Is xm forex legit

- Fantastic bonus system with ordinary updates of new bonus types

- Strong regulation and good reputation

- Great customer support services

- Strict NO re-quotes

- Efficient and fast trade execution of each trade

- Good leverage of 1:30 for clients registered under the EU regulated entity of the group. Leverage depends on the financial instrument traded.

Top forex bonuses

Learning information about a broker is an entire process you need to consider every time before signing in a particular website. And part of this process is to see if the available bonuses are ok for you. Thankfully, XM group offers numerous promotions and special extras you should definitely check out now.

XM group forex broker review

A decent and detailed review of a forex broker will give you the necessary information about it in brief. Such an action and filtering of all the available foreign currency exchange platforms is superb way for both – high punters and beginners – to find the best broker for their trading experience. And since we are here to give you the best and most optimal assistance into forex market, we are full of detailed reviews about the most popular and renewable brokers. Check out now our XM group review and find out if it is suitable for your preferences and needs in trading.

XM group overview and specifics

XM group is a group of online regulated brokers. Trading point of financial instruments ltd was established in 2009 with headquarters in limassol, cyprus and is regulated by cysec with license number 120/10. Trading point of financial instruments pty ltd was established in 2015 with headquarters sydney, australia and is regulated by ASIC with license number 443670. XM global limited was established in 2017 with headquarters in belize and it is regulated by international financial services commission (000261/106).

All countries that are in eurozone or in EU are provided with special regulation measures for both – gambling and trading websites. So when it comes to the safety for the customer`s personal data and money, XM group is the right and one of the most recommended websites. But this is not the only great and interesting thing about the XM group platform. The website has also a superb customer support. The services are provided 24/5 and on 17 multiple languages, which makes it easy for any client regardless he is beginner or high punter to make an inquiry at almost any time and to receive a respond to his question or requirement. Also, the XM group website has numerous trading options – including with foreign currenciest, commodity, stocks, precious materials and etc. 99,35% of the orders for trading are usually executed in less than one single second. Moreover, the leverage here is also ok – 1:30 and the XM group provides more than 100 financial instruments. Be aware that the currency options are also numerous on the website – USD, EUR, GBP, JPY, CHF, AUD and etc.

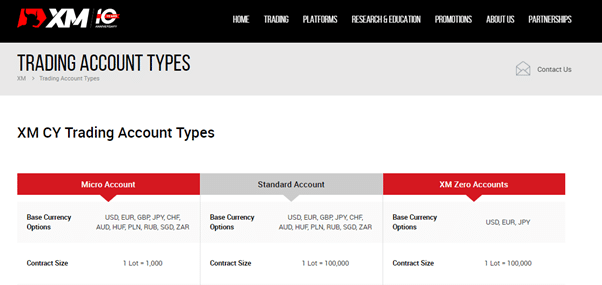

XM group forex broker has more than 60 currency pairs to trade with, while the minimum deposit is only 5 $, which makes it quite suitable for beginners in trading, who do not want to risk lots of money for their first steps on the market. XM group offers 4 type of accounts: micro, standard, zero and ultra low.” please include the following note regarding the XM ultra low account type: XM ultra low account is not applicable to all entities of the group. Account availability depends on the clients’ country of residence. Demo account is also available for people, who are not sure whether to remain on the website before testing its platform. There are no commissions or hidden fees in trading activity on the XM group broker, while the deposit and withdrawal payment methods are the general standard methods such as debit/credit card, neteller, skrill, bank wire transfer, etc.

XM group bonus system and types

Learning information about a broker is an entire process you need to consider every time before signing in a particular website. And part of this process is to see if the available bonuses are ok for you. Thankfully, XM group offers numerous promotions and special extras you should definitely check out now.

- No deposit bonus – the bets forex bonus ever – the no deposit bonus – is still part of the bonus system that XM group website provides to all of its clients. To be more specific only newly registered clients can actually benefit of it. The no deposit bonus here is 30 $ and you can use it only if you are new on the website and have just made your registration with a validated account to trade from.

- Welcome bonus – another welcome bonus for all the newly registered clients on the XM group website gives you up to 100% with a maximum reward of 5000 $ of your initial deposit. Unlike the previous bonus, you must make a deposit in advance and then to receive the bonus. So if you deposit 200 $ you can have in your wallet 400 $.

- Loyal bonuses and programs – become a regular customer on XM group at some point and you will be able to apply for a loyalty program. This program gives you several extras and special promotions and to reach it you will need to collect a particular amount of points, which are given during your experience on XM group platform.

- Special seasonal bonuses – do not forget to check out for special seasonal bonuses on XM group. This forex platform has a tradition to update its bonus system all the time, so you can receive an additional offer throughout your experience here.

- Trading bonus and loyalty program are not eligible for clients registered under trading point of financial instruments ltd.

XM group software information

Our recommended forex brokers

The software type a broker uses makes a website either customer-friendly and intuitive, or harsh and not that easy to be used. Thankfully, XM group offers the best forex broker platforms that are intuitive and great for daily usage. The standard software types XM group uses are metatrader 4, metatrader 5, and web trader. Besides those, XM group is also available on mobile, allowing you to trade any time and from any place you wish.

Why choosing XM group forex broker?

And now we have reached the best part of our XM group review – the list of the biggest benefits behind this forex broker platform. Check out them out and see why so many trader love XM group broker so much:

- Fantastic bonus system with ordinary updates of new bonus types

- Strong regulation and good reputation

- Great customer support services

- Strict NO re-quotes

- Efficient and fast trade execution of each trade

- Good leverage of 1:30 for clients registered under the EU regulated entity of the group. Leverage depends on the financial instrument traded.

Be confident and tranquil to test the XM group forex broker. It is safe and reliable, but it is also quite easy for beginners. Also, see yourself that this website is worth it to remain on even when you become and advanced trader!

XM review 2019 | is XM a scam or legit forex broker?

Average broker rating

Rating breakdown

XM overview

XM is a cysec, ASIC and IFSC regulated, multi-asset class broker offering to trade on more than 1,000+ tradable CFD’S on forex, stocks, commodities, indices, metals and energies on the globally-recognised trading platforms metatrader 4 and metatrader 5 for PC, mac, web, ios and android systems.

| # | broker's features | XM availability |

|---|---|---|

| # | commissions | ❌ |

| # | hedging | ✔ |

| # | PAMM | ❌ |

| # | scalping | ✔ |

| # | accepts US traders | ❌ |

| # | 24 hour trading | ✔ |

| # | swaps | ✔ |

| # | demo account | ✔ |

| # | daily analysis | ❌ |

| # | automated trading | ✔ |

| # | mobile trading | ✔ |

| # | trading by phone | ❌ |

| # | 1st deposit bonus | ❌ |

| # | forex contests competitions | ✔ |

| # | bonuses promotions | ✔ |

| # | interest charges on the balance | ✔ |

| # | free education | ❌ |

| # | expert advisors | ❌ |

| # | partnership programs | ❌ |

| # | trust management | ❌ |

| # | 24 hour support | ✔ |

The variety of online brokers on the internet is very huge, so it is necessary to do a transparent review and comparison of the companies. After spending several days researching different forex brokers for trading FX, our team at onlineforextrading.Net team collected over 50 data points. For this review, we will review XM.

Financial trading and investment services: first of all, you should know which financial instrument you want to trade and then searching for the right broker. This can be stocks, forex, cfds, cryptocurrencies or options. XM offers online financial trading and investment services such as CFD, forex, cryptocurrency, stocks, futures.

Tradable products: XM offers clients more than 1,000+ tradable assets to trade on, across forex, stocks, indices, commodities, metals and energies via spot, futures and CFD products.

Broker type: many types of brokers can be found in the most dynamic market in the world. XM is market maker.

