Top brokeri forex

We publish unbiased product reviews, our opinions are our own and are not influenced by payment we receive from our advertising partners.

Top forex bonuses

Learn more about how we review products and read our advertiser disclosure for how we make money. The global foreign exchange (forex) market is the largest and most actively traded financial market in the world, by far. When looking for the "best" forex broker, both beginners and experienced traders generally look for several key features and benefits. Among the most important of these are: the overall trading experience, the breadth and depth of product offerings (currencies, cfds, indexes, commodities, spread betting, cryptocurrencies, etc.), fees (including spreads and commissions), trading platform(s) (web-based, downloadable software, mobile, charting, and third-party platforms), customer support, trading education and research, and trustworthiness.

Best forex brokers

These forex brokers offer the best platforms for all types of traders

We publish unbiased product reviews; our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

The global foreign exchange (forex) market is the largest and most actively traded financial market in the world, by far. When looking for the "best" forex broker, both beginners and experienced traders generally look for several key features and benefits. Among the most important of these are: the overall trading experience, the breadth and depth of product offerings (currencies, cfds, indexes, commodities, spread betting, cryptocurrencies, etc.), fees (including spreads and commissions), trading platform(s) (web-based, downloadable software, mobile, charting, and third-party platforms), customer support, trading education and research, and trustworthiness.

Through extensive research and a strict adherence to our robust methodology, we have determined the best forex brokers in all of these areas and more, which has resulted in our top rankings below. Our mission has always been to help people make the most informed decisions about how, when, and where to trade and invest. Given recent market volatility and the changes in the online forex brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top trading platforms for traders of all levels, for every kind of market.

Top 7 of best US forex brokers for 2021

Top rated:

Are you searching for the best US forex brokers?

Luckily, our team of professional forex broker reviewers can take care of your every need.

Let alone the best forex broker in USA, our team realizes it is tough to find any broker which offers a trustworthy, and still value for money proposition when you want to trade forex in the USA. Forex brokers accepting US clients may be few and far between, but we have combined years of experience to narrow your selection down to the top five brokers.

These five are among the best forex brokers USA has to offer.

In fact, they are some of the best forex brokers for residents of any country. These brokers will ensure you feel safe, secure, and still have the ability to prosper in your trading career. They have been selected as the best US forex brokers for a variety of reasons.

Among these reasons are the amount of trading support they offer you, they wide range of markets and instruments that are available for trading, and the very competitive pricing and fee structure offered by these top forex brokers.

Table of contents

Is forex trading legal in the USA?

As a forex trader in the US, one of the most important questions you may be asking yourself from the outset surrounds the legality of forex trading in the US. Well, we are pleased to tell you that yes, forex trading is legal in the US. In fact, the US has several top financial regulators providing the best protection to you as a trader. These bodies are FINRA, the SEC, CFTC, and NFA with the latter two being the main regulators when it comes to forex trading and trading in derivatives such as futures. Remember also that cfds trading in the US is not permitted.

How to trade forex in the USA

The process of getting started with a forex broker in the US is typically similar to that of any other country. With any top broker you will usually be asked for the following information:

- Proof of identity. A passport is typically best for this purpose.

- Proof of residence, usually in the form of a bank statement at your current address.

Once these documents are uploaded and verified, a process that takes most forex brokers just a few minutes, you will be free to get started trading forex.

Top 7 forex brokers in the USA listing for 2021

Here’s our list of the best US forex brokers:

1. Forex.Com

When it comes to US forex brokers, forex.Com has to be an immediate consideration for opening your forex trading account in the USA. They are CFTC licensed and NFA regulated (#0339826) and provide a selection of flexible and accessible account types with low spreads starting from 0.2 pips, including their direct market access account. This offers some of the most unbeatable spreads among any of the forex trading brokers USA. They also provide extensive trading options in all of the top forex currency pairs, metals including gold and silver, as well as futures trading. When it comes to forex brokers accepting US clients, forex.Com certainly offers among the most comprehensive range of services to their US-based traders.

The forex.Com minimum deposits starting form $1000 on standard, and commission accounts, and $25,000 on DMA accounts with demo accounts available. There are also a range of other great benefits such as cash rebates and reduced or no fees for active traders.

2. IG markets

With over 40-years in the industry, IG markets is a true pioneer of the industry, and among the most long standing forex brokers accepting US clients. The broker has evolved continually, keeping the requirements of US-based traders as a top priority. These can be traded on MT4, the mainstay trading platform for top US forex brokers and traders from all around the world as well as being both CFTC licensed, and NFA regulated (#0509630). IG markets offers one type of account to all traders and this has a minimum deposit requirement of $250.

Accessibility with IG is also excellent, you can engage with a number of top professional charting packages using your desktop, phone, or other smart device. Beyond the USA, IG markets also featured in our top 10 largest forex brokers australia. This showcases their global appeal to traders. This appeal is further enhanced by a great cost of trading on more than 90 forex pairs with spreads starting at 0.8 pips.

3. Interactive brokers

You will very often find interactive brokers among our lists of top forex brokers. This is also true when it comes to our choice of top US forex brokers. This is thanks to a number of positive aspects which the longstanding broker uses to attract clients around the world. These include an excellent proprietary trading platform which offers some of the most advanced trading tools available on any market, and a widespread list of products which are available at highly competitive rates. These products include currencies, options, metals, and indices within a list which is ever increasing. IB are a FINRA member and regulated by both the CFTC and NFA (#0392970), as well as the SEC (#8-47257).

They have two account types, you can choose the IBKR lite, or IBKR pro both at no minimum deposit though the pro account has a $10 maintenance fee. As mentioned the product range is excellent as is the trading cost with spreads from 0.1 pips on 105 forex pairs. All of these features make IB a top choice particularly for experienced traders.

4. Oanda

Oanda is also making progress toward becoming the best forex broker in the USA. The industry leader is making progressive inroads in the US market, and now offers trading in more than 70 diverse forex currency pairs. This is more than enough for you to trade successfully. Added to this, you can also benefit from the powerful educational and research infrastructure oanda provides. This includes marketpulse, a selection of news, technical analysis, and research resources which are provided by the in-house oanda team. This can combine perfectly with our own online investment guides and educational content. Oanda are also well-regulated by both the CFTC, and NFA (#325821) offering traders two account types.

The standard account type is attractive thanks to the fact it has no minimum deposit, while the premium account requires a $2,000 minimum deposit but has benefits like lower spreads and other costs. An unlimited oanda demo account is also available. The broker also use the much respected MT4 trading platform for trading in all 70 forex pairs and more at a very competitive spread starting from 0 pips. All traders but particularly newer ones, seem to fit well within oanda.

Top U.S.-regulated forex brokers

The foreign exchange (forex) market runs 24/7, offers global currency pairs for trading. The market is driven by geopolitical developments, news, the release of macro-economic data, and related developments. On one hand, such a global market offers enormous trading opportunities, but on the other, it is challenging to protect individual traders from any financial irregularities. Thus, regulations were introduced through an established framework that ensures that financial intermediaries, like forex brokers, comply with the necessary rules to offer loss protection and controlled risk exposure to individual traders.

Learn more about the basics of forex market regulation in the U.S., as well as some of the popular forex brokers in the country.

Key takeaways

- The commodity futures trading commission and the national futures association are responsible for regulating the forex market in the U.S.

- All U.S. Forex brokers must be registered with the NFA.

- The dodd-frank act, which was signed into law in 2010, constitutes the primary body of rules governing forex trading.

- Some of the most popular forex brokers include FOREX.Com, OANDA, TD ameritrade, ATC BROKERS, thinkorswim, interactive brokers, and ally invest.

U.S. Forex market regulation

There are two institutions responsible for regulating the forex market in the united states—the commodity futures trading commission (CFTC) and the national futures association (NFA).

Every forex broker operating in the U.S. Must register with the CFTC. The laws enforced by the CFTC and NFA apply to both U.S.-based forex brokers, as well as any other forex broker who intends to serve clients in the country.

All U.S. Forex brokers (including the introducing brokers) must be registered with the national futures association (NFA), the self-regulating governing body that provides the regulatory framework to ensure transparency, integrity, abiding of regulatory responsibilities, and protection of various market participants. The NFA also offers an online verification system called background affiliation status information center (BASIC), where forex brokerage firms can be verified for having necessary regulatory compliance and approval.

One point to note is that the securities exchange commission (SEC) does not have authority over the forex market because it doesn't consider currency pairs a security.

Daily trading volume has reached as high as $4 trillion in the forex market.

