Forex all

Forex and other leveraged products involve significant risk of loss and may not be suitable for all investors.

Top forex bonuses

Products that are traded on margin carry a risk that you may lose more than your initial deposit. Increasing leverage increases risk. Spot gold and silver contracts are not subject to regulation under the U.S. Commodity exchange act. Please read the full disclosure. Foreign exchange (forex) products and services are offered to self-directed investors through ally invest forex LLC. Ally invest forex LLC, NFA member (ID #0408077), acts as an introducing broker to GAIN capital group, LLC ("GAIN capital"), a registered FCM/RFED and NFA member (ID #0339826). Your forex account is held and maintained at GAIN who serves as the clearing agent and counterparty to your trades. GAIN capital, attn: ally invest forex, bedminster one, 135 US highway 202/206, suite 11, bedminster, NJ 07921, USA.

Diversify your investments and take

advantage of the most traded

market in the world.

Trade currencies with ally invest forex.

- Trade over 80 currency pairs plus gold and silver in real time

- Benefit from sophisticated trading platforms, premium charting tools

- Access extensive education, actionable research, detailed charts, and more

- Superior customer support, 24 hours from 10:00am (ET) sunday to 5:00pm (ET) friday.

Open a free $50,000 practice account.

Open a live forex account.

Why ally invest forex?

Trading platforms

Education

Forex support

Foreign exchange (forex) products and services are offered to self-directed investors through ally invest forex LLC. Ally invest forex LLC, NFA member (ID #0408077), acts as an introducing broker to GAIN capital group, LLC ("GAIN capital"), a registered FCM/RFED and NFA member (ID #0339826). Your forex account is held and maintained at GAIN who serves as the clearing agent and counterparty to your trades. GAIN capital, attn: ally invest forex, bedminster one, 135 US highway 202/206, suite 11, bedminster, NJ 07921, USA.

Forex and other leveraged products involve significant risk of loss and may not be suitable for all investors. Products that are traded on margin carry a risk that you may lose more than your initial deposit. Increasing leverage increases risk. Spot gold and silver contracts are not subject to regulation under the U.S. Commodity exchange act. Please read the full disclosure.

There are risks associated with using an internet-based trading system including, but not limited to, the failure of hardware, software, and internet connection. Ally invest forex is not responsible for communication failures or delays when trading via the internet. Any opinions, news, research, analysis, prices, or other information contained on this website are provided as general market commentary, and do not constitute investment advice. Ally invest forex is not liable for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content on this website is subject to change at any time without notice.

Forex accounts are NOT PROTECTED by the securities investor protection corporation (SIPC), NOT FDIC INSURED, NOT BANK GUARANTEED, and MAY LOSE VALUE.

All that you require to know about forex and best forex robot

Related articles

Best youtube to mp3 converter to use

Top 5 intro makers for youtubers

Common denial of services that you need to know about

The foreign trade market is a worldwide, decentralized, or over-the-counter market to exchange monetary forms. This market decides unfamiliar trade rates for each cash. It incorporates all parts of purchasing, selling, and monetary trading standards at current or decided costs. Forex market is a portmanteau of foreign trade and cash. Foreign trade is the way toward transforming one cash into another money for an assortment of reasons, normally for business, exchanging, or the travel industry. The forex market is the largest in the world, but what does that mean to you? How can it benefit you? Take a closure look at the forex trading market with this guide.

What is the forex trading market?

The foreign trade market is the place where monetary forms are exchanged. Monetary standards are critical to the vast majority worldwide if they understand it since monetary standards should be traded to direct foreign exchange and business. One special part of this global market is that there is no focal commercial center for unfamiliar trade. Or maybe, cash exchanging is directed electronically over-the-counter (OTC), which implies that all exchanges happen using computer networks between brokers far and wide, instead of on one incorporated trade. Meanwhile, before entering the market, you must know about the forex robot.

What is a forex robot?

Finding all that product to accurately perform robotized exchanges can be tedious, such countless brokers decide to enroll a forex robot’s assistance. Once in a while, alluded to as forex robots or, basically, ‘bots’, these are not actual robots – all things considered, they are exceptionally particular PC programs made to do various exchanging capacities. If you are put on those brokers looking for a robot to perform automated exchanges for you, you must go with the best forex robot. Some of the forex robots are programmed to send signals to traders, while some FX robots can act upon those signals.

How is the forex market regulated?

Regardless of the huge size of the forex exchange market, you might not digest the fact that there is next to no guideline because there is no overseeing body to police it every minute of every day. All things being equal, a few public exchanging bodies the world over who administers homegrown forex exchanging, just as different business sectors, to guarantee that all forex suppliers stick to specific principles.

