Real account forex

For traders who are seeking ultra-tight spreads with fixed commissions. It's your world.

Top forex bonuses

Trade it.

Open an account

Ideal for traders who want a traditional, spread pricing, currency trading experience

For traders who are seeking ultra-tight spreads with fixed commissions.

Not available on metatrader.

Not available on metatrader.

Recommended bal. $25,000, min. Trade size 100K

Active trader program

- Cash rebates of up to $10/mil volume traded

- Professional guidance from your own market strategist

- Reimbursement of any bank fees on all wire transfers

Related faqs

How do I open a joint or corporate account?

What are the differences between a demo and live account?

How does FOREX.Com make money?

Try a demo account

Try a demo account

It's your world. Trade it.

I would like to learn about

Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Contracts for difference (cfds) are not available to US residents.

FOREX.Com is a trading name of GAIN global markets inc. Which is authorized and regulated by the cayman islands monetary authority under the securities investment business law of the cayman islands (as revised) with license number 25033.

FOREX.Com may, from time to time, offer payment processing services with respect to card deposits through its affiliate, GAIN capital UK ltd, devon house, 58 st katharine’s way, london, E1W 1JP, united kingdom.

GAIN global markets inc. Is part of the GAIN capital holdings, inc. Group of companies, which has its principal place of business at 135 US hwy 202/206, bedminster, NJ 07921, USA. All are separate but affiliated subsidiaries of stonex group inc.

Real account forex

As an existing XM real account holder you can simply register an additional account through the members area with 1 click. No additional validation is required.

Unlimited loyalty program

Earn XM points on every trade, then redeem those points for real cash rewards and credit points.

Extra promotions

Get additional exclusive promotions throughout the year either on a seasonal basis or by invitation only.

© 2021 XM is a trading name of trading point holdings ltd. All rights reserved. | privacy policy | cookie policy | terms and conditions

Legal: this website is operated by trading point of financial instruments limited with registered address at 12 richard & verengaria street, araouzos castle court, 3rd floor, 3042 limassol, cyprus.

Trading point holdings ltd is the holding company of trading point of financial instruments limited, XM global limited, trading point of financial instruments UK limited, trading point of financial instruments pty ltd, trading point MENA limited.

Trading point of financial instruments limited is authorised and regulated by the cyprus securities and exchange commission (licence number: 120/10).

XM global limited is authorised and regulated by the international financial services commission (IFSC) (000261/106).

Trading point of financial instruments UK limited is authorised and regulated by the financial conduct authority (FRN: 705428).

Trading point of financial instruments pty ltd is authorised and regulated by the australian securities and investment commission (AFSL 443670).

Trading point MENA limited is authorised and regulated by the dubai financial services authority (DFSA) (reference no. F003484).

Risk warning: forex and CFD trading involves significant risk to your invested capital. Please read and ensure you fully understand our risk disclosure.

Trading point of financial instruments limited provides investment and ancillary services to residents of the european economic area (EEA) and the united kingdom.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

For more information please read our cookie policy.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

Read more, or change your cookie settings.

Your cookie settings

What are cookies?

Cookies are small data files. When you visit a website, the website sends the cookie to your computer. Your computer stores it in a file located inside your web browser.

Cookies do not transfer viruses or malware to your computer. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs (i.E. They record user activity and remember stateful information) and they get updated every time you visit a website.

We may obtain information about you by accessing cookies, sent by our website. Different types of cookies keep track of different activities. For example, session cookies are used only when a person is actively navigating a website. Once you leave the website, the session cookie disappears.

Why are cookies useful?

We use functional cookies to analyse how visitors use our website, as well as track and improve our website’s performance and function. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. The latter also helps us to track if you were referred to us by another website and improve our future advertising campaigns.

Another use of cookies is to store your log in sessions, meaning that when you log in to the members area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process.

In addition, functional cookies, for example, are used to allow us to remember your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which language you wish to see when you log in.

Here is an overview of some of the functions our cookies provide us with:

- Verifying your identity and detecting the country you are currently visiting from

- Checking browser type and device

- Tracking which site the user was referred from

- Allowing third parties to customize content accordingly

This website uses google analytics, a web analytics service provided by google, inc. ("google"). Google analytics uses analytical cookies placed on your computer, to help the website analyze a user's use of the website. The information generated by the cookie about your use of the website (including your IP address) may be transmitted to and stored by google on their servers. Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of google. Google will not associate your IP address with any other data held. By using this website, you give your consent to google to process data about you in the manner and for the purposes set out above.

