Cryptocurrency brokers uk

Hi, is coinbase a good platform - offers 17 crypto assets such as bitcoin, ethereum, litecoin etc.

Top forex bonuses

- largest in cryptocurrency trading.

- market open 24/7

- spread as low as 0.75%

- leverage 1:2

Best cryptocurrency trading platform 2021

Which is the best cryptocurrency trading platform in the UK? Our seasoned traders have, in december 2020, tried out all the major platforms for cryptocurrency trading in the UK and we’ll give you all the answers. Also in this article, how does cryptocurrency trading work? Where can I trade cryptocurrency? How do I trade cryptocurrency for cash? And how will cryptocurrencies and their unique features revolutionize the ways we exchange value and minimize trust?

Table of contents

- Best cryptocurrency trading platforms in the UK in 2021

- How to choose the best cryptocurrency trading platform?

- The cryptocurrency trading market

- Is cryptocurrency trading a hype?

- How to buy cryptocurrency?

- The difference between buying and trading cryptocurrencies

- What is a cryptocurrency and how does it work?

- What does trust minimization/censorship resistance mean?

- Why is bitcoin the biggest cryptocurrency and why is it likely to retain that title?

- The ups and downs of bitcoin

The 6 best cryptocurrency trading platforms in the UK are:

- Avatrade cryptocurrency trading platform

- Etoro cryptocurrency trading platform

- Pepperstone cryptocurrency trading platform

- Primexbt cryptocurrency trading platform

- Plus500 cryptocurrency trading platform

- Octafx cryptocurrency trading platform

Best cryptocurrency trading platforms in the UK 2021

Here you have the answer to where you, as a UK trader, can trade cryptocurrency. The following are solid brokers, that can be trusted and offer trading in both bitcoins and other major cryptocurrencies such as ethereum and litecoin. Take into account the quick facts of each broker in the top list and then read a more in-depth review of the broker and trading platform by clicking on the “read review” link:

- 24/7 cryptocurrency trading with support in 14 languages

- no hidden fees

- trade against fiat currencies.

- leverage 2:1(EU) 25:1(outside EU)

72% of retail investor accounts lose money when trading cfds with this provider.

- offers 17 crypto assets such as bitcoin, ethereum, litecoin etc.

- largest in cryptocurrency trading.

- market open 24/7

- spread as low as 0.75%

- leverage 1:2

75% of retail investor accounts lose money when trading cfds with this provider.

- crypto cfds are not available to UK retail clients.

- leverage 1:2

- no commission fees

- hedge on single account

- trade BTC, litecoin, ethereum, dash bitcoin cash

74-89% of retail investor accounts lose money when trading cfds with this provider.

- accepts bitcoin payments

- available across the globe

- trade all cryptocurrencies

- leverage 1:2

- trade all major cryptocurrencies

- long and short trading

74% of retail investor accounts lose money

- leverage up to 1:5

- no commissions

- spreads from 160.0

- start from 0.01 lots

- if you want to trade crypto with BD swiss you can do so by choosing FSC regulation

74-89% of retail investor accounts lose money

- offers trading in bitcoin, litecoin and ethereum

- 1:2 leverage

- $100 min. Deposit

- 24/7 cryptocurrency trading

How to choose the best cryptocurrency trading platform?

Our first recommendation is that you choose a trading platform that is regulated. You have to feel safe with your investment. The best crypto platforms in the UK are regulated in different jurisdictions as you can see in the top list above. The second important criteria you should look at is what cryptocurrencies are offered by the trading platform. And the third and very important criterion is how much it will cost you to trade on that crypto trading platform and how you can withdraw your money if you want to let go of your investment.

The cryptocurrency trading market

Cryptocurrencies surprised many people in 2015-2017, through the massive price-explosion many of them have gone through. Bitcoin is obviously the foremost exponent of the crypto industry and its price evolution has been the most spectacular thus far, see the ups and downs of bitcoin below. Volatility has always been a sort of natural accessory of the cryptocurrency markets, and it, coupled with the unprecedented gains registered by the market as a whole, has turned cryptocurrencies into extremely attractive potential investment vehicles.

Is cryptocurrency trading a hype?

More and more people are interested in purchasing cryptos as an investment and more and more people are worked up about trading various crypto-based financial products. The hype is understandable: while other asset classes yield absolute maximums around the 30% mark per year, with bitcoin and its ilk, we’re talking about growth in the neighborhood of 1,000%. Above and beyond the cries of “bubble” it elicited, this ridiculous accrual of value has caught the attention of hedge fund and mutual fund managers, who now see in cryptos a very attractive way of expanding their investment portfolios.

How to buy cryptocurrency?

The most rudimentary form of cryptocurrency trading is about purchasing and holding the currencies. Crypto exchanges provide the backdrop for this type of trading, which is essentially just a newer take on the age-old buy-low-and-sell-high angle. Such investors thrive under extreme volatility and the fact that by nature, bitcoin is a deflationary currency (there’s a limited number of btcs that will ever exist), gives them a nice theoretical safety-cushion.

The difference between buying and trading cryptocurrency

Based on the above-said, it is hardly a surprise that existing online forex/CFD brokerages have already gotten in on the ground-floor of cryptocurrency trading. Though most such operators advertise that they support the trading of bitcoin, what they offer are in fact bitcoin-based cfds (contracts for difference). Cfds are financial derivatives, which means that when trading them, traders don’t actually get to own any cryptocurrency. Instead, they work with the difference between the exit- and entry-prices of their trades. With cfds, the amount by which the underlying asset price goes up (or down) is crucial, as it determines the actual profits (or losses) traders will incur.

Such crypto cfds are featured by scores of brokers. In fact, the setup has become a sort of fad among online brokers, and all those who fancy themselves cutting edge, have pinned them to their product selection, as you can see above in our top list.

What is a cryptocurrency and how does it work?

A cryptocurrency is a virtual/digital cash, payment, and settlement system, that is double spend- and counterfeit-proof. Most cryptocurrencies use a blockchain to achieve double-spend protection. The ones that are decentralized offer several other features, such as:

- Trust minimization.

- Censorship resistance.

- Permission-less nature.

How does a cryptocurrency work?

Cryptocurrencies are virtual coins/tokens that people exchange online in a peer-to-peer manner, without an intermediary. The value of a crypto coin is defined by the market. More precisely, by what people are willing to pay for it.

On a deeper level, the value of a cryptocurrency also hinges on its utility. Scalability and transfer speeds are variables in the value equation as well.

Every cryptocurrency resides on a network. This network may be a decentralized or centralized one. In the case of bitcoin, we are talking about decentralization. The more people mine or stake a given cryptocurrency, the more decentralized its network becomes.

That raises the question: what is cryptocurrency mining?

Crypto miners are the backbone of pow (proof of work) cryptocurrency ecosystems, such as bitcoin’s. Mining consists of the painstaking churning of data with the help of specialized hardware. In addition to solving complex mathematical problems, miners also verify and add transactions to the blockchain ledger. They transmit and log transactions. They also verify and maintain the ledger. Miners get newly minted coins as a reward for their efforts and the energy they expend through computing power.

Pos (proof of stake) networks require participants to keep set amounts of digital coins in special wallets. The proof of stake method does not require computing power and it does not use up any energy to that end.

What does trust minimization/censorship resistance mean?

According to some, bitcoin is trustless. What this means is that A can pay B without the need for a third party to provide trust. According to nick szabo, one of the fathers of the cypherpunk movement, bitcoin is trust-minimized. It is as close to being trustless as possible, but it is not completely trustless.

From trust minimization stem some other attractive features. Bitcoin is permission-less. Meaning that it can be transferred from one person to another, across the globe if needed, without the permission of a third party.