Can you get rich by trading forex?

Although anyone’s first reaction is a ‘no.’ but in the meantime, there are only a few people out there who know that yes, forex can make you money. Forex exchanging may make you rich if you are a multifaceted investment with profound pockets or a surprisingly talented money dealer. However, at the same time, for the normal retail merchant, as opposed to being a simple street to wealth, forex exchanging can be a rough interstate to colossal misfortunes and expected penury.

Forex for beginners

In an environment as unique as the forex market, legitimate preparation is significant. Whether you are a prepared market veteran or shiny new to cash exchanging, being readied is basic to delivering predictable benefits.

It isn’t easy. To guarantee that you have your most obvious opportunity to succeed in the forex market, it is basic that your hands-on preparation never stops. Creating strong exchanging propensities, going to master online courses, and proceeding with your market schooling are a couple of approaches to stay serious in the quick-moving forex climate.

On the off chance that you will likely turn into a reliably productive forex merchant, at that point, your schooling won’t ever stop. As the saying goes, careful discipline brings about promising results; while flawlessness is frequently subtle for dynamic merchants, being ready for each meeting should be standard.

Forex trading for becoming successful traders

Being the largest market in the market, forex features more than trillions of turnover daily. In simple words, the forex is a digital trading platform where investors, financial specialists, speculators, and liquidity suppliers from around the globe collaborate. It is essential for all those who are new to the foreign exchange to construct an instructive establishment before bouncing in with the two feet. Understanding the forex’s fundamental purposes is a basic part of finding a good pace as fast as could reasonably be expected. You’re ready to peruse a statement, evaluate influence, and spot orders upon the market. However, at the same time, it has been guided that if you are interested in the market and want to be a successful trader, then you must get the training done. You must also have deep knowledge about the forex robot so that you can choose the best forex robot.

Forex trading: A beginner's guide

Forex is a portmanteau of foreign currency and exchange. Foreign exchange is the process of changing one currency into another currency for a variety of reasons, usually for commerce, trading, or tourism. According to a recent triennial report from the bank for international settlements (a global bank for national central banks), the average was more than $5.1 trillion in daily forex trading volume.

Key takeaways

- The foreign exchange (also known as FX or forex) market is a global marketplace for exchanging national currencies against one another.

- Because of the worldwide reach of trade, commerce, and finance, forex markets tend to be the largest and most liquid asset markets in the world.

- Currencies trade against each other as exchange rate pairs. For example, EUR/USD.

- Forex markets exist as spot (cash) markets as well as derivatives markets offering forwards, futures, options, and currency swaps.

- Market participants use forex to hedge against international currency and interest rate risk, to speculate on geopolitical events, and to diversify portfolios, among several other reasons.

What is the forex market?

The foreign exchange market is where currencies are traded. Currencies are important to most people around the world, whether they realize it or not, because currencies need to be exchanged in order to conduct foreign trade and business. If you are living in the U.S. And want to buy cheese from france, either you or the company that you buy the cheese from has to pay the french for the cheese in euros (EUR). This means that the U.S. Importer would have to exchange the equivalent value of U.S. Dollars (USD) into euros. The same goes for traveling. A french tourist in egypt can't pay in euros to see the pyramids because it's not the locally accepted currency. As such, the tourist has to exchange the euros for the local currency, in this case the egyptian pound, at the current exchange rate.

One unique aspect of this international market is that there is no central marketplace for foreign exchange. Rather, currency trading is conducted electronically over-the-counter (OTC), which means that all transactions occur via computer networks between traders around the world, rather than on one centralized exchange. The market is open 24 hours a day, five and a half days a week, and currencies are traded worldwide in the major financial centers of london, new york, tokyo, zurich, frankfurt, hong kong, singapore, paris and sydney—across almost every time zone. This means that when the trading day in the U.S. Ends, the forex market begins anew in tokyo and hong kong. As such, the forex market can be extremely active any time of the day, with price quotes changing constantly.

A brief history of forex

Unlike stock markets, which can trace their roots back centuries, the forex market as we understand it today is a truly new market. Of course, in its most basic sense—that of people converting one currency to another for financial advantage—forex has been around since nations began minting currencies. But the modern forex markets are a modern invention. After the accord at bretton woods in 1971, more major currencies were allowed to float freely against one another. The values of individual currencies vary, which has given rise to the need for foreign exchange services and trading.

Commercial and investment banks conduct most of the trading in the forex markets on behalf of their clients, but there are also speculative opportunities for trading one currency against another for professional and individual investors.

