Tickmill vip

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade.

Top forex bonuses

Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees. *no commissions on cfds on stock indices, oil and bonds.

VIP ACCOUNT

An exclusive account for high volume traders looking for competitive pricing and extra benefits.

Why choose our VIP account?

VIP ACCOUNT

Make the most of your trading with ultra-low spreads.

| Minimum balance | 50,000 |

|---|---|

| available base currencies | USD, EUR, GBP |

| spreads from | 0.0 pips |

| max leverage | 1:500 |

| min lots | 0.01 |

| commissions | 1 per side per 100,000 traded |

| all strategies allowed | |

| swap-free islamic account option |

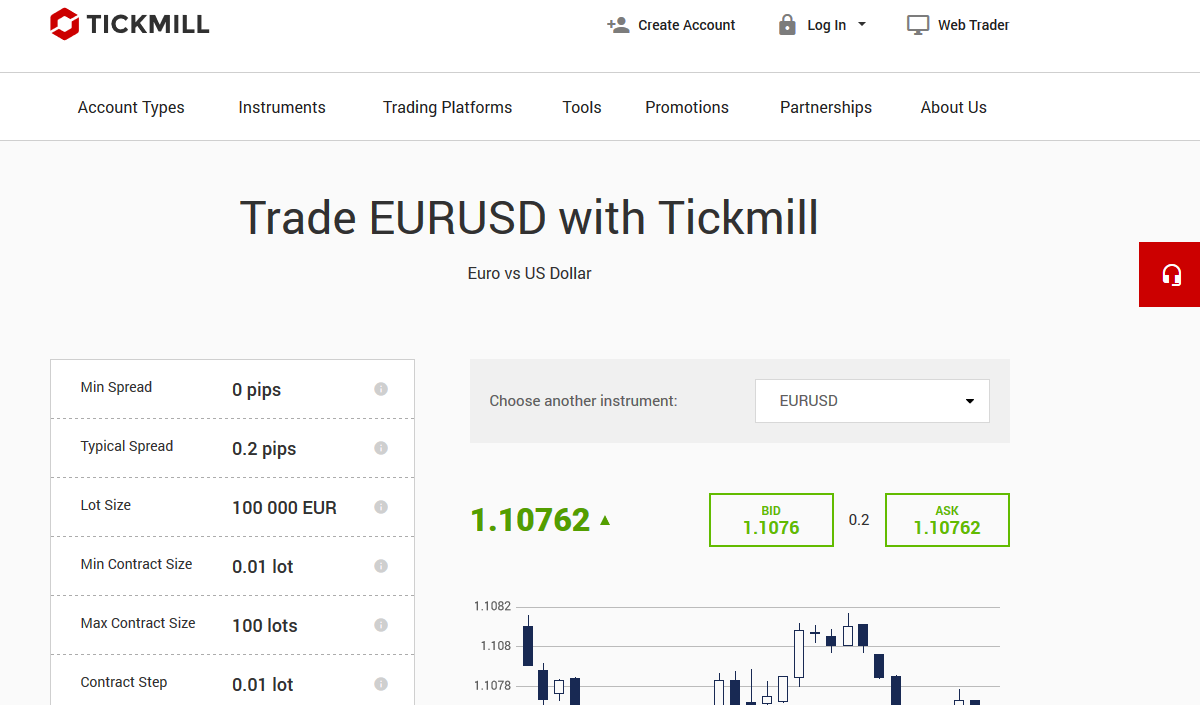

Trade cfds on 62 currency pairs, major stock indices, oil, precious metals and bonds on your VIP account with spreads starting from 0.0 pips.

You will pay commission of only 1 currency unit per side per lot (0.0010% notional) on your VIP account in the base currency of the trading instrument. Our standard commission is one of the lowest in the world.

Example: if you trade 1 lot of EURUSD, which has a contract size of 100,000 EUR, then your commission per side would be 1 EUR and 2 EUR round turn.

Though many brokers do not allow placing stop and limit orders close to market prices, we allow you to do just that. So, stop and limit levels for VIP account users are zero.

*no commissions on cfds on stock indices, oil and bonds.

Benefit from EXCEPTIONAL trading conditions

available base currencies: USD, EUR, GBP execution model: NDD execution type: market execution average execution speed: 0.20 seconds margin call / stop-out: 100% / 30%

Access some of the most

POPULAR INSTRUMENTS

of the market

FOREX

STOCK INDICES & OIL

METALS

BONDS

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

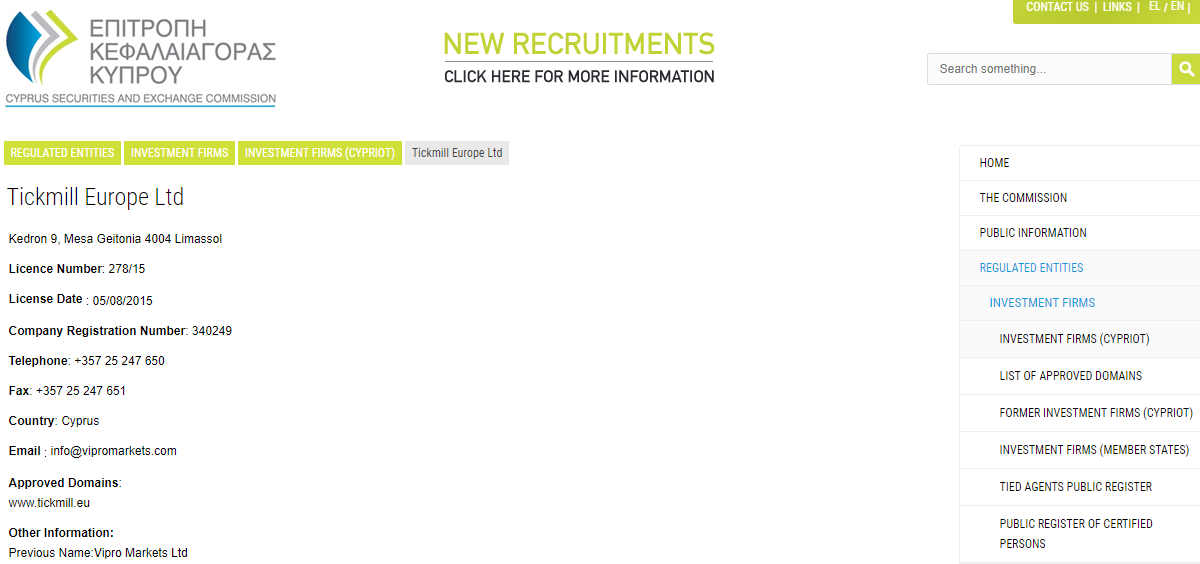

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

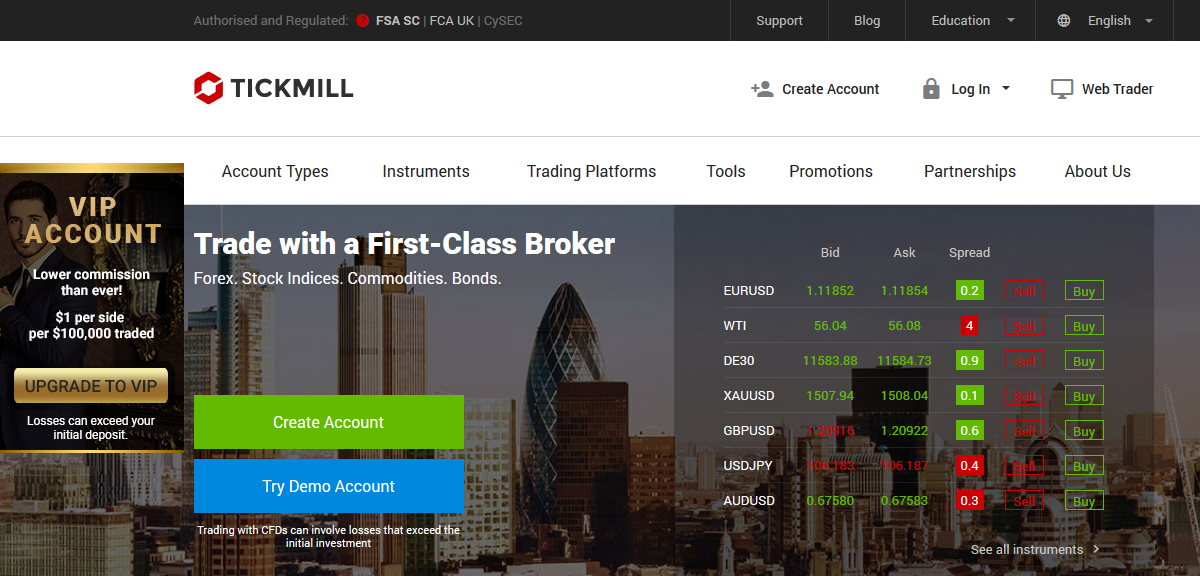

Tickmill now offers lower commission than ever on VIP accounts

Exceptional trading conditions form the bedrock of tickmill’s rapid growth. In line with our mission to maximising value for our clients, we are delighted to announce that we have lowered our commission on VIP accounts to $1 per side per $100,000 traded.