As such, the cryptocurrency is also censorship-resistant. There is no trust-providing intermediary involved in transfers, which could censor certain payments. Bitcoin is a lot like cash: as long as A wants to hand it to B, there is nothing anyone can do to prevent the transfer.

Why is bitcoin the biggest cryptocurrency and why is it likely to retain that title?

As the first widely-known cryptocurrency, bitcoin enjoys something called “the first-mover advantage”. It has been around for more than ten years now. By simply being around, it has proven its feasibility to some degree. This is more than other cryptocurrencies can boast.

Furthermore, despite being somewhat clunky and cumbersome, bitcoin is not an inflexible contraption. It is programmable money. It enjoys the backing of some of the brightest minds in the industry. Bitcoin can change and incorporate changes necessary for its survival in the future. It could theoretically even adopt a pos consensus model instead of the currently used pow, although such a move is not likely.

Given these attributes, some say it is futile to search for the “better bitcoin”. Bitcoin itself is capable of changing and improving, thus becoming the better version of itself.

The ups and downs of bitcoin

Over its decade-long existence, bitcoin has been a highly volatile digital asset. It went through several boom-and-bust cycles. After each such cycle, however, it managed to hold on to some of its gains.

Interestingly, these boom-and-bust cycles have coincided with bitcoin’s halving. Every four years or so, the mining reward for bitcoin is cut in half. Currently, miners earn 12.5 bitcoins every 10 minutes in the shape of block rewards. After may 2020, this reward will be just 6.25 bitcoins every 10 minutes.

The increasing scarcity of the digital asset explains these cycles up to a point. Beyond that, human greed and emotions step up and run away with the price.

Analysts have worked out predictions regarding BTC’s post-halving price, based on past data. Such exercises are hardly exact (or reliable), however. They predict massive price gains and another parabolic bull run, sometime after the halving.

Thus far, we have had three such cycles. The latest one, that of december 2017, took the price of one bitcoin to almost $20,000. If you want to trade bitcoin you can use one of the best crypto trading platforms in the UK above. For further reading, you can see our reviews of the overall best trading platforms in the UK here.

Please comment below

Pepperstone don’t trade bitcoin

Please note that crypto currencies are no longer available to clients under the FCA licence

Thank you for your comment. We are just in the process of updating that information now.

They do offer it for professional traders(for now at least)

Hi, is coinbase a good platform

To buy and sell bitcoin and other cryptocurrencies it’s probably the largest and most likely the best.

I am new to crypto trading. I have been following the market only for the past three months, and believe I am now ready to trade … however, I have some concerns about the comments in your article on CFD’s.

How do you know if your ‘purchase’ is part of a CFD or a straight purchase of crypto coins ? Are there good brokers who confirm I can just hold my coins, or do I have to specify ?

Apologies if this is a naive question.

Hi tim,

your question is a good one.

With etoro you actually own the bitcoin and don’t trade in CFD’s.

The other brokers on the list only offer CFD’s.

Let us know if you have any other questions. Thank you.

Has anyone heard of spectrum24pro? They are a crypto trading platform. I hear they are new but I cant find anything about them except for their website

Hi, it is not a platform we have heard about.

You should be cautious with platforms that are note well known in these times!

Can anyone tell me if they’ve used limeberg as a company to trade through.They provide you with an account manager who rings you weekly to advise on which trades to make and seem very competent.However I put in for my first withdrawal 2weeks ago and it’s still showing as pending in my account even though the account manager has told me it’s been sent to wondercoin.Com for conversation then to my bank?

Is this normal practice and how long should it take?

Hi, its not someone we have used or heard of. Maybe one of our readers can help you.

Thank you for your comment.

Can anyone tell me if they have tried fotrading.Com for trading cryptos. Is it trust worthy.

Hi, it’s not a crypto trading platform we’ve used. Maybe one of our other readers have?

Fxdailyreport.Com

Over the last few years, cryptocurrency trading has become one of the most attractive niches in forex trading. Other than it being extremely profitable, the lack of regulation is its biggest appeal. Still, cryptocurrencies like bitcoin, ethereum ripple, dash, and litecoin are dynamic, unstable instruments that need to be handled cautiously and in the most optimal way. To achieve this, you need to choose a trustworthy, well-established broker to carry out your cryptocurrency trading.

This is crucial to getting on the right track from the beginning when trading cryptocurrencies. When choosing a broker, it is important to note that not all are the same. A broker that meets the needs of another trader may not meet yours. Here are a few tips to help you choose the best forex broker for cryptocurrency trading:

- Regulation and reputation

To avoid dealing with an unprofessional broker and being scammed, you need to make sure all your crypto trades are made solely with a regulated broker. When choosing a forex broker to work with, make sure they are regulated within your jurisdiction to legally offer you their services. Regulated forex brokers are under constant supervision of the regulatory body. If you are in the UK, make sure to trade with a broker that is regulated by the FCA. If in europe, ensure they are regulated by the cysec. In case you are in australia, they should be regulated by the ASIC.

- An efficient trading platform

It is important to note that cryptocurrency trading is more volatile than forex. Therefore, it demands that the platform is superbly responsive to be able to make moves in time. A good broker’s platform should be efficient to use. To beat the competition, the best cryptocurrency brokers work to attract clients by creating an intuitive trading platform that is suitable for both experienced and new traders. They offer technical analysis tools and basic risk management features like take profit or stop loss. Other sites also offer additional features, including price alerts, social trading networks or advanced educational centers. The crypto trading platform should allow you to trade in the market manage your accounts, perform technical analysis, and receive the latest news on all cryptocurrencies.

Top recommended crypto forex brokers in 2021

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: 0 spread: non-spread, fee 0.1% per trade leverage: non-leverage regulation: - | visit broker | ||

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $100 spread: starting 0 pips leverage: up to 400:1 regulation: FCA UK, NFA, CFTC, ASIC, IIROC, FSA, CIMA | visit broker | |

| min deposit: $300 spread: floating, from 0 pips leverage: 500:1 regulation: FCA UK reference number 579202 | visit broker | ||

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: no minimum deposit spread: 1.2 pips leverage: 50:1 regulation: CFTC, NFA, FCA, MAS, ASIC, IIROC | visit broker | |

| min deposit: $10 spread: leverage: regulation: cysec | - | visit broker | |

| min deposit: $200 spread: from 3 pips leverage: 400:1 regulation: NFA, FCA, cysec | visit broker |

- Transparent fees and commissions

All brokers, whether trading crypto coins or forex, charge commissions and offer margin accounts to traders. A reliable forex broker for crypto coins should inform you precisely the type of fees and commissions they charge as well as the risks involved. The common fees and charges made by brokers include:

• wallet fees

• transaction fees

• trading fees

- Competitive technology

The last thing you want as a crypto trader is to get margin called simply because you could not log in to close an order. The cryptocurrency trading market is a 24/7 global market. The prices keep moving and are not limited to your time zone. Hence, when choosing a broker, you need to choose one whose platform offers full-time access.

For instance, when trading cryptocurrencies, mobile apps are a necessity as you may need to make or break deal-critical decisions throughout the day. If possible, consider using a reputable broker with a mobile app so that you are able to make successful trading decisions even while in transit.

- Access to crowd wisdom

Today, there are some broker platforms that let you leverage the wisdom of seasoned cryptocurrency traders. This feature can go a long way in improving your returns on investment. Such a trading platform lets you observe the hottest trading trends of other seasoned and successful traders in the market.

Digital currencies trading keeps growing in popularity by the day. More and more people, be it speculators or beginner traders want to be able to make key decisions on time, every minute. Therefore, they need to have a setup ready as soon as they are verified by a broker. When choosing a cryptocurrency broker to trade with, consider one that can quickly get you started so that you can begin trading with minimal downtime.