Spot market and the forwards & futures markets

There are actually three ways that institutions, corporations and individuals trade forex: the spot market, the forwards market, and the futures market. Forex trading in the spot market has always been the largest market because it is the "underlying" real asset that the forwards and futures markets are based on. In the past, the futures market was the most popular venue for traders because it was available to individual investors for a longer period of time. However, with the advent of electronic trading and numerous forex brokers, the spot market has witnessed a huge surge in activity and now surpasses the futures market as the preferred trading market for individual investors and speculators. When people refer to the forex market, they usually are referring to the spot market. The forwards and futures markets tend to be more popular with companies that need to hedge their foreign exchange risks out to a specific date in the future.

More specifically, the spot market is where currencies are bought and sold according to the current price. That price, determined by supply and demand, is a reflection of many things, including current interest rates, economic performance, sentiment towards ongoing political situations (both locally and internationally), as well as the perception of the future performance of one currency against another. When a deal is finalized, this is known as a "spot deal." it is a bilateral transaction by which one party delivers an agreed-upon currency amount to the counter party and receives a specified amount of another currency at the agreed-upon exchange rate value. After a position is closed, the settlement is in cash. Although the spot market is commonly known as one that deals with transactions in the present (rather than the future), these trades actually take two days for settlement.

Unlike the spot market, the forwards and futures markets do not trade actual currencies. Instead they deal in contracts that represent claims to a certain currency type, a specific price per unit and a future date for settlement.

In the forwards market, contracts are bought and sold OTC between two parties, who determine the terms of the agreement between themselves.

In the futures market, futures contracts are bought and sold based upon a standard size and settlement date on public commodities markets, such as the chicago mercantile exchange. In the U.S., the national futures association regulates the futures market. Futures contracts have specific details, including the number of units being traded, delivery and settlement dates, and minimum price increments that cannot be customized. The exchange acts as a counterpart to the trader, providing clearance and settlement.

Both types of contracts are binding and are typically settled for cash at the exchange in question upon expiry, although contracts can also be bought and sold before they expire. The forwards and futures markets can offer protection against risk when trading currencies. Usually, big international corporations use these markets in order to hedge against future exchange rate fluctuations, but speculators take part in these markets as well.

Note that you'll often see the terms: FX, forex, foreign-exchange market, and currency market. These terms are synonymous and all refer to the forex market.

Forex for hedging

Companies doing business in foreign countries are at risk due to fluctuations in currency values when they buy or sell goods and services outside of their domestic market. Foreign exchange markets provide a way to hedge currency risk by fixing a rate at which the transaction will be completed.

To accomplish this, a trader can buy or sell currencies in the forward or swap markets in advance, which locks in an exchange rate. For example, imagine that a company plans to sell U.S.-made blenders in europe when the exchange rate between the euro and the dollar (EUR/USD) is €1 to $1 at parity.

The blender costs $100 to manufacture, and the U.S. Firm plans to sell it for €150—which is competitive with other blenders that were made in europe. If this plan is successful, the company will make $50 in profit because the EUR/USD exchange rate is even. Unfortunately, the USD begins to rise in value versus the euro until the EUR/USD exchange rate is 0.80, which means it now costs $0.80 to buy €1.00.

The problem the company faces is that while it still costs $100 to make the blender, the company can only sell the product at the competitive price of €150, which when translated back into dollars is only $120 (€150 X 0.80 = $120). A stronger dollar resulted in a much smaller profit than expected.

The blender company could have reduced this risk by shorting the euro and buying the USD when they were at parity. That way, if the dollar rose in value, the profits from the trade would offset the reduced profit from the sale of blenders. If the USD fell in value, the more favorable exchange rate will increase the profit from the sale of blenders, which offsets the losses in the trade.

Hedging of this kind can be done in the currency futures market. The advantage for the trader is that futures contracts are standardized and cleared by a central authority. However, currency futures may be less liquid than the forward markets, which are decentralized and exist within the interbank system throughout the world.

Forex for speculation

Factors like interest rates, trade flows, tourism, economic strength, and geopolitical risk affect supply and demand for currencies, which creates daily volatility in the forex markets. An opportunity exists to profit from changes that may increase or reduce one currency's value compared to another. A forecast that one currency will weaken is essentially the same as assuming that the other currency in the pair will strengthen because currencies are traded as pairs.

Imagine a trader who expects interest rates to rise in the U.S. Compared to australia while the exchange rate between the two currencies (AUD/USD) is 0.71 (it takes $0.71 USD to buy $1.00 AUD). The trader believes higher interest rates in the U.S. Will increase demand for USD, and therefore the AUD/USD exchange rate will fall because it will require fewer, stronger USD to buy an AUD.

