Bonus credit

When you get extra money credited to your annuity account, this means that you are going to have more money available to invest.

Top forex bonuses

With more money to put into the financial markets, you can amplify the amount of money that you are able to earn for your retirement. Over the course of many years, these bonus credits could substantially help your retirement chances. Although these bonus credits can be attractive, there are a few potential disadvantages that you will need to be aware of. One of the most common drawbacks of this type of annuity is that it will have higher surrender charges attached to it. If you think that there is a chance that you could have to surrender your annuity before it matures, this could take a significant bite out of your retirement savings.

Understanding variable annuity bonus credits

Purchasing a variable annuity can provide you with many benefits in your retirement planning. One of the features that is commonly offered with variable annuities is bonus credits. Here are the basics of bonus credits with variable annuities and how they work.

A variable annuity is a contract between you and an insurance company. You are going to provide payment to the insurance company and they are going to allow you to invest part of this money into securities. When you reach the age of retirement, you will be able to receive a regular paycheck from the insurance provider. The size of your paycheck is going to depend on how your investments in the annuity perform.

As an incentive to invest in a variable annuity, many insurance providers are now offering bonus credits to investors. Bonus credits are an amount of money that is credited to your account when you invest. For example, your variable annuity company might provide you with a bonus of 2 percent of each payment that you make for the annuity. If you give them $10,000 for the purchase of an annuity, they are going to credit $200 to your account. In some cases, the bonus credit can be a nice incentive for you to invest more of your money into a variable annuity.

The major advantage of bonus credits is that you are essentially receiving free money. They are crediting money to your account based upon how much money you give them for the annuity.

When you get extra money credited to your annuity account, this means that you are going to have more money available to invest. With more money to put into the financial markets, you can amplify the amount of money that you are able to earn for your retirement. Over the course of many years, these bonus credits could substantially help your retirement chances.

Although these bonus credits can be attractive, there are a few potential disadvantages that you will need to be aware of. One of the most common drawbacks of this type of annuity is that it will have higher surrender charges attached to it. If you think that there is a chance that you could have to surrender your annuity before it matures, this could take a significant bite out of your retirement savings.

In addition to the surrender charges being higher, they might apply for longer than normal. For example, instead of having to worry about surrender charges for the first five years, you might have to worry about them for the first 15 years instead.

Another potential problem with variable annuities that offer bonus credits is that you may not be able to receive these credits for long. Many times, the insurance company is only going to offer bonus credits for payments that are made during the first year of your contract. After this, you will not be able to receive any more bonus credits.

Bonus credit

A bonus credit is an item introduced to buy extras on metroid prime 3: corruption. They are obtained through a variety of methods, such as scanning objects or defeating enemies in a certain manner. There are four types of bonus credits in that game:

Friend credits were obtained by receiving a friend voucher from players on one's friend roster. However, ever since june 28, 2013, the servers have been shut down, preventing vouchers from being exchanged. New players seeking to earn extras with friend credits must begin the game by downloading an existing save file with pre-dowloaded credits.

Bonus credits can be used to purchase concept art galleries, a sound test, and 3D dioramas, as well as miscellaneous features like a screen-shot tool.

Red, blue and gold (referred to as yellow) credits can be unlocked in the special mission flash game.

New play control and metroid prime trilogy [ edit | edit source ]

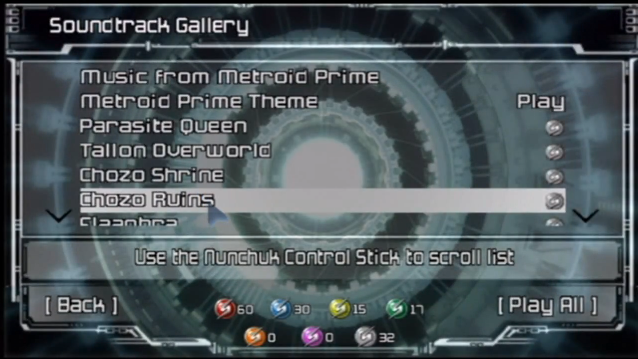

The soundtrack menu for the metroid prime trilogy. Note: all the credits are featured at the bottom center of the image.

Bonus credits are also used in the metroid prime trilogy and new play control versions of metroid prime and metroid prime 2: echoes, as well as metroid prime 3: corruption. The new types are:

- Orange credits for passing important objectives (mainly defeating bosses) in metroid prime.

- Purple credits, which have basically the same criteria as orange credits, except only while in metroid prime 2: echoes.

- Silver credits are achieved by obtaining chozo artifacts in metroid prime, the temple keys in metroid prime 2: echoes, all scans in each game, and all items in each game. One is also awarded for successfully escaping the frigate orpheon in prime.

There are a total of 48 playable songs, which are unlocked after hearing them in-game. There are 16 from metroid prime, 17 from metroid prime 2: echoes, and 15 from metroid prime 3: corruption. The songs from metroid prime and metroid prime 2: echoes cost one silver credit each. The songs from corruption cost 3 red (4 in the trilogy) , 2 blue, and 1 gold credit. Please see soundtrack gallery for a complete listing.

The prime and echoes art packages are 2 orange or purple credits each. As with the soundtrack gallery, all prices for artwork in corruption are unaltered. For a complete listing, see concept gallery.

European corruption site.

