Virtual forex online

We recommend playing with these settings over and over again until you discover the winning settings.

Top forex bonuses

The first step is to open the strategy tester window by simply pressing CTRL+R or by clicking the respective icon found in the top toolbar.

Best forex trading simulator - virtual money

In this article, we will cover the best forex simulator software of 2019. You’ll find step by step instructions for how to choose the best simulator software, how to use simulators for day trading, and also how to test your forex trading strategy.

Using simulators will help you get rid of the bad habits and become a better trader. Simulated forex trading can be one of the most efficient ways to practice trading risk-free. Throughout this guide, you’ll learn how to gain live-market experience and discover the benefits of using a forex trading simulator software.

Is this your first time on our website? The team at trading strategy guides welcomes you. Make sure you hit the subscribe button, so you get your free trading guide delivered every week to your inbox.

To determine whether or not forex trading is for you, you need to engage in the markets and to do your due diligence before committing any real money into the game. Using real-time historical data you can reduce your learning curve and quickly determine if forex trading is right for you.

Simulated forex trading does present some issues. Often times, positive results on a demo account can translate into negative results in a live trading environment. This can make people question the validity of simulated trading.

However, the real cause behind this discrepancy is due to the lack of emotional involvement you get when real money is at stake.

Moving forward, you will learn what simulated forex trading is and how you can benefit from sim trading.

What is simulated forex trading?

A forex trading simulator is a piece of software that allows you to test your strategy offline using the historical data from the markets. If you have new trading ideas, trading simulator software can help you test them. This allows you to find what works and what doesn't, and eliminate any losing strategies.

While you might be working with a demo account, the market conditions resemble the live trading environment. You can open and close trades and modify orders the same way you would do in a live trading session.

The main advantages of using a free forex trading simulator are as follows:

- Acts as a live trading environment.

- Ability to backtest and forward test your trading strategy.

- Implement new trading ideas to see if they work.

- Risk-free account trading with all the functionalities and trading features of live trading.

Using a free forex trading simulator can help you learn the ropes to succeed in trading. If you apply the 10,000-hour rule of mastery to your trading, you definitely need a forex sim to practice your skills.

Before you start evaluating your current trading strategy, you need to make sure you use the right setup.

In the next section, we'll show you what to look for when comparing the key features of the best forex trading simulator software.

Best forex trading simulator

There are several important factors that every forex trading sim needs to be equipped with. At a bare minimum, it’s important for your simulator to satisfy the following requirements:

1. Live pricing feed

It’s necessary to ensure your simulator has a real market environment that streams live pricing data. Without live pricing data, you’ll miss the opportunity to examine your trading strategy effectively.

A live pricing feed mimics the spreads. This means when you run your strategy through a simulator, it will use the actual spreads found in the market.

This feature is more important than anything else.

Having real-time price data will ensure that your backtested results are accurate. This helps you determine whether you can rely on the simulated historical data found in the software.

This brings us to the next important feature that any sim trading software should have.

2. Forex trading simulator historical data

Secondly, you need to have accurate historical forex data that goes several months back. Not having enough historical price data to simulate the performance of your trading strategy will lead to unrealistic backtested results.

The best online forex simulators will provide you with historical prices. It will also provide you with the ability to browse historical quote data for your preferred currency pair. Aside from the end-of-day quote data, the database should also cover intraday quotes. No matter your trading style, be it day trading or swing trading, the best forex trading simulator will be able to help.

The historical price data needs to be in a clear format where you get the high, low, open and closing prices for the selected currency pair and selected time frame. In some instances, you can also get the tick volume information. If your trading strategy is based on volume, it’s vital to have access to the volume data.

Let’s move forward and see what other features your free forex trading simulator needs to have.

3. Flexible virtual money account

In our experience, traders fail to see the importance of using a virtual account balance. It's recommended to start with a balance close to the amount you wish to use in your live trades. If you can only fund your live trading account with $5,000, there's no point to use a $100,000 demo balance.

This has the potential to set unrealistic expectations that will lead to bad habits once you start live trading.

Simply put, ensure that the virtual money account you’re using to backtest your trading strategy is the amount you will fund your trading account with. This will also allow you to implement a more realistic risk management strategy.

This way you will have no issues when you transition to live trades.

When you start trading with a demo account, you don’t need to invest any real money. Make sure you pick a free forex trading simulator that has the minimum of trading features and tools to get you started.

