Ewallet

This is a digital payment platform that allows you to manage your cryptocurrency. You can trade popular coins like bitcoin and ethereum, but not limited to them, and exchange them to other coins or even to US dollars or euros.

Top forex bonuses

This platform gives you the opportunity to store all your payment information as well as some personal data of your choice, through its very secure system. It also enables you to make all the usual online money transfers.

30 best ewallets in the world

There is no doubt that the electronic wallet market in 2019 is as huge as it is elaborate. For the most people using online platforms this is a convenient way to make transactions in a safe, controlled and easy way, without bringing forward the cash or the credit card, all the time. What is ewallet? The e-wallet concept must be able to keep money in a digital ewallet account, to give you the options to transfer money between the e-wallet (digital wallet) and your bank account or the credit card. The payment lanscape has been much improved by these apps and it also benefits from top online technologies.They bring cutting edge procedures regarding money transfer and security, so there are a lot of pros for using these apps. Plus, almost everybody is working with best online wallet these days. So, sooner or later we all have to understand that this is, so far, the best manner for transferring money, besides the old-fashioned cash and the already classic bank or card transfer.

It is good that we have so many options to choose from. This means we can expect ess fee amounts and faster service. There are many types of ewallet.

We have chosen, among so many, 30 top of the top ewallet apps , which have already been consacrated and have proven their worth and utility. These are the apps that are setting the trends on all markets, and here they are, presented for you:

Adyen

This app has spread globally, and allows to connect all types of cards (visa, mastercard etc.). It is considered an innovative payment processor, as cool and as stylish as there can be. It is great for international merchants, but too expensive for low-volume merchants.

Airtel money

It reaches globally but it is somehow restricted to just making recharges and online money transfers, as well as bill payment and online shopping. It doesn’t allow, however, cash withdrawal. If you have more queries then, you can make contact to airtel payment bank customer care number by clicking here !

Alliedwallet

It accepts all major credit and debit cards and almost every international currency. They have been established since 2002 and, are currently working in over 190 countries, thus having one of the best custumer support features.

Apple pay

Apple pay app is the oldest e-wallet app on the market and it accepts a large number of locations and card types. The connection is made simply, via phone with apple pay limit. Do you have questions - how to use apple pay? Or how to set up apple pay? Or how does apple pay work? Or how to pay with apple pay? Click here ! To get apply pay support in order to set up apple pay.

Brinks

It’s a mastercard app that lets you load money on the phone and manage your money on the go. It can perfectly work to send and receive money, as well as make online payments.

Cardfree

This is an integrated commerce system which includes gifts,loyalty, offers, order ahead, databases, complex data analytics. It is also ahead of its many competitiors as it offers the possibility to integrate with other mobile digital wallets on the market.

Chase pay

It is an all-in-one app that combines shopping apps, coupon, food, gas, reward and wallet and payment apps, all in just one that lets you do all that from your phone. They continually develop and add new features that simplify the entire process.

Citi masterpass

This was created to simplify your life to a great extent. It ensures faster checkout with a simple click. It stores all your credit, debit, prepaid, or loyalty cards and all your personal details in one very safe place. You can send, receive money and make online payments with just a click.

Coinbase

This app is dedicated to cryptocurrency transactions. It is one of the most popular in this area. You can sell, purchase, and securely store bitcoin, ethereum and litecoin. They also have a coinbase pro feature that brings an intuitive interface that gives options like real-time order books, charting tools and data exporting. It grants you access to real-time market data.

Due

This is a global app and it offers lots of features for individuals, freelancers or companies, just to mention a few: time tracking, bill payment, invoicing, cost splitting and a unique transaction fee of for all payments.

Ecopayz

It’s easy to create an digital ewallet account here without even having a bank account or credit check. This app is in the top due to its system of bonuses and gold VIP rewards, together with all the other benefits they offer.

Epayments

This is a cost-effective platform, with very low fees. They have also developed a mobile wallet app for all around the world. The platform is divided in two major directions: personal accounts for individuals and business accounts. It works both with visa and mastercard as well as with cryptocurrency.

Famacash

It’s a platform that provides you an online wallet for storing coupons, loyalty cards, sensitive account numbers for all debit and credit cards. It notifies you regarding all promotions and deals from stores and brands.

Gatehub

This is a digital payment platform that allows you to manage your cryptocurrency. You can trade popular coins like bitcoin and ethereum, but not limited to them, and exchange them to other coins or even to US dollars or euros.

Gyft

This e-wallet allows you to manage all the gift cards and coupons and vouchers and to store them on one device, so you can make the most of them, as these things usually get easily lost.

Key ring

This is another e-wallet specialized in managing loyalty and gift cards, coupons and vouchers, which allows customers to centralize them, as well as to share shopping lists, to search promotions and deals with various stores. However this best wallet app does not allow you to manage your debit or credit cards.

Moven

It is an app that operates only on mobile devices. It allows customers to store all their payment information as well as to operate online payments in a very secure manner.

Obopay

A global mobile payment supplier, provides streamline for the entire transaction process. It brings international solutions and specific data for each industry at a time.

Passkit

It is focused towards amplifying customer engagement through its geolocation feature. This is the main objective here, to help companies increase customer engagement, to ease transactions via wide digital payment network.

Paycloud

This platform allows you to store data regarding loyalty and reward cards on your mobile device. It allows local brands and stores within your area to deliver you special promotions and offers.

Papaya

It offers a safe alternative to cash and actual credit cards. It allows customers to shop, send and receive money instantly everywhere in the world.

Paypal

Does this wallet app need any introduction? I guess this is the first name that comes to everybody’s minds when thinking about online payments. They have based their popularity and fame step by step, in the entire world. And these days almost everybody in the online space works with them, at least as one of the options. It updates constantly with latest technologies and it also offers mobile card readers and POS systems.

Payoneer

This is also one of the big ewallet apps, used at a very large scale world wide. This is a great funds transfer solution, especially for freelancers in all the industries around the globe, working with foreign partners.

Paytoo

It acts like an electronic bank account and you can use your mobile feature for bill payment, share funds, money transfer. This app allows you to make direct deposits ans secure the money, manage gift cards etc.

Puut wallet

This platform gives you the opportunity to store all your payment information as well as some personal data of your choice, through its very secure system. It also enables you to make all the usual online money transfers.

Samsungpay

This app lets customers purchase online and make payments just with a tap. This is one of the most used e-wallets on the market. It also offers the option to link several cards to the smartphone, and make payments from all these interconnected cards.

Sequent

It connects all your cards to your mobile allowing you to make payments, securely digitize all the credit or debit cards, also the transit, loyality or even ID cards.

Stocard

It is a free app that allows you to store card information on your mobile device. This app is dedicated to loyalty and reward cards.

Stripe

It is a platform that enables you to make credit card processing and transfer funds. It is mainly focused on business clients, for companies of all sizes.

Tabbedout

This app is dedicated to bars and restaurants. Their clients can view the menu and make payments through their phone. It also helps them solve the issues regarding splitting of the bills, when larger groups are involved.

Zelle

This is a payment app that allows you to make transactions directly from your bank to everybody else. It enables same-day transfers to individual and businesses that have accounts at the participating banks. And this bank network is increasing constantly, by including the most popular players on the market. Up to this point, it allows you to connect only one bank account, so it must be wisely chosen upon registration.

In final words, there are many more famous ewallet apps like paytm, amazon pay, google pay, phonepe, mobikwik, BHIM axis pay and etcetera. Each country has different famous ewallets and each e-wallet provides special offers (discounts) which attracts you to install it in your smartphone and use it for great savings. In all the cases, e-wallet system (payment method) is perfect but, the biggest con of using such app is extreme worth shopping which you must need to control yourself for worth money spend.

