Gmi edge

They can be contacted by phone: +1800 282260, or you can send an email to cs@gmiedge.Com.

Top forex bonuses

An unregulated broker is clearly not authorized to operate in any country and you should definitely avoid it and never deposit your money into it.

GMI edge

GMI edge regulation

OFFSHORE

Have you been scammed by GMI edge?

GMI edge info

- Website: https://gmiedge.Com

- Address: govant building, BP 1276 port vila, vanuatu

- Phone: +1800 282260

- Email: cs@gmiedge.Com

- Company: global prime limited

GMI edge broker info

GMI edge is an offshore broker owned by global prime limited located at govant building, BP 1276 port vila, vanuatu. You should definitely avoid any offshore broker and GMI edge is one of them.

They can be contacted by phone: +1800 282260, or you can send an email to cs@gmiedge.Com.

GMI edge traders reviews

After reading some traders reviews, we found out that there are some problems that were reported by traders. Traders that have used GMI edge are giving bad reviews and warn other traders not to use them.

It is important to make sure that you know what other traders are thinking about a broker before you just start using them. And, in this case, the reviews aren’t really positive.

What are regulators saying?

This is the most important thing you need to know about brokers before making any commitments.

Is GMI edge regulated ? Is it an offshore regulation ?

Most brokers are unregulated or regulated by an offshore regulation authority which doesn't mean much because there wont be anyone making sure that they aren’t doing any illegal things. Keep in mind that if a broker steal your money, you won't be able to fight back unless they are regulated by a serious regulatory agency such as the cysec (cyprus securities and exchange commission), FCA (financial conduct authority).

An unregulated broker is clearly not authorized to operate in any country and you should definitely avoid it and never deposit your money into it.

Have you been scammed by GMI edge?

Have you been victim of GMI edge ? You have lost a lot of money, and the possibility to make some profit ? This is something that will make anyone furious. However, the good news is that we can help you.

Help is available for you to recover your funds from GMI edge. The only thing that you need to know is where you can get that help. You don’t wants to land in another scam besides the forex trading scam as well.

Chargeback is the solution

This is the good news. When you are making use of chargeback, you will be able to recover your funds from GMI edge. Funds that you thought you have lost forever. Yes, you can report it to the police or even open a case at your lawyer, but this isn’t going to bring your money back in most cases.

Using a chargeback service like mychargeback is the only way to get your money back into your account.

Platforms

SPREADS STARTING FROM AS LOW AS 0.1 PIPS

FAST & SECURE DEPOSIT/ WITHDRAW

Platforms

GMI edge is the trading name of global prime limited, a regulated and licensed dealer in securities by the vanuatu financial services commission with the registration number 14647. Registered address govant building, BP 1276 port vila, vanuatu. Global prime limited is the owner and operator of this website (www.Gmiedge.Com) and (www.Edgema.Biz).

GMI edge is part of the GMI group of companies. The GMI brand was established in 2009.

The GMI group of companies includes:

– global prime limited – registered address govant building, BP 1276 port vila, vanuatu

– GMI edge limited – registered address unit 7, 10/F, tower 1, china hong kong city, 33 canton road, tsim sha tsui, kowloon, hong kong

– global market index limited (UK), authorized and regulated by the financial conduct authority (FRN: 677530) with registered address at 125 old broad street, london, england, EC2N 1AR

– global market index limited (VN) (GMIVN), a company regulated and registered in vanuatu, company number 14646, with registered address at BP 1276, govant building, port vila, vanuatu

Clients contract with both global prime limited (license holder) and GMI edge limited (merchant), (collectively referred to as GMI edge), being registered companies organized under the laws of republic of vanuatu and hong kong respectively, its successors and assigns, and the party (or parties) executing this document.

General risk disclaimer: trading forex, cfds, and any financial derivative instruments on margin carries a high level of risk and may not be suitable for all investors, as you could sustain losses in excess of your deposits. The company, under no circumstances, shall be liable to any persons or entity for any loss or damage in the whole or part caused by, resulting from, or relating to any transactions related to CFD. GMI edge assumes no liability for errors, inaccuracies or omissions; does not warrant the accuracy, completeness of information, text, graphics, links or other items contained within these materials.

GMI edge review

GMI edge provides online forex and CFD trading with competitive trading conditions through the metatrader 4 platforms. They have a range of account funding options but lack in educational materials and additional trading tools. They do not offer any individual stocks or cryptocurrency trading whilst spreads can incur a mark-up on the commission free accounts. They are also regulated offshore and do not accept clients from certain countries including the UK and USA.

GMI edge review, pros & cons

- User-friendly metatrader 4 platform for multiple devices

- Variety of account funding options

- Flexible leverage

- Competitive trading conditions

- Minimum $25 deposit

- Swap free accounts

- Offshore broker

- No educational materials

- Limited additional trading tools

- No stocks or cryptocurrency trading

- Does not accept clients from the UK or USA

- Spread mark-ups

- No social trading platform integration

- USD currency accounts only

In this detailed GMI edge review, our online broker research team have covered some of the most important aspects for you to consider when choosing the best broker for your online trading needs.

GMI edge is not ranked in our best forex brokers, best stock brokers, best cfd brokers, best crypto brokers or best online brokers categories. You can use our free broker comparison tool to compare online brokers including GMI edge.

GMI edge review: summary

GMI edge is an offshore trading broker that provides online trading via metatrader 4 (MT4) on a variety of different asset classes including forex, indices, precious metals, energies and cfds. Whilst the broker offers leverage of up to 1:2000 depending on your account balance and type, it is imperative users are aware of the significant risks involved when using such high leverage.

GMI edge review: broker features

Founded in 2018, GMI edge have trade execution speeds from 0.005 seconds whilst forex spreads start from around 0.1 pips. The broker has low minimum deposit requirements from $25 along with a choice of fast and secure account funding options. However, they could improve on their regulation.

GMI edge review: regulation

GMI edge is the trading name of global prime limited, a regulated and licensed dealer in securities by the vanuatu financial services commission (VFSC). GMI edge is part of the GMI group of companies. The GMI brand was established in 2009.

Whilst regulation can give traders the peace of mind they are using a broker which must abide by strict rules and regulations that are put into place in order to protect investors, the trading brokers review team would prefer a broker to use a top tier regulator such as the FCA, cysec and ASIC.

GMI edge review: countries

Whilst GMI edge can provide brokerage services to many countries, there are some restrictions. They do not accept clients from the united kingdom and united states amongst other countries.

Some GMI edge broker features and products mentioned within this GMI edge review may not be available to traders from specific countries due to legal restrictions.

