Broker forex malaysia

Minimum deposits with the broker start from just $1 reaching up to $1,000 depending on your account choice and although MYR deposits are unavailable, funding via wire transfer, credit card, and ewallet are all available.

Top forex bonuses

Every account can also be made swap-free where needed. The simple answer to this question is yes.

Top 9 best forex brokers in malaysia for 2021

Top rated:

Searching for a trading broker in malaysia?

With this collection of the best forex brokers the country has to offer. Here you are sure to find one that fits your trading needs.

Making your malaysia forex broker search as easy as possible starts with choosing from one of these top choices, any of which can be opened both quickly and easily.

Table of contents

Is forex trading legal in malaysia?

This is a very valid question and concern since not very long ago forex trading in malaysia was not legal.

Now however, the rules are changing.

You will find that officially within malaysia, the only legal regulation is that people can only register with a financial services company that is regulated within malaysia and compliant with the laws of the country.

With that said, given that forex trading is relatively new to malaysia, there are not yet any brokers that are regulated by the SCM (securities commission of malaysia).

With that said, trading as a malaysian forex trader is still not illegal and some of the forex brokers that we have listed provide the very best in terms of regulatory oversight from top-tier bodies such as cysec, the FCA, or ASIC.

How to trade forex in malaysia

If you want to trade forex within malaysia then the process is in fact quite straightforward since the regulations are still quite new and allow for no particular restrictions in terms of what a forex trader can do or what a broker can offer.

The only key steps beyond choosing the correct malaysian forex broker for you is to submit the relevant documents to begin trading. These will typically include your proof of ID and residency.

From there, you are ready to begin trading.

Top 10 best forex brokers in malaysia

Here is our collection of what we feel are the best malaysia broker choices for you as a forex trader:

1. Instaforex

Starting our list of the best forex brokers in malaysia is instaforex. They are a well-known and award winning broker particularly within asia having won more than 19 awards and counting related to being the “best broker in asia”.

Beyond this, they are also very well regulated by multiple regulatory bodies including the FCA, ASIC, and cysec. When it comes to account types you will have a total of 6 to choose from. Instaforex minimum deposits here range from a bargain $1 up to $1,000 depending on account type. The account types available include 2 cent accounts, a standard account, 2 ECN accounts, and a scalping account.

You can deposit MYR through wire transfer within local banks and you can also utilize a fully functioning demo account to try out the broker. This is ideal, in combination with really low-risk cent accounts to help new forex traders get to know the market.

Finally, an islamic account type is available though there is an additional fee that replaces the swap fee. Instaforex also offers 4 bonuses to traders. This includes a 100% first deposit bonus.

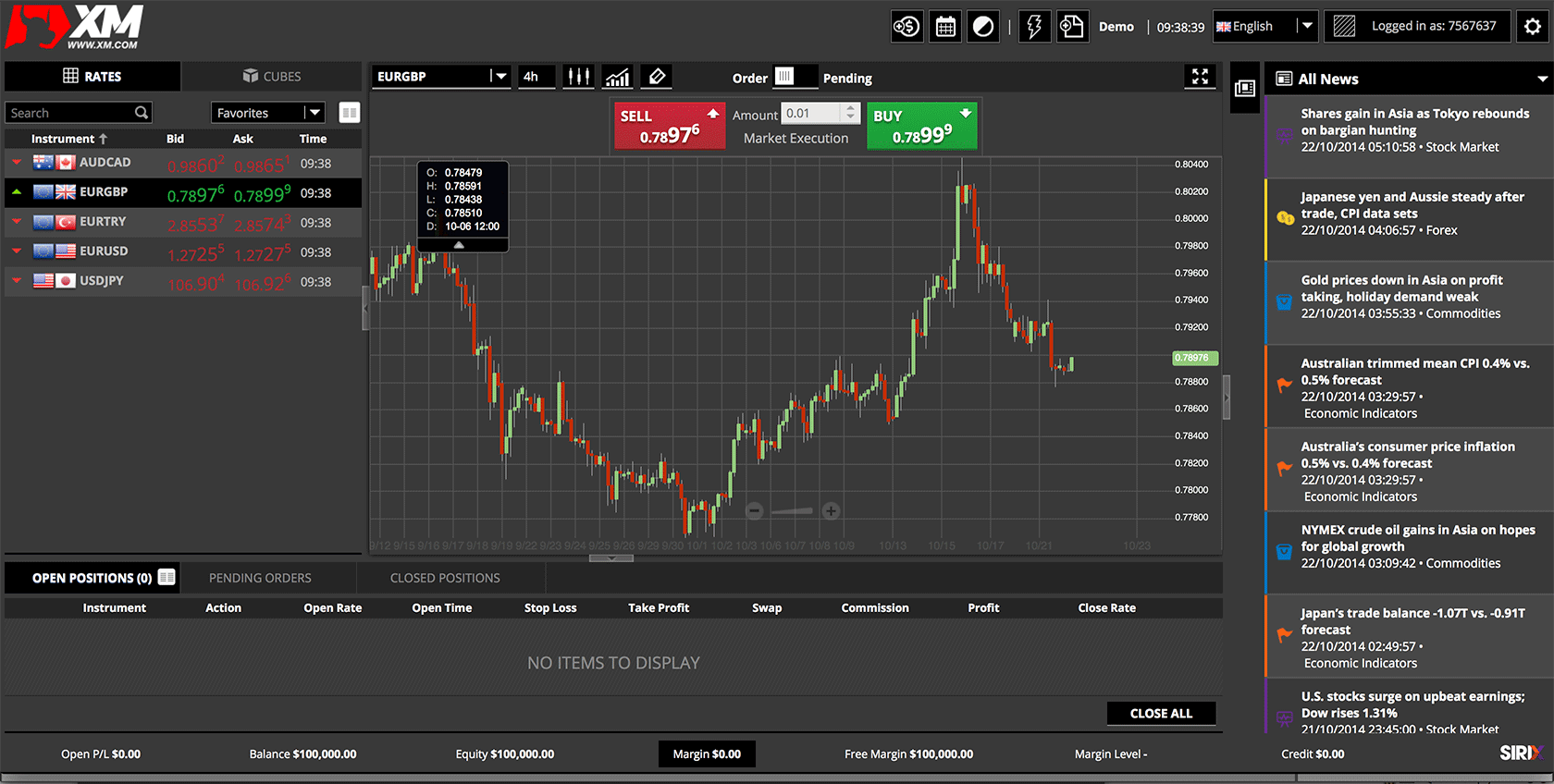

XM is renowned as one of the best forex brokers in the world and is available to malaysian forex traders. They are again regulated by some of the foremost authorities in the industry in the form of FCA, cysec, and ASIC. They were also awarded the “best forex broker in australasia” award along with numerous others.

Opening an XM account, you will be faced with a wide choice of 6 account types. Minimum deposits on these account types range from $5-$100 depending on account, or you can also opt for a shares account with a minimum deposit of $10,000. These deposits can be made through wire transfer, credit card, or ewallet although no MYR deposits are facilitated.

If you would like to try out the broker, you can avail of their full demo account. This, together with the XM micro account offers a great path to get into forex trading in malaysia and around the world.

Spreads at XM can start from as little as 0 pips in many cases, and the XM islamic account follows all of the same conditions of the regular accounts with no mark-ups, higher spreads, or additional commissions.

3. Octafx

Next in our collection of the top malaysian forex brokers is octafx. They are also regulated by two highly trusted regulatory bodies in the form of both the FCA in the UK and cysec in europe. They are reputed within the industry as offering some of the best swap-free services around. In fact, in 2015 they were recognized byb forextraders.Com as the “best forex islamic account” providers.

To that end, micro, ECN, and pro accounts are available with minimum deposits starting at $100 and reaching $500 for a pro account. It is also worth noting that every account is available as a swap-free account. The accounts utilize the top trading platforms of MT4, MT5, and ctrader.

MYR deposits are accepted and can be made through local banks, billplz, and help2pay services with an excellent exchange rate of 3 MYR per $1 USD available. Spreads also start from a highly competitive 0 pips across the board and the trading conditions feature no changes at all when it comes to islamic account trading.

In terms of octafx bonus offers, a 50% deposit bonus is made available on each deposit.

4. Hotforex

Hotforex is another globally recognized forex broker and top choice for you as a malaysian trader. They are well regulated by both cysec and ASIC and offer a wide choice of 6 forex account types to choose from.

Again here, this includes a micro trading account with a minimum deposit of only $5 ideal for new traders, a premium account with a $100 minimum, a zero spread account, and an auto trading account you can try for a minimum deposit of $200. If you are interested in copytrading this is available through hfcopy with a minimum of $100 deposit to copy, or $300 if you want others to copy your trades.

