Most trusted forex brokers

Below we have put in place a step by step type of checklist guide, which you should always use when you are considering opening an account at any online forex trading site.

Top forex bonuses

Deposit: $50 leverage: 1:1000

Honest forex brokers

However, there are many things you can do as a forex trader to ensure you only ever become a client of the better run brokers out there.

Below we have put in place a step by step type of checklist guide, which you should always use when you are considering opening an account at any online forex trading site.

Deposit: $10 leverage: 1000:1

Deposit: $50 leverage: 1:50

Deposit: $100 leverage: 1:30

Deposit: $50 leverage: 1:1000

Forex traders checklist

Here is our step by step checklist that will enable you to locate and sign up to the most honest forex brokers, always use it to compare any two trading sites you come across and the one that ticks all of the right boxes should of course be the one you join up to!

Licensed brokers – the first thing that you should always check is whether the forex broker you are thinking of joining and becoming a customer of holds a full trading licence, and one that has been issued by a recognised jurisdiction.

Many of the poorly run and operated brokers are not licensed, or if they are they are simply licensed as a business in the country where they are based, and this is something completely different to holding a full forex trading license.

So any forex broker site you come across must be licensed, for when they are in the very unlikely event of you experiencing any problems at that site you will have help at hand through the licensing authority.

Fees and charges – your forex trading budget is what you will be using to invest and place trades on many different currencies, and the more of that budget you can keep hold of the better. You do need to be aware that some forex brokers have a high set of fees and charges when you use their broking platforms, and these fees tend to kick in when you request a withdrawal of any trading profits from those sites.

There are more than enough forex brokers who do not have any charges what so every for either funding your account or making a withdrawal from that account, and as such always take not of the banking pages on any brokers website and check to see if you are allowed to withdraw funds from your account completely free of charge.

Some sites will allow you to make a nominal number of free withdrawals each month. However, there are many who have done away with any and all processing fees.

Currency pairings – the main aim of your trading any two currencies is of course to sport one currency that is going to move in value against another at any given time. With this in mind you need to ensure that any forex broker you sign up to offers you a very large range of currency pairings.

It may actually surprise you to learn that some brokers only offer a limited number of currency pairings and the fewer any site has then the least likely you are to be able to place your trades on the currency pairings you are seeking.

So always avoid any broker that only offers a limited number of forex pairings, as that could mean you will miss out repeatedly on potentially very profitable trades if you are a client of those sites.

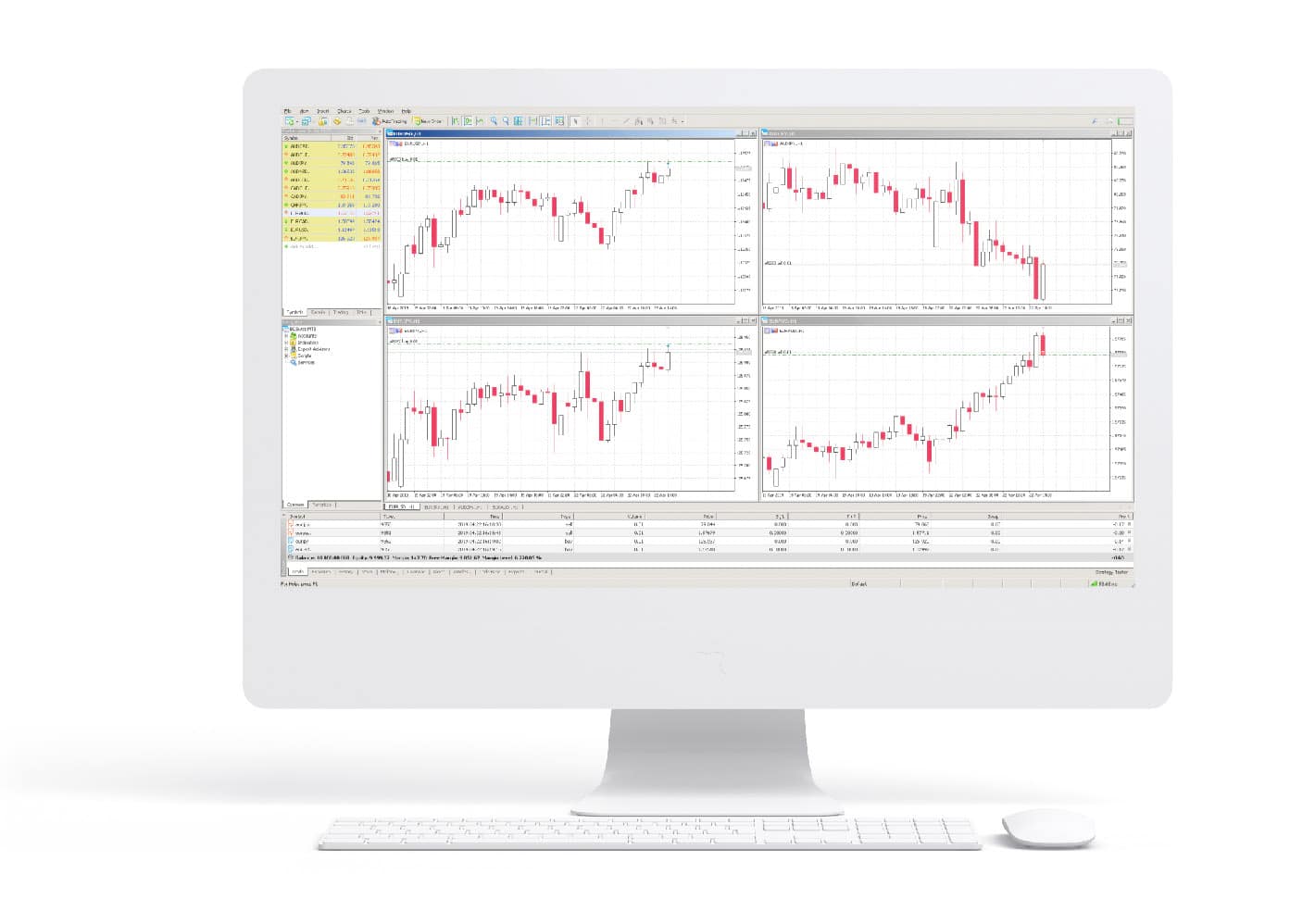

Trading platforms – there are forex trading platforms like in the UK that you can download onto your computer as well as there being web browser based trading platforms which will allow you to be able to trade no matter which computer you are near at the time you spot a potentially profitable trade.

However, we have seen a marked increase over the last year or so in traders who are now accessing mobile trading platforms, and there really are many additional benefits to be had of using such a platform.

The most obvious benefit of using a mobile trading platform is that you are going to be able to place any currency pairing you are looking to trade at the exact moment in time you wish to trade them, for even if you are out and about and nowhere near your computer or lap top, which just a few taps of your mobile devices screen you can place the currency trades you wish to place which any fuss or hassle.

