Best brokers in forex

Currency options: more than 80 pairs the offers that appear on this site are from companies that compensate us.

Top forex bonuses

This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Best online brokers for forex trading in january 2021

Advertiser disclosure

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional.

How we make money.

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Editorial disclosure.

All reviews are prepared by our staff. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication.

Share

At bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here’s an explanation for how we make money.

Editorial integrity

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.Com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, bankrate does not include information about every financial or credit product or service.

Trillions in currency are zipping around the world, 24 hours a day, five days a week, making the foreign exchange (also known as forex or fx) markets the world’s most active. Fortunes can be won and lost quickly, as brokers routinely let traders borrow heavily to finance their speculations.

If you’re looking to get in on this action, you’ll need a broker who deals in currency, and many of the big names in stock trading simply don’t offer this feature. Because the markets are so different, you’ll also need to evaluate a forex broker on different criteria from what you would use on a stock broker.

Below are some top forex brokers, including a couple that allow customers to trade cryptocurrencies.

Here are the best online brokers for forex trading in 2021:

What to consider when choosing a forex broker

While you may be familiar with many of the brand-name online stock brokers, only some of them deal in forex trading. Instead, a plethora of more specialized niche brokers populate the space, and they may cater to high-volume currency traders looking for every possible edge.

But regardless of which kind of broker you’re targeting, you’ll want to focus on at least a few features that are common to any forex broker:

- Pricing: forex brokers have two ways to price their services: by baking the price into the buy-sell spread or on a commission basis. Spreads are often quoted in pips, or one ten-thousandth of a point.

- Leverage: how much leverage will the broker let you assume? In general, traders are looking for a higher amount of leverage to magnify the moves in the currency market. The level may differ on the liquidity of the currency.

- Currency pairs: A handful of major pairs dominate trading, but how many other pairs (minors, exotics) does the broker offer? The most popular currencies include the U.S. Dollar, the euro, the japanese yen, the U.K. Pound and the swiss franc.

- Spreads: how wide are the broker’s spreads for trades? The larger the spread, the less attractive the trade. Of course, brokers who charge a spread markup will tend to have wider spreads because that’s how they get paid.

Investors looking to buy cryptocurrency may be able to do so through some of the traditional stock brokers such as TD ameritrade or robinhood. These have been noted below, though the trading works differently from regular forex trading as described above.

One downside for american traders is that many top forex brokers are based in the U.K. And simply won’t accept them because of their citizenship. The brokers below are all fine for americans, however.

Overview: top online forex brokers in january 2021

TD ameritrade

TD ameritrade offers a range of tradable products, and currency really rounds out its portfolio. Currency traders are able to use the broker’s highly regarded thinkorswim trading platform, and can also trade on a couple of mobile apps.

The broker uses spread pricing and offers 50:1 leverage, which is the legal maximum permitted in the U.S. It offers more than 70 currency pairs, providing plenty of options. TD ameritrade also allows clients to trade bitcoin futures, though you’ll need to get approval to trade futures, and pricing uses the broker’s futures scheme.

(charles schwab has purchased TD ameritrade, and will eventually integrate the two companies.)

Pricing: spread

Maximum leverage: 50:1 on major currencies; 20:1 on minors

Currency options: 73 pairs

Forex.Com

Like its name suggests, forex.Com specializes in currency trading (though it trades in metals and futures, too) and it offers a plethora of attractive features. Clients can select the pricing structure that suits them best: spread or commission, or the broker’s STP pro pricing, where prices come from global banks and others with no additional markup.

Forex.Com also gives traders access to more than 80 currency pairs, and its success with clients has the broker declaring that it’s the no. 1 forex broker in the U.S., in terms of assets held with the broker.

Pricing: spread and commission, depending on account type

Maximum leverage: up to 50:1

Currency options: more than 80 pairs

Ally invest

Ally invest is better known as a low-cost stock broker (and for its especially good prices on options trades), but currency trading really adds some breadth to its offerings. Ally is a good choice for traders just starting out, and it offers more than 80 currency pairs and easy-to-use charting software, including a mobile app.

Ally also allows you to open a $50,000 practice account so that you can see how currency trading works, even if you don’t intend to actually trade. Given the difficulty of forex trading, that’s a great resource for beginners to try it out.

Pricing: spread

Maximum leverage: up to 50:1

Currency options: more than 80 pairs

IG

IG is a more specialized broker focused on forex, and it’s open to american investors. It’s a high-powered broker that nevertheless offers many features, such as a demo account, that may help novice traders. The broker offers a web platform, a mobile app and access to metatrader4 and prorealtime platforms.

IG allows spreads as low as 0.8 pips, and says that its pricing is up to 20 percent lower on the euro-dollar pair than the top two U.S. Brokers. The broker also provides an extensive range of charting capabilities across its platforms.

Pricing: spread

Maximum leverage: up to 50:1

Currency options: more than 80 pairs

Robinhood

Robinhood doesn’t offer traditional currency trading, but it does bring the slick, easy-to-use interface it’s known for to the crypto space. Here clients can trade a range of cryptocurrencies, including some of the most popular. Tradable currencies include bitcoin, ethereum, litecoin and dogecoin, among a total of seven types of cryptos. You’ll also be able to get quotes on 10 other digital currencies.

Like its core brokerage that offers free trades on stocks and options, crypto trading is also gratis (free) on robinhood.

Top 7 of best US forex brokers for 2021

Top rated:

Are you searching for the best US forex brokers?

Luckily, our team of professional forex broker reviewers can take care of your every need.

Let alone the best forex broker in USA, our team realizes it is tough to find any broker which offers a trustworthy, and still value for money proposition when you want to trade forex in the USA. Forex brokers accepting US clients may be few and far between, but we have combined years of experience to narrow your selection down to the top five brokers.

These five are among the best forex brokers USA has to offer.

In fact, they are some of the best forex brokers for residents of any country. These brokers will ensure you feel safe, secure, and still have the ability to prosper in your trading career. They have been selected as the best US forex brokers for a variety of reasons.