When it comes to deposits, MYR is available through local bank transfer. In other cases, you can use your major credit card or ewallet methods. Either way, a fully realistic demo account is accessible as is an islamic account where needed.

Spreads here start from a competitive 0 pips across the board although some additional fees may apply on islamic accounts. You can offset these through cash rebates, 100% bonuses, and the higher leverage that hotforex try to offer along with many real prize winning trading contests.

5. FBS

Next on the list of the best malaysian forex brokers is FBS. As with all of our brokers they are well-trusted and fully regulated by both cysec and the IFSC. This is an excellent broker with 5 account choices including a great cent account offering that may be just perfect for new traders. These account types also include an ECN account.

Minimum deposits with the broker start from just $1 reaching up to $1,000 depending on your account choice and although MYR deposits are unavailable, funding via wire transfer, credit card, and ewallet are all available. Every account can also be made swap-free where needed.

Although FBS do add an additional admin fee if you hold a position for more than 2 days with a swap-free account, this can be somewhat balanced by the fact they have a comprehensive bonus offering that includes a 100% deposit bonus and contests including some particularly aimed at islamic traders during ramadan.

6. Oanda

Oanda is one of the few brokers to be regulated in the USA by the CFTC as well as the NFA, and globally through the FCA, MAS, ASIC, and IIROC. A who’s who of top regulators for a much trusted broker.

They offer just one account type but it is available with no minimum deposit at all. Perfect if you are new to the forex trading market. Another suitable point here is you can open positions for as low as just one currency unit ($1 or equivalent base currency), although no MYR deposits are available.

With that said, deposits can be made through wire transfers, major credit cards, and ewallets. Fully operational oanda demo accounts are available to try as are islamic accounts on request.

Spreads with this broker are low, starting from just 1 pips and trading is through MT4 trading platform. .

You may find that some additional fees are placed on the islamic account in place of the swap fee, and at the moment there is unfortunately no bonus offering in place.

7. Pepperstone

Pepperstone are another of the standard bearing top brokers offering service to malaysian forex traders. They are regulated by the top authorities of FCA and ASIC and are one of the most chosen ECN brokers around.

They have two available account types that can be opened with a minimum deposit of $200. These are the standard and ECN razor account types which are also both available as islamic accounts. For account deposits, wire transfers, credit cards, and ewallets are all accepted methods of funding although no MYR deposits are available.

Spreads with pepperstone start from 0 pips and trading is available through MT4, MT5, or ctrader and you are welcome to try the pepperstone demo account first.

On the islamic accounts, an admin fee will be applied on positions held for more than 10 days and no pepperstone bonus amount is currently available.

8. IC markets

IC market regulated by cysec and ASIC represent another of the best malaysian forex broker choices for any traders. They offer 2 account types in their standard and raw spread accounts, both of which can be opened with no minimum deposit.

These accounts can be easily funded through wire transfers, major credit cards, or ewallet methods although no MYR deposits are accepted. On the minimum deposit, although there is none in place, the broker do recommend depositing at least $200.

Spreads with IC markets start from the bottom at 0 pips and with the option of trying a demo account and opting for an islamic account through MT4, MT5, or ctrader platforms. Within this islamic account most conditions remain the same. The only change is an admin fee added on positions open for more than one day.

At this time IC markets does not provide for any kind of bonus offering.

9. Etoro

Last but not least on our listing of top malaysian broker choices is etoro. Known the world over, they are regulated well by cysec, FCA, and ASIC. They are well known of course as a top broker for social trading and a particularly good fit if you are new to the sector.

One account type is offered that can also be made swap-free though in this case the minimum deposit would increase from $200 to $1,000 with trading available through the brokers own user-friendly trading platform.

Spreads at etoro typically start from 1 pip though they can be higher. Deposits are catered for through wire transfer, credit card, and ewallets, though no MYR deposit option is available.

You will be glad to know that while there are no bonus offerings, trading conditions remain the same on islamic accounts.

Malaysian trader? Here’s what to look for in a forex broker

Although there are currently no particular set of stringent rules in place from the SCM and everything is routinely left at the discretion of the trader and broker in terms of what is offered in bonus, leverage, and account type terms, there are still a few things that you should try and look out for when choosing the best forex broker to deal with.

1. Stick with regulated brokers

Always try to choose a regulated forex broker like any of the top brokers listed above. The SCM have not yet officially regulated any themselves, but you can very much trust the listed brokers regulated by some of the top bodies worldwide like cysec, ASIC, and the FCA.

It is good practice to deal with these and any who are also ESMA compliant for the most trusted experience and to avoid offshore regulated or non-regulated brokers where you can.

2. Look for the best islamic account

The muslim population in malaysia is more than 50%. This, along with the fact that islam is the official religion mean there is always big demand for malaysian islamic forex trading accounts.

Since swap or overnight broker fees are considered haram when it comes to sharia law, you should be looking to open an islamic account that will not feature any of these fees in order to be fully compliant.

If you are unsure or interested to learn more about this topic, you can read our best islamic forex brokers guide for more information.

3. Choose the broker before choosing the bonus

One of the biggest final things to be sure of is that, since forex broker bonuses are legal in malaysia, that you do not get blinded by that fact.

This means choosing a broker that best suits your trading needs above considering what types of bonus they offer.

Being tempted by a big bonus offer can leave you dissatisfied in other areas when it comes it future trading and so. You should really not base your broker decision on that. Also, always make sure you read the terms and conditions first.

Finally, you should take advantage of any no deposit bonus opportunities offered by a broker as a great chance to see what they can offer.

How to verify if a forex broker is regulated in malaysia

Although there are not any forex broker officially regulated by the SCM as yet, this may well be possible in the future. In that case, you should take the opportunity to check this page for any further developments.

Checking registration with the other top regulatory bodies can also be as simple as a couple of clicks and a search of the following links:

Keep in mind if you are wondering about ESMA regulation, this depends on the country, but if they have registered in a european country, they will typically be ESMA compliant.

Is forex trading taxable in malaysia?

The simple answer to this question is yes.

Forex trading in malaysia is taxable. That is because all revenues should be declared through your ITN (income tax number) and these are unique to each person and issues by the IRBM (inland revenue board of malaysia).

More information on the precise filing processes can be found here.

With that said, since forex trading is new to malaysia, there is still a considerable grey area related to revenues and capital gains taxes, particularly is the broker you trade with is located outside of malaysia.

[disclaimer: we are not accountants, we have done internet research. Due to these grey areas, we strongly suggest you contacting malay local authorities before proceeding]

Compare brokers in malaysia

For our malaysia comparison, we found 16 brokers that are suitable and accept traders from united states of america.

We found 16 broker accounts (out of 147) that are suitable for malaysia.

Forex.Com

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About forex.Com

Platforms

Funding methods

79% of retail investor accounts lose money when trading cfds with this provider

Thinkmarkets

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About thinkmarkets

Platforms

Funding methods

Losses can exceed deposits

Between 54-87% of retail CFD accounts lose money. Based on 69 brokers who display this data.

The ultimate guide to

The malaysian financial market

Previously known as the kuala lumpur stock exchange, in 2004 malaysia’s primary stock market became the bursa malaysia exchange. Run by the bursa malaysia holding company in kuala lumpur, the exchange aims to provide a steady infrastructure for the country’s marketplace.

While well-established large-cap stocks trade on the main bursa malaysia exchange, smaller cap stocks of emerging companies trade on the ACE market . The main stock index for the bursa malaysia exchange is the FTSE bursa malaysia KLCI or simply the FBM KLCI, with KLCI standing for the kuala lumpur composite index. This capitalisation-weighted headline index is made up of the 30 biggest companies listed on the bursa malaysia that meet the index’s criteria.

To promote malaysia as an international nexus of islamic banking and finance, bursa malaysia established an islamic markets group. This aims to develop a shariah law compliant trading platform and suitable financial products. Shariah-compliant products traded on the bursa malaysia include i-stocks, i- indices, i-etfs, i-reits and sukuk (islamic financial certificates like bonds).

Furthermore, bursa malaysia derivatives berhad (BMD) was established in 1993 to provide a marketplace in commodity, equity and financial derivatives relevant to malaysia. BMD’s products are now tradable via the CME globex trading platform to allow greater access to malaysian derivatives within the global market. In addition, the labuan international financial exchange (LFX) was launched in november 2000 following the territory’s designation as an international financial centre in 1990.

Forex traders may recognise the malaysian ringgit (MYR) as malaysia’s national currency, although the MYR is not a common reserve currency among central banks, according to the international monetary fund (IMF). The ringgit was ranked 25 th by the bank for international settlements (BIS ) among the most actively traded currencies in 2016, making up around 0.4 percent of the overall forex market’s daily turnover that was about the same as its market share in 2013.

