Fbs pamm

- 1w

- 1m

- 3m

- 6m

- 12m

Top forex bonuses

Just share your FBS account from the personal area. Investors will get a chance to copy your orders, and you will get a commission from their trades. That’s it!

FBS copytrade

Profit by copying skilled traders

Join the league of smart investors with FBS copytrade. This social trading platform allows you to follow the strategies of the top market performers and copy them to earn money effortlessly. When professionals profit, you profit too!

Confusion and insecurity while trading are no more – now a huge professional community is by your side 24/7. Start today and let the selected experts work for you!

FBS copytrade introduces you to the financial market and helps to manage your investments wisely.

Copy the best traders and earn like a pro

Trade together with the best players by following in their footsteps

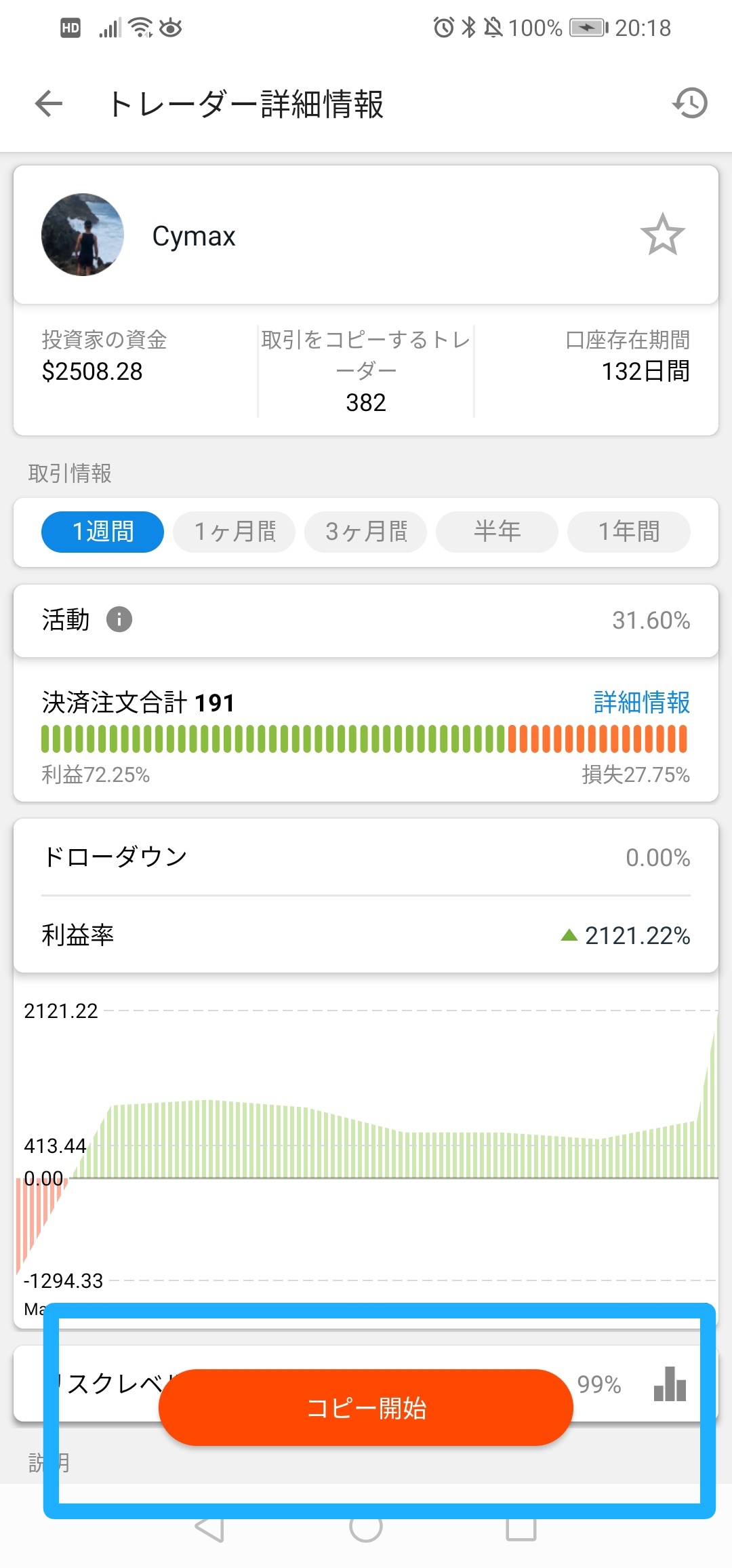

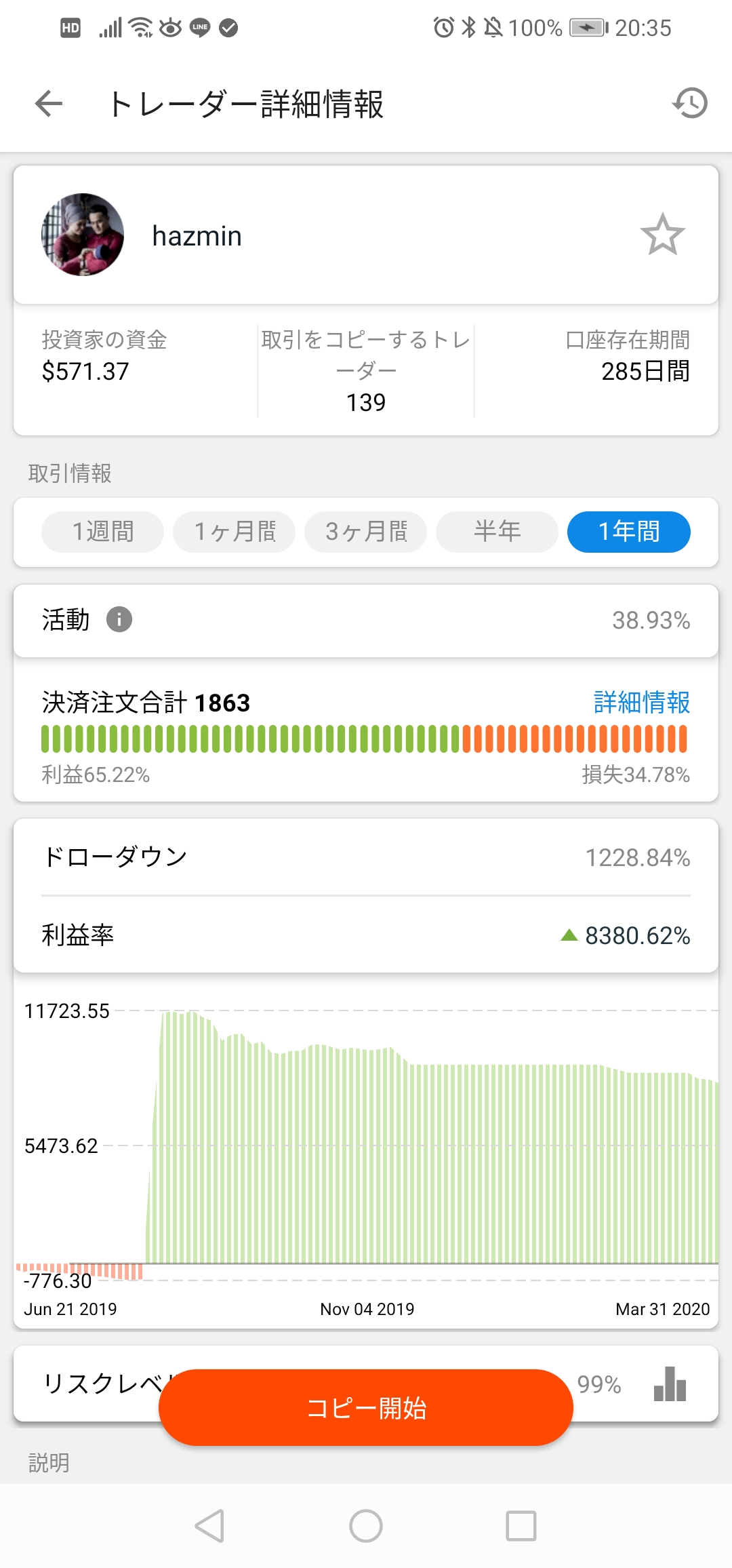

Get detailed trader information