Dodd-frank act: forex rules

In the united states, the dodd-frank act constitutes the primary body of rules governing forex trading. Signed into law in 2010 by president obama, it reformed insufficient financial regulation that allowed too much leeway to financial institutions, which contributed to causing the 2007-2008 financial crisis.

These regulations have scared off both forex brokers and retail traders. There are fewer forex brokers currently operating in the U.S. Compared to other areas in the world—primarily because of the regulations enforced by the NFA.

U.S.-regulated forex brokers

This list of seven U.S.-regulated forex brokers—that remain after dodd-frank washout—is not in any particular order, and it is not comprehensive:

FOREX.Com

Owned by NYSE-listed parent company, GAIN capital holdings, inc. (GCAP), FOREX.Com offers many salient features like tight forex spreads, timely trade executions, a mobile trading platform, and numerous technical research indicators in 29 different languages.

FOREX.Com trading offers integration across metatrader 4 or forextrader PRO platforms. There are three ways traders can trade—advanced trading, web trading and mobile trading applications.

High volume traders get cash rebates, earned interest, and bank fees waived.

OANDA

OANDA is another popular broker offering competitive spreads with no commissions and deep market liquidity, along with its OANDA marketplace. It offers loads of features for forex traders such as forex tools, products, advanced analytical tools, forex news, training videos, and MT4 plugins from OANDA and associated partners.

You can start with a free demo. The site also offers benefits for high volume traders. You can get a discounted spread, a subscription with a partner platform, free wire transfer among other perks.

TD ameritrade

TD ameritrade offers powerful charting tools, capable of comparing multiple currency pairs alongside each other, as well as providing any necessary technical indicators. Customers can also analyze social sentiment from twitter. The brokerage also provides reputable third-party research tools from morningstar and market edge.

The firm promises no hidden fees, access to its mobile trading app, and 24/7 support.

Verify a forex broker's status by using its NFA ID or firm name through the NFA's background affiliation status information center.

ATC BROKERS

STP execution, no dealing desk, scalping allowed, multiple brackets order along with other risk management tools like breakeven capability, custom trailing stop-loss, and more enable ATC BROKERS to be one of the popular regulated brokers in the U.S.

The broker also provides access to news events and an economic calendar, along with support through email, phone, and online chat.

Thinkorswim

Thinkorswim by TD ameritrade is another popular U.S.-regulated forex broker that offers to trade in more than 100 global currency pairs.

You can sync the platform on multiple devices and customize and share your alerts. You can also get in-app chat and sharing, so if you need help, the representative you're communicating with can access your screen. And like TD ameritrade, it promises no hidden fees, and data fees also don't apply.

Interactive brokers

Another popular broker having a global presence, interactive brokers claims to have low trading costs with high-level execution, global offerings, high-end trading technology, risk management tools, and trading tutorials.

It promises access to 23 different currencies, as well as 120 different markets in 31 different countries. You can stay connected to global markets 24 hours a day, six days a week.

Ally invest

Ally provides traders with comprehensive research and analysis, competitive pricing and robust educational resources. The trading platform includes a full suite of trading tools, 24/5 market access and a practice account for testing investing approaches.

The bottom line

Regulations are a balancing act. Too little will lead to financial irregularities and inadequate protection to individual traders; too much will lead to a lack of competitiveness in global markets. One major challenge reported with U.S. Forex regulators is that leverage provided is limited to 50:1, while global brokers, outside of U.S. Regulations purview, provide up to 1000:1 leverage. Traders and investors need to take a cautious approach, ensuring security first.

Disclaimer: information presented is as available at the time of writing this article, and may change in due course of time. The author does not hold an account with any of the mentioned brokers.

Best forex brokers

Luke jacobi

Contributor, benzinga

Want to jump straight to the answer? The best forex broker for most people is definitely FOREX.Com

Forex trading is arguably one of the easiest financial markets to begin trading in. To get started, you just need to open and fund an account with a regulated online broker. Choosing the best forex broker to trade forex through does require some initial research to find the one most suitable for your trading needs and experience level.

Best forex brokers right now:

- Best overall forex broker: FOREX.Com

- Best for beginner traders: etoro

- Best for non-US traders: HYCM

- Best for commodities: avatrade

- Best for intermediate traders: pepperstone

- Best for advanced forex traders: interactive brokers

- Best for mobile traders: plus500

- Best forex platform: IG markets

Table of contents [ hide ]

The best forex brokers

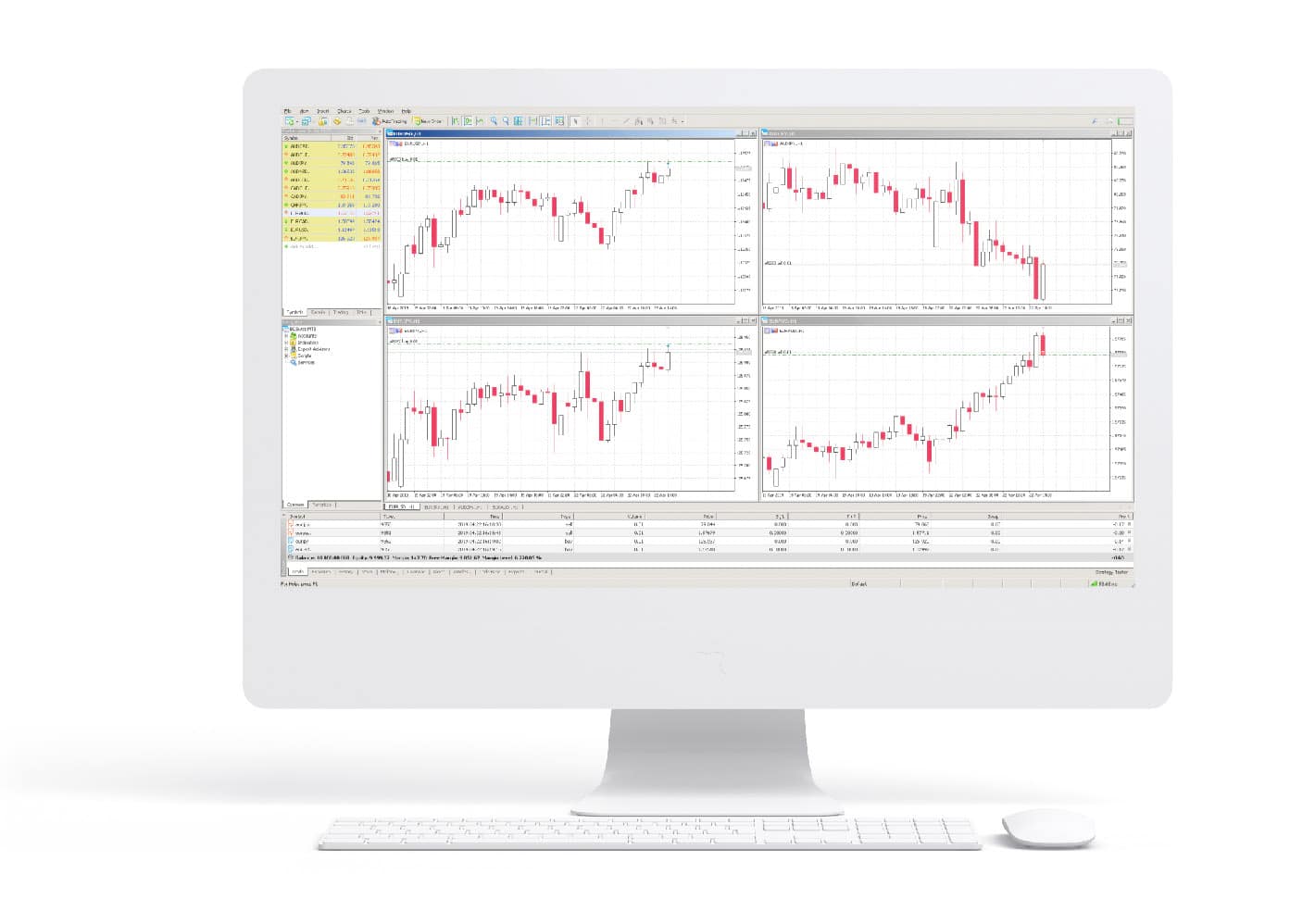

Benzinga’s picks for the best forex brokers in 6 key categories appear below along with details about each broker and a screenshot of their trading platforms.

Account minimum

Pairs offered

Minimum trade size

Spread

Commisions

1. Best overall forex broker: FOREX.Com

FOREX.Com is a subsidiary of GAIN capital holdings (NYSE: GCAP) and ranks as the best overall forex broker.