It should be noted that there are in fact several different types of mobile forex trading platforms available, so utilize the mobile web browser on your device and these trading platforms are often known as HTML5 compatible platforms.

You will also find that more and more of the better run and operated forex brokers are going to allow you to download an app onto your mobile device which does away with you having to access a mobile web browser compatible trading platform.

The best piece of advice that we can pads onto you is to ensure that your mobile device is always fully charged, for there is nothing worth than spotting a potential profitable forex trade only for your mobile to go flat at the point in time when you wish to place that trade!

Banking options – one final thing we would like you to consider is to use just one type of bank account or web wallet type of account for all of your forex trading, by keeping your trading funds well away from your day to day bank accounts and funds you will never run the risk of over trading and spend more that you can afford.

There are of course risks involved in trading forex, and as long as you stick to an honest broker and follow the above checklist you should have not have to make any double gambles when trading.

Honest forex brokers

However, there are many things you can do as a forex trader to ensure you only ever become a client of the better run brokers out there.

Below we have put in place a step by step type of checklist guide, which you should always use when you are considering opening an account at any online forex trading site.

Deposit: $10 leverage: 1000:1

Deposit: $50 leverage: 1:50

Deposit: $100 leverage: 1:30

Deposit: $50 leverage: 1:1000

Forex traders checklist

Here is our step by step checklist that will enable you to locate and sign up to the most honest forex brokers, always use it to compare any two trading sites you come across and the one that ticks all of the right boxes should of course be the one you join up to!

Licensed brokers – the first thing that you should always check is whether the forex broker you are thinking of joining and becoming a customer of holds a full trading licence, and one that has been issued by a recognised jurisdiction.

Many of the poorly run and operated brokers are not licensed, or if they are they are simply licensed as a business in the country where they are based, and this is something completely different to holding a full forex trading license.

So any forex broker site you come across must be licensed, for when they are in the very unlikely event of you experiencing any problems at that site you will have help at hand through the licensing authority.

Fees and charges – your forex trading budget is what you will be using to invest and place trades on many different currencies, and the more of that budget you can keep hold of the better. You do need to be aware that some forex brokers have a high set of fees and charges when you use their broking platforms, and these fees tend to kick in when you request a withdrawal of any trading profits from those sites.

There are more than enough forex brokers who do not have any charges what so every for either funding your account or making a withdrawal from that account, and as such always take not of the banking pages on any brokers website and check to see if you are allowed to withdraw funds from your account completely free of charge.

Some sites will allow you to make a nominal number of free withdrawals each month. However, there are many who have done away with any and all processing fees.

Currency pairings – the main aim of your trading any two currencies is of course to sport one currency that is going to move in value against another at any given time. With this in mind you need to ensure that any forex broker you sign up to offers you a very large range of currency pairings.

It may actually surprise you to learn that some brokers only offer a limited number of currency pairings and the fewer any site has then the least likely you are to be able to place your trades on the currency pairings you are seeking.

So always avoid any broker that only offers a limited number of forex pairings, as that could mean you will miss out repeatedly on potentially very profitable trades if you are a client of those sites.

Trading platforms – there are forex trading platforms like in the UK that you can download onto your computer as well as there being web browser based trading platforms which will allow you to be able to trade no matter which computer you are near at the time you spot a potentially profitable trade.

However, we have seen a marked increase over the last year or so in traders who are now accessing mobile trading platforms, and there really are many additional benefits to be had of using such a platform.

The most obvious benefit of using a mobile trading platform is that you are going to be able to place any currency pairing you are looking to trade at the exact moment in time you wish to trade them, for even if you are out and about and nowhere near your computer or lap top, which just a few taps of your mobile devices screen you can place the currency trades you wish to place which any fuss or hassle.

It should be noted that there are in fact several different types of mobile forex trading platforms available, so utilize the mobile web browser on your device and these trading platforms are often known as HTML5 compatible platforms.

You will also find that more and more of the better run and operated forex brokers are going to allow you to download an app onto your mobile device which does away with you having to access a mobile web browser compatible trading platform.

The best piece of advice that we can pads onto you is to ensure that your mobile device is always fully charged, for there is nothing worth than spotting a potential profitable forex trade only for your mobile to go flat at the point in time when you wish to place that trade!

Banking options – one final thing we would like you to consider is to use just one type of bank account or web wallet type of account for all of your forex trading, by keeping your trading funds well away from your day to day bank accounts and funds you will never run the risk of over trading and spend more that you can afford.

There are of course risks involved in trading forex, and as long as you stick to an honest broker and follow the above checklist you should have not have to make any double gambles when trading.

Best forex brokers

These forex brokers offer the best platforms for all types of traders

We publish unbiased product reviews; our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

The global foreign exchange (forex) market is the largest and most actively traded financial market in the world, by far. When looking for the "best" forex broker, both beginners and experienced traders generally look for several key features and benefits. Among the most important of these are: the overall trading experience, the breadth and depth of product offerings (currencies, cfds, indexes, commodities, spread betting, cryptocurrencies, etc.), fees (including spreads and commissions), trading platform(s) (web-based, downloadable software, mobile, charting, and third-party platforms), customer support, trading education and research, and trustworthiness.

Through extensive research and a strict adherence to our robust methodology, we have determined the best forex brokers in all of these areas and more, which has resulted in our top rankings below. Our mission has always been to help people make the most informed decisions about how, when, and where to trade and invest. Given recent market volatility and the changes in the online forex brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top trading platforms for traders of all levels, for every kind of market.

List of the best 23 forex brokers | trusted reviews

Are you looking for a good and serious forex broker? – then this page is the right place for you. Thanks to the large selection on the internet it is often difficult to make the right decision. With more than 7 years of experience in the financial markets, we present you with the best providers with top service and without hidden costs. Find out in the following texts how to select a secure forex provider and which online broker offers the best conditions.

| Broker: | review: | regulation: | spreads: | assets: | advantages: | open account: |

|---|---|---|---|---|---|---|

1. Bdswiss  | ➜ read the review | cysec, FSC | starting 0.0 pips + $ 2.0 commission per 1 lot | 250+ (50+ currency pairs) | + individual offers + trading signals + raw spreads + leverage up to 1:500 + best education + personal support |

Watch our full video review about the best forex brokers (risk warning: your capital is at risk):

Strict criteria for the forex broker review

In contrast to many other comparison sites, we present you on this website only the safest providers with the best conditions for traders. As experts with many years of experience, we have tested many forex brokers and still use some of them. A good provider should have certain characteristics that guarantee good and safe investing.

It is not uncommon to hear of fraud on the internet. This is to be avoided by this comparison. In addition, one would like to save on charges as a trader because the costs for the trade reduce of course the actual profits. Also, the security of customer’s money is of high priority. A regulation or license, for example, is urgently needed for secure trading with international brokers. All these criteria and many more are included in the test. Therefore we can present you on this page the best forex brokers in a list.

