Famous forex brokers

Nicholas leeson (born 1967) is the rogue trader who famously caused the collapse of barings bank.

Top forex bonuses

Leeson served four years in a singapore jail but later bounced back to become CEO of irish football club galway united. James rogers, jr. (born 1942) is the chairman of rogers holdings. He co-founded the quantum fund along with george soros in the early 1970s, which gained a staggering 4200% over 10 years. Rogers is renowned for his correct bullish call on commodities in the 1990s and also for his books detailing his adventurous world travels.

The world's 10 most famous traders of all time

There are several famous former traders who moved on to different careers, such as john key (who served as the 38th prime minister of new zealand) and jimmy wales (founder of wikipedia). However, this list is made up of traders famous for being traders. The lives of the world's most famous traders are colored by both triumph and tragedy, with some exploits achieving mythological status within the industry.

The list begins with legendary traders of history and progresses to those of the present day.

1. Jesse livermore

Jesse lauriston livermore (1877–1940) was an american trader famous for both colossal gains and losses in the market. He successfully shorted the 1929 market crash, building his fortune to $100 million. However, by 1934 he had lost his money and tragically took his own life in 1940.

2. William delbert gann

WD gann (1878–1955) was a trader who used market forecasting methods based on geometry, astrology, and ancient mathematics. His mysterious technical tools include gann angles and the square of 9. As well as trading, gann wrote a number of books and courses.

3. George soros

Hungarian-born george soros (born 1930) is the chairman of soros fund management, one of the most successful firms in the history of the hedge fund industry. He earned the moniker “the man who broke the bank of england” in 1992 after his short sale of $10 billion worth of pounds, yielding a tidy $1 billion profit.

4. Jim rogers

James rogers, jr. (born 1942) is the chairman of rogers holdings. He co-founded the quantum fund along with george soros in the early 1970s, which gained a staggering 4200% over 10 years. Rogers is renowned for his correct bullish call on commodities in the 1990s and also for his books detailing his adventurous world travels.

5. Richard dennis

Richard J. Dennis (born 1949) made his mark in the trading world as a highly successful chicago-based commodities trader. He reportedly acquired a $200 million fortune over ten years from his speculating. Along with partner william eckhardt, dennis was co-creator of the mythical turtle trading experiment.

6. Paul tudor jones

Paul tudor jones II (born 1954) is the founder of tudor investment corporation, one of the world's leading hedge funds. Tudor jones gained notoriety after making around $100 million from shorting stocks during the 1987 market crash.

7. John paulson

John paulson (born 1955), of the hedge fund paulson & co., rose to the top of the financial world after making billions of dollars in 2007 by using credit default swaps to effectively sell short the US subprime mortgage lending market.

8. Steven cohen

Steven cohen (born 1956) founded SAC capital advisors, a leading hedge fund focused primarily on trading equities. In 2013, SAC was charged by the securities and exchange commission with failing to prevent insider trading and later agreed to pay a $1.2 billion fine.

9. David tepper

David tepper (born 1957) is the founder of the wildly successful hedge fund appaloosa management. Tepper, a specialist in distressed debt investing, has made several appearances on CNBC where his statements are closely watched by traders.

10. Nick leeson

Nicholas leeson (born 1967) is the rogue trader who famously caused the collapse of barings bank. Leeson served four years in a singapore jail but later bounced back to become CEO of irish football club galway united.

The bottom line

The dramatic and varied life stories of the world's most famous traders have made compelling material for books and movies. Reminiscences of a stock operator, a fictionalized portrayal of jesse livermore's life, is widely viewed as a timeless classic and one of the most important books ever written about trading. Rogue trader (1999), starring ewan mcgregor, is based on the story of nick leeson and the collapse of barings bank.

The 5 best and most famous forex traders of all time

Day trade the world™ » trading blog » the 5 best and most famous forex traders of all time

In all industries there are people credited to being the best.

In the investment world, franklin graham and warren buffet are credited to be the best investors of all time. In american politics, there is a consensus that abraham lincoln was the best president of all time.

In fracking, the late aubrey mcclendon is credited to being the best fracker of all time. In design, steve jobs was credited of being the best in his industry.

In trading, a number of traders are known worldwide for their skills. In this article, we will look at the five most famous forex traders of all time.

#1 – george soros

George soros is the world’s best currency trader. Born in 1930, the hungarian trader is known for his 1992 short trade on great britain pound (GBP).

He sold short $10 billion and netted more than a billion dollars. He is known as the trader who broke the bank of england.

Following his successful trade, the UK withdrew the currency from the european exchange rate mechanism in what is known as the black wednesday.

Though he has already closed his quantum fund, soros remains one of the most successful man in the world. He is worth more than $25 billion.

#2 – james simmons

James simmons is one of the most successful hedge fund managers in the world. We actually believe that james is the most successful hedge fund manager.

He runs a quantitative hedge fund known as renaissance technologies that employs statistic and physics experts.

He is so successful such that in 2008 when most traders were having their worst year, he returned more than 80%.

#3 – stanley druckenmiller

Stan druckenmiller is a successful portfolio manager and one of the most featured forex traders of our time. He is a former trader for george soros.

He was involved in his 1992 bet against the pound. After serving for quantum fund for more than 20 years, he left to start his own fund, duquesne fund which has returned more than 20% annually.

He is also a widely sought out trader who appears in top financial events such as world economic forum (WEF) and sohn conference.

When he speaks, investors listen!

He was featured in the successful book, the new market wizards in 1994. He suffered major setbacks after the 2008 financial crisis and closed his fund.

#4 – bill lipschutz

His is a true story of rags-to-riches-to-rags-to-riches story.

Bill lipschutz is famous for turning a $12,000 investment to $250,000 and then losing it all. He lost his money following a single trading decision.

After this loss, bill learned an important mistake on risk management. He then went back to school to earn an MBA.

After this, he joined solomon brothers and was instrumental in establishing the firm’s foreign exchange division. He was a hit. He used his previous experience to earn the company more than $300 million every year.

After this, he established hathersage capital management which is now one of the most successful multi-asset management firm.

In 2015, it was one of the best performing funds.

#5 – bruce kovner

Bruce kovner is one of the most successful hedge fund managers who keeps a low profile. Born in 1945, bruce founded caxton associates when he was 32 years old.

He started trading by borrowing funds from his credit card. He bought soybean futures and made more than $20,000.

Today, caxton fund is one of the most successful funds in the world with more than $14 billion in assets under management.

He retired from the firm in 2011 and left the firm in the hands of his co-founder. Today, bruce spends most of his time in his charitable activities. He also sits in a number of boards.

Top 10 best scalping forex brokers 2021

Top rated:

