Tickmill live spread

Wenn sie mit dem handel beginnen, werden sie feststellen, dass ihnen ein "gebotspreis" (oder "verkaufspreis") und ein "anfragepreis" (oder "kaufpreis") angeboten wird.

Top forex bonuses

Das "gebot" ist der preis, zu dem sie die basiswährung verkaufen, und die "anfrage" ist der preis, zu dem sie die basiswährung kaufen. Der unterschied zwischen diesen beiden preisen ist das, was wir den "spread“ nennen. Hochrisikohinweis: der handel mit contracts for difference (cfds) auf marge birgt ein hohes risiko und ist möglicherweise nicht für alle anleger geeignet. Bevor sie sich für den handel mit contracts for difference (cfds) entscheiden, sollten sie ihre handelsziele, den erfahrungsstand und die risikobereitschaft sorgfältig prüfen. Sie riskieren ihr investiertes kapital zu verlieren. Daher sollten sie kein geld einzahlen, das sie sich nicht leisten können, zu verlieren. Vergewissern sie sich, dass sie die risiken vollständig verstanden haben, und sorgen sie bei der verwaltung ihres risikos für angemessene vorsicht.

Spreads & swaps

Erfahren sie mehr über die mit ihrem handel verbundenen kosten

Absolut transparente

handelskosten

Schauen sie sich unsere typischen spreads und swaps unten an.

Was sind forex spreads?

Wenn sie mit dem handel beginnen, werden sie feststellen, dass ihnen ein "gebotspreis" (oder "verkaufspreis") und ein "anfragepreis" (oder "kaufpreis") angeboten wird. Das "gebot" ist der preis, zu dem sie die basiswährung verkaufen, und die "anfrage" ist der preis, zu dem sie die basiswährung kaufen. Der unterschied zwischen diesen beiden preisen ist das, was wir den "spread“ nennen.

Wenn ein handel eröffnet wird, gibt es immer dritte, die die eröffnung und schließung dieses handels ermöglichen, wie eine bank oder ein liquiditätsgeber. Diese dritten müssen sicherstellen, dass es einen geordneten fluss von kauf- und verkaufsaufträgen gibt, was bedeutet, dass sie für jeden verkäufer einen käufer finden müssen und umgekehrt.

Diese drittpartei akzeptiert das risiko eines verlustes bei gleichzeitiger ermöglichung des handels. Deshalb behält die drittpartei einen teil jedes handels ein - dieser teil wird als spread bezeichnet!

Wie kann man den

spread berechnen?

Wie berechnen sie ihre handelskosten?

Was sind swaps?

Wichtig swap/rollover rate fakten

die swapsätze werden um 00:00 uhr plattformzeit angewendet. Jedes währungspaar hat seine eigene swap-gebühr und wird auf einer standardgröße von 1 lot (100.000 basiseinheiten) gemessen. Swaps werden jede nacht auf ihre offenen positionen angewendet und wenn die position offenbleibt, erhält sie ein neues "valutadatum". Am mittwochabend wird jedoch das neue valutadatum für einen offenen handel auf montag geändert. Aus diesem grund werden swaps mit dem dreifachen satz berechnet. Überprüfen sie ihre swaps auf ihrem MT4 market watch panel. Klicken sie einfach mit der rechten maustaste, wählen "symbole", wählen das instrument aus und wählen dann "eigenschaften"

STARTEN SIE IHR TRADING mit tickmill

Es geht einfach und schnell!

REGISTRIEREN

Vollständige registrierung: loggen sie sich in ihren

KONTO ERÖFFNEN

Sobald ihre dokumente genehmigt sind, können sie ein live trading konto erstellen.

EINE EINZAHLUNG VORNEHMEN

Wählen sie eine zahlungsart aus, kapitalisieren sie ihr handelskonto und starten sie mit dem handel.

Handelsinstrumente

Handelsbedingungen

Handelskonten

Plattformen

Weiterbildung

Werkzeuge

Partnerschaften

Über uns

Kundendienst

Tickmill ist der handelsname der tickmill group of companies.

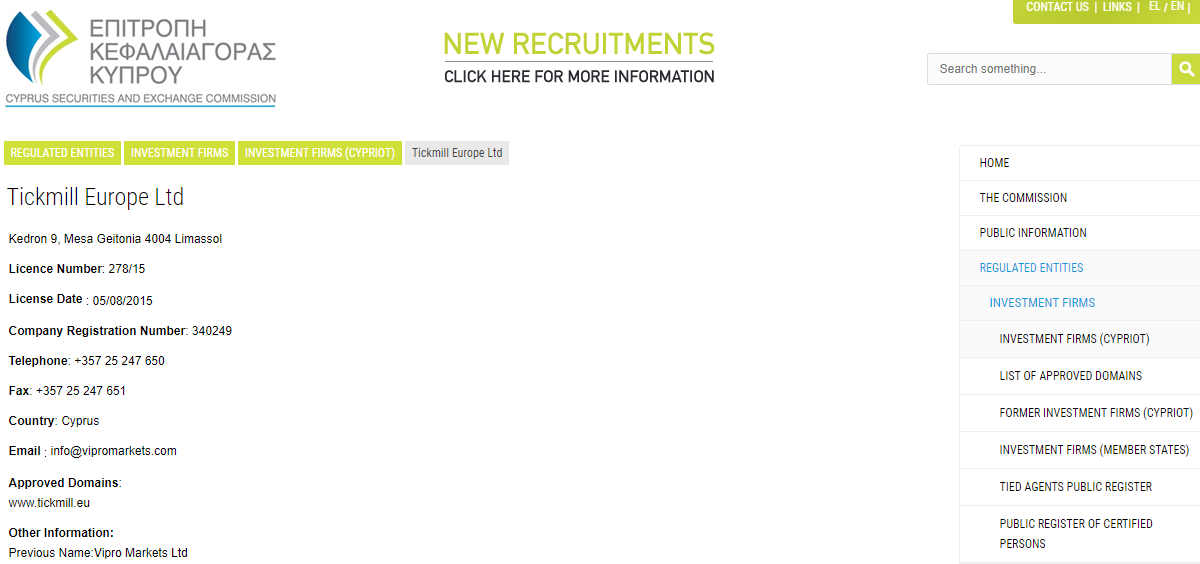

Tickmill.Com gehört und wird innerhalb der tickmill-unternehmensgruppe betrieben. Die tickmill group besteht aus tickmill UK ltd, reguliert von der britischen financial conduct authority (eingetragener sitz: 3. Stock, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, reguliert von den cyprus securities and exchange commission (eingetragener sitz: kedron 9, mesa geitonia, 4004 limassol, zypern), tickmill südafrika (PTY) ltd, FSP 49464, reguliert von der financial sector conduct authority (FSCA) (eingetragener sitz: the colosseum, 1. Stock, century way, office 10, century city, 7441 kapstadt), tickmill ltd, reguliert von der financial services authority der seychellen und seiner 100% igen tochtergesellschaft procard global ltd, britische registrierungsnummer 09369927 (eingetragener sitz: 3. Stock, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - reguliert von der financial services authority of labuan malaysia (lizenznummer: MB/18/0028 und eingetragener sitz: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T., labuan, malaysia).

Kunden müssen mindestens 18 jahre alt sein, um die dienstleistungen von tickmill nutzen zu können.

Hochrisikohinweis: der handel mit contracts for difference (cfds) auf marge birgt ein hohes risiko und ist möglicherweise nicht für alle anleger geeignet. Bevor sie sich für den handel mit contracts for difference (cfds) entscheiden, sollten sie ihre handelsziele, den erfahrungsstand und die risikobereitschaft sorgfältig prüfen. Sie riskieren ihr investiertes kapital zu verlieren. Daher sollten sie kein geld einzahlen, das sie sich nicht leisten können, zu verlieren. Vergewissern sie sich, dass sie die risiken vollständig verstanden haben, und sorgen sie bei der verwaltung ihres risikos für angemessene vorsicht.

