How to withdraw money from forex broker

Most forex traders trust these online payment systems and prefer using them instead of credit card.

Top forex bonuses

That’s because money can be sent immediately and securely to and from your forex broker. All of these payment options used by forex brokers may actually protect your money better than it would protect during any other similar online financial transaction. If you funded your account with US dollars: there is no fee for withdrawal requests via check. Withdrawal requests via wire transfer will incur a $25 fee for wires within the united states, and $40 fee for international wires (including canada).

How to withdraw money from forex broker

The painful beginning is over and you have finished reading all the basics of forex trading. You are sick and tired of the demo account, the nightmares where you speak only with forex terminology become more frequent and you are ready for the big jump – trading for real money. So how to trade with real money and how to make sure your funding is safe? More importantly, how do you receive the profit money you make?

Many forex beginners may be slightly confused about forex brokers withdrawal methods and brokerage deposit options. So let's review the process of withdrawal once and for all.

Most forex brokers generally accept deposits by credit card, wire transfer and, in some cases, checks. However many forex traders don’t feel safe using their credit card online and giving in to the possibility of endangering their saving account! What has become rather popular now is depositing and withdrawing money from your forex broker with alternative online payment methods such as neteller, skrill, paypal, e-bullion and others.

Most forex traders trust these online payment systems and prefer using them instead of credit card. That’s because money can be sent immediately and securely to and from your forex broker. All of these payment options used by forex brokers may actually protect your money better than it would protect during any other similar online financial transaction.

Each forex broker has different policies, terms and conditions. Many brokers allow you to withdraw your profits via the same payment method you used to deposit, but sometimes you won’t be able to withdraw until a certain amount of money is reached and/or the bonus requirements are met. Also, while most forex brokers do not charge any extra fees, it is common for some brokers to charge transaction fees when it comes to withdrawal.

Here is an example taken from forex.Com broker withdrawal requirements:

If you funded your account with US dollars: there is no fee for withdrawal requests via check. Withdrawal requests via wire transfer will incur a $25 fee for wires within the united states, and $40 fee for international wires (including canada).

If you funded your account with a non-USD deposit: FOREX.Com will convert your US dollar account balance back to the currency you initially deposited and wire your funds back to the originating bank account. A fee of US$40 will be assessed.

Most withdrawal processes are easy and fast, which requires filling in the online form. Some forex brokers, however, request filling the withdrawal form, printing it out, sign and sending it by fax or email. The waiting period varies from 24 hours to several weeks, depending on forex broker policies, which must be reviewed and fully comprehended.

I strongly suggest reading terms and conditions of your selected broker before you make a deposit. If you can’t find the details about withdrawal in terms and conditions, try reading frequently asked questions on the broker’s website. And if that doesn’t help, contact your forex broker via email, online chat or phone and make sure to find the answers to these questions:

1. What are the available payment methods?

2. Are there transaction fees? If so, what are they?

3. What is the withdrawal process?

4. How long does it take to receive the money?

5. What is the minimum amount required to make a withdrawal?

6. How does bonus affect the withdrawal policy?

And always remember that troubles arise from misunderstanding. Make sure that you have a clear vision of what lies ahead before you make a plunge!

Withdrawals

How do I withdraw funds from my account?

To withdraw funds, log into the trading platform and click “add funds” and then select the “withdraw funds” option. Funds must be withdrawn to the originating source of deposit.

Excess funds may be withdrawn by bank transfer or wire transfer. In the event you added a new bank account to withdraw excess funds, FOREX.Com will require evidence of the account by uploading a bank statement.

How will my withdrawal be processed?

Deposited funds must be returned to the originating source. If you have deposited funds using multiple methods, you must exhaust the total deposit amounts based in the following order:

- Bank transfer

- Debit card

- Wire

Excess funds may be withdrawn via bank transfer or wire. In the event you add a new bank account to withdraw excess funds, FOREX.Com will require evidence of the account by uploading a bank statement.

How much can I withdraw in one time?

The minimum withdrawal amount is $100, or all your available account balance (whichever is lower).

You can withdraw a maximum of $25,000 per transaction if you are funding by bank transfer, and $50,000 with debit card. Wire transfers have no restriction on transaction size.

How do I withdraw excess funds to a new bank?

In order to facilitate a withdraw of excess funds to a new bank, we’ll need to confirm your bank account information. To do this, you will need to provide us with a bank statement that clearly shows the full name on the account. You can upload a copy of the statement by logging into the platform and accessing myaccount.

How will bank transfer withdrawals be processed?

Bank transfer withdrawals may be up to the amount of total deposits plus any excess funds. There is a $25,000 per transaction limit on bank transfers. Bank transfer may take up to 24 hours to process. No fee.

How will debit card withdrawals be processed?

Debit card withdrawals is limited to the amount of total deposits. There is a $50,000 per transaction limit on debit card transfers. Bank transfer may take up to 24 hours to process. No fee.

How will wire withdrawals be processed?

Wire withdrawals may be up to the amount of total deposits plus any excess funds.

Wire transfer may take up to two business with the US and five business days. A $25 fee is charged within the US, $40 for international wires (including canada). There are no fees for withdrawals greater than $10,000. Processing time only reflects the time it takes FOREX.Com to complete the withdrawal during normal business hours. Your bank may take additional time to credit the funds to your account.

Please be aware that fees may be applied by the receiving bank that involve a bank outside of the US and require an intermediary US bank. Intermediary banks may charge an additional transaction fee.

How will paper check withdrawal be processed?

Currently, we are not processing personal or business checks.

I funded my account by bank transfer. Why don't I see this amount available for withdrawal or transfer?

Funds deposited by bank transfer are not available for withdrawal for 5 business days after the deposit date.

What if I have open positions when I submit a withdrawal or transfer request?

A withdrawal of funds will result in a reduction of funds available to be used for margin to maintain open positions. This may result in the liquidation of any or all of my open positions. It is your responsibility to ensure that the account holds enough margin to maintain open positions.

Why is my card withdrawal request being processed partially or in installments?

