Real account 3

There are mainly three types of accounts in accounting: real, personal and nominal, personal accounts are classified into three subcategories: artificial, natural, and representative.

Top forex bonuses

Three types of accounts

What are the three types of accounts?

There are mainly three types of accounts in accounting: real, personal and nominal, personal accounts are classified into three subcategories: artificial, natural, and representative.

If you fail to identify an account correctly as either a real, personal or nominal account, in most cases, you will get end up recording incorrect journal entries.

Three types of accounts

1. Real accounts

All assets of a firm, which are tangible or intangible, fall under the category of ‘real accounts’.

Tangible real accounts are related to things that can be touched and felt physically. Few examples of tangible real accounts are building, machinery, stock, land, etc.

Intangible real accounts are related to things that can’t be touched and felt physically. Few examples of such real accounts are goodwill, patents, trademarks, etc.

The golden rule for real accounts

The transaction below shows the interaction of two different real accounts: one is ‘ furniture’ and the other is ‘cash’, both of them are assets of the company and hence classified as real accounts.

- Purchased furniture for 10,000 in cash

| accounts involved | debit/credit | rule applied |

| furniture A/C | debit | real A/C – dr. What comes in |

| to cash A/C | credit | real A/C – cr. What goes out |

*amount will be 10,000 in both debit and credit.

2. Personal accounts

Second among three types of accounts are personal accounts which are related to individuals, firms, companies, etc. Few examples are debtors, creditors, banks, outstanding account, prepaid accounts, accounts of customers, accounts of goods suppliers, capital, drawings, etc.

Natural personal accounts: this type of personal accounts is the simplest to understand out of all and includes all of god’s creations who have the ability to deal, who, in most cases, are people. E.G. Kumar’s A/C, adam’s A/C, etc.

Artificial personal accounts: personal accounts which are created artificially by law, such as corporate bodies and institutions, are called artificial personal accounts. E.G. Private companies, llcs, llps, clubs, schools, etc.

Representative personal accounts: accounts which represent a certain person or a group directly or indirectly. E.G. Let’s say that wages are paid in advance to an employee – a wage prepaid account will be opened in the books of accounts. This wages prepaid account is a representative personal account indirectly linked to the person .

The golden rule for personal accounts

The transaction below demonstrates the interaction between two different personal accounts, one of which is a private limited company and the other one is a bank.

- Paid unreal company 24,000 by check

| accounts involved | debit/credit | rule applied |

| unreal company A/C | debit | personal – dr. The receiver |

| to bank A/C | credit | personal – cr. The giver |

*amount will be 24,000 in both debit and credit.

Related topic – difference between journal and ledger

3. Nominal accounts

Accounts which are related to expenses, losses, incomes or gains are called nominal accounts. The dictionary meaning of the word ‘nominal’ is “existing in name only“ and the meaning remains absolutely true in accounting sense too, furthermore nominal accounts do not really exist in physical form, but behind every nominal account money is involved.

Example – purchase A/C, salary A/C, sales A/C, commission received A/C, bad debt A/C, etc. The final result of all nominal accounts is either profit or loss which is then transferred to the capital account.

The golden rule for nominal accounts

The following example shows a transaction where a nominal account interacts with a real a/c.

- Purchased good for 15,000 in cash

| accounts involved | debit/credit | rule applied |

| purchase A/C | debit | nominal A/C – dr. All expenses |

| to cash A/C | credit | real A/C – cr. What goes out |

The amount will be 15,000 in both debit and credit.

What is a real account?

Definition: A real account is a permanent account in the general journal that does not close at the end of a period. In other words, these accounts stay open allowing their balances to accumulate and carry over to the next period for the company’s lifetime.

What does real account mean?

What is the definition of real account? Real accounts reflect the current and ongoing financial status of a company because they carry their balance forward into the next accounting period. These accounts are typically reported on the balance sheet at the end of the year as assets, liabilities, or equity.

These account balances change throughout the accounting period. Management can review the extent of these changes by comparing initial and final balance of each account. The final balance will become reported on the balance sheet at the end of the period and will be carried over to the next period becoming the initial balance for the next accounting period.

The relationship between real and nominal accounts is that a change in one of them might derive in a change on the other. This means that if a nominal account increases or decreases it will increase or decrease a permanent account.

Let’s illustrate this concept with an example.

Example

Young motors co. Is a startup company that produces motorcycles. Today is the first day of the company and its owners contribute the following things:

- Cash: $30,000

- Inventory: $25,000

- Fixed assets: $50,000

The company has no liabilities. After a few months of operations, the company has the following:

- Revenues: $25,000

- Cost of goods sold: $10,000

- Rent: $5,000

- Other expenses: $1,500

The accounting period started on january 1 and it will end on december 31.