- User-friendly platform

This is one of the most important features to consider when choosing a trading platform to trade with. Digital money trading can be unclear, especially when a technical language is used. Also, because digital money works a little bit differently from any traditional money system. A good broker should be able to understand blockchain and cryptography terms. They should make an effort to explain it in their platform to make it easy to understand by a layman.

They should include clear notifications about the spreads offers, leverage available, deposit methods, the minimum cryptocurrency deposit to trade and the least amount that can be placed in a trade. Make sure you are able to establish all these details before registering with a broker.

- High-quality customer service

Cryptocurrency trading occurs 24/7. This demands the need for round the clock customer support. Better still, live support is highly preferred over auto attendants taking into consideration the intricacies involved in trading digital currencies.

- Deposits and withdrawals

Make sure to choose a broker that allows deposits and withdrawals through multiple platforms such as wire transfer, credit/debit card e-payment among others.

- Good financial backing

A good FX broker for cryptocurrency should have a sound financial backing. This ensures that your digital coins are safe and that the forex broker will not go bankrupt soon after signing up with them.

Cryptocurrency trading is a risky investment. New and fraudulent forex brokers for cryptocurrency trading are emerging every month, launching with crafty marketing campaigns intended to prey on an innocent investor. Therefore, ensure you proceed with caution. Cryptocurrencies are extremely volatile instruments to trade. So, ensure you are in the know of any breaking news, regulatory matters, and rumors which all dictate the market behavior. Above all, make sure you are working with a reputable, reliable and experienced broker.

While it would be easier to point a finger and tell you the best crypto broker, we know and understand that each client has different preferences. Be knowledgeable about all your options and think about how you can spot a broker that is safe now, and in the long-run.

Best cryptocurrency brokers

Luke jacobi

Contributor, benzinga

Want to jump straight to the answer? The best crypto platform for most people is definitely etoro.

Many people believe that cryptocurrencies are the future of finance. When you’re ready to leap into crypto, choosing a broker to trade or invest in cryptocurrencies is one of the most important steps to your success in the crypto market.

Get started now with benzinga’s picks for the best cryptocurrency brokers and choose the right one for you.

Best crypto brokers and trading platforms:

- Best for social trading: etoro

- Best for ease-of-use: gemini

- Best for new investors: coinbase

- Best for gold investments: itrustcapital

- Best for high-volume forex traders: cryptorocket

- Best for accessibility: altrady

- Best for multiple exchanges: voyager

- Best for security: kraken

Best crypto brokers

Since different brokers have different strengths, you need to figure out what kind of broker best suits your cryptocurrency interests. Some brokers provide a social trading platform where you copy other cryptocurrency traders’ trades in your own account. Others can offer the ability to make transactions in a broader selection of altcoins.

Choosing the best crypto broker depends largely on addressing your needs as an investor or trader. The following list crypto brokers been selected for different reasons to meet the needs of differing cryptocurrency trading and investing styles.

Commissions

Account minimum

1. Best for social trading: etoro

Etoro fundamentally changed the way many people trade and invest with its social trading platform. Social trading involves mirroring another trader or investor’s transactions in a special social trading account. While you make the same amount proportionally as the trader you’re copying, you also take the same percentage of losses the trader takes in their account.

In addition to its regular crypto trading platform, etoro offers an advanced cryptocurrency exchange platform called etorox. This platform is designed for algorithmic traders and institutional grade investors. It offers traders access to tight-dealing spreads, and its algox application programming interface (API) can be used to create custom automated trading tools.

Commissions

Account minimum

2. Best for ease-of-use: gemini

Stay on top of market trends, build your crypto portfolio and execute your trading strategy with gemini’s easy-to-use tools. The gemini app is available on all the major app stores, and it puts the industry’s best crypto exchange and wallet in your hands.

Gemini’s app is easy to use. You can track asset prices and real-time market prices and set price alerts so you can act fast on price movements for individual assets. You can also schedule recurring buys on bitcoin and other cryptocurrencies.

Invest with peace of mind with gemini’s solid cybersecurity and custody solutions. Create a free account and make your 1st buy in as little as 3 minutes.

Commissions

Account minimum

3. Best for new investors: coinbase

Coinbase is 1 of the largest and oldest cryptocurrency exchanges. It currently services 35 million customers worldwide. Coinbase has extensive educational resources and an intuitive interface ideal for new traders and investors.

The exchange also provides clients with a hosted wallet and offers global customer support. Coinbase is an excellent choice for those new to the cryptocurrency market who do not wish to use social trading services.

Pricing

Account minimum

4. Best for gold investments: itrustcapital

Itrustcapital is 1 of the few cryptocurrency brokers that lets you trade and hold physical gold in your individual retirement account (IRA). You can also trade bitcoin (BTC), ethereum (ETH), litecoin (LTC) and bitcoin cash (BTH) in your IRA. Itrustcapital provides you with a personal wallet by curv for your crypto transactions.

While itrustcapital has no minimum trade or account size, the company charges account holders a flat fee of $29.95 per month. This amount includes all IRA fees, asset custody charges and access to its trading platform, although all cryptocurrency trades carry an additional 1% transaction charge based on the trade size.

If you’re planning for your retirement and want to add physical gold to your cryptocurrency portfolio as an inflation hedge, then itrustcapital is a solid choice.

5. Best for high volume forex traders: cryptorocket

Cryptorocket offers straight through processing (STP) to its trading clients. This means you deal directly with the crypto and forex markets and not through intermediaries or market makers. This broker model is ideal for high volume forex traders who tend to be sensitive to dealing spreads.

In addition to the 35 crypto pairs offered, you can trade 55 fiat currency pairs, 64 major stocks and 11 indices. If you are based in a jurisdiction with relatively lax retail forex trading regulatory oversight, you may even be able to take advantage of cryptorocket’s 500:1 maximum leverage ratio for forex trades.

Cryptorocket also supports the popular 3rd-party metatrader4 trading platform.

6. Best for accessibility: altrady

Altrady is built by crypto traders for crypto traders. It makes cryptocurrency trading accessible for beginner, intermediate and advanced traders.

You can get the tools that professional crypto traders use without the expensive price tag. Altrady’s platform is intuitive and easy-to-use. Its crypto trading software platform adapts to your needs.

It combines 10 connected exchanges. It also offers immediate price alerts, portfolio manager, break-even calculator, and customizable trading pages by allowing traders to manipulate widgets to create preferred layout in order to trade comfortably, limit ladder order, gain quick access to market tabs, and integrated market scanners.

Commissions

Account minimum

7. Best for multiple exchanges: voyager

Voyager connects to more than a dozen of the most trusted and secure crypto exchanges so you have access to the largest crypto trading market available anywhere. Voyager gives you faster, more reliable execution, plus:

- Access to multiple exchanges: voyager partnered with over a dozen of the most trusted and secure crypto exchanges and liquidity providers. Voyager’s exchange connectivity offers you competitive prices on your trades and faster, more reliable execution.

- Commission-free trading: voyager operates commission free to save you money. You save money on trades through its extensive crypto market and best execution technology. Voyager achieves price improvement on over 90% of customer orders.

Start trading at a better price today! Download the voyager app today.

8. Best for security: kraken

Kraken takes a comprehensive approach to protecting your investments and builds in a number of sophisticated methods to prevent money or information theft.

- Financial stability with full reserves

- Healthy banking relationships

- The highest standards of legal compliance

Crypto advantages vs. Disadvantages

Trading and investing in cryptocurrencies often carry a considerable degree of risk, as you may have observed given the volatility of bitcoin and some other digital currencies. Despite the disadvantages currently associated with cryptos versus fiat currencies (like lower liquidity and minimal payment options), the advantages of holding cryptocurrencies will increase as they become a more common form of payment.