Finally, there is the bonus gallery. This gallery features multiple miscellaneous features, such as the screen-shot tool from which to take images ingame, the fusion suit from metroid fusion being an unlockable, usable cosmetic recolor in prime only, several dioramas, the ship bumper stickers and the mii bobblehead that appear in the cockpit for samus' gunship in corruption only. Unlike the gamecube version of prime, metroid is no longer an unlockable bonus due to its inclusion on the virtual console service for the wii.

How to get the best credit card sign-up bonus each time you apply

An eye-catching welcome bonus often attracts many to the world of miles and points. As much as we love using recurring benefits, the welcome bonus is the initial offer that makes us dip our toes into the water. Having said that, the motive for starting this blog was to help readers get the best possible offers so that they could travel farther for less. That begs the key question. Is there a way to ensure that you get the best possible sign-up bonus for a credit card? What are the different avenues that you should explore before you sign up for a card in order to get the highest possible welcome bonus?

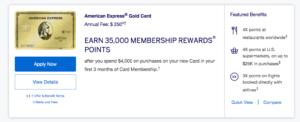

1. Is the best credit card bonus offer the one that’s publicly available?

This is the most obvious bonus that usually pops up when you do a google search. More often than not, you’ll find that the publicly available bonus isn’t the highest offer available.

The publicly available bonus if 35k, but it isn’t the highest

2. Affiliate channel

Many bloggers have partnerships with affiliate networks. Banks often partner with bloggers to launch partner only or limited opportunity offers through specific affiliate channels. In certain cases, you may be able to get a higher offer if specifically advertised.

As written earlier , the points pundit has no partnerships with credit card marketing affiliates. If you like the content and want to support the blog, I always encourage readers to use my refer-a-friend links .

3. Targeted offers (online)

Targeted offers can be of different types. Firstly, a bank targets you for a specific card and a welcome bonus. Very often, you’ll see these offers once you log into your account.

For example, chase recently targeted me with an offer even though I was above their 5/24 threshold for credit card approvals. Similarly, you can find pre-qualified offers when you log into your american express account. Other banks may send you targeted offers via email.

Similarly, an airline or hotel chain may target you with an offer. Very often, you’ll see these offers once you log into your loyalty program accounts. An airline or hotel may target you for various reasons like recent stays, flights or elite status levels.

4. Targeted offers (mail)

If you play the miles and points game, you’re surely one who keeps a tab of what’s in the mail. Banks, airlines and hotels often target customers with offers sent by mail. It’s always a good strategy check your mail regularly for any offers that may pop up. Who knows, may be your best credit card sign-up bonus arrived by snail mail?

5. In-flight sign-ups or at airport kiosks

Very often, you’ll find these offers to be lower in comparison to offers that you see online. However, it doesn’t hurt to take a quick look when your airline makes an announcement or passes on co-brand credit card offers while in flight, at an airport kiosk or a lounge.

6. Incognito offers

This is my personal favorite and continues to be for many of my readers, especially for american express credit cards. I’ve consistently found higher welcome bonuses while using the incognito mode while applying for american express credit cards. This post details some of the latest offers and how you can access them.

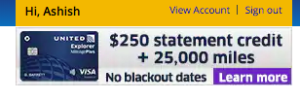

7. Shopping cart trick

The shopping cart trick is simply a trick where you access the airline or hotel website to complete a purchase but don’t finish it. When you reach the end of the process and you have to enter payment details, you’ll see a small banner with a credit card offer. Very often, these offers provide with handy statement credits of $100 or even more.

$250 statement credit while completing a booking on united.Com

8. Refer a friend offer

Credit card issuers offer refer-a-friend links to existing customers so that they serve as customer advocates to help acquire their friends or family as new customers. Amex has a fairly lucrative refer-a-friend program where you can refer for a card across the entire amex portfolio if you hold a card that earns membership rewards points. Similarly, chase also has a referral program, however it’s generally limited to only the card you refer.

The pundit’s mantra

Many people make a mistake by getting carried away and applying for offers. Limited time offers are designed to generate buzz and make people apply for a card. However, not all limited time offers may be the best possible offers available.

I hope I was able to help you gain some insight into the different avenues you should first explore before you apply for the card. Certain issuers like amex have a once-in-a-lifetime restriction, so it’s in your best interest to get a card when it’s offering the highest possible bonus.

Which other avenues or tricks do you use to attain the best possible welcome bonus for a credit card? Let us know in the comments section.

The american express gold card is currently offering a welcome bonus of 60,000 membership rewards points. You’ll earn a welcome bonus of 60,000 membership rewards points after you spend $4,000 in the first 6 months after you’re approved for the card.

Moreover, the card offers lucrative bonus earning categories, benefits and credits.

- 4x points on dining (including takeout and delivery) and grocery spend

- 3x points on flights

- $120 dining credit annually

- $120 uber eats/uber credit annually

- $100 airline credit (ends on december 31, 2021)

- No foreign transaction fees

Please note that american express may not approve you for the welcome bonus on this card if you currently have the card or have had the card in the past and received a welcome bonus for the same. This may also include any upgrade or downgrade offers that you may have signed up for.

Never miss out on the deals, analysis, news and travel industry trends. Like us on facebook , follow us on instagram and twitter and get the latest content!

Disclosure: the points pundit receives NO compensation from credit card affiliate partnerships. Support the blog by applying for a card through my personal referral links . This article is meant for information purposes only and doesn’t constitute personal finance, health or investment advice. Please consult a licensed professional for advice pertaining to your situation.

