Octafx regulated broker

As an EU member state resident you are currently viewing the website www.Octafx.Eu operated by octa markets cyprus ltd with registration number HE359992.

Top forex bonuses

Octa markets cyprus ltd is authorized and regulated by the cyprus securities and exchange commission (cysec) with license number 372/18. The registered office of octa markets cyprus ltd is in the republic of cyprus. The account(s) you may open on this website will be opened with octa markets cyprus ltd. Octa markets cyprus ltd is authorised and regulated by the cyprus securities and exchange commission (cysec) with license №372/18. Octa markets cyprus ltd complies with european securities and market authority's (ESMA) regulatory standards as well as with market in financial instruments directive (mifid II)

Trade with a regulated broker that adheres to placing clients' asset protection at the forefront.

Octa markets cyprus ltd offers spot forex and contracts for differences (cfds) on assets including equity indices, spot metals and commodities. Octa markets cyprus ltd offers easy-to-use platforms such as metatrader 5 and ctrader.

Octa markets cyprus ltd is authorised and regulated by the cyprus securities and exchange commission (cysec) with license №372/18. Octa markets cyprus ltd complies with european securities and market authority's (ESMA) regulatory standards as well as with market in financial instruments directive (mifid II)

Explore our platforms

Trading platforms are designed to enhance your trading experience. Access your trading account via mobile and desktop platforms.

Metatrader 5 and ctrader trading platforms are carefully designed to meet your trading needs.

Mobile and desktop trading on demo accounts

Trade markets with unlimited virtual funds. Test our trading platforms and your trading strategies with no risk involved by opening a demo account.

Octa markets cyprus ltd security

Negative balance protection

Octa markets cyprus ltd notice

As an EU member state resident you are currently viewing the website www.Octafx.Eu operated by octa markets cyprus ltd with registration number HE359992. Octa markets cyprus ltd is authorized and regulated by the cyprus securities and exchange commission (cysec) with license number 372/18. The registered office of octa markets cyprus ltd is in the republic of cyprus. The account(s) you may open on this website will be opened with octa markets cyprus ltd.

As an EU member state resident you are currently viewing the website www.Octafx.Eu operated by octa markets cyprus ltd with registration number HE359992. Octa markets cyprus ltd is authorized and regulated by the cyprus securities and exchange commission (cysec) with license number 372/18. The registered office of octa markets cyprus ltd is in the republic of cyprus. The account(s) you may open on this website will be opened with octa markets cyprus ltd.

The website is the property of octa markets cyprus ltd.

Brokers

Regulated forex brokers

When viewing the forex broker or a trading platform, it is the paramount priority to choose from the hundreds the most reliable one and the best forex provider, as it will determine the whole trading experience. Indeed, doing research and compare the vast number of forex brokers with many aspects to consider, maybe not an easy choice, as well time-consuming. So here we are ready to assist your selection and answer the most common questions.

Can I trade forex without a broker?

This may be the first question you would ask, as indeed forex market, FX or currency market is the largest global non-centralized exchange where trading process performed electronically via networks. While main forex participants are international banks and financial institutions operating huge volumes through a need to exchange currencies, presented as currency pairs, and assist international business with the conversion which is known as the interbank market.

Therefore, in order to trade fx you should be authorized dealer to do so, as well as operate a quite sufficient amount so before forex brokers were introduced to retail traders and global community it was not possible for trade markets. For this reason, forex trading brokers are the companies or agent if you like that gives retail forex traders access through its platform to operate forex market and trade various markets including commodity futures, indices, bonds, etc.

Do I need license to trade forex?

So this is another pleasant and great opportunity which is given by forex brokers, as you may access trading without financial or dealer license. Moreover, there are hundreds of opportunities with a relatively small investment which allows you to trade forex, do technical analysis and analyze markets almost instantly.

Are forex brokers regulated?

And now we will check the most crucial question if forex broker can be regulated, since the market is decentralized, and is it safe to trade forex? Obviously, this is the biggest trump you may fall as a retail trader if you choose a non-reliable, mainly non-regulated or offshore firm without a proper license you may easily fall into a scam and lose money.

So due to increasing demand and mainly that traders got no easy access to trading or financial education, the world countries established particular organizations or authorities in order to oversee the market proposals and regulate forex broker firms. So yes, forex brokers are regulated while holding a license from a local authority alike world known FCA in the UK, ASIC in australia, commodity futures trading commission CFTC in the USA, MAS in singapore and more.

What does a regulated broker mean?

The whole concept of regulation is to oversee forex business in a particular country or region, protect clients and ensure safe conditions while trading forex. So in simple words, regulated broker means a safe and legit broker that is compliant to various rules and criteria set by the international authority with the purpose to provide secure trading and good customer service. So its trading environment and provided services like technical analysis, education and tools are also aligned to the best practices.

In addition to its constant check on the service providing, authorities protecting clients throughout compensation schemes and other security checks, however, these conditions may vary from the regulator to another.

How do I know if my forex broker is regulated?

In order to check if broker is regulated or not, you should verify this information through the official brokers’ website first, as regulated companies always provide its licenses. And the next step is to verify a license through the official regulatory website. However, in our forex broker review you will find all the necessary information and license check as well.

It is a fact, unscrupulous brokers may easily fake information and assure you of its license while its not true, so always verify information through the official source. As well, adhere to trade with brokers regulated in serious jurisdictions, not the offshore once, as they luck of strong regulation, requirements and necessary safety measures. Read more by the link why avoid brokers from st vincent & the grenadines.

How to choose best forex broker?

Security of funds is always first in forex trading, for that reason, we recall your attention to open an account with regulated brokers only. Making it simple, regulated broker means that you will trade forex with proper security of funds and investment itself, so first of all good broker is a sharply regulated broker.

Further on, you should also check the necessary conditions and select offer suitable for you and trading strategy you deploy.

For this reason, we assist your selection and provide an assortment of efficient regulated brokers with updated on a weekly basis in-depth forex broker list. A professional detailed analysis with trading fees account overview, platform breakdowns while sorted by regulation, country or trading conditions, along with traders comments so smarter decision is easier now.

Best forex brokers in nigeria for 2021

We compared & then selected the 8 best forex brokers in nigeria that are regulated with FCA (UK), cysec & FSCA.

Forex trading is a popular financial instrument for investing in the markets. However, choosing the right forex broker can be a tricky task.

In a rapidly developing country such as nigeria, there are so many good brokers, but there are also a lot more scam brokers operating in the market. So it is really important to only choose trusted & regulated nigerian forex brokers and avoid the bad ones.

In order to help you find the best forex broker, we have tracked & compared over 10 different brokers that accept nigerian investors.

List of 8 best regulated forex brokers in nigeria for 2021

There are various aspects that we looked into in order to assess each broker, these include the broker’s compliance with multiple top-tier regulations, broker reviews, the amount of fee charged (even the hidden charges), leverage offered, minimum deposit, funding & withdrawal methods and time taken etc.

