Brokers like xm

XM has oppened accounts in over 190 countries and is regulated by multiple regulators including cysec, ASIC, and IFSC.

Top forex bonuses

With 99.35% of trades executed in under a second and strictly no requotes and no rejections policy you can trade confidently with XM.

For more information about trading with XM, we have put together an indepth XM review with all the pros and cons about this broker. Interactive brokers offer IB TWS for mobile, IB trader workstation, IB webtrader platforms to make your trades and support 9 different languages.

XM group vs interactive brokers

If you're choosing between XM group and interactive brokers, we've compared hundreds of data points side-by-side to make finding the right broker for you easier. We've also displayed one of our most popular brokers, XTB, as another alternative to consider.

What would you like to compare?

- Trading services

- Markets & instruments

- Platform & features

- Account features

- Trading conditions

- Risk management

- Funding methods

- Fees

update results

The BROKERDNA ™ score tells you, overall, how reputable, suitable, and affordable a broker is compared to other brokers.

This score is algorithmically-generated based on 31 factors. Neither our team, nor the brokers featured on our site, are able to change this without changing their service offering. Learn more here.

The BROKERDNA ™ score tells you, overall, how reputable, suitable, and affordable a broker is compared to other brokers.

This score is algorithmically-generated based on 31 factors. Neither our team, nor the brokers featured on our site, are able to change this without changing their service offering. Learn more here.

The BROKERDNA ™ score tells you, overall, how reputable, suitable, and affordable a broker is compared to other brokers.

This score is algorithmically-generated based on 31 factors. Neither our team, nor the brokers featured on our site, are able to change this without changing their service offering. Learn more here.

The BROKERDNA ™ score tells you, overall, how reputable, suitable, and affordable a broker is compared to other brokers.

This score is algorithmically-generated based on 31 factors. Neither our team, nor the brokers featured on our site, are able to change this without changing their service offering. Learn more here.

XM group is regulated by the IFSC, cysec and ASIC. XM have provided forex, commodities, equity and indice trading services since 2009.

Interactive brokers is regulated by NFA 0258600. Interactive brokers have provided forex, CFD trading services since 1977.

XTB is regulated by the financial conduct authority. XTB have provided forex, CFD, and social trading services since 2002.

TRADING SERVICES OFFERED

78.04% of retail investors lose money when trading spread bets and cfds with this provider.

Losses can exceed deposits

82% of retail investor accounts lose money when trading cfds with this provider.

PLATFORM & FEATURES

See the platforms and features offered by each broker

Arabic, chinese, english, french, german, greek, hindi, hungarian, indonesian, italian, japanese, korean, malay, polish, portuguese, russian, spanish, swedish, thai, and turkish

English, french, german, spanish, italian, russian, mandarin, cantonese, and japanese

English, spanish, czech, chinese, german, french, italian, polish, portuguese, romanian, slovenian, turkish, arabic, and russian.

78.04% of retail investors lose money when trading spread bets and cfds with this provider.

Losses can exceed deposits

82% of retail investor accounts lose money when trading cfds with this provider.

ACCOUNT INFORMATION

From micro accounts to ECN accounts, compare the accounts offered by XM group and interactive brokers

78.04% of retail investors lose money when trading spread bets and cfds with this provider.

Losses can exceed deposits

82% of retail investor accounts lose money when trading cfds with this provider.

TRADING CONDITIONS

RISK MANAGEMENT

FUNDING METHODS

78.04% of retail investors lose money when trading spread bets and cfds with this provider.

Losses can exceed deposits

82% of retail investor accounts lose money when trading cfds with this provider.

DETAILED INFO

78.04% of retail investors lose money when trading spread bets and cfds with this provider.

Losses can exceed deposits

82% of retail investor accounts lose money when trading cfds with this provider.

78.04% of retail investors lose money when trading spread bets and cfds with this provider.

Losses can exceed deposits

82% of retail investor accounts lose money when trading cfds with this provider.

All information collected from www.Xm.Com. Last updated on 01/01/2021.

All information collected from https://www.Interactivebrokers.Com/. Last updated on 01/01/2021.

All information collected from www.Xtb.Com. Last updated on 01/01/2021.

Since starting in 2009, XM group has opened over 300,000 trading accounts, establishing itself as an industry leader with a focus on customer service it offers support in over 20 languages. With its size and resources, its users have access to a wide range of expert advice to hep everybody in the trading world.

XM has oppened accounts in over 190 countries and is regulated by multiple regulators including cysec, ASIC, and IFSC. With 99.35% of trades executed in under a second and strictly no requotes and no rejections policy you can trade confidently with XM.

For more information about trading with XM, we have put together an indepth XM review with all the pros and cons about this broker.

Interactive brokers is an online forex trading sevice provider who are regulated by the financial conduct authority. To open an account with interactive brokers, minimum deposits start from $10,000.

With interactive brokers you can trade stocks, options, futures, forex, foreign equities, and bonds. If you like to trade on the go, interactive brokers have iphone, ipad and android apps so you can trade from anywhere on your phone.

Interactive brokers offer IB TWS for mobile, IB trader workstation, IB webtrader platforms to make your trades and support 9 different languages.

They also offer traders free educational material to better understand the markets and trading strategies.

The spreads offered by interactive brokers for the most popular instruments are:

0.61 EUR/USD, variable FTSE 100, variable GOLD,

4.56 GBP/USD, 164.17 DOW/JONES, 0 crude oil,

see all the spreads here.

XTB provides hyper fast execution and facilitates seminars with external professional traders, providing personalised education depending on your individual circumstances.

XTB operates with two factors in mind; to provide traders with the fastest execution speeds and to be the most transparent broker on the market, which is reflected by the services and products they provide.

XTB also have a dedicated education area - the trading academy - which contains material to help you become a better trader, including video tutorials, trading courses, articles and much more to improve your skills at every step of your trading journey.

If you are looking for a broker that is regulated by the financial conduct authority and focuses on transparency, fast execution speeds and customer service, XTB is a great option.

For more information about trading with XTB, we have put together an in-depth XTB review covering the pros and cons of this broker.

