Brokers for forex trading

Oanda is also making progress toward becoming the best forex broker in the USA.

Top forex bonuses

The industry leader is making progressive inroads in the US market, and now offers trading in more than 70 diverse forex currency pairs. This is more than enough for you to trade successfully. Added to this, you can also benefit from the powerful educational and research infrastructure oanda provides. This includes marketpulse, a selection of news, technical analysis, and research resources which are provided by the in-house oanda team. This can combine perfectly with our own online investment guides and educational content. Oanda are also well-regulated by both the CFTC, and NFA (#325821) offering traders two account types. With over 40-years in the industry, IG markets is a true pioneer of the industry, and among the most long standing forex brokers accepting US clients. The broker has evolved continually, keeping the requirements of US-based traders as a top priority. These can be traded on MT4, the mainstay trading platform for top US forex brokers and traders from all around the world as well as being both CFTC licensed, and NFA regulated (#0509630). IG markets offers one type of account to all traders and this has a minimum deposit requirement of $250.

Top 7 of best US forex brokers for 2021

Top rated:

Are you searching for the best US forex brokers?

Luckily, our team of professional forex broker reviewers can take care of your every need.

Let alone the best forex broker in USA, our team realizes it is tough to find any broker which offers a trustworthy, and still value for money proposition when you want to trade forex in the USA. Forex brokers accepting US clients may be few and far between, but we have combined years of experience to narrow your selection down to the top five brokers.

These five are among the best forex brokers USA has to offer.

In fact, they are some of the best forex brokers for residents of any country. These brokers will ensure you feel safe, secure, and still have the ability to prosper in your trading career. They have been selected as the best US forex brokers for a variety of reasons.

Among these reasons are the amount of trading support they offer you, they wide range of markets and instruments that are available for trading, and the very competitive pricing and fee structure offered by these top forex brokers.

Table of contents

Is forex trading legal in the USA?

As a forex trader in the US, one of the most important questions you may be asking yourself from the outset surrounds the legality of forex trading in the US. Well, we are pleased to tell you that yes, forex trading is legal in the US. In fact, the US has several top financial regulators providing the best protection to you as a trader. These bodies are FINRA, the SEC, CFTC, and NFA with the latter two being the main regulators when it comes to forex trading and trading in derivatives such as futures. Remember also that cfds trading in the US is not permitted.

How to trade forex in the USA

The process of getting started with a forex broker in the US is typically similar to that of any other country. With any top broker you will usually be asked for the following information:

- Proof of identity. A passport is typically best for this purpose.

- Proof of residence, usually in the form of a bank statement at your current address.

Once these documents are uploaded and verified, a process that takes most forex brokers just a few minutes, you will be free to get started trading forex.

Top 7 forex brokers in the USA listing for 2021

Here’s our list of the best US forex brokers:

1. Forex.Com

When it comes to US forex brokers, forex.Com has to be an immediate consideration for opening your forex trading account in the USA. They are CFTC licensed and NFA regulated (#0339826) and provide a selection of flexible and accessible account types with low spreads starting from 0.2 pips, including their direct market access account. This offers some of the most unbeatable spreads among any of the forex trading brokers USA. They also provide extensive trading options in all of the top forex currency pairs, metals including gold and silver, as well as futures trading. When it comes to forex brokers accepting US clients, forex.Com certainly offers among the most comprehensive range of services to their US-based traders.

The forex.Com minimum deposits starting form $1000 on standard, and commission accounts, and $25,000 on DMA accounts with demo accounts available. There are also a range of other great benefits such as cash rebates and reduced or no fees for active traders.

2. IG markets

With over 40-years in the industry, IG markets is a true pioneer of the industry, and among the most long standing forex brokers accepting US clients. The broker has evolved continually, keeping the requirements of US-based traders as a top priority. These can be traded on MT4, the mainstay trading platform for top US forex brokers and traders from all around the world as well as being both CFTC licensed, and NFA regulated (#0509630). IG markets offers one type of account to all traders and this has a minimum deposit requirement of $250.

Accessibility with IG is also excellent, you can engage with a number of top professional charting packages using your desktop, phone, or other smart device. Beyond the USA, IG markets also featured in our top 10 largest forex brokers australia. This showcases their global appeal to traders. This appeal is further enhanced by a great cost of trading on more than 90 forex pairs with spreads starting at 0.8 pips.

3. Interactive brokers

You will very often find interactive brokers among our lists of top forex brokers. This is also true when it comes to our choice of top US forex brokers. This is thanks to a number of positive aspects which the longstanding broker uses to attract clients around the world. These include an excellent proprietary trading platform which offers some of the most advanced trading tools available on any market, and a widespread list of products which are available at highly competitive rates. These products include currencies, options, metals, and indices within a list which is ever increasing. IB are a FINRA member and regulated by both the CFTC and NFA (#0392970), as well as the SEC (#8-47257).

They have two account types, you can choose the IBKR lite, or IBKR pro both at no minimum deposit though the pro account has a $10 maintenance fee. As mentioned the product range is excellent as is the trading cost with spreads from 0.1 pips on 105 forex pairs. All of these features make IB a top choice particularly for experienced traders.

4. Oanda

Oanda is also making progress toward becoming the best forex broker in the USA. The industry leader is making progressive inroads in the US market, and now offers trading in more than 70 diverse forex currency pairs. This is more than enough for you to trade successfully. Added to this, you can also benefit from the powerful educational and research infrastructure oanda provides. This includes marketpulse, a selection of news, technical analysis, and research resources which are provided by the in-house oanda team. This can combine perfectly with our own online investment guides and educational content. Oanda are also well-regulated by both the CFTC, and NFA (#325821) offering traders two account types.

The standard account type is attractive thanks to the fact it has no minimum deposit, while the premium account requires a $2,000 minimum deposit but has benefits like lower spreads and other costs. An unlimited oanda demo account is also available. The broker also use the much respected MT4 trading platform for trading in all 70 forex pairs and more at a very competitive spread starting from 0 pips. All traders but particularly newer ones, seem to fit well within oanda.

Top 10 forex brokers and trading platforms to trade online

Forex is a portmanteau word consisted of the words foreign exchange and forex trading signifies the trading of currencies. Currency trade has existed for many centuries, even millennia, in fact it can be said that it is as old as money and trading in general. The international forex market is massive, in fact, it is the largest market in the world in terms of volume of trading. Currency trading is essential for international businesses and forex trading is very useful for companies that import or export products and/services.

Below is information that you will require to know while deciding to go with forex trades at any of the top forex brokers site we have listed out below.

Here you will check out each of the sites that are more popular in currency trades. They have been provided here in addition to the other valuable information which will permit you in making your own decision on the forex broker that you will be making use of the services.