Features: XM offers additional algorithmic trading tools and the ability to access trading signals from their own guru, as well as from MQL5.

XM allows you to execute a minimum trade of 0.01. This may vary depending on the account you open. The maximum trade requirements vary depending on the trader and the instrument. As a market maker, XM may have lower entry requirements compared to an ECN broker who benefits from a higher volume of trades and typically has larger capital and minimum trade requirements. Market makers typically have a lower minimum deposit, smaller minimum trade requirements and no commission on trades. XM also offers a number of useful risk management features, such as negative balance protection, price alerts and much more.

Minimum deposit requirement: to properly understand if a broker is suitable for a certain trader, we will then take a look at how much is required as a basic minimum to open an account. You need to consider how much money you can spare to start off a forex brokerage. XM recommended minimum capital is $5.

Is the forex broker regulated? Commissions and fees aside, let's take a look at regulation. Trust is critical, and you should highly consider choosing a broker that regulated in a major hub. XM is regulated by ASIC, cysec, IFSC. For our reviews, official regulation of an official financial authoritarian is required. Brokers have to fulfill certain conditions to get these licenses. In order to violate the rules, they would lose their license and a lot of money.

Investor protection & regulations: XM is authorised and regulated by the cyprus securities and exchange commission (cysec), the australian securities and investments commission (ASIC) and the international financial services commission of belize (IFSC), offering segregated client funds and negative balance protection.

Account currencies: next lets consider the account currencies each broker offers. XM offers EUR, USD, GBP, JPY, CHF, HUF, PLN, RUB, SGD, ZAR, different account currencies for each account types.

Account openning: XM offers 4 different types of trading accounts globally across different regulatory jurisdictions, with each account offering unique features and benefits for beginner and advanced traders.

XM offers a demo account for practicing trading skills and get familiar with the broker’s trading platform.

Languages available: next lets have a look at each broker's different language options. XM offers english, arab, bulgarian, vietnamese, greek, indonesian, spanish, italian, chinese, korean, malay, deutsch, polish, portuguese, russian, turkish, french, swede, japanese.

Payment methods: next lets have a look at each broker's payment options. XM offers credit/debit cards, netteler, skrill, klarna, przelewy 2 different payment methods for each account types.

Deposit and withdrawal: uniquely, XM covers all deposit and withdrawal transfer fees for payments made via neteller, moneybookers and all major credit cards including visa, electron, mastercard, maestro and china unionpay, with instant account funding.

Trading platforms: next, let's look at the tools and features fx traders desire. With trading platforms, XM makes MT4, MT5, webtrader available to clients.

Web & desktop trading platforms: XM traders have access to the globally-recognised metatrader 4 and metatrader 5 trading platforms, accessible on PC, mac and web.

Mobile trading platforms: XM offers traders the ability to trade on the metatrader 4 and metatrader 5 mobile trading apps for ios and android operating systems, as well as tablets. The broker also offers the XM trading app which allows users to manage their MT4 and MT4 accounts.

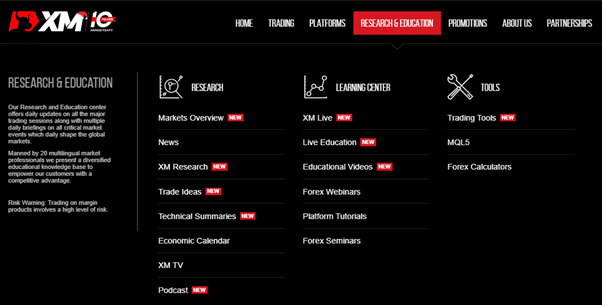

Trader education

XM offers an impressive suite of unique educational products include forex seminars, educational videos, webinars, platform tutorials and live daily interactive education rooms.

Promotions

XM is currently offering two promotional offers but this could be subject to change – free VPS services and zero fees on deposits and withdrawals.

Support

XM offers 24 hours a day, monday to friday, customer support via live chat, email, online contact form and phone on more than 25 different languages.

Recup

XM offers 4 different trading account types with the choice of commission-free, or commission-based trading on more than 1,000+ tradable asset classes across forex cfds, stocks cfds, indices cfds, commodities cfds,precious metals cfds and energies cfds. Traders can use the globally recognised metatrader platforms and enjoy access to an impressive research and education section.

Final thoughts

the XM standard account and XM micro account offer commission-free trading. The XM zero account offers commission-based trading on forex pairs, albeit with lower spreads.

Trading experience

XM offers a wide variety of trading accounts giving a unique and flexible offering to trade on more than 1,000+ tradable assets across both metatrader 4 and metatrader 4 for PC, mac, web, ios and android. The broker also offers an impressive range of research and educational tools suitable for both beginner and advanced traders.

XM review 2021

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

🏆 top 5 stock brokers

🏆 top 5 forex brokers

Summary

Recommended for forex and CFD traders who prefer metatrader platforms and seek great account opening

XM is an online broker whose parent company is trading point holding, a global CFD and FX broker founded in 2009.

XM is available globally and is regulated by three financial authorities: the cyprus securities and exchange commission (cysec), the australian securities and investments commission (ASIC) and the international financial services commission of belize (IFSC).

Disclaimer: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.04% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

XM pros and cons

XM has low stock CFD and withdrawal fees. Account opening is user-friendly and fast. You can use many educational tools, such as webinars and a demo account.

On the other hand, XM has a limited product portfolio as it offers mainly cfds and forex. Its forex and stock index CFD fees are average, and there is no investor protection for clients onboarded outside the EU.

| Pros | cons |

|---|---|

| • low stock CFD and withdrawal fees | • limited product portfolio |

| • easy and fast account opening | • average forex and stock index CFD fees |

| • great educational tools | • no investor protection for non-EU clients |

| ��️ country of regulation | cyprus, australia, belize, united arab emirates |

| �� trading fees class | average |

| �� inactivity fee charged | yes |

| �� withdrawal fee amount | $0 |

| �� minimum deposit | $5 |

| �� time to open an account | 1 day |

| �� deposit with bank card | available |

| �� depositing with electronic wallet | available |

| �� number of base currencies supported | 11 |

| �� demo account provided | yes |

| ��️ products offered | forex, CFD, real stocks for clients under belize (IFSC) |

Author of this review

Author of this review

Ádám nasli

Everything you find on brokerchooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

XM review

fees

XM has low trading fees for cfds and charges no withdrawal fee. On the other hand, forex and stock index fees are only average, and there is a fee for inactivity.

| Pros | cons |

|---|---|

| • no withdrawal fee | • inactivity fee |

| • low stock CFD fees | • average FX fees |

| assets | fee level | fee terms |

|---|---|---|

| S&P 500 CFD | average | the fees are built into the spread, 0.7 points is the average spread cost during peak trading hours. |

| Europe 50 CFD | average | the fees are built into the spread, 2.6 points is the average spread cost during peak trading hours. |

| EURUSD | average | with standard, micro, and ultra-low accounts the fees are built into the spread. 1.7 pips is the standard account's average spread cost during peak trading hours. With XM zero accounts, there is a $3.5 commission per lot per trade and a small spread cost. |

| Inactivity fee | low | $15 one-off maintenance fee after one year of inactivity, followed by $5 per month fee if the account remains inactive. |

How we ranked fees

We ranked XM's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

First, let's go over some basic terms related to broker fees. What you need to keep an eye on are trading fees and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

In the sections below, you will find the most relevant fees of XM for each asset class. For example, in the case of forex and stock index trading, spreads, commissions and financing rates are the most important fees.

We also compared XM's fees with those of two similar brokers we selected, XTB and etoro. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of XM alternatives.

To have a clear overview of XM, let's start with the trading fees.

XM trading fees

XM trading fees are average. XM has many account types, which all differ in pricing. The standard, micro, and ultra low accounts charge higher spreads but there is no commission. The XM zero account charges lower spreads, but there is a commission. The following calculations were made using the standard account.

