Free trading credit

Top forex bonuses

Once the credit is canceled, all positions are closed forcibly (stop out). In the case of a 1000 USD deposit, the trader chose 10% as a trading credit. In this case, 1100 USD will be credited to the account, while 100 USD will be reflected in the credit field.

Trading credits

Trading credits are termless and interest-free, and can be used as equity when effecting forex trading. The obligatory condition for getting a trading credit is an account replenishment with own funds. The amount of credit may be up to 50% of the deposit.

Trading credits terms

- Trading credits are available for the following types of accounts: MT4.Directfx, MT4.Classic+, cent-MT4.Directfx, cent-MT4.Classic+;

- A trading credit may be received for each deposit and the client can choose the amount of credit at the time the account is replenished: 10%, 20%, 30%, 40%, 50% of the deposit;

An example:

In the case of a 1000 USD deposit, the trader chose 10% as a trading credit. In this case, 1100 USD will be credited to the account, while 100 USD will be reflected in the credit field.

An example:

The trader refilled his account for 10 000 USD and got a trading credit in the amount of 1000 USD. In case the equity goes down to level 1000 USD (value in the credit field), all active trading credits (the credit field displays the sum of active credits) will be automatically cancelled, and all positions will be closed forcibly.

7 best free stock trading platforms

Thanks to the rise of fintech, investors now have the option to buy and sell stocks online or through mobile apps - and often free of charge.

There are dozens of trading apps and platforms that allow investors to invest cash in a variety of securities with minimal to no fees. With the increase in choices, here are the best free stock-trading platforms and how they compare.

7 best free stock trading platforms

Whether you're a beginner investor or have been playing the market since before the last recession, free stock trading platforms and apps provide a great opportunity to maximize your returns and keep trading easy and simple.

These investment platforms are top-notch.

1. E*TRADE

Although E*TRADE (ETFC) - get report accounts aren't always free, there are some promotions and accounts that allow investors to invest for free. Currently, E*TRADE is having a promotion when you open a new account. The promotion offers 60 days of commission-free trading for up to 500 trades with a minimum deposit of $10,000 or more.

The site offers 24/7 customer service, easy mobile trading, data and research information, and has trading vehicles that range from etfs to options. And while E*TRADE's commissions usually hit just under the $7 mark for normal (nonpromotional) trades, the site is still very popular for its ease of use and retirement services.

2. Robinhood

The free stock trading app has seen a meteoric rise in popularity in recent years, accumulating 6 million users in 2019 - and with good reason. Robinhood seems to be the darling of commission-free trading - as a fintech startup founded by baiju bhatt and vlad tenev in 2013 with their free stock trading model.

Although there has been some speculation over how robinhood makes money (given their free trading model), the app is very popular for its easy, free trading and variety of investment vehicles - including options and even cryptocurrency.

To get started, you simply have to submit an application to robinhood and meet a few basic requirements (although if you are planning to participate in options trading, additional requirements are necessary) - with no account minimum. As a bonus, there are no maintenance fees.

As somewhat of a drawback, robinhood doesn't currently allow fractional investing (you can only buy whole shares). But for its cost-efficiency and easily-accessible app format, robinhood is clearly a crowd favorite for a reason.

3. Charles schwab

Ideal for investors looking to get into etfs, charles schwab (SCHW) - get report has an impressive array of 200 etfs to choose from, all commission-free. And, as a bank and stockbroker all-in-one, the schwab app is a great one-stop-shop for investors.

Schwab also has no-transaction-fee mutual funds, with around 4,000 available. Their regular trades will set you back around $5 apiece. There is no minimum balance requirement (although normal accounts typically come with a $1,000 minimum).

Because of their wide selection of the commission-free etfs and mutual funds, schwab is a strong contender for free stock trading.

4. Acorns

If you're a beginner investor looking to make money in stocks, acorns is the perfect introductory stock trading app.

Acorns specializes in micro-investing - that is, investing your spare change in stocks. There is no minimum to create an account, but there is a $5 minimum to start investing.

The app takes the spare change you've got from linked debit or credit cards to invest in commission-free etfs. There are no fees for inactivity.

5. Vanguard

Boasting around 1,800 commission-free etfs (just shy of robinhood's 2,000,) vanguard offers a wide selection of free trading options. The platform offers over 3,000 transaction-free mutual funds to boot - including S&P 500 index funds.

The trading platform doesn't have a minimum account requirement, but they do charge $20 a year for a service fee.

6. TD ameritrade

Much like E*TRADE, TD ameritrade (AMTD) - get report offers a free trading promotional if you open an account. You can get up to 60 days of commission-free trading for options, etfs and other equities, as well as up to $600 if you deposit $3,000 or more.

And even when the 60 days runs out, trades average about $6.95 a trade - on par with several other competitors. But TD ameritrade also offers over 300 commission-free etfs, and hundreds of transaction-fee-free mutual funds to choose from.

As one of the biggest online trading platforms, TD ameritrade offers a variety of top-notch services including research, data, and information on stocks as well as cash management, among others.

7. M1 finance

M1 finance does things a bit differently (think: customization.)

In addition to being completely commission-free and fee-free, M1 finance allows investors to invest in fractional shares as small as one penny. And, what makes M1 finance different is it allows users to create "pies" - that is, pie graphs that are comprised of a variety of etfs, stocks, and bonds. The app also allows users to choose different kinds of pies based on their investment needs and risk tolerance.

Although there is a $100 minimum for investing, the app allows for total customization of your own portfolio, and offers different kinds of "pies" from moderate to "ultra-aggressive" or "market cap 100."

For a completely free, zero-commission stock trading app, M1 finance seems to offer a pretty good deal for the DIY investor.

The bottom line

So, which free stock trading platform is best for you?

While some platforms like TD ameritrade and E*TRADE only offer short-term free stock trading services through promotions or new accounts, they do offer some industry-leading services that may be worth the extra cost you'll incur when your trial run ends.

However, for the investor who wants a truly free stock trading experience, robinhood, acorns and M1 finance offer a formidable range of services and offerings - even including cryptocurrency and options. And, as trading is increasingly becoming mobile, these app-focused companies are optimized to provide a solid, easy-to-use trading experience from the comfort of your ios or android-enabled device.

Still, as always, it is important to examine your personal investment goals and be realistic about how much you are willing to pay for extra services (if you do opt for one of the bigger brokerage names). But thanks to the surge of fintech companies in recent years, there are plenty of investment options that offer free stock trading services that can help grow your returns - all with the touch of a button.

Trade credit

What is a trade credit?

