Get ewallet pin

The PIN, or private identification number, is a four-digit security code that will be used to verify your identity whenever you interact with ewallet or make a transaction.

Top forex bonuses

You will have to define this PIN during the registration process. Browse through our frequently asked questions or search for your specific concern

Get ewallet pin

How can we help?

Browse through our frequently asked questions or search for your specific concern

What is KYC?

KYC, or Know Your Customer, is a banking standard where you need to provide your personal details with evidence of their accuracy for proper verification.

What is the difference between digital and physical KYC?

- Digital KYC: this allows you to digitally upload your details from the comfort of your home without physical verification. In this status, you will have some limitations in the use of your account. This status is for a limited period of time only and you will be required to physically verify yourself as advised by the system.

- Physical KYC: you attain this status only after physical verification, or if you directly register via an agent. This status gives you a full account benefits without any limitations

How do I upgrade to physical KYC?

Simply visit an ewallet registration agent to present your EID into the reader and validate with your fingerprint on the scanner. To find your nearest agent, click here.

What is a PIN?

The PIN, or private identification number, is a four-digit security code that will be used to verify your identity whenever you interact with ewallet or make a transaction. You will have to define this PIN during the registration process.

Do I need a bank account to use ewallet?

No, ewallet primarily uses a digital wallet for transactions and does not need a bank account. All you need to do is download the app and register.

Is there a minimum balance for ewallet?

No, with ewallet you have access to all your funds without any obligation to maintain a minimum balance and with no low balance charges.

Get ewallet pin

This is your third and last login attempt available.

Your profile will be blocked if you fail to enter your login details correctly.

Oh no!

We've noticed that you've tried to login more than 3 times.

You might have blocked your online banking profile.

In order to unblock your profile, reset your username and password.

Cellphone banking

- Dial *130*321#

- Select send money

- Select the account you want to send money from

- Key in the cellphone number you want to send to

- Enter the amount you want to send

- Confirm that all is correct (make sure you entered the right cellphone number)

To send money using FNB cellphone banking you need to be registered for cellphone banking.

To register for cellphone banking, dial *130*321#

Online banking

- Log into FNB online banking

- Select the payments tab

- Enter your one time PIN (OTP)

- Select send money

- Select the account you want to send money from

- Select the amount you want to send

- Key in the cellphone number you want to send money to

- Click on finish

You need to register for online banking to send money via the internet

FNB ATM

- Insert your card and enter your PIN

- Select more options

- Select buy it/pay it

- Select send money. Read the terms and conditions and then select proceed

- Key in the cellphone number you want to send money to and select proceed

- Key in the amount you want to send money to and select proceed

- Confirm that all the details are correct and select proceed

- Remember to take your card

No registration or application is necessary if you send money via an FNB ATM

| fee (BWP) | |

|---|---|

| send money | P9.40 |

| withdrawal (you get 1 free withdrawal with every wallet send without exceeding maximum of 4 free withdrawals in the wallet) | FREE |

| dormant ewallet (up to 6 months) | FREE |

| dormant ewallet (after 6 months) | FREE |

Standard network operator rates apply when using your cellphone.

You have access to ewallet

If you are an FNB client with an active transactional account, you already have access to the ewallet service.

Login to online banking, cellphone banking or visit your nearest ATM and select send money to make use of this safe and convenient way to send money to anyone.

Ewallet

Send money anywhere, any time

The ewallet allows FNB customers to send money to anyone with an active cell number. Money is transferred instantly. Recipients can use the money in the ewallet to buy airtime, send money to other cellphones and more.

How it works

Instantly send money or make payments

- You can send money to friends and family members or make a payment to anyone simply and hassle free

- Money can be sent to anyone who has a valid botswana cellphone number and the recipient does not need to have a bank account

- Any GSM cellphone model can be used to send money or to receive money

- Money is instantly available in the ewallet

- Money will be stored in an ewallet. Recipients will be able access the money immediately at an FNB ATM without needing a bank card and without filling in any forms

- Recipients will get all of the money sent as there are no ATM charges to withdraw money

- Recipients don't have to withdraw all the money at once

- Recipients can also check the balance, get a mini statement, buy prepaid airtime, send money on to someone else's cellphone

- You can send money at any time of the day or night via cellphone banking, FNB online banking, FNB app or at an FNB ATM

What's hot

It's for everyone

Send money to anyone with a valid botswana cellphone number

It's simple

The recipient does not need a bank account or bank card

It's convenient

Money can be sent anytime, anywhere, from the comfort and safety of your own home

It's fast

The money is sent immediately and the recipient can access the funds immediately

It's free of bank charges

Pay no bank charges when you send money via ewallet

Ways to send

Send the way you want to

As an FNB customer you can use one of FNB's convenient digital channels to send money to anyone with a valid cellphone number on any network.

Online banking

View how to send money via online banking

Cellphone banking

View how to send money via cellphone banking

View how to send money via FNB ATM

Ways to use

Withdraw, buy + spend

When you receive an SMS notifying you that money has been sent to your cellphone, you can do the following

- Send a portion of the money in the ewallet to another ewallet in exactly the same way

- Withdraw all or some of the money from the ewallet at an FNB ATM without needing a bank card. The rest of the money can be withdrawn at a later stage

- Buy prepaid airtime from the ewallet

- Check the ewallet account balance or get a mini statement

- How to receive money

How to receive money

Turn your phone into a wallet

Once you've received an SMS telling you that you have been sent money

- Dial *130*392# to access the ewallet

- Set a secret 5-digit PIN for the ewallet

- Select 'withdraw cash' and then 'get ATM PIN'

- You'll receive an SMS with an ATM PIN

- Go to an FNB ATM

- At the ATM press the green button (enter/ proceed) and then wallet services

- Key in your cellphone number and ATM PIN

- Choose the amount of money to withdraw. Make sure that either your transaction has ended or that you press 'cancel' before leaving the ATM

If you have been sent money but you have no airtime , dial *103*392# to buy airtime with the money that has been sent to you. Then dial *130*321# .

Is using FNB ewallet safe?

FNB ewallet is a safe and secure way to send money. The FNB ewallet can hold up to R5000, which can be drawn at any FNB ATM or selected retailers.

There are four options for sending money:

- Cellphone banking

- Online banking

- Banking app

- FNB ATM

You can use any of the channels to send money to anyone with a valid south african cellphone number.

Is using FNB ewallet safe?

There have been a few reported incidents of customers not receiving their pins to be able to withdraw from an FNB ATM. The temporary ATM PIN refers to the 5 digit one time PIN that gives the recipient access to withdraw funds from the ewallet at FNB atms and FNB atms with automated deposits, without needing a bank card.

FNB emphasises that it’s important to ensure that the correct cellphone number is used. Customers should also keep their pins safe before drawing the ewallet money.

Since its launch in 2009, more than 700 000 ewallets have been created, with 50 000 new ewallets created on a monthly basis.

The popularity of the money transfer service makes it a potential target for scammers. This is why it’s important for customers to be vigilant when using online banking as well as atms.