Starting out with the world’s most popular forex trading platform aka metatrader4 might save you time in the long run.

Below you’ll find a step-by-step guide to use MT4 strategy tester

Best forex trading simulator – MT4 strategy tester

In this section, you’re going to learn how to backtest a strategy using the MT4 strategy tester. For this reason, we’re going to use a default strategy that can be found in the MT4 strategy library.

The first step is to open the strategy tester window by simply pressing CTRL+R or by clicking the respective icon found in the top toolbar.

Make sure you’ve selected the preferred time frame window and the appropriate settings. For the purpose of this example, we have chosen the following settings:

- Expert advisor = moving average.Ex4 (the name of the strategy we backtest)

- Symbol = EUR/USD (the instrument we run our strategy on)

- Model = every tick which is the most precise method

- Period = 1H (the preferred time frame to run our strategy)

- Spread = current

We recommend playing with these settings over and over again until you discover the winning settings.

Once finished with selecting the settings, click on the start button so that the simulation can begin. You can check the results of the backtesting strategy under the report tab.

In the proposed example, we can notice that the default moving average trading strategy has produced a net loss of approximately -$400 during the tested period. This means that we’re not yet ready to jump into live trading.

We need to work more on our strategy and fine-tune the strategy parameters until you discover a profitable trading strategy that you’re comfortable to go live with.

Check out our guide how to backtest a trading strategy for more trading tips and tricks.

Conclusion – forex trading simulator

The goal of simulated forex trading is to filter out bad trading strategies and to optimize your trades to get bigger profits out of your trading system. The key to successful trading is to make the transition to live trading as soon as the simulation provides evidence that you have an edge on the market.

Find a forex trading simulator that's popular among other traders, and practice your trading strategy without the risk before you start trading in real time. Get the experience first, start live trading when you develop your strategy.

Sim trading is part of the process of becoming a profitable trader, and it’s the perfect environment to learn the skills of forex trading without losing money in the process. Also, check out our zero to $1 million forex strategy.

Feel free to leave any comments or advice below, we always respond!

Also, please give this strategy a 5 star if you enjoyed it!

Please share this trading strategy below and keep it for your own personal use! Thanks traders!

Trade with the no. 1 broker in the US for forex trading*

Why are traders choosing FOREX.Com?

No. 1 FX broker in the US*

We have served US traders for over 18 years.

Trade 80+ FX pairs, and gold & silver

Global opportunities 24/5 with flexible trade sizes.

EUR/USD as low as 0.2

Trade your way with flexible pricing options including spread only, spread + fixed commission, or STP pro.

*based on client assets per the 2019 monthly retail forex obligation reports published by the CFTC

Financial strength you can depend on

Your FOREX.Com account gives you access to our full suite of downloadable, web, and mobile apps.

Get 20 free, easy to install eas and custom indicators when you open a metatrader live or demo account.

* based on active metatrader servers per broker, apr 2019.

Reward yourself with our active trader program

- Save up to 18% with cash rebates as high as $9 per million traded

- Interest paid up to 1.5% on your average daily available margin balance

- Get guidance and priority support from your dedicated market strategist

- No bank fees for wires

- Access to exclusive events and product previews

Open an account in as little as 5 minutes

Tell us about yourself

Fund your account

Start trading

Ready to learn about forex?

New trader?

Welcome, we’ll show you how forex works and why you should trade it.

Have some experience?

Let’s create a trading plan that will help you stay on track and meet your goals.

Want to go deep on strategy?

Great, we have guides on specific strategies and how to use them.

Not sure where to start?

Take our short quiz and get matched resources that fit your trading style.