Here’s a quick shot of crypto advantages and disadvantages.

Advantages

- Security. Technology advances typically lead to increased intrusion into your privacy. In contrast, all identities and transactions are strictly secured in the digital currency environment. While most cryptocurrency transactions are very secure, you still could be vulnerable to cybercriminal actions, like hacking.

- Low transaction fees. Because of the elimination of intermediaries like financial institutions, cryptocurrency transaction fees are generally quite low.

- Decentralized. The lack of a central exchange or authority overseeing cryptocurrencies is one of their defining characteristics. Many people consider this among the biggest advantages of cryptocurrencies and blockchain technology.

- High potential returns. You only have to look at a long-term bitcoin price chart to get an idea of the returns you can make investing wisely in digital currencies. The crypto world is still developing and expanding, so investing in the right digital currency now could translate into considerable returns in the future.

Disadvantages

- Acceptance. Because digital currencies have not yet become mainstream, most businesses will not accept them as payment for goods or services. This situation will eventually change as public perception makes digital currencies more acceptable as forms of payment. For example, paypal has recently allowed customers to hold bitcoin balances and has plans to allow payments using that cryptocurrency by early 2021.

- Volatility. The market volatility observed in some digital currencies can lead to large gains or large losses. Trading and investing in crypto is not for everyone, especially those with a low pain threshold or aversion to risk.

- Taxes. The internal revenue service (IRS) states on its official website that “virtual currency transactions are taxable by law just like transactions in any other property.” that IRS web page also links to a guide about how existing general tax principles apply to transactions made using digital currencies.

- Illegal activities. Due to the fact that digital currency transactions generally provide identity security, many people operating outside the law are thought to use digital currency for illegal activities. These activities could include money laundering, “dark web” transactions, and drug and human trafficking.

Cryptocurrency vocabulary

Like many other financial markets, the cryptocurrency market has evolved its own jargon. Some of the key terms used by market operators are defined below.

- Block. A collection of transactions permanently recorded on a digital ledger that occur regularly in every time period on a blockchain.

- Blockchain. A constantly growing list of blocks in a peer-to-peer network that records transactions.

- Cryptocurrency exchanges. Also called digital currency exchanges, these generally consist of online businesses that allow customers to exchange cryptocurrencies for fiat currencies or other cryptocurrencies.

- Cryptocurrency wallet. A secure digital account used to send, receive and store digital currencies. Crypto wallets can either be cold wallets that are used for storing cryptos in an offline environment or hosted wallets that are hosted by 3rd parties. Hosted wallets store your private keys and provide security for your digital currency balances.

- Distributed ledger. A network of decentralized nodes or computers that connect to a network where transaction data is stored. Distributed ledgers do not have to involve cryptocurrencies and can be either private or permissioned.

- Fork. Also known as a “chain split,” a fork is a split that creates an alternate version of a blockchain that then leaves 2 blockchains running simultaneously. For example, bitcoin and bitcoin cash came about due to a fork in the original bitcoin blockchain. Another type of fork is known as a “project” or “software fork.” this occurs when cryptocurrency developers take the source code of an existing altcoin project and create a new project. For example, litecoin is a project fork of bitcoin.

- ICO. An initial coin offering (ICO) occurs when a new digital currency or token is sold, typically at a discount, to its first set of investors. An ICO lets issuing cryptocurrency companies raise funds from the public to support their coin’s development and maintenance.

- Mining. A computationally-intensive process performed within a cryptocurrency network where blocks are added to the blockchain by verifying transactions on its distributed ledger. Miners are rewarded with digital coins as compensation for their successful computational efforts.

Are you ready for the future?

Digital currency and the blockchain appear to be the future of finance. Despite their current typical volatility and lack of widespread acceptance as a payment method, cryptocurrencies seem destined to become increasingly used for online payments. They could therefore make an interesting long-term investment, especially if you have a strong appetite for risk.

Where we will be in 20 years is anyone’s guess, but cryptocurrencies and blockchain technology show growing promise as forces to be reckoned with in the financial world. Get started today with 1 of our recommended crypto brokers.

Try gemini

Gemini builds crypto products to help you buy, sell, and store your bitcoin and cryptocurrency. You can buy bitcoin and crypto instantly and access all the tools you need to understand the crypto market and start investing, all through one clear, attractive interface. Gemini crypto platform offers excellent account management options. You can manage your account at a glance, view your account balance 24-hour changes and percent changes. Get started with gemini now.

Best cryptocurrency brokers for 2021

Daniel ‘harris’ major

I have tested 40+ crypto brokers. You can find the best cryptocurrency brokers below. This is by far the easiest way to get started with cryptocurrencies.

Cryptocurrency trading has become really popular in the past years. It’s growing more ever year.

Many big trading brokers have already added some of these cryptocurrencies. Everybody can sign up and start trading bitcoin or other crypto coins. This is the easiest and probably the simplest way to invest in cryptocurrency.

After trying out most brokers, here are the best cryptocurrency brokers:

Best cryptocurrency brokers (non-US traders only)

Plus500 – top rated trading platform

Plus500 is a big name in the trading industry. They have a really low minimum deposit requirement and a great trading site.

Buy/sell cfds on bitcoin in addition to buying stocks, commodities, forex etc (traded only through cfds). Plus500 is the most complete trading platform.

- Trade cfds on bitcoin & many other cryptos

- Minimum deposit is only $100

- Regulated and trusted platform

- Very fast signup process

- Live chat

- Many payment methods (even paypal)

- You cannot withdraw any cryptocurrency

- You have to complete a questionnaire, upon sign up

Plus500 disclaimer: 76.4% of retail CFD accounts lose money.

IQ option – lowest minimum deposit ($10)

If you don’t want to make a huge initial investment, then IQ option is the best broker for you. The minimum deposit requirement is only $10. This is by far the lowest in the industry.

- You can trade many cryptocurrencies

- Minimum deposit is only $10

- Best trading platform

- Multiple account currencies

- Free demo account

- Regulated by CYSEC (#247/14)

Etoro – top crypto broker

Etoro is a really popular trading site. They have been around since 2006. Etoro is regulated by CYSEC, FCA and ASIC.

Buy/sell bitcoin on etoro in addition to buying stocks, commodities, forex etc. Etoro is the most complete trading platform.

- Trade bitcoin & many other cryptos

- Minimum deposit is $200

- Regulated and trusted platform

- Australian traders are also accepted

- Great support team

- Many payment methods (even paypal)

- You cannot withdraw any cryptocurrency

- You have to complete a questionnaire, upon sign up

Etoro disclaimer: 71% of retail CFD accounts lose money.

Highlow – best all-round crypto broker

Due to regulation highlow stopped accepting traders from the EU and UK.

Highlow is an australian trading broker (AFSL no.364264). What I like most about this broker is the intuitive platform. It is so easy to use. Especially new traders will like the clean layout.

I’ve been using highlow for a few years now and I never had a problem. Highlow publishes their number of trades on the homepage. There are millions of trades on this broker each month.

I use the main platform which is web based. This means, that you don’t have to download any software. This platform is stable and safe (they use SSL).

I have also tried the ios app and the android app. They are great, but I just don’t like trading on smartphones in general.

The payouts on highlow are amazing (up to 200%, which is more than on other brokers).

Highlow is a great broker for cryptocurrencies (but only if you are not from EU,UK, US). They have a good reputation, great support team and awesome promotions for new traders.