At the end of the period, the revenues, cost of goods sold, rent, and other expenses are reported on the income statement as an $8,500 net income. These accounts are then closed with year-end closing entries to the retained earnings account leaving the company with the following permanent accounts that will carry over into the next period:

- Cash: $50,000

- Inventory: $15,000

- Fixed assets: $50,000

- Retained earnings: $115,000

Summary definition

Define real accounts: real account means a general journal account that isn’t closed at the end of the year.

Types of accounts: real, personal and nominal accounts with examples

There are credit and debit rules of accounting which is referred as 3 golden rules of accounting. It is also referred as 3 types of accounts in accounting. Here we will also see examples of real account, examples of nominal account as well as examples of personal account. Let us understand further in detail:

Three types of accounts into accounting system are:

1. Real account definition:

Any kind of assets which is either tangible (for example: land, stock, building, etc.) or intangible (for example: goodwill, copyrights, patents, etc.) are categorized into real account.

| Frist golden rule – real accounts |

| debit what’s come in and credit what goes out. |

Example of real accounts:

Mr. Joe purchased furniture of rs.75,000/- for cash.

| Accounts | debit | credit | applied rules |

| furniture A/c | 75,000 | debit what’s come in. | |

| To cash A/c | 75,000 | credit what goes out. |

2. Personal account definition:

Those accounts which are either directly or indirectly related to individuals, companies, firms or organisations are known as personal account. Example of personal accounts includes: kumar account, xyz pvt. Ltd. Account, capital account, prepaid account, bank account, drawings account, creditors account, outstanding account, debtors account, suppliers account, etc.

| Second golden rule – personal accounts |

| debit the receiver and credit the giver |

Example of personal accounts:

Mr. Jennifer paid rs.45,000/- to xyz-pqr private limited company by cheque.

Personal accounts are one of the three types of accounts. As per the second golden rule of personal accounts – xyz-pqr pvt. Ltd. A/c is debited with rs.45,000/- and bank A/c is credited with rs.45,000/-.

3. Nominal account definition:

Those accounts which are associated with income, gains, losses or expenses are known as nominal account. At the end remaining balances of nominal accounts are then posted to capital account.

| Third golden rule – nominal accounts |

| debit all expenses & losses and credit all income’s & gain’s |

Example of nominal accounts:

Ms. Jenny purchased goods of rs.22,000/- for cash.

Nominal accounts are one of the three types of accounts. As per the third golden rule of nominal accounts – purchase A/c is debited with rs.22,000/- and cash A/c is credited with rs.22,000/-.

Read E-learning tutorial courses - 100% free for all

Basics of accounting for beginners

- Chapter 1: what is accounting with examples

- Chapter 2: objectives of accounting

- Currently reading: types of accounts

- Chapter 4: branches of accounting

- Chapter 5: accounting process

- Chapter 6: what is assets and current assets?

- Chapter 7: what is liability and current liabilities?

- Chapter 8: what is revenue and expenses?

- Chapter 9: what is a single entry system?

- Chapter 10: what is double entry system?

- Chapter 11: what are journal entries? Format and examples

- Chapter 12: what is a general ledger? Format with example

- Chapter 13: what is a trial balance? Examples and limitations

- Chapter 14: what is a profit and loss statement or income statement?

- Chapter 15: what is a balance sheet? Definition, format and examples

- Chapter 16: what is managerial accounting? Role, job and objectives

- Chapter 17: accounting quiz – basics of accounting for beginners module

How useful was this post?

Click on a star to rate it!

Average rating 4.9 / 5. Vote count: 416

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you!

リアルアカウント 3 [ real account 3 ]

(real account #3)

キミは、誰にホントに必要とされてる? 舞台はSNS! 賭けるはツナガリ! 新世紀型デスゲーム始動!! 衝撃と興奮の「頭脳バトルコンペ」受賞作!!

『黒歴史裁判』を生き延びた柏木アタルが目撃したのは死別したはずの兄・ユウマの姿だった‥。そして、始まるアナザーサイドの物語。新主人公・向井ユウマは、スマホの保存画像を使った『悪いいね! ゲーム』に挑む! 人間の欲望をムキダシにする『リアアカ生放送』 も登場。いきなりの主人公交代から、急転直下の衝撃展開!!

