Free bonus trading brokers

Assets from bank of america, merrill lynch, pierce, fenner & smith incorporated (MLPF&S), U.S.

Top forex bonuses

Trust, or 401(k) accounts administered by MLPF&S aren’t qualifying net new assets. Here are the bonus tiers for this offer:

Best brokerage account bonuses in january 2021

Advertiser disclosure

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional.

How we make money.

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Editorial disclosure.

All reviews are prepared by our staff. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication.

Smith collection/gado/getty images

Share

At bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here’s an explanation for how we make money.

Editorial integrity

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.Com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, bankrate does not include information about every financial or credit product or service.

Brokerages are aggressively competing for your money. One way they do so is by offering competitive bonuses that you can add right to your brokerage account. It’s important to know the best offers so that you can decide whether it’s a good time to open a brokerage account and take advantage of what is often risk-free cash.

Here bankrate tracks the best brokerage account bonuses to help you compare active offers.

Best brokerage account bonuses in january 2021

- Ally invest: $50 to $3,500

- Merrill edge: $150 to $900

- Charles schwab: $100 to $500 (personally referred friend offer)

- E-trade: $50 to $2,500

Ally invest: $50, $200, $300, $600, $1,200, $2,500 or $3,500 bonus

New ally invest clients can earn up to a $3,500 cash bonus if they open a new account by march 31, 2021. The qualifying deposit must contain funds from outside of ally financial, and a person can only get the offer on one new ally invest securities LLC account. As an extra incentive, ally will credit your transfer fees from another brokerage, up to $150 as long as you bring at least $2,500 over to the new account.

Ally invest checks your deposit 60 days after your account is opened to determine the total qualifying deposit. You’ll receive your cash bonus within 10 business days after this review.

To receive a cash bonus, you must:

- Deposit at least $10,000 in a new ally invest account.

- Be a U.S. Resident.

- Not be an existing ally invest account holder or a former ally invest account holder (which includes former tradeking securities LLC account holders). You’re not eligible to receive the cash bonus if you closed one of these ally invest accounts within the past 90 days.

You must use the “open account” button associated with this offer on ally invest’s site for opening your account to be eligible for this offer.

Here are the bonus tiers for this offer:

- To receive the $50 bonus, deposit or transfer $10,000-$24,999.

- To receive the $200 bonus, deposit or transfer $25,000-$99,999.

- To receive the $300 bonus, deposit or transfer $100,000-$249.999.

- To receive the $600 bonus, deposit or transfer $250,000-$499,999.

- To receive the $1,200 bonus, deposit or transfer $500,000-$999,999.

- To receive the $2,500 bonus, deposit or transfer $1 million -$1,999,999.

- To receive the $3,500 bonus, deposit or transfer $2 million or more.

Once you receive your bonus, both the cash bonus and your qualifying deposit (minus any trading losses that are incurred) can’t be withdrawn for 300 days. A withdrawal may cause ally invest to revoke your bonus.

Read bankrate’s ally invest review to learn more.

Merrill edge: $150, $225, $375 or $900 bonus

When you open a merrill edge IRA or cash management account and make a qualifying deposit within 45 days of opening you can earn up to a $900 bonus. You need to use offer code 900ME during the account opening. This can be done while applying online or using it when speaking to a merrill edge financial adviser on the phone or at select bank of america branches. This offer expires april 15, 2021.

To receive a cash reward, you must:

- Enroll for the offer at the time of account opening.

- Deposit net new assets of at least $20,000 into your merrill edge account within 45 days of opening the account.

- You must be enrolled in the preferred rewards program within 90 days of making the deposit.

- Maintain that balance for at least 90 days.

The offer limits you to one IRA — rollover, traditional, roth and sole-proprietor SEP only — and one cash management account. Each account holder can’t have more than two enrolled accounts.

Assets from bank of america, merrill lynch, pierce, fenner & smith incorporated (MLPF&S), U.S. Trust, or 401(k) accounts administered by MLPF&S aren’t qualifying net new assets.

You’ll receive your cash reward two weeks after the initial 90-day period, assuming you meet eligibility requirements.

Business/corporate accounts, investment club accounts, partnership accounts and certain types of fiduciary accounts held at merrill edge aren’t eligible for this offer. The offer also doesn’t apply to accounts, which include iras or cmas, held with other business units of MLPF&S.

Here are the bonus tiers:

- To receive the $150 cash reward, deposit $20,000 to $49,999.99.

- To receive the $225 cash reward, deposit $50,000 to $99,999.99.

- To receive the $375 cash reward, deposit $100,000 to $199,999.99.

- To receive the $900 cash reward, deposit $200,000 or more.

Read bankrate’s merrill edge review to learn more.

Charles schwab: $100, $200, $300 or $500 (if you’re referred by a friend)

Schwab is offering personally referred friends the opportunity to earn up to $500 when they use a referral code, given to you by a current schwab customer, and open an eligible account at schwab.

To receive the bonus award, you must:

- Receive a referral code from a friend or family member.

- Be a new schwab client and make a qualifying net deposit within 45 days of both becoming a schwab customer and opening an eligible retail brokerage account.

You’re limited to one per account and only one account per client when you receive a referral.

Schwab retail brokerage accounts and iras are eligible for this offer. This includes accounts that are enrolled in schwab-sponsored investment advisery programs, such as schwab intelligent portfolios, schwab managed portfolios, schwab managed account select and connection and schwab private client.

You’ll receive your bonus approximately a week or two after the 45-day period ends if you made a qualifying deposit when becoming a new schwab customer and enrolling in the referral offer.

Schwab may charge back its bonus award if taxable accounts aren’t kept at schwab for at least one year.

Here are the bonus tiers for this offer:

- To receive a $100 bonus, deposit $1,000-$24,999.

- To receive a $200 bonus, deposit $25,000-$49,999.

- To receive a $300 bonus, deposit $50,000-$99,999.

- To receive a $500 bonus, deposit $100,000 or more.

Read bankrate’s charles schwab review to learn more.

E-trade: $50, $100, $150, $200, $300, $600, $1,200 or $2,500 bonus

You can earn a cash bonus if you open a retirement or brokerage account and fund it with $5,000 or more within 60 days of account opening. Your account must be opened by jan. 31, 2021.

To receive a cash bonus, you must:

- Use promo code WINTER21 when opening the account.

- Open your new account with funds or securities from accounts outside of E-trade. You need to also keep the new account (minus any trading losses) for at least 12 months to keep the cash bonus.

Here are the cash bonus tiers for this offer:

- To receive a $50 bonus, deposit or transfer $5,000-$9,999.

- To receive a $100 bonus, deposit or transfer $10,000-$19,999.

- To receive a $150 bonus, deposit or transfer $20,000-$24,999.

- To receive a $200 bonus, deposit or transfer $25,000-$99,999.

- To receive a $300 bonus, deposit or transfer $100,000-$249,999.

- To receive a $600 bonus, deposit or transfer $250,000-$499,999.

- To receive a $1,200 bonus, deposit or transfer $500,000-$999,999.

- To receive a $2,500 bonus, deposit or transfer $1 million or more.

Read bankrate’s E-trade review to learn more.

No deposit casino bonuses and bonus codes for 2021

531 bonuses in our database

Online casino bonuses offered by all casinos in our database you can choose from. This list of bonuses offers the biggest selection, but that also means it contains bonuses from casinos not recommended by casino guru. Keep that in mind.