One of the ways that scammers are using to steal customer information at atms is through thermal technology.

Thermal technology:

Using a smartphone and thermal technology (an imaging attachment), criminals can easily steal your PIN. The way this works is that your thermal signature is left behind when you press buttons, so criminals can use a smartphone with a FLIR ONE thermal imaging attachment to figure out your PIN. A way to avoid this is by lightly touching some other keys on the keypad.

Get ewallet pin

FNB offers a network of branches for all your face to face banking requirements

Postal address

first national bank zambia limited

PO box 36187

lusaka, zambia

Physical address

stand number 22768

acacia office park

cnr thabo mbeki and great east roads

lusaka, zambia

Telephone numbers: +260 211 366 800

fax number: +260 211 253 057 / 250 602

email: fnb@fnbzambia.Co.Zm

Stand number 22768

acacia office park

cnr thabo mbeki and great east roads

lusaka, zambia

Telephone numbers: +260 211 366 800

fax number: +260 211 250 090

branch code: 260001

Society house

first floor, shop number G040

plot 3 & 3a cairo road,

central business district

lusaka, zambia

Telephone numbers: +260 211 366 800

branch code: 260050

Shakes investment limited building

plot number 16808

lumumba road

lusaka, zambia

Telephone numbers: +(260) 211 366 900

fax number: +(260) 211 845 453

branch code: 260002

Plot no. 617

shop number 4 musenga house

kwacha road

PO box 11262

chingola, zambia

Telephone numbers: +260 211 366 800

branch code: 260322

Kaonde house

plot no. 921

independence avenue

solwezi, zambia

Telephone numbers: +260 211 366 800

branch code: 262823

Union house

plot 493/494

zambia way and oxford street

kitwe, zambia

Telephone numbers: +260 211 366 800

fax number: +260 212 657 145

branch code: 260212

Centro mall premier banking

Unit 63 corner bishop & kabulonga roads

centro mall, kabulonga

lusaka, zambia

Telephone numbers: +260 211 366 800

fax number: +260 211 250602

Neighbours city estate

plot number 50

buteko avenue

ndola, zambia

Telephone numbers: +260 211 366 800

fax number: +260 212 610009

branch code: 260103

Plot 7A livingstone road

PO box 670159

mazabuka, zambia

Telephone numbers: +260 211 366 800

fax number: +260 213 239 023

branch code: 263613

Plot 414 independence road

mkushi, zambia

Telephone numbers: +260 211 366 800

branch code: 262319

Plot 9471/2/3, makeni mall

kafue road, lusaka

PO box 38911,

lusaka, zambia

Telephone numbers: +260 211 366 800

fax number: +260 211 369 398

branch code: 260016

Stand no.3539 jacaranda mall

corner of mushili & kabwe road

PO box 73642

ndola, zambia

Telephone numbers: +260 211 366 800

branch code: 260049

PHI shopping mall

plot no. 38147

bennie mwiinga road

lusaka, zambia

Telephone numbers: +260 211 366 800

branch code: 260049

Plot 19222, zone 3 building, manda hill mall

corner great east & manchichi road, lusaka

PO box 36187,

lusaka, zambia

Telephone numbers: +260 211 366 800

fax number: +260 211 366 875

branch code: 260014

Plot no.87A shop no.2

buntungwa street

kabwe, zambia

Telephone numbers: +260 211 366 800

branch code: 260937

Plot no.ME 46

along livingstone

PO. Box 630819

choma, zambia

Telephone numbers: +260 211 366 800

branch code: 261238

Plot no. 646

corner of pererinyatwa road

& umodzi highway

PO. Box 510080

chipata, zambia

Telephone numbers: +260 211 366 800

branch code: 261121

Plot no.4 wada chovu building

zaone avenue, PO box 90953

luanshya, zambia

Telephone numbers: +260 211 366 800

branch code: 260741

Mukuba mall premier branch

Shop no. 43, mukuba mall, 6939

cnr freedom way & chiwala ave

parklands, kitwe

Telephone numbers: +260 211 366 800

branch code: 260243

Budget stores complex

stand no:8,buteko street

town centre, mufulira

Telephone numbers: +260 211 366 800

branch code: 260544

Kitwe industrial branch

Plot no: 2503 turnpan zambia building

heavy industrial area

off independence avenue

kitwe

Telephone numbers: +260 211 366 800

branch code: 260247

Plot 150/27/4586

chilumbulu road

chilenje

Telephone numbers: +260 211 366 800

branch code: 260046

Spar supermarket

plot 360/S, mosi-O-tunya rd,

livingstone, zambia

Telephone numbers: +260 211 366 800

branch code: 260046

Stand no. 795

kalumbila high street

kalumbila town

Telephone numbers: +260 211 366 800

Find an ATM

Our atms (automated teller machines) are situated within the FNB zambia branches

Stand number 22768

acacia office park

thabo mbeki and great east roads

lusaka

telephone number: +260 211 366 800

Union house

plot 493/494

zambia way & oxford street

kitwe

telephone number: 260 212 657 100

Shakes investment limited building

plot number 16808

lumumba road

lusaka

telephone number: +260 211 366 900

Plot 7A

livingstone road

mazabuka

telephone number: +260 213 239 000

Neighbours city estate

plot number 50

butek

telephone numbers: +260 212 610 006/ 610 007

Makeni mall

plot 9471/2/3

kafue road

lusaka

telephone number: +260 211 369379

Plot 414 independence road

mkushi

telephone numbers: +260 971254871

mobile number: +260 977 995 476

Jacaranda mall

stand no.3539

corner of mushili & kabwe road

ndola

telephone number: +260 212 626 000

Plot 19222, zone 3 building, manda hill mall

corner great east & manchichi road,

lusaka

telephone number: +260 211 366 863

Musenga house

plot no. 617, shop number 4

kwacha road

chingola

telephone number: +260 212657130

Plot no. ME 46

along livingstone road.

Choma

mobile number: +260 969417613

Plot no. 646

corner of pererinyatwa road

& umodzi highway

chipata

telephone number: +260 216222003

Plot no. 921

kaonde house

independence avenue

solwezi

telephone number: +260 212626013

PHI shopping mall

stand 38147

bennie mwiinga road,

lusaka

telephone number: +260 211366919

Plot no. 87A shop no. 2

buntungwa street

kabwe

mobile number: (+260) 965 085 195

Wada chovu building

shop no. 4

along zaone avenue

mobile number: +260 965 841097

Kabulonga shopping mall,

lusaka

zambia

Phase V ATM lobby,

stand number 2374

arcades shopping centre,

great east road.

Lusaka

zambia

Down town shopping mall,

kafue road,

lusaka

zambia

Stand no. 22845, shop no. 28A,

crossroads shopping mall

leopards hill road

lusaka,

zambia

Plot number 3, independence avenue

city centre

kitwe

Stand no. 272

buteko drive

kalulushi

House no. 33 ndola road

fairview

mufulira

Stand no. KWE/71

kwacha east

kitwe

Stand no. 3680

kabala

kitwe

Plot 643 parklands shopping centre

corner kuomboka/freedom way

kitwe.