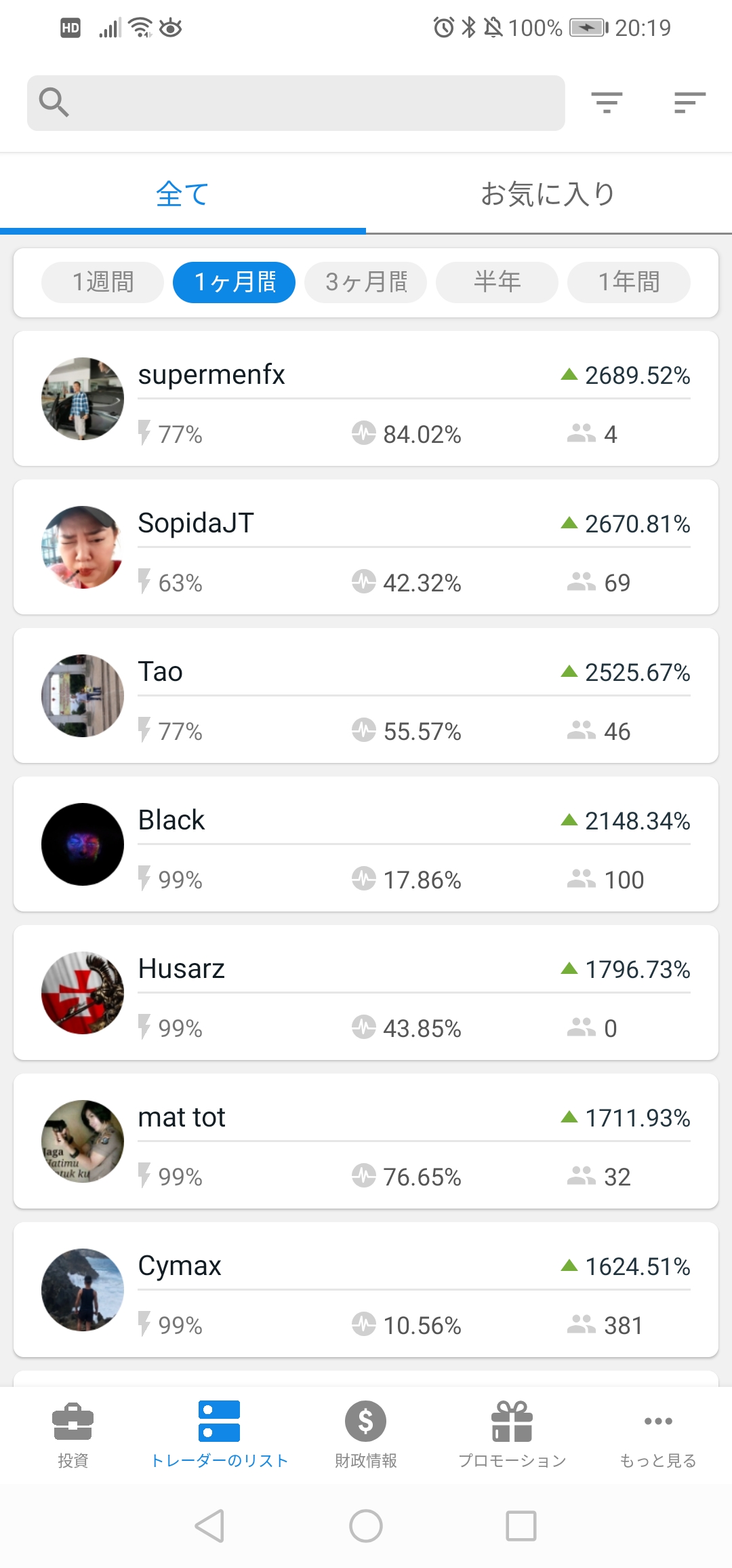

Browse the list of top traders, check their profit statistics, and pick the most successful ones to copy

Create a unique portfolio

Favorite the best traders, track their progress, network with them, and make money

Start and stop copying anytime you want

Take action when traders are doing their best and alter the schedule depending on your needs

Copy pro traders with the app

Investing has never been easier!

- Enter the market without any specific financial knowledge

- Earn money effortlessly – chill while others work

- Invest in just one tap!

- Deposit and withdraw via a variety of payment systems

- Track all your progress and manage risks

- Increase your investment amount whenever needed

Share your skills and get paid!

Once confident enough, you can become a trader to be followed in FBS copytrade. Just share your FBS account from the personal area. Investors will get a chance to copy your orders, and you will get a commission from their trades. That’s it!