Tickmill has built a strong reputation as one of the fastest-growing brokers in the world with solid financial results by providing an award-winning trading environment to clients. Our size and significant trading volumes enable us to enjoy good trading conditions from our lps and to pass on these benefits to our clients.

Commission reduction up to 37.5%

VIP account holders can now enjoy ultra-low commission of only 1 per side per lot (0.0010% notional) in the base currency of the traded instrument and save up to 37.5% on commissions. We are proud to have managed to secure such a substantial reduction for our valued clients and offer commissions that are hard to beat.

The commission reduction, in combination with our tight spreads and lightning-speed execution, will allow our clients to:

- Decrease the cost of their trading

- Increase their potential profitability

- Maximise the efficiency of their strategies

This improvement not only gives our elite VIP traders great value, but it also reflects our unwavering commitment to customer satisfaction on our way to becoming the broker of choice for professional clients.

Upgrade to a VIP account and get access to some of the world’s lowest trading costs.

Losses can exceed your initial deposit.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

TÀI KHOẢN VIP

Một tài cao cấp cho các nhà giao dịch khối lượng lớn đang tìm kiếm chí phí cạnh tranh và lợi ích tăng thêm.

Tại sao nên chọn tài khoản VIP của chúng tôi?

TÀI KHOẢN VIP

Tận dụng tối đa giao dịch của bạn với mức spread cực thấp.

| Số dư tối thiểu | 50,000 |

|---|---|

| loại tiền cơ sở có sẵn | USD, EUR, GBP |

| spread từ | 0.0 pip |

| đòn bẩy tối đa | 1:500 |

| lot tối thiểu | 0.01 |

| phí giao dịch | 1 đơn vị cho mỗi bên của 100,000 đơn vị giao dịch |

| cho phép tất cả các chiến lược giao dịch | |

| lựa chọn tài khoản hồi giáo miễn phí swap |

Giao dịch CFD cho 62 cặp tiền, 15 chỉ số chứng khoản, dầu thô, kim loại quý và trái phiếu trên tài khoản VIP của bạn với spread cực thấp từ 0.0 pip.

Bạn sẽ chỉ phải trả phí giao dịch 1 đơn vị cho mỗi bên của một lot (0,0010% tương đương) trên tài khoản VIP của bạn bằng loại tiền cơ bản của công cụ giao dịch . Phí giao dịch tiêu chuẩn của chúng tôi là một trong những mức thấp nhất trên thế giới.

Ví dụ: nếu bạn giao dịch 1 lot EURUSD, tương đương với khối lượng giao dịch là 100.000 EUR, thì chi phí giao của bạn sẽ là 1 EUR cho mỗi bên và 2 EUR tổng cộng.

Mặc dù nhiều nhà môi giới không cho phép đặt lệnh dừng và giới hạn gần với giá thị trường, chúng tôi cho phép bạn làm điều đó. Vì vậy, lệnh dừng và lệnh giới hạn cho người dùng tài khoản VIP bằng không.

* không có phí giao dịch cho CFD của chỉ số chứng khoán, dầu thô và trái phiếu.

Hưởng lợi từ các điều kiện giao dịch TUYỆT VỜI

loại tiền cơ sở có sẵn: USD, EUR, GBP mô hình thực hiện lệnh: NDD hình thức khớp lệnh: lệnh thị trường tốc độ thực hiện lệnh trung bình: 0.20 giây margin call / stop-out: 100% / 30%

Tiếp cận được những

CÔNG CỤ GIAO DỊCH PHỔ BIẾN

nhất của thị trường

FOREX

CHỈ SỐ CHỨNG KHOÁN

KIM LOẠI

TRÁI PHIẾU

BẮT ĐẦU GIAO DỊCH với tickmill

Nó thật đơn giản và tham gia dễ dàng!

ĐĂNG KÝ

Hoàn tất đăng ký, đăng nhập vào khu vực khách hàng của bạn và tải lên các tài liệu cần thiết.

TẠO MỘT TÀI KHOẢN

Khi hồ sơ của bạn được duyệt, tạo một tài khoản giao dịch live.

TIẾN HÀNH NẠP TIỀN

Chọn phương thức thanh toán, nạp tiền vào tài khoản giao dịch của bạn và bắt đầu giao dịch.

CÔNG CỤ GIAO DỊCH

ĐIỀU KIỆN GIAO DỊCH

TÀI KHOẢN GIAO DỊCH

NỀN TẢNG

ĐÀO TẠO

CÔNG CỤ HỖ TRỢ

ĐỐI TÁC

CHƯƠNG TRÌNH KHUYẾN MÃI

VỀ CHÚNG TÔI

HỖ TRỢ

Tickmill là tên giao dịch của tập đoàn tickmill.

Tickmill.Com được sở hữu và quản lý bởi tập đoàn tickmill. Tập đoàn tickmill gồm có tickmill UK ltd, được quản lý bởi cơ quan quản lý tài chính (văn phòng đăng ký tại: 1 fore street avenue, london EC2Y 9DT, vương quốc anh), tickmill europe ltd, được quản lý bởi ủy ban giao dịch chứng khoán cyprus (văn phòng đăng ký tại: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (PTY) LTD, FSP 49464, được quản lý bởi cơ quan quản lý tài chính khu vực (FSCA) (văn phòng đăng ký tại: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, được quản lý bởi cơ quan dịch vụ tài chính của seychelles và công ty con procard global ltd có vốn chủ sở hữu 100%, UK đăng ký số 09369927 (văn phòng đăng ký tại: 1 fore street avenue, london EC2Y 9DT, vương quốc anh), tickmill asia ltd - được quản lý bởi cơ quan dịch vụ tài chính labuan malaysia (giấy phép số: MB/18/0028 và văn phòng đăng ký tại: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Khách hàng phải ít nhất 18 tuổi để sử dụng các dịch vụ của tickmill.

Cảnh báo rủi ro cao: giao dịch hợp đồng chênh lệch (CFD) sử dụng đòn bẩy tiềm ẩn rủi ro cao và có thể không phù hợp với tất cả các nhà đầu tư. Trước khi quyết định giao dịch hợp đồng chênh lệch (CFD), bạn nên xem xét cẩn thận mục tiêu giao dịch, mức độ kinh nghiệm và khả năng rủi ro của mình. Giao dịch có thể dẫn tới các khoản lỗ vượt quá số vốn đầu tư bạn đầu của bạn và do đó bạn không nên đầu tư số vốn mà mình không đủ khả năng để mất. Vui lòng đảm bảo bạn hiểu đầy đủ các rủi ro và có biện pháp quản lý rủi ro thích hợp.

Trang web này có bao gồm các liên kết đến các trang web được kiểm soát hoặc cung cấp bởi các bên thứ ba. Tickmill chưa thể xem xét và từ chối trách nhiệm đối với bất kỳ thông tin hoặc tài liệu nào được đăng tại bất kỳ trang web nào được liên kết đến trang web này. Bằng cách tạo liên kết đến trang web của bên thứ ba, tickmill không xác nhận hoặc đề xuất bất kỳ sản phẩm hoặc dịch vụ nào được cung cấp trên trang web đó. Nội dụng trên trang web này chỉ nhằm mục đích thông tin. Do đó, nó không nên được coi là một đề nghị hoặc chào mời cho bất kỳ người nào trong bất kỳ khu vực tài phán nào trong đó một đề nghị hoặc chào mời như vậy không được ủy quyền hoặc cho bất kỳ ai mà nó sẽ là bất hợp pháp để đưa ra một đề nghị hoặc chào mời như vậy, cũng không được coi là khuyến nghị để mua, bán hoặc giao dịch với bất kỳ loại tiền tệ cụ thể hoặc giao dịch kim loại quý nào. Nếu bạn không chắc chắn đồng tiền nội địa của mình và các quy định về giao dịch kim loại giao ngày, thì bạn nên rời khỏi trang web này ngay lập tức.

Bạn được khuyên nên tìm kiếm tư vấn độc lập về tài chính, pháp lý và thuế trước khi tiến hành bất kỳ giao dịch tiền tệ hoặc kim loại giao ngay nào. Không có bất kỳ nội dung nào trong trang web này nên được đọc hoặc hiểu như là lời khuyên đầu tư của tickmill hoặc bất kỳ chi nhánh, giám đốc, cán bộ hoặc nhân viên nào.

Các dịch vụ của tickmill và thông tin trên trang web này không hướng đến công dân / cư dân hoa kỳ và không nhằm mục đích phân phối hoặc sử dụng bởi bất kỳ người nào ở bất kỳ quốc gia hoặc khu vực tài phán nào mà việc phân phối hoặc sử dụng đó sẽ trái với luật hoặc quy định của địa phương.

