Forex p150

We have served US traders for over 18 years. Global opportunities 24/5 with flexible trade sizes.Top forex bonuses

Trade with the no. 1 broker in the US for forex trading*

Why are traders choosing FOREX.Com?

No. 1 FX broker in the US*

We have served US traders for over 18 years.

Trade 80+ FX pairs, and gold & silver

Global opportunities 24/5 with flexible trade sizes.

EUR/USD as low as 0.2

Trade your way with flexible pricing options including spread only, spread + fixed commission, or STP pro.

*based on client assets per the 2019 monthly retail forex obligation reports published by the CFTC

Financial strength you can depend on

Your FOREX.Com account gives you access to our full suite of downloadable, web, and mobile apps.

Get 20 free, easy to install eas and custom indicators when you open a metatrader live or demo account.

* based on active metatrader servers per broker, apr 2019.

Reward yourself with our active trader program

- Save up to 18% with cash rebates as high as $9 per million traded

- Interest paid up to 1.5% on your average daily available margin balance

- Get guidance and priority support from your dedicated market strategist

- No bank fees for wires

- Access to exclusive events and product previews

Open an account in as little as 5 minutes

Tell us about yourself

Fund your account

Start trading

Ready to learn about forex?

New trader?

Welcome, we’ll show you how forex works and why you should trade it.

Have some experience?

Let’s create a trading plan that will help you stay on track and meet your goals.

Want to go deep on strategy?

Great, we have guides on specific strategies and how to use them.

Not sure where to start?

Take our short quiz and get matched resources that fit your trading style.

Forex (FX)

What is forex (FX)?

Forex (FX) refers to the marketplace where various currencies and currency derivatives are traded, as well as to the currencies and currency derivatives traded there. Forex is a portmanteau of "foreign exchange." the forex market is the largest, most liquid market in the world by trading volume, with trillions of dollars changing hands every day. It has no centralized location, rather the forex market is an electronic network of banks, brokers, institutions, and individual traders (mostly trading through brokers or banks).

Many entities, from financial institutions to individual investors, have currency needs, and may also speculate on the direction of the movement of a particular pair of currencies. They post their orders to buy and sell currencies on the network so they can interact with other currency orders from other parties.

The forex market is open 24 hours a day, five days a week, except for holidays. The forex market is open on many holidays on which stock markets are closed, though trading volume may be lower.

Key takeaways

- The forex market is a network of institutions, allowing for trading 24 hours a day, five days per week, with the exception of when all markets are closed because of a holiday.

- Retail traders can open a forex account and then buy and sell currencies. A profit or loss results from the difference in price the currency pair was bought and sold at.

- Forwards and futures are another way to participate in the forex market. Forwards are customizable with the currencies exchanged after expiry. Futures are not customizable and are more readily used by speculators, but the positions are often closed before expiry (to avoid settlement).

- The forex market is the largest financial market in the world.

- Retail traders typically don't want to have to deliver the full amount of currency they are trading. Instead, they want to profit on price differences in currencies over time. Because of this, brokers rollover positions each day.

Forex market basics

Forex pairs and quotes

When trading currencies, they are listed in pairs, such as USD/CAD, EUR/USD, or USD/JPY. These represent the U.S. Dollar (USD) versus the canadian dollar (CAD), the euro (EUR) versus the USD and the USD versus the japanese yen (JPY).

There will also be a price associated with each pair, such as 1.2569. If this price was associated with the USD/CAD pair it means that it costs 1.2569 CAD to buy one USD. If the price increases to 1.3336, then it now costs 1.3336 CAD to buy one USD. The USD has increased in value (CAD decrease) because it now costs more CAD to buy one USD.

Forex lots

In the forex market currencies trade in lots, called micro, mini, and standard lots. A micro lot is 1000 worth of a given currency, a mini lot is 10,000, and a standard lot is 100,000. This is different than when you go to a bank and want $450 exchanged for your trip. When trading in the electronic forex market, trades take place in set blocks of currency, and you can trade with whatever size you want within the limits allowed by your trading account balance. For example, you can trade seven micro lots (7,000) or three mini lots (30,000) or 75 standard lots (750,000), for example.

How large is the forex?

The forex market is unique for several reasons, mainly because of its size. Trading volume is generally very large. As an example, trading in foreign exchange markets averaged $6.6 trillion per day in april 2019, according to the bank for international settlements.

The largest foreign exchange markets are located in major global financial centers like london, new york, singapore, tokyo, frankfurt, hong kong, and sydney.

How to trade in the forex

The forex market is open 24 hours a day, five days a week across major financial centers across the globe. This means that you can buy or sell currencies at any time during the week.

From a historical standpoint, foreign exchange trading was largely limited to governments, large companies, and hedge funds. But in today's world, trading currencies is as easy as a click of a mouse. Accessibility is not an issue, which means anyone can do it. Many investment firms, banks, and retail forex brokers offer the chance for individuals to open accounts and to trade currencies.

When trading in the forex market, you're buying or selling the currency of a particular country, relative to another currency. But there's no physical exchange of money from one party to another. That's what happens at a foreign exchange kiosk—think of a tourist visiting times square in new york city from japan. He may be converting his physical yen to actual U.S. Dollar cash (and may be charged a commission fee to do so) so he can spend his money while he's traveling. But in the world of electronic markets, traders are usually taking a position in a specific currency, with the hope that there will be some upward movement and strength in the currency they're buying (or weakness if they're selling) so they can make a profit.

A currency is always traded relative to another currency. If you sell a currency, you are buying another, and if you buy a currency you are selling another. In the electronic trading world, a profit is made on the difference between your transaction prices.

Spot transactions

A spot market deal is for immediate delivery, which is defined as two business days for most currency pairs. The major exception is the purchase or sale of USD/CAD, which is settled in one business day. The business day calculation excludes saturdays, sundays, and legal holidays in either currency of the traded pair. During the christmas and easter season, some spot trades can take as long as six days to settle. Funds are exchanged on the settlement date, not the transaction date.

The U.S. Dollar is the most actively traded currency. The euro is the most actively traded counter currency, followed by the japanese yen, british pound and swiss franc.

Market moves are driven by a combination of speculation, economic strength and growth, and interest rate differentials.

Forex (FX) rollover

Retail traders don't typically want to take delivery of the currencies they buy. They are only interested in profiting on the difference between their transaction prices. Because of this, most retail brokers will automatically "rollover" currency positions at 5 p.M. EST each day.

The broker basically resets the positions and provides either a credit or debit for the interest rate differential between the two currencies in the pairs being held. The trade carries on and the trader doesn't need to deliver or settle the transaction. When the trade is closed the trader realizes their profit or loss based on their original transaction price and the price they closed the trade at. The rollover credits or debits could either add to this gain or detract from it.

Since the fx market is closed on saturday and sunday, the interest rate credit or debit from these days is applied on wednesday. Therefore, holding a position at 5 p.M. On wednesday will result in being credited or debited triple the usual amount.

Forex forward transactions

Any forex transaction that settles for a date later than spot is considered a "forward." the price is calculated by adjusting the spot rate to account for the difference in interest rates between the two currencies. The amount of adjustment is called "forward points." the forward points reflect only the interest rate differential between two markets. They are not a forecast of how the spot market will trade at a date in the future.

A forward is a tailor-made contract: it can be for any amount of money and can settle on any date that's not a weekend or holiday. As in a spot transaction, funds are exchanged on the settlement date.

Forex (FX) futures

A forex or currency futures contract is an agreement between two parties to deliver a set amount of currency at a set date, called the expiry, in the future. Futures contracts are traded on an exchange for set values of currency and with set expiry dates. Unlike a forward, the terms of a futures contract are non-negotiable. A profit is made on the difference between the prices the contract was bought and sold at. Most speculators don't hold futures contracts until expiration, as that would require they deliver/settle the currency the contract represents. Instead, speculators buy and sell the contracts prior to expiration, realizing their profits or losses on their transactions.

Forex market differences

There are some major differences between the forex and other markets.

