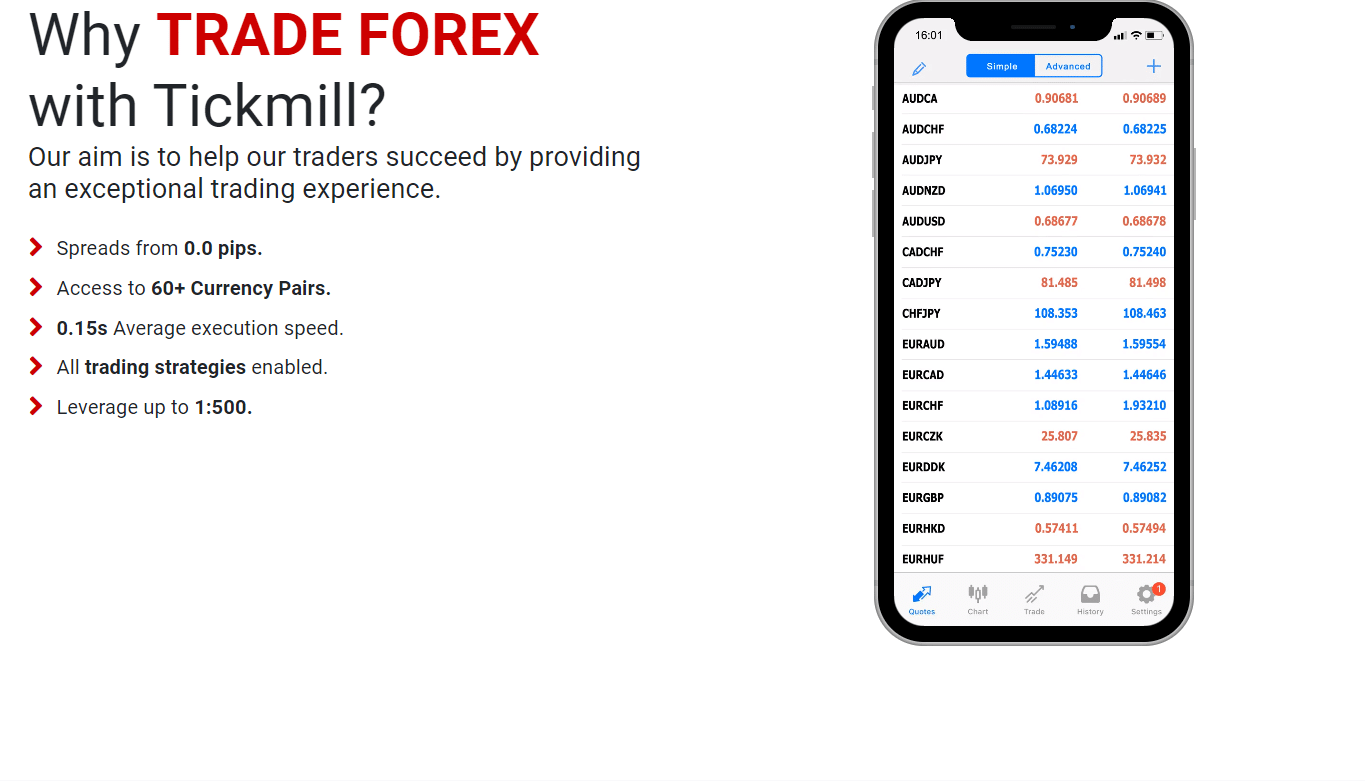

- 62 currency pairs

- FSA, FCA and cysec law

- Metatrader 4 along with webtrader

- Leverage of 1:500

- Demo trading account

- Leverage of 1:500 is remarkably high for UK brokerages, therefore care is advised

- Relatively new brokerage

- None of those top UK brokerages provide welcome bonuses after all it fights with FCA law

Tickmill presents intuitive forex trading solutions to UK customers. As perhaps one of the very renowned brand new forex platforms tickmill boasts millions of rewards from leading industry governments like global brands magazine, and also the chinese forex expo. This internet trading brokerage maintains the maximum security and safety standards for customers, with tempered accounts, full policy up to 50,000 under the financial services compensation scheme, and also cross-platform, multi-device functionality.

Overview/ desktop

Tickmill takes pride in its own fully licensed and regulated trading platform. UK customers may enjoy whole FCA (financial conduct authority) licensing, along with cypress securities and exchange commission (cysec) regulation. This forex broker can also be accredited by the financial services authority of the seychelles (FSA). Customers may enjoy an exceptional trading experience using metatrader 4 to windows, OSX, webtrader, android, along with ios apparatus. Tickmill is owned and operated by tickmill UK limited and registered in england & wales. The business registration number is 09592225. It’s founded in london, with the subsequent FCA enrollment #717270. Customers are needed to be partially 18 decades old to relish forex trading services in this brokerage.

Account types

Various account types are all readily available to traders including the classic account, the pro account, and also the VIP account.

Features of this classic account:

- Minimum deposit of 25

- Spreads from 1.6 pips

- Leverage 1:500

- Minimum lots 0.01

- Zero commissions and fees

- Swap free islamic account option available

Features of this pro account:

- Minimum deposit of 25

- Spreads from 0.0 pips

- Leverage 1:500

- Minimum lots 0.01

- Commissions of two per side for every 100,000 traded

Features of this VIP accounts:

- A minimum balance requirement of 50,000

- Spreads from 0.0 pips

- Leverage of 1:500

- Minimum lots of 0.01

- Commissions of 1.6 each aspect for every 100,000 traded

Additionally, tickmill offers customers full usage of islamic accounts, and demonstration accounts around every one of the account types.

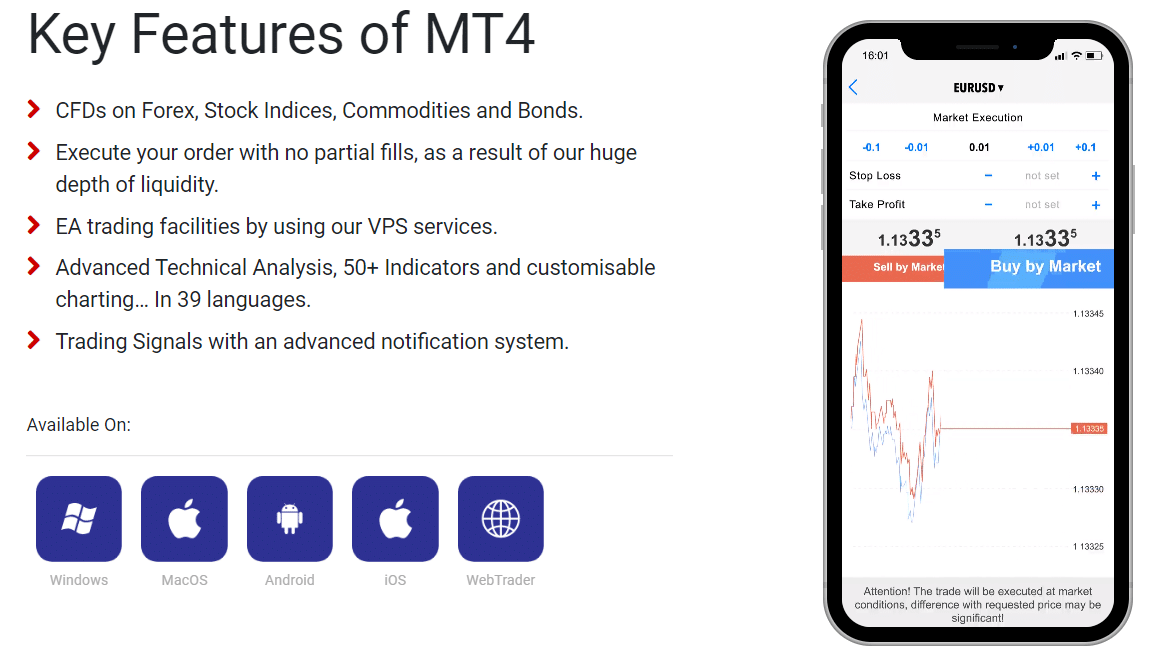

Trading platform/ applications

Tickmill provides all its forex trading services in metatrader 4. This stage was fully customised to supply the maximum personal trading experience for most customers. Together with metatrader 4, customers obtain to relish expert advisers, micro heaps, no tight suits, and also contracts for a gap on a vast array of tools including products, indices, assets, and even money pairs. Metatrader 4 is currently available for windows, OS X, webtrader, android, along with ios. Customers may certainly download their favorite edition of metatrader 4 guide from the site.