Our below vetted list is created especially for nigerian traders; it will quickly allow you to compare the key features that you need to look for in any reputed forex broker.

Best forex brokers in nigeria

Here’s our updated list of the 8 best performing forex brokers in nigeria in terms of trading & non-trading fees, promptness of deposits & withdrawals, trade execution, support & deposit bonus (last 6 months):

1. FXTM – best forex broker in nigeria (instant order execution, low deposit & easy withdrawals)

Overall rating 9/10

- Fees: 1.9 pips average spread for EUR/USD with standard account. And 0.3 pips (plus $0.4 per mini lot) with ECN MT5 account.

- Account minimum: ₦2000 or $10 (cent account)

- Leverage: 1:1000

- Promotion: no deposit bonus available currently

Ranks #1 forex broker in nigeria

Forextime or FXTM is the best forex broker in nigeria, and they are one of the few forex brokers that has local office & phone number in nigeria. They are safe for nigerian traders as they are regulated under various trusted jurisdictions such as the FCA in UK, cysec in cyprus, FSCA and FSC of mauritius. FXTM is our recommended forex broker for nigerian traders.

FXTM’s was founded in 2011 & they are a FCA regulated forex broker, which is a top tier regulation, so we consider them to be a safe broker. They offer various account types, all of them can be funded in USD or naira & have very low minimum deposit requirements starting from just ₦2000 with the cent account. This makes FXTM a very good choice for nigerian traders.

Apart from forex trading, FXTM also offer other instruments such as cfds on commodity futures and cfds on spot metals making them a very attractive choice for traders looking to diversify their portfolio. They have also recently upgraded its range of currencies & now offer 57 major & minor currency pairs.

Another important factor that we look for in a broker is their promptness of support & withdrawals, and FXTM beats other brokers hands down in this area.

FXTM broker offers local customer support in english & has 19 deposit & withdrawal options which includes many methods for nigerian traders including bank deposit & card payment. Even allows users to create a demo account in order to build their confidence and learn the art of trading. FXTM also offers a wide range of educational material to its clients, including trading webinars.

- FXTM is a highly regulated forex broker, so trading with them is safe. They are regulated globally with 3 top tier regulators i.E. FCA(UK), FSCA & cysec.

- You can start trading with ₦2000 deposit, making them a good option for new traders.

- Low spreads for most major & minor currency pairs including EUR/USD with ECN MT5 account.

- Fast withdrawals in nigeria.

- Live chat support is available 24/5 & for few hours during weekends. Their support overall is quite good.

- FXTM has bit higher spread with their standard accounts compared to other brokers. For ex. Their typical EUR/USD spread with standard account is around 1.9 pips on average, but its still competitive.

2. Hotforex – best regulated forex broker with low spread & 100% deposit bonus

Overall rating 9.0/10

- Typical fees: 1.2 pips spread for EUR/USD with micro account & 0.3 pips with zero account. This would be variable depending in the market conditions.

- Account minimum: $5 (₦2000)

- Leverage: 1:1000

- Promotion: get 100% bonus on new deposits with at-least ₦30,000 deposit required.

Ranks #2 forex broker in nigeria

Hotforex is our recommended low cost broker for nigeria. They have a local office & phone support in nigeria & are a highly regulated broker (FCA, FSCA & cysec). They are a 100% STP broker which ensures very fair dealing. Plus they offer very good order execution on all trades, have really low spreads for EUR/USD & other majors, and very good customer support as well. We highly recommend hotforex for beginner traders looking for a well regulated low cost broker in nigeria.

Hotforex was established in the year 2010. They are regulated with FCA (UK), cysec & even financial sector conduct authority (south africa), so we find them to be a trusted broker for nigerians.

They have very low minimum deposit, as low as $5. Also, they offer extremely competitive spread of 0.3 pips for EUR/USD with zero account (1.2 pips with premium, micro accounts), 0.8 for USD/JPY, 0.6 for GBP/USD (this may vary depending on the market fluctuations).

Further, hotforex offers trading on various platforms that can be accessed from android, iphone and desktop. You can trade on the metatrader 4 or metatrader 5 platforms, both of which are the most widely used trading platforms in the world.

Hotforex also offers local bank withdraw and deposit methods for nigerian traders, and there are many wallet options as well. Plus, hotforex have ongoing deposit bonus promotion available for traders in nigeria.

- Hotforex is a highly regulated broker, as they are regulated by 3 top-tier regulatory authorities FCA, FSCA & CYSEC. This ensures very fair dealing.

- Low minimum deposit requirements of $5.

- Hotforex has one of the lowest spread of all the brokers that we have compared. Around 0.3 pips typical spread for EUR/USD with their zero account.

- Very attractive 100% sign up bonus for new customers & good loyalty program for existing customers.

- Hotforex offers local deposit options like bank transfers for nigerian customers. You would need to talk to their live chat for the local bank funding options.

- Very good support available via live chat, phone & emails.

- 100% depoit bonus available for every deposit of $250 or higher.

- Their commission per lot of $6 (roundturn) with zero account is higher than other brokers like IC markets, FXTM that offer similar low spread ECN type accounts.

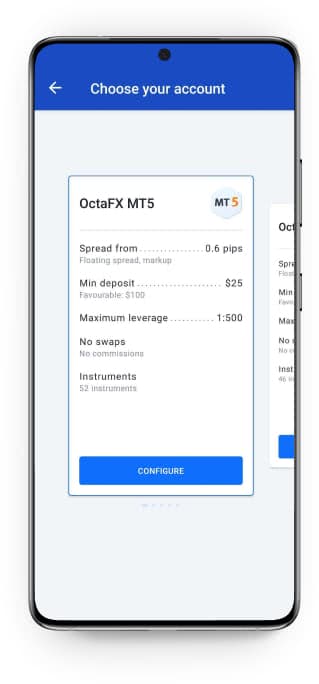

3. Octafx – low spread broker, commission free local deposits, withdrawals & 50% deposit bonus

Overall rating 8.9/10

- Fees: 1.1 pips typical spread for EUR/USD with MT4 micro accounts. And 0.7 pips (plus $0.3 per mini lot) with ECN ctrader account.

- Account minimum: $50 (₦18,000)

- Leverage: 1:500

- Promotion: 50% deposit bonus on all deposits

Ranked #3 forex broker in nigeria

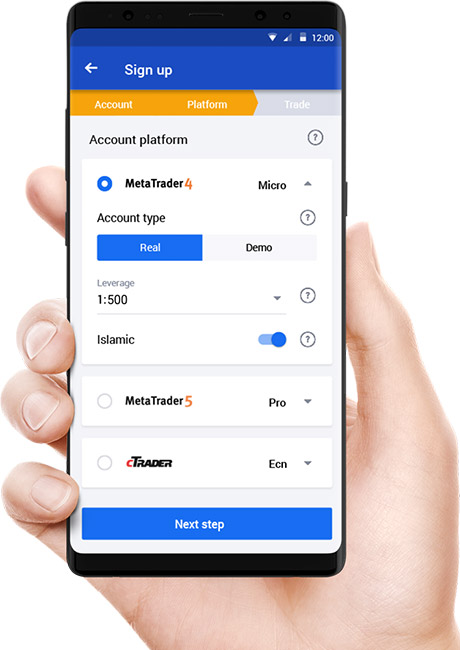

Octafx is a cysec regulated forex broker that also accepts nigerian clients. They offer good trading conditions including competitive spread, fixed as well as variable spread MT4 accounts, local nigerian bank deposit & withdrawal methods, and multiple trading platforms i.E. MT4, MT5 & ctrader for mobile, web, and desktop.