Get A copy

Friend reviews

Reader Q&A

Be the first to ask a question about リアルアカウント 3 [ real account 3 ]

Lists with this book

Community reviews

So, I wasn't really expecting this series to pull a death proof, but it totally did. What I mean by that is (in as spoiler-free of an explanation as I can give, for those who haven't seen the movie), the story goes on for a good while, getting us acquainted with the characters so we care about what happens to them, and then. Just switches to an entirely new cast, partway through. Volume 3 begins literally back at the beginning of the overall plot, but from a different character's perspective, a so, I wasn't really expecting this series to pull a death proof, but it totally did. What I mean by that is (in as spoiler-free of an explanation as I can give, for those who haven't seen the movie), the story goes on for a good while, getting us acquainted with the characters so we care about what happens to them, and then. Just switches to an entirely new cast, partway through. Volume 3 begins literally back at the beginning of the overall plot, but from a different character's perspective, and for a variety of reasons, I don't feel that this was a good decision.

Let's start with the plot, itself. For a sizable chunk of this volume, I got a real feeling of "I've read this before," because the exact same sequence of events happens. Kind of. People get sucked into the world of real account, they're confused and angry, marble kills one to set an example and explain the rules, and so on, and so on. It isn't until about a third of a way through this book, that we get to material that feels truly new (apart from introducing the new protagonist, but I'll get to that). The problem is, this new material seems to directly contradict events that happened in the previous volumes.

For example, the first game is no longer the "no answer," hot or not-esque challenge from the first volume. The game that follows it is entirely different from the second game we saw in the previous volumes, too. There are some interesting set pieces here, but none of it makes sense. Hell, it's even a different person who gets "made an example of," at the beginning of the death game. The only explanation that makes any sense, is that this particular iteration of the death game is taking place in a different part of the country--but it's been established in volume 1, that the game is being broadcast across the entire country, so that doesn't seem plausible, either. The only nod we get that something doesn't add up, is a single line from a random person in the real world, on the phone with someone, expressing confusion about the "RT game," which is a game from an earlier volume that wasn't shown as happening in this one. Which suggests that the author is aware that none of this makes sense at present, and there might be an explanation coming. Maybe. As it stands now, this volume was more confusing than anything.

The new characters don't help make things more palatable, either. The key ones are basically inversions of their original counterparts: yuma is ataru without the shyness, but otherwise fills the same role as the crafty everyman whose ingenuity gives hope to the rest of the contestants. Ayame is the off-the-shelf tsundere counterpart to the sweet and timid koyomi. There's even an (unnamed) straight-up sociopath, whose cold, calculating demeanor contrasts with the deceptive, cheerful mask worn by another character in volume 2, who I won't name in case you haven't read that yet.

I kinda see what the author might be doing, setting things up this way, considering how volume 2 ended, but I don't feel as attached to any of these folks yet. I want to know more about what happened to the original cast, not some pale imitations. There is a part set in the real world, at the very end that raises a lot of questions, so I'm certainly willing to stick with real account for one more volume to see if that twist gets expanded upon, but still. With so many unanswered--indeed, completely ignored--questions, volume 4 is going to have to cover a lot of ground, to get me solidly back on board with this series. . More

Types of accounts

Types of accounts in accounting

- Real account:- real accounts are related to asset account which can be touched felt, eg building account, machinery account ,stock,furniture etc

- Personal account:- personal accounts are related to persons , institutions companies. Examples are bank account, creditors a/c etc. Personal accounts are sub-divided into natural persons and artificial persons. Natural persons are individuals or human .Where are artificial persons are the organizations created by law like companies, trusts, firms etc.

- Nominal account:- nominal accounts are related to income and expenses or losses and gains , examples are rent, commission, salary etc

What is dual aspect

- Car is coming in to business

- Cash going out from the business

Rules for debit and credit

The rules of debit and credit is popularly known as golden rules of accounting in india.These rules are the pillars of accounting.All financial statements are based on these rules.

Real account

The rules for real account in accounting is

Debit what comes in

Credit what goes out

| Particulars | debit(dr) | credit(cr) |

| furniture | 2500.00 | 0.00 |

| cash | 0.00 | 2500.00 |

Personal account

The rule for personal account is

Debit the receiver

Credit the giver

| Particulars | debit(dr) | credit(cr) |

| furniture | 3000.00 | 0.00 |

| mozart furnitures | 0.00 | 3000.00 |

Nominal account

Debit all expenses or losses

credit all incomes or gains

| Particulars | debit(dr) | credit(cr) |

| salary | 100000.00 | 0.00 |

| cash | 0.00 | 100000.00 |

Balance of real account

Real accounts are relate to assets.When assets are received in the business the particular asset accounts are debited.When assets are sold or otherwise disposed of, the particular assets accounts are credited.So if an asset account has a balance it must be a debit balance.It indicates the value of asset in the possession of business.