You will only need $50 to open up an account to start trading up to 80 currency pairs on FOREX.Com’s advanced trading platforms, which include metatrader for non-U.S. Residents.

This broker accepts U.S. Clients and is regulated in the U.S. By the commodities futures trading commission (CFTC) and the national futures association (NFA). FOREX.Com also has oversight from regulators in 6 major world jurisdictions through its subsidiaries.

You can check out benzinga’s FOREX.Com review for more information about this excellent broker.

Account minimum

Pairs offered

Minimum trade size

Spread

Commisions

2. Best for beginner traders: etoro

Etoro specializes in social trading, which is ideal for beginners since you can follow the trades of expert traders with a proven track record. In addition to its world-class social trading network, etoro has excellent educational resources for forex beginners. Etoro’s intuitive multi-asset trading and social trading platforms and apps can be used by anyone immediately. Unfortunately, etoro does not support the metatrader 4 and 5 (MT4 and MT5) trading platforms.

The broker lets you trade over 2,000 different assets and has a minimum deposit of $50. Etoro currently accepts clients from most U.S. States where it is registered with the U.S. Financial crimes enforcement network (fincen) as a money services business, instead of with the NFA and CFTC as an online broker. The company is also regulated in australia, the U.K. And cyprus in the EU.

Account minimum

Pairs offered

Minimum trade size

Spread

Commisions

3. Best for non-US traders: HYCM

Highly regulated HYCM offers stocks, forex, indices, cryptocurrencies, commodities and etfs. The company also offers excellent trading conditions and great liquidity.

HYCM uses metatrader 4 to trade the markets and adds in technical analysis, flexible trading systems and expert advisors (eas).

You’ll also encounter low spreads and low-cost trading, which includes 3 spread levels: fixed spreads, variable spreads and raw spreads:

- You can access up to 500:1 leverage through HYCM, depending on where you live and which currency pair you’re trading.

- Account minimums with HYCM may vary depending on your base currency and the type of account you open. You should have at least $100 to $200 ready to go before you open an account.

- You can customize your account levels with varying fee structures to fit your risk tolerance and trade frequency.

- HYCM even offers swap-free accounts that do not accrue interest for each of its fee types to allow islamic investors to trade freely without worrying about being in conflict with religious laws.

You’ll also find a range of education and research tools for endless education opportunities through HYCM.

Account minimum

Pairs offered

Minimum trade size

Spread

Commisions

4. Best for commodities: avatrade

Avatrade, one of the most secure brokers in the industry, carries 7 regulations across 6 continents (europe, australia, japan, british virgin islands, UAE and south africa). You’ll be pleasantly surprised by its asset availability, leading platforms and generous trading conditions (you can leverage your positions up to 400:1).

Avatrade offers an exceptionally user-oriented perspective, including a 24-hour multilingual support desk for a broad range of instruments, platforms and services for every level of trader. Instruments include:

- Forex

- Stocks

- Commodities

- Cryptocurrencies

- Indices

You’ll find a range of automated trading platforms, including desktop, tablet, mobile and web-based trading with metatrader 4, metatrader 5, its proprietary webtrader, avaoptions and the award-winning avatradego. Client funds are held in segregated accounts for increased security and fast profits withdrawal.

Avatrade’s innovative technology and cutting-edge trading features also include 1-on-1 training sessions with a dedicated account manager.

Commissions

Account minimum

5. Best for intermediate traders: pepperstone

U.K.-based pepperstone gets our vote for best broker for intermediate traders. It has regulatory oversight in the U.K. And australia, although it does not currently accept U.S. Clients. The broker lets you trade in 61 major, minor and exotic currency pairs and requires a minimum deposit of $200. Pepperstone provides support for the metatrader 4 and 5 and ctrader platforms.

In addition to forex, pepperstone offers trading in cryptocurrencies, energy, metals, commodities and stock index contracts for difference (cfds). Customer balances are maintained in segregated accounts for safety in the australian national bank and barclays U.K.

Pricing

Account minimum

6. Best for advanced forex traders: interactive brokers

Interactive brokers offers some of the lowest costs in the business, including a $0 commission on U.S.-listed stocks and exchange-traded funds (etfs). Because of interactive’s world-class brokerage services in 33 countries that cover 134 markets worldwide, the company has oversight from most of the world’s largest financial regulators, including the U.S. SEC, CFTC and NFA. Interactive also submits to regulatory oversight in the U.K., australia and canada, and it has agencies in japan, hong kong, india and luxembourg.

Interactive brokers offers trading in 23 different currencies and their pairs, and the broker requires a $10,000 minimum margin deposit that is applied to commissions for the first 8 months, followed by a $2,000 minimum starting on the 9th month.

Minimum commissions apply, as well as maintenance fees and charges for inactivity, so interactive brokers would be best for advanced, active and well-funded professional traders. Interactive’s proprietary trading platforms, including its client portal, desktop trader workstation (TWS) and mobile application have been rated as some of the best in the business.

7. Best for mobile traders: plus500

U.K.- based plus500 has oversight from the FCA and is a leading provider of CFD trading on over 1,000 tradable assets including forex currency pairs, stock shares, cryptocurrencies, etfs, options and indices. The company keeps your money in segregated accounts but does not offer services to U.S.-based clients.

Plus500 offers trading in 70 currency pairs featuring competitive spreads on its forex cfds and leverage of up to 300:1. The intuitive interface featured on both the plus500 desktop and mobile trading platforms can be accessed immediately by novices and professionals, which makes plus500 our pick for mobile traders.

Commissions

Account minimum

8. Best forex platform: IG markets

IG markets gives clients access to trade cfds in more than 17,000 different markets including forex, shares, indices, commodities, bonds, etfs, options and short-term interest rate cfds. You can trade up to 80 different currency pairs through IG and the broker requires a $250 minimum deposit.

IG accepts U.S.-based clients due to oversight from the CFTC and NFA. IG holds your money in segregated accounts under trustee arrangements for added security. In addition to its proprietary trading platform, IG offers support for 3rd-party forex platforms such as metatrader 4 and prorealtime. It also allows application programming interface (API) trading.

Forex market explained

In the forex market, traders agree to exchange 1 currency for another to make a transaction in that currency pair at a particular level known as the exchange rate. Like stock prices, this exchange rate fluctuates based on supply and demand factors, as well as on the forex market’s overall expectations of future events.

Forex traders can make money on a currency transaction in 2 ways. First, if they buy or go long a currency and it goes up in value versus the sold currency, then they earn a profit. Second, if they sell or go short a currency and it goes down versus the bought currency, then they also profit.

Many currency pairs quoted in the forex market show substantial volatility or fluctuations, which can result in gains or losses for traders. The daily candlestick chart below shows changes in the exchange rate of the EUR/USD currency pair, which is the european union’s euro quoted in terms of the U.S. Dollar from november 2018 until april 2020.

Risk and reward in forex trading

Rewards are generated in forex trading when you take a long or short position in a currency pair that subsequently appreciates in value. The risk in doing a forex transaction is when the market doesn’t perform as expected once you have done a forex trade.

Many brokers allow traders to magnify the gains or losses they take on a position via the use of leverage. Leverage is typically expressed as the ratio of the size of a position you can control by placing one unit of base currency on deposit as margin. Hence, a 500:1 leverage ratio would mean that you can control a $500 position with a $1 margin deposit.

Furthermore, most successful traders have a minimum risk/reward ratio for a trade before they will consider taking it, such as 1:2 or 1:3. For example, if you think the chances of a trade making 20 pips is around the same as the chances of it losing 10 pips, then your risk/reward ratio of that trade is 1:2. If that meets your risk/reward ratio criteria, then you might consider that trade worthy of executing.

Choose your broker wisely

Since your forex broker will be your primary trading partner, you want to choose one carefully to make sure they are reputable and will fit your requirements as a trader. Open a demo account with an online broker you’re thinking of using to see whether it is a good fit. Demo account trading can also help prevent potentially costly errors that might arise from you being unfamiliar with the broker’s trading platform.

Methodology

These top brokers were chosen for this review for various reasons depending on the specific category in which we felt they excelled. Baseline requirements included the strength of their regulatory environment, their generally good overall reputation with clients earned over an extended period and a substantial number of currency pairs available for trading.