Octafx is a forex & CFD broker that was established in 2011. They have 3 account types i.E: MT4 micro account for new traders with spread starting from 0.4 pips, the MT5 account for expert traders with 0.2 pips spread & ctrader ECN account for professional traders with the lowest raw spread & direct market execution. All their accounts have good trading conditions with support for scalping & hedging.

Their trading instruments on offer are limited though, as octafx offers forex trading on 28 currency pairs, and CFD trading on metals, energies, indices & cryptocurrencies. But they have competitive spread on their available trading assets, especially for traders who are looking to trade major currency pairs, and 3 main cryptos (bitcoin, ethereum and litecoin).

Their support is also very responsive in handing issues. Their live chat support is available for 5 week days, and email support is available 24/7. They also have whatsapp text support available. But they don’t have a nigerian phone number currently.

The funding & withdrawal options at octafx are very wide for nigerian traders. They offer instant funding via skrill, neteller, and quick zero fees funding via bank transfer, or cash, or ATM in their gtbank account. Also they offer BTC funding & withdrawal.

- Octafx is a cysec regulated forex broker, so it is considered safe for nigerian traders to trade with them.

- Their spreads for major currency pairs is quite competitive. For ex. Their spread for EUR/USD starts from 0.4 pips even with their beginner MT4 micro account.

- Local deposit & withdrawals options available in nigeria, and they don’t charge any fees with this method. Also instant wallet funding and withdrawals options are available.

- Their support overall is good, as their live chat support is available 24/5, and their email support is available 24/7.

- They have a 50% deposit bonus available for all deposits.

- Octafx has lesser trading assets available as compared to other forex brokers. They have 28 currency pairs, cfds on 4 metals, 10 indices & 3 cryptos (bitcoin, litecoin, ethereum).

Octafx regulated broker

- Language support: bengali, chinese, english, hindi, indonesian, malay, portuguese, spanish, thai

- Create trading accounts, modify leverage, enable swap-free options, edit and restore passwords

- Make deposits and withdrawals using the most popular payment options

- View your detailed overall or account operation history, apply convenient filters to it and cancel your previous deposit

- Start trading in a compatible trading platform app

- Top up your demo account

- View contest statistics and access your contest accounts

- Activate bonuses and view statistics on active and completed bonuses

get it on

Forex trading accessibility for everyone

Octafx - one of the best forex brokers on the market, for traders all round the world. Octafx offers access to CFD trading, commodity trading and indices trading with award-winning forex trading conditions. As well as access to the forex market, octafx offers a variety of promotions that can help you:

50% bonus on deposit

Negative balance protection

Why choose forex trading with octafx

Octafx forex broker ensures reliable forex trading conditions to provide traders of all skill levels with an opportunity to earn more. This is possible due to:

- No commissions on deposits and withdrawals

- No swaps

- No slippage

- No delays

Octafx – highly regulated broker with powerful trading options

Establishment and regulation

Octa markets incorporated, the company behind octafx, is a globally known business operation. Despite the company’s recent establishment in 2011, it operates in more than 100 countries. The company was founded in st vincent and the grenadines, but the head office was transferred to indonesia with the asian market as the primary focus.

- Established in 2011

- Founded in st vincent and the grenadines, with the head office now in indonesia

- Licensed and regulated by the UK’s FCA

- Octafx operates in more than 100 countries

It is licensed by the FCA, the UK ultimate authority on forex business conduct. The registration with FCA already gives them a good name. The FCA is known for the strictest policies and highest standards imposed upon their subjects of regulation. Regulation of forex broker companies plays a crucial role in terms of customer protection and fair business conditions in the turbulent and highly decentralized capital market. Forex trading has been expanding rapidly in the last decade, and more and more people want to explore the potentially profitable ground. With octafx you can be sure that your funds will be safe and carefully handled. The clients’ funds are kept separate from the company’s operational funds, enabling a transparent working environment. This octafx review focuses on the main characteristics of this fast-growing brokerage magnate and the various possibilities it offers to its customers.

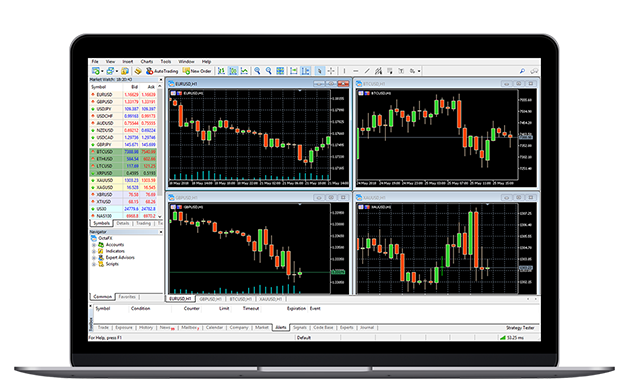

Octafx: available trading platforms

The most popular and highly reliable metatrader 4 platform is part of the standard offer at octafx. This platform is fully equipped with all the necessary elements for undisrupted trading. This highly-rated technological software comes with an appealing design too. You can opt to try the new version of meta trader, metatrader 5 if you sign up with octafx. The multi-functional software offers a powerful trading system supporting all features relevant for trading.

- Standard metatrader 4 trading platform available

- Meta trader 5 can be used as well for those who like to experiment with new software

- Proprietary octafx trading platform, ctrader, is also at clients’ disposal

- Octafx mobile apps for numerous devices

Since octafx is following the new trends and innovations in the business, they also provide a relatively new trading platform called ctrader. It is an innovative platform with numerous features and an easy-to-navigate interface. We see that octafx follows the latest inventions in the market and really tries to provide as many options to its customers as possible. They provide both, the downloadable and web-based versions of these platforms. Also, octafx mobile apps for the trading platforms are available for ios and android devices, including iphone for MT 5.

Account types available at octafx

Besides a free demo account which is the practice account for beginners, three more accounts are offered for the more experienced traders.

- MT4 micro account with a minimum deposit of $5. This account suits best the needs of traders in their early phase.

- The MT5 PRO account is for experienced traders with a minimum $500 deposit.

- The ctrader ECN account requires a minimum deposit of only $5 and is suitable for both, beginners and experienced traders.

Accepted deposit currencies are the EURO and USD. All types of accounts support expert advisors (forex robots), scalping, and hedging, while the MT 4 micro account includes the swap-free option in contrast to the other two.

