Top 10 forex brokers

The global foreign exchange (forex) market is the largest and most actively traded financial market in the world, by far.

Top forex bonuses

When looking for the "best" forex broker, both beginners and experienced traders generally look for several key features and benefits. Among the most important of these are: the overall trading experience, the breadth and depth of product offerings (currencies, cfds, indexes, commodities, spread betting, cryptocurrencies, etc.), fees (including spreads and commissions), trading platform(s) (web-based, downloadable software, mobile, charting, and third-party platforms), customer support, trading education and research, and trustworthiness. We publish unbiased product reviews, our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

Best forex brokers

These forex brokers offer the best platforms for all types of traders

We publish unbiased product reviews; our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

The global foreign exchange (forex) market is the largest and most actively traded financial market in the world, by far. When looking for the "best" forex broker, both beginners and experienced traders generally look for several key features and benefits. Among the most important of these are: the overall trading experience, the breadth and depth of product offerings (currencies, cfds, indexes, commodities, spread betting, cryptocurrencies, etc.), fees (including spreads and commissions), trading platform(s) (web-based, downloadable software, mobile, charting, and third-party platforms), customer support, trading education and research, and trustworthiness.

Through extensive research and a strict adherence to our robust methodology, we have determined the best forex brokers in all of these areas and more, which has resulted in our top rankings below. Our mission has always been to help people make the most informed decisions about how, when, and where to trade and invest. Given recent market volatility and the changes in the online forex brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top trading platforms for traders of all levels, for every kind of market.

Recommended top 10 forex brokers rating and reviews

Narrowing down the number of forex brokers to just the top 10 forex brokers in the world is complicated. However, we have made a list of the top 10 forex brokers and as with the previous lists; it took vast amounts of forex education.

Many of the experts who provide most of the forex education on our site made the top 10 forex brokers in the world list. They included in this process, many important things you should know.

Read on to find out how we know that this list contains only the best of the best.

1. Forex ratings

This is something we do mathematically. Calculating points is not an easy feat. We base it on so many things. Among them, one is forex education. To understand what it’s like to come up with a rating system, you first need to know what’s important.

When picking the top 10 forex brokers in the world, there is a criterion. The criterion helps us categorize features, services, and versatility.

Here is a list of some of the most important things we consider:

- Regulation authorities

- How old is the company?

- Offices and branches

- Commissions and spreads

- Analytical services, reviews, and forecasts

- Customer reviews

- News about the company

- ECN and PAMM accounts availability

- Forex competitions

- Education for free

- Number of payment systems available

- Automated withdrawals

- Website performance

After doing the ratings, it becomes very easy to pick the names on our top 10 forex brokers in the world. As you can see, it is exhaustive. We examine all the angles we know you care about as the customer.

2. Customer reviews

This is a big part of something that we call ‘ social proof ’ in the world of digital marketing. The word of someone who has used service is worth more than an advert. We read through reviews left by customers to compile an acceptable top 10 forex brokers in the world list.

Reviews make up some points we use in the rating system. However, on their own, they represent accuracy. You want to know that the people telling you an FX broker is good to have the first-hand experience.

Reviews help with:

- Providing a cautionary step before you take any action

- Giving you social proof

- Assuring you of credibility

- Confirming the reliability of a company

We read as many of them as possible to form a clear picture of a company.

3. Reputation

The reputation of a company can help you know about it even before you meet anyone from there. Some of these companies are on the top 10 forex brokers in the world list because of reputation.

Several trusted financial authorities, experts in the forex market and customers speak well about them.

Most of these top 10 forex brokers get their name out there by doing things that include offering free forex education on their websites. We look out for where they get mentioned, why and the impression we get from that.

Read on to find out which ones will be the best for you.

4. Regulation authorities

When it comes to forex brokers, we always want to know that they are regulated. When they are not, it becomes a problem because this lack of regulations opens up doors for fraudulent operations.

Before you sign up with a broker, always make sure that they are appropriately regulated. When you check the bottom of the website for any broker, you will find a license number, if they are genuine.

If you do not see it, ask them for it or avoid them because that is a red flag that they may not be who they say they are.

If they have the number, just copy it and check for their name on the website of the regulator that they claim oversees them. If you do not find it, you should know that they are lying. Some of the most well-known regulators in the world are:

- ASIC – australian securities and investments commission

- Bafin – the bundesanstalt für finanzdienstleistungsaufsicht (germany)

- CFTC – commodities and futures trading commission (united states)

- Cysec – cyprus securities and exchange commission

- FCA – financial conduct authority (united kingdom)

- FFMS – federal financial markets service

- FINMA – swiss financial market supervisory authority

- FMA – financial market authority (austria)

- FSA – financial services agency

- FSB – financial services board (south africa)

- Financial services commission – BVI

- Financial services commission (FSC) – mauritius

- IFSC – international financial services commission

- FSP NZ – new zealand financial service provider

- ISA – israel securities authority

- MFSA – malta financial services authority

- SEBI – securities and exchange board of india

- VFSC – vanuatu financial services commission

- UAE – abu dhabi central bank

With these, you can never go wrong. If the broker is not certified by them, they do not qualify for our list of the top 10 forex brokers in the world. The more the regulation, the better. However, it is not the only metric that makes the companies qualify.

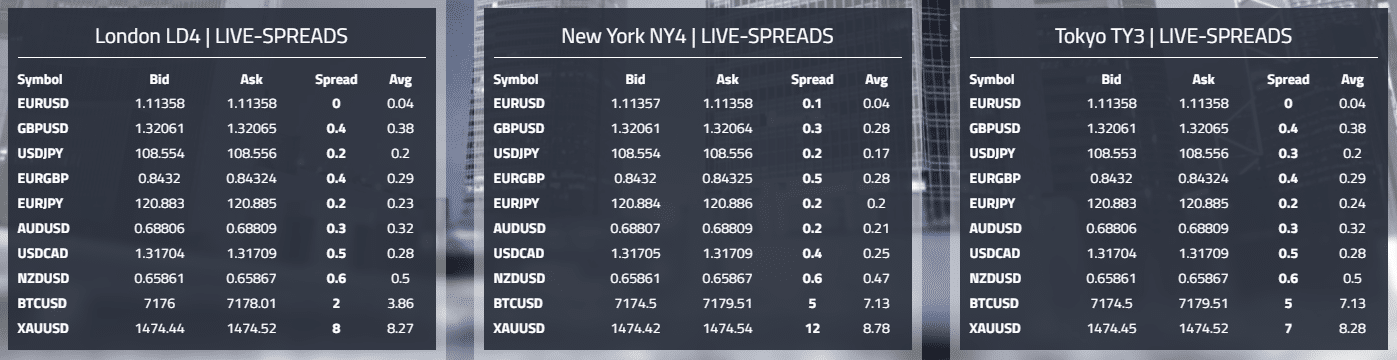

5. Commissions and spreads

The opportunity for a broker to take advantage of you comes in when they do not come clean about the charges. When we look at the commissions and spreads, we want to see them at the industry standard or even lower than usual.

To be clear, we do not pick the top 10 forex brokers in the world because of unusually low fees. The trading fees need only to be reasonably low and not too low. When the deal starts to look too good, always be careful because that is a sign of a scam broker trying to get you.

In picking the top 10, we look at the brokers with the lowest spreads among the points that we look at. When they allow you to make profits reasonably, we add them to our shortlist as we check the other things.

Sometimes, the brokers might advertise a low spread and not have it. In most markets, the aim for most traders is to look for the lowest spreads because they allow you to trade cheaply. So, we make sure to look at the validity of the claims before picking them for this list.

The trader wants to have a profitable strategy that will allow them to lower the transaction costs, as much as possible. Since the spread is the difference between the bid and asks prices, standard accounts will try to charge as much as they can without oppressing the trader too much.

6. News about the company

Knowing as much about a company as possible, require that we look through their past to make sure that they are not hiding something that could be potentially damaging to the clients that they serve. The top 10 forex brokers in the world are the ones with a good track record.

