Best international forex brokers

If you’ve traded through a brokerage in the united states, you’ve probably paid a flat-rate commission fee.

Top forex bonuses

For example, if you’re buying tesla stock through ally invest, you’ll pay a flat $4.99 commission no matter if you buy a single share or you buy 1,000 shares, as long as your buy is done in a single movement. There are a few basic differences to be aware of before you make a deposit in your account, including:

Best international brokers

Sarah horvath

Contributor, benzinga

Want to jump straight to the answer? The best forex broker for most people is definitely FOREX.Com

Featured international broker: interactive brokers

Featured international broker: interactive brokers

Interactive brokers gives you access to market data 24 hours a day, 6 days a week. The broker also services 120 markets, 31 countries, and 23 currencies using one account login.

Though the NASDAQ and the new york stock exchange hog most of the glory when it comes to stock trading, international exchanges have quickly picked up the pace, improved their offerings and ease-of-use in order to compete with the united states.

For example, the tokyo stock exchange now trades an average volume of $3.9 trillion worth of shares per day. The toronto stock exchange moves an average of 39.7 billion shares per day and the national stock exchange of india has reached a market capitalization of over $2.27 trillion.

There’s little question why investors around the globe have turned to international exchanges for their next big opportunities.

If you’re an american investor and you want to directly invest in a foreign market, you’ll need to work through a brokerage firm native to that country. The best online brokerages can give you access to some of the largest international markets from the comfort of your own home. However, trading internationally can be a little different than trading on the NYSE or NASDAQ.

Though most international exchanges follow the basic principles used by the american markets. We’ve created a quick guide to help you learn more about international exchanges and how you can start buying and selling on non-U.S. Stock markets .

Quick look: the best international brokers

Table of contents [ hide ]

Trading internationally: what’s different

Most principles of market trading and market psychology are the same no matter where you go in the world. Whether you’re trading in the united states, the united kingdom, japan or hong kong, you can still use your technical indicators or choice or candlestick analysis to make profitable trades. Most international stock markets also permit outside investors to buy and sell shares of stock as long as their trades are executed by a domestic brokerage firm.

There are a few basic differences to be aware of before you make a deposit in your account, including:

Times and hours of operation

If you’ve ever traded stocks in the united states, you probably already know that you can only trade during certain hours — specifically between the hours of 9:30 a.M. And 4 p.M. Likewise, individual stock markets set their own hours that vary significantly depending on the country’s time zone.

For example, the australian securities exchange is open between the hours of 10 a.M. And 4 p.M. Local time; this means that if you want to trade australian stocks and you’re in new york city, you’ll need to be prepared to trade between the hours of 6 p.M. And midnight eastern time.

Each individual exchange may also set their own holidays when the markets are closed, and these holidays can be very different from the market holidays in the united states. For example, the tokyo stock exchange is closed for a wide range of japanese holidays including the emperor’s birthday (december 23), coming of age day (second monday of january), and health and sports day (second monday in october) but is open during the american holidays of christmas, thanksgiving and labor day.

Mobile app compatibility

In the united states, most major brokers offer mobile trading software that mimics the full compatibility of their desktop software. However, in other countries, mobile compatibility is a relatively new idea and variability between brokerages will vary significantly. If you only trade on a mobile phone, make sure you research mobile offerings before you make a commitment and open an account.

Commission structure and pricing

If you’ve traded through a brokerage in the united states, you’ve probably paid a flat-rate commission fee. For example, if you’re buying tesla stock through ally invest, you’ll pay a flat $4.99 commission no matter if you buy a single share or you buy 1,000 shares, as long as your buy is done in a single movement.

International brokers often charge based on the total value of the trade, and higher value trades pay a percentage of commission instead of a single flat rate. Make sure to read your brokerage’s policies before you sign on so there are no surprises.

What to look for in an international broker

Not every broker offers access to every market in the world. Research the specific international markets you’re interested in and look for a brokerage firm that offers access to those markets. You may have to open more than one account if you’re interested in trading on multiple international markets.

Offers the equities you want to trade

If you’re only interested in buying and selling japanese stocks, every japanese brokerage firm will allow you the access you need. However, if you’re also interested in buying and selling options contracts, futures contracts, forex and cryptocurrencies, don’t assume that every brokerage will offer you the wide range of equity access we’re used to in the united states.

Read through your brokerage’s total list of offerings to make sure they have everything that you need before you open an account or make a deposit.

Consider commission and fee structure

Because international brokerages often use varying fee structures, it’s easy to miscalculate how much you’ll have to pay per trade. This can seriously cut into your profits, especially if you’re a high-level investor who makes multiple trades per week. Look for a broker that offers an upfront reasonable commission and fee structure so you’re not surprised when you make your first trade.

Enhanced security options

Prosecuting fraud that occurs online is difficult. Prosecuting fraud that occurs online across international borders is virtually impossible. Look for a brokerage that offers enhanced account security options (like personal question account recovery features or two-factor authentication) and make sure that you turn these features on.

The best international brokers

Check out which brokers made benzinga’s top international brokers for this year.

Best international forex brokers

Luke jacobi

Contributor, benzinga

Want to jump straight to the answer? The best forex broker for most people is definitely FOREX.Com

You must find a broker that complies with U.S. Laws if you live in the united states and want to trade in the forex market. You’ll have a significantly larger selection of international brokerages if you live outside the united states.

The dodd-frank wall street reform and consumer protection act was signed into U.S. Law on july 21, 2010, to respond to the 2008 global financial crisis, and it affected all U.S. Federal financial regulatory agencies and the entire U.S. Financial services industry, including online forex brokers and the stock market .

Learn more about how you can trade forex with our review of the best international forex brokers.

Best international forex brokers:

Table of contents [ hide ]

Best for

Overall rating

Best for

1 minute review

IG is a comprehensive forex broker that offers full access to the currency market and support for over 80 currency pairs. The broker only offers forex trading to its U.S.-based customers, the brokerage does it spectacularly well. Novice traders will love IG’s intuitive mobile and desktop platforms, while advanced traders will revel in the platform’s selection of indicators and charting tools. Though IG could work on its customer service and fees, the broker is an asset to new forex traders and those who prefer a more streamlined interface.

Best for

- New forex traders who are still learning the ropes

- Traders who prefer a simple, clean interface

- Forex traders who trade primarily on a tablet

- Easy-to-navigate platform is easy for beginners to master

- Mobile and tablet platforms offer full functionality of the desktop version

- Margin rates are easy to understand and affordable

- Access to over 80 currency pairs

- U.S. Traders can currently only trade forex

- Customer service options are lacking

- No 2-factor authentication on mobile

Account minimum

Pairs offered

Account minimum

Pairs offered

1 minute review

FOREX.Com is a one-stop shop for forex traders. With a massive range of tradable currencies, low account minimums and an impressive trading platform, FOREX.Com is an excellent choice for brokers searching for a home base for their currency trading. New traders and seasoned veterans alike will love FOREX.Com’s extensive education and research center that provides free, informative forex trading courses at multiple skill levels. While FOREX.Com is impressive, remember that it isn’t a standard broker.

Best for

- Impressive, easy-to-navigate platform

- Wide range of education and research tools

- Access to over 80 currencies to buy and sell

- Leverage available up to 50:1

Account minimum

Pairs offered

Account minimum

Pairs offered

1 minute review

Though australian and british traders might know etoro for its easy stock and mobile trading, the broker is now expanding into the united states with cryptocurrency trading. U.S. Traders can begin buying and selling both major cryptocurrencies (like bitcoin and ethereum) as well as smaller names (like tron coin and stellar lumens).