Pairs, spreads and leverage

Twenty eight currency pairs are available for MT4 and MT5 accounts, while the ctrader ECN displays 48 currency pairs. Spreads can be as low as 0.2 pips for the major USD/EUR pair, while typical spreads usually amount to 0.6 pips. The leverage policy is also reasonable varying from 1:200 (for MT4 and ctrader ECN) to 1:500 (for the MT5 trading account).

Funding your octafx trading account

Payment methods are also one of the most crucial elements in this market. It is a money-dealing business, and all focus is on the money. A well-regulated payment system is a part of every professional broker company. Clients have different preferences, and octafx tries to cover the favorite payment methods of their customers. The banking options offered by this vibrant company include:

- Internal transfer where no commission is charged and waiting time does not exceed two hours.

- Visa, mastercard with the min. Deposit of $5 (no commission charged)

- Electronic payment via skrill and neteller with a minimum $50 deposit (no commission charged)

These banking options refer to both, depositing and withdrawal. The processing of a withdrawal request takes just 1 hour.

Best forex brokers in nigeria for 2021

We compared & then selected the 8 best forex brokers in nigeria that are regulated with FCA (UK), cysec & FSCA.

Forex trading is a popular financial instrument for investing in the markets. However, choosing the right forex broker can be a tricky task.

In a rapidly developing country such as nigeria, there are so many good brokers, but there are also a lot more scam brokers operating in the market. So it is really important to only choose trusted & regulated nigerian forex brokers and avoid the bad ones.

In order to help you find the best forex broker, we have tracked & compared over 10 different brokers that accept nigerian investors.

List of 8 best regulated forex brokers in nigeria for 2021

There are various aspects that we looked into in order to assess each broker, these include the broker’s compliance with multiple top-tier regulations, broker reviews, the amount of fee charged (even the hidden charges), leverage offered, minimum deposit, funding & withdrawal methods and time taken etc.

Our below vetted list is created especially for nigerian traders; it will quickly allow you to compare the key features that you need to look for in any reputed forex broker.

Best forex brokers in nigeria

Here’s our updated list of the 8 best performing forex brokers in nigeria in terms of trading & non-trading fees, promptness of deposits & withdrawals, trade execution, support & deposit bonus (last 6 months):

1. FXTM – best forex broker in nigeria (instant order execution, low deposit & easy withdrawals)

Overall rating 9/10

- Fees: 1.9 pips average spread for EUR/USD with standard account. And 0.3 pips (plus $0.4 per mini lot) with ECN MT5 account.

- Account minimum: ₦2000 or $10 (cent account)

- Leverage: 1:1000

- Promotion: no deposit bonus available currently

Ranks #1 forex broker in nigeria

Forextime or FXTM is the best forex broker in nigeria, and they are one of the few forex brokers that has local office & phone number in nigeria. They are safe for nigerian traders as they are regulated under various trusted jurisdictions such as the FCA in UK, cysec in cyprus, FSCA and FSC of mauritius. FXTM is our recommended forex broker for nigerian traders.

FXTM’s was founded in 2011 & they are a FCA regulated forex broker, which is a top tier regulation, so we consider them to be a safe broker. They offer various account types, all of them can be funded in USD or naira & have very low minimum deposit requirements starting from just ₦2000 with the cent account. This makes FXTM a very good choice for nigerian traders.

Apart from forex trading, FXTM also offer other instruments such as cfds on commodity futures and cfds on spot metals making them a very attractive choice for traders looking to diversify their portfolio. They have also recently upgraded its range of currencies & now offer 57 major & minor currency pairs.

Another important factor that we look for in a broker is their promptness of support & withdrawals, and FXTM beats other brokers hands down in this area.

FXTM broker offers local customer support in english & has 19 deposit & withdrawal options which includes many methods for nigerian traders including bank deposit & card payment. Even allows users to create a demo account in order to build their confidence and learn the art of trading. FXTM also offers a wide range of educational material to its clients, including trading webinars.

- FXTM is a highly regulated forex broker, so trading with them is safe. They are regulated globally with 3 top tier regulators i.E. FCA(UK), FSCA & cysec.

- You can start trading with ₦2000 deposit, making them a good option for new traders.

- Low spreads for most major & minor currency pairs including EUR/USD with ECN MT5 account.

- Fast withdrawals in nigeria.

- Live chat support is available 24/5 & for few hours during weekends. Their support overall is quite good.

- FXTM has bit higher spread with their standard accounts compared to other brokers. For ex. Their typical EUR/USD spread with standard account is around 1.9 pips on average, but its still competitive.

2. Hotforex – best regulated forex broker with low spread & 100% deposit bonus

Overall rating 9.0/10

- Typical fees: 1.2 pips spread for EUR/USD with micro account & 0.3 pips with zero account. This would be variable depending in the market conditions.

- Account minimum: $5 (₦2000)

- Leverage: 1:1000

- Promotion: get 100% bonus on new deposits with at-least ₦30,000 deposit required.

Ranks #2 forex broker in nigeria

Hotforex is our recommended low cost broker for nigeria. They have a local office & phone support in nigeria & are a highly regulated broker (FCA, FSCA & cysec). They are a 100% STP broker which ensures very fair dealing. Plus they offer very good order execution on all trades, have really low spreads for EUR/USD & other majors, and very good customer support as well. We highly recommend hotforex for beginner traders looking for a well regulated low cost broker in nigeria.

Hotforex was established in the year 2010. They are regulated with FCA (UK), cysec & even financial sector conduct authority (south africa), so we find them to be a trusted broker for nigerians.

They have very low minimum deposit, as low as $5. Also, they offer extremely competitive spread of 0.3 pips for EUR/USD with zero account (1.2 pips with premium, micro accounts), 0.8 for USD/JPY, 0.6 for GBP/USD (this may vary depending on the market fluctuations).

Further, hotforex offers trading on various platforms that can be accessed from android, iphone and desktop. You can trade on the metatrader 4 or metatrader 5 platforms, both of which are the most widely used trading platforms in the world.

Hotforex also offers local bank withdraw and deposit methods for nigerian traders, and there are many wallet options as well. Plus, hotforex have ongoing deposit bonus promotion available for traders in nigeria.

- Hotforex is a highly regulated broker, as they are regulated by 3 top-tier regulatory authorities FCA, FSCA & CYSEC. This ensures very fair dealing.

- Low minimum deposit requirements of $5.

- Hotforex has one of the lowest spread of all the brokers that we have compared. Around 0.3 pips typical spread for EUR/USD with their zero account.

- Very attractive 100% sign up bonus for new customers & good loyalty program for existing customers.

- Hotforex offers local deposit options like bank transfers for nigerian customers. You would need to talk to their live chat for the local bank funding options.

- Very good support available via live chat, phone & emails.

- 100% depoit bonus available for every deposit of $250 or higher.

- Their commission per lot of $6 (roundturn) with zero account is higher than other brokers like IC markets, FXTM that offer similar low spread ECN type accounts.