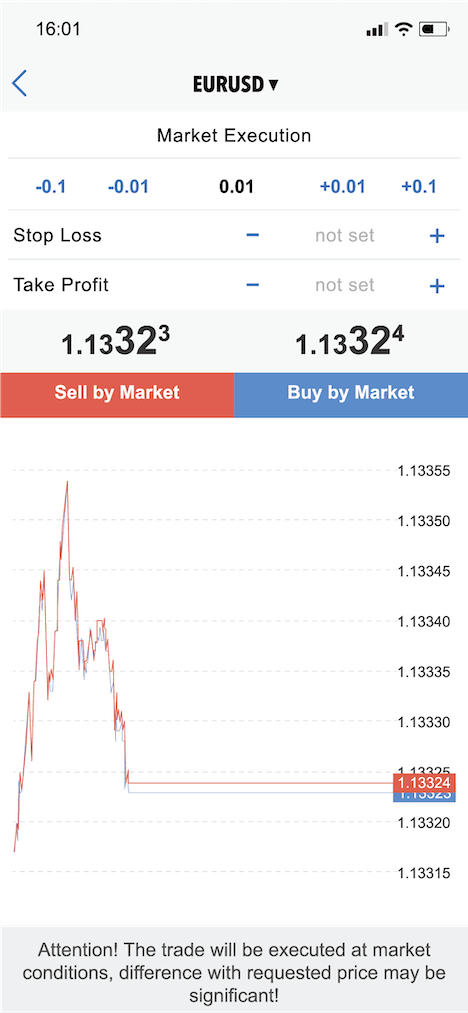

Metatrader 4

(MT4) platform

Tickmill’s MT4 platform is fully customisable and designed to give you that trading edge.

Why trade with tickmill’s

metatrader 4?

Designed specifically for traders, our metatrader 4 platform provides a user-friendly and highly customisable interface, accompanied by sophisticated order management tools help you control your positions quickly and efficiently.

MT4 is widely recognised as the world’s favorite forex trading platform. It offers an easy-to-use user interface, enhanced charting functionality, indicators and supports MQL language. So, you can easily program indicators and expert advisors (eas) to trade the forex market 24/5 with no intervention needed from your side.

Combined with tickmill’s enhanced trading conditions, you’re able to use a globally recognised trading platform accompanied by spreads from 0 pips and 0.20s execution.

Key features of MT4

cfds on forex, stock indices, commodities and bonds. Execute your order with no partial fills, as a result of our huge depth of liquidity. EA trading facilities by using our VPS services. Advanced technical analysis, 50+ indicators and customisable charting… in 39 languages. Trading signals with an advanced notification system.

User manuals

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADE

Launch the platform, enter tickmill’s server name to log in and start trading!

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Why tickmill?

Tickmill provides premium trading products and services with transparency and innovative technology.

Why choose tickmill?

- SUPERIOR TRADING CONDITIONS

get access to 80+ instruments with spreads as low as 0.0 pips and some of the lowest commissions on the market. - ULTRA-FAST EXECUTION

we take pride in providing one of the industryвђ™s fastest execution times вђ“ 0.15s on average and no requotes. - ALL STRATEGIES ALLOWED

trade the worldвђ™s financial markets by using virtually any trading strategy, including eas, hedging and scalping. - SAFETY OF CLIENTS FUNDS

client funds are held in segregated accounts with top-tier banks while negative balance protection is also provided. - PIONEERING TECHNOLOGY

all our trading platforms are powered by innovative technology and advanced features to cater for our clientsвђ™ evolving needs. - DEDICATED SUPPORT

our multilingual team of professionals remains by your side to ensure you receive expert support in a timely manner.

Why open an account

with tickmill?

- 80+ TRADING INSTRUMENTS

- SPREADS FROM 0.0 pips

- FAST DEPOSITS & WITHDRAWALS

- TOP-TIER CLIENT FUND SAFETY

- MULTILINGUAL CLIENT SUPPORT

- EAS & ALGOS ALLOWED

Risk warning: trading financial products on margin carries a high degree of risk and is not suitable for all investors. Losses can exceed the initial investment. Please ensure you fully understand the risks and take appropriate care to manage your risk.

CREATE VIP ACCOUNT NOW

Are you a member already?

Just add a new account.

IB SELECT 'new introducing broker',

enter below CODE in the IB CODE field.

IB79616275

บัญชี VIP

บัญชีพิเศษสำหรับเทรดเดอร์ที่มีปริมาณการเทรดสูง และกำลังมองหาราคาที่สร้างความได้เปรียบพร้อมกับผลประโยชน์พิเศษ

ทำไมควรเลือก บัญชี VIP ของเรา

บัญชี VIP

| balance ขั้นต่ำ | 50,000 |

|---|---|

| base currencies ที่สามารถใช้ได้ | USD, EUR, GBP |

| สเปรดจาก | 0.0 pips |

| leverage สูงสุด | 1:500 |

| ขนาด lots ขั้นต่ำ | 0.01 |

| คอมมิชชั่น | 1 ต่อด้านต่อ 100,000 |

| ไม่จำกัดกลยุทธ์การเทรด | |

| swap-free บัญชี islamic |

เทรด cfds 62 คู่สกุลเงิน, ดัชนีหุ้นหลัก, น้ำมัน, โลหะมีค่า พันธบัตร บนบัญชีประเภท VIP ด้วยค่าสเปรดเริ่มต้นเพียง 0.0 pips

คุณสามารถจ่ายคอมมิชชั่นเพียง 1 per side per lot* (0.0010% notional) เมื่อเทรดตราสารในสกุลเงินของบัญชี VIP ของคุณ *ซึ่งเป็นหนึ่งในบัญชีที่มีค่าคอมมิชชั่นต่ำที่สุดในโลก

ตัวอย่าง: หากคุณเทรด 1 lot EURUSD, ซึ่งมีขนาดสัญญาที่ 100,000 EUR, คอมมิชชั่นต่อด้านคือ 1 EUR และ 2 EUR สำหรับสองด้าน

แม้โบรกเกอร์อื่นจะไม่อนุญาติให้คุณวาง stop and limit orders ใกล้กับราคาตลาด แต่เราสามารถให้คุณทำได้ stop และ limit levels สำหรับบัญชี pro สามารถตั้งค่าได้ถึง 0

* ไม่มีคอมมิชชั่นสำหรับ cfds ดัชนีหุ้น, น้ำมัน และพันธบัตร.

สร้างความได้เปรียบจากเงื่อนไขการเทรดที่ไม่เหมือนใคร

base currencies ที่สามารถใช้ได้: USD, EUR, GBP รูปแบบการประมวลผล: NDD ประเภทการประมวลผล: market execution ความเร็วการประมวลผลเฉลี่ย: 0.20 วินาที margin call / stop-out: 100% / 30%

เข้าถึง

ตราสารยอดนิยม

ในตลาด

ฟอเร็กซ์

ดัชนีหุ้น

โลหะมีค่า

พันธบัตร

เริ่มต้นเทรด กับ tickmill

เริ่มต้นอย่างง่ายและรวดเร็ว!

ลงทะเบียน

เปิดบัญชี

ทำการฝากเงิน

เลือกช่องทางการฝากเงิน, ฝากเงินเข้าสู่บัญชีเทรด และเริ่มต้นเทรด

ตราสารสำหรับเทรด

เงื่อนไขการเทรด

บัญชีเทรด

แพลตฟอร์ม

การศึกษา

เครื่องมือ

พันธมิตร

โปรโมชั่น

เกี่ยวกับเรา

การสนับสนุนลูกค้า

Tickmill คือชื่อทางการค้าของกลุ่มบริษัท tickmill

Tickmill.Com เป็นเจ้าของและดำเนินการภายใต้กลุ่ม บริษัท tickmill กลุ่มบริษัท tickmill ประกอบด้วย tickmill UK ltd, กำกับดูแลโดย financial conduct authority (สำนักงานจดทะเบียน: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ ENGLAND), tickmill europe ltd, กำกับดูแลโดย cyprus securities and exchange commission (สำนักงานจดทะเบียน: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (PTY) LTD, FSP 49464, กำกับดูแลโดย financial sector conduct authority (FSCA) (สำนักงานจดทะเบียน: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd,กำกับดูแลโดย financial services authority of seychelles และเป็นเจ้าของบริษัท 100% procard global ltd, UK หมายเลขจดทะเบียน 09369927(สำนักงานจดทะเบียน: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england) tickmill asia ltd - กำกับดูแลโดย financial services authority of labuan malaysia (หมายเลขทะเบียน: MB/18/0028 สำนักงานจดทะเบียน: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia)

ลูกค้าจะต้องมีอายุอย่างน้อย 18 ปีจึงจะสามารถใช้บริการของ tickmill ได้

คำเตือนความเสี่ยงสูง: การเทรด contracts for difference (cfds) ด้วยมาร์จิ้นมีความเสี่ยงสูงและอาจไม่เหมาะสำหรับนักลงทุนทุกคน ก่อนตัดสินใจซื้อขาย contracts for difference (CFD) คุณควรพิจารณาอย่างรอบคอบถึงวัตถุประสงค์การซื้อขาย ระดับประสบการณ์ และความเสี่ยงที่อาจเกิดขึ้น มีความเป็นไปได้ที่ความสูญเสียจะสูงเกินกว่าเงินลงทุนของคุณ คุณไม่ควรฝากเงินที่คุณไม่สามารถสูญเสียได้ โปรดตรวจสอบให้แน่ใจว่าคุณเข้าใจความเสี่ยงทั้งหมดและใช้ความระมัดระวังในการจัดการความเสี่ยงของคุณ