Inos holding 93

president avenue

town centre

ndola

Plot no. F/31096

chilengwa road

masaiti area

ndola

Plot no. 10709

kabwe road

ndola

Plot 012

corner president avenue & T3 highway

kafubu mall

ndola

Plot lub/3276/1

chibesa kunda road

ndola

Stand no. 437

cairo road

ndola

SGC filling station

ndola

Stand no. CH/108 hard K shopping complex

chifubu market

ndola

Plot no. 1320,

along great north road

mkushi

Farm no. 3168

farm centre

mkushi farm block

mkushi

SGC filling station

independence avenue

mitech area

solwezi

Industrial park

kalumbila mineral areas

kalumbila,

solwezi

Plot no. 53, 14th street

luanshya town centre

luanshya

Plot no. 2057

corner of gizenda road and chindo road

lusaka

Plot no. 9/65/4586

muramba road

chilenje south

lusaka.

At the real meat stand

lusaka

Oryx filling station

chongwe

Kobil filling station ATM

Corner of ben bella & lumumba road,

lusaka

Plot no. 12/70 - 45/86

kasama road

chilenje south

lusaka

SGC filling station ATM

Plot no.5065

mungwi road

lusaka.

Shop no. 18B

manda hill shopping mall

manchinchi road

lusaka

Odys filling station ATM

Plot no. 298

lumumba road

matero

lusaka

Radian stores

along chinika road

lusaka

Shop no. 465

maunda road

kabwata main market

lusaka

Vuma filling station ATM

Plot no. 6076

kafue road

lusaka

Engen filling station ATM

Engen filling station

los angeles road

long acres

lusaka

University of zambia main campus

lusaka

Along alick nkhata road

Plot no. 609

foxdale court

zambezi road

lusaka

Plot no. 8674, shop no.1A

corner jambo/almalik drive

riverside

kitwe

36 kabengele avenue

kitwe

Stand no. 100

katilungu road, chimwemwe

kitwe

Plot no. 396A

starbuck food centre

midway road, kamenza

chililabombwe

Konkola hypermarket limited,

mazabuka

Mazabuka sugar farms ATM

Edwina ceri coventry, 52690

lubombo

mazabuka

Near hungry lion

lusaka

Intercity bus terminus

lusaka

Shop no. 43, mukuba mall, 6939

cnr freedom way & chiwala ave

parklands, kitwe

Budget stores complex

stand no:8,buteko street

town centre, mufulira

Kitwe industrial branch

Plot no: 2503 turnpan zambia building

heavy industrial area

off independence avenue

kitwe

Plot 150/27/4586

chilumbulu road

chilenje

mobile: 0964-619518

Spar supermarket

plot 360/S, mosi-O-tunya rd,

livingstone, zambia

telephone numbers: +260 211 366 800

Choose the best ewallet app in 2020

Whether you want to improve your consumer experience online or just enjoy yourself by playing your favorite casino games without any fuss, ewallets must be your default payment processing option.

It doesn’t matter where you live & it doesn’t matter why you do it, having an ewallet account in 2020 is virtually mandatory. Just ask the hundreds of millions of customers who use an ewallet application on a day-to-day basis.

Don’t worry if you aren’t familiar with this awesome payment method or you are on an information overload after searching for the best digital wallet for you. We’re here to help by providing you with only the best options out there. Follow our ewallet reviews 2020.

What is an ewallet?

An ewallet or a digital wallet is nothing more than a web application developed by a payment processing company that greatly facilitates the communication between a buyer and a seller.

It’s an online account where you can manage your money just as you would with a normal wallet. You take some cash with you or you grab your credit/debit card, depending on the situation, you place it in your wallet, and start spending. The same applies to a digital wallet. After you’ve created your account following some simple steps - in most cases, just typing your name, e-mail address, and password - you can top-up your ewallet by adding funds via a variety of sources likebank transfer, credit/debit card, or even the trending prepaid vouchers like paysafecard or neosurf.

After that, the (online) world is yours for the taking. You can spend your ewallet money on virtually anything, from food, clothes, appliances, and electronics to various services like online courses, hosting & domain registrations, IT troubleshooting, you name it. The possibilities are endless!

Why use an ewallet

Convenience

Firstly, convenience and unmatched user-friendly choices you can make. To start using a digital wallet, all you have to do is create an account by typing in your name, e-mail address, and password. After you verified your e-mail, you can add funds and start spending.

When you first use an ewallet app, there will be some limitations. To unlock and use it at its full potential, you will need to go through the verification process, necessary given today’s know-your-customer (KYC) and anti-money laundering (AML) legislation. It won’t take long though; once you provided the payment processing company with your ID and proof of residence, you will set up your own limits, no other third parties involved.

Security

Secondly, by just using a digital wallet, you will greatly minimize the risk of compromising your financial data. Since you will not type down your private financial data like credit/debit card information every time you buy something, your bank funds will be safe.

Instead, you will use your digital wallet’s e-mail/username and password to pay for goods & services. You will only give away your credit/debit card information in a secure environment, guaranteed by the payment processing company & only when you want to add funds in your ewallet.

Variety

Last but not least, the digital wallet payment option is just as popular as the credit/debit card method. What does that mean?

You can pay for most goods & services online by just typing in your ewallet’s e-mail/username and password. You can also play your favorite online casino games with real money without sharing your private financial data… fast & easy.

Moreover, since most ewallets give their client the option to order a physical prepaid card, you can also shop offline, at your local supermarket, general store, kiosk, or gas station. As long as the vendor accepts VISA/mastercard, your prepaid card will be always accepted.

Which ewallet is best

It all depends on what you want to achieve with it.

Do you just want to spend your ewallet money on general goods & services? Then we got the perfect option for you! Do you want to use it more specifically for igaming/online gambling? We’ve got you covered! Are you located in a certain region with specific legislation for online payments? That’s right, we’ve got options for you also.

Top-rated ewallet for general use

Paypal

Paypal is the most popular ewallet on the internet. With almost 280 million active accounts from over 200 markets around the world, it is as used as the VISA/mastercard option online.

Best ewallets for online casinos & gambling

Skrill

Skrill may not be as popular as paypal but it is definitely the top ewallet for online gambling, widely used by millions of players & accepted on most online casino platforms.

Neteller

Neteller began processing payments for online casinos 19 years ago, in 2000 and has the most experience of any gambling-friendly ewallets. You can’t go wrong with neteller!

Region-based ewallets

Yandex money

Yandex is the largest tech company and search engine in all russia. It’s no wonder the corporation extended its services by creating a unique ewallet, targeted for russians & not only.

Myneosurf

Whether you are based in europe or in australia, myneosurf may be the ewallet for you, especially if you use the popular neosurf vouchers constantly. Start using it today!

Webmoney

Originally targeted for russia, webmoney quickly extended its services to europe and the USA. Your money is guaranteed by a company based in your region, working with webmoney.