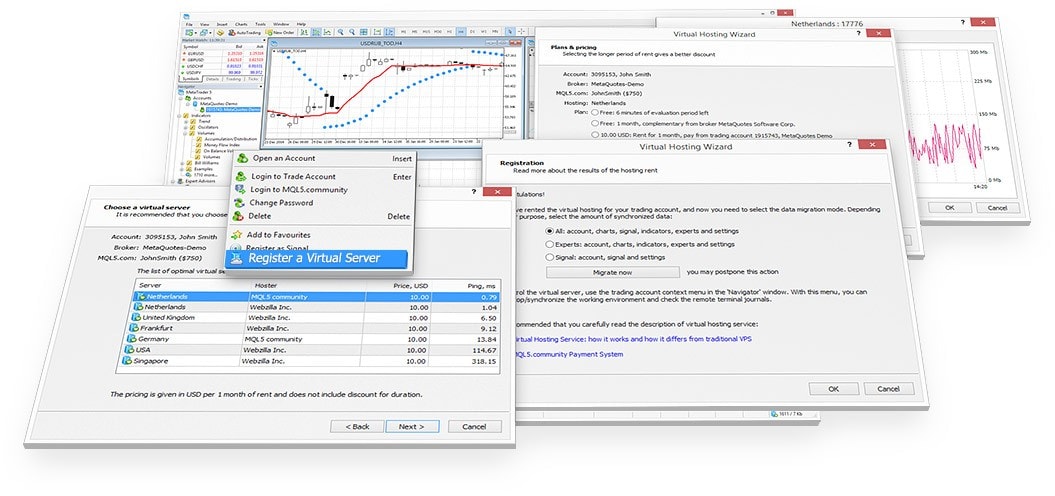

Virtual hosting in metatrader 4

Use trading robots and copy signal providers' deals 24/7 (forex VPS)

The virtual hosting provides round-the-clock operation of the client terminal (forex VPS). This is very convenient if you use trading robots or copy deals using trading signals. The virtual hosting service allows your trades to be executed at any time with minimum delay!

Renting a virtual server right from the metatrader 4 terminal is the optimal way to ensure uninterrupted operation of your trading robots and signal subscriptions. Essentially, it is an analogue of a service as is the VPS, although it is a superior and more suitable service for addressing the needs and challenges that a trader comes across. The server can be rented directly from your metatrader 4. It takes only a couple mouse clicks for experts advisors, indicators, scripts together with signal subscriptions and other settings to be transferred to the virtual server.

The major advantages of the built-in virtual hosting include minimum network latency to a broker server, ease of use and reasonable price. This is the optimal solution for traders who want to use robots and signals 24 hours a day.

Watch the tutorial video to learn more about renting a virtual server and its advantages!

Forex 101 - the forex and CFD trading course

Step up your trading game with our free online forex and CFD trading course. We hope that this 3 step programme will help you learn everything you need to know to begin trading forex and cfds. Don`t just take our word for it, see for yourself!

9 online lessons

The full course is available online and in 18 different languages. You`ll get access to 9 video lessons, each of which will be accompanied by detailed written notes and be followed by a quiz!

Learn from the pros

Learn forex from experienced professional traders. Each lesson focusses on a key topic and has been carefully crafted and delivered by two leading industry experts.

Access

Access the first 3 lessons now – free for all, get a demo trading account to unlock the rest of the course and put your knowledge to practice.

Train anytime, anywhere

Learn to trade on your commute, in a cafe, or after work - it`s up to you! With all 9 lessons available online, you can easily fit your learning around your life.

What is forex 101?

Our previous education campaign, zero to hero, was so popular that we decided to make a brand new one! Forex 101 is a forex trading course designed to help even absolute beginners learn how to trade. The training course is absolutely free and 100% online. Each lesson will feature a video, written notes and a follow-up quiz. The course will be split over 3 steps - `beginner`, `intermediate` and `advanced`. The world of forex trading awaits. Are you ready for class?

Getting started

Kick off this forex trading course by learning the basics. Our experts will tell you all about the impact of the forex market on the world-stage, teach you all the key terms you`ll need and walk you through creating your very own demo trading account.

1. Getting to know forex

2. A trader`s starter pack

3. Practise time! Get your own demo account!

1. Setting up MT4

2. Making your first trade

3. Thinking strategically

Getting a feel for forex trading

You're getting there now! Over these three lessons our forex trading experts will teach you how to set up your trading platform, how to make your first demo trade and then explain the power of utilising a trading strategy.

Getting a feel for forex trading

You're getting there now! Over these three lessons our forex trading experts will teach you how to set up your trading platform, how to make your first demo trade and then explain the power of utilising a trading strategy.

1. Setting up MT4

2. Making your first trade

3. Thinking strategically

Taking it to the next level

In this final step of the forex course our experts will teach you how to perfect your trading set ups. You`ll learn all about making a trading plan and how to use vital indicators, as well as get some tips that may help you minimise risk.

1. Creating your game plan

2. The power of indicators

3. Managing risk effectively

So, are you ready to begin?