Copy pro traders with the app

Top 5 traders to copy

Return rate over the period

- 1w

- 1m

- 3m

- 6m

- 12m

- Zopim

- Wechat

- Fb-msg

- Viber

- Line

- Telegram

- 口座開設で100ドルが貰えるボーナス

- 入金額の100%分が貰えるボーナス

- 取引毎にポイントが貯まるボーナス

- MT5のみで獲得可能

- ボーナス期限は30日間

- 注文量は0.01ロットまで

- 引き出し可能な金額は100ドル

- 同時に開ける最大ポジション数は5つまで

- 利用期限の30日以内に少なくとも5ロット以上の取引

- 口座開設で100ドルが貰えるボーナス

- 入金額の100%分が貰えるボーナス

- 取引毎にポイントが貯まるボーナス

- MT5のみで獲得可能

- ボーナス期限は30日間

- 注文量は0.01ロットまで

- 引き出し可能な金額は100ドル

- 同時に開ける最大ポジション数は5つまで

- 利用期限の30日以内に少なくとも5ロット以上の取引

- PAMM口座とは?メリット・デメリット

- MAM口座とは?メリット・デメリット

- EA(自動売買)とPAMM・MAM口座の違いは?

- PAMM・MAMの違法性について

- PAMM・MAMが利用できるおすすめ海外FX業者は?

- よくある質問(Q&A方式)

- PAMMとMAMはマネージド・アカウントである

- PAMM口座とは?メリット・デメリット

- PAMM口座とは?

- PAMM口座のメリット・デメリット

- MAM口座とは?メリット・デメリット

- MAM口座とは?

- MAM口座のメリット・デメリット

- PAMM口座とMAM口座の違い

- PAMM・MAM口座の違いを表で解説

- PAMM・MAM口座で共通するメリット

- PAMM・MAM口座で共通するデメリット

- EA(自動売買)とPAMM・MAM口座の違いは?

- PAMM・MAMの違法性について

- PAMM・MAMが利用できるおすすめ海外FX業者は?

- Gemforex(ゲムフォレックス)

- FBS

- Hotforex

- よくある質問(Q&A方式)

- まとめ

- 投資のプロが資産を運用してくれる

- 誰が運用しているか明確にわかる

- 比較的に手数料が安い

- 資金を持ち逃げされるリスクがない

- トレーダーの運用姿勢が真剣

- 運用状況の透明性が高い

- 自分は何もしなくても良い

- 初心者でも安心して取り組める

- FBSではプロのトレーダーと自分の口座を自動的に紐づけて、完全自動で取引をしてくれるコピートレードサービスを提供している

- まずはFBSに口座開設→アプリをダウンロードし、ID、パスワードを入力→入金・コピートレード先を選ぶ→取引スタートという流れで始められる

- PAMMであること、レバレッジ最大5000倍、専用アプリがあるのが特徴

- FBSは誰でもコピートレードの配信者になれるため、しっかりと見極めが必要

- Top forex bonuses

- FBS copytrade

- Profit by copying skilled traders

- Copy the best traders and earn like a pro

- Get detailed trader information

- Create a unique portfolio

- Top 5 traders to copy

- Video tutorial for ios

- Video tutorial for android

- FBS at social media

- Contact us

- Data collection notice

- 【裏話】海外FX業者FBSのリアルな評判!騙されてはいけない3つの落とし穴

- 1. FBSの4つの良い評判・口コミ・体験談

- 2. FBSの悪い評判・口コミ・体験談

- Opera por la gloria

- Abrir cuenta

- Selecciona tu sistema de pago

- Ármate con las últimas noticias

- Feeling a little confused about brokers with MAM,...

- Three different types of money management systems

- FBS regulation – is FBS safe?

- Efficient, innovative and reliable FBS regulation

- How is FBS regulated, and is it secure?

- 【裏話】海外FX業者FBSのリアルな評判!騙されてはいけない3つの落とし穴

- 1. FBSの4つの良い評判・口コミ・体験談

- 2. FBSの悪い評判・口コミ・体験談

- Feeling a little confused about brokers with MAM,...

- Three different types of money management systems

- 海外FXのPAMM・MAM口座とは?違いやメリットデメリット、おすすめの海外FX業者を紹介

- PAMMとMAMはマネージド・アカウントである

- PAMM口座とは?メリット・デメリット

- MAM口座とは?メリット・デメリット

- PAMM口座とMAM口座の違い

- FBSのコピートレード(ミラートレード)は『本当に勝てるのか?』評判や口コミ・始め方を紹介!

- FBSのコピートレード(ミラートレード)の概要

- FBSのコピートレード(ミラートレード)の特徴について

- FBSのコピートレード(ミラートレード)の口座開設方法

- FBSのコピートレード(ミラートレード)は安全?

- FBSのコピートレード(ミラートレード)の評判は?稼げるのか?

- おすすめコピートレード・MAMをご紹介!

Video tutorial for ios

Video tutorial for android

FBS at social media

Contact us

The website is operated by FBS markets inc.; registration no. 119717; FBS markets inc is regulated by IFSC, license IFSC/000102/124; address: 2118, guava street, belize belama phase 1, belize

The service is not provided in the following countries: japan, USA, canada, UK, myanmar, brazil, malaysia, israel and the islamic republic of iran

Payment transactions are managed by НDС technologies ltd.; registration no. HE 370778; address: arch. Makariou III & vyronos, P. Lordos center, block B, office 203

For cooperation, please contact us via support@fbs.Com or +35 7251 23212.

Risk warning: before you start trading, you should completely understand the risks involved with the currency market and trading on margin, and you should be aware of your level of experience.

Any copying, reproduction, republication, as well as on the internet resources of any materials from this website is possible only upon written permission.

Data collection notice

FBS maintains a record of your data to run this website. By pressing the “accept” button, you agree to our privacy policy.