We know it's hard to compare trading fees for CFD brokers. So how did we approach the problem of making their fees clear and comparable? We compared brokers by calculating all the fees of a typical trade for selected products.

We chose popular instruments within each asset class:

- Stock index cfds: SPX and EUSTX50

- Stock cfds: apple and vodafone

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

A typical trade means buying a leveraged position, holding it for one week and then selling. For volume, we chose a $2,000 position for stock index and stock cfds, and $20,000 for forex transactions. The leverage we used was:

- 20:1 for stock index cfds

- 5:1 for stock cfds

- 30:1 for forex

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for XM fees.

CFD fees

XM has low stock CFD, while average stock index CFD fees.

| XM | XTB | etoro | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.6 | $1.4 | $1.5 |

| europe 50 index CFD fee | $2.4 | $1.8 | $2.7 |

| apple CFD fee | $6.4 | $17.3 | $6.7 |

| vodafone CFD fee | $1.2 | $20.8 | - |

Forex fees

XM's forex fees are average compared to its competitors.

| XM | XTB | etoro | |

|---|---|---|---|

| EURUSD benchmark fee | $9.5 | $8.3 | $8.8 |

| GBPUSD benchmark fee | $8.4 | $6.0 | $8.5 |

| AUDUSD benchmark fee | $10.3 | $6.5 | $8.2 |

| EURCHF benchmark fee | $9.7 | $8.9 | $12.6 |

| EURGBP benchmark fee | $10.5 | $8.4 | $12.3 |

Real stock fees

Clients onboarded under IFSC can also trade real stocks using the shares account.

The real stock fees are lower than XTB's, but lag behind etoro's commission-free real stock offers.

| XM | XTB | etoro | |

|---|---|---|---|

| US stock | $1.0 | $10.0 | $0.0 |

| UK stock | $9.0 | $12.0 | $0.0 |

| german stock | $5.0 | $12.0 | $0.0 |

The commissions are volume-tiered with a minimum fee.

| stock market | commission | minimum commission |

|---|---|---|

| USA | $0.04 per share | $1 |

| UK | 0.10% | $9 |

| germany | 0.10% | $5 |

Non-trading fees

XM has average non-trading fees. There is no account fee and XM charges no withdrawal fee in most cases, though bank withdrawals below $200 carry a $15 fee.

There is a $15 one-off maintenance fee after 1 year of inactivity, and this is followed by a $5 monthly fee if the account remains inactive.

XM group forex broker broker review

Reviewer : justin freeman

Published: 7th december, 2020.

Broker information

- Company name: XM group

- Founded: 2009, 2015 and 2017

- Country: cyprus, australia, belize

Platform info

- Platform: metatrader 4, metatrader 5

- Dealing desk: no

- Web based: yes

- Mobile trading: yes

Broker services

- Regulators: cysec, IFSC, ASIC

- Bonus: 50% and 20% deposit bonus up to $,5000 (T&C apply) *clients registered under the EU regulated entity of the group are not eligible for the bonus.

- Minimum deposit: $5

- Leverage: 1:30 *this leverage applies to clients registered under the EU regulated entity of the group.

- US clients: no

- Funding methods: credit/ debit card, bank wire transfer, local bank transfer, neteller, moneybookers, skrill, and more.

Open free

demo account

5

Bonus offer for forexfraud visitors

Expert’s viewpoint

The online broker XM is long-established and reliable. It has a solid reputation within the trading community.

The firm has a global client base. As a result, the exact entity you trade through and the regulatory framework you are protected by will be determined by where you live.

Understanding the breakdown is important because you always need to get to know your broker. The XM platform is a high-quality operation; it’s just worth noting that the exact offering might differ depending on where you reside.

The platform is very user-friendly. The trading platforms on offer (MT4 and MT5) are powerful, robust and firm favourites in the trading community. There is a focus on trade execution quality, research and educational support.

Setting up an account is straightforward and there are multiple payment processing options when it comes to funding.

The minimum opening balance requirement is low, only $5. That is, of course, not a large enough amount with which to trade effectively. It does though highlight how XM supports traders. The established wisdom is that you should start trading at a small size, so XM deserves some credit for facilitating that.

The XM micro account which is expressly set up to allow for small-scale trading, remains a stand-out feature of the XM service.

There’s a lot to like and hardly anything to dislike. In fact, as XM ticks so many boxes, it’s worth visiting the site to set up a demo account. Spending some time trying out risk-free trading is an excellent way to test your strategies in the markets. You’d also get a better understanding of a broker which is right up there in the broker rankings.

Broker summary

XM group is a collection of regulated online brokers. Financial instruments ltd was founded in 2009 and is regulated by the cyprus securities and exchange commission (cysec 120/10).

Financial instruments pty ltd was founded in 2015 and regulated by the australian securities and investment commission. (ASIC 443670) and XM global limited, which is regulated by the international financial services commission with license number IFSC / 60/354 / TS / 19.

The XM family also includes XM global, a brand owned and operated by XM global limited, an authoritative body established in 2017. It is licensed and regulated by the belize international financial services committee.

Broker introduction

It’s essential to check the detail of the T&cs to be100% sure which entity you will be registered with; however, a rough breakdown is that:

- EU clients – will trade with financial instruments ltd which was founded in 2009 and is regulated by the cyprus securities and exchange commission.

- Australian clients – will trade with financial instruments pty ltd, which was founded in 2015 and is regulated by the australian securities and investment commission.

- Rest of world clients – will trade with XM global limited, which is regulated by the international financial services commission of belize.

Cysec and ASIC are regarded as tier-1 regulators. IFSC falls into tier-2 but is considered one of the more robust authorities in that group.

The trading services provided by XM are top-grade, regardless of which entity you are registered with.

Spreads and leverage

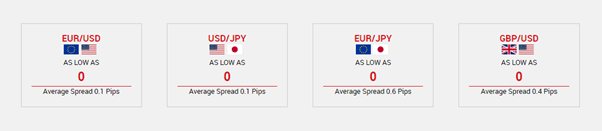

One of the big draws of XM is its tight trading spreads. There are three account types, micro, standard and XM zero. The XM zero option is a new addition and features ultra-thin spreads, even as low as zero pips.

The micro and standard accounts are more ‘entry-level’ in terms of functionality but still have very competitive pricing.

Experienced traders will share that trading isn’t just about spreads; quality of execution also needs to be considered. The XM zero account also comes with features such as VPS trading infrastructure and a ‘no re-quotes’ guarantee.

In line with standard industry practice, leverage is capped at a level set by the regulator. In the EU, for example, the limit is 1:30. Clients outside of europe might find they can apply even higher leverage than that.

XM group offers its clients several types of accounts. Micro trading account – the minimum deposit is only $5. Standard trading account – the minimum deposit is only $5. XM zero – the minimum deposit is only $100. Islamic and free demo accounts are provided.

Platforms & tools

Opening an account at XM will take no more than five minutes. Registration is online and the protocols followed are typical for a regulated broker and include uploading ID to provide proof of residence.

XM supports markets in more than 1,000 financial instruments which can be traded on the ever-popular MT4 and MT5 platforms. XM is particularly good at ensuring that clients can find a platform type which suits them. That is best reflected in the fact that there is a market-leading number of 16 platforms from which to choose.

Easy access to a variety of platforms gives traders the flexibility to trade from anywhere and at any time. Metatrader MT4 also supports an unlimited number of demo and real accounts, and expert advisors (eas) for those looking to incorporate the ideas of others in their trading.

Asset groups covered include forex, stocks, cfds, commodities cfds, equity indices cfds, precious metals cfds and energies cfds.