Die website enthält links zu websites, die von dritten kontrolliert oder angeboten werden. Tickmill hat keine überprüfung vorgenommen und lehnt hiermit jegliche haftung für informationen oder materialien ab, die auf einer der mit dieser website verlinkten seiten veröffentlicht wurden. Durch die einrichtung eines links zu einer drittanbieter-website unterstützt oder empfiehlt tickmill keine produkte oder dienstleistungen, die auf dieser website angeboten werden. Die informationen auf dieser website dienen nur zu informationszwecken. Es sollte daher nicht als angebot oder aufforderung an eine person in einer rechtsordnung, in der ein solches angebot oder eine aufforderung nicht zulässig ist, oder an eine person, der ein solches angebot oder eine solche aufforderung unzulässig wäre, oder als empfehlung angesehen werden einen bestimmten währungs- oder edelmetallhandel zu kaufen, zu verkaufen oder anderweitig damit zu handeln. Wenn sie sich nicht sicher sind, ob sie in ihrer lokalen währung handeln und handelsregeln für metalle beachten, sollten sie diese seite sofort verlassen.

Es wird dringend empfohlen, eine unabhängige finanz-, rechts- und steuerberatung einzuholen, bevor sie mit einem devisen- oder spothandel mit metallen beginnen. Nichts auf dieser website sollte als hinweis von tickmill oder einem seiner verbundenen unternehmen, direktoren, leitenden angestellten oder mitarbeitern gelesen oder ausgelegt werden.

Die dienstleistungen von tickmill und die informationen auf dieser website richten sich nicht an bürger / einwohner der vereinigten staaten von amerika und sind nicht zur verteilung an oder nutzung durch eine person in einem land oder einer rechtsordnung bestimmt, in der eine solche verteilung oder verwendung entgegenstehen würde nach lokalen gesetzen oder vorschriften.

