Fixed spread forex broker

Requotes are very common with fixed spread arrangements since pricing is coming from just one source.

Top forex bonuses

There will always be times when pricing moves very fast as a result of supply-demand dynamics. With no room for spread adjustment to accommodate these movements, the broker has no option but to ask the trader to accept a new entry price provided for the trade. The question of which is a better option between fixed and variable spreads depends on the situation of each individual trader. There are traders who will find the use of fixed spreads more advantageous than using variable spread brokers. However, the reverse can also be the true for other traders. Generally speaking, traders with smaller accounts and fewer monthly trades will benefit from fixed spread pricing.

Compare fixed spread brokers

For our fixed spread comparison, we found 14 brokers that are suitable and accept traders from united states of america.

We found 14 broker accounts (out of 147) that are suitable for fixed spread.

Forex.Com

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About forex.Com

Platforms

Funding methods

79% of retail investor accounts lose money when trading cfds with this provider

Between 54-87% of retail CFD accounts lose money. Based on 69 brokers who display this data.

The ultimate guide to

Finding the best fixed spread brokers for you

What is the spread in forex?

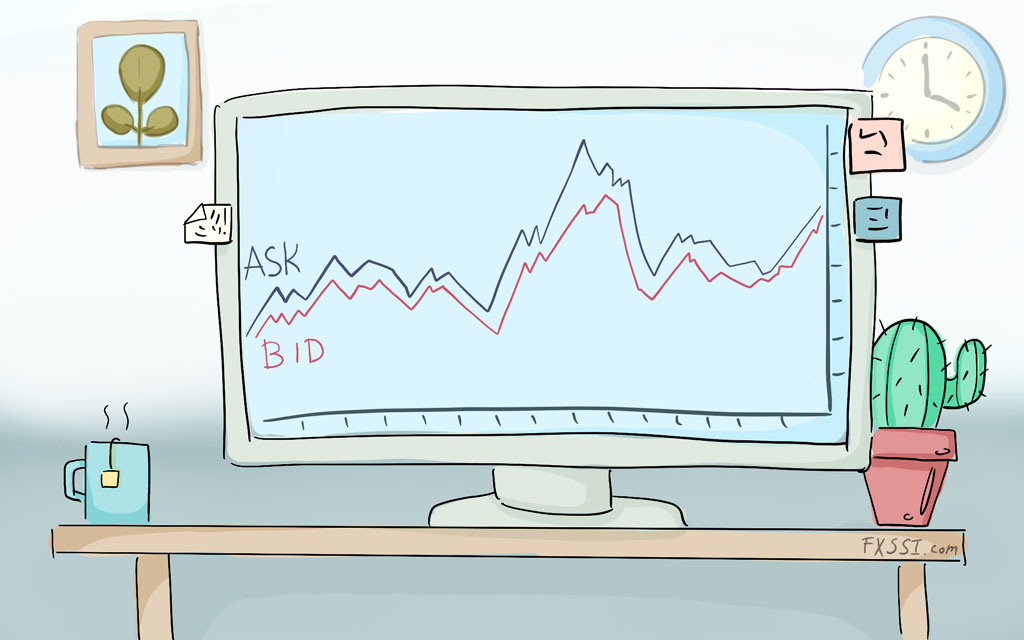

Forex brokers normally quote two different prices for currency pairs: the bid (buy) and ask (sell) price. The difference between these two prices is known as the spread. Generally speaking, the spread is how “no commission” brokers make their money. Instead of charging separate fees for making trades, the cost is built into the buy and sell price of the forex pair you want to trade.

How is the spread in forex measured?

The spread is usually measured in pips, which is the smallest unit of price movement of a traded asset. For most currency pairs, one pip is equal to 0.0001. An example of a 4 pip spread for EUR/GPB would be 1.2339/1.2335. However, currency pairs involving the japanese yen are quoted to only 2 decimal places – an example of a USD/JPY quotes would be 109.53/109.45. The example quote indicates an 8 pip spread.

What types of spreads are in forex?

The type of spreads seen on a forex platform is determined by the structure of business offered by the forex broker. There are two types of spreads:

- Fixed

- Variable (sometimes referred to as ‘floating’)

Fixed spreads are usually offered by brokers that operate a market maker model of business while variable spreads are offered by brokers operating a non-dealing desk model of brokerage business.

What are fixed spreads in forex?

Fixed spreads stay the same irrespective of what market conditions are at play at any given time. In other words, conditions of slippage or intense volatility do not affect a fixed spread. Fixed spreads are seen with brokers that offer the market maker business model.

With this model, the broker buys off large positions from the liquidity providers and offers these positions in smaller chunks to traders using a dealing desk. Thus, the market maker acts as the counterparty to the trade. In this manner, the broker is able to offer fixed spreads to its clients because they are able to control what is offered to these traders using the dealing desk.

What are the benefits of a fixed spread broker?

Fixed spreads have smaller capital requirements, so trading with variable spreads requires a lot of liquidity which many retail traders cannot afford. Therefore, fixed spreads offer a viable and cheaper alternative.

Trading with fixed spreads also enables better trade planning. This is because traders are always sure of what they can expect to pay when they execute a trade. If you are a scalper, then the fixed spread is for you. Scalping involves taking very small profits in many trades within a day. Obviously, the spread will impact on any profits made, so scalpers will be better served using fixed spreads.

What are the disadvantages of a fixed spread broker?

Requotes are very common with fixed spread arrangements since pricing is coming from just one source. There will always be times when pricing moves very fast as a result of supply-demand dynamics. With no room for spread adjustment to accommodate these movements, the broker has no option but to ask the trader to accept a new entry price provided for the trade.