Best forex robots

Since forex had a tremendous evolution over the last 10 years, and with this market also the trading software, known as forex robots or expert advisors, I have decided to draw up a list of the best forex robots I have and use.

The best forex robots in 2020:

On the contrary to the binary options market, where the robots never had success, in the forex market there are numerous examples of good forex robots / expert advisors.

There are thousands of robots and every day new ones appear.

However, the problem with many of the robots is that they have never been tested on a real account simply because whoever sells or leases them is just looking for a way to make money from the sale and does not offer something that really works.

This problem is the same in forex robots as in binary options robots or for other financial markets.

Making a robot work requires an investment from those who develop it.

It takes knowledge, time and then using it for months in real accounts. This testing phase in real accounts means loss of money. Until a robot is tuned to work, sometimes more than 10 updates are needed. And in every update, there is been money that has been lost in the meantime.

The problem with many of the existing robots is that 99% of the robot “manufacturers” do not do this. They develop the robot, do some back-testing and think the job is done.

They do not want to invest neither time nor money, they want to make money at the expense of customers, not caring if the customer will make a profit or lose money with that robot.

Unfortunately, this is how 95% of forex robots work, and for that reason, I consider that the majority are SCAMS.

Olymp trade is one of the companies that now have an MT4 platform and for that reason, accepts forex robots.

If you have a regular account with olymp trade, you will need to open a new account, since the regular platform and account, does not communicate with the new one, MT4 belongs to metaquotes, and external company.

The best forex robots – the list

This list was developed by me and is based on robots that I use in real accounts. Many forex robots on back-tests or demo accounts promise fabulous results but then in practice, they do not offer consistent results or just don’t work.

For this reason, the list of the best forex robots will have a real account using each robot, where you can check the results of the robot in this account.

This way you can be sure that the published data of the best forex robots is true.

My opinion is personal. I am not advising you to use it or not to use it.

I write my opinion based on my personal experience because that’s what I can talk about.

I don’t want the reader to think that I want you to use these robots or that I advise their use.

I’m just reporting personal experiences.

Some of these robots are available on websites, brokers, etc.

Some are free, some have licenses, others can be sold or used only in specific brokers.

The list below of the best forex robots, whenever possible, will have an account (real or demo) with a link to allow the reader to follow the account.

Sometimes we will try to give access to the account via the MT4 application, or link to MQL5, myfxbook or fxblue which are sites where they allow the publication and verification of demo or real accounts and thus make their results public for consultation.

Some of these sites even have a way to copy the robot trades into private accounts.

Check the conditions, because they can vary a lot, either in the way the copy is made, or the prices or conditions.

Best forex robots – 1st place

This robot has an interesting history. I met a guy who used a system very similar to this one 2 or 3 years ago. At the time on a social trading platform, where I had an account.

Below check the table that explains everything you need to know about this forex robot

| Name of the robot | hit and run |

| platform | meta trader 4 |

| robot’s strategy | this robot uses a breakout strategy, based on trends and disruptions. It also uses some complementary indicators such as stochastic, SAR, moving averages, etc. |

| Security systems of the robot | it can be used with SL or without stop loss, depending on how it is configured. With SL less profit, less risk. |

| Suggested minimum deposit | US $ 1000. Being a robot that opens many operations and therefore needs a margin, it is prudent to have an account with good leeway. |

| Average monthly profits (%) | the average varies between 10% to 15% per month. This amount is already discounted from broker fees. |

| Maximum loss (%) | up to 100% of the account balance. For accounts above 5,000 USD, the maximum loss can and should be placed at 50%, unless an anomalous situation exists in the market or the broker. |

| Used assets | the main forex pairs. For accounts under 2000 USD, it usually opens only 1 to 2 currency pairs. For larger accounts, you can operate with up to 9 pairs simultaneously. |

| Advantages of this robot | operates 100% automatically and 24 hours a day. You can follow all operations 24 hours a day in a free android or ios application. The robot is installed on the customer’s computer or notebook so everything is under your control and security. |

| Disadvantages of this robot | in small accounts, it can only operate with 1 pair. Therefore, profit and risk are dependent on how this pair behaves. When the market is with indefinite trend or very quiet that is when the robot wins less. |

| Robot cost | FREE. ROBOT LINK |

His account that I followed had been doing very good results for a long time, and the accumulated profits that the account showed were really good.