Tickmill live spread

- Tickmill homepage

- Client support

- Login

- English

- Русский

- Polski

- Español

- 中文

- Deutsch

- Italiano

- 한국어

- Portuguese

- Türkçe

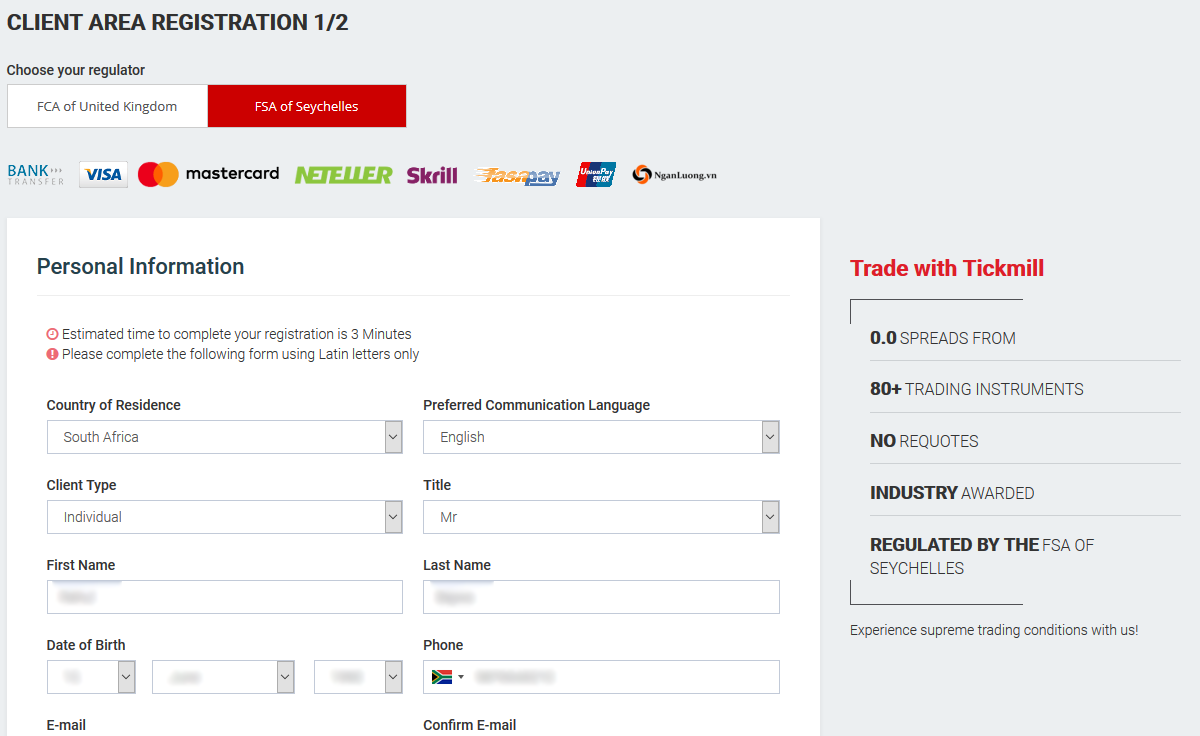

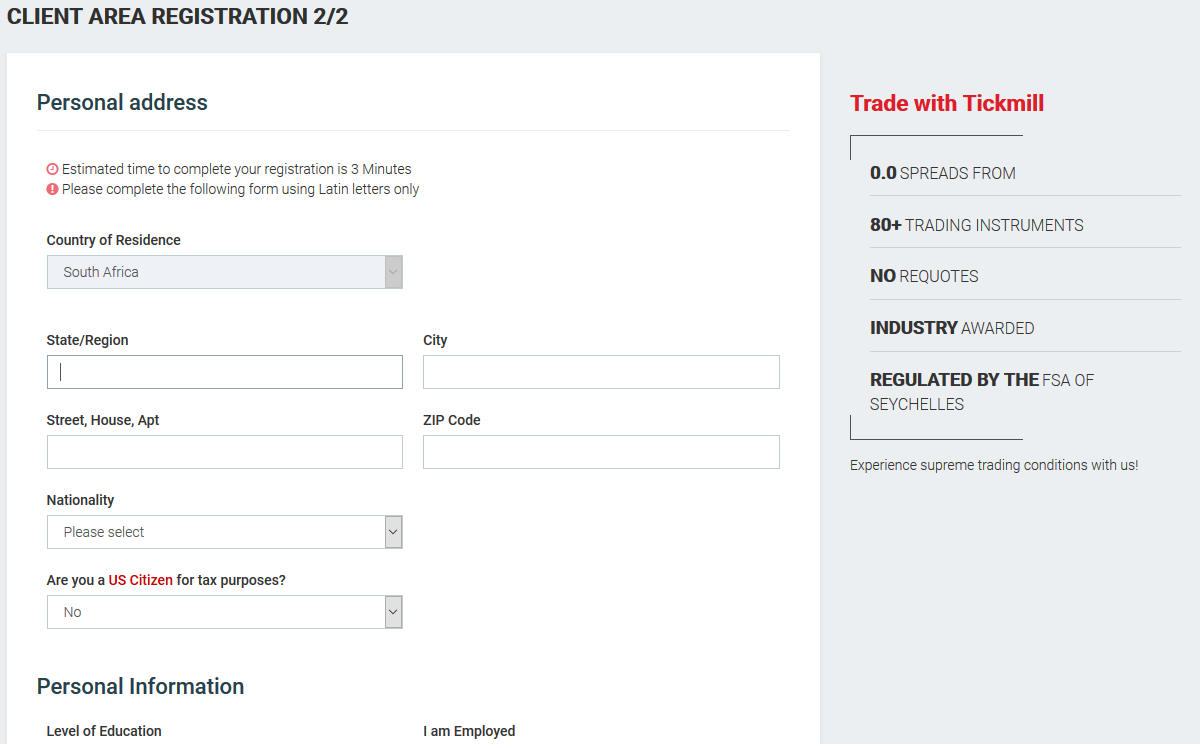

Client area registration 1/2

Estimated time to complete your registration is 3 minutes

please complete the following form using latin letters only

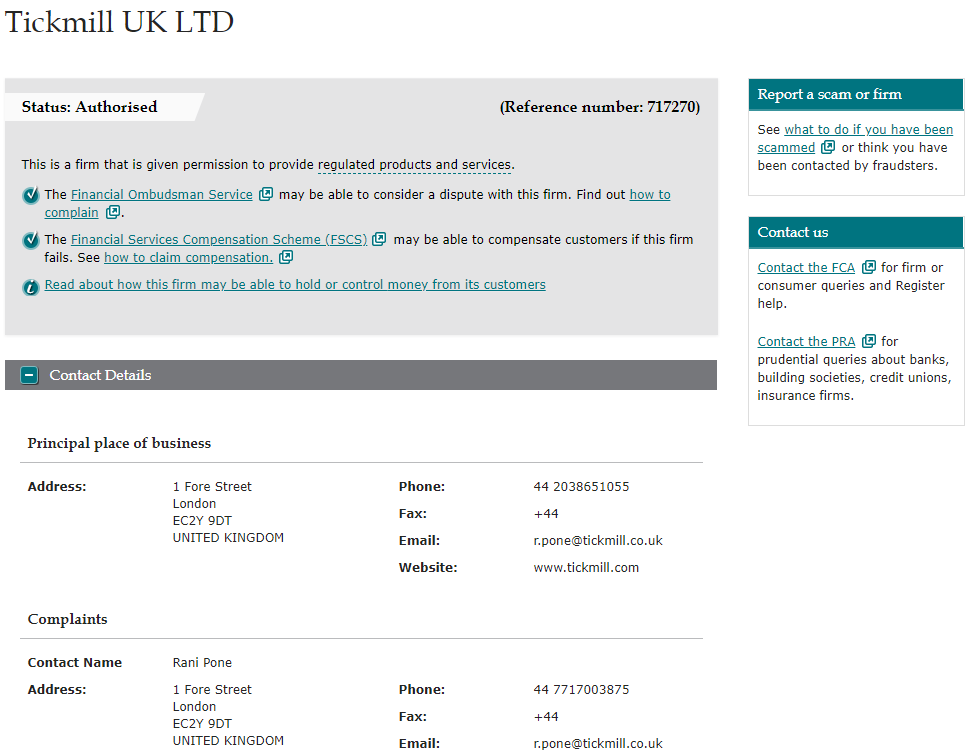

Tickmill is a trading name of tickmill UK ltd (a company registered in england and wales under number 09592225). Principal and registered office: 3rd floor, 27-32 old jewry, london EC2R 8DQ. Authorised and regulated by the UK financial conduct authority. FCA register number: 717270.

High risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading cfds with tickmill UK ltd. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. You should be aware of all the risks associated with trading contracts for difference (cfds) and seek advice from an independent adviser if you have any doubts. Please refer to the summary risk disclosure.

The information on this site is not directed at residents of the united states and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Important notice

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill ltd, a company registered in the seychelles and regulated by the financial services authority of seychelles.

Spreads & swaps

Erfahren sie mehr über die mit ihrem handel verbundenen kosten

Absolut transparente

handelskosten

Schauen sie sich unsere typischen spreads und swaps unten an.

Was sind forex spreads?

Wenn sie mit dem handel beginnen, werden sie feststellen, dass ihnen ein "gebotspreis" (oder "verkaufspreis") und ein "anfragepreis" (oder "kaufpreis") angeboten wird. Das "gebot" ist der preis, zu dem sie die basiswährung verkaufen, und die "anfrage" ist der preis, zu dem sie die basiswährung kaufen. Der unterschied zwischen diesen beiden preisen ist das, was wir den "spread“ nennen.

Wenn ein handel eröffnet wird, gibt es immer dritte, die die eröffnung und schließung dieses handels ermöglichen, wie eine bank oder ein liquiditätsgeber. Diese dritten müssen sicherstellen, dass es einen geordneten fluss von kauf- und verkaufsaufträgen gibt, was bedeutet, dass sie für jeden verkäufer einen käufer finden müssen und umgekehrt.

Diese drittpartei akzeptiert das risiko eines verlustes bei gleichzeitiger ermöglichung des handels. Deshalb behält die drittpartei einen teil jedes handels ein - dieser teil wird als spread bezeichnet!

Wie kann man den

spread berechnen?

Wie berechnen sie ihre handelskosten?

Was sind swaps?

Wichtig swap/rollover rate fakten

die swapsätze werden um 00:00 uhr plattformzeit angewendet. Jedes währungspaar hat seine eigene swap-gebühr und wird auf einer standardgröße von 1 lot (100.000 basiseinheiten) gemessen. Swaps werden jede nacht auf ihre offenen positionen angewendet und wenn die position offenbleibt, erhält sie ein neues "valutadatum". Am mittwochabend wird jedoch das neue valutadatum für einen offenen handel auf montag geändert. Aus diesem grund werden swaps mit dem dreifachen satz berechnet. Überprüfen sie ihre swaps auf ihrem MT4 market watch panel. Klicken sie einfach mit der rechten maustaste, wählen "symbole", wählen das instrument aus und wählen dann "eigenschaften"

STARTEN SIE IHR TRADING mit tickmill

Es geht einfach und schnell!

REGISTRIEREN

Vollständige registrierung: loggen sie sich in ihren

KONTO ERÖFFNEN

Sobald ihre dokumente genehmigt sind, können sie ein live trading konto erstellen.

EINE EINZAHLUNG VORNEHMEN

Wählen sie eine zahlungsart aus, kapitalisieren sie ihr handelskonto und starten sie mit dem handel.

Handelsinstrumente

Handelsbedingungen

Handelskonten

Plattformen

Weiterbildung

Werkzeuge

Partnerschaften

Über uns

Kundendienst

Tickmill ist der handelsname der tickmill group of companies.

Tickmill.Com gehört und wird innerhalb der tickmill-unternehmensgruppe betrieben. Die tickmill group besteht aus tickmill UK ltd, reguliert von der britischen financial conduct authority (eingetragener sitz: 3. Stock, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, reguliert von den cyprus securities and exchange commission (eingetragener sitz: kedron 9, mesa geitonia, 4004 limassol, zypern), tickmill südafrika (PTY) ltd, FSP 49464, reguliert von der financial sector conduct authority (FSCA) (eingetragener sitz: the colosseum, 1. Stock, century way, office 10, century city, 7441 kapstadt), tickmill ltd, reguliert von der financial services authority der seychellen und seiner 100% igen tochtergesellschaft procard global ltd, britische registrierungsnummer 09369927 (eingetragener sitz: 3. Stock, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - reguliert von der financial services authority of labuan malaysia (lizenznummer: MB/18/0028 und eingetragener sitz: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T., labuan, malaysia).

Kunden müssen mindestens 18 jahre alt sein, um die dienstleistungen von tickmill nutzen zu können.

Hochrisikohinweis: der handel mit contracts for difference (cfds) auf marge birgt ein hohes risiko und ist möglicherweise nicht für alle anleger geeignet. Bevor sie sich für den handel mit contracts for difference (cfds) entscheiden, sollten sie ihre handelsziele, den erfahrungsstand und die risikobereitschaft sorgfältig prüfen. Sie riskieren ihr investiertes kapital zu verlieren. Daher sollten sie kein geld einzahlen, das sie sich nicht leisten können, zu verlieren. Vergewissern sie sich, dass sie die risiken vollständig verstanden haben, und sorgen sie bei der verwaltung ihres risikos für angemessene vorsicht.