ไซต์นี้มีลิงก์ไปยังเว็บไซต์ที่ควบคุมหรือนำเสนอโดยบุคคลที่สาม tickmill ไม่ได้ตรวจสอบและไม่ขอรับผิดชอบต่อข้อมูลหรือเนื้อหาใด ๆ ที่โพสต์ไว้ในไซต์ใด ๆ ที่เชื่อมโยงกับไซต์นี้ โดยการสร้างลิงก์ไปยังเว็บไซต์ของบุคคลที่สาม tickmill ไม่รับรองหรือแนะนำผลิตภัณฑ์หรือบริการใด ๆ ที่นำเสนอบนเว็บไซต์นั้น ข้อมูลที่มีอยู่ในเว็บไซต์นี้มีวัตถุประสงค์เพื่อเป็นข้อมูลเท่านั้น ดังนั้นจึงไม่ควรถือเป็นข้อเสนอหรือการชักชวนบุคคลใดในเขตอำนาจศาลใด ๆ ที่ข้อเสนอหรือการชักชวนดังกล่าวไม่ได้รับอนุญาตหรือบุคคลที่ไม่ชอบด้วยกฎหมายที่จะทำข้อเสนอหรือการชักชวนดังกล่าวและไม่ถือว่าเป็นคำแนะนำ เพื่อซื้อขายหรือจัดการกับสกุลเงินใดสกุลหนึ่งหรือการค้าโลหะมีค่า หากคุณไม่แน่ใจเกี่ยวกับกฎหมายในท้องถิ่นของคุณที่เกี่ยวข้องของกำกับดูแลการเทรดสกุลเงินและการเทรดโลหะมีค่าคุณควรออกจากไซต์นี้ทันที

ข้อมูลที่ปรากฏอยู่ในเว็บไซต์นี้มีวัตถุประสงค์เพื่อให้ข้อมูลเท่านั้น. ดังนั้น จึงไม่นับว่าเป็นข้อเสนอหรือการชักชวนให้บุคคลใดในเขตอำนาจใดในที่ดังกล่าวเสนอหรือชักชวนโดยที่ไม่ได้รับอนุญาต หรือให้กับบุคคลใดๆ ซึ่งจะเป็นการกระทำที่ไม่ชอบด้วยกฎหมาย หรือการให้ข้อเสนอหรือชักชวนนั้นไม่ได้ถือว่าเป็นคำเสนอแนะให้ทำการซื้อ, ขาย หรือ ทำข้อตกลงกับการลงทุนใดๆ. หากคุณไม่แน่ใจเกี่ยวกับการกฎระเบียบของการเทรดสกุลเงินท้องถิ่น และโลหะ คุณควรออกจากเว็บไซต์นี้ทันที

ขอแนะนำให้คุณขอรับคำแนะนำทางการเงิน, ด้านกฎหมาย และด้านภาษีจากผู้แนะนำที่เป็นอิสระ ก่อนดำเนินการกับเทรดสกุลเงินหรือโลหะมีค่า ไม่มีสิ่งใดในเว็บไซต์นี้ควรอ่านหรือตีความว่าเป็นการให้คำแนะนำในส่วนของ tickmill หรือ ผู้เกี่ยวข้อง, ผู้บริหาร, เจ้าหน้าที่ หรือลูกจ้าง

บริการของ tickmill และข้อมูลภายในไซต์นี้ไม่ได้นำเสนอแก่พลเมือง / ผู้อยู่อาศัยในประเทศสหรัฐอเมริกา และไม่ได้มีวัตถุประสงค์เพื่อแจกจ่าย ให้บริการ หรือใช้โดยบุคคลในประเทศหรือเขตอำนาจศาลใด ๆ ที่การให้บริการดังกล่าวขัดต่อ กฎหมายหรือข้อบังคับในท้องถิ่น

Tickmill review 2021

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

🏆 top 5 stock brokers

🏆 top 5 forex brokers

Summary

Recommended for forex traders looking for low fees and prefer metatrader 4 platform

Tickmill is a global forex and CFD broker, established in 2014. The company is regulated by several financial authorities globally, including the top-tier financial conduct authority (FCA) in the united kingdom.

Tickmill is considered safe because it is regulated by the top-tier FCA.

Disclaimer: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill pros and cons

Tickmill has low forex and non-trading fees. The account opening is fast, easy, and fully digital. You can use a lot of options for deposit or withdrawal, and they're free of charge.

On the negative side, tickmill has a limited product portfolio as it offers only forex and cfds. Popular asset classes, such as stocks and etfs are missing. Trading platforms are provided by metatrader, and they have outdated designs. Finally, the news feed is basic and not structured.

| Pros | cons |

|---|---|

| • low forex fees | • only forex and cfds |

| • fast and easy account opening | • trading platforms with outdated design |

| • free deposit and withdrawal | • basic news feeds |

| ��️ country of regulation | UK, cyprus, seychelles, south africa, malaysia |

| �� trading fees class | low |

| �� inactivity fee charged | no |

| �� withdrawal fee amount | $0 |

| �� minimum deposit | $100 |

| �� time to open an account | 1 day |

| �� deposit with bank card | available |

| �� depositing with electronic wallet | available |

| �� number of base currencies supported | 4 |

| �� demo account provided | yes |

| ��️ products offered | forex, CFD |

Author of this review

Author of this review

Ádám nasli

Everything you find on brokerchooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Tickmill review

fees

Tickmill has low forex, but average CFD fees. There is no fee for deposit, withdrawal, or inactivity.

| Pros | cons |

|---|---|

| • low forex fees | • average CFD fees |

| • no withdrawal fee | |

| • no inactivity fee |

| assets | fee level | fee terms |

|---|---|---|

| EURUSD | low | pro account pricing: €2 commission per trade per lot plus spread cost. 0.1 pips is the average spread cost during peak trading hours. |

| GBPUSD | low | pro account pricing: £2 commission per trade per lot plus spread cost. 0.3 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | average | the fees are built into the spread, 0.4 points is the average spread cost during peak trading hours. |

| Inactivity fee | low | no inactivity fee |

How we ranked fees

We ranked tickmill's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

To get things rolling, let's go over some lingo related to broker fees. What you need to keep an eye on are trading fees, and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

Below you will find the most relevant fees of tickmill for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

We also compared tickmill's fees with those of two similar brokers we selected, axitrader and FXCM. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of tickmill alternatives.

To have a clear overview of tickmill, let's start with the trading fees.

Tickmill trading fees

Tickmill's trading fees are low. There are different cost structures for different account types. We tested the pro account, which charges a commission but offers tight spreads.

We know it's hard to compare trading fees for forex brokers. So how did we approach the problem of making their fees clear and comparable? We compare brokers by calculating all the fees of a typical trade for selected products.

We have chosen popular instruments in each asset class usually provided by the forex brokers:

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

- Stock index cfds: SPX and EUSTX50

A typical trade means buying a leveraged product, holding it for one week and then selling. For the volume, we chose a $20,000 position for forex and a $2,000 position for stock index and stock CFD transactions. The leverage we used was:

- 30:1 for forex

- 20:1 for stock index cfds

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for tickmill fees.

Forex fees

Tickmill has low forex fees. The forex fees are one of the lowest among the brokers we have reviewed.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| EURUSD benchmark fee | $6.8 | $5.1 | $12.5 |

| GBPUSD benchmark fee | $5.0 | $4.3 | $5.6 |

| AUDUSD benchmark fee | $5.0 | $3.4 | $8.8 |

| EURCHF benchmark fee | $4.7 | $2.9 | $3.3 |

| EURGBP benchmark fee | $7.8 | $5.2 | $16.4 |

The low forex fees are mainly due to the low commission tickmill charges. The commission is 2 base currency units (first currency pair) per lot per trade. For example, it's €2 per lot per trade for EURUSD, while £2 per lot per trade for GBPUSD.

CFD fees

CFD fees are average.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.5 | $1.3 | $1.5 |

| europe 50 index CFD fee | $1.2 | $2.3 | $1.6 |

Non-trading fees

Tickmill has low non-trading fees. There is no fee for deposit, withdrawal, or inactivity.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| account fee | no | no | no |

| inactivity fee | no | no | yes |

| deposit fee | $0 | $0 | $0 |

| withdrawal fee | $0 | $0 | $0 |

Tickmill review

account opening

Tickmill has a fast and easy account opening process. Our account was verified within one business day. The minimum deposit is low, $100 for all account types, except VIP accounts.

Can you open an account?

Open account

73% of retail CFD accounts lose money

Tickmill accepts clients from all over the world. There are only a few exceptions, e.G. Customers from the US or canada can't open an account.