- Trade bitcoin & other cryptos

- Minimum deposit is only $50

- Regulated and trusted platform

- Fastest signup process (no questionnaires)

- Multiple account currencies

- Free demo account (no registration needed)

Nadex – US traders welcome

Nadex is a CFTC regulated broker. In fact, this is probably the only US broker that has this regulation.

Only US traders are allowed on nadex. Non-US traders check out the next broker.

Update OCTOBER 2019: looks like nadex removed crypto trading. After contacting them I found out that they will add it back soon. Register on nadex now and get updated when they add it.

Recently, nadex started offering bitcoin trading.

- Trade bitcoin, forex or binary options

- Minimum deposit is $250

- CFTC regulated broker

- Great support team

- Many payment methods (even paypal)

Crypto brokers with most cryptocurrencies

Here are the most popular cryptocurrencies offered by cryptocurrency brokers:

- Etoro – bitcoin, ethereum, litecoin, dash, ethereum classic, NEO and ripple.

- Plus500 – bitcoin, ethereum, litecoin, bitcoin cash, ripple, IOTA.

- Avatrade – bitcoin, ethereum, ethereum classic, ripple, dash, bitcoin cash litecoin, monero and NEO.

Lowest minimum deposit brokers

These are the best brokers with low minimum deposit requirements:

- Etoro – $200

- Plus500 – $100

- Avatrade – $100

This is really important because the crypto market itself is unregulated. Depositing on a regulated broker means that your money is safe.

We’ve also looked at the support team and the payment methods. You can deposit easily using multiple payment methods on the brokers below.

Top rated brokers that have cryptocurrencies

While we are all familiar with the broad definition of a broker, is there something more to it when it comes to cryptocurrencies?

Simply put, a cryptocurrency broker refers to a website that traders will visit to trade cryptocurrencies at a set price. In many ways, they are similar to forex brokers whose services are a lot more familiar to the general public.

Etoro disclaimer: 71% of retail CFD accounts lose money.

You still can’t decide which broker is best for you?

How to choose your cryptocurrency broker

Is leverage really necessary? Cryptocurrency markets are volatile in nature with prices fluctuating immensely thereby generating high profits even in the absence of leverage. But for some traders, the desire for more earnings justifies the use of leverage.

Before choosing your broker, settle yourself on whether the already immense profits that come from a cryptocurrency market are enough for you or you would like to use leverage to enhance them even further, bearing in mind, of course, that will also significantly increase the risk factor to your funds.

Negative balance protection: it is always advisable to trade with a broker that affords the negative balance protection facility. That way, you will never be at risk of losing more than what you invested in case you sustain very heavy losses.

How suitable is the required capital for you? This is another subjective part to your decision. Do you prefer trading with a small capital or bigger one to help you zero in on bigger returns? Find out what size trades your broker is offering before you open an account.

Narrow spreads for the win: let us be honest, it is only fair that your broker gets a cut from the money you generated having provided you with the essential facilities for it and all. But let us be honest, you definitely want every last dime for yourself.

A spread refers to the difference between the buying price and selling price of a trade and it varies with each broker. The spread is what counts as fees for your broker so the smaller it is, the lower the cost will be on your part.

Lets go into what aspects you as a trader must consider when choosing a broker to trade cryptocurrencies.

Which cryptocurrencies are you interested in trading?

Make sure you have decided on which cryptocurrencies you want to trade in before signing up with your broker.

If your choice is a prominent cryptocurrency like bitcoin (official site), litecoin (official site), or ethereum(official site), there will be a relatively broad availability of brokers that have trading options for those. However, less prevalent examples like monero, IOTA, or zcash may be a little harder to come by.

So study the cryptocurrencies being offered by a broker before you sign up for an account.

Pros and cons of cryptocurrency brokers

Here are some features that these broker have or don’t:

pros

- Signup up with a crypto broker is probably the fastest way to get started with cryptocurrency trading

- If you are less tech-savvy then a broker is safer for you

- You can start buying cryptocurrency while traditional exchanges don’t always accept this payment method

- Most of the time you can’t withdraw cryptocurrencies from a broker. You have to exchange it back to fiat money (USD/EUR etc.)

Cryptocurrency brokers – what to look for

Here are some of the more understated details about your cryptocurrency broker that could make your trading experiences so much more efficient and successful.

1. What are the weekend hours like?

This is a key detail that distinguishes cryptocurrencies from other prominent trading markets like forex, futures, and equity. Cryptocurrency brokers operate during the weekends as well.

There is virtually no difference in purchasing bitcoin at the end of the week as opposed to the middle of the week during peak hours.

But there is a catch. While digital currency exchanges are available during the weekend, your broker may not (why is the stock market closed on the weekend?). So in effect, if there is considerable movement within your relevant cryptocurrency market during a weekend when your broker is not operating, you may not have the ability to respond in any way.

2. How is it hedging?

Your broker is probably not keen on revealing if it is hedging cryptocurrency traders but it is important information for you to know.

Why is it so important for you to know?

Because, as a trader, you want to be absolutely in the clear regarding the policies for risk management being followed by your broker. Let us not forget that cryptocurrency markets are extremely volatile and an unhedged broker is more easily prone to major losses incurred by its clients. Naturally, those costs will warrant compensation via fatter spreads and additional costs for traders. It will be best to sign up with a broker that will not withhold the relevant information from you.

More great features you could be interested in

Commissions and trading on margin – an important thing to note while trading cryptocurrencies is that their prices tend to be more similar to equities than they are to real currencies. So your broker could be charging you commissions in addition to a wide spread on each trade. That, of course, raises the cost probably a bit much for your liking.

Another similarity with equities is that the margin conditions with cryptocurrencies are significantly more than they are with forex or cfds. Consequently, leverage is usually up to 10x. How considerable the margin rate will be for traders is down to what trading strategies and risk management they subscribe to.

Authenticity of market data – aside from merely evaluating how it influences spreads, market data for cryptocurrency CFD prices can be a good indicator of how the quality of the product will be in the future.

One of the more recent examples of this is BTC-e which was an immensely popular platform for trading bitcoin before it was shut down by feds. BTC-e was the first bitcoin exchange to incorporate forex trades and so made their exchange accessible via MT4 and supplied cryptocurrency liquidity for brokers.

But once it was shut down, every broker that depended squarely upon BTC-e was left with no hedging options or market data to put a price on its crypto cfds.

Are short sales available? For many traders, shorting is a crucial strategy option, the lack of which can be a deal breaker with a potential broker. Many brokers tend to offer ‘long’ only since there are only a few hedging solutions when opening short trades.

As you see, investing in cryptocurrencies can be a truly lucrative venture for you but only if you get it right.

And a lot of that is down to which broker you decide to trade with.

Ready to start trading?

Trade with the cryptocurrency brokers listed above to make sure that your money is safe, you pick a broker with a stellar reputation and you keep the fees low. Excel at trading bitcoin by creating your own trading strategy.

These cryptocurrency brokers make it really easy to trade bitcoin and other coins. You don’t have to be a trading expert. It helps if you know what a blockchain is or how the ledger and transactions work, but this is all optional.

Sign up now and see for yourself how easy it is to get started.

Compare cryptocurrency brokers

For our trading cryptos comparison, we found 13 brokers that are suitable and accept traders from united states of america. Disclaimer: availability subject to regulations.

We found 13 broker accounts (out of 147) that are suitable for trading cryptos.

Between 54-87% of retail CFD accounts lose money. Based on 69 brokers who display this data.

The ultimate guide to

What are cryptocurrencies?

The word “cryptocurrency” is thrown around a lot these days, but what is it really? Some say it’s the greatest technological breakthrough of our time, while some say it’s the biggest scam of our time. But few people can actually explain what it is. In this article, we help shed light on the topic of cryptocurrencies.