The trading platform additionally comprises webtrader. Using webtrader, customers obtain to trade forex immediately, direct their browser off. The profits of employing this metatrader 4 web trading platform incorporates these: 100% secure and safe forex trades, 1-click trading functionality, each of the advantages of metatrader 4 straight your browser off, along with prompt access to your world wide marketplace of trading options out of any desktop apparatus. One of the other characteristics of webtrader is realtime quotes, 9 graph time-frames, basic analytical items, and also customisable cost calculating features.

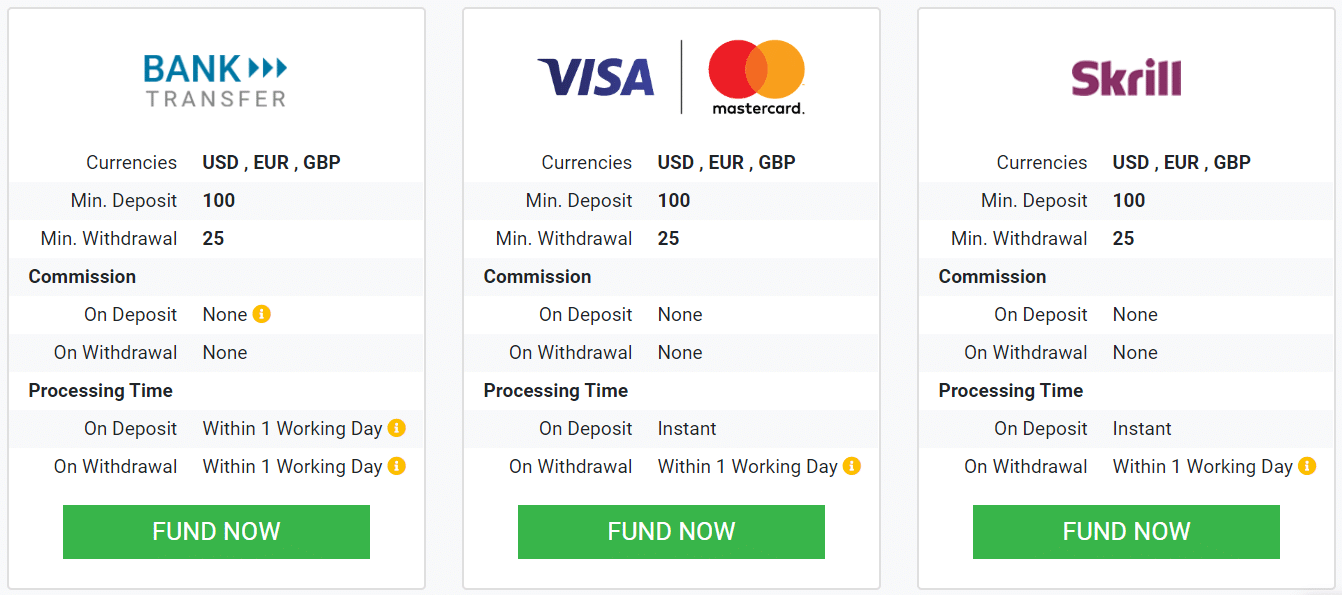

Deposit options

Deposit options come with a thorough assortment of payment procedures. These generally include bank transfer (barclays), visa, mastercard, skrill, neteller, fasapay, unionpay, dotpay, qiwi wallet and nganluong.Vn. Typically, the deposit is 25 (bank transfer, charge card, skrill, neteller, fasapay), however, it might change in 1 deposit option to this following.Commissions on deposits over $5,000 are insured by the brokerage to get bank transfers, also there are not any commissions on some additional deposit procedures. There aren’t any commissions online withdrawals. Deposits are processed immediately for some options, and concessions are processed within one business day.

Markets

The selection of financial tools open to traders in tickmill comprises cryptocurrencies, bonds, gold and silver coins, cfds, and forex. Within each of the broad types are many tools.

Bonds: german government bonds (EURBOBL, EURBUND, EURBUXL, EURSCHA)

Precious metals: silver and gold

Contracts for difference: africa 40, australian ASX 200, german DAX 30, france CAC 40, hang seng index, india NSC nifty 50, nikkei 225, eurostoxx50, NASDAQ 100, dow jones 30, S&P 500, spot WTI crude petroleum

Forex – forex pairs comprise 62 options like the AUD/USD, EUR/USD, GBP/USD, NZD/USD, USD/CAD, USD/CHF, USD/JPY, AUD/CAD, CAD/CHF, GBP/AUD, along with heaps of others.

Bonuses

Unlike lots of additional forex brokerages while in the UK, tickmill provides a vast assortment of promotional deals. Included in these are the gold miner IB contest where customers stand an opportunity to acquire 20 x one oz gold bars or 10,000 in prizes. Other supplies comprise traders of this month where it is possible to trade your path to a $1000 prize, the tickmill NFP machine where cash awards are shared, and also the 30 welcome account bonus. It’s rare to obtain a top UK forex brokerage offering fresh trader bonuses, traders of the month awards, or even ample promotional competitions.

Customer support

Customer service is available from english, indonesian, russian, spanish, chinese, polish, german, italian, vietnamese, portuguese and other languages. Customers might obtain in contact with tickmill service agents for any range of trading, technical, registration, regulation, or compliance problems. The business cell phone number and any office telephone number would be the similarly: 44-0-20-3608-2100. Customers may send unsolicited email into the business at another address:

Tickmill LTD could be reached at the next customer service number: 852-5808-2921. Work phone is 248-434-7072. The current email in the cases may be the following: [emailprotected]. Many other contact options are offered on social-media like facebook, twitter, youtube, linkedin, along with russian social media internet sites. The FAQ section offers useful methods to a lot of client questions.

Safety

Safety is ensured as a result of FCA law, FSA regulation, segregated trading balances, multiple industry awards, along with SSL encryption technology. The security of capital will be further ensured by the 50,000 FSCS (financial services compensation scheme) policy. Considering all client funds have been kept in segregated accounts, there’s not any probability of loss when the organization declares bankruptcy or gets conclusions against it. Other security and protection measures incorporate cysecs investor compensation fund as much as 20,000.

Ease of use

Tickmill is an instinctive forex brokerage which makes it simple for both UK traders to choose the 62 money pairs out there. There are many major, exotic and minor money pairs available only at that brokerage. The normal lot size is on average 100,000 currency components, also you can find not any limitation & prevent levels (pips) on forex trading actions. This may make it straightforward to utilize this brokerage. The enrollment method is smooth and simple to browse.