Deposit: $10 leverage: 1000:1

Deposit: $50 leverage: 1:50

Deposit: $100 leverage: 1:30

Deposit: $50 leverage: 1:1000

What are forex brokers

In the past, only large international financial institutions were allowed to trade currencies, but with the introduction of online forex brokers, i.E. Forex trading platforms, individuals are also given an opportunity to invest and increase their capital by trading currencies. Basically, a forex broker is a company which provides a platform for individuals who like to engage in speculative trading of currencies. This type of forex trading, where individuals get to trade via a platform is also known as ‘retail forex trading’, a term used to distinguish it from the more traditional type of forex trading. Even though it appeared only about 20 years ago, online forex trading is now a huge market and recent reports show that the daily trading turnover in 2016 was over $280 billion. There are numerous forex brokers that offer forex trading services to individuals all over the world.

The basic definition of the word broker is ‘someone who sells products or services on behalf of other people’. And that is pretty much true for forex brokers. They buy and sell currencies on your behalf. Unlike conventional brokers that you’ve surely seen in wall street themed movies, you don’t have to call this brokers and they don’t have to be at a particular place in order to trade.

How to choose a forex broker

There are more than few forex brokers that operate online, in fact there are dozens of them.

Choosing the best online forex broker, isn’t always easy, especially since almost every forex trader seems to be the bets. But, you shouldn’t worry, as there are ways to determine which forex broker is trustworthy and reliable.

Licencing

The legal aspect is primary here. You definitely can’t trust a forex broker which isn’t licensed and regulated. Even if their offer looks good and everything seems appealing, you shouldn’t trust a company that lacks appropriate certification. Different countries have different legislation and standards which are applied to forex brokers and their operations. The first step for every trader is to make sure that the forex broker has the appropriate licence and is completely legal.

Currency pairs

There are multiple currencies in the world, but not all of them have the same reputation and not all of them are equally traded. Typically, the american dollar is one of the most interesting currencies.

In addition to the american dollar, there are 7 other currencies which are rated highly:

- Euro (€) – EUR

- Pound sterling (£) – GBP

- Australian dollar ($) – AUD

- New zealand dollar ($) – NZD

- Canadian dollar ($) – CAD

- Swiss franc (fr) – CHF

- Japanese yen (¥) – JPY

A pair consisted of one of the currencies listed above and the USD is called a major. The majors are the most frequently traded pairs and these pairs constitute 85% of the total forex trading on the market. Other, lower-rated currencies are usually paired with the USD and such a pair is called a minor. When a lower-rated currency is paired with the currency other than the US dollar, that pair is called a currency cross, or just a cross.

The number of currency pairs which are offered by a forex brokers is one of the key criteria for establishing the reputation of the brokers. Brokers that offer a larger number of currency pairs should be preferred over ones that offer fewer pairs. Most brokers offer all majors, as well as a number of minors and crosses. If you’re looking to trade a particular pair, then you should definitely check whether the broker in question offers that pair. On the other hand, if you’re looking to trade only the majors, there are other things which you should take into consideration.

Leverage and lot size

Leverage in forex trading is used as a means to provide higher profits which are derived from the changes in the exchange rates of the two respectively paired currencies. In fact, it might be simplest to describe it as a loan provided by the broker to the investor. The leverage may vary, it can be 50:1, 100:1 or even 200:1. Higher leverage provides you with a chance of earning more money through trading, but it also means taking larger risks. Traders that have a higher understanding on the market will be looking for higher leverage.

As you don’t buy the actual currency units, but you actually invest in the expected fluctuation of how two currencies are paired against each other, the traders actually trade larger unit blocks, called lot sizes. A lot size is the number of currency units which are traded. The lot size may be 100, 1,000 or even 10,000 units of the second currency in the pair. It would be wiser to look for a forex broker that offers a variety of lot sizes, including smaller ones which are perfect for traders who are new to forex trading and don’t want to risk large amounts of money.

Market spread

Forex brokers allow you to trade the currency pairs you want and make a profit. The have to make a profit as well, though. Most forex brokers don’t charge any fees, so that you won’t have any initial expenses, but they make their profit through the market spread.

- The spread is the difference between the two positions, which are the buy (bid) and the sell (ask) position. Higher spreads allow brokers to make bigger profits, but they are less favourable for the traders.

The spread percentage is very important, and if you’re looking for a forex trader, it would be wise to choose one that offers lower spreads.

Sometimes, forex traders don’t offer the same spread on different currencies. Usually for large currencies, that take are traded more frequently, the spread will be lower, whereas for smaller currencies, and currencies with a larger volatility the spread will be higher.

Trading platforms

We have already mentioned that the emergence of forex trading was enabled by the internet. Forex brokers may offer different sorts of trading platforms, downloadable, web-based and from few years ago mobile trading platforms. It all boils down what is more convenient for you as a trader.

Some mobile apps for example, include only some of the features that are offered in the desktop version, whereas other include more options. Moreover, some forex traders offer more than one platform, and each of them may include different elements. It is best to look for a forex broker that offers both a platform for traders who aren’t very experienced. Those platforms are usually easier to use and a lot more user-friendly.

Payment methods

Forex brokers usually offer their customers more than one payment method that will enable them to fund their trading accounts. Some brokers charge fees on deposits and/or withdrawals, whereas with others no extra fees will be charge, other than the ones applied by the provider of the financial service. The deposit and withdrawal limits may differ. The principle here is simple, the brokers that provide more methods and don’t charge any fees have a definite advantage over those that offer a limited amount of payment methods and charge fees on deposits and withdrawals.

Bonuses, training materials and support

As there is a pretty large competition on the forex broker market and multiple companies provide forex trading to customers all over the world, brokers are looking for ways to attract new customers, while also trying to keep their existing ones.

- Bonuses

- Training materials

- Customer support

These three are also very important parts of the overall offer of every forex broker, in conjunction, of course, with the pairs, leverage and market spread.

The types of bonuses that are offered may vary. Many brokers offer a welcome bonus, where traders get additional funds, on top of the ones that they deposited. Some brokers offer bonus funds even before the traders make their first deposit.

Some traders are new to forex trading and that is why it is only fair for brokers to provide them with the necessary learning materials that will help them improve their understanding of the market fluctuations and forex trading as a whole. Many brokers allow traders to open a demo account, which will allow them to simulate forex trading without any risk of losing real money. In addition, e-books, videos and even webinars on forex trading are also provided.

Customer support is an important aspect for every service industry and forex brokers aren’t excluded. Help is provided via phone, email and live chat and most brokers’ websites have an FAQ section which provides answers to specific questions.

Why trade forex online?

There are many reasons why you should seriously consider placing forex trades online, and if you are new to this environment it can often be something of a confusing forex trading environment at first, as there are many different currencies that can be paired together and lots of different trading platforms to choose from.