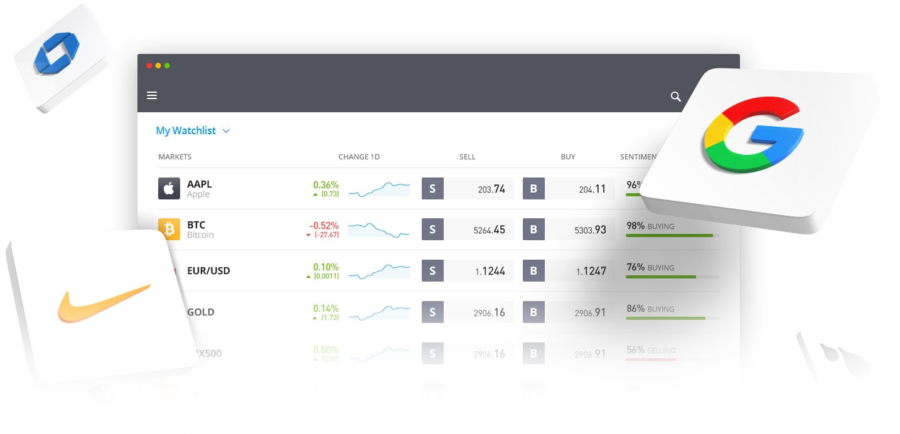

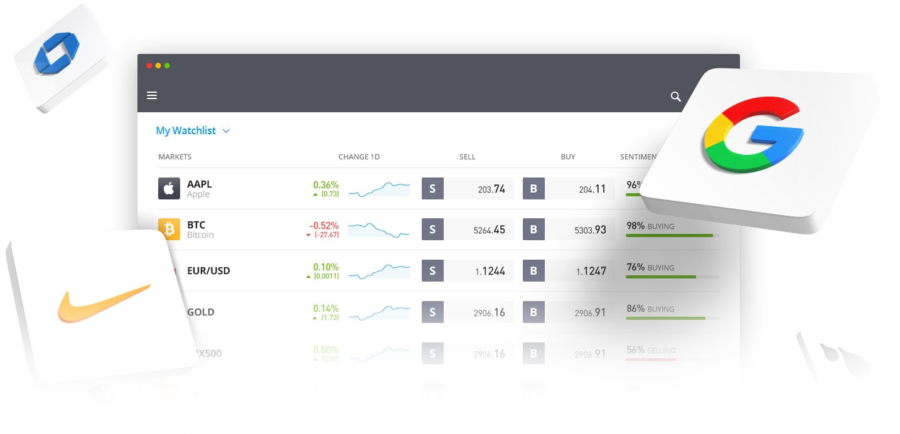

Would you like to give scalping a go, or are you a veteran just looking for the best scalping forex brokers?

We have searched for, and compiled a list of the top 10 brokers for scalping 2021 (even encouraging it, in some cases).

To understand this all better, let’s see what scalping is, and what features and services should be offered by a forex broker to be one of the best.

Table of contents

What is scalping?

Scalping is a trading technique which focuses on profiting from the subtlest price variations of a financial asset.

The scalper, is the trader who, more than anyone else, can achieve returns regardless of the general trend of the underlying asset. An index which loses an overall 2% value in one day could mean quite a few percentage points of profits for a good scalper.

A scalper doesn’t care for the trend direction of the financial asset, as long as it keeps moving.

But now, let’s see the list of the best forex brokers for scalping. At the bottom of the post you can find other useful information on how scalping works.

Best forex brokers for scalping 2021

This is why we have prepared a ranking of the 10 best broker for scalping. These brokers, besides not forbidding it, favour it through several services aimed at excelling in the above-mentioned features.

1. Pepperstone

Operating since 2010, pepperstone has quickly become one of the best forex brokers in australia and in the world (as its many awards can prove). The ECN access through ctrader with DMA (direct market access), the low commission fees, and the reduced spreads make pepperstone ideal for scalping thus our best scalping broker.

These features are great for making scalping very accessible to traders. Another key attraction is the fact that pepperstone manage to keep trading costs low. This is achieved through having a very competitive spread that starts from 0 pips as well as an active trader program to help in further reductions. With a minimum deposit starting at just $200 and a range of social trading features that can help you decide on markets as well as trading availability through all the major trading platforms of MT4, MT5, and ctrader. It becomes quite clear why pepperstone is a favored choice among a huge proportion of scalpers.

2. IC markets

Ranked as one of the top 10 best forex brokers in the world, IC markets is one of the fastest growing brokers in australia. The cysec and ASIC regulated broker is headquartered in sydney, and it has offices all over the world, including vietnam and china. Its high financial leverage, low spreads, the absence of a withdrawal commission fee, the multitude of available trading platforms (including ctrader), make IC markets perfect for scalping.

Much of this favorable nature for scalping is driven by keeping costs low with a very competitive spread that starts at only 0.1 pips and of course their lightning fast execution meaning you never miss a move. The fact that IC markets boast a no minimum deposit policy also keeps them as a good choice for new traders and scalpers alike. With markets available on indices, commodities, stocks, futures, bonds, and crypto, there is also certainly no shortage of trading opportunities.

3. Admiral markets

Next on our listing of top scalping brokers is admiral markets. They are a top market maker broker also hugely popular for scalping and particularly well-regulated by both the FCA and cysec. Scalpers are in for a treat here with more than 4,000 assets available for trading. This selection includes bonds, and even etfs and cryptos among others. Admiral markets continues to present value too through an accessible prime or standard account with minimum deposits of just $100 and spreads at great value from 0 pips on a standard account.

Trading and scalping with admiral markets takes place through the top trusted platforms of MT4, MT5, and webtrader, all of which are available. The broker also provides well for the future development of scalpers with a detailed education section offering a lot of free lessons and support on scalping and other techniques.

4. Fxpro

Fxpro is one of the most famous non-dealing desk forex brokers. An english broker famous all over the world for its quality of execution, innovation, and platforms, make this the perfect candidate for scalping. Through the development of several technologies, fxpro has always welcomed traders looking to easily automate their strategies (see calgo algorithmic trading, fxpro library, fxpro quant strategy builder, and fxpro VPS).

Another very welcoming factor for all levels of scalper is the fact you need only have a minimum deposit of $100 to get started. This, combined with the low costs that are supported by the 0 pips spreads that the broker offers, are both very important points for any scalper given the margins involved. If you open an MT4 account, you will also have access to fixed spreads. These may not suit everyone but do help you maintain an accurate trading cost.

5. Octafx

Operating since 2011, octafx has been awarded the “best ECN broker in asia – 2014” by the global banking and finance review, and the “best broker in central asia – 2014” by the forex report magazine. The broker offers a wide range of assets, is highly liquid and ideal for scalping. They also offer great promotions, such as their trading contests, carried out through their demo accounts, which do however include real money prizes. Their 50% bonus on deposits is also extremely appealing as is the low minimum deposit of just $100 to start trading.

The costs too are kept low, with variable spreads from 0 pips perfect for scalping. Fixed spreads from 2 pips, or 0.2 pips with a $500 minimum deposit to open an MT5 account may also be attractive to many scalpers with this helping calculate costs at the same time as keeping them low.

6. Avatrade

Avatrade is next on our list of top brokers for scalping and the irish-based broker does not disappoint here. A favorite among european-based scalpers, the broker is globally operated and regulated. In fact, it is the perfect place for scalping with fixed spreads since that is what they offer at avatrade.

The great value fixed spread starts from just 1.3 pips on forex with scalpers and traders alike attracted by this and the low barrier of a $100 minimum deposit, great for a top broker. Once you are inside, you also have a great selection of markets that includes 60 forex pairs all available for scalping. With all of the trading taking place through MT4, or MT5, traders know they can trust this broker. A further attraction, particularly for new traders, is the avaprotect feature that temporarily shields you from losses. An amazing feature from any top broker.

7. Vantage FX

Vantagefx is the next top scalping broker to make the selection. They have already been around for a number of years and gained a strong popularity among all types of forex traders. A strong degree of this support may have been garnered through the comprehensive regulation the broker has in place from ASIC, the FCA, and CIMA.

Scalpers will also be very much attracted by the ECN execution style that provides for maximum speed and efficiency through the 2 account types. Both the raw ECN, and pro ECN have competitive spreads that start from 0 pips and a respective minimum deposit of $500, and $20,000 for the big hitters. The range of markets with more than 150 available in cfds and 40 forex pairs is also of great appeal for scalping through either the MT4, or MT5 trusted trading platforms available.

8. FP markets

FP markets are another top australian broker and one of our best selections if you want to get started forex scalping. The broker have been around for many years since their foundation in 2005 and are a very well trusted market maker broker that are already popular for scalping. They boast regulation from both ASIC, and cysec.

One of the major points that helps to attract traders for scalping is the very low spreads on offer. These start from just 0 pips across the board and are perfect for limiting your scalping costs, a key to your success. The ECN/STP execution offered is also fast and highly efficient, another very appealing aspect of FP markets. The low minimum deposit of just $100 can also be of great support in getting started if you are new to scalping, and you can’t go wrong with the experience of MT4, MT5, and webtrader platforms all being available.