Balance of personal account

The debit balance of a personal account indicates debts owing by the person and credit balance indicates debts owing to the person concerned.For the business the first one is account receivable or asset ,while the second is account payable or liability. The debit balance of all personal accounts on a certain date put together will make sundry debtors and the credit balances of all personal accounts put together will make “sundry creditors”sundry debtors are assets and sundry creditors are liabilities.Where as asset accounts have debit balances liability accounts have credit balances.

Closing of nominal accounts

Only accounts relating to assets and liabilities ,that is real account and personal accounts are balanced periodically.Nominal accounts are accounts of expenses and incomes.They are not balanced;they are closed at the end of the trading period by transferring the amounts to the debit and credit of a profit and loss account.Before a nominal account is closed it will either show a debit balance ( expense) or a credit balance ( income).

Do it your self

Find out the debit and credit aspects of the following transactions

- 01-07-2016 purchased land for 105000.00

- 02-07-2016 purchased goods from S.K creation on credit 200000.00

- 03-07-2016 stationery purchased for 1000.00

- 03-07-2016 goods sold to indian cotton for credit 45000.00

- 05-07-2016 rent paid to building owner 1500.00

- 06-07-2016 cash withdrawn for personal use 5000.00

- 07-07-2016 tea expenses incurred for staff 100.00

- 08-07-2016 computer purchased from computer solutions 30000.00

- 15-07-2016 paid commission 500.00

- 20-07-2016 deposit cash in to SBI 15000.00

- 20-07-2016 cash sales 25000.00

- 21-07-2016 cheque received from indian cotton 25000.00

- 22-07-2016 goods returned by indian cotton 2500.00

- 28-07-2016 cash withdrawn from SBI 10000.00

- 31-07-2016 goods returned to S.K creation 5000.00

Click on below link TO KNOW THE ANSWERS

| journal | |||||

| sr no | date | particulars | ledger folio( LF ) | debit amount | credit amount |

| 1 | 1/7/2016 | land A/c ………dr | 105000.00 | ||

| to ; cash | 105000 | ||||

| (being purchase land) | |||||

| 2 | 2/7/2016 | purchase A/c …..Dr | 200000 | ||

| to; S.K creation | 200000 | ||||

| (goods purchased from SK creation on credit) | |||||

| 3 | 3/7/2016 | printing & stationery A/c ….Dr | 1000 | ||

| to; cash | 1000 | ||||

| being stationery purchased as per bill noxxxx | |||||

| 4 | 3/7/2016 | indian cottons A/c ……..Dr | 45000 | ||

| to; sales | 45000 | ||||

| (being credit sales to indian cotton) | |||||

| 5 | 5/7/2016 | rent A/c …………….Dr | 1500 | ||

| to;cash /ac | 1500 | ||||

| (rent paid for the month of june) | |||||

| 6 | 6/7/2016 | drawings A/c ………dr | 5000 | ||

| to; cash | 5000 | ||||

| ( cash drawn for personal use) | |||||

| 7 | 7/7/2016 | staff welfare A/c……. Dr | 100 | ||

| to; cash | 100 | ||||

| (tea expense for staff ) | |||||

| 8 | 8/7/2016 | computer A/c ……dr | 30000 | ||

| to; computer solutions | 30000 | ||||

| ( being computer purchased from computer solutions for credit) | |||||

| 9 | 15/07/2016 | commision A/c …………..Dr | 500 | ||

| to; cash | 500 | ||||

| ( paid commission) | |||||

| 10 | 20/7/2016 | SBI A/c …………..Dr | 15000 | ||

| to; cash | 15000 | ||||

| ( cash deposited in SBI) | |||||

| 11 | 20/7/2016 | cash ……………………dr | 25000 | ||

| to; sales | 25000 | ||||

| ( cash sales) | |||||

| 12 | 21/7/2016 | SBI ( BANK A/C) ….Dr | 25000 | ||

| to; indian cotton | 25000 | ||||

| (being cheque received from indian cotton) | |||||

| 13 | 22/7/2016 | sales retrun A/c ………dr | 2500 | ||

| to; indian cotton | 2500 | ||||

| ( being goods returned by indian cotton) | |||||

| 14 | 28/07/2016 | cash A/c ……………..Dr | 10000 | ||

| to; SBI A/c | 10000 | ||||

| ( being cash withdrwan for business use) | |||||

| 15 | 31/7/2016 | S.K creation …………dr | 5000 | ||

| to; purchase return | 5000 | ||||

| ( goods returned to sk creation) | |||||

17 thoughts on “ types of accounts ”

First of all you have to write the journal entrys as for business transaction you can divided in to ledger performer if it is case transaction you should enter the cash ledger

In accounts tea expenses made sum of rs 200, for cash payment what account head i want to account?