Risk warning: trading forex (foreign exchange) or cfds (contracts for difference) on margin carries a high level of risk and may not be suitable for all investors. There is a possibility that you may sustain a loss equal to or greater than your entire investment. Therefore, you should not invest or risk money that you cannot afford to lose. Before using admiral markets UK ltd, admiral markets AS or admiral markets cyprus ltd services, please acknowledge all of the risks associated with trading.

The content of this website must not be construed as personal advice. We recommend that you seek advice from an independent financial advisor.

All references on this site to ‘admiral markets' refer jointly to admiral markets UK ltd, admiral markets AS and admiral markets cyprus ltd. Admiral markets' investment firms are fully owned by admiral markets group AS.

Admiral markets UK ltd is registered in england and wales under companies house – registration number 08171762. Admiral markets UK ltd is authorised and regulated by the financial conduct authority (FCA) – registration number 595450. The registered office for admiral markets UK ltd is: 60 st. Martins lane, covent garden, london, united kingdom, WC2N 4JS.

Admiral markets AS is registered in estonia – commercial registry number 10932555. Admiral markets AS is authorised and regulated by the estonian financial supervision authority (EFSA) – activity license number 4.1-1/46. The registered office for admiral markets AS is: maakri 19/1, 11th floor, 10145 tallinn, estonia.

Admiral markets cyprus ltd is registered in cyprus – with company registration number 310328 at the department of the registrar of companies and official receiver. Admiral markets cyprus ltd authorised and regulated by the cyprus securities and exchange commission (cysec), license number 201/13. The registered office for admiral markets cyprus ltd is: dramas 2, 1st floor, 1077 nicosia, cyprus

Admiral markets pty ltd registered office: level 10,17 castlereagh street sydney NSW 2000. Admiral markets pty ltd (ABN 63 151 613 839) holds an australian financial services licence (AFSL) to carry on financial services business in australia, limited to the financial services covered by its AFSL no. 410681.

Fxdailyreport.Com

Forex VPS stands for forex virtual private servers. These are remote servers which are used to host forex trading software, expert advisors and indicators in order to allow for continuous, round-the-clock trading even when the trader’s local computer is not running. A forex VPS operates on the principle of shared hosting, as it requires servers placed in specially constructed data centres with controlled environments for optimal performance.

How does a forex VPS work ?

The diagrams below indicate how a forex VPS works.

(courtesy of forexcrunch.Com)

This is the traditional setup for the trader. The trader has a local computer, which has to be connected to the internet for the trading station (usually the MT4) to run and trade. An expert advisor (EA) attached to the local computer requires internet connection to be able to trade. Without an internet connection, the EA cannot trade. This puts a limitation on the trader as trading opportunities can only be taken by the eas when the computers they are attached to are internet-enabled.

(modified from original snapshot from forexcrunch.Com)

The second scenario shows the role of the forex VPS. The forex VPS bypasses this limitation by creating a direct and continuous internet connection through its servers hosted in the data centres. What is required is for the trader to host the EA on the forex VPS. The forex VPS is by default, configured to transmit data and trade orders to the broker’s MT4 server. In order to get the best of the forex VPS, the hosting servers must be “co-located” with the broker’s servers. In other words, the forex VPS server’s data centres must be located as close to the broker’s servers as possible.

This is why the institutional traders host their trading stations in the same buildings where the exchanges and brokerage centres are located. For instance, the new york stock exchange houses a facility within its building where institutional traders can rent space to locate their high frequency trading facilities.

Features of forex VPS software

Forex VPS software have CPU cores, storage space and bandwidth. These are all features that are seen with regular web hosting. These features are all arranged into plans by the forex VPS providers. Each plan will therefore have a unique product offering in terms of how much storage space or bandwidth it allocates to the user. It is important for the trader to get a plan that will serve their trading purposes. These plans are paid for on a monthly or annual basis. As we will examine later, getting plans that have huge storage and bandwidth do not necessarily translate into better forex VPS services.

How to use a forex VPS

These are the steps required to successfully use a forex VPS.

Step 1: the first step is to purchase a suitable forex VPS plan from a provider. When this is done, the trader is allocated a username and a password with which to create access between the local computer and the remote computer (the forex VPS). Your forex VPS provider will usually give you instructions on how to install the forex VPS.

Step 2: click on the windows start button, and in the search bar, type remote desktop connection. This calls up the file and its location. Click on it.