Banking bonuses and credit union promotions

Earn extra money by participating in banking bonuses and credit union promotions from national, regional and local banks and credit unions that offer cash rewards for opening new checking, savings, and business accounts.

Nationwide banking bonuses

These banking promotions are available for all U.S. Residents:

- Aspiration - $150 (debit card).

- Axos bank - $20-$100 (direct deposit).

- Bank of america - $100 (direct deposit).

- Brex cash (smbs) - $750 (debit card).

- Capital one - $400 (direct deposit).

- Chime - $75 (direct deposit).

- Citibank - $200-$1,500 ($5,000+ funding).

- HSBC bank - $200-$450 (direct deposit).

- Lili - $25 (debit card).

- Northone - $75 ($50 funding).

- One finance - $50 ($250 direct deposit).

- Oxygen - $25 ($200 funding & debit card).

- Porte - $50 (direct deposit/ACH).

- Radius bank - $50 ($500 funding).

- Sofi money - $50 ($500 funding).

- Step - $3 (open account).

Credit union promotions

Anyone in the U.S.A. Can get these credit union bonuses:

- American heritage - $200 (direct deposit & debit card).

- DCU (digital federal) - $20 (debit card).

- First tech - $100 ($250 funding).

- Premier members - $50 ($5 funding).

- Redstone FCU - $100 (debit card).

- Service CU - $75 (direct deposit).

- Skyone - $25 ($5 funding).

- Unify financial - $50 (opening & debit card).

Regional bank deals

Depending on where you live, you may earn these banking offers:

- BMO harris - $200-$500 (direct deposit).

- Chase bank - $150-$600 (varies).

- Huntington bank - $150-$200 ($1,000 funding).

- M&T bank - $250 (direct deposit).

- PNC bank - $300 (direct deposit & debit card).

- Suntrust bank - $200-$400 (direct deposit).

- TD bank - $150-$300 (direct deposit).

Recent banking offers

Review more banking bonuses and credit union promotions below:

One – shared banking: $50 referral bonus + 3% APY on autosave

Check out one to share a bank account with family or friends and access a 3% APY on your autosave deposits, plus earn a $50 bonus when you join and up to $500 for referring new members to join one. [read more] one – shared banking: $50 referral bonus + 3% APY on autosave

Lili – banking for freelancers: $25 bonus and $25 referrals + $1,000 end of 2020 bonus

Check out lili for online-only banking services if you are a freelancer, gig worker, online seller, or small business owner, plus get a $25 sign-up bonus with your new lili visa debit card, and earn up to $1,250 in rewards for referring your friends. [read more] lili – banking for freelancers: $25 bonus and $25 referrals + $1,000 end of 2020 bonus

Redstone federal credit union: $100 checking account referral bonuses (open membership)

Redstone federal credit union is offering a special $100 referral bonus for both parties when a current member refers a new member who opens a new checking account, plus membership is openly available to anyone in the U.S.A. For this promotion. [read more] redstone federal credit union: $100 checking account referral bonuses (open membership)

Step – banking for young adults: get $3 to join and $3 to refer friends

Step is a mobile banking solution for teens and young adults that offers no banking fees, instant money transfers between friends and family, and financial tools to help you manage your money better, plus you can earn $3 when you create a free step account and an additional $3 for each friend that you refer who also joins step. [read more] step – banking for young adults: get $3 to join and $3 to refer friends

First tech federal credit union: $100 checking bonus + $100 referrals (open membership)

First tech federal credit union has introduced a new referral program that provides a $100 bonus to both new and current members with only a $250 initial deposit, plus anybody in the U.S.A. Can qualify for membership. [read more] first tech federal credit union: $100 checking bonus + $100 referrals (open membership)

Capital one – 360 checking: $400 bonus with 2 direct deposits of $1,000+

Get $400 in bonus cash when you open a new 360 checking account from capital one, available online nationwide across the U.S.A. [read more] capital one – 360 checking: $400 bonus with 2 direct deposits of $1,000+

Service credit union: $75 checking bonus + $75 referral rewards (nationwide)

With free membership open to anyone in the U.S.A., you can earn a $75 bonus when you open an everyday checking account with service credit union, plus you’ll get unlimited $75 referral rewards for sharing service with your friends. [read more] service credit union: $75 checking bonus + $75 referral rewards (nationwide)

Chime banking service $75 sign-up bonus and $75 referral bonuses

Sign up for chime banking to get a $75 bonus when you set up a direct deposit to a fee-free spending account with a visa debit card, plus earn a $75 bonus for every friend that you refer who banks with chime. [read more] chime banking service $75 sign-up bonus and $75 referral bonuses

Best credit card welcome bonuses for 2021

If you’re in the market for a new credit card, you may be hoping to cash in on the hundreds of dollars in welcome bonuses offered to new customers.

Welcome bonuses are a marketing tool that credit card issuers use to lure new customers: they offer the chance to score extra rewards points or get cash back for a limited time. Some are easy to get if you spend a relatively small amount on your new card. Others offer a greater cash reward but may carry an annual fee and require that you spend heavily right away.

Top welcome bonus credit cards right now

Money expert clark howard cautions against making a long-term decision for a short-term reward.