Cross-platform ready

You can use your chosen ewallet in whatever way you like.

If you are a PC guy or girl, the most popular digital wallets offer you a user-friendly & intuitive interface. You’ll learn how they work and what can you do to pay for online goods & services in no time, on the go. Plus you’ll always have the support by your side, ready to solve any problem you may run into.

If you are a gadget-friendly user, all popular digital wallets offer high mobility with their optimized app for both android & ios platforms. Their interfaces are simple and accessible at a single touch or swipe so you can spend your ewallet money as fast as you like. Google & apple approved!

Is my ewallet app safe & secure?

Our chosen top ewallets are as safe & secure as any other widely-used payment processing method.

Furthermore, you don’t need to worry about some malicious actor peeking at your every move. Since you only use the credit/debit card details or bank transfer information inside your digital wallet, in a secure environment, your private financial data is safer than ever. Not even the company behind the ewallet can actually access your private data.

Authorized

The ewallets are authorized by the official financial institutions where they are based. Thus, you are always protected from any highly unlikely illegal attempt from the payment processing company to steal your money.

Audited

All popular ewallets are regularly audited by tech security companies. Moreover, all encrypt their customers’ data using the state-of-the-art encryption technologies around, to avoid any possible leaks.

To fully secure your ewallet account, most offer the popular and bulletproof two-factor authentication. Even though the hacker might know the ewallet’s password, he can’t guess the one-time 2FA PIN code.

Online casino ewallets in 2020

All popular online casinos have at least one ewallet as both a deposit & a cashout option. While it may not be paypal - the company behind paypal is very picky with the online gambling industry - you can certainly assume other options like skrill & neteller are there by default.

The process of depositing is as simple as it can get: just enter your login credentials, click one more button, and you can safely play your favorite casino games.

If you hit jackpot, cashing out is even simpler: you only have to select the ewallet option and igaming company will send your winnings your way, in no time, faster than any bank transfer & card withdrawal.

Frequently asked questions (FAQ)

Before you read our top ewallet reviews, be sure to check out this general FAQ section that will answer all the questions you may have about this unique payment method.

How can I add funds and top-up my ewallet account?

It depends on the ewallet. All have the bank transfer & credit/debit card options, but, if you need something different, you’ll have to check our reviews. Many, for example, have the internet banking system, while specific ewallets have specific deposit methods - myneosurf gives you the option to add funds using the neosurf vouchers.

Can I withdraw my ewallet money?

Of course, you can. You can always transfer your ewallet money directly to your bank account using the bank transfer & credit/debit card options. You can also use your prepaid ewallet card to withdraw cash via any VISA/mastercard-willing ATM.

What other features does an ewallet provide?

Besides the physical prepaid card, many ewallets also give the user the option to create a virtual card that works just like a physical one. In addition, if you are a high-roller, check our ewallets that offer VIP programs, based on your transaction volume and spending habits.

Can I use an ewallet to buy bitcoin?

Luckily, you can. Skrill & neteller - which are part of the same company, paysafe group - offer any customer the possibility to buy & sell bitcoin, plus several other cryptocurrencies like bitcoin cash, litecoin ether, XRP, stellar, or EOS. No additional verification required!

What are the fees for any given ewallet?

Depends from ewallet to ewallet. Check our reviews for more specific information related to your chosen payment processing option.

Summary

Forget about complicated bank transfers and risky card usage on the internet.

Using an ewallet in 2020 is probably the best decision you can make financial-wise. It doesn’t matter its actual usage, once you use a digital wallet, you’ll never look back. Convenience, accessibility, and ease of money transfer at their best!

With the recent record-breaking increases showing no signs of slowing, more people are considering investing in the crypto than ever before. If you’re one of them, here are 5 questions you should ask yourself before taking the plunge.

Tuesday, january 12th, 2021, 10:11:18 PM

The covid-19 pandemic is changing the way we live and do business. Fintech has suffered along with every other sector of the economy. But thanks to changing needs in the financial sector, fintech companies are better positioned than most to weather the storm

Wednesday, october 21st, 2020, 10:34:37 AM

The global pandemic has forced us to conduct more of our lives online, including our financial transactions. Fintech is coming into its own. Here we compare how these new services compare with traditional banks and the potential for synergy between the two.

Thursday, october 8th, 2020, 8:21:13 AM

Despite the hits to the global economy caused by the pandemic, 2020 has seen massive gains for bitcoin. But will there be more, and will they last? Here we look at some of the factors that will determine this and give our predictions for the future of BTC.

Monday, august 17th, 2020, 9:54:30 AM

Most of the world now knows about the recent twitter hack where prominent accounts were co-opted for use in a bitcoin scam. But there are a lot of questions still remaining to be answered, not least being what does it mean for the future of the company.