Final thoughts

Forex traders will profit from the instinctive metatrader 4 stage on ios, android, windows and mac OS X platforms. The webtrader is a potent tool to get into the MT4 without download required. Even the 80 monetary tools available to customers is significantly less than that which you’d ordinarily expect from the major brokerage, but adequate to meet the requirements forex traders.

Tickmill review 2021

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

🏆 top 5 stock brokers

🏆 top 5 forex brokers

Summary

Recommended for forex traders looking for low fees and prefer metatrader 4 platform

Tickmill is a global forex and CFD broker, established in 2014. The company is regulated by several financial authorities globally, including the top-tier financial conduct authority (FCA) in the united kingdom.

Tickmill is considered safe because it is regulated by the top-tier FCA.

Disclaimer: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill pros and cons

Tickmill has low forex and non-trading fees. The account opening is fast, easy, and fully digital. You can use a lot of options for deposit or withdrawal, and they're free of charge.

On the negative side, tickmill has a limited product portfolio as it offers only forex and cfds. Popular asset classes, such as stocks and etfs are missing. Trading platforms are provided by metatrader, and they have outdated designs. Finally, the news feed is basic and not structured.

| Pros | cons |

|---|---|

| • low forex fees | • only forex and cfds |

| • fast and easy account opening | • trading platforms with outdated design |

| • free deposit and withdrawal | • basic news feeds |

| ��️ country of regulation | UK, cyprus, seychelles, south africa, malaysia |

| �� trading fees class | low |

| �� inactivity fee charged | no |

| �� withdrawal fee amount | $0 |

| �� minimum deposit | $100 |

| �� time to open an account | 1 day |

| �� deposit with bank card | available |

| �� depositing with electronic wallet | available |

| �� number of base currencies supported | 4 |

| �� demo account provided | yes |

| ��️ products offered | forex, CFD |

Author of this review

Author of this review

Ádám nasli

Everything you find on brokerchooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Tickmill review

fees

Tickmill has low forex, but average CFD fees. There is no fee for deposit, withdrawal, or inactivity.

| Pros | cons |

|---|---|

| • low forex fees | • average CFD fees |

| • no withdrawal fee | |

| • no inactivity fee |

| assets | fee level | fee terms |

|---|---|---|

| EURUSD | low | pro account pricing: €2 commission per trade per lot plus spread cost. 0.1 pips is the average spread cost during peak trading hours. |

| GBPUSD | low | pro account pricing: £2 commission per trade per lot plus spread cost. 0.3 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | average | the fees are built into the spread, 0.4 points is the average spread cost during peak trading hours. |

| Inactivity fee | low | no inactivity fee |

How we ranked fees

We ranked tickmill's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

To get things rolling, let's go over some lingo related to broker fees. What you need to keep an eye on are trading fees, and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

Below you will find the most relevant fees of tickmill for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

We also compared tickmill's fees with those of two similar brokers we selected, axitrader and FXCM. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of tickmill alternatives.

To have a clear overview of tickmill, let's start with the trading fees.

Tickmill trading fees

Tickmill's trading fees are low. There are different cost structures for different account types. We tested the pro account, which charges a commission but offers tight spreads.

We know it's hard to compare trading fees for forex brokers. So how did we approach the problem of making their fees clear and comparable? We compare brokers by calculating all the fees of a typical trade for selected products.

We have chosen popular instruments in each asset class usually provided by the forex brokers:

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

- Stock index cfds: SPX and EUSTX50

A typical trade means buying a leveraged product, holding it for one week and then selling. For the volume, we chose a $20,000 position for forex and a $2,000 position for stock index and stock CFD transactions. The leverage we used was:

- 30:1 for forex

- 20:1 for stock index cfds

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for tickmill fees.

Forex fees

Tickmill has low forex fees. The forex fees are one of the lowest among the brokers we have reviewed.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| EURUSD benchmark fee | $6.8 | $5.1 | $12.5 |

| GBPUSD benchmark fee | $5.0 | $4.3 | $5.6 |

| AUDUSD benchmark fee | $5.0 | $3.4 | $8.8 |

| EURCHF benchmark fee | $4.7 | $2.9 | $3.3 |

| EURGBP benchmark fee | $7.8 | $5.2 | $16.4 |

The low forex fees are mainly due to the low commission tickmill charges. The commission is 2 base currency units (first currency pair) per lot per trade. For example, it's €2 per lot per trade for EURUSD, while £2 per lot per trade for GBPUSD.

CFD fees

CFD fees are average.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.5 | $1.3 | $1.5 |

| europe 50 index CFD fee | $1.2 | $2.3 | $1.6 |

Non-trading fees

Tickmill has low non-trading fees. There is no fee for deposit, withdrawal, or inactivity.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| account fee | no | no | no |

| inactivity fee | no | no | yes |

| deposit fee | $0 | $0 | $0 |

| withdrawal fee | $0 | $0 | $0 |

Tickmill review

account opening

Tickmill has a fast and easy account opening process. Our account was verified within one business day. The minimum deposit is low, $100 for all account types, except VIP accounts.

Can you open an account?

Open account

73% of retail CFD accounts lose money

Tickmill accepts clients from all over the world. There are only a few exceptions, e.G. Customers from the US or canada can't open an account.

What is the minimum deposit at tickmill?

The required minimum deposit at tickmill is $100 . For a VIP account, you need to maintain a minimum $50,000 balance.

Account types

Tickmill has several account types that differ in pricing, minimum deposit, and minimum account balance.

| pro | classic | VIP | |

|---|---|---|---|

| minimum deposit | $100 | $100 | - |

| minimum account balance | - | - | $50,000 |

| pricing | tight spread plus commission | wide spread, but no commission | tight spread plus commission |

| commission per $100,000 trade | $2 | no commission | $1 |

Retail clients of tickmill ltd can use leverage up to 1:500 while retail clients of tickmill UK ltd and tickmill europe ltd can use maximum leverage of 1:30. If you qualify for a professional trader, you can trade with higher leverage, up to 1:500 (tickmill UK ltd) or up to 1:300 (tickmill europe ltd).

The criteria for professional clients:

- An average frequency of 10 trades per quarter in the previous four quarters

- Size of your financial instrument portfolio exceeds €500k

- You have at least one year experience in a relevant financial position

You can also open corporate and swap-free islamic accounts. The main difference between islamic aand other accounts is that instead of daily swap rates, an administration fee is charged if you hold some exotic currencies for more than 3 nights.

How to open your account

Account opening is fully digital, fast and straightforward. You can fill out the online application form in a matter of minutes. Our account was verified within one day.

To open an account at tickmill, you have to go through these steps:

- 'choose your regulator' will determine whether you sign up for the tickmill site regulated by the UK, cyprus or the seychelles authority. We recommend going for the UK one or the EU one (cyprus) if available in your country

- Fill in your name, country of residence, email address and telephone number

- Add your personal information, such as your date of birth and address

- Select the base currency

- Provide your financial information and answer questions about your financial knowledge

- Select your account type: pro, classic or VIP

- Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency.

Tickmill review

Tickmill is forex broker. Tickmill offers the MT4 and MT4 webtrader trading currency platforms. Tickmill.Com offers over 60 currency pairs, gold, sliver, bonds and cfds for your personal investment and trading options.