Etoro offers traders the opportunity to invest their assets into premade portfolios or cryptocurrencies, similar to services offered by robo-advisors through traditional brokers. Though etoro isn’t a one-stop-shop for everything an investor needs, its easy-to-use platform and low spreads is a great way to enter the cryptocurrency market.

Best for

- International forex/CFD traders

- New cryptocurrency traders looking for an easy-to-use platform

- Traders who want to buy and sell cryptocurrencies on-the-go

- Simple platform that is easy to master

- Copytrader feature that allows new traders to copy the same strategies used by professionals

- Virtual dummy account that gives you $100,000 to practice trades

- U.S. Traders currently limited to cryptocurrencies

- Only 15 major coins available to trade

Account minimum

Pairs offered

Account minimum

Pairs offered

1 minute review

HYCM is 1 of the world’s leading forex brokers, offering investors access to over 69 unique currency pairs. However, forex isn’t the only thing the broker offers — HYCM also offers high rates of leverage, stock and ETF trading, commodity investing and much more. Getting started with HYCM is quick and easy, and most investors can open an account in as little as 10 minutes.

HYCM offers a varying fee structure, which allows investors to choose the spread option that’s best for them. A wide range of educational and investing tools are available, which can be equally beneficial to both experienced and novice traders. Though HYCM isn’t currently available in the united states, it can be a great choice for residents of the other 140 countries where it offers service.

Best for

- Investors who want a customizable fee schedule

- Traders comfortable using the metatrader platform

- Islamic traders who need swap-free accounts that don’t build interest

- Wide range of currency pairs available

- Excellent selection of educational tools

- $0 deposit and withdrawal fees

Account minimum

Pairs offered

Account minimum

Pairs offered

1 minute review

A fully regulated broker with a presence in europe, south africa, the middle east, british virgin islands, australia and japan, avatrade deals with mainly forex and cfds on stocks, commodities, indexes, forex, cryptocurrencies, etc. This brokerage is headquartered in dublin, ireland and began offering its services in 2006. It offers multiple trading platforms and earns mainly through spreads.

Best for

- Beginners

- Advanced traders

- Traders looking for a well-diversified portfolio

- Controlled by regulatory agencies of multiple countries

- Choice offered in terms of trading platforms

- Support available in 14 languages and trading platforms in 20 languages

- Practice/demo account available for trying out

- Breadth of trading assets

- Does not accept customers from the U.S. As it isn’t regulated in the U.S.

- Transferring funds to the account may take up to five days; withdrawals could take up to 10 days

Trading forex internationally

In january 2015, the national futures association (NFA) imposed limits on the leverage allowed on forex positions and other restrictions on U.S.-based forex traders. Many international forex brokers stopped accepting clients from the U.S. Also, due to the new restrictions, international forex brokers increased in popularity relative to american brokers because they typically give traders better terms than U.S.-based forex brokers.

For example, forex brokers in the united states only allow a maximum leverage ratio of 50:1, while some international brokers offer client leverage up to 3,000:1. This high amount of leverage, while extremely profitable when you’re on the right side of the market, could be disastrous if you hold a losing position, especially if you have limited capital.

Another example is the FIFO regulation. FIFO stands for “first in, first out,” and this rule requires you to liquidate positions in the same currency pair in the order that they were established instead of choosing which opposing transaction to liquidate.

The new U.S. Legislation also banned hedging a forex position by taking an opposing position in the same currency pair as 1 already established. Doing this means you effectively hedge the original position and can trade out of both sides individually, which is no longer allowed for U.S.-based forex traders.

Do international forex brokers accept U.S. Clients?

Just because you live in the united states doesn’t mean you can’t trade forex. Many top-tier forex brokers such as IG are based in the united states and also fully comply with the relevant regulations of the NFA and the commodities futures trading commission (CFTC).

Best online brokers for international trading

A key component of a balanced portfolio is exposure to international markets

We publish unbiased product reviews; our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. Our mission has always been to help people make the most informed decisions about how, when and where to invest. Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for investors of all levels, for every kind of market.

A key component of a balanced portfolio is exposure to international markets. Exchange-traded funds (etfs) focused on a particular geographical area can be added to any portfolio, but the investor has little control over the stocks included in the fund. Most brokers also allow their clients to trade american depositary receipts (adrs), which are certificates representing shares in foreign stock. Adrs are traded on U.S. Exchanges.

Best online brokers for international trading:

- Interactive brokers: best online broker for international trading and best online broker for non-U.S. Investors

Interactive brokers: best broker for international trading and best broker for non-U.S. Investors

:max_bytes(150000):strip_icc()/interactive_brokers_productcard-5c61eec746e0fb0001f25462.png)

- Account minimum: $0

- Fees: maximum $0.005 per share for pro platform or 1% of trade value, $0 for IBKR lite

For the international trading category, category weightings for the range of offerings were adjusted upwards to measure which broker offered the largest selection of assets across international markets. After that, overall platform functionality and variety of orders types were also measured as these are important to successful trading when undertaking position management in markets that span the globe. These adjustments revealed a clear winner for both the overall best broker for international trading and the best online broker for non-U.S. Investors.

Interactive brokers (IBKR) easily took the best overall with its direct access to 135 global exchanges in 31 countries. this allows traders to trade around the clock using more than 60 different order types to manage their position entry and exit points. many of the features aimed at international trading are built into IBKR’s downloadable traders workstation (TWS) platform, meaning that you’ll end up using it as a primary tool even if you don’t consider yourself a trader. this can be a challenge at first because of the plethora of tools and customizations available through TWS. Learning the platform takes some time, but the learning curve is shorter if you are only using basic functions.

In addition to access to markets across the world, interactive brokers also offers a massive inventory of assets, including european debt issues and 115 currency pairs. the only nominal knock on interactive brokers in this sense is that fractional share trading only works for U.S. Listed stocks, but that is true of every other broker reviewed as well. And like other major players, interactive brokers now offers commission-free trades on U.S. Stocks and etfs, helping to make it our consensus pick for international trading two years in a row.

It is worth mentioning the runners up to interactive brokers in the overall category, as they are still decent options for investors who may find IBKR's reach and platform — admittedly geared for traders — a bit too intimidating. Fidelity came in second to IBKR with the ability to trade in 25 countries using 16 different currencies. schwab came in third with its more limited direct access to 12 foreign markets in their domestic currency. as you can see, there is a significant gap between interactive brokers and the overall runners up.

This year we also evaluated online brokers in terms of which one best fits the needs of non-U.S. Investors, as our audience is increasingly global. Here again, interactive brokers’ reach was the deciding factor. Investors with interactive brokers can fund their accounts with many different base currencies and then convert at market rates to purchase assets in other markets. so, no matter which market you are going to and from, you’ll be able to make the investment without holding separate accounts or arranging conversion.

If you are a non-U.S. Trader or sophisticated investor, you will get much more out of IBKR. The features of IBKR as a trading platform are covered at length in our review, but all that power opens new opportunities when combined with a global outlook. In addition to the incredible tool set in TWS, interactive brokers’ asset inventory makes it easier to set up complex, multi-layered trades without using proxies.

The idea of an individual trader placing a multi-market bet including stocks, currencies, options, and commodity futures used to be quite intimidating. Back in the 90s when george soros’ quantum fund broke the bank of england, it was actually a team of traders shorting the pound against the german mark, going long on UK stocks, and purchasing german bonds in advance of underperformance in german stocks. with the market reach and asset choice through interactive brokers, you can now do the same style of trade from your desktop and monitor it in real-time. Traders can also queue up conditional orders and essentially trade 24 hours as markets close and open around the globe.

Interactive brokers is unparalleled in its market reach and asset variety.

TWS was our strongest overall trading platform with powerful tools and a high level of customization.

The direct access to exchanges worldwide allows for 24-hour trading.