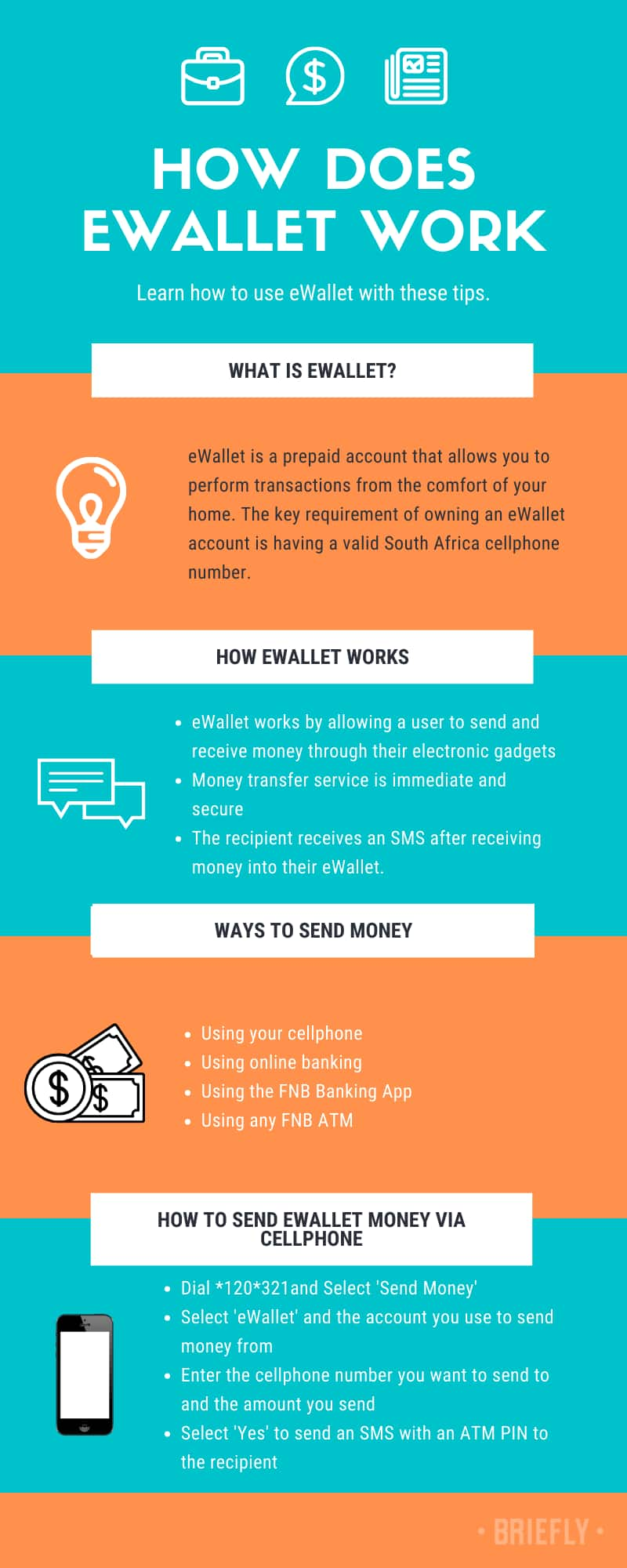

How ewallet work: this simple guide will help you

South africa is one of the countries whose technological industry is constantly making advancements. One of the greatest inventions that the country has made is ewallet. If you have not heard about it, you can now know how to use ewallet with these tips.

What is ewallet? Ewallet is a prepaid account that allows you to perform transactions, both online and offline, via your computer or smartphone. It works as a fast mode electronic wallet that allows you to perform transactions from the comfort of your home. The key requirement of owning an ewallet account is a south africa cellphone number via FNB atms, FNB cellphone banking, FNB online banking or FNB app.

How does FNB ewallet work?

Being a fast mode of transaction, ewallet works by allowing a user to send and receive money through their electronic gadgets. The first step of the transaction is for the user to load money into their accounts. The money is debited from the user’s account into their ewallet accounts in the form of digital representation. Being in the form of the digital representation means that the money is with the service provider who is responsible for keeping ledgers and records of all the users and their data. Therefore, for any deposits that a user makes, the money is transferred from the user’s bank account to the dedicated bank account that the user has chosen. The records of the ledgers are also automatically updated.

When a user chooses to send money to another ewallet user, there is no actual money transfer from one account to the other. Instead, what happens is that the ledgers are automatically updated to show that a transaction was performed and money was sent from your account to the recipient’s account. The recipient receives an SMS after receiving money into the ewallet. That is how convenient ewallet is. These how to do ewallet operation guides will be beneficial for you if you are a new user.

How to send money via ewallet

There are different ways to send money, including:

- Using your cellphone

- Using online banking

- Using the FNB banking app

- Using any FNB ATM

Sending money is one of the most basic operations that you can do with ewallet. The operation does not require any form of two-factor authentication. The service is, however, available for anyone with a south african cellphone number. The procedure on how to send ewallet money via cellphone is as simple as:

- Dialing *120*321#

- Selecting the ‘send money’ option and clicking okay

- Selecting the ‘ewallet’ option

- Selecting the account from which you want to send money from

- Keying in the cellphone number of the recipient, for this case, the user that you want to send money to

- Entering the amount of money that you want to send

- Selecting the yes option to complete the transaction. That option will also authorize the service to send the recipient a PIN that they will require when withdrawing the funds.

The sender will also be required to confirm the details of the recipient and the amount of money that they wish to send. Senders are advised to be cautious when confirming the details of the recipient since they will be liable for any transactions that are wrongly conducted. Now you know how to send ewallet funds.

FNB ewallet withdrawal

After you have received funds and wish to withdraw them from your ewallet account, the procedure for doing so is not as complex as it may sound. These are the simple steps to follow on how to withdraw ewallet:

- Start by dialing *120*277# for you to access your ewallet.

- In the list of options that will be displayed, select option 1 to get the PIN. You will receive a unique message sending you the five-digit PIN that will be required when withdrawing the money from the ATM. The PIN will expire after sixteen hours.

- Visit the nearest FNB ATM within sixteen hours after receiving the five-digit PIN.

- At the ATM, if you do not have an ATM card, you could opt for the cardless services transaction option.

- Select the “ewallet services” on the screen.

- Enter your valid south african phone number on the keypad and select the “proceed” option.

- The next dialogue box will require you to enter the five-digit PIN that was sent to you at the beginning of the transaction.

- Enter the withdrawal amount that you wish to withdraw from your account. The amount should be less than or equal to the amount of funds that you have in your account. The ATM will dispense the amount of money that you have keyed in.

Apart from the ATM, a user can withdraw cash from the ATM or withdraw funds from any of the selected retail stores. The procedure is as follows:

- Start by dialing *120*277# for you to access ewallet.

- Select option 1 to select the withdraw cash option.

- From the list of options that will be displayed, select option 1, which is the “get retail PIN” option.

- You can then visit any of these listed retail stores in the country to withdraw the cash;

Sutherland ridge SUPERSPAR

- At any of the selected retail stores, you will be required to purchase a credit or debit card. This step is mandatory.

- After purchasing, you will be required to select the “withdraw cash” at checkout option.

- The following screen will ask you to “withdraw cash from ewallet.”

- You will then be prompted to enter your phone number.

- The following dialogue box will require you to enter the four-digit PIN that was sent to you as a text message.

The cashier will then give you the money that you have withdrawn. There is no fee for withdrawing funds from ewallet. You need to, however, check the balance in your account by following the procedure on how to check ewallet balance.

How long does ewallet last?

When performing a transaction, the PIN that is sent to you in the form of a text message lasts for a maximum of sixteen hours. A user is then advised to complete the transaction as soon as they can to avoid any forms of inconveniences that are likely to arise.

How to request a new pin for ewallet

In case your ewallet PIN expires before you complete your transaction, you can request for another PIN to be sent to you by dialing *120*277#. The new PIN that will be sent to you will enable you to withdraw funds from your account without fail.

Technology has made the financial market convenient for users. One of the greatest inventions is ewallet, which has made it possible for users to perform transactions with ease. These details on how does ewallet work will come in handy.

How to use ewallet

Ewallet is a cash transfer service that was introduced by FNB. It allows us to send money to individuals without the need for a bank account on the receiver’s end. All you do is you send money to the receiver’s cellphone number. They will receive a message telling them that you have sent money, and they can go to any FNB ATM to withdraw the money within as specified time period.

There are two sides to using FNB ewallet, the first is on the sending side and the other is to send money to a recipient. All you need to be able to receive ewallet money is a valid south african phone number on which you can receive the funds.

The same applies to sending, with the difference that if you want to send an ewallet using the app, you will need a smartphone and the FNB app installed. You will also need enough airtime or data to conduct the sending transaction.

There are two ways to send money through ewallet. The first and most common method used, is by using the FNB app the second way to send money to ewallet is by using a cellphone without the app (also known as cellphone banking).