“I never want people to be so enamored with the sign-up bonus that they end up with a card that over time will ultimately under-reward,” clark says. “the credit card issuers are making an assumption that you’re going to be really profitable over time for them. So often the bonus will be really generous, but the card itself will be pretty rotten.”

In this article, I’ll identify some of the top credit card welcome bonuses available right now. This list of cards is updated frequently as offers change:

There are some caveats to shopping for welcome bonus cards. Here are four things to consider before picking your favorite from the list below:

- I considered only those cards that carry an annual fee of $100 or less. While there are some great welcome bonuses for credit cards with annual fees that can be as high as $500, clark believes most consumers are best served by avoiding large annual fees.

- The welcome bonus offers will be listed from most valuable to least. In the case of rewards points bonuses, note that there sometimes is no cash value. And the cash-equivalent value of those points can fluctuate based on how you redeem them.

- You may get a welcome bonus offer for a card that’s different from the offer listed in this article. Welcome bonuses can vary based on a number of factors, such as date and location. I checked these offers in various web browsers over multiple days to get the most recent and accurate information possible, but please note that your results may vary.

- Clark’s philosophy is that you should never carry a balance on a rewards credit card. All welcome bonus advice issued here is given with the assumption that you’ll pay your bill in full each month as part of following clark’s 7 rules for using credit cards.

Chase sapphire preferred®

Welcome bonus offer: earn 60,000 bonus points when you spend $4,000 within your first three months of card membership. Reward points can equate to $750 toward travel when redeemed through chase ultimate rewards®.

What to know about this card

- Annual fee: $95

- 2x points bonus on travel and restaurant dining

- Chase offers 25% more value on points when redeemed for airfare, hotels, car rentals and cruises

- You can transfer rewards points to travel partners’ rewards programs at a point-for-point exchange rate

- No foreign transaction fees

Why we like it: this welcome bonus can be a big win, especially if you are a frequent traveler. For example, that $750 applied to travel could be enough to cover expenses for a weekend getaway!

Citi premier credit card

Welcome bonus offer: earn 60,000 bonus points after spending $4,000 on new purchases within three months of account opening. 60,000 of citi’s thankyou® points are redeemable for $600 in gift cards.

What to know about this card

- Annual fee: $95

- 3x points on travel, which includes gas stations

- 2x points on restaurants and entertainment

- Use points to shop virtually at retailers like amazon and best buy

- No foreign transaction fees

Why we like it: while you do have to spend $4,000 in three months to get there, the ability to snag $600 worth of rewards is a nice welcome bonus win. This card also carries good points multipliers on frequently-used spending categories.

Bank of america® premium rewards® credit card

Welcome bonus offer: earn 50,000 online bonus points, which is a $500 value, if you spend at least $3,000 within the first 90 days of card membership.

What to know about this card

- Annual fee: $95

- Unlimited 2x points on every dollar spent on dining and travel

- Get a $100 airport security statement credit towards TSA precheck or global entry application fee every four years

- Get up to a $100 airline incidental statement credit each year for qualifying purchases

- No foreign transaction fees

Why we like it: if you’re a frequent traveler, the airport security and incidentals credits are a nice perk. You’ll also get double rewards points each time you use the card to travel.

Venture rewards from capital one

Welcome bonus offer: earn 60,000 bonus miles when you spend at least $3,000 within the first 3 months of card membership.

What to know about this card

- Annual fee: $95

- Unlimited 2x miles per dollar on all purchases

- Up to $100 credit for global entry or TSA precheck

- You can transfer miles to partner loyalty programs

- No foreign transaction fees

Why we like it: this is another card with rewards geared toward serious travel. Recouping money for airport security purchases is nice, and there is no category limit on the double miles promotion.

Savor rewards from capital one

Welcome bonus offer: earn $300 cash back when you spend $3,000 within your first three months of card membership.

What to know about this card

- Annual fee: $95

- 4% cash back on dining and entertainment

- 2% cash back at grocery stores

- No foreign transaction fees

- No expiration dates or redemption minimums on cash back rewards

Why we like it: the $300 cash back reward is very strong. And with 4% cash back rewards on dining and entertainment, you’ll want to have this card near the front of your wallet when you leave the house for a bite to eat or a night on the town. You can read team clark’s full review of this card here.

Blue cash preferred® card from american express

Welcome bonus offer: earn $250 cash back when you spend $1,000 within your first three months of card membership.

What to know about this card

- Annual fee: $95

- 6% cash back on U.S. Supermarkets and streaming services

- 3% cash back on U.S. Gas station and transit purchases

- 0% APR on new purchases for the first 12 months

- Access to premium services from shoprunner is included

Why we like it: this is one of the top cards on the market for grocery shopping. You’ll be able to save 6% on purchases at most supermarkets, and that welcome bonus can help foot the bill on that annual fee for your first few years. You can read team clark’s full review of this card here.

Quicksilver from capital one

Welcome bonus offer: earn $200 cash back when you spend $500 within your first three months of card membership.

What to know about this card

- Annual fee: none

- Unlimited 1.5% cash back on all purchases

- 0% APR on new purchases for the first 15 months

- No foreign transaction fees

- No expiration dates or redemption minimums on cash back rewards

Why we like it: this welcome bonus is extremely easy to clear and delivers an effective 30% cash back rate on your first $500 in spending. The 1.5% cash back on all purchases is not nearly as good as some 2% cash back cards on the market, but it’s competitive for a no-annual-fee card. You can read team clark’s full review of this card here.