At the time I decided to follow the account. However I was unlucky because my account was small and when the market made a sudden change I had an exposure above 40% and then I thought it was better to leave.

I never knew if his account recovered because it had a higher value.

However, while the robot worked I really liked his strategy idea.

Best forex robots – 2nd place

Below check the table that explains everything you need to know about this forex robot

| Name of the robot | immortality |

| platform | meta trader 4 |

| robot’s strategy | this robot uses a technical analysis strategy with unique operations on each asset. |

| Security systems of the robot | use of individual stop loss and individual take profit. |

| Suggested minimum deposit | 500 USD. |

| Average monthly profits (%) | the average varies between 3% and 7% per month. This value is already discounted the broker commissions and fees. |

| Maximum loss (%) | up to 100% of the account balance. For accounts over 1,000 USD or EURO the maximum loss is 50%, except for abnormal market or brokerage situations. |

| Used assets | EURUSD, AUDUSD, AUDJPY, EURJPY, USDJPY |

| advantages of this robot | it operates 100% automatically and 24 hours a day. Diversification of the investment portfolio. You can follow 24 hours a day all the operations in real-time in a free android or ios application. The robot is installed on the client’s computer or notebook so everything is under their control and security. |

| Disadvantages of this robot | the profit potential is lower, although working with single orders offers less risk and you get paid. |

| Robot cost | 68 USD – ROBOT LINK |

Best forex robots – 3rd place

This robot I have no account to show now, as I am using the other two, and I end up not having time to test or use everyone I meet.

However it has had some interesting results, but as I explain below it works best when the market has a long trend, when it does not end up not having great results.

Below check the table that explains everything you need to know about this forex robot

| Robot name | S/Z scalper |

| plataform | meta trader 4 |

| robot’s strategy | this robot uses a strategy of technical analysis, based on an upward trend. It uses supports and resistances. It opens only buy positions. |

| Security systems of the robot | general stop loss and individual take profit. |

| Suggested minimum deposit | 2,000 USD, or 200 USD in the case of a cents account. |

| Average monthly profits (%) | it depends on the amount of the account, but the average varies between 5% and 10% per month. This amount is already discounted brokerage fees and fees. |

| Maximum loss value (%) | up to 100% in small accounts. |

| Used assets | EURUSD, GBPUSD, USDCAD, USDJPY, USDCHF, NZDUSD. |

| Advantages of this robot | it operates 100% automatically and 24 hours a day. You can follow all operations 24 hours a day in real-time in a free android or ios application. The robot is installed on the client’s computer or notebook so everything is under your control and security. |

| Disadvantages of this robot | when the market drops, knowing that it only places buy orders will increase losses, so it is important to have a good stop loss. |

| Robot cost | FREE. ROBOT LINK |

| brokers where you can use ROBOT |

Best forex robots: advice

– keep in mind that past performance does not guarantee future performance.

– investing in forex, as in any financial market, always entails risks. Even the best forex robots, forex signals or any system that has an excellent track record, may fail to achieve the results it previously achieved.

– the market sometimes changes and has phases and however good your system is, there will always be phases where the results will not be good.

– the more profits a robot offers on average, the more risk it has of loss, and the more likely it is to lose.

– even the best forex robots lose at certain times. There are no perfect and infallible systems that always win.

– A higher account balance and more variety of assets traded in the account result in a lower risk of large losses.

– some of the best forex robots or expert advisors are only available with higher values. Accounts above 10,000 USD, to be able to offer the security that many seek. They need a large margin to withstand the times of high market volatility. However, it is common that their profits are smaller, between 1% and 3%. But well, safety and profit never go hand in hand. For greater security, lower profits.

One of the most used ways these days to send binary options signals is via telegram channels. Clicking on the image, you can find a link to one of the channels that offer signals. The signals are free.

Remember that you should analyze the signals received before placing them and that the responsibility for using the signals is yours, so you should always use the signals wisely.

Never forget the basic rule of investments: everyone, but all investments have risks. And the past results, are not an example of results for the future, because what a system did yesterday, or last month or last year, is no guarantee that it will make equal results in the future.

So, always be careful.

If you enjoyed the best forex robots, and the advice, please don’t forget to share. Thanks.

The list of the best forex robots is only informative about some systems I know or have tested, it does not serve as advice. Always test on demo accounts before using on real accounts.

