Fx online trading

Let’s create a trading plan that will help you stay on track and meet your goals.

Top forex bonuses

*based on client assets per the 2019 monthly retail forex obligation reports published by the CFTC

Trade with the no. 1 broker in the US for forex trading*

Why are traders choosing FOREX.Com?

No. 1 FX broker in the US*

We have served US traders for over 18 years.

Trade 80+ FX pairs, and gold & silver

Global opportunities 24/5 with flexible trade sizes.

EUR/USD as low as 0.2

Trade your way with flexible pricing options including spread only, spread + fixed commission, or STP pro.

*based on client assets per the 2019 monthly retail forex obligation reports published by the CFTC

Financial strength you can depend on

Your FOREX.Com account gives you access to our full suite of downloadable, web, and mobile apps.

Get 20 free, easy to install eas and custom indicators when you open a metatrader live or demo account.

* based on active metatrader servers per broker, apr 2019.

Reward yourself with our active trader program

- Save up to 18% with cash rebates as high as $9 per million traded

- Interest paid up to 1.5% on your average daily available margin balance

- Get guidance and priority support from your dedicated market strategist

- No bank fees for wires

- Access to exclusive events and product previews

Open an account in as little as 5 minutes

Tell us about yourself

Fund your account

Start trading

Ready to learn about forex?

New trader?

Welcome, we’ll show you how forex works and why you should trade it.

Have some experience?

Let’s create a trading plan that will help you stay on track and meet your goals.

Want to go deep on strategy?

Great, we have guides on specific strategies and how to use them.

Not sure where to start?

Take our short quiz and get matched resources that fit your trading style.

WELCOME TO

24 hours

customer service

We are always there for you when you need us.

Experienced trade experts

With over 10 years of experience in various financial markets

Massive income

Binary options

Market analytics

Market analytics

Customer insights

Customer insights

What we do

We are experts in this industry with over 10 years of experience. What that means is you are going to get the right solution.

World coverage

Providing services in 99% of the countries around the globe

Strong security

Your transactions with us is safe and secured.

Cost efficiency

Full payment of investment capital

We are global

About us & FAQ's

We provide the easiest and most purchased effective binary options and market trades for individuals to start their future investment and binary trading management journey. Our solution is easy to understand, safe investment, user friendly interface and offers a great ROI. This is the currency of the future and our job is to make it accessible to everyone..

How can I invest with coinfxonlinetrading.Com?

To make an investment, you must first become a member of coinfxonlinetrading.Com. Once you have signed up, then you need to purchase bitcoin and make deposit with the wallet address in the members dashboard. Copy the wallet address in your profile and make your deposit with it.

How do I open my coinfxonlinetrading.Com account?

It's quite easy and convenient. Follow this link , fill in the registration form and then press "register".

How can I make withdrawals?

Login to your account using your username and password and click on the withdraw button to make withdrawal.

Testimonials

John dickson

I was literally BLOWN AWAY by the company work! They went above and beyond all of our expectations with design, usability. And transparency, I will reccommend them to everyone I know!

Janet west

Coinfxonlinetrading is the award winning trade platform for cryptocurrency trading and effective customer service delivery. I am highly satisfied in using this broker and will always recommend it.

Angelina brook

I could not stop staring! Coinfxonlinetrading are by far the most elegant trading solutions, you can't beat their quality and attention to detail!

Fx online trading

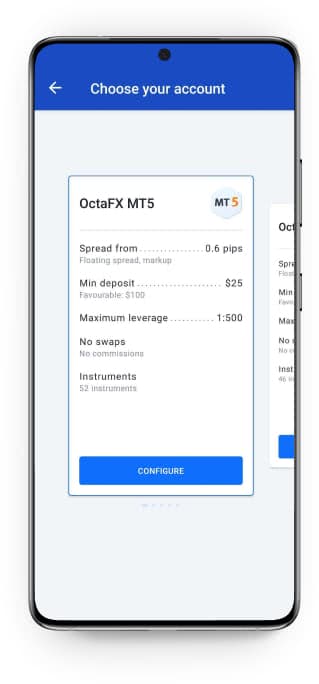

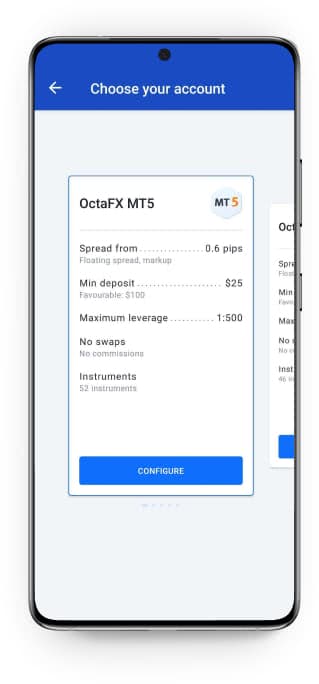

- Language support: bengali, chinese, english, hindi, indonesian, malay, portuguese, spanish, thai