9. Hotforex

Hotforex are next on the list of our top scalping brokers and they are something of a household name among all traders in the industry. Perfect for scalpers and others from top to bottom thanks to their variety of deposit methods and base currencies making it so easy to get started. The amazingly low $5 minimum deposit is also perfect for new scalpers.

The minimum deposit here for an ideal scalping account is $200 which is still competitive in the sector. This is well balanced by the fantastic value spreads that start from 0 pips. You can also try it out first with a free unlimited demo account. Making it most suited to those new to scalping is the negative balance protection available globally as well as the very well supported range of video tutorials, webinars, and more to help you keep growing in scalping and forex trading.

How does scalping work?

The old (and correct) adage “let profits run, cut losses short” isn’t particularly relevant to scalping, at least as regards letting profits run. The scalper takes advantage of the market’s micro-oscillations, which have a set duration in time, from a few seconds to a few minutes, which is why it bears slim profits.

People who use this technique settle for small, yet fast, profits, continuously opening new positions on the market, trying to exploit its many oscillations, cutting losses to a minimum.

To take advantage of the continuous price variations, scalpers must dedicate several hours of activity to graphs, keeping a steady and constant focus and carrying out many operations. It isn’t rare to see scalpers performing even more than 100 operations in just a day’s trading.

How does the scalper trader earn?

As we’ve already mentioned, given the nature of scalping, the profits earned with just one operation are quite slim, ranging from a couple of pips to a few tens, at most.

So, for scalping to produce real profits, traders must focus on two things:

- Finding many trading opportunities throughout the day;

- Having a high percentage of trades closed with profits.

Other categories of professional traders, generally speaking, aim at having a good risk/returns ratio (from 1:2 up), which allows them to sustain even smaller percentages of success, even below 50%, still generating profits. However, this isn’t the case for scalpers. Taking profits after such short times, the risk/returns value tends to be quite low, which forces scalpers to keep an extremely high percentage of winning trades to constantly generate profits.

This activity isn’t for anyone. Besides having solid technology assets (such as PC, monitors, etc.) and a fast, stable connection, scalping requires extremely high self-discipline and concentration.

Furthermore, obviously, it is necessary to work with a good scalping forex broker, preferably one from the list below.

How much money does scalping require?

In addition to the high psychological capital, scalping normally requires a certain amount of financial resources. Having to profit from small market investments (a few pips or points at a time), to have noteworthy profits, the investment volume must be kept high.

Therefore, scalpers must have an appropriately funded account, or else work on a high financial leverage, which however does notably increase risks.

The best financial assets for scalping

High liquidity assets are among the preferred scalping markets, to avoid that the lack of buyers and sellers increases the spread between purchase and sell price to an excessive amount, making profits harder to achieve over the short term.

Highly capitalized and traded assets are therefore favoured, such as indexes, forex trades, and other assets which tend to have a good quantity of variations over the trading day.

The forex broker features for scalping

Given this peculiar activity, it is necessary to find a broker presenting the following basic features:

- Availability of high liquidity assets (high capitalized assets, index and exchange rates);

- Possibility to analyze markets with several indicators, possibly customizable;

- “market depth” visibility;

- Direct market visibility, not an “artificial” version of it (dealing desk);

- Exclusive intermediation activity, possibly directly on the market;

- Swift order execution;

- High financial leverage;

- Bare-boned brokerage fees;

- Easy trading platforms, fast and intuitive.

Given the peculiarities of scalping, not all forex brokers encourage it. Some even forbit it.

3 best US forex brokers for 2021

The forexbrokers.Com annual forex broker review (five years running) is the most cited in the industry. With over 50,000 words of research across the site, we spend hundreds of hours testing forex brokers each year. How we test.

Trading forex (currencies) in the united states (US) is popular among fx traders. Before any fx broker can accept US forex traders as clients, they must become registered as retail foreign exchange dealer (RFED) by the financial regulatory body, the commodity futures trading commission (CFTC) and also regulated by the national futures association (NFA) as a futures commission merchant (FCM). The NFA website is nfa.Futures.Org. We recommend US residents also follow the CFTC on twitter, @CFTC.

The CFTC is a federal regulatory agency that was established by congress in 1974 with jurisdiction over the commodity futures (derivatives) markets. The same legislation authorized the creation of the registered futures associations, and in 1982 the NFA started as a self-regulatory organization for the US derivatives industry. For a historical breakdown here is a link to the NFA's webpage on wikipedia.

Best US forex brokers for 2021

To find the best forex brokers in the USA, we created a list of all CFTC registered brokers, then ranked brokers by their trust score. Here is our list of the top forex brokers in the united states.

- IG - best overall broker 2021, most trusted

- TD ameritrade forex - best desktop platform, US only

- FOREX.Com - great all-round offering

Best forex brokers US comparison

Compare US registered forex brokers side by side using the forex broker comparison tool or the summary table below. This broker list is sorted by the firm's forexbrokers.Com trust score.

| Forex broker | accepts US residents | average spread EUR/USD - standard | minimum initial deposit | trust score | overall | visit site |

|---|---|---|---|---|---|---|

| IG | yes | 0.745 | £250.00 | 99 | 5 stars | visit site |

| TD ameritrade | yes | 1.065 | $0.00 | 98 | 4.5 stars | visit site |

| FOREX.Com | yes | 1.400 | $100.00 | 93 | 4.5 stars | visit site |

How to verify CFTC registration

To identify if a forex broker is CFTC-registered and regulated by the NFA, the first step is to identify the NFA ID number from the disclosure text at the bottom of the broker's US homepage. For example, here's the key disclosure text from FOREX.Com's website.

FOREX.Com is a registered FCM and RFED with the CFTC and member of the national futures association (NFA # 0339826).

Next, look up the firm on the NFA website to validate the current status of the id number. Here is the official NFA page for FOREX.Com.

More forex guides

Methodology

For our 2021 forex broker review we assessed, rated, and ranked 27 international forex brokers. Each broker was graded on 108 different variables and, in total, over 50,000 words of research were produced.

While encouraged, broker participation was optional. Each broker had the opportunity to complete an in-depth data profile and provide executive time (live in person or over the web) for an annual update meeting.

All data submitted by brokers is hand-checked for accuracy. Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors quality data they can trust. Learn more about how we test.

Forex risk disclaimer

"there is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses." learn more.

About the author: steven hatzakis steven hatzakis is the global director of research for forexbrokers.Com. Steven previously served as an editor for finance magnates, where he authored over 1,000 published articles about the online finance industry. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Over the past 20 years, steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative.

About the author: blain reinkensmeyer as head of research, blain reinkensmeyer has 18 years of trading experience with over 1,000 trades placed during that time. Referenced as a leading expert on the US online brokerage industry, blain has been quoted in the new york times, forbes, and the chicago tribune, among others.

Trading cfds, FX, and cryptocurrencies involve a high degree of risk. All providers have a percentage of retail investor accounts that lose money when trading cfds with their company. You should consider whether you can afford to take the high risk of losing your money and whether you understand how cfds, FX, and cryptocurrencies work. All data was obtained from a published website as of 12/14/2020 and is believed to be accurate, but is not guaranteed. The forexbrokers.Com staff is constantly working with its online broker representatives to obtain the latest data. If you believe any data listed above is inaccurate, please contact us using the link at the bottom of this page.

The names, products, services, branding/logos, and other trademarks or images featured or cited within this website (www.Forexbrokers.Com) are the property of their respective owners and the owners retain all legal rights therein. These trademark holders are not affiliated with forexbrokers.Com and the use or display of names, trademarks or service marks of another is not a representation that the other is affiliated with, sponsors, or endorses forexbrokers.Com or any of its reviews, products, or services. Forexbrokers.Com declares no affiliation, sponsorship, nor any partnership with any trademark holders unless otherwise stated.

IG - 76% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you can afford to take the high risk of losing your money.