You can create account like ” staff welfare expense” “tea expense” etc

Thanx a tonne… ��

it was so simple

Single ledger-create or add any ledger under any parent group.. Aftr tht display the list of ledger u have created then u want to changes usinf alter-delete or modification in ledger..

Thank s for good info sir i want more material

I really like the way it was explained, even a kid can understand it.

Real asset

What is a real asset?

Real assets are physical assets that have an intrinsic worth due to their substance and properties. Real assets include precious metals, commodities, real estate, land, equipment, and natural resources. They are appropriate for inclusion in most diversified portfolios because of their relatively low correlation with financial assets, such as stocks and bonds.

Key takeaways

- A real asset is a tangible investment that has an intrinsic value due to its substance and physical properties.

- Commodities, real estate, equipment, and natural resources are all types of real assets.

- Real assets provide portfolio diversification, as they often move in opposite directions to financial assets like stocks or bonds.

- Real assets tend to be more stable but less liquid than financial assets.

Real asset

Understanding real assets

Assets are categorized as either real, financial, or intangible. All assets can be said to be of economic value to a corporation or an individual. If it has a value that can be exchanged for cash, the item is considered an asset.

Intangible assets are valuable property that is not physical in nature. Such assets include patents, copyrights, brand recognition, trademarks, and intellectual property. For a business, perhaps the most important intangible asset is a positive brand identity.

Financial assets are a liquid property that derives value from a contractual right or ownership claim. Stocks, bonds, mutual funds, bank deposits, investment accounts, and good old cash are all examples of financial assets. They can have a physical form, like a dollar bill or a bond certificate, or be nonphysical—like a money market account or mutual fund.

In contrast, a real asset has a tangible form, and its value derives from its physical qualities. It can be a natural substance, like gold or oil, or a man-made one, like machinery or buildings.

Special considerations

Financial and real assets are sometimes collectively referred to as tangible assets. For tax purposes, the internal revenue service (IRS) requires businesses to report intangible assets differently than tangible assets, but it groups real and financial assets under the tangible asset umbrella.

Most businesses own a range of assets, which typically fall into real, financial, or intangible categories. Real assets, like financial assets, are considered tangible assets. For example, imagine XYZ company owns a fleet of cars, a factory, and a great deal of equipment. These are real assets. However, the company also owns several trademarks and copyrights, which are its intangible assets. Finally, the company owns shares of stock in a sister company, and these are its financial assets.

Real assets vs. Financial assets

Although they are lumped together as tangible assets, real assets are a separate and distinct asset class from financial assets. Unlike real assets, which have intrinsic value, financial assets derive their value from a contractual claim on an underlying asset that may be real or intangible.

For example, commodities and property are real assets, but commodity futures, exchange-traded funds (etfs) and real estate investment trusts (reits) constitute financial assets whose value depends on the underlying real assets.

It is in those types of assets that overlap and confusion over asset categorization can occur. Etfs, for example, can invest in companies that are involved in the use, sale or mining of real assets, or more directly linked etfs can aim to track the price movement of a specific real asset or basket of real assets.

Physically backed etfs include some of the most popular etfs in the world based on volumes, such as state street's SPDR gold shares (GLD) and ishares silver trust (SLV). Both invest in precious metals and seek to mirror the performance of those metal. Technically speaking, though, these etfs are financial assets, while the actual gold or silver bullion they own is the real asset.

Advantages and disadvantages of real assets

Real assets tend to be more stable than financial assets. Inflation, shifts in currency values, and other macroeconomic factors affect real assets less than financial assets. Real assets are particularly well-suited investments during inflationary times because of their tendency to outperform financial assets during such periods.

In a 2017 report, asset management firm brookfield cited a global value of real asset equities totaling $5.6 trillion. Of this total, 57% consisted of natural resources, 23% was real estate, and 20% was in infrastructure. In the firm's 2017 report on real assets as a diversification mechanism, brookfield noted that long-lived real assets tend to increase in value as replacement costs and operational efficiency rise over time. Further, the found that cash-flow from real assets like real estate, energy servicing, and infrastructure projects can provide predictable and steady income streams for investors.

Real assets, however, have lower liquidity than financial assets, as they take longer to sell and have higher transaction fees in general. Also, real assets have higher carrying and storage costs than financial assets. For example, physical gold bullion often has to be stored in third-party facilities, which charge monthly rental fees and insurance.

Opening of accounts

Terminal allows to work with two types of accounts: demo accounts and real accounts. Demo accounts enable working under training conditions, without real money on them, but they allow to work out and test trading strategy very well. They possess all the same functionality as the real ones. The distinction consists in that demo accounts can be opened without any investments, though one cannot count on any profit from them.