Die website enthält links zu websites, die von dritten kontrolliert oder angeboten werden. Tickmill hat keine überprüfung vorgenommen und lehnt hiermit jegliche haftung für informationen oder materialien ab, die auf einer der mit dieser website verlinkten seiten veröffentlicht wurden. Durch die einrichtung eines links zu einer drittanbieter-website unterstützt oder empfiehlt tickmill keine produkte oder dienstleistungen, die auf dieser website angeboten werden. Die informationen auf dieser website dienen nur zu informationszwecken. Es sollte daher nicht als angebot oder aufforderung an eine person in einer rechtsordnung, in der ein solches angebot oder eine aufforderung nicht zulässig ist, oder an eine person, der ein solches angebot oder eine solche aufforderung unzulässig wäre, oder als empfehlung angesehen werden einen bestimmten währungs- oder edelmetallhandel zu kaufen, zu verkaufen oder anderweitig damit zu handeln. Wenn sie sich nicht sicher sind, ob sie in ihrer lokalen währung handeln und handelsregeln für metalle beachten, sollten sie diese seite sofort verlassen.

Es wird dringend empfohlen, eine unabhängige finanz-, rechts- und steuerberatung einzuholen, bevor sie mit einem devisen- oder spothandel mit metallen beginnen. Nichts auf dieser website sollte als hinweis von tickmill oder einem seiner verbundenen unternehmen, direktoren, leitenden angestellten oder mitarbeitern gelesen oder ausgelegt werden.

Die dienstleistungen von tickmill und die informationen auf dieser website richten sich nicht an bürger / einwohner der vereinigten staaten von amerika und sind nicht zur verteilung an oder nutzung durch eine person in einem land oder einer rechtsordnung bestimmt, in der eine solche verteilung oder verwendung entgegenstehen würde nach lokalen gesetzen oder vorschriften.

PRO ACCOUNT

Designed for experienced traders who expect advanced features and optimal conditions.

Why choose our PRO account?

PRO ACCOUNT

Take advantage of tight spreads and competitive commissions.

| Minimum deposit | 100 |

|---|---|

| available base currencies | USD, EUR, GBP |

| spreads from | 0.0 pips |

| max leverage | 1:500 |

| min lots | 0.01 |

| commissions | 2 per side per 100,000 traded |

| all strategies allowed | |

| swap-free islamic account option |

Trade cfds on 62 currency pairs, major stock indices, oil, precious metals and bonds on your pro account, with fluctuating spreads starting from 0.0 pips.

You will pay commission of only 2 currency units per side per lot (0.0020% notional) on your pro account in the base currency of the trading instrument.Our standard commission is one of the lowest in the world.

Example: if you trade 1 lot of EURUSD, which has a contract size of 100,000 EUR, then your commission per side would be 2 EUR and 4 EUR round turn.

Though many brokers do not allow placing stop and limit orders close to market prices, we allow you to do just that. So stop and limit levels for pro account users are zero.

*no commission on cfds on stock indices, oil and bonds.

Benefit from EXCEPTIONAL trading conditions

available base currencies: USD, EUR, GBP execution model: NDD execution type: market execution average execution speed: 0.20 seconds margin call / stop-out: 100% / 30%

Access some of the most

POPULAR INSTRUMENTS

of the market

FOREX

STOCK INDICES & OIL

METALS

BONDS

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Tickmill live spread

- Tickmill homepage

- Client support

- Login

- English

- Русский

- Polski

- Español

- 中文

- Deutsch

- Italiano

- 한국어

- Portuguese

- Türkçe

Client area registration 1/2

Estimated time to complete your registration is 3 minutes

please complete the following form using latin letters only

Tickmill is a trading name of tickmill UK ltd (a company registered in england and wales under number 09592225). Principal and registered office: 3rd floor, 27-32 old jewry, london EC2R 8DQ. Authorised and regulated by the UK financial conduct authority. FCA register number: 717270.

High risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading cfds with tickmill UK ltd. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. You should be aware of all the risks associated with trading contracts for difference (cfds) and seek advice from an independent adviser if you have any doubts. Please refer to the summary risk disclosure.

The information on this site is not directed at residents of the united states and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Important notice

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill ltd, a company registered in the seychelles and regulated by the financial services authority of seychelles.

CLASSIC ACCOUNT

Enter the world of trading in the easiest and simplest way possible.

Why choose our classic account?

CLASSIC ACCOUNT

Get access to global markets and trade commission-free.

| Minimum deposit | 100 |

|---|---|

| available base currencies | USD, EUR, GBP |

| spreads from | 1.6 pips |

| max leverage | 1:500 |

| min lots | 0.01 |

| commissions | zero commissions |

| all strategies allowed | |

| swap-free islamic account option |

Trade cfds on 62 currency pairs, major stock indices, oil, precious metals and bonds on your classic account, with variable spreads starting from 1.6 pips and no commissions.

The classic account is suitable for both novice and experienced traders and offers optimal trading conditions, ultra-fast order execution while enabling you to use virtually any trading strategy.

This account type is a great gateway to the world of trading and comes with several perks that add value to your trading experience.

Please note that classic account charts show market and spreads without the mark up.

Benefit from EXCEPTIONAL trading conditions

available base currencies: USD, EUR, GBP execution model: NDD execution type: market execution average execution speed: 0.20 seconds margin call / stop-out: 100% / 30%

Access some of the most

POPULAR INSTRUMENTS

of the market

FOREX

STOCK INDICES & OIL

METALS

BONDS

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Tickmill review

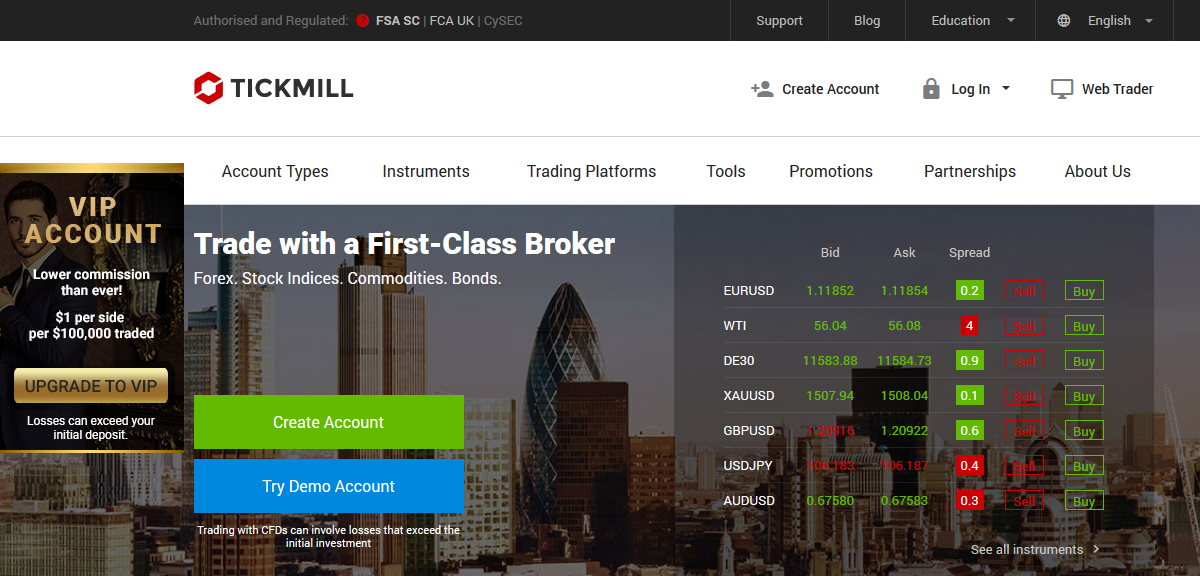

Tickmill is a forex trading services broker. They give traders access to a wide variety of instruments in several markets like currencies and indices.