If you are looking for a trading broker in a particular country, please see our best brokers USA, best brokers UK, best brokers australia, best brokers south africa, best brokers canada or our best brokers for all other countries.

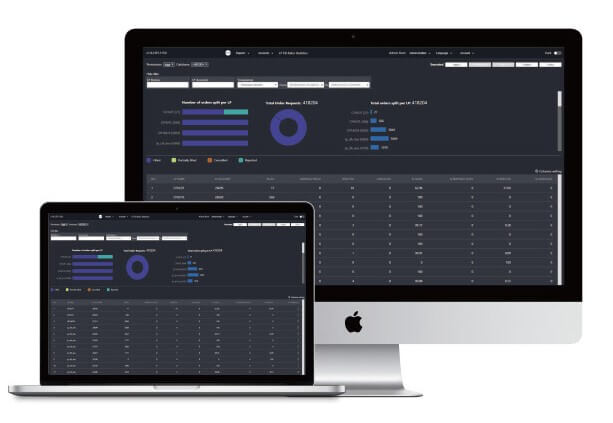

GMI edge review: trading platforms

Metatrader 4

Like the majority of online brokers, GMI edge provide traders with the user friendly yet powerful metatrader 4 (MT4) trading platform. MT4 is one of the most popular trading platforms and is used by millions of traders all over the world. It is well known for being fully customisable with an intuitive user interface and vast array of built-in trading tools enabling traders to deeply analyse the financial markets. The platform can support both beginner and experience traders with their day to day trading activities.

GMI edge review: metatrader 4 platform

You can download the MT4 platform for free on desktop and mobile devices running on ios and android. The MT4 mobile app is useful for those who would like to trade and manage their account whilst in the go from anywhere in the world provided there is an internet connection. MT4 is also available as a web trading platform that runs directly in your web browser without the need to download and install any additional software.

Some of the key metatrader 4 platform features include:

- Fully customisable and user-friendly interface

- Multiple chart types and time frames

- Variety of order types supported including one-click trading directly on charts

- Create, save and load trading strategy templates

- Real time bid/ask price quotes of trading instruments displayed in the market watch window

- Generous selection of technical indicators and graphical objects for chart analysis

- Automated trading supported through expert advisors (eas)

- Strategy tester to back test eas over historical data

- MQL programming interface to create customised indicators, eas and scripts

- MQL market place to download customised tools and get trading signals

- Large online community to share ideas and tools with other traders

- Set price and indicator alert notifications to be sent via SMS, email and pop-ups

- Virtual private server (VPS) support for remote hosting of platform

- Available for desktop, web and mobile devices

GMI edge review: trading tools

Whilst the broker states that GMI edge account holders get free access to trading central and market analysis, we were unable to find any evidence of this on the brokers website. That being said, the metatrader 4 platform is likely to have more than enough tools and functionality to satisfy the online trading needs of the average retail trader.

GMI edge review: education

Unfortunately, there are currently no educational materials available on the GMI edge website. We would like to have seen some trading guides, tutorial videos, webinars and seminars. These can all be useful to help traders improve their trading skills and knowledge whilst emphasising the brokers support for informed online trading.

GMI edge review: trading instruments

GMI edge offers over 50 FX currency pairs including major, minor and exotic crosses. The broker also has a modest selection of cfds on precious metals and energies. The trading brokers team found the asset range lacking when compared with some of the best trading brokers. There are currently no stocks or cryptocurrencies for trading online.

Forex trading

The broker has around 50 forex currency pairs with competitive spreads, minimal requotes and leverage up to 1:2000.

Metals trading

They offer precious metals through silver and gold trading.

Indices trading

GMI edge offers 8 global stock indices with 1:50 leverage and zero commission on the standard account: US30, SP500, US100, UK100, GE30, FR40, HSIHDK and CHN50U.

Energies trading

Trade long or short on oil and gas with leverage of up to 1:100.

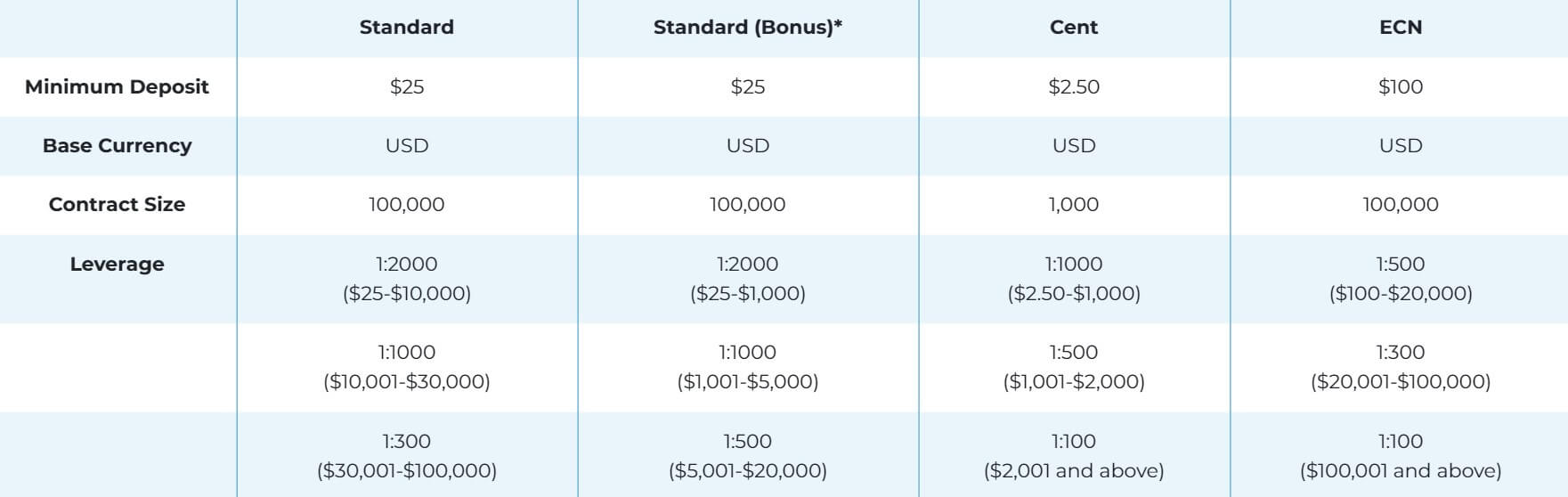

GMI edge review: trading accounts & fees

GMI edge have a choice of 3 main account types which vary on a number of factors such as the minimum deposit requirement, commission, leverage and lot sizes. There is also an additional “bonus” account. You can choose an account that is best suited towards your individual trading style and goals. The broker states that they accept all types of trading strategies including hedging, scalping and automated trading.