Discover it® cash back credit card

Welcome bonus offer: earn a dollar-for-dollar match on your cash back earned during the first year of card membership.

What to know about this card

- Annual fee: none

- Rotating 5% cash back category that change every three months

- Cash back rewards never expire and can be used for purchases or bill credits

- Can use cash back rewards as cash with select online retailers such as amazon

- 14-month 0% APR period for new purchases and balance transfers

Why we like it: the welcome bonus window for this card lasts for a full year, and can grow to a pretty large sum if you use it as an everyday spender. The rotating 5% cash back categories can be a real benefit, too. You can read team clark’s full review of this card here.

Final thoughts

Money expert clark howard acknowledges that shrewd credit card customers can “game the system” by jumping from one welcome bonus offer to another, but he believes that most consumers are going to find themselves unable to keep up.

“if you’re the kind of person who will get hooked by a signing bonus but won’t do anything about switching credit cards later — you’ve got to make sure that moving forward the card is still a good deal for you,” clark says.

Bottom line: A welcome bonus can be a great way to pocket a few hundred bucks during your honeymoon period with a new card. But it’s important to remember there are many other factors that determine whether a credit card is the right long-term fit for you. Clark believes you should focus on long-term factors like your APR, annual fees and rewards programs.

4 credit cards offering a $500 sign-up bonus

Score extra cash back with these generous introductory offers

Thomas barwick / getty images

Summary

Cash back cards are offering higher and higher bonuses to compete with other rewards currencies – even up to $500 or more.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our cardmatch™ tool to find cards matched to your needs.

Nowadays, it is easy to score a generous introductory bonus on a credit card. Just by meeting eligibility requirements and a specified spend threshold, you can bring home hundreds of dollars in extra pocket change when you sign up for a new card.

Essential reads, delivered weekly

Subscribe to get the week’s most important news in your inbox every week.

Your credit cards journey is officially underway.

Keep an eye on your inbox—we’ll be sending over your first message soon.

Plus, cash back cards are offering higher and higher bonuses to compete with other rewards currencies – even up to $500 or more.

Right now, $500 (or higher) intro bonuses are limited to business credit cards – but offers change regularly, so a personal card boasting an inflated bonus could be around the corner. Personal cards, including the capital one® savor® cash rewards credit card, have offered intro bonuses up to $500 in their history. Though the sign-up offer on the savor is not at its peak, keep an eye out for future limited-time offers on this and other cards.

Which cards are currently offering $500 introductory bonuses?

At the moment, only small business credit cards are offering intro bonuses of $500 or more. Take a look at four current offers below:

| Card | introductory offer |

|---|---|

| ink business cash® credit card | $750 if you spend $7,500 in first 3 months |

| ink business unlimited® credit card | $750 if you spend $7,500 in first 3 months |

| capital one spark cash for business | $500 if you spend $4,500 in first 3 months |

| U.S. Bank business cash rewards world elite™ mastercard® | $500 if you spend $4,500 in first 150 days |

As you can see, each of these generous intro offers requires a fairly high spend threshold to reach it. Before you sign up for one of these cards, ensure you can spend enough to earn the bonus without overextending your budget.

Who is eligible to earn these bonuses?

Before jumping at one of these generous offers, you should ensure you are eligible to earn the bonus. Issuers often have restrictions on who can take home a sign-up bonus.

For example, the ink business cash and ink business unlimited cards from chase are subject to the 5/24 rule. This means if you’ve opened five or more credit cards with any issuer in the last 24 months, you likely won’t qualify for either card.

On the bright side, chase business cards will not count against your 5/24 standing for future applications.

For the capital one spark cash card and U.S. Bank business cash rewards card, the sign-up bonus is limited to new account holders. If you currently have or have previously had one of these cards, you might not be eligible for a new bonus on the same card.

Cash bonuses vs. Points bonuses

The possibilities for a $500 sign-up bonus are endless – allowing you to book a trip, buy yourself a special something, offset your next major bill and so much more. It is easy to see how an extra $500 is valuable – but is it the best offer you can find?

The short answer is no. Points-based sign-up bonuses can offer incredible potential value when you redeem rewards strategically. Because the value of points and miles shifts depending on how you spend them, you can often get much more than the estimated cash value of a sign-up bonus by redeeming your points for well-priced flights, hotels or other promotions.

For example, check out some top points-based introductory offers and our estimated value. At first glance, the following bonuses seem to offer a similar value to a $500 cash bonus. But when you redeem your points for travel, they can actually take you much further.

But there is a big drawback – point bonuses are typically only worth their full value when you redeem them for a specific kind of purchase. If a card offers an 80,000-point bonus – but points are only worth a full 1 cent each when redeemed for travel – then that bonus is only ideal for cardholders who already spend a significant amount on travel. If you’d sacrifice half the value of your bonus offer to redeem it for another kind of purchase – such as a statement credit to cover your bills – then you are better off opting for a more flexible cash back offer.

Should you sign up for a $500 bonus offer?

Before jumping at a high bonus offer, you should always consider the spend requirement. If you will have to charge more than you can afford to pay off in order to earn the bonus, it might not be worth it.

Additionally, cash bonuses don’t always offer as much potential value as a points-based introductory bonus. Consider how you want to spend your rewards and which card’s earning rate works best for you before you apply.