Fewer rules

This means investors aren't held to as strict standards or regulations as those in the stock, futures or options markets. There are no clearing houses and no central bodies that oversee the entire forex market. You can short-sell at any time because in forex you aren't ever actually shorting; if you sell one currency you are buying another.

Fees and commissions

Since the market is unregulated, how brokers charge fees and commissions will vary. Most forex brokers make money by marking up the spread on currency pairs. Others make money by charging a commission, which fluctuates based on the amount of currency traded. Some brokers use both these approaches.

Full access

There's no cut-off as to when you can and cannot trade. Because the market is open 24 hours a day, you can trade at any time of day. The exception is weekends, or when no global financial center is open due to a holiday.

Leverage

The forex market allows for leverage up to 50:1 in the U.S. And even higher in some parts of the world. That means a trader can open an account for $1,000 and buy or sell as much as $50,000 in currency, for example. Leverage is a double-edged sword; it magnifies both profits and losses.

Example of forex transactions

Assume a trader believes that the EUR will appreciate against the USD. Another way of thinking of it is that the USD will fall relative to the EUR.

They buy the EUR/USD at 1.2500 and purchase $5,000 worth of currency. Later that day the price has increased to 1.2550. The trader is up $25 (5000 * 0.0050). If the price dropped to 1.2430, the trader would be losing $35 (5000 * 0.0070).

Currency prices are constantly moving, so the trader may decide to hold the position overnight. The broker will rollover the position, resulting in a credit or debit based on the interest rate differential between the eurozone and the U.S. If the eurozone has an interest rate of 4% and the U.S. Has an interest rate of 3%, the trader owns the higher interest rate currency because they bought EUR. Therefore, at rollover, the trader should receive a small credit. If the EUR interest rate was lower than the USD rate then the trader would be debited at rollover.

Rollover can affect a trading decision, especially if the trade could be held for the long term. Large differences in interest rates can result in significant credits or debits each day, which can greatly enhance or erode the profits (or increase or reduce losses) of the trade.

Most brokers also provide leverage. Many brokers in the U.S. Provide leverage up to 50:1. Let's assume our trader uses 10:1 leverage on this transaction. If using 10:1 leverage the trader is not required to have $5,000 in their account, even though they are trading $5,000 worth of currency. They only need $500. As long as they have $500 and 10:1 leverage they can trade $5,000 worth of currency. If they utilize 20:1 leverage, they only need $250 in their account (because $250 * 20 = $5,000).

Making a profit of $25 quite quickly considering the trader only needs $500 or $250 in the capital (or even less if using more leverage), shows the power of leverage. The flip side is that if this trader only had $250 in their account and the trade went against them they could lose their capital quickly.

It is recommended traders manage their position size and control their risk so that no single trade results in a large loss.

Imarketslive – forex trading for everyone

60-80% of broker profit + weekly pay

Imarkets live is a sustainable long term investment. You have the chance to learn a lot about forex trading and to earn 30% return per month.

International markets live LTD (iml) is a company that has merged network marketing and trading into one platform.

IML was founded in the USA in 2013 and has enjoyed tremendous growth since then. Through the multi-year experience of the executives and the review by the financial market FDIC, the company has mastered all hurdles with top performance. The founder of imarketslive is one of the most experienced professionals, christopher terry. He has been a full-time trader since 1998 and has been working with the professional trader linda bradford raschke for several years.

Imarketslive and the broker hotforex

IML’s business model allows networkers and traders to use the products of imarketslive to independently learn how to trade, or to build a network and spread the products of imarketslive.

The company is already licensed in over 120 countries.

Before the question arises “how do they earn their money?”, the answer is: imarketslive has developed products that make trades much easier and finances itself.

Income opportunities

There are 2 ways to use imarketslive. Either as a customer or as a networker (IBO)

Customer

As a customer you have the possibility to choose one of two products:

Platinum package for the first time 195 dollar and then 145 dollar monthly.

- Harmonic scanner (https://youtu.Be/0gmic-gocqa) the market is scanned here 24/7 and analyzed in order to recognize a trend and thus to find the best possible trading possibility and thereby to achieve profits.

- IML academy – this is where A-Z explains how the game works and how it is handled (more than 200 videos are subdivided into the individual levels, from the beginner to the professional, everyone can still learn something about it)

- IML TV (here you can watch on working days how the professionals trade, why they do it etc. And you can of course do it all by yourself)

- Daily swing trades (here, the CEO christopher terry of imarketslive offers personal analysis, set ups and insight how he would do this).

Platinum package plus for the first time 235 dollars and then 185 dollars monthly.

Contains the following extras:

- Swipetrades (here you can get traffic signals directly to your mobile phone from the experts of imarketslive – thus without experience you can copy and paste the signals from the professionals)

- Fusion trader (here the auto trade makes up to 30% monthly)

In addition, you have the possibility to receive the products free of charge if you affiliate 2 other partners.

IMPORTANT: imarketslive does not manage the money invested for trading – it is created directly at hot-forex (broker) and thus your money is available at any time.

Networker (IBO)

As a networker (IBO), you have the possibility to build up a network and earn passive money.

- Through the building of a sales structure

- By the trading of your downline

My goal here is to build imarketslive with a 3×3 matrix so as not to lose unnecessarily commissions and to help other partners to earn money through the network.

Here ares the compensation plan of imarketslive:

Here is exactly explained how to get partner commissions.

Example 1:

if you affiliate 3 new partners with your personal link, you will be eligible for platinum 150 and receive $ 37.50 every friday on your paylution account. ($ 150 monthly)

Example 2:

if you affiliate 12 new partners (ie your 3 partners affiliate each 3 partners) you reach the platinum 600 rank and receive $ 150 every friday on your paylution account. ($ 600 monthly)

Example 3:

if you affiliate 30 new partners, you will be eligible for platinum 1000 and receive $ 250 every friday on your paylution account. ($ 1000 monthly)

As you can see, you must not only reach the number of partners, but also the persons you affiliate have to purchase one of the 2 products to count as a partner since the purchased packages are converted into points ($ 145 package brings 145 points)

The commissions here are automatically transferred to your paylution account every friday. No payment requests are necessary.

Income opportunity by trading of your team

Through a special broker deal with hot forex, we benefit from 2 levels of trading volume from our team.

This varies between 60-80% of broker profit depending on the team volume. Imarkets live earns nothing here since it is a pure product network. The capital lies at the broker and is completely independent of imarkets live which gives us again an additional security.

The registration at hot forex is completely independent from imarkets live. If you build your team with a 3×3 construct and you have partners further below you can put these people directly under yourself at hot forex. If someone is already registered at hot forex and trades there, the affiliate ID can be subsequently re-registered, which also gives us enormous advantages.

Profit, duration and costs

- The profit varies up to 30% a month.

- There are no costs for direct deposits to the broker hotforex!

- There is no duration limit, so the investment runs as long as you want. The investment is available at any time.

Deposits and withdrawals

As you’ve already read above, imarketslive’s commission is credited to a paylution account.

As soon as you have registered 3 partners, you will receive a link from imarketslive with the registration link from paylution, where a free registration is necessary to get commissions. The commissions can then be paid out from there.

Paylution is a virtual account where you can pay and transfer money or even withdraw with the prepaid card.

Of course, you can also transfer payments to your bank account. This takes a couple of days.

The payout is made weekly every friday on the paylution account.

The payout to bank account takes 2-3 working days longer.

Video review

Conclusion

Imarkets live is a sustainable long term investment. You have the chance to learn a lot about forex trading and to earn 30% return per month.

Best forex signals with E-mail, SMS mobile alerts, 97% accuracy!

Why use ace forex signals

Ace forex signals provides accurate BUY / SELL signals for most major and exotic pairs. We primarily base our calculations on “supply and demand” which is the most effective method of getting in the market. The same method is used by the world banks! Unlike many other forex signals providing services, we do not intend on charging high fees for our services. We want to make sure that you get more than what you paid for. We want to help you grow your account so you can make the money that you’ve been wanting. We provide all kinds of features when you sign up. Signals will be sent directly to your E-mail!