Ewallet reviews 2021

Detailed expert review

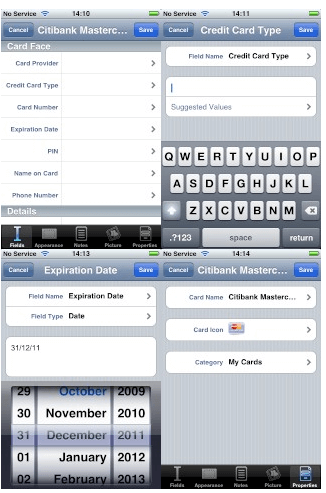

Ilium takes pride in its “simple software,” especially its password manager, ewallet — but is it really as easy to use as the company claims? Ewallet certainly runs smoothly, and it’s jam-packed with useful features like unlimited password storage, a random password generator, cloud sync, and more. In fact, its functionality is super solid. But there’s no free version, which means that its features need to be worth the money you’re paying.

I’ve reviewed nearly 70 password managers in order to give you the low-down on whether ewallet is worth your time and money. Here’s what I found out.

Ewallet features

While the technology behind ewallet is pretty sophisticated, the platform itself is simple and easy to use. Features include unlimited password storage, multiple device support, automatic password entering, random password generator, fingerprint scanner, auto-lock, data backup, 256-bit AES encryption, and seamless sync between devices.

While other password managers (lastpass, truekey) offer some of these features, ewallet is one of the only ones that offers such a complete package. For example, many free password managers (like dashlane’s free version) offer password storage and good security, but the number of passwords you can store is limited, or sync and backup is not included. If you want those extras, you will usually have to get a paid version that in many cases will be more expensive than ewallet.

There’s only one small downside when it comes to ewallet: the features are not totally uniform across platforms. For example, the import wizard is only available on desktop, and sync options differ depending on the device. The iphone/ipad version seem to be the most advanced; they offer face ID support and autofill provider for safari and other apps, whereas the android version doesn’t. Lastpass, this isn’t.

Password storage

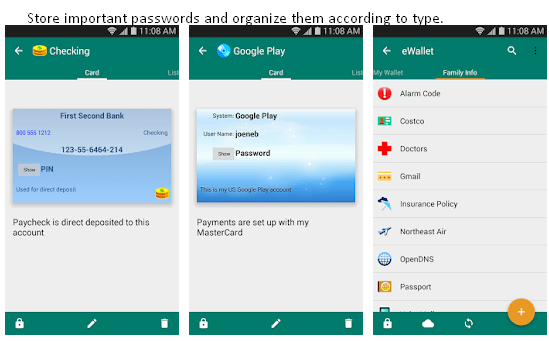

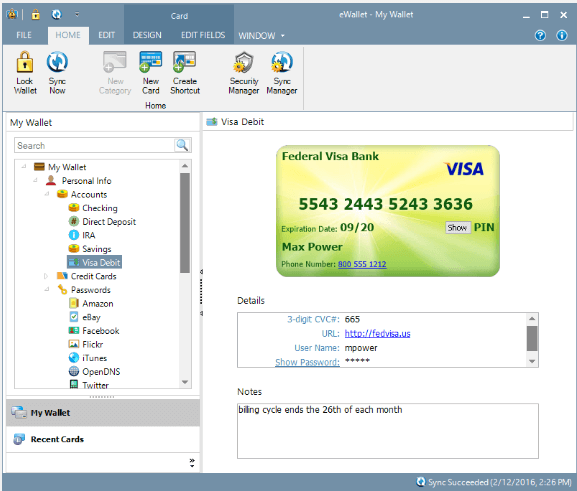

Storage of passwords and other important information is the bread and butter of any password manager, and ewallet excels in this area. You can store all kinds of info, including credit card numbers, bank accounts, web passwords, driver’s licenses, clothing sizes, even voter registration numbers. There’s also autopass automatic password entering, so when you visit a site on your desktop or mobile, your password is automatically filled in.

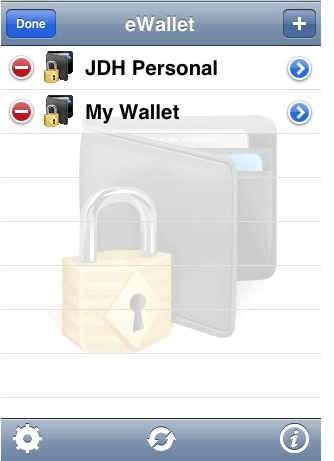

Ewallet provides highly-organized password storage. As opposed to other password managers that lump all your information together, ewallet offers multiple wallets, which can have their own passwords (or not). So you can keep all your financial information in one place, all your online shopping details in another, your insurance info in another, etc.

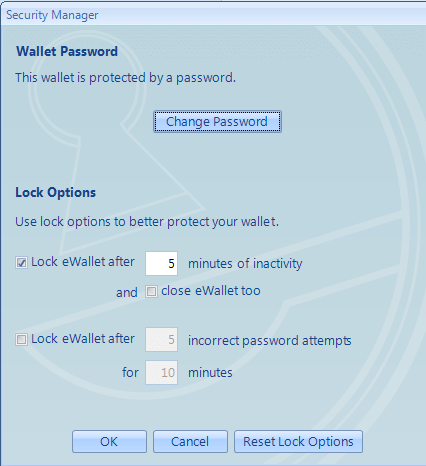

Each wallet has its own security settings, so you can choose to activate automatic lock, intruder lockout, number of invalid password attempts, and more.

Syncpro

If you download ewallet to multiple devices, you’ll naturally want to sync them. Syncpro is ewallet’s syncing system, and it works via cloud and direct sync (similar to how myki works). There are different methods of sync depending on the devices you use, but the gist is that cloud sync automatically syncs your devices without the need for a direct connection, and direct sync works via wifi.

Syncpro also lets you backup your information; if you want further backup, ewallet also offers an email and restore option.

Customization

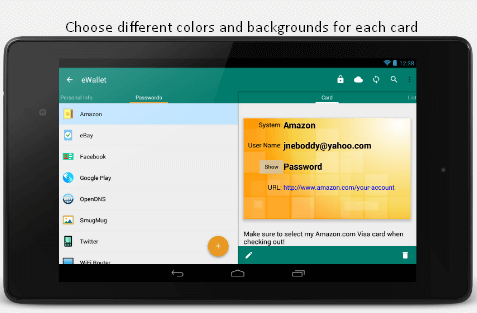

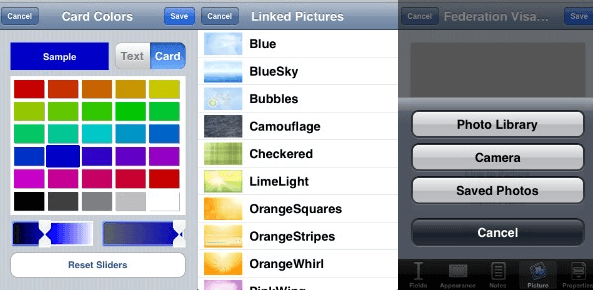

A standout feature of ewallet is its high level of aesthetic customization. Each password you store has its own card, and you can choose the background and colors for each one. While this isn’t integral to the functionality, it can be super-fun. And if you’re planning to use ewallet for your kids, this special feature makes ewallet an attractive choice.