However, do remember that if you do decide to trade forex online then at no point in time are you having to actually buy the two currencies you are trading against each other and therefore your costs of becoming a forex trader are massively reduced.

When you chose to trade at any of our top 10 forex brokers you are only going to be placing a trade on which way you think one currency is going to move against another, and as such your leverage is far greater online.

Imagine the fuss and hassle involved with having to first buy one currency, and then if it moves in the direction you want it to then finding somewhere to sell that currency to and then buy the other one! Those days are long gone now and you really are going to be amazed at all of the next generation of forex brokers listed and fully reviewed throughout this website!

The respective financial authorities of every countries provide licences under which forex brokers are allowed to operate and offer their services to citizens of that particular country.

Forex trading is legal in most countries of the world, even if the country doesn’t have a financial authority who issues licences.

Yes, forex brokers are able to offer services outside the country they’re based in. Some countries would require a broker to obtain a licence, others will allow them to operate under a licence issued elsewhere. It really depends on the local laws.

Many forex brokers also offer contract-for- difference (CFD), commodities, as well as stocks and indices and it is possible for traders to use one account for all of them.

They are usually open the whole time, but when it comes to trading, it is offered monday through friday. The starting hour on monday and the closing hour on friday depends on the pair in question.

Most forex brokers have a deposit limit. The specific limit depends on your choice of currency, but usually it isn’t very high.

Licenced forex brokers comply with all financial standards and security measures that are employed by the world’s leading financial institutions. Encryption technology is used to ensure that no third parties will be allowed to access customers’ financial information and the customers’ details are not handed to third parties. Most reliable companies, keep their customers’ trading funds in a separate account, to ensure that they won’t be lost no matter what.

Some forex brokers allow their customers to open multiple trading accounts, but they are advised to use the same personal details for each of them.

Yes, all forex traders require customers to provide identity verification documents, either when they register or when they’re about to make their first withdrawal. Most forex brokers would require you to present a proof of identity and a proof residency, so they can confirm that you are who you claim to be and that you are legally allowed to trade forex.

Yes, there are no legal limits on the number of forex trading accounts that may be opened in your name. As long as you are legally allowed to have one account, you are also able to have as many as you want.

Yes, you can trade any of the forex pairs that are offered by the broker, not just pairs that include your preferred currency/ the currency of your country.

The best U.S. Forex brokers

Forex trading is highly regulated in the united states. In this guide, we review the best U.S.-complaint forex brokers, comparing their fees, leverage, pros, and cons.

Tim fries

Tim fries is the cofounder of the tokenist. He has a B. Sc. In mechanical engineering from the university of michigan, and an MBA from the university .

Shane neagle

Meet shane. Shane first starting working with the tokenist in september of 2018 — and has happily stuck around ever since. Originally from maine, .

All reviews, research, news and assessments of any kind on the tokenist are compiled using a strict editorial review process by our editorial team. Neither our writers nor our editors receive direct compensation of any kind to publish information on tokenist.Com. Our company, tokenist media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. Click here for a full list of our partners and an in-depth explanation on how we get paid.

Settling on a good forex broker in the U.S. Should be easy, right? After all, the united states is still the world’s largest economy, and there’s a market for trading every currency with USD.

Well, easier said than done…

Foreign exchange, the exchange of one currency to another, runs 24 hours, 5 days a week through over-the-counter markets, generating a huge trading volume per day. This highly liquid market allows for seamless access to traders across the globe. Australian traders, for example, can trade in british pounds (GBP) and euros (EUR) through a US-based broker.

This decentralized and global nature of the industry also carries significant risk, making it an ideal target for fraud. The growth of speculative trading has resulted in an increase in intermediaries, including brokers and banks engaging in scams, financial irregularities, exorbitant charges and exposure to high-risk through bad practices.

It’s no wonder then that U.S. Regulators now play such an important role in the industry. That is to say, the most important criteria to take into consideration when choosing a U.S. Forex broker is the regulatory approval status of the broker and its governing authority.

However, regulation enforcement isn’t a straightforward process, and due to the global scale of the market, there is no standard regulatory framework that applies across all jurisdictions. So, can you trade forex in the USA?

Yes, though forex trading in the US is generally considered highly regulated. Forex brokers in the US are heavily regulated by the commodity futures trading commission (CFTC) and national futures association (NFA), independent agencies that enforce strict rules, including a restriction on leverage offered.

Furthermore, if you are a united states citizen, the regulation impacts your eligibility for non-U.S. Based brokers, unless they are registered with the NFA.

There are stark differences in regulation that make it imperative for you to be aware of and understand the regulation that applies to the broker you are considering.

Additionally, the forex market is highly vulnerable to significant volatility as a result of economic turbulence. We can see this through the current coronavirus pandemic, the impact of which can be felt, in this case, regardless of regulations. ��

In this article, we’re going to take you through:

- Our recommendations for the best brokers

- Key provisions of U.S. Forex trading regulations

- How U.S. Forex regulations differ

- Quick Q&A on forex regulations in the united states

Leading US forex brokers

The following list presents the advantages of the best forex brokers for US clients:

The following list presents the advantages of the best forex brokers for US clients:

- Interactive brokers

best overall - IG US

best investment selection - TD ameritrade

superb app for US forex brokers - FOREX.Com

best charting tools - Nadex

best exchange

Top 5 US forex brokers 2020

1. Best US forex broker overall: interactive brokers

When it comes to currency pairs offered, trading technology, ease-of-use, regulation, and fees — there’s one broker that takes the cake. Interactive brokers is easily our top forex broker for US traders.

- Highly regulated

- Substantial range of global markets and asset classes

- Low fees including discounts for high-volume traders

- Complex desktop platform may be unsuitable for beginners

- A lack of forex charts on web platform

- Minimum activity charges per month

Interactive brokers (IBKR) should be a serious consideration for professional FX traders. The company is headquartered in the U.S and boasts strong regulatory licences.

This broker is most suited to professional traders and offers 105 forex pairs, 7,400 cfds, US-traded bitcoin futures, and much more. IBKS’s trader workstation is more difficult to use but does provide a full range of features.

Interactive brokers fees appears to be competitive overall, however, the company does not publish its average spread for forex which makes it difficult to pinpoint exactly. Forex traders will receive an aggregated price from some of the largest dealers around the world, and then be charged a commission per trade that can range from $16-$40 per million round turn, as opposed to charging a spread.

Traders looking to prioritize research will appreciate the comprehensive array of third-party research, including both free and premium content. The company does however, lack a full-featured research offering for forex.

⚡️ important: interactive brokers requires forex traders in the U.S to be classified as an eligible contract participant (ECP), “an [ECP] is generally an individual or organization with assets of over $10 MM (5 MM for trades that are hedging)”.