3. Octafx – low spread broker, commission free local deposits, withdrawals & 50% deposit bonus

Overall rating 8.9/10

- Fees: 1.1 pips typical spread for EUR/USD with MT4 micro accounts. And 0.7 pips (plus $0.3 per mini lot) with ECN ctrader account.

- Account minimum: $50 (₦18,000)

- Leverage: 1:500

- Promotion: 50% deposit bonus on all deposits

Ranked #3 forex broker in nigeria

Octafx is a cysec regulated forex broker that also accepts nigerian clients. They offer good trading conditions including competitive spread, fixed as well as variable spread MT4 accounts, local nigerian bank deposit & withdrawal methods, and multiple trading platforms i.E. MT4, MT5 & ctrader for mobile, web, and desktop.

Octafx is a forex & CFD broker that was established in 2011. They have 3 account types i.E: MT4 micro account for new traders with spread starting from 0.4 pips, the MT5 account for expert traders with 0.2 pips spread & ctrader ECN account for professional traders with the lowest raw spread & direct market execution. All their accounts have good trading conditions with support for scalping & hedging.

Their trading instruments on offer are limited though, as octafx offers forex trading on 28 currency pairs, and CFD trading on metals, energies, indices & cryptocurrencies. But they have competitive spread on their available trading assets, especially for traders who are looking to trade major currency pairs, and 3 main cryptos (bitcoin, ethereum and litecoin).

Their support is also very responsive in handing issues. Their live chat support is available for 5 week days, and email support is available 24/7. They also have whatsapp text support available. But they don’t have a nigerian phone number currently.

The funding & withdrawal options at octafx are very wide for nigerian traders. They offer instant funding via skrill, neteller, and quick zero fees funding via bank transfer, or cash, or ATM in their gtbank account. Also they offer BTC funding & withdrawal.

- Octafx is a cysec regulated forex broker, so it is considered safe for nigerian traders to trade with them.

- Their spreads for major currency pairs is quite competitive. For ex. Their spread for EUR/USD starts from 0.4 pips even with their beginner MT4 micro account.

- Local deposit & withdrawals options available in nigeria, and they don’t charge any fees with this method. Also instant wallet funding and withdrawals options are available.

- Their support overall is good, as their live chat support is available 24/5, and their email support is available 24/7.

- They have a 50% deposit bonus available for all deposits.

- Octafx has lesser trading assets available as compared to other forex brokers. They have 28 currency pairs, cfds on 4 metals, 10 indices & 3 cryptos (bitcoin, litecoin, ethereum).

Fxdailyreport.Com

OCTAFX

- Online since 2011

- Spread from 0.2 pips

- Leverage up to 1:500

- 5 digit (5 decimal pricing)

- Metatrader 4

- Regulation: FSA (saint vincent and the grenadines), cysec

- Scalping, hedging, EA robot, news trading allowed

- Free swap & commission

- Payment options : credit cards, wire, neteller, skrill moneybookers, local bank for indonesian.

Visit now

Details

| broker | OCTAFX |

|---|---|

| website URL | www.Octafx.Com |

| founded | 2011 |

| headquarters | vincent and the grenadines, VC0100, octafx UK in london, UK. |

| Support types | phone , E-mail , live chat , whatsapp |

| trading platform | metatrader, ctrader |

| minimum 1st deposit | $5 |

| minimum account size | $5 |

| minimum trade amount | 0.01 lot |

| bonus | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. |

| Leverage | 500:1 |

| spread | from 0.2 pips |

| free demo account |  |

| regulated |  |

| regulation | FSA (saint vincent and the grenadines), cysec |

| deposit methods | credit cards , wire transfer , neteller , skrill moneybookers , local bank for indonesian |

| withdrawal methods | credit cards , wire transfer , neteller , skrill moneybookers , local bank for indonesian |

| US traders allowed |  |

| mobile trading |  |

| tablet trading |  |

| overall score | 9.77 |

| deposit methods: | VISA, awepay, bitcoin, fasapay, local bank deposits, local bank transfers, neteller, paytm, skrill, unionpay |

| withdrawal methods: | VISA, awepay, bitcoin, fasapay, local bank transfers, neteller, paytm, skrill, unionpay |

Live discussion

Join live discussion of octafx.Com on our forum

Octafx.Com profile provided by john, may 29, 2012

Octa markets incorporated is a worldwide recognized forex broker. Octafx provides forex brokerage services to its clients in over 100 countries of the world. Octafx uses the most up-to-date technology and knowledge to make your forex trading experience outstandingly convenient. Our top goal is the trust and satisfaction of each client's need and requirements. Octafx sets the highest service level standards and maintains them as well as constantly develops new services and promotions.

Video

Your company video here? Contact ad sales

Let other traders know if this service is worth checking or should be avoided.

Traders reviews

Length of use: over 1 year

Length of use: 0-3 months

DISCLAIMER: this review is not to state that octafx is the best broker in the world. I've traded with a lot of brokers and never had problems with any of them, with respect to deposit and withdrawals.

Herein are the list of transactions that I did on my account with octafx. It has the ID, time the request was created, and the time it was processed.

DEPOSIT

deposit ID 4703156

created dec 27, 2020 03:23 PM

processed on dec 27, 2020 03:50 PM

WITHDRAWALS

withdrawal ID 1930065

created dec 30, 2020 11:51 AM

processed on dec 30, 2020 12:17 PM

Withdrawal ID 1927033

created dec 29, 2020 08:00 PM

processed on dec 29, 2020 09:42 PM

Withdrawal ID 1920756

created dec 28, 2020 05:53 PM

processed on dec 28, 2020 09:43 PM

Withdrawal ID 1919630

created dec 28, 2020 03:09 PM

processed on dec 28, 2020 03:24 PM

SUMMARY:

I made the deposit to their GTB nigeria account, and made withdrawals to my GTB account. This might be the reason why I never had issues with them.

I'll advise traders to ask them [octafx] questions when they have issues, and be ready to hear and understand.

Thank you for such great feedback. We appreciate you taking the time to share it with our community and giving us one more reason to be proud of the work we’re doing with our team. We’re sure they will be excited to read your review, too, as they do their best to ensure fast and secure payment services.

Please send us a direct message if you have other questions or suggestions. Our team is always here to help, and we'll be more than happy to chat whenever you have time for us.

Kind regards,

octafx rep.

Length of use: 3-6 months

Deposit take less than 1sec

withdrawal take forever.

If you guys want to withdraw the money. Please do 1 year in advance

Thank you for reaching out and sharing your feelings with us. We're sorry to read about your dissatisfaction with our processing times. Please let us remind you that all withdrawal requests at octafx are processed within a few business hours. However, when our financial department handles a high number of requests, in rare cases, we ask to allow extra time, but it does not exceed 24 hours overall.

Please note that since you didn't provide your trading account number, we couldn't look into your previous requests. However, we wish to assure you that we always strive to improve our services and reduce the processing time. We also want you to know that if your payment is delayed or you feel like it’s taking longer than it should, you can send us a message in the live chat available on the website. Our team will be more than happy to update you on your request status.