Any company that is worth making it to the list would be in the news in one form or another. We also check what the people who signed up for it say. This helps us have a clear picture of what a company is all about so we can give you accurate information when we compile the top 10 forex brokers list.

7. Education

Most of the top forex brokers in the world know that education for their customers is an essential thing. So, it is not uncommon to find that they provide it. Even the most professional traders know the value of information and will check information before they make a decision.

Having all the information you need for any of the things you need to do in the market is handy. Education forms the backbone of all traders who make it in the market.

8. ECN and PAMM accounts availability

Many of you do not know where to look when trying to find the best ECN brokers online. In our list of the top 10 forex brokers in the world, we have listed some of them who have ECN accounts. With these accounts, you get direct access to liquidity providers.

PAMM accounts are a little trickier. With them, you make use of other traders who are more competent than yourself. They trade on your behalf, for a percentage of the profits. To be on the safe side, you should not go independent when it comes to this.

We have listed the best companies that offer access to this service, it allows you to make money without having to do all that work or take risks as a novice who may not be able to thrive in a competitive market.

To wrap up

The process of picking the top 10 forex brokers in the world is not an easy one, but we had fun doing it because it allowed us to know more about an industry that is one of the biggest in the world. As a trader, you will be safe when you go with any of these choices.

To make sure that no one has to fall prey to scams, we also prepared lists for those who want to know how to avoid scams, lists of true ECN accounts and other reviews that will complement this one to create a fuller picture that will make sure you are adequately prepared when you step out into the world of forex as a trader.

Top 10 forex brokers and trading platforms to trade online

Forex is a portmanteau word consisted of the words foreign exchange and forex trading signifies the trading of currencies. Currency trade has existed for many centuries, even millennia, in fact it can be said that it is as old as money and trading in general. The international forex market is massive, in fact, it is the largest market in the world in terms of volume of trading. Currency trading is essential for international businesses and forex trading is very useful for companies that import or export products and/services.

Below is information that you will require to know while deciding to go with forex trades at any of the top forex brokers site we have listed out below.

Here you will check out each of the sites that are more popular in currency trades. They have been provided here in addition to the other valuable information which will permit you in making your own decision on the forex broker that you will be making use of the services.

Deposit: $50 leverage: 1:50

Deposit: $50 leverage: 1:1000

What are forex brokers

In the past, only large international financial institutions were allowed to trade currencies, but with the introduction of online forex brokers, i.E. Forex trading platforms, individuals are also given an opportunity to invest and increase their capital by trading currencies. Basically, a forex broker is a company which provides a platform for individuals who like to engage in speculative trading of currencies. This type of forex trading, where individuals get to trade via a platform is also known as ‘retail forex trading’, a term used to distinguish it from the more traditional type of forex trading. Even though it appeared only about 20 years ago, online forex trading is now a huge market and recent reports show that the daily trading turnover in 2016 was over $280 billion. There are numerous forex brokers that offer forex trading services to individuals all over the world.

The basic definition of the word broker is ‘someone who sells products or services on behalf of other people’. And that is pretty much true for forex brokers. They buy and sell currencies on your behalf. Unlike conventional brokers that you’ve surely seen in wall street themed movies, you don’t have to call this brokers and they don’t have to be at a particular place in order to trade.

How to choose a forex broker

There are more than few forex brokers that operate online, in fact there are dozens of them.

Choosing the best online forex broker, isn’t always easy, especially since almost every forex trader seems to be the bets. But, you shouldn’t worry, as there are ways to determine which forex broker is trustworthy and reliable.

Licencing

The legal aspect is primary here. You definitely can’t trust a forex broker which isn’t licensed and regulated. Even if their offer looks good and everything seems appealing, you shouldn’t trust a company that lacks appropriate certification. Different countries have different legislation and standards which are applied to forex brokers and their operations. The first step for every trader is to make sure that the forex broker has the appropriate licence and is completely legal.

Currency pairs

There are multiple currencies in the world, but not all of them have the same reputation and not all of them are equally traded. Typically, the american dollar is one of the most interesting currencies.

In addition to the american dollar, there are 7 other currencies which are rated highly:

- Euro (€) – EUR

- Pound sterling (£) – GBP

- Australian dollar ($) – AUD

- New zealand dollar ($) – NZD

- Canadian dollar ($) – CAD

- Swiss franc (fr) – CHF

- Japanese yen (¥) – JPY

A pair consisted of one of the currencies listed above and the USD is called a major. The majors are the most frequently traded pairs and these pairs constitute 85% of the total forex trading on the market. Other, lower-rated currencies are usually paired with the USD and such a pair is called a minor. When a lower-rated currency is paired with the currency other than the US dollar, that pair is called a currency cross, or just a cross.

The number of currency pairs which are offered by a forex brokers is one of the key criteria for establishing the reputation of the brokers. Brokers that offer a larger number of currency pairs should be preferred over ones that offer fewer pairs. Most brokers offer all majors, as well as a number of minors and crosses. If you’re looking to trade a particular pair, then you should definitely check whether the broker in question offers that pair. On the other hand, if you’re looking to trade only the majors, there are other things which you should take into consideration.

Leverage and lot size

Leverage in forex trading is used as a means to provide higher profits which are derived from the changes in the exchange rates of the two respectively paired currencies. In fact, it might be simplest to describe it as a loan provided by the broker to the investor. The leverage may vary, it can be 50:1, 100:1 or even 200:1. Higher leverage provides you with a chance of earning more money through trading, but it also means taking larger risks. Traders that have a higher understanding on the market will be looking for higher leverage.

As you don’t buy the actual currency units, but you actually invest in the expected fluctuation of how two currencies are paired against each other, the traders actually trade larger unit blocks, called lot sizes. A lot size is the number of currency units which are traded. The lot size may be 100, 1,000 or even 10,000 units of the second currency in the pair. It would be wiser to look for a forex broker that offers a variety of lot sizes, including smaller ones which are perfect for traders who are new to forex trading and don’t want to risk large amounts of money.

Market spread

Forex brokers allow you to trade the currency pairs you want and make a profit. The have to make a profit as well, though. Most forex brokers don’t charge any fees, so that you won’t have any initial expenses, but they make their profit through the market spread.

- The spread is the difference between the two positions, which are the buy (bid) and the sell (ask) position. Higher spreads allow brokers to make bigger profits, but they are less favourable for the traders.

The spread percentage is very important, and if you’re looking for a forex trader, it would be wise to choose one that offers lower spreads.

Sometimes, forex traders don’t offer the same spread on different currencies. Usually for large currencies, that take are traded more frequently, the spread will be lower, whereas for smaller currencies, and currencies with a larger volatility the spread will be higher.