Popular comparisons feat. XM group

Popular comparisons feat. Interactive brokers

Popular comparisons feat. XTB

XM alternatives

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

The best alternatives to XM are

Let's see in a bit more detail how the XM alternatives compare to XM and each other:

| XM | XTB | etoro | plus500 | markets.Com | |

|---|---|---|---|---|---|

| overall score | 4.4 | 4.6 | 4.7 | 4.3 | 4.3 |

| fees score | 3.5 stars | 3.7 stars | 4.3 stars | 2.9 stars | 2.4 stars |

| account opening score | 5.0 stars | 5.0 stars | 5.0 stars | 5.0 stars | 5.0 stars |

| deposit and withdrawal score | 5.0 stars | 4.5 stars | 3.5 stars | 5.0 stars | 4.5 stars |

| web platform score | 2.8 stars | 4.4 stars | 4.4 stars | 4.4 stars | 3.8 stars |

| markets and products score | 2.5 stars | 2.8 stars | 3.8 stars | 1.9 stars | 2.8 stars |

| visit broker 78.04% of retail CFD accounts lose money | visit broker 82% of retail CFD accounts lose money | visit broker your capital is at risk | visit broker 76.4% of retail CFD accounts lose money | visit broker 75.6% of retail CFD accounts lose money |

Why are these brokers considered good alternatives to XM? There are many areas based on which XM can be compared with others. When we say a given online broker is a good alternative to XM we mean these brokers are comparable in the following areas:

- The products they offer, meaning you can buy mostly the same things, i.E. Stocks, cfds, options, etc.

- The type of clients they target, i.E. Beginners, experienced investors, or day traders.

XM alternatives recommendations

Brokers are different in a number of ways, which means each of them may be suitable for different people. Here's how they compare overall:

- XM is recommended for forex and cfd traders who prefer metatrader platforms and seek great account opening

- XTB is recommended for forex and cfd traders looking for low fees and great deposit/withdrawal service

- Etoro is recommended for traders interested in social trading (i.E. Copying other investors’ trades) & zero commission stock trading

- Plus500 is recommended for experienced traders looking for an easy-to-use platform and a great user experience

- Markets.Com is recommended for traders looking to venture into cfd trading

Important factors of finding XM alternatives

So far brokerchooser has reviewed 78 online brokers in detail, which gives this comparison a solid starting point.

Not only that, but all of these brokers are reviewed using the exact same broker review methodology, which makes everything easily comparable. For each broker, we

- Open a live account

- Check over 100 criteria, with weighting based on readers' preferences

- Refresh data regularly

Whether XM or one of its alternatives is the best choice for you is on the following five broker characteristics that most interest people:

Fees. There are different types of fees that your online brokerage may charge, and both the number and the size of these fees may vary significantly from broker to broker. Both of these aspects can impact your returns and your overall experience. XM is one of the cheaper brokers, so if this is an important consideration for you, make sure you pick a similarly low-cost XM alternative.

Account opening. To open an account some brokers require at least €50,000 to be invested, while others don't set a minimum first-time deposit. The time it takes to open your account can be very different as well. At XM this is not a problem as you can have it ready on the same day you registered.

Deposit/withdrawal. The number of ways that you can deposit or withdraw money to or from your account matters a lot. For example, while you can make a deposit with a credit card at XM, this might not be the case at its alternatives.

Web trading platform. While online brokers are usually available on various platforms like mobile apps, tablet apps or desktop software, most people use them through their web platform in a browser. User-friendly trading platforms that offer many different resources can significantly increase your trading comfort.

Markets and products. A lot of people have specific products they would like to invest in. Knowing whether stocks, forex, mutual funds, and other products are available at the given XM alternative is a must.

Now let's dive into the details of how XM and its alternatives perform in the most important areas!

XM no deposit 30 USD bonus – read an honest review

Platform

Min. Volume

Action

XM forex broker is a great place to get started for a next FX professional. This broker gives you access to XM no deposit 30 USD bonus campaign and allows you to use metatrader4 and MT5. This is one of the only brokers that makes MT4 live trading available to you without making a deposit. You should certainly try this XM no deposit bonus, as metatrader 4 is the platform you will most likely have to change to eventually and this promo campaign lets you test drive the platform without any deposits.

XM free 30 USD no deposit bonus description

Getting the 30 USD no deposit bonus on XM is pretty easy. The only thing you need, except for the wish to trade forex, is to go through XM registration, get your account, and confirm your phone number via SMS. As for the bonus, within the maximum of 24 hours (but usually in around 30 minutes), you will get the money credited to your account and you will be able to trade currencies online with XM without making a deposit.

XM free trial available platforms

When it comes to FX trading online, the choice of available trading platforms becomes quite important. Most of the traders end up on MT4 or MT5 platform and this is certainly an advantage of XM. With XM FX broker, traders using mac laptops and desktops will find a hustle way to trade since they offer native access to metatrader 4 for mac OS. Also, the MT4 web platform is also available with XM, this trading terminal could be used for windows and other operating systems too. Like most of the brokers, XM account also enables you to trade on your smartphone.

XM 30$ bonus terms and conditions

XM no deposit 30 USD bonus is unavailable for withdrawals, however, every cent from the profit is yours. You can take your time and only make relevant trades that get you great money on the XM no deposit bonus.

XM free account critics

Many traders have been complaining about this promotion and XM broker in general, this is why forex trading bonus team would strictly advise against it. You may, of course, try your luck and see how fast you can triple your initial balance, however, some traders did have their accounts removed without any prior notification.

We decided to check this bonus on our own. We have to admit, we were positively surprised by the quality of services and web platform from XM. This is why we recommend you try XM trading bonus!

How to get XM $30 no deposit bonus?

XM is a quickly growing international investment firm with over 2.5 million users and 300 professionals. The company offers a trustworthy and convenient trading environment and is one of the few brokers who will allow MT4 live trading without making any deposits. After getting their XM global login, users will be rewarded with $30 no deposit bonus that is available for trading right away. It shouldn’t take longer than a day for the funds to show up in the account.

Steps for getting the no deposit XM bonus:

Getting the bonus is fairly simple. A user only has to register on the platform and activate the account. The registration procedures are very easy to follow. On any page on XM’s website, in the top right corner, there is a green button titled “open an account”. Clicking the button will start the registration process.