How to send ewallet with FNB app

- Open the FNB app

- Go to payments

- Go to “send money”

- Go to ewallet

- Choose the account that you want send the money from (if you have more than one account linked to the FNB app

- Enter the amount that you want to send via ewallet

- Choose the number to send the money to (you can search from the number in your contacts by pressing the plus sign next to “cell”)

- Check the box that says “send ATM pin to recipient” if you want them to receive the pin

Once you are done, the recipient will receive an SMS with a 5 digit pin notifying them that they have received money in the ewallet and the that they have 16 hours to withdraw the money with the pin.

How to send ewallet with your phone

To send ewallet using the cellphone without the app, follow the steps below:

Dial *120*321# from your mobile phone

- Select ‘send money’

- Select ‘ewallet’

- Select the account you want to send money from (if you have more than 1 account).

- Enter in the cellphone number you want to send

to. - Enter the amount of money that you want to send.

- Select ‘yes’ to send an SMS with an ATM PIN to the recipient so that they can withdraw from the ATM.

- Confirm the amount and cellphone number.

You can only send money from an FNB account

You can also use the code to do things like check how much you have in your ewallet that is associated with your number.

Ewallet has a daily limit of R5000. This means that as a recipient, you cannot receive or spend more than R5000 in a day. Additionally, an ewallet can only hold R5000. If you have R5000 in your ewallet, you cannot receive anymore until you spend some of what you have.

The monthly limit for ewallet is R25000.

Do I have to pay to use ewallet?

As a recipient there are no charges for using ewallet. A transaction fee is charged to the sender when they send the money to you. That is the only charge that is involved in usage of the service.

When you send someone money through ewallet there will be a checkbox that you can in order to send the recipient a pin that they can use at the ATM to with draw the money. If you forget to send them the pin there is a way for them to get the pin.

How to get ewallet pin?

If you have forgotten your ewallet pin or it was not sent to you by the sender, you can follow the following steps.

· dial “*120*277#” on your mobile phone

· press “1” to select “withdraw cash”.

· press “1” to select “get ATM PIN”.

You will now get an SMS with your new pin. The pin is valid for 16 hours after it is generated.

This will also allow you to reset your ewallet pin to a new one if you think that your current pin has been compromised.

How to withdraw money from ewallet

You will need to go to any FNB ATM and follow the steps as laid out below

- Select cardless withdrawal

- Select ewallet services

- Enter your cellphone number

- Enter the ewallet pin that was sms’ed to you

- Enter the amount of money you want to withdraw

And that sums up the process of using ewallet. Below, we will provide some answers to some common questions with regards to ewallet. For the full document on how to use ewallet and all the terms and conditions associated, you can check out the ewallet section on the official FNB website.

How long is an ewallet transfer valid?

From the moment the ewallet is sent, it is valid for 12 business days. If the ewallet is not activated within that time period, the funds will be sent back to the account of the sender.

Can you reverse an ewallet transaction?

No. There is no option to reverse an ewallet transaction once you have sent the money. The only thing near to a solution is if the recipient agrees to not withdraw the money for 12 business days until the funds are returned to the sender. Any changes or removal of the pin can only be made by the person who the money was sent to on their cellphone, as they are the one who receives the pin to give access to the ewallet.

What is the minimum amount for ewallet withdrawal?

The minimum amount that you can withdraw at an ATM is R20. This can, however vary from ATM to ATM, and if the ATM does not issue R20 notes that time, the minimum will probably be R50. It is also possible to withdraw less than R20 if it is from a participating retailer.

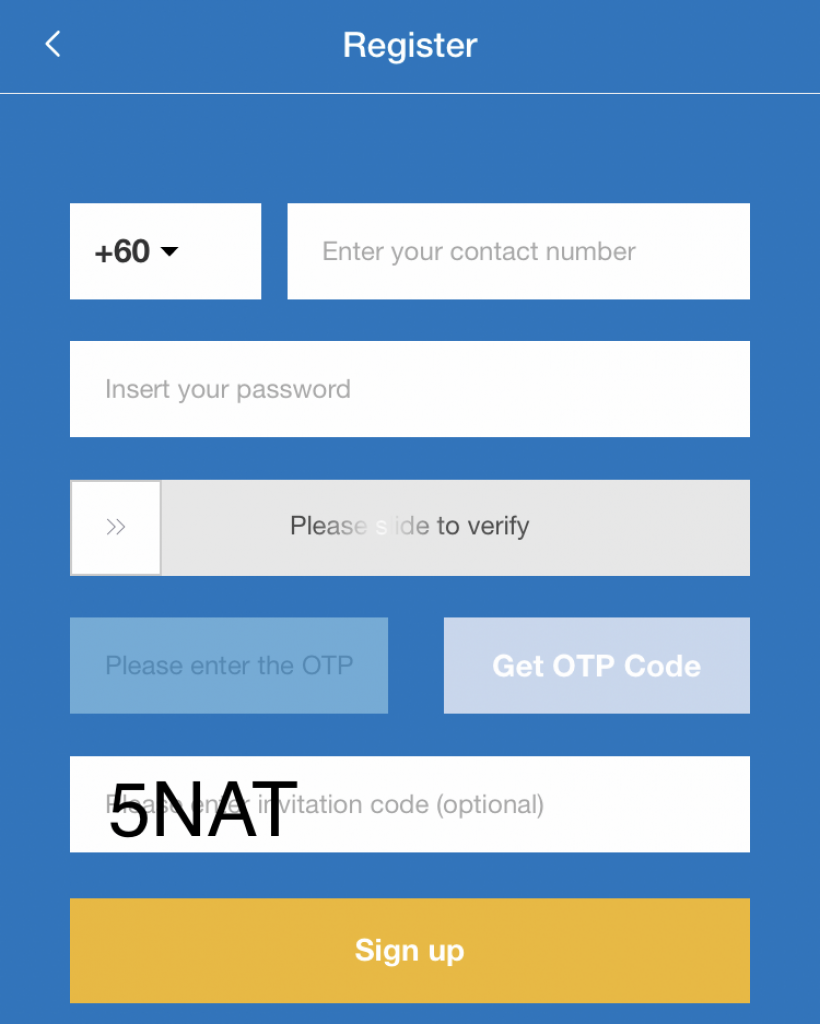

Pay RM25.50 and get RM30 TNG ewallet pin via Z-city app

Pay RM25.50 and get RM30 TNG ewallet pin via Z-city app

Follow these steps and enjoy discounted touch n go ewallet pin.

Step 1: register via this link: http://bit.Ly/Z-city

Step 2: enter invitation code (get 200 reward points): 5NAT

Referral/invitation code: 5NAT

Step 3: fill in your phone number + password and slide to verify.