Proven facts for a good forex broker:

- Regulation and license of an official finance authority

- High safety of customer funds

- Fast and reliable market execution

- Small forex trading fees and no hidden fees

- No requotes (high liquidity)

- User-friendly trading platform

- Free and unlimited demo account

- Professional support

- Fast deposit and withdraw methods

How does a forex broker work?

A forex broker is an intermediary between a client (trader) and the interbank market for currencies (wikipedia). In addition, the broker can lend capital to the trader so that he can trade with leverage. The broker’s income is generated by the spread and the cost of financing the leveraged positions.

There are 2 different models of brokers: market maker and ECN/NDD broker

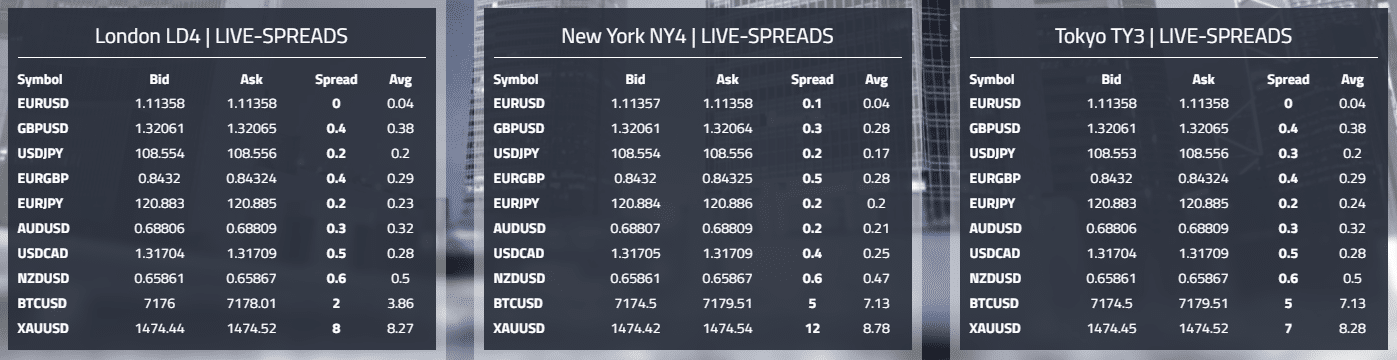

Example of live spreads for forex brokers

Market maker:

This broker does not place the trader’s orders directly into the real interbank or spot market. There is an internal matching system between the positions of the traders. Of course, the broker can hedge himself on the real markets so that there are no distortions in supply and demand. In most cases, this system can be opaque, and only as a broker employee, you know the exact functions. A market maker forex broker is not bad or scam. Nowadays, most providers offer good and exact executions.

ECN/NDD (no dealing desk) broker:

ECN and NDD mean direct access to the interbank market through various liquidity providers. These are large banks or very large forex brokers. The provider places the trader’s orders directly into the real market. So the customers get direct and real market prices for trading. With this model, there is no conflict of interest between trader and broker. Zero (no) spread accounts are offered.

Warning: only trade with regulated and licensed forex brokers

Security has the highest priority in online trading. When it comes to trading leveraged financial products, you have to be able to trust the forex broker. It is not uncommon for large sums of money to be used to generate a large profit. For example, brokers in europe must have regulations or licenses if they want to offer their services. The regulation can be in any european country. The same or almost the same requirements apply to brokers everywhere. In order to avoid fraud, it is important to look for such a license.

Licenses are only issued under certain conditions and criteria. If a broker violates these conditions, the license may be withdrawn immediately. All tested companies of mine are always concerned to keep the highest criteria and to guarantee a safe trade. Many brokers, for example, are regulated in cyprus. This has tax advantages. Nevertheless, there are also forex brokers with more than one regulation. The various regulatory authorities can be seen in the table above.

Facts of reliable and secure companies:

- Regulation and license

- Separated customer funds

- Regulated deposit and withdrawal methods

- Using well-known banks

- Large liquidity providers

Another important point for serious trading is the security of customer funds. Payouts of winnings or the deposited amount should work smoothly. It was not uncommon for some brokers to speculate on customer funds themselves. In the end, withdrawals were refused or delays occurred.

How risky is forex trading?

Forex trading is managed by leveraged financial products. That means you are able to trade a bigger contract size than the amount of money in your account. Some brokers offer the leverage up to 1:3000. Many traders are afraid of the obligation to make margin calls and this is not without reason as the past has shown. Account balances could slip into the negative balance. This is possible due to extreme market situations and too large a position size in relation to the account balance.

The providers shown above all have no obligation to make additional contributions (except IC markets and vantage FX). With the providers in the upper table, you are therefore protected against such a scenario. In our experience, this can only happen if the account is too heavily leveraged. You should always beware of sensible risk management.

Beginners should always start with the free demo account to practice forex trading.

A demo account is essential for successful trading. The trading column form and conditions can be tested extensively with this account. It is a virtual credit account that simulates real money trading. It can be traded without risk. This means that new strategies can be developed or new markets tested. The demo accounts of the compared providers are completely free and unlimited. This account is best suited for entry into forex trading.

How to deposit and withdrawal money:

For most traders, the first deposit into their account is very exciting. It should work smoothly and be highly secure. Forex brokers offer well-known and proven payment methods. Capitalize the trading account with electronic methods (credit card, e-wallet, paypal, crypto) or with the classic way of bank transfer. Electronic methods work in real-time and the money is credited directly to the trading account. Trading can be started immediately. The minimum deposit at the compared brokers is very low. For example, you can open an account from as little as 1$. If this is worth it, you have to decide for yourself. There are no fees for deposits.

Example of payment methods of a forex broker

The payout is also very uncomplicated. With a few clicks, you can request a withdrawal on the menu. This is then released in 1-3 working days. However, most brokers payout customer money in less than 24 hours. All presented brokers passed this test. The fees can be high for small payouts. With payments over 200$, the most forex brokers take over the fees but some brokers do not charge any commissions.

Facts about the payments:

- Instant deposit of money

- Fast withdrawal within 1 – 3 working days

- Electronic methods (skrill, neteller, paypal, and more)

- Cryptocurrencies

- Bank wire

Not every country is available for forex trading

Not every country is available for forex brokers and trading. This is because there are some restrictions and special regulations. For example, in some countries, an international broker needs a special license for that specific country. So it is too much afford for some companies to get the license and they stop taking clients from these countries. You can clearly see on the homepage which clients they accept. Not many brokers accept clients of the united states of amerika.

From my experience, the fastest-growing countries are in africa and asia. Because of the development of mobile internet, more people get connected to the forex market. India, nigeria, philippines, malaysia, and china are at the moment the fastest-growing countries.

Is forex trading legal?

Forex trading is fully legal if there is not any ban from the government. Forex trading is just changing money into another currency. This is not an illegal practice. The brokers on my review got official regulations so they act fully legal.