You can fund your account in many different base currencies and the conversion at market rates for non-native currency transactions is directly supported through the platform.

Interactive brokers offers the lowest margin interest of all the brokers we reviewed.

Taking full advantage of the international trading tools requires investors to use TWS, which can be daunting for non-traders.

Interactive brokers still uses a fee-based pricing structure for trades, albeit a modest one.

Best international brokers for stock trading 2021

The stockbrokers.Com best online brokers 2021 review (11th annual) took three months to complete and produced over 40,000 words of research. Here's how we tested.

This guides summarizes the best online brokers for internationally trading in 2021. To qualify, online brokers must be based in the united states, US-regulated, and offer international investors the ability to buy and sell stocks.

Currently, there are only several US brokers that support non-US citizens as clients. This is mostly due to the complexities surrounding international regulations, customer service, and language translation.

If you are US citizen and want to buy stocks overseas, the three best international brokers are interactive brokers, fidelity investments, and charles schwab.

Best international brokers for stock trading

- Interactive brokers - best overall, 184 countries

- Tradestation - 156 international countries

- Firstrade - 21 international countries

International trading guides

If you are resident of the united states, united kingdom, canada, or australia, read our full international trading guide below. Similarly, if you are looking for an international forex broker, we have a separate tool for forex through our sister site, forexbrokers.Com.

Interactive brokers: 184 countries

Overall | open account

Exclusive offer: new clients that open an account today receive a special margin rate.

Traditionally known for its leading offering of platforms, tools, and pricing for professionals, interactive brokers has made significant strides in recent years and today also appeals to casual investors, thanks to $0 trades and its client portal web platform.

Interactive brokers countries: andorra, united arab emirates, antigua and barbuda, anguilla, albania, armenia, antarctica, argentina, american samoa, australia, aruba, azerbaijan, bosnia and herzegovina, barbados, bangladesh, burkina faso, bahrain, burundi, benin, bermuda, brunei, bolivia, brazil, bahamas, bhutan, botswana, belize, canada, central african republic, switzerland, cook islands, chile, cameroon, china, colombia, costa rica, cape verde, djibouti, dominica, dominican republic, algeria, ecuador, egypt, eritrea, ethiopia, fiji, falkland islands, federated states of micronesia, faroe islands, gabon, united kingdom, grenada, georgia, french guiana, ghana, gibraltar, greenland, gambia, guinea, guadeloupe, equatorial guinea, guatemala, guam, guinea-bissau, guyana, hong kong, honduras, haiti, indonesia, israel, india, british indian ocean territory, iceland, jamaica, hashemite kingdom of jordan, japan, kenya, kyrgyzstan, cambodia, kiribati, comoros, saint kitts and nevis, republic of korea, kuwait, cayman islands, kazakhstan, laos, lebanon, saint lucia, liechtenstein, sri lanka, liberia, lesotho, morocco, monaco, montenegro, madagascar, marshall islands, macedonia, mali, mongolia, macao, northern mariana islands, martinique, mauritania, montserrat, mauritius, maldives, malawi, mexico, malaysia, mozambique, namibia, new caledonia, niger, norfolk island, nicaragua, norway, nepal, niue, new zealand, oman, panama, peru, french polynesia, papua new guinea, philippines, pakistan, saint pierre and miquelon, pitcairn islands, puerto rico, palestine, palau, paraguay, qatar, réunion, serbia, russia, rwanda, saudi arabia, solomon islands, seychelles, singapore, saint helena, svalbard and jan mayen, san marino, senegal, suriname, são tomé and príncipe, el salvador, swaziland, turks and caicos islands, chad, french southern territories, togo, thailand, tajikistan, tokelau, east timor, turkmenistan, tunisia, tonga, turkey, trinidad and tobago, tuvalu, taiwan, ukraine, uganda, U.S. Minor outlying islands, united states, uruguay, uzbekistan, vatican city, saint vincent and the grenadines, venezuela, british virgin islands, U.S. Virgin islands, vietnam, vanuatu, wallis and futuna, samoa, mayotte, south africa, zambia. If you are a resident of any of these countries, you can open an account with interactive brokers and invest in US stocks.

Tradestation: 156 countries

Overall

As a trading technology leader, tradestation supports casual traders through its web-based platform and active traders through its award-winning desktop platform, all with $0 stock and ETF trades.

Tradestation countries: andorra, united arab emirates, antigua and barbuda, anguilla, antarctica, argentina, american samoa, austria, australia, aruba, åland, barbados, belgium, bulgaria, bahrain, saint-barthélemy, bermuda, brunei, bolivia, "bonaire, sint eustatius, and saba", brazil, bhutan, belize, canada, cocos [keeling] islands, republic of the congo, switzerland, cook islands, chile, colombia, costa rica, cape verde, curaçao, christmas island, cyprus, czechia, germany, denmark, dominica, dominican republic, estonia, spain, finland, fiji, falkland islands, federated states of micronesia, faroe islands, france, united kingdom, grenada, french guiana, guernsey, gibraltar, greenland, guadeloupe, greece, south georgia and the south sandwich islands, guatemala, guam, hong kong, honduras, croatia, hungary, indonesia, ireland, israel, isle of man, india, british indian ocean territory, iceland, italy, jersey, jamaica, hashemite kingdom of jordan, japan, kiribati, saint kitts and nevis, republic of korea, kuwait, cayman islands, laos, saint lucia, liechtenstein, lesotho, republic of lithuania, luxembourg, latvia, monaco, republic of moldova, saint martin, marshall islands, northern mariana islands, martinique, montserrat, malta, mauritius, malawi, mexico, malaysia, new caledonia, norfolk island, netherlands, norway, nauru, niue, new zealand, oman, panama, peru, french polynesia, papua new guinea, philippines, poland, saint pierre and miquelon, pitcairn islands, puerto rico, portugal, palau, paraguay, qatar, réunion, romania, saudi arabia, solomon islands, sweden, singapore, saint helena, slovenia, svalbard and jan mayen, slovak republic, san marino, senegal, suriname, são tomé and príncipe, el salvador, sint maarten, turks and caicos islands, french southern territories, togo, thailand, tokelau, tonga, tuvalu, taiwan, tanzania, U.S. Minor outlying islands, united states, uruguay, vatican city, saint vincent and the grenadines, british virgin islands, U.S. Virgin islands, wallis and futuna, samoa, kosovo, south africa. If you are a resident of any of these countries, you can open an account with tradestation and invest in US stocks.

Firstrade: 21 countries

Overall | open account

Special offer: commission-free trading on 700+ etfs.

Firstrade offers $0 stock, ETF, and options trades and is best known for its easy-to-use web platform, alongside its chinese language services. While firstrade offers morningstar research and various tools, its overall offering struggles to stand out against household name brands who are also priced at $0.

Firstrade countries: belgium, china, china, germany, spain, france, united kingdom, hong kong, ireland, israel, italy, japan, republic of korea, macao, mexico, new zealand, poland, singapore, taiwan, united states. If you are a resident of any of these countries, you can open an account with firstrade and invest in US stocks.

Other online brokers

Site visitors frequently ask about other popular online brokers and the countries of residence they support. Most brokers only offer trading to residents of the united states.

Charles schwab countries: united states, argentina, australia, bahamas, belgium, bermuda, brazil, cayman islands, chile, china, columbia, costa rica, ecuador, germany, guam, guatemala, hong kong, india, israel, malaysia, mexico, panama, peru, philippines, puerto rico, qatar, spain, switzerland, taiwan (province of china), thailand, united arab emirates, united kingdom, uruguay, venezuela, british virgin islands, US virgin islands. If you are a resident of any of these countries, you can open an account with charles schwab and invest in US stocks.