OANDA - cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Advertiser disclosure: forexbrokers.Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. How do we make money? Our partners compensate us through paid advertising. While partners may pay to provide offers or be featured, e.G. Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data. Here is a list of our partners.

Disclaimer: it is our organization's primary mission to provide reviews, commentary, and analysis that are unbiased and objective. While forexbrokers.Com has some data verified by industry participants, it can vary from time to time. Operating as an online business, this site may be compensated through third party advertisers. Our receipt of such compensation shall not be construed as an endorsement or recommendation by forexbrokers.Com, nor shall it bias our reviews, analysis, and opinions. Please see our general disclaimers for more information.

© 2021 reink media group LLC.

All rights reserved.

Famous commodity traders of the last decade

Jim rogers

Jim rogers is best-known as the co-founder of the quantum fund of the similarly-famous george soros. While this fund’s claim to fame is its legendary pound short position during the UK black wednesday crisis of 1992, rogers’ commodity trades also contributed a considerable chunk to its gains.

In 1998, rogers created his own commodity index fund at an initial $200 million investment, raking gains of 165% by 2007. Around that time, the commodity markets cooled as global investors turned their attention to equities and currencies during the financial crisis, but rogers has been a regular guest at financial news programs to discuss his longer-term outlook for commodities.

He retains his bullish outlook for agricultural commodities, primarily because students aren’t studying to be farmers anymore. For him, this could lead to a period of lower supply coupled with steadily growing demand, thereby keeping an upward pressure on prices.

George soros

While george soros is more popularly dubbed as “the man who broke the bank of england” with his short pound position, he is also a successful commodities trader. In 2012, he cashed in a 65% gain on its gold and silver holdings, adding 884,000 shares of SPDR gold to soros fund management. Just like quantum fund co-founder rogers, soros is also bullish on agricultural commodities and has a $232 million stake in a south american food and energy company. In 2015, soros moved $2 million into coal producers peabody energy and arch coal.

Earlier this year, it was reported that soros increased his bullish position on gold. According to SEC filings, soros fund management bought 19.4 million shares of barrick gold and bought call options on 1.05 million shares of SPDR gold trust, which is the world’s biggest exchange-traded gold ETF.

Stanley druckenmiller

Sharing soros’ latest bullish gold bias is stanley druckenmiller, who is a popular american hedge fund

Manager. He is the former chairman and president of duquesne capital, which was founded in 1981 then closed in 2010 due to its inability to deliver high returns.

Druckenmiller managed money for george soros in 1988 to 2000 as the lead portfolio manager of quantum fund, generating $260 million in 2008. In 2015, he set a large new investment in SPDR gold trust ETF to the tune of 2,880,000 shares. He also has investments in newmont mining corp, haliburton, and freeport mcmoran.

John arnold

John arnold is known for his positions on natural gas and energy commodities. He started his career at enron in 1995 before founding centaurus energy in 2002 with an initial capital of $8 million from his own pockets.

This firm rose to fame when the fund raked in billions of profits in a single timely natural gas position. Around that time, a different hedge fund called amaranth advisors had large long positions on natural gas in anticipation of a run-up in prices following hurricane katrina in 2005. Arnold’s fund took the opposite position and chalked up more than 300% in returns for its investors for a $1 billion position.

Louis bacon

Louis bacon began his commodities trading career right from the new york cotton exchange before eventually working his way up to be the senior vice president of futures trading at shearson lehman brothers. He also had brief stints as a clerk on new york coffee, cocoa, and sugar exchanges. A few years later, he founded his own firm called remington trading partners which profited from a market rebound in the 90s.

Soon after, he created moore global investments with $25,000 of his inheritance. This fund earned 86% in returns during its very first year, due partly to a purchase of oil contracts ahead of saddam hussein’s invasion of kuwait. Word through the grapevine is that bacon was able to earn $100 million in most of his trading years, making him one of the top 20 earners in wall street. Currently, moore capital management is known to have more than $9 billion in funds under management.

Larry hite

Larry hite ventured into commodities trading after a few failed endeavors in the 70s. He founded mint investment management in 1981, a fund based on computerized statistical models. This fund generated more than 30% in returns each year from its inception until 1994, growing into the largest commodity trading advisory in the world.

Hite continued to focus on trading models then soon formed hite capital management, which is a family organization that boasted of a 70% return in 2008 and only a single year of losses. He is known as the forefather of trading systems, eventually partnering with the international standard asset management (ISAM) to create a multi-strategy platform of liquid hedge fund strategies.

Victor sperandeo

Victor sperandeo or “trader vic” is currently the president of alpha financial technologies and is considered an expert in the metals and energy sectors. His foray into the financial markets started during his days as a wall street quote boy before he opened his own personal account and never had a losing year since 1971 to 1988.

He is also known to have predicted a market crash back in 1987, earning a spot among renowned forward-thinkers in the trading community. His trading techniques focus mostly on technical analysis as he puts life expectancies on bullish or bearish moves.

Apart from his profits in the commodities sector, he is also known for his dow short position ahead of black monday and the 300% in profits that he reaped. Sperandeo is also the author of several trading books such as trader vic: methods of a wall street master, trader vic II: principles of professional speculation, and trader vic on commodities: what’s unknown, misunderstood, and too good to be true.

Regulated forex brokers

The forex market attracts thousands of new traders around the world every day. With daily turnover approaching $7 trillion, the low capital requirements to start a portfolio and high leverage combine with countless trading opportunities that drive demand. Many professional firms and multi-national companies deal with forex every day, and retail traders remain indirectly exposed in numerous ways. A rapidly rising number of them show interest in the attractiveness of forex trading. They open new online forex broker trading accounts to get access to the fast-moving market, keeping demand for trading services elevated. One of the most critical requirements for a successful trading career is trading with one of the many regulated forex brokers. I cannot stress the significance of it enough. Never deposit with an unregulated forex broker, regardless of how attractive an offer they make. The negatives outweigh any short-term positive marketing-related push. One of the worst nightmares of profitable forex traders is the inability to withdraw their earned capital because their unregulated forex broker does not honor it. Therefore, traders must ignore any offers from unregulated sources and pay attention to competitive trading environments maintained by regulated forex brokers.

Not all regulators are the same, and trading from the proper jurisdiction provides a competitive edge. The UK was home to the best regulatory trading environment maintained by the financial conduct authority (FCA). It changed following counter-productive regulatory changes by the european securities and markets authority (ESMA). It made EU-based forex brokers the least competitive globally. With the brexit transition period ending at 23:00 on december 31st, 2020, european central time (ECT), the UK financial sector is expected to make changes and return to its previous glory. London remains the financial center of the world and is ideally positioned to expand its leadership position. UK forex brokers have always been among the industry leaders. Australia offers forex traders another excellent and competitive trading environment. The australian securities and investments commission (ASIC) ensures one of the best regulatory jurisdictions. Since former hotspot cyprus and the cyprus securities and exchange commission (cysec) fall under ESMA jurisdiction, one exciting regulatory environment to monitor is south africa and the financial sector conduct authority (FSCA). South africa shares the same time zone as cyprus, is an english-speaking country and a G-20 member.

Highly regulated, choice of fixed or floating spreads

Mifid, central bank of ireland, FSA, ASIC, BVI, FFAJ, FSCA, ADMG - FRSA

Highly regulated, choice of fixed or floating spreads

Best all-around: high floating leverage + fast execution

Best all-around: high floating leverage + fast execution

ECN trading with leverage up to 1:500

Deposit $500 and trade with $1000!

ECN trading with leverage up to 1:500

Wide range of cfds + trailing stop losses

Cysec, FCA, ASIC, FMA, FSB, MAS

Wide range of cfds + trailing stop losses

Excellent educational offerings

1:500 (ASIC entitiy only), 1:30 cysec retail, 1:300 cysec pro

Cysec, FCA, ASIC, FSC, FSCA

Excellent educational offerings

What is forex regulation?