Originally, IBKR’s customer support was far from the most loved. Fortunately, the service has improved immensely, for example with the introduction of ibot on mobile, a virtual assistant that permits users to ask questions by voice command.

In addition, the interactive brokers‘ team can be contacted in a variety of ways, including by phone, with an average wait time of 1 to 2 minutes.

Best brokers for day trading

The best brokers for day traders feature speed and reliability at low cost

We publish unbiased product reviews; our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. Our mission has always been to help people make the most informed decisions about how, when and where to invest. Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for investors of all levels, for every kind of market

When choosing an online broker, day traders place a premium on speed, reliability, and low cost. Features designed to appeal to long-term, infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in their portfolios, make a lot of transactions, and end the day having closed all of those trades.

Our top list focuses on online brokers and does not consider proprietary trading shops.

Best online brokers for day trading:

- Interactive brokers: best online broker for day trading, best broker for advanced day traders, and best charting platform for day traders

- Fidelity: best low-cost day trading platform

Interactive brokers: best broker for day trading, best for advanced day traders, and best charting platform for day traders

:max_bytes(150000):strip_icc()/interactive_brokers_productcard-5c61eec746e0fb0001f25462.png)

- Account minimum: $0

- Fees: maximum $0.005 per share for pro platform or 1% of trade value, $0 for IBKR lite

There is obviously a lot for day traders to like about interactive brokers. Interactive brokers allows day traders to invest in a wide array of instruments on a global scale with access to 125 markets in 31 countries. The broker also offers you the widest array of order types and a wealth of analysis tools to find your next trading opportunity.

The only real weakness is the fact that interactive brokers went from one of the lowest cost brokers for day traders to one of the few that still charges fees (albeit still very low) while the rest of the industry has moved to zero. This fact has allowed fidelity to prevent interactive brokers from sweeping the day trading portion of our review. Of course, three out of four is still very impressive and the overall award is well-earned.

Interactive brokers’ primary platform for day traders, the traders workstation (TWS) platform, is excellent across the board. There are a few platforms that can beat it in a particular type of trading, such as options trading, but none offer the overall quality of trading experience across the same number of markets and instruments. TWS is the most customizable platform we reviewed, which comes as a trade-off in terms of a learning curve you have to climb before you can use the software to its full potential.

Interactive brokers tied with TD ameritrade in terms of the range and flexibility of the charting tools. These platforms allow you to trade directly from a chart and they allow you to customize your charting views to almost any conceivable specification. Interactive brokers took this category for day trading based on its overall strength and the fact that there are so many more charts because the overall asset pool is much larger.

Advanced day traders will find that interactive brokers’ TWS gets better as you need more from it. Backtesting and all the other tools required to implement multi-layered trades with contingent orders are present and all among the best available. Moreover, TWS shines when it comes to controlling your entry and exit, which is critical to trading success in less liquid markets or assets. In addition to 60 supported order types, interactive brokers has third-party algorithms that can further fine tune order selection. The algorithms give you control over how a position is entered or exited so that you can minimize slippage or maximize speed. The algorithms take different approaches ranging from blasting orders to exchanges simultaneously to subtly working them into market close or breaking up a position through an iceberg order.

On top of the rich features, wide range of assets, and extensive order types, interactive brokers also offers the lowest margin interest rates of all the brokers we reviewed. While this may not matter to buy and hold investors, this changes some of the cost calculations for advanced traders expecting to utilize margin heavily in their trading. That being said, most day traders will see the cost aspect as secondary once they experience the capabilities of TWS and see the buffet of markets and assets offered by interactive brokers.

No broker can match interactive brokers in terms of the range of assets you can trade and the number of markets you can trade them in.

TWS is the strongest overall platform for day trading with customizations and tools that will satisfy even the most sophisticated traders.

Interactive brokers allows fractional share trading - something that many of its direct competitors are still catching up on.

Interactive brokers still charges nominal fees, meaning that other brokerages can offer an overall lower trading cost.

Day traders can only stream data to one device at a time, which may affect traders with a multi-device workflow.

TWS is very powerful and customizable, but this also means it takes some time to learn and fully unlock the potential.

Fidelity: best low-cost day trading platform

:max_bytes(150000):strip_icc()/fidelity_investments_productcard-5c742f0e46e0fb000143628b.png)

- Account minimum: $0

- Fees: $0 for stock/ETF trades, $0 plus $0.65/contract for options trade

Fidelity is not only the best low-cost day trading platform in our review, but it was actually the overall runner-up to interactive brokers, coming in just slightly ahead of TD ameritrade. When we are looking at fidelity from the day trading perspective, it is all about active trader pro. Active trader pro is an excellent free platform for trading that will meet the needs of most traders without missing a beat. That said, it is fidelity’s pricing that adds the real value for a typical day trader.

Fidelity charges no fees on stocks, etfs, or OTCBB (penny stock) trades. Although no-fee stocks and ETF trades are now commonplace, no-fee penny stocks are still relatively rare. There are some brokers that match fidelity in this, but many of them scored lower in terms of trading technology and customizability. Another edge for fidelity, however, is the firm’s order execution. Over 96% of fidelity orders take place as a price that is better than the national best bid or offer. This results in cost savings for day traders on almost every trade. If you are primarily trading equities and you want to keep your costs down as low as possible, then fidelity is the brokerage for you.

Fidelity’s costs are low, its order execution is exceptional, and it sweeps your idle cash to give you a little more return while you are waiting to deploy your money.

Fidelity offers a range of excellent research and screeners.

Active trader pro is a flexible and powerful trading platform that is a close competitor with interactive brokers’ TWS in terms of functionality.

Fidelity does not offer futures, futures options, or cryptocurrency trading.

Day traders looking for more fundamental research may have to use the web platform in addition to active trader pro.

How day traders use their online broker

Day traders may place their trades manually, often from a chart, or set up an automated system that generates orders on their behalf. Fundamental data is not a concern, but the ability to monitor price volatility, liquidity, trading volume, and breaking news, is key to successful day trading.

Day traders often prefer brokers who charge per share (rather than per trade). Traders also need real-time margin and buying power updates. Each broker ranked here affords their day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen. We sought brokers who allow traders to place multiple orders simultaneously, designate which trading venue will handle the order, and customize trading defaults.

Are you a day trader?

A key consideration for day traders is trading platform quality, which can impact things such as execution speed and price quotes. Day traders, especially those who trade using their own algorithms, need flawless data feeds or they risk entering orders based on errors in the data. In an environment where high-frequency traders place transactions in milliseconds, human traders must possess the best tools. Most brokers offer speedy trade executions, but slippage remains a concern. Traders should test for themselves how long a platform takes to execute a trade.