References and further information about best forex robots:

If you enjoyed reading the post about the best forex robots please share this post, and before leaving the page check below other posts suggested to you.

Opening of accounts

Terminal allows to work with two types of accounts: demo accounts and real accounts. Demo accounts enable working under training conditions, without real money on them, but they allow to work out and test trading strategy very well. They possess all the same functionality as the real ones. The distinction consists in that demo accounts can be opened without any investments, though one cannot count on any profit from them.

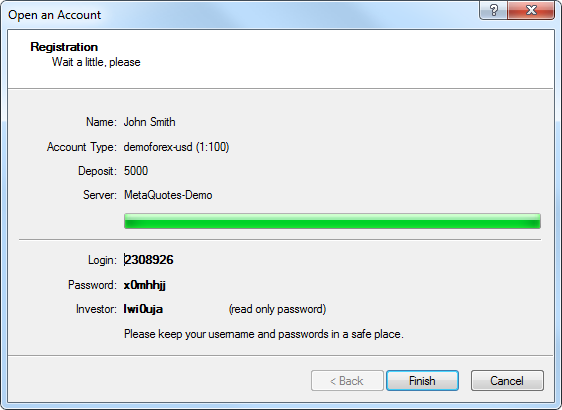

Opening of a demo account #

A demo account can be opened by the "file – open an account" menu command or by the same command of the "navigator – accounts" window context menu. Besides, the terminal will offer to open a demo account at the first program start to begin working immediately.

The process of opening an account consists of several steps:

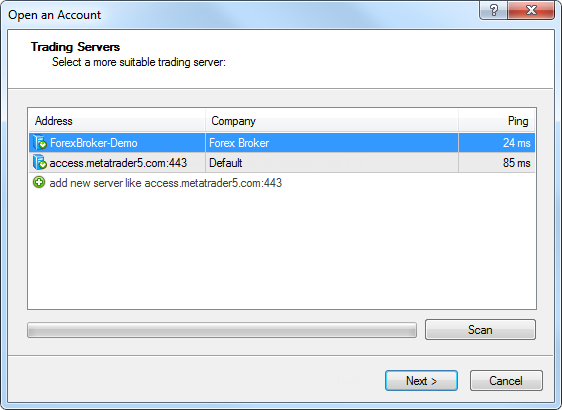

Selecting server

The first stage of account opening is selection of a server to connect to. Addresses of available servers, their names and ping are listed there. The most preferable is the server having the lowest ping. To perform additional checking the ping, you should press the "scan" button. After that the ping information becomes refreshed.

Also in this window you can add a new server to connect to. To do it, press the " add new server" button or the "insert" key. A server can be specified in different ways:

- Write its address and port separated with a colon. For example, 192.168.0.100:443;

- Write its domain name and port separated with a colon. For example, mt.Company.Com:443;

- Write an accurate name of a brokerage company.

As soon as you specify a server, press "enter". To delete a server, select it and press the "delete" key.

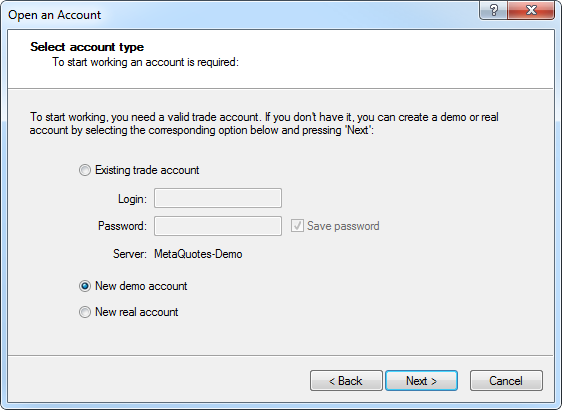

Account type #

At this stage a user can specify details of an existing trade account or start creating a new one.

This window contains three options:

- Existing trade account – if this option is chosen, it is necessary to fill out the "login" and "password" fields with the corresponding account details. A server selected at the previous step is displayed below these fields. You will be authorized at the specified server using the specified account as soon as you press the "done" button.

- New demo account – if you choose this option and press the "next" button, you will go to the creation of a new demo account.

- New real account – if you choose this option you will pass to specifying personal details for sending a request to open a real account.