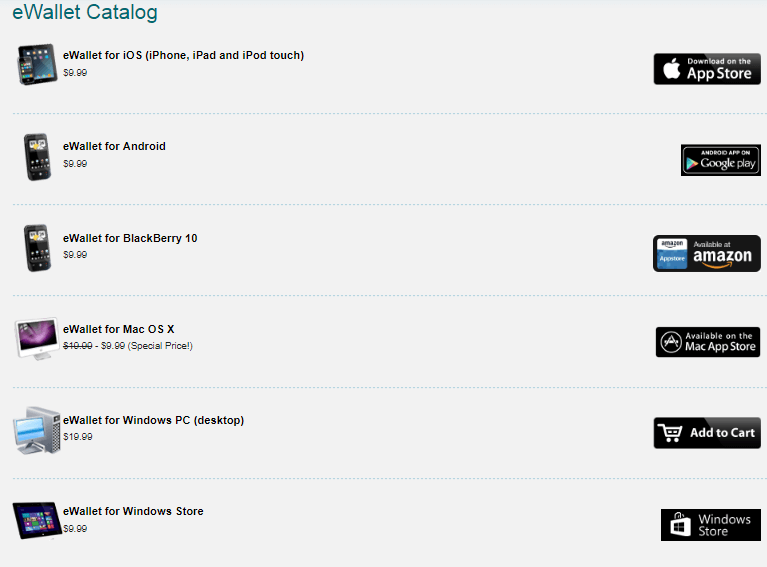

Ewallet plans and pricing

I’ll be honest—I’m disappointed with ewallet’s payment system, which is why I’m giving it a rating of 3/5. As opposed to selling one version that can be downloaded to desktop and smartphone, ilium sells ewallet as totally different products for

- Windows PC

- Windows store

- Mac OS X

- Android

- Blackberry

- Iphone/ipad/ipod touch

So if you want to use it on desktop and mobile, you’ll have to pay separately for each product. And if you want to use it for your entire family, it can get really costly. For android, an ewallet license can’t work on multiple store accounts, which means if your kids have their own play store accounts, you have to buy ewallet separately for each one. Iphone is more advanced and supports family sharing, which means that up to 6 family members can use the app.

But before you write off ewallet as too expensive, let’s quickly review what’s included:

- Unlimited password storage

- Cloud and direct sync

- Auto-locking feature

- Autopass automatic password entering

- Individual password security settings

- Random password generator

- Wallet customization

- 256-bit military grade AES encryption

- Fingerprint scanner (and facial ID on iphones)

The fact is, ewallet’s standard package comes with all the features of a high-quality password manager, and it’s made by ilium, a respected name in the software industry. It’s up to you to decide whether a high-qualty product (and the peace of mind that comes with it) is worth the cost.

If you’re not sure you want to buy it, you can try out any ewallet product for 30 days. If it suits your needs, you can go ahead and buy it. If not, you’re not obligated in any way.

Ewallet ease of use and setup

Ewallet is really easy to use; if you have any familiarity at all with computers or smartphones, you’ll be able to use it with no trouble at all. As opposed to storing all of your info in one unsorted mess, ewallet allows for a high level of organization. This includes creating multiple wallets for different categories (personal, finance, work, etc.). Within each wallet you can create folders to further sort your info. And finally, each password or financial detail gets its own card, and you decide which wallet/folder to store it in.

The only thing that I would like to see added is a manual search option; at this point, ewallet doesn’t offer it. But because the level of organization is so high, it’s easy to find what you’re looking for even without it.

As you can see below, each card includes plenty of details — and you get to decide what to include.

Another convenient feature is autopass, which automatically fills in your information for various sites. So when you visit amazon, ebay, your bank, etc., your sign-in information will appear in the appropriate fields and you can log in immediately.

Installation and set up take just a few minutes; the only disappointment is that the desktop version requires a .NET framework if it’s not already installed on your computer. That adds about five minutes to installation, not really a big deal. Once everything is installed on your desktop, the platform runs smoothly. Same goes for ios and android.

I’d say this is all impressive, just not as impressive as other simple (or even one-click) installation processes, like lastpass.

Ewallet security

Ewallet allows you to create passwords for different wallets; it also includes a password generator to create passwords that are not easily guessable by others. You don’t have to create passwords for each wallet, but the option is there. Of course, you need one password to log into your account, but android and iphone offer fingerprint access as well. Iphone also offers facial ID access. I’m still more impressed by truekey’s 15 types of two-factor authentication though.

You can easily edit, change, or delete your passwords.

Other security settings in each wallet are:

- Limit password attempts

- Lock after 5 attempts

- Lock for 30 minutes

- Lock when inactive

Ewallet uses 256-bit military grade AES encryption to protect your data, which makes it virtually impossible to hack. However, there’s no 2-step verification, which is why I didn’t give a 5/5 rating.

Ewallet customer support

For such an impressive software company, ilium’s ewallet support leaves something to be desired. You can contact only contact them by email, not phone or live chat. When I sent them a test email, the automatic response said I’d receive an answer within 2 business days. I wasn’t too happy about that, since 2 business days is a pretty long time to wait. It reminded me of how slow dashlane were to get back to me.

However, in reality, I received a response within a few hours. I sent a few more emails to judge the response time, and consistently received responses within a few hours from a friendly support rep.

The FAQ pages are not the clear and neat pages that I’m used to; yes, they contain information, but many articles date back to 2016 and the look itself is a bit old-fashioned. Don’t get me wrong — there is information, it’s just not as easy to read or find as most modern websites. Or other password managers – like bitdefender’s very active forums.

As for refunds, ewallet accepts returns made within 30 days of your purchase of the software. However, this is only for products purchased directly from ewallet; the play store and app store each have their own refund policies.

Ewallet products & pricing

Ewallet is a comprehensive password manager that comes with lots of features, including unlimited password storage, cloud and direct sync, a password generator, high-level customization, and more. It’s also really easy to use, so you don’t have to break your head trying to figure out how to make it work.

My main gripe is that it sells its desktop and mobile products separately. If you’re the only one who needs it, you’re still getting really good value for your money, even with the separate products. But if you want it for your whole family, it can get really costly buying different licenses for multiple smartphones and desktops.

As with any product, it’s up to you to decide whether what you’re getting is worth the cost. The one thing you can be sure about is that when it comes to features and ease of use, there’s no question that ewallet is superb. I’d still recommend a more solid all-rounder like lastpass though.

30 best ewallets in the world

There is no doubt that the electronic wallet market in 2019 is as huge as it is elaborate. For the most people using online platforms this is a convenient way to make transactions in a safe, controlled and easy way, without bringing forward the cash or the credit card, all the time. What is ewallet? The e-wallet concept must be able to keep money in a digital ewallet account, to give you the options to transfer money between the e-wallet (digital wallet) and your bank account or the credit card. The payment lanscape has been much improved by these apps and it also benefits from top online technologies.They bring cutting edge procedures regarding money transfer and security, so there are a lot of pros for using these apps. Plus, almost everybody is working with best online wallet these days. So, sooner or later we all have to understand that this is, so far, the best manner for transferring money, besides the old-fashioned cash and the already classic bank or card transfer.

It is good that we have so many options to choose from. This means we can expect ess fee amounts and faster service. There are many types of ewallet.

We have chosen, among so many, 30 top of the top ewallet apps , which have already been consacrated and have proven their worth and utility. These are the apps that are setting the trends on all markets, and here they are, presented for you:

Adyen

This app has spread globally, and allows to connect all types of cards (visa, mastercard etc.). It is considered an innovative payment processor, as cool and as stylish as there can be. It is great for international merchants, but too expensive for low-volume merchants.