Opening of a demo account #

A demo account can be opened by the "file – open an account" menu command or by the same command of the "navigator – accounts" window context menu. Besides, the terminal will offer to open a demo account at the first program start to begin working immediately.

The process of opening an account consists of several steps:

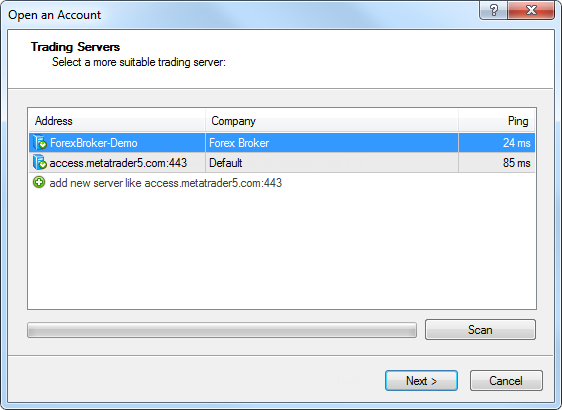

Selecting server

The first stage of account opening is selection of a server to connect to. Addresses of available servers, their names and ping are listed there. The most preferable is the server having the lowest ping. To perform additional checking the ping, you should press the "scan" button. After that the ping information becomes refreshed.

Also in this window you can add a new server to connect to. To do it, press the " add new server" button or the "insert" key. A server can be specified in different ways:

- Write its address and port separated with a colon. For example, 192.168.0.100:443;

- Write its domain name and port separated with a colon. For example, mt.Company.Com:443;

- Write an accurate name of a brokerage company.

As soon as you specify a server, press "enter". To delete a server, select it and press the "delete" key.

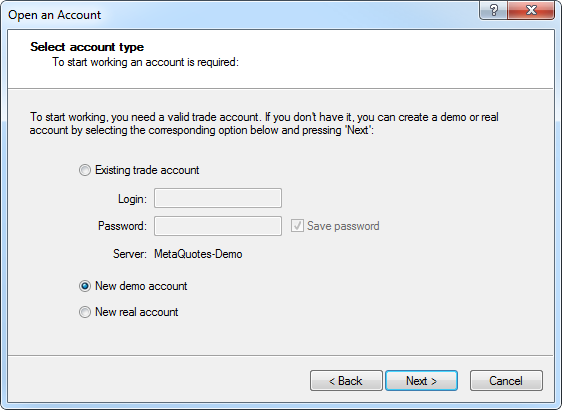

Account type #

At this stage a user can specify details of an existing trade account or start creating a new one.

This window contains three options:

- Existing trade account – if this option is chosen, it is necessary to fill out the "login" and "password" fields with the corresponding account details. A server selected at the previous step is displayed below these fields. You will be authorized at the specified server using the specified account as soon as you press the "done" button.

- New demo account – if you choose this option and press the "next" button, you will go to the creation of a new demo account.

- New real account – if you choose this option you will pass to specifying personal details for sending a request to open a real account.

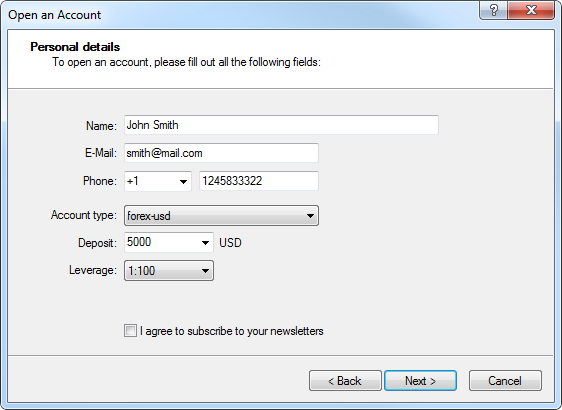

Personal details

The next stage of opening an account is specifying personal details:

The following data will be requested to open an account:

- Name – the user's full name.

- E-mail – email address.

- Phone – contact telephone number.

- Account type – account type to be selected from the list defined by the brokerage company.

- Deposit – the amount of the initial deposit in terms of the basic currency. The minimum amount is 10 units of the specified currency.

- Currency – the basic currency of the deposit to be set automatically depending on the account type selected.

- Leverage – the ratio between the borrowed and owned funds for trading.

To activate the "next" button and continue registration, it is necessary to flag "I agree to subscribe to your newsletters".