Step 3: you will be shown a pop-up where you will be asked to enter your forex VPS username in order to connect to the server.

Step 4: enter your username and password (your forex VPS credentials).

This connects you to the forex VPS server. Follow the set of instructions provided by your forex VPS provider to connect your eas to the remote computer for trading.

Considerations in selecting a forex VPS software

When choosing a forex VPS software, there are certain considerations that must be made. It is important to realize that the single most important factor is not necessarily size of bandwidth or storage space, but whether the VPS space allocated to the trader is insulated from the activities of other users on the same forex VPS. VPS hosting is essentially done by hosting several users on the same server, and allocating resources of the server accordingly in a process known as virtualization. However, it this virtualization is done using software that does not promote independence of each user’s resources, you may have a situation where one user’s activities start to affect other users adversely. For instance, some users may not use their forex VPS exclusively for forex trading and may add other software to their remote computer. Some traders may have so many instances of forex trading software, charts and add-ons running that it starts to slow the server down, causing other users to experience delays, network interruptions or even downtimes. This will prove costly to you as a trader if you experience this phenomenon. Therefore, to prevent downtimes and interruptions, you have to be careful of the forex VPS you choose for your trading.

So when choosing your forex VPS provider, you must ensure you follow these considerations to avoid issues in the future:

- Only use forex VPS providers that provide technology that allows insulation/independence of individual forex VPS users. This technology is the hyper-V technology for users on forex VPS that run on microsoft windows servers, and openvz for users that use computers that run on linux. These are the only forex VPS configurations that will guarantee a super-stable forex VPS operation.

- Avoid forex VPS providers that run their systems on virtuozzo software, as this software does not promote independence of forex VPS allocated resources and therefore puts users at risk from overloading of the system by another user.

- If possible, choose a forex VPS provider that already has an instance of the MT4 trading terminal installed. All you need to do in this case is to change the server location to point to that of your broker. This can be done from the options tab.

- Choose a forex VPS that has a good uptime record. 99.99% uptime is ok for your business.

Conclusion

A forex VPS is a necessity for today’s retail traders, as this is the closest they can get to mimicking the co-location setups of the institutional traders. Make sure that when you choose a forex VPS server, it is one which is located closest to the broker’s server. Your forex VPS provider will tell you in what town the data centre hosting your forex VPS, is located.

Related articles of VPS for forex trading

Trade with the global forex trading specialist

Why FOREX.Com?

Metatrader

Trade over 500 markets including equities, indices, FX and commodities on the new and improved MT5

Competitive pricing

Maximize your potential with straightforward pricing choices to suit your trading style

Active trader

Earn rebates and one-on-one professional support when you qualify for our active trader program

Financial strength you can depend on

Your FOREX.Com account gives you access to our full suite of downloadable, web, and mobile apps.

Trade on one of the world's most popular trading platforms with access to dedicated support and integrated trading tools exclusive to FOREX.Com.

Leverage our experts

Our global research team identifies the information that drives markets so you can forecast potential price movement and seize forex trading opportunities.

Ready to learn about forex?

New trader?

Welcome, we’ll show you how forex works and why you should trade it.

Have some experience?

Let’s create a trading plan that will help you stay on track and meet your goals.

Want to go deep on strategy?

Great, we have guides on specific strategies and how to use them.

Not sure where to start?

Take our short quiz and get matched resources that fit your trading style.

Open an account in as little as 5 minutes

Tell us about yourself

Fund your account

Start trading

Go to content for my region

Try a demo account

It's your world. Trade it.

I would like to learn about

Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Contracts for difference (cfds) are not available to US residents.

FOREX.Com is a trading name of GAIN global markets inc. Which is authorized and regulated by the cayman islands monetary authority under the securities investment business law of the cayman islands (as revised) with license number 25033.

FOREX.Com may, from time to time, offer payment processing services with respect to card deposits through its affiliate, GAIN capital UK ltd, devon house, 58 st katharine’s way, london, E1W 1JP, united kingdom.

GAIN global markets inc. Is part of the GAIN capital holdings, inc. Group of companies, which has its principal place of business at 135 US hwy 202/206, bedminster, NJ 07921, USA. All are separate but affiliated subsidiaries of stonex group inc.