Airtel money

It reaches globally but it is somehow restricted to just making recharges and online money transfers, as well as bill payment and online shopping. It doesn’t allow, however, cash withdrawal. If you have more queries then, you can make contact to airtel payment bank customer care number by clicking here !

Alliedwallet

It accepts all major credit and debit cards and almost every international currency. They have been established since 2002 and, are currently working in over 190 countries, thus having one of the best custumer support features.

Apple pay

Apple pay app is the oldest e-wallet app on the market and it accepts a large number of locations and card types. The connection is made simply, via phone with apple pay limit. Do you have questions - how to use apple pay? Or how to set up apple pay? Or how does apple pay work? Or how to pay with apple pay? Click here ! To get apply pay support in order to set up apple pay.

Brinks

It’s a mastercard app that lets you load money on the phone and manage your money on the go. It can perfectly work to send and receive money, as well as make online payments.

Cardfree

This is an integrated commerce system which includes gifts,loyalty, offers, order ahead, databases, complex data analytics. It is also ahead of its many competitiors as it offers the possibility to integrate with other mobile digital wallets on the market.

Chase pay

It is an all-in-one app that combines shopping apps, coupon, food, gas, reward and wallet and payment apps, all in just one that lets you do all that from your phone. They continually develop and add new features that simplify the entire process.

Citi masterpass

This was created to simplify your life to a great extent. It ensures faster checkout with a simple click. It stores all your credit, debit, prepaid, or loyalty cards and all your personal details in one very safe place. You can send, receive money and make online payments with just a click.

Coinbase

This app is dedicated to cryptocurrency transactions. It is one of the most popular in this area. You can sell, purchase, and securely store bitcoin, ethereum and litecoin. They also have a coinbase pro feature that brings an intuitive interface that gives options like real-time order books, charting tools and data exporting. It grants you access to real-time market data.

Due

This is a global app and it offers lots of features for individuals, freelancers or companies, just to mention a few: time tracking, bill payment, invoicing, cost splitting and a unique transaction fee of for all payments.

Ecopayz

It’s easy to create an digital ewallet account here without even having a bank account or credit check. This app is in the top due to its system of bonuses and gold VIP rewards, together with all the other benefits they offer.

Epayments

This is a cost-effective platform, with very low fees. They have also developed a mobile wallet app for all around the world. The platform is divided in two major directions: personal accounts for individuals and business accounts. It works both with visa and mastercard as well as with cryptocurrency.

Famacash

It’s a platform that provides you an online wallet for storing coupons, loyalty cards, sensitive account numbers for all debit and credit cards. It notifies you regarding all promotions and deals from stores and brands.

Gatehub

This is a digital payment platform that allows you to manage your cryptocurrency. You can trade popular coins like bitcoin and ethereum, but not limited to them, and exchange them to other coins or even to US dollars or euros.

Gyft

This e-wallet allows you to manage all the gift cards and coupons and vouchers and to store them on one device, so you can make the most of them, as these things usually get easily lost.

Key ring

This is another e-wallet specialized in managing loyalty and gift cards, coupons and vouchers, which allows customers to centralize them, as well as to share shopping lists, to search promotions and deals with various stores. However this best wallet app does not allow you to manage your debit or credit cards.

Moven

It is an app that operates only on mobile devices. It allows customers to store all their payment information as well as to operate online payments in a very secure manner.

Obopay

A global mobile payment supplier, provides streamline for the entire transaction process. It brings international solutions and specific data for each industry at a time.

Passkit

It is focused towards amplifying customer engagement through its geolocation feature. This is the main objective here, to help companies increase customer engagement, to ease transactions via wide digital payment network.

Paycloud

This platform allows you to store data regarding loyalty and reward cards on your mobile device. It allows local brands and stores within your area to deliver you special promotions and offers.

Papaya

It offers a safe alternative to cash and actual credit cards. It allows customers to shop, send and receive money instantly everywhere in the world.

Paypal

Does this wallet app need any introduction? I guess this is the first name that comes to everybody’s minds when thinking about online payments. They have based their popularity and fame step by step, in the entire world. And these days almost everybody in the online space works with them, at least as one of the options. It updates constantly with latest technologies and it also offers mobile card readers and POS systems.

Payoneer

This is also one of the big ewallet apps, used at a very large scale world wide. This is a great funds transfer solution, especially for freelancers in all the industries around the globe, working with foreign partners.

Paytoo

It acts like an electronic bank account and you can use your mobile feature for bill payment, share funds, money transfer. This app allows you to make direct deposits ans secure the money, manage gift cards etc.

Puut wallet

This platform gives you the opportunity to store all your payment information as well as some personal data of your choice, through its very secure system. It also enables you to make all the usual online money transfers.

Samsungpay

This app lets customers purchase online and make payments just with a tap. This is one of the most used e-wallets on the market. It also offers the option to link several cards to the smartphone, and make payments from all these interconnected cards.

Sequent

It connects all your cards to your mobile allowing you to make payments, securely digitize all the credit or debit cards, also the transit, loyality or even ID cards.

Stocard

It is a free app that allows you to store card information on your mobile device. This app is dedicated to loyalty and reward cards.

Stripe

It is a platform that enables you to make credit card processing and transfer funds. It is mainly focused on business clients, for companies of all sizes.

Tabbedout

This app is dedicated to bars and restaurants. Their clients can view the menu and make payments through their phone. It also helps them solve the issues regarding splitting of the bills, when larger groups are involved.

Zelle

This is a payment app that allows you to make transactions directly from your bank to everybody else. It enables same-day transfers to individual and businesses that have accounts at the participating banks. And this bank network is increasing constantly, by including the most popular players on the market. Up to this point, it allows you to connect only one bank account, so it must be wisely chosen upon registration.

In final words, there are many more famous ewallet apps like paytm, amazon pay, google pay, phonepe, mobikwik, BHIM axis pay and etcetera. Each country has different famous ewallets and each e-wallet provides special offers (discounts) which attracts you to install it in your smartphone and use it for great savings. In all the cases, e-wallet system (payment method) is perfect but, the biggest con of using such app is extreme worth shopping which you must need to control yourself for worth money spend.

Ewallet | everything you should know about prepaid wallets

It’s the new age of the digital world and ewallet is in the spotlight. With the development of technology and demonetization of higher currencies in the country, electronic and in-app wallets have emerged as an alternate payment option to cash. But the companies have all the plans to remove the prefix alternate and increase their market share substantially.

What is an ewallet?

Ewallet is an online prepaid account used to store money and transact online and offline through a computer or a smartphone whenever required. It is a pre-equipped electronic wallet which, just like a real wallet, is used by the customers to transact immediately (and securely). Unlike bank accounts, ewallets are considered to be a fast mode of digital transactions.

Types of ewallet in the market

Mobile wallets are used for numerous transactions, be it shopping (online and offline), payment of goods and services (including financial services) or transactions through ATM. However, the scope of their usage depends on the wallet type.

Electronic wallets doesn’t (usually) pay interest to the users. But they do to the companies operating them. It all depends on the type of wallet. According to the reserve bank of india (RBI), there are three kinds of wallets prevalent in the indian market:

Closed wallet

Companies like flipkart.Com, makemytrip.Com, bookmyshow.Com etc. Issue closed wallets to their consumers. The money stored in these wallets can only be used to transact with the companies who have issues such wallets. Closed wallets are online accounts where money gets credited in case of a refund due to cancellation or return of a product or service. Some companies even earn interests on these deposits.