Among these reasons are the amount of trading support they offer you, they wide range of markets and instruments that are available for trading, and the very competitive pricing and fee structure offered by these top forex brokers.

Table of contents

Is forex trading legal in the USA?

As a forex trader in the US, one of the most important questions you may be asking yourself from the outset surrounds the legality of forex trading in the US. Well, we are pleased to tell you that yes, forex trading is legal in the US. In fact, the US has several top financial regulators providing the best protection to you as a trader. These bodies are FINRA, the SEC, CFTC, and NFA with the latter two being the main regulators when it comes to forex trading and trading in derivatives such as futures. Remember also that cfds trading in the US is not permitted.

How to trade forex in the USA

The process of getting started with a forex broker in the US is typically similar to that of any other country. With any top broker you will usually be asked for the following information:

- Proof of identity. A passport is typically best for this purpose.

- Proof of residence, usually in the form of a bank statement at your current address.

Once these documents are uploaded and verified, a process that takes most forex brokers just a few minutes, you will be free to get started trading forex.

Top 7 forex brokers in the USA listing for 2021

Here’s our list of the best US forex brokers:

1. Forex.Com

When it comes to US forex brokers, forex.Com has to be an immediate consideration for opening your forex trading account in the USA. They are CFTC licensed and NFA regulated (#0339826) and provide a selection of flexible and accessible account types with low spreads starting from 0.2 pips, including their direct market access account. This offers some of the most unbeatable spreads among any of the forex trading brokers USA. They also provide extensive trading options in all of the top forex currency pairs, metals including gold and silver, as well as futures trading. When it comes to forex brokers accepting US clients, forex.Com certainly offers among the most comprehensive range of services to their US-based traders.

The forex.Com minimum deposits starting form $1000 on standard, and commission accounts, and $25,000 on DMA accounts with demo accounts available. There are also a range of other great benefits such as cash rebates and reduced or no fees for active traders.

2. IG markets

With over 40-years in the industry, IG markets is a true pioneer of the industry, and among the most long standing forex brokers accepting US clients. The broker has evolved continually, keeping the requirements of US-based traders as a top priority. These can be traded on MT4, the mainstay trading platform for top US forex brokers and traders from all around the world as well as being both CFTC licensed, and NFA regulated (#0509630). IG markets offers one type of account to all traders and this has a minimum deposit requirement of $250.

Accessibility with IG is also excellent, you can engage with a number of top professional charting packages using your desktop, phone, or other smart device. Beyond the USA, IG markets also featured in our top 10 largest forex brokers australia. This showcases their global appeal to traders. This appeal is further enhanced by a great cost of trading on more than 90 forex pairs with spreads starting at 0.8 pips.

3. Interactive brokers

You will very often find interactive brokers among our lists of top forex brokers. This is also true when it comes to our choice of top US forex brokers. This is thanks to a number of positive aspects which the longstanding broker uses to attract clients around the world. These include an excellent proprietary trading platform which offers some of the most advanced trading tools available on any market, and a widespread list of products which are available at highly competitive rates. These products include currencies, options, metals, and indices within a list which is ever increasing. IB are a FINRA member and regulated by both the CFTC and NFA (#0392970), as well as the SEC (#8-47257).

They have two account types, you can choose the IBKR lite, or IBKR pro both at no minimum deposit though the pro account has a $10 maintenance fee. As mentioned the product range is excellent as is the trading cost with spreads from 0.1 pips on 105 forex pairs. All of these features make IB a top choice particularly for experienced traders.

4. Oanda

Oanda is also making progress toward becoming the best forex broker in the USA. The industry leader is making progressive inroads in the US market, and now offers trading in more than 70 diverse forex currency pairs. This is more than enough for you to trade successfully. Added to this, you can also benefit from the powerful educational and research infrastructure oanda provides. This includes marketpulse, a selection of news, technical analysis, and research resources which are provided by the in-house oanda team. This can combine perfectly with our own online investment guides and educational content. Oanda are also well-regulated by both the CFTC, and NFA (#325821) offering traders two account types.

The standard account type is attractive thanks to the fact it has no minimum deposit, while the premium account requires a $2,000 minimum deposit but has benefits like lower spreads and other costs. An unlimited oanda demo account is also available. The broker also use the much respected MT4 trading platform for trading in all 70 forex pairs and more at a very competitive spread starting from 0 pips. All traders but particularly newer ones, seem to fit well within oanda.

Top 7 of best US forex brokers for 2021

Top rated:

Are you searching for the best US forex brokers?

Luckily, our team of professional forex broker reviewers can take care of your every need.

Let alone the best forex broker in USA, our team realizes it is tough to find any broker which offers a trustworthy, and still value for money proposition when you want to trade forex in the USA. Forex brokers accepting US clients may be few and far between, but we have combined years of experience to narrow your selection down to the top five brokers.

These five are among the best forex brokers USA has to offer.

In fact, they are some of the best forex brokers for residents of any country. These brokers will ensure you feel safe, secure, and still have the ability to prosper in your trading career. They have been selected as the best US forex brokers for a variety of reasons.

Among these reasons are the amount of trading support they offer you, they wide range of markets and instruments that are available for trading, and the very competitive pricing and fee structure offered by these top forex brokers.

Table of contents

Is forex trading legal in the USA?

As a forex trader in the US, one of the most important questions you may be asking yourself from the outset surrounds the legality of forex trading in the US. Well, we are pleased to tell you that yes, forex trading is legal in the US. In fact, the US has several top financial regulators providing the best protection to you as a trader. These bodies are FINRA, the SEC, CFTC, and NFA with the latter two being the main regulators when it comes to forex trading and trading in derivatives such as futures. Remember also that cfds trading in the US is not permitted.

How to trade forex in the USA

The process of getting started with a forex broker in the US is typically similar to that of any other country. With any top broker you will usually be asked for the following information:

- Proof of identity. A passport is typically best for this purpose.

- Proof of residence, usually in the form of a bank statement at your current address.

Once these documents are uploaded and verified, a process that takes most forex brokers just a few minutes, you will be free to get started trading forex.