Broker details

| established: | 2015 |

| address: | 3, F28-F29 eden plaza, eden island, mahe, seychelles |

| contact: | support@tickmill.Com, +852 5808 2921 |

| regional offices: | |

| regulators: | cysec #278/15, FSA-S #SD 008, FCA #717270 |

| prohibited countries: |

| deposit methods: | bank wire, VISA, mastercard, fasapay, globe pay, local bank transfers, neteller, ngan luong, qiwi, skrill, sticpay, unionpay |

| withdrawal methods: | bank wire, VISA, mastercard, fasapay, globe pay, local bank transfers, neteller, ngan luong, qiwi, skrill, sticpay, unionpay |

Live discussion

Join live discussion of tickmill.Com on our forum

Tickmill.Com profile provided by tickmill, nov 10, 2016

Tickmill is an award-winning global ECN broker, authorized and regulated by the FCA of the united kingdom and the FSA of seychelles. Tickmill offers its retail and institutional clients various trading services with a prime focus on forex, stock indices, commodities, cfds and precious metals. The company has distinguished itself among global ECN forex brokers by providing excellent services with low spreads, some of the industry’s lowest ECN commissions and ultra-fast execution with the state-of-the-art london trading servers located at equinix LD4 data center. Our team members have trading experience that goes back to 1989 and we have successfully traded all major financial markets from asia to north america.

In june 2016, tickmill recorded a monthly trading volume of $49.1 billion, followed by a record-high trading volume of $51.7 billion in july, which makes it one of the largest retail forex brokers in the world.

Video

Your company video here? Contact ad sales

Let other traders know if this service is worth checking or should be avoided.

Traders reviews

Length of use: over 1 year

I have been with tickmill over 5 years and they are my experience with them is excellent.

They provide direct market trading with minimal commission and almost no slippage.

Deposits and withdrawals are fast if using skrill or neteller even faster.

They do have a client outreach and communicate with you occasionally on promotions or events they hold.

I have had no qualms' with them at all.

Commendable and one of the best. Keep up the good work.

Length of use: over 1 year

Tickmill threatens with legal action against me because I expose truth on social media how they refuse to pay me my funds, $35 966! Funds are not paid for more then 6 months already, and they now even threaten with legal action against me. I fight this SCAM company hard with regulators and I am going also to bring my case on court. This unjustice and fraudulent behavior must be stopped!

I strongly advise everyone to stay away from tickmill. This is SCAM company and I kindly ask forexpeacearmy to mark this company with SCAM label and their ratings erased to 0.

Aug 17, 2020 - 1 star this is SCAM company and it should be put where it belongs, to SCAM brokers. Their ratings erased.

Their price at the moment is on 24.10 $. Also straight forward crippled price action. While at same time december futures 2020 contract price which they claim they follow is on 43.22 $ with very much visible dips during upside movement. Something which we do not see in tickmill's price action!

For situation to be even worse, they charge insane swap for long positions of more then 14 points! Total SCAM! This must be punished!

Tickmill continues their fraudulent activity by offering imaginary, fake, and wrong spot WTI price. Price which has nothing to do with reality, or with any futures contract price. Random number they transmit.

I am in close contact with FSA regulator which works on my case, and hopefully this week there will be some real progress regarding my case, and my funds paid in full.

Tickmill must pay me funds they owe me, $35 966 must be paid to my trading account # 3033967.

For more information about my case, you can follow it here: scam - scam alerts - tickmill SCAM! Offers invalid WTI price in close only mode, wrong price execution for all bigger trades.

May 11, 2020 - 1 star I am going to describe 2 problems I ran into with tickmill. My trading account # 3033967.

First and main problem is fake and imaginary WTI CFD price they offer in the moment. Their price currently is at 9.64$ for barrel, while true WTI CFD price is 26$ for barrel, it can be checked with any other broker, or simply by looking at CME futures prices for WTI, all contracts are above 25$ for barrel. Tickmill have applied close only mode on WTI, and since I have 3 long positions I am not able to close my positions with significant profit of 26 000$, and trader can not open new long positions on that absurd, fake, low price they offer because it is only close only mode applied. I would have no problems with their close only mode if they offer true WTI CFD price, instrument I was trading with. Their excuse is that they follow movement of december 2020 futures price, which is also invalid since price for december futures is over 30$ for barrel, and also price movement is completely different. They refuse to pay my winnings after weeks of annoying conversations and invalid arguments they try to provide. I am experienced trader who has account with over 10 brokers, and what they say is completely absurd and not acceptable! Difference in their price from true price is almost 300%, no LP can justify that. There is only one true WTI CFD price and it is between 26$ and 27$ for barrel at the moment I am writing this review.

Second problem I encountered with wrong price execution for trades bigger then 1 lot size. This applies for all FX pairs and metals. Order is executed on price NOT SHOWN in MT4, but on price worse for client by 1-2 points. This happens every time, for manually opened positions and pending positions. They stole from me on over 500 trades these 1-2 point. It is not slippage, it is wrong price execution! I brought this issue also to them, and gave them chance to refund what they were stealing from me for years, but they refused with no true explanation provided, only fake arguments which has nothing to do with reality. Experienced trader like me can not be fooled or tricked like that.

I am going to continue to fight with them with these two problems and claim my funds via court if necessary if they continue to refuse to pay what they owe me.

Everyone can feel free to contact me directly here on FPA if further details about tickmill are wanted.

Reply by tickmill submitted may 15, 2020 hi deltoid88,

We have provided all necessary clarifications and have assisted with detailed explanation in regards to your trades.

If you have any additional concerns, you can reach out to our support team.

Tickmill.Com review: is tickmill A legit or scam broker?

Tickmill review: this is the name of a forex broker that it is located in seychelles but is partly owned by a london based company. Is tickmill.Com a scam or legit forex broker?

The broker is owned by tickmill ltd. Seychelles and payments are processed partly by procard global ltd. Its parent company is licensed and regulated by the cysec, FSA and the FCA. The broker address is:

HAVE YOU BEEN SCAMMED? If you have lost your money to online scammers, there is an opportunity you could get back your money.

HAVE YOU BEEN SCAMMED? If you have lost your money to online scammers, there is an opportunity you could get back your money.

Click HERE to start the recovery process

3, F28-F29 eden plaza, eden island, mahe, seychelles.

This broker promises that traders can trade with forex, stock indices, commodities, and bonds. They promise security of funds and good trading conditions. No restrictions are placed on strategies that are allowed with the broker.

Trading platform of tickmill

It is mentioned that tickmill trading software is operated on a metatrader platform available to all their clients.

Legit brokers are known to offer at least the popular metatrader 4 trading platform.

This platform is a very good sign along with MT5, as they have become some of the most widely used by experienced traders. They are found to be compatible with various devices’ operating system. All can be used on desktops, linus, windows, ios and android.

Tools that comes with these trading platforms are also found to be useful for traders. It has proven to be user friendly as well and helps traders in analyzing the market easily.

Trading instruments offered to traders includes: 60+ forex currencies, cryptocurrencies, 20+ cfds on precious metals, stock indexes, bonds, and oil.

Maximum leverages offered by the trader is 1:500 and spreads vary according to accounts with the classic one giving a spread of 1.6 pips.

Spreads of 1.5 pips or below are what is obtainable in the forex industry and traders are asked to look out for this. Leverages of between 1:30, 1:50 and 1:25 are also common among regulated brokers.

Deposit and withdrawal methods on tickmill

Methods of making payments and withdrawals are available via: bank wire, visa, mastercard, fasapay, globe pay, local bank transfer, neteller, ngan luong, qiwi, skrill, sticpay, and unionpay. It is encouraging to find this.

This is because standard and legit brokers make deposit and withdrawals available via visa, mastercard and wire transfer. Many offer e-wallets like: skrill, neteller, unionpay, fasapay, and so on.

A minimum deposit of $100 is required to start trading with this broker and this is affordable. We could not find out if charges and fees apply on withdrawals.

This information is important so that clients can invest any little amount they can spare. In order to be able to first watch the working of the brokerage. If then they are satisfied with what they see, they can determine when to withdraw their money.