Fidelity countries: united states, guam, puerto rico, and US virgin islands.

E*TRADE countries: united states residents only.

TD ameritrade countries: united states and canada residents only.

Read next

Explore our other online trading guides:

About the author: blain reinkensmeyer as head of research at stockbrokers.Com, blain reinkensmeyer has 20 years of trading experience with over 1,000 trades placed during that time. Referenced as a leading expert on the US online brokerage industry, blain has been quoted in the wall street journal, the new york times, and the chicago tribune, among others.

All pricing data was obtained from a published web site as of 01/19/2021 and is believed to be accurate, but is not guaranteed. For stock trade rates, advertised pricing is for a standard order size of 500 shares of stock priced at $30 per share. For options orders, an options regulatory fee per contract may apply.

Advertiser disclosure: stockbrokers.Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. How do we make money? Our partners compensate us through paid advertising. While partners may pay to provide offers or be featured, e.G. Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data. Here is a list of our partners.

Disclaimer: it is our organization's primary mission to provide reviews, commentary, and analysis that are unbiased and objective. While stockbrokers.Com has all data verified by industry participants, it can vary from time to time. Operating as an online business, this site may be compensated through third party advertisers. Our receipt of such compensation shall not be construed as an endorsement or recommendation by stockbrokers.Com, nor shall it bias our reviews, analysis, and opinions. Please see our general disclaimers for more information.

© 2021 reink media group LLC.

All rights reserved.

List of the best 23 forex brokers | trusted reviews

Are you looking for a good and serious forex broker? – then this page is the right place for you. Thanks to the large selection on the internet it is often difficult to make the right decision. With more than 7 years of experience in the financial markets, we present you with the best providers with top service and without hidden costs. Find out in the following texts how to select a secure forex provider and which online broker offers the best conditions.

| Broker: | review: | regulation: | spreads: | assets: | advantages: | open account: |

|---|---|---|---|---|---|---|

1. Bdswiss  | ➜ read the review | cysec, FSC | starting 0.0 pips + $ 2.0 commission per 1 lot | 250+ (50+ currency pairs) | + individual offers + trading signals + raw spreads + leverage up to 1:500 + best education + personal support |

Watch our full video review about the best forex brokers (risk warning: your capital is at risk):

Strict criteria for the forex broker review

In contrast to many other comparison sites, we present you on this website only the safest providers with the best conditions for traders. As experts with many years of experience, we have tested many forex brokers and still use some of them. A good provider should have certain characteristics that guarantee good and safe investing.

It is not uncommon to hear of fraud on the internet. This is to be avoided by this comparison. In addition, one would like to save on charges as a trader because the costs for the trade reduce of course the actual profits. Also, the security of customer’s money is of high priority. A regulation or license, for example, is urgently needed for secure trading with international brokers. All these criteria and many more are included in the test. Therefore we can present you on this page the best forex brokers in a list.

Proven facts for a good forex broker:

- Regulation and license of an official finance authority

- High safety of customer funds

- Fast and reliable market execution

- Small forex trading fees and no hidden fees

- No requotes (high liquidity)

- User-friendly trading platform

- Free and unlimited demo account

- Professional support

- Fast deposit and withdraw methods

How does a forex broker work?

A forex broker is an intermediary between a client (trader) and the interbank market for currencies (wikipedia). In addition, the broker can lend capital to the trader so that he can trade with leverage. The broker’s income is generated by the spread and the cost of financing the leveraged positions.

There are 2 different models of brokers: market maker and ECN/NDD broker

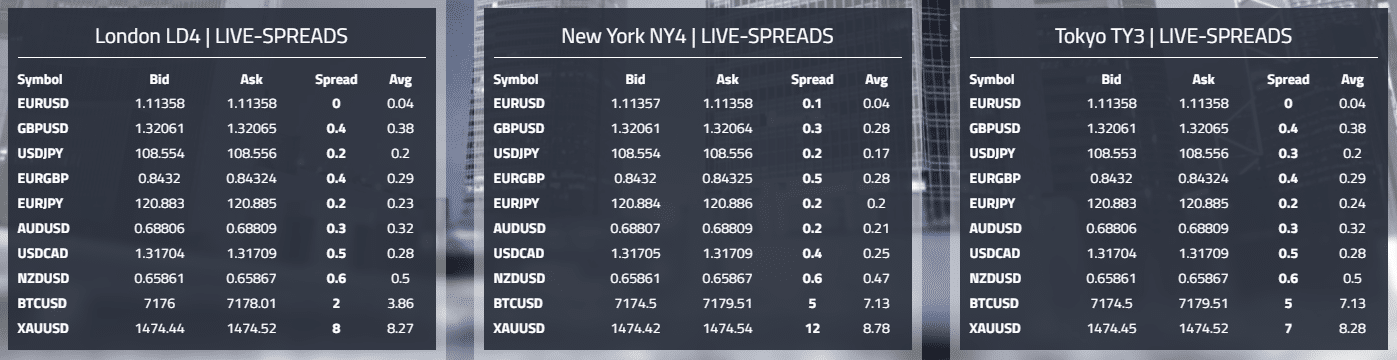

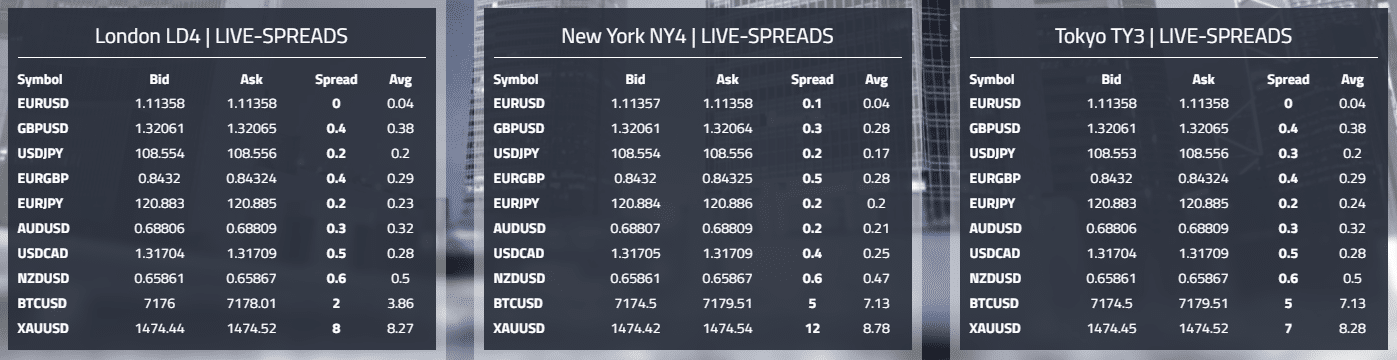

Example of live spreads for forex brokers

Market maker:

This broker does not place the trader’s orders directly into the real interbank or spot market. There is an internal matching system between the positions of the traders. Of course, the broker can hedge himself on the real markets so that there are no distortions in supply and demand. In most cases, this system can be opaque, and only as a broker employee, you know the exact functions. A market maker forex broker is not bad or scam. Nowadays, most providers offer good and exact executions.

ECN/NDD (no dealing desk) broker:

ECN and NDD mean direct access to the interbank market through various liquidity providers. These are large banks or very large forex brokers. The provider places the trader’s orders directly into the real market. So the customers get direct and real market prices for trading. With this model, there is no conflict of interest between trader and broker. Zero (no) spread accounts are offered.

Warning: only trade with regulated and licensed forex brokers

Security has the highest priority in online trading. When it comes to trading leveraged financial products, you have to be able to trust the forex broker. It is not uncommon for large sums of money to be used to generate a large profit. For example, brokers in europe must have regulations or licenses if they want to offer their services. The regulation can be in any european country. The same or almost the same requirements apply to brokers everywhere. In order to avoid fraud, it is important to look for such a license.