Forex regulation is a set of rules by an authority with enforcement powers that ensures brokers treat customers fairly. It also enables the financial health and stability of the system and provides dispute resolution. In some cases, an investor compensation fund in case of bankruptcy by a broker exists. Not all regulators grant equal protection and enforcement, and some maintain an uncompetitive trading environment like the ESMA, which applies to all EU-based brokers. I highly recommend that traders always trade with one of the thousands of regulated forex brokers. While it cannot guarantee against fraud and malpractice, as well-documented cases in the US and cyprus have shown, it offers a layer of protection and security that traders should demand from their brokers. Traders should seek a minimum of five years under a well-regulated environment and must also check the track record. Many brokers faced fines but continue to cater to clients. It shows that an attempt to take advantage of unknown retail traders was made, but the regulator caught them.

Why should you choose a regulated broker?

Most traders conduct some research and due diligence to identify a trustworthy forex broker and often follow the best-marketed one or the one with the most appealing offer, usually in the form of bonuses and promotions. While the majority of brokers and all traders hope for the best outcome, issues may arise. They do not necessarily originate from malpractice, but a technological glitch, communication error, administrative backlog, or a third-party mistake may occur. Trading with a regulated broker provides traders access to a qualified team to resolve those issues. Regulated forex brokers must adhere to financial regulations and maintain a certain amount of capital reserves before receiving a license to operate. Frequent audits ensure that client deposits and earnings reflect the accurate value, and regulated forex brokers must segregate client funds from corporate ones. The processing times of financial transaction is faster and more transparent. It also enforces the protection of information provided by traders during the registration process.

Regulated forex brokers must satisfy know-your-client (KYC) and anti-money laundering (AML) stipulations, adding another layer of security. A compensation fund protects against any unexpected financial failure of the broker, which remains dependent on the jurisdiction. Some take out additional insurance protection or apply for membership with the hong-kong-based financial commission, an independent self-regulatory organization and external dispute resolution (EDR) body focused on the forex market. The compensation fund provides coverage for traders up to €20,000 per case if the broker defrauded traders. It emerged as a favorite to many regulators. It enables brokers to register in business-friendly jurisdictions while offering superior protection. Regulated forex brokers also process withdrawals swiftly, act in the best interest of clients, and stay clear of manipulating prices or stop-loss hunting. An ECN execution model generally provides more safety than a market maker model. The broker is not the counterparty and receives compensation via volume-based commissions rather than a mark-up on spreads and client losses.

Major regulatory bodies

All countries have a financial regulator, but there are several major regulatory bodies for the forex market with a distinct cluster of brokers. Below is a list of the most dominant ones for forex traders to be familiar with and to recognize:

- Australia -australian securities and investments commission (ASIC): A member of the UK commonwealth of nations, australia quietly grew into another forex hotspot with excellent and competitive regulation.

- Belize -international financial services commission (IFSC): the IFSC is another trusted regulator that offers excellent trading conditions and serves as a significant forex broker location, especially for latin american expansion.

- Canada –investment industry regulatory organization of canada (IIROC): at a federal level, IIROC oversees forex regulation in canada, with a legal duty to supervise and regulate investment dealers although the provinces have their own localized regulations. The IIROC has a reputation of a strict regulator – many analysts would say overly strict, although canadian residents are certainly well protected. In any case, much of the overly harsh canadian regulation is imposed at provincial level, especially in alberta.

- Cyprus -cyprus securities and exchange commission (cysec): A former haven for forex brokers, the ESMA turned it into the least competitive and most recognized forex regulator. Numerous high-level scams operated under its oversight.

- Dubai -dubai financial services authority (DFSA): regional traders, thanks to the DFSA, have a secure and competitive trading environment. Dubai is the financial service center of the middle east, gaining traction among forex brokers.

- Mauritius -financial services commission (FSC): another well-known regulator with a business-friendly environment preferred by many forex brokers.

- Seychelles -financial services authority (FSA): the FSA maintains an offshore center for many financial firms. It remains a top location for forex brokers with an active regulator.

- Singapore -monetary authority of singapore (MAS): singapore remains an excellent gateway to asia, is a growing asian financial hub, and an attractive destination for asian-focused international forex brokers.

- South africa -financial sector conduct authority (FSCA): an up-and-coming regulator set to benefit from missteps by the EU.

- Switzerland -swiss financial market supervisory authority (FINMA): the global banking center provides well-trusted regulatory oversight with a forward-thinking approach.

- UK -financial conduct authority (FCA): the FCA remains the best overall financial regulator globally. Many of the best-regulated forex brokers operate under its jurisdiction. Following brexit, the competitiveness the UK lost under the ESMA will return and enable UK-based brokers to increase their market share further.

- US -commodity futures trading commission (CFTC): three of the most significant brokerage frauds occurred under its oversight over the past decade. This regulator cripples financial innovation, and US traders operate under the least competitive framework.

The above listing includes the most prominent national regulatory bodies. The reader is encouraged to explore our detailed listing of financial regulatory bodies for each country set out in alphabetic order.

How forex regulations protect you

Forex regulations protect traders by ensuring that brokers segregate client deposits from corporate funds. They also provide an enforcement mechanism against broker fraud, police the financial sector, and issue warnings. Traders can check their websites and databases to retrieve information about brokers. Regulators require brokers to submit trade execution and financial data and command minimum capital requirements before granting an operating license. Some regulations remain counter-productive, like the ill-advised ESMA crackdown on leverage and bonuses, but traders should never trade with an unregulated forex broker. Trading with uncompetitive EU-based brokers can harm profitability and limit competitiveness, but there are many viable options. I urge all traders to conduct their due diligence and select any of the regulated forex brokers in competitive jurisdictions with a clean track record.

Is forex trading regulated?

Most forex trading remains unregulated in the over the counter (OTC) market, but all trustworthy forex brokers maintain regulation. Traders should never trade with unregulated forex brokers, regardless of the offer they receive.

What does a regulated broker mean?

A regulated broker satisfied requirements by the supervising authority to receive an operating license. It includes financial stability, staff training, support infrastructure, risk management, and compliance.

Are forex brokers regulated?

Many forex brokers have an operating license from one or multiple regulators, but numerous brokers operate as unregulated entities, including subsidiaries, from well-known brokers.

How are brokers regulated?

The level of regulation depends on the authority. Not all regulated forex brokers provide the protection and security that traders believe. Some rules and stipulations render the trading environment uncompetitive. Others do not enforce regulations or punish violations. I recommend trading with a broker operating under the oversight of the regulatory bodies mentioned above.

Do I need a license to trade forex?

No, a license for individual traders who manage their capital in their portfolios does not exist. Some brokers will demand traders fill out a questionnaire to determine if they are fit to trade. Several countries ban retail forex trading, and traders should consult legal advice if in doubt.

Can I trade forex without a broker?

Yes, it is possible to trade forex via a bank, exchange office, or peer-to-peer. Trading via an online forex broker is more convenient and efficient.

How do I know if my broker is regulated?

Each broker provides its regulatory information at the bottom of their homepage. Traders can confirm it by checking the license number against the database of the issuing regulatory authority.

Best forex brokers

Luke jacobi

Contributor, benzinga

Want to jump straight to the answer? The best forex broker for most people is definitely FOREX.Com

Forex trading is arguably one of the easiest financial markets to begin trading in. To get started, you just need to open and fund an account with a regulated online broker. Choosing the best forex broker to trade forex through does require some initial research to find the one most suitable for your trading needs and experience level.

Best forex brokers right now:

- Best overall forex broker: FOREX.Com

- Best for beginner traders: etoro

- Best for non-US traders: HYCM

- Best for commodities: avatrade

- Best for intermediate traders: pepperstone

- Best for advanced forex traders: interactive brokers

- Best for mobile traders: plus500

- Best forex platform: IG markets

Table of contents [ hide ]

The best forex brokers

Benzinga’s picks for the best forex brokers in 6 key categories appear below along with details about each broker and a screenshot of their trading platforms.