Casino guru

We want players to understand gambling.

$45 NO DEPOSIT BONUS

Use promo code in your account

How easy was it to get this bonus?

Thank you for your feedback!

Why didn't this bonus work?

Thank you for your feedback!

$40 NO DEPOSIT BONUS

Use promo code in your account

$35 NO DEPOSIT BONUS

Enter promo code during registration

$35 NO DEPOSIT BONUS

Use promo code in your account

$300 NO DEPOSIT BONUS

Use promo code in your account

$140 NO DEPOSIT BONUS

Use promo code in your account

$60 NO DEPOSIT BONUS

Use promo code in your account

$12 NO DEPOSIT BONUS

Activate bonus in your account

$25 NO DEPOSIT BONUS

Use promo code in your account

$50 NO DEPOSIT BONUS

Use promo code in your account

531 bonuses found based on your search. Showing 1 - 10

clear all filters to find more casino bonuses

We’ve done our best to put together the following listing of free casino bonuses which should suit your needs the most. The list is based mostly on your country, as many bonuses are only valid to players from certain countries. However, other ranging factors, such as the bonus value and the casino's rating, have been added into the mix as well.

If we haven’t guessed your country correctly from your IP address, you can change it by clicking the flag in the top right corner.

If you are new to no deposit casino bonuses , the answers to the following questions may interest you:

Note: you should be aware that not all casinos treat their players fairly. That's why we recommend reading our casino reviews before registering and using our list of best online casinos when choosing a new site to play at, especially if you intend to deposit your own money into the casino.

Introduction to free slot bonuses

No deposit bonuses are a promotion given by online casinos to attract new players. These bonuses usually take the form of free credit , which can be used to bet on various games, or the form of several prepaid spins on certain slots.

No-deposit bonuses are usually given as a gift to attract new players . The main goal of these bonuses is to promote the casino's brand and get an email address or a phone number from potential players. These contacts will very likely be used for marketing purposes.

Terms and conditions of free registration bonuses

"one bonus per player" is the most important of the no deposit bonus policies. As the bonus is free, the casino obviously doesn’t want to give it to the same player over and over. If you manage to meet the bonus wagering requirements and want to withdraw your win, the casino will verify your identity. If you have signed up yourself as john smith (and it isn't your actual name), you’ll never make a successful withdrawal.

Casinos are quite smart when it comes to this, so your only chance is to sign up with your own name and only once for every bonus and every casino.

If a bonus has the form of a free credit, you’ll have to roll it over many times before you can withdraw. No deposit bonuses have very high wagering requirements – sometimes up to 100x.

This means that if you got $10 of free credit, you’ll have to play for example 1000 spins at $1 each to roll it over. Note that not all games are allowed to be played with the bonus credit, and not all games contribute at the same rate to roll over requirements. For example blackjack is usually either completely forbidden, or contributes only 5% of each bet. In that case you would need to place 20 times more bets on blackjack than on slots.

In the case of prepaid spins, the casino will total your winnings from these spins. When you finish spinning, you’ll have to roll over the total amount you’ve won in free spins many times over.

You won $3.69 from 10 free spins on starburst. With 50x wagering requirements, you’ll have to bet more than $184.50 in total to be able to withdraw your money.

You will lose the vast majority of free bonuses before meeting the wagering requirements. But if you are lucky enough to roll the bonus over, then you have to be aware of the MAXIMUM CONVERTED VALUE rule. Even if you end up with a bonus value higher than $500, you usually won’t be allowed to withdraw more than $50-$100.

Another rule is the maximum allowed bet . If the casino defines the maximum bet when playing with a bonus, you must not exceed it. Otherwise, the casino will have an excuse to refuse to pay you out. And the majority of casinos really will use this excuse. Be aware that this rule is not enforced by the casino system, so it’s up to you to read bonus terms and conditions carefully .

The last rule applied by some casinos is that you’ll need to make a deposit before cashing out your no deposit bonus. I think that casinos use this as another form of verification. But be careful, because some casinos may try to trick you and force you to play with this "verification deposit". Always ask on live chat to make sure you understand the terms and conditions properly - and save the conversation.

Can I really win on slots without risking my money?

Many casinos are fair about their no deposit promotions, and a clear reputation is one of their most important assets. We are quite strict when it comes to casinos that don’t keep their word.

The maximum win is usually limited, and an amount like $50 is too low to risk the casino’s reputation.

How do casinos make money on free slots bonuses?

The answer is simple: they don’t.

From the casino’s perspective, no deposit bonuses on slots are an expense for marketing . The casino hopes to attract new players, which will spread the word about their brand. Also, some players will stay and deposit real money.

A lot depends on the habits of players from every particular country . Players from western europe are more likely to be real casual players. This kind of player often makes a small deposit after playing with a no deposit bonus. Players from russia and eastern europe are more likely to be pure bonus gatherers who are looking just for a profit without the risk. That is the reason why most casinos don’t give free bonuses to players from these countries.

Despite the fact that high rollers and the most valuable players are usually not very interested in 10 free spins at $0.10 each, no deposit bonuses can help the casinos attract at least casual players . With a long term perspective, these bonuses may pay for themselves.

Can I get a casino registration bonus several times?

Casinos are very strict about the one bonus per player policy , and childish attempts get around it have no chance to succeed. You have to sign up with a name for which you have a valid ID and passport.

- If you are not able to prove your identity, you won’t get paid.

- If you sign up multiple times from same IP, you won’t get paid.

- If you slightly modify your name, you won’t get paid.

Our advice is: don’t try to do that . Casinos have to pay for the free spins to the game providers, so you’ll just increase their expenses and won’t help yourself in any way. The only effect will be that you piss the casino manager off, and he may exclude players from your country from this promotion in the future.

Instead of using a no deposit bonus multiple times, we suggest looking for other bonuses from different casinos , either in our list of no deposit bonuses, or on other websites, such as lcb.Org. Another well renowned website is nodepositfriend.Com, which offers a comprehensive list with numerous no deposit bonus offers for you to enjoy. If you've already used all bonuses listed here, on casino guru, remember that there are other sites where you can find new bonus offers for you to try.

No deposit bonuses FAQ

What are no deposit bonuses?

No deposit bonuses are a type of casino bonuses given to players without the need for them to deposit their own money into the casino. Casinos use them as a promotional tool to give new players an incentive to create an account and start playing. No deposit bonuses make it possible to essentially gamble for free, but their values are generally low.

How do no deposit bonuses work?

Using a no deposit bonus is simple. They are given to new players as a reward for registering. Some of them are given to players automatically, while others require entering a specific promotional code, or contacting the customer support and asking for it. After getting a bonus, players are free to play with it but have to follow rules specified by the casino. These rules differ from bonus to bonus and generally also influence how much you can win from your bonus, so it is good to check them out in advance.

Can I claim all listed no deposit bonuses?

You can only have one account in each casino and claim each free bonus just once, however, there is a big number of online casinos, and many of them offer no deposit bonuses to new players. That said, no deposit bonuses are generally offered only to players from selected countries, so you will only be able to use those offered to residents of your country.

What types of no deposit bonuses are there?

There are two main types of no deposit bonuses – free spins and free cash. Both allow players to play real-money casino games for free, but there is an important difference. Free spin bonuses are tied to specific slots, while free cash bonuses can be used on any game that has not been restricted for that bonus.

What are free cash bonuses?