Review conclusion: start trading with a reliable forex broker

On this page, we have presented you with our current list of the top 23 forex brokers in comparison. Now you have a selection of good and reputable companies in front of you. It was particularly important to us that we only present providers here, which we have tested by ourselves with real money. This is not the case with most comparisons.

Profit now from the most favorable fees and the best conditions by my experience of many years. With these providers, you are 100% safe and can take your forex trading to the next level.

We hope you could learn something in this comparison and act now with better providers through my recommendations. If you can’t make up your mind, please also read the reviews.

Successful forex trading requires a good and reliable broker. In this review, we showed you the top 23 secure forex brokers. Now you can choose your professional trading partner.

Top U.S.-regulated forex brokers

The foreign exchange (forex) market runs 24/7, offers global currency pairs for trading. The market is driven by geopolitical developments, news, the release of macro-economic data, and related developments. On one hand, such a global market offers enormous trading opportunities, but on the other, it is challenging to protect individual traders from any financial irregularities. Thus, regulations were introduced through an established framework that ensures that financial intermediaries, like forex brokers, comply with the necessary rules to offer loss protection and controlled risk exposure to individual traders.

Learn more about the basics of forex market regulation in the U.S., as well as some of the popular forex brokers in the country.

Key takeaways

- The commodity futures trading commission and the national futures association are responsible for regulating the forex market in the U.S.

- All U.S. Forex brokers must be registered with the NFA.

- The dodd-frank act, which was signed into law in 2010, constitutes the primary body of rules governing forex trading.

- Some of the most popular forex brokers include FOREX.Com, OANDA, TD ameritrade, ATC BROKERS, thinkorswim, interactive brokers, and ally invest.

U.S. Forex market regulation

There are two institutions responsible for regulating the forex market in the united states—the commodity futures trading commission (CFTC) and the national futures association (NFA).

Every forex broker operating in the U.S. Must register with the CFTC. The laws enforced by the CFTC and NFA apply to both U.S.-based forex brokers, as well as any other forex broker who intends to serve clients in the country.

All U.S. Forex brokers (including the introducing brokers) must be registered with the national futures association (NFA), the self-regulating governing body that provides the regulatory framework to ensure transparency, integrity, abiding of regulatory responsibilities, and protection of various market participants. The NFA also offers an online verification system called background affiliation status information center (BASIC), where forex brokerage firms can be verified for having necessary regulatory compliance and approval.

One point to note is that the securities exchange commission (SEC) does not have authority over the forex market because it doesn't consider currency pairs a security.

Daily trading volume has reached as high as $4 trillion in the forex market.

Dodd-frank act: forex rules

In the united states, the dodd-frank act constitutes the primary body of rules governing forex trading. Signed into law in 2010 by president obama, it reformed insufficient financial regulation that allowed too much leeway to financial institutions, which contributed to causing the 2007-2008 financial crisis.

These regulations have scared off both forex brokers and retail traders. There are fewer forex brokers currently operating in the U.S. Compared to other areas in the world—primarily because of the regulations enforced by the NFA.

U.S.-regulated forex brokers

This list of seven U.S.-regulated forex brokers—that remain after dodd-frank washout—is not in any particular order, and it is not comprehensive:

FOREX.Com

Owned by NYSE-listed parent company, GAIN capital holdings, inc. (GCAP), FOREX.Com offers many salient features like tight forex spreads, timely trade executions, a mobile trading platform, and numerous technical research indicators in 29 different languages.

FOREX.Com trading offers integration across metatrader 4 or forextrader PRO platforms. There are three ways traders can trade—advanced trading, web trading and mobile trading applications.

High volume traders get cash rebates, earned interest, and bank fees waived.

OANDA

OANDA is another popular broker offering competitive spreads with no commissions and deep market liquidity, along with its OANDA marketplace. It offers loads of features for forex traders such as forex tools, products, advanced analytical tools, forex news, training videos, and MT4 plugins from OANDA and associated partners.

You can start with a free demo. The site also offers benefits for high volume traders. You can get a discounted spread, a subscription with a partner platform, free wire transfer among other perks.

TD ameritrade

TD ameritrade offers powerful charting tools, capable of comparing multiple currency pairs alongside each other, as well as providing any necessary technical indicators. Customers can also analyze social sentiment from twitter. The brokerage also provides reputable third-party research tools from morningstar and market edge.

The firm promises no hidden fees, access to its mobile trading app, and 24/7 support.

Verify a forex broker's status by using its NFA ID or firm name through the NFA's background affiliation status information center.

ATC BROKERS

STP execution, no dealing desk, scalping allowed, multiple brackets order along with other risk management tools like breakeven capability, custom trailing stop-loss, and more enable ATC BROKERS to be one of the popular regulated brokers in the U.S.

The broker also provides access to news events and an economic calendar, along with support through email, phone, and online chat.

Thinkorswim

Thinkorswim by TD ameritrade is another popular U.S.-regulated forex broker that offers to trade in more than 100 global currency pairs.

You can sync the platform on multiple devices and customize and share your alerts. You can also get in-app chat and sharing, so if you need help, the representative you're communicating with can access your screen. And like TD ameritrade, it promises no hidden fees, and data fees also don't apply.

Interactive brokers

Another popular broker having a global presence, interactive brokers claims to have low trading costs with high-level execution, global offerings, high-end trading technology, risk management tools, and trading tutorials.

It promises access to 23 different currencies, as well as 120 different markets in 31 different countries. You can stay connected to global markets 24 hours a day, six days a week.

Ally invest

Ally provides traders with comprehensive research and analysis, competitive pricing and robust educational resources. The trading platform includes a full suite of trading tools, 24/5 market access and a practice account for testing investing approaches.

The bottom line

Regulations are a balancing act. Too little will lead to financial irregularities and inadequate protection to individual traders; too much will lead to a lack of competitiveness in global markets. One major challenge reported with U.S. Forex regulators is that leverage provided is limited to 50:1, while global brokers, outside of U.S. Regulations purview, provide up to 1000:1 leverage. Traders and investors need to take a cautious approach, ensuring security first.

Disclaimer: information presented is as available at the time of writing this article, and may change in due course of time. The author does not hold an account with any of the mentioned brokers.

Best forex brokers in the world 2021 – best most trusted forex brokers

You will need the help of a regulated and reliable forex broker when you decide to start trading in forex trading. However, choosing the best forex brokers in the world is a much more difficult task than you think with some of them who provide online trading services today.

The characteristics of a good forex broker should be to provide a reliable and secure trading platform, low spreads, 24-hour customer support, free training tools and resources for novice traders, adequate trading tools and features for experienced traders and an intuitive trading platform. Even with many comments and reactions that are available for most online forex brokers, it is certainly not easy to choose the right one according to your needs.

However, we have simplified a lot for you and have released this list of the best forex brokers in the world who are considered to be among the best in the industry and who are confident in providing you with reliable and efficient services.