Licenses are only issued under certain conditions and criteria. If a broker violates these conditions, the license may be withdrawn immediately. All tested companies of mine are always concerned to keep the highest criteria and to guarantee a safe trade. Many brokers, for example, are regulated in cyprus. This has tax advantages. Nevertheless, there are also forex brokers with more than one regulation. The various regulatory authorities can be seen in the table above.

Facts of reliable and secure companies:

- Regulation and license

- Separated customer funds

- Regulated deposit and withdrawal methods

- Using well-known banks

- Large liquidity providers

Another important point for serious trading is the security of customer funds. Payouts of winnings or the deposited amount should work smoothly. It was not uncommon for some brokers to speculate on customer funds themselves. In the end, withdrawals were refused or delays occurred.

How risky is forex trading?

Forex trading is managed by leveraged financial products. That means you are able to trade a bigger contract size than the amount of money in your account. Some brokers offer the leverage up to 1:3000. Many traders are afraid of the obligation to make margin calls and this is not without reason as the past has shown. Account balances could slip into the negative balance. This is possible due to extreme market situations and too large a position size in relation to the account balance.

The providers shown above all have no obligation to make additional contributions (except IC markets and vantage FX). With the providers in the upper table, you are therefore protected against such a scenario. In our experience, this can only happen if the account is too heavily leveraged. You should always beware of sensible risk management.

Beginners should always start with the free demo account to practice forex trading.

A demo account is essential for successful trading. The trading column form and conditions can be tested extensively with this account. It is a virtual credit account that simulates real money trading. It can be traded without risk. This means that new strategies can be developed or new markets tested. The demo accounts of the compared providers are completely free and unlimited. This account is best suited for entry into forex trading.

How to deposit and withdrawal money:

For most traders, the first deposit into their account is very exciting. It should work smoothly and be highly secure. Forex brokers offer well-known and proven payment methods. Capitalize the trading account with electronic methods (credit card, e-wallet, paypal, crypto) or with the classic way of bank transfer. Electronic methods work in real-time and the money is credited directly to the trading account. Trading can be started immediately. The minimum deposit at the compared brokers is very low. For example, you can open an account from as little as 1$. If this is worth it, you have to decide for yourself. There are no fees for deposits.

Example of payment methods of a forex broker

The payout is also very uncomplicated. With a few clicks, you can request a withdrawal on the menu. This is then released in 1-3 working days. However, most brokers payout customer money in less than 24 hours. All presented brokers passed this test. The fees can be high for small payouts. With payments over 200$, the most forex brokers take over the fees but some brokers do not charge any commissions.

Facts about the payments:

- Instant deposit of money

- Fast withdrawal within 1 – 3 working days

- Electronic methods (skrill, neteller, paypal, and more)

- Cryptocurrencies

- Bank wire

Not every country is available for forex trading

Not every country is available for forex brokers and trading. This is because there are some restrictions and special regulations. For example, in some countries, an international broker needs a special license for that specific country. So it is too much afford for some companies to get the license and they stop taking clients from these countries. You can clearly see on the homepage which clients they accept. Not many brokers accept clients of the united states of amerika.

From my experience, the fastest-growing countries are in africa and asia. Because of the development of mobile internet, more people get connected to the forex market. India, nigeria, philippines, malaysia, and china are at the moment the fastest-growing countries.

Is forex trading legal?

Forex trading is fully legal if there is not any ban from the government. Forex trading is just changing money into another currency. This is not an illegal practice. The brokers on my review got official regulations so they act fully legal.

Review conclusion: start trading with a reliable forex broker

On this page, we have presented you with our current list of the top 23 forex brokers in comparison. Now you have a selection of good and reputable companies in front of you. It was particularly important to us that we only present providers here, which we have tested by ourselves with real money. This is not the case with most comparisons.

Profit now from the most favorable fees and the best conditions by my experience of many years. With these providers, you are 100% safe and can take your forex trading to the next level.

We hope you could learn something in this comparison and act now with better providers through my recommendations. If you can’t make up your mind, please also read the reviews.

Successful forex trading requires a good and reliable broker. In this review, we showed you the top 23 secure forex brokers. Now you can choose your professional trading partner.

Forex brokers for US traders (accepting US clients)

Below you will find a list of forex brokers accepting US traders as clients. Due to the strict and complicated regulatory environment, it became quite a challenge for FX companies to operate in the US. To make it worse, thanks to the dodd-frank act and the memorandum of understanding, many licensed forex brokers all over the world stopped accepting US clients. Still, there are some offshore countries where local authorities haven't yet imposed the restrictions. Unfortunately, most unchained brokers are not regulated, although that’s exactly the reason why there’s an opportunity to open a trading account with them. Notable benefits of going offshore: no hedging prohibition, no FIFO rule application and trading leverage is much higher.

Over the last decades, the forex market in the US has emerged as one of the most regulated markets anywhere in the world. Rules that were introduced and backed up by federal laws have made it very difficult for brokers and traders alike to operate in the US forex market. For many years, only three brokers operated in the US forex market: oanda, GAIN capital LLC (forex.Com) and TD ameritrade. Others were either put out of business or were forced to close down as a result of the strangulating environment created by the regulators, backed up by the dodd-frank wall street reform and consumer protection act of 2010.

What changed?

After the global financial crisis of 2008 which had its origins in the US subprime mortgage market, there were general calls for better regulation of the various markets operating in the united states. The dodd-frank act was a direct consequence of this agitation. This law strengthened the commodities and futures trading commission, enabling it to oversee not just the conventional financial markets, but also the swaps market which was valued in trillions of dollars.

Changes to the way business was conducted in the US financial markets were sweeping and aggressive. Some of the changes which were directly targeted at the retail segment of the market were as follows:

- A) introduction of leverage caps in forex and options, pegging leverage at 1:50 for forex majors, and 1:20 for forex minors, and forex options trading.

- B) elimination of hedging ability via the introduction of the first in, first out (FIFO) rule. Thus rule states that a position on an asset must first be closed before another can be opened on the same asset. The FIFO rule effectively ended the hedging style of traders placing opposing positions on the same asset.

- C) stratification of traders in the FX market was institutionalized, as these rules were targeted at the so-called “unsophisticated’ investors, defined as traders with assets that are less than $10million, as well as small businesses. Professional and commercial traders (investment banks) were largely exempted from these changes.

According to the CFTC, these rules were meant to protect the retail clients from overexposing their money to the market and from taking excessive risk. But to what extent these rules have actually protected the retail consumers of forex products in the US is anyone’s wildest guess.

What the regulators of the US financial markets will not readily reveal, is that many traders in the US simply exited the US market and migrated their accounts to brokerage platforms in other countries. Forex brokers located in the US have had whatever market share they had badly eroded, and brokers without the kind of purposeful structure that the former US brokers suddenly emerged as less desirable but ready alternatives to traders who were unwilling to trade under the new conditions in the US.

In other words, the dodd-frank act actually stifled the forex brokerage business in america and the statistics do not lie. During the good times, more than 40 retail FX brokers were serving both US and international clients. Ever since dodd-frank became law, that number dwindled to the three brokers mentioned above, and the international clientele base simply moved away from the US and on to brokerages in the UK, europe, australia and the caribbean. A lot of the damage in the US forex brokerage business environment came as a result of the $20million bond which was imposed as a requirement for starting a forex brokerage business in the US. Tax reporting requirements have also scared off many brokerages from accepting US clients. Clearly, no foreign forex company wants to get the same kind of attention that huawei got from the US government in 2019, or what tiktok got in 2020.

What are the current options for US forex traders?