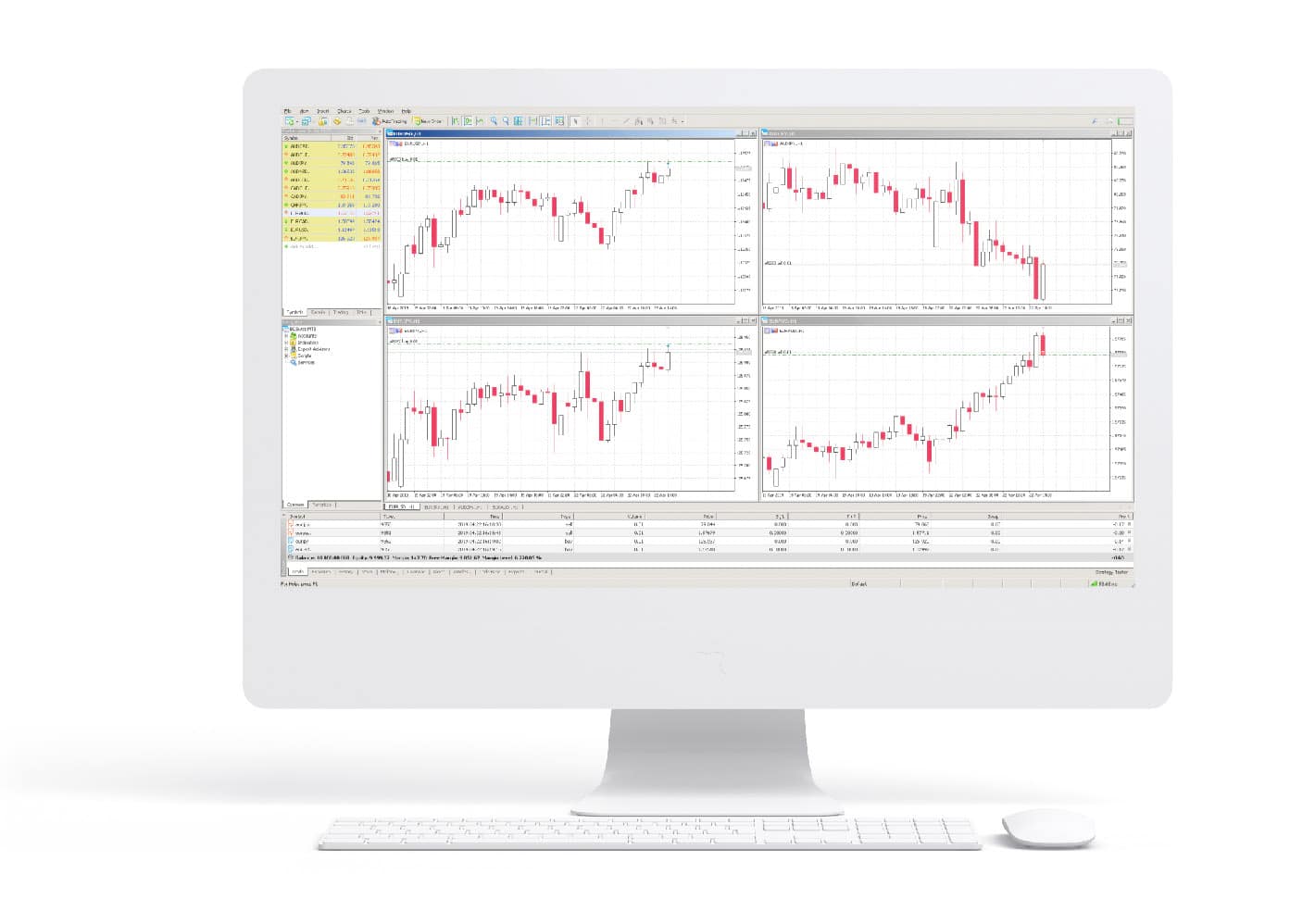

Trading platforms

We have already mentioned that the emergence of forex trading was enabled by the internet. Forex brokers may offer different sorts of trading platforms, downloadable, web-based and from few years ago mobile trading platforms. It all boils down what is more convenient for you as a trader.

Some mobile apps for example, include only some of the features that are offered in the desktop version, whereas other include more options. Moreover, some forex traders offer more than one platform, and each of them may include different elements. It is best to look for a forex broker that offers both a platform for traders who aren’t very experienced. Those platforms are usually easier to use and a lot more user-friendly.

Payment methods

Forex brokers usually offer their customers more than one payment method that will enable them to fund their trading accounts. Some brokers charge fees on deposits and/or withdrawals, whereas with others no extra fees will be charge, other than the ones applied by the provider of the financial service. The deposit and withdrawal limits may differ. The principle here is simple, the brokers that provide more methods and don’t charge any fees have a definite advantage over those that offer a limited amount of payment methods and charge fees on deposits and withdrawals.

Bonuses, training materials and support

As there is a pretty large competition on the forex broker market and multiple companies provide forex trading to customers all over the world, brokers are looking for ways to attract new customers, while also trying to keep their existing ones.

- Bonuses

- Training materials

- Customer support

These three are also very important parts of the overall offer of every forex broker, in conjunction, of course, with the pairs, leverage and market spread.

The types of bonuses that are offered may vary. Many brokers offer a welcome bonus, where traders get additional funds, on top of the ones that they deposited. Some brokers offer bonus funds even before the traders make their first deposit.

Some traders are new to forex trading and that is why it is only fair for brokers to provide them with the necessary learning materials that will help them improve their understanding of the market fluctuations and forex trading as a whole. Many brokers allow traders to open a demo account, which will allow them to simulate forex trading without any risk of losing real money. In addition, e-books, videos and even webinars on forex trading are also provided.

Customer support is an important aspect for every service industry and forex brokers aren’t excluded. Help is provided via phone, email and live chat and most brokers’ websites have an FAQ section which provides answers to specific questions.

Why trade forex online?

There are many reasons why you should seriously consider placing forex trades online, and if you are new to this environment it can often be something of a confusing forex trading environment at first, as there are many different currencies that can be paired together and lots of different trading platforms to choose from.

However, do remember that if you do decide to trade forex online then at no point in time are you having to actually buy the two currencies you are trading against each other and therefore your costs of becoming a forex trader are massively reduced.

When you chose to trade at any of our top 10 forex brokers you are only going to be placing a trade on which way you think one currency is going to move against another, and as such your leverage is far greater online.

Imagine the fuss and hassle involved with having to first buy one currency, and then if it moves in the direction you want it to then finding somewhere to sell that currency to and then buy the other one! Those days are long gone now and you really are going to be amazed at all of the next generation of forex brokers listed and fully reviewed throughout this website!

The respective financial authorities of every countries provide licences under which forex brokers are allowed to operate and offer their services to citizens of that particular country.

Forex trading is legal in most countries of the world, even if the country doesn’t have a financial authority who issues licences.

Yes, forex brokers are able to offer services outside the country they’re based in. Some countries would require a broker to obtain a licence, others will allow them to operate under a licence issued elsewhere. It really depends on the local laws.

Many forex brokers also offer contract-for- difference (CFD), commodities, as well as stocks and indices and it is possible for traders to use one account for all of them.

They are usually open the whole time, but when it comes to trading, it is offered monday through friday. The starting hour on monday and the closing hour on friday depends on the pair in question.

Most forex brokers have a deposit limit. The specific limit depends on your choice of currency, but usually it isn’t very high.

Licenced forex brokers comply with all financial standards and security measures that are employed by the world’s leading financial institutions. Encryption technology is used to ensure that no third parties will be allowed to access customers’ financial information and the customers’ details are not handed to third parties. Most reliable companies, keep their customers’ trading funds in a separate account, to ensure that they won’t be lost no matter what.

Some forex brokers allow their customers to open multiple trading accounts, but they are advised to use the same personal details for each of them.

Yes, all forex traders require customers to provide identity verification documents, either when they register or when they’re about to make their first withdrawal. Most forex brokers would require you to present a proof of identity and a proof residency, so they can confirm that you are who you claim to be and that you are legally allowed to trade forex.

Yes, there are no legal limits on the number of forex trading accounts that may be opened in your name. As long as you are legally allowed to have one account, you are also able to have as many as you want.

Yes, you can trade any of the forex pairs that are offered by the broker, not just pairs that include your preferred currency/ the currency of your country.

Top 10 ECN forex brokers in 2021

It would be best if you kept in mind that not all brokers work in every single country. That’s why you will need to figure out the top 10 forex brokers from different country-specific regulatory bodies. Besides, with the development of technologies, many brokers offer some new forex strategies. So, while selecting the top 10 forex brokers, make sure you look at their trading strategies.

In this article, we will thoroughly educate you on all the available forex trading strategies you should look at while choosing a forex broker.

First, let’s get to know the forex brokers in different countries.

Top 10 ECN forex brokers

15% bonus

100% bonus

100% bonus

How many forex brokers are available in the world?

It is tough to know the exact broker’s number, as new brokers are being introduced frequently. However, according to the MT4 brokerage user’s data, more than 1200 forex brokers are now available worldwide.

Those more 1200 brokers are handling 13.9 million online traders worldwide, which is increasing daily.