Semi-closed wallet

Semi-closed wallets are the payment wallets prevalent in the system. Wallets like paytm wallet, freecharge wallet, citrus, oxygen, etc. Are labelled as semi-closed wallets. An RBI approval is required to start and operate a semi-closed wallet. These wallets can be used to transact online and offline which include buying goods and services, financial services, payment of fees, premiums, etc. Through/to merchants which have a specific contract with the issuer to accept the payment instruments.

Since these wallets are handled by non-banking agencies (banks and non-banking financial agencies cannot issue semi-closed wallets), they are required to deposit this money in an escrow account with a partner bank. Interest on these deposits depends on the agreement between the payment company and the bank.

Semi-closed wallets in india

Paytm wallet

Launched in 2010, paytm is india’s largest mobile commerce platform. Paytm wallet, because of its amazing marketing and operation strategies, has been able to capture maximum market share of this industry. Its investors include ant financial (alipay), SAIF partners, sapphire venture and silicon valley bank. The wallet can be used to send money directly to bank accounts as well.

Paytm is the first company in india to receive a license from the RBI to start a payments bank.

Freecharge wallet

Owned by snapdeal, freecharge is an e-commerce website just like paytm which also offers an online wallet features to its users. Freecharge wallet positions itself as the fastest e-wallet in india where one can even transfer money through whatsapp.

Mobikwik wallet

Started in 2009, mobikwik currently is among the top ewallet service providers in india. Mobikwik offers various features to its users. Users can add money using debit, credit card, net banking and even doorstep cash collection service and make payments for products and services in one click via the mobile app, web site, SMS, or by dialling a number.

Oxigen wallet

Oxigen, in the market since 2004, has a very distinctive USP where it has partnered with VISA and issued a virtual prepaid VISA feature which lets users pay online with oxigen wallet anywhere they see a VISA logo.

Airtel money

Telecommunications giant airtel, in collaboration with infosys and smarttrust (now giesecke & devrient), offers an ewallet service – airtel money. Airtel money has far better features if compared to any other semi-closed ewallet.

- No need of a bank account

- Internet isn’t necessary

- A smartphone isn’t required to register for airtel money

- Users get interest on their deposit (4%).

However it has loads of limitations which resist users from using it as a primary their primary ewallet.

- Airtel money isn’t a free ewallet.

- Big amount cannot be transferred.

- Not supported by some handsets.

- Users must use airtel money at least once in six months or they’ll lose their balance.

However, airtel is the first company to actually launch a payments bank in india which can be operated with airtel money application.

Other semi-closed ewallets

Open wallet

Open wallets can only be issued by banks or in partnerships with banks. These wallets can be used to perform all the transactions of semi-closed wallets plus withdraw cash at atms or banks and transfer funds. M-pesa by vodafone and ICICI bank, pay zapp by HDFC bank, etc. Are few open wallets in india.

Difference between an ewallet and a digital wallet

Masterpass by citibank isn’t the same as paytm wallet. The term digital wallet cannot be used interchangeably with the term ewallet/prepaid wallet.

Digital wallets save users’ cards for easy future transactions. They are required to save and validate their card details in the digital wallet only once. Once registered, they just have to remember the digital wallet username and password and can use their saved cards from the digital wallets itself. That is, digital wallets save users card details for faster and easier transactions.

E-wallets or prepaid wallets require money to be loaded in them prior to any transaction (online or offline). E-wallets like paytm, mobikwik, etc. Can make you go cardless only if you load money to their wallets.

| Digital wallet | E-wallet |

|---|---|

| cards details are saved in the wallets to transact cardless. | Money is preloaded in the wallets to transact cardless. |

| Money remains in the user’s bank account or credit card. | Money moves from the user’s account to either a merchant’s current account or an escrow account |

| example – masterpass, google wallet, apple’s passbook | example – paytm wallet, freecharge wallet, mobikwik. |

However, some companies, like paypal, provide both ewallet and digital wallet services.

How to use an ewallet?

Ewallets have revolutionized the market habits. Transactions are becoming more digital with more people adopting to ewallets because of their ease and pace of operation.

Future of ewallets

Leather wallets are no more a fashion trend. It’s the E-wallet which has taken the spotlight. While online and mobile banking has been around for a long time, E-wallets have made it even easier and faster to transact online and offline. The mobile wallet transactions are estimated to leapfrog from rs. 5,500 crore in 2015-16 to rs. 30,000 crore in 2022 with a 9.5% month-on-month growth rate.

E-wallets have surely revolutionized the market but there’s one step that can be (and has been) eliminated – loading money to the wallets. Many new applications (like phone pe) has been released which let users transact using their bank account balance directly. Hence, wallet service providers, to stay in the market for long, has to keep innovating and changing their business model. Payments banks have already emerged in the market and will lead e-wallets soon.

Go on, tell us what you think!

Did we miss something? Come on! Tell us what you think of our article on ewallet in the comments section.

A startup consultant, dreamer, traveller, and philomath. Aashish has worked with over a 100 startups and successfully helped them ideate, raise money, and succeed. When not working, he can be found hiking, camping, and stargazing.

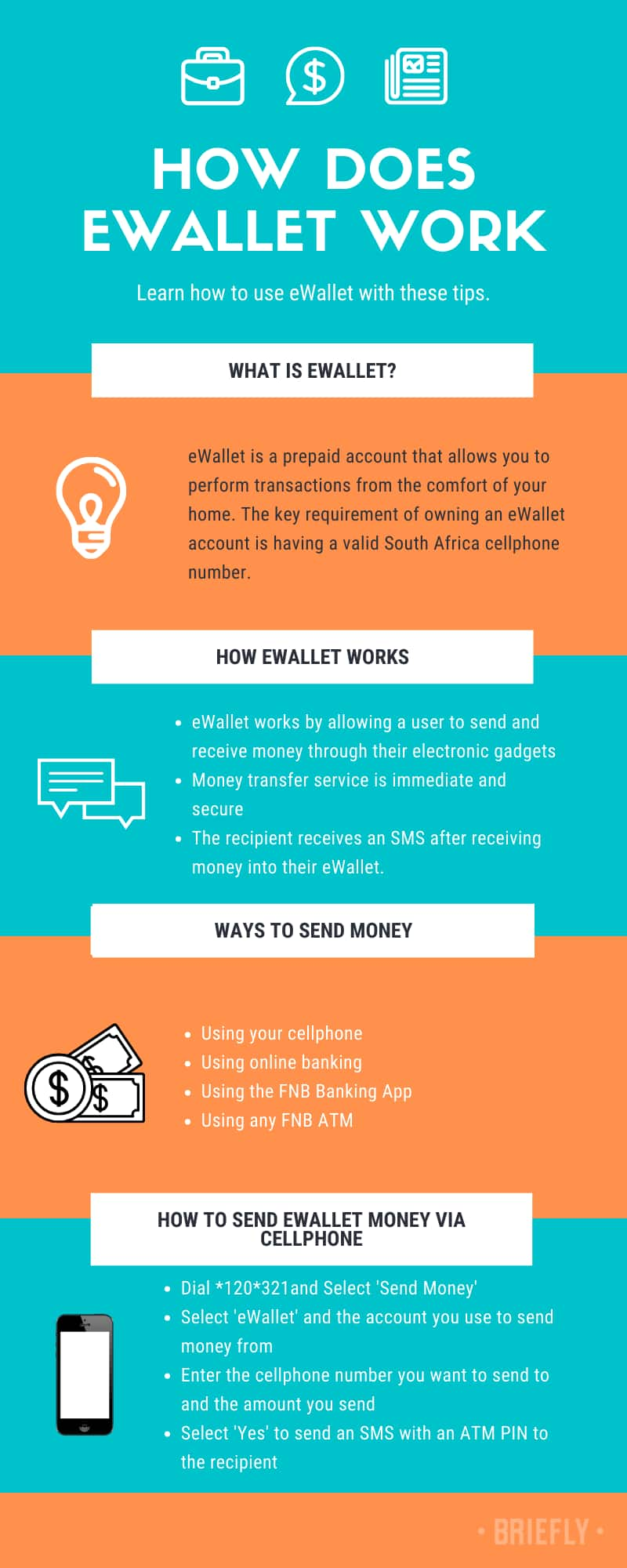

How does ewallet work

South africa is one of the countries whose technological industry is constantly making advancements. One of the greatest inventions that the country has made is ewallet. If you have not heard about it, you can now know how to use ewallet with these tips.