Is tickmill licensed?

Yes. Tickmill is a licensed company in the UK by the FCA and in south africa by FSA. However, the tickmill broker is registered in an offshore location. This is discouraging as offshore locations have become popular for harboring scammers.

Support

The customer care representative can be reached by dialing: +852 5808 2921 or emailing: support@tickmill.Com

Conclusion

Although the broker is in an offshore location, it is owned by a duly licensed firm. Trading conditions are also encouraging and the minimum deposit is available. Tickmill offers a good trading platform and account options.

COMPARE WITH A TRUSTED BROKER

Fortrade

Fortrade is a UK-based broker with address at michelin house, 81 fulham road london, SW3 6RD, united kingdom. They are among the best brokers in the industry offering trades in numerous assets including stocks, commodities, currencies, indices and cryptocurrencies. Fortrade is regulated and licensed by the FCA(financial conduct authority) in the UK well as ASIC in australia which makes client funds safe. They accept traders worldwide.. Visit their official website

Tickmill review

Overview

One of the startup forex brokers, successfully providing a trader with low spreads, STP and DMA technologies etc.

Details

| broker | tickmill |

|---|---|

| website URL | tickmill.Com |

| founded | 2014 |

| headquarters | trop-X securities exchange building, 3 F28-F29 eden plaza, eden island, mahe, republic of seychelles |

| support number | + 852-5808-2921, + 65-3163-0958 (seychelles), + 44-203-608-6100 (united kingdom) |

| support types | chat, phone, email |

| languages | english, russian, indonesian, spanish, italian, thai, malaysian, portuguese, chinese, etc. |

| Trading platform | metatrader 4, web trader |

| minimum 1st deposit | $100 |

| minimum trade amount | 0,1$ |

| bonus | 2 kinds of bonuses |

| leverage | 1:500 |

| spread | from 0.0 points |

| free demo account | open demo |

| regulated |  |

| regulation | FCA (№ SD008) |

| account types | demo, classic, pro, VIP |

| deposit methods | bank transfers, credit, debit cards visa, mastercard, neteller, skrill |

| withdrawal methods | bank transfers, credit, debit cards visa, mastercard, neteller, skrill |

| number of assets | 60+ |

| types of assets | forex, CFD, valuable metals, indices, bonds, cryptocurrency (bitcoin) |

| account currency | USD, EUR, GBP, PLN |

| US traders allowed |  |

| mobile trading |  |

| overall score | 3/10 |

Full review

And yet, is tickmill a scam or a dignified startup broker, which is certainly worth to be looked at? We answer this question in the detailed broker review.

Terms of trade with tickmill

Tickmill is a trending broker with headquarters in UK and representational offices in estonia, on seychelles etc., successfully providing services in trading currencies and precious metals to retail clients and marquee investors in the forex market. Today the company, despite of being yet a very startup, is a technology-packed ECN-broker created by traders for traders, making online trading gainful and comfortable. For the company work the top-sawyers only, forex trading in financial markets from asia to north america since 1994, this experience helps the broker in effective enhancement of the really quality service, providing the best and differing from its competitors.

Due to DMA, NDD, ECN and STP technologies traders get the direct access to the best liquidity suppliers with favorable prices (commerzbank, HSBC, credit suisse, jpmorgan, BNP paribas etc.). Please note among the advantages of the broker also the scalping option, along with automated trading, hedging, phone dealing, up-to-date trading services (autochartist, VPS-hosting, swap-free account, autotrade etc.).

Safe software provision is one of the main company focuses. So the broker provides its customer with the latest online trading technologies only: the popular terminal metatrader4, which won the trust and can continuously process any amount of trader’s orders in various market conditions. Both, newcomers of the market and professionals will be concerned about quality training materials, customized trading training, video lessons, webinars.

Deposit and withdrawal

Tickmill offers various deposit and withdrawal ways. To deposit you need to sign up by broker and replenish the sum by any convenient way (minimal deposit is 100$) of the list of the payment systems offered by company:

- Bank transfers,

- Credit, debit cards visa, mastercard,

- Payment terminal (neteller, skrill).

Please note that there are yet just a few ways for deposit and withdrawal, there is no even webmoney, which is so popular by traders. The account may be opened in any of currencies at option: USD, EUR, GBP. The withdrawal is possible for recognized and verified traders only, through the payment system used for deposit, too. The withdrawal speed: within one business day. There is no commission for all withdrawal options, just the extra pay may be charged by payment systems.

Tickmill bonuses

Any trader of the company can get 2 kinds of bonuses:

The broker offers a gainful welcome bonus of 30$ for the newcomers of the platform. Taking part on the offer will let you test the potential of dealing with the company with no risk for your own funds. The bonus may be used just once, you also can create just one query for transfer of funds from the bonus trading. Ask your account manager about the criteria of taking part on the offer.

- Traders of the month: 1 000$ for a winner

The profitable contest with a solid prize pool takes place every month, 1 000$ may be won by two best traders, by selecting a winner not only profit, but also risk management system is considered. All real accounts take part on the contest automatically. The contest participation results are published and publicly available on the «fame wall». Ask your account manager about the criteria of taking part on the contest.

Complaints about tickmill

Tickmill is a startup forex broker, yet has enough various references in internet. Some traders point the transparency, solid track record and reliability among the advantages of the broker, providing one of the cheap trading accesses, quality technical support, stable terminal operation (no re-quotations and slippages), favorable trading terms (low spreads, quick orders execution, nice liquidity, stable quotations), numerous materials on the website, deposit and withdrawal procedures in due time fixed by broker, user friendly personal account, quick verification procedure, insightful fundamental reviews and quality analytics, no withdrawal commissions, scalping options. Traders trust the company, recommend it.

There are also negative comments concerning withdrawal issues, inconvenient personal account, no contact with technical support, terminal deadlocks, slippages. Besides, the broker’s agent is rarely to see on forums, to resolve the negative issues and users problems. To avoid the negative dealing with the company, ask your account manager about the account verification terms, guideline for using bonuses and withdrawal aspects. Please point also that the broker has yet to find and win its audience, which means there will be more references about it and its early to draw any conclusions now.

If we find complaints about tickmill, we will post it on social media. Follow us to be well informed:

Tickmill broker regulator

Tickmill possess some solid licenses, which make trading with the company safe and secured. The broker is a member of the company tmill UK limited, which is subject to regulation of the financial supervision agency of UK (FCA, № 717270). The company possesses also the FSA license of seychelles (tickmill ltd seychelles, № SD008), is registered in estonian ministry of economic affairs (№ VVT000289).

Is tickmill a scam?

Despite the fact that tickmill is a startup company in the market of forex-services and has yet to show its potential and capacities, it already won the user’s trust, has the image of safe and stable company, which differs it from paper brokers (truth about forex). There is a large number of references about the broker in internet, besides they are more positive, this proves the commitment of the company, which main concern is to provide its user with the best conditions only (low spreads, accurate quotations, automated trading option, low entry threshold etc.). Traders recommend the broker, point the company as one of the main lowcosters of trading, which also describes it positive. Please note also that there is a company representative working on negative feedback, he is inactive though.

The quality service issue is of great importance for the company. So the broker offers for trading the terminal metatrader 4, tested by millions of traders, securing the stable trade, which got positive references from the company customers. Among the advantages of the broker are provision of trading tools, services, bonuses, professional technical support, this is to say about the well considered strategy of cooperation with the customer.

Also worth noting is that the tickmill official website, which is user friendly, contains a lot of helpful materials about the company, trading terms, licenses, analytics and training information. The solid certification of tickmill is also a significant point of confidence for a user.