Free cash bonuses are a type of no deposit casino bonuses. After a player claims them, the bonus amount is added to their player account as bonus money. The player can then play any casino games, with the exception of so-called restricted games, which are specified in the terms and conditions of each specific bonus. We advise reading the T&cs before playing.

What are free spin bonuses?

Free spin bonuses are a type of no deposit casino bonuses. These bonuses grant the player the possibility to play a certain number of spins on selected slot machines. The amount the player wins is then added to their player account as bonus money, and wagering requirements need to be met to be able to make a withdrawal.

Can I play any games with my bonus?

Generally speaking, no. Most casino bonuses, including the no deposit ones, have some restricted games specified in their terms and conditions. This means that you can play all casino games apart from those that have been restricted.

Additionally, for free spin bonuses, the free spins you get from the casino can generally be used just on selected slot machine or slot machines.

What are wagering requirements?

Wagering requirements are a key part of all online casino bonuses. You can’t just get a bonus and instantly withdraw your money. Before being allowed to make a withdrawal, you need to play with your bonus money. Wagering requirements describe how many times you need to play through your bonus money to "unlock" it for a withdrawal.

For example, if you get a $10 bonus with 40x wagering requirements, it means you need to place bets with a total value of $400 before making a withdrawal.

Best cryptocurrency brokers for 2021

Daniel ‘harris’ major

I have tested 40+ crypto brokers. You can find the best cryptocurrency brokers below. This is by far the easiest way to get started with cryptocurrencies.

Cryptocurrency trading has become really popular in the past years. It’s growing more ever year.

Many big trading brokers have already added some of these cryptocurrencies. Everybody can sign up and start trading bitcoin or other crypto coins. This is the easiest and probably the simplest way to invest in cryptocurrency.

After trying out most brokers, here are the best cryptocurrency brokers:

Best cryptocurrency brokers (non-US traders only)

Plus500 – top rated trading platform

Plus500 is a big name in the trading industry. They have a really low minimum deposit requirement and a great trading site.

Buy/sell cfds on bitcoin in addition to buying stocks, commodities, forex etc (traded only through cfds). Plus500 is the most complete trading platform.

- Trade cfds on bitcoin & many other cryptos

- Minimum deposit is only $100

- Regulated and trusted platform

- Very fast signup process

- Live chat

- Many payment methods (even paypal)

- You cannot withdraw any cryptocurrency

- You have to complete a questionnaire, upon sign up

Plus500 disclaimer: 76.4% of retail CFD accounts lose money.

IQ option – lowest minimum deposit ($10)

If you don’t want to make a huge initial investment, then IQ option is the best broker for you. The minimum deposit requirement is only $10. This is by far the lowest in the industry.

- You can trade many cryptocurrencies

- Minimum deposit is only $10

- Best trading platform

- Multiple account currencies

- Free demo account

- Regulated by CYSEC (#247/14)

Etoro – top crypto broker

Etoro is a really popular trading site. They have been around since 2006. Etoro is regulated by CYSEC, FCA and ASIC.

Buy/sell bitcoin on etoro in addition to buying stocks, commodities, forex etc. Etoro is the most complete trading platform.

- Trade bitcoin & many other cryptos

- Minimum deposit is $200

- Regulated and trusted platform

- Australian traders are also accepted

- Great support team

- Many payment methods (even paypal)

- You cannot withdraw any cryptocurrency

- You have to complete a questionnaire, upon sign up

Etoro disclaimer: 71% of retail CFD accounts lose money.

Highlow – best all-round crypto broker

Due to regulation highlow stopped accepting traders from the EU and UK.

Highlow is an australian trading broker (AFSL no.364264). What I like most about this broker is the intuitive platform. It is so easy to use. Especially new traders will like the clean layout.

I’ve been using highlow for a few years now and I never had a problem. Highlow publishes their number of trades on the homepage. There are millions of trades on this broker each month.

I use the main platform which is web based. This means, that you don’t have to download any software. This platform is stable and safe (they use SSL).

I have also tried the ios app and the android app. They are great, but I just don’t like trading on smartphones in general.

The payouts on highlow are amazing (up to 200%, which is more than on other brokers).

Highlow is a great broker for cryptocurrencies (but only if you are not from EU,UK, US). They have a good reputation, great support team and awesome promotions for new traders.

- Trade bitcoin & other cryptos

- Minimum deposit is only $50

- Regulated and trusted platform

- Fastest signup process (no questionnaires)

- Multiple account currencies

- Free demo account (no registration needed)

Nadex – US traders welcome

Nadex is a CFTC regulated broker. In fact, this is probably the only US broker that has this regulation.

Only US traders are allowed on nadex. Non-US traders check out the next broker.

Update OCTOBER 2019: looks like nadex removed crypto trading. After contacting them I found out that they will add it back soon. Register on nadex now and get updated when they add it.

Recently, nadex started offering bitcoin trading.

- Trade bitcoin, forex or binary options

- Minimum deposit is $250

- CFTC regulated broker

- Great support team

- Many payment methods (even paypal)

Crypto brokers with most cryptocurrencies

Here are the most popular cryptocurrencies offered by cryptocurrency brokers:

- Etoro – bitcoin, ethereum, litecoin, dash, ethereum classic, NEO and ripple.

- Plus500 – bitcoin, ethereum, litecoin, bitcoin cash, ripple, IOTA.

- Avatrade – bitcoin, ethereum, ethereum classic, ripple, dash, bitcoin cash litecoin, monero and NEO.

Lowest minimum deposit brokers

These are the best brokers with low minimum deposit requirements:

- Etoro – $200

- Plus500 – $100

- Avatrade – $100

This is really important because the crypto market itself is unregulated. Depositing on a regulated broker means that your money is safe.

We’ve also looked at the support team and the payment methods. You can deposit easily using multiple payment methods on the brokers below.

Top rated brokers that have cryptocurrencies

While we are all familiar with the broad definition of a broker, is there something more to it when it comes to cryptocurrencies?

Simply put, a cryptocurrency broker refers to a website that traders will visit to trade cryptocurrencies at a set price. In many ways, they are similar to forex brokers whose services are a lot more familiar to the general public.

Etoro disclaimer: 71% of retail CFD accounts lose money.

You still can’t decide which broker is best for you?

How to choose your cryptocurrency broker

Is leverage really necessary? Cryptocurrency markets are volatile in nature with prices fluctuating immensely thereby generating high profits even in the absence of leverage. But for some traders, the desire for more earnings justifies the use of leverage.

Before choosing your broker, settle yourself on whether the already immense profits that come from a cryptocurrency market are enough for you or you would like to use leverage to enhance them even further, bearing in mind, of course, that will also significantly increase the risk factor to your funds.

Negative balance protection: it is always advisable to trade with a broker that affords the negative balance protection facility. That way, you will never be at risk of losing more than what you invested in case you sustain very heavy losses.

How suitable is the required capital for you? This is another subjective part to your decision. Do you prefer trading with a small capital or bigger one to help you zero in on bigger returns? Find out what size trades your broker is offering before you open an account.

Narrow spreads for the win: let us be honest, it is only fair that your broker gets a cut from the money you generated having provided you with the essential facilities for it and all. But let us be honest, you definitely want every last dime for yourself.

A spread refers to the difference between the buying price and selling price of a trade and it varies with each broker. The spread is what counts as fees for your broker so the smaller it is, the lower the cost will be on your part.