Financial regulation in malaysia for online forex and contract for difference (CFD) brokers falls under the auspices of the securities commission malaysia (SCM) that was established in march of 1993 under the authority of the securities commission act 1993 (SCA). This self-funded statutory body reports to the minister of finance and has responsibility for regulating and developing the malaysian capital markets, including businesses and persons who hold licenses under the capital markets and services act of 2007.

Trading in malaysia

When looking for an online broker to trade forex or cfds with, make sure to choose a well-regulated broker that has a strong reputation with clients, since they should be suitable for entrusting a margin deposit with them.

Online brokers generally offer several trading accounts for traders, including:

- Forex trading: exchanging one currency for another forms the basis of forex trading. Exchange rates fluctuate as one currency rises or falls relative to another in particular currency pair. The popularity of forex trading has expanded greatly once online trading became possible. The forex market is the most liquid and largest financial market globally and had a daily turnover of $5.1 trillion/day in april 2016, according to data compiled by the BIS .

- CFD trading: making transactions in derivative financial instruments known as contracts for difference (cfds) allows traders to speculate on the future of their underlying assets. Such assets can consist of a currency pair, commodity, stock, stock index or other financial instruments.

- Demo accounts: funded with virtual money, these accounts can be used to practice trading, test a strategy or check out a broker’s services and platform. Find out more on opening demo accounts here .

- Islamic accounts: these are suitable for traders who wish to trade in an account that conforms to sharia law. Find out more on trading with an islamic account .

With respect to trading stocks, the bursa malaysia exchange provides trade execution in malaysian stocks, fixed income products, funds and exchange-traded funds (etfs), including islamic products. Exchange transactions are largely executed in malaysian ringgits.

Opportunities of trading in malaysia

According to export.Gov , malaysia also has a very favourable geographical position as “a crossroads of trade between the east and west” and has especially liberal trade policies that can result in good trading opportunities. International trade remains very important to malaysia, with the world trade organization (WTO) reporting that imports and exports of goods and services equated to roughly 130% of GDP as of 2016.

Malaysia also has a strong financial services sector that specialises in providing islamic investment products and accounts. The country offers additional advantages for doing business as follows:

- A relatively high-tech and competitive nation

- Gas and oil producing country

- Widespread use of english

- A well-established legal framework

- Excellent infrastructure

- High visa approval rate

- Recognises the importance of international trade and relations

- Was a founding member of the world trade organisation

Furthermore, malaysia was ranked 15 th for the overall ease of doing business by the world bank , and the country ranked even better at 2 nd for protecting minority investors. When it comes to practical matters for new businesses planning on opening an office, like getting electricity and dealing with registering property, malaysia ranked favourably at 4 th and 29 th respectively. The country also ranked an impressive 3 rd for ease of dealing with construction permits.

Challenges of trading in malaysia

China and the united states remain two of malaysia’s largest trading partners , so any strain in the relationship between these neighbours, such as an escalating trade war, could cast significant uncertainty on the malaysian economy. As a consistent net exporter with a high trade-to-GDP ratio , malaysia’s economy can suffer from tariffs, trade wars and the failure of major trade agreements.

Furthermore, the overall forecast for malaysian and other asian stock markets in 2019 have, according to reports , remained rather negative. This is largely due to concerns about global economic health, as well as ongoing profit taking activity and worries over the U.S.-china trade war.

Bank negara malaysia , the malaysian central bank, has often intervened in the currency market to stabilise the USD/MYR exchange rate, which can sometimes trend notably over time. These currency valuation shifts can cause foreign exchange uncertainty for traders and businesses looking for a more stable environment to operate in.

When it comes to starting a business, the world bank ranked malaysia a rather poor 122 nd compared to other countries, although the country ranked 32 nd for obtaining credit. This indicates a relatively unfavourable environment for starting up a business that requires local financing.

Summary

Overall, many traders and businesses find malaysia a relatively favourable country to operate in due to its liberal trade laws and diligent financial regulatory oversight by securities commission malaysia.

When searching for a broker to trade through in malaysia, people should check to see that they offer a suitable range of asset classes, a decent trading platform, strong regulation and adequate financial security for a margin deposit. Furthermore, islamic traders may find malaysia an especially good place to open sharia law compliant accounts and trade islamic financial products.

Why choose forex.Com

for malaysia?

Forex.Com scored best in our review of the top brokers for malaysia, which takes into account 120+ factors across eight categories. Here are some areas where forex.Com scored highly in:

- 19+ years in business

- Offers 300+ instruments

- A range of platform inc. MT4, web trader, ninjatrader, tablet & mobile apps

Forex.Com offers one way to tradeforex. If you wanted to trade EURUSD

The two most important categories in our rating system are the cost of trading and the broker’s trust score. To calculate a broker’s trust score, we take into account a range of factors, including their regulation history, years in business, liquidity provider etc.

Broker forex terbaik di malaysia 2021

Dengan peningkatan jumlah broker forex atas laman web, sesetengah pedagang mempercayai bahawa memilih broker forex yang terbaik merupakan satu tugas yang menakutkan. Sesetengah pedagang adalah kecil, tidak dikawal selia serta tidak dapat dipercayai, dan sekiranya anda tidak tahu cara memilih seorang broker bagus, anda mungkin menjadi mangsa mereka dan kehilangan wang anda.

Jika anda tidak pernah berdagang dalam pasaran forex sebelum ini, taruhan terbaik anda adalah untuk mencari broker forex yang terbaik. Anda tidak sepatutnya hanya mencari broker yang bagus dan boleh dipercayai untuk mengendalikan kerjaya dagangan anda. Apabila anda berasa yakin dengan broker anda, anda boleh menumpukan perhatian dengan mudah terhadap pembelajaran cara berdagang dengan berjaya dan menerapkan strategi-strategi dagangan terbaik anda dengan ketenangan fikiran.

Cara yang termudah adalah untuk mencari broker forex dengan penarafan pelanggan yang memuaskan, tetapi, bagaimanakah kita mengetahui hal tersebut? Rupa-rupanya, mencari dan memilih broker forex yang terbaik adalah tugas yang agak mudah. Apa yang anda perlu lakukan adalah: jadi lebih bijak! Selain itu, bacakan dan pelajari tentang kualiti-kualiti utama yang anda sepatutnya mencari dalam broker forex.

Untuk menjadikannya lebih mudah untuk anda, kami telah menyenaraikan broker-broker forex terbaik di malaysia yang memenuhi kualiti-kualiti tersebut dan menawarkan perkhidmatan terbaik kepada pedagang-pedagang forex malaysia!

Senarai broker forex terbaik

Apakah ciri-ciri dan kualiti-kualiti utama untuk broker forex terbaik?

Perkara yang pertama adalah untuk mencari seorang broker forex yang dikawal selia. Secara idealnya, anda sepatutnya mencari seorang broker yang dikawal selia oleh pihak berkuasa yang mantap, seperti pihak berkuasa kelakuan ( вђ˜ FCA вђ™ ) kewangan UK atau pesuruhjaya keselamatan dan pertukaran cyprus (cysec) yang menguatkuasakan piawaian pematuhan yang ketat, amalan urusan yang adil, dan audit berkala. Jika seorang broker memiliki lesen untuk beroperasi, mereka dijangka mencapai piawaian yang paling tinggi dan keperluan modal terperinci sepanjang masa, dengan itu membuatkan mereka lebih boleh dipercayai. Sebenarnya, banyak pedagang telah kerugian wang mereka kepada broker yang tidak dikawal selia. Anda dinasihati untuk mengelakkan broker yang tidak dikawal selia. Jika tidak, anda mungkin tidak akan melihat wang anda lagi. Jadi, faktor #1 anda adalah untuk berdagang dengan seorang broker forex yang dikawal selia sepenuhnya. Walaubagaimanapun, anda perlu mengingati bahawa peraturan bukan sahaja satu-satunya faktor yang penting, tetapi terdapat juga faktor-faktor lain yang anda juga perlu mengambil kira.

Рџ‘‰ kualiti perkhidmatan, akaun-akaun dagangan, dan syarat-syarat dagangan

untuk menutup dagangan yang menguntungkan, anda perlu mengambil kira kualiti produk dagangan dan syarat-syarat broker anda kerana ia pasti akan mendatangkan kesan kepada dagangan anda. Salah satu ciri-ciri yang paling penting yang anda perlu memberikan perhatian ialah spread. Apakah spread terendah (tetap atau terapung)? Ciri yang kedua bergantung pada kelajuan pelaksanaan dagangan dengan mengambil kira server broker serta keseluruhan teknologi dalam sistem harga mereka. Anda pasti tidak mahu menghadapi kelambatan pada masa tepat anda membuka dan menutup suatu dagangan, betul tidak? Tambahan pula, anda sepatutnya selalu memilih jenis akaun dagangan yang sesuai untuk anda dan strategi anda dengan sebaik-baiknya (cent, mikro, standard, ECN) dan juga spesifikasi mereka, seperti leverage, saiz dagangan minimum, pasaran dagangan yang sedia ada (forex, CFD, logam dan tenaga) serta platform dagangan. Metatrader4 ialah platform dagangan kegemaran dan boleh diakses daripada pelbagai alatan (komputer meja, mobil dan laman web) untuk kemudahan anda.