What is the minimum deposit at tickmill?

The required minimum deposit at tickmill is $100 . For a VIP account, you need to maintain a minimum $50,000 balance.

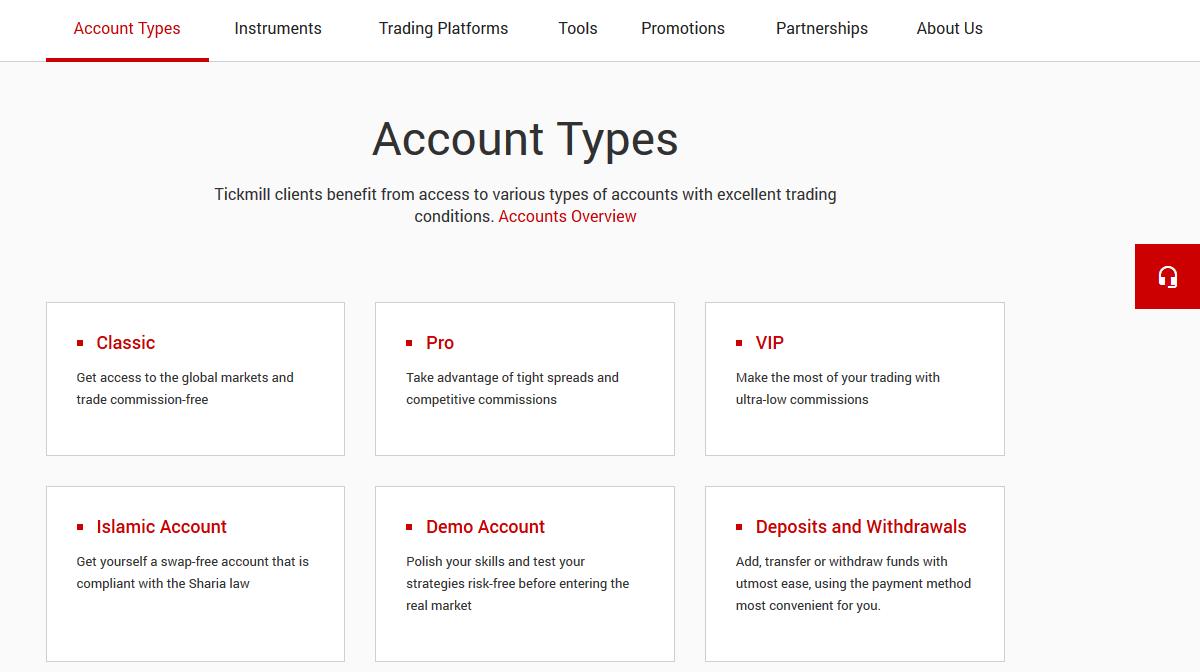

Account types

Tickmill has several account types that differ in pricing, minimum deposit, and minimum account balance.

| pro | classic | VIP | |

|---|---|---|---|

| minimum deposit | $100 | $100 | - |

| minimum account balance | - | - | $50,000 |

| pricing | tight spread plus commission | wide spread, but no commission | tight spread plus commission |

| commission per $100,000 trade | $2 | no commission | $1 |

Retail clients of tickmill ltd can use leverage up to 1:500 while retail clients of tickmill UK ltd and tickmill europe ltd can use maximum leverage of 1:30. If you qualify for a professional trader, you can trade with higher leverage, up to 1:500 (tickmill UK ltd) or up to 1:300 (tickmill europe ltd).

The criteria for professional clients:

- An average frequency of 10 trades per quarter in the previous four quarters

- Size of your financial instrument portfolio exceeds €500k

- You have at least one year experience in a relevant financial position

You can also open corporate and swap-free islamic accounts. The main difference between islamic aand other accounts is that instead of daily swap rates, an administration fee is charged if you hold some exotic currencies for more than 3 nights.

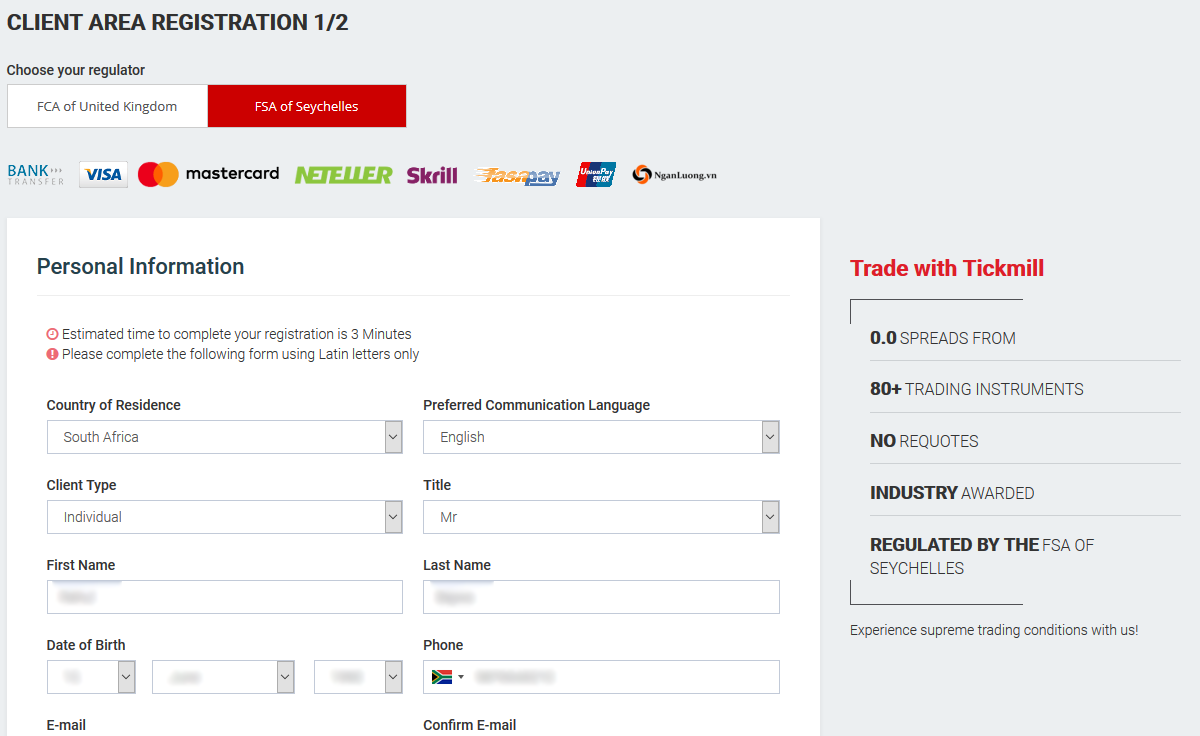

How to open your account

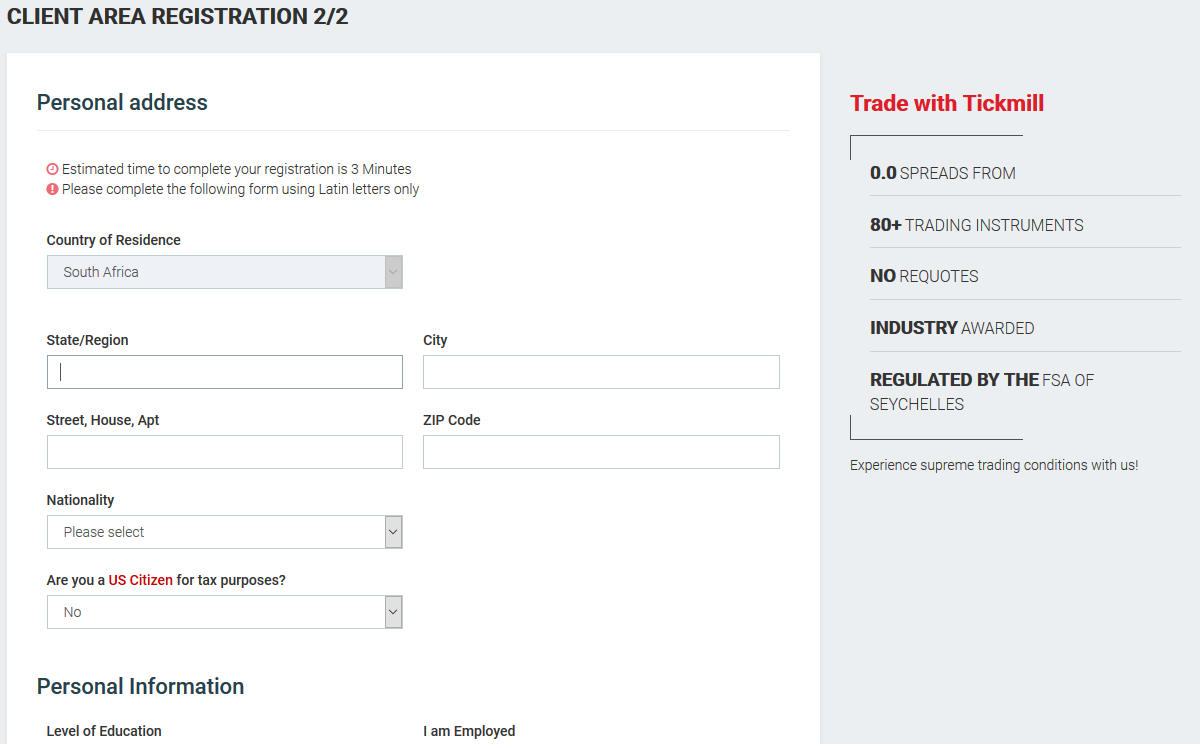

Account opening is fully digital, fast and straightforward. You can fill out the online application form in a matter of minutes. Our account was verified within one day.