Lets go into what aspects you as a trader must consider when choosing a broker to trade cryptocurrencies.

Which cryptocurrencies are you interested in trading?

Make sure you have decided on which cryptocurrencies you want to trade in before signing up with your broker.

If your choice is a prominent cryptocurrency like bitcoin (official site), litecoin (official site), or ethereum(official site), there will be a relatively broad availability of brokers that have trading options for those. However, less prevalent examples like monero, IOTA, or zcash may be a little harder to come by.

So study the cryptocurrencies being offered by a broker before you sign up for an account.

Pros and cons of cryptocurrency brokers

Here are some features that these broker have or don’t:

pros

- Signup up with a crypto broker is probably the fastest way to get started with cryptocurrency trading

- If you are less tech-savvy then a broker is safer for you

- You can start buying cryptocurrency while traditional exchanges don’t always accept this payment method

- Most of the time you can’t withdraw cryptocurrencies from a broker. You have to exchange it back to fiat money (USD/EUR etc.)

Cryptocurrency brokers – what to look for

Here are some of the more understated details about your cryptocurrency broker that could make your trading experiences so much more efficient and successful.

1. What are the weekend hours like?

This is a key detail that distinguishes cryptocurrencies from other prominent trading markets like forex, futures, and equity. Cryptocurrency brokers operate during the weekends as well.

There is virtually no difference in purchasing bitcoin at the end of the week as opposed to the middle of the week during peak hours.

But there is a catch. While digital currency exchanges are available during the weekend, your broker may not (why is the stock market closed on the weekend?). So in effect, if there is considerable movement within your relevant cryptocurrency market during a weekend when your broker is not operating, you may not have the ability to respond in any way.

2. How is it hedging?

Your broker is probably not keen on revealing if it is hedging cryptocurrency traders but it is important information for you to know.

Why is it so important for you to know?

Because, as a trader, you want to be absolutely in the clear regarding the policies for risk management being followed by your broker. Let us not forget that cryptocurrency markets are extremely volatile and an unhedged broker is more easily prone to major losses incurred by its clients. Naturally, those costs will warrant compensation via fatter spreads and additional costs for traders. It will be best to sign up with a broker that will not withhold the relevant information from you.

More great features you could be interested in

Commissions and trading on margin – an important thing to note while trading cryptocurrencies is that their prices tend to be more similar to equities than they are to real currencies. So your broker could be charging you commissions in addition to a wide spread on each trade. That, of course, raises the cost probably a bit much for your liking.

Another similarity with equities is that the margin conditions with cryptocurrencies are significantly more than they are with forex or cfds. Consequently, leverage is usually up to 10x. How considerable the margin rate will be for traders is down to what trading strategies and risk management they subscribe to.

Authenticity of market data – aside from merely evaluating how it influences spreads, market data for cryptocurrency CFD prices can be a good indicator of how the quality of the product will be in the future.

One of the more recent examples of this is BTC-e which was an immensely popular platform for trading bitcoin before it was shut down by feds. BTC-e was the first bitcoin exchange to incorporate forex trades and so made their exchange accessible via MT4 and supplied cryptocurrency liquidity for brokers.

But once it was shut down, every broker that depended squarely upon BTC-e was left with no hedging options or market data to put a price on its crypto cfds.

Are short sales available? For many traders, shorting is a crucial strategy option, the lack of which can be a deal breaker with a potential broker. Many brokers tend to offer ‘long’ only since there are only a few hedging solutions when opening short trades.

As you see, investing in cryptocurrencies can be a truly lucrative venture for you but only if you get it right.

And a lot of that is down to which broker you decide to trade with.

Ready to start trading?

Trade with the cryptocurrency brokers listed above to make sure that your money is safe, you pick a broker with a stellar reputation and you keep the fees low. Excel at trading bitcoin by creating your own trading strategy.

These cryptocurrency brokers make it really easy to trade bitcoin and other coins. You don’t have to be a trading expert. It helps if you know what a blockchain is or how the ledger and transactions work, but this is all optional.

Sign up now and see for yourself how easy it is to get started.

Free bonus trading brokers

The essence of various cryptocurrencies and

Bitcoin already embellishing the world

Start trading in the most trending digital asset; to promote authenticity & decentralisation, removing whole coating of regulatory commission.

Merry christmas & happy new year

THIS NEW YEAR WE WISH YOU ABUNDANCE & JOYUS MOMENTS FOR IT HAS BEEN ENRICHING FOR US TO HAVE HAD YOU AS OUR VALUED CLIENTS.

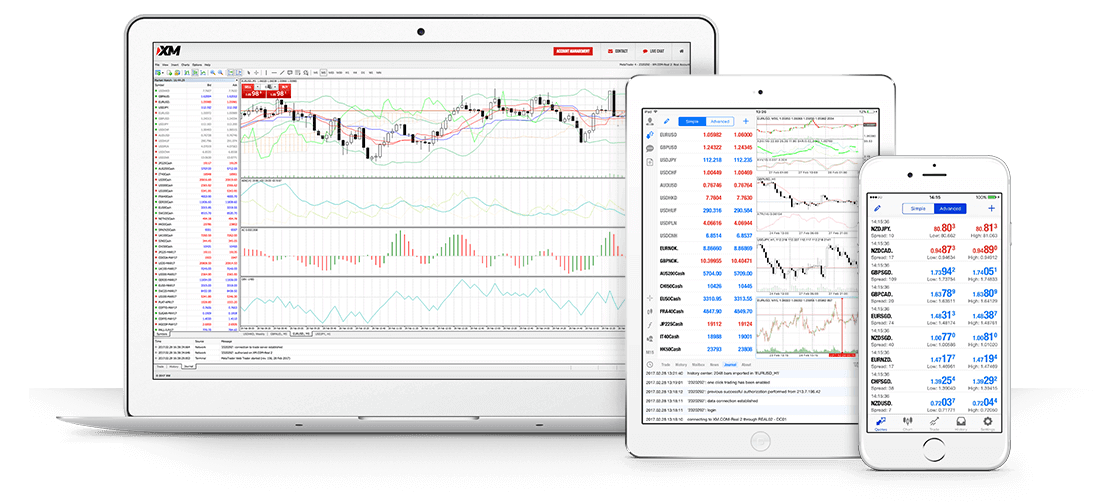

FOREX, PRECIOUS METALS, COMMODITIES, etfs, INDICES & SHARES

MULTI LANGUAGE SUPPORT | LOWEST SPREAD | HIGHEST LEVERAGE | MINIMUM DEPOSIT $100 | FREE TRAINING | & A LOT MORE .

PCM takes a stand to build a community with your support

Contribute to make a better world

A significant portion of commissions received by us goes toward free education in least developed countries (LDC) that come under africa & asia.

About PCM

As always, traders grows with us!

Perfect capital markets (PCM) is a UK based, online forex brokerage company. We offer various accounts, trading software and trading tools to trade in forex market for individuals, fund managers and institutional customers. Currently, we have more than 10,000 individual clients, institutional clients and channel partners. We are committed to offering the latest and state of the art trading platforms to ensure that you get the best trading experience in financial market.

Contests & offers

Win real money in your trading account through contests and offers. Win upto $1,000 .

Local deposits - local withdrawls

Withdraw your funds directly to your local bank account; no matter where you are, our executives are there to pickup your funds .

Lowest spread & highest leverage

We offer lowest spread i.E 0.0 and highest leaverage upto 1:500.