Рџ‘‰ kepentingan dan kualiti perkhidmatan pelanggan

adakah broker yang anda sedang berfikir membuka satu akaun dengan tawaran cepat dan sokongan yang boleh dipercayai? Bolehkah anda menghubungi jabatan sokongan broker tersebut, bukan sahaja melalui emel tetapi juga melalui telefon dan sembang langsung? Adakah mereka sedia ada pada bila-bila masa memandangkan forex merupakan pasaran 24-jam? Adakah mereka mampu menjawab soalan-soalan anda dan membalas permintaan anda dengan sopan dan profesional? Jawapan kepada soalan-soalan yang dinyatakan di atas sepatutnya ialah вђ˜ ya вђ™ . Jika anda belum lagi menyedari tentang perkara ini, sokongan broker anda akan tidak lama lagi menjadi lebih penting daripada apa yang anda pernah fikirkan, hanya kerana masanya akan datang apabila anda menghadapi masalah atau mempunyai permintaan dalam dagangan anda, lalu anda akan ingin bercakap dengan seseorang. Sesetengah broker forex mengambil langkah selanjutnya dean menyediakan seorang pengurus persendirian yang berdedikasi terhadap akaun anda, jadi anda boleh menghubungi mereka secara langsung pada bila-bila masa. Broker forex yang mantap dan berdedikasi biasanya menawarkan perkhidmatan sokongan berbilang bahasa termasuk bahasa malaysia, anda selalu rasa paling bagus dan paling selesa apabila bercakap dengan broker anda dengan menggunakan bahasa sendiri, betul tidak?

Рџ‘‰ populariti dan keluasan broker

apabila anda mencari broker forex yang tebaik, keadaan besar, mantap dan persediaan modal yang bagus adalah sangat penting. Pengawalseliaan oleh pihak berkuasa yang mengawal selia, (seperti FCA, cysec atau ASIC) bermaksud seorang broker mesti mematuhi tahap permodalan minimum yang mempunyai hubungan langsung dengan kebolehan broker untuk kekal berupaya melangsaikan semua hutang dan menunjukkan saiz syarikat tersebut. Semakin tinggi modal broker, semakin bagus hubungan kredit yang boleh ditubuhkan dengan pembekal liquiditi mereka, dan mereka boleh memperoleh harga yang lebih berdaya saing untuk diri sendiri dan pelanggan mereka. Anda juga sepatutnya mengambil kira pengiktirafan antarabangsa broker tersebut, nama jenama dan populariti. Tanyalah soalan seperti: berapa besarkah broker tersebut? Di manakah ibu pejabat mereka? Adakah mereka memiliki pejabat tempatan? Adakah mereka mempunyai interaksi manusia yang tulen (di luar talian) dengan pelanggan mereka? Apakah anugerah industri, penajaan mereka dan sebagainya? Akhir sekali, ketelusan syarikat sentiasa mendatangkan kebaikan dalam perkara-perkara seperti jumlah pekerja, pasukan pengurusan dan CEO syarikat tersebut.

Рџ‘‰ keselamatan dana pelanggan

satu faktor lain yang anda patut mengambil kira ialah keselamatan dana anda dengan broker anda. Anda pasti tidak ingin risau tentang kerugian deposit dana atau keuntungan, bukan? Sekarang, anda perlu mengingati bahawa keselamatan dana serta pengasingan biasanya berkaitan dengan keadaan sama ada seorang broker adalah dikawal selia atau tidak. Jadi, broker yang terbaik biasanya menyimpan dana pelanggan mereka dalam akaun-akaun berasingan dalam bank-bank utama. Broker sebegini biasanya ialah ahli-ahli skim pampasan untuk memastikan dana anda dilindungi dengan selanjutnya. Sebagai contoh, ICF (dana pampasan pelabur) yang ditubuhkan oleh bank pusat cyprus dan cysec menginsuranskan dana pelanggan broker setinggi 20,000 euro, dan FSCS (skim pampasan perkhidmatan kewangan) yang ditubuhkan oleh FCA akan membayar pampasan kepada pelanggan setinggi 85,000 paun british sekiranya broker tersebut tidak dapat memenuhi komitmen mereka. Ia membawa keyakinan dan ketenangan fikiran yang lebih tinggi untuk membuka satu akaun dengan seorang broker, iaitu ahli organisasi perlindungan pengguna sebegini.

Akhir sekali, pilihlah broker forex anda dengan berhati-hati supaya anda boleh berdagang dengan ketenangan fikiran. Kami telah menyenaraikan broker forex yang terbaik di malaysia dengan semua kualiti yang dinyatakan di atas seperti yang anda akan menjangka daripada seorang broker forex yang boleh dipercayai.

Senarai broker forex terbaik di malaysia 2020

Last updated: august 21st 2020

Di bawah ini adalah senarai broker forex terbaik di malaysia pada tahun 2020.

XM.COM

XM merupakan satu syarikat subsidiari kepada XM group, iaitu broker FX dan CFD global yang telah diasaskan pada tahun 2009.

Walaupun begitu, XM juga mempunyai kesan kehadiran global dan telah dikawal selia oleh empat pihak berkuasa kewangan yang berbeza: FCA di UK, securities and investments commission (ASIC) australia, securities and exchange commission (cysec) cyprus, dan international financial services commission di belize (IFSC). Ini bermakna XM adalah salah satu platform forex paling selamat untuk menjalankan aktiviti perdagangan.

XM juga mempunyai ciri yuran pengeluaran dan CFD terendah. Di samping itu, proses untuk membuka akaun adalah cepat dan mudah. Ia juga datang dengan pelbagai alat pembelajaran untuk anda membina kemahiran tersendiri.

Portfolio produk XM adalah terhad kerana ia hanya menawarkan forex, CFD, dan mata wang kripto untuk pelanggan eropahnya. Mereka juga mengenakan caj bayaran tidak aktif jika anda gagal menggunakan akaun anda lebih daripada 90 hari.

Kebaikan

- Anda boleh berdaftar di bawah XM global dan menerima nisbah 888:1

- Deposit minimum hanya sebanyak $10

- Spread sangat rendah bermula dari 0,0 pips! (akaun XM ZERO)

- Pelaksanaan perdagangan pantas dalam 600 mili saat.

- Pembukaan akaun dengan mudah dan pantas

- CFD dan yuran pengeluaran yang rendah

- Ketersediaan bahan pembelajaran lengkap.

- Perlindungan baki negatif

Keburukan

- Hanya tertumpu kepada forex

- Mengenakan caj yuran tidak aktif

- Portfolio stok terhad

Pepperstone

Pepperstone merupakan satu forex broker ECN australia yang berpusat di melbourne yang menyediakan pelaksanaan perdagangan persaingan kepelbagaian ciri melalui pelbagai platform perdagangan termasuklah peranti mudah alih dan meta trader 4, meta trader 5, ctrader. Anda mempunyai pilihan terhadap lebih 150 instrumen yang boleh didagangkan dalam lingkungan pelbagai kelas aset termasuklah mata wang kripto, forex, logam dan komoditi-komoditi lain.

Pepperstone membolehkan anda untuk melaksanakan perdagangan ini daripada dimana sahaja anda berada di dunia melalui pelbagai jenis akaun.

Untuk membuka akaun dengan broker ini, mereka memerlukan deposit minimum sebanyak $150 . Akaun ini disokong oleh senarai sumber dana yang banyak termasuklah mastercard, visa, skrill, pemindahan bank, paypal, dan neteller. Yuran deposit debit/kredit biasa masih dikenakan 3%.

Perkara yang terbaik tentang akaun ini adalah ia menyediakan anda sumber pembelajaran yang banyak untuk anda tingkatkan tahap kemahiran sendiri supaya anda boleh mengecam peluang keuntungan dengan lebih mudah.

Kebaikan

- Pelaksanaan perdagangan sangat pantas dalam 300ms

- „tanpa meja berunding“ broker

- Pelaksanaan perdagangan sangat pantas

- Spread sangat rendah bermula dari 0,0 pips (akaun razor)

- Menyediakan banyak sumber pembelajaran

- Mempunyai jumlah instrumen boleh didagang yang banyak (180+ mata wang!)