Because we are required to return deposited funds to their source, this is typically due to the requested amount being larger than your previous deposit(s). For example: let’s say you deposited $100 and then $200 using your card, and then requested a $300 withdrawal. In most cases, our system will automatically refund the two transactions you had made, therefore you will not see a single transaction of $300, but instead two transactions totaling $300 ($100 and $200). Keep in mind that once this is completed on our side, your card-issuing bank and processor (visa or mastercard) may not necessarily process and post all transactions at the same time.

Forex brokers with best money withdrawal options in 2021

The best and most exciting thing about forex trading is, of course, to withdraw your profit from the forex broker. Say you have been trading, made a considerable amount of profit and now you want to spend your profit. In order to be able to do it, first you have to get your money back from the broker. To withdraw money from your forex account is very straightforward in general but does require you to take few steps.

Forex brokers with best money withdrawal options

Forex.Com

Forex.Com is owned and operated by an industry giant; GAIN capital holdings who has been around for more than 20 years. Forex.Com is registered and regulated by CFTC, NFA and CIMA. The broker accepts clients from the US. Investors can deposit and withdraw funds by credit card, bank card and wire transfer. Digital wallets are going to be available soon.

Money withdrawal options: credit card, bank card, wire transfer

XM

XM puts more than ten methods of deposit and withdrawal under disposal of its clients. In addition to international bank transfer and credit card which has become industry standards as deposit and withdrawal methods, XM clients can use various other methods. Those methods include neteller, skrill, unionpay, web money, ideal, moneybookers, moneygram, sofort and western union. One important detail which makes XM even more favorable is that the broker covers international wire transfer commission of its own part which considerably reduces the withdrawal cost.

Money withdrawal options: wire transfer, credit card, neteller, skrill, unionpay, web money, ideal, moneybookers, moneygram, sofort, western union

Fxpro

Regulated by FCA,cysec and SCB, fxpro is headquarted in london and one of the most prominent forex brokers in the industry. Traders who open an account at fxpro can withdraw and deposit funds through credit card, international bank transfer (SWIFT), paypal, skrill, neteller and china unionpay.

Money withdrawal options: wire transfer, credit card, paypal, skrill, neteller, unionpay

Hotforex

Established in 2010 and headquartered in cyprus, hotforex is an award winning forex broker that offers a wide range of account types and trading instruments. The broker is pursuing a policy of providing the most convenient and advantageous trading conditions for the traders. You can deposit money in hotforex using credit or debit cards and bank wire transfers. Apart from that hotforex also accepts skrill, neteller, fasapay, sofort, mybitwallet, ideal and webmoney.

Money withdrawal options: wire transfer, credit card, skrill, neteller, fasapay, sofort, ideal, webmoney, bitcoin

Exness

Exness was founded in 2008 in russia and has grown into one of the most popular forex brokers in europe since then. The company is regulated by cysec in cyprus and FCA in UK. Having a wide array of payment methods, transacting money on this brokerage platform is pretty easy and quick.

Money withdrawal options: wire transfer, credit card, skrill, neteller, webmoney, perfect money, sticpay, jeton wallet

Choose the withdrawal option

When it comes to withdraw your profit from forex brokers, the methods are not scarce including credit card, wire transfer, paypal, neteller, skrill, western union, bitcoin to name a few.

I usually go with wire transfer when withdrawing my profit. Nevertheless it comes with some caveats. Wire transfer is recommended if only you are going to withdraw an amount over a thousand. Otherwise the bank transfer fees are going to eat up your hard earned profit. Bear in mind that when you choose to get your money back through wire transfer, you are going to get double charged (once by the bank in where your forex broker is located and again by your local bank). The fees could range from $50 to $100 in total. The certain amount completely depends on the bank the broker is working with and your local bank. International wire transfer fees charged by some US banks are explained in this article.

My second favorite option to withdraw funds from forex account is credit card. Again there are some caveats. Some forex brokers don’t allow you to withdraw more than what you deposited with the same credit card. When you deposit $1000 to your forex account using credit card, you can only withdraw an amount up to $1000 by the same card. So you will have to choose another withdrawal method to transfer your profit.

Though I haven’t used so far, other popular methods are digital wallets like neteller, skrill, paypal. Forex brokers don’t charge extra fees to withdraw money by digital wallets however those services apply their own fees when you want to transfer money from the wallet to your bank account.

Submit your withdrawal request

After you decided the best transfer option for you, you have to submit your withdrawal request. Forex brokers used to demand clients to print out a withdrawal form then fill, sign and forward it to the broker by mail or e-mail.

However nowadays you don’t have to go through this cumbersome process. Majority of the forex brokers provide clients with a username and password for the client portal where they can submit their money withdrawal request in just seconds.

Just log in to the client portal, navigate to the money withdrawal section, fill the online form and click the submit button. Congratulations!

An important caveat is that some forex brokers do not require clients to verify their account till to the point they wish to withdraw funds from their account. If this is the case for the broker that you are trading with, you will need to verify your forex trading account by loading proof documents for ID and address. However, you will have always the chance to verify your account upon registration in case you do not want to worry about the last minute rush.

Wait until your fund is transferred to your bank account / credit card / digital wallet

It ranges between one to three business days depending on the forex broker and withdrawal option you used. Wire transfer and credit card transfers could take up to three business days. Though I remember several times that I received the funds same day when I used wire transfer as the transfer option. The commission and fees are not fixed for wire transfer. Since there are three banks involved at a wire transfer transaction, it is hard to know the exact amount that is going to be charged as commission. However, based on my experience, I can say that it should range between $30 and $100.

Digital wallets such as skrill and neteller has a different commission and time schedule. First time you incur any commission is the moment you withdraw funds from your trading account. The rate changes between %3 and %2 of the amount you like to withdraw. It takes fews days between the time that money leaves your trading account and arrives at your digital wallet. Second time you will get charged is the moment you transfer the money from your skrill account to your bank account. That is another %3 – %2 commission.

Wire transfer is my preferred withdrawal and deposit method. I use digital wallets only if wire transfer is not among the methods offered by the forex broker. Credit card is fast and more reasonable than any other withdrawal and deposit method. Nevertheless, I shall kindly point out that in the case you choosed credit card as a withdrawal method, you can only withdraw the amount you deposited by the same credit card. Therefore, you will have to use another method in order to be able to withdraw your profit.