Multi language support

Feel at home with our team of trained experts, ready to assist you, in your local language.

Live cross rates

Why we

As always, partners grows with us!

UNBEATABLE LEVERAGE

Unlike other brokers, we provide one of the highest leverage ratios in the forex industry, up to 1:500. By trading with a higher leverage, you may increase your earning potential

FREE TECHNICAL & FUNDAMENTAL ANALYSIS

We provide a high standard of technical and fundamental analysis, and some of the world's leading media seem to think so too as they quote us on a regular basis..

Free E-books and educational webinars

Free E-books and and weekly free webinars . Know all the pros and cons of forex trading.Get daily tips via email and our mobile apps

Free education

Not an expert? No problem. We'll provide you with a wide range of articles, webinars and seminars that'll teach you how to use the most effective trading strategies.

Taxation

The lysine contingency it's intended to prevent the spread of the animals is case they ever got off the island. Dr. Wu inserted a gene that makes a single faulty enzyme.

Accumulation

The lysine contingency it's intended to prevent the spread of the animals is case they ever got off the island. Dr. Wu inserted a gene that makes a single faulty enzyme.

Business planning

The lysine contingency it's intended to prevent the spread of the animals is case they ever got off the island. Dr. Wu inserted a gene that makes a single faulty enzyme.

Risk management

The lysine contingency it's intended to prevent the spread of the animals is case they ever got off the island. Dr. Wu inserted a gene that makes a single faulty enzyme.

Taxation

The lysine contingency it's intended to prevent the spread of the animals is case they ever got off the island. Dr. Wu inserted a gene that makes a single faulty enzyme.

Accumulation

The lysine contingency it's intended to prevent the spread of the animals is case they ever got off the island. Dr. Wu inserted a gene that makes a single faulty enzyme.

Business planning

The lysine contingency it's intended to prevent the spread of the animals is case they ever got off the island. Dr. Wu inserted a gene that makes a single faulty enzyme.

Risk management

The lysine contingency it's intended to prevent the spread of the animals is case they ever got off the island. Dr. Wu inserted a gene that makes a single faulty enzyme.

Learner $100 plus per month -->

- Leverage 1:500

- Spread from 0.0 (floating)

- Commission $9

- Min.Lot size 0.01

- Max.Lot size unlimited

- Instant execution

- Stop out 50%

- Bonus 0

- Hedge allowed

get plan

Startup $500 plus per month -->

- Leverage 1:400

- Spread from 0.0 (floating)

- Commission $8

- Min.Lot size 0.01

- Max.Lot size unlimited

- Instant execution

- Stop out 50%

- Bonus 30%

- Hedge allowed

get plan

Business $1000 plus per month -->

- Leverage 1:400

- Spread from 0.0 (floating)

- Commission $7

- Min.Lot size 0.01

- Max.Lot size unlimited

- Instant execution

- Stop out 50%

- Bonus 50%

- Hedge allowed

get plan

Corporate $5000 plus

- Leverage 1:200

- Spread from 0.0 (floating)

- Commission $6

- Min.Lot size 0.01

- Max.Lot size unlimited

- Instant execution

- Stop out 50%

- Bonus 0

- Hedge allowed

get plan

Islamic $1000 plus any account*

- Leverage 1:400

- Spread from 0.5 (floating)

- No commission

- Min.Lot size 0.01

- Max.Lot size unlimited

- Instant execution

- Stop out 50%

- Bonus 0%

- Hedge allowed

get plan

What our clients say

We love to hear from our raving fans

PCM is undoubtedly the best in the market. I learnt forex from the PCM experts and my learning experience so enjoyable. They held my hand through all my trades. With their support I have doubled my account in 2 months while doing my full time job.

I always wanted to start trading as the earning in forex trading attracted me for a long time; but I was reluctant to invest because I had heard that one needs a lot of expertise to excel in forex. PCM made it so simple for me by providing the demo account at zero investment. I was able to experience the global market and then with full confidence I started my live account. You guys are awesome. Thanks a lot PCM.

I am working with PCM for many years now. I have witnessed continuous growth in the company in terms to services, technology, education etc. One thing which has not changed in all these years in the customer service attitude of your team. I really admire the support and always recommend PCM to my family and friends.

PCM has the tools, technology, power and the best team in the world. I loved your new customer login portal, it made deposits, trading, withdrawal so easy. Thank you PCM!.

Request a call back

Our financial advisers are always ready to help you

Deposit and withdrawal options.

Multiple deposit and withdrawal options, for hassle-free transactions!

About PCM

Perfect capital markets (PCM) is a UK based, online forex broker. We offer various trading accounts, software and trading tools to trade in forex market for individuals, fund managers and institutional customers.

Head office

Company links

Our branches

Risk warning: trading foreign exchange, commodity futures options, and other on-exchange and over-the-counter products carry a high level of risk and may not be suitable for all investors. The high degree of leverage associated with such trading can result in substantial losses, as well as gains. The past performance of any trading strategy or methodology is not indicative of future results, which can vary due to market volatility; it should not be interpreted as a forecast of future performance. You should carefully consider whether such trading is suitable for you in light of your financial condition, level of experience and appetite for risk and seek advice from an independent financial advisor, if you have any doubts.

Best no deposit bonus forex brokers 2021

The brokers below represent the best no deposit bonus forex brokers.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 79.27% and 73.32% of retail investor accounts lose money when trading cfds with tickmill UK ltd and tickmill europe ltd respectively. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Cysec, FCA, FSA(SC), FSCA, labuan-fsa

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 79.27% and 73.32% of retail investor accounts lose money when trading cfds with tickmill UK ltd and tickmill europe ltd respectively. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Trading derivatives and leveraged products carries a high level of risk, including the risk of losing substantially more than your initial investment. It is not suitable for everyone. Before you make any decision in relation to a financial product you should obtain and consider our product disclosure statement (PDS) and financial services guide (FSG) available on our website and seek independent advice if necessary.

Trading derivatives and leveraged products carries a high level of risk, including the risk of losing substantially more than your initial investment. It is not suitable for everyone. Before you make any decision in relation to a financial product you should obtain and consider our product disclosure statement (PDS) and financial services guide (FSG) available on our website and seek independent advice if necessary.

Your capital is at risk

Ctrader, MT4, MT5, proprietary

Dealing desk, ECN, market maker, no dealing desk, STP

Your capital is at risk

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Note: not all forex brokers accept US clients. For your convenience we specified those that accept US forex traders as clients.

Tickmill

Regulated by: cysec, FCA, FSA(SC), FSCA, labuan-fsa

Headquarters : 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 79.27% and 73.32% of retail investor accounts lose money when trading cfds with tickmill UK ltd and tickmill europe ltd respectively. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill was founded in 2014 and is regulated by the UK financial conduct authority (FCA), the cyprus securities and exchange commission (cysec) and the seychelles financial services authority (FSA).

The broker provides more than 80+ CFD instruments to trade on covering forex, indices, commodities and bonds through three core trading accounts called the pro account, classic account and VIP account. They also offer a demo trading account and islamic swap-free account.

GO markets

Regulated by: ASIC, cysec

Headquarters : level 22, 600 bourke street, melbourne, VIC 3000, australia

Trading derivatives and leveraged products carries a high level of risk, including the risk of losing substantially more than your initial investment. It is not suitable for everyone. Before you make any decision in relation to a financial product you should obtain and consider our product disclosure statement (PDS) and financial services guide (FSG) available on our website and seek independent advice if necessary.