To open a live account, you’ll need a minimum deposit of at least $25. Alternatively, tickmill offers a demo account that you can use to practice and familiarise yourself with their platform.

Regulated by the financial conduct authority, UK (FRN: 717270). Tickmill puts all client funds in a segregated bank account and uses tier-1 banks for this. Tickmill has been established since 2014, and have a head office in seychelles, UK.

Before we dive into some of the more detailed aspects of tickmill’s spreads, fees, platforms and trading features, you may want to open tickmill’s website in a new tab by clicking the button below in order to see the latest information directly from tickmill.

Full disclosure: we may receive a commission if you sign up with a broker using one of our links.

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

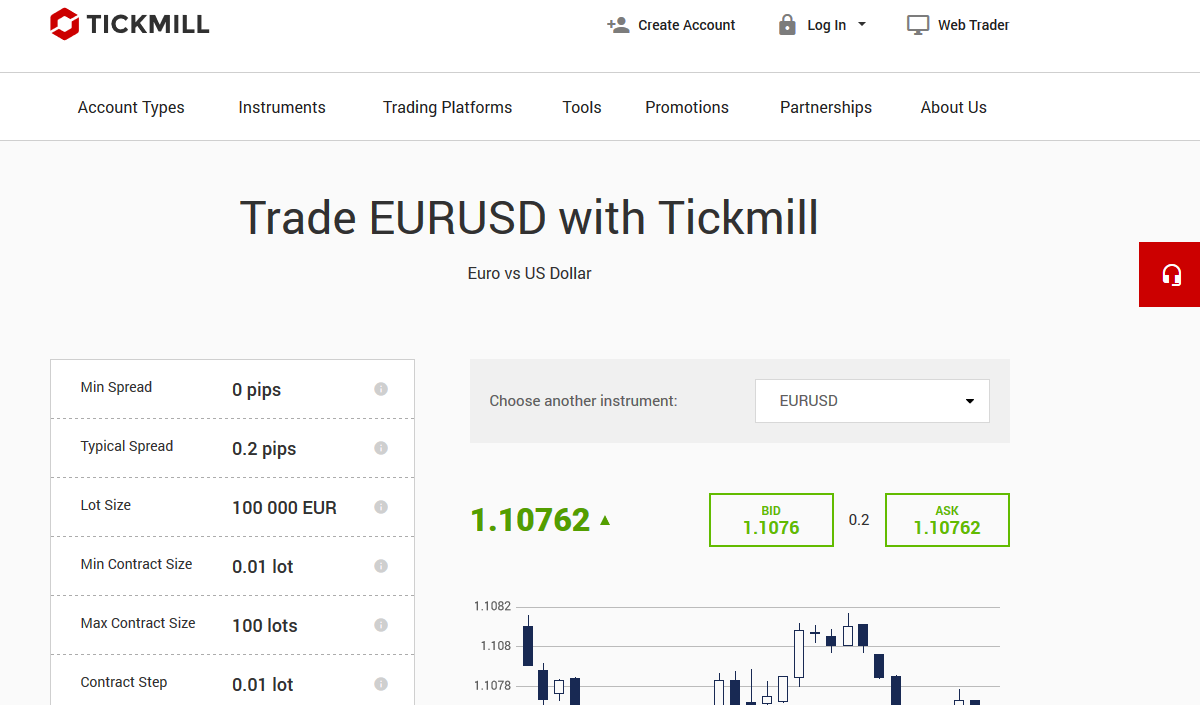

What are tickmill's spreads & fees?

Like most brokers, tickmill takes a fee from the spread, which is the difference between the buy and sell price of an instrument.

The commisions and spreads displayed below are based on the minimum spreads listed on tickmill’s website. The colour bars show how competitive tickmill's spreads are in comparison to other popular brokers featured on brokernotes.

| Tickmill | |||

|---|---|---|---|

| EUR/USD (average: 0.7 pips) | 0.2 pips + $4.00 | 0.7 pips | 0.1 pips |

| GBP/USD (average: 1.1 pips) | 0.7 pips + $4.00 | 1.7 pips | 0.1 pips |

| USD/JPY (average: 1.1 pips) | 0.2 pips + $4.00 | 0.6 pips | 0.1 pips |

| AUD/USD (average: 0.8 pips) | 0.4 pips + $4.00 | 0.6 pips | 0.2 pips |

| USD/CHF (average: 2.3 pips) | 0.7 pips + $4.00 | 2.3 pips | 0.2 pips |

| USD/CAD (average: 2.9 pips) | 0.6 pips + $4.00 | 0.5 pips | 0.3 pips |

| NZD/USD (average: 3.6 pips) | 0.7 pips + $4.00 | 2.8 pips | 0.3 pips |

| EUR/GBP (average: 2.4 pips) | 0.5 pips + $4.00 | 0.5 pips | 0.1 pips |

Spreads are dynamic and are for informational purposes only.

As you can see, tickmill’s minimum spread for trading EUR/USD is 0.2 pips - which is relatively low compared to average EUR/USD spread of 0.70 pips. Below is a breakdown of how much it would cost you to trade one lot of EUR/USD with tickmill vs. Similar brokers.

How much does tickmill charge to trade 1 lot of EUR/USD?

If you were to buy one standard lot of EUR/USD (100k units) with tickmill at an exchange rate of 1.1719 and then sell it the next day at the same price you would likely pay $6.94. Here’s a rough breakdown of the fees and how this compares against IG & XTB .

| Tickmill | IG | XTB | |

|---|---|---|---|

| spread from : | $ 0.00 | $ 6.00 | $ 2.00 |

| commission : | $0.00 | $0.00 | $0.00 |

| total cost of a 100k trade: | $ 0.00 | $ 6.00 | $ 2.00 |

| $6 more | $2 more | ||

| visit tickmill | visit IG | visit XTB |

All fees/prices are for informational purposes and are subject to change.

What can you trade with tickmill?

Tickmill offers over different instruments to trade, including over currency pairs. We’ve summarised all of the different types of instruments offered by tickmill below, along with the instruments offered by IG and XTB for comparison.

| FX / currency cfds | tickmill | IG | XTB |

|---|---|---|---|

| # of forex pairs offered | 90 | 48 | |

| major forex pairs | yes | yes | yes |

| minor forex pairs | yes | yes | |

| exotic forex pairs | yes | yes | |

| cryptocurrencies | no | yes | yes |

| commodity cfds | tickmill | IG | XTB |

|---|---|---|---|

| # of commodities offered | 34 | 21 | |

| metals | yes | yes | yes |

| energies | no | yes | yes |

| agricultural | no | yes | yes |

| index & stock cfds | tickmill | IG | XTB |

|---|---|---|---|

| # of stocks offered | 8000 | 1606 | |

| UK shares | no | yes | yes |

| US shares | no | yes | yes |

| german shares | yes | yes | yes |

| japanese shares | yes | yes | yes |

| see tickmill's instruments | see IG's instruments | see XTB's instruments |

What’s the tickmill trading experience like?