A trade credit is a business-to-business (B2B) agreement in which a customer can purchase goods on account without paying cash up front, paying the supplier at a later scheduled date. Usually businesses that operate with trade credits will give buyers 30, 60, or 90 days to pay, with the transaction recorded through an invoice. Trade credit can be thought of as a type of 0% financing, increasing a company’s assets while deferring payment for a specified value of goods or services to some time in the future and requiring no interest to be paid in relation to the repayment period.

Trade credit

Understanding trade credit

A trade credit is an advantage for a buyer. In some cases, certain buyers may be able to negotiate longer trade credit repayment terms which provides an even greater advantage. Often, sellers will have specific criteria for qualifying for trade credit.

A B2B trade credit can help a business to obtain, manufacture, and sell goods before ever having to pay for them. This allows businesses to receive a revenue stream that can retroactively cover costs of goods sold. Walmart is one of the biggest utilizers of trade credit, seeking to pay retroactively for inventory sold in their stores. International business deals also involve trade credit terms. In general, if trade credit is offered to a buyer it typically always provides an advantage for a company’s cash flow.

The number of days for which a credit is given is determined by the company allowing the credit and is agreed upon by both the company allowing the credit and the company receiving it. Trade credit can also be an essential way for businesses to finance short-term growth. Because trade credit is a form of credit with no interest, it can often be used to encourage sales.

Since trade credit puts suppliers at somewhat of a disadvantage, many suppliers use discounts when trade credits are involved to encourage early payments. A supplier may give a discount if a customer pays within a certain number of days before the due date. For example, a 2% discount if payment is received within 10 days of issuing a 30-day credit. This discount would be referred to as 2%/10 net 30 or simply just 2/10 net 30.

Key takeaways

- Trade credit is a type of commercial financing in which a customer is allowed to purchase goods or services and pay the supplier at a later scheduled date.

- Trade credit can be a good way for businesses to free up cash flow and finance short-term growth.

- Trade credit can create complexity for financial accounting.

- Trade credit financing is usually encouraged globally by regulators and can create opportunities for new financial technology solutions.

Trade credit accounting

Trade credits are accounted for by both sellers and buyers. Accounting with trade credits can differ based on whether a company uses cash accounting or accrual accounting. Accrual accounting is required for all public companies. With accrual accounting a company must recognize revenues and expenses at the time they are transacted.

Trade credit invoicing can make accrual accounting more complex. If a public company offers trade credits it must book the revenue and expenses associated with the sale at the time of the transaction. When trade credit invoicing is involved, companies do not immediately receive cash assets to cover expenses. Therefore, companies must account for the assets as accounts receivable on their balance sheet.

With trade credit there is the possibility of default. Companies offering trade credits also usually offer discounts which means they can receive less than the accounts receivable balance. Both defaults and discounts can require the need for accounts receivable write-offs from defaults or write-downs from discounts. These are considered liabilities a company must expense.

Alternatively, trade credit is a useful option for businesses on the buying side. A company can obtain assets but would not need to credit cash or recognize any expenses immediately. In this way a trade credit can act like a 0% loan on the balance sheet. The company’s assets increase but cash does not need to be paid until some time in the future and no interest is charged during the repayment period. A company only needs to recognize the expense when cash is paid using the cash method or when revenue is received using the accrual method. Overall, these activities greatly free up cash flow for the buyer.

Trade credit trends

Trade credit is most rewarding for businesses that do not have a lot of financing options. In financial technology, new types of point of sale financing options are being provided for businesses to utilize in place of trade credits. Many of these fintech firms partner with sellers at the point of sale to provide 0% or low interest financing on purchases. These partnerships help to alleviate trade credit risks for sellers while also supporting growth for buyers.

Trade credit has also brought about new financing solutions for sellers in the form of accounts receivable financing. Accounts receivable financing, also known as invoice financing or factoring, is a type of financing that provides businesses with capital in relation to their trade credit, accounts receivable balances.

From an international standpoint, trade credit is encouraged. The world trade organization reports that 80% to 90% of world trade is in some way reliant on trade finance. Trade finance insurance is also a part of many trade finance discussions globally with many new innovations. Liquidx for example now offers an electronic marketplace focused on trade credit insurance for global participants.

Research conducted by the U.S. Federal reserve bank of new york also highlights some important insights. The 2019 small business credit survey finds that trade credit finance is the third most popular financing tool used by small businesses with 13% of businesses reporting that they utilize it.

Related concepts and other considerations

Trade credit has a significant impact on the financing of businesses and is therefore linked to other financing terms and concepts. Other important terms that affect business financing are credit rating, trade line, and buyer’s credit.

A credit rating is an overall assessment of the creditworthiness of a borrower, whether a business or individual, based on financial history that includes debt repayment timeliness and other factors. Without a good credit rating, trade credit may not be offered to a business. If businesses do not pay trade credit balances according to agreed terms, penalties in the form of fees and interest are usually incurred. Sellers can also report delinquencies on trade credit which may affect a buyer’s credit rating. Delinquencies affecting a buyer’s credit rating can also affect their ability to obtain other types of financing as well.

A trade line, or tradeline, is a business credit account record provided to a business credit reporting agency. For large businesses and public companies, trade lines can be followed by rating agencies such as standard & poor’s, moody’s, or fitch.

Buyer’s credit is related to international trade and is essentially a loan given to specifically finance the purchase of capital goods and services. Buyer’s credit involves different agencies across borders and typically has a minimum loan amount of several million dollars.

Best online stock trading platforms

Sarah horvath

Contributor, benzinga

Trading stocks means you can end up with a mixed bag of emotions. You might be excited at the prospect of watching your money grow, overwhelmed at the number of stock options available to you or even frustrated if you’re having trouble making your 1st buy.

You don’t want to pile on the feeling of being overcharged by your online trading platform. Commissions, account maintenance charges and other hidden fees can quickly add up and eat into your profits. As a new trader, you may already feel especially hesitant to start investing. You might not be sure which broker to trust and which is worth the price.

Luckily, most brokerages have recognized this fear and created free options to help new traders save more money when getting started. Take a look at our top picks to compare services and find your match today.

Best online trading platforms:

- Best overall online trading platform: tradestation

- Best mobile brokerage: webull

- Best for advanced traders: moomoo

- Best advanced platform: TD ameritrade

- Best for professional traders: interactive brokers

- Best for beginners: robinhood

- Best for advanced traders: schwab

- Best for saving on taxes: vanguard

Compare online brokers

Take a look at our top picks for online stock brokers. Compare what each offers to find the right service for you.

Best for

Overall rating

Best for

1 minute review

Webull, founded in 2017, is a mobile app-based brokerage that features commission-free stock and exchange-traded fund (ETF) trading. It’s regulated by the securities and exchange commission (SEC) and the financial industry regulatory authority (FINRA).

Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Webull’s trading platform is designed for intermediate and experienced traders, although beginning traders can also benefit.