【裏話】海外FX業者FBSのリアルな評判!騙されてはいけない3つの落とし穴

しかし、 FBSのメリットの裏には、最悪な3つの落とし穴が隠されている ことを見逃してはいけません。

他の情報サイトでは書かれていない驚くべき悪評も判明 したので、FBSの利用をお考えの方は、

1. FBSの4つの良い評判・口コミ・体験談

特に、 レバレッジ倍率の高さ・お得なボーナスを実施している事が評価されている 印象でした。

1-1. レバレッジ倍率がかなり高い

別件ですが、FBS FX … レバレッジ3000倍 … 凄まじいですね。使い方次第だろうな~、レバレッジの数字だけ見て来太一が上がるトレーダーが多そう。

レバレッジ無制限 exness

レバレッジ5000倍 gem forex

レバレッジ3000倍 FBS

レバレッジ3000倍 just forex

実際に、評判でも高いレバレッジで取引するならFBSと言われることから、 とにかくハイレバで取引したいユーザーに好まれています。

1-2. お得なボーナスを実施している

ボーナスを利用すると、 資金を大きく増やす事ができるので、資金の少ないトレーダーにも有利 です。

1-3. Bitwalletでの利益分の出金も可能

しかし、 FBSに関してはFXで得た利益分に関してもしっかり出金する事が可能。

1-4. コピートレード(PAMM)が利用可能

ただし、 コピートレードの利用には手数料がかかる事や、トレーダによっては損失を産むリスクもあるので注意しましょう。

2. FBSの悪い評判・口コミ・体験談

FBSの利用を考えている方は、大損してしまわないようにデメリットを詳しく理解しておきましょう。

2-1. スプレッドが広い

そのため、 スプレッドの狭さを求めるトレーダーにとってはFBSは不利 になるでしょう。

2-2. 約定が滑るとの意見が多い

902 :名無しさん@お金いっぱい。:2020/03/27(金) 18:32:31 ID:za8c7tvf0.Net

特に スキャルピングなど短期売買では大きく不利 になるでしょう。

2-3. ボーナスの出金条件は厳しい

714 :名無しさん@お金いっぱい。:2020/03/20(金) 06:17:28.91 ID:eisqw71zo[2/2]

Fbsは100ドルボーナス口座はそもそも0.01しか注文無理みたいだ

回数は最大5回の0.05まで

30日以内に5lot取引したら10000円までは出金可能

出金までのハードル高すぎ

793 :名無しさん@お金いっぱい。:2020/03/23(月) 18:45:57 ID:V+5ljrcj0.Net

841 :名無しさん@お金いっぱい。:2020/03/25(水) 03:27:02 ID:e0sf+J340.Net[1/2]

>>793

今からやってるけどこれめちゃくちゃしんどい

5lotも使わんでクリアできる

クリアしたらリアル口座に移せるらしいからそこまでいけば出金できるだろ、できんかったらFBSは詐欺

特に、 1回0.01ロットというかなり少ない単位で、30日以内に合計5ロットも取引しないといけない ので、かなり厳しいと言えます。

Opera por la gloria

FBS – patrocinador oficial del FC barcelona

Con FBS es fácil ganar dinero en el trading de forex. ¡nos esforzamos por ofrecer la mejor experiencia al cliente y las mayores oportunidades a nuestros traders!

Más de 10 años de experiencia

Compartimos experiencias y educamos clientes

Resolvemos tus problemas y recopilamos tu feedback

Mayor apalancamiento de 1:500 para profesionales

Depósitos y retiros rápidos

Únete para trabajar tu dinero de forma rápida y sencilla

Abrir cuenta

Para participantes del mercado experimentados que están construyendo su camino a la cima en forex.

Para principiantes que desean operar fondos reales sin arriesgar demasiado.

Se adapta perfectamente a aquellos que apenas están comenzando su camino hacia el éxito en forex.

Para esos traders cautelosos que desean probar sus habilidades y herramientas de trading con pequeños fondos virtuales.

Tu capital está en riesgo. Te cubrimos con protección por saldo negativo.

Selecciona tu sistema de pago

Ármate con las últimas noticias

Cambios en el horario de trading debido al día de martin luther king, jr.

Nuevas cimas – informe anual para el 2020

EUR/GBP volviendo dentro el triángulo

Nasdaq 100, ofreciendo mejores precios para retomar compras!

EUR/NZD esperando la reunión del BCE antes de continuar en ventas

El BCE podrían iniciar la continuación alcista del EUR/USD

¿qué tiene la primera reunión de la fed de 2021 para el USD?

Muchos pmis para el viernes

Advertencia de riesgo: el 74% de las cuentas minoristas pierden dinero al operar ᏟᖴᎠs con este proveedor. Los ᏟᖴᎠs son instrumentos complejos y tienen un alto riesgo de pérdida de dinero rápidamente debido al apalancamiento. Debe considerar si comprende cómo funcionan las ᏟᖴᎠs y si está dispuesto a arriesgarse a perder su dinero. Por favor, consulte nuestra declaración de conocimiento de riesgo.

El sitio web es propiedad y está operado por tradestone limited (dirección: 89, vasileos georgiou street, 1er piso, oficina 101, potamos germasogeias, 4048 limassol, chipre), número de registro HE 353534, autorizado por la comisión nacional del mercado de valores de chipre, número de licencia 331/17.

Feeling a little confused about brokers with MAM, PAMM, and LAMM accounts? Let’s explain…

All three types of account are managed accounts with which a fund manager controls multiple accounts from a single one. They involve a fully segregated account that is individually owned by one trader at a brokerage firm. A professional trader or money-maker makes all the trades on the individual account holder’s behalf. This manager is only given access for trading – full control remains with the account holder.

Three different types of money management systems

MAM, PAMM, and LAMM may sound very similar, but there are some significant differences.

MAM (multi-account manager) – this is a combination of LAMM and PAMM. It gives a trader who is managing investor accounts far greater flexibility.

LAMM (lot allocation management module) – this is a trading system that allows a trader to allocate different trade lots to individual investors’ accounts. This also means that a trader gets to enjoy the flexibility of being allowed to use different leverages for different types of investor.

PAMM (percent allocation management module) – this type of system allows a trader to distribute gains, losses, and fees on an equal percentage basis. Each account in the module will have the same percentage of returns as all the others, regardless of the size of the account. In effect, any investors are part of a pool that includes separate accounts and sub-accounts, all of which are traded by one professional trader or money manager who has a limited power of attorney. The money manager will have one master account, the equity of which equals the sum of all the balances held in the sub-accounts.

Whichever type of managed system is chosen, it will be easily accessed via a live-read feed. This feed will either be via an online report viewer, or through direct access to the trading platform. Everything to do with the account, such as the balance and profit, as well as open and closed trades, will be visible. The downside, if you can call it one, of these types of account is that a trader is unable to use them to place their own trades unless the power of attorney is revoked. Whether this is a downside will really depend on the reason for choosing one of these accounts. If you want an account that is managed by another person, there is unlikely to be an occasion when you will want to place your own trades.