One area where XM stands out is in terms of quality of trade execution. There are no re-quotes or rejections of trading orders, no hidden fees or commissions, and 99.35% of orders are executed in less than one second.

Commissions & fees

Clients can benefit from tight spreads as low as 0 pip on the major currency pairs.

There are three account types, with pricing schedules across all of them being very competitive.

- MICRO account (1 micro lot = 1,000 units of the base currency)

- STANDARD account (1 standard lot is 100,000 units of the base currency)

- XM ZERO account (1 standard lot is 100,000 units of the base currency).

Base currency options include USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD and ZAR. That is a healthy number of base currency options that helps keep down the frictional costs associated with converting from one currency to another.

There are generally tight spreads on over 60 currency pairs and a spread as low as 1 for micro and standard account types and as low as 0 for an XM zero account.

XM also provides fractional pip pricing so that clients can trade with tighter spreads and benefit from the most accurate quoting possible.

The process of making deposits and withdrawals is fast and easy. Multiple payment options are supported including, VISA, VISA electron, mastercard, switch, solo), bank transfer, neteller, moneybookers and skrill.

The recently introduced local bank transfer option enables investors to fund their accounts through their local banks (in 58 countries worldwide) and in their local currencies. There are no hidden fees, or commissions for funds transfers and XM covers all transfer fees.

Account funding is 100% automatic and is processed 24/7, while same-day withdrawals are guaranteed.

Education

A wide range of educational material is freely available. It covers the basics of ‘how things work’ and moves on to more advanced presentations on trading strategies and advanced analysis.

There are podcasts, free weekly interactive webinars, as well as all the research developed and shared by metatrader on their MQL5 platform.

The research is designed to help you trade. The multilingual economic calendar, along with forex news and market analysis reports provided by XM’s in-house experts, enables you to follow market changes and to adapt trading decisions accordingly.

Customer service

Multilingual personal account managers are available to holders of both demo and live accounts. They can be contacted via live chat, telephone or email in over 14 languages. The coverage is also impressive, with professional support available 24-hours a day from monday to friday.

Additional extras include phone trading. Being able to contact a dealing desk can be a deal-breaker should your IT systems go down. There are also personal account managers to help guide you through the markets.

Final thoughts

XM will appeal to both beginner and seasoned traders. Low-cost trading never goes out of fashion but XM is much more than a no-frills operation. Registration is available in 17 languages and the fact that trading can be started with a minimum deposit of $5 is a positive feature. Beginners especially are encouraged to start small and to stay that way until their trading results justify scaling up on positions.

XM has been around long enough to be considered established. It still has the feel of a next-generation broker providing clients with a range of progressive and innovative features.

The firm continues to receive recognition in terms of positive client feedback and industry awards. It’s easy to see why.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

About the author : justin freeman

Justin has twenty-two years' of experience working in the financial markets with brokers. He's held trading and risk management positions at boutique asset managers and large investment banks. Justin helps people understand their trading options in a clear, jargon-free manner.

XM review – is XM scam or legit broker?

Rating

- Wide selection of educational tools

- FCA, mifid, cysec, ASIC law

- 300 fiscal tools

XM is a fully licensed and regulated forex broker. The business is licensed to provide FX trading services by the FCA, ASIC and cysec. With customers in 196 states and surgeries across 120 cities around the earth, XM is now really a worldwide provider of forex trading.

Overview/ desktop

XM.Com trades under the title trading point holdings limited, together with enrollment #HE322690, accredited in limassol, cyprus. The business is fully licensed and governed by the cyprus securities and exchange commission using permit #120/10. It’s likewise fully documented to provide financial trading at the united kingdom, with the FCA, mention number 538324. XM has won multiple awards over the years including best FX provider for 20 17, industry selection of world finance 100, and also the best local customer service 2016 from FX 168. XM prides itself having functioned 1million customers all over the globe. A vast assortment of trading currency applications is available, together with major pairs, little pairs, along with exotic pairs.

Account types

XM includes several account types, such as a micro account, a standard account, along with also an XM zero account. These accounts kinds appeal to particular kinds of traders, together with the subsequent specifications:

- A minimum deposit of 5 together with hedging, together with optional islamic accounts, spreads as little as 1 pip, leverage as large as 1:500, and also a contract bunch size of 1000. Base currency options comprise ZAR, SGD, RUB, GBP, EUR, USD and many others.

- A minimum deposit of 5 using optional islamic accounts, hedging up to 200 rankings max, spreads as little as 1 pip, leverage as large as 1:500 and base money options for example the CHF, GBP, EUR, USD, AUD, ZAR and SGD.

- These reports require a minimum deposit of 100, together with optional islamic accounts accessibility and settlement granted. The minimum trade volume will be 0.01 lots, and traders may start around 200 rankings max.Commission is comprised and spreads all significant pairs are equally low as 0%. Maximum leverage is 1:500 and the bottom money options incorporate the EUR, JPY and USD.

Traders could start a demo account with a $100,000 virtual balance, or even perhaps a real money account using A25 trading bonus.

Trading platform/ applications

The trading programs in XM comprise metatrader 4, without a rejections without a requotes. Leverage ranges from as few as 1:1 completely up to 500:1. Metatrader 4 allows one log in with up to 8 programs, together with spreads as little as 0 g along with some 300 tools out there. MT4 is readily available for mac, PC, multi-terminal, webtrader, iphone, android, ipad, along with android tablet computer. Metatrader 5 – 5 MT 5 is one platform using 6 stock classes out there. A few 80 analytical items are contained with the stage and the most recent amount quotes are given. The whole quantity of financial tools available is 300, and such comprise forexstocks, indices, commodities and cfds. The most significant gap medially MT4 and MT 5 is that MT4 is a forex trading platform, even whilst MT5 is targeted towards multi-asset trading. Smartphone trading is found in XM, by simply downloading the application form on android and also ios apparatus.

Deposit options

Currency traders have accessibility to a vast selection of deposit methods in XM. Included in these are: visa, visa electron, mastercard, maestro, diners club international, union pay, neteller, webmoney, skrill, sofort, ideal, giropay, boleto, OXXO, bank wire transfer, along with neighborhood financial transport.

At XM, there’s not any minimum deposit required for that typical accounts along with your micro account. But, there’s a $5 minimum for electronic financing that’s on neteller, moneybookers, skrill and charge cards.

Bonuses

Currency traders are going to have the ability to take pleasure from multiple trading bonuses, including deposit bonuses, and forex world championship bonus supplies and loyalty program provides, and amongst others. The subsequent promotional supplies are offered at the time of composing:

- 25 trading incentive (for new customers only and all benefits left could be removed )

- 50 percent deposit up to $500 20percent deposit bonus up to $5,000

- Win $50,000 at the 1 billion forex world championship each month

- Enjoy exclusive bonuses along with seasonal bonuses together with all the XM loyalty app

- Free VPS services

Customer support

Customer service is found in 5 nations. These include greece, australia, cyprus, hungary, and also the united kingdom. The UK cell phone number is 44-2031-501-500. Customer care is obtained 24/5 GMT. There are mobile, facsimile and email addresses such as service desk, bookkeeping, affiliate department, individual resources, back office, working room, sales department, and also PR enquiries.

Safety

Safety & security will be a priority in XM. This FX trading platform is completely licensed and governed by multiple governments for example cysec, ASIC, FCA plus it functions in compliance with the european union’s markets in financial instruments directive (mifid). The ethics of customer accounts is guarded in any way times, together with SSL technology, and also the maximum encryption protocols.

Ease of use

XM is userfriendly, and all characteristics of this trading platform might be retrieved from the upper left of this screen with the dropdown menu. As a whole, you can find 300 trading tools, spreads as much as 0%, 16 trading programs (XM webtrader, MT4 and MT5), as well as $5,000 in bonuses. Participants can quickly deposit funds, draw funds, switch medially programs, like forex webinars and conferences and conduct extensive marketplace research with the broad assortment of applications out there. Full fundamental and technical analysis is potential, together with forex calculators included as well.