Assume that the trader is correct and interest rates rise, which decreases the AUD/USD exchange rate to 0.50. This means that it requires $0.50 USD to buy $1.00 AUD. If the investor had shorted the AUD and went long the USD, he or she would have profited from the change in value.

Currency as an asset class

There are two distinct features to currencies as an asset class:

- You can earn the interest rate differential between two currencies.

- You can profit from changes in the exchange rate.

An investor can profit from the difference between two interest rates in two different economies by buying the currency with the higher interest rate and shorting the currency with the lower interest rate. Prior to the 2008 financial crisis, it was very common to short the japanese yen (JPY) and buy british pounds (GBP) because the interest rate differential was very large. This strategy is sometimes referred to as a "carry trade."

Why we can trade currencies

Currency trading was very difficult for individual investors prior to the internet. Most currency traders were large multinational corporations, hedge funds or high-net-worth individuals because forex trading required a lot of capital. With help from the internet, a retail market aimed at individual traders has emerged, providing easy access to the foreign exchange markets, either through the banks themselves or brokers making a secondary market. Most online brokers or dealers offer very high leverage to individual traders who can control a large trade with a small account balance.

Forex trading: A beginner’s guide

Forex trading risks

Trading currencies can be risky and complex. The interbank market has varying degrees of regulation, and forex instruments are not standardized. In some parts of the world, forex trading is almost completely unregulated.

The interbank market is made up of banks trading with each other around the world. The banks themselves have to determine and accept sovereign risk and credit risk, and they have established internal processes to keep themselves as safe as possible. Regulations like this are industry-imposed for the protection of each participating bank.

Since the market is made by each of the participating banks providing offers and bids for a particular currency, the market pricing mechanism is based on supply and demand. Because there are such large trade flows within the system, it is difficult for rogue traders to influence the price of a currency. This system helps create transparency in the market for investors with access to interbank dealing.

Most small retail traders trade with relatively small and semi-unregulated forex brokers/dealers, which can (and sometimes do) re-quote prices and even trade against their own customers. Depending on where the dealer exists, there may be some government and industry regulation, but those safeguards are inconsistent around the globe.

Most retail investors should spend time investigating a forex dealer to find out whether it is regulated in the U.S. Or the U.K. (dealers in the U.S. And U.K. Have more oversight) or in a country with lax rules and oversight. It is also a good idea to find out what kind of account protections are available in case of a market crisis, or if a dealer becomes insolvent.

Pros and challenges of trading forex

Pro: the forex markets are the largest in terms of daily trading volume in the world and therefore offer the most liquidity. this makes it easy to enter and exit a position in any of the major currencies within a fraction of a second for a small spread in most market conditions.

Challenge: banks, brokers, and dealers in the forex markets allow a high amount of leverage, which means that traders can control large positions with relatively little money of their own. Leverage in the range of 100:1 is a high ratio but not uncommon in forex. A trader must understand the use of leverage and the risks that leverage introduces in an account. Extreme amounts of leverage have led to many dealers becoming insolvent unexpectedly.

Pro: the forex market is traded 24 hours a day, five days a week—starting each day in australia and ending in new york. The major centers are sydney, hong kong, singapore, tokyo, frankfurt, paris, london, and new york.

Challenge: trading currencies productively requires an understanding of economic fundamentals and indicators. A currency trader needs to have a big-picture understanding of the economies of the various countries and their inter-connectedness to grasp the fundamentals that drive currency values.

The bottom line

For traders—especially those with limited funds—day trading or swing trading in small amounts is easier in the forex market than other markets. For those with longer-term horizons and larger funds, long-term fundamentals-based trading or a carry trade can be profitable. A focus on understanding the macroeconomic fundamentals driving currency values and experience with technical analysis may help new forex traders to become more profitable.

What is forex?

The foreign exchange market – also known as forex or the FX market – is the world’s most traded market, with turnover of $5.1 trillion per day.*

To put this into perspective, the U.S. Stock market trades around $257 billion a day; quite a large sum, but only a fraction of what forex trades.

Forex is traded 24 hours a day, 5 days a week across by banks, institutions and individual traders worldwide. Unlike other financial markets, there is no centralized marketplace for forex, currencies trade over the counter in whatever market is open at that time.

How FX trading works

Trading forex involves the buying of one currency and simultaneous selling of another. In forex, traders attempt to profit by buying and selling currencies by actively speculating on the direction currencies are likely to take in the future.