- Create trading accounts, modify leverage, enable swap-free options, edit and restore passwords

- Make deposits and withdrawals using the most popular payment options

- View your detailed overall or account operation history, apply convenient filters to it and cancel your previous deposit

- Start trading in a compatible trading platform app

- Top up your demo account

- View contest statistics and access your contest accounts

- Activate bonuses and view statistics on active and completed bonuses

get it on

Forex trading accessibility for everyone

Octafx - one of the best forex brokers on the market, for traders all round the world. Octafx offers access to CFD trading, commodity trading and indices trading with award-winning forex trading conditions. As well as access to the forex market, octafx offers a variety of promotions that can help you:

50% bonus on deposit

Negative balance protection

Why choose forex trading with octafx

Octafx forex broker ensures reliable forex trading conditions to provide traders of all skill levels with an opportunity to earn more. This is possible due to:

- No commissions on deposits and withdrawals

- No swaps

- No slippage

- No delays

Master the forex markets

And build a legacy for your life.

Current members

Chat members

JOBS QUIT

45612

Trades taken

BEGIN YOUR JOURNEY

FXCO academy

FXCO academy provides you the tools & resources necessary to achieve mastery in the forex markets utilizing the powerful jackpot strategy. Whether you aim to become an empowered and self sufficient trader, or you’re chasing pursuit of a passionate, purpose driven life, FXCO academy serves as an educational foundation to get you there.

We show you A-Z everything you need to become a successful career trader, from learning the basic fundamentals, to advanced multi-market analysis and jackpot strategy execution. Thousands, from all walks of life, have decided to take the leap – and they’ve never looked back. Are you ready to step into change?

BEGIN YOUR JOURNEY

FXCO academy

FXCO academy provides you the tools & resources necessary to achieve mastery in the forex markets utilizing the powerful jackpot strategy. Whether you aim to become an empowered and self sufficient trader, or you’re chasing pursuit of a passionate, purpose driven life, FXCO academy serves as an educational foundation to get you there.

We show you A-Z everything you need to become a successful career trader, from learning the basic fundamentals, to advanced multi-market analysis and jackpot strategy execution. Thousands, from all walks of life, have decided to take the leap – and they’ve never looked back. Are you ready to step into change?

Mentorship

As a diamond or platinum level member of FXCO academy, you receive exclusive 1-on-1 mentorship from the founders themselves. You get hours of in-depth, hands on training where you will you learn & master the jackpot™ trading strategy, ask any question you need, and get valuable feedback in real time. Not only will you have this key advantage over other members, you will develop full confidence in your ability to trade without assistance, so you can start earning even sooner. Join FXCO academy as a diamond or platinum member today!

Meet the founders

Founder

Alonzo

Founder

Our mission

Is to provide you the tools necessary to achieve financial prosperity through high level education and personal engagement. We believe every individual has the power to tap into unrealized potential and become the best version of themselves. Your success is our #1 priority, now let’s work together and make it happen.

Bringing wall street to main street

Our mission

Is to provide you the tools necessary to achieve financial prosperity through high level education and personal engagement. We believe every individual has the power to tap into unrealized potential and become the best version of themselves. Your success is our #1 priority, now let’s work together and make it happen.

FXCO academy

Account

Policies

$40 OFF silver membership

$60 OFF gold membership

Automatically applied at checkout.

Terms and conditions

The terms and conditions contained herein including the privacy policy which is incorporated by reference as if fully set forth herein (to be read in combination and referred to herein in their entirety as “the agreement”) shall be binding on each and every customer who accesses fxcapitalonline.Co and shall inure in the benefit of fxcapital online, LLC d/b/a fxcapitalonline.Co (“company”) and company’s successors and assigns AND (2) SUPERSEDE AND REPLACE ANY INCONSISTENT STATEMENT IN ANY OF OUR MATERIALS, ADVERTISEMENTS OR WEBSITES.

THESE TERMS AND CONDITIONS ARE LEGALLY BINDING ON YOU WITH RESPECT TO ANY “TRANSACTION” AS THAT TERM IS DEFINED BELOW. BY ACCESSING THE SERVICE, YOU AGREE TO THESE TERMS AND CONDITIONS AS A PREREQUISITE TO ANY OF THE AFOREMENTIONED ACTIVITIES WITH US.

The terms “you” and “your” refer to the person(s) or entity wishing to purchase the company materials (collectively hereinafter referred to as “materials”), as well as accessing or using our websites and providing us with your personal information. (collectively hereinafter referred to as “transaction”). “we”, “our”, and “us” refer to company and its employees, agents, members, owners, directors, officers, successors and assigns. By using our services and/or purchasing our materials, you agree to the terms and conditions set forth herein.