Final thoughts

XM is an industry pioneer in forex trading. FX traders may enjoy the demo account a real money account at the click of a single button. Merely traders from regulated authorities can enroll at XM and trade to get a real income. The customized MT4 platform is based really on the currency, whatever money you’re utilizing.

XM reviews

132 • poor

Write a review

Write a review

Reviews 132

This is a scam company

This is a scam company, do not trust these people with your money. I invested over £30,000 with this company and when I asked for a withdrawal during the pandemic they asked me to put in more money. Like why would I put in more money when they wouldn't let me make a withdrawal? I told them I wanted my money back and they kept giving me excuses until they finally stopped picking my calls or responding to my emails. I told a friend everything and he recommended a professional expert on traderefund who's gregorywilliez at aol•ccom I messaged him and I can say that I am impressed. They handled my case so well and got my money back. I highly recommend them to anyone who has been scammed.

Great!

Great!

Great experience,I claim all my loss after an encounter with

Www . Recoverystation. Net

Get in touch with them and be happy.

I was down in the dumps after my…

I was down in the dumps after my encounter with this company. I should have known better but their attractive offers made me ignore the red flags.

They took a lot from me and i kept falling for their tricks. Some tech expert from

Pulled a successful chargeback and i recovered my loss.

It is not my thing to write reviews

It is not my thing to write reviews, but i have to share this to save other traders from becoming a victim of this company, like i am already. On the 6th of march , i started trading with this company, upon recommendation from a friend. Prior to that time, i had practised so much with the demo app and i felt i had known much about trading strategy already. However, when i started trading, i kept recording more losses than expected. Even, when my stop loss is set at -5%. It will get exceeded to -20%. I started feeling all was not right when i compared their chart with that of other companies, and i noticed a huge difference. . The journey of getting it back is a story to tell another day, but my appreciation goes to mr foster who helped me redeem my funds back, I reached him via; jamerabinowitz@;aol comm. To all traders, please beware of this company.

If you have a job

If you have a job, you're undoubtedly familiar with the concept of working for your money. Investing allows you to turn the tide by making your money work for you. Through the magic of compound interest, for example if you invest on david broker you earn a return of 10% in 3days , 50% in a 7days plan , 250% in a 14days plan and 500% in a monthly plan. This is the best way to financial freedom. ( shaw david 332 at ya hoo)

I was down in the dumps after my…

I was down in the dumps after my encounter with this company. I should have known better but their attractive offers made me ignore the red flags.

They took a lot from me and i kept falling for their tricks. Some tech expert from

Www. Globalfundsreclaim. Net

Pulled a successful chargeback and i recovered my loss.

Had a bad experience ,it wasn’t easy…

Had a bad experience ,it wasn’t easy for me until I met this recovery expert company on my headline

I will highly recommend this company above(headline).

They are sincere and honest in all way round, getting back lost assets is their priority.

I was down in the dumps after my…

I was down in the dumps after my encounter with this company. I should have known better but their attractive offers made me ignore the red flags.

They took a lot from me and i kept falling for their tricks. Some tech expert from

Www. Direct recovery tech. Net

Pulled a successful chargeback and i recovered my loss.

No matter what they tell you

No matter what they tell you, they are not the bro.Ker agency to tr.Ade with. If only trustpilot has a feature for media uploads. I would have uploaded evidences of how I was ri.Pped a total inv.Estment of € 22000 last year. The details is a long one and I don't like to talk about it. Just avoid them and I am sure there are many more like me who were sca.Mmed in similar way. I am just grateful to mr jacob who came to my help with her master-class re.Covery strategy and crypocurrency technology. I was able to get my m.Oney back yesterday. His m ail is jacob39salbert''at aol'comreach him if you're in similar situation.

I was down in the dumps after my…

I was down in the dumps after my encounter with this company. I should have known better but their attractive offers made me ignore the red flags.

They took a lot from me and i kept falling for their tricks. Some tech expert from

Www. Direct recovery tech. Net

Pulled a successful chargeback and i recovered my loss.

I was down in the dumps after my…

I was down in the dumps after my encounter with this company. I should have known better but their attractive offers made me ignore the red flags.

They took a lot from me and i kept falling for their tricks. Some tech savvy experts from direct recovery tech . Net pulled a successful chargeback and i recovered my loss.

Its a fraud company NOT registered in FCA

Its a fraud company, contact FCA and give them the (FRN: 705428) number shown in the bottom of the xm.Com website and FCA (https://www. Fca. Org. Uk/contact) will tell you xm.Com is not a genuine company and does not appear in FCA record at all. The company which appears in the FCA record is trading point of financial instruments UK limited which has not notified the FCA that xm.Com is part of them. So under these circumstances FCA will tell you xm.Com is not a registered entity in the FCA record. So any dispute with xm.Com will not be dealt by FCA but by action fraud team (https://www. Actionfraud. Police. Uk/). Which makes xm.Com illegal to provide any kind of CFD or trading services to the UK residents. So whoever used xm.Com can contact their bank to freez and dispute the transactions.

The MT4 platform will play against you, as it did against my BUY STOP order. It did execute the order before the price reach to that point. Also my trailing which was supposed to close previous position was not started and my account was drained to zero. I have solid evidence of snapshot which I have taken. Xm.Com is full scammed. Contact FCA in uk and they will tell you xm.Com is not registered and cant use (FRN: 705428) for their illegal services in U.K

Stop loss not reliable

Stop loss not reliable ! Account came to ZERO because position didn’t close when stop loss was hit but faaar below !! Support contacted but they are rude and don’t give a sh.. ! Avoid these robbers

This is really bad trading platform…

This is really bad trading platform they close the deal with their own do not recommend this to anyone

Very poor complaint resolution process

They will take ages to respond if you lodge a complaint. High slippage with gold. Overall a shady broker

The worst of all

The worst of all, they are so rude to thank god I didn't make any transaction with them. They called me and they're asking me for hundreds of documents, cheaters, and fake people never trust this company. They're full of shiz.

When all efforts seems hopeless

When all efforts seems hopeless

when all efforts seems hopeless, i finally got blessed with delgado mary. She kept her promises. I was really skeptical towards her at first but thanks to this great platform it worked out beautifully. She was able to reclaim my money as promised. You can reach her: delgadomary827 at

It is a SCAM with big letters

It is a SCAM with big letters. After 2 weeks i have the following problem, which i will describe in steps.

1) i had some accounts in the past ( one of them had a 19euro deposit with bitcoins)

2) the accounts closed after inactivity and this year i decided to participate again, and rock n roll a bit with the stocks since i enjoy their leverages.

3) i open an account and i place 70 euros inside with DEBIT CARD

4) i win around 58 euros, and i try to take them out. They gave me back the 70 i placed but they told me use another way for the winings.

In this step i need to clarify that they currently have 4 ways of withdrawing. A) card B) bank C) E-wallet D)bitcoin

5) I tried with card and i got a response to try an alternative way. I tried with bank and they sent me an email regarding these 19 euros from the old account and that i had to withdraw another way. I tried with ewallet for the rest of the winnings but they did not let me either if i did not first get these 19 with bitcoin.

6) so, i used my ledger nano S wallet to withdraw my winings and guess what. They did not accept the wallet! After 2 weeks of struggling all i got is: find another wallet this is not valid.