Australian brokers are definitely making a name for themselves in the trading arena as some of the most reliable, intuitive and forward thinking firms around. This broker is no different with a wide variety of tools, assets and reasonable trading conditions.

GO markets pty ltd an ASIC regulated broker has been in operation since 2006. The head office is located in melbourne, australia. With over a decade of experience, GO markets has grown to become a leading broker with a huge client base from over 150 countries. GO markets offers forex, share cfds, indices, metals and commodities for trading on the MT4 and MT5 trading platforms.

Roboforex

Headquarters : 2118 guava street, belama phase 1, belize city, belize

Your capital is at risk

The roboforex brand is operated by the roboforex group, and is located in belize. Roboforex began operations in 2009 and has grown in size and capacity. The brand offers over multiple trading instruments which include forex, stocks, indices, etfs, commodities, energies, metals and cryptocurrencies.

They also offer cutting edge platforms. Roboforex boasts of over 800,000 clients from 169 countries. They are both a dealing desk and non dealing desk broker offering ECN and STP trading accounts through their platforms. This means a different payment model to you the trader eg. Lower spreads for ECN accounts with some commissions to pay.

*leverage depends on the financial instrument traded and on the client’s country of residence.

Axiory

Headquarters : no.1 corner of hutson street and marine parade belize city, belize

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Axiory was founded in 2012 and is a trading name of axiory global ltd which is authorised and regulated by the international financial services commission (IFSC) of belize. The broker segregates client funds from their own and offers negative balance protection. The company is also audited by pricewaterhousecoopers and is a member of the financial commission.

Users can choose from three types of trading accounts called nano, standard and max to trade on 80 different markets covering forex and cfds on indices, energies, stocks and metals. Axiory offers maximum leverage of up to 1:500 and also provides access to islamic swap-free accounts and a demo trading account. Users can also access data regarding execution times and slippage distribution for even more transparency.

What is a no deposit forex bonus?

A no deposit forex bonus is a cash award that is deposited by the broker into the forex trader’s account, without requiring an initial deposit into the trading account by the trader.

Just like the deposit bonuses in forex (which require you to deposit first), the no-deposit bonus is used strictly for trading purposes and can only be withdrawn from the account on fulfillment of the broker’s trade volume requirements.

Typically, the no-deposit forex bonuses are not as large as the deposit bonuses. They range from between $10 and $200, depending on the broker. They are actually meant to introduce new traders into the world of real money trading and are not meant to be used for profit-oriented trading. Think of it as a form of live, real money practice account where you keep all the gains. If you lose money, you have lost nothing.

What should I do to get my bonus?

Most of the no-deposit forex bonuses in the market can be obtained as exclusive offers through affiliate partners of the forex brokers that offer them. The forex brokers who award the no-deposit forex bonuses directly are typically in the minority.

What is the difference between no deposit bonuses and deposit bonuses?

No-deposit forex bonuses do not require an initial deposit into the trading account before they are awarded. This factor distinguishes the no-deposit forex bonus from deposit bonus, which like the name implies, requires a deposit from the trader before it is awarded.

No-deposit forex bonuses are smaller in size as they mostly serve for live account practice.

What other bonus and promotion types do brokers offer?

Other bonuses and promotions may be given out by brokers occasionally.

- The cashback is the commonest bonus which a trader can get. Although this requires that some previous deposit would have been made by the trader, cashbacks are a good way to earn back any money that has been lost in previous trades. These are provided by brokers automatically without requiring further deposits.

- Trade contest awards do not require a previous deposit. You can participate in various trade contests on broker platforms for a share of the prizes. Cash prizes are usually awarded to traders as a no-deposit bonus. All you need is to ensure your account KYC documents are in place and you can claim your award if you win.

- Some brokers provide traders with tools they need to trade with on fulfillment of certain conditions such as attaining certain trade volumes within a specified time frame.

Conclusion

Are you looking for the best no deposit bonus forex brokers for 2017? Here we show a list of these brokers which we have compiled after careful evaluation of various candidates. Ensure you use the no-deposit forex bonus wisely and use it to enhance your live account trading experience.

The 14 best brokerage account promotions and bonuses for 2021

Updated january 21, 2021

Some links below are from our sponsors.

This blog has partnered with cardratings for our coverage of credit card products. This site and cardratings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author's alone and have not been reviewed, endorsed or approved by any of these entities.

As an amazon associate, I earn from qualifying purchases. More information

Are you looking to open a new brokerage account to manage your portfolio of investments but aren’t sure which one?

Many online investment platforms compete for business by offering new account promotions based on the assets you can transfer to their platform. While promotions shouldn’t be the only consideration, these promotion/bonus amounts are too hard to look past.

There are a range of bonuses listed below, whether you have an established portfolio and looking to transfer stocks, or starting new.

Continue reading to review the best brokerage account promotions for new accounts.

Our top picks:

Webull – 4 free stocks worth up to $1,600

Webull is a free trading app from webull financial. They are a brokerage based out of new york city and regulated by FINRA, you can look them up on brokercheck. We have a full review of webull and their offer here.

For new signups, open and fund an account with $100 and they will give you 4 free stocks worth up to $1,600. They have no fees and no account minimums so it’s truly free stock.

Robinhood – free share of stock

Robinhood is a relatively new brokerage that will give you a free share of stock when you open an account. There are no other requirements of the offer, you just need to open an account. No deposit, no transfer, no nothing. You can read more about the free share of stock promotion here.

Ally invest – up to $3,500

Ally invest is the online brokerage account I use because they offer free trades (U.S. Stock, etfs, and options) with no minimums and monthly balance requirements. I have an ally bank account so managing it all with one login is convenient too. I wish I would’ve taken advantage of their new account bonuses for transfers because it’s one of the most generous, here is the schedule based on how much you deposit within 60 days of account opening:

Here is the ally invest bonus structure:

| Deposit or transfer amount | your bonus |

|---|---|

| $10,000 – $24,999 | $50 |

| $25,000 – $99,999 | $200 |

| $100,000 – $249,999 | $300 |

| $250,000 – $499,999 | $600 |

| $500,000 – $999,999 | $1,200 |

| $1,000,000 – $1,999,999 | $2,500 |

| $2,000,000 or more | $3,500 |

They will also credit transfer fees if you move your account from another brokerage – up to $150 ACAT fee reimbursement.

NVSTR –

NVSTR has a referral program where you can get up to $1,000 (but at least $10) when you sign up. The referring customer gets $10 to $1,000 too – and it’s a limited time offer. If you’ve never heard of them before, our NVSTR review can get you up to speed.

The only requirement is that you make one trade within a year and you can keep the bonus. There are no other requirements for the new account bonus.

There is also a deposit bonus. For a limited time, after you open your account, you can get a bonus based on what you deposit. You need to maintain this amount for one year to keep the deposit bonus.

Tastyworks

Tastyworks will give you 100 shares of a “highly liquid stock” when you open and fund a new cash or margin account with $2,000. The shares will be selected at random from a list of eleven stocks priced between $1 and $6, so you can get anywhere from $100 to $600 in this promotion with a stated average bonus of $200 – $220. There is a 70% chance of getting a stock priced under $2 and a 30% chance of getting a stock priced over $2.

You must keep the initial value of the stock, less any loss in value, in the account for a minimum of three months.