Eligibility:

By using the website or services, you represent and warrant that you are at least 18 years old, a resident of the united states, and are otherwise legally qualified to enter into and form contracts under applicable law. This agreement is void where prohibited.

Method of payment and refund policy:

The company offers its materials for a one-time payment. For these materials, a valid debit or credit card will be required to complete the purchase, and the amount of the purchase will be charged to the debit or credit card concurrently with the completion of the purchase on the website.

When you purchase an individual product, you will receive a streaming or digital version; no physical copies of products or other materials will be shipped or provided to you.

All payments made to the company in connection with the materials purchased are non-refundable; and the company does not offer, and is not required to provide, any refunds or credits for any reason, including, without limitation, satisfaction of the materials. There is no circumstance in which you will be entitled to, or the company is required to provide, a refund or credit for any reason, including, without limitation, satisfaction of the materials.

Trading forex carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade forex, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of any initial investment. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Any opinions, research, analyses, prices, or other information contained in the materials is provided as general market commentary and does not constitute investment advice and is subject to change at any time without notice. Any opinions, research, analyses, prices, or other information contained in the materials are for the sole purpose of assisting traders to make independent investment decisions. The company has taken reasonable measures to ensure the accuracy of the information on the website; however, it does not guarantee accuracy and will not accept liability for any loss or damage which may arise directly or indirectly from the content or from your inability to access the website, or for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this website. The company will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

This site is not intended for distribution or use by any person in any country where such distribution or use would be contrary to local law or regulation. None of the services or investments referred to in this website are available to persons residing in any country where the provision of such services or investments would be contrary to local law or regulation. It is the responsibility of visitors to this website to ascertain the terms of and comply with any local law or regulation to which they are subject.

The company may express or utilize testimonials or descriptions of past performance, but such items are not indicative of future results or performance, or any representation, warranty or guaranty that any result will be obtained by you. Your results may differ materially from those expressed or utilized by us due to a number of factors.

COMMODITY FUTURES TRADING COMMISSION RULE 4.41: hypothetical performance results have many inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those being shown.

Electronic communication and signature:

FOR PURPOSES OF THE TRANSACTION, YOU HEREBY AGREE TO THE USE OF ELECTRONIC SIGNATURES, RECEIPT OF NOTICES BY E-MAIL, USE OF ELECTRONIC CONTRACTS, AND TO ACCEPT THESE TERMS AND CONDITIONS BY ELECTRONIC MEANS. YOU AGREE THAT CLICKING THE SUBMIT BOX AT THE END OF THE OUR GET STARTED FORM CONSTITUTES YOUR ELECTRONIC SIGNATURE.

YOU AGREE AND CONSENT TO BE CONTACTED BY THE US, OUR AGENTS, EMPLOYEES, AFFILIATES, VENDORS, AND RELATED THIRD-PARTIES THROUGH THE USE OF EMAIL, AND/OR TELEPHONE CALLS AND/OR SMS/MMS TEXT MESSAGES TO YOUR CELLULAR, HOME OR WORK NUMBERS, AS WELL AS ANY OTHER TELEPHONE NUMBER YOU HAVE PROVIDE IN CONJUNCTION WITH A TRANSACTION, INCLUDING THE USE OF AUTOMATIC TELEPHONE DIALING SYSTEMS, AUTODIALERS, OR AN ARTIFICIAL OR PRERECORDED VOICE.

Limitation of liability:

BY AGREEING TO THESE TERMS AND CONDITIONS AND/OR ENGAGING IN A TRANSACTION WITH US, YOU AGREE AND UNDERSTAND THAT THE LEGAL LIMIT OF OUR LIABILITY TO YOU FOR ANY CLAIM, LAWSUIT, ACTION, DISPUTE, CONTROVERSY OR OTHER MATTER YOU MAY ASSERT AGAINST US SHALL NOT EXCEED THE COST OF THE MATERIALS YOU PURCHASED AND UNDERSTAND THAT WE WILL NOT BE LIABLE FOR ANY MONETARY, INCIDENTAL, SPECIAL, INDIRECT, CONSEQUENTIAL, OR PUNITIVE, OR OTHER SIMILAR DAMAGES, INCLUDING, WITHOUT LIMITATION, LOST INCOME, REVENUE, PROFIT OR OPPORTUNITY, WHETHER OR NOT FORESEEABLE AND HOWEVER ARISING AND WHETHER BASED IN CONTRACT, EQUITY, TORT, STATUTE, STRICT LIABILITY, OR ANY OTHER THEORY OF LIABIILTY. WE EXPRESSLY DISCLAIM ALL WARRANTIES, REPRESENTATIONS OR GUARANTEES, WHETHER EXPRESS OR IMPLIED, THAT ARE NOT EXPRESSLY STATED HEREIN. EXCEPT AS EXPRESSLY PROVIDED HEREIN, WE DISCLAIM ALL, AND WILL HAVE NO, AND ASSUME NO LIABILITY, WHETHER ARISING IN CONNECTION WITH A TRANSACTION, OUR WEBSITE(S) OR ANY MATERIALS PROVIDED BY US, OR FOR ANY OTHER REASON, INCLUDING, WITHOUT LIMITATION, OUR OWN INTENTIONAL, ACCIDENTAL OR NEGLIGENT ACTS OR OMISSIONS.