Slippage can be another huge problem. When prices are moving fast, the ability of the broker to offer a fixed spread is compromised and the price fill may end up being far worse than if a widened variable spread was use. Because fixed spreads are only possible because the broker’s dealing desk is controlling the order flows and execution prices, you may find the concept of trading with fixed spreads not very attractive.

Fixed vs variable spreads: which is better?

The question of which is a better option between fixed and variable spreads depends on the situation of each individual trader. There are traders who will find the use of fixed spreads more advantageous than using variable spread brokers. However, the reverse can also be the true for other traders. Generally speaking, traders with smaller accounts and fewer monthly trades will benefit from fixed spread pricing.

What are the different types of fixed spread traders?

Scalpers

those who get in and out of the market very quickly, multiple times a day and just take a few pips at a time generally prefer trading with fixed spread brokers. However, there is a caveat that a broker offering wide fixed spreads may not be the best fit.

News traders

traders who trade the news could benefit from using fixed spreads. Some traders have complained of spreads widening to as high as 50 pips during news trades with variable spread brokers, therefore choosing a broker with the fixed spreads brokers could prevent this.

Micro accounts traders

low-frequency traders and those with smaller deposits using micro accounts could be better off with fixed spread brokers. You will not pay extra commissions (just the spread as discussed above) on trades, unlike with variable spread brokers who charge commissions on each side (buy and sell) of trades.

Why choose forex.Com

for fixed spread?

Forex.Com scored best in our review of the top brokers for fixed spread, which takes into account 120+ factors across eight categories. Here are some areas where forex.Com scored highly in:

- 19+ years in business

- Offers 300+ instruments

- A range of platform inc. MT4, web trader, ninjatrader, tablet & mobile apps

Forex.Com offers one way to tradeforex. If you wanted to trade EURUSD

The two most important categories in our rating system are the cost of trading and the broker’s trust score. To calculate a broker’s trust score, we take into account a range of factors, including their regulation history, years in business, liquidity provider etc.

Top 10 forex brokers with the lowest fixed spread for 2021

Top rated:

As a forex trader, there is little doubt that one of the key things you will be considering when choosing your forex broker in 2021 is the spread. The spread in forex is one of the most important things to take into account when you are entering the market.

With that in mind, we have charted the brokers with some of the best-fixed spread offers in the industry for you to select from.

Table of contents

Top 10 fixed spread brokers

In no particular order, here are some of the best we have found in the forex market:

1. Avatrade

One of the top brokers when it comes to finding a great fixed spread in the forex market is avatrade. This broker offers fixed spread accounts only, with these fixed spreads starting from a very competitive 1.3 pips in total on a host of markets.

The range of markets offered includes more than 50 major, minor, and exotic currency pairs. The fixed spread offers here help you to know exactly where you stand before placing every trade.

The avatrade minimum deposit is also one that remains competitive across the forex trading market at a simple $100.

The broker is also one of the most comprehensively regulated in the industry with regulation coming from a variety of trusted bodies including ASIC, FSCA, and four others. This, along with their long track record of award-winning success can make them an excellent choice as a fixed spread broker.

2. Easymarkets

This australian broker offer more great choices when it comes to trading at the very best rates on a fixed spread account. They provide forex trading accounts with a minimum deposit starting from a very competitive $100 worldwide.

Easymarkets also offer trading through the well-known MT4 trading platform. This can be accessed through download or on the web. With that, forex trading is made available on a huge range of assets. There are more than 120 currency pairs to choose from as well as commodities and other assets. The key thing here is that every asset is available to trade with fixed spreads from a highly competitive 0.9 pips.

In addition, this forex broker is very well regulated by two of the foremost authorities in the industry in cysec and ASIC. Of course, there will still be some risk warning as with trading any markets, though this is well managed by such respected compliance.

3. Forex.Com

Forex.Com is a long-time stalwart of the forex trading industry. They offer accounts for you as a forex trader from a minimum deposit of $50 with some fixed spread assets available for trading.

When you are trading through forex.Com you will note that hundreds of assets are available. Of these, the commodities trading assets are available for those who wish to utilize a fixed spread starting from a very low 0.06 pips on sugar markets. Crude oil (5 pips), coffee (0.9pips), cotton (0.35pips), and cocoa (8pips), are also available for fixed spread trading.

With a longstanding history in the industry, the broker is also very well regulated around the world by as many as 5 top regulators including the FCA, and ASIC. They are considered a top choice for commodity fixed spread trading.

4. Fxpro

Fxpro is another excellent choice if you are in the forex market and looking for a top fixed-spread broker to advance your trading. They offer 3 account types that give you options to trade on several top trading platforms.

You can choose between MT4, MT5, or ctrader trading platforms. These trading platforms are among the most prevalent and respected in the industry. If you are looking to trade with fixed spreads through this broker though, you should note that these are available with MT4 only.

Fxpro as a forex broker offers an extensive choice in what you can trade. Of the 65 major, minor, and exotic currency pairs that are offered, a total of 6 are available with fixed spreads that begin from 1.6pips.

The broker is also trusted in regulatory terms being cysec, FCA, and FSCA regulated and compliant.

5. Plus500

Another of the most experienced and well-known brokers in the forex trading market that you should certainly consider if you are looking for good value fixed spread trading is plus500. While they do not explicitly publicize a listing of the assets they make available to you as a fixed spread forex trader, there are many.

The account with this broker can be opened with an excellent value $100 minimum deposit. Then once you have chosen your markets or currency pairs to trade, you can check out the fixed spread if it is available although they do focus mainly on offering a floating spread. The best thing you can do is contact the plus500 team to confirm availability of you are unsure.

Looking beyond that, as a trader in the forex market, regulation is always key. Therefore you will be glad to note that plus500 are well-regulated by a host of top authorities including cysec, FCA, ASIC, FSCA, and MAS. They are also well-respected as one of the best CFD trading brokers around.