List of the best 23 forex brokers | trusted reviews

Are you looking for a good and serious forex broker? – then this page is the right place for you. Thanks to the large selection on the internet it is often difficult to make the right decision. With more than 7 years of experience in the financial markets, we present you with the best providers with top service and without hidden costs. Find out in the following texts how to select a secure forex provider and which online broker offers the best conditions.

| Broker: | review: | regulation: | spreads: | assets: | advantages: | open account: |

|---|---|---|---|---|---|---|

1. Bdswiss  | ➜ read the review | cysec, FSC | starting 0.0 pips + $ 2.0 commission per 1 lot | 250+ (50+ currency pairs) | + individual offers + trading signals + raw spreads + leverage up to 1:500 + best education + personal support |

Watch our full video review about the best forex brokers (risk warning: your capital is at risk):

Strict criteria for the forex broker review

In contrast to many other comparison sites, we present you on this website only the safest providers with the best conditions for traders. As experts with many years of experience, we have tested many forex brokers and still use some of them. A good provider should have certain characteristics that guarantee good and safe investing.

It is not uncommon to hear of fraud on the internet. This is to be avoided by this comparison. In addition, one would like to save on charges as a trader because the costs for the trade reduce of course the actual profits. Also, the security of customer’s money is of high priority. A regulation or license, for example, is urgently needed for secure trading with international brokers. All these criteria and many more are included in the test. Therefore we can present you on this page the best forex brokers in a list.

Proven facts for a good forex broker:

- Regulation and license of an official finance authority

- High safety of customer funds

- Fast and reliable market execution

- Small forex trading fees and no hidden fees

- No requotes (high liquidity)

- User-friendly trading platform

- Free and unlimited demo account

- Professional support

- Fast deposit and withdraw methods

How does a forex broker work?

A forex broker is an intermediary between a client (trader) and the interbank market for currencies (wikipedia). In addition, the broker can lend capital to the trader so that he can trade with leverage. The broker’s income is generated by the spread and the cost of financing the leveraged positions.

There are 2 different models of brokers: market maker and ECN/NDD broker

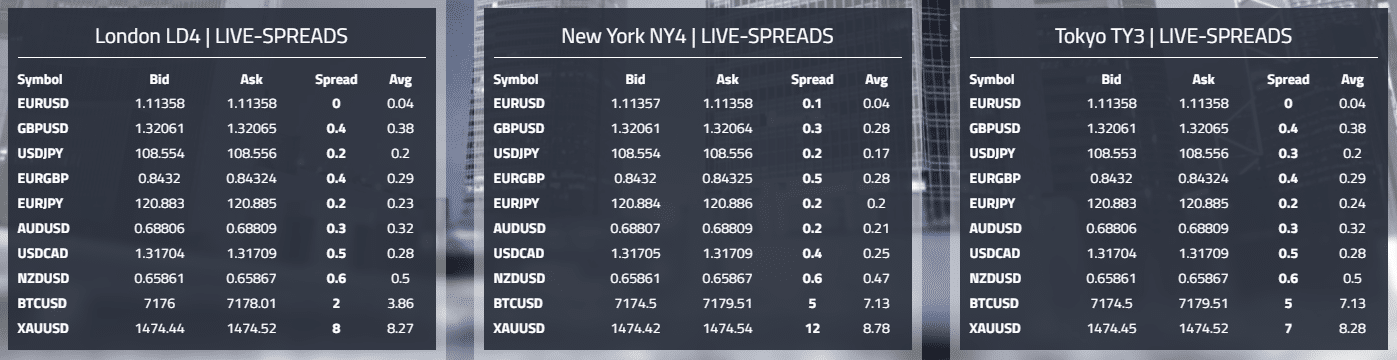

Example of live spreads for forex brokers

Market maker:

This broker does not place the trader’s orders directly into the real interbank or spot market. There is an internal matching system between the positions of the traders. Of course, the broker can hedge himself on the real markets so that there are no distortions in supply and demand. In most cases, this system can be opaque, and only as a broker employee, you know the exact functions. A market maker forex broker is not bad or scam. Nowadays, most providers offer good and exact executions.

ECN/NDD (no dealing desk) broker:

ECN and NDD mean direct access to the interbank market through various liquidity providers. These are large banks or very large forex brokers. The provider places the trader’s orders directly into the real market. So the customers get direct and real market prices for trading. With this model, there is no conflict of interest between trader and broker. Zero (no) spread accounts are offered.

Warning: only trade with regulated and licensed forex brokers

Security has the highest priority in online trading. When it comes to trading leveraged financial products, you have to be able to trust the forex broker. It is not uncommon for large sums of money to be used to generate a large profit. For example, brokers in europe must have regulations or licenses if they want to offer their services. The regulation can be in any european country. The same or almost the same requirements apply to brokers everywhere. In order to avoid fraud, it is important to look for such a license.

Licenses are only issued under certain conditions and criteria. If a broker violates these conditions, the license may be withdrawn immediately. All tested companies of mine are always concerned to keep the highest criteria and to guarantee a safe trade. Many brokers, for example, are regulated in cyprus. This has tax advantages. Nevertheless, there are also forex brokers with more than one regulation. The various regulatory authorities can be seen in the table above.

Facts of reliable and secure companies:

- Regulation and license

- Separated customer funds

- Regulated deposit and withdrawal methods

- Using well-known banks

- Large liquidity providers

Another important point for serious trading is the security of customer funds. Payouts of winnings or the deposited amount should work smoothly. It was not uncommon for some brokers to speculate on customer funds themselves. In the end, withdrawals were refused or delays occurred.

How risky is forex trading?

Forex trading is managed by leveraged financial products. That means you are able to trade a bigger contract size than the amount of money in your account. Some brokers offer the leverage up to 1:3000. Many traders are afraid of the obligation to make margin calls and this is not without reason as the past has shown. Account balances could slip into the negative balance. This is possible due to extreme market situations and too large a position size in relation to the account balance.

The providers shown above all have no obligation to make additional contributions (except IC markets and vantage FX). With the providers in the upper table, you are therefore protected against such a scenario. In our experience, this can only happen if the account is too heavily leveraged. You should always beware of sensible risk management.

Beginners should always start with the free demo account to practice forex trading.

A demo account is essential for successful trading. The trading column form and conditions can be tested extensively with this account. It is a virtual credit account that simulates real money trading. It can be traded without risk. This means that new strategies can be developed or new markets tested. The demo accounts of the compared providers are completely free and unlimited. This account is best suited for entry into forex trading.

How to deposit and withdrawal money:

For most traders, the first deposit into their account is very exciting. It should work smoothly and be highly secure. Forex brokers offer well-known and proven payment methods. Capitalize the trading account with electronic methods (credit card, e-wallet, paypal, crypto) or with the classic way of bank transfer. Electronic methods work in real-time and the money is credited directly to the trading account. Trading can be started immediately. The minimum deposit at the compared brokers is very low. For example, you can open an account from as little as 1$. If this is worth it, you have to decide for yourself. There are no fees for deposits.

Example of payment methods of a forex broker

The payout is also very uncomplicated. With a few clicks, you can request a withdrawal on the menu. This is then released in 1-3 working days. However, most brokers payout customer money in less than 24 hours. All presented brokers passed this test. The fees can be high for small payouts. With payments over 200$, the most forex brokers take over the fees but some brokers do not charge any commissions.

Facts about the payments:

- Instant deposit of money

- Fast withdrawal within 1 – 3 working days

- Electronic methods (skrill, neteller, paypal, and more)

- Cryptocurrencies

- Bank wire

Not every country is available for forex trading

Not every country is available for forex brokers and trading. This is because there are some restrictions and special regulations. For example, in some countries, an international broker needs a special license for that specific country. So it is too much afford for some companies to get the license and they stop taking clients from these countries. You can clearly see on the homepage which clients they accept. Not many brokers accept clients of the united states of amerika.

From my experience, the fastest-growing countries are in africa and asia. Because of the development of mobile internet, more people get connected to the forex market. India, nigeria, philippines, malaysia, and china are at the moment the fastest-growing countries.

Is forex trading legal?

Forex trading is fully legal if there is not any ban from the government. Forex trading is just changing money into another currency. This is not an illegal practice. The brokers on my review got official regulations so they act fully legal.

Review conclusion: start trading with a reliable forex broker

On this page, we have presented you with our current list of the top 23 forex brokers in comparison. Now you have a selection of good and reputable companies in front of you. It was particularly important to us that we only present providers here, which we have tested by ourselves with real money. This is not the case with most comparisons.

Profit now from the most favorable fees and the best conditions by my experience of many years. With these providers, you are 100% safe and can take your forex trading to the next level.