Fxdailyreport.Com

To answer this question, you need to understand how the trading market works. Forex brokers (dealing centers or dcs) are such licensed companies that provide traders with professional services for access to trade in the international currency market. The success of work on forex depends on the right choice of a dealing center.

Therefore, you should give a preference to a reliable and experienced broker with a variety of trading instruments. The company should have a long history of completed foreign exchange transactions. But how to choose the best forex broker for withdrawal?

How to choose the best forex broker for withdrawal?

Choosing a broker for trading on exchanges should begin with collecting information about successful transactions and openness in working with clients. A reliable broker has its portfolio of deals, a large number of reviews from customers.

The simplest way is to check the published lists of traders, which are continually changing and updated. The trader with the most reviews will offer some of the safest working conditions. We also recommend paying attention to how the process of registering and depositing money with a particular broker is going.

- Forex broker license

The presence of a broker license allows you to judge his conscientiousness and honesty in his approach to trading. A licensed broker is more likely to complete all transactions and also carries them with benefits not only for himself but also for the client.

But to obtain a license from well-known world communities or government agencies, a broker needs to try hard and earn a positive reputation. If you see that an unknown office located on a distant island issued the permit – you should avoid working with this broker.

- Forex brokers rating

On the internet, you can find several independent from each other ratings of popular brokers. You can sort them by the number and quality of reviews, working hours, and other essential parameters. We recommend you to pay attention to the number of completed transactions, the regularity in payments to customers, and not to leverage or the promised interest.

Top 10 forex brokers

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker |

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $100 spread: starting 0 pips leverage: up to 400:1 regulation: FCA UK, NFA, CFTC, ASIC, IIROC, FSA, CIMA | visit broker | |

| min deposit: $300 spread: floating, from 0 pips leverage: 500:1 regulation: FCA UK reference number 579202 | visit broker | ||

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: no minimum deposit spread: 1.2 pips leverage: 50:1 regulation: CFTC, NFA, FCA, MAS, ASIC, IIROC | visit broker | |

| min deposit: $10 spread: leverage: regulation: cysec | - | visit broker | |

| min deposit: $200 spread: from 3 pips leverage: 400:1 regulation: NFA, FCA, cysec | visit broker |

In general, do your first steps in trading with the help of brokers with caution, trading on small amounts. Hence the preference in favor of traders with work experience and safe conditions.

- How do brokers earn?

Usually, brokerage support in the foreign exchange market is not free. And dealing companies, like traders, have some financial interests. How do they earn? Providing comprehensive support for trader transactions, such agents get income that makes up the difference between the purchase/sale prices of traded currency pairs (spreads).

Or they receive direct payment from the trader for each trade transaction conducted. Depending on the chosen scheme of work, a brokerage company can only get commissions or have additional sources of income.

- Reliable forex brokers

How to find a dealing center to which you can safely entrust your trading operations? One of the surest ways is to choose a broker on the recommendation of traders already working with them. Numerous ratings will also help ease the choice.

They publish information on the most successful and reliable forex brokers regularly. Besides, remember about such vital points as the transparency of the information provided on the dealing company activities. Check the legal documents and the availability of client support, working 24/7.

Three categories of brokers

In the modern foreign exchange market, there are three leading categories of brokers.

- Classical (most expensive) intermediaries work in the full-service format. They provide clients with a full range of services – from receiving orders to legal support of accounts.

- Discount dealing centers (discount broker) put the orders to the forex market. As payment for their work, they receive a monetary reward in the form of a percentage commission.

- Electronic or online brokers specialize in online transactions and have been extremely popular lately.

Withdrawal process in different brokers

How to withdraw money from your trading account? Every trader should ask himself this question when signing a service agreement. Let us talk about the withdrawal process on forex.

Why does a trader come to the forex currency market? Generally, not for fun, but profit. For this purpose, you study the basics of technical analysis, try various trading strategies, and read a lot of information. Finally, you achieved the result – profit. And the most critical question arises – how to get your hard-earned money?

How to withdraw money on forex?

The problem is that many traders choose brokers to trade without getting known how to get your earnings back. Many brokers have enormous commissions, and it may be that you did not even know about them. Let’s talk in more detail about how to withdraw money from a forex broker trading account.

What to do before opening a real account

Before you open a real deposit with a chosen forex broker, you should inquire about what conditions the broker withdraws the earned profit.

As a rule, money is available for withdrawal only after passing the verification procedure.

At the same time, verification can have several levels, on each of which you will need scans or photos of identity documents. Naturally, during registration, to avoid further problems, you should indicate your real last name and first name.

It is highly advisable to do the verification procedure before depositing funds. The requirements of a forex broker regarding the quality and quantity of necessary documents can seem needlessly strict to you. In this case, nothing stops you from changing your company before starting a financial relationship with it.

As a rule, there are no difficulties with verification. Most forex brokers request a standard set of documents: a passport scan and the confirmation of the address of your residence. After completing the verification, you only have to choose a suitable withdrawal method.

Most companies have a bonus program. Carefully read the terms of granting this bonus. Some bonuses limit the withdrawal of profits or even make it impossible without losing the reward.

Most popular ways of withdrawal

The methods for withdrawing profits, as well as the timing of this procedure, are different for each forex broker. For example, big companies withdraw money only to a bank account. Naturally, everything goes officially, including the income tax for individuals.

Dealing centers and brokers do not limit their services only in this way but offer many more ways to get your profits – from electronic payment systems to cryptocurrency. That is why you should choose a broker that uses the withdrawal method most convenient to you.

- Electronic payment systems

Most companies allow you to withdraw profits on electronic wallets of the most common payment systems. The leaders are paypal, skrill, and neteller. When choosing a payment system, be sure to check how much money you will lose when withdrawing profits. For example, neteller has a commission of 1% (no more than 11.41 USD or 10 EUR) and a fee of 1.39% of the withdrawal amount.

At the same time, pay attention to the timing. The withdrawal may take from several business hours to several business days – this will be indicated on the broker’s website and in the contract.