Account minimum

Pairs offered

Minimum trade size

Spread

Commisions

1. Best overall forex broker: FOREX.Com

FOREX.Com is a subsidiary of GAIN capital holdings (NYSE: GCAP) and ranks as the best overall forex broker.

You will only need $50 to open up an account to start trading up to 80 currency pairs on FOREX.Com’s advanced trading platforms, which include metatrader for non-U.S. Residents.

This broker accepts U.S. Clients and is regulated in the U.S. By the commodities futures trading commission (CFTC) and the national futures association (NFA). FOREX.Com also has oversight from regulators in 6 major world jurisdictions through its subsidiaries.

You can check out benzinga’s FOREX.Com review for more information about this excellent broker.

Account minimum

Pairs offered

Minimum trade size

Spread

Commisions

2. Best for beginner traders: etoro

Etoro specializes in social trading, which is ideal for beginners since you can follow the trades of expert traders with a proven track record. In addition to its world-class social trading network, etoro has excellent educational resources for forex beginners. Etoro’s intuitive multi-asset trading and social trading platforms and apps can be used by anyone immediately. Unfortunately, etoro does not support the metatrader 4 and 5 (MT4 and MT5) trading platforms.

The broker lets you trade over 2,000 different assets and has a minimum deposit of $50. Etoro currently accepts clients from most U.S. States where it is registered with the U.S. Financial crimes enforcement network (fincen) as a money services business, instead of with the NFA and CFTC as an online broker. The company is also regulated in australia, the U.K. And cyprus in the EU.

Account minimum

Pairs offered

Minimum trade size

Spread

Commisions

3. Best for non-US traders: HYCM

Highly regulated HYCM offers stocks, forex, indices, cryptocurrencies, commodities and etfs. The company also offers excellent trading conditions and great liquidity.

HYCM uses metatrader 4 to trade the markets and adds in technical analysis, flexible trading systems and expert advisors (eas).

You’ll also encounter low spreads and low-cost trading, which includes 3 spread levels: fixed spreads, variable spreads and raw spreads:

- You can access up to 500:1 leverage through HYCM, depending on where you live and which currency pair you’re trading.

- Account minimums with HYCM may vary depending on your base currency and the type of account you open. You should have at least $100 to $200 ready to go before you open an account.

- You can customize your account levels with varying fee structures to fit your risk tolerance and trade frequency.

- HYCM even offers swap-free accounts that do not accrue interest for each of its fee types to allow islamic investors to trade freely without worrying about being in conflict with religious laws.

You’ll also find a range of education and research tools for endless education opportunities through HYCM.

Account minimum

Pairs offered

Minimum trade size

Spread

Commisions

4. Best for commodities: avatrade

Avatrade, one of the most secure brokers in the industry, carries 7 regulations across 6 continents (europe, australia, japan, british virgin islands, UAE and south africa). You’ll be pleasantly surprised by its asset availability, leading platforms and generous trading conditions (you can leverage your positions up to 400:1).

Avatrade offers an exceptionally user-oriented perspective, including a 24-hour multilingual support desk for a broad range of instruments, platforms and services for every level of trader. Instruments include:

- Forex

- Stocks

- Commodities

- Cryptocurrencies

- Indices

You’ll find a range of automated trading platforms, including desktop, tablet, mobile and web-based trading with metatrader 4, metatrader 5, its proprietary webtrader, avaoptions and the award-winning avatradego. Client funds are held in segregated accounts for increased security and fast profits withdrawal.

Avatrade’s innovative technology and cutting-edge trading features also include 1-on-1 training sessions with a dedicated account manager.

Commissions

Account minimum

5. Best for intermediate traders: pepperstone

U.K.-based pepperstone gets our vote for best broker for intermediate traders. It has regulatory oversight in the U.K. And australia, although it does not currently accept U.S. Clients. The broker lets you trade in 61 major, minor and exotic currency pairs and requires a minimum deposit of $200. Pepperstone provides support for the metatrader 4 and 5 and ctrader platforms.

In addition to forex, pepperstone offers trading in cryptocurrencies, energy, metals, commodities and stock index contracts for difference (cfds). Customer balances are maintained in segregated accounts for safety in the australian national bank and barclays U.K.

Pricing

Account minimum

6. Best for advanced forex traders: interactive brokers

Interactive brokers offers some of the lowest costs in the business, including a $0 commission on U.S.-listed stocks and exchange-traded funds (etfs). Because of interactive’s world-class brokerage services in 33 countries that cover 134 markets worldwide, the company has oversight from most of the world’s largest financial regulators, including the U.S. SEC, CFTC and NFA. Interactive also submits to regulatory oversight in the U.K., australia and canada, and it has agencies in japan, hong kong, india and luxembourg.

Interactive brokers offers trading in 23 different currencies and their pairs, and the broker requires a $10,000 minimum margin deposit that is applied to commissions for the first 8 months, followed by a $2,000 minimum starting on the 9th month.

Minimum commissions apply, as well as maintenance fees and charges for inactivity, so interactive brokers would be best for advanced, active and well-funded professional traders. Interactive’s proprietary trading platforms, including its client portal, desktop trader workstation (TWS) and mobile application have been rated as some of the best in the business.

7. Best for mobile traders: plus500

U.K.- based plus500 has oversight from the FCA and is a leading provider of CFD trading on over 1,000 tradable assets including forex currency pairs, stock shares, cryptocurrencies, etfs, options and indices. The company keeps your money in segregated accounts but does not offer services to U.S.-based clients.

Plus500 offers trading in 70 currency pairs featuring competitive spreads on its forex cfds and leverage of up to 300:1. The intuitive interface featured on both the plus500 desktop and mobile trading platforms can be accessed immediately by novices and professionals, which makes plus500 our pick for mobile traders.

Commissions

Account minimum

8. Best forex platform: IG markets

IG markets gives clients access to trade cfds in more than 17,000 different markets including forex, shares, indices, commodities, bonds, etfs, options and short-term interest rate cfds. You can trade up to 80 different currency pairs through IG and the broker requires a $250 minimum deposit.

IG accepts U.S.-based clients due to oversight from the CFTC and NFA. IG holds your money in segregated accounts under trustee arrangements for added security. In addition to its proprietary trading platform, IG offers support for 3rd-party forex platforms such as metatrader 4 and prorealtime. It also allows application programming interface (API) trading.

Forex market explained

In the forex market, traders agree to exchange 1 currency for another to make a transaction in that currency pair at a particular level known as the exchange rate. Like stock prices, this exchange rate fluctuates based on supply and demand factors, as well as on the forex market’s overall expectations of future events.

Forex traders can make money on a currency transaction in 2 ways. First, if they buy or go long a currency and it goes up in value versus the sold currency, then they earn a profit. Second, if they sell or go short a currency and it goes down versus the bought currency, then they also profit.

Many currency pairs quoted in the forex market show substantial volatility or fluctuations, which can result in gains or losses for traders. The daily candlestick chart below shows changes in the exchange rate of the EUR/USD currency pair, which is the european union’s euro quoted in terms of the U.S. Dollar from november 2018 until april 2020.

Risk and reward in forex trading

Rewards are generated in forex trading when you take a long or short position in a currency pair that subsequently appreciates in value. The risk in doing a forex transaction is when the market doesn’t perform as expected once you have done a forex trade.

Many brokers allow traders to magnify the gains or losses they take on a position via the use of leverage. Leverage is typically expressed as the ratio of the size of a position you can control by placing one unit of base currency on deposit as margin. Hence, a 500:1 leverage ratio would mean that you can control a $500 position with a $1 margin deposit.

Furthermore, most successful traders have a minimum risk/reward ratio for a trade before they will consider taking it, such as 1:2 or 1:3. For example, if you think the chances of a trade making 20 pips is around the same as the chances of it losing 10 pips, then your risk/reward ratio of that trade is 1:2. If that meets your risk/reward ratio criteria, then you might consider that trade worthy of executing.