Commissions, margin rates, and other expenses are also top concerns for day traders. Even if a day trader can consistently beat the market, the profit from those positions must exceed the cost of commissions. For a high volume trader, commission costs can easily run into the hundreds or thousands of dollars per day. Traders can check these rates by contacting the broker or checking the broker website, but most offer special rates for highly active day traders.

It is also important for day traders to consider factors such as customer service and the broker’s financial stability. Customer service is vital during times of crisis. A crisis could be a computer crash or other failure when you need to reach support to place a trade. The best brokers offer dedicated account representatives for highly active day traders to assist in this regard.

The financial strength of the firm is also important since small brokerages can and do go out of business, but the main player in whether or not you can recover your assets is the clearing firm. Take a look at FINRA's brokercheck page before signing on with a small firm to make sure they have not had claims filed against them for misdeeds or financial instability.

Methodology

Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Our reviews are the result of months of evaluating all aspects of an online broker’s platform, including the user experience, the quality of trade executions, the products available on its platforms, costs and fees, security, the mobile experience and customer service. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system.

In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices.

When choosing an online broker, day traders place a premium on speed, reliability, and low cost. Features designed to appeal to long-term infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in its portfolios, make a lot of transactions, and end the day with having closed all of those trades. The ability to monitor price volatility, liquidity, trading volume, and breaking news is key to successful day trading. Traders need real-time margin and buying power updates. Each broker ranked here affords its day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen. We sought brokers who allow traders to place multiple orders simultaneously, designate which trading venue will handle the order, and customize trading defaults.

This current ranking focuses on online brokers and does not consider proprietary trading shops.

Our team of industry experts, led by theresa W. Carey, conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Click here to read our full methodology.

Best online brokers for forex trading in january 2021

Trillions in currency are zipping around the world, 24 hours a day, five days a week, making the foreign exchange (also known as forex or fx) markets the world's most active. Fortunes can be won and lost quickly, as brokers routinely let traders borrow heavily to finance their speculations.

Popular searches

If you're looking to get in on this action, you'll need a broker who deals in currency, and many of the big names in stock trading simply don't offer this feature. Because the markets are so different, you'll also need to evaluate a forex broker on different criteria from what you would use on a stock broker.

Below are some top forex brokers, including a couple that allow customers to trade cryptocurrencies.

Here are the best online brokers for forex trading in 2021:

What to consider when choosing a forex broker

While you may be familiar with many of the brand-name online stock brokers, only some of them deal in forex trading. Instead, a plethora of more specialized niche brokers populate the space, and they may cater to high-volume currency traders looking for every possible edge.

But regardless of which kind of broker you're targeting, you'll want to focus on at least a few features that are common to any forex broker:

- Pricing: forex brokers have two ways to price their services: by baking the price into the buy-sell spread or on a commission basis. Spreads are often quoted in pips, or one ten-thousandth of a point.

- Leverage: how much leverage will the broker let you assume? In general, traders are looking for a higher amount of leverage to magnify the moves in the currency market. The level may differ on the liquidity of the currency.

- Currency pairs: A handful of major pairs dominate trading, but how many other pairs (minors, exotics) does the broker offer? The most popular currencies include the U.S. Dollar, the euro, the japanese yen, the U.K. Pound and the swiss franc.

- Spreads: how wide are the broker's spreads for trades? The larger the spread, the less attractive the trade. Of course, brokers who charge a spread markup will tend to have wider spreads because that's how they get paid.

Investors looking to buy cryptocurrency may be able to do so through some of the traditional stock brokers such as TD ameritrade or robinhood. These have been noted below, though the trading works differently from regular forex trading as described above.

One downside for american traders is that many top forex brokers are based in the U.K. And simply won't accept them because of their citizenship. The brokers below are all fine for americans, however.

Overview: top online forex brokers in january 2021

TD ameritrade

TD ameritrade offers a range of tradable products, and currency really rounds out its portfolio. Currency traders are able to use the broker's highly regarded thinkorswim trading platform, and can also trade on a couple of mobile apps.

The broker uses spread pricing and offers 50:1 leverage, which is the legal maximum permitted in the U.S. It offers more than 70 currency pairs, providing plenty of options. TD ameritrade also allows clients to trade bitcoin futures, though you'll need to get approval to trade futures, and pricing uses the broker's futures scheme.

(charles schwab has purchased TD ameritrade, and will eventually integrate the two companies.)

Pricing: spread

Maximum leverage: 50:1 on major currencies; 20:1 on minors

Currency options: 73 pairs

Forex.Com

Like its name suggests, forex.Com specializes in currency trading (though it trades in metals and futures, too) and it offers a plethora of attractive features. Clients can select the pricing structure that suits them best: spread or commission, or the broker's STP pro pricing, where prices come from global banks and others with no additional markup.

Forex.Com also gives traders access to more than 80 currency pairs, and its success with clients has the broker declaring that it's the no. 1 forex broker in the U.S., in terms of assets held with the broker.

Pricing: spread and commission, depending on account type

Maximum leverage: up to 50:1

Currency options: more than 80 pairs

Ally invest

Ally invest is better known as a low-cost stock broker (and for its especially good prices on options trades), but currency trading really adds some breadth to its offerings. Ally is a good choice for traders just starting out, and it offers more than 80 currency pairs and easy-to-use charting software, including a mobile app.

Ally also allows you to open a $50,000 practice account so that you can see how currency trading works, even if you don't intend to actually trade. Given the difficulty of forex trading, that's a great resource for beginners to try it out.

Pricing: spread

Maximum leverage: up to 50:1

Currency options: more than 80 pairs

IG

IG is a more specialized broker focused on forex, and it's open to american investors. It's a high-powered broker that nevertheless offers many features, such as a demo account, that may help novice traders. The broker offers a web platform, a mobile app and access to metatrader4 and prorealtime platforms.

IG allows spreads as low as 0.8 pips, and says that its pricing is up to 20 percent lower on the euro-dollar pair than the top two U.S. Brokers. The broker also provides an extensive range of charting capabilities across its platforms.

Pricing: spread

Maximum leverage: up to 50:1

Currency options: more than 80 pairs

Robinhood

Robinhood doesn't offer traditional currency trading, but it does bring the slick, easy-to-use interface it's known for to the crypto space. Here clients can trade a range of cryptocurrencies, including some of the most popular. Tradable currencies include bitcoin, ethereum, litecoin and dogecoin, among a total of seven types of cryptos. You'll also be able to get quotes on 10 other digital currencies.

Like its core brokerage that offers free trades on stocks and options, crypto trading is also gratis (free) on robinhood.

What does forex trading cost in 2020?

Would you like to know what forex trading fees may apply? – then you have come to the right place. We show you from our experiences the costs, which can come up to you and describe to you, why these results to you. In addition, we will show you options for how you can trade most cost-effectively.