What is not valid? One of the biggest companies securing crypto assets? Come on. So they told me either get another company ( but its my legal right not to trust another company ) or you can not get your funds. This is illegal since their platform has the problem and not the wallet obviously. Stay way. Very easy to deposit money, but as i saw here as well, many have problems withdrawing. Unbelievable experience i dropped out from them and i suggest you do the same. I also operate on etoro the last 8 years and i never had issues like that. Stupid platform and their support does not help at all

PS here is a hint, if you insist they connect you to a superior support member who can connect to your account manager and maybe that way you can have someone call you. At least they did for me, although this person ( woman ) told me that they would disable the btc withdrawal so that i could get my money with e-wallet, only to find out that after a few hours they sent me an email that what they told me on the phone was not possible. Amazing guys i will report that to the cybercrime unit first thing tomorrow morning as well and sue them for my time lost.

Fxdailyreport.Com

The forex market transacts enormous amounts of money every day. With possible trillions moving in and out of the market every trading day, the forex market offers a great profit potential. However, where there is profit, there is also the potential for loss. In this case, the loss could begin with choosing the wrong broker. These factors should help any trader looking to invest in forex:

Regulatory compliance

before settling on a broker to trade with, it is important to know who regulates them. If a broker operates in a number of countries, they must be regulated by the authority mandated to oversee financial institutions in those states. For instance, if a broker is based in australia and operates in the US and UK, they must be regulated by the regulatory bodies of those three countries (ASIC, NFA and CFTC, and FCA and PRA respectively).

Regulatory bodies make sure that the broker you want to invest with operates within the financial laws of the host country. They also provide consumer security to traders by lending legitimacy to a broker.

Top 10 legit forex brokers

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker |

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $100 spread: starting 0 pips leverage: up to 400:1 regulation: FCA UK, NFA, CFTC, ASIC, IIROC, FSA, CIMA | visit broker | |

| min deposit: $300 spread: floating, from 0 pips leverage: 500:1 regulation: FCA UK reference number 579202 | visit broker | ||

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: no minimum deposit spread: 1.2 pips leverage: 50:1 regulation: CFTC, NFA, FCA, MAS, ASIC, IIROC | visit broker | |

| min deposit: $10 spread: leverage: regulation: cysec | - | visit broker | |

| min deposit: $200 spread: from 3 pips leverage: 400:1 regulation: NFA, FCA, cysec | visit broker |

Data safety

Fees

any fees incurred are the standard cost of doing business. However, these expenses could affect your profits, especially if they are hidden. Still, your broker has to charge. Most brokers will opt to make their profit from spreads. Spreads are the difference between the ask and the bid price. Tight spreads mean you can easily enter and exit the market, and as such, a broker will reap maximum profits on wider spreads. Tight spreads are common in higher trading currency pairs such as the dollar/euro pair or dollar/pound pair. Highly volatile pairs will have wider spreads.

Other expenses that you might incur include fees charged during any fund transfers (deposits and withdrawals) and additional costs related to your bank account. It is, therefore imperative that you have another party look at the fee clause in your broker-trader contract to make sure you have full knowledge.

Platforms and software

A trading platform serves as your gateway to the market. A reliable platform should be highly responsive and easy to navigate, and it should have the necessary tools that allow traders to react to the market in real time. It is common for brokers to have a custom-made trading platform. However, if your broker does not have their own software, they most likely use more common trading platforms such as the metatrader 4 (MT4) or metatrader 5 (MT5).

Each platform has several features that give them an edge over competitor platforms. One of the common features of an excellent platform is the ability to run on different devices and their compatibility with various operating systems. Some platforms come with inbuilt strategies that you can use to plan your trades. Additionally, you can develop your own strategies and save them into the platform.

To expand your options, some platforms let you communicate with other traders to chart strategies or to learn from more experienced traders.

Ease of transaction

A legit forex broker allows you to access your money easily. Reputable forex brokers use the money you deposit to trade, and once they make their profit, what you earn should be easy to withdraw. Some brokers make these processes seamless by offering more access options. For instance, you can deposit or withdraw your money through paypal, debit, and credit as well as direct wire transfers.

Currency pairs

on any day, there are plenty of currency pairs getting traded. A legit broker should at least offer the major pairs. The euro, dollar, yen, and pound are the most popular currency pairs.

However, a trader can choose which pairs they prefer to trade. More established brokers tend to have a broader range of currency pairs. Check if your broker offers the currencies you would like to trade.

Accounts

A good forex broker allows traders to open an account of their choice. The initial amount determines which account you can create. Some brokers will let you open accounts with as little as $50. However, such accounts are considered risky because of the lack of flexibility with open positions. The required amount to open a standard account is about $10,000. In some cases, a broker will offer exclusive accounts that require initial capital of up to $20,000. These types of accounts usually have VIP benefits such as fewer fees and premium tools. In islamic countries, brokers may offer accounts that adhere to sharia law. These accounts do not accrue interest.

It is also vital to know if your broker offers a demo account with which you can trade risk-free before you go live. Demo accounts don’t require any financial commitment and are perfect for beginners looking to get hands-on market experience.

Customer services

forex trading is a 24-hour business rife with a number of issues that require immediate assistance. A good broker is only as effective as their support system. Fortunately, most legit forex brokers have customer service that allows you to speak to agents, lodge ticketed complains and receive technical support on various platforms. Timely support ensures that you get real-time help with sensitive information when you need it.

Broker type

the type of broker you choose in this case is purely based on profit. Electronic communication network brokers (ECN brokers) have the edge over dealing desk brokers (DD) brokers since they offer better spreads, translating to better profits for a trader. ECN brokers match trades between other traders, unlike DD brokers who might have to trade against their own clients.

Additional services

other than the basics, a good forex broker could sweeten the deal for you by offering in-house services such as tax statement preparation, up to date market news, additional expert analysis and occasional classes that help you better your skill as a trader.

Is XM forex legit?

At scamorno.Com, we stick to strict standards of a review process. We may receive compensation from the companies mentioned in this post.

[insert_php] $id = $_GET[“id”]; [/insert_php]

XM forex REVIEW

XM forex preview: (to pause video, simply tap/click on it)

Summary

XM forex is a subsidiary company of trading point holdings ltd.

XM forex is an MT4-based platform for trading forex on mac, PC, ipad, iphone, and android tablets and phones

Read 100% free XM forex review by scamorno team

Details

Overview OF XM forex benefits:

- No fees on withdrawals or deposits

- Forex trading signals

- Webinars and many other training resources

- 888:1 leverage

- No re-quotes

- 8 full trading platforms

- Negative account balance protection

Which platform does XM forex run on?

The XM trading platform is based on the popular MT4 platform. Metatrader 4, or MT4, used by XM offers a single log in access to all 8 platforms, over 100 trading instruments including forex, futures, and CFD’s, 3 different chart typesone click trading, chart tools, technical analysis indicators, and the same features for trading micro lots as full lots. The MT4 multiterminal is specifically designed for traders and money managers with multiple accounts. While this isn’t of interest to most traders, it’s nice to know you are using a broker that can handle large clients and take care of you as your trading volume and needs grow. Ourselves and many other traders we have contacted are all pleased with the XM forex trading experience.

Review verdict: XM forex is a legitimate product that works

Should you use mt4 platform to use XM forex?

In our experience traders tend to like the platform they have learned to use first best. This makes sense because every trading platform will have a small learning curve and we like the things that are familiar.

If you learned how to trade using a different platform, we highly recommend give the MT4 a chance. It’s one of the best platforms for trading forex on the market and is highly configurable and flexible. Once you learn how to manipulate the platform you should find that it works as good as anything on the market and better than most.

XM offers free deposits and withdrawals, a minimum deposit amount of $5, and multiple ways to make a deposit. Here is a list of deposit methods available at time of writing: mastercard, visa, webmoney, neteller, diners club international, skrill, visa electron, bank wire, QIWI, paysafecard, fasapay, sofort, giro pay, przelewy24, and ideal.

Which forex pairs can you trade with XM forex?

XM has over 50 forex pairs you can trade, offering more than most brokers and more than any professional trader can keep up with.