Top 7 forex brokers in the USA listing for 2021

Here’s our list of the best US forex brokers:

1. Forex.Com

When it comes to US forex brokers, forex.Com has to be an immediate consideration for opening your forex trading account in the USA. They are CFTC licensed and NFA regulated (#0339826) and provide a selection of flexible and accessible account types with low spreads starting from 0.2 pips, including their direct market access account. This offers some of the most unbeatable spreads among any of the forex trading brokers USA. They also provide extensive trading options in all of the top forex currency pairs, metals including gold and silver, as well as futures trading. When it comes to forex brokers accepting US clients, forex.Com certainly offers among the most comprehensive range of services to their US-based traders.

The forex.Com minimum deposits starting form $1000 on standard, and commission accounts, and $25,000 on DMA accounts with demo accounts available. There are also a range of other great benefits such as cash rebates and reduced or no fees for active traders.

2. IG markets

With over 40-years in the industry, IG markets is a true pioneer of the industry, and among the most long standing forex brokers accepting US clients. The broker has evolved continually, keeping the requirements of US-based traders as a top priority. These can be traded on MT4, the mainstay trading platform for top US forex brokers and traders from all around the world as well as being both CFTC licensed, and NFA regulated (#0509630). IG markets offers one type of account to all traders and this has a minimum deposit requirement of $250.

Accessibility with IG is also excellent, you can engage with a number of top professional charting packages using your desktop, phone, or other smart device. Beyond the USA, IG markets also featured in our top 10 largest forex brokers australia. This showcases their global appeal to traders. This appeal is further enhanced by a great cost of trading on more than 90 forex pairs with spreads starting at 0.8 pips.

3. Interactive brokers

You will very often find interactive brokers among our lists of top forex brokers. This is also true when it comes to our choice of top US forex brokers. This is thanks to a number of positive aspects which the longstanding broker uses to attract clients around the world. These include an excellent proprietary trading platform which offers some of the most advanced trading tools available on any market, and a widespread list of products which are available at highly competitive rates. These products include currencies, options, metals, and indices within a list which is ever increasing. IB are a FINRA member and regulated by both the CFTC and NFA (#0392970), as well as the SEC (#8-47257).

They have two account types, you can choose the IBKR lite, or IBKR pro both at no minimum deposit though the pro account has a $10 maintenance fee. As mentioned the product range is excellent as is the trading cost with spreads from 0.1 pips on 105 forex pairs. All of these features make IB a top choice particularly for experienced traders.

4. Oanda

Oanda is also making progress toward becoming the best forex broker in the USA. The industry leader is making progressive inroads in the US market, and now offers trading in more than 70 diverse forex currency pairs. This is more than enough for you to trade successfully. Added to this, you can also benefit from the powerful educational and research infrastructure oanda provides. This includes marketpulse, a selection of news, technical analysis, and research resources which are provided by the in-house oanda team. This can combine perfectly with our own online investment guides and educational content. Oanda are also well-regulated by both the CFTC, and NFA (#325821) offering traders two account types.

The standard account type is attractive thanks to the fact it has no minimum deposit, while the premium account requires a $2,000 minimum deposit but has benefits like lower spreads and other costs. An unlimited oanda demo account is also available. The broker also use the much respected MT4 trading platform for trading in all 70 forex pairs and more at a very competitive spread starting from 0 pips. All traders but particularly newer ones, seem to fit well within oanda.

The best U.S. Forex brokers

Forex trading is highly regulated in the united states. In this guide, we review the best U.S.-complaint forex brokers, comparing their fees, leverage, pros, and cons.

Tim fries

Tim fries is the cofounder of the tokenist. He has a B. Sc. In mechanical engineering from the university of michigan, and an MBA from the university .

Shane neagle

Meet shane. Shane first starting working with the tokenist in september of 2018 — and has happily stuck around ever since. Originally from maine, .

All reviews, research, news and assessments of any kind on the tokenist are compiled using a strict editorial review process by our editorial team. Neither our writers nor our editors receive direct compensation of any kind to publish information on tokenist.Com. Our company, tokenist media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. Click here for a full list of our partners and an in-depth explanation on how we get paid.

Settling on a good forex broker in the U.S. Should be easy, right? After all, the united states is still the world’s largest economy, and there’s a market for trading every currency with USD.

Well, easier said than done…

Foreign exchange, the exchange of one currency to another, runs 24 hours, 5 days a week through over-the-counter markets, generating a huge trading volume per day. This highly liquid market allows for seamless access to traders across the globe. Australian traders, for example, can trade in british pounds (GBP) and euros (EUR) through a US-based broker.

This decentralized and global nature of the industry also carries significant risk, making it an ideal target for fraud. The growth of speculative trading has resulted in an increase in intermediaries, including brokers and banks engaging in scams, financial irregularities, exorbitant charges and exposure to high-risk through bad practices.

It’s no wonder then that U.S. Regulators now play such an important role in the industry. That is to say, the most important criteria to take into consideration when choosing a U.S. Forex broker is the regulatory approval status of the broker and its governing authority.

However, regulation enforcement isn’t a straightforward process, and due to the global scale of the market, there is no standard regulatory framework that applies across all jurisdictions. So, can you trade forex in the USA?

Yes, though forex trading in the US is generally considered highly regulated. Forex brokers in the US are heavily regulated by the commodity futures trading commission (CFTC) and national futures association (NFA), independent agencies that enforce strict rules, including a restriction on leverage offered.

Furthermore, if you are a united states citizen, the regulation impacts your eligibility for non-U.S. Based brokers, unless they are registered with the NFA.

There are stark differences in regulation that make it imperative for you to be aware of and understand the regulation that applies to the broker you are considering.