World’s major currencies

| COUNTRY | SYMBOL | COUNTRY | SYMBOL |

|---|---|---|---|

| united states | USD | switzerland | CHF |

| eurozone | EUR | canada | CAD |

| japan | JPY | australia | AUD |

| great britain | GBP | new zealand | NZD |

Want to know more about how to trade forex?

Our free let’s get to know forex guide will cover how to get started, help you make your first trades and outline how to create a long-term trading plan for long-term success.

*april 2016 interbank forex market average daily volume from bank for international settlements.

Forex all

Student testimonials

Janet laderman

I was laid off from the city of fort lauderdale after having worked there for approximately 15 years. Due to the economic downfall and real estate market crash I found myself in a situation where finding a new job was unrealistic. Unfortunately it took me 2 years of unemployment to realize it and to finally decide to try forex trading. I can't say enough how this training saved me financially, I can now pay my bills I no longer depend on a job, the confidence I have now is priceless. Don't wait forever like I did, start your training .

Edward oliveras

I am a full time FIU student in miami, business major with student loans adding up, rent to pay, and mandatory child support payments to make. I was working part time jobs, and not even close to earning enough to make ends meet. While waiting in traffic getting from one of my part time jobs, I picked up my cell phone and started dialing a number from an ad on the back of a white suv that said "learn to make money 24/7." wow, is that person for-real I said. It was one of the best phone call I could make, the training one on one with erixon and his energy and enthusiasm, gave me the motivation I needed. My new knowledge in forex trading is superb, know when I get in front of the computer is to make money, not to spend time in face book.

Saul ortega, pembroke pines, FL.

Had some forex trading experience from a trading course I took previously. I was unhappy with the outcome, I didn't have a grasp on the right way of setting up strategies to win. After having lost in trading at least 5 times of what erixon's course costs, I was skeptical towards this forex training, but I knew I had to try it to be able to compare outcomes. Forex south florida. Com training far surpassed my expectations, for the cost its amazing. Trading use to feel a lot like a legal scam, giving my money to the world markets just so they could steal from me. All of my trades where closed as loosing trades. Know I am beating the market making anywhere between 30 to 45% monthly of my trading capital.

Howard smolensky tamarac, florida

my retirement funds, always seemed reasonable to me until I retired. I'm retired but very active, all of a sudden I acquired wants I didn't have when I was busy in my work routine. I want to travel, be a generous grandfather, eat out for dinner and so on and so on. Truly forex trading is the only way I have been able to give myself these wants, I highly recommend the one on one educational training with erixon at forex south florida.Com

Sonia galfano, coral gables, FL.

Super easy, made the impossible possible. I thought analyzing graphs, and trying to figure out all of the negative news from europe was going to be impossible. No matter if the stock market is moving up or down , I make money in forex trading. I can say I went from having no knowledge of forex trading ,to feeling confident enough to placing more than 10 trades daily and make more money than I use to working in my 40 hour a week job.

The fundamentals

The first thing I tell all my students is that forex is risky and not suitable for everyone. This is the reason why education in the markets is so important. I want my students to accomplish their purpose when trading, to stick to a specific idea so they can achieve their financial goals one day at a time. "your success will be measured by your ability to keep on trying, so never give up. The world will always give you opportunities, it is up to you to grab it."

Why learn forex from me?

In the internet you could find lots of information on forex for free, but attached to that free information you will get a million other products that they are trying to sell you.. On top of that you could spend months trying to figure out all of the information involved with forex trading. Face it, there is really nothing for free. With me you will get straight forward professional education that will teach you the proper ways to make money on a daily basis. In short, only those that get training from a professional trader manage to make money in forex. I have spent thousands of dollars in my investing education, I'm giving you my time and knowledge for only a fraction of the cost.

Happy trading to all of my studentsвђ¦

Forex today: all eyes on the US dollar and biden's stimulus plan

Here is what you need to know monday, january 14th 2021:

- The comeback in the US dollar has been the focus in the forex space for the start of the year. On wednesday, the greenback resumed its rebound from near three-week lows.

- Hopes of higher government spending by president-elect joe biden's incoming administration and ongoing economic recovery from the coronavirus crisis as lead to a rise in US treasury yields, supporting the greenback.

- The greenback has also benefitted from expectations of a continued economic recovery in the united states while countries in europe resort to lockdowns to fend off a second COVID-19 wave.

- However, there was a temporary bump in the road on wednesday for the greenback when US treasury yields dipped on the back of the treasury department completing its final sale of $120 billion in coupon-bearing supply this week. Investors showed strong demand for long-dated bonds. Yields on the benchmark treasury note slid to 1.071%. This is down from an almost 10-month high of 1.187% on tuesday.