In 2019, some brokers made moves to re-enter the US market. Unfortunately, the COVID-19 pandemic slowed down the process dramatically. Still, some new brokers managed to enter the US forex market in recent years, so traders now have more choice than before.

So what is the current state of the US market as it concerns US forex traders?

1) consumer-friendly regulators

Regulators in the US have made a series of changes designed to improve trading outcomes for US forex traders. For instance, the commodities and futures trading commission (CFTC) has made its weekly CFTC positioning report (also known as the commitment of traders report, or COT) more readily available. This report shows what the major players in the commodities and currency markets are doing. Using this information, summaries of which are found on some MT4 platforms of US forex brokers, traders can consider their positions against the backdrop of the institutional speculators are trading. This provides for more informed trade decisions.

Additionally, the CFTC is now more reachable as a number of channels are now open so the public can make complaints or submit inquiries and observations.

2) more robust database of providers

Everyone working in the industry must be registered with the CFTC and NFA. The NFA has taken it a step further by requiring biometric registration of those who provide services to traders, be it brokerage services or fund management. This biometric information can be shared with the federal bureau of investigation (FBI), and this has been a strong deterrence against wrongdoing by brokers. When last did you hear of US forex brokers swindling customers of their funds?

The CFTC database of providers is very vast. All floor traders/brokers, introducing brokers, swap dealers, retail forex dealers, commodities pool operators (cpos) and commodities trading advisors (ctas) who are licensed to provide services to US forex traders are all on this database.

If you are approached by anyone claiming to be any of these, you can easily contact the CFTC for near-instant verification. Even those who are not listed on the CFTC database by reason of exemption must appear on the NFA database, and the reason for the CFTC exemption provided.

3) expanded list of US-regulated forex brokers

There used to be a time when more than 70 brokers operated in the US forex market. The dodd-frank act thinned them out to just 3, and it remained this way for a nearly a decade. At the present day, there are now 8 regulated forex brokers in the US. Oanda, forex.Com (GAIN capital) and TD ameritrade retained their positions, and are now joined by ATC brokers, IG US, interactive brokers, ally invest and thinkorswim (now owned by TD ameritrade).

4) leverage caps

The 2018 ESMA rules in europe forced all local brokers to set a 1:30 leverage limit for all major FX currency pairs. In the US, this cap remains at the 1:50 level introduced in 2010. US forex traders will continue to enjoy what now seems to be the most liberal leverage caps in the tier 1 regulatory jurisdictions.

5) credit-based funding for customer forex accounts

Bank drafts and direct debits from a bank-linked ATM card are now the recognized means of account funding for US forex traders. The use of credit cards is now prohibited.

These are some of the changes that US forex traders have faced in 2020. 2020 also marked the year of the COVID-19 global pandemic that has completely changed the face of the global economy. However, while many other economic sectors have been badly hit, forex trading and other forms of financial market activity have thrived. In fact, the massive job losses and furloughs across the world that left millions without a source of income, drove the same people to the financial markets. Many brokerages have witnessed a surge in new trading account registrations as well as inquiries about trading. COVID-19 has changed the face of financial trading and it is likely that a number of changes as to how forex is traded in the US are coming.

What does the future hold for US forex traders?

So what possible changes can US forex traders hope to see in 2021 or in the years to come?

1) changes to margin rules

It is likely that forex traders in the US may face changes to margin rules on their accounts. US forex brokers are expected to have rolled out the phase 5 and phase 6 rules on uncleared margin, known as UMR 5 and UMR 6. UMR stands for uncleared margin rules. These rules have to do with how buy side participants in the forex market handle initial margin and variation margin among all counterparties in the market. Compliance with the UMR 5 and 6 means that there is a consolidated margin threshold of 50 million units of either the EUR or the USD that must be adhered to, among other requirements.

These rules were originally conceived in the aftermath of the 2008-2009 global financial crisis to enable firms handle risk better, and were meant to be implemented in phases. UMR 1 commenced in 2017. Full compliance with phase 5 UMR rules was to kick in by september 2020, but has been moved by a year to september 2021. While the full details of these rules would be out of the scope of this piece, suffice it to say that these new rules would make it harder for new players to enter into the retail FX brokerage space in the US. It would also stretch the resources of existing brokerages in terms of compliance with these rules. Ultimately, the entry point for opening a forex trading account may climb dramatically, putting it out of the reach of many. If you have been thinking of opening a US forex trading account, this may be the best time to do it.

2) advancements in technology

Algo adoption is expected to grow, whole artificial intelligence (AI) will start to feature more prominently in the development of market trading software. 2021 may be the year when US forex traders who want to maintain an edge in their trading may have to start using tools and software that can perform smarter analysis and make more rational trading decisions.

3) blockchain-based platforms

2021 may be the year when blockchain-based trading platforms may start to hit the US forex market. Some brokerages in japan and singapore have started to experiment with these platform types. Perhaps 2021 may be the year that we could see these used more widely in the US. Will this signal the beginning of the end for the MT4, or will metaquotes respond accordingly?

4) increased volatility on the US dollar, euro and british pound

Coronavirus vaccines will be out in 2021, but the availability of these vaccines seem to be geographically defined. Countries like the US and UK are buying up stocks in advance, so it is likely that these vaccines will not go round the world. Remember the dark days of the HIV epidemic when there was disproportionate access until PEPFAR and the global fund kicked in? This is probably what will happen unless something is done about the situation. COVID-19 will continue to dominate headlines, along with attempts to rescue the global economy. It is looking like there will be a change of guard at the white house. 2021 will see more volatility on the US dollar, euro and british pound.

It is prudent to say that there may be other occurrences in 2021 which have not been captured here, but which cannot be ruled out. Nobody can predict the future with 100% certainty.

Closing note

One of the best things that consumers of any product can enjoy is the power to choose, and to be able to make that choice from a wide range of service providers. This is what the dodd-frank law has taken away from US forex traders… but things have changed. Aside from a few forex brokerages operating in the US, there are a number of offshore forex brokers expressing willingness to take US traders on their platforms.

There are a number of advantages and also drawbacks to this arrangement. In terms of benefits, this is what US forex traders will enjoy when they use the offshore brokers presented in the list below.

- A) the ability to hedge trades is a risk management tool. The FIFO rule basically prevents this from happening. Realizing this great folly in the US forex brokerage setup, the offshore brokers in the list provide below have created a system which allows traders to hedge, even if it means placing opposing positions on the same asset.

- B) the CFTC has argued that the leverage caps protect retail traders by stopping them from overexposing their capital and accounts to the market. The leverage caps imposed a high minimum capital requirement on forex accounts opened in the US. This requirement only served to lock out a large segment of the trading public. With the forex brokers for US traders introduced here, you get lower capital requirements you can actually meet. You also trade with a wider spectrum of leverage, which allows you to trade under non-restrictive leverage conditions.

- C) your greatest asset as a consumer (the power to choose) is restored. You have a choice of not just a few brokers, but many ones. If a broker does not match your requirements, move to the next one on the list.

The brokers featured in the list below have been carefully selected to offer you a forex brokerage service that rivals what you can get anywhere in the world, and under non-restrictive conditions. They are great for beginners who can make a transition from a demo account to a lightly funded live account, just to ensure they can understand what live trading is all about before they get more heavily committed. ECN style accounts are also available for those who prefer to trade directly with the FX interbank market. There is a lot of choice for you as you go through this list of brokers, one after the other.

Fxdailyreport.Com

The advantages of trading with high leverage brokers can make the mouths of even the most experienced traders water. The sheer unpredictability with which positions emerge and the appeal of massive gains from relatively minimal capital investment make it an exciting world to do business. But just as the gains are sweet, trouble is real when trading with high leverage forex brokers. In fact, there have been rising calls amongst international regulators looking to clamp down on the less savvy consumer.