Additionally, the forex market is highly vulnerable to significant volatility as a result of economic turbulence. We can see this through the current coronavirus pandemic, the impact of which can be felt, in this case, regardless of regulations. ��

In this article, we’re going to take you through:

- Our recommendations for the best brokers

- Key provisions of U.S. Forex trading regulations

- How U.S. Forex regulations differ

- Quick Q&A on forex regulations in the united states

Leading US forex brokers

The following list presents the advantages of the best forex brokers for US clients:

The following list presents the advantages of the best forex brokers for US clients:

- Interactive brokers

best overall - IG US

best investment selection - TD ameritrade

superb app for US forex brokers - FOREX.Com

best charting tools - Nadex

best exchange

Top 5 US forex brokers 2020

1. Best US forex broker overall: interactive brokers

When it comes to currency pairs offered, trading technology, ease-of-use, regulation, and fees — there’s one broker that takes the cake. Interactive brokers is easily our top forex broker for US traders.

- Highly regulated

- Substantial range of global markets and asset classes

- Low fees including discounts for high-volume traders

- Complex desktop platform may be unsuitable for beginners

- A lack of forex charts on web platform

- Minimum activity charges per month

Interactive brokers (IBKR) should be a serious consideration for professional FX traders. The company is headquartered in the U.S and boasts strong regulatory licences.

This broker is most suited to professional traders and offers 105 forex pairs, 7,400 cfds, US-traded bitcoin futures, and much more. IBKS’s trader workstation is more difficult to use but does provide a full range of features.

Interactive brokers fees appears to be competitive overall, however, the company does not publish its average spread for forex which makes it difficult to pinpoint exactly. Forex traders will receive an aggregated price from some of the largest dealers around the world, and then be charged a commission per trade that can range from $16-$40 per million round turn, as opposed to charging a spread.

Traders looking to prioritize research will appreciate the comprehensive array of third-party research, including both free and premium content. The company does however, lack a full-featured research offering for forex.

⚡️ important: interactive brokers requires forex traders in the U.S to be classified as an eligible contract participant (ECP), “an [ECP] is generally an individual or organization with assets of over $10 MM (5 MM for trades that are hedging)”.

Originally, IBKR’s customer support was far from the most loved. Fortunately, the service has improved immensely, for example with the introduction of ibot on mobile, a virtual assistant that permits users to ask questions by voice command.

In addition, the interactive brokers‘ team can be contacted in a variety of ways, including by phone, with an average wait time of 1 to 2 minutes.

Fxdailyreport.Com

- Proper regulation

In an industry that requires a lot of trust, regulation is key. Proper regulation will ensure that the broker is capitalized in case of trading losses, keeps your money in safe, secure as well as segregated accounts and sticks to fair dealing practices to make sure your trades are always done at the current market prices. The MT4 forex broker you choose should have a strong regulatory record.

Most countries have taken the initiative of regulating forex trading. However, the fine print of the regulations may vary from country to country. Brokers who operate in different countries need to be registered and licensed. When making your choice, ask the broker which regulator has licensed them, and if possible, request to be provided with the registration number for verification.

Best metatrader 4 forex brokers fully regulated in 2021

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker |

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $100 spread: starting 0 pips leverage: up to 400:1 regulation: FCA UK, NFA, CFTC, ASIC, IIROC, FSA, CIMA | visit broker | |

| min deposit: $300 spread: floating, from 0 pips leverage: 500:1 regulation: FCA UK reference number 579202 | visit broker | ||

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: no minimum deposit spread: 1.2 pips leverage: 50:1 regulation: CFTC, NFA, FCA, MAS, ASIC, IIROC | visit broker | |

| min deposit: $100 spread: starting 0 pips leverage: up to 500:1 regulation: FCA UK, ASIC australia, MAS singapore | visit broker | ||

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker |

- Data security

When you are opening an account with your broker, you’ll provide lots of personal and financial information. Usually, you’ll be requested to provide copies of your passport, bank account information, utility bills, and credit card number.

Having poor internet security protocols puts your data at risk of theft. It could also disrupt your trading activities and even lead to identity theft. Before committing to any forex broker, ensure they have great internet security. The internet security could include SSL, a 2-factor authentication and a privacy policy.

To ensure that you always get the best rates at the required times, you should choose a broker with exceptional trade execution methods/practices. Essentially, forex brokers can be classified into two: market makers (those dealing desks) and STP brokers (those that pass your directives to interbank markets).

With market makers, any loss you make registers as a loss on their end and vice versa. But this doesn’t mean that they are working against you. The idea is to spread the bid when clients enter as well as exit the trades. They offset the risk of the trade with other trades from their clients and with their current liquidity provider.

On the flip side, STP brokers route all your directives to financial institutions like hedge funds, mutual funds, and banks. They see a good quote in the interbank market and then add some fractional pips as compensation before they route the order to liquidity providers.

- Product coverage

Today, you can trade several currencies with a broker. A good broker will grant you access to several capital market areas via one forex account. It’s therefore important to note that broad coverage doesn’t always mean deep coverage. If your goal is to trade a lot more than forex, then the number of products that your broker covers is imperative.

Now that you know how to pick an MT4 forex broker, let’s look at the benefits you stand to gain using the MT4 platform.

- Exemplary user experience

The MT4 interface is user-friendly. This enables forex trading newbies to navigate the volatile and complex market with great comfort and ease. Moreover, MT4 has a mobile app which allows access to the platform anytime and anywhere.

MT4 supports lots of languages all over the world. This means that you can use the platform in your native language.

Charts

in addition to its user-friendliness, MT4 provides advanced chart features, which help traders to analyze the technical aspects of their market. Also, you can change the style and color of the charts and use different templates that you like.

Communication

the platform has advanced tools of communication which enable the brokers to communicate with traders in real time. This gets rid of long email threads which can be a pain to follow. It makes trading and collaboration easier and simpler.

As you prepare to venture into the forex trading, be patient and a good communicator. Hopefully, you don’t think it is a get rich quick scheme, but you will undoubtedly enjoy great returns if you do it right.

Top 10 ECN forex brokers in 2021

It would be best if you kept in mind that not all brokers work in every single country. That’s why you will need to figure out the top 10 forex brokers from different country-specific regulatory bodies. Besides, with the development of technologies, many brokers offer some new forex strategies. So, while selecting the top 10 forex brokers, make sure you look at their trading strategies.

In this article, we will thoroughly educate you on all the available forex trading strategies you should look at while choosing a forex broker.