Shall we say that tickmill is a scam lottery and a bucket shop? Despite of the fact that the broker is the one of the startup brokers in forex market, it managed to give a solid performance already, proving its stability and commitment to stated aims. And yet, at this stage of the company growth it is too early to draw conclusions, if tickmill is a scam artist or not, but you can protect yourself properly dealing with your account manager.

Summary

The forex broker tickmill is a startup, rapidly growing company with all chances for the leadership among its competitors. Even now it has the image of a successful and stable company, numerous positive comments (about favorable trading terms, quality service, professional support service etc.) and references from customers, this is in a lot of ways to say that the broker is on the right path of development.

The safe terminal, gainful bonuses, quality analytics, training option – all this also describes the broker in a positive way. The company has negative references, too, not that much though, besides there is a broker’s agent working on forums. It is to be hoped that the company plans to attend to customers references and enhance its service keeping the pace of its successful start. It is fair to say that tickmill didn’t yet profile itself at full breath, it is early to appraise it as a reliable or a fraudulent company. Yet the feedback from traders, which we expect to this review, may not only change broker ratings significantly, but caution users against possible problems, too.

A comprehensive tickmill review – is this broker trustworthy?

Minimum deposit

Bonus

Maximum leverage

Year founded

Regulation

Trading platform

When setting out to start trading forex, stocks, or other tradable assets, one of the first things every trader should think about is a broker. The internet is full of scam brokerages that you absolutely need to stay away from, however, given how skilled they are at tricking potential customers, it may not be as easy to spot hidden flaws under their platform.

But it doesn’t mean that you have no means of distinguishing legitimate brokers from fraudulent ones. It just takes a little effort and research into the broker’s offerings to assess their credibility and make the right decision.

On forex trading bonus, we’re trying to make the broker selection process a little bit easier by offering our comprehensive reviews about them. And today, we’ll do the same for the tickmill forex broker.

In order to determine whether tickmill is a trustworthy broker or a scam, we will take a look at its website and software support, then move to the licensing, and finish off by talking about the actual trading conditions. So, let’s get started.

Initial overview

Tickmill is a forex broker established in 2015 in seychelles. The broker brings together a team of professional traders whose experience in this field has started off back in the 80s, therefore, the new clients of tickmill are already in good hands.

While the main focus of tickmil forex broker can be gathered from what we’ve just said – forex trading, the broker also offers many other instruments to its traders: stocks, indices, commodities, and bonds. But before we delve deeper into these instruments and what the actual conditions on them are, let’s do a brief overview of everything we’ll talk about in this article.

A brief tickmill.Com review

When you go to tickmill’s website, the first thing you’re going to notice is how slender and simplistic the interface looks. One image here or there, several visual effects, and very decent font make up a visual that is hardly ever distracting the visitor from getting the information.

And information is certainly there. We have seen websites with decent thematic separation but what we saw on tickmill was something else: the broker has divided the website into the sections that answer all the questions effortlessly. For instance, want to know the conditions for spreads? Go to the spreads & swaps section and find out everything about it.

This level of simplicity is definitely an advantage that we will take into account when making a final tickmill rating.

We were also pretty pleased when we came across 5 different account types on the website. All of them are designed for specific users and make trading a once-in-a-lifetime experience for them.

As for trading platforms, tickmill definitely doesn’t invent a bicycle here: it uses metatrader 4 and webtrader for all the trading executions. And to be fair, it doesn’t need to be original because these pieces of software have proven to be the most effective and efficient in this industry.

The license

Next up, we will take a look at the broker’s licensing material. This is the part that actually reveals a lot about the broker’s code of conduct and its legitimacy issues.

So, the very first line that you read when entering the website is this: “authorised and regulated: FSA SC, FCA UK, cysec.” this means that the broker has regulatory obligations to three separate countries and their financial institutions.

And actually going through these institutions can reveal a lot. For instance, when seeing that one of the main regulators of tickmill is the UK’s financial conduct authority, all the tickmill scam suspicions or suggestions are instantly dissipated for us. There’s just no way of being a scam and having this level of regulatory oversight monitoring your activities.

We will talk about this section more further down below.

Actual tickmill promotions

At last, we’ll discuss every important trading condition available on tickmill. We’ll start with the leverage and spreads. On the broker’s website, we can see that the maximum leverage ratio that the traders can use is 1:500, which is definitely a lucrative offering.

As for spreads, the broker offers two different levels of bid-ask price differences on forex pairs: 1.6 pips for classic account and 0 pips for pro and VIP accounts. Both conditions are pretty decent, although, as you can imagine, the 0-pip offering is far more attractive.

As for the tickmill bonus, the broker offers multiple promotions to its clients, ranging from the $30 welcome account, trader of the month, and many more. These bonuses give additional trading funds to the lucky winners who also can withdraw the bonus money to their personal account.

Finally, we’ll take a look at the minimum deposit requirement, as well as how you can make that deposit, as well as withdrawal. On tickmill, the minimum amount you need to deposit in order to set up a classic account is $100. As for financial platforms, the broker supports bank wire, credit/debit cards, as well as many e-wallets like neteller, skrill, etc.

In short, we think that tickmill is a trustworthy brokerage that offers quite impressive trading conditions to its clients. Now, let’s review each of the above-mentioned points more closely.

What’s the software experience like on tickmill?

As per usual, we’ll begin with the website. As we noted earlier, the visual side of the website is pretty spot-on: it’s not overburdened with unnecessary imagery or transition effects; everything is used moderately and adequately. What this achieves is it makes the navigation through the website much easier.

When it comes to finding the actual information on this website, it’s safe to say that all you need is one mouse click to go where you want. The website is separated into six different sections: trading, platforms, clients tools, promotions, partnerships, and about us. Within those sections, you can find anything about the broker’s regulatory measures, trading numbers, platforms, and payment methods.

As for the account types, there are five different packages that fulfill the demand coming from every type of trader: there are three live accounts (classic, pro, and VIP), one islamic, and one demo account. And all of them are special in their own way; some have lower spreads but higher minimum deposit requirements, some come with no swaps, etc. All in all, these accounts are perfect for specific users.

The last point of this section is trading software. Instead of going all fancy and offering proprietary trading software, tickmill chose a safer and more trustworthy route and gone with metatrader 4. MT4 is a well-tested and widely-used platform that has proven to be the most effective software across the board. What’s more, the broker also offers the MT4-based webtrader that works on all major web browsers.

Is tickmill legit?

Moving on, let’s talk about how legit the broker is based on its licensing materials. As we have already mentioned earlier, there are three separate regulatory pieces that monitor and even direct the broker’s financial activities, and all of them are pretty significant.

These licenses include: FSA from seychelles, FCA from the UK, and cysec from cyprus. Now, if there only was the FSA license, we would at least acknowledge the legitimacy of the tickmill scam suspicions. That’s because for some traders, seychelles isn’t the country with the biggest political or economic prowess to hold the broker accountable for its actions.

However, when we see the licensing materials from the UK and cyprus, all the suspicions are instantly dissipated. Just take a look at the FCA from the UK. Do you think that any brokerage would engage in fraudulent activity and be forgiven by this institution? We certainly don’t think that.

And then there’s the cysec license as some sort of cherry topping as it’s also a very strong licensing material from within the EU. In short, all three of the licenses make sure that the broker abides by the strictest financial rules.

Trading terms and conditions

Finally, let’s talk about what the actual offerings on tickmill are. As noted earlier, the leverage goes as high as 1:500, which is a very impressive and lucrative offering. With it, traders can increase their initial deposits by x500 times, increasing profits by the same multiplication rate.