6. Octafx

If you are looking for the lowest fixed spread broker as a forex trader, then there is no doubt that octafx should be high on your list of choices. The broker provides for access to the forex trading market through a number of fixed spread trading options.

The choices include the ability to select your preferred trading platform from the three major players in the industry, MT4, MT5, and ctrader. Accounts can be open for a minimum deposit of $200 and those looking to enjoy fixed spread trading can do so through the MT4 trading platform.

A total of more than 20 currency pairs are made available, although only 10 of these are currently available to be traded using fixed spreads. Gold and silver trading with the USD as a currency pair is also available if you are looking for more fixed spread markets. Trading on these and other forex markets with a fixed spread starts from 2pips.

Our octafx review noted that they are an excellent choice if you wish to engage in gold or silver trading along with your forex trading.

7. City index

City index is another top forex broker that has worked hard to offer highly competitive choices when it comes to fixed spread trading. The fixed spread account types that are on offer can be accessed by forex traders with a minimum deposit starting at $100.

Trading on these fixed-spread accounts is made available through the MT4 trading platform as with many of our best forex brokers listed. As a forex trader here, you can expect to encounter thousands of assets available. This includes a very low starting spread on forex currency pairs as well as 16 indices from around the world that can be traded from 0.3 pips spread in spread betting. 15 of these indices are also available for fixed spread trading if you select them for futures trading.

City index is again a well-regulated and trusted broker with this regulation coming from the FCA in the UK. With so many markets available, this is ideal if you are a forex trader interested in maximum choice. They are also well known as a top broker for trading indices with a fixed spread.

8. Instaforex

As a forex trading seeking the most competitive fixed spread offerings, instaforex is another that has made our listing of top forex trading brokers. These fixed spreads are easily available through the brokers standard account and the minimum deposits remain very competitive throughout.

This is exemplified by the fact you can deposit from as low as $1 to engage in micro trading with the micro account. A mini account is available from $100, and the standard trading account form $1000.

A key market as a forex trader looking for fixed spreads is the forex currency pairs trading. You will be glad to know that instaforex offer fixed spreads throughout these markets with an impressive range of more than 100 forex pairs available with a minimum spread starting at 2 pips.

Further than that, the broker is renowned among asian traders having collected no fewer than 19 awards related to the asian market. To top it off, they are well-regulated by both cysec and the FSC.

9. HYCM

HYCM offer a fixed spread account with a number of assets available for trading and should be one of the major considerations you make if you are a forex trader looking to engage the financial services of the industry’s top brokers.

The HYCM fixed spread trading account is available with a minimum deposit starting from only $100 and the account itself features trading in a wide range of key markets including forex currency pairs, indices, commodities, and stocks. This is a wide and welcome selection to any trader and the fixed spreads usually start from around 1.8pips in most major forex trading markets.

The fact that they are well regulated by the FCA, cysec, and others is one of the main reasons behind many forex traders choosing to deal with HYCM around the world. They have also won multiple awards globally for their service.

10. Trading 212

Last but by no means least on our listing of the lowest fixed spread forex brokers around is trading 212. They again make fixed spread trading available across a range of markets including trading in 27 currency pairs, metals, and indices.

You can get started as a forex trader with trading 212 for as little as $10 and have many options within their CFD trading account. The fixed spreads that are available from this forex market broker begin from 6 pips on forex trading markets. As an added positive, the broker is well regulated by both the FSC, and FCA in the UK as well as being a top choice for those forex traders from outside europe thanks to a wide choice of assets and a high leverage availability.

This can be great for those who wish to move beyond the restrictions of trading with a maximum leverage, but still remain protected by top-tier financial regulation.

What is spread

The spread when you are engaged in forex trading is very simply the difference between the bid and the ask prices of a forex currency pair or another trading market. This spread is sometimes the way in which almost all of the top forex brokers make a marginal profit through having their own small markup, although they remain as competitive as possible.

What does fixed spread mean?

Thinking about the spread in forex, you will typically encounter 2 types. Fixed spreads, and variable or floating spreads. The latter of these is usually more common and means that the spread can change (or float/vary) depending on the demand or volatility of a market. As mentioned above, this can provide some opportunity for a broker markup.

Fixed spreads on the other hand, as the name would imply, do not move. These are set by the broker and will almost never change, at least not in any short frame of time. Brokers who used fixed spreads can also be termed as a market maker broker.

Floating spread vs fixed spreads

Looking at the spread in forex from a trader perspective, you may wonder which one is best as a forex trader. This simply depends on the market and on the moment. Some may say that floating spreads tend to be averagely lower, although this is not always the case and the fact they can change does provide you as a forex trader with some level of unpredictability.

Many in the forex trading industry like to eliminate this uncertainty and so they choose to deal with what may be a marginally higher fixed spread but they can understand the exact cost of their trade with ease.

With that said, when choosing a market maker broker for forex trading, you are relying a lot on the integrity and reputation of that broker to set the fixed spread in a fair and reasonable manner. Thus, you should always try to go with a very well-regulated broker like all that we have listed above. If you can do this, then in the long-term, depending on your forex trading style and the movements of the market itself, you may well find that you can save money and trade in a more economical manner with the fixed spread in place.

Top fixed spreads accounts for 2021

We found 11 online brokers that are appropriate for trading fixed spreads accounts.

Best fixed spreads accounts guide

Fixed spreads

A fixed spread is the difference between the ask and bid price stays the same even when the market prices are changing.

Usually, brokers who operate as a market maker offer fixed spreads while those who operate as a non- dealing desk offer variable spreads.