Choose your broker wisely

Since your forex broker will be your primary trading partner, you want to choose one carefully to make sure they are reputable and will fit your requirements as a trader. Open a demo account with an online broker you’re thinking of using to see whether it is a good fit. Demo account trading can also help prevent potentially costly errors that might arise from you being unfamiliar with the broker’s trading platform.

Methodology

These top brokers were chosen for this review for various reasons depending on the specific category in which we felt they excelled. Baseline requirements included the strength of their regulatory environment, their generally good overall reputation with clients earned over an extended period and a substantial number of currency pairs available for trading.

Famous forex brokers

Haven’t found your broker in the list? Contact us, and we will consider the possibility of adding it!

Premium trading rebate – compensation paid by premium trading for each transaction, specified in pips, percent of spread, or percent of commission.

Rebate, $ per lot – compensation in USD (USD cents for cent accounts) paid by premium trading for transactions amounting to 1 round turn lot (100,000 reference currency units) on selected trading instrument.

Account type – an account type name. Basic account types include cent (balance in US cents), micro (usually having minimum lot from 0.01 (1,000 reference currency units), standard (classic accounts normally having ultimate functionality), pro accounts intended for use by professional traders, usually having reduced spread, ECN (electronic communications network) – accounts having access to one of electronic stock exchange systems, NDD (no dealing desk) – accounts with execution without the dealer’s participation, STP (sraight through processing).

Min. Deposit – minimum deposit necessary for opening this type of account.

Min. Lot – minimum position amount where 1 lot = 100,000 reference currency units.

Typical spread – difference between the bid and ask prices for the selected instrument. For account types with fixed spread constant value is specified. For account types with floating spread normally average daily spread is specified. If the broker doesn’t specify this value, the typical spread is calculated by premium trading as average daily value.

Commission, $ per lot – commission in USD (USD cents for cent accounts), charged by the broker for full transaction (including opening and closing) amounting to 1 lot (100,000 reference currency units) on selected trading instrument.

Pure costs, $ per lot (spread + commission – rebate) – pure costs in USD (USD cents for cent accounts) per transaction (including opening and closing) amounting to 1 lot (100,000 reference currency units) on selected trading instrument including premium trading rebate.

Spread type – "=" – fixed spread, "

Quote accur. – quote accuracy – number of digits after the decimal point in quotation value.

Exec. – method for execution of trading positions: IE (instant execution) – when market order is either executed at charged price or, should the price have changed, confirmation of order execution at a new price is requested (requote). ME (market execution) – order is executed at affordable price with possible positive or negative gapping (without requote).

Max. Lev. – maximum size of broker leverage.

Trading platform – MT4 – metatrader 4, MT5 – metatrader 5, web – web trading platform.

Year of found. – year of the company foundation.

Reg. – regulating organization.

Regulation in europe – brokers registered and regulated in the european union.

TOP forex brokers comparison from premium trading

The brokerage services market in forex is being actively developed, its legislation is being changed, trade mechanisms are improving, new brokers are appearing, and the latest technology are being introduced, so the question of choosing the best forex broker for trading will always be relevant both for the beginners and for experienced traders. Premium trading offers a special forex brokers list rating and a unique comparison of trading conditions offered by the TOP forex brokers taking into account cash rebates from premium trading.

The table of forex brokers comparison from premium trading offers you the possibility to compare not only the trading conditions offered by different brokers, but also different types of accounts within the same broker. The table lists the main parameters that are sure to draw the attention of experienced traders in choosing the best broker.

Choose a currency pair for which you plan to do most of the trading operations. By default, for the comparison of selected brokers EURUSD pair – the most liquid and popular pair in the forex market – has been chosen. Depending on the pair the spread values, commissions and rebates specified in $ per 1 lot (100,000 units of base currency) are changed as well.

Compare the best forex brokers list: TOP trading platforms

In our forex brokers rating, we paid great attention to the value of the spread, which is one of the main criteria for selection and comparison of the forex brokers to trade with. The most important value of the spread to compare forex brokers is a "typical" spread which is the average spread for the day. Some brokers instead of the typical spread indicate the minimum value, the range of spread, or the average spread in the most liquid trading time – in such cases, the value of a typical spread is calculated by premium trading. In addition, the comparison table reflects the commission calculated in $ per 1 lot for the selected pair if this type of account is charged by the broker. But most important is the fact you can collate the value of brokers’ "spread + commission – rebate" – this is your net cost, calculated in $ per 1 lot for the selected pair for this type of account with a broker, taking into account the rebates from premium trading. The best forex brokers with a maximum rebate on EURUSD trade are listed in the "TOP brokers" rating.

You can also apply filters to compare forex brokers meeting your criteria in terms of minimum deposit size, having in their arsenal the most popular trading platform metatrader 4, and also you can compare forex brokers, registered in the EU and regulated by european legislation. By clicking on the "details" button you will be directed to the broker’s webpage with even more detailed information, including legal information about the company, users’ reviews. You can get acquainted with the methods of deposit/withdrawal, the main advantages of the broker, the conditions of obtaining rebates, as well as current promotions and bonuses offered by the broker.

Best forex brokers

Luke jacobi

Contributor, benzinga

Want to jump straight to the answer? The best forex broker for most people is definitely FOREX.Com

Forex trading is arguably one of the easiest financial markets to begin trading in. To get started, you just need to open and fund an account with a regulated online broker. Choosing the best forex broker to trade forex through does require some initial research to find the one most suitable for your trading needs and experience level.

Best forex brokers right now:

- Best overall forex broker: FOREX.Com

- Best for beginner traders: etoro

- Best for non-US traders: HYCM

- Best for commodities: avatrade

- Best for intermediate traders: pepperstone

- Best for advanced forex traders: interactive brokers

- Best for mobile traders: plus500

- Best forex platform: IG markets

Table of contents [ hide ]

The best forex brokers

Benzinga’s picks for the best forex brokers in 6 key categories appear below along with details about each broker and a screenshot of their trading platforms.

Account minimum

Pairs offered

Minimum trade size

Spread

Commisions

1. Best overall forex broker: FOREX.Com

FOREX.Com is a subsidiary of GAIN capital holdings (NYSE: GCAP) and ranks as the best overall forex broker.

You will only need $50 to open up an account to start trading up to 80 currency pairs on FOREX.Com’s advanced trading platforms, which include metatrader for non-U.S. Residents.

This broker accepts U.S. Clients and is regulated in the U.S. By the commodities futures trading commission (CFTC) and the national futures association (NFA). FOREX.Com also has oversight from regulators in 6 major world jurisdictions through its subsidiaries.

You can check out benzinga’s FOREX.Com review for more information about this excellent broker.

Account minimum

Pairs offered

Minimum trade size

Spread

Commisions

2. Best for beginner traders: etoro

Etoro specializes in social trading, which is ideal for beginners since you can follow the trades of expert traders with a proven track record. In addition to its world-class social trading network, etoro has excellent educational resources for forex beginners. Etoro’s intuitive multi-asset trading and social trading platforms and apps can be used by anyone immediately. Unfortunately, etoro does not support the metatrader 4 and 5 (MT4 and MT5) trading platforms.

The broker lets you trade over 2,000 different assets and has a minimum deposit of $50. Etoro currently accepts clients from most U.S. States where it is registered with the U.S. Financial crimes enforcement network (fincen) as a money services business, instead of with the NFA and CFTC as an online broker. The company is also regulated in australia, the U.K. And cyprus in the EU.

Account minimum

Pairs offered

Minimum trade size

Spread

Commisions

3. Best for non-US traders: HYCM

Highly regulated HYCM offers stocks, forex, indices, cryptocurrencies, commodities and etfs. The company also offers excellent trading conditions and great liquidity.

HYCM uses metatrader 4 to trade the markets and adds in technical analysis, flexible trading systems and expert advisors (eas).