Headings in these terms and conditions are for convenience only and shall not be used to interpret or construe the same.

The invalidity, in whole or in part, of any provision of these terms and conditions shall not affect the validity of the remainder of the provisions of the terms and conditions

These terms and conditions are intended to confer rights and benefits only on the parties and categories of individuals and entities related to us that are referenced herein and are not intended to confer any right or benefit upon any other person or entity.

Links to third-party sites are provided for your convenience. Such sites are not within our control and may not follow the same privacy, security, or accessibility standards as ours. The company neither endorses nor guarantees offerings of the third-party providers, nor is the company responsible for the security, content or availability of third-party sites, their partners or advertisers.

Applicable law, waiver of jury trial, and agreement to arbitrate:

We expressly reserve the right modify these terms and conditions, as well as any transaction or other agreement with us to comply with applicable state or federal law. You agree that any transaction or other agreement you enter into with us shall be construed and enforced in accordance with and governed by the laws of the state of florida and applicable federal law, without reference to or application of florida’s conflict of law principles. YOU EXPRESSLY AGREE THAT ANY CLAIMS, LAWSUITS, ACTIONS, OR DISPUTES AGAINST COMPANY MUST BE EXCLUSIVELY FILED AND TAKE PLACE IN THE STATE OR FEDERAL COURTS LOCATED IN MIAMI-DADE COUNTY, BROWARD COUNTY, OR PALM BEACH COUNTY, FLORIDA, USA and you expressly agree that any such court has personal jurisdiction over you. You waive all defenses of lack of personal jurisdiction and forum non-convenience.

CLICKING ON THE SUBMIT BOX AT THE END OF THE OUR “GET STARTED” FORM CONSTITUTES YOUR ELECTRONIC SIGNATURE AND AGREEMENT TO THESE TERMS AND CONDITIONS AND THAT YOU AGREE AND ACKNOWLEDGE THAT YOU HAVE CAREFULLY READ AND UNDERSTOOD ALL THE TERMS AND CONDITIONS.

Forex trading: A beginner's guide

Forex is a portmanteau of foreign currency and exchange. Foreign exchange is the process of changing one currency into another currency for a variety of reasons, usually for commerce, trading, or tourism. According to a recent triennial report from the bank for international settlements (a global bank for national central banks), the average was more than $5.1 trillion in daily forex trading volume.

Key takeaways

- The foreign exchange (also known as FX or forex) market is a global marketplace for exchanging national currencies against one another.

- Because of the worldwide reach of trade, commerce, and finance, forex markets tend to be the largest and most liquid asset markets in the world.

- Currencies trade against each other as exchange rate pairs. For example, EUR/USD.

- Forex markets exist as spot (cash) markets as well as derivatives markets offering forwards, futures, options, and currency swaps.

- Market participants use forex to hedge against international currency and interest rate risk, to speculate on geopolitical events, and to diversify portfolios, among several other reasons.

What is the forex market?

The foreign exchange market is where currencies are traded. Currencies are important to most people around the world, whether they realize it or not, because currencies need to be exchanged in order to conduct foreign trade and business. If you are living in the U.S. And want to buy cheese from france, either you or the company that you buy the cheese from has to pay the french for the cheese in euros (EUR). This means that the U.S. Importer would have to exchange the equivalent value of U.S. Dollars (USD) into euros. The same goes for traveling. A french tourist in egypt can't pay in euros to see the pyramids because it's not the locally accepted currency. As such, the tourist has to exchange the euros for the local currency, in this case the egyptian pound, at the current exchange rate.

One unique aspect of this international market is that there is no central marketplace for foreign exchange. Rather, currency trading is conducted electronically over-the-counter (OTC), which means that all transactions occur via computer networks between traders around the world, rather than on one centralized exchange. The market is open 24 hours a day, five and a half days a week, and currencies are traded worldwide in the major financial centers of london, new york, tokyo, zurich, frankfurt, hong kong, singapore, paris and sydney—across almost every time zone. This means that when the trading day in the U.S. Ends, the forex market begins anew in tokyo and hong kong. As such, the forex market can be extremely active any time of the day, with price quotes changing constantly.