Step 4: enter OTP and tap sign up. DONE, very simple to register

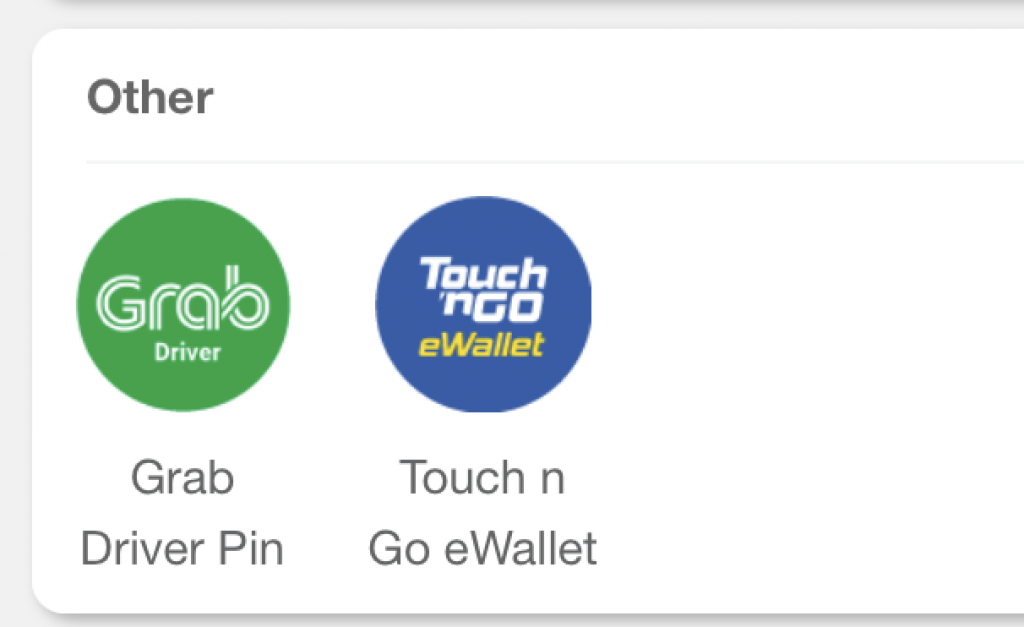

Step 5: next, go to home>bill>scroll down to TNG ewallet

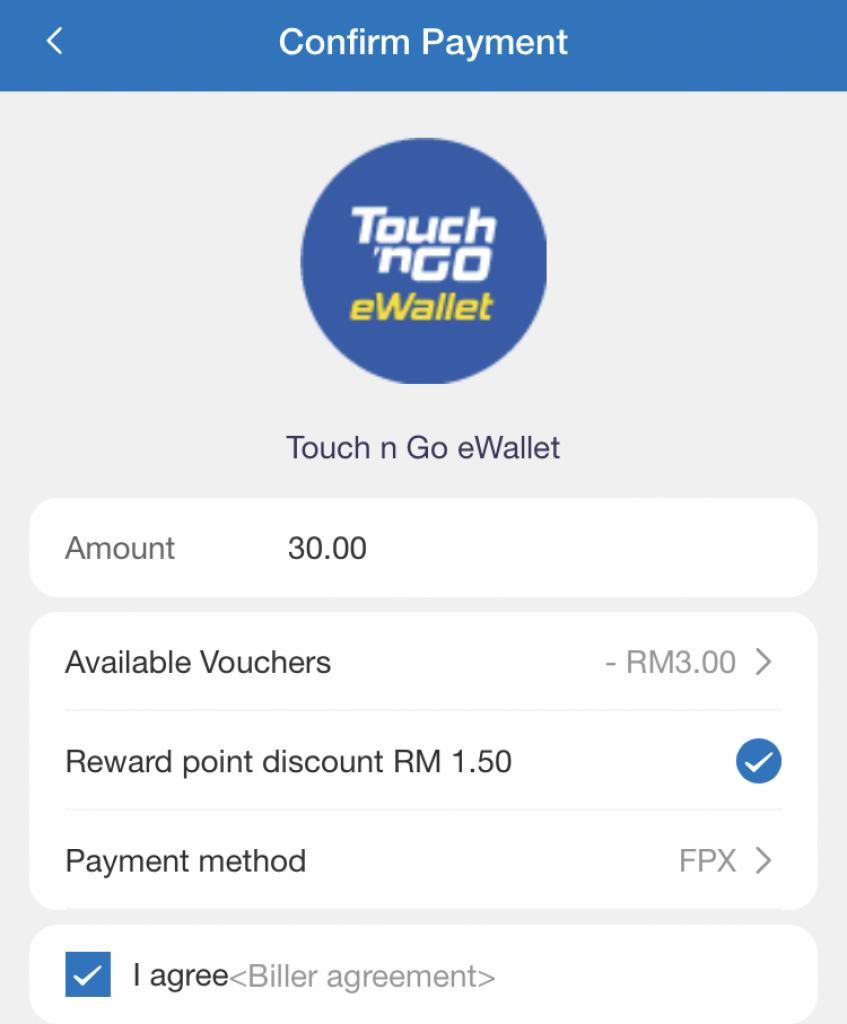

Step 6: select RM30

Step 7: apply RM3 voucher and 150 reward points

Step 8: select payment-FPX and submit

Step 9: insert email address for receipt

Step 10: pay RM25.50 via FPX

Step 11: copy RM30 TNG pin, paste and top up in TNG app

There, you just saved RM4.50. And, you also received 25.50 reward points-equivalent to 25.5 cents.

There are many more bills that you can pay via Z-city and earn reward points which you can use to off set your future payments.

How does ewallet work

South africa is one of the countries whose technological industry is constantly making advancements. One of the greatest inventions that the country has made is ewallet. If you have not heard about it, you can now know how to use ewallet with these tips.

Image: canva.Com (modified by author)

source: original

What is ewallet? Ewallet is a prepaid account that allows you to perform transactions, both online and offline, via your computer or smartphone. It works as a fast mode electronic wallet that allows you to perform transactions from the comfort of your home. The key requirement of owning an ewallet account is a south africa cellphone number via FNB atms, FNB cellphone banking, FNB online banking or FNB app.

How does FNB ewallet work?

Being a fast mode of transaction, ewallet works by allowing a user to send and receive money through their electronic gadgets. The first step of the transaction is for the user to load money into their accounts. The money is debited from the user's account into their ewallet accounts in the form of digital representation. Being in the form of the digital representation means that the money is with the service provider who is responsible for keeping ledgers and records of all the users and their data. Therefore, for any deposits that a user makes, the money is transferred from the user's bank account to the dedicated bank account that the user has chosen. The records of the ledgers are also automatically updated.

When a user chooses to send money to another ewallet user, there is no actual money transfer from one account to the other. Instead, what happens is that the ledgers are automatically updated to show that a transaction was performed and money was sent from your account to the recipient's account. The recipient receives an SMS after receiving money into the ewallet. That is how convenient ewallet is. These how to do ewallet operation guides will be beneficial for you if you are a new user.