Webull is widely considered one of the best robinhood alternatives.

Best for

- Commission-free trading in over 5,000 different stocks and etfs

- No account maintenance fees or software platform fees

- No charges to open and maintain an account

- Leverage of 4:1 on margin trades made the same day and leverage of 2:1 on trades held overnight

- Intuitive trading platform with technical and fundamental analysis tools

Best for

Overall rating

Best for

1 minute review

Tradestation is for advanced traders who need a comprehensive platform. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Tradestation’s app is also equally effective, offering full platform capabilities.

Best for

- Comprehensive trading platform and professional-grade tools

- Wide range of tradable securities

- Fully-operational mobile app

- Confusing pricing structure to leave new traders with a weak understanding of what they pay

- Cluttered layout to make navigating tradestation’s platform more difficult than it should be

Best for

Overall rating

Best for

1 minute review

This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients.

Best for

- World-class trading platforms

- Detailed research reports and education center

- Assets ranging from stocks and etfs to derivatives like futures and options

- Thinkorswim can be overwhelming to inexperienced traders

- Derivatives trading more costly than some competitors

- Expensive margin rates

Best for

Overall rating

Best for

1 minute review

Moomoo is a commission-free mobile trading app available on apple, google and windows devices. A subsidiary of futu holdings ltd., it’s backed by venture capital affiliates of matrix, sequoia, and tencent (NASDAQ: FUTU). Securities offered by futu inc., regulated by the securities and exchange commission (SEC) and the financial industry regulatory authority (FINRA).

Moomoo is another great alternative for robinhood. This is an outstanding trading platform if you want to dive deep into smart trading. It offers impressive trading tools and opportunities for both new and advanced traders, including advanced charting, pre and post-market trading, international trading, research and analysis tools, and most popular of all, free level 2 quotes.

Get started right away by downloading moomoo to your phone, tablet or another mobile device.

Best for

- Free level 2 market data for all users who open an account

- Commission-free trading in over 5,000 different stocks and etfs

- Over 8,000 different stocks that can be sold short

- $0 contract fee for trading options, no commission either

- Strong market data and analysis tools with over 50 technical indicators

- Access trading and quotes in pre-market (4 a.M. To 9:30 a.M. ET) and post-market hours (4 p.M. To 8 p.M. ET)

- No minimum deposit to open an account.

- Active trading community with more than 100,000 app users

Characteristics of a successful online stock trader

Though each trader has his own individual set of financial and personal goals, the most successful stock traders enter the market with the following 3 characteristics:

Commitment to education. The most successful traders never buy stocks based on a “gut feeling.” they do their research, look at the history of the company and its leadership and make selections based on hard data and perspectives of industry experts.

They also stay up to date on political happenings both at home and abroad and they factor in how new laws and regulations affect the market. Looking to increase your knowledge of the stock market? Check out our list of the best low-cost day trading courses you can sign up for right now.

Things to look for in an online trading platform

Though most stock trading platforms charge account maintenance fees and commissions, you’ll find a number of brokers that will allow you to trade for free. Some characteristics that all reliable free trading platforms share include:

- An intuitive trading site. A brokerage firm isn’t very useful if you can’t understand how to get started. Watch a few youtube tutorials or website overviews to get a feel for the platform before you commit desktop space and time to the broker. If the platform isn’t intuitive, check the brokerage’s customer service options. A responsive team of customer service professionals may be able to help you understand how to operate a more complicated platform.

- Clear and easy-to-understand free trading. Though some platforms will allow you to trade for free indefinitely, some may only allow commission-free trades within a limited window after opening an account. When you sign up for an account on a free trading platform, make sure you read the terms of service to understand how many free trades you are entitled to with your account. Brokerages that try to hide this information may make their money “tricking” users into thinking that trades are free indefinitely, only to stick them with high fees later on by hiding a clause in the fine print.

- Realistic claims. Trading platforms that make unrealistic claims (like promising a dollar amount of returns or claiming that they have “secrets” that other brokers hide) are more than likely just trying to take your money with a hidden fee or commission. Remember, if it sounds too good to be true, it probably is.

The best online trading platforms

Based on the criteria above, we’ve compiled a list of the best online trading platforms to get started trading stocks for free.

Free bitcoin

Try executium for free

Free bitcoin for you

When you first sign up to executium, you will be pleased to know that we offer all of our new users a free sign up bonus of 0.002 bitcoin. This free bitcoin is given to you, by us, to show you just how much each and every one of our new users means to us. It also means that you can start trading right away.

Enabling you to trade instantly

We give every new sign up this free bitcoin which is basically going to be a way for you to cover the commissions that are taken by us, during your early days of using our platform. This means that you do not have to initially deposit any money into the system, allowing you to trial executium without having to worry about losing any of your own money.

Make your cryptocurrency work for you

When it comes to the commissions we take, here at executitum we pride ourselves on taking one of the lowest commission fees in the business, at the very low 0.015% commission. This means that, should you put in an order for 1 bitcoin, then we would take our 0.015% commission, which would actually come off of your free bitcoin.

So, if you were considering signing up with executium and giving our platform a go, then why not take advantage of this free bitcoin offer and spend a little bit of time trying us out, before you realise just how great we are. You are going to love it.

What is day trading with bitcoin?

A day trader is an investor who prefers to take advantage of the minor fluctuations in the token price that take place within the opening and the closing bell. This means that a day trader would close out all positions when the day ends and would start again the next day. By that time, he would have 100% cash position to purchase and sell. According to the securities and exchange commission, a day trader is someone who invests and makes same-day buy and sell transactions for at least 4 times in a 5-day time frame.

If you buy something from the market on monday and then sell it on tuesday, then that won't fall under day trading. Same day trading must be at least 6% of an investor's activity. To be a good day trader, an investor should make sure that they have a good understanding of the cryptocurrencies and bitcoin they are currently holding and how they have been performing, in order to give them a better understanding of when to hold on to them, when to buy more of them, and when to sell.

Some of the investors keep at least 2 accounts to separate the trading accounts. Doing this will prevent confusion, as they perform day trading on one account and intra-day trading on another account.

What is intra-day trading?

An intra-day trader is an investor who doesn't only limit themselves to same-day trading. Intra-day trading (or short term trading) doesn't have the same limitations and restrictions as day trading. Investors in bitcoin and cryptocurrencies can easily start this trading method even with a small amount of capital. The biggest notable difference between the two is that a day trader only profits on small price fluctuations while an intra-day trader profits by holding the positions for a number of days, hoping for the profit to be bigger.

Some suggest that intra-day trading is a lot less hectic than day trading, as you are not trying to get it all done within a one day margin, so you can relax a little bit more. However, those who are involved in trading will tell you that this is not always the case, as along with the possibility of bigger profits from intra-day trading, also comes the possibility of bigger losses.