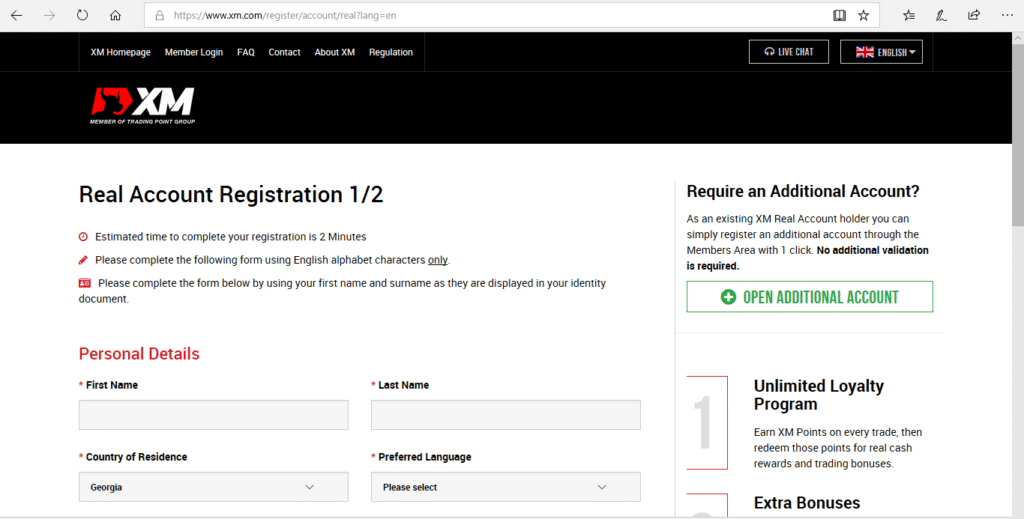

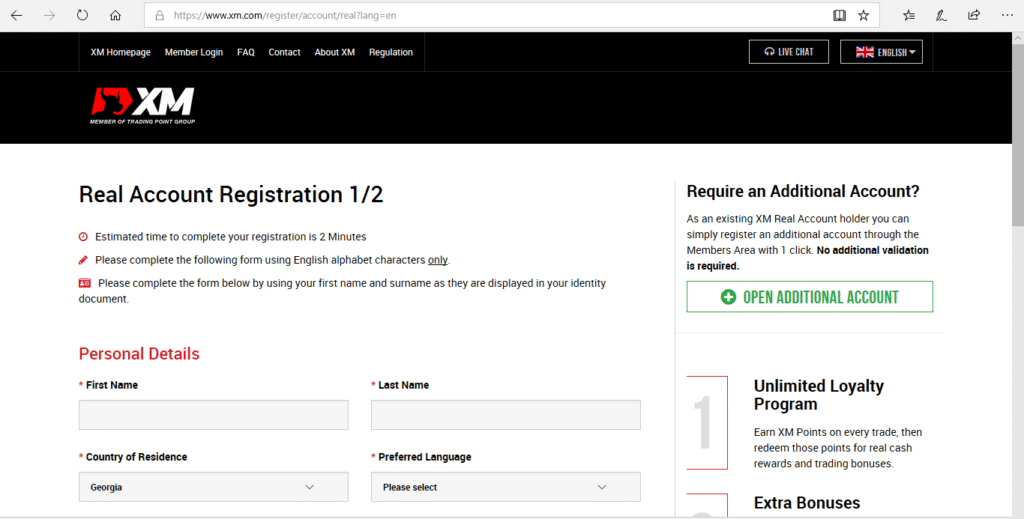

The registration includes filling out a standard questionnaire. The first part of it is depicted on the screen below. In this section, the user is asked to fill out some details like name, country of residence and a phone number. A user will also get to choose an account type and trading platform type on this page.

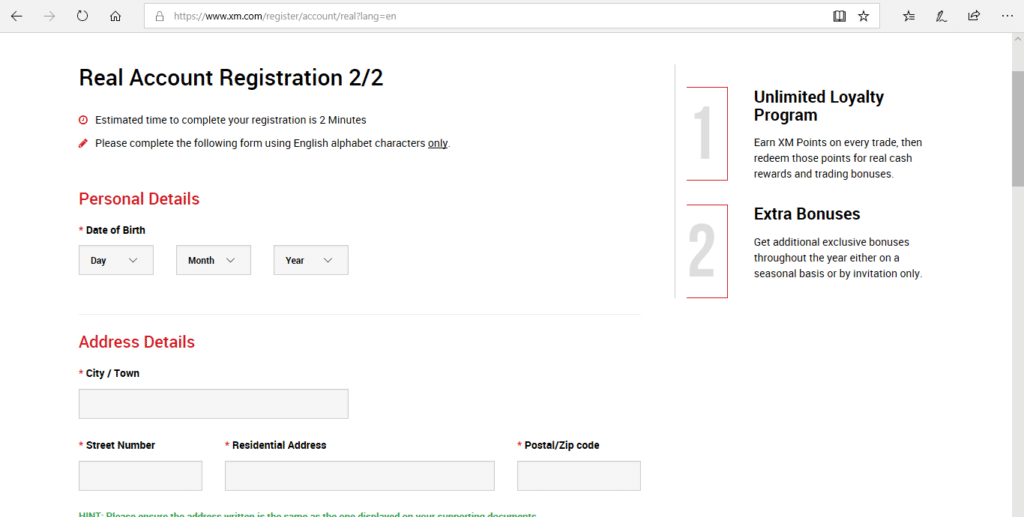

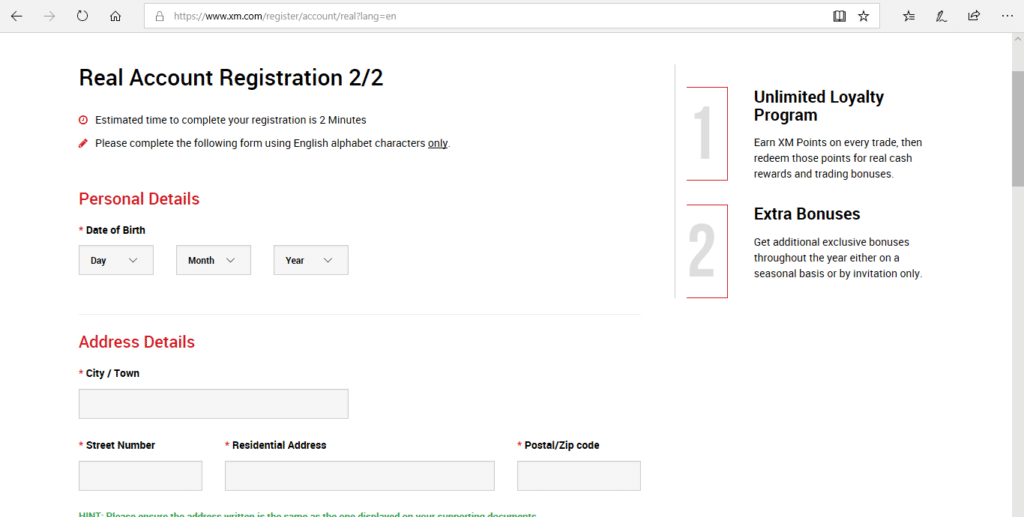

After this information is filled out, the second part of the questionnaire will load. Here, the user is asked to provide some additional details, like the date of birth and address.