1) platforms and apps

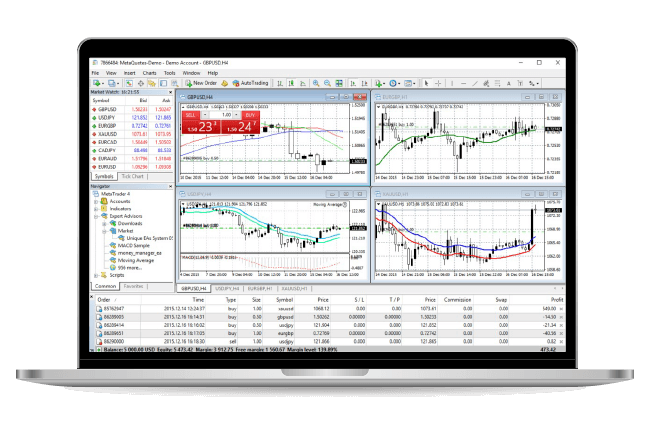

Tickmill offers the popular MT4 forex trading platform. To see a list of the top MT4 brokers, see our comparison of MT4 brokers. The combination of downloadable platforms for both mac and windows allows traders to trade with their device of choice.

Tickmill also offer mobile apps for android and ios, making it easier to keep an eye on and execute your trades while you are on the move.

Still not sure?

2) executing trades

Tickmill allows you to execute a minimum trade of 0.01 lot. This may vary depending on the account you open. The maximum trade requirements vary depending on the trader and the instrument. As tickmill offer ECN and STP execution, you can expect very tight spreads with more transparency over the price you’re paying to execute your trades.

As a market maker, tickmill may have lower entry requirements compared to an ECN broker who benefits from a higher volume of trades and typically has larger capital and minimum trade requirements. Market makers typically have a lower minimum deposit, smaller minimum trade requirements and no commission on trades.

As a nice bonus, tickmill are one of very few brokers that claim to have no requotes, so you don’t have to worry about slippage (your trades being ordered at a different price to what you executed them at).

As with most brokers, margin requirements do vary depending on the trader, accounts and instruments. You can see the latest margin requirements on their website.

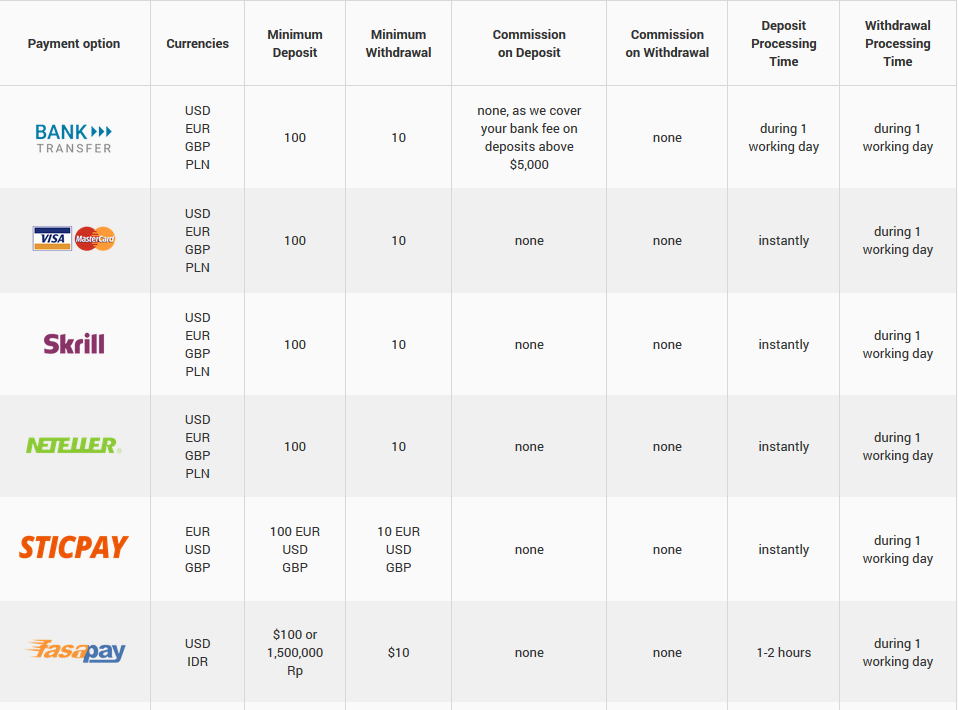

Finally, we’ve listed some of the popular funding methods that tickmill offers its traders below.

Trading features:

Accounts offered:

- Demo account

- Mini account

- Standard account

- Zero spread account

- ECN account

- Islamic account

Funding methods:

3) client support

Tickmill support a wide range of languages including english, spanish, russian, chinese, indonesian, and vietnamese.

Tickmill has a brokernotes double AA support rating because tickmill offer over three languages email and phone support.

4) what you’ll need to open an account with tickmill

As tickmill is regulated by financial conduct authority , every new client must pass a few basic compliance checks to ensure that you understand the risks of trading and are allowed to trade. When you open an account, you’ll likely be asked for the following, so it’s good to have these handy:

- A scanned colour copy of your passport, driving license or national ID

- A utility bill or bank statement from the past three months showing your address

You’ll also need to answer a few basic compliance questions to confirm how much trading experience you have, so it’s best to put aside at least 10 minutes or so to complete the account opening process.

While you might be able to explore tickmill’s platform straight away, it’s important to note that you won’t be able to make any trades until you pass compliance, which can take up to several days, depending on your situation.

To start the process of opening an account with tickmill you can visit their website here.

Marcus founded brokernotes in 2014 after trying hard to find a broker for himself to trade and struggling to compare brokers like-for-like. You can find more about brokernotes & marcus here.

Cfds are leveraged products and can result in the loss of your capital. All trading involves risk. Only risk capital you’re prepared to lose. Past performance does not guarantee future results.

This post is for educational purposes and should not be considered as investment advice. All information collected from http://www.Tickmill.Com/ on 01/01/2021.

Tickmill not quite right?

Compare these tickmill alternatives or find your next broker using our free interactive tool.

Tickmill live spread

- Tickmill homepage

- Client support

- Login

- English

- Русский

- Polski

- Español

- 中文

- Deutsch

- Italiano

- 한국어

- Portuguese

- Türkçe

Client area registration 1/2

Estimated time to complete your registration is 3 minutes

please complete the following form using latin letters only

Tickmill is a trading name of tickmill UK ltd (a company registered in england and wales under number 09592225). Principal and registered office: 3rd floor, 27-32 old jewry, london EC2R 8DQ. Authorised and regulated by the UK financial conduct authority. FCA register number: 717270.

High risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading cfds with tickmill UK ltd. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. You should be aware of all the risks associated with trading contracts for difference (cfds) and seek advice from an independent adviser if you have any doubts. Please refer to the summary risk disclosure.

The information on this site is not directed at residents of the united states and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Important notice

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill ltd, a company registered in the seychelles and regulated by the financial services authority of seychelles.

Tickmill review 2020

Tickmill is a NDD (no dealing desk) forex and CFD broker. They are regulated with top-tier regulators i.E. FCA (UK) & cysec. They offer demo account and live account with minimum deposit of $100. Read our tickmill review to find if they are good for south african traders.

Tickmill is a UK based forex & CFD broker established in 2014. Tickmill ltd. Is regulated with FSA in seychelles, as tckmill UK ltd. With FCA in UK, and with cysec in cyprus.

Tickmill is a no dealing desk (NDD) broker, which means that all orders will be passed to their third party liquidity providers. This means that tickmill have no conflict of interest with their traders.

They offer metatrader 4 as trading platform to their clients, but they don’t offer the latest MT5 platform. Moreover tickmill offers 24/5 support via email, chat, international phone support.

Read our indepth review on tickmill to know more about them before choosing them. We have compared their fees, support, platforms & more.

- South african clients can open trading account with tickmill with minimum deposit of $100.

- Tickmill is a NDD broker so there is no conflict of interest with their clients.

- Competitive spread of 1.6 pips on average for EUR/USD with their classic account. The spread is even lower with their pro account (but includes commissions per lot).

- No deposit and withdrawal charges.