- Withdrawal to a bank account

This method is not so popular among ordinary traders. The commission charged in this case is slightly higher than when withdrawing funds to the same card using the chain trading account – electronic payment system – bank card. It is especially true if the country of residence of the trader and the broker’s country are different. In some cases, for citizens of other states, this method is generally not available.

The timing of the withdrawal of money also decreases the popularity of this method. Unlike electronic payment systems, it can take from 1 to 7 banking days. Nevertheless, many traders with a substantial profit (several thousand dollars) use this system. For such traders, it is not the waiting time that matters, but its maximum reliability.

- Forex brokers cards

The trend of issuing payment cards by brokers gains popularity. Each company names them different, but they are the same – an international mastercard. This method has many advantages. Using a mastercard, you can withdraw cash at any ATM, pay in stores, make purchases on ebay or amazon.

However, the most significant benefit is different. Brokers open their cards in the offshore zone. And the law of their native state doesn’t regulate them.. Therefore, if your profit from forex trading has reached a grandiose size, this method will be most profitable.

But there are some drawbacks. The issuance of such a card is not free, and the broker also charges a card maintenance fee. Therefore, if your profit is not too big, there is no reason for using it.

Conclusion

As you see, choosing the best forex broker for withdrawal is a quite complicated task. First of all, you should determine your needs and the most convenient withdrawal method for you. And only then you can start looking for a broker.

You have come to the foreign exchange market with serious intentions to make money. So the question of money withdrawal should interest you first of all. After all, the goal of a trader is earning, and not to deposit money on a forex broker account.

XM deposit and withdrawal methods in 2021

In our xm.Com broker review, we described the basic features and offers of this famous forex broker. In this article, we will analyze only deposit and withdrawal options.

XM is one of the leading foreign exchange (forex) brokers globally, and millions of traders worldwide are using XM for forex trading. Many of these forex traders are investing large amounts of money for forex trading. They would like to find out the XM deposit and withdrawal methods to make a decision accordingly. One of the factors affecting the choice of the deposit or withdrawal method is the country in which the trader is residing. Some payment/withdrawal methods are popular in each country due to several factors, and the trader will usually use that method since the fees will be less. Unless specified, the currencies for the deposit and withdrawal methods are USD, EUR, GBP, CHF, HUF, PLN, AUD.

XM deposit and withdrawal methods are online payment methods that XM forex broker allows for traders. XM.Com deposit and withdrawal methods are credit card, debit card, neteller, skrill, unionpay, bank wire. XM withdrawal options for partners are skrill, neteller, and bank wire.

XM offers payment options for traders, such as:

- VISA

- VISA electron

- Mastercard

- Maestro

- Diners club international

- Unionpay

- XM card

- Skrill

- Neteller

- Web money

- Bank wire

The minimum deposit for an XM account is $5 for MICRO and STANDARD forex trading accounts, $50 for ULTRA LOW trading accounts, $10 000 for SHARES accounts.XM minimum withdrawal value is $5 for MICRO and STANDARD forex trading accounts, $50 for ULTRA LOW trading accounts, while for SHARES accounts is $10 000. The minimum deposit value for the XM account and minimum withdrawal for the XM account is related to the type of order and not the payment method. Skrill withdrawal option is one of the most used payment methods, and the minimum deposit for skrill (withdrawal too) is based on account types.

XM deposit methods

How to deposit the XM account? There are several XM deposit options:

XM credit/debit card

XM accepts deposits using credit and debit cards from visa, visa electron, mastercard, maestro. The minimum deposit amount is $5, and the amount is immediately credited to the user’s forex account. There are no fees for using this deposit method. Since most people have a debit or credit card, this deposit method is widely preferred. However, most credit and debit cards have a limit, so the amount which can be deposited is also limited.

XM electronic payment

All the electronic payment methods have no fees and a minimum deposit of $5. Neteller, skrill, and unionpay are some of the electronic payment methods. For neteller and skrill, the amount is credited to the forex account immediately, while for union pay, the deposit will be processed within 24 hours. Cash only accepts USD deposits and przelewy24 accepts PLN deposits, and the amount is instantly credited to the forex account. For bitcoin, deposits in only three currencies, USD, EUR, JPY, are accepted, and it may take up to one hour for the payment to get processed.

XM banking

For sofort banking, deposits are only accepted in eur & GBP. Though the minimum amount is $5, and there are no fees, the deposit processing time will vary depending on the country. For conventional bank transfer of deposit amount in the forex account, at least two hundred USD or equivalent will have to be deposited in the forex account at a time. The fees depend on the bank, which is used. The amount deposited in the bank account will be credited to the forex account within two to five business days.

XM withdrawal review

If a user wishes to withdraw his money from the XM account, they will have to provide the know your customer (KYC) documents, which are specified. These documents are necessary to prevent money laundering according to the various regulatory bodies’ requirements in different countries. XM has an online and offline form where the customer’s personal information and background details have to be provided. This information will help XM in providing better service to their customers.

Compared to deposits, there are fewer withdrawal methods, which are discussed below. Unless specified, the XM user will have to withdraw at least five USD at a time, and there are no fees for withdrawal. The processing time for the withdrawal request is usually 24 hours on working days if the customer has completed the KYC requirements and submitted the documents required. These documents are the identity proof and proof of address of the trader. However, the amount will be credited to the linked bank account, usually only after three to five business working days.

XM credit cards and electronic payment

Visa, visa electron credit and debit cards, maestro and mastercard credit cards can be used for withdrawing funds. Unionpay is another option for fund withdrawal. Similarly, skrill ( earlier called moneybookers) and neteller are electronic payment methods used for fund withdrawal. Bitcoin can also be used for withdrawing the money in the XM account, though funds can only be withdrawn in USD, EUR, and JPY. Usually, credit/debit card withdrawals are given top priority by XM, followed by bitcoin withdrawals and neteller/skrill (e-wallet) withdrawals.

XM bank wire transfer

Many of the forex traders are trading in large amounts, and they prefer to make bank wire transfers to withdraw their profit.

The smallest amount permitted for making a withdrawal to a bank account is two hundred dollars. The withdrawal fees will vary based on the bank selected by the trader. The amount is usually credited to the bank account two to five business days after the withdrawal request is made. XM may process the bank withdrawal requests more slowly. The longest period of XM bank wire transfer withdrawal was 5 days in my last 8 years.