First, let’s get to know the forex brokers in different countries.

Top 10 ECN forex brokers

15% bonus

100% bonus

100% bonus

How many forex brokers are available in the world?

It is tough to know the exact broker’s number, as new brokers are being introduced frequently. However, according to the MT4 brokerage user’s data, more than 1200 forex brokers are now available worldwide.

Those more 1200 brokers are handling 13.9 million online traders worldwide, which is increasing daily.

Country-specific

If you are actively looking for a fully rounded forex trading experience, we strongly advise you to check the top 10 brokers from different countries. The following list contains an overview of country-specific regulatory and licensing bodies for seven different countries. This comprehensive list will help you understand what you should look for when gathering forex strategies for the top 10 forex brokers.

Forex strategies for UK regulated brokers

The top 10 forex brokers in UK should show the commitment to give you unsurpassed trading along with the first-rate trading experience. Besides, they should be regulated by the UK financial conduct authority (FCA) .

When you join any brokers from the UK, make sure you can deposit and withdraw using GBP.

US regulated forex brokers

Because of strict US regulations, you may not find too many forex brokers to offer you based on the USA. That’s why it may take a longer time for you to sort out the top 10 forex brokers in the US. Some of the brokers are the USA doesn’t offer service in all states. However, when you come to know about a broker, you should check that license and regulations first.

For verification, you can check out with either the national futures association (NFA) or the commodity futures trading commission (CFTC). If you find any non-regulated broker in the USA, we suggest you avoid those. By joining a regulated broker, you will have peace of mind. You will know that regulatory bodies are there if you face and fraudulent activities. Additionally, check the broker’s forex strategies if they have any. A US broker should be making transactions only in USD currencies.

Australian regulated forex brokers and platforms

There are several forex brokers who offer their services exclusively australian residents. To find out the top 10 forex brokers in australia, make sure you check their funding method. If any broker claims to be australian, they are supposed to allow you to deposit in AUD currencies. Besides, they should be regulated by the australian securities and investments commission (ASIC).

Canadian regulated top 10 forex brokers

All the related financial services in canada are licensed and regulated by the investment industry regulatory organisation of canada (IIROC). However, this authority doesn’t regulate forex brokers in canada. So, if you are seeking to work with any legit canadian forex broker, you will find it hard to find one.

To look for a canadian forex broker, you have to put your highest effort on research. Especially, cross-check with different forex-related forums and communities.

Forex brokers with european regulation

Since many europeans are involved in forex trading, you will find plenty of forex brokers located in europe. Different countries are actively trading currencies such as germany, netherlands, spain, sweden, france, cyprus, and italy. All of these countries have their regulations regarding forex trading. If you are in europe, it will be easier to find the top 10 forex brokers in europe.

However, you still have to do plenty of research to find the broker with the best forex strategies.

The common checklist for top 10 forex brokers

The first this you have to check is, the forex broker you sign up should be licensed to your home country. Besides, that country-specific broker should allow you to make the transaction in that country’s local currencies. On the other hand, their forex trading strategies should include a wide range of currency pairs.

As the forex market is developing day by day, more brokers offer their services to private traders. So, making the right choice and not stumble on the scams is difficult. The second thing you should check is their reputation in different communities and forums. Instead of finding all the positive reviews, you should check for the negative reviews too. That’s how you will get to know the actual condition of a broker.

Forex strategies and goals

Before discussing forex strategies, we need to first elaborate, why would one consider trading foreign currencies in the first place? According to the experts, there are two reasons to trade forex: hedging, and the other is speculation.

Hedging is the way to protect companies from losses. Brokers get their profits from foreign countries. After that, they transfer it to their own country with the expectation of fluctuation in the currency. However, this practice is not relevant to forex strategies.

On the other hand, speculation is the prediction of a move a company can make in some certain situation. If the prediction is correct, it can improve the trading results. Speculation is all about day trading. With decent trading strategies, you can progress in the FX trading. In the end, you may apply your own forex strategies. Although applying their strategy could be time-consuming and difficult.

But, there is good news that plenty of pre-made trading strategies are available for your convenience. However, it is advisable to play it safe, especially when you are a new trader. Let’s dig the available pre-made strategies.

What is the best forex strategies?

Here, we will show you the overview of some working strategies that have been running in the forex industries over the years. From those strategies, you may research the one you might want to apply.

The following are some methods that will help you to apply strategies and gain pips.

The bladerunner trade

This strategy is suitable for currency pairings for all timeframes. Right now, bladerunner trade is one of the trending strategies that is taking by most of the traders. It is mainly a price action strategy.

Bolly band bounce trade

Bolly band focus on the ranging market. It works very well with the combination of confirming signals. If you are interested in bollinger bands, you should check the bolly band bounces forex strategies.

Daily fibonacci pivot trade

It uses only daily pivots. However, according to this strategy, you can extend to a longer timeline. Fibonacci pivot combines fibonacci retracements and extensions. On the other hand, fibonacci can incorporate any amount of pivots.

Forex overlapping fibonacci trading strategies

Most of the traders follow this strategy, but the reliability of this method is a bit lower. However, it is used with the combination of appropriate confirming signals, and ultimately they become accurate.

Pop ‘n’ stop trade

Unless you know the trick, trying to chase the price when it goes reverse rarely works. This forex strategy will provide you a tip so that you may know whether the price will keep rising or drop.

Trading the forex fractal

It is considered a concept, rather than a strategy. However, it teaches you about the market fundamentals that accelerate your efficiency in trading.

Trading is usually a game of trial and error. You have to apply different strategies to know the right one for you.

To some traders, scalping is time-consuming and needs a lot of work. However, it is not useful for all traders. Although scalping works if you can do it properly. Some traders might think that scalping could take the fun out of forex strategies.

On the other hand, if you are looking for the best forex trading strategy, this might be the safest one for you. As a day trader, you might dip in and out of the forex market one in a day or twice, including carrying a position into another period. Eventually, the profit will come back.

If you are a knowledgeable scalper, you may trade in and out several times a day. However, you may see a small profit, but they would be steady. The more you scalp, the more money you make.