- AUD / CAD

- AUD / CHF

- AUD / JPY

- AUD / NZD

- AUD / USD

- CAD / CHF

- CAD / JPY

- CHF / JPY

- CHF / SGD

- EUR / AUD

- EUR / CAD

- EUR / CHF

- EUR / DKK

- EUR / GBP

- EUR / HKD

- EUR / HUF

- EUR / JPY

- EUR / NOK

- EUR / NZD

- EUR / PLN

- EUR / RUB

- EUR / SEK

- EUR / SGD

- EUR / TRY

- EUR / USD

- EUR / ZAR

- GBP / AUD

- GBP / CAD

- GBP / CHF

- GBP / DKK

- GBP / JPY

- GBP / NOK

- GBP / NZD

- GBP / SEK

- GBP / SGD

- GBP / USD

- NZD / CAD

- NZD / CHF

- NZD / JPY

- NZD / SGD

- NZD / USD

- SGD / JPY

- USD / CAD

- USD / CHF

- USD / CNH

- USD / DKK

- USD / HKD

- USD / HUF

- USD / JPY

- USD / MXN

- USD / NOK

- USD / PLN

- USD / RUB

- USD / SEK

- USD / SGD

- USD / TRY

- USD / ZAR

In addition to all of the forex pairs listed above members can also trade commodities, equity indices, precious metals, and energies.

Review verdict: XM forex is a legitimate product that works

Is XM forex right for you?

XM offers both a $30 no deposit bonus and as much as $5,000 in deposit bonuses. Though it is not required to read the terms and conditions for the bonuses, it is definitely a good idea. The terms and conditions for both bonuses are described in five page documents. There is a separate five page document for each bonus details.

These may be the longest terms and conditions files dealing with bonuses in the industry. We’re sure these documents were some of the longest we have ever read.

In order to be able to withdraw the no deposit bonus you must trade a minimum of 50 micro lots and complete at least five round turn trades. You can always check the current status of your bonus clearings and trades by logging into your account under the account history tab.

The $5,000 bonus is earned by trading positions and then closing trades. You receive a $10 bonus credit for each standard lot you trade. In order to earn the entire $5,000 bonus you will have to trade 500 standard lots.

What are the drawbacks of XM forex?

It seems like you can find the same complaints about every single forex broker if you look deep enough. The most common complaints about XM forex we have found are regarding spreads. The good news is that XM doesn’t seem to have as many problems as most brokers, but they still have some. We’re going to cover the main ones below: spreads – we did find a few complaints about the spreads, but when we compared them to other brokers they are still among the best in the business.

If you can find a broker offering better spreads you can consider trading with them, but you would not have to worry about XM taking advantage of you in this aspect.

While this is not a problem we’ve had, we’ve read a few complaints about some of the XM trading platforms freezing or crashing, causing a missed trade opportunity or other issue. All software can have issues from time to time and one of the issues could be the traders’ computer that is running the software.

Review verdict: XM forex is a legitimate product that works

Conclusion about XM forex

The free demo account is the best place to get started and the $30 no deposit bonus gives traders an opportunity to start trading micro lots for real money when they’re ready to get a feel for playing for real cash. One should also not ignore the training and free resources they offer. Many beginning traders make the mistake of thinking if the training is free it must not be worth much.

We’re firm believers in training and education and you will never know when you might learn the one thing that transforms you from a losing trader to a profitable one.

XM is a scam FOREX broker? Should we trade in XM?

Those who think XM is a scam just had a lousy time trading, they made the wrong move or didn’t have a good luck selling, and it happened while they were using XM, just as it happens with many forex brokers. So, if they had a bad time while using XM, they’ll blame XM for it when XM had nothing to do with it. XM has been a forex broker praised by many traders for their quick and responsible customer support, excellent trading conditions, liquidity, and numerous bonuses and promotions.

About XM

XM forex made its way to put its mark in the trading network by offering unique features that not all forex brokers provide, like low spreads from 0 pips onward. Regarding minimum deposits, XM isn’t exigent with minimum deposits required to test their trading conditions. XM is registered under the umbrella company name of trading point of financial instruments ltd. They have built their reputation in the corporate business through following their core mission which is to conduct their business transparently and professionally. XM broker is subscribed to the rules and regulations dictated by FI, FIN, bafin, AFM, and CNMV. Another feature that adds liquidity to XM is the fact that XM has always succeeded its requirements of implementing speedy execution of orders in the market.

Should we trade in XM?

XM brokers offer a vast variety of features, different types of accounts and instruments to attract more clients. They also provide a wide range of trading platforms with support on various devices, each one suiting different kinds of trades, and providing a simple and intuitive interface. Having a strong educational base with varied types of materials, including webinars and courses, XM helps both experienced and beginner traders. So, if you want to get into the trails of forex trading, or looking for a new forex broker, XM should be a must-see in your list; and if you are not entirely sure, there are many of its features for you to see. Moreover, everyone can find XM office address, so there's no worry.

XM trading platforms

XM covers windows and mac with its three platforms being the MT4 and MT5 metatrader platforms and its webtrader platform. You can use MT4 and MT5 on windows and mac, with high support on mobile devices, like smartphone and tablet and its web-based webtrader, available in every platform with an internet browser. All of these platforms are an advantageous feature in XM if you are into working with few accounts at once, getting an advantage of XM different instruments.

XM account types

XM offers three different types of account, covering the needs of its clients depending on what they are searching for, these are MICRO accounts, STANDARD accounts, and XM ZERO accounts.

- MICRO accounts has many base currency options, including USD, EUR and many more. Its contract size is one lot equal to 1000, and its minimum trade volume is 0.01. Spreads are as low as one pip. XM leverage goes from 1:1 to 1:888 spreads on all major pairs available with a minimum deposit of 5 USD.

Click to learn more micro account here

- STANDARD accounts provides almost the same features as MICRO accounts, but have a contract size of one lot equal to 100000, a maximum of 200 positions on open or pending orders per client and a minimum of 1,000 units in its trading volume. Can be opened with only 5 USD.

Click to learn more standard account here

- XM ZERO accounts has USD, EUR or JPY as base currencies. XM spreads are as low as 0 pips, and traders can operate a minimum volume of 0.01. XM ZERO accounts can be opened with a minimum investment of 100 USD.

Click to learn more zero account here

XM bonus and promotions

Bonuses and promotions are some of XM most attractive features. It offers plenty of promotions, making sure that your trading experience is different and better than with other forex brokers. Between XM promotions, you can find:

- The XM trading bonus, available to all traders in the instant they open an XM real account for the first time. It is a 30 USD trading bonus that allows users to test the quality of XM execution in a real trading environment, without worrying about investment risk (or not that much). This bonus is available to be claimed as soon as you are done creating your account, it will be credited to your account, and it will be removed as quickly as you withdrawn profits for the first time.

- Zero fees above 200 USD; according to XM zero fees policy, XM has made sure to cover all deposits and withdrawal fees above 200 USD processed by wire transfer.

- Any trader who can or it’s maintaining a minimum amount of 5,000 USD (or its equivalent in other currencies) can request XM’s free VPS service from the member area and enjoy the XM VPS. Linking to XM VPS allows traders to remotely connect to XM virtual private servers located in london, near their data center, and enjoy trading without worrying about natural factors that could ruin your ability to trade, like a low internet connection.

- XM loyalty program is also available as soon as you sign up. Every time you make a trade at XM, it gives you XM points; these points can be redeemed for credit bonus rewards. Everyone who creates a real account starts in the “executive level,” trading and earning XM points will automatically upgrade your status until and so on until you reach a new level, each new level, the amount of XM points you earn per lot increases, allowing you to receive XM points at faster rates. The more, the better, after you have tons of XM points, you’ll be able to redeem credit bonus rewards.