- Bekerja dengan jumlah kelas aset yang luas

- Platform perdagangan mesra pengguna

- Perlindungan baki negatif

Keburukan

Avatrade

Platform perdagangan avatrade yang berpandukan laman web adalah sangat mesra pengguna dan mudah, menjadikannya sesuai untuk berdagang CFD pada saham, forex, komoditi dll.

Broker menyediakan akses kepada lebih 70 mata wang.

Selain daripada forex, plus500 membolehkan untuk berdagang CFD pada saham, indeks saham, mata wang kripto, dan opsyen untuk diperdagangkan sebagai CFD, tetapi bukan sebagai aset sebenar bersama simpanan dompet.

Plus500 boleh menjadi satu pilihan ideal untuk pedagang yang kurang berpengalaman kerana platform tersebut digunakan dan direka khas untuk menjadikan pengalaman perdagangan lebih mudah.

Kebaikan:

- Spread rapat!

- Pelaksanaan perdagangan pantas

- Platform mudah digunakan

- Kami mengesyorkan broker ini kepada semua pedagang forex

- Akses kepada instrumen kewangan yang luas

- Salah satu penyedia CFD yang diberi penilaian tertinggi

Keburukan:

- Kekurangan alat analitik pasaran yang lebih mendalam dan maju

- Strategi perdagangan scalping tidak dibenarkan

Cara cari broker forex terbaik ?

Yang merupakan broker forex terbaik semua? Jawapannya adalah tidak ada yang mana yang terbaik untuk semua orang tetapi jika mengambil kira perkara di bawah apabila memilih satu, anda akan mendapati syarikat perdagangan forex terbaik yang akan menampung gaya dagangan anda.

Marilah kita menjimatkan banyak masa mencari dan sakit kepala! Kami melakukan penyelidikan untuk anda, anda akan berterima kasih kepada kami!

Seberapa baik perkhidmatan pelanggan?

Ketahui jenis sokongan yang diberikan broker forex berpotensi anda.

- Adakah mereka bersembunyi di belakang peti mel tanpa nama atau mempunyai pusat sokongan sebenar dalam bahasa ibu anda yang anda bercakap?

- Adakah pusat sokongan mereka terletak di zon waktu yang sama seperti anda, di suatu tempat di eropah atau di seberang dunia?

- Adakah mereka mempunyai talian telefon sokongan pelanggan di mana mereka boleh dihubungi untuk masalah teknikal?

- Adakah mereka menyediakan sokongan sembang dalam talian?

- Adakah anda akan diberikan penasihat peribadi yang boleh anda hubungi dengan soalan perdagangan pada bila-bila masa?

Sebagai contoh, broker forex XM.COM menyediakan berdasarkan pengalaman kami yang benar-benar mendapat sokongan pelanggan yang memenangi anugerah dalam 24 bahasa, termasuk latihan forex dalam talian percuma.

Gaya perdagangan

Pertama sekali, anda harus memikirkan gaya dagangan anda dan memilih platform yang sewajarnya:

- Adakah anda seorang pemula lengkap dalam forex?

- Adakah anda akan berdagang pasangan matawang EURUSD atau mata wang eksotik yang paling popular?

- Adakah anda mempunyai modal besar atau anda memerlukan akaun mini / mikro?

- Adakah anda menggunakan telefon bimbit untuk berdagang?

- Adakah anda bergantung kepada isyarat forex?

- Adakah anda akan kulit kepala pasaran?

Peraturan & lesen broker forex malaysia

Walaupun peraturan itu, masih terdapat banyak penjahat dalam perniagaan ini, yang boleh menanggung banyak wang!

Sekiranya anda berdagang dengan broker yang dikawal selia, anda akan mendapat perlindungan dari segi keselamatan wang anda dan broker akan mempunyai pedoman mengenai cara akaun anda ditangani untuk memastikan anda mendapat perkhidmatan terbaik dan anda boleh menghubungi pengawalselia untuk menyelesaikan apa-apa pertikaian yang anda mungkin ada.

Sebagai contoh, jika anda adalah pemastautin kesatuan eropah, maka anda harus tahu bahawa mana-mana syarikat yang bereputasi yang beroperasi di pasaran kesatuan eropah harus dilesenkan sekurang-kurangnya oleh pengawasan cyprus cysec.

Selain cysec, NFA di amerika syarikat dan FCA di UK dilihat secara meluas sebagai badan pengawalseliaan terbaik di dunia, walaupun terdapat banyak lagi orang lain, seperti peraturan yang menyebar ke lebih banyak kawasan di dunia.

Sentiasa berhasrat untuk memilih syarikat forex yang dikawal selia, jadi misalnya jika anda tinggal di afrika selatan maka anda pasti mahu memilih yang dikawal oleh broker forex yang diisytiharkan FSB atau sekiranya anda tinggal di dubai, maka pilih broker forex di UAE yang adalah DFSA dikawal.

Satu lagi badan kawal selia yang dihormati ialah suruhanjaya sekuriti dan pelaburan australia (asic.Gov.Au).

Tidak perlu berurusan dengan syarikat perdagangan forex yang tidak dikawal jadi jangan menganggapnya!

Akaun demo forex

Sentiasa periksa sama ada broker forex anda akan membolehkan anda membuka akaun demo forex di mana anda boleh menyemak bagaimana platform mereka berfungsi dan mengenalinya. Adalah penting untuk mengetahui apabila demo mereka sah, sesetengah syarikat hanya menyediakan platform demo untuk tempoh tetap, iaitu, platform itu dinyahaktifkan secara automatik contohnya selepas 30 hari. Sesetengah broker forex akan membolehkan anda untuk berdagang di akaun demo anda selama-lamanya, dan anda boleh mula berdagang dengan tajam hanya apabila anda merasakan bahawa anda mengetahui platform dengan sempurna.

Leverage

Leverage bervariasi dari broker ke broker tetapi mereka semua memberikan lebih banyak leverage daripada yang anda perlukan dan 500: 1 leverage bukan keuntungan! Peniaga forex yang paling berpengalaman hanya berdagang dengan leverage 10: 1 dan semua broker terbaik, akan memberikan anda tahap leverage ini.

Kedudukan kewangan broker forex

Berapa banyak modal yang syarikat forex ada di belakangnya – dengan kata lain – seberapa kuat neracanya? Anda harus mempertimbangkan ini apabila memilih broker dan juga tempoh masa mereka dalam perniagaan. Seorang broker dengan kunci kira-kira yang kuat yang telah berniaga selama bertahun-tahun mungkin akan menjadi broker yang baik untuk mendepositkan wang anda dengan. Anda harus selalu mendepositkan tunai yang diperolehi anda dengan pembrokeran yang kuat dari segi kewangan sahaja.

Platform dagangan forex – dapatkan paling keluar dari dagangan anda

Platform dagangan forex juga merupakan pertimbangan dari segi kelancaran operasi, kebolehpercayaan, bilangan pasangan mata wang yang ditawarkan dan tambahan lain seperti alat carta berita dan teknikal. Anda boleh dengan mudah mengetahui betapa baiknya platform dagangan dengan hanya membuka akaun demo dan melihat jika anda menyukai perkhidmatan tersebut.

〉〉 webtrader and ios android trading apps

Hampir setiap broker forex kini menawarkan platform webtrader sendiri dan aplikasi mudah alih untuk dagangan. Platform ini mengandungi fungsi dagangan yang sangat asas dan kemungkinan carta asas. Sebaliknya, ia berjalan di bawah hampir mana-mana pelayar internet dan tidak memerlukan muat turun dan memasang. Satu-satunya perkara yang anda perlukan adalah PC / mac dengan sambungan internet atau telefon pintar dengan app yang dipasang.

〉〉 metatrader 4

Jika anda benar-benar serius mengenai forex trading, maka anda pasti perlu mencari broker fx yang membolehkan anda berdagang dengan metatrader.

Metatrader adalah platform industri standard dan merupakan yang paling terkenal dan paling biasa digunakan dan menawarkan keselamatan, kebolehpercayaan dan beberapa ciri analitis dan kebanyakan broker akan membolehkan anda menggunakannya.

Metatrader 4 digunakan kebanyakannya oleh peniaga forex, sementara 5 termasuk selain fx juga ETF, komoditi dll.

〉〉 social trading

Walaupun ramai peniaga mahu berdagang sendiri terdapat ramai yang ingin mendapatkan bantuan dan baru-baru ini terdapat peningkatan besar dalam perdagangan fx sosial.

Terdapat banyak platform perdagangan sosial dan konsepnya mudah – anda boleh mengikuti pedagang lain dalam rangkaian dan menyalin perdagangan mereka dan mudah-mudahan membuat wang berikutan isyarat perdagangan mereka.