A brief history of forex

Unlike stock markets, which can trace their roots back centuries, the forex market as we understand it today is a truly new market. Of course, in its most basic sense—that of people converting one currency to another for financial advantage—forex has been around since nations began minting currencies. But the modern forex markets are a modern invention. After the accord at bretton woods in 1971, more major currencies were allowed to float freely against one another. The values of individual currencies vary, which has given rise to the need for foreign exchange services and trading.

Commercial and investment banks conduct most of the trading in the forex markets on behalf of their clients, but there are also speculative opportunities for trading one currency against another for professional and individual investors.

Spot market and the forwards & futures markets

There are actually three ways that institutions, corporations and individuals trade forex: the spot market, the forwards market, and the futures market. Forex trading in the spot market has always been the largest market because it is the "underlying" real asset that the forwards and futures markets are based on. In the past, the futures market was the most popular venue for traders because it was available to individual investors for a longer period of time. However, with the advent of electronic trading and numerous forex brokers, the spot market has witnessed a huge surge in activity and now surpasses the futures market as the preferred trading market for individual investors and speculators. When people refer to the forex market, they usually are referring to the spot market. The forwards and futures markets tend to be more popular with companies that need to hedge their foreign exchange risks out to a specific date in the future.

More specifically, the spot market is where currencies are bought and sold according to the current price. That price, determined by supply and demand, is a reflection of many things, including current interest rates, economic performance, sentiment towards ongoing political situations (both locally and internationally), as well as the perception of the future performance of one currency against another. When a deal is finalized, this is known as a "spot deal." it is a bilateral transaction by which one party delivers an agreed-upon currency amount to the counter party and receives a specified amount of another currency at the agreed-upon exchange rate value. After a position is closed, the settlement is in cash. Although the spot market is commonly known as one that deals with transactions in the present (rather than the future), these trades actually take two days for settlement.

Unlike the spot market, the forwards and futures markets do not trade actual currencies. Instead they deal in contracts that represent claims to a certain currency type, a specific price per unit and a future date for settlement.

In the forwards market, contracts are bought and sold OTC between two parties, who determine the terms of the agreement between themselves.

In the futures market, futures contracts are bought and sold based upon a standard size and settlement date on public commodities markets, such as the chicago mercantile exchange. In the U.S., the national futures association regulates the futures market. Futures contracts have specific details, including the number of units being traded, delivery and settlement dates, and minimum price increments that cannot be customized. The exchange acts as a counterpart to the trader, providing clearance and settlement.

Both types of contracts are binding and are typically settled for cash at the exchange in question upon expiry, although contracts can also be bought and sold before they expire. The forwards and futures markets can offer protection against risk when trading currencies. Usually, big international corporations use these markets in order to hedge against future exchange rate fluctuations, but speculators take part in these markets as well.

Note that you'll often see the terms: FX, forex, foreign-exchange market, and currency market. These terms are synonymous and all refer to the forex market.

Forex for hedging

Companies doing business in foreign countries are at risk due to fluctuations in currency values when they buy or sell goods and services outside of their domestic market. Foreign exchange markets provide a way to hedge currency risk by fixing a rate at which the transaction will be completed.

To accomplish this, a trader can buy or sell currencies in the forward or swap markets in advance, which locks in an exchange rate. For example, imagine that a company plans to sell U.S.-made blenders in europe when the exchange rate between the euro and the dollar (EUR/USD) is €1 to $1 at parity.

The blender costs $100 to manufacture, and the U.S. Firm plans to sell it for €150—which is competitive with other blenders that were made in europe. If this plan is successful, the company will make $50 in profit because the EUR/USD exchange rate is even. Unfortunately, the USD begins to rise in value versus the euro until the EUR/USD exchange rate is 0.80, which means it now costs $0.80 to buy €1.00.

The problem the company faces is that while it still costs $100 to make the blender, the company can only sell the product at the competitive price of €150, which when translated back into dollars is only $120 (€150 X 0.80 = $120). A stronger dollar resulted in a much smaller profit than expected.

The blender company could have reduced this risk by shorting the euro and buying the USD when they were at parity. That way, if the dollar rose in value, the profits from the trade would offset the reduced profit from the sale of blenders. If the USD fell in value, the more favorable exchange rate will increase the profit from the sale of blenders, which offsets the losses in the trade.

Hedging of this kind can be done in the currency futures market. The advantage for the trader is that futures contracts are standardized and cleared by a central authority. However, currency futures may be less liquid than the forward markets, which are decentralized and exist within the interbank system throughout the world.

Forex for speculation

Factors like interest rates, trade flows, tourism, economic strength, and geopolitical risk affect supply and demand for currencies, which creates daily volatility in the forex markets. An opportunity exists to profit from changes that may increase or reduce one currency's value compared to another. A forecast that one currency will weaken is essentially the same as assuming that the other currency in the pair will strengthen because currencies are traded as pairs.