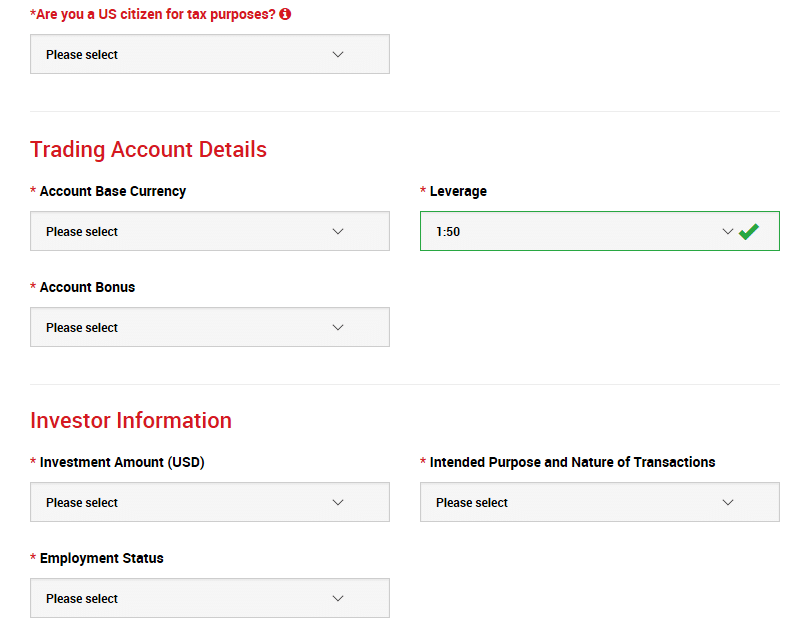

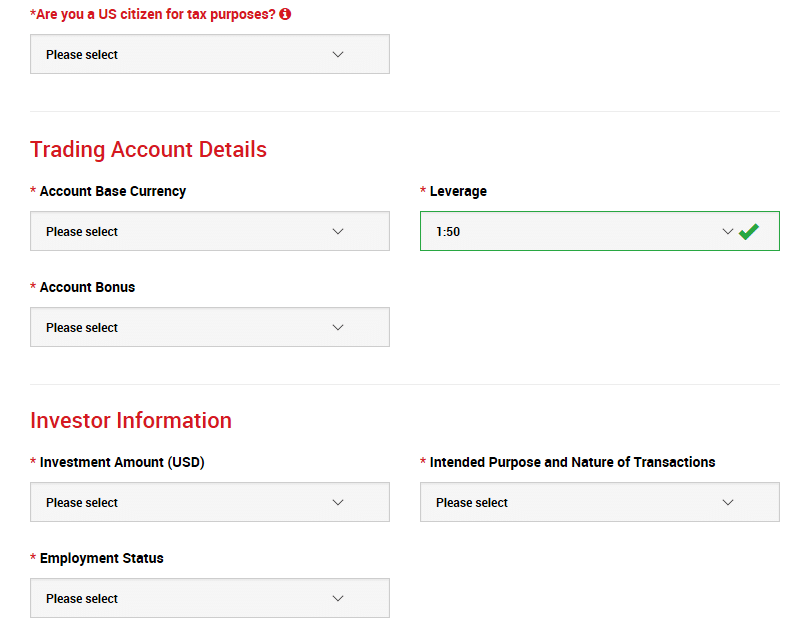

The website will also ask whether the user is a US citizen or not, as well as some additional questions to determine the purpose of the client. Once, this information is filled out, the user will set the password, agree to the terms and conditions as well as some other policies that can be viewed through the links and will click the button “open a real account”, and with that, you XM signup will be complete. Don’t stress out, your free XM bonus is almost here!

Once the questionnaire is complete, the user is very close to getting the bonus. All that is left to do is to confirm the email. The notification will be generated and the user will be asked to check the inbox of the indicated email address. Through the link provided in the email, the user will be able to confirm the transaction.

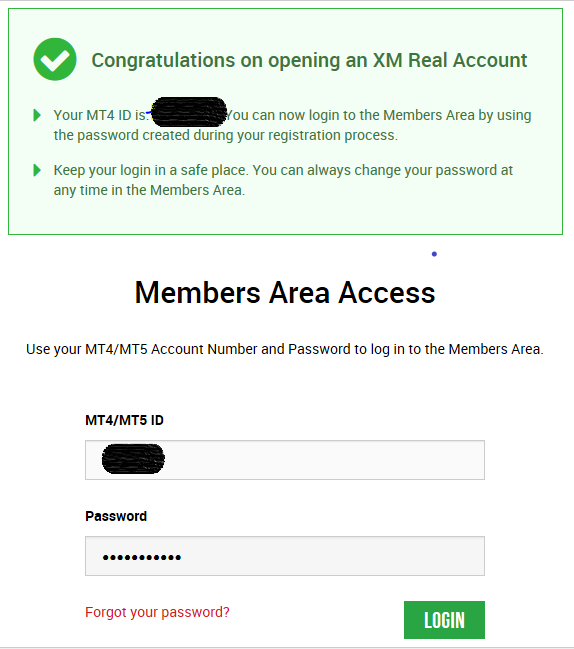

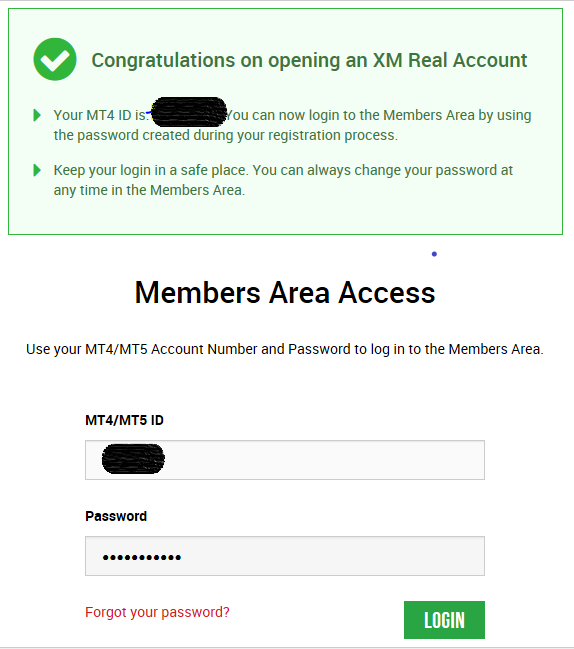

After confirming the transaction the user will finally get to log into the system using their XM members login . They will also be assigned an MT4 ID, which functions as a username when logging into the platform.