Last chance to order gifts from amazon — how to not leave cash or points on the table

This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. Terms apply to the offers listed on this page. For an explanation of our advertising policy, visit this page.

Update: some offers mentioned below are no longer available. View the current offers here.

Attention last-minute holiday shoppers: there’s still time to order (some) holiday gifts from amazon that will be delivered in time for christmas day on dec. 25.

As reported in USA today, amazon prime members have until wednesday, dec. 23 to order up to 10 million items eligible for one-day delivery and until thursday, dec. 24 to order millions more items that are eligible for same-day delivery, which is free for prime members or those who place orders of at least $35 and reside in qualifying areas.

For more TPG news delivered each morning to your inbox, sign up for our daily newsletter.

And of course, if you like to leave things to the absolute last moment, you can still purchase digital gifts such as amazon e-gift cards and prime memberships for your loved ones from the comfort of your bed on christmas morning.

But just because you’re a last-minute shopper doesn’t mean you have to leave cash — or valuable credit card points — on the table. This year, more than ever before, credit card companies are incentivizing you to use their card for your amazon shopping by offering bonus points and even large cash discounts.

These bonus points and savings can add up quickly — here’s a look at how you can save on your amazon purchases.

In this post

Save money on amazon using as little as 1 point

Amazon allows you to use your chase ultimate rewards, amex membership rewards or citi thankyou points to pay for some or all of your next order of items shipped and sold by amazon. Unfortunately, the redemption rate usually isn’t at a value that we recommend since it comes in at under 1 cent per point.

But — when there are offers encouraging you to get used to redeeming points at amazon by offering a big discount for point redemptions, it can make sense. Often, these promos are targeted, so you may or may not be able to take advantage, but it’s worth checking. You will likely need to connect your credit card points account to amazon and pay with that method of payment in order to become eligible for these deals.

Here are three recent offers:

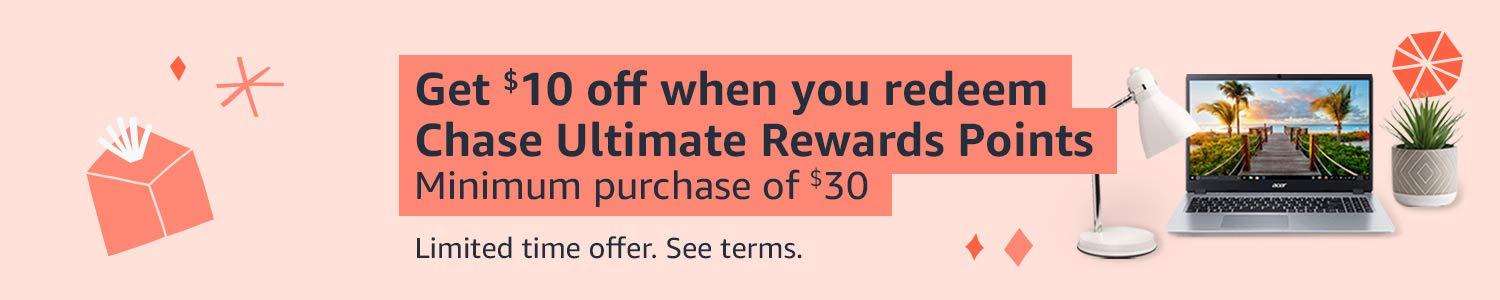

Chase ultimate rewards

- Save $10 on amazon orders using as few as 1 chase ultimate rewards point.

- Check here to see if you’re targeted for the offer.

- Load up your cart with $30 or more of eligible items sold by amazon (amazon gift cards excluded) and save $10 by redeeming as few as 1 chase ultimate rewards point.

- The promotion runs through jan. 31, 2021, or when 45,000 customers have redeemed the offer (whichever is earlier).

Citi thankyou

- Save $20 off amazon orders using as few as 1 citi thankyou point.

- Check here to see if you’re targeted for the offer.

- Load up your cart with eligible items sold by amazon (amazon gift cards excluded) totaling $50 or more.

- The promotion runs through dec. 31, 2020, or when 10,000 customers have redeemed this offer, whichever is earlier.

Amex membership rewards

- Save $10 to $50 on amazon by using just 1 amex point.

- Check here to see if you have a targeted offer.

- Maximum discount and rules vary by promotion.

- The promotion runs until dec. 31, 2020, or until 70,000 customers have redeemed the offer, whichever comes first.

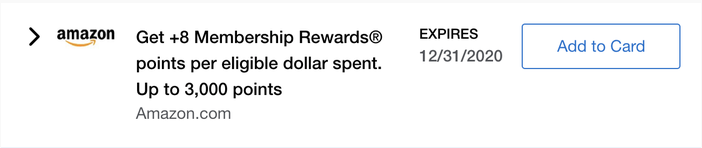

Earn up to 8x points per $1 at amazon

This holiday season, there is a very lucrative offer from amex: use your card at amazon, target and walmart through dec. 31, to earn 8x points on up to a total of $375 in eligible purchases. Log in to your american express account and look for this promotion in the amex offers tab.

Note that with this offer, you’re capped at a total of 3,000 bonus points. This means you’ll only receive this bonus for $375 in spending. Note that you can only register one type of amex card in your account for this deal, so choose wisely.