Image: canva.Com (modified by author)

source: original

What is ewallet? Ewallet is a prepaid account that allows you to perform transactions, both online and offline, via your computer or smartphone. It works as a fast mode electronic wallet that allows you to perform transactions from the comfort of your home. The key requirement of owning an ewallet account is a south africa cellphone number via FNB atms, FNB cellphone banking, FNB online banking or FNB app.

How does FNB ewallet work?

Being a fast mode of transaction, ewallet works by allowing a user to send and receive money through their electronic gadgets. The first step of the transaction is for the user to load money into their accounts. The money is debited from the user's account into their ewallet accounts in the form of digital representation. Being in the form of the digital representation means that the money is with the service provider who is responsible for keeping ledgers and records of all the users and their data. Therefore, for any deposits that a user makes, the money is transferred from the user's bank account to the dedicated bank account that the user has chosen. The records of the ledgers are also automatically updated.

When a user chooses to send money to another ewallet user, there is no actual money transfer from one account to the other. Instead, what happens is that the ledgers are automatically updated to show that a transaction was performed and money was sent from your account to the recipient's account. The recipient receives an SMS after receiving money into the ewallet. That is how convenient ewallet is. These how to do ewallet operation guides will be beneficial for you if you are a new user.

How to send money via ewallet

There are different ways to send money, including:

- Using your cellphone

- Using online banking

- Using the FNB banking app

- Using any FNB ATM

Image: instagram.Com, @fnbsa

source: UGC

READ ALSO: how to apply and use PEP money transfer

Sending money is one of the most basic operations that you can do with ewallet. The operation does not require any form of two-factor authentication. The service is, however, available for anyone with a south african cellphone number. The procedure on how to send ewallet money via cellphone is as simple as:

- Dialing *120*321#

- Selecting the 'send money' option and clicking okay

- Selecting the 'ewallet' option

- Selecting the account from which you want to send money from

- Keying in the cellphone number of the recipient, for this case, the user that you want to send money to

- Entering the amount of money that you want to send

- Selecting the yes option to complete the transaction. That option will also authorize the service to send the recipient a PIN that they will require when withdrawing the funds.

The sender will also be required to confirm the details of the recipient and the amount of money that they wish to send. Senders are advised to be cautious when confirming the details of the recipient since they will be liable for any transactions that are wrongly conducted. Now you know how to send ewallet funds.

FNB ewallet withdrawal

Image: facebook.Com, @fnbsa

source: UGC

After you have received funds and wish to withdraw them from your ewallet account, the procedure for doing so is not as complex as it may sound. These are the simple steps to follow on how to withdraw ewallet:

- Start by dialing *120*277# for you to access your ewallet.

- In the list of options that will be displayed, select option 1 to get the PIN. You will receive a unique message sending you the five-digit PIN that will be required when withdrawing the money from the ATM. The PIN will expire after sixteen hours.

- Visit the nearest FNB ATM within sixteen hours after receiving the five-digit PIN.

- At the ATM, if you do not have an ATM card, you could opt for the cardless services transaction option.

- Select the "ewallet services" on the screen.

- Enter your valid south african phone number on the keypad and select the "proceed" option.

- The next dialogue box will require you to enter the five-digit PIN that was sent to you at the beginning of the transaction.

- Enter the withdrawal amount that you wish to withdraw from your account. The amount should be less than or equal to the amount of funds that you have in your account. The ATM will dispense the amount of money that you have keyed in.

- Verify that you have completed the transaction before leaving the ATM. In case you do not approve the transaction, you can select the " cancel" option to stop the transaction.

Apart from the ATM, a user can withdraw cash from the ATM or withdraw funds from any of the selected retail stores. The procedure is as follows:

- Start by dialing *120*277# for you to access ewallet.

- Select option 1 to select the withdraw cash option.

- From the list of options that will be displayed, select option 1, which is the "get retail PIN" option.

- You can then visit any of these listed retail stores in the country to withdraw the cash;

Sutherland ridge SUPERSPAR

- At any of the selected retail stores, you will be required to purchase a credit or debit card. This step is mandatory.

- After purchasing, you will be required to select the "withdraw cash" at checkout option.

- The following screen will ask you to "withdraw cash from ewallet."

- You will then be prompted to enter your phone number.

- The following dialogue box will require you to enter the four-digit PIN that was sent to you as a text message.

The cashier will then give you the money that you have withdrawn. There is no fee for withdrawing funds from ewallet. You need to, however, check the balance in your account by following the procedure on how to check ewallet balance.

READ ALSO: how does standard bank instant money transfer work

How long does ewallet last?

When performing a transaction, the PIN that is sent to you in the form of a text message lasts for a maximum of sixteen hours. A user is then advised to complete the transaction as soon as they can to avoid any forms of inconveniences that are likely to arise.

How to request a new pin for ewallet

In case your ewallet PIN expires before you complete your transaction, you can request for another PIN to be sent to you by dialing *120*277#. The new PIN that will be sent to you will enable you to withdraw funds from your account without fail.

Technology has made the financial market convenient for users. One of the greatest inventions is ewallet, which has made it possible for users to perform transactions with ease. These details on how does ewallet work will come in handy.

READ ALSO:

- FNB reverse payment - how can you reverse an EFT payment FNB with ease?

- How to send money to zimbabwe cheap, fast and securely

- How to reverse ewallet payment in 2020?

Pay your bills safely online with ewallet, and enjoy up to AED 50 cashback.

Easy, fast and secure

Now you can go cashless without needing a bank account. Ewallet is the app to handle all your payments. Send and receive money on your UAE mobile number. Pay etisalat bills and complete your purchases through a secure smartphone application.

Pay with ewallet at your favourite outlet!

Ewallet connects customers and brands with just a click. Shop from your favourite outlets with a network that includes multiple industries including fine dining, casual dining, hospitality, healthcare and much more.

NO registration fees, NO minimum balance and NO bank account required.

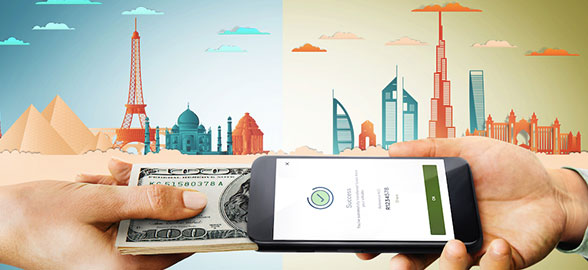

Introducing international remittance

In addition to local transfers, ewallet allows you to send money to your loved ones wherever they are. With over 200 countries and territories globally, ewallet ensures that you are covered with three options:

- Send money directly to a bank account

- Send money directly to a mobile wallet

- Traditional over-the-counter transfer

Special offer

Get up to AED 100 cash back when you send money to your loved ones in your home country. No more waiting in queues for international money transfers with ewallet.

Limited time offer! T&cs apply.