XM fund safety

To keep their clients’ funds, the forex traders safe, XM takes all measures to prevent unauthorized access to their information systems. All the funds of their clients are segregated and kept with the most reputed banks worldwide. Additionally, XM is also offering negative balance protection to their clients. XM has a risk management system implemented, which will ensure that the trader’s loss will be limited to the amount deposited with XM only.

Forex trading without any deposit

Many people are interested in forex trading yet do not have the money to take the risk. However, it is still possible to get some experience in forex trading without making a deposit.

XM no deposit bonus

To encourage people who are curious about forex trading, XM offers a $30 no deposit bonus to all those who create a new account with XM. This allows the new trader to take the risk of trading without risking his own money. The amount is directly credited to the live trading account and helps the trader understand market conditions.

XM demo account

XM also allows new traders to create a demo or virtual account to trade in forex with virtual money. The trader will be given $50,000 in virtual money for each account created, which he can use to trade, become familiar with the features, and test strategies. A trader can create any number of demo accounts to practice trading. If the demo account is inactive for a long period, it will be deleted immediately.

777research.Com is for sale

Make 24 monthly payments of $195.63 | pay 0% interest | start using the domain today. See details.

30-day money

back guarantee

Quick delivery of

the domain

Safe and secure

shopping

Since 2005, we’ve helped thousands of people get the perfect domain name

Super easy process. Just the way we like for everything to be. TY!

- susan kopynec, december 28, 2020

They worked with us to create an alternative financing program.

- john millen III, december 28, 2020

The communication with hugedomains is very good.

- wuxiang jiang, december 25, 2020

- JOSE FRANCISCO SERRANO CUEVAS, december 23, 2020

5 / 5 stars for the transaction and transfer of the domain name. But I really don't like hugedomains at all because they outbid me on a lot of godaddy expired auctions. So they've cost me a lot of money over the years. I stumbled on this name which I thought they underpriced. If you're buying from hugedomains, great experience! If you're competing with them, they suck! Boooo!

Turbocharge your website. Watch our video to learn how.

Other domains you might like:

Once you purchase the domain we will push it into an account for you at our registrar, namebright.Com, we will then send you an email with your namebright username and password. In most cases access to the domain will be available within one to two hours of purchase, however access to domains purchased after business hours will be available within the next business day.

Yes you can transfer your domain to any registrar or hosting company once you have purchased it. Since domain transfers are a manual process, it can take up to 48 hours to transfer the domain.

Once you have received access to your account with the domain's current registrar you will be able to move the domain to any registrar of your choosing.

* when a domain is purchased on a payment plan, a registrar-lock is placed on the domain until all payments have been made. This registrar-lock prevents transfers.

Nothing else is included with the purchase of the domain name. Our registrar namebright.Com does offer email packages for a yearly fee, however you will need to find hosting and web design services on your own.

Yes we offer payment plans for up to 12 months. See details.

If you wish the domain ownership information to be private, add whois privacy protection to your domain. This hides your personal information from the general public.

To add privacy protection to your domain, do so within your registrar account. Namebright offers whois privacy protection for free for the first year, and then for a small fee for subsequent years.

Whois information is not updated immediately. It typically takes several hours for whois data to update, and different registrars are faster than others. Usually your whois information will be fully updated within two days.

It's easy to think a domain name and a website are the same. While they are related, they are very different things.

• A domain name is like the address of your home. It just tells people where to go to find you.

• websites are the code and content that you provide.

• A web host is a service that provides technology, allowing your website to be seen on the internet.

Deposit and withdrawal

Choose the most comfortable payment method!

Frequently asked questions

How can I withdraw money from my account?

- Open the withdrawal within the finances section in your personal area .

- Select the preferred payment method and click the withdraw button.

- Select the FBS account you wish to withdraw funds from and fill in all the necessary fields.

- Type the amount of money you want to withdraw.

- Click on the confirm withdrawal button.

Please note that you must verify your account to request a withdrawal.

How long does it take to process my withdrawal?

FBS financial department processes all withdrawal requests on a first-come, first-served basis. As soon as it approves your withdrawal request, we send you the funds. However, the final time required to transfer funds to your account will depend on the payment method used:

- Bank wire: 7-10 business days

- Credit or debit cards: 3-4 business days

- E-payments: up to 30 minutes

Be aware that the minimum withdrawal amount for bank wire is $50. For all the other payment systems, it is $1.

Can I withdraw trade 100 bonus?

Trade 100 bonus is a great way to start your trading career. You cannot withdraw the bonus itself, but you can withdraw profit gained on trading with it if you fulfill the conditions required:

- Trade at least 30 days.

- Have more pips from profitable than losing orders.

- Have at least 5 lots traded during 30 active trading days.

- Fulfill the above conditions within 50 days from the moment of getting the bonus.

Is FBS a legit broker?

FBS is a legitimate forex broker regulated by the international financial services commission, license IFSC/000102/124, which makes it a trustworthy and reliable broker. FBS offers its services for more than 11 years already and has over 16 million active traders.

FBS at social media

Contact us

- Zopim

- Wechat

- Fb-msg

- Viber

- Line

- Telegram

The website is operated by FBS markets inc.; registration no. 119717; FBS markets inc is regulated by IFSC, license IFSC/000102/124; address: 2118, guava street, belize belama phase 1, belize

The service is not provided in the following countries: japan, USA, canada, UK, myanmar, brazil, malaysia, israel and the islamic republic of iran

Payment transactions are managed by НDС technologies ltd.; registration no. HE 370778; address: arch. Makariou III & vyronos, P. Lordos center, block B, office 203

For cooperation, please contact us via support@fbs.Com or +35 7251 23212.

Risk warning: before you start trading, you should completely understand the risks involved with the currency market and trading on margin, and you should be aware of your level of experience.

Any copying, reproduction, republication, as well as on the internet resources of any materials from this website is possible only upon written permission.

Data collection notice

FBS maintains a record of your data to run this website. By pressing the “accept” button, you agree to our privacy policy.