To open an account at tickmill, you have to go through these steps:

- 'choose your regulator' will determine whether you sign up for the tickmill site regulated by the UK, cyprus or the seychelles authority. We recommend going for the UK one or the EU one (cyprus) if available in your country

- Fill in your name, country of residence, email address and telephone number

- Add your personal information, such as your date of birth and address

- Select the base currency

- Provide your financial information and answer questions about your financial knowledge

- Select your account type: pro, classic or VIP

- Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency.

Tickmill

- Educational section is a little limited.

- No cfds on individual stocks.

- $50,000 deposit required to access really low commission.

Min deposit

Max leverage

Mini account

Bonus

Platforms

Withdrawal options

Review

Comparison

Review

Introduction

Tickmill is a relatively new broker which was founded in 2015. There are two entities with a UK company complying with new CFD and forex regulations and the seychelles registered company offering greater levels of leverage.

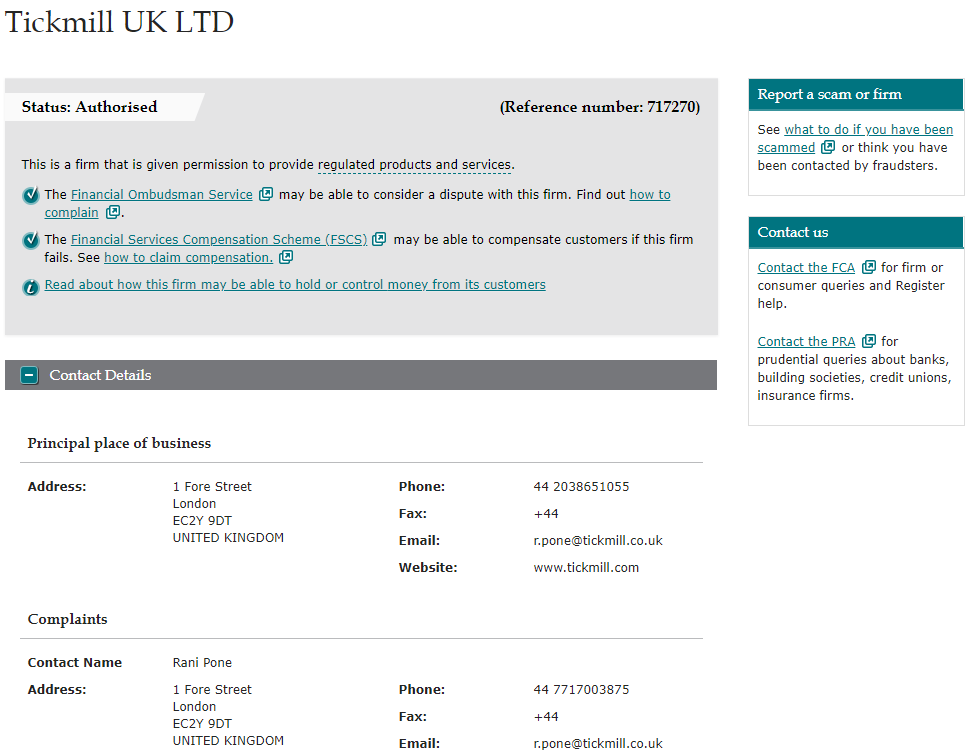

Tickmill is regulated by the FCA in the UK and the FSA in the seychelles. They are also authorised by cysec in cyprus.

Tickmill is managing to establish a name for themselves and were awarded the best forex execution broker at the UK forex awards in 2018.

The easy to navigate website is available in 15 languages.

Trading conditions

Tickmill charges floating spreads for all accounts, though the spreads for pro and VIP are zero on some instruments. Stop loss and take profit orders can be entered with no limitations. Trailing stops are only active while MT4 is open.

Leverage for accounts held with tickmill UK complies with ESMA regulations. Maximum leverage for major FX pairs is 1:30, for other currencies, major indices and gold it is 1:20, for silver, oil and other indices 1:10 and for bonds it is 1:5. UK accounts are stopped out at 50% of margin.

Accounts held in the seychelles can increase their leverage to 1:500 and the stop out level falls to 30%.

A new client bonus of $30 is currently offered.

Tickmill offers 4 different types of accounts, including demo accounts.

Classic accounts require a minimum deposit of $100 and offer spreads starting at 1.6 pips with no commission.

Pro accounts require a minimum deposit of $100 and spreads starting at 0, but charge commission.

VIP accounts require a minimum deposit of $50,000 and spreads starting at 0 and charge lower commissions.

All of these accounts can be converted to islamic swap free accounts. They can also all be funded in USD, EUR, GBP and PLN.

Demo accounts allow newbie clients to practice their trading with all the available platforms, instruments and with real time pricing.

Tickmill also offers bespoke solutions for money managers and institutions.

Newbie traders should start with the classic account in the UK which offers competitive spreads, a relatively low deposit requirement and modest leverage.

Products

Tickmill offers more than 60 currency pairs and cfds on 14 stock indexes, oil, precious metals, bonds and cryptocurrencies.

The currency pairs include all major pairs and all the minor and exotic pairs that are favoured by forex traders. Indices include the dow 30, S&P500, FTSE 100 and most other major global indices. These cfds are based on the index futures contracts.

Clients can also trade west texas oil, gold, silver, german government bonds and cfds on bitcoin.

Cfds on individual stocks are not available from this broker.

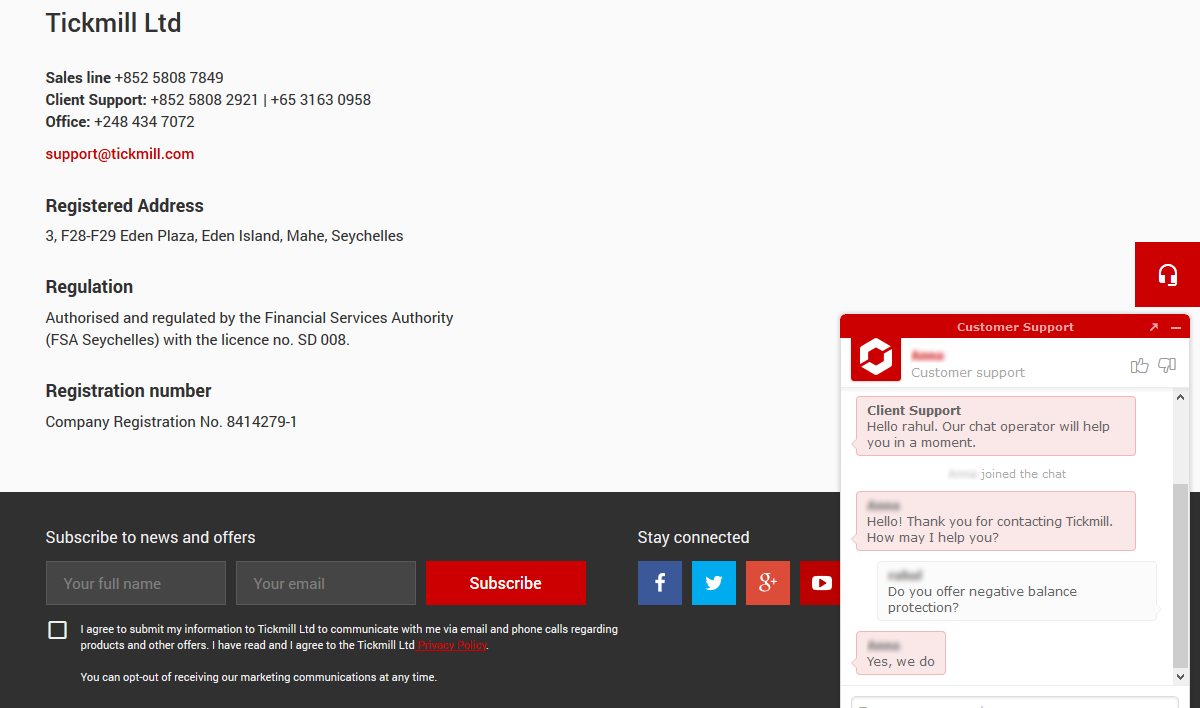

Regulation

Tickmill UK is based at 1 fore street, london, EC2Y 9DT. This entity is regulated by the financial conduct authority (register number: 717270). UK accounts also benefit from deposit protection.