Imagine a trader who expects interest rates to rise in the U.S. Compared to australia while the exchange rate between the two currencies (AUD/USD) is 0.71 (it takes $0.71 USD to buy $1.00 AUD). The trader believes higher interest rates in the U.S. Will increase demand for USD, and therefore the AUD/USD exchange rate will fall because it will require fewer, stronger USD to buy an AUD.

Assume that the trader is correct and interest rates rise, which decreases the AUD/USD exchange rate to 0.50. This means that it requires $0.50 USD to buy $1.00 AUD. If the investor had shorted the AUD and went long the USD, he or she would have profited from the change in value.

Currency as an asset class

There are two distinct features to currencies as an asset class:

- You can earn the interest rate differential between two currencies.

- You can profit from changes in the exchange rate.

An investor can profit from the difference between two interest rates in two different economies by buying the currency with the higher interest rate and shorting the currency with the lower interest rate. Prior to the 2008 financial crisis, it was very common to short the japanese yen (JPY) and buy british pounds (GBP) because the interest rate differential was very large. This strategy is sometimes referred to as a "carry trade."

Why we can trade currencies

Currency trading was very difficult for individual investors prior to the internet. Most currency traders were large multinational corporations, hedge funds or high-net-worth individuals because forex trading required a lot of capital. With help from the internet, a retail market aimed at individual traders has emerged, providing easy access to the foreign exchange markets, either through the banks themselves or brokers making a secondary market. Most online brokers or dealers offer very high leverage to individual traders who can control a large trade with a small account balance.

Forex trading: A beginner’s guide

Forex trading risks

Trading currencies can be risky and complex. The interbank market has varying degrees of regulation, and forex instruments are not standardized. In some parts of the world, forex trading is almost completely unregulated.

The interbank market is made up of banks trading with each other around the world. The banks themselves have to determine and accept sovereign risk and credit risk, and they have established internal processes to keep themselves as safe as possible. Regulations like this are industry-imposed for the protection of each participating bank.

Since the market is made by each of the participating banks providing offers and bids for a particular currency, the market pricing mechanism is based on supply and demand. Because there are such large trade flows within the system, it is difficult for rogue traders to influence the price of a currency. This system helps create transparency in the market for investors with access to interbank dealing.

Most small retail traders trade with relatively small and semi-unregulated forex brokers/dealers, which can (and sometimes do) re-quote prices and even trade against their own customers. Depending on where the dealer exists, there may be some government and industry regulation, but those safeguards are inconsistent around the globe.

Most retail investors should spend time investigating a forex dealer to find out whether it is regulated in the U.S. Or the U.K. (dealers in the U.S. And U.K. Have more oversight) or in a country with lax rules and oversight. It is also a good idea to find out what kind of account protections are available in case of a market crisis, or if a dealer becomes insolvent.

Pros and challenges of trading forex

Pro: the forex markets are the largest in terms of daily trading volume in the world and therefore offer the most liquidity. this makes it easy to enter and exit a position in any of the major currencies within a fraction of a second for a small spread in most market conditions.

Challenge: banks, brokers, and dealers in the forex markets allow a high amount of leverage, which means that traders can control large positions with relatively little money of their own. Leverage in the range of 100:1 is a high ratio but not uncommon in forex. A trader must understand the use of leverage and the risks that leverage introduces in an account. Extreme amounts of leverage have led to many dealers becoming insolvent unexpectedly.

Pro: the forex market is traded 24 hours a day, five days a week—starting each day in australia and ending in new york. The major centers are sydney, hong kong, singapore, tokyo, frankfurt, paris, london, and new york.

Challenge: trading currencies productively requires an understanding of economic fundamentals and indicators. A currency trader needs to have a big-picture understanding of the economies of the various countries and their inter-connectedness to grasp the fundamentals that drive currency values.

The bottom line

For traders—especially those with limited funds—day trading or swing trading in small amounts is easier in the forex market than other markets. For those with longer-term horizons and larger funds, long-term fundamentals-based trading or a carry trade can be profitable. A focus on understanding the macroeconomic fundamentals driving currency values and experience with technical analysis may help new forex traders to become more profitable.

FX online @ CIBC

Get the right tools to manage your business’ foreign exchange needs with FX online @ CIBC.

Designed for business clients with CIBC bank account(s), FX online lets you order foreign currency wires, send drafts and transfer funds between accounts — all conveniently from your desktop, laptop or tablet.

Access CIBC’s real-time exchange rates for approximately 200 currency pairs 1 to execute spot, forward (fixed-dated or open-dated contracts) and swaps out to one year 2 .