Conclusion

XM is an established broker, known to be reliable and highly professional at what it does. It aims to make your trading experience unique through all its features and bonuses, and proportionate help to its users with their interactive, friendly and helpful customer support, available 24 hours, five days a week. With all these said, why aren’t you trading at XM already? If you still have doubts, try the free XM demo account.

Peter pan

Hey, I’m peter pan. I am a writer currently resided in thailand. For my forex experience, I have been trading with many forex brokers from all over the world for 5 years now. I hope that my articles about forex brokers can help you succeed in this market just like me.

South asian airlines are about to launch blockhain payment

South asian airlines are about to launch blockhain payment

XM is a scam FOREX broker? Should we trade in XM?

Those who think XM is a scam just had a lousy time trading, they made the wrong move or didn’t have a good luck selling, and it happened while they were using XM, just as it happens with many forex brokers. So, if they had a bad time while using XM, they’ll blame XM for it when XM had nothing to do with it. XM has been a forex broker praised by many traders for their quick and responsible customer support, excellent trading conditions, liquidity, and numerous bonuses and promotions.

About XM

XM forex made its way to put its mark in the trading network by offering unique features that not all forex brokers provide, like low spreads from 0 pips onward. Regarding minimum deposits, XM isn’t exigent with minimum deposits required to test their trading conditions. XM is registered under the umbrella company name of trading point of financial instruments ltd. They have built their reputation in the corporate business through following their core mission which is to conduct their business transparently and professionally. XM broker is subscribed to the rules and regulations dictated by FI, FIN, bafin, AFM, and CNMV. Another feature that adds liquidity to XM is the fact that XM has always succeeded its requirements of implementing speedy execution of orders in the market.

Should we trade in XM?

XM brokers offer a vast variety of features, different types of accounts and instruments to attract more clients. They also provide a wide range of trading platforms with support on various devices, each one suiting different kinds of trades, and providing a simple and intuitive interface. Having a strong educational base with varied types of materials, including webinars and courses, XM helps both experienced and beginner traders. So, if you want to get into the trails of forex trading, or looking for a new forex broker, XM should be a must-see in your list; and if you are not entirely sure, there are many of its features for you to see. Moreover, everyone can find XM office address, so there's no worry.

XM trading platforms

XM covers windows and mac with its three platforms being the MT4 and MT5 metatrader platforms and its webtrader platform. You can use MT4 and MT5 on windows and mac, with high support on mobile devices, like smartphone and tablet and its web-based webtrader, available in every platform with an internet browser. All of these platforms are an advantageous feature in XM if you are into working with few accounts at once, getting an advantage of XM different instruments.

XM account types

XM offers three different types of account, covering the needs of its clients depending on what they are searching for, these are MICRO accounts, STANDARD accounts, and XM ZERO accounts.

- MICRO accounts has many base currency options, including USD, EUR and many more. Its contract size is one lot equal to 1000, and its minimum trade volume is 0.01. Spreads are as low as one pip. XM leverage goes from 1:1 to 1:888 spreads on all major pairs available with a minimum deposit of 5 USD.

Click to learn more micro account here

- STANDARD accounts provides almost the same features as MICRO accounts, but have a contract size of one lot equal to 100000, a maximum of 200 positions on open or pending orders per client and a minimum of 1,000 units in its trading volume. Can be opened with only 5 USD.

Click to learn more standard account here

- XM ZERO accounts has USD, EUR or JPY as base currencies. XM spreads are as low as 0 pips, and traders can operate a minimum volume of 0.01. XM ZERO accounts can be opened with a minimum investment of 100 USD.

Click to learn more zero account here

XM bonus and promotions

Bonuses and promotions are some of XM most attractive features. It offers plenty of promotions, making sure that your trading experience is different and better than with other forex brokers. Between XM promotions, you can find:

- The XM trading bonus, available to all traders in the instant they open an XM real account for the first time. It is a 30 USD trading bonus that allows users to test the quality of XM execution in a real trading environment, without worrying about investment risk (or not that much). This bonus is available to be claimed as soon as you are done creating your account, it will be credited to your account, and it will be removed as quickly as you withdrawn profits for the first time.

- Zero fees above 200 USD; according to XM zero fees policy, XM has made sure to cover all deposits and withdrawal fees above 200 USD processed by wire transfer.

- Any trader who can or it’s maintaining a minimum amount of 5,000 USD (or its equivalent in other currencies) can request XM’s free VPS service from the member area and enjoy the XM VPS. Linking to XM VPS allows traders to remotely connect to XM virtual private servers located in london, near their data center, and enjoy trading without worrying about natural factors that could ruin your ability to trade, like a low internet connection.

- XM loyalty program is also available as soon as you sign up. Every time you make a trade at XM, it gives you XM points; these points can be redeemed for credit bonus rewards. Everyone who creates a real account starts in the “executive level,” trading and earning XM points will automatically upgrade your status until and so on until you reach a new level, each new level, the amount of XM points you earn per lot increases, allowing you to receive XM points at faster rates. The more, the better, after you have tons of XM points, you’ll be able to redeem credit bonus rewards.

Conclusion

XM is an established broker, known to be reliable and highly professional at what it does. It aims to make your trading experience unique through all its features and bonuses, and proportionate help to its users with their interactive, friendly and helpful customer support, available 24 hours, five days a week. With all these said, why aren’t you trading at XM already? If you still have doubts, try the free XM demo account.

Peter pan

Hey, I’m peter pan. I am a writer currently resided in thailand. For my forex experience, I have been trading with many forex brokers from all over the world for 5 years now. I hope that my articles about forex brokers can help you succeed in this market just like me.

South asian airlines are about to launch blockhain payment

South asian airlines are about to launch blockhain payment

so, let's see, what we have: this review tells you everything you need to know about XM group broker. They offer not only generous bonuses but webinars that can make you a better forex trader! At is xm forex legit

Contents of the article

- Top forex bonuses

- XM group forex broker review

- XM group overview and specifics

- Our recommended forex brokers

- XM review 2019 | is XM a scam or legit forex...

- XM review 2021

- Summary

- XM review fees

- XM group forex broker broker review

- Expert’s viewpoint

- Broker summary

- Broker introduction

- Spreads and leverage

- Commissions & fees

- Education

- Customer service

- Final thoughts

- XM review – is XM scam or legit broker?

- Overview/ desktop

- Account types

- Trading platform/ applications

- Deposit options

- Bonuses

- Customer support

- Safety

- Ease of use

- Final thoughts

- XM reviews

- 132 • poor

- Write a review

- Write a review

- Reviews 132

- This is a scam company

- Great!

- I was down in the dumps after my…

- It is not my thing to write reviews

- If you have a job

- I was down in the dumps after my…

- Had a bad experience ,it wasn’t easy…

- I was down in the dumps after my…

- No matter what they tell you

- I was down in the dumps after my…

- I was down in the dumps after my…

- Its a fraud company NOT registered in FCA

- Stop loss not reliable

- This is really bad trading platform…

- Very poor complaint resolution process

- The worst of all

- When all efforts seems hopeless

- It is a SCAM with big letters

- Fxdailyreport.Com

- Top 10 legit forex brokers

- Is XM forex legit?

- XM forex REVIEW

- Details

- Which platform does XM forex run...

- Should you use mt4 platform to use XM...

- Which forex pairs can you trade with XM...

- Is XM forex right for you?

- What are the drawbacks of XM...

- Conclusion about XM forex

- XM is a scam FOREX broker? Should we trade in XM?

- About XM

- Should we trade in XM?

- XM trading platforms

- XM account types

- XM bonus and promotions

- Conclusion

- XM is a scam FOREX broker? Should we trade in XM?

- About XM

- Should we trade in XM?

- XM trading platforms

- XM account types

- XM bonus and promotions

- Conclusion

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.