How to send money via ewallet

There are different ways to send money, including:

- Using your cellphone

- Using online banking

- Using the FNB banking app

- Using any FNB ATM

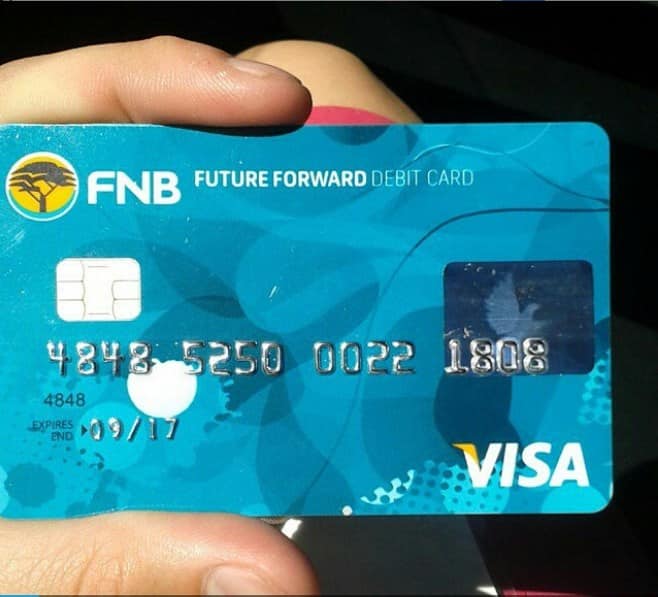

Image: instagram.Com, @fnbsa

source: UGC

READ ALSO: how to apply and use PEP money transfer

Sending money is one of the most basic operations that you can do with ewallet. The operation does not require any form of two-factor authentication. The service is, however, available for anyone with a south african cellphone number. The procedure on how to send ewallet money via cellphone is as simple as:

- Dialing *120*321#

- Selecting the 'send money' option and clicking okay

- Selecting the 'ewallet' option

- Selecting the account from which you want to send money from

- Keying in the cellphone number of the recipient, for this case, the user that you want to send money to

- Entering the amount of money that you want to send

- Selecting the yes option to complete the transaction. That option will also authorize the service to send the recipient a PIN that they will require when withdrawing the funds.

The sender will also be required to confirm the details of the recipient and the amount of money that they wish to send. Senders are advised to be cautious when confirming the details of the recipient since they will be liable for any transactions that are wrongly conducted. Now you know how to send ewallet funds.

FNB ewallet withdrawal

Image: facebook.Com, @fnbsa

source: UGC

After you have received funds and wish to withdraw them from your ewallet account, the procedure for doing so is not as complex as it may sound. These are the simple steps to follow on how to withdraw ewallet:

- Start by dialing *120*277# for you to access your ewallet.

- In the list of options that will be displayed, select option 1 to get the PIN. You will receive a unique message sending you the five-digit PIN that will be required when withdrawing the money from the ATM. The PIN will expire after sixteen hours.

- Visit the nearest FNB ATM within sixteen hours after receiving the five-digit PIN.

- At the ATM, if you do not have an ATM card, you could opt for the cardless services transaction option.

- Select the "ewallet services" on the screen.

- Enter your valid south african phone number on the keypad and select the "proceed" option.

- The next dialogue box will require you to enter the five-digit PIN that was sent to you at the beginning of the transaction.

- Enter the withdrawal amount that you wish to withdraw from your account. The amount should be less than or equal to the amount of funds that you have in your account. The ATM will dispense the amount of money that you have keyed in.

- Verify that you have completed the transaction before leaving the ATM. In case you do not approve the transaction, you can select the " cancel" option to stop the transaction.

Apart from the ATM, a user can withdraw cash from the ATM or withdraw funds from any of the selected retail stores. The procedure is as follows:

- Start by dialing *120*277# for you to access ewallet.

- Select option 1 to select the withdraw cash option.

- From the list of options that will be displayed, select option 1, which is the "get retail PIN" option.

- You can then visit any of these listed retail stores in the country to withdraw the cash;

Sutherland ridge SUPERSPAR

- At any of the selected retail stores, you will be required to purchase a credit or debit card. This step is mandatory.

- After purchasing, you will be required to select the "withdraw cash" at checkout option.

- The following screen will ask you to "withdraw cash from ewallet."

- You will then be prompted to enter your phone number.

- The following dialogue box will require you to enter the four-digit PIN that was sent to you as a text message.

The cashier will then give you the money that you have withdrawn. There is no fee for withdrawing funds from ewallet. You need to, however, check the balance in your account by following the procedure on how to check ewallet balance.

READ ALSO: how does standard bank instant money transfer work

How long does ewallet last?

When performing a transaction, the PIN that is sent to you in the form of a text message lasts for a maximum of sixteen hours. A user is then advised to complete the transaction as soon as they can to avoid any forms of inconveniences that are likely to arise.

How to request a new pin for ewallet

In case your ewallet PIN expires before you complete your transaction, you can request for another PIN to be sent to you by dialing *120*277#. The new PIN that will be sent to you will enable you to withdraw funds from your account without fail.

Technology has made the financial market convenient for users. One of the greatest inventions is ewallet, which has made it possible for users to perform transactions with ease. These details on how does ewallet work will come in handy.

READ ALSO:

- FNB reverse payment - how can you reverse an EFT payment FNB with ease?

- How to send money to zimbabwe cheap, fast and securely

- How to reverse ewallet payment in 2020?

So, let's see, what we have: get ewallet pin how can we help? Browse through our frequently asked questions or search for your specific concern what is KYC? KYC, or K now Y our C ustomer, is a banking at get ewallet pin

Contents of the article

- Top forex bonuses

- Get ewallet pin

- How can we help?

- What is KYC?

- What is the difference between digital and...

- How do I upgrade to physical KYC?

- What is a PIN?

- Do I need a bank account to use ewallet?

- Is there a minimum balance for ewallet?

- Get ewallet pin

- Cellphone banking

- Online banking

- FNB ATM

- You have access to ewallet

- Send money anywhere, any time

- Instantly send money or make payments

- What's hot

- Send the way you want to

- Withdraw, buy + spend

- Turn your phone into a wallet

- Is using FNB ewallet safe?

- Get ewallet pin

- Find an ATM

- Choose the best ewallet app in 2020

- What is an ewallet?

- Why use an ewallet

- Which ewallet is best

- Cross-platform ready

- Is my ewallet app safe & secure?

- Online casino ewallets in 2020

- Frequently asked questions (FAQ)

- How can I add funds and top-up my ewallet account?

- Can I withdraw my ewallet money?

- What other features does an ewallet provide?

- Can I use an ewallet to buy bitcoin?

- What are the fees for any given ewallet?

- Summary

- How ewallet work: this simple guide will help you

- How does FNB ewallet work?

- How to send money via ewallet

- FNB ewallet withdrawal

- How long does ewallet last?

- How to request a new pin for ewallet

- How to use ewallet

- How to send ewallet with FNB app

- How to send ewallet with your...

- Do I have to pay to use ewallet?

- How to get ewallet pin?

- How to withdraw money from...

- How long is an ewallet transfer...

- Can you reverse an ewallet...

- What is the minimum amount for ewallet...

- Pay RM25.50 and get RM30 TNG ewallet pin via...

- How does ewallet work

- How does FNB ewallet work?

- How to send money via ewallet

- FNB ewallet withdrawal

- How long does ewallet last?

- How to request a new pin for ewallet

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.