Accurate buy/sell signals

Get forex signals for major and exotic pairs. Gold and silver also!

Award-winning user experience

With the option of getting forex signals directly to your mobile phone as well as browser, we are #1!

Top performing

Grow your account balance with our high performance forex signals.

Forex (FX)

What is forex (FX)?

Forex (FX) refers to the marketplace where various currencies and currency derivatives are traded, as well as to the currencies and currency derivatives traded there. Forex is a portmanteau of "foreign exchange." the forex market is the largest, most liquid market in the world by trading volume, with trillions of dollars changing hands every day. It has no centralized location, rather the forex market is an electronic network of banks, brokers, institutions, and individual traders (mostly trading through brokers or banks).

Many entities, from financial institutions to individual investors, have currency needs, and may also speculate on the direction of the movement of a particular pair of currencies. They post their orders to buy and sell currencies on the network so they can interact with other currency orders from other parties.

The forex market is open 24 hours a day, five days a week, except for holidays. The forex market is open on many holidays on which stock markets are closed, though trading volume may be lower.

Key takeaways

- The forex market is a network of institutions, allowing for trading 24 hours a day, five days per week, with the exception of when all markets are closed because of a holiday.

- Retail traders can open a forex account and then buy and sell currencies. A profit or loss results from the difference in price the currency pair was bought and sold at.

- Forwards and futures are another way to participate in the forex market. Forwards are customizable with the currencies exchanged after expiry. Futures are not customizable and are more readily used by speculators, but the positions are often closed before expiry (to avoid settlement).

- The forex market is the largest financial market in the world.

- Retail traders typically don't want to have to deliver the full amount of currency they are trading. Instead, they want to profit on price differences in currencies over time. Because of this, brokers rollover positions each day.

Forex market basics

Forex pairs and quotes

When trading currencies, they are listed in pairs, such as USD/CAD, EUR/USD, or USD/JPY. These represent the U.S. Dollar (USD) versus the canadian dollar (CAD), the euro (EUR) versus the USD and the USD versus the japanese yen (JPY).

There will also be a price associated with each pair, such as 1.2569. If this price was associated with the USD/CAD pair it means that it costs 1.2569 CAD to buy one USD. If the price increases to 1.3336, then it now costs 1.3336 CAD to buy one USD. The USD has increased in value (CAD decrease) because it now costs more CAD to buy one USD.

Forex lots

In the forex market currencies trade in lots, called micro, mini, and standard lots. A micro lot is 1000 worth of a given currency, a mini lot is 10,000, and a standard lot is 100,000. This is different than when you go to a bank and want $450 exchanged for your trip. When trading in the electronic forex market, trades take place in set blocks of currency, and you can trade with whatever size you want within the limits allowed by your trading account balance. For example, you can trade seven micro lots (7,000) or three mini lots (30,000) or 75 standard lots (750,000), for example.

How large is the forex?

The forex market is unique for several reasons, mainly because of its size. Trading volume is generally very large. As an example, trading in foreign exchange markets averaged $6.6 trillion per day in april 2019, according to the bank for international settlements.

The largest foreign exchange markets are located in major global financial centers like london, new york, singapore, tokyo, frankfurt, hong kong, and sydney.

How to trade in the forex

The forex market is open 24 hours a day, five days a week across major financial centers across the globe. This means that you can buy or sell currencies at any time during the week.

From a historical standpoint, foreign exchange trading was largely limited to governments, large companies, and hedge funds. But in today's world, trading currencies is as easy as a click of a mouse. Accessibility is not an issue, which means anyone can do it. Many investment firms, banks, and retail forex brokers offer the chance for individuals to open accounts and to trade currencies.

When trading in the forex market, you're buying or selling the currency of a particular country, relative to another currency. But there's no physical exchange of money from one party to another. That's what happens at a foreign exchange kiosk—think of a tourist visiting times square in new york city from japan. He may be converting his physical yen to actual U.S. Dollar cash (and may be charged a commission fee to do so) so he can spend his money while he's traveling. But in the world of electronic markets, traders are usually taking a position in a specific currency, with the hope that there will be some upward movement and strength in the currency they're buying (or weakness if they're selling) so they can make a profit.

A currency is always traded relative to another currency. If you sell a currency, you are buying another, and if you buy a currency you are selling another. In the electronic trading world, a profit is made on the difference between your transaction prices.

Spot transactions

A spot market deal is for immediate delivery, which is defined as two business days for most currency pairs. The major exception is the purchase or sale of USD/CAD, which is settled in one business day. The business day calculation excludes saturdays, sundays, and legal holidays in either currency of the traded pair. During the christmas and easter season, some spot trades can take as long as six days to settle. Funds are exchanged on the settlement date, not the transaction date.

The U.S. Dollar is the most actively traded currency. The euro is the most actively traded counter currency, followed by the japanese yen, british pound and swiss franc.

Market moves are driven by a combination of speculation, economic strength and growth, and interest rate differentials.

Forex (FX) rollover

Retail traders don't typically want to take delivery of the currencies they buy. They are only interested in profiting on the difference between their transaction prices. Because of this, most retail brokers will automatically "rollover" currency positions at 5 p.M. EST each day.

The broker basically resets the positions and provides either a credit or debit for the interest rate differential between the two currencies in the pairs being held. The trade carries on and the trader doesn't need to deliver or settle the transaction. When the trade is closed the trader realizes their profit or loss based on their original transaction price and the price they closed the trade at. The rollover credits or debits could either add to this gain or detract from it.

Since the fx market is closed on saturday and sunday, the interest rate credit or debit from these days is applied on wednesday. Therefore, holding a position at 5 p.M. On wednesday will result in being credited or debited triple the usual amount.

Forex forward transactions

Any forex transaction that settles for a date later than spot is considered a "forward." the price is calculated by adjusting the spot rate to account for the difference in interest rates between the two currencies. The amount of adjustment is called "forward points." the forward points reflect only the interest rate differential between two markets. They are not a forecast of how the spot market will trade at a date in the future.

A forward is a tailor-made contract: it can be for any amount of money and can settle on any date that's not a weekend or holiday. As in a spot transaction, funds are exchanged on the settlement date.

Forex (FX) futures

A forex or currency futures contract is an agreement between two parties to deliver a set amount of currency at a set date, called the expiry, in the future. Futures contracts are traded on an exchange for set values of currency and with set expiry dates. Unlike a forward, the terms of a futures contract are non-negotiable. A profit is made on the difference between the prices the contract was bought and sold at. Most speculators don't hold futures contracts until expiration, as that would require they deliver/settle the currency the contract represents. Instead, speculators buy and sell the contracts prior to expiration, realizing their profits or losses on their transactions.

Forex market differences

There are some major differences between the forex and other markets.

Fewer rules

This means investors aren't held to as strict standards or regulations as those in the stock, futures or options markets. There are no clearing houses and no central bodies that oversee the entire forex market. You can short-sell at any time because in forex you aren't ever actually shorting; if you sell one currency you are buying another.

Fees and commissions

Since the market is unregulated, how brokers charge fees and commissions will vary. Most forex brokers make money by marking up the spread on currency pairs. Others make money by charging a commission, which fluctuates based on the amount of currency traded. Some brokers use both these approaches.

Full access

There's no cut-off as to when you can and cannot trade. Because the market is open 24 hours a day, you can trade at any time of day. The exception is weekends, or when no global financial center is open due to a holiday.

Leverage

The forex market allows for leverage up to 50:1 in the U.S. And even higher in some parts of the world. That means a trader can open an account for $1,000 and buy or sell as much as $50,000 in currency, for example. Leverage is a double-edged sword; it magnifies both profits and losses.

Example of forex transactions

Assume a trader believes that the EUR will appreciate against the USD. Another way of thinking of it is that the USD will fall relative to the EUR.