The XM no deposit bonus should show up on the account within a day after completing the registration process. The $30 no deposit bonus from XM cannot be withdrawn but can be used to trade in the system. It is a great feature to test the platform and get acquainted with it. It is an especially good feature for beginners, who might not want to risk their own funds while figuring out the basics of trading.

Spreads

Tight spreads as low as 0 pips

Tight spreads as low as 0 pips on all major currency pairs

100+ financial instruments

Trade with NO hidden fees

The lowest possible spreads for all trading account types

6 asset classes - 16 trading platforms - over 1000 instruments.

Trade forex, individual stocks, commodities, precious metals, energies and equity indices at XM.

To keep spreads as narrow as possible, we aim to get optimal prices from all our liquidity providers. Real time prices are aggregated from liquidity providers in order to offer best bid and ask prices to clients. Our electronic pricing engine allows us price updating on every currency pair three times per second, and thanks to this our prices reflect the current global forex market levels.

John papatheodoulou, chief dealer

XM offers tight spreads to all clients, irrespective of their account types and trade sizes. We recognize the fact that tight spreads only make sense for our clients if they can trade with them. This is the reason why we attribute great importance to our execution quality.

Fixed or variable spreads?

XM operates with variable spreads, just like the interbank forex market. Because fixed spreads are usually higher than variable spreads, in case you trade fixed spreads, you will have to pay for an insurance premium.

Many times, forex brokers who offer fixed spreads apply trading restrictions around the time of news announcements – and this results in your insurance becoming worthless. XM imposes no restrictions on trading during news releases.

Fractional pip pricing

XM also offers fractional pip pricing to get the best prices from its various liquidity providers. Instead of 4-digit quoting prices, clients can benefit from even the smallest price movements by adding a 5th digit (fraction).

With fractional pip pricing you can trade with tighter spreads and enjoy most accurate quoting possible.

XM spreads / conditions

- To view XM spreads / conditions for FX instruments ->click here

- To view XM spreads / conditions for commodities instruments ->click here

- To view XM spreads / conditions for equity indices instruments ->click here

- To view XM spreads / conditions for precious metal instruments ->click here

- To view XM spreads / conditions for energies instruments ->click here

© 2021 XM is a trading name of trading point holdings ltd. All rights reserved. | privacy policy | cookie policy | terms and conditions

Legal: this website is operated by trading point of financial instruments limited with registered address at 12 richard & verengaria street, araouzos castle court, 3rd floor, 3042 limassol, cyprus.

Trading point holdings ltd is the holding company of trading point of financial instruments limited, XM global limited, trading point of financial instruments UK limited, trading point of financial instruments pty ltd, trading point MENA limited.

Trading point of financial instruments limited is authorised and regulated by the cyprus securities and exchange commission (licence number: 120/10).

XM global limited is authorised and regulated by the international financial services commission (IFSC) (000261/106).

Trading point of financial instruments UK limited is authorised and regulated by the financial conduct authority (FRN: 705428).

Trading point of financial instruments pty ltd is authorised and regulated by the australian securities and investment commission (AFSL 443670).

Trading point MENA limited is authorised and regulated by the dubai financial services authority (DFSA) (reference no. F003484).

Risk warning: forex and CFD trading involves significant risk to your invested capital. Please read and ensure you fully understand our risk disclosure.

Trading point of financial instruments limited provides investment and ancillary services to residents of the european economic area (EEA) and the united kingdom.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

For more information please read our cookie policy.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

Read more, or change your cookie settings.

Your cookie settings

What are cookies?

Cookies are small data files. When you visit a website, the website sends the cookie to your computer. Your computer stores it in a file located inside your web browser.

Cookies do not transfer viruses or malware to your computer. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs (i.E. They record user activity and remember stateful information) and they get updated every time you visit a website.

We may obtain information about you by accessing cookies, sent by our website. Different types of cookies keep track of different activities. For example, session cookies are used only when a person is actively navigating a website. Once you leave the website, the session cookie disappears.

Why are cookies useful?

We use functional cookies to analyse how visitors use our website, as well as track and improve our website’s performance and function. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. The latter also helps us to track if you were referred to us by another website and improve our future advertising campaigns.

Another use of cookies is to store your log in sessions, meaning that when you log in to the members area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process.

In addition, functional cookies, for example, are used to allow us to remember your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which language you wish to see when you log in.

Here is an overview of some of the functions our cookies provide us with:

- Verifying your identity and detecting the country you are currently visiting from

- Checking browser type and device

- Tracking which site the user was referred from

- Allowing third parties to customize content accordingly

This website uses google analytics, a web analytics service provided by google, inc. ("google"). Google analytics uses analytical cookies placed on your computer, to help the website analyze a user's use of the website. The information generated by the cookie about your use of the website (including your IP address) may be transmitted to and stored by google on their servers. Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of google. Google will not associate your IP address with any other data held. By using this website, you give your consent to google to process data about you in the manner and for the purposes set out above.

XM minimum deposit guide (2021)

Trading with a top forex broker like XM is a forward step in the trading career of anyone looking to break into the sector.

Our XM review details exactly what is on offer with this broker providing extensive access to a wide range of markets.

Here we will take a closer look at the financial side of things.

The XM minimum deposit to be exact.

This is something which can certainly influence how you trade so it is well worth noting.

We will look at the minimum deposit for XM by funding method and account type to make sure that we cover all traders.

Table of contents

69.75% of retail CFD accounts lose money

XM account base currency

As with most top brokers, XM accounts are available with many several base currencies. The XM base currency is the one that you trade with and effectively depends upon which account and regulatory type you fall under.

If you have an XM standard or micro account, you can look forward to choosing every major currency as your XM base currency. Also included are PLN and HUF as other options as well as ZAR and SGD.

Russian RUB is available only if you are located outside of cysec and FCA regulatory areas.

If you are an XM zero account holder, you can access USD or EUR as base currencies with JPY available under global market regulation.

XM ultra-low account holders can select between five base currencies. These are EUR, USD, GBP, AUD, and CHF.

If you are an XM shares account holder, USD only is available for trading with.