You’ll also encounter low spreads and low-cost trading, which includes 3 spread levels: fixed spreads, variable spreads and raw spreads:

- You can access up to 500:1 leverage through HYCM, depending on where you live and which currency pair you’re trading.

- Account minimums with HYCM may vary depending on your base currency and the type of account you open. You should have at least $100 to $200 ready to go before you open an account.

- You can customize your account levels with varying fee structures to fit your risk tolerance and trade frequency.

- HYCM even offers swap-free accounts that do not accrue interest for each of its fee types to allow islamic investors to trade freely without worrying about being in conflict with religious laws.

You’ll also find a range of education and research tools for endless education opportunities through HYCM.

Account minimum

Pairs offered

Minimum trade size

Spread

Commisions

4. Best for commodities: avatrade

Avatrade, one of the most secure brokers in the industry, carries 7 regulations across 6 continents (europe, australia, japan, british virgin islands, UAE and south africa). You’ll be pleasantly surprised by its asset availability, leading platforms and generous trading conditions (you can leverage your positions up to 400:1).

Avatrade offers an exceptionally user-oriented perspective, including a 24-hour multilingual support desk for a broad range of instruments, platforms and services for every level of trader. Instruments include:

- Forex

- Stocks

- Commodities

- Cryptocurrencies

- Indices

You’ll find a range of automated trading platforms, including desktop, tablet, mobile and web-based trading with metatrader 4, metatrader 5, its proprietary webtrader, avaoptions and the award-winning avatradego. Client funds are held in segregated accounts for increased security and fast profits withdrawal.

Avatrade’s innovative technology and cutting-edge trading features also include 1-on-1 training sessions with a dedicated account manager.

Commissions

Account minimum

5. Best for intermediate traders: pepperstone

U.K.-based pepperstone gets our vote for best broker for intermediate traders. It has regulatory oversight in the U.K. And australia, although it does not currently accept U.S. Clients. The broker lets you trade in 61 major, minor and exotic currency pairs and requires a minimum deposit of $200. Pepperstone provides support for the metatrader 4 and 5 and ctrader platforms.

In addition to forex, pepperstone offers trading in cryptocurrencies, energy, metals, commodities and stock index contracts for difference (cfds). Customer balances are maintained in segregated accounts for safety in the australian national bank and barclays U.K.

Pricing

Account minimum

6. Best for advanced forex traders: interactive brokers

Interactive brokers offers some of the lowest costs in the business, including a $0 commission on U.S.-listed stocks and exchange-traded funds (etfs). Because of interactive’s world-class brokerage services in 33 countries that cover 134 markets worldwide, the company has oversight from most of the world’s largest financial regulators, including the U.S. SEC, CFTC and NFA. Interactive also submits to regulatory oversight in the U.K., australia and canada, and it has agencies in japan, hong kong, india and luxembourg.

Interactive brokers offers trading in 23 different currencies and their pairs, and the broker requires a $10,000 minimum margin deposit that is applied to commissions for the first 8 months, followed by a $2,000 minimum starting on the 9th month.

Minimum commissions apply, as well as maintenance fees and charges for inactivity, so interactive brokers would be best for advanced, active and well-funded professional traders. Interactive’s proprietary trading platforms, including its client portal, desktop trader workstation (TWS) and mobile application have been rated as some of the best in the business.

7. Best for mobile traders: plus500

U.K.- based plus500 has oversight from the FCA and is a leading provider of CFD trading on over 1,000 tradable assets including forex currency pairs, stock shares, cryptocurrencies, etfs, options and indices. The company keeps your money in segregated accounts but does not offer services to U.S.-based clients.

Plus500 offers trading in 70 currency pairs featuring competitive spreads on its forex cfds and leverage of up to 300:1. The intuitive interface featured on both the plus500 desktop and mobile trading platforms can be accessed immediately by novices and professionals, which makes plus500 our pick for mobile traders.

Commissions

Account minimum

8. Best forex platform: IG markets

IG markets gives clients access to trade cfds in more than 17,000 different markets including forex, shares, indices, commodities, bonds, etfs, options and short-term interest rate cfds. You can trade up to 80 different currency pairs through IG and the broker requires a $250 minimum deposit.

IG accepts U.S.-based clients due to oversight from the CFTC and NFA. IG holds your money in segregated accounts under trustee arrangements for added security. In addition to its proprietary trading platform, IG offers support for 3rd-party forex platforms such as metatrader 4 and prorealtime. It also allows application programming interface (API) trading.

Forex market explained

In the forex market, traders agree to exchange 1 currency for another to make a transaction in that currency pair at a particular level known as the exchange rate. Like stock prices, this exchange rate fluctuates based on supply and demand factors, as well as on the forex market’s overall expectations of future events.

Forex traders can make money on a currency transaction in 2 ways. First, if they buy or go long a currency and it goes up in value versus the sold currency, then they earn a profit. Second, if they sell or go short a currency and it goes down versus the bought currency, then they also profit.

Many currency pairs quoted in the forex market show substantial volatility or fluctuations, which can result in gains or losses for traders. The daily candlestick chart below shows changes in the exchange rate of the EUR/USD currency pair, which is the european union’s euro quoted in terms of the U.S. Dollar from november 2018 until april 2020.

Risk and reward in forex trading

Rewards are generated in forex trading when you take a long or short position in a currency pair that subsequently appreciates in value. The risk in doing a forex transaction is when the market doesn’t perform as expected once you have done a forex trade.

Many brokers allow traders to magnify the gains or losses they take on a position via the use of leverage. Leverage is typically expressed as the ratio of the size of a position you can control by placing one unit of base currency on deposit as margin. Hence, a 500:1 leverage ratio would mean that you can control a $500 position with a $1 margin deposit.

Furthermore, most successful traders have a minimum risk/reward ratio for a trade before they will consider taking it, such as 1:2 or 1:3. For example, if you think the chances of a trade making 20 pips is around the same as the chances of it losing 10 pips, then your risk/reward ratio of that trade is 1:2. If that meets your risk/reward ratio criteria, then you might consider that trade worthy of executing.

Choose your broker wisely

Since your forex broker will be your primary trading partner, you want to choose one carefully to make sure they are reputable and will fit your requirements as a trader. Open a demo account with an online broker you’re thinking of using to see whether it is a good fit. Demo account trading can also help prevent potentially costly errors that might arise from you being unfamiliar with the broker’s trading platform.

Methodology

These top brokers were chosen for this review for various reasons depending on the specific category in which we felt they excelled. Baseline requirements included the strength of their regulatory environment, their generally good overall reputation with clients earned over an extended period and a substantial number of currency pairs available for trading.

So, let's see, what we have: here is a review of the most famous and infamous traders in history and how they affected the world. At famous forex brokers

Contents of the article

- Top forex bonuses

- The world's 10 most famous traders of all time

- 1. Jesse livermore

- 2. William delbert gann

- 3. George soros

- 4. Jim rogers

- 5. Richard dennis

- 6. Paul tudor jones

- 7. John paulson

- 8. Steven cohen

- 9. David tepper

- 10. Nick leeson

- The bottom line

- The 5 best and most famous forex traders of all...

- #1 – george soros

- #2 – james simmons

- #3 – stanley druckenmiller

- #4 – bill lipschutz

- #5 – bruce kovner

- Top 10 best scalping forex brokers 2021

- What is scalping?

- Best forex brokers for scalping 2021

- 1. Pepperstone

- 2. IC markets

- 3. Admiral markets

- 4. Fxpro

- 5. Octafx

- 6. Avatrade

- 7. Vantage FX

- 8. FP markets

- 9. Hotforex

- How does scalping work?

- How does the scalper trader earn?

- How much money does scalping require?

- The best financial assets for scalping

- The forex broker features for scalping

- 3 best US forex brokers for 2021

- Best US forex brokers for 2021

- Best forex brokers US comparison