They buy the EUR/USD at 1.2500 and purchase $5,000 worth of currency. Later that day the price has increased to 1.2550. The trader is up $25 (5000 * 0.0050). If the price dropped to 1.2430, the trader would be losing $35 (5000 * 0.0070).

Currency prices are constantly moving, so the trader may decide to hold the position overnight. The broker will rollover the position, resulting in a credit or debit based on the interest rate differential between the eurozone and the U.S. If the eurozone has an interest rate of 4% and the U.S. Has an interest rate of 3%, the trader owns the higher interest rate currency because they bought EUR. Therefore, at rollover, the trader should receive a small credit. If the EUR interest rate was lower than the USD rate then the trader would be debited at rollover.

Rollover can affect a trading decision, especially if the trade could be held for the long term. Large differences in interest rates can result in significant credits or debits each day, which can greatly enhance or erode the profits (or increase or reduce losses) of the trade.

Most brokers also provide leverage. Many brokers in the U.S. Provide leverage up to 50:1. Let's assume our trader uses 10:1 leverage on this transaction. If using 10:1 leverage the trader is not required to have $5,000 in their account, even though they are trading $5,000 worth of currency. They only need $500. As long as they have $500 and 10:1 leverage they can trade $5,000 worth of currency. If they utilize 20:1 leverage, they only need $250 in their account (because $250 * 20 = $5,000).

Making a profit of $25 quite quickly considering the trader only needs $500 or $250 in the capital (or even less if using more leverage), shows the power of leverage. The flip side is that if this trader only had $250 in their account and the trade went against them they could lose their capital quickly.

It is recommended traders manage their position size and control their risk so that no single trade results in a large loss.

Forex trading: A beginner's guide

Forex is a portmanteau of foreign currency and exchange. Foreign exchange is the process of changing one currency into another currency for a variety of reasons, usually for commerce, trading, or tourism. According to a recent triennial report from the bank for international settlements (a global bank for national central banks), the average was more than $5.1 trillion in daily forex trading volume.

Key takeaways

- The foreign exchange (also known as FX or forex) market is a global marketplace for exchanging national currencies against one another.

- Because of the worldwide reach of trade, commerce, and finance, forex markets tend to be the largest and most liquid asset markets in the world.

- Currencies trade against each other as exchange rate pairs. For example, EUR/USD.

- Forex markets exist as spot (cash) markets as well as derivatives markets offering forwards, futures, options, and currency swaps.

- Market participants use forex to hedge against international currency and interest rate risk, to speculate on geopolitical events, and to diversify portfolios, among several other reasons.

What is the forex market?

The foreign exchange market is where currencies are traded. Currencies are important to most people around the world, whether they realize it or not, because currencies need to be exchanged in order to conduct foreign trade and business. If you are living in the U.S. And want to buy cheese from france, either you or the company that you buy the cheese from has to pay the french for the cheese in euros (EUR). This means that the U.S. Importer would have to exchange the equivalent value of U.S. Dollars (USD) into euros. The same goes for traveling. A french tourist in egypt can't pay in euros to see the pyramids because it's not the locally accepted currency. As such, the tourist has to exchange the euros for the local currency, in this case the egyptian pound, at the current exchange rate.

One unique aspect of this international market is that there is no central marketplace for foreign exchange. Rather, currency trading is conducted electronically over-the-counter (OTC), which means that all transactions occur via computer networks between traders around the world, rather than on one centralized exchange. The market is open 24 hours a day, five and a half days a week, and currencies are traded worldwide in the major financial centers of london, new york, tokyo, zurich, frankfurt, hong kong, singapore, paris and sydney—across almost every time zone. This means that when the trading day in the U.S. Ends, the forex market begins anew in tokyo and hong kong. As such, the forex market can be extremely active any time of the day, with price quotes changing constantly.

A brief history of forex

Unlike stock markets, which can trace their roots back centuries, the forex market as we understand it today is a truly new market. Of course, in its most basic sense—that of people converting one currency to another for financial advantage—forex has been around since nations began minting currencies. But the modern forex markets are a modern invention. After the accord at bretton woods in 1971, more major currencies were allowed to float freely against one another. The values of individual currencies vary, which has given rise to the need for foreign exchange services and trading.

Commercial and investment banks conduct most of the trading in the forex markets on behalf of their clients, but there are also speculative opportunities for trading one currency against another for professional and individual investors.

Spot market and the forwards & futures markets

There are actually three ways that institutions, corporations and individuals trade forex: the spot market, the forwards market, and the futures market. Forex trading in the spot market has always been the largest market because it is the "underlying" real asset that the forwards and futures markets are based on. In the past, the futures market was the most popular venue for traders because it was available to individual investors for a longer period of time. However, with the advent of electronic trading and numerous forex brokers, the spot market has witnessed a huge surge in activity and now surpasses the futures market as the preferred trading market for individual investors and speculators. When people refer to the forex market, they usually are referring to the spot market. The forwards and futures markets tend to be more popular with companies that need to hedge their foreign exchange risks out to a specific date in the future.

More specifically, the spot market is where currencies are bought and sold according to the current price. That price, determined by supply and demand, is a reflection of many things, including current interest rates, economic performance, sentiment towards ongoing political situations (both locally and internationally), as well as the perception of the future performance of one currency against another. When a deal is finalized, this is known as a "spot deal." it is a bilateral transaction by which one party delivers an agreed-upon currency amount to the counter party and receives a specified amount of another currency at the agreed-upon exchange rate value. After a position is closed, the settlement is in cash. Although the spot market is commonly known as one that deals with transactions in the present (rather than the future), these trades actually take two days for settlement.

Unlike the spot market, the forwards and futures markets do not trade actual currencies. Instead they deal in contracts that represent claims to a certain currency type, a specific price per unit and a future date for settlement.

In the forwards market, contracts are bought and sold OTC between two parties, who determine the terms of the agreement between themselves.

In the futures market, futures contracts are bought and sold based upon a standard size and settlement date on public commodities markets, such as the chicago mercantile exchange. In the U.S., the national futures association regulates the futures market. Futures contracts have specific details, including the number of units being traded, delivery and settlement dates, and minimum price increments that cannot be customized. The exchange acts as a counterpart to the trader, providing clearance and settlement.

Both types of contracts are binding and are typically settled for cash at the exchange in question upon expiry, although contracts can also be bought and sold before they expire. The forwards and futures markets can offer protection against risk when trading currencies. Usually, big international corporations use these markets in order to hedge against future exchange rate fluctuations, but speculators take part in these markets as well.

Note that you'll often see the terms: FX, forex, foreign-exchange market, and currency market. These terms are synonymous and all refer to the forex market.

Forex for hedging

Companies doing business in foreign countries are at risk due to fluctuations in currency values when they buy or sell goods and services outside of their domestic market. Foreign exchange markets provide a way to hedge currency risk by fixing a rate at which the transaction will be completed.

To accomplish this, a trader can buy or sell currencies in the forward or swap markets in advance, which locks in an exchange rate. For example, imagine that a company plans to sell U.S.-made blenders in europe when the exchange rate between the euro and the dollar (EUR/USD) is €1 to $1 at parity.

The blender costs $100 to manufacture, and the U.S. Firm plans to sell it for €150—which is competitive with other blenders that were made in europe. If this plan is successful, the company will make $50 in profit because the EUR/USD exchange rate is even. Unfortunately, the USD begins to rise in value versus the euro until the EUR/USD exchange rate is 0.80, which means it now costs $0.80 to buy €1.00.

The problem the company faces is that while it still costs $100 to make the blender, the company can only sell the product at the competitive price of €150, which when translated back into dollars is only $120 (€150 X 0.80 = $120). A stronger dollar resulted in a much smaller profit than expected.

The blender company could have reduced this risk by shorting the euro and buying the USD when they were at parity. That way, if the dollar rose in value, the profits from the trade would offset the reduced profit from the sale of blenders. If the USD fell in value, the more favorable exchange rate will increase the profit from the sale of blenders, which offsets the losses in the trade.