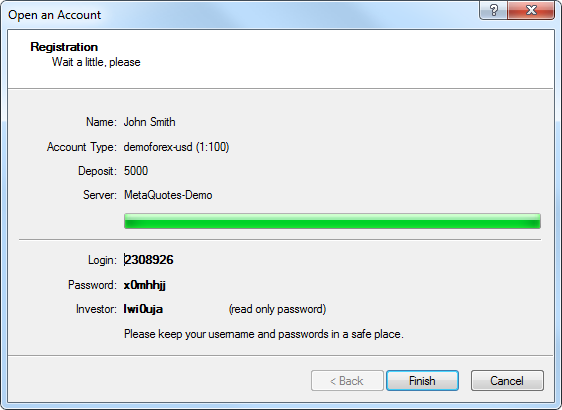

After the registration has successfully completed, a window will appear that contains information about the open account: "login" – the account number, "password" – the password for access, "investor" – the investor's password (connection mode in which it is possible to check the account status, analyze the price dynamics, etc., but no trading is allowed).

After registration has been completed, the new account will appear in the "navigator – accounts" window, and it is ready to work with. At that, the server sends a message to the terminal containing login and passwords of this newly opened account. This message can be found in the "terminal – mailbox" window. Besides, after the account has been successfully registered, it will be authorized automatically.

Attention: if any problems occur at the account opening, technical support service of the brokerage company should be asked for help.

Opening of a real account #

Real accounts, unlike demo accounts, cannot be opened from the terminal. They can only be opened by brokerage companies under certain terms and conditions. Real accounts are marked correspondingly in the "navigator – accounts" window. To start working with them, one must perform authorization.

Account types or kinds of accounts - personal, real, nominal

Personal accounts

Tangible

In the initial stages of learning accounting, we assume real accounts to be those representing tangible elements. This is because all the elements that we deal with at this stage have that characteristic.

There is no hard and fast rule that all assets should be tangible.

Eg : goodwill of an organisation is an intangible asset.

There are many other ways the terms real accounts and the term asset can be interpreted and understood. For now, please, stick to the simple understanding that assets are tangible aspects and are thus identified as real accounts.

Nominal accounts

We do not come across such accounts till a later stage of our learning. For now, please, assume that such accounts exist.

Profit on sale of asset a/c - representing the profit made on sale of assets, a gain.

We do not come across such accounts till a later stage of our learning. For now, please, assume that such accounts exist.

Every account head belongs to one of the three types

We use this property to identify the nature of an account sometimes. Where an account cannot be classified under two types, it should be the third type.

- Nominal accounts are accounts other than personal and real accounts

- Real accounts are accounts other than personal and nominal accounts

- Personal accounts are accounts other than real and nominal accounts

Accounting system - minimum accounting heads

Where the information needed by the organisation is very minimal, it can account for the transactions relating to its business with a minimum of four accounting heads.

Assets and liabilities

Assets a/c

All the real accounts and the personal accounts representing debtors are to be assumed to be represented by the account head named asset a/c. Asset a/c would take the place of furniture a/c, machinery a/c, land a/c, buildings a/c, shyam's a/c (debtor), bank a/c, cash a/c etc.

Liabilities a/c

Liabilities are generally made up of personal accounts representing owned capital and loaned capital. Liabilities a/c would take the place of capital a/c, ram's a/c (creditor) etc.

Note : assets and liabilities include only accounts of the type real and personal.

Incomes/gains and expenses/losses

Expenses/losses a/c

All the nominal accounts representing expenses and losses are to be assumed to be represented by the account head named expenses/losses a/c

Incomes/gains a/c

All the nominal accounts representing incomes and gains are to be assumed to be represented by the account head named incomes/gains a/c

Minimum five account heads

Thus to have a clear and better understanding/information regarding liabilities, the liabilities a/c is replaced by two accounts: capital a/c and liabilities a/c.

The more the information we need the more the accounting heads we have to maintain.

Therefore, the minimum accounting heads to be maintained would be 5 i.E. Capital a/c, liabilities a/c, assets a/c, expenses/losses a/c, incomes/gains a/c.

Elements effected by a transaction - identifying account type

The business is proposed to be started.

Started business with a capital of 1,00,000.

Since capital in the form of cash is being brought into the business, capital increases by 1,00,000 and cash increases by 1,00,000

Elements effected by the transaction are

Bought furniture for cash 25,000

Since furniture is being bought by paying cash, the value of furniture increases by 25,000 and the cash available with the business would reduce by 25,000.

Elements effected by the transaction are

Bought goods for cash 25,000 from M/s roxy brothers.

Since goods are bought by paying cash, the value of goods increases by 25,000 and the cash available with the business would reduce by 25,000.

Elements effected by the transaction are

Bought goods from mr. Shyam rao on credit for 10,000.

Since goods are bought on credit, the value of goods increases by 10,000. The liabilities of the business would increase by 10,000. This liability is indicated by an element identified by the name of the vendor who gave the goods on credit i.E. Mr. Shyam rao.

Elements effected by the transaction are

Sold goods for cash 20,000 to mr. Peter.