Why a trader might choose to open a managed account

There are a number of valid reasons for choosing to open a managed account, and there is a good selection of MAM, PAMM, and LAMM forex brokers to pick from. A managed account provides a trader with maximum security, control, safety, and transparency. The process is really quite simple as well. First, an investor picks a reputable forex broker and opens a trading account, and makes a deposit which only they will have access to. The difference with this type of account is that the money is added to a pool, which is handled by a professional trader or money manager. The account holder is able to see exactly what is going on, and if they aren’t all that happy with the way the money is being managed there is the option of revoking the power of attorney. An account holder isn’t locked in for any particular time, and has the option to opt out should they want to.

But what about the money manager’s point of view? There are good points for a money maker too, as they get to trade all investors’ accounts as if they were one large one, thereby increasing the opportunities for making sizeable profits. The broker handles everything else, which makes it a seamless experience for all involved.

Managed account systems provide traders with a safe and easy way to participate in the forex world.

Choosing a forex broker offering MAMM, PAM, or LAMM accounts will mean you get to keep your finger on the pulse 24/7. When it comes to forex trading, any level of success is going to take a lot of hard work, effort and determination, and a fair amount of trial and error. Managing your own trades can be a full-time job, but not everybody has the time or inclination to walk away from their normal 9-to-5 career and set off down the forex trading road to who knows where. Managed accounts can be the perfect solution for those who don’t want to trade on their own, or for those who want to have a life outside of their forex investment.

Are they the perfect solution? We have to be honest and say there are no guarantees in the forex world. As with any other form of investment, the value of foreign currencies can go up as well as down. There are so many variables and outside influences that can have an effect, but there are ways you can improve your chances and reduce the risk. Brokers with MAM, PAMM, or LAMM accounts are one way, and we’ll be featuring a number of others later.

FBS regulation – is FBS safe?

Efficient, innovative and reliable FBS regulation

FBS forex broker has registration no. 119717, and FBS markets inc is regulated by IFSC, license IFSC/60/230/TS/17.

A detailed review of FBS and FBS regulation

FBS is cyprus, an abased forex broker operated by tradestone ltd and has its main office in limassol, cyprus. Established in 2009, the brokerage is governed by rules by cyprus securities and exchange commission (cysec). FBS has been conferred with several recognitions from diverse global recognitions and awards. Today, the brokerage serves more than 13,000,000 clients.

As per the official estimates, the firm gets 7,000 applications for new accounts each day. Further, the brokerage receives and processes a request for withdrawal every 20 seconds. As many an 80% of their clients are loyal to the broker, and the main source of income for the brokerage is 48% of the clients. Serving clients across the globe in 190 countries, FBS keeps increasing its share in the market every day.

How is FBS regulated, and is it secure?

Is FBS safe? FBS being under the regulatory setup in cyprus can be traced back when cyprus joined the EU under a set of regulations as per the 2004/39/EC/mifid. It has been in existence since november 2007. It aims to maintain a high-quality with balanced protection for investors in the market of financial instruments. Mifid II became effective in january 2018. It was empowered to make investor protection effective by improving transparency.

The EU brought out the 4th anti-money laundering law, one of the toughest laws in europe. FBS abides by all the rules under the EU and is a member of ICF. This ensures retail clients are entitled to get reimbursement if their broker fails to pay because of financial issues.

FBS address

FBS headquarters or FBS address is no.1 orchid garden street, belmopan, belize, C.A.

Fee payable

FBS gets its revenue mainly from the spread of instruments. It is calculated in terms of the difference between the asking price and the bid price. Further, the swap rates for holding a position overnight are also taken into account. As FB does not offer accounts for ECN, nor does it collect a commission for trading. Spreads begin at the lowest level at 1.0 pip and rise according to the liquidity of the currency. For muslim traders, the brokerage offers islamic accounts. This is because religious norms bar muslims from taking or accept interest.

Forex traders can take this sort of account. You can also check out the swap rates on the MT4 platform using these steps:

Right-click the symbol for desires and in the market watch window and choose symbols. Choose the currency of your choice and click ‘properties’ on the right. Scroll down to reach ‘swap long and ‘swap short.’

Another benefit for forex traders is that they can use calculator by FBS to know about the trade before starting. FBS does not charge traders for withdrawals or deposits, reducing the total cost per unit of trade. For retail traders and institutional entities, this will be highly beneficial.

What can I deal with?

FBS offers a small collection of sets comprising 28 currency pairs and two metals. The specifications in the contract differ for applicants applying for the cent account and the standards account. The overall groups should be taken as just a minimum or and is not sufficient for professional clients.

It’s not in the greater interest of traders when there is a lack of adequate currency pairs and metals. It’s also important to note that fbs lack cfds on indexes and equity, and cryptocurrencies. Of course, it offers the minimum that real diversification cannot happen for a forex trading account. This makes it unfit for traders who are looking for opportunities in trading across assets.

Types of accounts

FBS offers services in serving trading account. Its scheme offers two sorts of accounts, namely the standard account and the cent account. The principal difference between the two is the minimum deposit. The minimum deposit starts at one $/€10 for cent account and one at $/€100 for standard accounts.FBS standard account minimum deposit is $100.

The minimum spread in both floating one and starting 1.0 pip and the maximum is 1:30.

The cent account also offers a maximum amount of orders o five standard lots (one standard lot is equal to 100,000 units. Under the situation, the /standard account sees a sport in units to 500 standards.

The maximum number of pending or open positions is fixed at 200 at a starting speed of 0.3 seconds.

Fbs islamic account

muslim traders in the forex industry are prohibited from receiving or paying interest. To make trading ethical and provide equal opportunities to all clients, FBS offers the swap free account – fbs islamic account. When the swap-free account is activated, there is no swap or rollover on overnight positions.

Cent account defined

The cent account is primarily a starting level account for new forex traders. To start with, you can go with micro-deposits and best suits to create and test new strategies. However, they are hardly relevant as the standard account has a fairly small deposit requirement.

Note that FBS does not provide any special trading conditions to traders even if they have a higher balance or more often trading with FBS. This is as well not in the greater interest of the FBS nor the forex traders.

What are the trading platforms?

FBS offers services that can be done on the MT4 platform for apple, windows, macos, apple ios, android, and FBS web trader. MT4 is the most widely used trading platform used by forex traders. However, FBS does not endeavor to offer traders exclusive – something not included in the MT4 trading platform’s standard license.