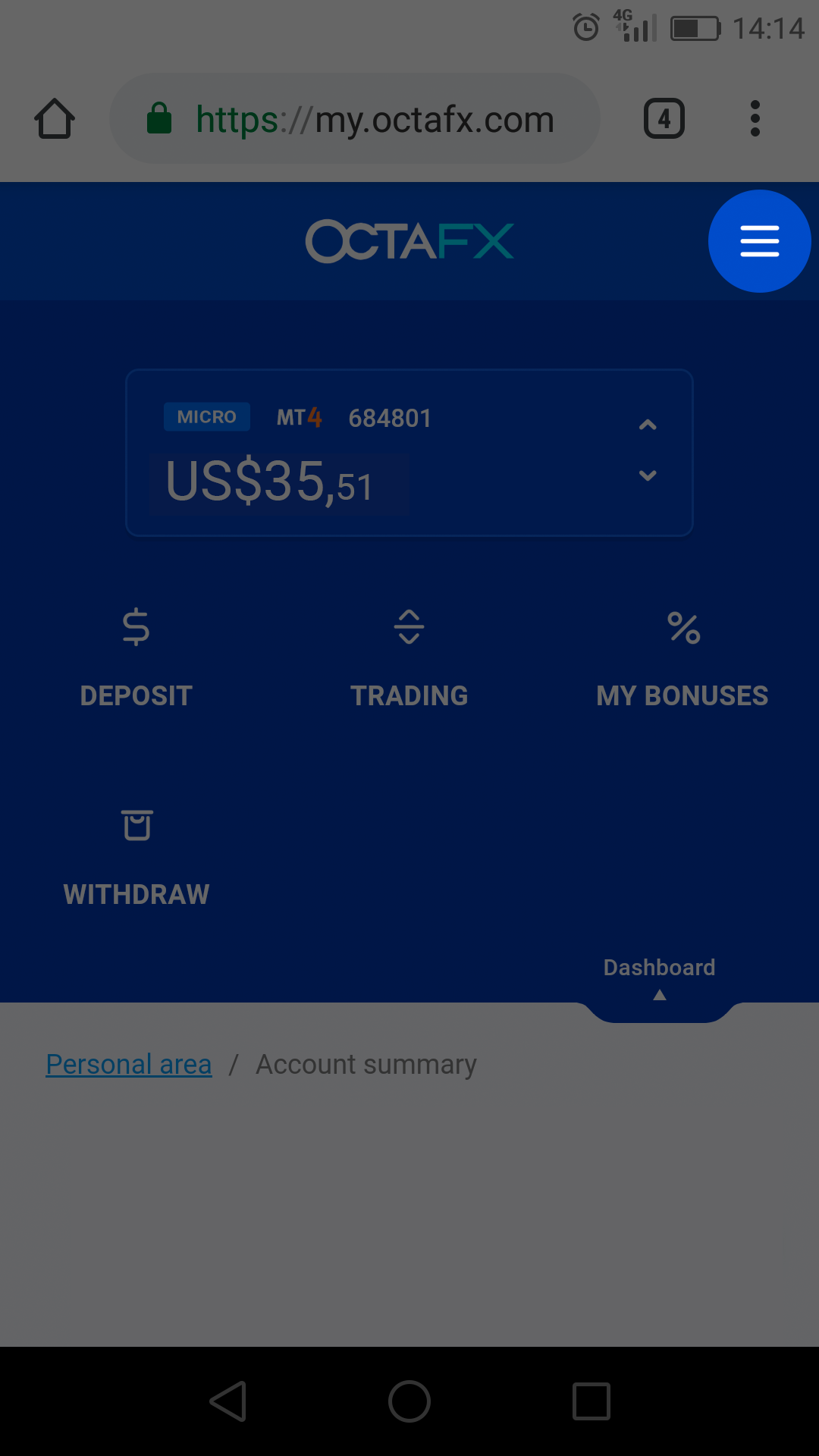

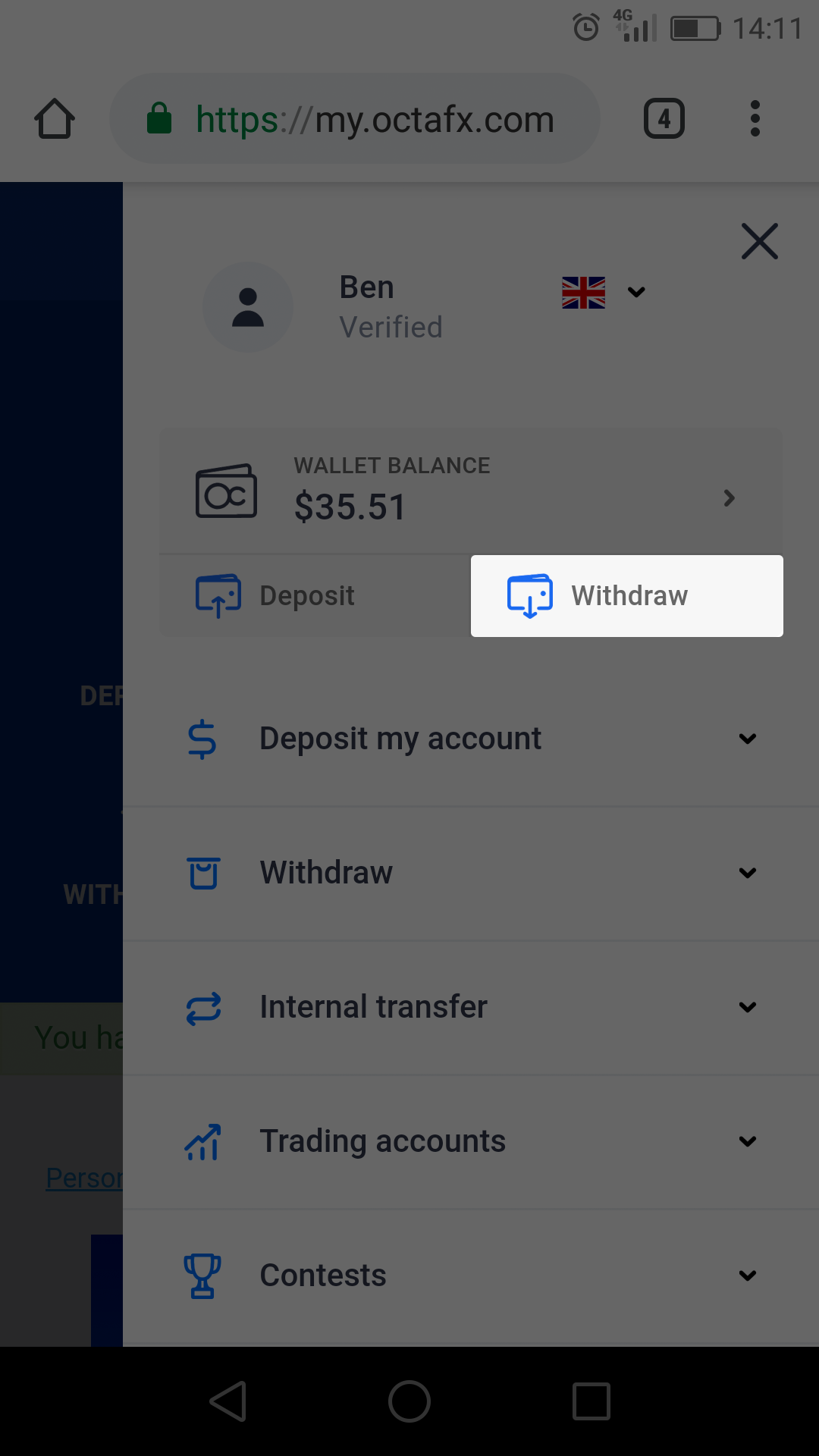

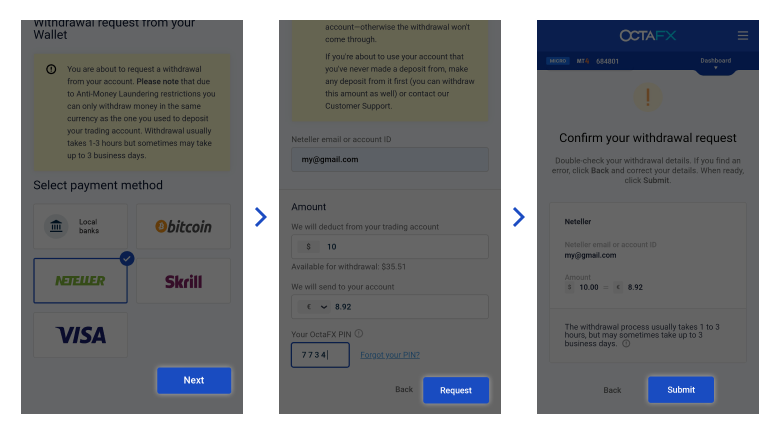

How to withdraw money from your trading account or wallet

Important: by the law, you can only withdraw money after verifying your profile—this is required by law.

Log in to your personal area on our site.

Further actions depend on whether you want to withdraw money from your wallet or your trading account.

From your wallet

View the main menu by pressing the icon in the top-right corner of the screen. Then press withdraw under your wallet balance.

From your trading account

Select the account you want to withdraw money from on the main screen. Then press withdraw.