Hedging of this kind can be done in the currency futures market. The advantage for the trader is that futures contracts are standardized and cleared by a central authority. However, currency futures may be less liquid than the forward markets, which are decentralized and exist within the interbank system throughout the world.

Forex for speculation

Factors like interest rates, trade flows, tourism, economic strength, and geopolitical risk affect supply and demand for currencies, which creates daily volatility in the forex markets. An opportunity exists to profit from changes that may increase or reduce one currency's value compared to another. A forecast that one currency will weaken is essentially the same as assuming that the other currency in the pair will strengthen because currencies are traded as pairs.

Imagine a trader who expects interest rates to rise in the U.S. Compared to australia while the exchange rate between the two currencies (AUD/USD) is 0.71 (it takes $0.71 USD to buy $1.00 AUD). The trader believes higher interest rates in the U.S. Will increase demand for USD, and therefore the AUD/USD exchange rate will fall because it will require fewer, stronger USD to buy an AUD.

Assume that the trader is correct and interest rates rise, which decreases the AUD/USD exchange rate to 0.50. This means that it requires $0.50 USD to buy $1.00 AUD. If the investor had shorted the AUD and went long the USD, he or she would have profited from the change in value.

Currency as an asset class

There are two distinct features to currencies as an asset class:

- You can earn the interest rate differential between two currencies.

- You can profit from changes in the exchange rate.

An investor can profit from the difference between two interest rates in two different economies by buying the currency with the higher interest rate and shorting the currency with the lower interest rate. Prior to the 2008 financial crisis, it was very common to short the japanese yen (JPY) and buy british pounds (GBP) because the interest rate differential was very large. This strategy is sometimes referred to as a "carry trade."

Why we can trade currencies

Currency trading was very difficult for individual investors prior to the internet. Most currency traders were large multinational corporations, hedge funds or high-net-worth individuals because forex trading required a lot of capital. With help from the internet, a retail market aimed at individual traders has emerged, providing easy access to the foreign exchange markets, either through the banks themselves or brokers making a secondary market. Most online brokers or dealers offer very high leverage to individual traders who can control a large trade with a small account balance.

Forex trading: A beginner’s guide

Forex trading risks

Trading currencies can be risky and complex. The interbank market has varying degrees of regulation, and forex instruments are not standardized. In some parts of the world, forex trading is almost completely unregulated.

The interbank market is made up of banks trading with each other around the world. The banks themselves have to determine and accept sovereign risk and credit risk, and they have established internal processes to keep themselves as safe as possible. Regulations like this are industry-imposed for the protection of each participating bank.

Since the market is made by each of the participating banks providing offers and bids for a particular currency, the market pricing mechanism is based on supply and demand. Because there are such large trade flows within the system, it is difficult for rogue traders to influence the price of a currency. This system helps create transparency in the market for investors with access to interbank dealing.

Most small retail traders trade with relatively small and semi-unregulated forex brokers/dealers, which can (and sometimes do) re-quote prices and even trade against their own customers. Depending on where the dealer exists, there may be some government and industry regulation, but those safeguards are inconsistent around the globe.

Most retail investors should spend time investigating a forex dealer to find out whether it is regulated in the U.S. Or the U.K. (dealers in the U.S. And U.K. Have more oversight) or in a country with lax rules and oversight. It is also a good idea to find out what kind of account protections are available in case of a market crisis, or if a dealer becomes insolvent.

Pros and challenges of trading forex

Pro: the forex markets are the largest in terms of daily trading volume in the world and therefore offer the most liquidity. this makes it easy to enter and exit a position in any of the major currencies within a fraction of a second for a small spread in most market conditions.

Challenge: banks, brokers, and dealers in the forex markets allow a high amount of leverage, which means that traders can control large positions with relatively little money of their own. Leverage in the range of 100:1 is a high ratio but not uncommon in forex. A trader must understand the use of leverage and the risks that leverage introduces in an account. Extreme amounts of leverage have led to many dealers becoming insolvent unexpectedly.

Pro: the forex market is traded 24 hours a day, five days a week—starting each day in australia and ending in new york. The major centers are sydney, hong kong, singapore, tokyo, frankfurt, paris, london, and new york.

Challenge: trading currencies productively requires an understanding of economic fundamentals and indicators. A currency trader needs to have a big-picture understanding of the economies of the various countries and their inter-connectedness to grasp the fundamentals that drive currency values.

The bottom line

For traders—especially those with limited funds—day trading or swing trading in small amounts is easier in the forex market than other markets. For those with longer-term horizons and larger funds, long-term fundamentals-based trading or a carry trade can be profitable. A focus on understanding the macroeconomic fundamentals driving currency values and experience with technical analysis may help new forex traders to become more profitable.

Imarketslive bussiness opportunity – forex trading and network marketing

What would be your reaction/options if be it that a business idea that can be life changing is presented to you? Would you be among the few that takes the opportunity and make it a reality, or you would be among the masses that would ignore it with negative perceptions of what if this happens and what if that happens?

Have you ever thought about finding a way to earn part-time or full time to supplement your income? Do you keep your options open when it comes to earning income? Are you a network marketer that would want to build your team and stream of income from a reliable business?

Well if you answered “YES” to any of the above questions, then I believe this business opportunity will be a fit for you. Let me not waste time beating around the bush and let’s get to the main deal but before then, let me give you a hint on all what this is about in order to have a great interest in it. This writeup concerns a business opportunity that brings all the means of making money in the 21 st century under one company called iml – international markets live.

What is imarketslive?

Imarketslive is a first-class forex education academy that teaches and exposes its customers to the skills and materials needed to trade currencies in the worlds biggest financial market (i.E. Forex market). The world of forex is the biggest market in the world where over $5.3 trillion is traded averagely per a single day. This market is made up of banks, hedge-funds and few individuals that have the knowledge in trading in this market. The good news is, you can also participate in this market and get a share of the trillion of dollars that exchanges hands between brokers, banks and few individuals. This is where iml comes in to teach you how to trade in this market and make a fortune out of it. “until you learn the required skill, you would probably be gambling and losing your money out there.”

You will be intrigued to know that christopher terry the founder and CEO of imarketslive is a multiple 8 figure trader and has been trading and educating masses in the forex, futures, and equity markets since 1994. Chris who is termed one of the god in the forex market has been a headline speaker at the major derivative conferences, has been mentioned in several books and written many magazine articles. Imarketslive was officially established on july 4 th , 2013. Without getting out of context, I would simply conclude that the team behind imarketslive consist of great and top notches in the forex market that you can count on.

Imarketslive products and services.

International markets live offers the following to its client.

- IML academy: that is step by step education on how to become a professional forex trader. The school starts from basic 1 to advanced with over 60 videos to learn from expert traders.

- IML TV: to increase your chances of success, we operate a live tv sessions where students can follow master traders and see how they trade. The tv session is over 120 hours per week and its always a live session. Finally, all live trading sessions are recorded for students to learn from in case they miss the live sessions (IML TV LIVE RECORDIN

- The harmonic scanner: this is a robot that assist beginners to read the market. It scans the markets to provide you with all information needed to enter a trade and make profit. It is a privately-owned software of IML and it has a high accuracy confirmation of (98%)

- The web analyzer: this is also a robot that scans the cryptocurrency markets. It is built and maintained by in-house programming team. It sends precise trade setups to users to help them maximized profit.

- The swing trades: this is weekly trading experience with the CEO christopher terry

- The swipe trades: you receive trade alerts on your smart phone and all you you do is to copy and paste. You don’t need any trading experience to succeed with swipe trade. It is meant to supplement your income without changing your day to day routine.

With all these skills and products available, you can earn $100+ in a day based on how well you learn from the study materials and apply the skills.

In a nutshell, imarketslive exposes you to all the means of making money in the 21 st century on your own. These are some of the aspect that iml helps you to earn from.

- Forex trading

- Network marketing

- Binary options

- Crypto mining (buying hash rates or a part of their horse power and you just relax and earn.)

Iml NETWORK MARKETING.