For more information, call 800ewallet.

How do I send money?

Benefits

Watch this short how-to video of international money remittance using our ewallet app.

This service is open to all registered ewallet customers. All you need to do is:

- Log into the app

- Select 'transfers'

- Select 'international remittance'

- Enter the recipient’s destination

- Select the product and currency (where applicable)

- Enter the amount (you can enter it in AED or the receiving currency)

- Accept the fraud warning and terms & conditions

- Enter the required recipient details

- Confirm the transaction with your PIN

The confirmation message will include a tracking number. You can share this with your loved ones via email, SMS or whatsapp.

Important to know

The must-know details about this service.

Terms of use:

No transaction fees and VAT will be applied to the sender. The recipient might be charged according to their country's fees and taxes.

Please make sure to read the updated terms and conditions.

Ewallet

How paynetics adds value:

redefining mobile payments on a digital banking platform

Introduction

The paynetics ewallet is a digital platform which provides seamless user experience which enables consumers to make payments directly from their phones either online or in-store. Our interoperable ewallet connect shoppers with merchants creating value for both parties. For the consumer, spending analytics, payment notifications, full card control, cashback and digitalization of loyalty cards, vouchers and coupons all offer huge benefits. For the merchants, a customizable app for vouchers and loyalty cards can drive repeat business and generate increase demand.

All in one

Our ewallet proposition combines software as a service with payments as a service, significantly reducing time to market for our partners

Secure

New technologies ensure safe flow of payment information, money is held securely and transferred in multiple ways

Efficient

Lower fraud risk, reduced transaction fees, and an effective instrument for businesses to reach new customers

Some of our clients

What we offer to our partners

With consumers using smartphones for all aspect of their lives, the ewallet solution and payment app is becoming the ‘go-to’ secure and convenient method of payment. Merchants therefore need to support these payment methods as part of providing customers with a secure online payment journey and experience. For consumers, the ewallet is fast-becoming a “must-have” in any digital payment offer.

However, launching a financial or banking service is very laborious and time consuming process, requiring providers to overcome a number of hurdles:

- Regulatory - need to get through the tough licensing processes and strictly comply with all the regulation, incurring high upfront investment cost

- Technology - need to build great user experience matching best of class fintechs, while keeping bank grade security, regulatory compliance and connection to financial infrastructure providers

- Team - need to get the right people from the industry with deep domain knowledge

- Time - need to plan 24-36 months to go live

Through our white label ewallet solution, we empower our partners to offer digital banking and financial services in a short period of time – we have implemented a commercial ewallet solution from a client within just three months of signing a contract.

Features of the paynetics digital banking platform

Our platform has evolved from a pure ewallet solution to a full digital banking infrastructure, offering a wide range of functionality. A key feature of our approach is that we work with easy to integrate modular services, meaning that we can scale quickly and easily with our customers.

We offer full support for IBAN accounts management and money transfers. On our platform, our partners can:

- Create and manage IBAN account via simple API

- Enable your customers to easily send instant P2P, SEPA and SWIFT bank transfers

- Allow customers to top-up funds via any credit/debit card or through bank transfers

- Issue and control virtual and physical mastercard payment cards

- Use a back-office portal for customer support purposes

And since we offer card acquiring services, we provide a wealth of additional features for our clients and partners:

- Tap to pay just by using your phone (supports apple pay and android MDES)

- Multiple virtual cards, including single use cards

- Full card management - order and control payment cards from the phone

- Plastic cards on demand

As we strive to remove friction in the payment process, our ewallet platform offers QR payments as a viable alternative method, driving customer engagement, reducing costs and helping merchants offer the broadest range of payment options to their clients:

- Lower fees: merchants accepting QR payments benefit from much lower transaction costs via an easy to integrate API

- Flexible UX: merchant-initiated or user-initiated - users can scan a QR code to pay or generate their QR code which can be scanned to authorize the transaction

- Merchants web portal allows digital onboarding and business account management like transaction tracking, refunds, reconciliation, cash-out and executing bank transfers

In order to deliver additional value to both merchants and consumers we have integrated a sophisticated loyalty and rewards module, offering:

- Digitised loyalty cards: users no longer need to carry plastic cards

- Customer analytics: help merchants to understand their customers’ behavior based on real purchase data across various market verticals

- Digital vouchers: enable merchants to attract new customers and drive repeat business from existing customers with 100% measurable digital vouchers, delivered via a superior user experience

- Cashback system: empower merchants with flexible cashback program designed to drive repeat visits while decreasing discount cost. Coalition between retailers enabled.

The power of interoperability

The paynetics digital banking platform is built to support multiple instances and allow them to be interoperable, creating its own payment infrastructure. We are able to do that as we offer both software as a service and payment as a service. It creates enormous additional value for all participants – for our partners, for the merchants and for the consumers. As all white label solutions are interoperable, the reinforce each other:

- Free peer to peer for customers of all wallets

- Close loop QR payments within the network lowering costs

- Advanced merchant services for retailers boarded on the various wallets

- Next generation marketing engine, based on coherent and actionable data

Security is the guiding principle

Our ewallets effectively remove inputting payment card information from the process when making online (and offline) transactions. It is a more secure way to pay, as no actual payment data is used to process the transaction (read more about our payment tokenization).

In-person transactions are also more secure. It reduces the risk of losing cash or a payment card, having it stolen, as well as the threat of skimming.

The ewallet solution has benefits for merchants as well. Transactions via our ewallet solution keep sensitive payment card data secure reducing PSI DSS scope and costs. At paynetics we also use dynamic authentication methods to reduce payment fraud, protecting both customers and merchants from fraudulent activity.

Ewallet

How paynetics adds value:

redefining mobile payments on a digital banking platform

Introduction

The paynetics ewallet is a digital platform which provides seamless user experience which enables consumers to make payments directly from their phones either online or in-store. Our interoperable ewallet connect shoppers with merchants creating value for both parties. For the consumer, spending analytics, payment notifications, full card control, cashback and digitalization of loyalty cards, vouchers and coupons all offer huge benefits. For the merchants, a customizable app for vouchers and loyalty cards can drive repeat business and generate increase demand.

All in one

Our ewallet proposition combines software as a service with payments as a service, significantly reducing time to market for our partners

Secure

New technologies ensure safe flow of payment information, money is held securely and transferred in multiple ways

Efficient

Lower fraud risk, reduced transaction fees, and an effective instrument for businesses to reach new customers

Some of our clients

What we offer to our partners

With consumers using smartphones for all aspect of their lives, the ewallet solution and payment app is becoming the ‘go-to’ secure and convenient method of payment. Merchants therefore need to support these payment methods as part of providing customers with a secure online payment journey and experience. For consumers, the ewallet is fast-becoming a “must-have” in any digital payment offer.

However, launching a financial or banking service is very laborious and time consuming process, requiring providers to overcome a number of hurdles:

- Regulatory - need to get through the tough licensing processes and strictly comply with all the regulation, incurring high upfront investment cost

- Technology - need to build great user experience matching best of class fintechs, while keeping bank grade security, regulatory compliance and connection to financial infrastructure providers

- Team - need to get the right people from the industry with deep domain knowledge

- Time - need to plan 24-36 months to go live

Through our white label ewallet solution, we empower our partners to offer digital banking and financial services in a short period of time – we have implemented a commercial ewallet solution from a client within just three months of signing a contract.

Features of the paynetics digital banking platform

Our platform has evolved from a pure ewallet solution to a full digital banking infrastructure, offering a wide range of functionality. A key feature of our approach is that we work with easy to integrate modular services, meaning that we can scale quickly and easily with our customers.