In many cases, forex brokers offer to pay the license fee and obtain their trading platform with the aid of partnerships of a white label via another forex broker at a small fraction of the cost.

The most often choice made by new traders is social trading or copy trading. They remain truant as FBS has to abide by its minimalistic approach. It offers just the minimum to stay operational as a forex firm. The features listed are part of the MT4 trading platform, and it should not be credited to what FBS offers.

Salient features

Thought the features are not unique because FBS does not operate vigorously out of their normal operating procedure. However, whatever FBS does is of high-quality, which is reflected in the numerous awards and recognitions.

These include research, including publishing and telecasting in-depth news coverage and offer relevant information. These are extremely beneficial for entry-level traders. It covers in-depth news in forex markets, analyzes the daily market, webinars on forex, and lessons in video format. All this makes FBS a great platform to learn, stay informed, and updated.

High-quality customer support

The customer support service operates round the clock and is highly responsive in just 30 seconds; the customer support is available in diverse languages.

FBS services are most commonly used in the context of asian forex. This is a unique aspect, as it correlates the location of each FBS service. FBS services are commonly located in malaysia, jordan, the philippines, indonesia, and russia. These countries actively participate in FBS services. FBS accounts feature unique aspects such as minimum deposits, maximum leverage, different types of accounts, and ECN accounts offers. The services from this platform can be applied effectively in many different areas. This is very important as it contributes to the overall success in a certain time frame. FBS services are best analyzed through their use in the asian forex market. The asian forex market helps FBS regulation and directly contributes to investments conducted through the market.

Traders may choose the ENC account over the zero standards as a pet compared to SBS regulations. PNC account directly correlates the demand of time and space used to complete transactions. Transactions can be completed easily and without hassle. When transactions are completed using the EMC method to eat, the forks market does not continue to excel. When the asian forks market uses an XL, one of the best ways is to ensure it is brought to those around. Some of the most important asian ice markets can be with china or japan. These markets are well developed and have been consistently a product of investment over the past decade. These industries have bloomed as a result of agricultural and other commercial licensing programs. There are many commercial licensing programs available, and in the asian forex market, the most common licensing programs available in the asian forex machina for the japan and china trade. Depend trying to trade it some of the best markets to have due to their unique and satisfying structure the structure of the asian for tomorrow some of the best in the country. For the most part, many different types of markers can be used in asia. Some of the most important market analytical strategies can determine what type of markets are used in and out of the state; when markets are used in and out of the state, the FBS as a say over which has a market to use within the state lines. There are many different currencies they can be traded example, when their currency trading in USD, there a certain level that must be maintained. When currently treating you

Currencies can help develop and for the skill sets. When the currencies help develop and for the skill set, there are many different aspects. Currencies are one part of trading forex, but there are many other aspects of trading forex. FBS is one of the best trading currencies available on the market is it directly correlates to the retreat as an interactive platform. Non-reputable try traders will not be included in the mark, and if you’re not making your way to the best of the platform, non-reputable traders are not allowed to complete the process in a way that they. Some of the other aspects of if it’ll market include those that may include certain aspects. When these marketing lutheran aspects, many different things can be done in a certain amount of time.

Conclusion

A well-governed, regulated, and managed forex brokerage can win their traders’ trust because traders can be assured of the minimum guarantee that their money is safe with the agency. FBS could be among the best in forex markets and worth trying to enter the business.

The most important thing is that FBS is a regulated broker and safe.

【裏話】海外FX業者FBSのリアルな評判!騙されてはいけない3つの落とし穴

しかし、 FBSのメリットの裏には、最悪な3つの落とし穴が隠されている ことを見逃してはいけません。

他の情報サイトでは書かれていない驚くべき悪評も判明 したので、FBSの利用をお考えの方は、

1. FBSの4つの良い評判・口コミ・体験談

特に、 レバレッジ倍率の高さ・お得なボーナスを実施している事が評価されている 印象でした。

1-1. レバレッジ倍率がかなり高い

別件ですが、FBS FX … レバレッジ3000倍 … 凄まじいですね。使い方次第だろうな~、レバレッジの数字だけ見て来太一が上がるトレーダーが多そう。

レバレッジ無制限 exness

レバレッジ5000倍 gem forex

レバレッジ3000倍 FBS

レバレッジ3000倍 just forex

実際に、評判でも高いレバレッジで取引するならFBSと言われることから、 とにかくハイレバで取引したいユーザーに好まれています。

1-2. お得なボーナスを実施している

ボーナスを利用すると、 資金を大きく増やす事ができるので、資金の少ないトレーダーにも有利 です。

1-3. Bitwalletでの利益分の出金も可能

しかし、 FBSに関してはFXで得た利益分に関してもしっかり出金する事が可能。

1-4. コピートレード(PAMM)が利用可能

ただし、 コピートレードの利用には手数料がかかる事や、トレーダによっては損失を産むリスクもあるので注意しましょう。

2. FBSの悪い評判・口コミ・体験談

FBSの利用を考えている方は、大損してしまわないようにデメリットを詳しく理解しておきましょう。

2-1. スプレッドが広い

そのため、 スプレッドの狭さを求めるトレーダーにとってはFBSは不利 になるでしょう。

2-2. 約定が滑るとの意見が多い

902 :名無しさん@お金いっぱい。:2020/03/27(金) 18:32:31 ID:za8c7tvf0.Net

特に スキャルピングなど短期売買では大きく不利 になるでしょう。

2-3. ボーナスの出金条件は厳しい

714 :名無しさん@お金いっぱい。:2020/03/20(金) 06:17:28.91 ID:eisqw71zo[2/2]

Fbsは100ドルボーナス口座はそもそも0.01しか注文無理みたいだ

回数は最大5回の0.05まで

30日以内に5lot取引したら10000円までは出金可能

出金までのハードル高すぎ

793 :名無しさん@お金いっぱい。:2020/03/23(月) 18:45:57 ID:V+5ljrcj0.Net

841 :名無しさん@お金いっぱい。:2020/03/25(水) 03:27:02 ID:e0sf+J340.Net[1/2]

>>793

今からやってるけどこれめちゃくちゃしんどい

5lotも使わんでクリアできる

クリアしたらリアル口座に移せるらしいからそこまでいけば出金できるだろ、できんかったらFBSは詐欺

特に、 1回0.01ロットというかなり少ない単位で、30日以内に合計5ロットも取引しないといけない ので、かなり厳しいと言えます。

Feeling a little confused about brokers with MAM, PAMM, and LAMM accounts? Let’s explain…

All three types of account are managed accounts with which a fund manager controls multiple accounts from a single one. They involve a fully segregated account that is individually owned by one trader at a brokerage firm. A professional trader or money-maker makes all the trades on the individual account holder’s behalf. This manager is only given access for trading – full control remains with the account holder.