Understand peer-to-peer foreign currency exchange

Anyone who has studied or worked, or even done business overseas has probably come across the problem of how to exchange and send money abroad. Banks and brokers usually charge a premium on the total amount exchanged as well as a transfer fee. But over time, a new niche developed in the market to address this need. A new wave of internet-based, peer-to-peer (P2P) foreign currency exchange services is cutting banks—not to mention their fees—out of the exchange.

Through an online P2P platform, individuals can find and safely exchange currency with individuals in other countries at much lower costs. Most online P2P companies claim to provide up to a 90% cost saving to clients on international exchange and transfer fees. Read on to find out more about how this part of the industry works.

Key takeaways

- Peer-to-peer foreign currency exchanges provide users with an online platform where they can exchange currencies with one another.

- These services cut out banks and foreign exchange services.

- P2P exchanges provide users with cost savings and convenience.

- Some P2P companies are regulated by more than one country.

What is a P2P currency exchange?

Peer-to-peer foreign currency exchanges provide users with an online platform where they can exchange currencies. P2P networks depend on digital transfers rather than the exchange of physical currency. Users rely on an internet connection, which means they can use desktop computers, tablets, and smartphones to make any exchanges.

These services essentially cut out the middleman—banks, foreign exchange (forex) services, and other institutions—by allowing users to make trades between themselves. Since there are no dealers involved, users may be able to get a better rate on their exchange.

Exchanges are particularly convenient for common currencies like dollars, pounds, euros, and yen where there are always many people looking to exchange. Because the platforms depend on connecting individual users in different countries, users of smaller currencies may not immediately find a good corresponding match. Some users may find that certain platforms do not deal with small currencies at all. Users who want to exchange a very large amount of money may also have trouble finding a match.

How P2P exchanges work

Using an exchange is fairly simple. Users register with a P2P currency exchange service for an online account in order to make deposits. Depending on the site, users can accept a given exchange rate or bid on an exchange rate of their choosing. The site then makes a match, shows a change in the ownership of funds, and remits them within one to two days through a simple domestic transfer. No currency ever leaves the country but is merely exchanged between users. Users can send money to any person or business account—even to their own account in another country.

For example, suppose mary is an american working in paris for a year and earns euros. She needs to convert them to dollars and place them in her american bank account in order to pay her american mortgage. Meanwhile, john in los angeles wants to convert dollars into euros to send to his son who is studying in france. Instead of going to a bank, mary and john sign up for accounts on a P2P currency exchange website. Mary deposits euros into her P2P account and john deposits dollars into his. The P2P website shows mary and john how many dollars or euros they will receive for their transfers, and they each confirm the transfer. Within a day or two, the P2P currency exchange service will have john’s dollars transferred into mary’s american bank account. At the same time, mary’s euros will be transferred to john’s son in france.

But what happens if there's a shortfall or there are no good currency matches? The provider steps in to provide liquidity. In these situations, the user may be charged an additional fee. For example, if there is no suitable currency match, currencyfair, charges between 0.4% and 0.6% to make the exchange with its own funds—slightly more than the platform's 0.25% to 0.3% for peer matches.

Significant cost savings

The most attractive feature of P2P foreign currency transfer is the cost savings. By sidestepping banks and brokers, these platforms provide currency exchange at much lower rates. The average saving rate on international transfers for P2P users compared to banks ranges between 75% to 90%. Naturally, the savings depend on how much banks charge, which in most cases hovers between 2% to 5%.

According to P2P foreign currency exchange platform currencyfair, a typical bank would transfer £2,000 for a fee of £100 or about 5% of the exchange—£40 for international transfer fee plus £60 for the exchange rate margin. For the same £2,000, currencyfair charges just £8.50 or about 0.5%—£2.50 for the transfer fee plus £6 for the exchange rate margin.

Another advantage that these marketplaces offer is convenience. Users can access them anytime from anywhere. They are easy to use for both small and large sums and the transactions clear quickly—usually within one to two days, but users can pay extra for guaranteed same-day or next-day transfers.

P2P foreign currency exchanges aren't just for the everyday consumer. In fact, these exchanges also target businesses. Kantox is an online marketplace that specializes in dealing with mid-cap companies, along with small- and medium-sized enterprises. According to the exchange's website, it has more than 800 corporate clients.

Choosing the right P2P currency exchange service

Before choosing and using a P2P foreign currency exchange platform, do some basic research. Here are a few tips to get you started:

- Look for a firm that does high volume—the more transactions, the more liquidity. This is essential for better rates, quick conversions, and smooth transfers. Check the number of currencies the exchange offers along with the time it takes to carry out the transfers.