- However, the rise in the 10-year treasury yield above 1% has put a firmer floor under the mightily US dollar.

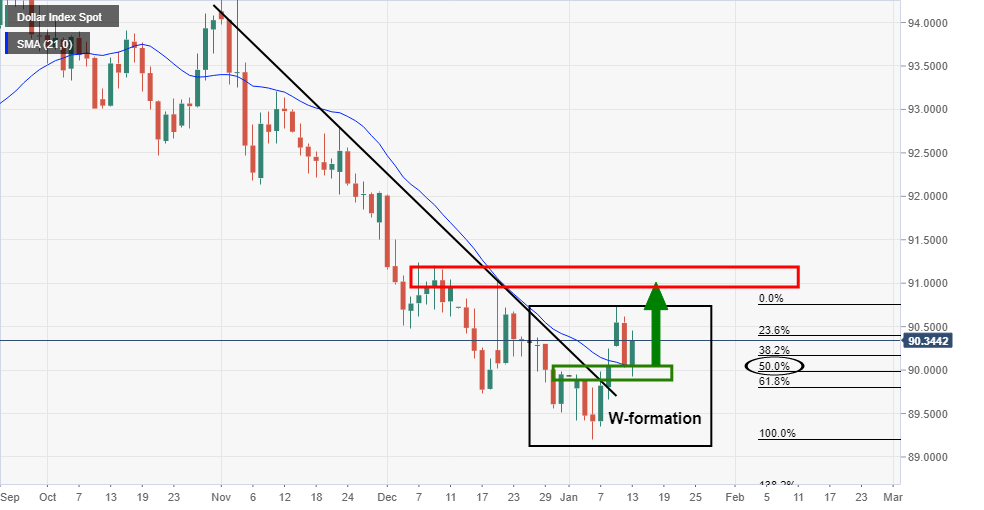

- The DXY was 0.37% higher at 90.359. The index has climbed 1.3% since falling to near a three-year low of 89.21 last week

- In data, US december consumer price index arrived were as expected. US december CPI was in line with expectations, rising 0.4% mom, with core up 0.1% m/m. That left annual headline inflation at 1.4% yoy and core unchanged at 1.6% yoy.

- Comments from fed speakers pushed back on the possibility of tapering bond purchases any time soon.

- Richard clarida, the vice-chair of the federal reserve system, said ''we are not going to hike until we actually get inflation to 2% and asset purchases are an important part of fed strategy.';

- The S&P 500 was up 0.3%, the euro stoxx 50 was up 0.1% and the FTSE 100 was down 0.1%. WTI lost 0.6% to USD52.9/bbl. Gold was flat and unchanged around $1,857.3/oz.

- Cryptocurrencies posted modest recoveries with BTC rallying to print a higher high in its steep correction of the 2021 pull back.

- Coming up, as the news that US president trump's impeachment was voted for by the house, US president-elect joe biden will reveal his stimulus plan on thursday. Markets will be tuned in and time will tell as to whether the US dollar can withstand what is about to be unveiled.

DXY technical analysis

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Fxstreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in open markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of fxstreet nor its advertisers.

Secure login

Designed for active traders looking for an edge

This windows-based platform offers a rich user interface in a highly

customizable trading environment for maximum performance.

Log in to the windows platform by launching forextrader from your start menu.

You can download the software from our download center.

Important legal notice: the information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase of sale of any currency. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Web trading, brought to you by trading view, combines power and simplicity to help you get the most out of your trading strategy. Compatible with all browsers and operating systems, no download required.

Myaccount login section

Why ally invest forex?

Trading platforms

Education

Forex support

Foreign exchange (forex) products and services are offered to self-directed investors through ally invest forex LLC. Ally invest forex LLC, NFA member (ID #0408077), acts as an introducing broker to GAIN capital group, LLC ("GAIN capital"), a registered FCM/RFED and NFA member (ID #0339826). Your forex account is held and maintained at GAIN who serves as the clearing agent and counterparty to your trades. GAIN capital, attn: ally invest forex, bedminster one, 135 US highway 202/206, suite 11, bedminster, NJ 07921, USA.

Forex and other leveraged products involve significant risk of loss and may not be suitable for all investors. Products that are traded on margin carry a risk that you may lose more than your initial deposit. Increasing leverage increases risk. Spot gold and silver contracts are not subject to regulation under the U.S. Commodity exchange act. Please read the full disclosure.