Three different types of money management systems

MAM, PAMM, and LAMM may sound very similar, but there are some significant differences.

MAM (multi-account manager) – this is a combination of LAMM and PAMM. It gives a trader who is managing investor accounts far greater flexibility.

LAMM (lot allocation management module) – this is a trading system that allows a trader to allocate different trade lots to individual investors’ accounts. This also means that a trader gets to enjoy the flexibility of being allowed to use different leverages for different types of investor.

PAMM (percent allocation management module) – this type of system allows a trader to distribute gains, losses, and fees on an equal percentage basis. Each account in the module will have the same percentage of returns as all the others, regardless of the size of the account. In effect, any investors are part of a pool that includes separate accounts and sub-accounts, all of which are traded by one professional trader or money manager who has a limited power of attorney. The money manager will have one master account, the equity of which equals the sum of all the balances held in the sub-accounts.

Whichever type of managed system is chosen, it will be easily accessed via a live-read feed. This feed will either be via an online report viewer, or through direct access to the trading platform. Everything to do with the account, such as the balance and profit, as well as open and closed trades, will be visible. The downside, if you can call it one, of these types of account is that a trader is unable to use them to place their own trades unless the power of attorney is revoked. Whether this is a downside will really depend on the reason for choosing one of these accounts. If you want an account that is managed by another person, there is unlikely to be an occasion when you will want to place your own trades.

Why a trader might choose to open a managed account

There are a number of valid reasons for choosing to open a managed account, and there is a good selection of MAM, PAMM, and LAMM forex brokers to pick from. A managed account provides a trader with maximum security, control, safety, and transparency. The process is really quite simple as well. First, an investor picks a reputable forex broker and opens a trading account, and makes a deposit which only they will have access to. The difference with this type of account is that the money is added to a pool, which is handled by a professional trader or money manager. The account holder is able to see exactly what is going on, and if they aren’t all that happy with the way the money is being managed there is the option of revoking the power of attorney. An account holder isn’t locked in for any particular time, and has the option to opt out should they want to.

But what about the money manager’s point of view? There are good points for a money maker too, as they get to trade all investors’ accounts as if they were one large one, thereby increasing the opportunities for making sizeable profits. The broker handles everything else, which makes it a seamless experience for all involved.

Managed account systems provide traders with a safe and easy way to participate in the forex world.

Choosing a forex broker offering MAMM, PAM, or LAMM accounts will mean you get to keep your finger on the pulse 24/7. When it comes to forex trading, any level of success is going to take a lot of hard work, effort and determination, and a fair amount of trial and error. Managing your own trades can be a full-time job, but not everybody has the time or inclination to walk away from their normal 9-to-5 career and set off down the forex trading road to who knows where. Managed accounts can be the perfect solution for those who don’t want to trade on their own, or for those who want to have a life outside of their forex investment.

Are they the perfect solution? We have to be honest and say there are no guarantees in the forex world. As with any other form of investment, the value of foreign currencies can go up as well as down. There are so many variables and outside influences that can have an effect, but there are ways you can improve your chances and reduce the risk. Brokers with MAM, PAMM, or LAMM accounts are one way, and we’ll be featuring a number of others later.

海外FXのPAMM・MAM口座とは?違いやメリットデメリット、おすすめの海外FX業者を紹介

PAMMとMAMはマネージド・アカウントである

成功報酬制をとっているため 手数料を払うのは利益が出た場合のみ 。

ちなみに、 損失が出た場合は手数料を支払う必要はありません 。

PAMM口座とは?メリット・デメリット

PAMM口座とは?

海外FXの PAMM口座 (パムこうざ)は、 顧客から委託された資金をプロのトレーダーが資金運用する口座 のこと。

Percentage allocation management moduleを略してpamm口座 と呼ばれています。

顧客は自分の資金・発注権限を運用者に委託することになるため、顧客が運用者の発注状況を確認することができません。

PAMM口座のメリット・デメリット

PAMM口座の メリット は「運用成績の良いプロのトレーダーが参加している」ことで、 デメリット は「トレーダーの運用方法がわからない」ことです。

いっぽうで、取引成績の多いトレーダーが多く参加しているというメリットもあります。

MAM口座とは?メリット・デメリット

MAM口座とは?

MAM口座 (マムこうざ)は、 顧客の口座をプロトレーダーが直接取り引きして資金運用をする口座 のこと。

Multi account managerを略してmam口座 と呼ばれています。

そのため、顧客は運用者が取引した履歴を確認することが可能です。

MAM口座のメリット・デメリット

海外FXならではのMAM口座の メリット は「プロのトレーダーの売買ロジックを知ることができる」で、 デメリット は「運用成績の良いプロのトレーダーが参加していない」こと。

これは 取引の透明性が高い・プロトレーダーのエントリー・ポジショニング・決済ルールなどを知ることができる ということを意味します。

MAM口座の弱みは、勝てるトレーダーが参加したがらない ことといえます。

PAMM口座とMAM口座の違い

PAMM・MAM口座の違いを表で解説

| PAMM | MAM | |

| 資金を管理する口座 | マスター口座 | 顧客の口座 |

| 取引状況 | 確認できない | リアルタイムで確認できる |

資金を管理する口座

取引状況の確認方法

PAMM・MAM口座で共通するメリット

海外FXのPAMM口座・MAM口座には多くの メリット があります。

資金をプロに運用してもらえる

PAMM口座・MAM口座を利用する最大の メリット は、 自分の資金をプロに運用してもらえる こと。

プロトレーダーが運用してくれるため、取引に自信がない初心者でも損するリスクを抑えることが可能。

自分が取引しないため、取引のために余計な時間を割く必要がないといえます。

FBSのコピートレード(ミラートレード)は『本当に勝てるのか?』評判や口コミ・始め方を紹介!