These costs can be charged in forex trading:

- Spreads

- Commission

- Swap (financing fees of the position)

Additional costs of the forex broker:

- Account fees

- Fees for deposits and withdrawals

Example of forex trading fees

In the following texts, we will discuss the trading fees in detail and show you how to pay the lowest fees.

The forex trading costs are depending on the broker

The forex trading broker determines the fees that a trader must pay when opening a position. There are cheap and expensive providers. The costs have a decisive effect on a trader’s profits. The cheaper the fees are, the higher your profit will logically be.

In many cases, 2 different account models are offered. The only difference here is how the forex broker earns his money. A distinction is made between a spread and a commission account. From my experience, the commission account is much cheaper and offers more advantages.

Often there are 2 fee models for traders:

- Spread model: you pay an additional spread when a position is opened (this may depend on the market situation).

- Commission model: you pay a minimum spread (often 0.1 points or less) and you pay a fixed commission per 1 lot traded (100,000 of the underlying).

How the forex broker earns money from the spread?

Definition of the spread: the spread is a difference between the buy and sells price.

This spread can always fluctuate due to the market situation because there are not always enough buyers and sellers on one price (this rarely happens). This phenomenon is often seen with very strong price fluctuations (high volatility). The forex broker also adds a spread to the market spread to earn money.

In principle, the trader thus gets an execution on a worse price in the market. The difference between the order opening and the current market price is the broker’s profit.

Facts about the spread:

- The forex broker earns money through an additional spread

- The spread depends on the market situation

The commission fees explained

Some forex brokers offer the commission model for forex trading. First of all, I have to say from my experience that a commission account is always cheaper after my test. Instead of an additional spread, you get the direct market spread for your order execution. The forex provider now charges a commission per lot traded.

The size 1 lot describes 100,000 units of the underlying of the forex pair. For example, in the EUR/USD 1 lot exactly would be 100.000€. A fixed commission is charged depending on the trading volume. The average value is between 5$ and 10$ per 1 lot traded. If you trade a smaller size than 1 lot then the commission is of course also smaller.

Facts of the commissions:

- The commission is a fixed amount and depends on the trading volume

- Traders do not pay an additional spread but the commission

- Commission based account models are the cheapest accounts

Financing of your trading position: the swap for leveraged forex

The swap, also known as an interest rate swap, is incurred when trading in leveraged derivatives. It can also be described as the financing fee for a position. Forex trading is carried out with a lever and the trader borrows money from the forex broker for his position. This, in turn, borrows the money from a bank and lends the money to you at higher interest rates.

The difference in interest is the broker’s profit. The position is therefore financed. This fee only applies to longer-term positions that are held overnight. The amount of the swap depends on the current interest rates of the currency pair and is also dependent on the broker. The swap usually occurs after the market closes at 23:00 hrs.

Advantage: the swap can be positive in forex trading

The swap can also be positive. For example, trade the EUR/USD with a short position, invest in the USD and sell the euro. Interest rates in USD are much higher than in EUR. So you even get one credit per day. This is also called carry trade.

Carry trade example:

The interest rate of the EURO is 0% and the interest rate in the USD. Now you buy the USD and sell the EUR. This means short the currency pair EUR/USD. Now there is a huge difference between these 2 interest rates and you borrow money for the position. You get credited with the interest difference to your trading account.

Facts about the swap:

- The swap occurs because forex trading is leveraged

- The fee is only for positions which are opened overnight

- The swap can be positive or negative

- The swap depending on the forex broker and the interest rates

Pay fewer fees with a good forex broker

A good forex broker is essential for success in trading. When making your choice, you should make sure that the provider is officially regulated, has good support and offers good conditions for trading.

In the table below you will find our top forex brokers, which are self-tested. They are the best and cheapest on the market. With over 7 years of experience in forex trading, we have compared a total of hundreds of providers. Bdswiss, tickmill, and XM has the best forex trading conditions in the world. You can already trade from 0.0 pips spread and pay a maximum commission of 2$.

| Broker: | review: | spreads: | advantages: | open account: |

|---|---|---|---|---|

1. Bdswiss  | ➔ read review | starting 0.0 pips | + individual offers + trading signals + personal service |

Additional fees which can occur for traders

In our experience, many forex brokers do not charge these fees in order to gain a market advantage over other providers. However, it often happens that there are account maintenance fees for inactivity. If the trader has not opened a position after up to 3 – 12 months, a fee of up to 50€ may apply. This is however dependent on the offerer.

Further costs are possible with the payment of customer money. There are usually no fees for the deposit. But also with the disbursement, many providers do not charge any fees. Should this still be the case, you can view it transparently in the button.

Conclusion: rarely there are additional costs.

Conclusion: the fees are very low in forex trading

On this page, we have shown you which costs you may incur when trading. Due to the competition among online brokers, the fees have become very low, but you should still look for the cheapest providers to make bigger profits. We have again all the important points of this page for you structured:

Forex brokers offer different fee models:

- There is the spread model

- There is the commission model

- Swap fees may apply overnight

- Find yourself a cheap forex broker

- As a rule, all fees should be transparently visible to the forex broker

Forex trading fees are very important. The fees are critical for your profit and loss. So choose a trusted and cheap forex broker.

FCA flags city FX broker as unauthorized forex trading platform

Is city FX broker scam or reliable? The FCA has warned against this firm in another tireless effort to crack down on unregulated brokerages.

January 21, 2021 | atoz markets – british regulator, the financial conduct authority (FCA) has continued its ongoing efforts to warn the general public against fraudulent and unauthorized entities. Particularly, the UK watchdog today warned against an online brokerage city FX broker.

FCA warns against city FX broker

Today’s announcement is the latest in the FCA’s series of warnings about unregulated firms posing as legitimate, approved businesses to con UK consumers into making payments for investment services.

City FX broker is not based in the UK, but it is targeting british investors by offering them FX trading services. However, according to the warning, the broker is doing so without having the required authorization. The following details were provided about the suspicious firm:

Address: suite 305 griffith corporate centre, PO box 1510, beachmont kingstown, st vincent, and the grenadines

Telephone: +442080899127

Email: support@cityfxbroker.Com

Website: www.Cityfxbroker.Com

So you need to be wary

Unauthorized FX brokers are becoming common in the industry, as fraudsters have grown increasingly resourceful in recent years. A commonly adopted tactic is for scammers to advertise an illegal operation as a reputable brand or entity. They do this in order to dupe unsuspecting investors into parting with their personal details or cash.

For example, an FX broker called budsfx was also blacklisted by the UK’s watchdog after the company claimed that it operated with an FCA license. The regulator, however, clarified that the company does not have any valid license to provide investment services in the country.

Echoing previous warnings, the FCA ignores that unauthorized brokers continue to promote unregulated investments, taking money from the general public, and the regulator is powerless to do anything.