We’re looking to hearing from you, so please don’t hesitate to get in touch with us anytime. Our team is available 24/7, and they're always here to help you whenever you need it.

Kind regards,

octafx rep.

Length of use: 0-3 months

Thank you for letting us know about the problem. We deeply regret that you were having a hard time trying to deposit, and you couldn't reach out to our support team. Unfortunately, we couldn't identify you on our system and look into your previous inquiries since you didn't provide your account details in your review. If you could contact us directly and share this information with our team, it will help us investigate the issue and understand what happened with your payment.

Please note that generally, it takes a couple of hours for bank transfers to be processed. However, we ask you to allow us extra time when our financial department handles a high number of requests. There could be different causes of why your payment is delayed and not reflected in your account. This requires an investigation, and we strongly encourage you to send us your payment proof if your deposit wasn't credited into your account after 24 hours have passed. These actions could help our team look up your payment and process it.

In the meantime, don’t forget that our team composes of real agents committed to helping you whenever you need it, so please contact us after reading this reply. We’ll make sure to find your payment as soon as possible and keep you updated.

Kind regards,

octafx rep.

Bank negara malaysia

Length of use: over 1 year

Thank you for reaching out and bringing this question to our attention. Unfortunately, we couldn't identify you on our system and look into your review since you didn't provide any details about your trading account or the bank you were using at the time. We’d really appreciate it if you could get in touch with our team and share the necessary details to help us find out what happened and investigate the matter.

We also want to remind you that our support team is always here to help you. They're available 24/7, and we'll be more than happy to hear from you and assist whenever you need it.

We're looking forward to hearing from you soon.

Kind regards,

octafx rep.

Length of use: 6-12 months

I have a lot of experience with various brokers, but octafx is the absolut best.

Low spreads.

Great bonus conditions.

Very fast withdrawal without any fees..

Good customer service.

Thank you for sharing such thoughtful feedback about our brokerage. We try really hard to provide the best trading experience for our customers here at octafx. Reading reviews like yours is a great hint that we’re providing our customers with the services that meet their needs, and we truly couldn’t be happier that that’s the case for you. We appreciate you being our client and want to say that you're always welcome on our chat at any time if you have any questions or suggestions.

Kind regards,

octafx rep.

Length of use: 0-3 months

As we’re already addressed your complaint in the thread you’ve created here on FPA, please allow us to echo what we’ve said here.

Thank you for your patience while we consulted your case with our team. After looking into the matters you brought to our attention, we can see that the cards you used to fund your trading account for the first and second time were different.

Please note that in such cases, our financial department may request verification of the second card to ensure it belongs to you and not to a third party, as all third-party transactions are strictly prohibited here at octafx. Therefore, the procedure is fully in line with our security measures.

We cannot merely block the possibility of conducting further transactions because in cases where funds do belong to a third party, we have to ensure that they’re refunded to the originating account. Therefore, it’s the trading activity that must be restricted to ensure that such money is not used for trading.

Looking into your trading history, we can see that the orders you're referring to were closed 17 hours after you got back access to your account. However, those orders could have been closed before the stop out occurred either in profit or with less loss as the two hours of account locking did not impact them. You decided to trade in the same direction, and it eventually led to the stop out. There were no issues from our side, and your orders were executed as per the market conditions. Unfortunately, there are no grounds for compensation/reimbursement as it was solely your decision to continue trading.

We want to remind you that despite this incident, you're always welcomed to contact us anytime, and we'll be more than happy to hear from you and help with any questions you may have.

Kind regards,

octafx rep.

Length of use: 0-3 months

I have been trading with this useless trader for 3 months now and im becoming more and more worried about the way this company handles my query or any issues.

1. They say there will be no swaps charged to accounts having funded more than 10k.

But they still keep charging the swaps and later asks me to provide details against the wrongly charged swaps. As in I'm working for octa FX and I will keep all this information ready for them.

2. They don't have a trading practice called partially closing a trade. If you are making losses on the trade you cant close it partially to minimize the loss. Rather it will book the entire loss and again open a new trade of the remaining lot. This is so weird and when I spoke to my account manager he gave fake promises of being working on the resolution.

3. They treat their customer with the least priority and I'm still to get my money reversed from them which now more than 50 days.

Nov 6, 2020 - 1 star octafx is a fraud company.. Beware.. You can lose money even without trading. There is no way you can contact there finance team. It's only the customer support team that never has any clue of what is happening.. In my case, 2 transactions of INR50000 got debited from my account on the 5th october 2020 but did not credit to my trading account. Since then I'm chatting with them every day.. But getting the same response .." madam we have requested for update sorry for the delay".. Every single day they are responding with the same message. After 1 month today on 05th nov, I asked them to arrange a call back from the account manager, when that human called me he was clueless about what is happening on my issue. He said he is following up with the finance team but he was not ready to provide a single email communication regarding the same. Still, no one knows what will happen to my funds. They don't have a call-in number. Only chat support. I have been trading with multiple traders and this is the worst of all. You cant talk to them at all. They don't respond to emails.. I'm very frustrated..

Reply by octafx rep submitted nov 20, 2020 dear shaziya shaikh,

Thank you for taking the time to share your experience with us. We're sorry to read that you had trouble depositing your funds at octafx. We've looked into your review, and as we can see, it is still being investigated by our financial department. We can also see that you've recently mentioned on social media that one of the transactions got back successfully, but there's still one missing. We're extremely sorry that it's taking so long, and we apologize for all the inconvenience you may have faced as a result. Please note that we’re still exchanging with the payment processor and are waiting for updates to provide you with as soon as new information reveals itself.

We wish to assure you that we’re committed to resolving this issue as soon as possible but want to ask you to allow us a bit more time. We understand how uncomfortable you may feel about the matter, and we want to tell you that we take it very seriously. We'll do everything that it takes to prevent such cases in the future and reduce the processing times. Please bear with us and remember that our customer support is constantly checking your case and they will be more than happy to provide you with the latest details.

We're looking forward to hearing from you soon. And we hope that it won't take much time to receive your funds back.

We deeply regret to read about your dissatisfaction with our services. We'll be more than happy to receive feedback from you about what could be improved, considering that the issue with swaps has been resolved and you were compensated.

As for the partial order closure, we're aware of the issue. However, it's not something we could influence and fix immediately as it would require an extensive amount of time and effort once such feedback is passed to the relevant department. However, we want to ensure you that we take your suggestions and recommendations very seriously, and we'll make sure they're all addressed and considered by our team.

We would also appreciate it if you could share what could be improved regarding our customer support services to meet your standards. It's one of our top priorities to ensure that we provide the most convenient trading experience to our customers and everything is done to your satisfaction.

Please send us a message anytime soon. Our team is always here for you, and we'll be happy to hear from you whenever you have any questions.