Cryptocurrencies are digital or virtual currencies that use cryptography to secure and verify transactions so that they work as a medium of exchange. Cryptography is also used to control the number of units and prevent changes to the cryptocurrency’s code unless certain conditions are fulfilled.

As well, cryptocurrencies have three characteristics that they all share in common.

They are trustless. Meaning no third party is involved by replacing trust verification with a peer to peer network. Individuals can directly send cryptocurrencies to one another without permission or control from corporate institutions or governments.

They are immutable. Cryptocurrency transactions cannot be undone, reversed, double spent, or altered. Therefore, cryptocurrencies are far more transparent and effective than traditional fiat currencies.

They are decentralized. A cryptocurrency is controlled via its distributed ledger technology, known as the blockchain. The creation of new units is coded into the system and no one entity controls it.

What is blockchain?

Blockchain is the underlying technology of bitcoin and most other cryptocurrencies.

In its essence, it is a growing list of recorded data, called blocks, which are linked together using cryptography. All of the recorded data is referred to as a “ledger”, and every time there is a data exchange, a “transaction”, a new block is added to the ledger or “blockchain”.

Therefore, the blockchain or ledger can have information added onto it, but it is always added on in the form of a new block. Previous blocks in the blockchain can never be changed, edited, or adjusted.

Another important aspect of blockchain is that they are consensus driven. Meaning a large number of computers in a distributed system are needed to verify each transaction. This is also known as a peer-to-peer network of nodes.

What is mining?

Cryptocurrency mining is a process in which miners use powerful computers and hard drives to solve complicated mathematical problems. These mathematical problems have cryptographic hash functions which are associated with a block containing transactional data. While solving these problems, the miner is competing against other cryptocurrency miners and the first one to solve the mathematical problem is rewarded with small amounts of cryptocurrency.

The reward is too incentivise miners to continue mining and thus securing the network. The mining award comes from the transaction fees users pay as well as newly released crypto.

What is a cryptocurrency wallet?

A cryptocurrency wallet is a digital wallet used to store, send, and receive cryptocurrency. A big misconception of crypto wallets is that the cryptocurrency is stored within the wallet’s software or hardware. However, this is not the case. Crypto wallets simply store a cryptocurrency’s public and private keys, while the crypto itself remains on the blockchain. So essentially, a crypto wallet stores the information in which gives you access to your crypto assets.

There are 3 different types of cryptocurrency wallets you can use.

- The most secure being a hardware wallet such as a ledger nano S, keepkey, or trezor (all data is kept safely offline)

- Another secure wallet but quite inconvenient is a paper wallet.

- A wallet more focused on convenience is a software wallet that sits on your desktop computer’s hard drive or in your smartphone, examples are jaxx, exodus, and electrum. (these are also known as hot wallets where your cryptos are not kept in cold storage eg. Are kept online.)

What is an ICO?

An ICO (initial coin offering) is a method of fundraising that new cryptocurrency projects use to build start-up capital. They work by selling their underlying crypto tokens in exchange for bitcoin or ethereum. Investors buy these crypto tokens during the projects ICO if they think the project will succeed.

An ICO is similar to an IPO (initial public offering) in which investors purchase shares of a company when they go public. Both icos and ipos allow investors to get in at an early stage and make a profit if the company succeeds.

The biggest difference between an ICO and an IPO is that anyone from anywhere in the world can participate in an ICO. This has led to an explosion of icos with over $6 billion being raised in 2017 and over $7 billion so far in 2018.

What is a token?

The term “token” has taken on a few different meanings in the cryptocurrency space. Tokens are a kind of cryptocurrency that represent an asset or a utility. While cryptocurrencies are primarily used as a means of exchange like a currency, crypto tokens actually represent a specific asset or are actually meant to be used for something.

The topic of crypto tokens is a deep one, but we will give some examples here.

- A crypto token can be used as customer loyalty points in which they can be redeemed to receive a discount on a product, or even used to pay for the product.

- A crypto token can be used to represent something. For instance, a token could be used to represent 5 bitcoins per token.

- A crypto token might be used in order to watch a video on a tokenised video streaming service.

The examples go on and on and they are always up for debate as the concept of crypto tokens is still very new.

What is a smart contract?

A smart contract is a self executing contract that’s built using a computer protocol running on top of a blockchain. The contract itself is built into the code along with the terms of the agreement between two parties. The smart contract code can facilitate, verify, and enforce the terms of an agreement or transaction. Essentially, smart contracts are the simplest form of decentralised automation.

The idea behind smart contracts is to provide a superior contract to traditional contract law by increasing security and lowering expenses involved in a contract. Smart contracts can facilitate trusted transactions and agreements between dishonest and anonymous parties without the need for external enforcement such as legal systems, central authorities, etc.

What is a cryptocurrency exchange?

A cryptocurrency exchange is a business that allows customers to buy, sell, or trade cryptocurrencies. Some exchanges only allow crypto to crypto trading while others allow crypto to fiat and vise versa.

The largest and most popular crypto exchange in the world in terms of daily trading volume is the binance exchange. Binance only facilitates crypto to crypto trading with no support for fiat currencies. Traders on binance can trade various cryptos against bitcoin (BTC), ethereum (ETH), binance coin (BNB), or tether (USDT).

Another popular exchange is coinbase. Coinbase differs from binance because they accept the on and off boarding of fiat currencies. Currently, users can trade bitcoin (BTC), bitcoin cash (BCH), ethereum (ETH), ethereum classic (ETC), litecoin (LTC), 0x (ZRX) and basic attention token (BAT). Coinbase has plans to add hundreds if not thousands more cryptocurrencies in the near future. The fiat currencies accepted at coinbase include USD, EUR, and GBP.

A cryptocurrency exchange that differs from the ones already mentioned is localbitcoins. This exchange facilities over-the-counter trading of local currency for bitcoin. Users post their bitcoin for sale on the website along with their exchange rate and payment methods.

The volatility of cryptocurrency

Cryptocurrency is the most volatile asset class of our time. It’s not uncommon to see price swings 50%+ in any direction within a given day. The volatility is largely due to the highly speculative market of cryptocurrencies. As well, cryptocurrencies do not follow any regulatory oversight, have thin order books, lack institutional capital, and currently have no intrinsic value.

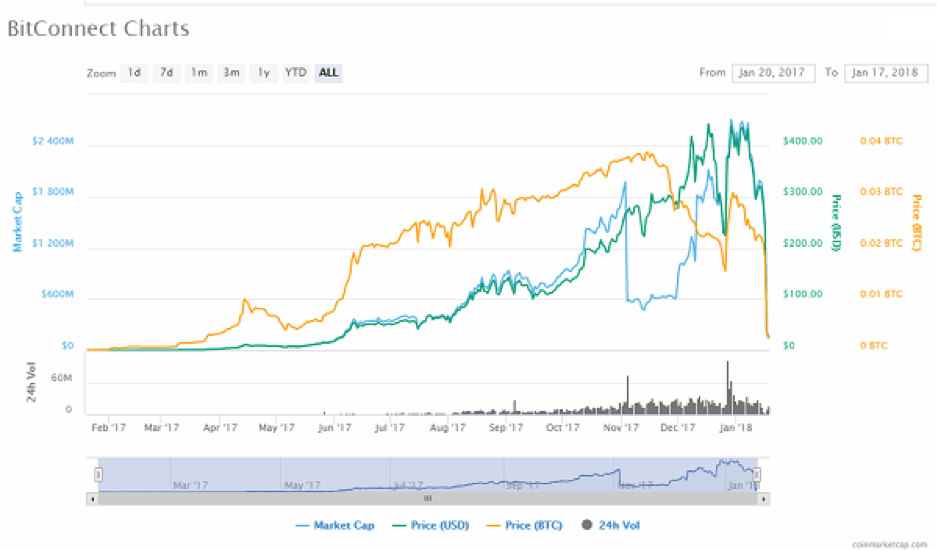

To give an example of the volatility apparent in cryptos, look at the graph below of the most popular cryptocurrency, bitcoin.