Best online stock trading platforms

Sarah horvath

Contributor, benzinga

Trading stocks means you can end up with a mixed bag of emotions. You might be excited at the prospect of watching your money grow, overwhelmed at the number of stock options available to you or even frustrated if you’re having trouble making your 1st buy.

You don’t want to pile on the feeling of being overcharged by your online trading platform. Commissions, account maintenance charges and other hidden fees can quickly add up and eat into your profits. As a new trader, you may already feel especially hesitant to start investing. You might not be sure which broker to trust and which is worth the price.

Luckily, most brokerages have recognized this fear and created free options to help new traders save more money when getting started. Take a look at our top picks to compare services and find your match today.

Best online trading platforms:

- Best overall online trading platform: tradestation

- Best mobile brokerage: webull

- Best for advanced traders: moomoo

- Best advanced platform: TD ameritrade

- Best for professional traders: interactive brokers

- Best for beginners: robinhood

- Best for advanced traders: schwab

- Best for saving on taxes: vanguard

Compare online brokers

Take a look at our top picks for online stock brokers. Compare what each offers to find the right service for you.

Best for

Overall rating

Best for

1 minute review

Webull, founded in 2017, is a mobile app-based brokerage that features commission-free stock and exchange-traded fund (ETF) trading. It’s regulated by the securities and exchange commission (SEC) and the financial industry regulatory authority (FINRA).

Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Webull’s trading platform is designed for intermediate and experienced traders, although beginning traders can also benefit.

Webull is widely considered one of the best robinhood alternatives.

Best for

- Commission-free trading in over 5,000 different stocks and etfs

- No account maintenance fees or software platform fees

- No charges to open and maintain an account

- Leverage of 4:1 on margin trades made the same day and leverage of 2:1 on trades held overnight

- Intuitive trading platform with technical and fundamental analysis tools

Best for

Overall rating

Best for

1 minute review

Tradestation is for advanced traders who need a comprehensive platform. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Tradestation’s app is also equally effective, offering full platform capabilities.

Best for

- Comprehensive trading platform and professional-grade tools

- Wide range of tradable securities

- Fully-operational mobile app

- Confusing pricing structure to leave new traders with a weak understanding of what they pay

- Cluttered layout to make navigating tradestation’s platform more difficult than it should be

Best for

Overall rating

Best for

1 minute review

This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients.

Best for

- World-class trading platforms

- Detailed research reports and education center

- Assets ranging from stocks and etfs to derivatives like futures and options

- Thinkorswim can be overwhelming to inexperienced traders

- Derivatives trading more costly than some competitors

- Expensive margin rates

Best for

Overall rating

Best for

1 minute review

Moomoo is a commission-free mobile trading app available on apple, google and windows devices. A subsidiary of futu holdings ltd., it’s backed by venture capital affiliates of matrix, sequoia, and tencent (NASDAQ: FUTU). Securities offered by futu inc., regulated by the securities and exchange commission (SEC) and the financial industry regulatory authority (FINRA).

Moomoo is another great alternative for robinhood. This is an outstanding trading platform if you want to dive deep into smart trading. It offers impressive trading tools and opportunities for both new and advanced traders, including advanced charting, pre and post-market trading, international trading, research and analysis tools, and most popular of all, free level 2 quotes.

Get started right away by downloading moomoo to your phone, tablet or another mobile device.

Best for

- Free level 2 market data for all users who open an account

- Commission-free trading in over 5,000 different stocks and etfs

- Over 8,000 different stocks that can be sold short

- $0 contract fee for trading options, no commission either

- Strong market data and analysis tools with over 50 technical indicators

- Access trading and quotes in pre-market (4 a.M. To 9:30 a.M. ET) and post-market hours (4 p.M. To 8 p.M. ET)

- No minimum deposit to open an account.

- Active trading community with more than 100,000 app users

Characteristics of a successful online stock trader

Though each trader has his own individual set of financial and personal goals, the most successful stock traders enter the market with the following 3 characteristics:

Commitment to education. The most successful traders never buy stocks based on a “gut feeling.” they do their research, look at the history of the company and its leadership and make selections based on hard data and perspectives of industry experts.

They also stay up to date on political happenings both at home and abroad and they factor in how new laws and regulations affect the market. Looking to increase your knowledge of the stock market? Check out our list of the best low-cost day trading courses you can sign up for right now.

Things to look for in an online trading platform

Though most stock trading platforms charge account maintenance fees and commissions, you’ll find a number of brokers that will allow you to trade for free. Some characteristics that all reliable free trading platforms share include:

- An intuitive trading site. A brokerage firm isn’t very useful if you can’t understand how to get started. Watch a few youtube tutorials or website overviews to get a feel for the platform before you commit desktop space and time to the broker. If the platform isn’t intuitive, check the brokerage’s customer service options. A responsive team of customer service professionals may be able to help you understand how to operate a more complicated platform.

- Clear and easy-to-understand free trading. Though some platforms will allow you to trade for free indefinitely, some may only allow commission-free trades within a limited window after opening an account. When you sign up for an account on a free trading platform, make sure you read the terms of service to understand how many free trades you are entitled to with your account. Brokerages that try to hide this information may make their money “tricking” users into thinking that trades are free indefinitely, only to stick them with high fees later on by hiding a clause in the fine print.

- Realistic claims. Trading platforms that make unrealistic claims (like promising a dollar amount of returns or claiming that they have “secrets” that other brokers hide) are more than likely just trying to take your money with a hidden fee or commission. Remember, if it sounds too good to be true, it probably is.

The best online trading platforms

Based on the criteria above, we’ve compiled a list of the best online trading platforms to get started trading stocks for free.

Avoiding cash account trading violations

There are 3 types of potential violations to avoid when trading in your cash account: cash liquidations, good faith violations, and free riding.

- By fidelity learning center

Before placing your first trade, you will need to decide whether you plan to trade on a cash basis or on margin. In this lesson, we will review the trading rules and violations that pertain to cash account trading.

As the term implies, a cash account requires that you pay for all purchases in full by the settlement date. For example, if you bought 1,000 shares of ABC stock on monday for $10,000, you would need to have $10,000 in cash available in your account to pay for the trade on settlement date. According to industry standards, most securities have a settlement date that occurs on trade date plus 2 business days (T+2). That means that if you buy a stock on a monday, settlement date would be wednesday.

If you plan to trade strictly on a cash basis, there are 3 types of potential violations you should aim to avoid: cash liquidations, good faith violations, and free riding.