Octafx review and tutorial 2021

Go to the brokers list for alternatives

Octafx offers multi-asset trading on a range of platforms and mobile solutions.

Octafx offers leveraged trading on currencies.

Trade popular digital currencies at octafx.

Octafx is a forex, CFD and copy trading broker offering the MT4, MT5 and ctrader platforms. In this broker review, we’ll login to the personal area and uncover the key features, including leverage, demo accounts, regulation and more. Read on to find out if octafx is a good forex broker or not.

Octafx details

Octafx was established in 2011. The company’s headquarters are located in saint vincent and the grenadines, with an additional support office in jakarta, indonesia. The broker’s EU entity, octa markets cyprus ltd, is located in limassol, cyprus, and is regulated by the cysec.

With over 1.5 million trading accounts and a long list of forex industry awards, the founder and owner has ensured the company has amassed a global reach.

Trading platforms

Metatrader 4

The MT4 platform is a trusted software used by both individual traders and institutions, due to its ease of use and flexibility.

The platform allows you to develop your own expert advisors and technical indicators to suit your trading style. In addition to the 30 in-built technical indicators, advanced charting tools allow you to analyse price fluctuations and trends in the market, using 3 customisable chart and graph types.

Note that MT4 is currently only available for non-EU clients.

Metatrader 5

MT5 is the next-generation platform that offers all the benefits of its predecessor but with additional speed, accuracy and more advanced features.

Users enjoy 8 types of pending orders, 44 analytical objects including gann and fibonacci retracement, plus additional technical indicators which are unique to MT5, such as trend oscillators and bill williams’ tools. There’s also an economic calendar as well as two major accounting modes for greater flexibility: hedging and netting.

Both platforms come in several languages, including english, arabic and hindi, and are compatible with windows pcs. Octafx provides a useful download guide on the website.

Metatrader webtrader

For those using mac pcs, octafx also offers the web terminal version of MT4 and MT5, meaning traders can access the markets straight from an internet browser.

The web platforms are highly functional and customisable, boasting the same features found in the desktop versions, including charting tools, market indicators, scripts and expert advisors, plus access to diverse order types and execution modes.

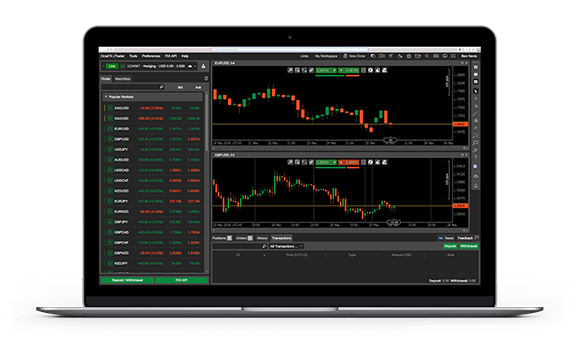

Ctrader

The ctrader platform is a robust system designed for forex and CFD trading. The platform includes over 26 in-built chart views and up to 50 chart templates on a fully customisable interface. The platform boasts an impressive suite of 70 technical indicators and 28 chart timeframes, plus advanced level scalping and visual back-testing using cbot. With full market depth, traders can also execute advanced online trading strategies as well as programmable algorithms.

The ctrader platform is ready to download from the website once you have completed the registration process. The ctrader web terminal is also available for macos users.

Markets

Octafx offers some of the most popular products, including:

- Forex – 28 currency pairs including EUR/USD and USD/JPY

- Indices – 10 CFD indices available such as US30 and NASDAQ

- Commodities – including spot gold and silver contracts, plus brent and crude oil

- Cryptocurrencies – 3 major digital currencies available; bitcoin, ethereum and litecoin

Trading fees

Typical variable spreads for EUR/USD are around 0.7 pips in both the metatrader and ctrader platforms. Gold spreads (XAUUSD) start from around 2 pips and major indices such as NAS100 are around 3.5 points. Bitcoin spreads (BTCUSD) are around 3.1 pips. Fixed spreads are also available for MT4 USD accounts.

Trading commissions are only charged in the ctrader account, at 0.03 USD per 0.01 lots. There are also rollover rates applied on positions held over 3 days. Details of these fees are listed in the product specifications.

Leverage

Octafx offers generous leverage limits up to 1:500 for currencies in the MT4 and ctrader accounts. Leverage in the MT5 account is available up to 1:200 on currencies. Metals can be leveraged up to 1:200, indices and energies up to 1:50, and cryptocurrencies up to 1:2.

Note that EU clients can only trade with leverage up to 1:30.

Mobile apps

Octafx delivers mobile app versions of the MT4, MT5 and ctrader platforms, available for iphone and android devices. The apps offer many of the essential features found in the desktop applications, including a complete set of orders in metatrader and full balance, margin and P&L information in ctrader. All trading apps come with a customisable mobile interface with clean and accurate trading functions, as well as custom mobile price alerts.

Octafx (non-EU) also offers a downloadable proprietary copy trading mobile app, currently available only on android (APK) devices. The app allows you to manage and keep track of trading accounts whilst on the go. Users can also activate bonuses, access trader tools and deposit into their accounts. The app download process is quick and can be accessed from the google play store.

Payment methods

Octafx offers a few fast funding methods which vary depending on your origin country, including bank cards, perfect money and bitcoin. Local bank transfers are also available for traders from certain countries, including thailand, india and nigeria.

The minimum withdrawal and deposit amounts are 5 USD for perfect money, 0.00096000 for bitcoin and 50 EUR for cards. All deposits methods are generally processed instantly or within a few minutes.

There are no commissions charged on deposits, withdrawals or currency exchange rates, except for 0.5% on perfect money deposits. The withdrawal time for all methods is 1 to 3 hours to approve and up to 30 minutes to transfer the funds. There is no withdrawal limit on earnings.

Demo account review

Octafx traders can open a demo account which provides the same trading experience as a live account but without risking any real investment. Each demo account is loaded with unlimited demo dollars and opportunities to participate in the broker’s demo contest to be one of the next champions. You can sign up for a free demo account in just a few minutes.

Octafx bonuses & promo codes

Octafx (non-EU) offers several deposit bonus deals, including a 50% bonus and a 100% bonus during special offer periods. In addition, there’s the trade & win promotion where traders can win gifts such as octafx t-shirts or gadgets. There are also contest opportunities, including the octafx 16 cars contest where traders are entered into a car prize draw every 3 months, as well as the champion demo contest 2020 for MT4 users.

Make sure to check all bonus terms and conditions before participating.

Regulation review

Octa markets cyprus ltd is authorised and regulated by the cyprus securities and exchange commission (cysec), under license number 372/18. EU member state residents are therefore protected by strict regulatory standards, including segregated client accounts and protection by the investor compensation fund.

The non-EU entity also claims to provide segregated client accounts to protect trader funds, as well as negative balance protection which ensures that trader account balances never fall below zero.

Additional features

Traders benefit from a range of additional education features and trading tools at octafx, including video tutorials and webinars, plus regular forex market insights and news. The brokerage also offers profit and margin calculators, as well as a forex signal service with the autochartist plugin and live quotes.