- Check that the firm exchanges your specific currencies.

- Compare the exchange rates and fees of different firms.

- Check that the firm is registered with the authorized country agency and has all the necessary licenses.

- Use a firm that keeps customer money in segregated accounts versus common accounts. Segregation offers the consumer better protection if the company ever has financial difficulty.

Do your research before you decide which P2P currency exchange service to use.

Regulation

P2P currency exchanges move incredible sums of money. Currencyfair’s website shows a running tally of funds the company has transferred. As of march 2020, it stood at €9 billion. And there are plenty of other services in the market including:

But have financial regulators properly caught on and—more importantly—are consumers safe?

Many P2P foreign currency exchange firms are either based in or have registered offices in the united kingdom. As registered money service businesses, they are administered by her majesty’s revenue & customs (HMRC) and must follow the money laundering regulations 2007. As payment institutions, they also fall under the scrutiny of the U.K. Financial conduct authority (FCA).

There are two categories within the FCA—registered or smaller firms and authorized. Authorized firms, which are larger, must separate the customers’ money from their own at the end of each day in a process known as ringfencing. This provides better security for the user and a higher chance of recovering money should the company slip into financial difficulty. You can check the financial services register for the FCA status of the company.

Some companies are regulated by more than one country. Currencyfair in australia is regulated by the australian securities and investment commission (ASIC). The firm also has a registered office in ireland where it is regulated by the central bank of ireland. Another company, moneyswap is licensed as a hong kong money services operator and is further regulated under the FCA in the united kingdom as a small payment institution. International foreign exchange is authorized by the FCA in the united kingdom while its dubai operations are regulated by the dubai financial services authority.

In the united states, the U.S. Department of the treasury’s financial crimes enforcement network (fincen) oversees P2P currency exchange firms like venstar exchange. Firms are licensed as money transmitters by their respective state banking departments and must follow the anti-money laundering (AML) policies.

The bottom line

Peer-to-peer currency exchanges support fast transfers and provide substantial savings over banks. P2P exchange companies are growing at a fast pace by offering a lower-cost alternative to individuals and small businesses. On the downside, the P2P currency exchange marketplace does not fully protect the customers. Users should choose an established and fully regulated firm for currency exchange.

Virtual forex online

Hello, my dear reader, dani oh here, trader, investor, and cashforex trading and investing system creator!

Y ou see, welcome to the exciting world of online forex.

When you get started with online forex, you stand at the threshold of an adventure that can take you further than you ever imagined in your life.

Online forex is easy to learn, easy to get into, and easy to make a profit.

There are three rules-three building blocks to success- you should keep in mind when you’re working with online forex:

1.) learn all of the terminologies and study the market.

This won’t take you long, so be patient b etter to invest some time learning upfront than to be in the thick of online forex without a clue as to what move to make next.

A builder just didn’t decide one day that he didn’t need blueprints and didn’t need any knowledge of how building apartments worked.

He got the education first, and then he built the apartments.

Online forex is a great chance for every trader who chooses to trade in forex.

But a blueprint-or strategy with online forex is a must-have.

2.) have your strategy in place and stick to the strategy.

Don’t react with your heart.

Trade with your head, knowing the blueprint of online forex will keep you from overreacting no matter what the market does.

3.) put up stop signs in your online forex.

In every enterprise you choose to spend time doing, you need to have boundaries set.

These boundaries in online forex are known as stop-loss orders.

While there are risks with online forex (as there are in anything you do in life), it’s to know how to handle the risks that make a difference. Once you identify those risks in online forex, you can trade with confidence.

The way to trade with confidence is by having a strategy in place before you begin.

Online forex trading with a plan is like having that set of blueprints on hand to build an apartment complex. There are many variables, many things to consider when building each individual apartment building.

In order to finish the complex, you don’t start on several different buildings at once.

No, you build them one at a time and when that one building is complete, you move on to the next. When you’re finished, you have the apartment complex.

With online forex, you put a strategy in place just like building an apartment complex, but instead of buildings, you’re creating your online forex wealth one step at a time.

P:S: if you have any questions regarding this post, kindly, go ahead and comment in the comment section below or share this post with your forex trader friends using the share button on this post page, thank you!

I want to see you succeed in life and at trading.