As a scalper, you should know when inflation rates, unemployment figures, and GDP information are about to release. Those factors affect strategies. Scalping can help you out in those situations trading with top 10 forex brokers.

Positional trading

As we already know that scalping will teach you about the current market; at the same time, it is time-consuming. You have to sit for a long time in front of the computer while scalping. Considering that, it would be more efficient to find a less time-consuming strategy.

Positional trading can be great alternatives. It will take only a few hours a week, and it can provide a handsome amount of profit.

Having your position opened for a long period is usually the position trading. It allows you to catch some large market moves. On position trading, you have to avoid using high leverage and keep the focus on currency swaps.

Final thoughts

Among all the forex strategies, applying the right one with top 10 forex brokers would be hard. To become successful in forex, you should research yourself and work with experiments.

Whether you are a new or seasoned trader, everything depends on the broker. That is why it is suggested to work with the top 10 forex brokers. You will find many brokers claiming themselves as a top broker. However, your job is to filter all the brokers and choose a perfect one for your trading.

The best 10 ECN forex brokers for traders – review & comparison

| broker: | review: | regulation: | spreads: | min. Deposit: | account: |

|---|---|---|---|---|---|

| 1. Blackbull markets | ➜ read the review | FSPR, FSCL | starting 0.0 pips + negotiable commission per 1 lot | $200 |

Are you searching for a reliable ECN forex broker? – then you are right on this website. We show your the best 10 ECN providers for private traders. With more than 7 years in financial trading, we tested each one separately. Inform yourself in the next sections how the ECN forex broker is working and why it is so important to choose one. Should you invest your money there? – find out in this review.

What is an ECN forex broker? – how does it work?

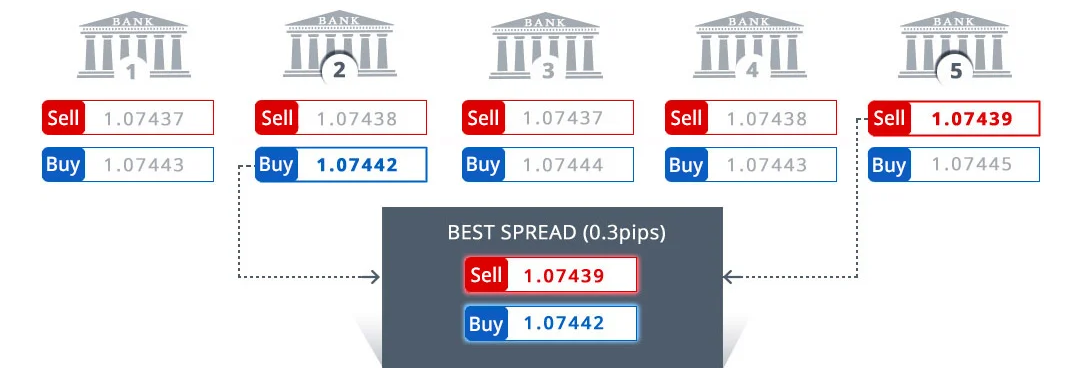

ECN means “electronic communication network”. It is well-known in the trading industry and every successful trader knows this term. A forex broker can be a market maker or an ECN broker to provide currency trading. Traders want to buy and sell currencies and the broker is delivering the liquidity for it. But where does the liquidity come from? – see the picture below.

ECN forex broker liquidity system

The ECN forex broker gives you direct access to the currency market. Traders buy and sell into the network and get the best prices through different liquidity providers. The liquidity providers are competing versus each other to give you the best price and execution. For example, if you open a very large position the order can be executed by different liquidity providers.

Advantages of ECN trading:

- No requotes: you will get an instant execution of your order on the best prices.

- High liquidity (deep pool): ECN forex brokers offer very high liquidity by different providers.

- Low costs: ECN trading ist most of the time very cheap with low trading fees.

- No conflict of interest: the broker is not trading against you.

- Raw spreads: the broker is offering the real and raw market spreads.

- No slippage: ECN prevents slippage

ECN liquidity providers

Liquidity providers are most of the time big banks or even forex brokers by themself. If you ask your broker the support team can tell you the exact liquidity provider. Often you will see the logos on their webpage. ECN liqduity providers have the license to give liquidity in forex. So it is not possible for everyone to do it.

ECN forex liquidity provider

The network is also called the “interbank market”. This is the top-level foreign exchange market where the banks trade different currencies. The brokers are dealing directly with each other. On electronic brokering platforms over 1,000 banks are connected.

Popular liquidity providers:

- Goldman sachs

- J.P. Morgan

- Deutsche bank

- Saxo bank

- Barclays

- UBS

- HSBC

Benefit from raw ECN spreads

ECN spreads are the best spreads for traders. Some brokers provide a 0.0 pip spread execution with high liquidity which you can see in the market-depth. Note that the spread is always depending on the market situation. Sometimes there can be less liquidity and the spread can be higher. Market news is a good example of it because a lot of traders are canceling their limit orders before the market news.

- Raw and direct spreads

- Starting from 0.0 pips

- The spread is always depending on the market situation

In the picture below you will see some raw spreads:

Use the best technology – equinix servers

Some ECN forex brokers offering you access to the most important exchange servers in new york, london, and tokyo. The servers are called “equinix servers” and they are made for fast and big execution. Market makers, hedge funds, and institutional investors using the servers too. No matter which trading software you are using the execution will be very fast.

Example of equinix servers:

- New york (NY4)

- London (LD5)

- Tokyo (TY3)

Advantages:

- Deep pool liquidity (liquidity providers compete for the best price)

- Depth of markets

- Low latency

- Georpahic advantage = fast execution

ECN means trading without conflict of interest – no dealing desk

ECN forex brokers are without a dealing desk. No dealing desk brokers do not manipulate charts or spreads because it is not possible. The orders go directly to the exchange servers. On the internet, you will often find some cases where users are saying the broker manipulate the chart, spreads, or execution. This can be possible but from our experience, it is very rare.