As for the spreads, the bid-ask price difference for forex pairs is different on different account but the minimum spread can go as low as 0 pips, meaning there’s no actual price difference and traders can buy the same amount of assets as they sell.

When it comes to the bonuses, tickmill FX brokerage offers at least five different promotions: the trader of the month, tickmill’s NFP machine, $30 welcome account, IB contest, and rebate promotion. All of them offer money prizes to the traders, making the experience on tickmill so much better.

And finally, let’s talk about the minimum deposit requirements and financial platforms backing those deposits. On tickmill, the least amount of money you can deposit to your account is $100. This means that even the beginner traders can fire off their career on tickmill without breaking the bank.

The payment platforms that drive those deposits, as well as withdrawals, are also very attractive: the broker offers both traditional (bank wire, debit/credit cards) and e-wallet platforms (neteller, skrill, fasapay, etc). As for tickmill withdrawals, the same platforms can be used for taking out the money you have earned. And transactions are secured with the SSL protocol, which is the highest security standard in the industry.

Should you trade with tickmill?

So, what is our final tickmill opinion? Should you use its services and platforms to trade forex, stocks, and commodities?

Judging from what we’ve just said in this review, it is safe to say that the broker offers some of the most exciting trading conditions you can find on the market right now. Whether you want to leverage large trading positions with fewer of your own money, shallow spreads, or sophisticated financial mechanisms, you can never go wrong by choosing tickmill.

Besides, the broker has three separate licensing materials that ensure that there’s no tickmill fraud going on. In short, we freely recommend this broker with all its offerings and requirements.

Tickmill scam or legitimate – A detailed look into the broker

Tickmill

Considering all the features outlined above, it can be safely stated that there is no tickmill scam. Instead, it is one of the best brokers that traders can opt for if they want to trade forex currencies or want to participate in CFD trading.

Tickmill scam or legitimate

Want to become a trader? There are lots of people who aspire to be trader nowadays because doing so enables them to have flexible routines, be their own boss and earn as much as they like. Since online trading has become the norm, it has become easier than ever for anyone to fulfill their desire to become a trader. The only thing they need, along with some capital, is a good broker. Sure, you can easily find thousands of broker, but not all of them can be classified as good. There are only a handful of brokers who can be deemed good and others are either scam or simply unregulated and untrustworthy.

Get a FREE consultation with a money-back.Com fund recovery agent. A top fund recovery agency helping thousands of investment and trading scam victims get back their funds in over 40 countries!

One of the brokers that will pop up again and again is none other than tickmill. Having its headquarters in london, united kingdom, tickmill is an international broker for trading in the forex market and other cfds. But, is tickmill scam or legitimate? This is the top question that any potential trader should ask in order to ensure they don’t fall into a trap. Tickmill has been around for more than a few years and it has proven itself as a professional brokerage. The broker also has its branches in seychelles and cyprus.

But, how do you determine if it is a scam or not? The best way to do so is to weigh the different features that tickmill provides and judge it accordingly. Read on to know some important facts about the broker.

Is tickmill a regulated broker?

In case of tickmill scam, it would be a given that the broker would be unregulated as they wouldn’t be able to fulfill the criteria to qualify for regulation. Licenses and regulations are important in the eye of traders because they can help create a trusting relationship. To be regulated, a broker has to meet a certain criteria and if they violate a policy, they can lose their license. There is no such thing as tickmill scam because it is a fully regulated broker and is, in fact, regulated by multiple organizations.

The broker is regulated by the FCA in UK, cysec in cyprus and the FSA in seychelles. This is an assurance that there is no tickmill scam because if there was, then the broker wouldn’t have been regulated by such reputable organizations.

What kind of safety of funds is available?

You need a trusted broker who can provide safety of funds and not put your hard-earned money at risk. When it comes to trading online, finding a trustworthy broker is of the utmost importance. A number of small brokers who don’t have proper license and experience often don’t handle money properly. If you don’t want to deal with such a fraud, then you need to pay attention to this particular factor in broker selection.

There is no need to worry about tickmill scam because the broker ensures that client funds remain safe and keeps them separate from corporate funds to make management easier. The broker deposits the funds with barclays bank, since it is international and can provide liquidity to the broker. Moreover, in the event that tickmill goes bankrupt or faces any financial issues, clients don’t have to worry about their investment. Tickmill is a member of the financial services compensation scheme (FCSC), which protects clients for up to £75,000.

This can easily clear any doubts that traders may have about tickmill scam because there is a guarantee that your funds will be returned and you will not have to worry about losing them due to the broker’s mistakes.

What trading conditions are provided?

Tickmill is not a market maker and is actually an NDD (non-dealing desk) broker with renowned liquidity providers. This means there is no conflict of interest between the trader and the broker. It gives its clients access to more than 84 financial instruments for trading and is constantly trying to expand its offerings and has integrated newer assets, such as bitcoin to its trading platform. Apart from that, tickmill provides traders with the opportunity of trading currencies in the forex market and cfds (contract for difference) for government bonds, commodities or stock indices.

When it comes to the trading conditions, tickmill is offering low commissions and tight spreads. The commissions fall as your deposits rise and there are absolutely no requotes. This allows you to open and close trading positions for the next best market price. Traders can also enjoy fast executions that work in their favor and maximum leverage of 1:500.

Which trading platform can be found?

Another indication that there is no tickmill scam is the fact that the broker offers its clients the option of using the metatrader 4 trading platform. This is a worldwide and proven trading platform for professional and private traders. It is available for the browser (web), desktop (download) as well as mobile apps for ios and android. The metatrader allows you to access the markets easily and flexibly from anywhere around the world. It is the ideal platform for any trader who wants to make significant returns in the market. It also boasts free indicators, numerous analysis tools as well as automated trading.

What accounts can be opened?

There are a total of three account options that tickmill offers to its clients, which are classic, pro and VIP. Along with these accounts, the broker has also incorporated a demo account for customers. If there was any tickmill scam, a demo account wouldn’t be available as it could be used to identify the scam. It is a great way for traders to get in some practice and understand the broker’s offerings. The minimum deposit for the classic account is $100 and the features in every account are different, meant for varying kind of traders.

Conclusion

Considering all the features outlined above, it can be safely stated that there is no tickmill scam. Instead, it is one of the best brokers that traders can opt for if they want to trade forex currencies or want to participate in CFD trading.

Tickmill – is it scam or safe?

Tickmill – is it scam or safe?

Tickmill is a trading name of tmill UK limited, which is licensed and regulated by the financial conduct authority (FCA). The FCA license allows it to conduct financial services, including forex.

However, there are some publications in forex forums that inform about bad practices related to a dealing desk fulfillment of orders, negative slippage, spread-widening and pushing clients to deposit more money.

So far, we haven’t received any complaints from clients of tickmill.Com.

If you feel frustrated by tickmill.Com and have something to share with us, please fill in the form below, describing your case:

7 complains

This is an average broker with average trading conditions and beware – this is an offshore company. I haven’t got many problems with them except big slippage and nonstop requotes, especially when important news published. I decided to quit and now I trade with a real ECN broker. Do not involve with tickmill!

They act as marker makers, not ECN. They do everything possible to lose your money. They offer benefits but just to lure you. I have traded with them for some time. They always closed my positions before they will hit my take profit order. When I asked them, they excused telling me it was slippage.

No, they re NOT ECN !! I just lost all my money for just one day and this happened while I was hedged. They can blame french election and the volatility connected but I also noticed too big spread widening. Especially when my deal is profitable. I recommend stay away. Better deal with some honest market maker than these scammers.