Fixed spreads defined

Lets explain fixed spreads. A trader buys a product at a wholesale price and sells it at a retail price to earn profit with a slight increase in price. The seller adjusts the profit depending on the volatility of the market. This means if the market is volatile; the retail price would be more compared to the usual market.

Similarly, the spreads between buy and sell of currencies in forex trading change depending on the volatility of the market. But if the buyer and seller fix up the price irrespective of market volatility, it is known as fixed spreads.

So, in fixed spreads you know what would be the spread is in the future and develop your trading strategy accordingly.

Fixed spreads vs variable spreads

As mentioned above, spreads are of two types. One is fixed spreads and the other is variable spreads, which is also called as floating spreads.

In variable or floating spreads the value differences between buy and sale price change constantly.

The fluctuation depends on factors like supply, demand and trading activities. Usually, the spreads are very tight when the trading sessions are highly active and liquidity is at the optimal level.

In short, the variable or floating spreads are completely based on market phenomenon.

In fixed spreads, the differences between buy and sale are fixed and are not affected by a volatile market.

Fixed spreads advantages

There is a couple of fixed spreads advantages worth mentioning here and those are as below:

- Fixed spreads are more transparent, unlike variable spreads. Both buyer and seller know exactly what would be the transaction amount when the trade takes place in the future. This means the price cannot be manipulated by brokers.

- The cost of trading is minimized when fixed spreads are opted as there remain no surprises and you can budget your transaction cost.

- You are well safeguarded with fixed spreads against volatility and the arrangement is perfect for short term strategies.

Fixed spreads disadvantages

- The first disadvantage is that requotes are common. If the movement of pricing is faster, the requotes are more frequent.

- Slippage is also a problem in fixed spreads arrangement. Brokers usually compromise when the price movement is fast.

Fixed spreads trader types

There are basically three types of fixed spreads and those are as below:

Fixed spread micro account trading

Investors who want to make lower deposit amounts with their broker or do not trade very often may prefer using a fixed spread broker.

Fixed spread scalpers

If you are a bit fickle-minded and usually take an entry and exit several times a day, scalpers are best for you.

Fixed spreads news traders

If you trade the news, you can understand the role of news traders. If the market is highly volatile, it is suggested to opt for fixed spreads.

Fixed spreads verdict

Fixed spreads are a useful trading strategy for some. Fixed spreads play an important role when the market is highly volatile.

We've collected thousands of datapoints and written a guide to help you find the best fixed spreads accounts for you. We hope this guide helps you find a reputable broker that matches what you need. We list the what we think are the best fixed spreads accounts below. You can go straight to the broker list here.

Reputable fixed spreads accounts checklist

There are a number of important factors to consider when picking an online fixed spreads accounts trading brokerage.

- Check your fixed spreads accounts broker has a history of at least 2 years.

- Check your fixed spreads accounts broker has a reasonable sized customer support of at least 15.

- Does the fixed spreads accounts broker fall under regulation from a jurisdiction that can hold a broker responsible for its misgivings; or at best play an arbitration role in case of bigger disputes.

- Check your fixed spreads accounts broker has the ability to get deposits and withdrawals processed within 2 to 3 days. This is important when withdrawing funds.

- Does your fixed spreads accounts broker have an international presence in multiple countries. This includes local seminar presentations and training.

- Make sure your fixed spreads accounts can hire people from various locations in the world who can better communicate in your local language.

Our team have listed brokers that match your criteria for you below. All brokerage data has been summarised into a comparison table. Scroll down.

Our brokerage comparison table below allows you to compare the below features for brokers offering fixed spreads accounts.

We compare these features to make it easier for you to make a more informed choice.

- Minimum deposit to open an account.

- Available funding methods for the below fixed spreads accounts.

- What you are able to trade with each brokerage.

- Trading platforms offered by these brokers.

- Spread type (if applicable) for each brokerage.

- Customer support levels offered.

- We show if each brokerage offers micro, standard, VIP and islamic accounts.

Top 15 fixed spreads accounts of 2021 compared

Here are the top fixed spreads accounts.

Compare fixed spreads accounts min deposits, regulation, headquarters, benefits, funding methods and fees side by side.

All brokers below are fixed spreads accounts. Learn more about what they offer below.

You can scroll left and right on the comparison table below to see more fixed spreads accounts that accept fixed spreads accounts clients

Top fixed spreads accounts for 2021

We found 11 online brokers that are appropriate for trading fixed spreads accounts.

Best fixed spreads accounts guide

Fixed spreads

A fixed spread is the difference between the ask and bid price stays the same even when the market prices are changing.

Usually, brokers who operate as a market maker offer fixed spreads while those who operate as a non- dealing desk offer variable spreads.

Fixed spreads defined

Lets explain fixed spreads. A trader buys a product at a wholesale price and sells it at a retail price to earn profit with a slight increase in price. The seller adjusts the profit depending on the volatility of the market. This means if the market is volatile; the retail price would be more compared to the usual market.

Similarly, the spreads between buy and sell of currencies in forex trading change depending on the volatility of the market. But if the buyer and seller fix up the price irrespective of market volatility, it is known as fixed spreads.

So, in fixed spreads you know what would be the spread is in the future and develop your trading strategy accordingly.

Fixed spreads vs variable spreads

As mentioned above, spreads are of two types. One is fixed spreads and the other is variable spreads, which is also called as floating spreads.

In variable or floating spreads the value differences between buy and sale price change constantly.

The fluctuation depends on factors like supply, demand and trading activities. Usually, the spreads are very tight when the trading sessions are highly active and liquidity is at the optimal level.

In short, the variable or floating spreads are completely based on market phenomenon.

In fixed spreads, the differences between buy and sale are fixed and are not affected by a volatile market.