This is to stop traders from investing their life savings without a comprehensive understanding of the pros and cons of this intricate and potentially high-risk investment strategy. That said, here is a comprehensive list of the pros and cons of trading with high leverage forex brokers.

10 best forex brokers with highest leverage

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker |

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $100 spread: starting 0 pips leverage: up to 400:1 regulation: FCA UK, NFA, CFTC, ASIC, IIROC, FSA, CIMA | visit broker | |

| min deposit: $300 spread: floating, from 0 pips leverage: 500:1 regulation: FCA UK reference number 579202 | visit broker | ||

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: no minimum deposit spread: 1.2 pips leverage: 50:1 regulation: CFTC, NFA, FCA, MAS, ASIC, IIROC | visit broker | |

| min deposit: $10 spread: leverage: regulation: cysec | - | visit broker | |

| min deposit: $200 spread: from 3 pips leverage: 400:1 regulation: NFA, FCA, cysec | visit broker |

Before we delve into the pros and cons, it is worth explaining what leverage is.

What is leverage ?

Pros of trading with high leverage forex brokers

The first and most obvious benefit of trading with high leverage forex brokers is that it earns you more money for less effort. Regardless of the nature of the instrument being traded or whether you are staking a small or large amount, the key role of high leverage brokers is to increase your profit by multiplying the stakes. Although the same effect could be achieved by investing more capital in each position, leverage works to ensure it is a step ahead in artificially boosting your available capital, usually by hundreds or even a thousand times.

- Increases capital efficiency

In conjunction with the point above, high leverage forex brokers give you the ability to earn high profits per transaction, naturally increasing the efficiency with which you are using your capital. For instance, if it takes you a week to generate $100 with an unleveraged position, leveraging it up means it will take a shorter period to deliver the same results.

In essence, this means that your capital and revenues will be freed up sooner and can be reinvested more times to deliver the most significant and fastest yields possible.

- Trading with low capital

A few years back, only the wealthy could make a profit through forex trading. This is until the introduction of leverage which allows anyone to do it. Leverage allows traders to start trading without having to provide large amounts of funds.

- Eases low volatility

Another important benefit of higher leverage forex trading is its ability to mitigate against low volatility. A volatile trade is one that delivers the highest profits. Unfortunately, due to the cautious nature of forex market traders, volatility tends to be at the lowest end of the scale. High leverage mitigates this by offering larger profits from smaller transaction sizes. High leverages allow traders to capitalize on even the smallest degrees of movement in market pricing.

High leverage FX brokers are the true double-edged sword. When they work for you, they really work for you. But when they turn against your position, trading with them can do some serious damage to your finances within the blink of an eye. Therefore, it is important that as a trader you also understand the disadvantages of trading forex with high leverage brokers.

- Heavier loss risks

The main disadvantage of using high leverage brokers in trading is that it carries a high amount of risk by paving the way for heavy losses. The goal of leveraging is simply upping your ante so that you are essentially playing with more money. Hence, when the games are up and done, you keep huge profits but also bear the losses.

High leverage can end up costing you a lot more than you bargained for, especially when your positions inevitably head south time and again. It is important to know that the higher the leverage you are trading with, the larger your chances of profit and loss are.

- A constant liability

When trading forex, it is crucial to understand that leveraging automatically builds a liability that must be met by your account by the end of the day. Regardless of whether a transaction is up or down, or how many additional costs you have covered at the end of the day, the basic cost must be met and will automatically be applied to your account.

This means that by simply entering into a position, you are by default handicapped since you will need to meet the automatic liability of the leverage portion at the close of the trade. Even if the transaction eventually trends towards zero, the leverage amount will still be owed and must be paid before you can move forward.

Any leveraged trade earns a higher cost. The funding applied to your position must be paid for in terms of interest. Whenever you leverage your transaction, you are essentially borrowing money from your broker and will be required to pay with interest. This interest is calculated and applied daily depending on the rates set by your broker.

Note that the higher the leverage amounts in the trade, the more interest you will incur and the commission the broker will charge to open the contract.

There is also the ever-present risk of falling below the margin requirements set by your broker. The margin call is the set percentage of any transaction size you are required to fulfill in terms of your own capital. If at any time you fall below that threshold, you can expect your brokers to prompt the margin call, which automatically liquidates your portfolio as far as meeting your obligations is concerned.

This could mean that any standing positions that could have run on to deliver massive profits are closed out early in addition to settling losing positions that may never recover.

The bottom line

when managed well, trading with high leverage brokers can be a successful and profitable move. Just make sure to never use high leverage if you are taking a hands-off approach to your trades.

Best international forex brokers

Счета raw spread – это все, что вам нужно! Спреды от 0 пунктов, отсутствие реквотинга, манипуляций и ограничений. IC markets – отличный выбор для крупных трейдеров, скальперов, и тех, кто пользуется роботами.

Основная цель IC markets – создание лучших и наиболее прозрачных условий для розничных и корпоративных трейдеров. Оператор IC markets создан трейдерами и для трейдеров, поэтому мы делаем все для предоставления лучшего спреда, исполнения и обслуживания.

Торговля на форекс

Характеристики

О компании IC markets

Основная цель IC markets – создание лучших и наиболее прозрачных условий для розничных и корпоративных трейдеров. Оператор IC markets создан трейдерами и для трейдеров, поэтому мы делаем все для предоставления лучшего спреда, исполнения и обслуживания.

Торговля на форекс

Характеристики

О компании IC markets

The website www.Icmarkets.Com/global is operated by IC markets global an entity that is not established in the EU or regulated by an EU national competent authority. The entity falls outside the EU regulatory framework i.E. Mifid II and there is no provision for an investor compensation scheme. Please read our terms & conditions

Please confirm, that the decision was made independently at your own exclusive initiative and that no solicitation or recommendation has been made by IC markets or any other entity within the group.

**данные, полученные из независимых источников, подтверждают, что сводный недельный спред по EURUSD был лучше, чем среди 32 прямых конкурентов в секторе форекс в 96% времени в период с января по декабрь 2019 года.

***среднее время исполнения ордера, включающее его получение, обработку и подтверждение исполнения, составляет 36,5 мс.

IC markets не принимает запросы на открытие счета от жителей США, канады, израиля и исламской республики иран. Информация на этом сайте не предназначена для жителей любой страны, территории или юрисдикции, где распространение или использование такой информации противоречит местному законодательству или нормативным актам.

Risk warning: trading derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. Please read our legal documents and ensure you fully understand the risks before you make any trading decisions. We encourage you to seek independent advice.

The information on this site in not intended for residents of the U.S. Canada, israel, new zealand, japan and islamic of iran and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

IC markets is an over the counter derivatives issuer, transactions are entered into on a principal to principal basis. The products issued by us are not traded on an exchange.

International capital markets pty ltd (ACN 123 289 109), trading as IC markets, holds an australian financial services licence (AFSL no. 335692) to carry on a financial services business in australia, limited to the financial services covered by its AFSL. The trading name, IC markets, used by international capital markets pty ltd is also used by other entities.

IC markets EU ltd is authorised and regulated by the cyprus securities and exchange commission with license number 362/18, registration number 356877 and with registered office at 141 omonoias avenue, the maritime centre, block B, 1st floor, 3045 limassol, cyprus.

Raw trading ltd registered in seychelles with company number: 8419879-2, trading as IC markets global, regulated by the financial services authority of seychelles with a securities dealer licence number: SD018. The website is operated by IKBK holdings ltd, registered in cyprus with registration number 362049 and registered address at 38 karaiskaki street, kanika alexander center, block 1, 1 st floor office 113B, 3032, limassol cyprus.