Tickmill seychelles is based at 3, F28-F29 eden plaza, eden island, mahe, seychelles and regulated by the financial services authority (with licence no. SD 008).

Platforms

Tickmill offers clients a choice of two platforms, metatrader 4 and web trader, which is a browser-based version of the same platform. Tickmill doesn’t seem to have any proprietary platforms on offer.

Metatrader 4 is an award-winning trading platform widely recognised as the gold standard for forex trading. It offers 9 time frames and more than 85 indicators. Users can access and share eas (expert advisors) and automated trading systems, and back test their own trading strategies.

MT4 can be installed on windows and OS X pcs, as well as mobile devices.

Mobile trading

As far as mobile accessibility goes, tickmill’s offering is fairly standard.

The website is reasonably easy to access and navigate using mobile devices. MT4 can be installed as an app on ios and android devices. This allows traders to access their accounts while on the go, with nearly all the functionality of the desktop platforms.

The browser-based version of MT4 is also mobile friendly.

Pricing

Tickmill’s pricing is competitive when compared to other brokers. The spreads charged on the classic accounts are higher, but about average for small accounts.

Both the pro and VIP accounts are ECN accounts and offer lower spreads but charge commission. The low commission on the VIP account is especially attractive, but a $50,000 deposit is required. The higher commission on the pro account is about average for similar accounts, though spreads can add an unknown factor.

The typical spreads for ECN accounts on the EUR/USD pairs seems to be 0.2 pips which is toward the lower end of the range when compared to other brokers.

We didn’t find complaints about the spreads, though some people commenting in online forums complained about slippage.

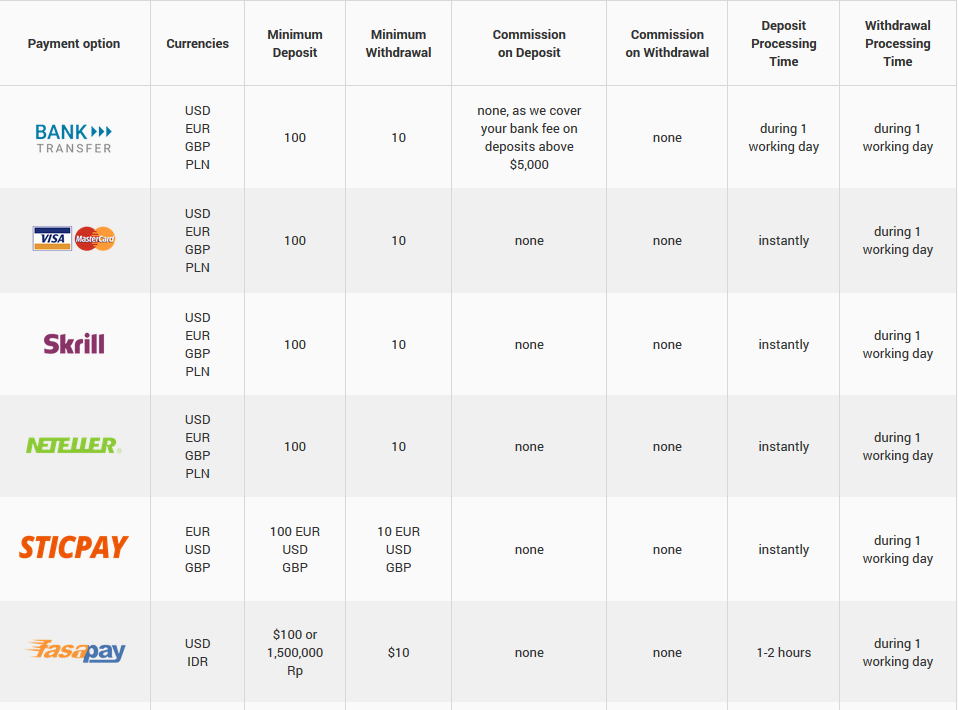

Deposits & withdrawals

Tickmill offers the usual range of deposit and withdrawal options, including credit and debit cards, wire transfers, neteller, skrill, and a few other ewallet solutions. Minimum deposits are generally $100, and minimum withdraws $10. No fees are charged for any deposits or withdrawals apart from wire deposits below $5,000.

The broker claims deposits are all processed instantly and withdrawals within 1 working day. We did find some complaints online about withdrawals taking longer which tickmill said was due to service providers.

Customer support

Customer support is available via email, phone, call back and live chat. The broker can also be reached on social media channels. Support is advertised as being available 24 hours a day on business days.

Support is available in english, indonesian, italian, chinese, russian, spanish, and polish.

We did find a few complaints regarding the level of professionalism and knowledge of the support staff.

Research & education

Tickmill’s education section consists of an extensive glossary, video tutorials and educational articles. For the most part these are fairly basic and cover the fundamentals clients will need to get started.

Regular webinars are also hosted to discuss the market, though these all appeared to be in portuguese and german when we checked.

The educational resources are sufficient for newbies to get started, but to become a competent trader more material will be needed. That’s not necessarily a problem as there are plenty of educational resources available around the web for free.

Noteworthy points

For the most part tickmill’s offering is very standard, but there are a few unique features. The broker runs a trader of the month competition with a prize of $1,000. The prize is based not only on profits but on risk management as well.

Another unique competition is the NFP machine competition in which clients predict the price of a specific instrument 30 minutes after US non-farm payrolls are released. The prize is $500 for an exact match or $200 for the closest guess.

In 2016 tickmill won the chinese forex expo awards for “the most trusted forex broker” and “the best ECN/STP broker.”

In 2017 they won the “most trusted broker 2017” award from the UK global brands magazine.

IN 2017 tickmill was awarded the ‘best forex trading conditions’ prize at the UK forex awards, and in 2018 they won “best forex execution broker” at the same event.

In general, the broker seems to have a good reputation and most complaints we found seemed to be relatively trivial. They don’t appear to be the subject of any major investigations or disputes

Conclusion

Tickmill is a very standard broker in many respects. For newbie traders the range of instruments is good, and the pricing is fair for small account sizes. The UK entity’s low leverage is ideal for those still learning the ropes. The educational resources are enough to get started. Another advantage for new traders is that the offering is simple without an endless range of platforms and instruments which can be confusing.

More advanced traders may also find the pro account feasible depending on the frequency of their trades. The spreads are very low and the commission reasonable.

Comparison

Broker comparison maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

Tickmill review 2020

Tickmill is a NDD (no dealing desk) forex and CFD broker. They are regulated with top-tier regulators i.E. FCA (UK) & cysec. They offer demo account and live account with minimum deposit of $100. Read our tickmill review to find if they are good for south african traders.

Tickmill is a UK based forex & CFD broker established in 2014. Tickmill ltd. Is regulated with FSA in seychelles, as tckmill UK ltd. With FCA in UK, and with cysec in cyprus.

Tickmill is a no dealing desk (NDD) broker, which means that all orders will be passed to their third party liquidity providers. This means that tickmill have no conflict of interest with their traders.

They offer metatrader 4 as trading platform to their clients, but they don’t offer the latest MT5 platform. Moreover tickmill offers 24/5 support via email, chat, international phone support.

Read our indepth review on tickmill to know more about them before choosing them. We have compared their fees, support, platforms & more.

- South african clients can open trading account with tickmill with minimum deposit of $100.

- Tickmill is a NDD broker so there is no conflict of interest with their clients.

- Competitive spread of 1.6 pips on average for EUR/USD with their classic account. The spread is even lower with their pro account (but includes commissions per lot).

- No deposit and withdrawal charges.

- Large trading instruments including currencies & cfds.

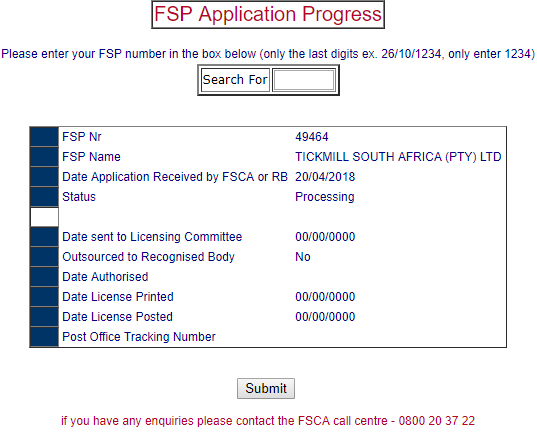

- Tickmill is not regulated with FSCA. But they have applied with FSCA (FSP no. 49464) since 20/04/2018 & their application status is currently “processing”.

- No local phone number for support.

- Tickmill does not offer the latest metatrader5 version.

Tickmill – a quick look

| broker name | tickmill ltd |

| year founded | 2014 |

| website | www.Tickmill.Com |

| registered address | 3, F28-F29 eden plaza, eden island, mahe, seychelles |

| tickmill minimum deposit | $100 |

| maximum leverage | 1:500 |

| major regulations | bafin, cysec, FCA. |

| Trading instruments | currencies, cfds on commodities, stock indices, bonds |

| trading platforms | MT4 (metatrader4), webtrader |

Regulation and safety of funds

We consider tickmill to be a safe forex broker for south africans based on their regulation with tier 1 regulator FCA. But they are not yet regulated with local regulator FSCA.