Fixed spreads advantages

There is a couple of fixed spreads advantages worth mentioning here and those are as below:

- Fixed spreads are more transparent, unlike variable spreads. Both buyer and seller know exactly what would be the transaction amount when the trade takes place in the future. This means the price cannot be manipulated by brokers.

- The cost of trading is minimized when fixed spreads are opted as there remain no surprises and you can budget your transaction cost.

- You are well safeguarded with fixed spreads against volatility and the arrangement is perfect for short term strategies.

Fixed spreads disadvantages

- The first disadvantage is that requotes are common. If the movement of pricing is faster, the requotes are more frequent.

- Slippage is also a problem in fixed spreads arrangement. Brokers usually compromise when the price movement is fast.

Fixed spreads trader types

There are basically three types of fixed spreads and those are as below:

Fixed spread micro account trading

Investors who want to make lower deposit amounts with their broker or do not trade very often may prefer using a fixed spread broker.

Fixed spread scalpers

If you are a bit fickle-minded and usually take an entry and exit several times a day, scalpers are best for you.

Fixed spreads news traders

If you trade the news, you can understand the role of news traders. If the market is highly volatile, it is suggested to opt for fixed spreads.

Fixed spreads verdict

Fixed spreads are a useful trading strategy for some. Fixed spreads play an important role when the market is highly volatile.

We've collected thousands of datapoints and written a guide to help you find the best fixed spreads accounts for you. We hope this guide helps you find a reputable broker that matches what you need. We list the what we think are the best fixed spreads accounts below. You can go straight to the broker list here.

Reputable fixed spreads accounts checklist

There are a number of important factors to consider when picking an online fixed spreads accounts trading brokerage.

- Check your fixed spreads accounts broker has a history of at least 2 years.

- Check your fixed spreads accounts broker has a reasonable sized customer support of at least 15.

- Does the fixed spreads accounts broker fall under regulation from a jurisdiction that can hold a broker responsible for its misgivings; or at best play an arbitration role in case of bigger disputes.

- Check your fixed spreads accounts broker has the ability to get deposits and withdrawals processed within 2 to 3 days. This is important when withdrawing funds.

- Does your fixed spreads accounts broker have an international presence in multiple countries. This includes local seminar presentations and training.

- Make sure your fixed spreads accounts can hire people from various locations in the world who can better communicate in your local language.

Our team have listed brokers that match your criteria for you below. All brokerage data has been summarised into a comparison table. Scroll down.

Our brokerage comparison table below allows you to compare the below features for brokers offering fixed spreads accounts.

We compare these features to make it easier for you to make a more informed choice.

- Minimum deposit to open an account.

- Available funding methods for the below fixed spreads accounts.

- What you are able to trade with each brokerage.

- Trading platforms offered by these brokers.

- Spread type (if applicable) for each brokerage.

- Customer support levels offered.

- We show if each brokerage offers micro, standard, VIP and islamic accounts.

Top 15 fixed spreads accounts of 2021 compared

Here are the top fixed spreads accounts.

Compare fixed spreads accounts min deposits, regulation, headquarters, benefits, funding methods and fees side by side.

All brokers below are fixed spreads accounts. Learn more about what they offer below.

You can scroll left and right on the comparison table below to see more fixed spreads accounts that accept fixed spreads accounts clients

Fixed spread forex brokers

The trading cost always is the key feature to any trader or investor, as by the end of the day a significant amount can be paid just for the difference between the sell and buy price. It is a fact that typically the trading costs charged by the broker are built into a difference between the price for a particular instrument or more known as a spread.

- Initially, there are known two types of spread offering, which is either the fixed spread or the variable or floating one.

The fixed spread, as its obvious from the name, is fixed to the particular charge, which remains the same under any market conditions, throughout liquidity or volatility. This model brings a stable trading environment and makes it a way easier to predict or calculate the total trading cost.

- Fixed spreads usually offer a wider cost, as the broker should include into the proposal all risks, rather than the floating spread that changes according to the market conditions.

- Nevertheless, there are many strategies which demanding, in particular, the fixed spread due to its nature and is a necessary demand within the long-term traders or the beginning ones.

Important to note that it is common the fixed spread forex brokers are operating as OTC or market makers in order to provide the liquidity. Most often reputable and well-regulated companies offering fixed spread to the potential benefit of their traders. Yet, always consider only sharply authorized brokers as the risk to fall under the fraud through a non-regulated brokerage offering fixed spread opportunity is extremely high due to its loose of obligations towards any laws.

Fixed spreads vs variable spreads

How spread structure affects your bottom line as a trader

Fixed spreads vs. Variable spreads

When looking for a prospective broker, it is important to research how they price their spreads. Over time, the spreads that a trader pays ends up costing a significant amount, and should be a key consideration when choosing a forex broker.

Forex brokers generally offer two types of trade spreads, variable or fixed. So, which is the better option? Opinions differ amongst traders and it does depend on individual trading styles. First, let’s look at the difference between the two spread structures.

With variable spreads, the difference between the buy and sell price of a particular currency pair fluctuates in a range. A variable spread for the EUR/USD pair generally differs between 1 to 4 pips for most brokers, but during volatile market conditions can actually widen to as much as 8 or even 10 pips. A variable spread widens in correlation with increased liquidity in the market and is really only low during times of market inactivity.

On the other hand, fixed spreads are predetermined and remain constant throughout all trading conditions. A fixed spread will usually fall within the range of a variable spread, and is commonly set at either 2 or 3 pips for EUR/USD. Though traders essentially pay a small premium during quiet market hours, when a variable spread may be lower, the broker ensures that the spread will not widen during even the most volatile market conditions. Fixed spreads allow traders to better strategize without factoring in an unpredictable variable that inflates transaction costs during times most critical to traders.

Quiet versus volatile markets, what kind of trader are you?