XM funding and deposit methods

Again there is a range of XM deposit methods available to traders. These will depend on the country in which you live and not the regulatory jurisdiction you fall under.

Wondering for example if you can make a minimum deposit in ZAR?

The answer is yes, you can deposit in any currency, this includes ZAR. These funds will then simply be converted into your base currency for trading on your account.

Wire transfer

XM deposit by wire transfer is, of course, available and widely used. This funding method is available to traders worldwide and there is an minimum deposit of $60 in place here.

With that said, you will incur a fee if the wire transfer you make falls below $200. If the deposit is above this amount, then not only will XM waive any fees they charge, they will also cover any fee you would usually incur from your own bank side. Therefore, although it is not explicitly required, it is in your best interest to deposit more than $200.

Credit cards

Credit card deposits are available through both visa and mastercard at XM. These are accessible to traders around the world with a minimum deposit amount of just $5.

There are no fees associated from the broker side, but again if your financial provider does levy a fee, this will be covered for anything over a $200 deposit by XM.

Ewallet

Again, the minimum XM deposit through an ewallet is only $5. This can be made through neteller, skrill, perfect money, or a host of others dependent upon your country. At this time XM paypal deposits are not available.

Cryptocurrency deposit in the form of bitcoin is available but again this will depend on your location to determine if this option is open to you or not. There are no fees from the broker side for deposits through these methods.

Other XM deposit options

Other XM deposit options available include both western union and moneygram although these will depend on your location and fees may be applied for these services although not from the broker side.

Various local methods and local bank transfer deposits may also be open to you depending on your area. These minimum deposits will vary.

69.75% of retail CFD accounts lose money

XM minimum deposits

As with most low deposit forex brokers, beyond the funding methods, the XM broker minimum deposits may also depend on the account type you are holding. Here is a rundown of what to expect depending upon the account type you have.

Standard account

The XM standard account is available under every jurisdiction and with a very good value $5 being the minimum deposit here, it is easy to see why many choose to trade with it.

Islamic accounts are also available if you should require them.

Micro account

Again, the XM minimum deposit on their micro accounts is suitably small at just $5. These accounts facilitate trading in micro lots at excellent rates and are available to all traders in every regulatory area. Islamic traders are also catered for.

XM zero account

Changing things up slightly, we arrive at the XM zero account. This account type is available under cysec, FCA, and most of the countries regulated under the XM global market regulatory framework.

The spreads here are unbeatable starting at 0 pips although commissions are charged on trading. The XM minimum deposit for trading on these accounts is still just $100. This represents good value since you can also have access to your own VPS. Again islamic, shariah law compliant accounts are available.

Ultra low account

This XM low spread account type is available to traders based in australia and within the XM global market regulatory framework. This account comes with extra low spreads and no commission to worry about.

The minimum deposit on this account type is $50.

Shares account

Finally, the XM shares account which focuses on shares trading is available only within the XM global market regulatory area and with a $10,000 minimum deposit.

Related guides:

69.75% of retail CFD accounts lose money

Deposit bonus

XM bonus amounts and XM deposit bonuses are available though not to those regulated under cysec or FCA rules. Also, although you can receive bonuses under certain circumstances with XM, the bonus amounts themselves are typically not eligible to withdraw, though any profits derived from them usually are.

No deposit bonus

Unlike many brokers, an XM no deposit bonus is available. This means you can effectively start trading without any real money. While you cannot withdraw the bonus funds, you can withdraw any profits made from them.

This XM bonus amount is in the form of a $30 welcome bonus or the equivalent amount based on your account.

XM bonus program

An XM bonus program is in place. This program provides for a 50% deposit bonus up to $500 and then a further 20% deposit bonus on amounts up to $4500. This can be redeemed through trading with the broker. The only exception with this is that it is not available with XM ultra-low accounts.

69.75% of retail CFD accounts lose money

Fxdailyreport.Com

Many forex traders prefer to work with ECN brokers because it means more liquidity, faster execution, and accurate pricing. According to some experts, true ECN forex brokers are the real future as far as forex trading is concerned. If you are new to forex trading, this may be confusing to you. Read on to learn more about ECN forex brokers, the advantages of trading with them, and a few top true ECN forex brokers.

ECN translates to electronic communication network and it enables forex trading. In this electronic system, the orders entered by the market makers are distributed to several third parties. The orders may be executed in part or full.

The ECN network connects liquidity providers (for example, major banks) and retail traders through an online broker. The ECN network makes use of a sophisticated technological system referred to as financial information exchange protocol (FIX protocol). The ECN brokerage makes money by charging a commission on each trade. So, for higher returns, the network has to encourage trades to do more transactions.

True ECN forex brokers

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $300 spread: floating, from 0 pips leverage: 500:1 regulation: FCA UK reference number 579202 | visit broker | ||

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker | |

| min deposit: $250 spread: as low as 0.1 pips leverage: up to 400:1 regulation: ASIC australia and FCA UK | visit broker | ||

| min deposit: $100 spread: starting 0 pip leverage: 500:1 regulation: FCA UK, FSA (seychelles), cysec | visit broker |

Advantages of trading forex with top true ECN forex brokers

There are many advantages of trading with ECN brokers. Some of the key advantages are as follows:

Anonymity is guaranteed

If you choose to trade forex on an online platform provided by an ECN broker, you can be sure of the fact that others will not get to know as to who you are. Anonymity enables you to execute trades using neutral prices which reflect the true market conditions. The client’s trading direction – based on certain strategies, tactics, or market positions – will not bias the broker.

Instantaneous execution of trades

As trading takes place on the basis of prices, you get the best executable prices and the order gets confirmed immediately. Further, there are no re-quotes because ECN brokers are no-dealing desk brokers.

This type of broker does not offer fixed spreads. They offer variable spreads. This is because ECN forex brokers do not have any control over the bid/ask spread. Therefore, they cannot offer the same spreads at all times.

If you follow a risk management system or trading model of your own, you can connect the same to ECN brokers’ data feed. This means that you will have access to the best bid/ask prices and certain other data.

Access to liquidity providers around the globe

With ECN brokers, you get access to global liquidity providers such as leading world banks and other financial institutions.

Finally, an ECN forex broker only matches the trades between the participants. They cannot trade against their clients. This is something very important. Many people are people worried about brokers, especially the market makers, trading against them.

There are not many drawbacks as far as ECN brokers are concerned. They charge a fixed fee as commission, but it is cheaper and more transparent compared to that charged by the market maker. Another disadvantage is that it is difficult to calculate stops and targets on an ECN platform. This is because the prices keep changing and they offer variable spreads. The possibility of slippage is also there, particularly when sessions overlap.