FBSのコピートレード(ミラートレード)の概要

FBSとは、ベリーズとバヌアツに拠点を持つFXブローカー になります。

FBSのコピートレード(ミラートレード)の特徴について

レバレッジが最大5000倍

FBSはレバレッジが最大5000倍というのが特徴です。

FBSのコピートレードはPAMM

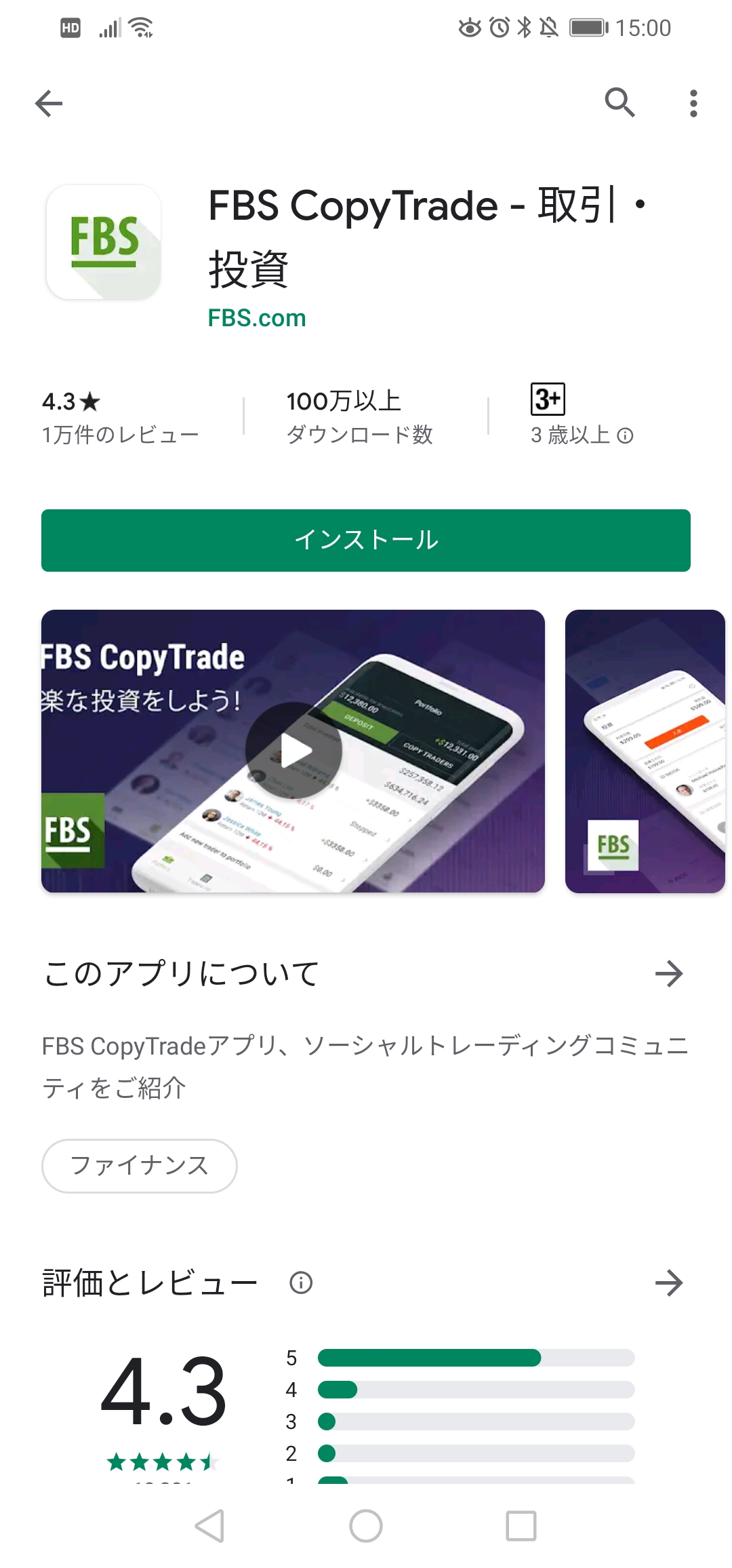

専用のアプリがある

「FBS copy trade」 という専用のアプリがありそちらで管理を行います。

利益率順にトレーダーを検索できる

FBSのコピートレードでは利益率順にトレーダーを検索出来たりと便利な機能が充実 しています。

FBSのコピートレード(ミラートレード)の口座開設方法

アプリのダウンロードは、「FBS copy trade」と検索してみてください。

FBSのコピートレード(ミラートレード)は安全?

FBSのコピートレード(ミラートレード)の評判は?稼げるのか?

しかし、海外ではシステムトレードに変わる第3の取引手法となりつつあるのでこれから流行ると思います。

コピートレード先を選ぶ際に大切なことは、 安定した利益を出し続けているかどうか です。

おすすめコピートレード・MAMをご紹介!

あなたはこんなお悩みをお持ちではありませんか?

☑自動売買の運用をしては溶かしては、また他のツールを探す。を繰り返している

☑コピートレードを始めてみたいけども、どれを選んだらいいかわからず悩んでいる

☑何もしなくても稼げる収入の柱がもう一つ欲しい

☑高額な自動売買を購入したが結局稼げなかった

☑資産を銀行に預けるのではなくて、有効的に投資していきたい

上記のようなお悩みが1つでも当てはまるようでしたら、「automatictrade」がおすすめです。

年利1000%以上出ている取引をあなたの口座で複数個コピーすることができます。

実際のフォワードテストの成績で完全放置でこれだけの成績が出ています!

◎

600種類以上あるトレードの中から厳選されたトレードの中から好きなものを複数選べる

◎

出金・停止がいつでも行えて手動で決済ができる。各トレードごとにロット比率も変更可能

× 出金も停止も制限がある。さらにlotの比率なども変更不可

▲

MT4のスクショでの結果のみしか公開されておらず、実際に利益が出ているのかわからない

◎

1年で1000%以上の利益が出ているものや平均月利20~30%のものもある

▲

フォワードテストの期間が短いものが多いため、今後利益が出続けるか不安

Automatic tradeは安定した利益が出せるように、600種類以上のトレードの中から本当に勝てるトレードを厳選して選び、その中から好きなものを複数個コピーするという最新のコピートレードです。

トレードを選択してコピーが始まれば後は何もしなくても口座残高が増えていきます!

so, let's see, what we have: take your chance to increase your capital with FBS copytrade app! Copy the most profitable traders, use various tools to prevent yourself from loss, and don't hesitate to contact our 24/7 support team in your language! At fbs pamm

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.