Variable spreads may be more suited to long-term traders who do not trade during news events and are prone to entering and exiting during quiet market conditions. This way they can more consistently obtain a price that is in the lower range of the variable spread. For example, if a trader were to enter the market during off-peak times with a variable spread of 1 or 1.5 pips on EUR/USD as opposed to the fixed 2 or 3 pip spread on many platforms, he would save money on the spread in the long run.

- 100 trades at 1 pip (or 1.5 pips) = $100 ($150) in spreads

- 100 trades at 2 pips (or 3 pips) = $200 ($300) in spreads

However, flat markets and off-peak times are periods of consolidation when it is less clear where the price will head next. Most traders prefer to place positions when a clearer direction is evident in the market.

During swift market activity, especially around important fundamental releases such as a speech by a central bank official or the opening of local business hours and stock exchanges, spreads are widened to the upper part of their ranges. Likewise, during breaks of key technical levels, the market may also be very volatile sometimes moving as much as 100 pips in as little as 5 minutes. During these vulnerable times, opening positions becomes more expensive, which can be a deterrent to trading.

Consider this example: A trader prefers to enter and exit the market more when it is reacting to key news and events. He opens 100 positions of EUR/USD; he places 20 trades at a spread of 1.5 pips, 20 at 2 pips, and 30 each at 5 and 8 pips, when the spread has widened to the upper part of its range.

- 20 trades at 1.5 pips = $30 in spreads

- 20 trades at 2 pips = $40 in spreads

- 30 trades at 5 pips = $150 in spreads

- 30 trades at 8 pips = $240 in spreads

- 100 trades at avg. (4.6 pips) = $460

- All together the 100 trades cost $460.

- 100 trades at fixed 2 pips = $200 in spreads.

With a fixed spread those same trades would have amounted to a cost savings of $260. This is a very simple case, but highlights the point that it depends a lot on the kind of trader you are and if you prefer trading during busy fast moving markets or times when the market is calmer.

Variable spreads and stops

Variable spreads may even set off protective stops and limits unwittingly. If the difference between the bid and ask widens and reaches the level of a stop or limit, this large gap may suddenly execute a conditional order. This adds an extra variable to your strategy that you need to consider. This might be less likely to occur with fixed spreads because the bid and ask are always synchronized. Fixed spreads minimize the element of surprise; traders know exactly what the parameters are at all times, allowing for better strategic planning and money management.

The verdict

Tight, competitive spreads affect your bottom line as a trader, and the best spread structure for you depends on your trading style, appetite for risk, ability to react in a fast-moving market, and ultimately, the quality of execution. Fixed spreads are consistent and predictable regardless of market liquidity. On the other hand, variable spreads tend to provide lower costs only during quiet market conditions—times of limited market activity when traders may have less incentive to trade. CMS forex offers one of the lowest fixed spreads in the industry; EUR/USD and USD/JPY are offered with a spread of just 2 pips. Coupled with the commitment to offering quality execution, CMS forex remains a truly competitive player in the forex arena. Perhaps you are interested in trading during a stagnant market or simply prefer the most popular brand name. The choice is yours.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. Fxstreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in open markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of fxstreet nor its advertisers.

Fixed spread vs floating spread: which one is better?

First you need to understand what does the spread mean in forex and to be honest, it's not that difficult.

Spread in the forex market is a difference between the buy (ask) and sell (bid) prices that a broker receives as a commission for participating in trades. In case of sell trades, the spread is taken after the trade is closed, and for buy trades – at the beginning.

For a start, let’s look at the difference between a fixed and a floating spread in forex on the image above.

It’s hard to determine with just one look which kind of spread is better.

It seems that the fixed spread size is constant while the floating spread can be smaller in size than the fixed one. Regardless of which spread you have chosen, it is very convenient to track live floating spread using the spead.Warner indicator.

Let’s name the pros and cons of each of them for more accurate comparison.

Fixed spread

Fixed spread is a broker's set income from any of your trade.

Pros and cons of fixed spread:

+ commission size you must pay is known in advance;

− trading limits are often common during news releases;

− in most cases, you’ll be offered 4-digit pricing along with the fixed spread;

Floating spread

Floating spread is a broker's volatile income from each of your trades. It can be minimal during quiet trading and can rise sharply during market turbulence.

Pros and cons of floating spread:

+ for the most part, it is less in size than the fixed spread;

− significant spread widening is possible during news releases and holidays.

Which one to choose?

Our personal opinion is that: if you trade profitably you’ll be able to trade in profit no matter what kind of spread you choose (if only your broker lets you withdraw the money you’ve made).

Your aim is to reduce trading costs, and these are our recommendations on how you can do it:

Your aim is to reduce trading costs. Trading currency pairs with low spreads will also increase your profits. Below are a few more recommendations.

- If its size for the selected instrument is less than that of the floating one;

- If you’re planning to activate a rebate service on your account;

Choose the floating spread

- In all other cases.

We would add that in our practice the costs of trading on account with the floating spread are always far less than that with the fixed one.

This is why we strongly recommend the floating spread for manual trading.

We want you to remember that the fixed spread is an artificial concept created by brokers as an advertising trick. However, it shouldn’t be any concern of yours if your broker faithfully lets you withdraw your profits.

Fixed spreads

They never change no matter what the market conditions

Fixed spreads help traders know their bottom line i.E. Their spread cost, regardless of market conditions. No matter what the market’s liquidity or volatility is, easymarkets spreads remain stable. Even during bitcoin’s historic bull run, when it reached $20,000 – easymarkets not only continued offering the cryptocurrency but kept its spreads unchanged.

What our traders say about us

What are fixed spreads?

A spread is the difference between the ask and bid price. In simple terms think of it as a retailer that purchases a product at a wholesale price and then sells it for a little bit more. Some brokers adjust this spread between the ask and bid price depending on volatility, meaning if markets are volatile your spread might be different for every trade you place within that period.