There are risks associated with using an internet-based trading system including, but not limited to, the failure of hardware, software, and internet connection. Ally invest forex is not responsible for communication failures or delays when trading via the internet. Any opinions, news, research, analysis, prices, or other information contained on this website are provided as general market commentary, and do not constitute investment advice. Ally invest forex is not liable for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content on this website is subject to change at any time without notice.

Forex accounts are NOT PROTECTED by the securities investor protection corporation (SIPC), NOT FDIC INSURED, NOT BANK GUARANTEED, and MAY LOSE VALUE.

All that you require to know about forex and best forex robot

Related articles

Best youtube to mp3 converter to use

Top 5 intro makers for youtubers

Common denial of services that you need to know about

The foreign trade market is a worldwide, decentralized, or over-the-counter market to exchange monetary forms. This market decides unfamiliar trade rates for each cash. It incorporates all parts of purchasing, selling, and monetary trading standards at current or decided costs. Forex market is a portmanteau of foreign trade and cash. Foreign trade is the way toward transforming one cash into another money for an assortment of reasons, normally for business, exchanging, or the travel industry. The forex market is the largest in the world, but what does that mean to you? How can it benefit you? Take a closure look at the forex trading market with this guide.

What is the forex trading market?

The foreign trade market is the place where monetary forms are exchanged. Monetary standards are critical to the vast majority worldwide if they understand it since monetary standards should be traded to direct foreign exchange and business. One special part of this global market is that there is no focal commercial center for unfamiliar trade. Or maybe, cash exchanging is directed electronically over-the-counter (OTC), which implies that all exchanges happen using computer networks between brokers far and wide, instead of on one incorporated trade. Meanwhile, before entering the market, you must know about the forex robot.

What is a forex robot?

Finding all that product to accurately perform robotized exchanges can be tedious, such countless brokers decide to enroll a forex robot’s assistance. Once in a while, alluded to as forex robots or, basically, ‘bots’, these are not actual robots – all things considered, they are exceptionally particular PC programs made to do various exchanging capacities. If you are put on those brokers looking for a robot to perform automated exchanges for you, you must go with the best forex robot. Some of the forex robots are programmed to send signals to traders, while some FX robots can act upon those signals.

How is the forex market regulated?

Regardless of the huge size of the forex exchange market, you might not digest the fact that there is next to no guideline because there is no overseeing body to police it every minute of every day. All things being equal, a few public exchanging bodies the world over who administers homegrown forex exchanging, just as different business sectors, to guarantee that all forex suppliers stick to specific principles.

Can you get rich by trading forex?

Although anyone’s first reaction is a ‘no.’ but in the meantime, there are only a few people out there who know that yes, forex can make you money. Forex exchanging may make you rich if you are a multifaceted investment with profound pockets or a surprisingly talented money dealer. However, at the same time, for the normal retail merchant, as opposed to being a simple street to wealth, forex exchanging can be a rough interstate to colossal misfortunes and expected penury.

Forex for beginners

In an environment as unique as the forex market, legitimate preparation is significant. Whether you are a prepared market veteran or shiny new to cash exchanging, being readied is basic to delivering predictable benefits.

It isn’t easy. To guarantee that you have your most obvious opportunity to succeed in the forex market, it is basic that your hands-on preparation never stops. Creating strong exchanging propensities, going to master online courses, and proceeding with your market schooling are a couple of approaches to stay serious in the quick-moving forex climate.

On the off chance that you will likely turn into a reliably productive forex merchant, at that point, your schooling won’t ever stop. As the saying goes, careful discipline brings about promising results; while flawlessness is frequently subtle for dynamic merchants, being ready for each meeting should be standard.

Forex trading for becoming successful traders

Being the largest market in the market, forex features more than trillions of turnover daily. In simple words, the forex is a digital trading platform where investors, financial specialists, speculators, and liquidity suppliers from around the globe collaborate. It is essential for all those who are new to the foreign exchange to construct an instructive establishment before bouncing in with the two feet. Understanding the forex’s fundamental purposes is a basic part of finding a good pace as fast as could reasonably be expected. You’re ready to peruse a statement, evaluate influence, and spot orders upon the market. However, at the same time, it has been guided that if you are interested in the market and want to be a successful trader, then you must get the training done. You must also have deep knowledge about the forex robot so that you can choose the best forex robot.

Forex market

Ideas

Hi there, AUDNZD is setting up for another bearish wave. So time to watch for sell. Watch lower time frame correction and look for sell and watch it to go down for another bearish wave. Good luck

Hello everyone, if you like the idea, do not forget to support with a like and follow. On DAILY: AUDUSD is sitting around strong resistance in orange so we will be looking for sell setups on lower timeframes. On H4: AUDUSD formed a valid channel in blue but this pair is not ready to sell yet. We want the sellers to prove to us that they are taking over by.