We offer full support for IBAN accounts management and money transfers. On our platform, our partners can:

- Create and manage IBAN account via simple API

- Enable your customers to easily send instant P2P, SEPA and SWIFT bank transfers

- Allow customers to top-up funds via any credit/debit card or through bank transfers

- Issue and control virtual and physical mastercard payment cards

- Use a back-office portal for customer support purposes

And since we offer card acquiring services, we provide a wealth of additional features for our clients and partners:

- Tap to pay just by using your phone (supports apple pay and android MDES)

- Multiple virtual cards, including single use cards

- Full card management - order and control payment cards from the phone

- Plastic cards on demand

As we strive to remove friction in the payment process, our ewallet platform offers QR payments as a viable alternative method, driving customer engagement, reducing costs and helping merchants offer the broadest range of payment options to their clients:

- Lower fees: merchants accepting QR payments benefit from much lower transaction costs via an easy to integrate API

- Flexible UX: merchant-initiated or user-initiated - users can scan a QR code to pay or generate their QR code which can be scanned to authorize the transaction

- Merchants web portal allows digital onboarding and business account management like transaction tracking, refunds, reconciliation, cash-out and executing bank transfers

In order to deliver additional value to both merchants and consumers we have integrated a sophisticated loyalty and rewards module, offering:

- Digitised loyalty cards: users no longer need to carry plastic cards

- Customer analytics: help merchants to understand their customers’ behavior based on real purchase data across various market verticals

- Digital vouchers: enable merchants to attract new customers and drive repeat business from existing customers with 100% measurable digital vouchers, delivered via a superior user experience

- Cashback system: empower merchants with flexible cashback program designed to drive repeat visits while decreasing discount cost. Coalition between retailers enabled.

The power of interoperability

The paynetics digital banking platform is built to support multiple instances and allow them to be interoperable, creating its own payment infrastructure. We are able to do that as we offer both software as a service and payment as a service. It creates enormous additional value for all participants – for our partners, for the merchants and for the consumers. As all white label solutions are interoperable, the reinforce each other:

- Free peer to peer for customers of all wallets

- Close loop QR payments within the network lowering costs

- Advanced merchant services for retailers boarded on the various wallets

- Next generation marketing engine, based on coherent and actionable data

Security is the guiding principle

Our ewallets effectively remove inputting payment card information from the process when making online (and offline) transactions. It is a more secure way to pay, as no actual payment data is used to process the transaction (read more about our payment tokenization).

In-person transactions are also more secure. It reduces the risk of losing cash or a payment card, having it stolen, as well as the threat of skimming.

The ewallet solution has benefits for merchants as well. Transactions via our ewallet solution keep sensitive payment card data secure reducing PSI DSS scope and costs. At paynetics we also use dynamic authentication methods to reduce payment fraud, protecting both customers and merchants from fraudulent activity.

Ewallet - password manager 17+

Secure storage and database

Ilium software, inc.

- #24 in productivity

- 4.7 • 1.4K ratings

- $9.99

Screenshots

Description

Lock your passwords, credit cards and bank account numbers behind military-grade encryption and carry them with you wherever you go by installing the most sophisticated and easy to-use password manager app on your iphone, ipad and ipod touch. Stay safe, stay strong, stay smart with the universal ios / ipados app, ewallet®.

COMPLETE PASSWORD MANAGEMENT

your digital life is at risk if you aren’t using secure passwords, but you needn’t worry about carrying sensitive information around in your pocket any more thanks to ewallet.

This robust security app provides password storage on-the-go, so you can still log in to your bank account, store your credit card and PIN numbers, and lock your online life away while still having full and free access whenever you want it.

SAFETY AND SIMPLICITY

with full icloud or dropbox backup of your secure “wallets” and the option to seamlessly sync data between devices and computers, ewallet is as convenient as it is strong. Check out its powerhouse features below, and find out more at https://www.Iliumsoft.Com/ewallet.

FEATURES:

* 256-bit military-grade AES encryption

* touch ID and face ID support for secure yet convenient access on compatible devices

* optimized for large and high resolution screens

* dark mode (ios / ipados 13+)

* support multitasking (slide over and split view) on ipad (ios 9+)

* backup your data to icloud or dropbox

* sync your data seamlessly via cloud or wi-fi with ewallet’s PC and mac apps (purchased separately)

* random password generator to keep your login details safe and secure

* store bank account, insurance and personal details. Keep all your info close at hand, and secure

* auto-locking feature

* create and sync multiple wallets between computers and devices

* customize your wallets with great-looking cards, backgrounds and categories

* autopass automatic password entering through built-in browser control

* autofill provider for entering usernames and passwords directly in safari and other apps (ios 12+)

Ilium software has over 23 years of mobile security software experience and is trusted by more than half a million users around the world to deliver the most comprehensive, user-friendly solution to personal data security. Don’t risk being without ewallet.

So, let's see, what we have: electronic wallet market in 2020 is as huge as it is elaborate. 30 best ewallets in the world | best money transfer app... At ewallet

Contents of the article

- Top forex bonuses

- 30 best ewallets in the world

- Adyen

- Airtel money

- Alliedwallet

- Apple pay

- Brinks

- Cardfree

- Chase pay

- Citi masterpass

- Coinbase

- Due

- Ecopayz

- Epayments

- Famacash

- Gatehub

- Gyft

- Key ring

- Moven

- Obopay

- Passkit

- Paycloud

- Papaya

- Paypal

- Payoneer

- Paytoo

- Puut wallet

- Samsungpay

- Sequent

- Stocard

- Stripe

- Tabbedout

- Zelle

- Ewallet reviews 2021

- Detailed expert review

- Ewallet features

- Ewallet plans and pricing

- Ewallet ease of use and setup

- Ewallet security

- Ewallet customer support

- Ewallet features

- Ewallet products & pricing

- 30 best ewallets in the world

- Adyen

- Airtel money

- Alliedwallet

- Apple pay

- Brinks

- Cardfree

- Chase pay

- Citi masterpass

- Coinbase

- Due

- Ecopayz

- Epayments

- Famacash

- Gatehub

- Gyft

- Key ring

- Moven

- Obopay

- Passkit

- Paycloud

- Papaya

- Paypal

- Payoneer

- Paytoo

- Puut wallet

- Samsungpay

- Sequent

- Stocard

- Stripe

- Tabbedout

- Zelle

- Ewallet | everything you should know about...

- What is an ewallet?

- Types of ewallet in the market

- Closed wallet

- Semi-closed wallet

- Semi-closed wallets in india

- Paytm wallet

- Freecharge wallet

- Mobikwik wallet

- Oxigen wallet

- Airtel money

- Other semi-closed ewallets

- Semi-closed wallets in india

- Open wallet

- Difference between an ewallet and a digital wallet

- How to use an ewallet?

- Future of ewallets

- Go on, tell us what you think!

- How does ewallet work

- How does FNB ewallet work?

- How to send money via ewallet

- FNB ewallet withdrawal

- How long does ewallet last?

- How to request a new pin for ewallet

- Pay your bills safely online with ewallet, and...

- How do I send money?

- Important to know

- Ewallet

- Introduction

- Some of our clients

- What we offer to our partners

- Features of the paynetics digital banking platform

- The power of interoperability

- Security is the guiding principle

- Ewallet

- Introduction

- Some of our clients

- What we offer to our partners

- Features of the paynetics digital banking platform

- The power of interoperability

- Security is the guiding principle

- Ewallet - password manager 17+

- Secure storage and database

- Ilium software, inc.

- Screenshots

- Description

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.