As you can see in the price chart above, the price of bitcoin went from $6300 in november to $20,000 in december. That’s a price rise of over 68% in the span of a month, and at the of this writing, roughly 10 months from its high, the price is back to where it was a year ago.

Img source: https://coinmarketcap.Com/currencies/bitconnect/

An example of a crypto that went to zero and is no longer available is bitconnect.

As you can see in the chart above, when people finally realized bitconnect was a ponzi scheme, it dropped from a price of over $400 to 0 in a matter of days. Therefore, it is important to understand the project you buy into as there are many scams in crypto with false promises.

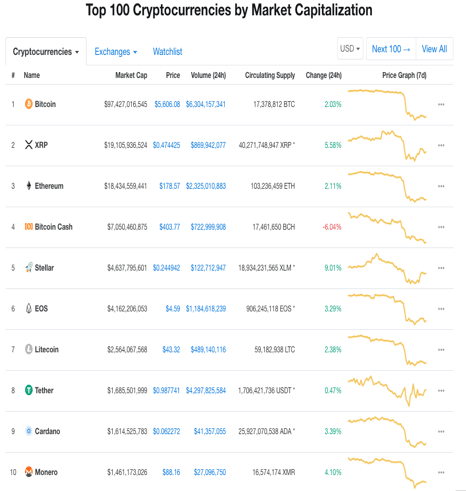

What are the top cryptocurrencies for traders

The top cryptocurrencies for traders are generally the ones with the highest market cap. For example, several brokers regulated by the financial conduct authority in the UK like city index, IG, etoro and XTB all offer the cryptocurrencies bitcoin, bitcoin cash, ethereum, ripple and lite coin for traders.

All five of these coins are in the top 10 cryptocurrencies based on market cap according to coinmarketcap as of the 16th of november:

1. Bitcoin (BTC) is by far the most popular cryptocurrency for traders as it has the largest market cap, was the first successful cryptocurrency, is available on nearly every exchange, and has the most liquidity.

2. Ripple (XRP), known for its relationship with the banking industry and speculation for potential.

3. Ethereum (ETH). A popular cryptocurrency that is widely available across exchanges, and it is also highly speculative.

4. Bitcoin cash (BCH), bitcoin cash was created to all an increase the block size to 32MB from the original bitcoin in an attempt to improve the usability of the cryptocurrency.

5. Litecoin (LTC), is a cryptocurrency that provides instant and low-cost payments globally.

Differences between trading cryptocurrencies as a CFD and through an exchange

When trading cryptocurrencies on an exchange, the trader is actually buying and selling the crypto asset. When a trader places a buy order and it’s fulfilled, they actually gain possession of the crypto asset and can send it to their personal wallet, spend it, transact it, etc.

When trading cryptocurrencies by using contracts for difference (cfds), the trader is simply speculating on the price movements. They do not actually buy or sell the crypto asset itself, but rather a contract on the price of the crypto asset.

For example, when trading with XBT, a CFD broker, buying 1 bitcoin would require the nominal value of 1 lot with 1:2 (50%) leverage. Essentially, the trader only has to put down a fraction of what 1 bitcoin costs in order to speculate on its price.

While buying 1 bitcoin on a cryptocurrency exchange, they would require the full price amount of 1 bitcoin, say $6500. Upon buying this bitcoin, it will be transferred to the trader’s exchange wallet. The trader can then choose to trade it again or send it to their own personal wallet.

Also, if the price of bitcoin went up 10% when trading a bitcoin CFD on leverage, the trader would receive a larger profit on their money than a trader who actually bought the bitcoin on an exchange. However, the same is true if the price of bitcoin drops 10%, the CFD trader can lose more money than the exchange trader because they are using leverage to trade.

Best online brokers for buying and selling cryptocurrency in january 2021

Advertiser disclosure

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional.

How we make money.

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Editorial disclosure.

All reviews are prepared by our staff. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication.

Share

At bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here’s an explanation for how we make money.

Editorial integrity

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.Com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, bankrate does not include information about every financial or credit product or service.

Cryptocurrency, especially bitcoin, has proven to be a popular trading vehicle, even if legendary investors such as warren buffett think it’s as good as worthless. Part of cryptocurrency’s popularity is due to its volatility, since these swings allow traders to make money on the price moves.

For example, at the start of 2017, the price of bitcoin broke through the $1,000 barrier. By the end of the year, the digital currency had reached nearly $20,000. Almost a year later, bitcoin was hovering around $3,200. But it sprung back to life in 2019, rising to more than $10,000 and has continued significantly higher since then — crossing the $20,000 level toward the end of 2020.

It’s this kind of price movement that has attracted traders looking to ride the waves to profit. While some traders like to own the currency directly, others turn to the futures market. Futures may be an even more attractive way to play the volatility of digital currencies such as bitcoin, because they allow traders to use leverage to magnify their gains (but also magnify losses).

Where can you buy and sell cryptocurrencies?

Traditional brokers have the advantage of offering a wide selection of investible securities, though typically you can’t trade bitcoin directly, only futures. Meanwhile, crypto exchanges are limited to digital currencies, though you can own the currencies directly and can often buy several, rather than simply bitcoin or bitcoin futures, as you would with a general broker. And paypal has also gotten in on the act, allowing U.S. Users to buy and sell cryptocurrencies.

Here are the best brokers for cryptocurrency trading, including traditional online brokers, as well as a new specialized cryptocurrency exchange. You might also want to check out which brokers offer the best bonuses for opening an account to determine where you can get a little extra.

Overview: best brokers for cryptocurrency trading

Robinhood

Robinhood is a great option for buying cryptocurrency directly. Not only that, you’ll get to take advantage of the broker’s wildly popular trading commissions: $0 per trade, or commission-free. And if you’re into more than just cryptocurrency, you can stick around for stock and ETF trades for the same low price. Robinhood’s slick app makes trading so easy, though those looking for a full-featured trading experience will be disappointed.

Commission: $0

Account minimum: $0

TD ameritrade

TD ameritrade is one of the top full-service brokers on the market, and not only does it offer access to traditional products such as stocks and bonds, but it’s expanded its offering to include bitcoin futures. However, TD ameritrade does not allow trading directly in the digital currency. You’ll need to meet the account minimum to get started with bitcoin futures. (charles schwab has purchased TD ameritrade, and will eventually integrate the two companies.)

Commission: $2.25 per contract

Account minimum: $25,000 for futures

Interactive brokers

Interactive brokers allows you to buy bitcoin futures rather than owning the currency directly. And in this broker’s case, you can actually buy futures on the chicago mercantile exchange, with all-in contracts costing $15.01 with five bitcoins per contract. In addition, interactive brokers brings its full suite of investment offerings, so you can buy almost anything that trades on an exchange.

Commission: $15.01 per contract

Account minimum: $0

Charles schwab

Charles schwab is routinely one of bankrate’s picks for top broker, and this investor-friendly company offers trading in bitcoin futures. Schwab also has no account minimum, but any futures contracts you trade will require some minimum margin to hold them open. Schwab offers an attractive commission of $1.50 per contract, and if you’re able to bring big money to the table, you’ll receive a welcome bonus, too.