Country-specific

If you are actively looking for a fully rounded forex trading experience, we strongly advise you to check the top 10 brokers from different countries. The following list contains an overview of country-specific regulatory and licensing bodies for seven different countries. This comprehensive list will help you understand what you should look for when gathering forex strategies for the top 10 forex brokers.

Forex strategies for UK regulated brokers

The top 10 forex brokers in UK should show the commitment to give you unsurpassed trading along with the first-rate trading experience. Besides, they should be regulated by the UK financial conduct authority (FCA) .

When you join any brokers from the UK, make sure you can deposit and withdraw using GBP.

US regulated forex brokers

Because of strict US regulations, you may not find too many forex brokers to offer you based on the USA. That’s why it may take a longer time for you to sort out the top 10 forex brokers in the US. Some of the brokers are the USA doesn’t offer service in all states. However, when you come to know about a broker, you should check that license and regulations first.

For verification, you can check out with either the national futures association (NFA) or the commodity futures trading commission (CFTC). If you find any non-regulated broker in the USA, we suggest you avoid those. By joining a regulated broker, you will have peace of mind. You will know that regulatory bodies are there if you face and fraudulent activities. Additionally, check the broker’s forex strategies if they have any. A US broker should be making transactions only in USD currencies.

Australian regulated forex brokers and platforms

There are several forex brokers who offer their services exclusively australian residents. To find out the top 10 forex brokers in australia, make sure you check their funding method. If any broker claims to be australian, they are supposed to allow you to deposit in AUD currencies. Besides, they should be regulated by the australian securities and investments commission (ASIC).

Canadian regulated top 10 forex brokers

All the related financial services in canada are licensed and regulated by the investment industry regulatory organisation of canada (IIROC). However, this authority doesn’t regulate forex brokers in canada. So, if you are seeking to work with any legit canadian forex broker, you will find it hard to find one.

To look for a canadian forex broker, you have to put your highest effort on research. Especially, cross-check with different forex-related forums and communities.

Forex brokers with european regulation

Since many europeans are involved in forex trading, you will find plenty of forex brokers located in europe. Different countries are actively trading currencies such as germany, netherlands, spain, sweden, france, cyprus, and italy. All of these countries have their regulations regarding forex trading. If you are in europe, it will be easier to find the top 10 forex brokers in europe.

However, you still have to do plenty of research to find the broker with the best forex strategies.

The common checklist for top 10 forex brokers

The first this you have to check is, the forex broker you sign up should be licensed to your home country. Besides, that country-specific broker should allow you to make the transaction in that country’s local currencies. On the other hand, their forex trading strategies should include a wide range of currency pairs.

As the forex market is developing day by day, more brokers offer their services to private traders. So, making the right choice and not stumble on the scams is difficult. The second thing you should check is their reputation in different communities and forums. Instead of finding all the positive reviews, you should check for the negative reviews too. That’s how you will get to know the actual condition of a broker.

Forex strategies and goals

Before discussing forex strategies, we need to first elaborate, why would one consider trading foreign currencies in the first place? According to the experts, there are two reasons to trade forex: hedging, and the other is speculation.

Hedging is the way to protect companies from losses. Brokers get their profits from foreign countries. After that, they transfer it to their own country with the expectation of fluctuation in the currency. However, this practice is not relevant to forex strategies.

On the other hand, speculation is the prediction of a move a company can make in some certain situation. If the prediction is correct, it can improve the trading results. Speculation is all about day trading. With decent trading strategies, you can progress in the FX trading. In the end, you may apply your own forex strategies. Although applying their strategy could be time-consuming and difficult.

But, there is good news that plenty of pre-made trading strategies are available for your convenience. However, it is advisable to play it safe, especially when you are a new trader. Let’s dig the available pre-made strategies.

What is the best forex strategies?

Here, we will show you the overview of some working strategies that have been running in the forex industries over the years. From those strategies, you may research the one you might want to apply.

The following are some methods that will help you to apply strategies and gain pips.

The bladerunner trade

This strategy is suitable for currency pairings for all timeframes. Right now, bladerunner trade is one of the trending strategies that is taking by most of the traders. It is mainly a price action strategy.

Bolly band bounce trade

Bolly band focus on the ranging market. It works very well with the combination of confirming signals. If you are interested in bollinger bands, you should check the bolly band bounces forex strategies.

Daily fibonacci pivot trade

It uses only daily pivots. However, according to this strategy, you can extend to a longer timeline. Fibonacci pivot combines fibonacci retracements and extensions. On the other hand, fibonacci can incorporate any amount of pivots.

Forex overlapping fibonacci trading strategies

Most of the traders follow this strategy, but the reliability of this method is a bit lower. However, it is used with the combination of appropriate confirming signals, and ultimately they become accurate.

Pop ‘n’ stop trade

Unless you know the trick, trying to chase the price when it goes reverse rarely works. This forex strategy will provide you a tip so that you may know whether the price will keep rising or drop.

Trading the forex fractal

It is considered a concept, rather than a strategy. However, it teaches you about the market fundamentals that accelerate your efficiency in trading.

Trading is usually a game of trial and error. You have to apply different strategies to know the right one for you.

To some traders, scalping is time-consuming and needs a lot of work. However, it is not useful for all traders. Although scalping works if you can do it properly. Some traders might think that scalping could take the fun out of forex strategies.

On the other hand, if you are looking for the best forex trading strategy, this might be the safest one for you. As a day trader, you might dip in and out of the forex market one in a day or twice, including carrying a position into another period. Eventually, the profit will come back.

If you are a knowledgeable scalper, you may trade in and out several times a day. However, you may see a small profit, but they would be steady. The more you scalp, the more money you make.

As a scalper, you should know when inflation rates, unemployment figures, and GDP information are about to release. Those factors affect strategies. Scalping can help you out in those situations trading with top 10 forex brokers.

Positional trading

As we already know that scalping will teach you about the current market; at the same time, it is time-consuming. You have to sit for a long time in front of the computer while scalping. Considering that, it would be more efficient to find a less time-consuming strategy.

Positional trading can be great alternatives. It will take only a few hours a week, and it can provide a handsome amount of profit.

Having your position opened for a long period is usually the position trading. It allows you to catch some large market moves. On position trading, you have to avoid using high leverage and keep the focus on currency swaps.

Final thoughts

Among all the forex strategies, applying the right one with top 10 forex brokers would be hard. To become successful in forex, you should research yourself and work with experiments.

Whether you are a new or seasoned trader, everything depends on the broker. That is why it is suggested to work with the top 10 forex brokers. You will find many brokers claiming themselves as a top broker. However, your job is to filter all the brokers and choose a perfect one for your trading.

Fxdailyreport.Com

Top 10 forex brokers list 2021

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker |

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $100 spread: starting 0 pips leverage: up to 400:1 regulation: FCA UK, NFA, CFTC, ASIC, IIROC, FSA, CIMA | visit broker | |

| min deposit: $300 spread: floating, from 0 pips leverage: 500:1 regulation: FCA UK reference number 579202 | visit broker | ||

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: no minimum deposit spread: 1.2 pips leverage: 50:1 regulation: CFTC, NFA, FCA, MAS, ASIC, IIROC | visit broker | |

| min deposit: $10 spread: leverage: regulation: cysec | - | visit broker | |

| min deposit: $200 spread: from 3 pips leverage: 400:1 regulation: NFA, FCA, cysec | visit broker |

XM.Com, a trade name of trading point holdings ltd, is owned as well as operated by trading point of financial instruments ltd, which is regulated by cysec. It is also european union-registered forex broker. XM has its headquarters in limassol, cyprus.

Broker type – DMA/STP, MM

minimum deposit – $5

deposit options: bank wire, neteller, skrill, webmoney, credit card, westernunion, moneygram, SOFORT, unionpay (china), etc.