FX online makes foreign exchange easy

FX online is right for you if:

Sign on to FX online or apply now.

Foreign exchange services are provided by the canadian imperial bank of commerce, the parent bank of CIBC world markets inc.

CIBC’s foreign exchange disclosure statement relating to guidelines contained in the FX global code can be found at www.Cibccm.Com/fxdisclosure www.Cibccm.Com/f x disclosure. Opens a new window in your browser .

The above services are subject to the terms and conditions set out in any related product agreements, including without limitation, the electronic dealing agreement.

1 availability can change at any time and not all currency pairs are available in spot, forward and swap trading.

2 please note that a forward exchange line of credit (FEC) needs to be established before you can book a forward or swap. You must also be compliant with canadian regulatory reporting requirements for over the counter (OTC) derivatives. Under current regulatory trade reporting rules the forward contracts offered through FX online @ CIBC must be reported to a designated trade repository. As such, clients must (1) obtain a legal entity identifier (LEI) and (2) provide a representation letter to CIBC so that CIBC may assess how the canadian trade reporting rules apply to transactions entered into through FX online @ CIBC. For more details, contact us at 1-877-224-2239 opens your phone app. .

Fx online trading

- Language support: bengali, chinese, english, hindi, indonesian, malay, portuguese, spanish, thai

- Create trading accounts, modify leverage, enable swap-free options, edit and restore passwords

- Make deposits and withdrawals using the most popular payment options

- View your detailed overall or account operation history, apply convenient filters to it and cancel your previous deposit

- Start trading in a compatible trading platform app

- Top up your demo account

- View contest statistics and access your contest accounts

- Activate bonuses and view statistics on active and completed bonuses

get it on

Forex trading accessibility for everyone

Octafx - one of the best forex brokers on the market, for traders all round the world. Octafx offers access to CFD trading, commodity trading and indices trading with award-winning forex trading conditions. As well as access to the forex market, octafx offers a variety of promotions that can help you:

50% bonus on deposit

Negative balance protection

Why choose forex trading with octafx

Octafx forex broker ensures reliable forex trading conditions to provide traders of all skill levels with an opportunity to earn more. This is possible due to:

- No commissions on deposits and withdrawals

- No swaps

- No slippage

- No delays

Trade forex cfds with plus500

Trade the most popular forex pairs like EUR/USD, GBP/USD and EUR/GBP at plus500. Use our advanced trading tools to protect your profits and limit losses.

Trade on 60+ forex pairs with leverage

Trade forex with up to 1:300 leverage. With as little as $100 you can gain the effect of $30,000 capital!

Advanced trading tools

Use our trading tools such as stop loss, stop limit and guaranteed stop to limit losses and lock in profits. Get FREE real-time forex quotes and set indicators to easily analyse charts.

Easy account opening

Apply for an account in a few minutes, practice trading with our FREE unlimited demo account until you're ready to move to the next level.

Learn more about trading

What is forex?

Popular forex terms you should know

How to trade forex cfds

Basic forex trading strategies and indicators

What events impact forex trading?

Most popular forex pairs

Forex trading alerts

Crypto and forex

Why plus500?

Simple & intuitive platform

Authorised and regulated

Negative balance protection

What is forex and how does forex trading work?

Forex trading (also commonly known as foreign exchange, currency or FX trading) is a global market for trading one country’s currency in exchange for another country's currency. It serves as the backbone of international trade and investment: imports and exports of goods and services; financial transactions by governments, economic institutions or individuals; global tourism and travel – all these require the use of capital in the form of swapping one currency for a certain amount of another currency.

When trading forex cfds, you are essentially speculating on the price changes in their exchange rate. For example, in the EUR/USD pair the value of one euro (EUR) is determined in comparison to the US dollar (USD), and in the GBP/JPY pair the value of one british pound sterling (GBP) is quoted against the japanese yen (JPY).

If you think the exchange rate will rise you can open a ‘buy’ position. Conversely, if you think the exchange rate will fall you can open a ‘sell’ position.

To see a full list of currency pairs offered by plus500, click here.

What economic factors may affect forex rates?

Forex rates are impacted by an array of political and economic factors relating to the difference in value of a currency or economic region in comparison to another country's currency, such as the US dollar (USD) versus the offshore chinese yuan (CNH) – these are the currencies of the two largest economies in the world.

Among the factors that might influence forex rates are the terms of trade, political relations and overall economic performance between the two countries or economic regions. This also includes their economic stability (for example GDP growth rate), interest and inflation rates, production of goods and services, and balance of payments.

To learn more, use our economic calendar to find real-time data on a wide range of events and releases that affect the forex market.

How is trading forex different from trading the stock market?

The 4 main differences between trading forex and shares are:

- Trading volume – the forex market has a larger trading volume than the stock market.