Peniaga dalam talian telah bertukar idea dan berdagang di forum, blog dan rangkaian sosial untuk masa yang lama dan idea untuk mengikuti pedagang yang berjaya dalam rangkaian perdagangan adalah perkembangan logik dan pertumbuhan segmen ini dalam industri perdagangan forex adalah besar dan jumlahnya daripada peniaga-peniaga yang mengambil bahagian dan jumlah dolar yang diuruskan adalah mengejutkan – mari kita lihat beberapa contoh.

Rangkaian sosial etoro sangat besar dengan lebih daripada 2 juta peniaga menggunakannya.

Platform ini adalah dua yang terbesar tetapi idea untuk mengikuti pedagang lain semakin berkembang pada kadar yang pantas dan platform baru akan datang dalam talian sepanjang masa.

Kebanyakan pembrokeran mendakwa platform dagangan forex mereka adalah yang terbaik tetapi dari segi platform teratas tidak banyak antara mereka dan yang anda suka akan turun ke perkhidmatan yang anda perlukan secara khusus sebagai pedagang.

Cara broker forex terbaik untuk mengetahui sejauh mana platform yang baik adalah anda perlu mencubanya di akaun praktik!

Compare brokers in malaysia

For our malaysia comparison, we found 16 brokers that are suitable and accept traders from united states of america.

We found 16 broker accounts (out of 147) that are suitable for malaysia.

Forex.Com

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About forex.Com

Platforms

Funding methods

79% of retail investor accounts lose money when trading cfds with this provider

Thinkmarkets

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About thinkmarkets

Platforms

Funding methods

Losses can exceed deposits

Between 54-87% of retail CFD accounts lose money. Based on 69 brokers who display this data.

The ultimate guide to

The malaysian financial market

Previously known as the kuala lumpur stock exchange, in 2004 malaysia’s primary stock market became the bursa malaysia exchange. Run by the bursa malaysia holding company in kuala lumpur, the exchange aims to provide a steady infrastructure for the country’s marketplace.

While well-established large-cap stocks trade on the main bursa malaysia exchange, smaller cap stocks of emerging companies trade on the ACE market . The main stock index for the bursa malaysia exchange is the FTSE bursa malaysia KLCI or simply the FBM KLCI, with KLCI standing for the kuala lumpur composite index. This capitalisation-weighted headline index is made up of the 30 biggest companies listed on the bursa malaysia that meet the index’s criteria.

To promote malaysia as an international nexus of islamic banking and finance, bursa malaysia established an islamic markets group. This aims to develop a shariah law compliant trading platform and suitable financial products. Shariah-compliant products traded on the bursa malaysia include i-stocks, i- indices, i-etfs, i-reits and sukuk (islamic financial certificates like bonds).

Furthermore, bursa malaysia derivatives berhad (BMD) was established in 1993 to provide a marketplace in commodity, equity and financial derivatives relevant to malaysia. BMD’s products are now tradable via the CME globex trading platform to allow greater access to malaysian derivatives within the global market. In addition, the labuan international financial exchange (LFX) was launched in november 2000 following the territory’s designation as an international financial centre in 1990.

Forex traders may recognise the malaysian ringgit (MYR) as malaysia’s national currency, although the MYR is not a common reserve currency among central banks, according to the international monetary fund (IMF). The ringgit was ranked 25 th by the bank for international settlements (BIS ) among the most actively traded currencies in 2016, making up around 0.4 percent of the overall forex market’s daily turnover that was about the same as its market share in 2013.

Financial regulation in malaysia for online forex and contract for difference (CFD) brokers falls under the auspices of the securities commission malaysia (SCM) that was established in march of 1993 under the authority of the securities commission act 1993 (SCA). This self-funded statutory body reports to the minister of finance and has responsibility for regulating and developing the malaysian capital markets, including businesses and persons who hold licenses under the capital markets and services act of 2007.

Trading in malaysia

When looking for an online broker to trade forex or cfds with, make sure to choose a well-regulated broker that has a strong reputation with clients, since they should be suitable for entrusting a margin deposit with them.

Online brokers generally offer several trading accounts for traders, including:

- Forex trading: exchanging one currency for another forms the basis of forex trading. Exchange rates fluctuate as one currency rises or falls relative to another in particular currency pair. The popularity of forex trading has expanded greatly once online trading became possible. The forex market is the most liquid and largest financial market globally and had a daily turnover of $5.1 trillion/day in april 2016, according to data compiled by the BIS .

- CFD trading: making transactions in derivative financial instruments known as contracts for difference (cfds) allows traders to speculate on the future of their underlying assets. Such assets can consist of a currency pair, commodity, stock, stock index or other financial instruments.

- Demo accounts: funded with virtual money, these accounts can be used to practice trading, test a strategy or check out a broker’s services and platform. Find out more on opening demo accounts here .

- Islamic accounts: these are suitable for traders who wish to trade in an account that conforms to sharia law. Find out more on trading with an islamic account .

With respect to trading stocks, the bursa malaysia exchange provides trade execution in malaysian stocks, fixed income products, funds and exchange-traded funds (etfs), including islamic products. Exchange transactions are largely executed in malaysian ringgits.

Opportunities of trading in malaysia

According to export.Gov , malaysia also has a very favourable geographical position as “a crossroads of trade between the east and west” and has especially liberal trade policies that can result in good trading opportunities. International trade remains very important to malaysia, with the world trade organization (WTO) reporting that imports and exports of goods and services equated to roughly 130% of GDP as of 2016.

Malaysia also has a strong financial services sector that specialises in providing islamic investment products and accounts. The country offers additional advantages for doing business as follows:

- A relatively high-tech and competitive nation

- Gas and oil producing country

- Widespread use of english

- A well-established legal framework

- Excellent infrastructure

- High visa approval rate

- Recognises the importance of international trade and relations

- Was a founding member of the world trade organisation

Furthermore, malaysia was ranked 15 th for the overall ease of doing business by the world bank , and the country ranked even better at 2 nd for protecting minority investors. When it comes to practical matters for new businesses planning on opening an office, like getting electricity and dealing with registering property, malaysia ranked favourably at 4 th and 29 th respectively. The country also ranked an impressive 3 rd for ease of dealing with construction permits.

Challenges of trading in malaysia

China and the united states remain two of malaysia’s largest trading partners , so any strain in the relationship between these neighbours, such as an escalating trade war, could cast significant uncertainty on the malaysian economy. As a consistent net exporter with a high trade-to-GDP ratio , malaysia’s economy can suffer from tariffs, trade wars and the failure of major trade agreements.

Furthermore, the overall forecast for malaysian and other asian stock markets in 2019 have, according to reports , remained rather negative. This is largely due to concerns about global economic health, as well as ongoing profit taking activity and worries over the U.S.-china trade war.

Bank negara malaysia , the malaysian central bank, has often intervened in the currency market to stabilise the USD/MYR exchange rate, which can sometimes trend notably over time. These currency valuation shifts can cause foreign exchange uncertainty for traders and businesses looking for a more stable environment to operate in.

When it comes to starting a business, the world bank ranked malaysia a rather poor 122 nd compared to other countries, although the country ranked 32 nd for obtaining credit. This indicates a relatively unfavourable environment for starting up a business that requires local financing.

Summary

Overall, many traders and businesses find malaysia a relatively favourable country to operate in due to its liberal trade laws and diligent financial regulatory oversight by securities commission malaysia.

When searching for a broker to trade through in malaysia, people should check to see that they offer a suitable range of asset classes, a decent trading platform, strong regulation and adequate financial security for a margin deposit. Furthermore, islamic traders may find malaysia an especially good place to open sharia law compliant accounts and trade islamic financial products.

Why choose forex.Com

for malaysia?

Forex.Com scored best in our review of the top brokers for malaysia, which takes into account 120+ factors across eight categories. Here are some areas where forex.Com scored highly in:

- 19+ years in business

- Offers 300+ instruments

- A range of platform inc. MT4, web trader, ninjatrader, tablet & mobile apps

Forex.Com offers one way to tradeforex. If you wanted to trade EURUSD

The two most important categories in our rating system are the cost of trading and the broker’s trust score. To calculate a broker’s trust score, we take into account a range of factors, including their regulation history, years in business, liquidity provider etc.

Top 9 best forex brokers in malaysia for 2021

Top rated:

Searching for a trading broker in malaysia?

With this collection of the best forex brokers the country has to offer. Here you are sure to find one that fits your trading needs.

Making your malaysia forex broker search as easy as possible starts with choosing from one of these top choices, any of which can be opened both quickly and easily.

Table of contents

Is forex trading legal in malaysia?

This is a very valid question and concern since not very long ago forex trading in malaysia was not legal.

Now however, the rules are changing.

You will find that officially within malaysia, the only legal regulation is that people can only register with a financial services company that is regulated within malaysia and compliant with the laws of the country.