Financial conduct authority (FCA): tickmill is registered as ‘tickmill UK LTD’ with financial conduct authority since 29/07/2016 under reference number 717270.

Cyprus securities exchange (cysec): tickmill europe ltd is registered with cyprus securities exchange under licence number 278/15 since 2015.

Financial service provider/FSCA (pending): tickmill is not regulated with FSCA currently. But we have checked & they have an application under processing status. Tickmill south africa (PTY) LTD had applied for FSCA regulation on 20-april-2018 (FSP no. 49464).

Note: south african traders that sign up on tickmill are registered under FSA seychelles regulator.

Tickmill fees and spread

Tickmill’s fees depends on your account type with them. We have researched & following is a breakdown of their trading & non-trading fees with all their account types.

Average spread: tickmill offers floating spread with all their 3 trading accounts (classic, pro & VIP). Their spread starts from 0.0 pip on pro and VIP accounts, and from 1.6 pips on average for EUR/USD with classic account. The classic account does not have any other fees besides their spread, but the pro & VIP accounts have commissions per trade.

Tickmill account types

Tickmill demo account

Demo account is also provided by the tickmill to help beginner to practice and learn forex trading.

You can signup with them on their website and start testing your trading strategies using the demo account. Once experienced, you can swap anytime to live account.

In demo account MT4 trading platform is offered by them. You can download it on your PC and laptop and start your trading in just one click.

Tickmill live accounts

- Market execution: tickmill is the NDD (no dealing desk) forex broker so they offer direct market execution. Tickmill claims that it doesn’t have any requotes.

- Account base currency: tickmill does not offer ZAR accounts. But you can choose USD, EUR or GBP as your base currency.

- Classic account: classic account start with minimum deposit of $100 and with the maximum leverage of 1:500. Spread start from 1.6 pips in this account. There is no commission in this account and swap-free islamic account option is also available.

- Pro account: spread in pro account start from 0.0 pips. The base currency of this account can be select from USD, EUR, GBP, PLN. Market execution offered in this account and average execution speed is 0.15 seconds. This account is the most popular and recommended account types as per the broker.

- VIP account: this VIP account start with minimum balance of 50,000 units of your selected account currency i.E. $50,000 if your account currency is USD. You can choose and select any of the base currency from USD, EUR, GBP, PLN in this account. You can trade 62 currency pairs, cfds on 15 stock indices, precious metals, bonds in vip account with spread of 0.0 pips.

How to open account with tickmill

Step 1) click on create account: open the home page of the tickmill and click on create account link at the top of the page.

Step 2) client area registration 1/2: now you will be redirected to page where you need to enter your personal details and choose your regulator as shown in the below screenshot.

Step 3) client area registration 2/2: after filling your personal details, you need to fill your financial details and set a password for your account with them.

Step 4) validate your e-mail address: now you need to verify your email by clicking on the link sent to them on your mentioned email.

Step 5) complete account verification: at last you need to verify your account by submitting your ID proofs. You can upload the scanned copy of your ID proof like passport, driving licence etc. And address proof like post paid phone bill, electricity bill etc.

That all! Your account has been created now. You can check your email to check all the details to start trading with them.

Tickmill trading platforms

- Metatrader 4 (MT4): you can download the MT4 trading platform and install it on your PC, android and ios mobile. You can start using their demo account with MT4 trading platform. Traders can see charts with multiple time frame in there MT4. Moreover various indicators and can monitor various trading process is available in MT4.

- Web trader: if you don’t want to download it in your device then you can access it online using the login details provided to you by them. This platform will give access you to do your task using a browser and just a internet connection.

Tickmill deposit & withdrawals methods

Tickmill offers various deposit & withdrawal methods. Let’s first look into their deposit methods.

Deposit methods

- Credit/debit cards: you can use your debit and credit cards offered by VISA and master card. The payment will be processed within working day made using this method.

- Bank transfer: traders can also add the funds using the transfer from their bank account to tickmill bank account. You can contact them and informed them after payment has been made.

- E-wallets: you can also transfer the funds using the E-wallets like skrill, neteller, paysafecard, fasapay, china unionpay. The processing time is 1 working day.

Withdrawal methods

- Credit/debit cards: you can send your card details while requesting for the withdrawal. And this can take 1 working day.

- Bank transfer: traders can also send their bank account details to them by contacting them on chat, email, etc.

- E-wallets: you can also send your E-wallets details like skrill, neteller, paysafecard, fasapay, china unionpay. The processing time is 1 working day.

Tickmill bonus

Tickmill has a no deposit bonus offer for new traders, and it is available in south africa as well.

$30 welcome account: tickmill is currently offering $30 welcome bonus to its new clients.

To avail this bonus, you just need to create an account with them, and submit your KYC documents for verification. The bonus amount will automatically credited to your account once your account has been verified.

You can use this welcome bonus for your trading. And the profit earned from trading using this deposit can be withdrawn.

Tickmill customer support

We found tickmill’s support to be lacking in some parts. We tested their chat support & email support. For both chat & email, we asked them basic questions, below is a review our overall experience with their support.

Slow chat support: we tested tickmill’s chat support by contacting them 3 times with different queries, and there was few minutes of hold time before connecting with a real agent. Once you are connected, their chat representatives are quick in answering questions. They are available from monday to friday within 09:00-22:00 (GMT+2h).

Do we recommend tickmill?

Tickmill is not a bad broker.

On the good side, they are a 100% NDD broker that is regulated with FCA. Their overall trading fees is competitive with some accounts. Also, they do not charge any deposit and withdraw fee, which is good.

But they don’t only offer MT4 platform for now. Also, their instruments other than forex are very limited. Their support also is not the best out there.

Overall, there are better forex brokers for south african traders to choose from.

"do you have experience with tickmill? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow south african traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: we don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome forex brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.

So, let's see, what we have: tickmill's VIP account is an exclusive account tailored for high volume traders looking for competitive pricing and premium benefits. At tickmill vip

Contents of the article

- Top forex bonuses

- VIP ACCOUNT

- Why choose our VIP account?

- VIP ACCOUNT

- Access some of the most POPULAR...

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- Tickmill now offers lower commission than ever on...

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- TÀI KHOẢN VIP

- Tại sao nên chọn tài khoản VIP...

- TÀI KHOẢN VIP

- Tiếp cận được những CÔNG CỤ GIAO...

- BẮT ĐẦU GIAO DỊCH với tickmill

- Nó thật đơn giản và tham gia dễ dàng!

- ĐĂNG KÝ

- TẠO MỘT TÀI KHOẢN

- TIẾN HÀNH NẠP TIỀN

- CÔNG CỤ GIAO DỊCH

- ĐIỀU KIỆN GIAO DỊCH

- TÀI KHOẢN GIAO DỊCH

- NỀN TẢNG

- ĐÀO TẠO

- CÔNG CỤ HỖ TRỢ

- ĐỐI TÁC

- CHƯƠNG TRÌNH KHUYẾN MÃI

- VỀ CHÚNG TÔI

- HỖ TRỢ

- Nó thật đơn giản và tham gia dễ dàng!

- Metatrader 4 (MT4) platform

- Why trade with tickmill’s ...

- Key features of MT4

- User manuals

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADE

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- Why tickmill?

- CREATE VIP ACCOUNT NOW

- บัญชี VIP

- ทำไมควรเลือก บัญชี VIP ของเรา

- บัญชี VIP

- เข้าถึง ตราสารยอดนิยม

- เริ่มต้นเทรด กับ tickmill

- เริ่มต้นอย่างง่ายและรวดเร็ว!

- ลงทะเบียน

- เปิดบัญชี

- ทำการฝากเงิน

- ตราสารสำหรับเทรด

- เงื่อนไขการเทรด

- บัญชีเทรด

- แพลตฟอร์ม

- การศึกษา

- เครื่องมือ

- พันธมิตร

- โปรโมชั่น

- เกี่ยวกับเรา

- การสนับสนุนลูกค้า

- เริ่มต้นอย่างง่ายและรวดเร็ว!

- Tickmill review 2021

- Summary

- Tickmill review fees

- Tickmill review account opening

- Can you open an account?

- What is the minimum deposit at tickmill?

- Account types

- How to open your account

- Tickmill

- Review

- Introduction

- Trading conditions

- Products

- Regulation

- Platforms

- Mobile trading

- Pricing

- Deposits & withdrawals

- Customer support

- Research & education

- Noteworthy points

- Conclusion

- Comparison

- Tickmill review 2020

- Tickmill – a quick look

- Regulation and safety of funds

- Tickmill fees and spread

- Tickmill account types

- How to open account with tickmill

- Tickmill trading platforms

- Tickmill deposit & withdrawals methods

- Tickmill bonus

- Tickmill customer support

- Do we recommend tickmill?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.