Maximum leverage – 888:1

minimum lot size – 0.01

spreads – variable

lowest spreads for EUR/USD – more than 1

FBS, an international forex broker, has presence in over 120 countries. The online forex company boasts of 2,000,000 traders (clients) and 130,000 partners. For muslim traders, the broker provides swap-free or islamic accounts. FBS was founded in 2009 and they do not offer financial services to people in the USA, belize and japan.

Broker type – ECN/STP, DMA/STP, MM

minimum deposit – $5

deposit options: visa/master card, neteller, skrill (7.5% commmission), webmoney, perfectmoney, OKPAY, FBS exchanger, wire transfer, yuupay (3% commission), etc.

Maximum leverage – 500:1

minimum lot size – 0.01

spreads – fixed and variable

lowest spreads for EUR/USD – 2 pips for mini accounts and 1 – 2 for standard accounts

Pepperstone, an execution-only forex as well as CFD broker, provides trading solutions that cater to both veteran and novice traders. Founded in 2010, the company has its headquarters located in melbourne, australia. The company has offices in shanghai, china and dallas, USA.

Broker type – electronic communication network/straight through processing and direct market access/straight through processing

regulation – australian securities and investments commission (ASIC)

platforms – metatrader4, ctrader

minimum deposit – $200

deposit options – bank wire, debit card, credit card, webmoney, neteller, fasapay, skrill, BPAY, poli, QIWI, paypal, unionpay(china), etc.

Maximum leverage – 400:1

minimum lot size – 0.01

spreads – variable

lowest spreads for EUR/USD – more than 0.5 pips for mini and standard; more than 0.1 pips for ECN

Tickmill, owned by tickmill limited and operated by tmill UK limited and tickmill ltd., which is a company registered in england and wales. Tickmill has principal and registered offices in london and seychelles. Tickmill is under the regulatory control of both financial operates conduct authority in the UK and financial services authority of seychelles.

Broker type – STP/ECN/NDD/DMA

regulation – FCA, UK and FSA, seychelles

platforms – web platform, metatrader 4, mobile platform

minimum deposit – $25

deposit options – wire transfer, credit/debit card, webmoney, unionpay, skrill, neteller, fasapay

maximum leverage – 500:1

minimum lot size – 0.01

spreads – variable

lowest spreads for EUR/USD – starts from 0.0

In 2013, fxopen launched its online trading platform. Fxopen UK, based in london, is regulated by the financial conduct authority in the UK.

Broker type – ECN/STP

regulation – FCA, UK

platforms – three versions of MT4

minimum deposit – $300

deposit options – bank wire transfer, credit/debit cards, webmoney, neteller, skrill, payza

maximum leverage – 500:1

minimum lot size – 0.01

spreads – variable

lowest spreads for EUR/USD – starts from 0 pips

Plus500 forex trading platform is provided by plus500cy ltd., which is a company based in cyprus and with headquarters in limassol. This broker is authorized as well as regulated by the cyprus securities and exchange commission.

Broker type – market maker

regulation – cyprus securities and exchange commission (cysec), financial conduct authority (FCA), australian securities and investments commission (ASIC)

platforms – windows trader, webtrader

minimum deposit – $100

deposit options – bank wire, paypal, credit card, skrill, etc.

Maximum leverage – 50:1

minimum lot size – 0.01

spreads – fixed

lowest spreads for EUR/USD – 2

ETX capital, a financial services company based in the UK, provides institutional, high net worth and retail customers with online platforms for trading forex and derivatives. ETX capital is the trading name of monecor (london) limited.

Broker type – forex and CFD broker

regulation – FFCA, UK

platforms – MT4, marketspulse

minimum deposit – $100

deposit options – china unionpay, giropay, neteller, credit card, sofort, wire transfer, skrill

maximum leverage – 400:1

minimum lot size – 0.01

spreads – fixed

lowest spreads for EUR/USD – 0.7

Octa markets was incorporated 2011 and the forex brokerage serves clients in more than 100 countries around the world. The company is registered in saint vincent and the grenadines. The company operates under the regulatory purview of IFSA.

Broker type – DMA/STP

minimum deposit – $5

deposit options: bank wire, debit card, credit card, skrill, neteller, unionpay (china), fasapay, etc.

Maximum leverage – 500

minimum lot size – 0.01

spreads – variable

lowest spreads for EUR/USD – more than 1.5

Avatrade, a pioneer in the field of online forex trading from 2006 onwards, was created for the purpose of providing great online trading experience to retail traders. Within a short time, avatrade had more than 20,000 registered customers executing over 2,000,000 trades in a month around the globe. The total value of trades surpasses $60 billion in a month.

Broker type – market maker

regulation – australian securities and investments commission (ASIC); central bank of ireland; financial futures association, japan; financial services board (FSB), south africa and israel securities authority (ISA)

platforms – metatrader 4, avatrader

minimum deposit – $100

deposit options – bank wire, paypal, webmoney, skrill, credit card, neteller, prepaid master card, etc.

Maximum leverage – 400

minimum lot size – 0.05

spreads – fixed

lowest spreads for EUR/USD – 3

Etoro, an online forex broker, offers trading in currencies, indices, commodities and CFD stocks. More than 4.5 million users from over 170 countries around the world make use of the online forex broker’s website. Founded in 2006 in tel aviv, the multi-asset brokerage company has registered offices in israel, the united kingdom and cyprus. One of the key features of etoro is the social investment platform with copy-trading feature that it offers.

Broker type – market maker

regulation – cyprus securities and exchange commission (cysec), markets in financial instruments directive (mifid), commodity futures trading commission (CFTC), financial conduit authority (FCA), national futures association (NFA), australian securities and investments commission (ASIC)

platforms – etoro openbook, etoro webtrader, etoro mobile trader

minimum deposit – $50

deposit options – bank wire transfer, credit/debit card, skrill, moneygram, paypal, neteller, webmoney, western union

maximum leverage – 400:1

minimum lot size – 0.01

spreads – fixed

lowest spreads for EUR/USD – 3

Best worldwide forex brokers in 2021

The top 10 forex brokers in the world were determined based on global forex regulation, spreads and the best forex trading platforms. The companies that made the top 10 list were outstanding at a unique forex trading category.

Compare the top forex brokers in the world based on their size, spreads, trading platform and more.

Top 10 forex brokers in the world 2021

By regulator and features here is the list of the largest forex brokers

Pepperstone – best global forex broker overall

IC markets – top ASIC broker with lowest spreads

CMC markets – FCA broker with range of currency pairs

Forex.Com – IIROC broker for canadian traders

IG – best broker for beginners with DFSA licence

FP markets – top CYSEC broker with metatrader 4

Interactive brokers – MAS fx broker and stockbroker

FXTM – top FSC broker with highest leverage

Pepperstone is the best global broker

Pepperstone is considered the best global broker overall, as it’s a great option for all styles of CFD and forex trading. All the tools and features required to develop successful currency trading strategies are offered by pepperstone, including low spreads, the best trading platforms, a great product range and award-winning customer services.

Spreads and account types

Regardless of the subsidiary you register with, pepperstone offers two account types that are suited to different strategies and levels of trading experience. You can choose between either commission-free standard spreads or razor spreads where you pay a flat rate commission fee.

Razor account – great for active traders

If you want to execute day trading, scalping or automated trading strategies, pepperstone’s razor account provides an ECN-style trading environment with ultra-tight spreads. As shown below, pepperstone offers low spreads that most of the world’s best brokers fail to match. For commonly traded forex pairs like the USD/JPY spreads average 0.13 pips with pepperstone, much less than what brokers such as tradersway and XTB offer, which average 0.50 pips.

Because you gain access to institutional grade spreads that can be as low as 0.0 pips, you pay a flat rate commission fee on top of the spread. Metatrader users incur a fee of AUD $3.50 per side per 100k traded, while ctrader has a 7 unit charge per lot. With ECN-like spreads and low commission fees, overall trading costs are low for razor account holders.