Cash liquidation violation

What is it? A cash liquidation violation occurs when you buy securities and cover the cost of that purchase by selling other fully paid securities after the purchase date. This is considered a violation because brokerage industry rules require you to have sufficient settled cash in your account to cover purchases on settlement date. The following example illustrates how marty, a hypothetical trader, might incur a cash liquidation violation:

Cash liquidation violation example, marty:

- Cash available to trade = $0.00

- On monday, marty buys $10,000 of ABC stock

- On tuesday, he sells $12,500 of XYZ stock to raise cash to pay for the ABC trade that will settle on wednesday

A cash liquidation violation will occur. Why? Because when the ABC purchase settles on wednesday, marty's cash account will not have sufficient settled cash to pay for the purchase because the sale of the XYZ stock will not settle until thursday.

Consequences: if you incur 3 cash liquidation violations in a 12-month period in a cash account, your brokerage firm will restrict your account. This means you will only be able to buy securities if you have sufficient settled cash in the account prior to placing a trade. This restriction will be effective for 90 calendar days.

Good faith violation

What is it? A good faith violation occurs when you buy a security and sell it before paying for the initial purchase in full with settled funds. Only cash or the sales proceeds of fully paid for securities qualify as "settled funds."

Liquidating a position before it was ever paid for with settled funds is considered a "good faith violation" because no good faith effort was made to deposit additional cash into the account prior to settlement date. The following examples illustrate how 2 hypothetical traders (marty and trudy) might incur good faith violations:

Good faith violation example, marty:

- Cash available to trade = $0.00

- On monday morning, marty sells XYZ stock and nets $10,000 in cash account proceeds

- On monday afternoon, he buys ABC stock for $10,000

If marty sells ABC stock prior to wednesday (the settlement date of the XYZ sale), the transaction would be deemed a good faith violation because ABC stock was sold before the account had sufficient funds to fully pay for the purchase.

Good faith violation example, trudy:

- Cash available to trade = $10,000, all of which is settled

- On monday morning, trudy buys $10,000 of XYZ stock

- On monday mid-day, she sells XYZ stock for $10,500

At this point, trudy has not incurred a good faith violation because she had sufficient settled funds to pay for the purchase of XYZ stock at the time of the purchase. However:

- Near market close on monday, trudy buys $10,500 of ABC stock

- On tuesday afternoon, she sells ABC stock and incurs a good faith violation

- This trade is a violation because trudy sold ABC before monday's sale of XYZ stock settled and those proceeds became available to pay for the purchase of ABC stock

Consequences: if you incur 3 good faith violations in a 12-month period in a cash account, your brokerage firm will restrict your account. This means you will only be able to buy securities if you have sufficient settled cash in the account prior to placing a trade. This restriction will be effective for 90 calendar days.

Free riding violation

What is it? While the term "free riding" may sound like a pleasant experience, it's anything but. A free riding violation occurs when you buy securities and then pay for that purchase by using the proceeds from a sale of the same securities. This practice violates regulation T of the federal reserve board concerning broker-dealer credit to customers. The following examples illustrate how 2 hypothetical traders (marty and trudy) might incur free riding violations.

Free riding example, marty:

- Marty has $0 cash available to trade

- On monday morning, marty buys $10,000 of ABC stock

- No payment is received from marty by wednesday's settlement date

- On thursday, marty sells ABC stock for $10,500 to cover the cost of his purchase

A free riding violation occurs because marty did not pay for the stock in full prior to selling it.

Free riding example, trudy:

- Trudy has $5,000 cash available to trade

- On monday morning, she buys $10,000 of ABC stock with the intention of sending a $5,000 payment before wednesday through an electronic funds transfer

- On tuesday, ABC stock rises dramatically in value due to rumors of a takeover

- Later in the day on tuesday, trudy sells ABC stock for $15,000 and decides it is no longer necessary to send the $5,000 payment

A free riding violation has occurs because the $10,000 purchase of ABC stock was paid for, in part, with proceeds from the sale of ABC stock.

Consequences: if you incur 1 free riding violation in a 12-month period in a cash account, your brokerage firm will restrict your account. This means you will only be able to buy securities if you have sufficient settled cash in the account prior to placing a trade. This restriction will be effective for 90 calendar days.

As these examples illustrate, it's easy to encounter problems if you are an active trader and don't fully understand cash account trading rules. It is important to maintain sufficient settled funds to pay for purchases in full by settlement date to help you avoid cash account restrictions.

Free trading credit

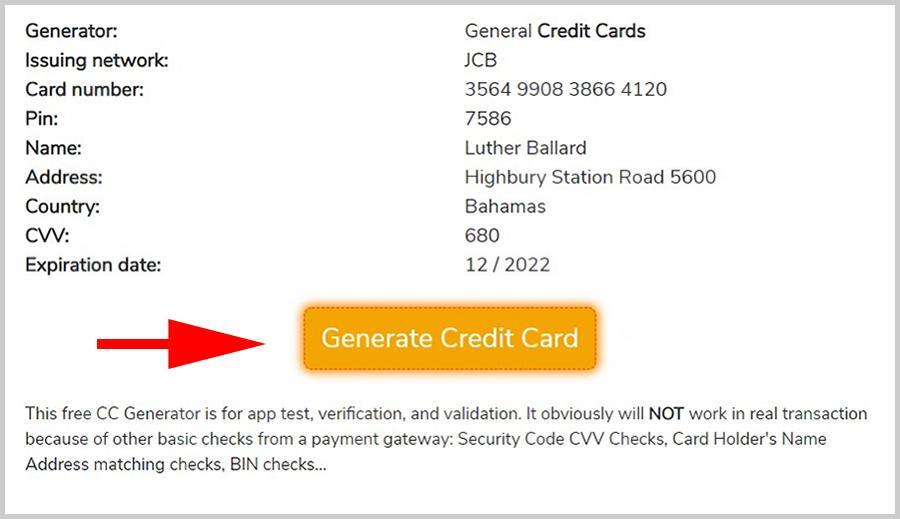

This free CC generator is for app test, verification, and validation. It obviously will NOT work in real transaction because of other basic checks from a payment gateway: security code CVV checks, card holder's name address matching checks, BIN checks.

|  |  |  |  |  |  |

Knowledge is golden. Check out credit card definition for knowledge before proceeding further down.

The credit card has become the most famous method to do payments. You can buy everything from groceries to software using credit cards. Most of the merchants and websites accept only credit cards. In many online websites, the only method to do payment is a credit card. Even in real-world cash has become a thing of the past. The credit card has become more important than your wallet.

Valid credit card generator that work

All of these credit cards have several numbers to identify them. The card number is the most important number as it identifies the bank which has issued that credit card. There are many more numbers like CVV and expiration date on your card. These numbers are never the same on two different cards. Thus, they uniquely identify the cardholder. There are several methods using which you can get free credit card numbers that work in 2021.