This is fraud. I was called from lakeshri in india and they took 12,000 INR from me. They make me deposit in tickmill and now 20 day later they don’t answer me. Scam! Fraud! Company and CEO! Do not be fooled with tickmil!!

I can confirm this is one of the worst market makers I met. I usual trade when news announced. But their spreads are too big – huge! They always touch my stop loss and I know it is intentional. I think you should keep away from this broker, market maker. Not honest

Are you a victim of the following ;

binary option, forex trading, romance, ICO scams, online betting, bitcoin, phishing, exchange scams etc

if in any case you have lost your hard earned money. Dont give up, I have a good news for you. Scams rescue is currently recovering funds for all victims. Service delivery is second to none. I obliged myself the priviledge to announce this to everyone. Hurry and contact on scamrescue at protonmail (dot) com

thank me later.

I also fell a victim to this scam broker. They kept on asking me to deposit more money. Then they stopped picking up my calls and doesn’t reply my mails. After loosing more money. Finally I have gotten back all my lost fund and bonus from CFD stocks. They stocked all my trading capital and deprived me access into my account for over two months now after I’ve invested $70, 000 with them. Thought I was not gonna see this day, but as god may have it, today I’ve got back all my money for real with the help of professional. Lesson learnt! I’m happy to share my experience.

If you’ve been locked out from logging into your binary option trading account or you are unable to make withdrawal from your broker account, maybe because your broker manager is asking you to make more deposit before you can place a withdrawal and you need my assistance, kindly get in contact with me via my email address:[email protected], and I will guide you on steps to take to regain access to your account, make withdrawal freely and easy, as well as recover all your lost funds in reality.

Tickmill.Com reviews

Trust score: 99/100 - excellent

we would recommend doing business with this site. However, please make sure to use only secure payment options, such as credit cards or paypal.

Domain age

We suggest you to stay away from the sites that are created less than 6 months (180 days) ago.

Spam? NO - this site is NOT on a blacklist for sending out SPAM E-mails

Security

SSL (secure sockets layer) is protocol for establishing authenticated and encrypted links between networked computers.

Comments

Add comment

This policy contains information about your privacy. By posting, you are declaring that you understand this policy:

- Your name, rating, website address, town, country, state and comment will be publicly displayed if entered.

- Aside from the data entered into these form fields, other stored data about your comment will include:

- Your IP address (not displayed)

- The time/date of your submission (displayed)

- Your email address will not be shared. It is collected for only two reasons:

- Administrative purposes, should a need to contact you arise.

- To inform you of new comments, should you subscribe to receive notifications.

- A cookie may be set on your computer. This is used to remember your inputs. It will expire by itself.

This policy is subject to change at any time and without notice.

These terms and conditions contain rules about posting comments. By submitting a comment, you are declaring that you agree with these rules:

- Although the administrator will attempt to moderate comments, it is impossible for every comment to have been moderated at any given time.

- You acknowledge that all comments express the views and opinions of the original author and not those of the administrator.

- You agree not to post any material which is knowingly false, obscene, hateful, threatening, harassing or invasive of a person's privacy.

- The administrator has the right to edit, move or remove any comment for any reason and without notice.

Failure to comply with these rules may result in being banned from further commenting.

These terms and conditions are subject to change at any time and without notice.

Tickmill review

Tickmill is a global forex CFD broker, that has been regulated by the FCA in the united kingdom since 2016.

Headquarters are located at: 1 fore street, london EC2Y 9DT united kingdom. Contact phone number is: +44 203 608 6100. Customer support email address is: [email protected] . Official website is at: https://www.Tickmill.Co.Uk.

Tickmill broker review

A review of the forex brokers tickmill shows, that this broker is offering day traders and investors the classic metatrader4 (MT4) trading platform. There is available both the desktop standalone version, along with the web based and mobile versions. They offer hundreds of underlying assets for trading CFD’s including all the popular major & minor forex pairs, market indexes, individuals shares, and commodities like brent, crude oil, platinum, coffee, sugar etc..

Leverage on all forex pairs is set at 1:30, and can go as high as 1:500 for professional investors. Their spreads are either 0 pips, with commissions or 1.6 pips with no commissions. Depending on your trading style, you will either choose a classic or pro account.

There are three different trading account types offered, with the main difference being commissions and spreads. The minimum deposit requirement for a new trading account is $100. Accounts can be denominated in either USD, EUR, PLN or GBP. Deposits can be done with either bank transfer, credit card or skrill. Withdrawals are processed within one working day.

Is tickmill a licensed broker?

Yes, they are a licensed and regulated broker by three different financial regulators.

- United kingdom: tickmill UK ltd is authorised and regulated by the financial conduct authority, license number: 717270. An FCA is one of the most prestigious licenses a forex broker can obtain.

- European union: tickmill europe ltd is licensed cysec (cyprus securities and exchange commission) with license number: 278/15. With mifid, the cyprus license is recognized by all EU member countries.

- South africa: tickmill south africa (pty) ltd, is licensed and regulated by the FSCA with FSP # 49464.

- Global: tickmill ltd is licensed as a securities dealer by the seychelles FSA, with license number: SD008

Scam broker investigator has reviews of hundreds of forex brokers, see here. The best way you can know if a broker is a scam or a legitimate broker, is by verifying that they are licensed by your countries financial regulator. The reason why smart people only use a licensed broker, is so that you can be assured your money is safe in a segregated bank account.

Compare licensed brokers

You should be aware that there are currently a lot of forex and crypto investment scams circulating online, read more. A smart person will always compare a few different brokers, before making a final choice.

Fortrade is a fast growing english broker, that is licensed in canada, united kingdom and australia, learn more.

They offers MT4 and a unique web based trading app, with free signals, signup here.

We ask current tickmill clients to please share your experience with this broker, in the comments section below.

So, let's see, what we have: tickmill review – is tickmill scam or legit broker? Tickmill rating 62 currency pairs FSA, FCA and cysec law metatrader 4 along with webtrader leverage of 1:500 at is tickmill legit

Contents of the article

- Top forex bonuses

- Tickmill review – is tickmill scam or legit...

- Tickmill

- Overview/ desktop

- Account types

- Trading platform/ applications

- Deposit options

- Markets

- Bonuses

- Customer support

- Safety

- Ease of use

- Final thoughts

- Tickmill review 2021

- Summary

- Tickmill review fees

- Tickmill review account opening

- Can you open an account?

- What is the minimum deposit at tickmill?

- Account types

- How to open your account

- Tickmill review

- Broker details

- Live discussion

- Tickmill.Com profile provided by tickmill, nov...

- Video

- Traders reviews

- Tickmill.Com review: is tickmill A legit or scam...

- Trading platform of tickmill

- Deposit and withdrawal methods on tickmill

- Is tickmill licensed?

- Support

- Conclusion

- COMPARE WITH A TRUSTED BROKER

- Fortrade

- Tickmill review

- Overview

- Details

- Full review

- Terms of trade with tickmill

- Deposit and withdrawal

- Tickmill bonuses

- Complaints about tickmill

- Tickmill broker regulator

- Is tickmill a scam?

- Summary

- A comprehensive tickmill review – is this broker...

- Initial overview

- What’s the software experience like on tickmill?

- Is tickmill legit?

- Trading terms and conditions

- Should you trade with tickmill?

- Tickmill scam or legitimate – A detailed look...

- Tickmill scam or legitimate

- Tickmill – is it scam or safe?

- Tickmill.Com reviews

- Tickmill review

- Tickmill broker review

- Is tickmill a licensed broker?

- Compare licensed brokers

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.