List of the best 23 forex brokers | trusted reviews

Are you looking for a good and serious forex broker? – then this page is the right place for you. Thanks to the large selection on the internet it is often difficult to make the right decision. With more than 7 years of experience in the financial markets, we present you with the best providers with top service and without hidden costs. Find out in the following texts how to select a secure forex provider and which online broker offers the best conditions.

| Broker: | review: | regulation: | spreads: | assets: | advantages: | open account: |

|---|---|---|---|---|---|---|

1. Bdswiss  | ➜ read the review | cysec, FSC | starting 0.0 pips + $ 2.0 commission per 1 lot | 250+ (50+ currency pairs) | + individual offers + trading signals + raw spreads + leverage up to 1:500 + best education + personal support |

Watch our full video review about the best forex brokers (risk warning: your capital is at risk):

Strict criteria for the forex broker review

In contrast to many other comparison sites, we present you on this website only the safest providers with the best conditions for traders. As experts with many years of experience, we have tested many forex brokers and still use some of them. A good provider should have certain characteristics that guarantee good and safe investing.

It is not uncommon to hear of fraud on the internet. This is to be avoided by this comparison. In addition, one would like to save on charges as a trader because the costs for the trade reduce of course the actual profits. Also, the security of customer’s money is of high priority. A regulation or license, for example, is urgently needed for secure trading with international brokers. All these criteria and many more are included in the test. Therefore we can present you on this page the best forex brokers in a list.

Proven facts for a good forex broker:

- Regulation and license of an official finance authority

- High safety of customer funds

- Fast and reliable market execution

- Small forex trading fees and no hidden fees

- No requotes (high liquidity)

- User-friendly trading platform

- Free and unlimited demo account

- Professional support

- Fast deposit and withdraw methods

How does a forex broker work?

A forex broker is an intermediary between a client (trader) and the interbank market for currencies (wikipedia). In addition, the broker can lend capital to the trader so that he can trade with leverage. The broker’s income is generated by the spread and the cost of financing the leveraged positions.

There are 2 different models of brokers: market maker and ECN/NDD broker

Example of live spreads for forex brokers

Market maker:

This broker does not place the trader’s orders directly into the real interbank or spot market. There is an internal matching system between the positions of the traders. Of course, the broker can hedge himself on the real markets so that there are no distortions in supply and demand. In most cases, this system can be opaque, and only as a broker employee, you know the exact functions. A market maker forex broker is not bad or scam. Nowadays, most providers offer good and exact executions.

ECN/NDD (no dealing desk) broker:

ECN and NDD mean direct access to the interbank market through various liquidity providers. These are large banks or very large forex brokers. The provider places the trader’s orders directly into the real market. So the customers get direct and real market prices for trading. With this model, there is no conflict of interest between trader and broker. Zero (no) spread accounts are offered.

Warning: only trade with regulated and licensed forex brokers

Security has the highest priority in online trading. When it comes to trading leveraged financial products, you have to be able to trust the forex broker. It is not uncommon for large sums of money to be used to generate a large profit. For example, brokers in europe must have regulations or licenses if they want to offer their services. The regulation can be in any european country. The same or almost the same requirements apply to brokers everywhere. In order to avoid fraud, it is important to look for such a license.

Licenses are only issued under certain conditions and criteria. If a broker violates these conditions, the license may be withdrawn immediately. All tested companies of mine are always concerned to keep the highest criteria and to guarantee a safe trade. Many brokers, for example, are regulated in cyprus. This has tax advantages. Nevertheless, there are also forex brokers with more than one regulation. The various regulatory authorities can be seen in the table above.

Facts of reliable and secure companies:

- Regulation and license

- Separated customer funds

- Regulated deposit and withdrawal methods

- Using well-known banks

- Large liquidity providers

Another important point for serious trading is the security of customer funds. Payouts of winnings or the deposited amount should work smoothly. It was not uncommon for some brokers to speculate on customer funds themselves. In the end, withdrawals were refused or delays occurred.

How risky is forex trading?

Forex trading is managed by leveraged financial products. That means you are able to trade a bigger contract size than the amount of money in your account. Some brokers offer the leverage up to 1:3000. Many traders are afraid of the obligation to make margin calls and this is not without reason as the past has shown. Account balances could slip into the negative balance. This is possible due to extreme market situations and too large a position size in relation to the account balance.

The providers shown above all have no obligation to make additional contributions (except IC markets and vantage FX). With the providers in the upper table, you are therefore protected against such a scenario. In our experience, this can only happen if the account is too heavily leveraged. You should always beware of sensible risk management.

Beginners should always start with the free demo account to practice forex trading.

A demo account is essential for successful trading. The trading column form and conditions can be tested extensively with this account. It is a virtual credit account that simulates real money trading. It can be traded without risk. This means that new strategies can be developed or new markets tested. The demo accounts of the compared providers are completely free and unlimited. This account is best suited for entry into forex trading.

How to deposit and withdrawal money:

For most traders, the first deposit into their account is very exciting. It should work smoothly and be highly secure. Forex brokers offer well-known and proven payment methods. Capitalize the trading account with electronic methods (credit card, e-wallet, paypal, crypto) or with the classic way of bank transfer. Electronic methods work in real-time and the money is credited directly to the trading account. Trading can be started immediately. The minimum deposit at the compared brokers is very low. For example, you can open an account from as little as 1$. If this is worth it, you have to decide for yourself. There are no fees for deposits.

Example of payment methods of a forex broker

The payout is also very uncomplicated. With a few clicks, you can request a withdrawal on the menu. This is then released in 1-3 working days. However, most brokers payout customer money in less than 24 hours. All presented brokers passed this test. The fees can be high for small payouts. With payments over 200$, the most forex brokers take over the fees but some brokers do not charge any commissions.

Facts about the payments:

- Instant deposit of money

- Fast withdrawal within 1 – 3 working days

- Electronic methods (skrill, neteller, paypal, and more)

- Cryptocurrencies

- Bank wire

Not every country is available for forex trading

Not every country is available for forex brokers and trading. This is because there are some restrictions and special regulations. For example, in some countries, an international broker needs a special license for that specific country. So it is too much afford for some companies to get the license and they stop taking clients from these countries. You can clearly see on the homepage which clients they accept. Not many brokers accept clients of the united states of amerika.

From my experience, the fastest-growing countries are in africa and asia. Because of the development of mobile internet, more people get connected to the forex market. India, nigeria, philippines, malaysia, and china are at the moment the fastest-growing countries.

Is forex trading legal?

Forex trading is fully legal if there is not any ban from the government. Forex trading is just changing money into another currency. This is not an illegal practice. The brokers on my review got official regulations so they act fully legal.

Review conclusion: start trading with a reliable forex broker

On this page, we have presented you with our current list of the top 23 forex brokers in comparison. Now you have a selection of good and reputable companies in front of you. It was particularly important to us that we only present providers here, which we have tested by ourselves with real money. This is not the case with most comparisons.

Profit now from the most favorable fees and the best conditions by my experience of many years. With these providers, you are 100% safe and can take your forex trading to the next level.

We hope you could learn something in this comparison and act now with better providers through my recommendations. If you can’t make up your mind, please also read the reviews.

Successful forex trading requires a good and reliable broker. In this review, we showed you the top 23 secure forex brokers. Now you can choose your professional trading partner.

So, let's see, what we have: compare the best international brokers for this year, based on commissions, customer service, asset classes and more. At best international forex brokers

Contents of the article

- Top forex bonuses

- Best international brokers

- Sarah horvath

- Featured international broker: interactive brokers

- Featured international broker: interactive brokers

- Quick look: the best international brokers

- Sarah horvath