The referral/promotion code for this offer is “STOCK_AWARD_20” and you must put it in the referral code field when applying.

Sofi invest – $50

Sofi invest is the brokerage arm of sofi, the student loan refinancing company. They’ve recently branched out into other areas, including sofi money (banking), and they are now offering a $50 bonus if you sign up and deposit at least $25.

With sofi invest, you can manage your portfolio (active investing) or go with a roboadvisor approach (auto investing). With active investing, you can invest in stocks, cryptocurrencies, and etfs without paying a trading commission.

For a limited time, get $50 in stock from sofi invest if you sign up with a referral link and deposit at least $1,000. There’s no trading requirement.

Betterment

Betterment is one of the largest and most respected robo-advisors, you can see our review of betterment for a closer look at their service.

For new accounts, they will waive the management fee of 0.25% depending on how much you transfer:

- Deposit $15,000 – $99,999, get 1 month managed free

- Deposit $100,000 – $249,999, get 6 months managed free

- Deposit $250,000+, get 12 months managed free

Citi personal wealth management

Citi personal wealth management has a juicy bonus offer when you transfer new-to-citibank funds within 2 months of opening an account. You also will need to enroll in e-delivery of statements and then keep those funds in the account through the end of the next month (or three months after the month of account enrollment). Bonus will be credited three months after you meet the maintenance requirement.

Here’s the citi bonus transfer schedule:

- Fund with $50,000 – $199,999 – $500

- Fund with $200,000 – $499,999 – $1,000

- Fund with $500,000 – $999,999 – $1,500

- Fund with $1,000,000 – $1,999,999 – $2,500

- Fund with $2,000,000 or more – $3,500

Merrill edge – up to $600

Merrill edge, a bank of america company, will give you up to $1,000 if you open a new merrill edge account using the offer code 600ME. You just need to transfer your funds within 45 days, maintain that balance for 90 days, and you will get the cash bonus in 2 weeks. This bonus applies to individual merrill edge iras or cash management accounts, which is what they call their taxable brokerage accounts.

Here’s the merrill edge bonus transfer schedule:

- Fund with $20,000 – $49,999: $100

- Fund with $50,000 – $99,999: $150

- Fund with $100,000 – $199,999: $250

- Fund with $200,000+ $600

If you are a preferred reward client, you may get up to $900 with this alternative offer.

Charles schwab – up to $500

Charles schwab will give stock plan services clients a bonus of up to $500 when you open a new account and transfer in new funds with 45 days. If you are not a stock plan service, they won’t give you this promotion (they will even let you apply and enter in a promotion code, but they won’t give you the bonus).

Here’s charles schwab’s bonus transfer schedule:

- Fund with $10,000 – $24,999: $100

- Fund with $25,000 – $45,999: $200

- Fund with $50,000 – $99,999: $300

- Fund with $100,000+ $500

Update: I have received reports from readers that you don’t get cash but instead get “trade credits” which can be used to pay the commission for trades. If you are considering this offer, call to confirm the details.

E*TRADE – up to $2,500

When I think of new account promotions, I think of E*TRADE. For years, they had an offer where you could get up to $3,000 (if you had over a million dollars in assets to transfer!) and 60 days of free trades if you open a non-retirement brokerage account.

With the recent rush of brokerages offering free trades, the promotion is now just cash.

You can find the full details here but this is the offer:

- Deposit $5,000 – $9,999, get $50 cash

- Deposit $10,000 – $19,999, get $100 cash

- Deposit $20,000 – $24,999, get $150 cash

- Deposit $25,000 – $99,999, get $200 cash

- Deposit $100,000 – $249,999, get $300 cash

- Deposit $250,000 – $499,999, get $600 cash

- Deposit $500,000 – $999,999, get $1,200 cash

- Deposit $1,000,000 or more, get $2,500 cash

Fidelity – promotion [expired]

Fidelity doesn’t offer any cash bonus right now and their last promotion, for free trades, no longer applies as they’ve made many trades commission free.

This offer has expired. We will update it when fidelity issues a new promotion.

Tradestation – $100 [expired]

Tradestation has a “cash madness” promotion where you can get $100 when you open and fund a tradestation securities account with $500 or more. All you have to do is open a new tradestation securities account using the offer code ZINGAFOG, deposit at least $500 within thirty days of opening your account, and then maintain the balance for one month after the funding date.

The promotion expired on july 1st, 2020. We will update this section when a new promotion arrives.

Frequently asked questions

Here are some frequently asked questions about bonuses and the brokerage transfer process.

Almost every brokerage firm supports ACATS, which stands for automated customer account transfer service, which lets you transfer your assets “in-kind.” this means that your holdings are transferred without you having to sell them (and create a taxable event). If you have big unrealized gains in a stock, the shares just get moved over without you having to sell them and you keep the same cost basis.

You may run into hiccups if some items can’t be transferred. One common example is vanguard admiral shares of their mutual funds. Some brokerages will take them, others won’t. In these cases, you may have to transfer them to another asset type (like the ETF version), which will accept them.

ACATS does take a week or two to complete the transfer.

I don’t think it’s worth switching from broker to broker, grabbing up the bonuses, but the process isn’t difficult.

If you’re looking to make a move anyway, getting paid a little for the effort is better than not being paid.

Some brokers may charge you to leave, which is something you’d be paying anyway, so hopping around may reduce your returns from the bonus perspective.

If you are creating new taxable brokerage accounts, the bonuses will be reported as income and you will have to claim them on your taxes as income.

If you are creating retirement accounts, like an IRA, the bonuses are going into those accounts so you won’t owe taxes on them immediately. For traditional iras, you’ll just be taxed when you start taking distributions. Roth iras will never be taxed. For each account, review the terms and conditions to see how the brokerage is treating it and you’ll know for certain.

No deposit forex bonus brokers - 2021

No deposit forex bonus is one of the most desired forex bonus and promotions by forex traders because you can trade without depositing your own money. Forex brokers offer many types of bonus and promotions to attract more clients or to reward the clients for choosing them as their broker. Free forex bonus and promotions certainly benefit the clients since they allow the clients to trade with a larger balance than they have deposited.

What about forex no deposit bonus 2021?

Of course, I am assuming that the broker is not a scam. Because, there are tons of scam brokers out there who allure novice traders through attractive bonuses just to fraud them at the end by rigging the trading conditions or simply pocketing the client’s deposit.

Therefore, free forex bonus and promotions should not be your only criteria when choosing a forex broker. Regulation, trading conditions, reputation and customer services are some of the other features that every trader has to take into account on the road to pick a suitable forex broker for yourself.

What is no deposit forex bonus?

There are many forex bonuses offered by brokers, some of them being granted to the traders post-trading, and others being rewarded to the trader’s forex account conditional on a certain amount of deposit or trading checkpoints. Deposit bonus, welcome bonus, redeposit bonus, rescue bonus and volume bonus are examples for different types of forex bonuses.

In addition to those, there is another type of free forex bonus. This forex bonus is credited to the trader’s account without any initial deposit or other condition whatsoever. Well, of course there is one condition; opening a forex account with the broker. As soon as you open the trading account, you will be rewarded with a free bonus. This type of forex bonus is called no deposit forex bonus.

No deposit free forex bonus brokers in 2021

Why is no deposit free forex bonus important?

No deposit free forex bonus is a great opportunity for beginner traders to gain experience without risking their real money. Besides, it allows seasoned traders to evaluate the services and live trading conditions provided by the broker before depositing money into their trading account.