Imarketslive went ahead to bundle their products/services with a network marketing compensation plan that allows its IBO’s (independent business owner) to earn a generous income by simply sharing their services or the business idea with others and building a residual income by building a network of IBO’s and customers.

I’ve been a network marketer in a few companies and I have never come across one with the best network marketing system com-plan that pays off than iml. IML “business building” opportunity alone can transform your financial life in a short time and make you fabulously rich.

Network marketing is all about recommending people to get the best solution to whatever they want. So why not recommend the services you get from joining iml to your friends, family and everyone and transfer that zeal into a great fortune.

IML says that we are a school and we want people to patronage our services. We can engage all forms of media platforms to get students to enroll into our academy as we pay this media houses or firms a very huge amount of money but no.

We love our students, so we will rather engage them to invite people or recommend IML academy for others to join and learn to trade on the forex market and we will pay anybody who is able to sign off people into our academy a very rewarding amount.

So how do they pay you for just recommending people to join?

For every personally enrolled, you will earn GH¢168 as fast start. This is your direct reward for bringing a person into the business.

When you are able to bring three people, you now qualify for the first level residual income…. Which is called P150 (platinum 150). GH¢720. This means that as long as this three people are active in the academy, you will be paid GH¢720 every month. This is the beginning of your business building earnings.

The second level is to teach this three people to also do what you did to qualify to p150 then you will have a team member of 12people. As soon as your downlines grows to 12 people, they will increase your monthly residual income to GH¢3,000 which means you have qualified as a business builder level 2 in IML (P600). The good thing is you only need to get the three people and you teach them or you help them to also get their three and then the cycle follows.

The rest of the com plan is tabled below

This is not all, there are other levels and a one-time payment or gift given to customers when they hit a certain rank. These includes sponsored trips to dubai and other countries. Good for network marketers huh.

REQUIREMENTS IN BEING A PART OF iml.

All you need to be part of this amazing opportunity is your willingness, commitment and readiness to obey simple instructions and principles of the business.

To be part of this academy, all you need to do is to make a onetime payment of $217 which is approximately GH₵1050 and a monthly membership fee.

If you are really don’t take advantage of this opportunity, then I don’t know what else you are waiting for. If we can pay thousands of cedis for first degree and earn at most GH¢1000 monthly and GH¢ 12000year and we are happy to do so then it shouldn’t be a problem to pay GH¢1100 to register into IML and earn this GH¢12000 in less than 3months.

CONCLUSION.

Let me boost your interest and spirit with these network marketing quotes.

Robert kiyosaki says, “the richest people in the world look for and build networks, everyone else looks for work.”

“if you want to go somewhere, it is best to find someone who has already been there.” –robert kiyosaki

“it’s all about people. It’s about networking and being nice to people and not burning any bridges.” –mike davidson

Money is actually a seed and in order to multiply it, you have to plant it by investing it.

Why not seize this opportunity to join us now and turn your phone or device into an ATM machine? I personally can testify that the education I have gone through so far has helped simplified the forex market for me and thus I have learnt to leverage and manage my earnings. The network marketing has as well been my greatest source of income thus the reason why I’m doing all it takes to build a strong team. Iml is keen in helping you to succeed at all cost. No time to waste, join us now.

To fully understand this business, you can follow this link http://imlpresentation.Com/ to watch the video presentation on both the forex trade and the network marketing aspect.

Feel free to contact me for financial help and guidelines in joining IML.

Contact: +233 0266100063 ; +233556729640

You can directly connect with me on whatsapp through this link.

IML – your phone your ATM

In IML, we say “everybody eats.

Forex p150

Scalping adalah salah satu strategi perdagangan yang populer di pasar valuta asing. Banyak trader menggunakan ini sebagai metode utama dalam perdagangan mereka. Dengan scalping, anda menggunakan metode jangka pendek. Anda masuk market dengan cepat dan keluar dengan cepat pula. Misal anda open posisi gold, lalu dalam satu jam order anda sudah profit 30-40 pips dan anda langsung close posisi keluar market.

Apa itu hedging ?

Metode trading dimana kita melakukan buy tapi juga melakukan sell saat open posisi. Begitu pula sebaliknya. Hedging biasanya dilakukan ketika posisi yang kita buka mengalami kerugian. Supaya kerugian tidak menjadi lebih besar, kita kunci dengan teknik hedging ini. Sehingga selanjutnya hedging ini dikenal juga dengan istilah locking ( mengunci), karena saat kita menggunakan teknik hedging ini posisi kita terkunci yang membuat nilai keuntungan dan kerugian selalu bergerak beriringan.

Apa itu requote ?

Requote adalah keadaan dimana ketika kita melakukan eksekusi order pada harga tertentu, namun broker merespon permintaan transaksi kita tersebut dengan quote harga yang berbeda.

Jeda waktu (delay) dalam esekusi market yangg tidak sesuai dengan harga yg diinginkan. Misal BUY GBP/USD, anda ingin di harga 1.5357 ternyata saat anda order, harga tiba-tiba berubah menjadi 1.5365.

Apa itu swap

Swap adalah biaya inap / bunga inap; apabila trader masih ada posisi floating sedangkan telah melewati satu hari trading, maka akan dikenakan biaya inap/swap.

APA MANFAATNYA BAGI TRADER DENGAN ADANYA SWAP ITU ?

- Jika trader ingin mencapai suatu harga tertentu tapi harga tersebut belum mencapai seperti yang diinginkan, maka trader akan "membiarkan" transaksi tersebut dan t idak menutupnya hingga lewat hari, hingga pasar tutup dan buka kembali di keesokan harinya. Hal ini disebut sebagai "menginapkan transaksi" hingga dapat tercapai take profit seperti yang diinginkan.

BERAPA BESARAN BIAYA SWAP ?

- Tergantung ketentuan setiap broker, ada yang fix swap, free swap & fluktuative

APA MAKSUD DARI FREE SWEAP, FIX SWAP & FLUKTUATIVE SWAP

- Free swap berarti trader tidak dikenakan biaya inap

- Fix swap berarti pihak broker sudah menentukan kisaran biaya inap untuk keseluruhan pair

- Fluktuative swap berarti pihak broker mengeluarkan tarif biaya inap yang berbeda-beda tergantung pada setiap pair

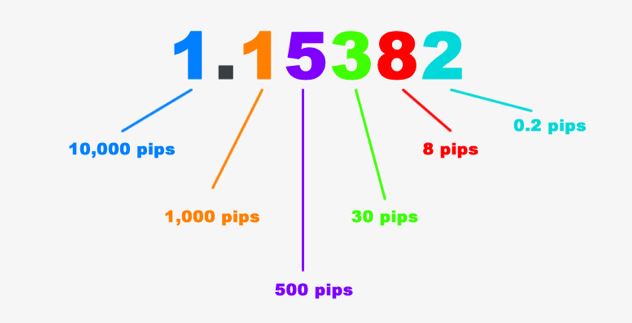

Apa itu PIPS ?

Pips adalah singkatan dari price interest points, yang merupakan unit satuan untuk mengukur perubahan nilai tukar antara dua mata uang atau pair. Saat anda mengambil posisi, pips digunakan sebagai penunjuk profit atau loss anda.

BAGAIMANA CARA MENGHITUNG NYA ?

- Sebelum menghitung pips, anda harus terlebih dahulu jumlah digit dari nilai sebuat pair. Ada yang terdiri dari 5 digit angka, ada yang 6 digit angka.

- Digit kedua dari ujung kanan, adalah pipsnya. Dan bentuknya adalah satuan. Semakin kekiri, maka semakin besar jumlah pipsnya (puluhan ratusan ribuan)

KITA AMBIL CONTOH

- EUR/USO buy di 1.07710, close di 1.07770 = 7-1 = 6 pips

- AUD/CAD buy di 0.99632, close di 0.99820 = 82 - 63 = 19 pips, perhatikan angka kedepannya juga berbeda, itu berarti pergerakan telah mencapai puluhan.