With that said, given that forex trading is relatively new to malaysia, there are not yet any brokers that are regulated by the SCM (securities commission of malaysia).

With that said, trading as a malaysian forex trader is still not illegal and some of the forex brokers that we have listed provide the very best in terms of regulatory oversight from top-tier bodies such as cysec, the FCA, or ASIC.

How to trade forex in malaysia

If you want to trade forex within malaysia then the process is in fact quite straightforward since the regulations are still quite new and allow for no particular restrictions in terms of what a forex trader can do or what a broker can offer.

The only key steps beyond choosing the correct malaysian forex broker for you is to submit the relevant documents to begin trading. These will typically include your proof of ID and residency.

From there, you are ready to begin trading.

Top 10 best forex brokers in malaysia

Here is our collection of what we feel are the best malaysia broker choices for you as a forex trader:

1. Instaforex

Starting our list of the best forex brokers in malaysia is instaforex. They are a well-known and award winning broker particularly within asia having won more than 19 awards and counting related to being the “best broker in asia”.

Beyond this, they are also very well regulated by multiple regulatory bodies including the FCA, ASIC, and cysec. When it comes to account types you will have a total of 6 to choose from. Instaforex minimum deposits here range from a bargain $1 up to $1,000 depending on account type. The account types available include 2 cent accounts, a standard account, 2 ECN accounts, and a scalping account.

You can deposit MYR through wire transfer within local banks and you can also utilize a fully functioning demo account to try out the broker. This is ideal, in combination with really low-risk cent accounts to help new forex traders get to know the market.

Finally, an islamic account type is available though there is an additional fee that replaces the swap fee. Instaforex also offers 4 bonuses to traders. This includes a 100% first deposit bonus.

XM is renowned as one of the best forex brokers in the world and is available to malaysian forex traders. They are again regulated by some of the foremost authorities in the industry in the form of FCA, cysec, and ASIC. They were also awarded the “best forex broker in australasia” award along with numerous others.

Opening an XM account, you will be faced with a wide choice of 6 account types. Minimum deposits on these account types range from $5-$100 depending on account, or you can also opt for a shares account with a minimum deposit of $10,000. These deposits can be made through wire transfer, credit card, or ewallet although no MYR deposits are facilitated.

If you would like to try out the broker, you can avail of their full demo account. This, together with the XM micro account offers a great path to get into forex trading in malaysia and around the world.

Spreads at XM can start from as little as 0 pips in many cases, and the XM islamic account follows all of the same conditions of the regular accounts with no mark-ups, higher spreads, or additional commissions.

3. Octafx

Next in our collection of the top malaysian forex brokers is octafx. They are also regulated by two highly trusted regulatory bodies in the form of both the FCA in the UK and cysec in europe. They are reputed within the industry as offering some of the best swap-free services around. In fact, in 2015 they were recognized byb forextraders.Com as the “best forex islamic account” providers.

To that end, micro, ECN, and pro accounts are available with minimum deposits starting at $100 and reaching $500 for a pro account. It is also worth noting that every account is available as a swap-free account. The accounts utilize the top trading platforms of MT4, MT5, and ctrader.

MYR deposits are accepted and can be made through local banks, billplz, and help2pay services with an excellent exchange rate of 3 MYR per $1 USD available. Spreads also start from a highly competitive 0 pips across the board and the trading conditions feature no changes at all when it comes to islamic account trading.

In terms of octafx bonus offers, a 50% deposit bonus is made available on each deposit.

4. Hotforex

Hotforex is another globally recognized forex broker and top choice for you as a malaysian trader. They are well regulated by both cysec and ASIC and offer a wide choice of 6 forex account types to choose from.

Again here, this includes a micro trading account with a minimum deposit of only $5 ideal for new traders, a premium account with a $100 minimum, a zero spread account, and an auto trading account you can try for a minimum deposit of $200. If you are interested in copytrading this is available through hfcopy with a minimum of $100 deposit to copy, or $300 if you want others to copy your trades.

When it comes to deposits, MYR is available through local bank transfer. In other cases, you can use your major credit card or ewallet methods. Either way, a fully realistic demo account is accessible as is an islamic account where needed.

Spreads here start from a competitive 0 pips across the board although some additional fees may apply on islamic accounts. You can offset these through cash rebates, 100% bonuses, and the higher leverage that hotforex try to offer along with many real prize winning trading contests.

5. FBS

Next on the list of the best malaysian forex brokers is FBS. As with all of our brokers they are well-trusted and fully regulated by both cysec and the IFSC. This is an excellent broker with 5 account choices including a great cent account offering that may be just perfect for new traders. These account types also include an ECN account.

Minimum deposits with the broker start from just $1 reaching up to $1,000 depending on your account choice and although MYR deposits are unavailable, funding via wire transfer, credit card, and ewallet are all available. Every account can also be made swap-free where needed.

Although FBS do add an additional admin fee if you hold a position for more than 2 days with a swap-free account, this can be somewhat balanced by the fact they have a comprehensive bonus offering that includes a 100% deposit bonus and contests including some particularly aimed at islamic traders during ramadan.

6. Oanda

Oanda is one of the few brokers to be regulated in the USA by the CFTC as well as the NFA, and globally through the FCA, MAS, ASIC, and IIROC. A who’s who of top regulators for a much trusted broker.

They offer just one account type but it is available with no minimum deposit at all. Perfect if you are new to the forex trading market. Another suitable point here is you can open positions for as low as just one currency unit ($1 or equivalent base currency), although no MYR deposits are available.

With that said, deposits can be made through wire transfers, major credit cards, and ewallets. Fully operational oanda demo accounts are available to try as are islamic accounts on request.

Spreads with this broker are low, starting from just 1 pips and trading is through MT4 trading platform. .

You may find that some additional fees are placed on the islamic account in place of the swap fee, and at the moment there is unfortunately no bonus offering in place.

7. Pepperstone

Pepperstone are another of the standard bearing top brokers offering service to malaysian forex traders. They are regulated by the top authorities of FCA and ASIC and are one of the most chosen ECN brokers around.

They have two available account types that can be opened with a minimum deposit of $200. These are the standard and ECN razor account types which are also both available as islamic accounts. For account deposits, wire transfers, credit cards, and ewallets are all accepted methods of funding although no MYR deposits are available.

Spreads with pepperstone start from 0 pips and trading is available through MT4, MT5, or ctrader and you are welcome to try the pepperstone demo account first.

On the islamic accounts, an admin fee will be applied on positions held for more than 10 days and no pepperstone bonus amount is currently available.

8. IC markets

IC market regulated by cysec and ASIC represent another of the best malaysian forex broker choices for any traders. They offer 2 account types in their standard and raw spread accounts, both of which can be opened with no minimum deposit.

These accounts can be easily funded through wire transfers, major credit cards, or ewallet methods although no MYR deposits are accepted. On the minimum deposit, although there is none in place, the broker do recommend depositing at least $200.

Spreads with IC markets start from the bottom at 0 pips and with the option of trying a demo account and opting for an islamic account through MT4, MT5, or ctrader platforms. Within this islamic account most conditions remain the same. The only change is an admin fee added on positions open for more than one day.

At this time IC markets does not provide for any kind of bonus offering.

9. Etoro

Last but not least on our listing of top malaysian broker choices is etoro. Known the world over, they are regulated well by cysec, FCA, and ASIC. They are well known of course as a top broker for social trading and a particularly good fit if you are new to the sector.

One account type is offered that can also be made swap-free though in this case the minimum deposit would increase from $200 to $1,000 with trading available through the brokers own user-friendly trading platform.

Spreads at etoro typically start from 1 pip though they can be higher. Deposits are catered for through wire transfer, credit card, and ewallets, though no MYR deposit option is available.

You will be glad to know that while there are no bonus offerings, trading conditions remain the same on islamic accounts.

Malaysian trader? Here’s what to look for in a forex broker

Although there are currently no particular set of stringent rules in place from the SCM and everything is routinely left at the discretion of the trader and broker in terms of what is offered in bonus, leverage, and account type terms, there are still a few things that you should try and look out for when choosing the best forex broker to deal with.

1. Stick with regulated brokers

Always try to choose a regulated forex broker like any of the top brokers listed above. The SCM have not yet officially regulated any themselves, but you can very much trust the listed brokers regulated by some of the top bodies worldwide like cysec, ASIC, and the FCA.

It is good practice to deal with these and any who are also ESMA compliant for the most trusted experience and to avoid offshore regulated or non-regulated brokers where you can.

2. Look for the best islamic account

The muslim population in malaysia is more than 50%. This, along with the fact that islam is the official religion mean there is always big demand for malaysian islamic forex trading accounts.

Since swap or overnight broker fees are considered haram when it comes to sharia law, you should be looking to open an islamic account that will not feature any of these fees in order to be fully compliant.