Cashforex trading and investing system creator

Forex market trader, investor and best 14days forex success mentor!

Virtual dealer plugins!

Are they used against forex traders?

Home » what are virtual dealer plugins? Are they used against forex traders?

What are MT4 and virtual dealer plugins?

Why plugins are used in MT4 trading platform?

Does virtual dealer plugins are used against forex traders?

How "virtual dealer plugin' is used against forex traders?

This plug-in allows the broker to intentionally delay an order placed by a trader from 2 to 15 seconds or more. It’s difficult for trader to notice this small delay.

Widening spreads in order to trigger STOP OUT levels, mostly for hedged positions.

This plug-in is used to induce slippages mostly asymmetrical slippages (explained below).

Ignoring, modifying or deleting outstanding (pending) orders.

Providing false or misleading prices

On-the-fly reduction of leverage to force liquidation of large positions the broker’s customer may have open.

How to figure out if broker is using a virtual dealer plugin?

Ehren alscher

Ehren is highly motivated and accomplished forex trader with over 8 years' of experience in forex trading. He worked with reputed forex brokers as a market analyst. He has done in-depth SWOT analysis of forex brokers and value added services. In his free time he likes to play tennis and chess.

Ehren alscher | 9 min read

Ehren alscher | 5 min read

Ehren alscher | 11 min read

90% of your failure in forex trading is due to your forex broker!

Check true ECN/STP forex broker to improve your trading result!

Risk notification: this website www.Dojiforex.Com is for informational purpose only. This website does not provide investment advice, nor it is an offer or solicitation of any kind to buy or sell investment products. Before deciding to trade forex or CFD’s, it is highly advised that you evaluate your financial position and deem if you are suitable to engage in trading activities. You must acknowledge that trading in such markets carries a high level risk. Any information or advice contained on this website is intended for educational purpose only and has been prepared without taking into account your objectives, financial situation or needs. You must make your financial decisions, we take no responsibility for money made or lost as a result of using information on this website. Past performance of any product described on this website is not a reliable indication of future performance.

© copyright 2020 dojiforex™ ltd. All rights reserved.

So, let's see, what we have: the best forex trading simulator will help you get rid of the bad habits and become a better trader. Simulated forex trading can be one of the most efficient ways to practice trading risk-free. At virtual forex online

Contents of the article

- Top forex bonuses

- Best forex trading simulator - virtual money

- What is simulated forex trading?

- Best forex trading simulator

- Best forex trading simulator – MT4 strategy tester

- Conclusion – forex trading simulator

- Trade with the no. 1 broker in the US for forex...

- Why are traders choosing FOREX.Com?

- Financial strength you can depend on

- Reward yourself with our active trader program

- Open an account in as little as 5 minutes

- Ready to learn about forex?

- New trader?

- Have some experience?

- Want to go deep on strategy?

- Not sure where to start?

- Virtual hosting in metatrader 4

- Use trading robots and copy signal providers'...

- Forex 101 - the forex and CFD trading course

- Step up your trading game with our free online...

- 9 online lessons

- Learn from the pros

- Access

- Train anytime, anywhere

- What is forex 101?

- Getting started

- 1. Getting to know forex

- 2. A trader`s starter pack

- 3. Practise time! Get your own demo account!

- 1. Setting up MT4

- 2. Making your first trade

- 3. Thinking strategically

- Getting a feel for forex trading

- Getting a feel for forex trading

- Taking it to the next level

- So, are you ready to begin?

- Fxdailyreport.Com

- How does a forex VPS work ?

- Trade with the global forex trading specialist

- Why FOREX.Com?

- Financial strength you can depend on

- Leverage our experts

- Ready to learn about forex?

- New trader?

- Have some experience?

- Want to go deep on strategy?

- Not sure where to start?

- Open an account in as little as 5 minutes

- Try a demo account

- Understand peer-to-peer foreign currency exchange

- What is a P2P currency exchange?

- How P2P exchanges work

- Significant cost savings

- Choosing the right P2P currency exchange service

- Regulation

- The bottom line

- Virtual forex online

- Virtual dealer plugins! Are they used...

- What are MT4 and virtual dealer plugins?

- Why plugins are used in MT4 trading platform?

- Does virtual dealer plugins are used against...

- How "virtual dealer plugin' is used against forex...

- How to figure out if broker is using a virtual...

- Ehren alscher

- Why plugins are used in MT4 trading platform?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.