Tips on how to choose a true ECN forex brokers

Now that you know a little bit about forex trading with ECN brokers, you might want to know how you can choose a true ECN broker. It is highly recommended that long-term traders should consider working with ECN brokers as they do not trade against customers. As with anything else in life, all brokers are not the same you can find out if the broker is really an ECN broker or not by asking the following simple questions:

Does the broker make any mention of a dealing desk anywhere on their website?

Does the broker change the spreads during news announcements? You may have to open a demo account and a real account in order to find this out. A true ECN broker will never change the spreads during news reports.

Is the broker offering fixed spreads or variable spreads? True ECN forex brokers never offer fixed spreads. They offer only variable or floating spreads.

What about negative slippage? The answer to this question is a no in the case of true ECN brokers.

Having understood how to identify true ECN brokers, here are some of the recommended true ECN forex brokers you can consider working with:

XM group review

28 october 2020 - kate leaman

With multiple licenses from top-tier regulatory bodies, our XM group review reveals a respected and reliable broker with over a decade of experience. Launched in 2009, XM group is a great choice for all types of traders as it offers a wide range of instruments, extensive research tools, and five different account types. XM group has also won multiple awards, including ‘best FX broker for europe 2020’.

- 1,200+ available instruments

- Free educational materials

- Licensed by FCA

- Best broker for forex trading beginners

- Only supports MT4 and MT5

XM group overall scores

In this review, you can find all the information you need to decide whether XM group is the right broker for you. Our expert team has thoroughly explored the broker, using a tested methodology and scoring system. This process places importance on the things we know matter most to traders. Below you can see how XM group scored in each of our high-priority categories.

Brokers available in united states

Discover a broker you can trust by reading our in-depth and honest reviews, created by industry experts. Since 2015, we’ve reviewed over 200 forex brokers.

XM no deposit 30 USD bonus – read an honest review

Platform

Min. Volume

Action

XM forex broker is a great place to get started for a next FX professional. This broker gives you access to XM no deposit 30 USD bonus campaign and allows you to use metatrader4 and MT5. This is one of the only brokers that makes MT4 live trading available to you without making a deposit. You should certainly try this XM no deposit bonus, as metatrader 4 is the platform you will most likely have to change to eventually and this promo campaign lets you test drive the platform without any deposits.

XM free 30 USD no deposit bonus description

Getting the 30 USD no deposit bonus on XM is pretty easy. The only thing you need, except for the wish to trade forex, is to go through XM registration, get your account, and confirm your phone number via SMS. As for the bonus, within the maximum of 24 hours (but usually in around 30 minutes), you will get the money credited to your account and you will be able to trade currencies online with XM without making a deposit.

XM free trial available platforms

When it comes to FX trading online, the choice of available trading platforms becomes quite important. Most of the traders end up on MT4 or MT5 platform and this is certainly an advantage of XM. With XM FX broker, traders using mac laptops and desktops will find a hustle way to trade since they offer native access to metatrader 4 for mac OS. Also, the MT4 web platform is also available with XM, this trading terminal could be used for windows and other operating systems too. Like most of the brokers, XM account also enables you to trade on your smartphone.

XM 30$ bonus terms and conditions

XM no deposit 30 USD bonus is unavailable for withdrawals, however, every cent from the profit is yours. You can take your time and only make relevant trades that get you great money on the XM no deposit bonus.

XM free account critics

Many traders have been complaining about this promotion and XM broker in general, this is why forex trading bonus team would strictly advise against it. You may, of course, try your luck and see how fast you can triple your initial balance, however, some traders did have their accounts removed without any prior notification.

We decided to check this bonus on our own. We have to admit, we were positively surprised by the quality of services and web platform from XM. This is why we recommend you try XM trading bonus!

How to get XM $30 no deposit bonus?

XM is a quickly growing international investment firm with over 2.5 million users and 300 professionals. The company offers a trustworthy and convenient trading environment and is one of the few brokers who will allow MT4 live trading without making any deposits. After getting their XM global login, users will be rewarded with $30 no deposit bonus that is available for trading right away. It shouldn’t take longer than a day for the funds to show up in the account.

Steps for getting the no deposit XM bonus:

Getting the bonus is fairly simple. A user only has to register on the platform and activate the account. The registration procedures are very easy to follow. On any page on XM’s website, in the top right corner, there is a green button titled “open an account”. Clicking the button will start the registration process.

The registration includes filling out a standard questionnaire. The first part of it is depicted on the screen below. In this section, the user is asked to fill out some details like name, country of residence and a phone number. A user will also get to choose an account type and trading platform type on this page.

After this information is filled out, the second part of the questionnaire will load. Here, the user is asked to provide some additional details, like the date of birth and address.

The website will also ask whether the user is a US citizen or not, as well as some additional questions to determine the purpose of the client. Once, this information is filled out, the user will set the password, agree to the terms and conditions as well as some other policies that can be viewed through the links and will click the button “open a real account”, and with that, you XM signup will be complete. Don’t stress out, your free XM bonus is almost here!

Once the questionnaire is complete, the user is very close to getting the bonus. All that is left to do is to confirm the email. The notification will be generated and the user will be asked to check the inbox of the indicated email address. Through the link provided in the email, the user will be able to confirm the transaction.

After confirming the transaction the user will finally get to log into the system using their XM members login . They will also be assigned an MT4 ID, which functions as a username when logging into the platform.

The XM no deposit bonus should show up on the account within a day after completing the registration process. The $30 no deposit bonus from XM cannot be withdrawn but can be used to trade in the system. It is a great feature to test the platform and get acquainted with it. It is an especially good feature for beginners, who might not want to risk their own funds while figuring out the basics of trading.

Regulation

XM group licenses

Cysec

Cyprus securities and exchange commission

Trading point of financial instruments ltd is licensed by cysec under license number 120/10.