Since goods are sold by taking cash, the value of goods decrease by 20,000 and the cash available with the business would increase by 20,000.

Elements effected by the transaction are

Sold goods on credit to M/s bharat & co., for 10,000.

Since goods are sold on credit, the value of goods decreases by 10,000. A new asset in the form of a debtor (those who owe us) is created. The new asset is indicated by an element identified by the name of the organisation which purchased the goods on credit i.E. M/s bharat & co.

Elements effected by the transaction are

Paid cash into bank 60,000.

Since cash is paid into bank, the available cash reduces by 60,000. The amount paid into the bank is held by the bank on our behalf. The bank has to pay us the same whenever we ask for it. The bank therefore stands in the position of a debtor to us (those who owe us money). The amount of balance in the bank which is newly created increases from zero by 60,000.

Elements effected by the transaction are

Paid cash to mr. Shyam rao, 5,000

Since cash is paid to mr. Shyam rao, the available cash reduces by 5,000 and the liability in the name of mr. Shyam rao (the amount due to him) also reduces by 5,000.

Elements effected by the transaction are

Received cash from M/s bharat & co., on account, 8,000

Since cash is received from M/s bharat & co., the available cash increases by 8,000 and the asset (debtor) in the name of M/s. Bharat & co (the amount receivable from them) also reduces by 8,000.

What is the difference between a nominal account and a real account?

Definition of nominal account

The balance in a nominal account is closed at the end of the accounting year. As a result, a nominal account begins each accounting year with a zero balance. Since the balance does not carry forward to the next accounting year, a nominal account is also referred to as a temporary account.

Examples of nominal accounts

The nominal accounts are almost always the income statement accounts such as the accounts for recording revenues, expenses, gains, and losses. When the income statement accounts are closed at the end of the accounting year, the net amount will ultimately end up in a balance sheet equity account such as the proprietor's capital account or the corporation's retained earnings account.

Definition of real account

The balance in a real account is not closed at the end of the accounting year. As a result, a real account begins each accounting year with its balance from the end of the previous year. Because the end-of-the-year balance is carried forward to the next accounting year, a real account is also known as a permanent account.

Examples of real accounts

The real accounts are the balance sheet accounts such as the accounts for recording assets, liabilities, and the owner's (or stockholders') equity. However, the sole proprietor's drawing account, which is reported on the balance sheet during the year, is a temporary account because it is closed directly to the owner's capital account at the end of the year.

So, let's see, what we have: there are mainly three types of accounts in accounting: real, personal and nominal accounts, personal accounts are classified under three subcategories.. At real account 3

Contents of the article

- Top forex bonuses

- What are the three types of accounts?

- 1. Real accounts

- 2. Personal accounts

- 3. Nominal accounts

- What is a real account?

- What does real account mean?

- Example

- Summary definition

- Types of accounts: real, personal and nominal...

- Three types of accounts into accounting system...

- 1. Real account definition:

- Example of real accounts:

- 2. Personal account definition:

- Example of personal accounts:

- 3. Nominal account definition:

- Example of nominal accounts:

- Basics of accounting for beginners

- リアルアカウント 3 [ real account 3 ]

- (real account #3)

- Get A copy

- Friend reviews

- Reader Q&A

- Lists with this book

- Community reviews

- Types of accounts

- Types of accounts in accounting

- Real account

- Personal account

- Nominal account

- 17 thoughts on “ types of accounts ”

- Real asset

- What is a real asset?

- Understanding real assets

- Special considerations

- Real assets vs. Financial assets

- Advantages and disadvantages of real assets

- Opening of accounts

- Opening of a demo account #

- Opening of a real account #

- Account types or kinds of accounts - personal,...

- Personal accounts

- Tangible

- Nominal accounts

- Every account head belongs to one of the three...

- Accounting system - minimum accounting heads

- Assets and liabilities

- Assets a/c

- Liabilities a/c

- Incomes/gains and expenses/losses

- Expenses/losses a/c

- Incomes/gains a/c

- Minimum five account heads

- Elements effected by a transaction - identifying...

- The business is proposed to be started.

- Started business with a capital of 1,00,000.

- Bought furniture for cash 25,000

- Bought goods for cash 25,000 from M/s roxy...

- Bought goods from mr. Shyam rao on credit for...

- Sold goods for cash 20,000 to mr. Peter.

- Sold goods on credit to M/s bharat & co., for...

- Paid cash into bank 60,000.

- Paid cash to mr. Shyam rao, 5,000

- Received cash from M/s bharat & co., on account,...

- What is the difference between a nominal account...

- Definition of nominal account

- Examples of nominal accounts

- Definition of real account

- Examples of real accounts

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.