Free credit card numbers 2021

First, you must understand the meaning of free credit card number. Every credit card number is unique. These numbers are not randomly generated. There are special algorithms by the bank through which these numbers are generated. You can't generate these numbers by yourself.

However, free credit card numbers are different. They are generated by similar algorithms. Also, these credit cards are available to every for certain purpose. We will talk about how to obtain these free credit card numbers. After that, we will explain you the use of these cards.

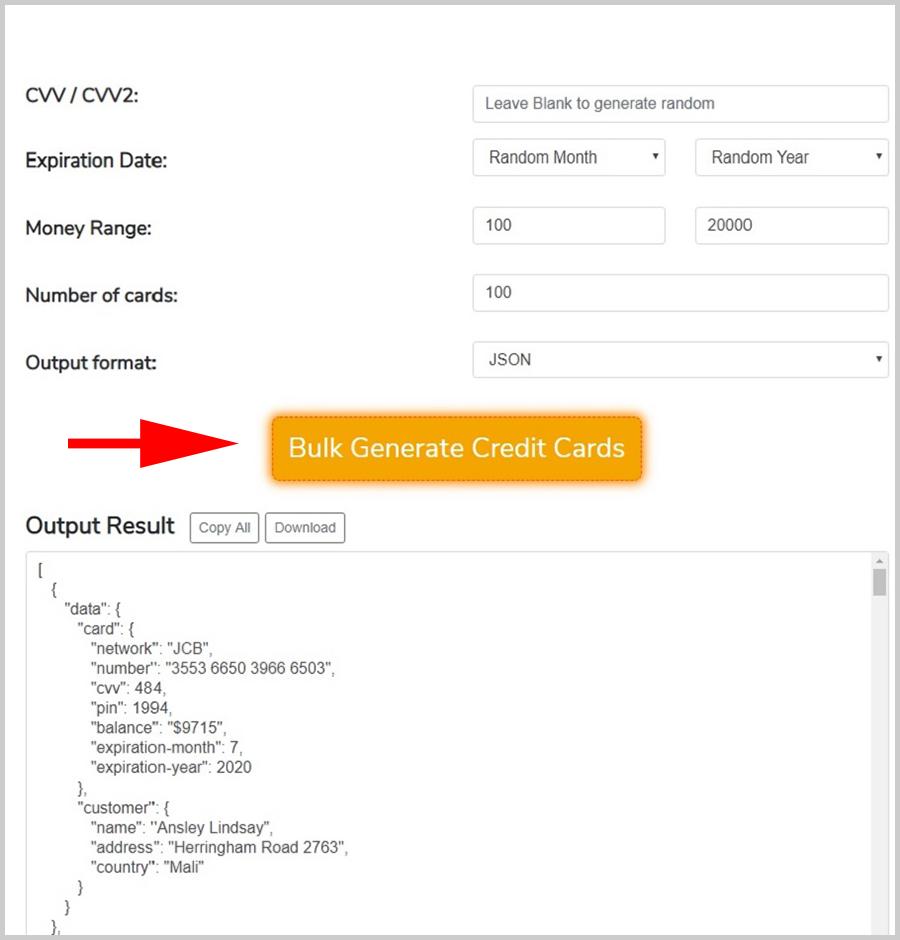

Bulk generate credit cards

Generator type:

Generate CC network

Issuing networks:

CVV / CVV2:

Expiration date:

Money range:

Number of cards:

Output format:

Output result copy all download

How to get free credit card numbers that work 2021

You might be thinking that are these credit card numbers legit. If the credit card is issued by a bank then it is legit. Anyone can use it for a different purpose. But, if the card is issued by an unauthorized entity then it is fake. You can't use such cards anywhere.

Get them from an official issuer

You might be thinking why bank expose these credit card numbers? A credit card is one of the most confidential information. Even if you call bank customer care and ask about the credit card, they will refuse you to give any information. You must have some proofs to prove that you are the legit card holder. This shows how sensitive this information is.

These free credit card numbers are available on a number of websites. The most surprising thing is that these numbers are available on the issuer official website. Also, you will find them on many testing websites. You can also check paypal for these free credit card numbers. For example, some free credit card numbers are 378245671264000 and 3548321457852145.

You can open paypal website and try to use these free credit cards. Select the issuer like american express while testing these cards. Paypal system will validate but you won't be able to do any payment. As all these cards don't have any balance in them.

Credit card issuers like mastercard and visa provide free credit card numbers. Anyone can use these cards for testing purpose. You can also use these cards to check if the website you are shopping on is legit or not. Many other issuers like discover, JCB and dinners club also provide free credit card numbers. You don't have to worry about anything as these cards are legit and legal.

Once you have checked if the website you are shopping is legit or not using these cards. You can use your real cards on that website. Many of the financial websites use these free credit cards for testing purpose. It helps them to secure their website from sniffing attack.

Get them from a credit card generator

Another easy method to obtain free cards is by credit card generator. These generators are available on the internet. Generator won't provide you with legit numbers. Legit numbers are always linked to a bank account. But, there is no way for generators to link these fake numbers with a real bank. They can only use algorithms similar to the bank to generate these numbers. You will receive similar looking numbers which are not connected to a bank account.

You can easily use these credit card generators. First, open any CC generator website. You can use google or some other search engine to find these websites. Make sure you are using a legit website to generate these cards. When you will visit these websites, you will see several options. You can select card type and issuer. After that, click on the generate button and your free card will be generated.

Some website will only generate credit card number. There are many websites which generate other personal information like name, address, and postal code. These details are also important to use your free credit card. By generating these details, credit card generators make these cards more legit looking.

You can generate thousands of credit cards using these details. But, they have very limited usage. If you try to use these credit cards during payment, then your account will get blocked. There is no way to use these credit cards during real payments. The reason for this is because all these cards are not linked to any bank account. Your credit card must be linked to a real account to do any transaction.

You might be wondering why these credit cards are useful. There are many uses of these cards. For starters, it is used to check if the website you are doing payment on is legit or not. Many developers also use these cards to verify their security system. They have to make sure that their app or website payment system is working perfectly. Thus, many bank or issuers provide free credit card numbers which you can try.

Random free credit card numbers that work 2021

Looking for some random credit card numbers for your application tests? Looking no futher. You can hit the "generate now" button above to get some instant results as in the demo below

Things to know about free credit card numbers with VCC 2021

It is very easy to generate these free credit card numbers. But, before generating these cards you must know its use. You can easily generate these cards with just a click after that. We will discuss the uses of such a card and how to use them without any security risk.

Card payment software tests

Most of these free credit card numbers are used to test applications. Many developers, who create apps and websites, have to test their payment systems. They have to make sure that their payment system is working perfectly before their website goes live. If the payment system is not working perfectly, then it can cost thousands of dollars to companies.