By going through the information provided here, it should easy for you to select best forex brokers in the world or top 10 forex brokers in the world that best matches your needs and expectation levels. Here is the list:

- Xm – best overall broker 2020, wide variety of trading tools instruments, global broker operating in safe regulatory environment

- Hotforex – different trading accounts are on offer, trade forex with ultra low spreads

- Markets.Com – multiple types of trading platforms, beginner friendly

- Easymarkets – 300 plus trading instruments, deal cancellation feature, fixed spreads.

- Fxtm – well regulated, low min. Deposit, tight spreads.

- Exness – A variety of account types and execution methods, offers metatrader 5

1. XM

XM group is a group of regulated online brokers. XM is available worldwide and is regulated by three financial authorities: the cyprus securities and exchange commission (cysec), the australian securities and investments commission (ASIC) and the international financial services commission of belize (IFSC).

The broker has more than 1000 financial instruments at its disposal

that can be traded on metatrader4/metatrader 5 platforms and this includes currency trading, equities and other commodities.

Cfds, cfds on raw materials, cfds on stock market indices, cfds on precious metals and energies

cfds .

XM offers 3 main types of trading accounts called micro, standard and XM zero the first two allowing trading and commission free from as little as 1 pip. Minimum deposit is $5 for micro accounts and the broker also offers islamic accounts without swaps.

Born in 2009, this forex broker is currently operational in 120 cities across the world and has successfully helped execute several thousands of trades with almost zero rejections or re-quotes.

Customer-friendly forex broker

it requires only $5 to open an account

more than 100 financial instruments to choose from

no hidden fees or commission

several video tutorials and webinars in different languages are available on the platform

customer support is available 24/7 in different languages

different payment modes are supported

2. Hotforex

this mauritius-based forex broker is regulated by the FSC (financial services commission) under the trading name of HF markets ltd.

To meet the demands and needs of a variety of traders, hotforex provides different types of forex trading accounts. Each of these account types has distinct and competitive trading accounts and can be opened with an amount as small as $5. Besides the regular accounts, hotforex also provides a zero account , VIP account, and the currenex account. There’s also a social account through which traders can interact with other traders in discussing news and different strategies.

Hotforex provides a wide range of educational tools and technical analysis to help users benefit from their trading moves. Breaking news is also offered by the broker at regular intervals. In all, this forex broker can be tried out by anyone that likes to get forex trading information and news in an organized and clear manner.

Pros:

different trading accounts are on offer

regulated by FSC

availability of demo accounts

different modes are available for funding the account and withdrawals

bonuses and promotions are available in plenty

list of educational tools is huge

customer support features are available via live chat, phone, and email

3. Easy markets

established in 2001, easy markets also goes by the name ‘easy-forex’. It is regulated in cyprus by cysec and is licensed by ASIC in australia and mifid in europe. As of today, the forex broker has offices in sydney, shanghai, and warsaw. It has more than 100,000 active traders on its platform and boasts of more than $1.5 trillion in turnover.

Easy markets offers a standard account for which one needs to make an initial deposit of $100. Besides this, the broker offers an islamic accoun t , especially for those that wish to carry the trade over to the next day without any rolling fee being charged on the same. A free-to-use demo account is available to users when they opt to trade using the broker’s proprietary platform. VIP account holders are entitled to receive SMS alerts and cash rebates regularly.

Pros:

A welcome bonus of $25 is provided to new traders

there are regular promotions and bonuses on offer

deposits and withdrawals can be initiated through multiple payment modes

there are plenty of educational materials and programs on offer

4. Exness

exness is a leading forex broker that was established in 2008. It is regulated by FCA in the united kingdom and cysec in cyprus. Currently, the broker offers two trading platforms – metatrader 5 (MT5) and metatrader 4 (MT4). Besides offering users with different trading account types, exness has eight metals contracts and 104 forex pairs on offer to its users.

There are various account types and execution types available with exness. Depending on your choice, the fees and commission may wary. The broker also offers mobile trading applications for its android and ios users. The same can be downloaded from the google play store and the itunes store.

A variety of account types and execution methods

offers metatrader 5

availability of mobile trading options

different deposit methods like mastercard, VISA, skrill, cashu, webmoney, bank transfers, fasapay, etc.

Different withdrawal options like VISA, webmoney, mastercard, neteller, skrill, perfectmoney, bitcoin, etc.

Support staff can be reached via live chat, phone, and email

5. FXTM

FXTM came into existence in 2011 and is also known by the name forex time. In a short period, it has been in the market; FXTM has carved a name for itself and even managed to win a few accolades, including ‘fastest growing forex broker’ and ‘best newcomer 2013’. Currently, FXTM has offices spread across different regions of the globe, including belize, the UK, and cyprus.

For beginners, FXTM provides a demo account so they can practice before they venture into the real forex market. For professionals, though, there are two trading accounts on offer – standard and ECN. While the former is further divided into standard, cent, and shares account with each requiring minimum deposits and contract specifications, the latter is divided into FXTM pro, ECN zero, and ECN with each of them having different commissions and spreads.

It is not just forex pairs, FTXM also specializes in providing services in financial products like cfds on spot metals, commodity futures, etc. FXTM is known to offer generous promotions and offers to its customers time and again. However, the users need to check their eligibility before applying for the same.

Pros:

availability of different trading accounts, including demo account

regulated by cysec, FSC, and FCA

A host of webinars and tutorials are provided

FXTM conducts workshops and seminars regularly

supports credit cards, wire transfers, cashu, neteller, debit cards, e-wallets, and skrill for deposits

customer support is available in multiple languages

6. Markets.Com

regulated and authorized by cysec (cyprus securities and exchange commission), markets.Com operates in the forex industry by the name safecap investments limited. Currently, it has offices spread across cyprus, south africa, and australia. Since its inception, markets.Com has won several awards and recognitions.

Today, when you wish to trade with markets.Com, there are different options available to you, like cfds, commodities, equities, currencies, stocks, gold, oils, etc. In addition to this, the forex broker offers trading leverages up to 1:300 and competitive spreads to all its non-EU users. To set up an account with markets.Com, all it takes is less than a few minutes. However, for this, users need to submit all necessary documents online.

For the benefit of thousands of traders, markets.Com provides chart analysis , alerts, oscillators, etc. Using these features, traders can predict the behavior of markets accurately and make informed decisions.

Pros:

variety of trading accounts on offer

extensive educational tools

accessibility of the website in multiple languages

availability of customer support 24/5 from 21 locations via live chat and email

wide variety of withdrawal and deposit methods

Best forex robots 2021

For a long period, we professionally research the forex automated trading market. Over the years, we have gained experience that we systematically share with you in our reviews. Choosing an EA is a very important procedure, as it involves using it on a real account in order to make money. In the table, we have put together the ratings and results of the best trading robots performing.