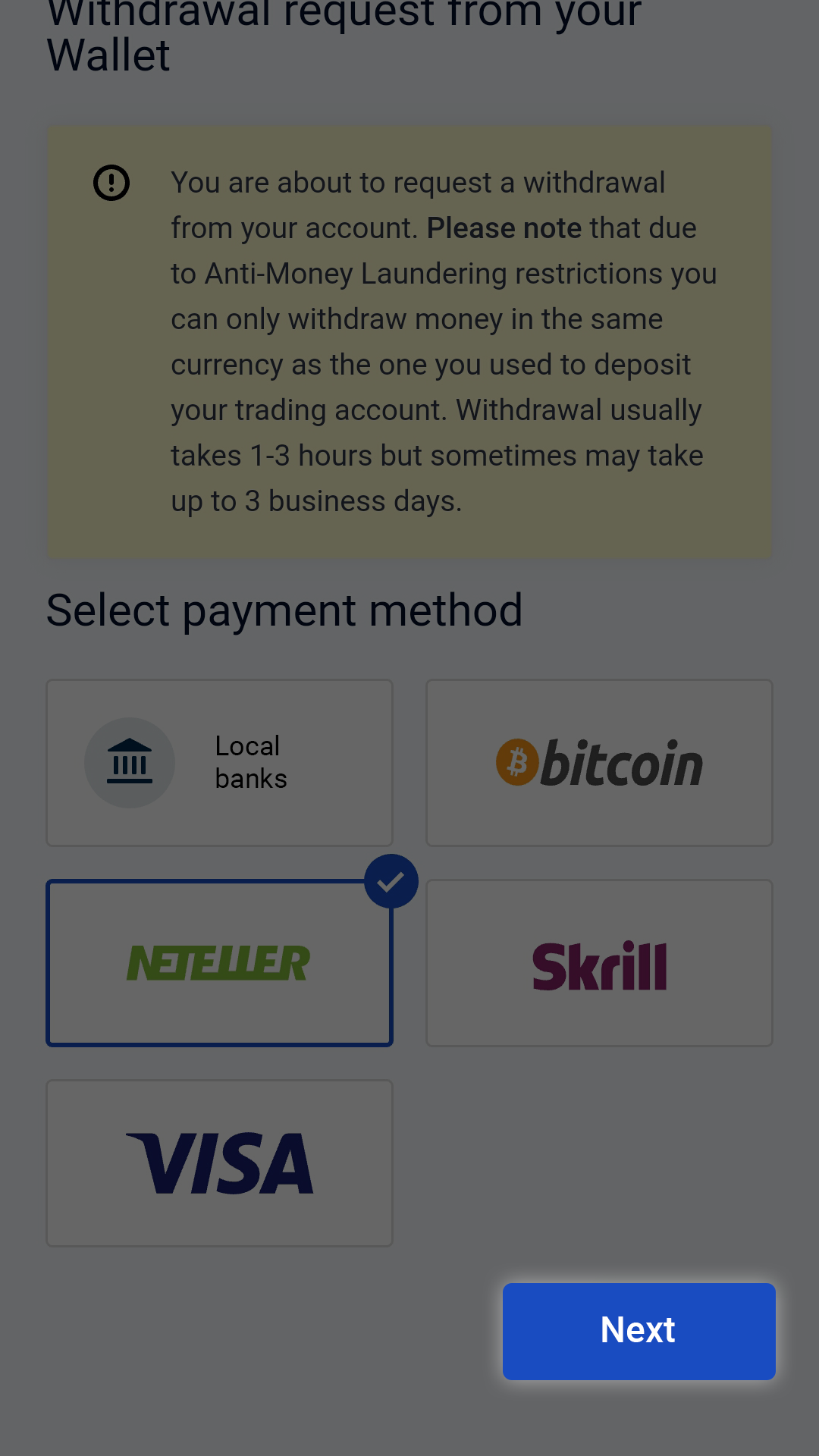

You will see a full list of payment options available in your region. Pick the one that suits you best and press next.

We usually process withdrawal requests for 1–3 hours, but it’s up to your payment system how long it will take the money to reach the destination.

- Skrill, perfect money, neteller—from 5 USD (5 EUR), without the maximum limit

- Bitcoin—from 0.00096 BTC, without the maximum limit

- Mastercard—from 50 USD (50 EUR) or the equivalent in other currency

- Visa—from 20 USD (20 EUR) or the equivalent in other currency

- Banks may apply their own limits

Then enter the details required for the selected payment method and press request. Make sure you specify correct currency.

.png)

On the last step, you can double check that you’ve entered all details correctly. Check them thoroughly and confirm that everything is okay by pressing submit again.

.png)

Withdrawal! Complete withdrawal request within 1 minute!

How to withdraw money on XM group

Withdrawal request from XM group, complete within 1 minute! Very simple

There are different ways to withdraw money such as credit card, debit card, NETELLER, bank transfer, but it should be noted that basically you can not withdraw money using methods other than those used to deposit funds.

This is not just limited to XM group but other foreign forex brokers to prevent money laundering.

Step 1 click “withdrawal” button on my account page

After logging in to my XM group account, click “withdrawal” on menu.

Step 2: select withdrawal options

Select the withdrawal method similar to the deposit method

Credit cards or debit cards can be withdrawn up to the deposit amount.

After withdrawing up to the amount deposited, you can choose to withdraw the remaining amount using whichever method you like.

For example: you deposited 100,000 VND into your credit card, and you make a profit of 100,000 VND after trading. If you want to withdraw money, you have to withdraw 100,000 VND or the amount deposited using credit card, the remaining 100,000 VND you can withdraw by other methods.

| Deposit methods | possible withdrawal methods |

|---|---|

| credit card | withdrawals will be processed up to the amount deposited by credit card. The remaining amount can be withdrawn via other methods |

| debit card | withdrawals will be processed up to the amount deposited by debit card. The remaining amount can be withdrawn via other methods |

| NETELLER | choose your withdrawal method other than credit or debit card. |

| Bank wire | choose your withdrawal method other than credit or debit card. |

Step 3 enter the amount you wish to withdraw and submit the request

Enter the amount you wish to withdraw. Note that you should not enter “comma” when entering the amount. Number only

Click “yes” to agree to the preferred withdrawal procedure, then click “request”

Thus, the withdrawal request has been submitted.

The withdrawal amount will be automatically deducted from your trading account. Withdrawal requests from XM group will be processed within 24 hours (except saturday, sunday, and public holidays)

As for credit cards and debit cards, since refunds are handled by card companies, even if XM group has completed the withdrawal request within 24 hours it could take a few weeks to a month to complete the process so, it is recommended that you withdraw the funds in a timely manner.

XMP (bonus) that has been redeemed will be removed entirely even if you only withdraw 1 USD

At XM, a client can open up to 8 accounts.

Therefore, it is possible to prevent the removal of the entire XMP (bonus) by opening another account, transferring the investment amount to this account and using it to withdraw money.

So, let's see, what we have: the painful beginning is over and you have finished reading all the basics of forex trading. You are sick and tired of the demo account, the nightmares where you speak only with forex terminology become more frequent and you are ready for the big jump – trading for real money. So how to trade with real money and how to make sure your funding is safe? More importantly, how do you receive the profit money you make? At how to withdraw money from forex broker

Contents of the article

- Top forex bonuses

- How to withdraw money from forex broker

- Here is an example taken from forex.Com...

- 1. What are the...

- 2. Are there transaction fees? If so,...

- 3. What is the withdrawal...

- 4. How long does it take to receive the...

- 5. What is the minimum amount required to...

- 6. How does bonus affect the withdrawal...

- Here is an example taken from forex.Com...

- Withdrawals

- How do I withdraw funds from my account?

- How will my withdrawal be processed?

- How much can I withdraw in one time?

- How do I withdraw excess funds to a new bank?

- How will bank transfer withdrawals be processed?

- How will debit card withdrawals be processed?

- How will wire withdrawals be processed?

- How will paper check withdrawal be processed?

- I funded my account by bank transfer. Why don't I...

- What if I have open positions when I submit a...

- Why is my card withdrawal request being processed...

- Forex brokers with best money withdrawal options...

- Forex brokers with best money withdrawal options

- Choose the withdrawal option

- Submit your withdrawal request

- Wait until your fund is transferred to your bank...

- Forex brokers with best money withdrawal options

- Fxdailyreport.Com

- How to choose the best forex broker for...

- XM deposit and withdrawal methods in 2021

- 777research.Com is for sale

- Since 2005, we’ve helped thousands of people get...

- Other domains you might like:

- Deposit and withdrawal

- Frequently asked questions

- How can I withdraw money from my account?

- How long does it take to process my withdrawal?

- Can I withdraw trade 100 bonus?

- Is FBS a legit broker?

- FBS at social media

- Contact us

- Data collection notice

- How to withdraw money from your trading account...

- Withdrawal! Complete withdrawal request within 1...

- How to withdraw money on XM group

- Step 1 click “withdrawal” button on my account...

- Step 2: select withdrawal options

- Step 3 enter the amount you wish to withdraw and...

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.