Standard account

- Minimum deposit $25

- Leverage up to 1:2000

- No commissions

- 100,000 contract size

- 0.01 minimum lots

- 50 maximum lots

- Variable spreads

Cent account

- Minimum deposit $2.50

- Leverage up to 1:1000

- No commissions

- 1,000 contract size

- 0.01 minimum lots

- 150 maximum lots

- Variable spreads

ECN account

- Minimum deposit $100

- Leverage up to 1:500

- $4 commission per lot

- 100,000 contract size

- 0.01 minimum lots

- 50 maximum lots

- Variable spreads

GMI edge review: broker account types

GMI edge MAM account

GMI edge have a managed account option for money managers. You can complete orders for all accounts in a timely and synchronized manner. All orders are executed at the same time/same price, and all accounts have the same ROI. Each MAM account can support up to 100 sub accounts. The MAM account can integrate with the MT4 platform on multiple devices.

Islamic account

The broker has a swap free option with no charges for holding a position overnight. They are a muslim friendly broker which can provide trading accounts that comply with sharia law.

Demo account

Demo trading accounts are available upon request if you wish to practice your trading strategies using virtual funds and to familiarise yourself with the trading platforms.

GMI edge review: customer service

GMI edge customer support is available via email, telephone and live chat. There is an online contact form if you wish to send them a message directly.

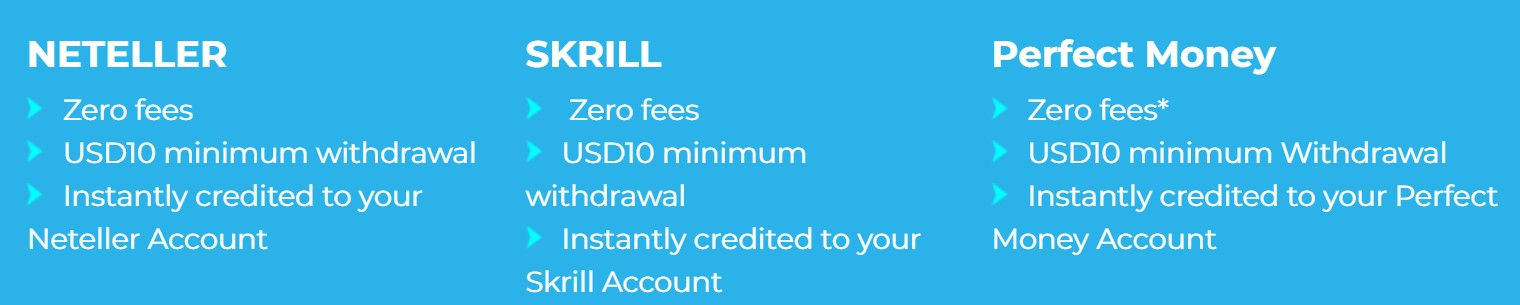

GMI edge review: deposit & withdrawal

GMI edge have a choice of convenient methods for depositing and withdrawing funds from your trading account. This includes bank transfer and online payment systems such as neteller, skrill and perfect money. The broker can also accept cryptocurrency payments through bitcoin. Please be aware that some methods may only be available to specific countries and not all are available for both deposit and withdrawal.

GMI edge review: account funding options

To deposit into your trading account, first you need to login to the members area, click deposits from the menu, and select your preferred payment option. You can then proceed with the necessary steps and details based on the instructions given. The same process applies if making withdrawals, just choose the withdrawal option instead.

Withdrawals under $1,000 will be processed instantly and sent to payment providers for verification. Withdrawals from $1,000 up to $19,999 will require manual approval and be sent to payment providers for verification within 24 hours depending on the method chosen by the client, and providing requests meet all appropriate risk / AML requirements. Withdrawals over $20,000 may take up to 4 business days.

Some fees may be charged when using certain payment methods. The withdrawal time can vary depending on the payment provider and method. Bank transfers may take a few business days to clear whilst some methods can be instant.

Some payment systems may have transaction limits, restrictions, and requirements which are indicated on their respective websites. You may need to verify your account to remove limits on particular methods in some countries. GMI edge strictly does not accept third-party payments. All funds deposited into your trading account must be under the same name as your GMI edge trading account.

You can only transfer funds to and from your account once the appropriate documentation has been submitted and verified in accordance with the brokers standard account opening procedures/KYC. Please note that all deposit/withdrawal transactions are also subject to internal anti-money laundering (AML) controls.

Accounts can only be opened USD. If the broker had different currency options, this would have been beneficial as currency conversion fees do not apply when using an account in your own currency.

As broker fees can vary and change, there may be additional fees that are not listed in this GMI edge review. It is imperative to ensure that you check and understand all of the latest information before you open a GMI edge broker account for online trading.

GMI edge review: account opening

In order to open a trading broker account with GMI edge, you will need to complete a short online application form. During your application, you will be requested to submit personal information and documents to verify your account. This is a normal part of a brokers KYC and AML procedures. Once your details have been verified by a member of the accounts team, you will be able to fund your account and commence trading online with GMI edge.

GMI edge review: account registration

It is imperative to ensure that when you are going through a broker application, you clearly read all of the brokers terms, conditions and policies. Only proceed if you fully understand and agree to them.

GMI edge review: conclusion

Overall, GMI edge has a reasonable online brokerage offering with competitive trading conditions and backing of the GMI group of companies. The trade execution speeds are swift and the spreads decent. The MT4 platform is easy to use and available on multiple devices. The broker also has a variety of account types and convenient payment options.

Despite the positives, we would like to see GMI edge provide some educational materials and additional trading tools. Furthermore, leverage is capped when your account reaches a certain amount and they do not have any social trading platform integration. There are no individual stock or cryptocurrency trading instruments. We would also like to see the broker implement regulation from other well-known regulators.

Trading forex, cfds, and any financial derivative instruments on margin carries a high level of risk and may not be suitable for all investors, as you could sustain losses in excess of your deposits.

platforms for desktop, web & mobile devices. The broker has competitive trading conditions but lacks in educational materials & additional trading tools.</p><br /><br /><h2 id=) Forex brokers lab

Forex brokers lab BROKERS with LOW SPREADS

ASIC REGULATED BROKERS

BROKERS with MINIMUM DEPOSIT

BEST FOREX BONUSES

Regulators : FCA, VFSC

Cryptocurrencies: no

Minimum deposit: $25

Maximum leverage: 1:2000

Spreads: high

My score: 0.8

GMI edge is the new name of GMPFX as of 12th september 2018. The broker is targeting malaysian investors. As you can see on the website, gmiedge.Com, trading conditions are based on malaysian investors. The official website can also be accessed on five levels: english, malay, indonesian, thailand and vietnam. Investors are naturally concerned about brokers who are just starting to offer services.