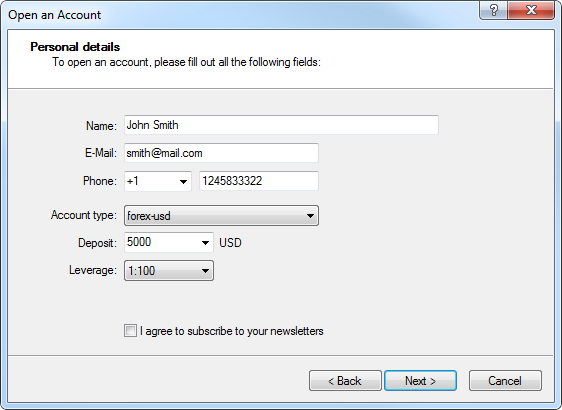

Personal details

The next stage of opening an account is specifying personal details:

The following data will be requested to open an account:

- Name – the user's full name.

- E-mail – email address.

- Phone – contact telephone number.

- Account type – account type to be selected from the list defined by the brokerage company.

- Deposit – the amount of the initial deposit in terms of the basic currency. The minimum amount is 10 units of the specified currency.

- Currency – the basic currency of the deposit to be set automatically depending on the account type selected.

- Leverage – the ratio between the borrowed and owned funds for trading.

To activate the "next" button and continue registration, it is necessary to flag "I agree to subscribe to your newsletters".

After the registration has successfully completed, a window will appear that contains information about the open account: "login" – the account number, "password" – the password for access, "investor" – the investor's password (connection mode in which it is possible to check the account status, analyze the price dynamics, etc., but no trading is allowed).

After registration has been completed, the new account will appear in the "navigator – accounts" window, and it is ready to work with. At that, the server sends a message to the terminal containing login and passwords of this newly opened account. This message can be found in the "terminal – mailbox" window. Besides, after the account has been successfully registered, it will be authorized automatically.

Attention: if any problems occur at the account opening, technical support service of the brokerage company should be asked for help.

Opening of a real account #

Real accounts, unlike demo accounts, cannot be opened from the terminal. They can only be opened by brokerage companies under certain terms and conditions. Real accounts are marked correspondingly in the "navigator – accounts" window. To start working with them, one must perform authorization.

Difference between forex demo and real account

Difference between forex demo and real account

One of the primary reasons people prefer to go for demo forex trading is because it allows you to trade with virtual money.

It helps in training yourself and understanding trading before you choose to invest your hard-earned money. Forex brokers provide demo accounts to the clients. Clients, who are a newbie to the industry can learn a lot and improve themselves by trading with these accounts’ aid.

The difference between a forex demo and real accounts is that forex demo accounts are training accounts that traders can practice trading without using real money, without the risk involved. On the other side, real accounts operate using real money, and traders risk money.

However, according to studies, even after a person has earned ample experience after trading with these demo accounts, things might turn out to be different as they begin to trade with the aid of real accounts. This is because trading with virtual money is easier than trading with real money as you do not need to risk anything.

This write-up shows the basic difference between forex demo and real account. Take a look!

What is a demo account?

Forex demo account refers to a trial account where investors use a specific amount of virtual money when they are new to trading. It is regarded as an educational tool and provides a risk-free start to trading.

In addition to this, you can test your strategies without putting anything to risk at all. Trading in the demo account provides many good services to newbies who otherwise would have lost a lot of real money.

As you choose a demo account, you can learn the tips of watching the market closely. It also offers a better feel and understanding of how the forex market operates without exposing yourself to any risk. In addition to this, it also helps you in learning the latest features of the trading account.

What is a live account?

In the forex live account, you will gain success in depositing and trading with real money. Hence, any profit or loss is going to be real as you start to use live accounts. If you are willing to start trading with live accounts, it is necessary to validate them first. Many forex brokers allow you to deposit the money and begin trading without any validation process.

On the other hand, some people might ask you to verify the account, and to do so; you need to address documents and upload identity proof before you deposit any money and start live trading.

Forex demo vs. Real account

Trade-related differences between live account and demo account

Certain trade-related differences exist between demo and live accounts, resulting in a plethora of performance differences while trading. When you are using a demo account for trading, no emotional commitment is evolved as you are not putting any real money at stake. However, when you are using a live trading account, the traders might experience a psychological block. The fear and worry of losing real money can be distracting and strong.

You will be surprised to know that trading psychology is regarded as one of the primary factors that significantly differentiate between the live account and the demo account. As your money is not at a stake while using the demo accounts, you can think clearly, and you do become unemotional and rational. But, as soon as you start using live accounts, everything changes.