- Large trading instruments including currencies & cfds.

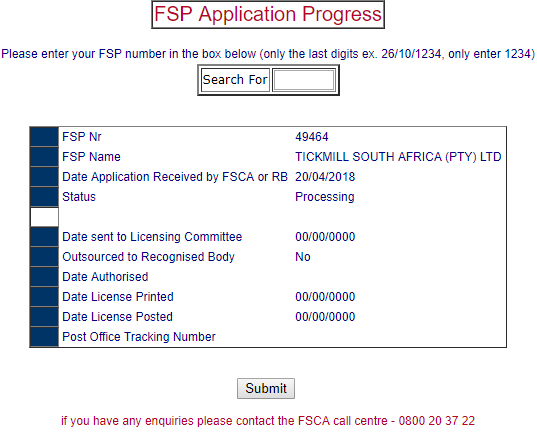

- Tickmill is not regulated with FSCA. But they have applied with FSCA (FSP no. 49464) since 20/04/2018 & their application status is currently “processing”.

- No local phone number for support.

- Tickmill does not offer the latest metatrader5 version.

Tickmill – a quick look

| broker name | tickmill ltd |

| year founded | 2014 |

| website | www.Tickmill.Com |

| registered address | 3, F28-F29 eden plaza, eden island, mahe, seychelles |

| tickmill minimum deposit | $100 |

| maximum leverage | 1:500 |

| major regulations | bafin, cysec, FCA. |

| Trading instruments | currencies, cfds on commodities, stock indices, bonds |

| trading platforms | MT4 (metatrader4), webtrader |

Regulation and safety of funds

We consider tickmill to be a safe forex broker for south africans based on their regulation with tier 1 regulator FCA. But they are not yet regulated with local regulator FSCA.

Financial conduct authority (FCA): tickmill is registered as ‘tickmill UK LTD’ with financial conduct authority since 29/07/2016 under reference number 717270.

Cyprus securities exchange (cysec): tickmill europe ltd is registered with cyprus securities exchange under licence number 278/15 since 2015.

Financial service provider/FSCA (pending): tickmill is not regulated with FSCA currently. But we have checked & they have an application under processing status. Tickmill south africa (PTY) LTD had applied for FSCA regulation on 20-april-2018 (FSP no. 49464).

Note: south african traders that sign up on tickmill are registered under FSA seychelles regulator.

Tickmill fees and spread

Tickmill’s fees depends on your account type with them. We have researched & following is a breakdown of their trading & non-trading fees with all their account types.

Average spread: tickmill offers floating spread with all their 3 trading accounts (classic, pro & VIP). Their spread starts from 0.0 pip on pro and VIP accounts, and from 1.6 pips on average for EUR/USD with classic account. The classic account does not have any other fees besides their spread, but the pro & VIP accounts have commissions per trade.

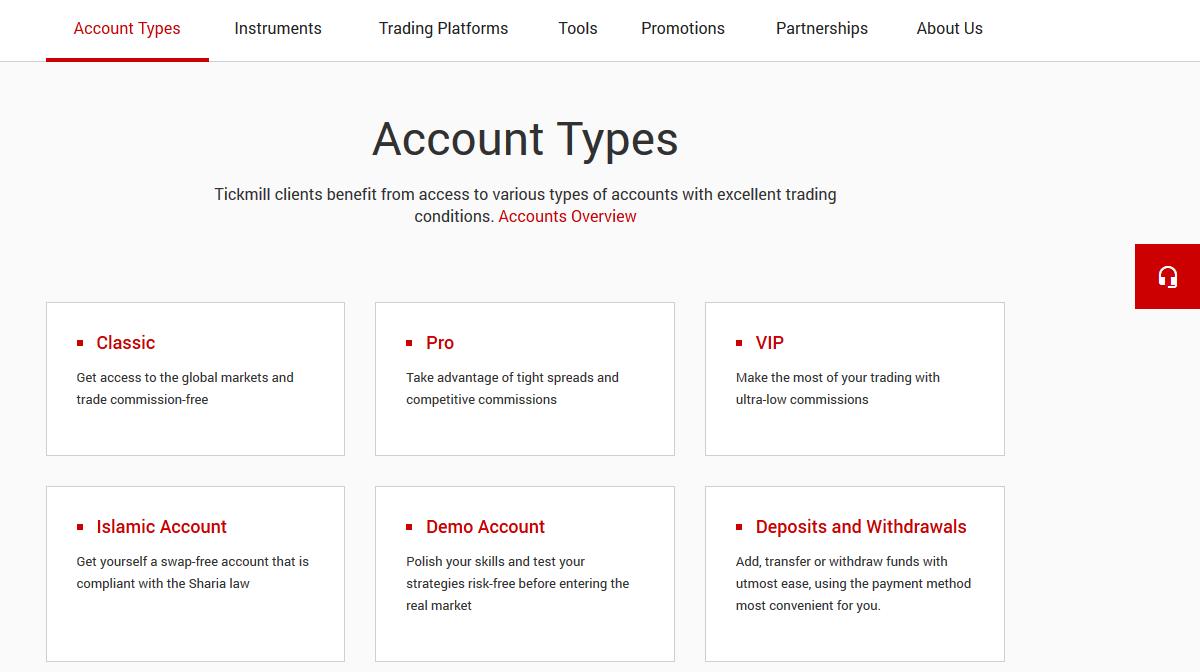

Tickmill account types

Tickmill demo account

Demo account is also provided by the tickmill to help beginner to practice and learn forex trading.

You can signup with them on their website and start testing your trading strategies using the demo account. Once experienced, you can swap anytime to live account.

In demo account MT4 trading platform is offered by them. You can download it on your PC and laptop and start your trading in just one click.

Tickmill live accounts

- Market execution: tickmill is the NDD (no dealing desk) forex broker so they offer direct market execution. Tickmill claims that it doesn’t have any requotes.

- Account base currency: tickmill does not offer ZAR accounts. But you can choose USD, EUR or GBP as your base currency.

- Classic account: classic account start with minimum deposit of $100 and with the maximum leverage of 1:500. Spread start from 1.6 pips in this account. There is no commission in this account and swap-free islamic account option is also available.

- Pro account: spread in pro account start from 0.0 pips. The base currency of this account can be select from USD, EUR, GBP, PLN. Market execution offered in this account and average execution speed is 0.15 seconds. This account is the most popular and recommended account types as per the broker.

- VIP account: this VIP account start with minimum balance of 50,000 units of your selected account currency i.E. $50,000 if your account currency is USD. You can choose and select any of the base currency from USD, EUR, GBP, PLN in this account. You can trade 62 currency pairs, cfds on 15 stock indices, precious metals, bonds in vip account with spread of 0.0 pips.

How to open account with tickmill

Step 1) click on create account: open the home page of the tickmill and click on create account link at the top of the page.

Step 2) client area registration 1/2: now you will be redirected to page where you need to enter your personal details and choose your regulator as shown in the below screenshot.

Step 3) client area registration 2/2: after filling your personal details, you need to fill your financial details and set a password for your account with them.

Step 4) validate your e-mail address: now you need to verify your email by clicking on the link sent to them on your mentioned email.

Step 5) complete account verification: at last you need to verify your account by submitting your ID proofs. You can upload the scanned copy of your ID proof like passport, driving licence etc. And address proof like post paid phone bill, electricity bill etc.

That all! Your account has been created now. You can check your email to check all the details to start trading with them.

Tickmill trading platforms

- Metatrader 4 (MT4): you can download the MT4 trading platform and install it on your PC, android and ios mobile. You can start using their demo account with MT4 trading platform. Traders can see charts with multiple time frame in there MT4. Moreover various indicators and can monitor various trading process is available in MT4.