So many investors are researching whether it is GMI edge scam or a reliable broker. If you are reading this GMI edge review; you are probably researching account types, deposit and withdrawal methods, minimum deposit, maximum leverage and bonus issues.

The way to earn money in forex is a good investment psychology. If you do not trust the broker and you do not know precisely what trading conditions the broker offers, you can not make a profit even if you do successful trades.

For all these reasons, do not open an account without reading this GMI edge reviews.

GMI edge regulation

The most crucial problem of newly established brokers is regulated. Because getting a license from reputable regulators like FCA, ASIC, cysec is a very challenging process. Because these regulators have strict requirements and the brokers must maintain these requirements. For this reason, new brokers tend to regulators that are relatively easy to obtain licenses. One of these is VFSC (vanuatu financial services commission) from vanuatu island.

GMI edge is the trading name of global prime limited. According to the information on the website, this company is a VFSC licensed broker but I have not attained the document of this license. When I search on the vanuatu financial services commission’ website the registration number (14647), there was no any result. Normally, VFSC-licensed brokers clearly state this in their website and put the original of this document on the relevant page. In addition, customer service can send this document as a PDF file. If they send me the document, I’ll add it to the review.

Several months after I wrote the above paragraphs, I received an email from GMI edge. They explained the licenses and regulation in the mail. As I promised, I add here.

The GMI group of companies includes:

- Global market index limited (UK), authorized and regulated by the financial conduct authority (FRN: 677530) with registered address at 125 old broad street, london, england, EC2N 1AR

- Global market index limited (VN) (GMIVN), a company regulated and registered in vanuatu, company number 14646, with registered address at BP 1276, govant building, port vila, vanuatu

- GMI edge limited with the registration number 2665994, (registered address unit 7, 10/F, tower 1, china hong kong city, 33 canton road, tsim sha tsui, kowloon, hong kong) being the entity responsible for processing of settlements for global prime limited.

I’ve checked the accuracy of these licenses. However, please note that the FCA license does not cover the GMI edge brand. When you query the license number on the official site of FCA, you will see gmimarkets.Com for this license.

Account types and spreads in GMI edge

GMI edge offers variety account types. These are standart, standart (with bonus), cent, cent (with bonus) and ECN. When we compare the old version of the broker, GMPFX, there are more account types. There was only standart account before.

Almost all brokers are trying to maintain account type diversity so that investors choose the most appropriate account type. For example, you can find nano account types that can be traded in nano lots on most of other brokers on my list. ECN account types are also offered by many brokers. GMI edge didn’t have before them but now have.

If we look at the standard account offered by GMI edge; the maximum leverage is 1: 2000 and the spreads are offered as 2 pips on EUR/USD.

This leverage ratio is quite high and above the average of brokerage industry which is 1:500. If you have not forex experience before, trading with such a high leverage can be quite risky for you. Also, spreads of 2 pips on EURUSD is not competitive when we compare other brokers. GMI edge minimum deposit is $25.

Let’s look at the ECN account. The maximum leverage is 1:500 and there is also commission $4 per lot. The minimum deposit is $100 for GMI edge ECN account.

Another major disadvantage of GMPFX is that it is not rich in terms of trading instruments. For example, cryptocurrencies are not available for FX trading.

Trading products

GMI edge offers forex and metals only. Indices and energy are incoming but there is no info about when they are coming. Trading products are very limited in GMI edge.

Trading platforms

GMI edge supports the metatrader4 platform which is well-known by forex traders and brokers. You can download and use the platform to start trading. MT4 has many advantages besides being the most used platform. The technical indicators are one the advantages. The platform is user-friendly. What is more, you can automate operations entirely by using EA (expert advisor).

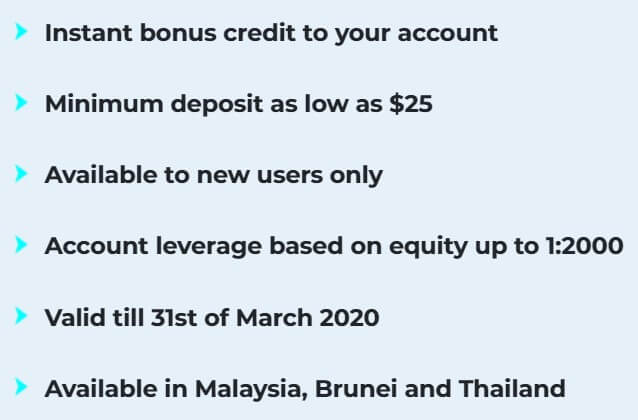

Bonuses

GMI edge offers its clients some bonuses. %10,%50 and %100 deposit bonus. And there is also GMI edge $30 welcome bonus. There are some terms and conditions for these bonuses you can check on the broker’ website.

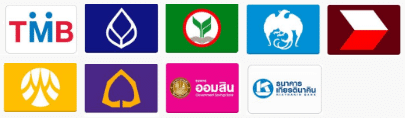

Payment methods

In terms of deposit and withdrawal methods, GMI edge offers very limited options. Many popular e-wallet systems for depositing and withdrawing are not available. Neteller is the only option you can use. According to the information on the website, fasapay will be available soon. Another option is to use local bank transfers. Supported banks are maybank, CIMB, RHB, public bank, hong leong bank. The minimum withdrawal is MYR50 for local banks transfer. For neteller, it is $10.

โบรกเกอร์ GMI edge รีวิว

โบรกเกอร์ GMI edge ภาพรวมทั้งหมด

GMI edge เป็นโบรกเกอร์ที่ดีไหม ?