ROFX is the best way to get started with forex. The system, based on machine learning and customizable patterns using AI, allows you to have up to 10% of monthly profit without the need for any effort. In confirmation of their capabilities, the first deposit to a real account with a robot was the amount of ten million dollars. ROFX provides a well-designed PAMM system that means that all robot performs go on the company servers.

Forex fury is an incredibly popular robot showing a stable and predictable profit. On the one hand, the robot allows you to make many settings to adjust the trading to the needs of the trader, but on the other hand, it requires not a little knowledge in order to effectively manage it. The robot holds its winning rating at a level above 90%, which in itself is a unique phenomenon in the world of trading robots.

Forex robotron is another example of the success of forex trading using a fully-automated trading robot. Trading with it shows high and predictable results. The monthly gain is more than 20%. At the same time, the robot requires deep knowledge and understanding of trading processes in order to achieve similar results. That is why it can be difficult for beginners to master working with it.

Each experienced forex trader has gone through a long phase of formation, ups, and downs. Many of them nulled their accounts several times while learning to trade. All this time, traders had to analyze the history of trades, follow the news, and trades on their own so on day after day. With the advent of trading robots, many of these routine functions were taken over by them.

The robot is a fully automatic program and doesn’t require you present. This allows beginners to start trading forex immediately after the deployment of the program and does not require previous experience. This is a great advantage for those who want to try their hand at forex trading.

The robot provides work in a fully automatic mode, giving a stable passive income. At the same time, its owner can control all its aspects of the activity, configure it at its discretion, control the current trading process from market analysis, to entering and exiting a position.

Robots are usually developed based on some strategies that have already brought substantial profit to their owners. By applying them at the core of the robot, devs thus allow you to get your profit too. A feature of some robots is that developers maintain the availability of analysis of the history of trading operations so that traders can use this data to improve their own strategies.

- Knowledge-free to start earning money on forex

- Fully-automated trading, without needing of understanding performing processes

- Usually, the seller provides back-tests and shows a robot perform on a real or demo account

- 30(60)-days money-back guarantee is an option from many sellers.

- Completely removes influence of the emotional statements during trading

- A robot can run on many accounts, as well as, trade effectively many currency pairs at the same time

- It can perform 24/7 giving you opportunities to spend your time whatever you want

- Free-trial a robot for applying it on the demo account is also quite often option

- You know the strongest sides of a robot you chose, so you can easily improve your own strategy.

- You can easily compare the official robot performing with the performing of your copy, so you’ll be able to simply find out when your robot becomes a scam.

- Running a robot on your PC is required to be online 24/7 and get a stable connection.

- There’s high enough chance to get a scam instead of a trading assistant.

- Price varies depending on futures, patterns, amount of currency pairs, etc.

- 30(60)-days money-back guarantee is an option from many sellers.

- Sometimes, there’s a high level of the min account balance for smooth trading with low risks.

Here are some functions which are applied in almost every good trading robot:

The forex robot is usually designed with the settings that are responsible for managing current trading transactions. These are the following functions: hard stop loss, trailing stop loss, and take profit features. Both experienced traders and beginners should take into account that without these functions, they will not receive full-fledged automated trading.

A developed set of patterns that include not only the parameters of the trade but also the specified criteria for market analysis. Thanks to this system, the robot is able to independently decide on the selection of the most successful entry and exit points. Typically, the robot is programmed to use technical analysis and indicators: order flow, support and resistance levels, and RSI or MACD.

With automated trading, a lot depends on how accurate and fast the robot is in making decisions. The EA must provide its owner with timely entry and exit points from transactions, which in turn should significantly increase the profitability of its work. The ability to enter a deal at the lowest point and exit it at the peak distinguishes a good robot from a bad one.

- Trade accuracy

- Numbers of traded currecny pairs

- Different risks level management

- Performing and order execution speed

- Official performing data (gain, profit) from myfxbook and fxblue sites

- Pricing for buying/subscriptions

- Support availability

- User interface

- Bitcoin or other crypto trading availability

- Customization of the standart patterns

It’s a computer program developed by devs and traders. It works on the proven patterns that allow you to make profit using robot owners’ trading experience.

A trading robot (EA) fits everyone. For beginners, it suggests the smooth start of trading on the forex. For good traders it lets relax more, using combined strategies of robots and trader to get better results with same amount of spent time.

Robots prices start from $99 to $25000 depends on futures and strategies. Most of the robots start to work well from a $1000 deposit

Not at all. From buying to applying usually goes about 10 minutes. No special knowledge is needed.

Yes, it does. Every robot is developed with the stop-loss system that allows you to lose not so much if it’s happened

It mostly depends on the risk you trade with. Our experience tells +100% of annually gain is good profitability.

Best forex brokers in philippines – TOP 10 list – january 2021

Last updated: december 10th, 2020

In below table you find the comparison of the best forex brokers for philippines residents.

Pepperstone is one of the most reputable fx brokers in the world trusted by thousands of satisfied traders!

Main features:

- One of the very few true ECN brokers in the world

- Very popular forex company in philippines

- Spreads starting from 0.0 pips on razor account

- Access to 180+ global forex pairs

- Max. Leverage up to 400: 1

- Multi awarded trading platforms: MT4 and ctrader

- Forex + CFD cryptocurrencies + cfdstocks

- English customer support

- Very fast trade execution 30 miliseconds

- Minimum deposit of just $150

- Large range of deposit methods

What is the best forex broker in the philippines?

Here is the summary of the best forex brokers:

- Pepperstone – best ECN forex broker with MT4/ctrader

- Etoro – world’s best social trading platform

- IQ option – instant access to investing

- XM – high leverage broker, low spread, MT4/MT5

- Forex.Com – #1 FX in the USA as of 2020

- Hotforex – multiple awards winning MT4 broker

Which forex trading company is the most popular with philippines traders ?

According to my private statistics from what I have seen on international fx forums, filipino traders prefer strong international brands with regulation, they trade mostly with metatrader 4 and trade mostly currency pairs that include USD and/or JPY. Out of all brands that can be found in the comparison table on this page, etoro seems to be the most preffered licensed forex broker in the philippines for a good reason.

Which forex broker is the best fit for you?

This is really a tricky question as it depends on many factors.

If you are a newbie in forex trading business, then you should definitely choose a broker which meets certain requirements:

- Etoro is the largest social trading platform which is on the market since 2008. This social trading platform connects thousands of traders from all over the world. This platform is focused mostly on forex and stock trading. Since 2019 they are known for their activities in crypto trading (created crypto wallet) and real stocks trading without paying a commision!

- XTB.COM is our 1st option for you. It is beginner very friendly and easy to understand online trading platform and also doesn’t require a big minimum deposit (actually the minimum first deposit is currently just $50). You can trade anything from forex + CFD on stocks or real stocks+ cryptocurrencies etc. Big plus is the ability to communicate and exchange trading ideas with other traders on the platform in the real time!