Since it is not your own money, it will not hurt you financially and emotionally in case you blow up the account. The bonus is also very useful for traders who wish to develop and test new trading strategies without investing and risking their capital.

It is a common exercise followed by the forex brokers to provide different trading conditions in terms of spread, execution time and slippage between demo and live trading accounts. Therefore, trading with a demo account may mislead traders regarding the trading conditions that come with a live account. No deposit forex bonus allows traders to experience a live trading environment with the actual conditions.

How to choose the best free forex bonus?

It is never an easy task to choose a forex broker. I always emphasize the inappropriateness of choosing a forex broker solely due to the appealing free bonus and promotions. Never pick a forex broker just because it gives you a higher percentage of free bonus than the other brokers do.

- Prefer a regulated forex broker

Regulation must be the first and foremost quality of a forex broker that you are going to trade with. You should always put regulation and license above all else when selecting a forex broker. I don’t recommend openening an account with an unregulated forex broker no matter how good the bonus and promotions are offered. After all, what is the use of a free $5000 bonus if you will not be able to withdraw your capital from the forex broker?

Another point to keep in mind is that many unregulated or poorly regulated forex brokers use free forex bonuses as a tool to attract more clients just to fraud them. Those are the scam forex brokers that you have to stay away from no matter how big bonus and promotions they pledge.

- Consider the trading conditions

Spreads, execution time and slippage are going to have a decisive impact on the fate of your trading strategy. Free forex bonus and promotions are very alluring however the trading conditions may be against your advantage just to strip you off the benefits of the bonus. In another word, the brokers may give you the bonus but may not let you benefit from it through adverse spreads, execution time and slippage.

- Read and understand the terms and conditions

Forex bonus and promotions usually come with certain terms and conditions. Some forex brokers let you enjoy the free bonus without verifying your trading account while some others require you to validate your account first. Some forex brokers even allow you to withdraw the free bonus conditioned on certain prerequisites.

Therefore, it is always a good idea to read and understand the terms and conditions of the no deposit bonus to avert an unpleasant surprise afterwards.

TRADE 100 BONUS —

WORK OUT FOR MORE

Bonus information

Get our trade 100 bonus and start your forex career! It works the same way as in sport – first you train and learn, then you earn and get stronger, faster and more efficient. Trade 100 bonus is your personal tool for toning up your brain

What you get with trade 100 bonus

FREE $100 TO TRADE

FBS gives you real money to start your forex journey and trade real

BOOST YOUR SKILLS

To level up your trading you need power-ups: besides $100 you get a full set of educational materials

START WITHOUT DEPOSIT

Learn how to trade and make a real profit out of it – with no need for your own money involved in the process

How can trade 100 bonus help

Trade 100 bonus gives beginner traders a chance to study the basics, get fully involved in the process of real, thorough and effective trading. And the best part is – you don’t need any initial investments for it! Take your time to get to know forex and FBS platform, test your hand, gear up with knowledge – with fewer risks involved

If you are an experienced trader, trade 100 bonus is your chance to get familiar with FBS platform. Trade on major currency pairs, enjoy low spreads and swap free option for your trading and, of course, make some profit out of our welcome gift!

How to get $100 of profit?

Register a bonus account with $100 on it

Use the money to get 30 days of active trading and trade 5 lots

Succeed and get your profit of $100

Bonus conditions

- The bonus is available on metatrader5 platform;

- The order volume is 0.01 lot;

- The sum available for withdrawal is 100 USD;

- The required number of active trading days is 30 (active trading day is a day when the order was opened or closed);

- The maximum number of positions opened at the same time is 5;

- Client should have at least 5 lots traded in the period of 30 active trading days

View the full terms and conditions in the personal area

Share with friends:

Instant opening

Withdraw with your local payment systems

FBS at social media

Contact us

- Zopim

- Wechat

- Fb-msg

- Viber

- Line

- Telegram

The website is operated by FBS markets inc.; registration no. 119717; FBS markets inc is regulated by IFSC, license IFSC/000102/124; address: 2118, guava street, belize belama phase 1, belize

The service is not provided in the following countries: japan, USA, canada, UK, myanmar, brazil, malaysia, israel and the islamic republic of iran

Payment transactions are managed by НDС technologies ltd.; registration no. HE 370778; address: arch. Makariou III & vyronos, P. Lordos center, block B, office 203

For cooperation, please contact us via support@fbs.Com or +35 7251 23212.

Risk warning: before you start trading, you should completely understand the risks involved with the currency market and trading on margin, and you should be aware of your level of experience.

Any copying, reproduction, republication, as well as on the internet resources of any materials from this website is possible only upon written permission.

Data collection notice

FBS maintains a record of your data to run this website. By pressing the “accept” button, you agree to our privacy policy.

Your request is accepted

Manager will call your number

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!

Beginner forex book

Beginner forex book will guide you through the world of trading.

South african forex no deposit bonus offers from trusted brokers

If you’re out there looking for a new forex broker to deal with, you might want to start considering working with one that offers a very beneficial bonus for trading with them. Though you might not be aware of what a forex bonus is, in which case, let us discuss the concept with you and explain why forex bonuses are some of the best and worst things south african forex broker or any other broker might offer.

The idea behind a forex no deposit bonus is simple: to attract new customers. There are many types of forex bonuses and all of them are there to attract new traders to a platform. Whether this is a welcome bonus forex broker offer or some kind of bonus received after trading a certain amount, there is no question about it, it is always there to attract a new customer. Some brokers might offer more than others and some scams might use bonus offers as a way to attract new victims, but there is always a way to find out what the intentions of the company are. I believe bonuses to be a blessing, simply because they give you more money to work with and a chance to generate more income, but I also cannot shed a feeling that they are a curse. A curse, since a bonus might make you think that it is okay to take a risk you should not be taking because the money isn’t yours, which results in more money being lost than you should have.

Though let’s get over the philosophical deliberations over what the dangers and advantages of a forex bonus are and get into the thick of it: how do you go about getting some sweet, sweet bonus money on your forex account?

What is a no deposit bonus?

What is a no deposit bonus?

First, let us explain what exactly no deposit welcome bonus is and how does it work. Unlike deposit bonuses, the no deposit bonus is usually the one that most traders are looking for in a new FX broker to work. These no deposit bonuses are welcome bonus forex brokers like to offer the least of. S outh african forex brokers with no deposit bonus will usually offer no more than 400 rand, but it will still be a significant benefit to a trader who knows what they are doing. For experienced traders, a no deposit bonus is like a free, no risk capital that can be spent on experimental currency pairs to see the results. If the capital is lost, it doesn’t mean much, but if it has returned, then the results are positive and indicate that further trading might be a good idea. The bonus can also be a nice piece of bait for the industry newcomers, who do not know which broker to start working with. While this is not a problem if you end up with a good broker, the danger of starting to trade with a scammer or a brokerage that trades against you is very real.

On the other hand, the no deposit bonus forex is also one of the best ways to start trading for a beginner trader. The cause for this is simple – new traders, with little experience, are too afraid to invest real money into forex trading. Many of them spend time working on demo accounts, trying to figure out how the market works. While a respectable endeavor, it is a limited one – a simulated market is not capable of showing the full spectrum of problems that perk up on the real market. This is why a nice no deposit bonus is a good way for a trader to move onto the market without risking their real money on the market.

How to find the best south african forex bonus