For this purpose, developers first test payment system. Of course, there is no use of using real credit cards while you are testing. Developers and testers use a mass number of free credit cards to do testing. They make sure that their website or app is working properly.

Paypal also has a testing environment on their website. You can visit paypal and get free credit card numbers. To check whether your paypal is working fine or not, you can use the testing environment. You need to enter free credit card details on this page. If they get validated then your paypal is working perfectly. Many other merchants also use a similar system to test their website.

Trial account creation

Most of the online streaming websites like netflix require you to enter your credit card information. You can only access their website after giving your credit card info. Netflix provides new users with one-month free trial accounts. After this free period, you will get charged every month.

For this purpose, a lot of people use free credit cards to get trial accounts. They make free trial accounts on websites like netflix and use them for a month. After a month they repeat this process. Thus, they can watch netflix for free for years. You don't have to worry about sharing your real credit card info if you use these fake cards. Also, you won't get auto-charged by netflix.

Verification bypass

You can also these free credit card numbers to bypass verification on some websites. This is different from getting free trial accounts. Most of the free trial accounts have limited access. But, you can get full membership after bypassing membership. This won't work on every website. But, it may work on some small websites.

Scam prevention

There are a number of scams happening online. A lot of fake website takes your real credit card information while signup. After some time they use it do shopping online and you can't do anything to stop them. To be safe from this, you can use free credit card numbers. Instead of providing this website with your real credit number, you can give fake credit card numbers. You will still be able to access that website.

What about getting real active credit card numbers of rich people ?

We can assure you it is not easy to use other people cards online. Credit card numbers are very sensitive information just like your bank account. Even if you know someone credit card number you won't be able to use it. The reason for this is because you need a PIN or/and other personal information to use that credit card. Some bank also uses OTP's to make sure that someone is not misusing their credit cards. All these steps are taken by banks to make sure their customer is safe from hackers. Hackers can easily find credit card details. But, still, there is no way as well as no point using it. It is illegal doing so.

Example free credit card numbers 2021 (latest update)

With the valid but fake bulk cc generator above, one can make some examples for testing purposes:

Never share your credit card PIN with anyone else. If you share your credit card PIN then anyone can use your credit card. It is the most important security layer that protects your card. If you see an offer that is asking for your PIN then it is 100% scam. These tempting offers are made by hackers and scammers to get your information.

How to get fake credit card numbers with CVV and expiration date 2021

Now, you can easily get fake credit card numbers online. Most of these credit cards will also have personal information. We have also told you the use of these free credit card numbers. If you are a developer then it is very important for you to learn how to use these cards. These cards are also useful for a normal person. You can use these cards to get free trial accounts on websites like netflix.

|  |  |  |  |  |  |

Adblock free CC

Ready to see the great stuff? Yay, now whitelist the site.

Once done. Hit refresh button below. Or try the free CC page.

|  |  |  |  |  |  |

Everyone consider credit cards to be an important means of the transaction these days. As far as dealing with a large amount of companies is concerned, people prefer to use their credit cards instead of using cash. It is so a lot more convenient, secure, and *stylish* that way.

Copyright 2021 creditcardgenerator - all rights reserved

Free trading credit

Just answer a few questions about your device. Based on what you tell us, we’ll offer you a competitive trade-in estimate for an apple gift card or instant credit at an apple store. 1 or you’ll have the option to recycle it for free.

Your data stays safe.

Before you hand off your device, we’ll show you how to safely back up and wipe your data, so you can keep all your information to yourself. 2 if it’s an apple product, it’s even easier. Just use icloud or time machine to move everything in a few steps.

It goes on to help the planet.

You may be done with your device, but chances are it still has more to give. If it’s in good shape, we’ll help it go to a new owner. If not, we’ll send it to our recycling partner, so we can save more precious materials and take less from the earth.

And if it’s an iphone, it could even go to daisy, our disassembly robot that can efficiently recover the resources inside.

Just mail it out, or bring it in.

Trading in your device is as easy as buying a new one. We’ll give you a prepaid trade-in kit or shipping label to send it off. Or you can bring it to an apple store. We’ll either give you instant credit toward the purchase of a new product or send your device on to our recyclers.

Frequently asked questions

What is apple trade in?

It’s our trade-in and recycling program that’s good for you and the planet. If your trade-in device is eligible for credit, you can offset the purchase price of a new one. If it’s not eligible for credit, you can recycle it for free.

How does it work?

Whether you’re making a purchase or not, we’ve made it easy to trade in an eligible device either in a store or online. Just answer a few questions regarding the brand, model, and condition of your device. We’ll provide an estimated trade-in value or a simple way to recycle it.

If you accept the trade-in estimate in the store, we’ll give you instant credit toward a purchase or a gift card you can use anytime.

If you accept the trade-in estimate online when you purchase a new mac, iphone, ipad, or apple watch, we’ll arrange for you to send us your old device. Once we receive it, we’ll inspect it and verify its condition. If everything checks out, we’ll credit your original purchase method and send you any remaining balance on an apple gift card by email.

If you choose to trade in your old device online for a gift card, we’ll also arrange for you to send it to us. When everything checks out, we’ll send you an apple gift card by email.

Regardless of how you choose to trade in, if the condition of your device doesn’t match what you described, a new estimated trade-in value will be provided. You’ll have the option to either accept this revised quote or reject it. If you reject it, your device will be returned to you at no charge.

Should I choose credit toward a purchase or an apple gift card?

It depends on where and when you make a purchase.

If you’re ready to buy a new product at an apple store, you can bring your old device with you. If it’s eligible for trade-in, we’ll apply an instant credit at the time of purchase. The only exception is that mac trade-ins are only available online.

If you’re ready to buy a new apple product online (apple.Com or the apple store app), you can trade in an old device and get credit toward your purchase.

If you’re not ready to make a purchase, you can trade in your old device online for an apple gift card by email that you can apply to any future apple purchase.

And no matter how you use apple trade in, if your device has no trade-in value, you can always recycle it responsibly for free.

How long does the online trade-in process take?

Generally it takes 2–3 weeks. But the sooner you send us your device, the sooner we can verify its condition and process your credit or gift card.

Recycling a device is much faster. As soon as we email you a prepaid shipping label, just send your device to our recycling partner.

If I buy a new device online with a trade-in, what kind of credit will I get?

It depends on what you buy and how you pay for it.

If you buy an iphone, ipad, mac, or apple watch and pay in full, we’ll apply a credit to your original payment method up to the total purchase price. For any remaining amount, you’ll receive an apple gift card by email.