Data taken from broker website. Accurate as at 05/01/2021

Standard account – great for new traders

Standard accounts are great for beginners as you can trade commission-free spreads, avoiding the need to calculate trading costs when you’re starting out and building confidence. Compared to other top brokers, pepperstone offers the tightest no commission spreads. For instance, the standard account holders can access spreads averaging 1.33 pips for the AUD/JPY, significantly lower than 4.90 pips at tradersway or 3.36 pips at fxpro.

Data taken from broker website. Accurate as at 05/01/2021

Trading platforms and market access

To access the broker’s diverse range of forex and cfds pepperstone clients can use choose either metatrader 4 (MT4), metatrader 5 (MT5) or ctrader as their trading platform. All are available as desktop trading platforms for PC and mac computers, mobile apps for ios and android devices as well as webtrader platforms for online trading.

Five different asset classes are available to trade being forex, commodities, shares, indices and cryptocurrencies. As well as major, minor and exotic currency pairs you can also trade currency indices such as the US dollar index (USDX), a weighted basket of six major currencies including the GBP, JPY and EUR.

Although the online broker offers access to over 150 financial markets, access depends on the trading platform you are using. For example, share trading only available on MT5 as it is a multi-asset platform, while ctrader and MT4 are predominately forex trading platforms.

Pepperstone is ideal if you want to focus on trading cryptocurrency. Spreads are competitive and commission-free for when trading crypto with pepperstone. Five CFD products are available (bitcoin, bitcoin cash, ethereum, litecoin and dash), with bitcoin spreads starting from $10.00.

Note: clients in the UK will not be able to trade cryptocurrencies as the UK regulator, the FCA, no longer allows crypto trading.

Whether you are trading forex, cryptocurrencies or share cfds, pepperstone trading platforms offer a great range of analysis and automation features to help you develop trading strategies and save time.

Trading tools:

- Algorithmic trading with expert advisors (eas) on metatrader platform or cbots when using ctrader.

- Social-copy trading via metatrader’s trading signals or third-party social trading services such as myfxbook, mirror trader and duplitrade.

- Charting tools to perform technical analysis and fundamental tools such as an economic calendar.

- Autochartist and add-on expert advisors and indicators (pepperstone’s smart trader tools) are free to download

Tier-1 regulators

As well as an excellent trading environment and product range, pepperstone is seen as safe and trustworthy as it’s overseen by top-tier financial authorities. The level of investor protection you receive as a pepperstone client depends on where you reside and the subsidiary you register with:

- Pepperstone, UK: regulated by the financial conduct authority, maximum leverage of 30:1 when trading forex and negative balance protection (NBP) is provided.

- Pepperstone, australia: regulated by the australian securities and investments commission (ASIC), no NBP or leverage caps, with a maximum leverage of 500:1 for forex instruments.

- Pepperstone, dubai: regulated by the dubai financial services authority (DFSA), maximum forex leverage 50:1.

- Pepperstone, EU (mainland europe): regulated by cyprus securities exchange (cysec), maximum leverage 30:1

- Pepperstone gmbh (germany and austria): regulated by the federal financial supervisory authority (bafin), maximum leverage 30:1

- Pepperstone, international: regulated by the securities commission of the bahamas, no investor protections such as NBP or leverage caps.

Note: clients in the UK should sign with pepperstone UK, clients in germany and austria should sign with pepperstone gmbh, clients in other mainland europe countries should sign with pepperstone EU.

Customer support

Pepperstone is known for its reliable and efficient customer service. Live chat, phone or email can be used to get in touch with the customer support team, with all contact methods available 24/6. The online broker has been recognised for its customer services for many years now, winning awards for the quality of trading support and relationship management provided by pepperstone.

Education

Pepperstone provides a range of free educational resources (such as webinars) to help you develop trading strategies and conduct market analysis.

| Education | research |

|---|---|

| webinars and videos | market news |

| trading platform tutorials | market analysis and commentary |

| educational articles | economic calendar |

| glossary | trading guides |

| demo accounts | trading ideas |

Another key educational resource is the broker’s demo account. As cfds and forex are complex instruments, trading comes with a high risk of losing money. Demos allow you to practise and build confidence in real-time currency trading conditions, but in a risk-free environment. The online broker offers trials for MT4, MT5 and ctrader with both standard and razor account pricing.

To open a real account with pepperstone, no minimum deposit is required, although the broker recommends at least $200.

Our rating

The overall rating is based on review by our experts

Top 10 ECN forex brokers in 2021

It would be best if you kept in mind that not all brokers work in every single country. That’s why you will need to figure out the top 10 forex brokers from different country-specific regulatory bodies. Besides, with the development of technologies, many brokers offer some new forex strategies. So, while selecting the top 10 forex brokers, make sure you look at their trading strategies.

In this article, we will thoroughly educate you on all the available forex trading strategies you should look at while choosing a forex broker.

First, let’s get to know the forex brokers in different countries.

Top 10 ECN forex brokers

15% bonus

100% bonus

100% bonus

How many forex brokers are available in the world?

It is tough to know the exact broker’s number, as new brokers are being introduced frequently. However, according to the MT4 brokerage user’s data, more than 1200 forex brokers are now available worldwide.

Those more 1200 brokers are handling 13.9 million online traders worldwide, which is increasing daily.

Country-specific

If you are actively looking for a fully rounded forex trading experience, we strongly advise you to check the top 10 brokers from different countries. The following list contains an overview of country-specific regulatory and licensing bodies for seven different countries. This comprehensive list will help you understand what you should look for when gathering forex strategies for the top 10 forex brokers.

Forex strategies for UK regulated brokers

The top 10 forex brokers in UK should show the commitment to give you unsurpassed trading along with the first-rate trading experience. Besides, they should be regulated by the UK financial conduct authority (FCA) .

When you join any brokers from the UK, make sure you can deposit and withdraw using GBP.

US regulated forex brokers

Because of strict US regulations, you may not find too many forex brokers to offer you based on the USA. That’s why it may take a longer time for you to sort out the top 10 forex brokers in the US. Some of the brokers are the USA doesn’t offer service in all states. However, when you come to know about a broker, you should check that license and regulations first.

For verification, you can check out with either the national futures association (NFA) or the commodity futures trading commission (CFTC). If you find any non-regulated broker in the USA, we suggest you avoid those. By joining a regulated broker, you will have peace of mind. You will know that regulatory bodies are there if you face and fraudulent activities. Additionally, check the broker’s forex strategies if they have any. A US broker should be making transactions only in USD currencies.

Australian regulated forex brokers and platforms

There are several forex brokers who offer their services exclusively australian residents. To find out the top 10 forex brokers in australia, make sure you check their funding method. If any broker claims to be australian, they are supposed to allow you to deposit in AUD currencies. Besides, they should be regulated by the australian securities and investments commission (ASIC).

Canadian regulated top 10 forex brokers

All the related financial services in canada are licensed and regulated by the investment industry regulatory organisation of canada (IIROC). However, this authority doesn’t regulate forex brokers in canada. So, if you are seeking to work with any legit canadian forex broker, you will find it hard to find one.

To look for a canadian forex broker, you have to put your highest effort on research. Especially, cross-check with different forex-related forums and communities.

Forex brokers with european regulation

Since many europeans are involved in forex trading, you will find plenty of forex brokers located in europe. Different countries are actively trading currencies such as germany, netherlands, spain, sweden, france, cyprus, and italy. All of these countries have their regulations regarding forex trading. If you are in europe, it will be easier to find the top 10 forex brokers in europe.

However, you still have to do plenty of research to find the broker with the best forex strategies.

The common checklist for top 10 forex brokers

The first this you have to check is, the forex broker you sign up should be licensed to your home country. Besides, that country-specific broker should allow you to make the transaction in that country’s local currencies. On the other hand, their forex trading strategies should include a wide range of currency pairs.

As the forex market is developing day by day, more brokers offer their services to private traders. So, making the right choice and not stumble on the scams is difficult. The second thing you should check is their reputation in different communities and forums. Instead of finding all the positive reviews, you should check for the negative reviews too. That’s how you will get to know the actual condition of a broker.