It is always depending on the broker when the execution is made. There are good and bad ECN providers. That is why we recommend our ECN forex broker list above. When you are trading with a market maker broker you are trading versus other traders on the broker’s platform or versus the broker. So this is not the best opportunity for you. To be 100% sure that the broker will not cheat you should choose an ECN broker.

Minimum deposit and account size for ECN traders

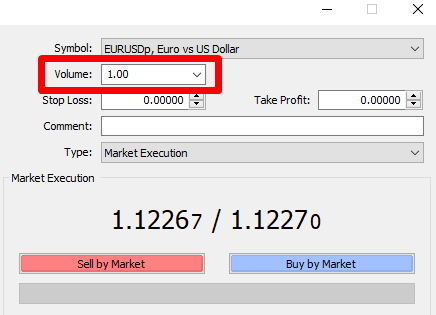

ECN trading is possible with a low minimum amount of money. As you saw in the table above the forex broker superforex is offering an ECN account with only $1 deposit. The minimum trading volume is 0.01 lot. This means the volume of 1,000 units of the base currency of the currency pair. For example, if you are trading 1 lot on the EUR/USD chart you trade the position size of 100,000€.

ECN forex position size

In addition, you can use a leverage of up to 500. The most ECN forex brokers are offering maximum leverage of 100 – 500 (1:100, 1:500). The currency market is moving very slow that is why most traders are trading large positions to make a profit.

- 0,01 = 1,000 units of the base currency

- 0,10 = 10,000 units of the base currency

- 1,00 = 100, units of the base currency

For depositing or withdrawing money you can use different payment which are provided by your broker. Often there are electronic methods and the classic bank transfer. You can capitalize your trading account instant and start trading.

Popular payment methods of ECN brokers

Trading high volume and profit from lower trading costs

The most ECN forex brokers in our list above are offering you different account types. If you deposit more money and trade higher volume in the market you can get better trading conditions and pay fewer fees. Also, you can negotiate with the broker if you are a high-frequency trader. The broker only earns money by the trading commission.

Trading commissions:

The broker will charge you a commission for each trade. Pay attention to the fees because it means that you pay a commission if you open and close the trade. When you open the trade you buy on the market and if you close the trade you sell. You made 2 trades by closing and opening the position.

Also, VIP accounts or professional accounts are offered. Just read through our full reviews to find out what’s the best account type for you.

Conclusion: ECN is the best way to trade forex

On this page, we showed you how the “electronic communications network (ECN)” is working and why you should use it. An ECN forex broker is the best way to trade currencies because you will get the best possible trading conditions from liquidity providers.

Also, there is no conflict of interest between the trader and the broker. The broker is only earning money by trading commissions. For high volume traders like scalpers or professional traders, it is important to get the best liquidity. With ECN trading there is a big pool of liquidity by different providers.

Start trading with 0.0 pip raw spreads and a low trading commission. We can truly recommend using a real ECN forex broker. Read our full reviews of the presented companies and start trading transparently with a reliable provider.

Our recommended ECN forex brokers:

ECN trading is necessary for every successful trader. Invest by using the best trading conditions.

Eaglefx: best FOREX broker and a trusted platform for traders

The broker has kept all the things in mind if it comes to the security of transactions.

About eaglefx platform and tools

Eaglefx was established in 2019 with a vision to serve people and make forex service accessible to people more effortlessly and securely. The broker is customer-centric and is passionate about offering attractive trading conditions. The firm uses the popular MT4 trading platform with spreads starting from 0.1 pips.

The eaglefx website is easily navigable for the users, and the FAQ section has all the answers and queries available. It has only one trading account, and it can be modified in several different ways.

The accounts can be opened with varying base currencies like the eaglefx ZAR account. Also, one can open an islamic or a demo account, and the user can also use the benefits to the fullest.

It is worth trading with eaglefx as it offers the most secure platform for its traders. Their money is safe and secure with the broker as they offer cold storage and offer offline transactions. The website has a modern design with pleasant colors.

The FAQ section gives detailed information on almost every query of the traders. If someone wants to know the commission rate, they can browse through the FAQ section. One can also find out queries on accounts, deposits, withdrawals, MT4 platform, trading, affiliate program, and general.

Investment choices eaglefx offer

In the login procedure, create a retail trading account, which gives a bunch of trading benefits. One can easily select the preferred base currency within the registration panel and the trading platform one would like to use. A swap-free account is also available if you are a muslim. A demo trading account can also be set up. This demo account helps to trade in the virtual market and hone the newly learned skills.

One can browse through multiple investment choices. The broker also offers currency pairs, stocks, and even cryptocurrencies. The conditions are also imposing, like the leverage rate, which is very lucrative, affordable commission rates.

Eaglefx claims to be the different broker in the market. The broker also gives one of the best security features to the clients. The broker provides a high-tier fund protection mechanism.

Trading features are also desirable. Traders can use MT4 and web trader platforms. These can be used on the demo accounts as well. Eaglefx is one of the best brokers with many benefits and leverage on offer for its traders.

Best online brokers for forex trading in january 2021

Advertiser disclosure

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional.

How we make money.

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Editorial disclosure.

All reviews are prepared by our staff. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication.

Share

At bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here’s an explanation for how we make money.

Editorial integrity

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.Com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, bankrate does not include information about every financial or credit product or service.

Trillions in currency are zipping around the world, 24 hours a day, five days a week, making the foreign exchange (also known as forex or fx) markets the world’s most active. Fortunes can be won and lost quickly, as brokers routinely let traders borrow heavily to finance their speculations.

If you’re looking to get in on this action, you’ll need a broker who deals in currency, and many of the big names in stock trading simply don’t offer this feature. Because the markets are so different, you’ll also need to evaluate a forex broker on different criteria from what you would use on a stock broker.

Below are some top forex brokers, including a couple that allow customers to trade cryptocurrencies.

Here are the best online brokers for forex trading in 2021:

What to consider when choosing a forex broker

While you may be familiar with many of the brand-name online stock brokers, only some of them deal in forex trading. Instead, a plethora of more specialized niche brokers populate the space, and they may cater to high-volume currency traders looking for every possible edge.