Octafx also offers a copy trading service, which is available on the desktop terminal and through the android mobile app. The copy trading services allows clients to automatically copy leading traders based on the equity and leverage of both the master trader and the copier’s accounts.

Account types

There are 3 account types available at octafx, which are determined by the trading platform you are using: micro (MT4), pro (MT5) and ECN (ctrader). Accounts are available in USD or EUR. The minimum trade volume across all accounts is 0.01 lots and there is no maximum.

The main differences between the accounts is the assets available to trade, the spreads and the minimum deposit amounts. The micro and ECN minimum deposit is 100 USD. The minimum deposit in the pro account is 500 USD. Commissions are also charged in the ECN account.

Account opening is easy and requires the submission of ID documents in line with KYC requirements. In most cases, if your documents are submitted clearly, verification should only take up to 3 hours.

There is also an islamic swap-free account for those worried about whether trading is haram or halal. Note clients from the united states are not accepted at octafx or octa markets cyprus ltd.

Benefits

Traders enjoy several benefits when trading with octafx vs the likes of FBS, IQ option and exness:

- Metatrader and ctrader platforms

- Bonuses and contests (non-EU)

- Commission-free trading

- EU regulation

Drawbacks

Compared to other brokers such as hotforex, XTB and olymptrade, octafx does fall short in some areas:

- Not FCA regulated

- Limited funding methods

- Zero pip spreads unavailable

- No copy trading on ios devices

Trading hours

Trading times in the MT4 and MT5 platforms are 24/5, from 00:00 on monday to 23:59 on friday server time (EET/EST). The ctrader server time zone is UTC +0, though you can set other time zones, such as GMT, for charts and trading information.

Customer support

For telephone support, non-EU clients can contact the helpline, +44 20 3322 1059, between 00:00 and 24:00, monday to friday (EET). For EU clients, the number to call is +357 25 251 973 between 09:00 and 18:00, monday to friday (EET).

There is also an email form, however, the fastest way to get in touch is via the 24/7 live chat service, which you can access by clicking on the chat logo at the bottom of the website. The support team are helpful if you need to know your withdrawal pin, any platform problems, VPS questions, or you want to delete an account.

In addition, you can find updates on the broker’s social media pages, as well as the octafx youtube channel.

The broker’s head office addresses are:

- Octafx, suite 305, griffith corporate centre, beachmont, kingstown, st vincent and the grenadines

- Octa markets cyprus ltd, 1 agias zonis and thessalonikis corner, nicolau pentadromos center, block: B’, office: 201, 3026, limassol, cyprus

The broker’s website is available in a number of languages for clients from indonesia, malaysia, pakistan and india.

Security

Octafx uses 128-bit SSL encryption and PIN codes in the personal area and trading platforms, which is the industry-standard security requirement for protecting personal data. The broker also applies 3D secure visa authorisation when processing credit and debit card transactions.

Octafx verdict

Octafx offers a promising trading service for novices and experienced traders, with a choice of metatrader or ctrader platforms as well as the copytrading app. The broker offers fee-free deposits and withdrawals, plus islamic accounts and a demo solution. The ECN spreads are also decent, though not as competitive as the zero spread accounts offered at other brokers like XM, for example.

Accepted countries

Octafx accepts traders from australia, thailand, canada, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use octafx from united states.

Is octafx a legit company and regulated broker?

Octafx is a legit company registered in saint vincent and the grenadines. The EU entity is registered in limassol, cyprus and regulated by cysec. If you’re unsure whether a broker is a scam or legit company, you can always check out customer reviews online.

Is octafx a market maker?

No, octafx is a no dealing desk (NDD) broker and therefore acts as an intermediary between the trader and the real market. Octafx receives commissions from its liquidity providers for each transaction.

How do I delete my octafx account?

To delete your account, you will need to get in touch with the customer support team. Note accounts are automatically deactivated if you never deposit or sign in to them.

How do I open a copytrading account at octafx?

You can sign up and login to the copytrading account in a few easy steps. Once you login to your personal area, you can set up your copytrading profile and make a deposit to your wallet. You can also sign in to your new account using the android app.

Why was my octafx withdrawal rejected?

If you encounter a withdrawal problem, you will receive a notification in your email explaining the issue. Alternatively, if you need to cancel a withdrawal, you can do this within your personal area.

Does octafx offer any free bonus deals?

At the time of writing, octafx is not offering any free bonus deals, no deposit bonus deals or promo codes. There are other promotions available for non-EU clients. Make sure to check the bonus conditions before participating.

Is octafx legal in india and pakistan?

Yes, you can legally open an octafx account from 100 countries, including india, pakistan, singapore, ghana and the UAE.

So, let's see, what we have: trade with reliable broker and best conditions: low spreads, no swaps, no commissions. Claim and withdraw 50% deposit bonus! At octafx regulated broker

Contents of the article

- Top forex bonuses

- Trade with a regulated broker that adheres to...

- Explore our platforms

- Mobile and desktop trading on demo accounts

- Brokers

- Regulated forex brokers

- Can I trade forex without a broker?

- Do I need license to trade forex?

- Are forex brokers regulated?

- What does a regulated broker mean?

- How do I know if my forex broker is regulated?

- How to choose best forex broker?

- Best forex brokers in nigeria for 2021

- Best forex brokers in nigeria

- 1. FXTM – best forex broker in nigeria (instant...

- 2. Hotforex – best regulated forex broker with...

- 3. Octafx – low spread broker, commission free...

- Octafx regulated broker

- Forex trading accessibility for everyone

- Why choose forex trading with octafx

- Octafx – highly regulated broker with powerful...

- Establishment and regulation

- Octafx: available trading platforms

- Account types available at octafx

- Pairs, spreads and leverage

- Funding your octafx trading account

- Best forex brokers in nigeria for 2021

- Best forex brokers in nigeria

- 1. FXTM – best forex broker in nigeria (instant...

- 2. Hotforex – best regulated forex broker with...

- 3. Octafx – low spread broker, commission free...

- Fxdailyreport.Com

- Details

- Why must trade in octafx forex broker ?

- Octafx review

- Broker details

- Live discussion

- Octafx.Com profile provided by john, may 29, 2012

- Video

- Traders reviews

- Bank negara malaysia

- Octafx review and tutorial 2021

- Octafx details

- Trading platforms

- Markets

- Trading fees

- Leverage

- Mobile apps

- Payment methods

- Demo account review

- Octafx bonuses & promo codes

- Regulation review

- Additional features

- Account types

- Benefits

- Drawbacks

- Trading hours

- Customer support

- Security

- Octafx verdict

- Accepted countries

- Is octafx a legit company and regulated broker?

- Is octafx a market maker?

- How do I delete my octafx account?

- How do I open a copytrading account at octafx?

- Why was my octafx withdrawal rejected?

- Does octafx offer any free bonus deals?

- Is octafx legal in india and pakistan?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.