GMI edge คือหนึ่งในโบรกเกอร์ของกลุ่มบริษัท GMI (global market index)

- ก่อตั้งขึ้นในปี 2009 ปัจจุบันมีสำนักงานอยู่ในหลายประเทศ

- บริษัทมีการจดทะเบียนกับหน่วยงานชั้นนำอย่าง FCA ประเทศอังกฤษ

- และ VFSC ประเทศ vanuatu

- การฝากถอนเงินสะดวก รองรับธนาคารไทย

- โปรโมชั่นที่มีความน่าสนใจ

- สามารถส่งคำสั่งซื้อได้เร็ว

- Commission สำหรับบัญชี ECN ต่ำเพียง 4$ ต่อ 1.00 lot

- ไม่มี platform metatrader 5

โบรกเกอร์ GMI edge จดทะเบียนที่ไหนบ้าง

กลุ่มบริษัท GMI มีการจดทะเบียนกับหน่วยงานหลายแห่ง ได้แก่:

- ที่อยู่จดทะเบียน: govant, BP 1276 port vila, vanuatu

- ที่อยู่จดทะเบียน: 7,10 / F, tower 1, china hong kong city, 33 canton road, tsim sha tsui, hong kong

3. Global market index limited (UK)

- ที่อยู่จดทะเบียน: 125 old broad street กรุงลอนดอน ประเทศอังกฤษ EC2N 1AR เปิดแผนที่

- ได้รับอนุญาตและถูกควบคุมโดย financial conduct authority (FCA)

- ใบอนุญาตเลขที่ FRN: 677530

- ตรวจสอบใบอนุญาต

4. Global market index limited (VN) (GMIVN)

- ที่อยู่จดทะเบียน: BP 1276 อาคาร govant port vila, vanuatu

- หมายเลขบริษัท: 14646, จดทะเบียนในประเทศ vanuatu

ประเภทบัญชีเทรด

โบรกเกอร์ GMI edge มีบัญชีเทรดทั้งหมด 4 ประเภท ได้แก่:

- เงินฝากขั้นต่ำ: 25$

- Leverage สูงสุด: 1:2000

- Spread EURUSD เฉลี่ย:15 point

- Commission: ไม่มี

- เงินฝากขั้นต่ำ : 25$

- Leverage สูงสุด : 1:2000

- Spread EURUSD เฉลี่ย : 15 point

- Commission : ไม่มี

- เงินฝากขั้นต่ำ : 2.5$

- Leverage สูงสุด : 1:1000

- Spread EURUSD เฉลี่ย : 15 point

- Commission : ไม่มี

- เงินฝากขั้นต่ำ : 100$

- Leverage สูงสุด : 1:500

- Spread EURUSD เฉลี่ย : 1 point

- Commission : 4$ ต่อ 1.00 lot

โปรโมชั่นของ GMI edge

1. โบนัสเงินฝาก 30% (สำหรับลูกค้าใหม่เท่านั้น)

- โปรโมชั่นนี้จะใช้ได้กับลูกค้าใหม่ ที่ฝากเงินเข้าบัญชีการซื้อขาย

- โดยจะได้รับโบนัสสูงสุด 500$ ในรูปแบบของเครดิต

- ซึ่งสามารถใช้ในการเทรดได้ตามปกติ และครอบคลุมการขาดทุนสำหรับคำสั่งซื้อที่เปิดอยู่

2. โบนัสเงินฝาก 15% (ทั้งลูกค้าเก่าและใหม่)

- โปรโมชั่นนี้ใช้ได้สำหรับลูกค้าทุกคน ซึ่งให้สูงสุดที่ 5,000$ ในรูปแบบของเครดิต

- รวมถึงลูกค้าใหม่ที่ฝากเงินเพื่อรับโบนัส 30% และมีการฝากเงินเข้ามาในบัญชีเทรดอย่างต่อเนื่อง

- ซึ่งสามารถใช้ในการเทรดได้ตามปกติ และครอบคลุมการขาดทุนสำหรับคำสั่งซื้อที่เปิดอยู่

ช่องทางการฝากถอน

รองรับการฝากถอนผ่านธนาคารไทย online banking หลายแห่ง และการชำระผ่าน QR code

- ธนาคารทหารไทย

- ธนาคารกรุงเทพ

- ธนาคารกสิกรไทย

- ธนาคารกรุงไทย

- ธนาคาร CIMB

- ธนาคารกรุงศรีอยุธยา

- ธนาคารไทยพาณิชย์

- ธนาคารออมสิน

- ธนาคารเกียรตินาคิน

- Neteller

- Skrill

- การฝากเงิน : โดยทั่วไปจะเข้าบัญชีเทรดแทบจะทันที หลังจากทำรายการเสร็จ

- การถอนเงิน : ภายใน 24 ชั่วโมง (เวลาทำการ)

ฝ่ายบริการลูกค้า

มีฝ่ายบริการลูกค้า live chat ภาษาไทย

- เวลาทำการ 09.00 - 18.00 น. (จันทร์-ศุกร์)

- Line official ID : @gmiedgeth

- เบอร์ติดต่อ : 1800 012648

GMI edge review

GMI edge is a forex broker that is registered and regulated in vanuatu, there isn’t much information on their website about them, no about ‘about us’ page or outline of their goals. So we will be going into this review blind, looking at all aspects of their service and site to see if they stand up to the competition and so you can decide if they are the right broker for your trading needs.

Account types

There are four different accounts available to choose from, each with its own features, so let’s outline what they are.

Standard account:

this account has a deposit requirement of $25 and must be in USD. The contract size is 100,000 units and leverage can go as high as 1:2000. Expert advisors are allowed as is hedging. There are no added commissions on the account which has a minimum trade size of 0.01 lots, a maximum of 50 lots and can have 200 orders open at any one time. Swap-free versions are available and the margin call level is set at 60% with the stop out level at 30%. It has a variable spread and has affiliate rewards available.

Standard (bonus) account:

this account has a deposit requirement of $25 and must be in USD. The contract size is 100,000 units and leverage can go as high as 1:2000. Expert advisors are allowed as is hedging. There are no added commissions on the account which has a minimum trade size of 0.01 lots, a maximum of 50 lots and can have 200 orders open at any one time. Swap-free versions are available and the margin call level is set at 60% with the stop out level at 30%. It has a variable spread and has affiliate rewards available.

Cent account:

this account has a deposit requirement of $2.50 and must be in USD. The contract size is 1,000 units and leverage can go as high as 1:1000. Expert advisors are allowed as is hedging. There are no added commissions on the account which has a minimum trade size of 0.01 lots, a maximum of 150 lots and can have 200 orders open at any one time. Swap-free versions are available and the margin call level is set at 60% with the stop out level at 30%. It has a variable spread and has affiliate rewards available.

ECN account:

this account has a deposit requirement of $100 and must be in USD. The contract size is 100,000 units and leverage can go as high as 1:5000. Expert advisors are allowed as is hedging. There is an added commission of $4 per lot on the account which has a minimum trade size of 0.01 lots, a maximum of 50 lots and can have 200 orders open at any one time. Swap-free versions are available and the margin call level is set at 60% with the stop out level at 30%. It has a variable spread and has affiliate rewards available.