We hope you could learn something in this comparison and act now with better providers through my recommendations. If you can’t make up your mind, please also read the reviews.

Successful forex trading requires a good and reliable broker. In this review, we showed you the top 23 secure forex brokers. Now you can choose your professional trading partner.

The best U.S. Forex brokers

Forex trading is highly regulated in the united states. In this guide, we review the best U.S.-complaint forex brokers, comparing their fees, leverage, pros, and cons.

Tim fries

Tim fries is the cofounder of the tokenist. He has a B. Sc. In mechanical engineering from the university of michigan, and an MBA from the university .

Shane neagle

Meet shane. Shane first starting working with the tokenist in september of 2018 — and has happily stuck around ever since. Originally from maine, .

All reviews, research, news and assessments of any kind on the tokenist are compiled using a strict editorial review process by our editorial team. Neither our writers nor our editors receive direct compensation of any kind to publish information on tokenist.Com. Our company, tokenist media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. Click here for a full list of our partners and an in-depth explanation on how we get paid.

Settling on a good forex broker in the U.S. Should be easy, right? After all, the united states is still the world’s largest economy, and there’s a market for trading every currency with USD.

Well, easier said than done…

Foreign exchange, the exchange of one currency to another, runs 24 hours, 5 days a week through over-the-counter markets, generating a huge trading volume per day. This highly liquid market allows for seamless access to traders across the globe. Australian traders, for example, can trade in british pounds (GBP) and euros (EUR) through a US-based broker.

This decentralized and global nature of the industry also carries significant risk, making it an ideal target for fraud. The growth of speculative trading has resulted in an increase in intermediaries, including brokers and banks engaging in scams, financial irregularities, exorbitant charges and exposure to high-risk through bad practices.

It’s no wonder then that U.S. Regulators now play such an important role in the industry. That is to say, the most important criteria to take into consideration when choosing a U.S. Forex broker is the regulatory approval status of the broker and its governing authority.

However, regulation enforcement isn’t a straightforward process, and due to the global scale of the market, there is no standard regulatory framework that applies across all jurisdictions. So, can you trade forex in the USA?

Yes, though forex trading in the US is generally considered highly regulated. Forex brokers in the US are heavily regulated by the commodity futures trading commission (CFTC) and national futures association (NFA), independent agencies that enforce strict rules, including a restriction on leverage offered.

Furthermore, if you are a united states citizen, the regulation impacts your eligibility for non-U.S. Based brokers, unless they are registered with the NFA.

There are stark differences in regulation that make it imperative for you to be aware of and understand the regulation that applies to the broker you are considering.

Additionally, the forex market is highly vulnerable to significant volatility as a result of economic turbulence. We can see this through the current coronavirus pandemic, the impact of which can be felt, in this case, regardless of regulations. ��

In this article, we’re going to take you through:

- Our recommendations for the best brokers

- Key provisions of U.S. Forex trading regulations

- How U.S. Forex regulations differ

- Quick Q&A on forex regulations in the united states

Leading US forex brokers

The following list presents the advantages of the best forex brokers for US clients:

The following list presents the advantages of the best forex brokers for US clients:

- Interactive brokers

best overall - IG US

best investment selection - TD ameritrade

superb app for US forex brokers - FOREX.Com

best charting tools - Nadex

best exchange

Top 5 US forex brokers 2020

1. Best US forex broker overall: interactive brokers

When it comes to currency pairs offered, trading technology, ease-of-use, regulation, and fees — there’s one broker that takes the cake. Interactive brokers is easily our top forex broker for US traders.

- Highly regulated

- Substantial range of global markets and asset classes

- Low fees including discounts for high-volume traders

- Complex desktop platform may be unsuitable for beginners

- A lack of forex charts on web platform

- Minimum activity charges per month

Interactive brokers (IBKR) should be a serious consideration for professional FX traders. The company is headquartered in the U.S and boasts strong regulatory licences.

This broker is most suited to professional traders and offers 105 forex pairs, 7,400 cfds, US-traded bitcoin futures, and much more. IBKS’s trader workstation is more difficult to use but does provide a full range of features.

Interactive brokers fees appears to be competitive overall, however, the company does not publish its average spread for forex which makes it difficult to pinpoint exactly. Forex traders will receive an aggregated price from some of the largest dealers around the world, and then be charged a commission per trade that can range from $16-$40 per million round turn, as opposed to charging a spread.

Traders looking to prioritize research will appreciate the comprehensive array of third-party research, including both free and premium content. The company does however, lack a full-featured research offering for forex.

⚡️ important: interactive brokers requires forex traders in the U.S to be classified as an eligible contract participant (ECP), “an [ECP] is generally an individual or organization with assets of over $10 MM (5 MM for trades that are hedging)”.

Originally, IBKR’s customer support was far from the most loved. Fortunately, the service has improved immensely, for example with the introduction of ibot on mobile, a virtual assistant that permits users to ask questions by voice command.

In addition, the interactive brokers‘ team can be contacted in a variety of ways, including by phone, with an average wait time of 1 to 2 minutes.

Cele mai bune brokerii forex 2021

Brokerii din SUA

Brokerii canadieni

Brokerii din marea britanie

Brokeri australieni

Brokerii din întreaga lume

Pârghie: 400: 1 | UE - 30: 1

400: 1 | clienții UE 30: 1

* leasingul depinde de entitatea grupului și de instrumentul financiar tranzacționat.

- Conturi demonstrative

- Brokerii FX de către organismele de reglementare

- Conturi forex islamice

- Brokerii FX pentru începători

- Sfaturi de tranzacționare FX

- Comerț social și comerț cu copii

- Platforma de tranzacționare forex pentru începători

- Ce este CFD trading

- Cum să evitați reglementările AEVMP

- Ghid ESMA

2021 top 5 forex broker review-uri

- Revizuirea AVATRADE

- XM review

- FX choice review

- IC markets opinie

- Revizuirea piețelor negre

Tranzacționarea forex nu este doar pentru comercianții profesioniști. Oricine își poate încerca mâna și poate avea succes, cu o pregătire adecvată, desigur.

Sunteți nou în tranzacționarea valutară?

Dacă aveți deja experiență în tranzacționarea online, veți găsi site-ul nostru util pentru a descoperi brokeri de top, care vă pot aduce mai mult succes și o experiență de broker mai bună.

Site-uri de tranzacționare forex legit

Sunt sute de brokeri de valută acolo, unele mai bune decât restul.

Dacă doriți să reușiți și să câștigați bani pe piața valutară, este esențial să faceți alegerea corectă chiar de la început.

- Scopul nostru este să clasează brokerii de schimb valutar , evaluați-le și comparați brokerii pentru dvs., astfel încât nu trebuie să extrageți prin sute de site-uri forex trading și mii de recenzii.

- Noi credem că mai puțin este mai mult când vine vorba de alegerile pe care vi le arătăm și le recomandăm.

- Suntem mereu în căutarea celor mai buni brokeri.

- Predăm cei mai buni brokeri forex care s-au dovedit a fi de încredere și respectabili și îi facem cu atenție înainte de a vă aduce pe voi pe listele noastre clasificate.

- Enumerăm NUMAI site-uri legale de tranzacționare forex.

Forex articolele

6 milionari forex de care nu ați auzit niciodată

6 milioane de forex pe care nu ai auzit-o niciodată de tranzacționare forex a fost recunoscută ca fiind una dintre cele mai rapide modalități de a acumula avere pe termen scurt

Cum să alegeți brokerul forex potrivit

Alegerea brokerului forex potrivit în prezent, există sute de brokeri forex din întreaga lume care pretind că sunt cei mai buni dintre ceilalți. Dar noi toți

De ce eșuează comercianții forex

De ce nu reușesc comercianții forex? S-a estimat că rata de eșec a noilor traderi forex este de până la 95%. De ce este această rată

Cea mai bună platformă de tranzacționare forex pentru începători

Cea mai bună platformă de tranzacționare forex pentru începători alegerea celei mai bune platforme de tranzacționare forex poate fi o sarcină provocatoare pentru începători. Selectarea celor mai potrivite, ușor de utilizat,

6 bazele managementului riscului forex

Gestionarea riscului valutar pentru a avea succes pe piața valutară ca comerciant, trebuie să dezvoltați strategii adecvate de gestionare a riscului valutar. Chiar dacă tranzacționarea dvs.