Commission: $1.50 per contract

Account minimum: $0, futures margin depends on contract

Tradestation

Traders have a couple options at this broker, which has rolled out direct currency trading via tradestation crypto, with commission-based pricing for traders. Pricing is based on your account balance with the broker and whether your order is directly marketable. Normally pricing ranges from 0.25 percent of your order to 1 percent. Traders can also buy and sell bitcoin futures as well as take advantage of substantial volume trading discounts.

Commission: 0.25-1 percent

Account minimum: $0, but futures margin depends on contract

Coinbase

Coinbase is a specialized cryptocurrency-focused platform that allows you to trade digital currencies directly, including bitcoin, ethereum, litecoin and bitcoin cash. In total, you’ll have access to more than three dozen cryptocurrencies. You’ll also be able to store your coins in a vault with time-delayed withdrawals for additional protection. The exchange’s commission structure is steep. It charges a spread markup of about 0.5 percent and adds a transaction fee depending on the size of the transaction and the funding source.

Commission: at least 1.99 percent of the transaction value

Account minimum: $0

Bottom line

Whenever you’re selecting a broker, it’s important to consider all of your needs. And for new traders in cryptocurrency, you’ll want to figure out whether you want to own the virtual currency directly or whether you want to trade futures, which offer higher reward, but also higher risk.

You’ll also need to consider whether you want to trade more than bitcoin, which is what the majority of traditional brokers restrict you to. If not, you may want to turn to a cryptocurrency exchange, since they offer more choice of tradable cryptocurrency.

Bitcoin investing: compare accounts for buying & selling bitcoin

Use our comparison table of bitcoin accounts to compare costs and the different ways to buy and sell bitcoin. Please note: investing in bitcoin and other cryptocurrencies is very high risk and not regulated by the FCA. There is a very high chance you may lose all your money.

How to choose an account for investing in bitcoin

Here are three tips and things to consider when deciding which provider to buy bitcoin through:

Look for a regulated provider who also offers bitcoin

Even though bitcoin is an unregulated digital currency, many providers that offer bitcoin investing are regulated by the FCA for other things such as stocks, bonds, bank accounts and trading. By choosing a bitcoin account that is attached to a regulated entity, you will be dealing with a provider who is responsible for treating clients fairly (although not directly for cryptocurrency investing).

Compare the costs of investing in bitcoin

The costs of investing in bitcoin can vary dramatically. The key things to consider are:

- Bitcoin commission- some bitcoin accounts will charge a fee when you buy and sell bitcoin on their platform.

- Bitcoin currency exchange fees- if you are buying bitcoin against the USD (BTCUSD) but depositing GBP into your bitcoin wallet, there will be a fee for converting the GBP into USD. It is possible with some exchanges to buy bitcoin against GBP where you do not need to convert fiat currencies.

- Bitcoin price spread- this is the difference between the buy and sell prices. As with investing in stocks, there is always a spread between where people are prepared to buy and people are prepared to sell. The bitcoin spread varies, depending on how active the market is (liquidity) and how much the price is moving (volatility), as well as which bitcoin platform you are investing through.

Understand the risks involved in investing in bitcoin

Before you start investing in bitcoin, decide if you should be investing in bitcoin. The major risks of investing in bitcoin are:

- Sudden price moves- the price of bitcoin can drop and rise quickly and for no apparent reason.

- High investment costs- compared to investing in stocks, it is still expensive to buy and sell bitcoin.

- Bitcoin scams- there are lots of scammers using fake bitcoin ads to scam potential bitcoin investors, so always research bitcoin accounts before investing.

How do you invest in bitcoin?

The world's most famous crypto-currency is an obvious target for investors and traders due to its history of rapid gains and falls in value. This volatility makes it both very risky and potentially very lucrative as an investment.

How to get started investing in bitcoin

If you are buying bitcoins, then you will require a bitcoin address. This is a code to which the bitcoins that you buy will be allocated. You can acquire an address by downloading a bitcoin client to your computer or setting up an online wallet.

What to avoid when you start investing in bitcoin

When using cfds or placing spread bets, it is possible to lose more than your initial stake. This will be amplified if you use leverage. Don't risk more money than you can afford to lose when you take a position. Placing stop loss orders, which automatically close down your position when bitcoin hits a particular value, are an essential way to limit the risk that you face.

What to look for when choosing an account to buy bitcoin in

The various bitcoin exchanges and CFD/spread-betting companies have different fee structures for their services. Make sure that you're not being overcharged and that the trading platform on offer is to your liking. As with any investment, the more you know about factors that will impact the price of bitcoin, the more likely you are to profit.

To invest in bitcoin, you need a bitcoin wallet or account. You can compare bitcoin accounts with our bitcoin account comparison table.

Bitcoin FAQ:

Here are some of the most frequently asked questions people ask before they invest in bitcoin:

What is bitcoin?

Bitcoin is a digital currency. It was launched in 2009, can be mined, bought and sold against many fiat currencies, and is the largest cryptocurrency by market capitalisation.

How much is bitcoin worth?

The price of bitcoin moves all the time and is priced most commonly against the USD. See our bitcoin price chart for the current price.

How does bitcoin work?

Bitcoin works as a digital currency where a record of all transactions are kept on the block chain. Each bitcoin is stored in a digital wallet where it can be spent or sent.

How to get bitcoins

There are two ways to get bitcoin. You can either mine them or buy them through a bitcoin exchange platform.

Is bitcoin safe?

This is undermined yet and the safety of bitcoin is one of the major risks of investing in bitcoin.

Is bitcoin regulated by the FCA?

No, bitcoin is not regulated by the FCA. However, there are FCA-regulated providers that also offer options for buying and selling bitcoin.

Are bitcoin adverts real?

From peter jones to PSY, new scam adverts advertising get-rich-quick bitcoin schemes are flooding the internet. Despite a global ban from google on non-regulated brokers advertising derivatives products, they are still getting through. Amazingly, you see them in the header of the dailymail and other mainstream media websites. Martin lewis, the money-saving-guru from money saving expert, recently sued facebook because they failed to stop scammers using his image in scam ads for get-rich-quick bitcoin schemes. Martin lewis settled with facebook for a £3m charitable donation in the end.

Is bitcoin a scam?

If you see an advert for bitcoin investing, it may well be a scam as google and facebook have banned cryptocurrency advertising. If it looks like a scam, it's a scam. And always check the FCA register for any broker you deal with.

Keep in mind too though that the scammers make clone websites of real brokerages to scam you. So, double and triple-check any broker before sending money. A quick google search can save you from becoming a victim.

How to make money with bitcoin

It is possible to make money investing in bitcoin in the same respect that it is possible to make money investing in high-risk stocks. If you buy low, sell high, you will make money. But unlike investing in stocks where a company generates revenue and profits, bitcoin has no underlying value so it is also possible to lose money very quickly by investing in bitcoin.

Where to buy bitcoin

For more information on where to buy bitcoin, read our guide to choosing a bitcoin account.

Is bitcoin legal?

How to use bitcoin

Bitcoin is becoming more usable every day. Some online merchants accept it as payment and recently, paypal announced that it would accept bitcoin as a payment source.

Is bitcoin a good investment?

Whether or not bitcoin is a good investment is relative to your investment objectives. It is a very high-risk investment.

How to sell bitcoin

When you choose a bitcoin account, make sure there is also the option to sell the bitcoin on it as well.

Where can you get bitcoin investing ideas?

Never believe anyone who says they can make you rich or adopt trading as a career if you are a complete beginner. However, if you do want trading ideas, you can find news and analysis on bitcoin here:

- Bloomberg

- Reuters

- Tradingview provides excellent crypto charts and lots of users post trading ideas.

ABOUT

The good money guide is a london based guide to trading and investment accounts for clients based in the UK, europe, asia, south africa, and australia. For more information on how this site makes money please find out more about us.

Disclaimer