Platforms

Platforms

The only platform on offer is metatrader 4 which is one of the most used and secure platforms for trading forex, allowing you to analyze the financial markets, use expert advisors (EA) and use a whole host of indicators and scripts to analyze your next move and transaction. Millions of traders with a wide range of needs choose metatrader 4 to trade in the market. Usable and accessible by all, MT4 is available as a mobile application, web trader and as a download for your desktop or laptop.

Leverage

The leverage that you get depends on the account you use and the balance you have. We have outlined the differences in available leverage below.

Standard account:

$25 – $10,000 = 1:2000 max

$10,001 – $30,000 = 1:1000 max

$30,001 – $100,000 = 1:300 max

$100,001 and above = 1:100 max

Standard (bonus) account:

$25 – $1,000 = 1:2000 max

$1,001 – $5,000 = 1:1000 max

$5,001 – $20,000 = 1:500 max

$20,001 – $100,000 = 1:200 max

$100,001 and above = 1:100 max

Cent account:

$2.50 – $1,000 = 1:1000 max

$1,001 – $2,000 = 1:500 max

$2,001 and above = 1:100 max

ECN account:

$100 – $20,000 = 1:500 max

$20,001 – $100,000 = 1:300 max

$100,001 and above = 1P:100 max

The leverage is fixed and selected when opening up an account.

Trade sizes

Trade sizes for all accounts start from 0.01 lots and go up in increments of 0.01 lots. The standard, standard (bonus) and ECN accounts have a max trade size of 50 lots and the cent account has a maximum of 150 lots. You can also have a maximum of 200 orders at any one time.

Trading costs

The ECN account is the only account that has an added commission, the commission of $4 per lot traded. The other accounts use a spread based system that we will look at later. There are also spread charges which are charged for holding trades overnight. Islamic swap-free versions of each account are also available.

Assets

The assets have been broken down into a few different categories. We have outlined them below including the instruments within them.

Forex: EURUSD, USDJPY, GBPUSD, USDCHF, AUDUSD, NZDUSD, USDCAD, EURGBP, EURCHF, EURJPY, GBPJPY, CHFJPY, AUDJPY, NZDJPY, CADJPY, AUDNZD, EURAUD, EURCAD, GBPCHF, GBPAUD, GBPCAD, GBPNZD, EURNZD, AUDCHF, AUDCAD, CADCHF, NZDCAD, NZDCHF, USDMXN, USDHKD, USDCNH, EURSEK, EURNOK, USDSEK, USDDKK, NOKSEC, USDZAR, USDNOK, EURTRY, USDTRY, USDSGD.

Energy: US crude oil and UK crude oil.

Indices: these are not yet available and the site states that it is coming soon.

Spreads

The different accounts have different spreads if we look at EURUSD, the standard and ent accounts have an average spread of 1.6 pips, the ECN account has an average spread of 0.2 pips. The spreads are variable which means they move with the markets when there is added volatility they will be seen higher. Different instruments also have different spreads so while EURUSD has an average of 1.6 pips, GBPJPY has an average of 2.8 pips.

Minimum deposit

The minimum deposit amount is $2.50 which will allow you to open up a cent account if you want a standard account the minimum deposit required is $25.

Deposit methods & costs

There are a number of different ways to deposit, these are local bank transfer, neteller, skrill, perfect money, dragonpay and fasapay. The site states that there are no added fees from GMI edge, however, there is an added fee of 3.95% on all deposits from neteller, skrill, perfect money, dragonpay and fasapay. So there is, in fact, an added fee.

Withdrawal methods & costs

The same methods are available to withdraw with, for clarification these are local bank transfer, neteller, skrill, perfect money, dragonpay and fasapay. There are no added fees for withdrawals but be sure to check with your own bank to see if they will add any incoming transaction fees.

Withdrawal processing & wait time

GMI edge will aim to process any withdrawals within 24 hours of the request. All methods are then transferred instantly apart from local bank transfer which will be available the next working day.

Bonuses & promotions

There are two different promotions on offer.

30% bonus: you can receive a 30% bonus up to $500 on your first deposit. This bonus is automatically available for all clients who deposit into their trading accounts with the maximum bonus amount of $500. Your bonus can be used to open positions as well as cover losses in floating positions. Any profits generated can be withdrawn at any point in time, however, any withdrawal of funds will result in the full removal of your trading bonus.

15% bonus: you can receive a 15% bonus of up to $5,000. This bonus is automatically available for all clients who have used the 30% deposit bonus and continue to make deposits into their trading accounts. You will continue to receive the 15% bonus until you reach the maximum total bonus amount of $5000. Your bonus can be used to open positions as well as cover losses in floating positions. Any profits generated can be withdrawn at any point in time, however, any withdrawal of funds will result in the full removal of your trading bonus.

Educational & trading tools

There doesn’t seem to be any educational material available, many brokers are now looking to help their clients improve their trading so it would be good to see GMI edge follow this route and add some educational material.

Customer service

Should you need to contact GMI edge, you can do so by using the online submission form to fill in your query and get a reply via email you can also use the available email address and phone number. There is also a live chat feature available.

Email: cs@gmiedge.Com

phone: 1800 282260

Demo account

Demo accounts are available and allow you to test out the trading conditions and strategies with no risk. We do not know the details of the account such as what account it mimics or any potential expiration times.

Countries accepted

This information is not available on the site so if you are interested in joining, get in touch with the customer service team first to see if you are eligible or not.

Conclusion

GMI edge is offering a few different accounts, each having its own conditions, they cater to everyone with both cent accounts and standard lot size accounts. The spreads and commissions are ok, the commission is below the industry average but the spreads are a little higher. There is also a small lack of tradable assets with indices coming soon it will help to improve this issue. Looking at deposits and withdrawals, there are enough options available and withdrawals are fee-free, there are some fees for depositing which could be a little expensive at just under 4%. Whether they are the right broker to sue is up to you.

GMI edge review - is gmiedge.Com scam or good forex broker?

RECOMMENDED FOREX BROKERS

Trading accounts and conditions

| Trading account | min. Deposit | min. Trade size | max. Leverage | average spread |

| cent | $2.50 | 0.01 | 1:1000 | N/A |

| standard | $25 | 0.01 | 1:2000 | N/A |

| ECN | $100 | 0.01 | 1:500 | N/A + $4 / lot |

Forex and CFD brokerage GMI edge offers its clients a choice of several account types and access to the popular MT4 platform. Read the whole review to find out the possible benefits and disadvantages in choosing to trade with this broker.