- Web trader: if you don’t want to download it in your device then you can access it online using the login details provided to you by them. This platform will give access you to do your task using a browser and just a internet connection.

Tickmill deposit & withdrawals methods

Tickmill offers various deposit & withdrawal methods. Let’s first look into their deposit methods.

Deposit methods

- Credit/debit cards: you can use your debit and credit cards offered by VISA and master card. The payment will be processed within working day made using this method.

- Bank transfer: traders can also add the funds using the transfer from their bank account to tickmill bank account. You can contact them and informed them after payment has been made.

- E-wallets: you can also transfer the funds using the E-wallets like skrill, neteller, paysafecard, fasapay, china unionpay. The processing time is 1 working day.

Withdrawal methods

- Credit/debit cards: you can send your card details while requesting for the withdrawal. And this can take 1 working day.

- Bank transfer: traders can also send their bank account details to them by contacting them on chat, email, etc.

- E-wallets: you can also send your E-wallets details like skrill, neteller, paysafecard, fasapay, china unionpay. The processing time is 1 working day.

Tickmill bonus

Tickmill has a no deposit bonus offer for new traders, and it is available in south africa as well.

$30 welcome account: tickmill is currently offering $30 welcome bonus to its new clients.

To avail this bonus, you just need to create an account with them, and submit your KYC documents for verification. The bonus amount will automatically credited to your account once your account has been verified.

You can use this welcome bonus for your trading. And the profit earned from trading using this deposit can be withdrawn.

Tickmill customer support

We found tickmill’s support to be lacking in some parts. We tested their chat support & email support. For both chat & email, we asked them basic questions, below is a review our overall experience with their support.

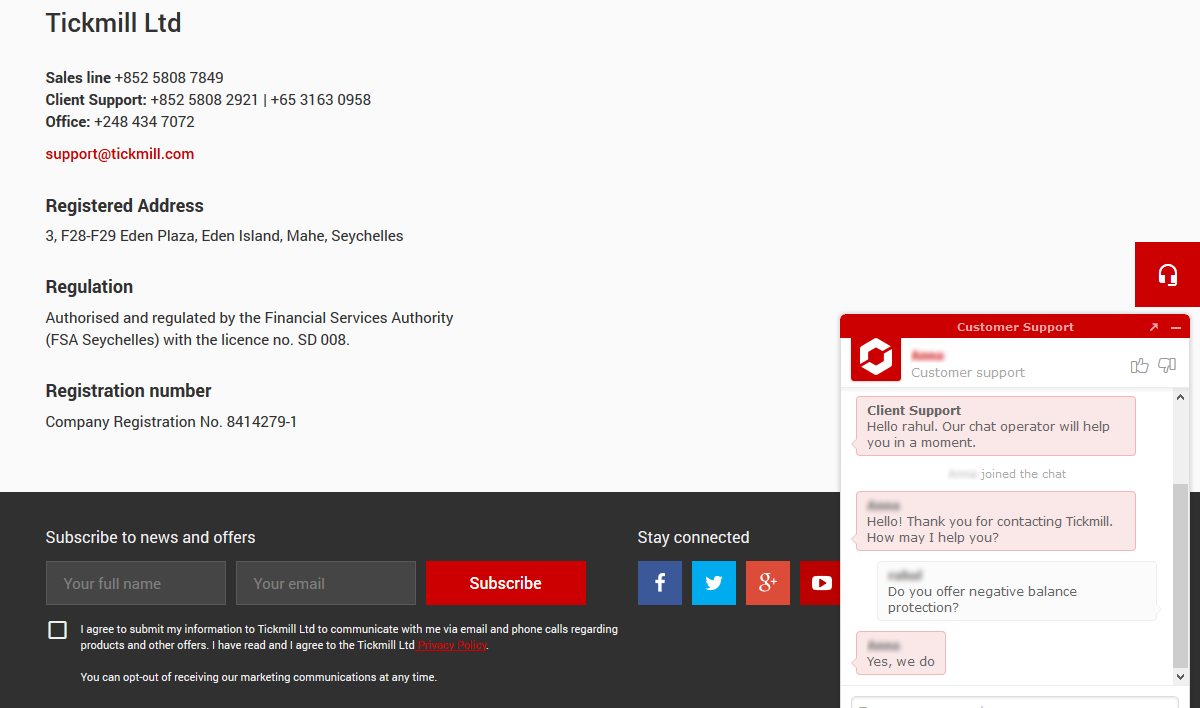

Slow chat support: we tested tickmill’s chat support by contacting them 3 times with different queries, and there was few minutes of hold time before connecting with a real agent. Once you are connected, their chat representatives are quick in answering questions. They are available from monday to friday within 09:00-22:00 (GMT+2h).

Do we recommend tickmill?

Tickmill is not a bad broker.

On the good side, they are a 100% NDD broker that is regulated with FCA. Their overall trading fees is competitive with some accounts. Also, they do not charge any deposit and withdraw fee, which is good.

But they don’t only offer MT4 platform for now. Also, their instruments other than forex are very limited. Their support also is not the best out there.

Overall, there are better forex brokers for south african traders to choose from.

"do you have experience with tickmill? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow south african traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: we don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome forex brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.

So, let's see, what we have: handeln sie mit höchster transparenz, indem sie alle ihre handelskosten im voraus kennen. Schauen sie sich unsere spreads und swaps an! At tickmill live spread

Contents of the article

- Top forex bonuses

- Spreads & swaps

- Absolut transparente

- Was sind forex spreads?

- Wie kann man den spread...

- Wie berechnen sie ihre...

- Was sind swaps?

- Wichtig swap/rollover rate fakten

- STARTEN SIE IHR TRADING mit...

- Es geht einfach und schnell!

- REGISTRIEREN

- KONTO ERÖFFNEN

- EINE EINZAHLUNG VORNEHMEN

- Handelsinstrumente

- Handelsbedingungen

- Handelskonten

- Plattformen

- Weiterbildung

- Werkzeuge

- Partnerschaften

- Über uns

- Kundendienst

- Es geht einfach und schnell!

- Tickmill live spread

- Client area registration 1/2

- Spreads & swaps

- Absolut transparente

- Was sind forex spreads?

- Wie kann man den spread...

- Wie berechnen sie ihre...

- Was sind swaps?

- Wichtig swap/rollover rate fakten

- STARTEN SIE IHR TRADING mit...

- Es geht einfach und schnell!

- REGISTRIEREN

- KONTO ERÖFFNEN

- EINE EINZAHLUNG VORNEHMEN

- Handelsinstrumente

- Handelsbedingungen

- Handelskonten

- Plattformen

- Weiterbildung

- Werkzeuge

- Partnerschaften

- Über uns

- Kundendienst

- Es geht einfach und schnell!

- PRO ACCOUNT

- Why choose our PRO account?

- PRO ACCOUNT

- Access some of the most POPULAR...

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- Tickmill live spread

- Client area registration 1/2

- CLASSIC ACCOUNT

- Why choose our classic account?

- CLASSIC ACCOUNT

- Access some of the most POPULAR...

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- Tickmill review

- What are tickmill's spreads & fees?

- What can you trade with tickmill?

- What’s the tickmill trading experience like?

- 1) platforms and apps

- Still not sure?

- 2) executing trades

- Trading features:

- Accounts offered:

- Funding methods:

- 3) client support

- 4) what you’ll need to open an account with...

- Tickmill not quite right?

- Tickmill live spread

- Client area registration 1/2

- Tickmill review 2020

- Tickmill – a quick look

- Regulation and safety of funds

- Tickmill fees and spread

- Tickmill account types

- How to open account with tickmill

- Tickmill trading platforms

- Tickmill deposit & withdrawals methods

- Tickmill bonus

- Tickmill customer support

- Do we recommend tickmill?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.