Tpgers report that this offer has been spotted on cards that earn membership rewards, such as:

- American express® gold card

- The platinum card® from american express

- The blue business® plus credit card from american express

In most cases, this will mean you’re earning a total of 9 amex membership rewards points per dollar spent, which according to TPG valuations, amounts to an 18% return in rewards for each dollar spent with amazon.

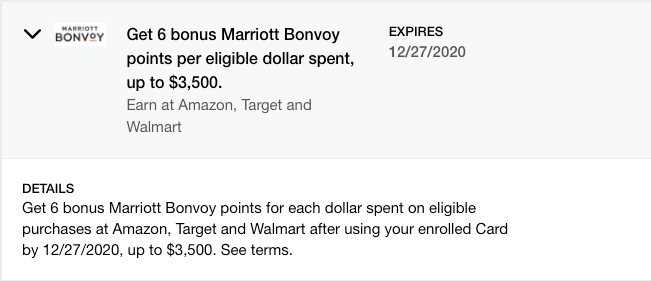

There is also a similar amex offer that awards 6x points per $1 at amazon, target and walmart promotion for marriott bonvoy brilliant™ american express® card holders. This deal is valid for up to $3,500 in combined charges until dec. 27, 2021.

Chase cards offer 5x amazon bonus plus 3x or 5x on groceries

If you’ve got a chase cobranded travel rewards card in your wallet, chances are you received an email about an excellent promo that offers 5x points per $1 on amazon purchases and either 3x or 5x per $1 on grocery purchases.

You must register for this promotion by dec. 31 and it’s valid from nov. 1–dec. 31, 2020, for up to $1,500 in combined purchases per month.

Here are the cards that may be offering this lucrative amazon and grocery bonus deal:

- Aer lingus visa signature card (5x amazon, 5x groceries)

- British airways visa signature card (5x amazon, 5x groceries)

- Iberia visa signature card (5x amazon, 5x groceries)

- Southwest rapid rewards® plus credit card (5x amazon, 5x groceries)

- Southwest rapid rewards® premier credit card (5x amazon, 5x groceries)

- Southwest rapid rewards® priority credit card (5x amazon, 5x groceries)

- United club infinite card (5x amazon, 5x groceries)

- United explorer card (5x amazon, 5x groceries)

- The world of hyatt credit card (5x amazon, 3x groceries)

- IHG® rewards club premier credit card (5x amazon, 3x groceries)

- IHG® rewards club traveler credit card (5x amazon, 5x groceries)

- Marriott bonvoy boundless credit card

If you have a “legacy” card, one that isn’t open to new applicants, it may still qualify for this promotion. Examples of qualifying legacy cards include:

- United club (5x amazon, 5x groceries)

- United mileage plus (5x amazon, 5x groceries)

- United mileage plus awards (5x amazon, 5x groceries)

- United mileageplus select (5x amazon, 5x groceries)

- United presidential plus (5x amazon, 5x groceries)

- Legacy hyatt card (5x amazon, 3x groceries)

- IHG rewards club select (5x amazon, 3x groceries)

Tips for whichever card you choose for your amazon spend

First and foremost, stop what you’re doing right now and register for the amazon bonus that makes the most sense for you. You can’t earn bonus points if you don’t register and it’s easy to forget.

Next, log in to your amazon account and make the credit card you’ve chosen to maximize a bonus offer the default method of payment. This way, you won’t accidentally pay using a card that’s offering a lesser — or no — bonus.

If you’re a big spender on amazon, keep track of your total expenditures. If you cap out on the bonus on one card, change out the default payment method with a different card that’s also offering bonus points per dollar spent.

Just be sure you’ve registered for that card’s bonus as well.

Featured image by paul hennessy/nurphoto/getty images

Understanding variable annuity bonus credits

Purchasing a variable annuity can provide you with many benefits in your retirement planning. One of the features that is commonly offered with variable annuities is bonus credits. Here are the basics of bonus credits with variable annuities and how they work.

A variable annuity is a contract between you and an insurance company. You are going to provide payment to the insurance company and they are going to allow you to invest part of this money into securities. When you reach the age of retirement, you will be able to receive a regular paycheck from the insurance provider. The size of your paycheck is going to depend on how your investments in the annuity perform.

As an incentive to invest in a variable annuity, many insurance providers are now offering bonus credits to investors. Bonus credits are an amount of money that is credited to your account when you invest. For example, your variable annuity company might provide you with a bonus of 2 percent of each payment that you make for the annuity. If you give them $10,000 for the purchase of an annuity, they are going to credit $200 to your account. In some cases, the bonus credit can be a nice incentive for you to invest more of your money into a variable annuity.

The major advantage of bonus credits is that you are essentially receiving free money. They are crediting money to your account based upon how much money you give them for the annuity.

When you get extra money credited to your annuity account, this means that you are going to have more money available to invest. With more money to put into the financial markets, you can amplify the amount of money that you are able to earn for your retirement. Over the course of many years, these bonus credits could substantially help your retirement chances.

Although these bonus credits can be attractive, there are a few potential disadvantages that you will need to be aware of. One of the most common drawbacks of this type of annuity is that it will have higher surrender charges attached to it. If you think that there is a chance that you could have to surrender your annuity before it matures, this could take a significant bite out of your retirement savings.

In addition to the surrender charges being higher, they might apply for longer than normal. For example, instead of having to worry about surrender charges for the first five years, you might have to worry about them for the first 15 years instead.