GMI edge advantages

Member of a group in which there is a FCA license holder

When we weighted the advantages of GMI edge, the one that stands out is that one of the members of the GMI group holds a license with the UK’s financial conduct authority (FCA). Generally speaking, if you deal with a broker regulated in the UK, you should feel pretty secure for your funds at the company. However, it seems that this is not the case with GMI edge.

Clients of GMI edge are offered access to the most widespread FX trading platform worldwide, the metatrader4 (MT4). It is equipped with technical analysis indicators, advanced charting package, a wide range of expert advisors (EA), allowing clients to automate their trades, and extensive back-testing environment.

Low initial deposit, high leverage

It is always preferable to start out with a small deposit, which you can afford to lose. Clients of GMI edge can open a cent account by depositing just $2.50 and make use of the high leverage levels, reaching 1:1000. Standard account holders are even extended higher leverage ratios.

Keep in mind that using leverage ratios that high is very dangerous, especially for inexperienced traders. Trading on margin is risky, so make sure you understand how leverage works, before you lose everything.

GMI edge disadvantages

Clients contracting an offshore firm, not the UK entity

Although one of the members of the GMI group holds a FCA license, if you contract GMI edge, you are actually dealing with an offshore broker, registered in vanuatu. The vanuatu financial services commission has rather lax requirements and practically does not exercise any oversight on “licensed” entities. With no regulatory oversight we can’t be certain about the company behind the operation and whether it will fulfill its obligation s towards clients.

Click on the image to zoom in.

It seems that the UK entity, global market index limited, operates only global market index (GMI) brokerage brand. So, if you plan on opening a trading account, be sure to check which company you are dealing with.

We also found out that the company behind GMI edge has operated another brokerage brand, GMP FX, the website of which is no longer active. Changing names and domain names is a popular scam tactic, so be careful with this broker.

Spreads not announced, demo ones too high

Unlike most decent brokers who present clearly their pricing and trading conditions, GMI edge has not disclosed its spreads on the website. So, we had to register a demo account to see the trading costs with this broker.

As you can see from the above image, the benchmark EUR/USD spread of GMI edge is well above 2 pips, which is not a competitive pricing.

Conclusion

Although it is a part of an international group in which there is a FCA license holder, GMI edge is an offshore broker. So, potential clients of GMI edge are exposed to many risks - mainly their funds are not safe. Furthermore, they are not provided with participation in a compensatory scheme, such as the investor compensation fund (ICF) of cysec, or the FSCS of the FCA. Such compensation schemes grant clients with assurance that their losses will be covered in case the broker goes bankrupt.

To sum up our recap of GMI edge in a few words:

| Pros | cons |

| member of a group in which there is a FCA license holder | clients not contracting the UK entity |

| MT4 offered | an offshore broker |

| low initial deposit, high leverage | spreads not announced, demo ones too highv |

Latest news about GMI edge

FXTM a regulated forex broker (regulated by cysec, FCA and FSC), offering ECN trading on MT4 an MT5 platforms. Traders can start trading with as little as $10 and take advantage of tight fixed and variable spreads, flexible leverage and swap-free accounts.

XM is broker with great bonuses and promotions. Currently we are loving its $30 no deposit bonus and deposit bonus up to $5000. Add to this the fact that it’s EU-regulated and there’s nothing more you can ask for.

FXCM is one of the biggest forex brokers in the world, licensed and regulated on four continents. FXCM wins our admirations with its over 200,000 active live accounts and daily trading volumes of over $10 billion.

Fxpro is a broker we are particularly keen on: it’s regulated in the UK, offers metatrader 4 (MT4) and ctrader – where the spreads start at 0 pips, level II pricing and full market depth. And the best part? With fxpro you get negative balance protection.

FBS is a broker with cool marketing and promotions. It runs an loyalty program, offers a $100 no-deposit bonus for all new clients outside EU willing to try out its services, and an FBS mastercard is also available for faster deposits and withdrawals.

Fxchoice is a IFSC regulated forex broker, serving clients from all over the world. It offers premium trading conditions, including high leverage, low spreads and no hedging, scalping and FIFO restrictions.

Hotforex is a EU regulated broker, offering wide variety of trading accounts, including auto, social and zero spread accounts. The minimum intial deposit for a micro account is only $50 and is combined with 1000:1 leverage - one of the highest in the industry.

Gmi edge

ONE STOP TRADING SOLUTION FOR YOU

FAST AND RELIABLE TRADING EXECUTION

COMPETITIVE & TIGHT SPREADS

STP-ECN BEST PRICE EXECUTION

WHY US

PLATFORM

World-class award winning platforms: split second execution & order transparency,

Multiple trading connectivity options.

PRODUCT

Offering state of the art execution services through multiple top-tier liquidity providers, GMI can provide you with a tailor-made solution to match the demanding requirements of your business. With multi-platform offerings, which provides ultra low latency and FIX API connectivity.

FOREX

EXOTIC

FOREX

SPOT GOLD

METALS

SPOT SILVER

METALS

INDICES

CRUDE OIL

TRADING ACCOUNT TYPE

Multiple account types: ultra-tight floating spreads, flexible leverage, flexible trade sizes;

will satisfy the needs of novice and experienced traders.

Partnership

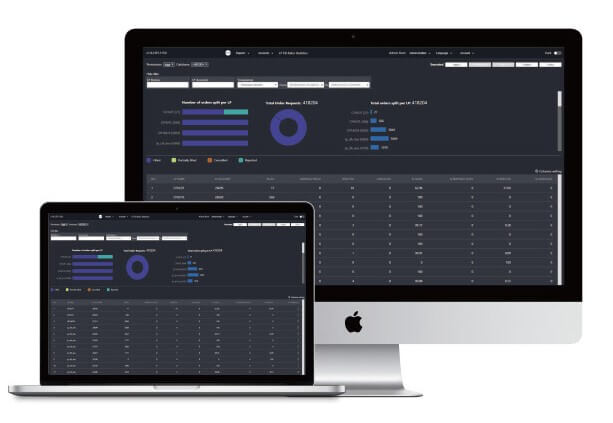

Institutional trader

GMI professional trading platforms contain a variety of cutting edge functions. You can easily access to our deep liquidity pool and obtain bespoke price feeds, which support multiple API connectivity options. Our liquidity depth reached 10+ levels deep, with up to 50 million contract size per click on certain instruments.

Introducing broker

GMI offers a win-win best-in-class introducing broker program. Being a B2B broker only, we don’t compete with our ibs for business, we provide them with wide range of reporting tools, super flexible trading terms, and highest rebates in the industry.