Think we missed something? Let us know in the comment section below.

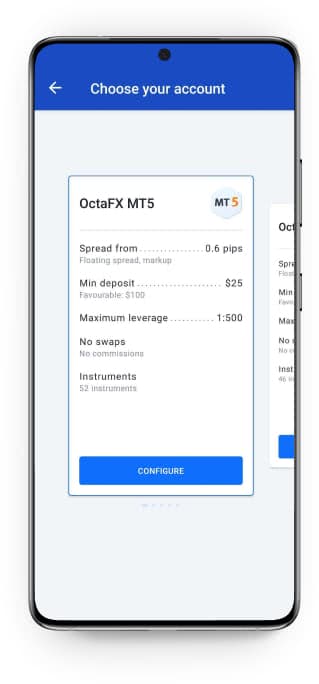

Brokers for forex trading

- Language support: bengali, chinese, english, hindi, indonesian, malay, portuguese, spanish, thai

- Create trading accounts, modify leverage, enable swap-free options, edit and restore passwords

- Make deposits and withdrawals using the most popular payment options

- View your detailed overall or account operation history, apply convenient filters to it and cancel your previous deposit

- Start trading in a compatible trading platform app

- Top up your demo account

- View contest statistics and access your contest accounts

- Activate bonuses and view statistics on active and completed bonuses

get it on

Forex trading accessibility for everyone

Octafx - one of the best forex brokers on the market, for traders all round the world. Octafx offers access to CFD trading, commodity trading and indices trading with award-winning forex trading conditions. As well as access to the forex market, octafx offers a variety of promotions that can help you:

50% bonus on deposit

Negative balance protection

Why choose forex trading with octafx

Octafx forex broker ensures reliable forex trading conditions to provide traders of all skill levels with an opportunity to earn more. This is possible due to:

- No commissions on deposits and withdrawals

- No swaps

- No slippage

- No delays

Top 10 forex brokers and trading platforms to trade online

Forex is a portmanteau word consisted of the words foreign exchange and forex trading signifies the trading of currencies. Currency trade has existed for many centuries, even millennia, in fact it can be said that it is as old as money and trading in general. The international forex market is massive, in fact, it is the largest market in the world in terms of volume of trading. Currency trading is essential for international businesses and forex trading is very useful for companies that import or export products and/services.

Below is information that you will require to know while deciding to go with forex trades at any of the top forex brokers site we have listed out below.

Here you will check out each of the sites that are more popular in currency trades. They have been provided here in addition to the other valuable information which will permit you in making your own decision on the forex broker that you will be making use of the services.

Deposit: $10 leverage: 1000:1

Deposit: $50 leverage: 1:50

Deposit: $100 leverage: 1:30

Deposit: $50 leverage: 1:1000

What are forex brokers

In the past, only large international financial institutions were allowed to trade currencies, but with the introduction of online forex brokers, i.E. Forex trading platforms, individuals are also given an opportunity to invest and increase their capital by trading currencies. Basically, a forex broker is a company which provides a platform for individuals who like to engage in speculative trading of currencies. This type of forex trading, where individuals get to trade via a platform is also known as ‘retail forex trading’, a term used to distinguish it from the more traditional type of forex trading. Even though it appeared only about 20 years ago, online forex trading is now a huge market and recent reports show that the daily trading turnover in 2016 was over $280 billion. There are numerous forex brokers that offer forex trading services to individuals all over the world.

The basic definition of the word broker is ‘someone who sells products or services on behalf of other people’. And that is pretty much true for forex brokers. They buy and sell currencies on your behalf. Unlike conventional brokers that you’ve surely seen in wall street themed movies, you don’t have to call this brokers and they don’t have to be at a particular place in order to trade.

How to choose a forex broker

There are more than few forex brokers that operate online, in fact there are dozens of them.

Choosing the best online forex broker, isn’t always easy, especially since almost every forex trader seems to be the bets. But, you shouldn’t worry, as there are ways to determine which forex broker is trustworthy and reliable.

Licencing

The legal aspect is primary here. You definitely can’t trust a forex broker which isn’t licensed and regulated. Even if their offer looks good and everything seems appealing, you shouldn’t trust a company that lacks appropriate certification. Different countries have different legislation and standards which are applied to forex brokers and their operations. The first step for every trader is to make sure that the forex broker has the appropriate licence and is completely legal.

Currency pairs

There are multiple currencies in the world, but not all of them have the same reputation and not all of them are equally traded. Typically, the american dollar is one of the most interesting currencies.

In addition to the american dollar, there are 7 other currencies which are rated highly:

- Euro (€) – EUR

- Pound sterling (£) – GBP

- Australian dollar ($) – AUD

- New zealand dollar ($) – NZD

- Canadian dollar ($) – CAD

- Swiss franc (fr) – CHF

- Japanese yen (¥) – JPY

A pair consisted of one of the currencies listed above and the USD is called a major. The majors are the most frequently traded pairs and these pairs constitute 85% of the total forex trading on the market. Other, lower-rated currencies are usually paired with the USD and such a pair is called a minor. When a lower-rated currency is paired with the currency other than the US dollar, that pair is called a currency cross, or just a cross.

The number of currency pairs which are offered by a forex brokers is one of the key criteria for establishing the reputation of the brokers. Brokers that offer a larger number of currency pairs should be preferred over ones that offer fewer pairs. Most brokers offer all majors, as well as a number of minors and crosses. If you’re looking to trade a particular pair, then you should definitely check whether the broker in question offers that pair. On the other hand, if you’re looking to trade only the majors, there are other things which you should take into consideration.

Leverage and lot size

Leverage in forex trading is used as a means to provide higher profits which are derived from the changes in the exchange rates of the two respectively paired currencies. In fact, it might be simplest to describe it as a loan provided by the broker to the investor. The leverage may vary, it can be 50:1, 100:1 or even 200:1. Higher leverage provides you with a chance of earning more money through trading, but it also means taking larger risks. Traders that have a higher understanding on the market will be looking for higher leverage.

As you don’t buy the actual currency units, but you actually invest in the expected fluctuation of how two currencies are paired against each other, the traders actually trade larger unit blocks, called lot sizes. A lot size is the number of currency units which are traded. The lot size may be 100, 1,000 or even 10,000 units of the second currency in the pair. It would be wiser to look for a forex broker that offers a variety of lot sizes, including smaller ones which are perfect for traders who are new to forex trading and don’t want to risk large amounts of money.

Market spread

Forex brokers allow you to trade the currency pairs you want and make a profit. The have to make a profit as well, though. Most forex brokers don’t charge any fees, so that you won’t have any initial expenses, but they make their profit through the market spread.