Forex strategies and goals

Before discussing forex strategies, we need to first elaborate, why would one consider trading foreign currencies in the first place? According to the experts, there are two reasons to trade forex: hedging, and the other is speculation.

Hedging is the way to protect companies from losses. Brokers get their profits from foreign countries. After that, they transfer it to their own country with the expectation of fluctuation in the currency. However, this practice is not relevant to forex strategies.

On the other hand, speculation is the prediction of a move a company can make in some certain situation. If the prediction is correct, it can improve the trading results. Speculation is all about day trading. With decent trading strategies, you can progress in the FX trading. In the end, you may apply your own forex strategies. Although applying their strategy could be time-consuming and difficult.

But, there is good news that plenty of pre-made trading strategies are available for your convenience. However, it is advisable to play it safe, especially when you are a new trader. Let’s dig the available pre-made strategies.

What is the best forex strategies?

Here, we will show you the overview of some working strategies that have been running in the forex industries over the years. From those strategies, you may research the one you might want to apply.

The following are some methods that will help you to apply strategies and gain pips.

The bladerunner trade

This strategy is suitable for currency pairings for all timeframes. Right now, bladerunner trade is one of the trending strategies that is taking by most of the traders. It is mainly a price action strategy.

Bolly band bounce trade

Bolly band focus on the ranging market. It works very well with the combination of confirming signals. If you are interested in bollinger bands, you should check the bolly band bounces forex strategies.

Daily fibonacci pivot trade

It uses only daily pivots. However, according to this strategy, you can extend to a longer timeline. Fibonacci pivot combines fibonacci retracements and extensions. On the other hand, fibonacci can incorporate any amount of pivots.

Forex overlapping fibonacci trading strategies

Most of the traders follow this strategy, but the reliability of this method is a bit lower. However, it is used with the combination of appropriate confirming signals, and ultimately they become accurate.

Pop ‘n’ stop trade

Unless you know the trick, trying to chase the price when it goes reverse rarely works. This forex strategy will provide you a tip so that you may know whether the price will keep rising or drop.

Trading the forex fractal

It is considered a concept, rather than a strategy. However, it teaches you about the market fundamentals that accelerate your efficiency in trading.

Trading is usually a game of trial and error. You have to apply different strategies to know the right one for you.

To some traders, scalping is time-consuming and needs a lot of work. However, it is not useful for all traders. Although scalping works if you can do it properly. Some traders might think that scalping could take the fun out of forex strategies.

On the other hand, if you are looking for the best forex trading strategy, this might be the safest one for you. As a day trader, you might dip in and out of the forex market one in a day or twice, including carrying a position into another period. Eventually, the profit will come back.

If you are a knowledgeable scalper, you may trade in and out several times a day. However, you may see a small profit, but they would be steady. The more you scalp, the more money you make.

As a scalper, you should know when inflation rates, unemployment figures, and GDP information are about to release. Those factors affect strategies. Scalping can help you out in those situations trading with top 10 forex brokers.

Positional trading

As we already know that scalping will teach you about the current market; at the same time, it is time-consuming. You have to sit for a long time in front of the computer while scalping. Considering that, it would be more efficient to find a less time-consuming strategy.

Positional trading can be great alternatives. It will take only a few hours a week, and it can provide a handsome amount of profit.

Having your position opened for a long period is usually the position trading. It allows you to catch some large market moves. On position trading, you have to avoid using high leverage and keep the focus on currency swaps.

Final thoughts

Among all the forex strategies, applying the right one with top 10 forex brokers would be hard. To become successful in forex, you should research yourself and work with experiments.

Whether you are a new or seasoned trader, everything depends on the broker. That is why it is suggested to work with the top 10 forex brokers. You will find many brokers claiming themselves as a top broker. However, your job is to filter all the brokers and choose a perfect one for your trading.

Top 7 of best US forex brokers for 2021

Top rated:

Are you searching for the best US forex brokers?

Luckily, our team of professional forex broker reviewers can take care of your every need.

Let alone the best forex broker in USA, our team realizes it is tough to find any broker which offers a trustworthy, and still value for money proposition when you want to trade forex in the USA. Forex brokers accepting US clients may be few and far between, but we have combined years of experience to narrow your selection down to the top five brokers.

These five are among the best forex brokers USA has to offer.

In fact, they are some of the best forex brokers for residents of any country. These brokers will ensure you feel safe, secure, and still have the ability to prosper in your trading career. They have been selected as the best US forex brokers for a variety of reasons.

Among these reasons are the amount of trading support they offer you, they wide range of markets and instruments that are available for trading, and the very competitive pricing and fee structure offered by these top forex brokers.

Table of contents

Is forex trading legal in the USA?

As a forex trader in the US, one of the most important questions you may be asking yourself from the outset surrounds the legality of forex trading in the US. Well, we are pleased to tell you that yes, forex trading is legal in the US. In fact, the US has several top financial regulators providing the best protection to you as a trader. These bodies are FINRA, the SEC, CFTC, and NFA with the latter two being the main regulators when it comes to forex trading and trading in derivatives such as futures. Remember also that cfds trading in the US is not permitted.

How to trade forex in the USA

The process of getting started with a forex broker in the US is typically similar to that of any other country. With any top broker you will usually be asked for the following information:

- Proof of identity. A passport is typically best for this purpose.

- Proof of residence, usually in the form of a bank statement at your current address.

Once these documents are uploaded and verified, a process that takes most forex brokers just a few minutes, you will be free to get started trading forex.

Top 7 forex brokers in the USA listing for 2021

Here’s our list of the best US forex brokers:

1. Forex.Com

When it comes to US forex brokers, forex.Com has to be an immediate consideration for opening your forex trading account in the USA. They are CFTC licensed and NFA regulated (#0339826) and provide a selection of flexible and accessible account types with low spreads starting from 0.2 pips, including their direct market access account. This offers some of the most unbeatable spreads among any of the forex trading brokers USA. They also provide extensive trading options in all of the top forex currency pairs, metals including gold and silver, as well as futures trading. When it comes to forex brokers accepting US clients, forex.Com certainly offers among the most comprehensive range of services to their US-based traders.

The forex.Com minimum deposits starting form $1000 on standard, and commission accounts, and $25,000 on DMA accounts with demo accounts available. There are also a range of other great benefits such as cash rebates and reduced or no fees for active traders.

2. IG markets

With over 40-years in the industry, IG markets is a true pioneer of the industry, and among the most long standing forex brokers accepting US clients. The broker has evolved continually, keeping the requirements of US-based traders as a top priority. These can be traded on MT4, the mainstay trading platform for top US forex brokers and traders from all around the world as well as being both CFTC licensed, and NFA regulated (#0509630). IG markets offers one type of account to all traders and this has a minimum deposit requirement of $250.

Accessibility with IG is also excellent, you can engage with a number of top professional charting packages using your desktop, phone, or other smart device. Beyond the USA, IG markets also featured in our top 10 largest forex brokers australia. This showcases their global appeal to traders. This appeal is further enhanced by a great cost of trading on more than 90 forex pairs with spreads starting at 0.8 pips.

3. Interactive brokers

You will very often find interactive brokers among our lists of top forex brokers. This is also true when it comes to our choice of top US forex brokers. This is thanks to a number of positive aspects which the longstanding broker uses to attract clients around the world. These include an excellent proprietary trading platform which offers some of the most advanced trading tools available on any market, and a widespread list of products which are available at highly competitive rates. These products include currencies, options, metals, and indices within a list which is ever increasing. IB are a FINRA member and regulated by both the CFTC and NFA (#0392970), as well as the SEC (#8-47257).

They have two account types, you can choose the IBKR lite, or IBKR pro both at no minimum deposit though the pro account has a $10 maintenance fee. As mentioned the product range is excellent as is the trading cost with spreads from 0.1 pips on 105 forex pairs. All of these features make IB a top choice particularly for experienced traders.