Money manager

GMI money manager program is designed to ensure both, investors and money managers to have the best trading experience. GMI provides the top-tier technology, such as MAM system, automated allocation positions, EA trading support, precise price order execution, and customized online reports.

White label

GMI white label program is designed to help you to establish your own brokerage with comprehensive solutions for your business needs. Including liquidity pool customization, white label platform assembly, back office management, technology support, and professional training on all aspects of broker operations.

24 hour real-time interbank pricing is obtained via dedicated FIX connectivity network.Which allows for tight spreads and fast execution, allowing full automation for all order processing.

PROFESSIONAL SERVICE

Report management

Intelligent user-defined trading activity report is convenient for clients to check all trading and account details, which allows for timely profit optimization, detailed cost breakdown and transparent order execution pricing.

Trading service

GMI works closely with multiple liquidity providers from top-tier banks and nonbanks to consistently provide our clients with deep liquidity. Meanwhile, GMI offers a series of FIX apis connectivity, and brings best bid best offer price flow to clients with ultra-low latency execution.

Account service

GMI offers multiple account types, which clients can trade in both demo, and live environments.

Customer service

Exceptional customer services, efficient case management, friendly 24/5 support.

- Best in class bridging technology allowing for greater platform stability

- Most popular retail trading platform in the world

- Powerful charting,intuitive interface,rich order set

- Automated trading enabled (AE)

- VPS hosting

- Precise hosting and collocation configuration allowing for smart order routing and ultra-fast execution

- Standard

- Standard (bonus)

- Cent

- ECN

- 30% deposit bonus

- 15% deposit bonus

- Trade & win lucky draw

- Get a brand-new car on U

- Top forex bonuses

- GMI edge

- GMI edge broker info

- GMI edge traders reviews

- What are regulators saying?

- Have you been scammed by GMI edge?

- Chargeback is the solution

- Platforms

- Platforms

- GMI edge review

- GMI edge review: summary

- GMI edge review: regulation

- GMI edge review: countries

- GMI edge review: trading platforms

- GMI edge review: trading tools

- GMI edge review: education

- GMI edge review: trading instruments

- GMI edge review: trading accounts & fees

- GMI edge review: customer service

- GMI edge review: deposit & withdrawal

- GMI edge review: account opening

- GMI edge review: conclusion

- Forex brokers lab

- GMI edge regulation

- Account types and spreads in GMI edge

- Payment methods

- โบรกเกอร์ GMI edge รีวิว

- GMI edge เป็นโบรกเกอร์ที่ดีไหม ?

- โปรโมชั่นของ GMI edge

- GMI edge review

- Account types

- Leverage

- Trade sizes

- Trading costs

- Assets

- Spreads

- Minimum deposit

- Deposit methods & costs

- Withdrawal methods & costs

- Withdrawal processing & wait time

- Bonuses & promotions

- Educational & trading tools

- Customer service

- Demo account

- Countries accepted

- Conclusion

- GMI edge review - is gmiedge.Com scam or good...

- RECOMMENDED FOREX BROKERS

- Trading accounts and conditions

- GMI edge advantages

- GMI edge disadvantages

- Conclusion

- Latest news about GMI edge

- Gmi edge

- WHY US

- PLATFORM

- PRODUCT

- EXOTIC

- SPOT GOLD

- SPOT SILVER

- INDICES

- CRUDE OIL

- TRADING ACCOUNT TYPE

- Partnership

- PROFESSIONAL SERVICE

- Report management

- Trading service

- Account service

- Customer service

- Marketing materials download

- Member area

- ABOUT US

- Awards

- GMI edge

Marketing materials download

GMI provides essential corporate marketing materials which cover all aspects of a company's products and services, company history, STP-ECN platform specifications, liquidity pools, traded instruments, and our company advantages.

Member area

Member area offers a one-stop solution for all your trading and account management needs, which is fully integrated with MT4 and is designed to fit the specific needs of GMI clients and ibs.

ABOUT US

Global market index is one of the most respected names in online leveraged forex trading, with representative offices in the major global financial hubs of london and shanghai. We are committed to providing a market-leading service based on fair and transparent pricing, cutting-edge technology and exceptional customer support.

Awards

Trading forex, cfds, and any financial derivative instruments on margin carries a high level of risk and may not be suitable for all investors, as you could sustain losses in excess of your deposits. Leverage can work for you as well as against you, please be aware and fully understand all risks associated with the market conditions and trading terms.

Please carefully consider your financial situation and investment experience prior to proceeding in trading any products offered by global market index limited (GMI). GMI assumes no liability for errors, inaccuracies or omissions; does not warrant the accuracy, completeness of information, text, graphics, links or other items contained within these materials. Read and understand the terms and conditions on GMI’s website prior to initiating your leveraged investment.

This website is owned and operated by GMIVN. GMI branded companies include GMIVN and GMIMU.

GMIVN is a trading name of global market index limited, a company registered in vanuatu, company number 14646, with registered address at BP 1276, govant building, port vila, vanuatu. GMIMU is the trading name of global market index limited, a company registered in mauritius, company number 158643 and is authorized and regulated by the financial service commission (license: C118023454).

Copyright © 2009 - 2021 global market index limited. All rights reserved.

GMI edge

GMI edge is the trading name of global prime limited, that was established in 2009. GMI edge is an online forex and CFD broker that’s been operating in over 8 countries worldwide. GMI edge provides a wide range of trading instruments to the financial markets including forex, cfds, indices, metals and energies.

GMI edge clients‘ funds are fully segregated in secured accounts separate from the company’s opreational funds.

Trading platforms

GMI edge provides the metatrader (MT4) platform to its traders that is available via PC, android, and iphone devices.

GMI edge provides maximum leverage of 1:2000, v ariable spreads starting as low as 0.1 pips and minmum requirement to open an account is $25 with no commission. Deposits/withdrawals can be made via bank transfer, neteller, perfectmoney and skrill.

Customer support

GMI edge provides customer support 24/5 to its clients via live chat, telephone and emails.

Regulation

GMI edge is authorised and regulated by the vanuatu financial services commission (VFSC).

Conclusion

GMI edge is an online forex and CFD broker that’s been providing a wide range of financial instruments across 8 different countries worldwide. GMI edge offers the user-friendly metatrader 4 platform that is available via any mobile devices. GMI edge provides excellent service, low spreads, low minimum and transparent costs, fast and secure deposits, and reliable customer service 24/5. GMI edge is authorised and regulated by the vanuatu financial services commission (VFSC).

So, let's see, what we have: • did GMI edge scammed you? We can assist you. Get a FREE consultation with our team right NOW and get a chargeback ! • at gmi edge

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.