- The spread is the difference between the two positions, which are the buy (bid) and the sell (ask) position. Higher spreads allow brokers to make bigger profits, but they are less favourable for the traders.

The spread percentage is very important, and if you’re looking for a forex trader, it would be wise to choose one that offers lower spreads.

Sometimes, forex traders don’t offer the same spread on different currencies. Usually for large currencies, that take are traded more frequently, the spread will be lower, whereas for smaller currencies, and currencies with a larger volatility the spread will be higher.

Trading platforms

We have already mentioned that the emergence of forex trading was enabled by the internet. Forex brokers may offer different sorts of trading platforms, downloadable, web-based and from few years ago mobile trading platforms. It all boils down what is more convenient for you as a trader.

Some mobile apps for example, include only some of the features that are offered in the desktop version, whereas other include more options. Moreover, some forex traders offer more than one platform, and each of them may include different elements. It is best to look for a forex broker that offers both a platform for traders who aren’t very experienced. Those platforms are usually easier to use and a lot more user-friendly.

Payment methods

Forex brokers usually offer their customers more than one payment method that will enable them to fund their trading accounts. Some brokers charge fees on deposits and/or withdrawals, whereas with others no extra fees will be charge, other than the ones applied by the provider of the financial service. The deposit and withdrawal limits may differ. The principle here is simple, the brokers that provide more methods and don’t charge any fees have a definite advantage over those that offer a limited amount of payment methods and charge fees on deposits and withdrawals.

Bonuses, training materials and support

As there is a pretty large competition on the forex broker market and multiple companies provide forex trading to customers all over the world, brokers are looking for ways to attract new customers, while also trying to keep their existing ones.

- Bonuses

- Training materials

- Customer support

These three are also very important parts of the overall offer of every forex broker, in conjunction, of course, with the pairs, leverage and market spread.

The types of bonuses that are offered may vary. Many brokers offer a welcome bonus, where traders get additional funds, on top of the ones that they deposited. Some brokers offer bonus funds even before the traders make their first deposit.

Some traders are new to forex trading and that is why it is only fair for brokers to provide them with the necessary learning materials that will help them improve their understanding of the market fluctuations and forex trading as a whole. Many brokers allow traders to open a demo account, which will allow them to simulate forex trading without any risk of losing real money. In addition, e-books, videos and even webinars on forex trading are also provided.

Customer support is an important aspect for every service industry and forex brokers aren’t excluded. Help is provided via phone, email and live chat and most brokers’ websites have an FAQ section which provides answers to specific questions.

Why trade forex online?

There are many reasons why you should seriously consider placing forex trades online, and if you are new to this environment it can often be something of a confusing forex trading environment at first, as there are many different currencies that can be paired together and lots of different trading platforms to choose from.

However, do remember that if you do decide to trade forex online then at no point in time are you having to actually buy the two currencies you are trading against each other and therefore your costs of becoming a forex trader are massively reduced.

When you chose to trade at any of our top 10 forex brokers you are only going to be placing a trade on which way you think one currency is going to move against another, and as such your leverage is far greater online.

Imagine the fuss and hassle involved with having to first buy one currency, and then if it moves in the direction you want it to then finding somewhere to sell that currency to and then buy the other one! Those days are long gone now and you really are going to be amazed at all of the next generation of forex brokers listed and fully reviewed throughout this website!

The respective financial authorities of every countries provide licences under which forex brokers are allowed to operate and offer their services to citizens of that particular country.

Forex trading is legal in most countries of the world, even if the country doesn’t have a financial authority who issues licences.

Yes, forex brokers are able to offer services outside the country they’re based in. Some countries would require a broker to obtain a licence, others will allow them to operate under a licence issued elsewhere. It really depends on the local laws.

Many forex brokers also offer contract-for- difference (CFD), commodities, as well as stocks and indices and it is possible for traders to use one account for all of them.

They are usually open the whole time, but when it comes to trading, it is offered monday through friday. The starting hour on monday and the closing hour on friday depends on the pair in question.

Most forex brokers have a deposit limit. The specific limit depends on your choice of currency, but usually it isn’t very high.

Licenced forex brokers comply with all financial standards and security measures that are employed by the world’s leading financial institutions. Encryption technology is used to ensure that no third parties will be allowed to access customers’ financial information and the customers’ details are not handed to third parties. Most reliable companies, keep their customers’ trading funds in a separate account, to ensure that they won’t be lost no matter what.

Some forex brokers allow their customers to open multiple trading accounts, but they are advised to use the same personal details for each of them.

Yes, all forex traders require customers to provide identity verification documents, either when they register or when they’re about to make their first withdrawal. Most forex brokers would require you to present a proof of identity and a proof residency, so they can confirm that you are who you claim to be and that you are legally allowed to trade forex.

Yes, there are no legal limits on the number of forex trading accounts that may be opened in your name. As long as you are legally allowed to have one account, you are also able to have as many as you want.

Yes, you can trade any of the forex pairs that are offered by the broker, not just pairs that include your preferred currency/ the currency of your country.

So, let's see, what we have: find out our top 7 of the best US forex brokers. Discover the best trustworthy US brokers to trade forex in the USA. Click here now! At brokers for forex trading

Contents of the article

- Top forex bonuses

- Top 7 of best US forex brokers for 2021

- Is forex trading legal in the USA?

- How to trade forex in the USA

- Top 7 forex brokers in the USA listing for 2021

- Top 10 forex brokers and trading platforms to...

- What are forex brokers

- How to choose a forex broker

- Licencing

- Currency pairs

- Leverage and lot size

- Market spread

- Trading platforms

- Payment methods

- Bonuses, training materials and support

- Why trade forex online?

- The best U.S. Forex brokers

- Top 5 US forex brokers 2020

- Best brokers for day trading

- The best brokers for day traders feature speed...

- Best online brokers for day trading:

- Interactive brokers: best broker for day trading,...

- Fidelity: best low-cost day trading platform

- How day traders use their online broker

- Are you a day trader?

- Best online brokers for forex trading in january...

- Here are the best online brokers for forex...

- What to consider when choosing a forex broker

- Overview: top online forex brokers in january 2021

- What does forex trading cost in 2020?

- The forex trading costs are depending on the...

- How the forex broker earns money from the spread?

- The commission fees explained

- Financing of your trading position: the swap for...

- Pay fewer fees with a good forex broker

- FCA flags city FX broker as unauthorized forex...

- FCA warns against city FX broker

- So you need to be wary

- Brokers for forex trading

- Forex trading accessibility for everyone

- Why choose forex trading with octafx

- Top 10 forex brokers and trading platforms to...

- What are forex brokers

- How to choose a forex broker

- Licencing

- Currency pairs

- Leverage and lot size

- Market spread

- Trading platforms

- Payment methods

- Bonuses, training materials and support

- Why trade forex online?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.