If you buy an iphone using apple card monthly installments, apple iphone payments, or the verizon device payment program and include a trade-in, your estimated trade-in credit will be applied directly to the purchase price of your new iphone. Once we receive your trade-in device and confirm that the condition matches what you described, there’s nothing more you need to do. If it doesn’t match, your original payment method will be charged the difference in value. In that case, we’ll work with you to confirm that you still want to move forward with the trade-in.

Can I see what my device is worth online, then bring it with me when I buy a new device in the store?

Yes, the apple trade in program is available on apple.Com as well as in all our retail stores.

However, keep in mind that the trade-in credit you get in the store may be different from the estimated trade-in value you received online.

How much will I get for my trade-in?

It depends on the device, model, manufacturer, and condition. Answer a few questions accurately, and once we receive the device within the specified time frame and verify its condition, you’ll most likely receive the full amount of the estimated refund.

Keep in mind that we need to receive your device within 14 days of initiating the trade-in, and the condition needs to match what you told us.

If the condition of the device is different from what you described, we’ll provide a revised value. You can either accept or reject it. If you accept it, we’ll continue with the trade-in and either charge or credit the difference in value to the card you provided. If you reject it, we’ll cancel the trade-in, return your old device, and charge the original trade-in value to your card. No matter what, we’ll send you email updates about the progress of your trade-in, so you’ll know what’s happening at every step.

Does apple offer recycling?

Yes. Apple trade in lets you recycle any apple device (including devices from apple-owned brands) at any apple store and on apple.Com for free. That includes your batteries and old electronic products as well as free, on-demand packaging recycling for our commercial, education, and institutional customers. When we receive your device, it will be thoroughly inspected to determine if components can be recycled or reused. Whether recycled or reused, all activities relating to the processing of your device will be managed in an environmentally responsible way.

What devices are eligible for trade-in with apple trade in?

You can trade in apple and third-party devices. Many apple and third-party devices are eligible for a trade-in credit or an apple gift card. And all apple devices are eligible for recycling. Either way, give us your used devices and we will handle them responsibly.

Can I trade in my current device when I join the iphone upgrade program?

If you are not already participating in the iphone upgrade program, you can trade in your eligible device at an apple store for credit toward your subsequent purchase as part of the iphone upgrade program.

If you are currently a member of the iphone upgrade program and wish to remain in the program, please do not proceed with apple trade in. After you upgrade and receive your new iphone, we’ll arrange for you to trade in your old one. If you do continue with apple trade in, you will be responsible for both your outstanding iphone upgrade program loan and the purchase price of any new iphone you purchase through apple trade in.

Is there a way to track my trade-in status?

If your trade-in will be applied as a credit toward an online purchase, you can track it from your apple store account.

If you’re trading in for an apple gift card, you can track it here.

Can I cancel a trade-in?

If you haven’t yet shipped your device, you can cancel your trade-in by simply keeping your device.

If you’ve already shipped your device, the trade-in can’t be cancelled. If you receive a revised trade-in value after the inspection of your device, you can then choose to reject it.

Do I have to include accessories like chargers and cables?

In some cases, your final trade-in value can vary depending on if you send in your power adapter or not. You don’t have to, but you can always send in your chargers and cables, and we will recycle them for you.

Can I trade in a device at an apple store?

Yes, apple trade in is available on apple.Com as well as in all our retail stores.

How do I pack my device for trade-in, and how quickly should I send it to you?

Follow the instructions included in your trade-in kit. It explains how to prepare, pack, and ship your device.

Keep in mind that the estimated trade-in value is valid for 14 days, and we encourage you to send the device to us within this time frame to ensure that you get this value. Recycled devices should be sent back as soon as possible, at a time that’s convenient for you.

How do I pack my device for recycling?

Devices that contain batteries should be packed in compliance with all applicable laws, regulations, and industry best practices, which typically include the guidelines below:

- Discharge the unit to less than 30%.

- Do not ship electronics that are disassembled into parts.

- Do not ship electronics with swollen or damaged batteries.

- For whole units, surround the product with at least 2.5 inches of suitable filler material, such as recycled or reused packaging, before placing inside a corrugated box.

- Ship only one device per box.

How do I find the serial number on my apple device?

To find your serial number, follow this guide.

So, let's see, what we have: trading credits are termless and interest-free, and can be used as guarantees when effecting transactions at free trading credit

Contents of the article

- Top forex bonuses

- Trading credits

- Trading credits terms

- 7 best free stock trading platforms

- 7 best free stock trading platforms

- The bottom line

- Trade credit

- What is a trade credit?

- Understanding trade credit

- Trade credit accounting

- Trade credit trends

- Related concepts and other considerations

- Best online stock trading platforms

- Best online trading platforms:

- Compare online brokers

- Characteristics of a successful online stock...

- Things to look for in an online trading platform

- The best online trading platforms

- Free bitcoin

- Try executium for free

- Free bitcoin for you

- Enabling you to trade instantly

- Make your cryptocurrency work for you

- What is day trading with bitcoin?

- What is intra-day trading?

- Best online stock trading platforms

- Best online trading platforms:

- Compare online brokers

- Characteristics of a successful online stock...

- Things to look for in an online trading platform

- The best online trading platforms

- Avoiding cash account trading violations

- Cash liquidation violation

- Good faith violation

- Free riding violation

- Free trading credit

- Valid credit card generator that work

- Free credit card numbers 2021

- Bulk generate credit cards

- Generator type:

- Generate CC network

- Issuing networks:

- CVV / CVV2:

- Expiration date:

- Money range:

- Number of cards:

- Output format:

- Output result copy all download

- How to get free credit card numbers that work 2021

- Get them from an official issuer

- Get them from a credit card generator

- Random free credit card numbers that work 2021

- Things to know about free credit card numbers...

- Card payment software tests

- Trial account creation

- Verification bypass

- Scam prevention

- What about getting real active credit card...

- Example free credit card numbers 2021 (latest...

- How to get fake credit card numbers with CVV and...

- Adblock free CC

- Free trading credit

- Your data stays safe.

- It goes on to help the planet.

- Just mail it out, or bring it in.

- Frequently asked questions

- What is apple trade in?

- How does it work?

- Should I choose credit toward a purchase or an...

- How long does the online trade-in process take?

- If I buy a new device online with a trade-in,...

- Can I see what my device is worth online, then...

- How much will I get for my trade-in?

- Does apple offer recycling?

- What devices are eligible for trade-in with apple...

- Can I trade in my current device when I join the...

- Is there a way to track my trade-in status?

- Can I cancel a trade-in?

- Do I have to include accessories like chargers...

- Can I trade in a device at an apple store?

- How do I pack my device for trade-in, and how...

- How do I pack my device for recycling?

- How do I find the serial number on my apple...

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.