However, it is possible to get over these psychological roadblocks and train yourself to remain unemotional and rational. To overcome the transition period, you need to give yourself some time. It is recommended to start trading on live accounts by investing some accounts and similarly practice a while as you did with your virtual accounts.

If a person fails while trading with demo accounts, there are no real losses. Owing to this, the trader might develop certain discipline related habits, which might cost a lot of money during live trading.

Traders tend to increase risks or overtrade while trading in demo accounts as no stakes are involved. However, it would help if you kept in mind that such behaviors can have serious negative consequences as they plan to switch to using live trading.

Execution related differences

There is a wide array of execution issues that account for performance differences between demo and live accounts. Forex broker generally does not requote a price while using a demo account. However, as they are using live accounts, they might requote the prices often.

The dealing spreads and price feed of demo forex trading are also different from those of the live accounts. In a demo trading account, the broker might go for executing demo stop losses. However, there are increased risks of a considerable amount of slippage when it comes to real trading.

If certain broker errors arise when trading with a live account, it takes a good amount of money, effort, and time to resolve them as they reach out to the forex broker’s customer service department.

However, traders do not experience any such phenomenon as they trade with the aid of demo accounts. At times, brokers do not provide a real trading platform for demonstration objectives. It indicates that as traders start to use live accounts, they might require learning and acclimate to the specific live platform.

The data feed contributes to being the primary reason why such a difference exists between live and demo trading environments. A broker requires paying a specific fee for getting access to the live market quotes.

In addition to this, there come a plethora of overheads like the liquidity provider’s fee, making it more expensive. However, it is possible to open the demo accounts absolutely free of cost. Hence, the forex brokers do not provide similar trading conditions and live feed in the demo trading accounts.

Once you have practiced trading in a demo trading environment and it is time to move to a live account, it is recommended to go for a micro account in the beginning. It will be useful to them in understanding the real trading conditions.

In addition to this, it also provides information about the marketing conditions with the specific broker to the trader. These micro accounts have turned out to be the prime choice of traders for testing the potential forex broker before they start trading with the aid of a standard trading account.

Forex demo or real account?

Forex trading: demo account or real account?

In forex there are two types of accounts: the demo account and the real account.

A forex demo account is a virtual account, used by traders to carry out trade simulations, and generally to practice forex trading. The essence of providing a forex demo account to traders is for them to do a whole lot of things that will enhance their trading experience and improve their ability to trade profitably in the forex market.

A real account is where traders can actually trade under real market conditions, with real money.

A few years ago, demo accounts were the only option that traders had when it came to practicing forex trading. But there are now opportunities to practice real money forex trading, either with no-deposit real money accounts, or even micro accounts that are provided by forex brokers.

So the question for today is: which account should traders use when they are still learning the ropes of forex trading? Should they use demo accounts or should they use real accounts? To properly answer this question, we need to look at some trading perspectives as concerns the use of demo accounts and real money forex accounts.

Demo accounts

What purposes does a forex demo account serve to traders?

A) helps traders understand the trading platform

Forex is not just about trading strategies, software and trading systems. Every product has a user manual which guides users on how to make use of the product. In forex, such usage must be made practical. A trader must be able to understand how the trading platform works.

There are a lot of things that a platform does apart from being the gateway to forex trade executions. Platforms contain charts, and traders need to understand how to use the charts. They also need to know how to switch from one time frame to another time frame with one click. Traders need to understand how to set the various types of forex orders on the platform. Traders need to know how to deploy indicators and other tools of technical analysis. There is a lot that needs to be understood about platforms. A real money account is not where such stuff should be learnt. That would be like sending a trainee pilot to a U2 stealth bomber without any type of flight simulator training.

Many bad trades are a result of improper use of the forex platforms. Not every broker uses the MT4, and so a trader must be able to understand how a proprietary platform works. So if you want to test how a platform works, the demo account is where you should do that.

B) testing eas and indicators

A demo account is usually equipped with facilities for coding eas and indicators, and testing same. So if you are a fan of automated trading, then the demo account should be used for designing and also performing initial testing of your eas and custom indicators.

C) strategy and trade simulations

A demo account is where your strategies and systems should be formulated and subjected to initial testing. Usually if a system does not hold up on demo testing, it is not suitable for use on a real account.