A complicated formula is usually necessary to calculate these variable spreads.

Fixed spreads on the other hand allow you to know your spread cost beforehand and develop your strategy (either long-term or daily) simply. This allows for better price transparency and ultimately a more predictable cost assessment before you even start trading.

What effects spreads?

Although fixed spreads do not change, they do differ from instrument to instrument. Variable spreads can reveal the liquidity of a market.

This is due to certain factors such as:

The supply and demand for a specific security

The underlying asset’s overall trading activity

Variable vs. Fixed spreads

In forex trading, spreads are of two types: variable or fixed.

A variable or floating spread is a constantly changing value between the ask and bid prices 2 . In other words, the spread you pay for purchasing a currency pair fluctuates because of things like supply, demand and total trading activity.

Brokers promising tight spreads typically offer variable spreads. Although it’s certainly possible that the actual spread you pay for matches the one advertised by the broker, this is not always the case. In general, spreads are usually tighter during active trading sessions where liquidity is optimal. A prime example of this is the london-new york overlap 3 .

After all, variable spreads are characterized as a “completely market phenomenon.” 4

- 1. Investopedia. Definition of ‘spread.’

- 2. Forex CFD trading: fixed spreads or variable spreads. Contracts-for-difference.Com

- 3. Capital spreads. Fixed or variable FX spreads

- 4. Investopedia. Forex scalping.

- 5. Fixed spread in forex trading – four solid reasons to choose it. Traderji.Com.

The 5 advantages of fixed spreads

Unlike variable spreads, fixed spreads are set by the broker and don’t change regardless of market conditions or volatility. The spread you are offered is the spread you pay.

Although variable spreads marketed at 0.1 pip look more appealing, fixed spreads can potentially save you more money throughout the course of your career. Below are five advantages of fixed spreads in forex.

1. More transparency

In forex, fixed spreads mean transparent costs. You know exactly what you’re going to pay for each time you trade, regardless of interbank liquidity, time of day or trading volumes. This ensures that brokers can’t manipulate the spreads in their favour.

2. Lower costs

By applying fixed spreads, you can greatly reduce the cost of trading. Fixed spreads offer no surprises, ensuring you can budget the costs of transactions well in advance. This will greatly improve your ability to manage costs over the course of your trading career.

3. Easier news trading

Volatility in the forex market has become commonplace and isn’t limited to news events. While variable spreads may be beneficial during quieter market times, fixed spreads are ideal for volatile market conditions 5 , which just also happen to potentially provide more opportunities to take advantage of.

4. Safeguard against volatility

Unfortunately, variable spread accounts can make news trading very confusing because of how wide the bid and ask fluctuate. By using a fixed spread, traders may approach news trading as they would any other market condition.

5. More effective short term strategies

Short term forex trading strategies involve making numerious trades in a short period of time – is much easier and more predictable using fixed spreads. Due to the nature of this strategy the potential gains can be small, so using fixed spreads ensures a higher level of price transparency.

- 1. Investopedia. Definition of ‘spread.’

- 2. IFC markets. Floating and fixed spreads.

- 3. Forex CFD trading: fixed spreads or variable spreads. Contracts-for-difference.Com

- 4. IFC markets. Floating and fixed spreads.

- 5. Capital spreads. Fixed or variable FX spreads

- 6. Investopedia. Forex scalping.

- 7. Fixed spread in forex trading – four solid reasons to choose it. Traderji.Com.

Enhance your trading experience with easymarkets app

- Contact us

- Company news

- Awards

- Legal

- Careers

- Partners

- Site map

Trade responsibly: EF worldwide ltd makes no recommendations as to the merits of any financial product referred to in this advertisement, emails or its related websites and the information contained does not take into account your personal objectives, financial situation and needs. Therefore you should consider whether these products are appropriate in view of your objectives, financial situation and needs as well as considering the risks associated in dealing with those products. EF worldwide ltd recommends that you read the client agreement before making any decision concerning EF worldwide ltd financial products. Trading involves substantial risk of loss. Do not invest money you cannot afford to lose. EF worldwide ltd is not under the supervision of the JFSA, it is not involved with any acts considered to be offering financial products and solicitation for financial services, and this website is not aimed at residents in japan. EF worldwide ltd (british virgin islands financial services commission - license number SIBA/L/20/1135)

Easymarkets is a trading name of EF worldwide ltd registration number: 2031075. This website is operated by EF worldwide limited (part of blue capital markets group).

Restricted regions: easymarkets group of companies does not provide services for residents of certain regions, such as the united states of america, israel, iran, syria, afghanistan, north korea, somalia, yemen, iraq, sudan, south sudan, british columbia, ontario, manitoba, equatorial guinea, guinea bissau, turkmenistan, venezuela, libya, republic of congo (brazzavile), democratic republic of congo, chad, haiti, quebec, cambodia, cuba and burundi.

Easymarkets is a registered trademark. Copyright © 2001 - 2021. All rights reserved.

Fxdailyreport.Com

In forex trading, the difference between a bid price and an asking price is known as a spread. Therefore a zero spread account is a type of account that has no difference between bid prices and ask price. A zero spread forex broker is a brokerage firm that offers its traders zero spread accounts. In other words, the spread takes the place of a typical transaction fees, meaning that you don’t have to pay anything.

With this unique account, you as the trader is aware of your entry and exit stages in advance. This means that when you open a trade in a particular position, you automatically know your exit point. This could be an enormous advantage to some traders.

While using a broker that offers this kind of account, it helps to understand that when the spread becomes bigger, the cost of trading rises. On the other hand, when the spread is narrow the cost stays low.