But regardless of which kind of broker you’re targeting, you’ll want to focus on at least a few features that are common to any forex broker:

- Pricing: forex brokers have two ways to price their services: by baking the price into the buy-sell spread or on a commission basis. Spreads are often quoted in pips, or one ten-thousandth of a point.

- Leverage: how much leverage will the broker let you assume? In general, traders are looking for a higher amount of leverage to magnify the moves in the currency market. The level may differ on the liquidity of the currency.

- Currency pairs: A handful of major pairs dominate trading, but how many other pairs (minors, exotics) does the broker offer? The most popular currencies include the U.S. Dollar, the euro, the japanese yen, the U.K. Pound and the swiss franc.

- Spreads: how wide are the broker’s spreads for trades? The larger the spread, the less attractive the trade. Of course, brokers who charge a spread markup will tend to have wider spreads because that’s how they get paid.

Investors looking to buy cryptocurrency may be able to do so through some of the traditional stock brokers such as TD ameritrade or robinhood. These have been noted below, though the trading works differently from regular forex trading as described above.

One downside for american traders is that many top forex brokers are based in the U.K. And simply won’t accept them because of their citizenship. The brokers below are all fine for americans, however.

Overview: top online forex brokers in january 2021

TD ameritrade

TD ameritrade offers a range of tradable products, and currency really rounds out its portfolio. Currency traders are able to use the broker’s highly regarded thinkorswim trading platform, and can also trade on a couple of mobile apps.

The broker uses spread pricing and offers 50:1 leverage, which is the legal maximum permitted in the U.S. It offers more than 70 currency pairs, providing plenty of options. TD ameritrade also allows clients to trade bitcoin futures, though you’ll need to get approval to trade futures, and pricing uses the broker’s futures scheme.

(charles schwab has purchased TD ameritrade, and will eventually integrate the two companies.)

Pricing: spread

Maximum leverage: 50:1 on major currencies; 20:1 on minors

Currency options: 73 pairs

Forex.Com

Like its name suggests, forex.Com specializes in currency trading (though it trades in metals and futures, too) and it offers a plethora of attractive features. Clients can select the pricing structure that suits them best: spread or commission, or the broker’s STP pro pricing, where prices come from global banks and others with no additional markup.

Forex.Com also gives traders access to more than 80 currency pairs, and its success with clients has the broker declaring that it’s the no. 1 forex broker in the U.S., in terms of assets held with the broker.

Pricing: spread and commission, depending on account type

Maximum leverage: up to 50:1

Currency options: more than 80 pairs

Ally invest

Ally invest is better known as a low-cost stock broker (and for its especially good prices on options trades), but currency trading really adds some breadth to its offerings. Ally is a good choice for traders just starting out, and it offers more than 80 currency pairs and easy-to-use charting software, including a mobile app.

Ally also allows you to open a $50,000 practice account so that you can see how currency trading works, even if you don’t intend to actually trade. Given the difficulty of forex trading, that’s a great resource for beginners to try it out.

Pricing: spread

Maximum leverage: up to 50:1

Currency options: more than 80 pairs

IG

IG is a more specialized broker focused on forex, and it’s open to american investors. It’s a high-powered broker that nevertheless offers many features, such as a demo account, that may help novice traders. The broker offers a web platform, a mobile app and access to metatrader4 and prorealtime platforms.

IG allows spreads as low as 0.8 pips, and says that its pricing is up to 20 percent lower on the euro-dollar pair than the top two U.S. Brokers. The broker also provides an extensive range of charting capabilities across its platforms.

Pricing: spread

Maximum leverage: up to 50:1

Currency options: more than 80 pairs

Robinhood

Robinhood doesn’t offer traditional currency trading, but it does bring the slick, easy-to-use interface it’s known for to the crypto space. Here clients can trade a range of cryptocurrencies, including some of the most popular. Tradable currencies include bitcoin, ethereum, litecoin and dogecoin, among a total of seven types of cryptos. You’ll also be able to get quotes on 10 other digital currencies.

Like its core brokerage that offers free trades on stocks and options, crypto trading is also gratis (free) on robinhood.

So, let's see, what we have: if you’re looking to get in on forex trading, you’ll need a broker who deals in currency, and many of the big names in stock trading simply don’t offer this feature. At best brokers in forex

Contents of the article

- Top forex bonuses

- Best online brokers for forex trading in january...

- Advertiser disclosure

- How we make money.

- Editorial disclosure.

- Share

- Editorial integrity

- Key principles

- Editorial independence

- How we make money

- Here are the best online brokers for forex...

- What to consider when choosing a forex broker

- Overview: top online forex brokers in january 2021

- Top 7 of best US forex brokers for 2021

- Is forex trading legal in the USA?

- How to trade forex in the USA

- Top 7 forex brokers in the USA listing for 2021

- Top 7 of best US forex brokers for 2021

- Is forex trading legal in the USA?

- How to trade forex in the USA

- Top 7 forex brokers in the USA listing for 2021

- The best U.S. Forex brokers

- Top 5 US forex brokers 2020

- Fxdailyreport.Com

- Best metatrader 4 forex brokers fully regulated...

- Top 10 ECN forex brokers in 2021

- Top 10 ECN forex brokers

- The common checklist for top 10 forex...

- The best 10 ECN forex brokers for traders –...

- What is an ECN forex broker? – how does it work?

- ECN liquidity providers

- Benefit from raw ECN spreads

- Use the best technology – equinix servers

- ECN means trading without conflict of interest –...

- Minimum deposit and account size for ECN traders

- Trading high volume and profit from lower trading...

- Conclusion: ECN is the best way to trade forex

- Eaglefx: best FOREX broker and a trusted platform...

- About eaglefx platform and tools

- Best online brokers for forex trading in january...

- Advertiser disclosure

- How we make money.

- Editorial disclosure.

- Share

- Editorial integrity

- Key principles

- Editorial independence

- How we make money

- Here are the best online brokers for forex...

- What to consider when choosing a forex broker

- Overview: top online forex brokers in january 2021

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.