So if we can do all these with a demo account, is there a place for the use of a low capital real account in forex? The answer is an absolute yes. The demo account is limited and cannot test all that needs to be tested prior to commencement of a real money trading career. Just as a pilot will need to actually get into a plane on training missions after flight simulation training, so a trader will need to actually get into a real trading atmosphere to see if all that has been learnt on demo will hold up, and more.

Real account

What is a real account to be used for as far as the learning process is concerned?

A) psychological trading

Emotions will never come to play on a demo account the way they do on a live trading account. The only way a trader will ever learn to control the various emotions at play is to use a real money account. A micro account which allows the trader to deposit about $200 is just the place to do this.

B) correction of mistakes

It has happened to all of us. The first attempts to make money on a real money account are not always successful. The mistake that many traders make is going back to their demo accounts to correct core trading mistakes. This is wrong as there is no way such mistakes will ever get corrected on demo. I give an example. How do you correct mistakes attributable to poor risk management on a demo account? The real money micro account is where such mistakes should be corrected.

C) live testing and optimization of eas

If you want to really test whether your EA is capable of making money on a real money account, use it on a real money account. You cannot know how good a meal tastes until you actually eat that meal.

Conclusion

To conclude this lesson, we put the question across: a demo account or a real account? The answer is that a trader will actually need both, but then a line will have to be drawn to demarcate when each account type should be used.

More about adam

Adam is an experienced financial trader who writes about forex trading, binary options, technical analysis and more.

OPEN REAL FOREX ACCOUNT

ZERO account opening and maintenance fee. NO minimum deposit or minimum account balance requirement!

The standard processing time for completing the account application form is approximately 10 mins.

Clients verified via bank transfer

- Fill in your information in the online account application form

- Make a transfer of no-less-than HK$10,000 for the first deposit (must be transferred from a bank account in the client’s name maintained with a licensed bank in hong kong )

- Send us the supporting documents via your registered email

Click here for more details.

Clients verified via cheque

- Fill in your information in the online account application form

- Print and sign the form

- Make a cheque deposit of no-less-than HK$10,000 (must be from a bank account in the client’s name maintained with a licensed bank in hong kong )

- Sign and submit the completed form, cheque along with the supporting documents by post or in person .

Click here for more details.

Note: according to SFC guidelines, if you need to designate more than one bank account for deposits and withdrawals, all designated bank accounts must complete the same verification procedure (i.E. You are required to make a fund transfer of no-less-than HK$10,000 from the bank account and the account must be in the client’s name maintained with a licensed bank in hong kong). Clients who are verified via cheque do not have this restriction.

Apply online: click below to start your application.

Our client services officer will handle your account opening face to face in our TST office.

Standard processing time for account opening is approximately 30 mins.

Bring along your supporting documents to complete the application and your account will be activated within 2 business days. Only_tcsc

Click here for more details.

Apply in person: click below to arrange for an appointment.

To open a corporate account, please contact us for details on application requirements and procedure.

Before you begin, please read the following:

To open an individual account with us, you must be able to meet our eligibility requirements detailed below.

- You are not a resident of japan;

- You are not a citizen or resident of the united states of america;

- You must be aged 18 or above;

- You have fulfilled our system requirements;

- You have a personal email address and phone number; and

- You are the beneficiary account holder,

If you are a person licensed by or registered with the securities and futures commission or an employee of a licensed person, an official consent letter from your employer is required. For more information, please contact our client services officer.

Forex demo or real account?

Forex trading: demo account or real account?

In forex there are two types of accounts: the demo account and the real account.

A forex demo account is a virtual account, used by traders to carry out trade simulations, and generally to practice forex trading. The essence of providing a forex demo account to traders is for them to do a whole lot of things that will enhance their trading experience and improve their ability to trade profitably in the forex market.

A real account is where traders can actually trade under real market conditions, with real money.

A few years ago, demo accounts were the only option that traders had when it came to practicing forex trading. But there are now opportunities to practice real money forex trading, either with no-deposit real money accounts, or even micro accounts that are provided by forex brokers.

So the question for today is: which account should traders use when they are still learning the ropes of forex trading? Should they use demo accounts or should they use real accounts? To properly answer this question, we need to look at some trading perspectives as concerns the use of demo accounts and real money forex accounts.

Demo accounts

What purposes does a forex demo account serve to traders?

A) helps traders understand the trading platform

Forex is not just about trading strategies, software and trading systems. Every product has a user manual which guides users on how to make use of the product. In forex, such usage must be made practical. A trader must be able to understand how the trading platform works.