10 sfaturi de tranzacționare forex pentru începători

10 sfaturi de tranzacționare forex pentru începători. Cariera multor comercianți forex a început la un început dur, fără sfaturile și forex-ul potrivit

Ghid pentru începători pentru tranzacționarea CFD

Ghid pentru începători la tranzacționarea CFD-urilor dacă sunteți un comerciant valutar care caută informații despre cum să vă extindeți abilitățile de tranzacționare pentru a include

Tranzacții forex vs

Tranzacționarea forex vs. Tranzacționarea acțiunilor - de ce bifează forex. Forex vs stocuri. Toleranța la risc, confortul și dimensiunea contului sunt factorii majori care influențează

Regulamentul forex

Reglementare în tranzacționarea forex top 5 regulatori fx piața riscantă de tranzacționare forex, care implică tranzacționarea perechilor valutare, are nevoie de o reglementare forex adecvată. Industria forex

Investigăm brokerii înainte de listare

Procesul nostru de clasificare a celor mai buni brokeri FX este un proces aprofundat în care filtrăm cu atenție concurenții.

Investigăm fiecare broker și reclamațiile acestora înainte de a le înscrie.

Alegem alegerile noastre de top în funcție de condițiile de tranzacționare, platformele de tranzacționare, viteza de execuție a tranzacțiilor, tipurile de cont, metodele de depunere și organismele reglementate.

Deoarece ne pasă de încrederea dvs. În noi, ne uităm în special la serviciul pentru clienți și la reputația generală a brokerilor pe care îi recomandăm. Siguranța fondurilor dvs. Este esențială.

Veți descoperi că toți brokerii noștri recomandați au primit recenzii bune de la comercianți pentru securitatea și serviciul pentru clienți.

Vrem ca clienții noștri să aibă încredere deplină în fiecare broker de pe site-ul nostru. Așadar, căutăm doar cei mai de încredere brokeri de tranzacționare în valută pe care să îi includem.

Este posibil să fiți deja familiarizați cu unii dintre acești brokeri de forex, dar poate că le-ați trecut fără o privire mai atentă.

Dar, cu îndrumarea noastră, promitem că veți găsi cele mai legitime site-uri de tranzacționare forex.

Ce este forex?

Să luăm în considerare o situație în care prietenul tău îți cere să investești în valută și te întrebi ce este forex?

Piața valutară sau piața valutară, valutară și valutară este o piață globală pentru tranzacționarea monedelor lumii sau, pur și simplu, atunci când o țară tranzacționează cu alta, este nevoie de schimb valutar. Piața valutară determină cursul valutar. Include toate aspectele legate de cumpărarea, vânzarea și schimbul de valute la prețuri curente sau determinate.

Însăși baza pentru a începe cu tranzacționarea fx este să înțelegeți de ce veți avea nevoie pentru a începe. Ar trebui să începeți cu un program de educație forex fiabil. Un program de educație valutară este o modalitate excelentă de a începe. Este foarte important să aveți o înțelegere rezonabilă a conceptelor valutare pentru a începe. Cheia pentru a câștiga în forex este alegerea strategiei potrivite, care necesită, de asemenea, o mulțime de antrenament. Aici, la forex rank, dorim să fiți pe deplin încrezători atunci când începeți să tranzacționați pe piața valutară.

Strategia corectă este despre minimizarea riscurilor

Când cineva vorbește despre investiții, vi se va cere automat să vă gândiți la randamente și riscuri. Învățarea controlului riscurilor este cheia înțelegerii forexului. Cel mai bun mod de a înțelege ce este forex este să înveți făcând. Această experiență este de neprețuit. Cu puțină pregătire strategică, puteți începe pe drumul cel bun. A începe pe calea cea bună presupune alegerea strategiei corecte.

Lucrați cu un plan de tranzacționare forex

Când alegeți să lucrați cu un anumit plan de tranzacționare valutară, începeți cu o înțelegere clară a forței, slăbiciunii, oportunităților și amenințărilor din strategie. Un plan nu trebuie să fie prea complicat. Un plan poate fi foarte simplu, dar eficient.

Începeți cu un plan simplu

Dacă sunteți un începător la tranzacționare cine abia începe să înțeleagă ce este forex, ar trebui să începeți cu un plan simplu. Crearea unui plan nu este deloc un proces obositor. Există diferite niveluri ale planurilor de tranzacționare. Când tranzacționați cu o strategie, încercați de fapt să veniți cu un set de reguli care pot fi folosite pentru a tranzacționa profit profitabil. Fiecare plan vizează controlul riscurilor și creșterea profiturilor. Gradul de risc și suma în profituri pe care sunteți dispus să o faceți va decide tipul de strategie pe care ar trebui să o alegeți?

Dezvolta îndemânarea

Pentru cei care încearcă să cumpere strategii valutare dezvoltate comercial, o abilitate crucială care are nevoie este de a evalua puterea strategiei. Dacă doriți să cumpărați un sistem de tranzacționare, ar trebui să fiți siguri de ceea ce va face pentru dvs. Nu are sens să cumperi ceva care nu îți va face niciun bine. Nu veți înțelege o strategie decât dacă cunoașteți detaliile tranzacționării valutare.

Concentrați-vă pe performanță

Când alegeți o strategie valutară, ar trebui să o alegeți în funcție de performanță. Proiectarea unei strategii complexe poate fi uneori înșelătoare, în timp ce o strategie simplă va funcționa robust decât v-ați imaginat. În același timp, este important să știm că strategiile de tranzacționare nu sunt potrivite pentru toți. O strategie care a făcut minune pentru cineva nu ți se va potrivi în niciun fel. În timp ce, o strategie care nu a funcționat pentru cineva ar putea să vă aducă multe profituri.

Oricine poate lovi dintr-o dată norocul și să obțină un profit mare, dar ceea ce contează este să obțină profituri în mod consecvent. Norocul va veni și va merge, dar abilitatea și strategia este ceea ce veți avea nevoie pentru consecvență în realizarea profitului.

Forex rank a fost creat având în vedere traderul, fie că este vorba de un newbie, intermediari sau experți. Vrem să te vedem reușind și în același timp să te distrezi! Forexrank.Co listează doar cei mai buni brokeri forex și conținut actualizat pe piața valutară.

Serviciile noastre

Pentru a vă ajuta să progresați pe piața valutară și să obțineți succes, oferim următoarele servicii:

- Clasament și comentarii ale brokerilor:clasificăm brokerii în funcție de siguranța, reputația, serviciul pentru clienți și punctajele generale ale fondurilor pentru clienți, pe lângă faptul că oferim o listă generală de brokeri de top în lume. Veți găsi, de asemenea, recenzii care vă vor spune despre experiențele altor comercianți de pe aceste platforme.

- Știri și calendar de tranzacționare forex:trebuie să urmăriți știrile economice valutare pentru a putea tranzacționa cu succes pe piață. Poate știți că știrile sunt cele care mișcă piața. Puteți găsi toate cele mai recente știri și evenimente chiar în calendarul nostru de știri economice.

- Listele de broker: am compilat o listă a brokerilor forex din întreaga lume. Cea mai bună listă de brokeri forex de pe web.

- Bonus de broker forex: O listă a brokerilor care oferă depozite gratuite sau înscrie bonusuri pentru a le încerca poate fi utilă, pentru a testa apele. Veți găsi doar cei mai buni brokeri de încredere în valută care oferă bonusuri pe site-ul nostru.

- Informații pentru începători:tranzacționarea cu succes FX depinde de strategiile de tranzacționare. Începătorii de tranzacționare forex trebuie să studieze tranzacțiile valutare înainte de a intra pe piață, pentru a evita dezamăgirile. Aducem informații și sfaturi despre tranzacționare, platforme de tranzacționare și tipuri de brokeri pentru a vă începe.

- Forex articolele: aici veți găsi articole legate de tranzacționare valutară, brokeri, platforme, valute, strategii și așa mai departe! Continuăm să adăugăm conținut nou pe forex în fiecare săptămână!

O parte din linkurile de înscriere către site-urile brokerilor sunt linkuri afiliate. Este posibil să primim un comision fără taxe pentru dvs. Acest lucru ne permite să continuăm să creăm gratuit conținut de tranzacționare forex pentru cititorii noștri.

Best forex robots 2021

For a long period, we professionally research the forex automated trading market. Over the years, we have gained experience that we systematically share with you in our reviews. Choosing an EA is a very important procedure, as it involves using it on a real account in order to make money. In the table, we have put together the ratings and results of the best trading robots performing.

ROFX is the best way to get started with forex. The system, based on machine learning and customizable patterns using AI, allows you to have up to 10% of monthly profit without the need for any effort. In confirmation of their capabilities, the first deposit to a real account with a robot was the amount of ten million dollars. ROFX provides a well-designed PAMM system that means that all robot performs go on the company servers.