If you are unsure or interested to learn more about this topic, you can read our best islamic forex brokers guide for more information.

3. Choose the broker before choosing the bonus

One of the biggest final things to be sure of is that, since forex broker bonuses are legal in malaysia, that you do not get blinded by that fact.

This means choosing a broker that best suits your trading needs above considering what types of bonus they offer.

Being tempted by a big bonus offer can leave you dissatisfied in other areas when it comes it future trading and so. You should really not base your broker decision on that. Also, always make sure you read the terms and conditions first.

Finally, you should take advantage of any no deposit bonus opportunities offered by a broker as a great chance to see what they can offer.

How to verify if a forex broker is regulated in malaysia

Although there are not any forex broker officially regulated by the SCM as yet, this may well be possible in the future. In that case, you should take the opportunity to check this page for any further developments.

Checking registration with the other top regulatory bodies can also be as simple as a couple of clicks and a search of the following links:

Keep in mind if you are wondering about ESMA regulation, this depends on the country, but if they have registered in a european country, they will typically be ESMA compliant.

Is forex trading taxable in malaysia?

The simple answer to this question is yes.

Forex trading in malaysia is taxable. That is because all revenues should be declared through your ITN (income tax number) and these are unique to each person and issues by the IRBM (inland revenue board of malaysia).

More information on the precise filing processes can be found here.

With that said, since forex trading is new to malaysia, there is still a considerable grey area related to revenues and capital gains taxes, particularly is the broker you trade with is located outside of malaysia.

[disclaimer: we are not accountants, we have done internet research. Due to these grey areas, we strongly suggest you contacting malay local authorities before proceeding]

Forex brokers in malaysia

It is not hard to find a forex broker who makes you feel safe and mentally comfortable, you just have to take into account the important factors in finding a reliable and trusted forex broker. Essentially, a trusted forex broker is ethical, law-abiding, fully devoted to its clients, and its background in the industry speaks for itself. Such a broker provides quality support, prompt deposits and withdrawals methods, and most importantly, reliable trading conditions so you can take a load off your mind and focus your attention solely on your trading career.

Here we have presented the most successful forex brokers in malaysia with years of presence in the forex industry. These brokers are also fully regulated by the top international financial regulatory bodies such as cysec, FCA, ASIC, and IFSC. They have acquired the very best rate of satisfaction among the traders from all over the world.

Choosing a safe forex broker is your #1 priority for successful trading. To learn more about each reliable forex broker listed below, simply go to the broker вђ™ s вђњ review вђќ page and check out their trading products, account types, platforms, spreads and so on.

List of trusted and reliable forex brokers in malaysia 2021

How to choose a trusted & reliable forex broker?

The regulation is one of the key factors to consider before anything else. You cannot entrust your funds to any random forex broker that you come across. It is imperative to thoroughly investigate the FX broker of your choice in terms of safety, security, and reliability by simply taking into account which supervisory authority oversees their overall financial activities i.E., an administrative body which regulates forex brokers in the interest of the public. Regulated forex brokers are required to be financially stable, provide segregated accounts for their customers, offer proper pricing, quality order execution, and most importantly ethical and fair business methods.

It's better to make sure that the chosen forex broker is headquartered in a country where a certain regulatory body enforces laws and regulations; for instance, the cysec of cyprus, FCA of the UK, ASIC of australia, IFSC of belize and other relevant authorities. Working with a forex broker that is not regulated and answers to no authority could put you at financial risks. A non-regulated forex broker is not under any obligation to process your transactions, give you the correct required charts or data, or support you in any way. Additionally, if you choose to work with an unauthorized broker, you do so at your own risk, and can't redeem your losses or officially complain to authorities since they are not members of a compensation fund scheme or any organization of that kind.

The quality of a forex broker's customer support says a lot about them. The services that you require from a forex broker need to be available at all hours (24/5) considering the level of activities in the FX market. Customer support should be within your reach via various methods including email, live chat, and phone calls just to make you more comfortable. The support staff has to be well-informed and well-mannered to answer all your questions and guide you to the best of their knowledge, so you'd know if you can count on them when a real problem occurs. You can review their overall response time and effort through live chat to see how they approach your questions about spreads, leverage, regulations, or any other details that you want to know. They should listen to your concerns patiently and offer their support to address your needs. Otherwise, you need to go to another forex broker whose support department would help to make your trading experience all the more rewarding.

An active forex broker in your region that offers support in your local language could be very helpful, especially if you are not very good at english. This also means that you will receive the best support to face your problems faster.

Forex traders are required to pay a spread - the difference between the bid and ask prices - to their forex brokers. The spread is offered either as fixed or floating which can be chosen according to your trading requirements. The fixed spread, as the name suggests, stays the same regardless of the size of your trade. The floating spread, however, changes with the market movements and is usually offered as low as 1 pip. So you need to consider which spread type fits your trading strategies and choose accordingly. Forex brokers earn a profit by charging a spread for the clients' transactions. Some brokers charge higher spreads to earn more money while others offer lower fees for their services to attract more customers. Dealing desk brokers (market makers) set the spread price for every currency pair ranging from 2-3 pips. Forex traders are always looking for the lowest spread forex brokers in order to reduce their own trading costs.

Forex is known for its high leverage, and there are forex brokers who offer high leverage ranging from 1:50, 1:100 or even as high as 1:3000. Aggressive traders tend to use leverage at its maximum level and take bigger risks, cautious traders, on the other hand, might want to approach leverage more carefully to stay on the safe side.

Another important issue is the speed and quality of order execution, especially for scalpers, EA users, and those who trade more often. Moreover, scalpers are more interested in ECN forex brokers through which they can receive better and friendlier trading conditions including the lowest spreads, no re-quotes, and ultra-fast order execution.

Every forex broker offers somewhat different deposit and withdrawal methods to its clients. Ideally, you need a broker whose payment systems are user-friendly, fast, and secure. Traders can now fund their accounts via bank wire and credit cards (visa, mastercard, etc.) at many forex brokers. Forex brokers also accept online payment systems including webmoney, skrill, neteller, fasapay, bitcoin and perfectmoney because of their speed, ease of access, and worldwide popularity. Funding time in bank wire transactions is usually up to a few business days, while with online payment systems, deposits and withdrawals are processed very quickly (deposits are made instantly and withdrawals in few hours or within a working day).

Moreover, forex brokers that are active in specific regions may accept funding via local banks. For example, the clients from malaysia are able to use their accounts with the local malaysian banks as a depositing method directly from their personal cabinet. In this way, the malaysian traders can fund their forex account faster and easier withdraw the funds (e.G., any earned profits) to their local bank account (in ringgit).

Go to forex deposit & withdrawal in malaysia to learn about all payments methods offered by forex brokers in malaysia.

Forex in malaysia

Forex trading is legal in malaysia, although the bank negara malaysia (BNM), the financial authority in malaysia, places restrictions. A law states that it is not allowed for any forex trader in malaysia to deal in currencies without an authorized broker in malaysia. Traders living abroad are not subject to this regulation.

List of best forex brokers in malay

Here you can find a list of global reliable forex brokers online offering service in bahasa malaysia for traders living abroad.

Risk warning: your capital is at risk. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 58-89% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please be advised that certain brokers, products, bonus and/or leverage may not be available for traders from some countries due to legal restrictions.

Risk warning: investments involve a high level of risk. It is possible to lose all your capital. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 58-89% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

The information on this site is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation and is not directed at residents of: belgium · france · japan · latvia · turkey · united states ·

Top malaysia brokers for 2021

We found 11 online brokers that are appropriate for trading malaysia.

Best malaysia brokers guide

Malaysia financial markets

We've collected thousands of datapoints and written a guide to help you find the best malaysia brokers for you. We hope this guide helps you find a reputable broker that matches what you need. We list the what we think are the best malaysia brokers below. You can go straight to the broker list here.

Trading in malaysia

When trading in malaysia you will need to know what your options with your malaysia trading broker are.

We list below the trading account types available in malaysia. If you are looking for brokers in malaysia that are suitable for trading in the forex, CFD's, indices and etfs, cryptocurrencies (availability subject to regulation) or commodity markets; this malaysia broker guide will explain the things you should check and be aware of before you invest.

Forex trading in malaysia

Forex trading is growing in popularity in malaysia. The volume of forex traded in malaysia has increased year on year over the last five years.

Across the world $5.1 trillion USD in volume is traded every single day. This is a huge amount in comparison with other financial market sectors.

Advances in online technology, higher internet coverage in malaysia and increased competition among brokerages have made forex trading more accessible and reduced the costs of trading generally.

Is forex trading legal in malaysia?

Their is a misconception that trading forex on the financial market in malaysia is considered unsafe. This is not the case, forex trading in malaysia is very active.