Australian securities and investments commission

Trading point of financial instruments pty ltd has been issued an australian financial services license by ASIC (number 443670)

Registrations for outward passporting

Financial conduct authority

Bafin

Federal financial supervisory authority

The national securities market commission

The hungarian national bank

CONSOB

The italian companies and exchange commission

The french prudential supervision and resolution authority

FIN-FSA

The finnish financial supervisory authority

Polish financial supervision authority

Netherlands authority for the financial markets

Financial supervisory authority

Safety of client funds

In the financial industry, the most essential requirement is the safety of our clients’ funds. As a licensed and regulated financial institution we safeguard our business by adopting the below procedures:

- Doing banking with investment grade bank barclays bank plc

- Doing business with paysafe group limited, which is regulated by the financial conduct authority (UK)

- Doing business with przelewy24, which is regulated by financial supervision authority (poland)

- Doing business with safecharge limited, which is regulated by central bank of cyprus (cyprus)

- Keeping clients’ funds segregated from our company funds, at tier-one banking institutions, ensuring that these can't be used either by us or by our liquidity providers under any circumstances

- Provide retail clients with additional protection through the investor compensation fund in the case of company insolvency

- Use an automated system for monitoring funds transactions and risk management for the sake of no negative balance, and thus protects clients from any losses bigger than their original investments

- Apply multiple transaction methods for funds withdrawals and deposits that guarantee transfer security and clients’ privacy through secure socket layer (SSL) technology

- Embrace the investor protection measures described by the markets in financial instruments directive (mifid)

- Adopt clear procedures to categorize clients and assess their investment suitability for the sake of risk management

- Follow a best execution policy for executing trading orders on terms most favorable to clients

- Ensure trading transparency for its financial instruments by providing detailed information about trading conditions

- Collaborate with multiple liquidity providers to offer the best spreads and liquidity at all times

- Follow a no re-quotes and no extra commissions policy that could negatively affect clients’ investments

Investors in people

XM is recognized by the UK based organization investors in people for its efforts in developing people to realize their full potential and achieve both personal and corporate goals. Investors in people provide a wealth of proven tools and resources designed to complement their unique operational framework in order to boost performance and maximize sustainability. By achieving this standard, XM demonstrates that it is a leading force in the online trading sector and is committed to the provision of quality services and products.

© 2021 XM is a trading name of trading point holdings ltd. All rights reserved. | privacy policy | cookie policy | terms and conditions

Legal: this website is operated by trading point of financial instruments limited with registered address at 12 richard & verengaria street, araouzos castle court, 3rd floor, 3042 limassol, cyprus.

Trading point holdings ltd is the holding company of trading point of financial instruments limited, XM global limited, trading point of financial instruments UK limited, trading point of financial instruments pty ltd, trading point MENA limited.

Trading point of financial instruments limited is authorised and regulated by the cyprus securities and exchange commission (licence number: 120/10).

XM global limited is authorised and regulated by the international financial services commission (IFSC) (000261/106).

Trading point of financial instruments UK limited is authorised and regulated by the financial conduct authority (FRN: 705428).

Trading point of financial instruments pty ltd is authorised and regulated by the australian securities and investment commission (AFSL 443670).

Trading point MENA limited is authorised and regulated by the dubai financial services authority (DFSA) (reference no. F003484).

Risk warning: forex and CFD trading involves significant risk to your invested capital. Please read and ensure you fully understand our risk disclosure.

Trading point of financial instruments limited provides investment and ancillary services to residents of the european economic area (EEA) and the united kingdom.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

For more information please read our cookie policy.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

Read more, or change your cookie settings.

Your cookie settings

What are cookies?

Cookies are small data files. When you visit a website, the website sends the cookie to your computer. Your computer stores it in a file located inside your web browser.

Cookies do not transfer viruses or malware to your computer. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs (i.E. They record user activity and remember stateful information) and they get updated every time you visit a website.

We may obtain information about you by accessing cookies, sent by our website. Different types of cookies keep track of different activities. For example, session cookies are used only when a person is actively navigating a website. Once you leave the website, the session cookie disappears.

Why are cookies useful?

We use functional cookies to analyse how visitors use our website, as well as track and improve our website’s performance and function. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. The latter also helps us to track if you were referred to us by another website and improve our future advertising campaigns.

Another use of cookies is to store your log in sessions, meaning that when you log in to the members area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process.

In addition, functional cookies, for example, are used to allow us to remember your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which language you wish to see when you log in.

Here is an overview of some of the functions our cookies provide us with:

- Verifying your identity and detecting the country you are currently visiting from

- Checking browser type and device

- Tracking which site the user was referred from

- Allowing third parties to customize content accordingly

This website uses google analytics, a web analytics service provided by google, inc. ("google"). Google analytics uses analytical cookies placed on your computer, to help the website analyze a user's use of the website. The information generated by the cookie about your use of the website (including your IP address) may be transmitted to and stored by google on their servers. Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of google. Google will not associate your IP address with any other data held. By using this website, you give your consent to google to process data about you in the manner and for the purposes set out above.

So, let's see, what we have: is XM or interactive brokers better? Well, it depends on whether you trade forex, crypto, indices or stocks, and what features matter to you. Compare XM and interactive brokers (plus one other) in this up-to-date comparison of their fees, platform, features, pros and cons, and what they allow you to trade in 2021 at brokers like xm

Contents of the article

- Top forex bonuses

- XM group vs interactive brokers

- What would you like to compare?

- TRADING SERVICES OFFERED

- PLATFORM & FEATURES

- ACCOUNT INFORMATION

- TRADING CONDITIONS

- RISK MANAGEMENT

- FUNDING METHODS

- DETAILED INFO

- XM alternatives

- XM no deposit 30 USD bonus – read an honest review

- XM free 30 USD no deposit bonus description

- XM free trial available platforms

- XM 30$ bonus terms and conditions

- How to get XM $30 no deposit bonus?

- Steps for getting the no deposit XM bonus:

- Spreads

- Tight spreads as low as 0 pips

- Fixed or variable spreads?

- Fractional pip pricing

- XM spreads / conditions

- XM minimum deposit guide (2021)

- XM account base currency

- XM funding and deposit methods

- XM minimum deposits

- Deposit bonus

- Fxdailyreport.Com

- True ECN forex brokers

- XM group review

- XM group overall scores

- Brokers available in united states

- XM no deposit 30 USD bonus – read an honest review

- XM free 30 USD no deposit bonus description

- XM free trial available platforms

- XM 30$ bonus terms and conditions

- How to get XM $30 no deposit bonus?

- Steps for getting the no deposit XM bonus:

- Regulation

- XM group licenses

- Registrations for outward passporting

- Financial conduct authority

- Bafin

- Federal financial supervisory authority

- The national securities market commission

- The hungarian national bank

- CONSOB

- FIN-FSA

- The finnish financial supervisory authority

- Polish financial supervision authority

- Netherlands authority for the financial markets

- Financial supervisory authority

- Safety of client funds

- Investors in people

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.