4. Oanda

Oanda is also making progress toward becoming the best forex broker in the USA. The industry leader is making progressive inroads in the US market, and now offers trading in more than 70 diverse forex currency pairs. This is more than enough for you to trade successfully. Added to this, you can also benefit from the powerful educational and research infrastructure oanda provides. This includes marketpulse, a selection of news, technical analysis, and research resources which are provided by the in-house oanda team. This can combine perfectly with our own online investment guides and educational content. Oanda are also well-regulated by both the CFTC, and NFA (#325821) offering traders two account types.

The standard account type is attractive thanks to the fact it has no minimum deposit, while the premium account requires a $2,000 minimum deposit but has benefits like lower spreads and other costs. An unlimited oanda demo account is also available. The broker also use the much respected MT4 trading platform for trading in all 70 forex pairs and more at a very competitive spread starting from 0 pips. All traders but particularly newer ones, seem to fit well within oanda.

List of the best 23 forex brokers | trusted reviews

Are you looking for a good and serious forex broker? – then this page is the right place for you. Thanks to the large selection on the internet it is often difficult to make the right decision. With more than 7 years of experience in the financial markets, we present you with the best providers with top service and without hidden costs. Find out in the following texts how to select a secure forex provider and which online broker offers the best conditions.

| Broker: | review: | regulation: | spreads: | assets: | advantages: | open account: |

|---|---|---|---|---|---|---|

1. Bdswiss  | ➜ read the review | cysec, FSC | starting 0.0 pips + $ 2.0 commission per 1 lot | 250+ (50+ currency pairs) | + individual offers + trading signals + raw spreads + leverage up to 1:500 + best education + personal support |

Watch our full video review about the best forex brokers (risk warning: your capital is at risk):

Strict criteria for the forex broker review

In contrast to many other comparison sites, we present you on this website only the safest providers with the best conditions for traders. As experts with many years of experience, we have tested many forex brokers and still use some of them. A good provider should have certain characteristics that guarantee good and safe investing.

It is not uncommon to hear of fraud on the internet. This is to be avoided by this comparison. In addition, one would like to save on charges as a trader because the costs for the trade reduce of course the actual profits. Also, the security of customer’s money is of high priority. A regulation or license, for example, is urgently needed for secure trading with international brokers. All these criteria and many more are included in the test. Therefore we can present you on this page the best forex brokers in a list.

Proven facts for a good forex broker:

- Regulation and license of an official finance authority

- High safety of customer funds

- Fast and reliable market execution

- Small forex trading fees and no hidden fees

- No requotes (high liquidity)

- User-friendly trading platform

- Free and unlimited demo account

- Professional support

- Fast deposit and withdraw methods

How does a forex broker work?

A forex broker is an intermediary between a client (trader) and the interbank market for currencies (wikipedia). In addition, the broker can lend capital to the trader so that he can trade with leverage. The broker’s income is generated by the spread and the cost of financing the leveraged positions.

There are 2 different models of brokers: market maker and ECN/NDD broker

Example of live spreads for forex brokers

Market maker:

This broker does not place the trader’s orders directly into the real interbank or spot market. There is an internal matching system between the positions of the traders. Of course, the broker can hedge himself on the real markets so that there are no distortions in supply and demand. In most cases, this system can be opaque, and only as a broker employee, you know the exact functions. A market maker forex broker is not bad or scam. Nowadays, most providers offer good and exact executions.

ECN/NDD (no dealing desk) broker:

ECN and NDD mean direct access to the interbank market through various liquidity providers. These are large banks or very large forex brokers. The provider places the trader’s orders directly into the real market. So the customers get direct and real market prices for trading. With this model, there is no conflict of interest between trader and broker. Zero (no) spread accounts are offered.

Warning: only trade with regulated and licensed forex brokers

Security has the highest priority in online trading. When it comes to trading leveraged financial products, you have to be able to trust the forex broker. It is not uncommon for large sums of money to be used to generate a large profit. For example, brokers in europe must have regulations or licenses if they want to offer their services. The regulation can be in any european country. The same or almost the same requirements apply to brokers everywhere. In order to avoid fraud, it is important to look for such a license.

Licenses are only issued under certain conditions and criteria. If a broker violates these conditions, the license may be withdrawn immediately. All tested companies of mine are always concerned to keep the highest criteria and to guarantee a safe trade. Many brokers, for example, are regulated in cyprus. This has tax advantages. Nevertheless, there are also forex brokers with more than one regulation. The various regulatory authorities can be seen in the table above.

Facts of reliable and secure companies:

- Regulation and license

- Separated customer funds

- Regulated deposit and withdrawal methods

- Using well-known banks

- Large liquidity providers

Another important point for serious trading is the security of customer funds. Payouts of winnings or the deposited amount should work smoothly. It was not uncommon for some brokers to speculate on customer funds themselves. In the end, withdrawals were refused or delays occurred.

How risky is forex trading?

Forex trading is managed by leveraged financial products. That means you are able to trade a bigger contract size than the amount of money in your account. Some brokers offer the leverage up to 1:3000. Many traders are afraid of the obligation to make margin calls and this is not without reason as the past has shown. Account balances could slip into the negative balance. This is possible due to extreme market situations and too large a position size in relation to the account balance.

The providers shown above all have no obligation to make additional contributions (except IC markets and vantage FX). With the providers in the upper table, you are therefore protected against such a scenario. In our experience, this can only happen if the account is too heavily leveraged. You should always beware of sensible risk management.

Beginners should always start with the free demo account to practice forex trading.

A demo account is essential for successful trading. The trading column form and conditions can be tested extensively with this account. It is a virtual credit account that simulates real money trading. It can be traded without risk. This means that new strategies can be developed or new markets tested. The demo accounts of the compared providers are completely free and unlimited. This account is best suited for entry into forex trading.

How to deposit and withdrawal money:

For most traders, the first deposit into their account is very exciting. It should work smoothly and be highly secure. Forex brokers offer well-known and proven payment methods. Capitalize the trading account with electronic methods (credit card, e-wallet, paypal, crypto) or with the classic way of bank transfer. Electronic methods work in real-time and the money is credited directly to the trading account. Trading can be started immediately. The minimum deposit at the compared brokers is very low. For example, you can open an account from as little as 1$. If this is worth it, you have to decide for yourself. There are no fees for deposits.

Example of payment methods of a forex broker

The payout is also very uncomplicated. With a few clicks, you can request a withdrawal on the menu. This is then released in 1-3 working days. However, most brokers payout customer money in less than 24 hours. All presented brokers passed this test. The fees can be high for small payouts. With payments over 200$, the most forex brokers take over the fees but some brokers do not charge any commissions.

Facts about the payments:

- Instant deposit of money

- Fast withdrawal within 1 – 3 working days

- Electronic methods (skrill, neteller, paypal, and more)

- Cryptocurrencies

- Bank wire

Not every country is available for forex trading

Not every country is available for forex brokers and trading. This is because there are some restrictions and special regulations. For example, in some countries, an international broker needs a special license for that specific country. So it is too much afford for some companies to get the license and they stop taking clients from these countries. You can clearly see on the homepage which clients they accept. Not many brokers accept clients of the united states of amerika.

From my experience, the fastest-growing countries are in africa and asia. Because of the development of mobile internet, more people get connected to the forex market. India, nigeria, philippines, malaysia, and china are at the moment the fastest-growing countries.

Is forex trading legal?

Forex trading is fully legal if there is not any ban from the government. Forex trading is just changing money into another currency. This is not an illegal practice. The brokers on my review got official regulations so they act fully legal.

Review conclusion: start trading with a reliable forex broker

On this page, we have presented you with our current list of the top 23 forex brokers in comparison. Now you have a selection of good and reputable companies in front of you. It was particularly important to us that we only present providers here, which we have tested by ourselves with real money. This is not the case with most comparisons.

Profit now from the most favorable fees and the best conditions by my experience of many years. With these providers, you are 100% safe and can take your forex trading to the next level.

We hope you could learn something in this comparison and act now with better providers through my recommendations. If you can’t make up your mind, please also read the reviews.