Who regulates forex brokers in philippines

The major financial market agency is the government owned BSP which means banco sentral ng pilipinas in english it means the central bank of philippines. As the central bank it is in charge of maintaining the inflation rate in acceptable levels, monitoring the growth of the GDP and unemployment rate and last but no the least protecting local philippine peso (PHP) currency stability. Established by the government in 2003 the main financial markets regulatory body is SEC – securities and exchange commision of philippines which overlooks the local financial market and its main role is to protect investors from fraud and ensure the stability of the capital market. They also issue the licenses to financial companies operating locally on the philippines territory. They have been working in the recent years to achieve the higher transparency of the capital market and also aim to educate small investors in order to protect them from scam. If you ever face any issue with a particular forex brokerage, you can submit a complaint through the online form on the website www.Sec.Gov.Ph

The main role of the BSP and SEC

There are some local forex brokerages who are listed by sec.Gov.Ph but according to our knowledge of local market, just like in other south east asian countries like in malaysia or singapore vast majority of filipinos trade forex through some of the world’s best fx companies who reside abroad and are regulated by worlds’ first class regulatory agencies like FCA in the united kingdom or cysec in cyprus. This is due to a fact there are not yet many top firms physically located in the philippines, since the currency trading market is still pretty small here and just slowly developing to a more mature stage. Once the country’s currency trading market will reach certain maturity level, we believe more and more brokers will establish local presence and obtain BSP license.

However with hundreds of brokers on the market, it is not easy to figure out which company is serious to deal with! We want to help you to start with forex trading and become profitable as fast as possible,therefore we prepared and regularly update the above table with comparison of the best forex companies!

Forex trading platforms

Besides a webtrader (trading software running in your internet browser without downloading anything to your PC) that each brokerage has at their disposal, nowadays many trusted forex brokers in philippines offer top trading tools like metatrader 4/5 and of course fantastic trading apps for your android/iphone. If you are just starting out, we recommend to try webtrader first before moving to metatrader 4 as it requires a steep learning curve.

Fees & commissions

Watch out for fees level as they are pretty important. Avoid those who charge inactivity fees and compare the spread with competition if you are in doubt.

Is forex trading legal in the philippines?

Yes it is legal as long as you choose a regulated forex trading company. As the economy of philippines continues to grow, there are more and more locals open forex accounts with foreign forex companies who offer them the best trading services.

Do you want to open a forex trading account in philippines and you are still unsure?

Are you uncertain about some forex brokers ? Feel free to ask below in comments! Our staff is monitoring this forum and replying to all questions usually within 48 hours.

Trusted forex brokers

The forex market is a decentralized market and involves all aspects related to trading and exchanging currencies at current/determined prices. It is the world’s largest financial market in terms of trading volume. According to the bank for international settlements, the average daily turnover in the global forex markets is approximately $5.09 trillion as of april 2016. The relative values of various currencies are not determined by the forex market, but it contributes to setting the current market prices of currencies against one another.

Top recommended and trusted forex brokers 2020

-

- Online since 2011

- Regulated by FSA (saint vincent and the grenadines) and cysec

- Spread from 0.4 pips

- 5 digit (5 decimal pricing)

- Leverage up to 1:500

- Metatrader 4 platform

- Free swap & commission

open account

-

- Online since 2009

- Regulated by cysec, IFSC (international financial services commision) belize

- Spread from 0 pips

- 5 digit (5 decimal pricing)

- Leverage up to 1:3000

- Metatrader 4 & MT5 platform

- Free swap & commission

open account

-

- Online since 2009

- Regulated by ASIC, cysec, FCA (UK), IFSC

- Spread from 1 pips

- 5 digit (5 decimal pricing)

- Leverage up to 1:888

- Metatrader 4 & MT5 platform

- Free swap & commission

open account

-

- Online since 2008

- Regulated by cysec, FCA UK, FSP, bafin, CRFIN

- Spread from 0 pip

- 5 digit (5 decimal pricing)

- Leverage up to 1:2000

- Metatrader 4 & MT5 platform

- Free swap & commission

open account

The history of modern forex trading can be traced back to 1973, but online forex trading happened for the first time in 1994. This combined with the technological developments, especially in the field of communication, enabled the participation of retail traders in the forex trading. With the widespread growth of the world wide web or the internet, retail forex trading segment also witnessed a great deal of expansion. Online forex brokers that offered platforms for trading currencies came into existence. Today, there are hundreds of online forex brokers and with an investment of $50 to $100 anyone can start trading currencies.

Individual speculative retail traders constitute one of the growing segments of the forex market, in terms of both size and importance. Their participation is indirect as they access the market through forex brokers. Retail forex brokers are controlled as well as regulated in the US by the national futures association and commodity futures trading commission. Regulatory bodies around the world have also stated regulation the forex brokers with a view to minimize fraud and create a safe environment for retail traders. However, regulation is very stringent in some countries and less stringent in some other countries. Regulated forex brokers have to meet minimum net capital requirements, maintain segregated accounts for companies’ funds and that of traders and comply with other requirements as specified by concerned regulatory authorities.

The forex market is unique in many ways. They are as follows:

The trading volume is huge and the forex market represents the largest asset class in the world. This makes the currency market the most liquid financial market.

The currency market does not have a central marketplace for foreign exchange.

It operates for 24 hours in a day, except weekends. The currency market is open from 22:00 GMT sunday (sydney) to 22:00 GMT friday (new york).

A variety of factors affect the exchange rates.

The margins of relative profit are low when compared with other fixed income markets.

The availability of leverage helps to enhance profit. If not used with discretion, leverage has the potential to enlarge losses.

As such, the forex market is referred to as the market that is closest to the ideal of perfect competition, of course notwithstanding the intervention by central banks.

Types of forex brokers

Mainly, there are two types of retail forex brokers that offer opportunities to speculative currency trader. They are no dealing desk (NDD) brokers and dealing desk (DD) brokers/market makers. In the broader forex market, NDD brokers serve as agents of the customers and seek the best price available in the market for each retail order. They deal on behalf of their retail customers. They earn by charging a commission or a mark-up on the price they obtain from the market. On the other hand, DD brokers/market makers act as principals in their transactions with their retail customers and quote a price that they choose.

No dealing desk forex brokers

These brokers never take the other side of the trades placed by their clients as they are only connecting two parties together. NDD brokers can be subdivided into straight through processing (STP) and electronic communication network (ECN) brokers.

STP brokers route their clients’ orders directly to the liquidity providers who work with them and have access to the interbank market. Typically, these brokers work with many liquidity providers. Each provider quotes their own bid and ask rates. STP brokers add a small, but fixed, mark up and pass on your order to a suitable liquidity provider. Most STP brokers offer variable spreads.

ECN brokers enable clients’ orders to interact with those of other participants (banks, hedge funds, retail traders, and even brokers) in the network. This is to say that the participants trade against each other by accessing the best bid and ask prices. This type of brokers often charge a small commission on each trade.