Another potential problem with variable annuities that offer bonus credits is that you may not be able to receive these credits for long. Many times, the insurance company is only going to offer bonus credits for payments that are made during the first year of your contract. After this, you will not be able to receive any more bonus credits.

Best credit card bonuses, miles & points mistakes & more

This week, we saw news that the biden administration could well continue travel restrictions put in place by the outgoing trump administration. The miles and points game is tricky. We often see a plethora of offers for some of the best credit card bonuses. How can you find one and ensure that you’re getting the best possible bonus? That & more as we recap stories from the week.

Best credit card bonuses: how do you ensure that you get one?

We see a myriad of credit bonuses from various credit card issuers. This post outlines the various steps you need to take in order to get the best possible welcome bonus. Many issuers like american express impose a once in a lifetime rule on these welcome bonuses, so it’s in our interest to do the due diligence to get the highest possible offer.

Why you may be losing the miles & points game, without even knowing it

If you’re looking to get the best deals for hotels and flights, then you need to use your miles and points tactfully. This post outlines some of the possible pitfalls and how you can ensure that you get a decent enough use of the miles and points you accumulate.

Incoming biden administration will extend existing travel restrictions

This doesn’t come as much of a surprise as the new biden administration plans to continue many of the travel restrictions that are already in place.

Amex blue cash everyday card: up to $350 welcome bonus, $0 annual fee

Given the current state of the travel industry, many are looking to switch to cash back cards for their daily spend. The amex blue cash everyday card offers great value and a nice welcome bonus, for no annual fee.

How to generate a ton of hilton points by maximizing these offers

If you’re looking to book a hilton stay any time soon, then you can maximize one or more of these offers in order to earn a hefty balance of hilton honors points for your next stay.

The american express gold card is currently offering a welcome bonus of 60,000 membership rewards points. You’ll earn a welcome bonus of 60,000 membership rewards points after you spend $4,000 in the first 6 months after you’re approved for the card.

Moreover, the card offers lucrative bonus earning categories, benefits and credits.

- 4x points on dining (including takeout and delivery) and grocery spend

- 3x points on flights

- $120 dining credit annually

- $120 uber eats/uber credit annually

- $100 airline credit (ends on december 31, 2021)

- No foreign transaction fees

Apply now

Please note that american express may not approve you for the welcome bonus on this card if you currently have the card or have had the card in the past and received a welcome bonus for the same. This may also include any upgrade or downgrade offers that you may have signed up for.

Never miss out on the deals, analysis, news and travel industry trends. Like us on facebook , follow us on instagram and twitter and get the latest content!

Disclosure: the points pundit receives NO compensation from credit card affiliate partnerships. Support the blog by applying for a card through my personal referral links . This article is meant for information purposes only and doesn’t constitute personal finance, health or investment advice. Please consult a licensed professional for advice pertaining to your situation.

So, let's see, what we have: purchasing a variable annuity can provide you with many benefits in your retirement planning. One of the features that is commonly offered with variable annuities is bonus credits. Here are the basics of bonus credits with variable annuities and how they work. Variable annuity A variable annuity is a at bonus credit

Contents of the article

- Top forex bonuses

- Understanding variable annuity bonus credits

- Bonus credit

- New play control and metroid prime trilogy...

- How to get the best credit card sign-up bonus...

- 1. Is the best credit card bonus offer the one...

- 2. Affiliate channel

- 3. Targeted offers (online)

- 4. Targeted offers (mail)

- 5. In-flight sign-ups or at airport kiosks

- 6. Incognito offers

- 7. Shopping cart trick

- 8. Refer a friend offer

- The pundit’s mantra

- Banking bonuses and credit union promotions

- Nationwide banking bonuses

- Credit union promotions

- Regional bank deals

- Recent banking offers

- One – shared banking: $50 referral bonus + 3% APY...

- Lili – banking for freelancers: $25 bonus and $25...

- Redstone federal credit union: $100 checking...

- Step – banking for young adults: get $3 to join...

- First tech federal credit union: $100 checking...

- Capital one – 360 checking: $400 bonus with 2...

- Service credit union: $75 checking bonus + $75...

- Chime banking service $75 sign-up bonus and $75...

- Best credit card welcome bonuses for 2021

- Top welcome bonus credit cards right...

- Chase sapphire preferred®

- Citi premier credit card

- Bank of america® premium rewards® credit...

- Venture rewards from capital one

- Savor rewards from capital one

- Blue cash preferred® card from american...

- Quicksilver from capital one

- Discover it® cash back credit...

- Final thoughts

- 4 credit cards offering a $500 sign-up bonus

- Summary

- Which cards are currently offering $500...

- Who is eligible to earn these bonuses?

- Cash bonuses vs. Points bonuses

- Should you sign up for a $500 bonus offer?

- Last chance to order gifts from amazon — how to...

- In this post

- Save money on amazon using as little as 1 point

- Earn up to 8x points per $1 at amazon

- Chase cards offer 5x amazon bonus plus 3x or 5x...

- Tips for whichever card you choose for your...

- Understanding variable annuity bonus credits

- Best credit card bonuses, miles & points mistakes...

- Best credit card bonuses: how do you...

- Why you may be losing the miles & points game,...

- Incoming biden administration will extend...

- Amex blue cash everyday card: up to $350...

- How to generate a ton of hilton points by...

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.