There are a lot of things that a platform does apart from being the gateway to forex trade executions. Platforms contain charts, and traders need to understand how to use the charts. They also need to know how to switch from one time frame to another time frame with one click. Traders need to understand how to set the various types of forex orders on the platform. Traders need to know how to deploy indicators and other tools of technical analysis. There is a lot that needs to be understood about platforms. A real money account is not where such stuff should be learnt. That would be like sending a trainee pilot to a U2 stealth bomber without any type of flight simulator training.

Many bad trades are a result of improper use of the forex platforms. Not every broker uses the MT4, and so a trader must be able to understand how a proprietary platform works. So if you want to test how a platform works, the demo account is where you should do that.

B) testing eas and indicators

A demo account is usually equipped with facilities for coding eas and indicators, and testing same. So if you are a fan of automated trading, then the demo account should be used for designing and also performing initial testing of your eas and custom indicators.

C) strategy and trade simulations

A demo account is where your strategies and systems should be formulated and subjected to initial testing. Usually if a system does not hold up on demo testing, it is not suitable for use on a real account.

So if we can do all these with a demo account, is there a place for the use of a low capital real account in forex? The answer is an absolute yes. The demo account is limited and cannot test all that needs to be tested prior to commencement of a real money trading career. Just as a pilot will need to actually get into a plane on training missions after flight simulation training, so a trader will need to actually get into a real trading atmosphere to see if all that has been learnt on demo will hold up, and more.

Real account

What is a real account to be used for as far as the learning process is concerned?

A) psychological trading

Emotions will never come to play on a demo account the way they do on a live trading account. The only way a trader will ever learn to control the various emotions at play is to use a real money account. A micro account which allows the trader to deposit about $200 is just the place to do this.

B) correction of mistakes

It has happened to all of us. The first attempts to make money on a real money account are not always successful. The mistake that many traders make is going back to their demo accounts to correct core trading mistakes. This is wrong as there is no way such mistakes will ever get corrected on demo. I give an example. How do you correct mistakes attributable to poor risk management on a demo account? The real money micro account is where such mistakes should be corrected.

C) live testing and optimization of eas

If you want to really test whether your EA is capable of making money on a real money account, use it on a real money account. You cannot know how good a meal tastes until you actually eat that meal.

Conclusion

To conclude this lesson, we put the question across: a demo account or a real account? The answer is that a trader will actually need both, but then a line will have to be drawn to demarcate when each account type should be used.

More about adam

Adam is an experienced financial trader who writes about forex trading, binary options, technical analysis and more.

OPEN REAL ACCOUNT

Start forex trading with orbex now

Newsletter subscription

Subscribe to our daily newsletter and get the best forex trading information and markets status updates

Thank you!

Ready to get started?

Thank you for choosing to trade with orbex!

With your trading preferences in mind, please choose your preferred orbex entity:

| Benefits | orbex global limited | orbex limited |

|---|---|---|

| competitive fixed & variable spreads |  |  |

| regulatory authority | FSC | cysec |

| leverage | up to 1:500 | up to 1:30, up to 1:500 for professional clients |

| minimum deposit | 200 USD | 500 USD |

| platform | MT4 | MT4 |

| seamless execution & access to tier-1 banks |  |  |

| fast deposits and withdrawals |  |  |

| 24/5 multilingual world-class support |  |  |

| access to forex market news and trading education |  |  |

| safety of funds | segregated accounts | segregated accounts & member of ICF (investor compensation fund) |

| OPEN YOUR ACCOUNT | OPEN YOUR ACCOUNT |

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 79.8% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money

Investor alert:

forex trading & trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose.

So, let's see, what we have: open a forex trading account with FOREX.Com. At real account forex

Contents of the article

- Top forex bonuses

- Open an account

- Active trader program

- Related faqs

- How do I open a joint or corporate account?

- What are the differences between a demo and live...

- How does FOREX.Com make money?

- Try a demo account

- Try a demo account

- Real account forex

- Best forex robots

- The best forex robots in 2020:

- The best forex robots – the list

- Best forex robots: advice

- Opening of accounts

- Opening of a demo account #

- Opening of a real account #

- Difference between forex demo and real account

- Forex demo vs. Real account

- Forex demo or real account?

- OPEN REAL FOREX ACCOUNT

- Forex demo or real account?

- OPEN REAL ACCOUNT

- Ready to get started?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.