Dealing desk forex brokers

This type of forex brokers make money by providing liquidity to their clients and through spreads. Market makers often take the other side of their clients’ trades. Clients of DD forex brokers do not have access to the real interbank market rates. However, because of stiff competition among brokers the rates offered by these brokers are often very close to the interbank rates.

Now that you have some idea of the forex market, how it works and the different types of forex brokers, let us see how to choose a trusted forex broker.

Choosing a trusted forex broker – some tips

If you are new in the field of forex trading or want to start currency trading, the first thing to be necessarily done is to identify a trusted forex broker to work with. It has been observed that beginner forex traders do not pay sufficient attention to this aspect only to find out later that this can lead to serious outcomes that affect the profitability of the trades. Other aspects that need to be evaluated by the forex trader include the trading platform offered by the forex brokers and the minimum deposit that is required to start trading. This article aims to provide a few tips on how to choose trusted forex brokers to pair with and achieve the financial goals that you have set for yourself.

The basic two methods that can be used to pick a forex broker are the simplified method and the professional method. They are briefly described below.

The trader chooses a broker with the best star rating based on the reviews. However, it is to be noted that in this case there are no guarantees about the quality of the broker whatsoever. Though a high star rating seems to point to the most trusted forex broker that the trader can work with, there is no guarantee that the feedback is genuine. This method is therefore not recommended.

This involves a complete research on various aspects before choosing a trusted forex broker. Given below is a step-by-step method that a trader can use to choose a forex broker to work with.

Step #1: the trader should have clarity regarding the goals to be achieved through forex trading

The choice becomes easier when the trader writes down the basic features that the forex broker needs to have. The trader can write these down easily by answering the following questions.

What currency pair would you want to trade in?

Can you pay a commission when engaged in forex trading?

Are you comfortable with fixed or variable spreads, and if so, how many pips?

What is the capital investment that you have allocated for forex trading? (answering this will help the trader choose the type of account)

what is the platform that you would like to use for trading?

What is the leverage ratio that you are comfortable with?

What indicators and tools are required that will help you to trade forex?

Do you use the scalping technique?

Are you looking at hedging?

Do you want the one-click execution feature to be made available?

Will you trade while on the move or are you looking for trading alerts?

Would you need a trailing stop?

Do you want to use a dealing desk or an ECN/STP broker?

How do you want to transfer funds to your trading account (choice from among wire transfer, paypal, credit card, etc., can help the trader to choose the broker)?

What is the fee you are ready to pay for the transfer of funds and withdrawal of your money from the account?

The above are only suggestions and not an exhaustive list. You can add to the list of questions provided to conduct your own research.

Step #2: study the forex brokers’ websites

After the trader has answered the questions and obtained clarity on the requirements, it is a good idea to visit and study the websites of the shortlisted brokers that satisfy the requirements. It is important to read through their policies and rules and try to get a feel of their method of doing the business. Checking the regulatory status of the broker, finding out whether the requisite licenses are in place, ascertaining the genuineness of their addresses and phone numbers and other contact details, etc., are important jobs that the trader has to do to be able to decide as to which broker to choose. Absence of a physical contact address on the website should tell the trader that the forex broker is not the right one to work with. The presence of a live chat facility and/or telephone numbers does not matter at all. Trusted forex brokers always have their physical addresses listed out.

Website appearances do make a statement about the owners and their businesses. Trusted forex brokers are likely to have websites that are professional and filled with relevant information. It will also be noticed that they are almost always fully functional.

Another important aspect that needs to be checked is the broker’s regulatory status. It is always advantageous for a newbie broker to open an account with a regulated broker. These brokers will be compliant with major financial and regulatory requirements and therefore maintain higher levels of integrity and reliability as far as the traders and their finances are concerned. Some of the different regulatory authorities around the world are: united kingdom: FCA, UK; united states: NFA, CFTC; japan: FFAJ, FSA japan; canada: BCSC, OSC, CIPF; switzerland: SFDF, FINMA, ARIF; sweden: swedish FSA; australia: ASIC; hong kong: SFC; denmark: danish FSA; dubai: DMCC, DFSA, DGCX, ESCA; spain: CNMV.

Other countries of the world have their own regulatory bodies to supervise the activities of forex brokers’ in their respective countries.

Step #3: go through reviews of selected trusted forex brokers

Though reviews may point the direction that needs to be followed by the trader, it may also leave them confused. It is easier to choose a broker if they follow the belowsaid rules while checking out on the reviews.

#1: in case the broker has been in operation for more than a decade, it is almost sure that the company has an idea of the business and they are likely to stay.

#2: that the broker is regulation-compliant is an indication that they are serious about the business and care for their clients’ money.

#3: if the broker offers many products for trading, such as stocks, futures, commodities, options, cfds, etc., it is a pointer to the fact that the broker has a large business base and is catering to a number of clients.

#4: if any reviews talk about a large number of withdrawal denials or profit cancellations for the clients, the trader should investigate more into the matter. Trusted forex brokers will not give a chance for any such reviews.

#5: it is a good idea to read reviews written by other professionals.

Step #4: additional tips to choose trusted forex brokers

Important factors that should be considered when selecting trusted forex brokers by the trader include transparency, reputation, ease of withdrawal and deposition of funds, and customer service that is offered.

Finally, as the most important one, the trader should sign up with a broker only after due clarifications of all doubts from the customer service personnel. It may happen that their websites are not updated with the latest changes.

so, let's see, what we have: we believe in showcasing to all of our forex trading website visitors a range of the very best forex brokers, and to enable us to do this we rigorously... At most trusted forex brokers

Contents of the article

- Top forex bonuses

- Honest forex brokers

- Forex traders checklist

- Honest forex brokers

- Forex traders checklist

- Best forex brokers

- These forex brokers offer the best platforms for...

- List of the best 23 forex brokers | trusted...

- Strict criteria for the forex broker review

- How does a forex broker work?

- Warning: only trade with regulated and...

- How risky is forex trading?

- How to deposit and withdrawal money:

- Not every country is available for forex trading

- Review conclusion: start trading with a reliable...

- Top U.S.-regulated forex brokers

- U.S. Forex market regulation

- Dodd-frank act: forex rules

- U.S.-regulated forex brokers

- FOREX.Com

- OANDA

- TD ameritrade

- ATC BROKERS

- Thinkorswim

- Interactive brokers

- Ally invest

- The bottom line

- Best forex brokers in the world 2021 – best most...

- Best forex robots 2021

- Best forex brokers in philippines – TOP 10 list –...

- What is the best forex broker in the philippines?

- Which forex trading company is the most popular...

- Which forex broker is the best fit for you?

- Who regulates forex brokers in philippines

- Is forex trading legal in the philippines?

- Do you want to open a forex trading account in...

- Trusted forex brokers

- Top recommended and trusted forex brokers 2020

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.