Hello traders, here is the full analysis for this pair, let me know in the comment section below if you have any questions, the entry will be taken only if all rules of the strategies will be satisfied. I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied.

Hi there. Price is forming a continuation pattern to the downside. Watch strong price action at the current levels for sell.

Hi there. Price is forming a continuation pattern to the downside. Watch strong price action at the current levels for sell.

I think this is due to the usd strength. The right shoulder is forming and I will wait for a confirmation before taking the trade or even if any will take a trade now it will be with a bigger stop loss. I will keep updating this chart if necessary. Comment, like follow for more accurate ideas. Thank you.

Hi there. Price is forming a continuation pattern to the downside. Watch strong price action at the current levels for sell.

Hi there, USDJPY is setting up for huge bullish wave. DONT let that go without you. Watch price action on lower time frame and look for buy at bottom or new lowes or wait for my updates. Good luck

I'm waiting that price can make new uptrend and break this level soon. If this will happen we can open long position. As a main target we can take next resistance (1.38500).

The short-term range is 1.2349 to 1.2054. Its retracement zone at 1.2202 to 1.2236 is potential resistance. Today’s high fell just short of this zone.

This is my take on EURUSD. Let's see price go up to the next major resistance for over 300 pips! ***trade at your own risk***

Patiently waiting to patiently make a few bucks

On the 4 hour time frame, it shows a downward channel and price has broken out of the channel and starting to retest a key level. If price shows wick rejections and bullish sentiment, I would be buy bias. 3 different targets are plotted at 1.60000, 1.61500 and 1.62500 with a SL of 38 pips below structure. However, 1.62500 would be for longer term. A minimum total.

In my opinion price can pull back from upside of channel. We can open short position as soon as JPY will start falling. Support (102.000) can be our main target.

Entries and TP's are highlighted, if it breaks make sure you enter even though this thing be moving pretty slow. It easily rejects at resistance zones like very heavy so be aware for a possible semi-long drop as we get to resistance entry.

As I have predicted earlier, EURUSD has successfully bounced from 1.206 horizontal structure support. This week the price has set a nice local bullish trend on 4H with a higher low and two higher highs. I remain bullish biased and expect more growth, HOWEVER: now we see a completed harmonic abcd pattern formation. For.

☑️ EUR_GBP broke out of the reverse bear flag pattern and we are now seeing a nice pullback this signal is bullish and I think the pair will go UP to at least retest the nearest resistance but it can potentially go higher too! LONG↗️ ✅like and subscribe to never miss a new idea!✅

About

Currencies are traded on the foreign exchange market, also known as forex. This is a decentralized market that spans the globe and is considered the largest by trading volume and the most liquid worldwide. Exchange rates fluctuate continuously due to the ever changing market forces of supply and demand. Forex traders buy a currency pair if they think the exchange rate will rise and sell it if they think the opposite will happen. The forex market remains open around the world for 24 hours a day with the exception of weekends.

Before the internet revolution only large players such as international banks, hedge funds and extremely wealthy individuals could participate. Now retail traders can buy, sell and speculate on currencies from the comfort of their homes with a mouse click through online brokerage accounts. There are many tradable currency pairs and an average online broker has about 40. One of our most popular chats is the forex chat where traders talk in real-time about where the market is going.

So, let's see, what we have: diversify your investments and take advantage of the most traded market in the world. Trade currencies with ally invest forex. Trade over 80 currency pairs plus gold and silver in real at forex all

Contents of the article

- Top forex bonuses

- Diversify your investments and take

- Trade currencies with ally invest forex.

- Open a free $50,000 practice account.

- Open a live forex account.

- All that you require to know about forex...

- Related articles

- Best youtube to mp3 converter to...

- Top 5 intro makers for youtubers

- Common denial of services that you need...

- Forex trading: A beginner's guide

- What is the forex market?

- A brief history of forex

- Spot market and the forwards & futures markets

- Forex for hedging

- Forex for speculation

- Currency as an asset class

- Why we can trade currencies

- Forex trading risks

- Pros and challenges of trading forex

- The bottom line

- What is forex?

- Forex all

- Student testimonials

- The fundamentals

- Forex today: all eyes on the US dollar and...

- Secure login

- All that you require to know about forex...

- Related articles

- Best youtube to mp3 converter to...

- Top 5 intro makers for youtubers

- Common denial of services that you need...

- Forex market

- Ideas

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.