- XAU/USD buy di 1212.10, close di 1212.61 = 6 - 1 = 5 pips

- AUD/ JPY buy di 86.020, close di 86.440 = 44 - 2 = 42 pips

- CAD/JPY buy di 86.355 close di 86.748 = 74 - 35 = 39 pips

Apakah arti leverage ?

Leverage adalah pinjaman dari broker yang diberikan kepada trader, sehingga dana yang dimiliki trader memiliki daya beli yang lebih besar. Leverage dituliskan dalam rasio perbandingan, misal 1:1, 1:100, 1:500, dan sebagainya. Artinya, kalau dana anda $100 jika menggunakan leverage 1:100 maka $100 tersebut memiliki kekuatan 100 kali lipatnya setara $10.000.

Kenapa harus ada leverage ?

Minimum dana yang dibutuhkan untuk open posisi 1 lot dalam market global sangat besar ($100,000). Dengan adanya leverage, dana kita dapat diungkit menjadi lebih besar. Apa manfaatnya bagi trader ? Sehingga trader dapat trading dengan modal yang lebih kecil di market. Namun di sisi lain, leverage yang semakin tinggi juga membawa resiko kerugian yang semakin besar. Karena semakin besar lot yang kita gunakan dalam membuka posisi dengan deposit yang kecil, maka ketahanan akun akan semakin kecil.

Leverage dalam perdagangan berjangka 1:100, 1:200, 1:500, 1:1000

Lalu apa maksud dari 1:100, 1:200, 1:500, 1:1000?

Agar dapat trading 1 lot, kita membutuhkan dana $100,000. Dengan adanya leverage 1:100, maka dana yang kita sediakan hanya 1/100 nya saja. $100,000 : 100 = $1000.

Dengan demikian, semakin besar leveragenya maka semakin kecil dana / modal yg dibutuhkan untuk trading begitu pula sebaliknya.

Apa itu lot ?

-lot adalah satuan hitung, dimana satuan hitung ini seringkali ditemukan di financial market (pasar saharn dan pasar futures).

- dalam trading futures, lot adalah satuan hitung / kontrak trading. Dalam analogi sederhana, lot bisa disarnakan

seperti kilo gram saat kita mernbeli beras.

- dalarn trading futures, 1 lot adalah $100,000. Ada rnernbutuhkan dana $100,000 untuk mernbeli 1 lot

Apa itu komoditas ?

Komoditas adalah barang dasar yang digunakan dalam perdagangan yang dapat dipertukarkan dengan barang lain dari jenis yang sama. Komoditas paling sering digunakan sebagai input dalam produksi barang atau jasa lain. Kualitas komoditas yang diberikan mungkin sedikit berbeda, tetapi pada dasarnya seragam di seluruh produsen.

Ketika mereka diperdagangkan di bursa, komoditas juga harus memenuhi standar minimum yang ditentukan, juga dikenal sebagai grade dasar. Mereka cenderung berubah dengan cepat dari tahun ke tahun.

Memahami komoditas

ide dasarnya adalah bahwa ada sedikit perbedaan antara komoditas yang berasal dari satu produsen dan komoditas yang sama dari produsen lain. Satu barel minyak pada dasarnya adalah produk yang sama, terlepas dari produsennya.

Sebaliknya, untuk barang elektronik, kualitas dan fitur produk yang diberikan mungkin sangat berbeda tergantung pada produsen. Beberapa contoh komoditas tradisional meliputi:

- Biji-bijian

- Emas

- Daging sapi

- Minyak

- Gas alam

Baru-baru ini, definisi tersebut telah diperluas untuk memasukkan produk-produk keuangan, seperti mata uang asing dan indeks. Kemajuan teknologi juga menyebabkan jenis komoditas baru dipertukarkan di pasar. Misalnya, menit dan bandwidth ponsel.

PEMBELI DAN PRODUSEN KOMODITAS

Penjualan dan pembelian komoditas biasanya dilakukan melalui kontrak berjangka di bursa yang menstandarisasi jumlah dan kualitas minimum komoditas yang diperdagangkan. Sebagai contoh, dewan perdagangan chicago menetapkan bahwa satu kontrak gandum untuk 5.000 gantang dan menyatakan berapa kadar gandum yang dapat digunakan untuk memenuhi kontrak.

Ada dua jenis pedagang yang berdagang komoditas berjangka. Yang pertama adalah pembeli dan produsen komoditas yang menggunakan kontrak berjangka komoditas untuk tujuan lindung nilai yang semula dimaksudkan. Pedagang ini melakukan atau menerima pengiriman komoditas aktual ketika kontrak berjangka berakhir. Misalnya, petani gandum yang menanam tanaman dapat melakukan lindung nilai terhadap risiko kehilangan uang jika harga gandum jatuh sebelum panen. Petani dapat menjual kontrak berjangka gandum ketika tanaman ditanam dan menjamin harga gandum yang telah ditentukan pada saat panen.

SPEKULAN KOMODITAS

Pedagang komoditas jenis kedua adalah spekulan. Ini adalah pedagang yang berdagang di pasar komoditas dengan tujuan semata-mata mengambil untung dari pergerakan harga yang fluktuatif. Pedagang ini tidak pernah berniat untuk membuat atau menerima pengiriman komoditas aktual ketika kontrak berjangka berakhir.

Banyak pasar berjangka sangat likuid dan memiliki tingkat jangkauan dan volatilitas harian yang tinggi, menjadikannya pasar yang sangat menggoda bagi para pedagang intraday. Banyak indeks berjangka digunakan oleh broker dan manajer portofolio untuk mengimbangi risiko. Juga, karena komoditas biasanya tidak berdampingan dengan pasar ekuitas dan obligasi, beberapa komoditas juga dapat digunakan secara efektif untuk mendiversifikasi portofolio investasi.

KOMODITAS SEBAGAI HEDGE UNTUK INFLASI

Harga komoditas biasanya naik ketika inflasi meningkat, itulah sebabnya investor sering berbondong-bondong ke sana untuk melindungi mereka selama masa kenaikan inflasi — khususnya inflasi yang tidak terduga. Ketika permintaan barang dan jasa meningkat, harga barang dan jasa naik, dan komoditas adalah apa yang digunakan untuk memproduksi barang dan jasa itu. Karena harga komoditas sering naik dengan inflasi, kelas aset ini sering dapat berfungsi sebagai lindung nilai terhadap penurunan daya beli mata uang.

Bagaimana perhitungannya profit dan lossnya ?

Keuntungan dalam trading forex muncul dari selisih harga jual dan harga beli (sama seperti bisnis jual beli pada

umumnya).

Misalkan, saat ini kurs atau harga USD/IDR = 13.000 yang artinya anda bisa membeli 1 USO dengan menukarkan

20 bagaimana perhitungannya profit dan lossnya ? 13.000 rupiah. Sebagai contoh, saat ini kita membeli sebanyak $1 dengan mengeluarkan rp 13.000, sehingga kini

kita memegang uang dollar sebanyak $1. Selang waktu 1 hari, ternyata harga USD/IDR naik menjadi rp 13.010 yang

artinya nilai $1 = rp 13.010

melihat harga dollar yang naik itu akhirnya kita jual $1 yang kita pegang itu sehingga kita mendapatkan rp 13.010.

Maka keuntungan kita adalah $10 (rpl3.010-rpl3.000)

Apa saja syarat buat masuk ke perdagangannya ?

Dengan mengikuti syarat dan ketentuan yang telah ditetapkan oleh broker seperti membuka akun trading di broker

yang telah anda pllih lalu melakukan deposit dana untuk modal trading.

Biasanya syarat membuka akun trading:

1. KTP, email, nomor telpon, dan nomor rekening.

2. Deposit dengan dana minimal sesuai ketentuan broker

Imarketslive bussiness opportunity – forex trading and network marketing

What would be your reaction/options if be it that a business idea that can be life changing is presented to you? Would you be among the few that takes the opportunity and make it a reality, or you would be among the masses that would ignore it with negative perceptions of what if this happens and what if that happens?