Forex fury is an incredibly popular robot showing a stable and predictable profit. On the one hand, the robot allows you to make many settings to adjust the trading to the needs of the trader, but on the other hand, it requires not a little knowledge in order to effectively manage it. The robot holds its winning rating at a level above 90%, which in itself is a unique phenomenon in the world of trading robots.

Forex robotron is another example of the success of forex trading using a fully-automated trading robot. Trading with it shows high and predictable results. The monthly gain is more than 20%. At the same time, the robot requires deep knowledge and understanding of trading processes in order to achieve similar results. That is why it can be difficult for beginners to master working with it.

Each experienced forex trader has gone through a long phase of formation, ups, and downs. Many of them nulled their accounts several times while learning to trade. All this time, traders had to analyze the history of trades, follow the news, and trades on their own so on day after day. With the advent of trading robots, many of these routine functions were taken over by them.

The robot is a fully automatic program and doesn’t require you present. This allows beginners to start trading forex immediately after the deployment of the program and does not require previous experience. This is a great advantage for those who want to try their hand at forex trading.

The robot provides work in a fully automatic mode, giving a stable passive income. At the same time, its owner can control all its aspects of the activity, configure it at its discretion, control the current trading process from market analysis, to entering and exiting a position.

Robots are usually developed based on some strategies that have already brought substantial profit to their owners. By applying them at the core of the robot, devs thus allow you to get your profit too. A feature of some robots is that developers maintain the availability of analysis of the history of trading operations so that traders can use this data to improve their own strategies.

- Knowledge-free to start earning money on forex

- Fully-automated trading, without needing of understanding performing processes

- Usually, the seller provides back-tests and shows a robot perform on a real or demo account

- 30(60)-days money-back guarantee is an option from many sellers.

- Completely removes influence of the emotional statements during trading

- A robot can run on many accounts, as well as, trade effectively many currency pairs at the same time

- It can perform 24/7 giving you opportunities to spend your time whatever you want

- Free-trial a robot for applying it on the demo account is also quite often option

- You know the strongest sides of a robot you chose, so you can easily improve your own strategy.

- You can easily compare the official robot performing with the performing of your copy, so you’ll be able to simply find out when your robot becomes a scam.

- Running a robot on your PC is required to be online 24/7 and get a stable connection.

- There’s high enough chance to get a scam instead of a trading assistant.

- Price varies depending on futures, patterns, amount of currency pairs, etc.

- 30(60)-days money-back guarantee is an option from many sellers.

- Sometimes, there’s a high level of the min account balance for smooth trading with low risks.

Here are some functions which are applied in almost every good trading robot:

The forex robot is usually designed with the settings that are responsible for managing current trading transactions. These are the following functions: hard stop loss, trailing stop loss, and take profit features. Both experienced traders and beginners should take into account that without these functions, they will not receive full-fledged automated trading.

A developed set of patterns that include not only the parameters of the trade but also the specified criteria for market analysis. Thanks to this system, the robot is able to independently decide on the selection of the most successful entry and exit points. Typically, the robot is programmed to use technical analysis and indicators: order flow, support and resistance levels, and RSI or MACD.

With automated trading, a lot depends on how accurate and fast the robot is in making decisions. The EA must provide its owner with timely entry and exit points from transactions, which in turn should significantly increase the profitability of its work. The ability to enter a deal at the lowest point and exit it at the peak distinguishes a good robot from a bad one.

- Trade accuracy

- Numbers of traded currecny pairs

- Different risks level management

- Performing and order execution speed

- Official performing data (gain, profit) from myfxbook and fxblue sites

- Pricing for buying/subscriptions

- Support availability

- User interface

- Bitcoin or other crypto trading availability

- Customization of the standart patterns

It’s a computer program developed by devs and traders. It works on the proven patterns that allow you to make profit using robot owners’ trading experience.

A trading robot (EA) fits everyone. For beginners, it suggests the smooth start of trading on the forex. For good traders it lets relax more, using combined strategies of robots and trader to get better results with same amount of spent time.

Robots prices start from $99 to $25000 depends on futures and strategies. Most of the robots start to work well from a $1000 deposit

Not at all. From buying to applying usually goes about 10 minutes. No special knowledge is needed.

Yes, it does. Every robot is developed with the stop-loss system that allows you to lose not so much if it’s happened

It mostly depends on the risk you trade with. Our experience tells +100% of annually gain is good profitability.

The best U.S. Forex brokers

Forex trading is highly regulated in the united states. In this guide, we review the best U.S.-complaint forex brokers, comparing their fees, leverage, pros, and cons.

Tim fries

Tim fries is the cofounder of the tokenist. He has a B. Sc. In mechanical engineering from the university of michigan, and an MBA from the university .

Shane neagle

Meet shane. Shane first starting working with the tokenist in september of 2018 — and has happily stuck around ever since. Originally from maine, .

All reviews, research, news and assessments of any kind on the tokenist are compiled using a strict editorial review process by our editorial team. Neither our writers nor our editors receive direct compensation of any kind to publish information on tokenist.Com. Our company, tokenist media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. Click here for a full list of our partners and an in-depth explanation on how we get paid.

Settling on a good forex broker in the U.S. Should be easy, right? After all, the united states is still the world’s largest economy, and there’s a market for trading every currency with USD.

Well, easier said than done…

Foreign exchange, the exchange of one currency to another, runs 24 hours, 5 days a week through over-the-counter markets, generating a huge trading volume per day. This highly liquid market allows for seamless access to traders across the globe. Australian traders, for example, can trade in british pounds (GBP) and euros (EUR) through a US-based broker.

This decentralized and global nature of the industry also carries significant risk, making it an ideal target for fraud. The growth of speculative trading has resulted in an increase in intermediaries, including brokers and banks engaging in scams, financial irregularities, exorbitant charges and exposure to high-risk through bad practices.

It’s no wonder then that U.S. Regulators now play such an important role in the industry. That is to say, the most important criteria to take into consideration when choosing a U.S. Forex broker is the regulatory approval status of the broker and its governing authority.

However, regulation enforcement isn’t a straightforward process, and due to the global scale of the market, there is no standard regulatory framework that applies across all jurisdictions. So, can you trade forex in the USA?

Yes, though forex trading in the US is generally considered highly regulated. Forex brokers in the US are heavily regulated by the commodity futures trading commission (CFTC) and national futures association (NFA), independent agencies that enforce strict rules, including a restriction on leverage offered.

Furthermore, if you are a united states citizen, the regulation impacts your eligibility for non-U.S. Based brokers, unless they are registered with the NFA.

There are stark differences in regulation that make it imperative for you to be aware of and understand the regulation that applies to the broker you are considering.

Additionally, the forex market is highly vulnerable to significant volatility as a result of economic turbulence. We can see this through the current coronavirus pandemic, the impact of which can be felt, in this case, regardless of regulations. ��

In this article, we’re going to take you through:

- Our recommendations for the best brokers

- Key provisions of U.S. Forex trading regulations

- How U.S. Forex regulations differ

- Quick Q&A on forex regulations in the united states

Leading US forex brokers

The following list presents the advantages of the best forex brokers for US clients:

The following list presents the advantages of the best forex brokers for US clients:

- Interactive brokers

best overall - IG US

best investment selection - TD ameritrade

superb app for US forex brokers - FOREX.Com

best charting tools - Nadex

best exchange

Top 5 US forex brokers 2020

1. Best US forex broker overall: interactive brokers

When it comes to currency pairs offered, trading technology, ease-of-use, regulation, and fees — there’s one broker that takes the cake. Interactive brokers is easily our top forex broker for US traders.

- Highly regulated

- Substantial range of global markets and asset classes

- Low fees including discounts for high-volume traders

- Complex desktop platform may be unsuitable for beginners

- A lack of forex charts on web platform

- Minimum activity charges per month

Interactive brokers (IBKR) should be a serious consideration for professional FX traders. The company is headquartered in the U.S and boasts strong regulatory licences.

This broker is most suited to professional traders and offers 105 forex pairs, 7,400 cfds, US-traded bitcoin futures, and much more. IBKS’s trader workstation is more difficult to use but does provide a full range of features.

Interactive brokers fees appears to be competitive overall, however, the company does not publish its average spread for forex which makes it difficult to pinpoint exactly. Forex traders will receive an aggregated price from some of the largest dealers around the world, and then be charged a commission per trade that can range from $16-$40 per million round turn, as opposed to charging a spread.