- Instrument diversity – there are thousands of stocks to choose from, as opposed to several dozen currency pairs.

- Market volatility – stock prices can fluctuate wildly from one day to the next, and their fluctuations are generally sharper than the ones found in forex markets.

- Leverage ratios – the available leverage for forex cfds on the plus500 platform is 1:300, while the leverage for shares cfds is 1:300.

Please note that when trading forex or shares cfds you do not actually own the underlying instrument, but are rather trading on their anticipated price change.

What are the risks involved in forex trading?

Foreign exchange trading has a number of risks that you should be aware of before opening a position. These include:

- Risks related to leverage – in volatile market conditions, leveraged trading can result in greater losses (as well as greater capital gains).

- Risks related to the issuing country – the political and economic stability of a country can affect its currency strength. In general, currencies from major economies have greater liquidity and generally lower volatility than those of developing countries.

- Risks related to interest rates – countries’ interest rate policy has a major effect on their exchange rates. When a country raises or lowers interest rates, its currency will usually rise or fall as a result.

We offer risk management tools that can help you minimise your trading risks.

If you're ready to start trading forex with plus500, click here.

Fx online trading

Most traders start their forex career with hopes for getting rich, but is that truly possible? As with any type of investing there are risks of course, and the best way to get rich is to start with a large amount of capital. Forex trading can be a real struggle, and data shows that more than two-thirds of forex traders don’t make money in any given year. Yet of the one-third that do make money some are indeed getting rich. If that’s your hope too then be sure to safeguard your account by using stop-losses, limiting your leverage, and use a reputable forex broker like avatrade.

Avatrade offers a forex mini-account where you can start your trading journey with as little as $100. It’s an excellent way to become familiar with the markets, and to begin learning about your own trading style. You may not get rich, but you will get some valuable trading experience in live market conditions, and that can’t be replaced, even by demo trading. In addition to that you should begin to develop some profitable strategies for trading the forex markets. If you have limited funds starting out this way can be your entryway to some of the most exciting markets available.

Forex trading can be extremely difficult when you’re just getting started, but as time goes by and you gain more experience it becomes easier. The early difficulties are simply the learning curve as you come to understand the jargon, how to use the trading platforms, begin studying technical and fundamental analysis, and everything else that goes along with trading forex. As time goes by many of these things become second nature, and at this point forex trading becomes much less difficult. It might never become easy, but nothing worth having is ever easy, is it?

Open a FX trading account with avatrade and enjoy the benefits of an internationally regulated broker!

So, let's see, what we have: FOREX.Com offers forex & metals trading with award winning trading platforms, tight spreads, quality executions, powerful trading tools & 24-hour live support at fx online trading

Contents of the article

- Top forex bonuses

- Trade with the no. 1 broker in the US for forex...

- Why are traders choosing FOREX.Com?

- Financial strength you can depend on

- Reward yourself with our active trader program

- Open an account in as little as 5 minutes

- Ready to learn about forex?

- New trader?

- Have some experience?

- Want to go deep on strategy?

- Not sure where to start?

- WELCOME TO

- 24 hours customer service

- Experienced trade experts

- What we do

- We are global

- About us & FAQ's

- Testimonials

- Fx online trading

- Forex trading accessibility for everyone

- Why choose forex trading with octafx

- Master the forex markets

- Current members

- Chat members

- JOBS QUIT

- 45612

- Trades taken

- FXCO academy

- FXCO academy

- Mentorship

- Meet the founders

- Founder

- Alonzo

- Founder

- Our mission

- Bringing wall street to main street

- Our mission

- Is to provide you the tools necessary to achieve...

- FXCO academy

- Account

- Policies

- $40 OFF silver membership $60 OFF gold...

- Automatically applied at checkout.

- Terms and conditions

- Eligibility:

- Forex trading: A beginner's guide

- What is the forex market?

- A brief history of forex

- Spot market and the forwards & futures markets

- Forex for hedging

- Forex for speculation

- Currency as an asset class

- Why we can trade currencies

- Forex trading risks

- Pros and challenges of trading forex

- The bottom line

- FX online @ CIBC

- Fx online trading

- Forex trading accessibility for everyone

- Why choose forex trading with octafx

- Trade forex cfds with plus500

- Trade the most popular forex pairs like EUR/USD,...

- Trade on 60+ forex pairs with leverage

- Advanced trading tools

- Easy account opening

- Learn more about trading

- What is forex?

- Popular forex terms you should know

- How to trade forex cfds

- Basic forex trading strategies and indicators

- What events impact forex trading?

- Most popular forex pairs

- Forex trading alerts

- Crypto and forex

- Why plus500?

- What is forex and how does forex trading work?

- What economic factors may affect forex rates?

- How is trading forex different from trading the...

- What are the risks involved in forex trading?

- Fx online trading

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.