Top forex brokers with starting from 0 pip spreads

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker |

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $300 spread: floating, from 0 pips leverage: 500:1 regulation: FCA UK reference number 579202 | visit broker | ||

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker | |

| min deposit: $250 spread: as low as 0.1 pips leverage: up to 400:1 regulation: ASIC australia and FCA UK | visit broker | ||

| min deposit: $100 spread: starting 0 pip leverage: 500:1 regulation: FCA UK, FSA (seychelles), cysec | visit broker | ||

| min deposit: $100 spread: from 0,2 pips leverage: 1:200 regulation: FCA UK (#186171), cysec (#259/14), CIMA (1442313) and DFSA (F000048) | 10% welcome bonus up to $5,000 | visit broker |

Though it may sound like no trader will be charged by a 0 spread forex broker, there is a probability that the broker will charge some traders in one way or another. In fact, there are numerous zero spread brokers that are keen on a particular range. This means that you might get charged, but the charges are not presented as you would expect as they may be in an indirect form.

Zero spread brokers

These types of brokers normally offer an electronic communications network (ECN) or what is termed as a straight through process (STP). They offer a much different approach to the traders in comparison to the typical forex trading brokers. With zero spread brokers, you get direct access to the available financial markets.

It is, however, important to note that the prices are not set by the brokers. Instead, they are set by the market itself.

The pros of zero spread forex brokers

- If you sign up with a zero spread broker, it opens the doors for you to access the market directly.

- As a trader, you know your entry and exit points beforehand as soon the positions are open. If you are into high-frequency scalping, then this kind of brokerage is extremely helpful with calculating non-trading loses. They also help you execute your day trading strategies with precision. Moreover, you can benefit from the speedy execution of your trading moves since you already have direct access to the relevant financial markets.

- Efficiency is another advantage of using 0 pip spread forex brokers. The whole model of trading allows you direct access as well as fast executions; this can be attributed to the fact that there are no interventions from the brokers to your trading decisions. The trading systems are automated, which provides you a great deal of efficiency.

The cons of zero spread forex brokers

While you may think that you will not be charged by this kind of brokerage, some costs might apply in a hidden way. This is detrimental to a trader in that you may end paying various charges without exactly knowing how they came about. Some of these charges are disguised as a huge initial account opening size. Sometimes, you are forced to put with disappointingly low execution speeds.

Also, if you like to make the use of the negative balance protection, it will certainly not help you with a zero spread forex brokers. Dealing directly in the market can be both good and bad. One of the ways in which this can be a disadvantage is that meeting the required liquidity threshold solely rests with you as the trader. For instance, the cost of opening an account is quite high and you have to meet it by yourself.

If you would like to try out a method of currency trading without having to pay hefty transaction costs, the zero spread brokers offer you a perfect opportunity to do so. Nevertheless, zero spread brokerage firms should be looked at more carefully. No trade that promises zero charges on anything really works that way. In fact, if you examine it closely, you may find out that you will be charged by these brokers in subtle ways that aren’t as clear cut as what you would experience with other options.

So, let's see, what we have: fixed spreads are offered by many brokers and allow you to trade with more predictability over how much you're going to pay in spreads. In this comparison, we've compared some of the top online brokers that offer tight fixed spreads for trading forex, crypto, stocks, indices & more. At fixed spread forex broker

Contents of the article

- Top forex bonuses

- Compare fixed spread brokers

- We found 14 broker accounts (out of 147)...

- Forex.Com

- Finding the best fixed spread brokers for you

- What is the spread in forex?

- How is the spread in forex measured?

- What types of spreads are in forex?

- What are fixed spreads in forex?

- What are the benefits of a fixed spread broker?

- What are the disadvantages of a fixed spread...

- Fixed vs variable spreads: which is better?

- What are the different types of fixed spread...

- Why choose forex.Com for fixed spread?

- Top 10 forex brokers with the lowest fixed spread...

- Top 10 fixed spread brokers

- 1. Avatrade

- 2. Easymarkets

- 3. Forex.Com

- 4. Fxpro

- 5. Plus500

- 6. Octafx

- 7. City index

- 8. Instaforex

- 9. HYCM

- 10. Trading 212

- What is spread

- What does fixed spread mean?

- Floating spread vs fixed spreads

- Top fixed spreads accounts for 2021

- Best fixed spreads accounts guide

- Fixed spreads

- Fixed spreads defined

- Fixed spreads vs variable spreads

- Fixed spreads advantages

- Fixed spreads trader types

- Fixed spreads verdict

- Reputable fixed spreads accounts checklist

- Top 15 fixed spreads accounts of 2021 compared

- Top fixed spreads accounts for 2021

- Best fixed spreads accounts guide

- Fixed spreads

- Fixed spreads defined

- Fixed spreads vs variable spreads

- Fixed spreads advantages

- Fixed spreads trader types

- Fixed spreads verdict

- Reputable fixed spreads accounts checklist

- Top 15 fixed spreads accounts of 2021 compared

- Fixed spread forex brokers

- Fixed spreads vs variable spreads

- How spread structure affects your bottom line as...

- Fixed spreads vs. Variable spreads

- Quiet versus volatile markets, what kind of...

- Variable spreads and stops

- The verdict

- Fixed spread vs floating spread: which one is...

- Fixed spread

- Floating spread

- Which one to choose?

- Fixed spreads

- They never change no matter what the market...

- What our traders say about us

- What are fixed spreads?

- What effects spreads?

- Variable vs. Fixed spreads

- The 5 advantages of fixed spreads

- 1. More transparency

- 2. Lower costs

- 3. Easier news trading

- 4. Safeguard against volatility

- 5. More effective short term strategies

- Fxdailyreport.Com

- Top forex brokers with starting from 0 pip spreads

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.