Traders looking to prioritize research will appreciate the comprehensive array of third-party research, including both free and premium content. The company does however, lack a full-featured research offering for forex.

⚡️ important: interactive brokers requires forex traders in the U.S to be classified as an eligible contract participant (ECP), “an [ECP] is generally an individual or organization with assets of over $10 MM (5 MM for trades that are hedging)”.

Originally, IBKR’s customer support was far from the most loved. Fortunately, the service has improved immensely, for example with the introduction of ibot on mobile, a virtual assistant that permits users to ask questions by voice command.

In addition, the interactive brokers‘ team can be contacted in a variety of ways, including by phone, with an average wait time of 1 to 2 minutes.

Fxdailyreport.Com

Top 10 forex brokers list 2021

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker |

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $100 spread: starting 0 pips leverage: up to 400:1 regulation: FCA UK, NFA, CFTC, ASIC, IIROC, FSA, CIMA | visit broker | |

| min deposit: $300 spread: floating, from 0 pips leverage: 500:1 regulation: FCA UK reference number 579202 | visit broker | ||

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: no minimum deposit spread: 1.2 pips leverage: 50:1 regulation: CFTC, NFA, FCA, MAS, ASIC, IIROC | visit broker | |

| min deposit: $10 spread: leverage: regulation: cysec | - | visit broker | |

| min deposit: $200 spread: from 3 pips leverage: 400:1 regulation: NFA, FCA, cysec | visit broker |

XM.Com, a trade name of trading point holdings ltd, is owned as well as operated by trading point of financial instruments ltd, which is regulated by cysec. It is also european union-registered forex broker. XM has its headquarters in limassol, cyprus.

Broker type – DMA/STP, MM

minimum deposit – $5

deposit options: bank wire, neteller, skrill, webmoney, credit card, westernunion, moneygram, SOFORT, unionpay (china), etc.

Maximum leverage – 888:1

minimum lot size – 0.01

spreads – variable

lowest spreads for EUR/USD – more than 1

FBS, an international forex broker, has presence in over 120 countries. The online forex company boasts of 2,000,000 traders (clients) and 130,000 partners. For muslim traders, the broker provides swap-free or islamic accounts. FBS was founded in 2009 and they do not offer financial services to people in the USA, belize and japan.

Broker type – ECN/STP, DMA/STP, MM

minimum deposit – $5

deposit options: visa/master card, neteller, skrill (7.5% commmission), webmoney, perfectmoney, OKPAY, FBS exchanger, wire transfer, yuupay (3% commission), etc.

Maximum leverage – 500:1

minimum lot size – 0.01

spreads – fixed and variable

lowest spreads for EUR/USD – 2 pips for mini accounts and 1 – 2 for standard accounts

Pepperstone, an execution-only forex as well as CFD broker, provides trading solutions that cater to both veteran and novice traders. Founded in 2010, the company has its headquarters located in melbourne, australia. The company has offices in shanghai, china and dallas, USA.

Broker type – electronic communication network/straight through processing and direct market access/straight through processing

regulation – australian securities and investments commission (ASIC)

platforms – metatrader4, ctrader

minimum deposit – $200

deposit options – bank wire, debit card, credit card, webmoney, neteller, fasapay, skrill, BPAY, poli, QIWI, paypal, unionpay(china), etc.

Maximum leverage – 400:1

minimum lot size – 0.01

spreads – variable

lowest spreads for EUR/USD – more than 0.5 pips for mini and standard; more than 0.1 pips for ECN

Tickmill, owned by tickmill limited and operated by tmill UK limited and tickmill ltd., which is a company registered in england and wales. Tickmill has principal and registered offices in london and seychelles. Tickmill is under the regulatory control of both financial operates conduct authority in the UK and financial services authority of seychelles.

Broker type – STP/ECN/NDD/DMA

regulation – FCA, UK and FSA, seychelles

platforms – web platform, metatrader 4, mobile platform

minimum deposit – $25

deposit options – wire transfer, credit/debit card, webmoney, unionpay, skrill, neteller, fasapay

maximum leverage – 500:1

minimum lot size – 0.01

spreads – variable

lowest spreads for EUR/USD – starts from 0.0

In 2013, fxopen launched its online trading platform. Fxopen UK, based in london, is regulated by the financial conduct authority in the UK.

Broker type – ECN/STP

regulation – FCA, UK

platforms – three versions of MT4

minimum deposit – $300

deposit options – bank wire transfer, credit/debit cards, webmoney, neteller, skrill, payza

maximum leverage – 500:1

minimum lot size – 0.01

spreads – variable

lowest spreads for EUR/USD – starts from 0 pips

Plus500 forex trading platform is provided by plus500cy ltd., which is a company based in cyprus and with headquarters in limassol. This broker is authorized as well as regulated by the cyprus securities and exchange commission.

Broker type – market maker

regulation – cyprus securities and exchange commission (cysec), financial conduct authority (FCA), australian securities and investments commission (ASIC)

platforms – windows trader, webtrader

minimum deposit – $100

deposit options – bank wire, paypal, credit card, skrill, etc.

Maximum leverage – 50:1

minimum lot size – 0.01

spreads – fixed

lowest spreads for EUR/USD – 2

ETX capital, a financial services company based in the UK, provides institutional, high net worth and retail customers with online platforms for trading forex and derivatives. ETX capital is the trading name of monecor (london) limited.

Broker type – forex and CFD broker

regulation – FFCA, UK

platforms – MT4, marketspulse

minimum deposit – $100

deposit options – china unionpay, giropay, neteller, credit card, sofort, wire transfer, skrill

maximum leverage – 400:1

minimum lot size – 0.01

spreads – fixed

lowest spreads for EUR/USD – 0.7

Octa markets was incorporated 2011 and the forex brokerage serves clients in more than 100 countries around the world. The company is registered in saint vincent and the grenadines. The company operates under the regulatory purview of IFSA.

Broker type – DMA/STP

minimum deposit – $5

deposit options: bank wire, debit card, credit card, skrill, neteller, unionpay (china), fasapay, etc.

Maximum leverage – 500

minimum lot size – 0.01

spreads – variable

lowest spreads for EUR/USD – more than 1.5

Avatrade, a pioneer in the field of online forex trading from 2006 onwards, was created for the purpose of providing great online trading experience to retail traders. Within a short time, avatrade had more than 20,000 registered customers executing over 2,000,000 trades in a month around the globe. The total value of trades surpasses $60 billion in a month.

Broker type – market maker

regulation – australian securities and investments commission (ASIC); central bank of ireland; financial futures association, japan; financial services board (FSB), south africa and israel securities authority (ISA)

platforms – metatrader 4, avatrader

minimum deposit – $100

deposit options – bank wire, paypal, webmoney, skrill, credit card, neteller, prepaid master card, etc.

Maximum leverage – 400

minimum lot size – 0.05

spreads – fixed

lowest spreads for EUR/USD – 3

Etoro, an online forex broker, offers trading in currencies, indices, commodities and CFD stocks. More than 4.5 million users from over 170 countries around the world make use of the online forex broker’s website. Founded in 2006 in tel aviv, the multi-asset brokerage company has registered offices in israel, the united kingdom and cyprus. One of the key features of etoro is the social investment platform with copy-trading feature that it offers.

Broker type – market maker

regulation – cyprus securities and exchange commission (cysec), markets in financial instruments directive (mifid), commodity futures trading commission (CFTC), financial conduit authority (FCA), national futures association (NFA), australian securities and investments commission (ASIC)

platforms – etoro openbook, etoro webtrader, etoro mobile trader

minimum deposit – $50

deposit options – bank wire transfer, credit/debit card, skrill, moneygram, paypal, neteller, webmoney, western union

maximum leverage – 400:1

minimum lot size – 0.01

spreads – fixed

lowest spreads for EUR/USD – 3

so, let's see, what we have: investopedia ranks the best online brokers to use for trading forex and cfds. At top brokeri forex

Contents of the article

- Top forex bonuses

- Best forex brokers

- These forex brokers offer the best platforms for...

- Top 7 of best US forex brokers for 2021

- Is forex trading legal in the USA?

- How to trade forex in the USA

- Top 7 forex brokers in the USA listing for 2021

- Top U.S.-regulated forex brokers

- U.S. Forex market regulation

- Dodd-frank act: forex rules

- U.S.-regulated forex brokers

- FOREX.Com

- OANDA

- TD ameritrade

- ATC BROKERS

- Thinkorswim

- Interactive brokers