Have you ever thought about finding a way to earn part-time or full time to supplement your income? Do you keep your options open when it comes to earning income? Are you a network marketer that would want to build your team and stream of income from a reliable business?

Well if you answered “YES” to any of the above questions, then I believe this business opportunity will be a fit for you. Let me not waste time beating around the bush and let’s get to the main deal but before then, let me give you a hint on all what this is about in order to have a great interest in it. This writeup concerns a business opportunity that brings all the means of making money in the 21 st century under one company called iml – international markets live.

What is imarketslive?

Imarketslive is a first-class forex education academy that teaches and exposes its customers to the skills and materials needed to trade currencies in the worlds biggest financial market (i.E. Forex market). The world of forex is the biggest market in the world where over $5.3 trillion is traded averagely per a single day. This market is made up of banks, hedge-funds and few individuals that have the knowledge in trading in this market. The good news is, you can also participate in this market and get a share of the trillion of dollars that exchanges hands between brokers, banks and few individuals. This is where iml comes in to teach you how to trade in this market and make a fortune out of it. “until you learn the required skill, you would probably be gambling and losing your money out there.”

You will be intrigued to know that christopher terry the founder and CEO of imarketslive is a multiple 8 figure trader and has been trading and educating masses in the forex, futures, and equity markets since 1994. Chris who is termed one of the god in the forex market has been a headline speaker at the major derivative conferences, has been mentioned in several books and written many magazine articles. Imarketslive was officially established on july 4 th , 2013. Without getting out of context, I would simply conclude that the team behind imarketslive consist of great and top notches in the forex market that you can count on.

Imarketslive products and services.

International markets live offers the following to its client.

- IML academy: that is step by step education on how to become a professional forex trader. The school starts from basic 1 to advanced with over 60 videos to learn from expert traders.

- IML TV: to increase your chances of success, we operate a live tv sessions where students can follow master traders and see how they trade. The tv session is over 120 hours per week and its always a live session. Finally, all live trading sessions are recorded for students to learn from in case they miss the live sessions (IML TV LIVE RECORDIN

- The harmonic scanner: this is a robot that assist beginners to read the market. It scans the markets to provide you with all information needed to enter a trade and make profit. It is a privately-owned software of IML and it has a high accuracy confirmation of (98%)

- The web analyzer: this is also a robot that scans the cryptocurrency markets. It is built and maintained by in-house programming team. It sends precise trade setups to users to help them maximized profit.

- The swing trades: this is weekly trading experience with the CEO christopher terry

- The swipe trades: you receive trade alerts on your smart phone and all you you do is to copy and paste. You don’t need any trading experience to succeed with swipe trade. It is meant to supplement your income without changing your day to day routine.

With all these skills and products available, you can earn $100+ in a day based on how well you learn from the study materials and apply the skills.

In a nutshell, imarketslive exposes you to all the means of making money in the 21 st century on your own. These are some of the aspect that iml helps you to earn from.

- Forex trading

- Network marketing

- Binary options

- Crypto mining (buying hash rates or a part of their horse power and you just relax and earn.)

Iml NETWORK MARKETING.

Imarketslive went ahead to bundle their products/services with a network marketing compensation plan that allows its IBO’s (independent business owner) to earn a generous income by simply sharing their services or the business idea with others and building a residual income by building a network of IBO’s and customers.

I’ve been a network marketer in a few companies and I have never come across one with the best network marketing system com-plan that pays off than iml. IML “business building” opportunity alone can transform your financial life in a short time and make you fabulously rich.

Network marketing is all about recommending people to get the best solution to whatever they want. So why not recommend the services you get from joining iml to your friends, family and everyone and transfer that zeal into a great fortune.

IML says that we are a school and we want people to patronage our services. We can engage all forms of media platforms to get students to enroll into our academy as we pay this media houses or firms a very huge amount of money but no.

We love our students, so we will rather engage them to invite people or recommend IML academy for others to join and learn to trade on the forex market and we will pay anybody who is able to sign off people into our academy a very rewarding amount.

So how do they pay you for just recommending people to join?

For every personally enrolled, you will earn GH¢168 as fast start. This is your direct reward for bringing a person into the business.

When you are able to bring three people, you now qualify for the first level residual income…. Which is called P150 (platinum 150). GH¢720. This means that as long as this three people are active in the academy, you will be paid GH¢720 every month. This is the beginning of your business building earnings.

The second level is to teach this three people to also do what you did to qualify to p150 then you will have a team member of 12people. As soon as your downlines grows to 12 people, they will increase your monthly residual income to GH¢3,000 which means you have qualified as a business builder level 2 in IML (P600). The good thing is you only need to get the three people and you teach them or you help them to also get their three and then the cycle follows.

The rest of the com plan is tabled below

This is not all, there are other levels and a one-time payment or gift given to customers when they hit a certain rank. These includes sponsored trips to dubai and other countries. Good for network marketers huh.

REQUIREMENTS IN BEING A PART OF iml.

All you need to be part of this amazing opportunity is your willingness, commitment and readiness to obey simple instructions and principles of the business.

To be part of this academy, all you need to do is to make a onetime payment of $217 which is approximately GH₵1050 and a monthly membership fee.

If you are really don’t take advantage of this opportunity, then I don’t know what else you are waiting for. If we can pay thousands of cedis for first degree and earn at most GH¢1000 monthly and GH¢ 12000year and we are happy to do so then it shouldn’t be a problem to pay GH¢1100 to register into IML and earn this GH¢12000 in less than 3months.

CONCLUSION.

Let me boost your interest and spirit with these network marketing quotes.

Robert kiyosaki says, “the richest people in the world look for and build networks, everyone else looks for work.”

“if you want to go somewhere, it is best to find someone who has already been there.” –robert kiyosaki

“it’s all about people. It’s about networking and being nice to people and not burning any bridges.” –mike davidson

Money is actually a seed and in order to multiply it, you have to plant it by investing it.

Why not seize this opportunity to join us now and turn your phone or device into an ATM machine? I personally can testify that the education I have gone through so far has helped simplified the forex market for me and thus I have learnt to leverage and manage my earnings. The network marketing has as well been my greatest source of income thus the reason why I’m doing all it takes to build a strong team. Iml is keen in helping you to succeed at all cost. No time to waste, join us now.

To fully understand this business, you can follow this link http://imlpresentation.Com/ to watch the video presentation on both the forex trade and the network marketing aspect.

Feel free to contact me for financial help and guidelines in joining IML.

Contact: +233 0266100063 ; +233556729640

You can directly connect with me on whatsapp through this link.

IML – your phone your ATM

In IML, we say “everybody eats.

So, let's see, what we have: FOREX.Com offers forex & metals trading with award winning trading platforms, tight spreads, quality executions, powerful trading tools & 24-hour live support at forex p150

Contents of the article

- Top forex bonuses

- Trade with the no. 1 broker in the US for forex...

- Why are traders choosing FOREX.Com?

- Financial strength you can depend on

- Reward yourself with our active trader program

- Open an account in as little as 5 minutes

- Ready to learn about forex?

- New trader?

- Have some experience?

- Want to go deep on strategy?

- Not sure where to start?

- Forex (FX)

- What is forex (FX)?

- Forex pairs and quotes

- Forex lots

- How large is the forex?

- How to trade in the forex

- Spot transactions

- Forex (FX) rollover

- Forex forward transactions

- Forex (FX) futures

- Forex market differences

- Example of forex transactions

- Imarketslive – forex trading for everyone

- Imarketslive and the broker hotforex

- Income opportunities

- Profit, duration and costs

- Deposits and withdrawals

- Video review

- Conclusion

- Best forex signals with E-mail, SMS mobile...

- Why use ace forex signals

- Forex (FX)

- What is forex (FX)?

- Forex pairs and quotes

- Forex lots

- How large is the forex?

- How to trade in the forex

- Spot transactions

- Forex (FX) rollover

- Forex forward transactions

- Forex (FX) futures

- Forex market differences