Tickmill commission

Tickmill has built a strong reputation as one of the fastest-growing brokers in the world with solid financial results by providing an award-winning trading environment to clients.

Top forex bonuses

Our size and significant trading volumes enable us to enjoy good trading conditions from our lps and to pass on these benefits to our clients.

- Decrease the cost of their trading

- Increase their potential profitability

- Maximise the efficiency of their strategies

Tickmill now offers lower commission than ever on VIP accounts

Exceptional trading conditions form the bedrock of tickmill’s rapid growth. In line with our mission to maximising value for our clients, we are delighted to announce that we have lowered our commission on VIP accounts to $1 per side per $100,000 traded.

Tickmill has built a strong reputation as one of the fastest-growing brokers in the world with solid financial results by providing an award-winning trading environment to clients. Our size and significant trading volumes enable us to enjoy good trading conditions from our lps and to pass on these benefits to our clients.

Commission reduction up to 37.5%

VIP account holders can now enjoy ultra-low commission of only 1 per side per lot (0.0010% notional) in the base currency of the traded instrument and save up to 37.5% on commissions. We are proud to have managed to secure such a substantial reduction for our valued clients and offer commissions that are hard to beat.

The commission reduction, in combination with our tight spreads and lightning-speed execution, will allow our clients to:

- Decrease the cost of their trading

- Increase their potential profitability

- Maximise the efficiency of their strategies

This improvement not only gives our elite VIP traders great value, but it also reflects our unwavering commitment to customer satisfaction on our way to becoming the broker of choice for professional clients.

Upgrade to a VIP account and get access to some of the world’s lowest trading costs.

Losses can exceed your initial deposit.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Tickmill review 2021

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

🏆 top 5 stock brokers

🏆 top 5 forex brokers

Summary

Recommended for forex traders looking for low fees and prefer metatrader 4 platform

Tickmill is a global forex and CFD broker, established in 2014. The company is regulated by several financial authorities globally, including the top-tier financial conduct authority (FCA) in the united kingdom.

Tickmill is considered safe because it is regulated by the top-tier FCA.

Disclaimer: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill pros and cons

Tickmill has low forex and non-trading fees. The account opening is fast, easy, and fully digital. You can use a lot of options for deposit or withdrawal, and they're free of charge.

On the negative side, tickmill has a limited product portfolio as it offers only forex and cfds. Popular asset classes, such as stocks and etfs are missing. Trading platforms are provided by metatrader, and they have outdated designs. Finally, the news feed is basic and not structured.

| Pros | cons |

|---|---|

| • low forex fees | • only forex and cfds |

| • fast and easy account opening | • trading platforms with outdated design |

| • free deposit and withdrawal | • basic news feeds |

| ��️ country of regulation | UK, cyprus, seychelles, south africa, malaysia |

| �� trading fees class | low |

| �� inactivity fee charged | no |

| �� withdrawal fee amount | $0 |

| �� minimum deposit | $100 |

| �� time to open an account | 1 day |

| �� deposit with bank card | available |

| �� depositing with electronic wallet | available |

| �� number of base currencies supported | 4 |

| �� demo account provided | yes |

| ��️ products offered | forex, CFD |

Author of this review

Author of this review

Ádám nasli

Everything you find on brokerchooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Tickmill review

fees

Tickmill has low forex, but average CFD fees. There is no fee for deposit, withdrawal, or inactivity.

| Pros | cons |

|---|---|

| • low forex fees | • average CFD fees |

| • no withdrawal fee | |

| • no inactivity fee |

| assets | fee level | fee terms |

|---|---|---|

| EURUSD | low | pro account pricing: €2 commission per trade per lot plus spread cost. 0.1 pips is the average spread cost during peak trading hours. |

| GBPUSD | low | pro account pricing: £2 commission per trade per lot plus spread cost. 0.3 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | average | the fees are built into the spread, 0.4 points is the average spread cost during peak trading hours. |

| Inactivity fee | low | no inactivity fee |

How we ranked fees

We ranked tickmill's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

To get things rolling, let's go over some lingo related to broker fees. What you need to keep an eye on are trading fees, and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

Below you will find the most relevant fees of tickmill for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

We also compared tickmill's fees with those of two similar brokers we selected, axitrader and FXCM. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of tickmill alternatives.

To have a clear overview of tickmill, let's start with the trading fees.

Tickmill trading fees

Tickmill's trading fees are low. There are different cost structures for different account types. We tested the pro account, which charges a commission but offers tight spreads.

We know it's hard to compare trading fees for forex brokers. So how did we approach the problem of making their fees clear and comparable? We compare brokers by calculating all the fees of a typical trade for selected products.

We have chosen popular instruments in each asset class usually provided by the forex brokers:

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

- Stock index cfds: SPX and EUSTX50

A typical trade means buying a leveraged product, holding it for one week and then selling. For the volume, we chose a $20,000 position for forex and a $2,000 position for stock index and stock CFD transactions. The leverage we used was:

- 30:1 for forex

- 20:1 for stock index cfds

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for tickmill fees.

Forex fees

Tickmill has low forex fees. The forex fees are one of the lowest among the brokers we have reviewed.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| EURUSD benchmark fee | $6.8 | $5.1 | $12.5 |

| GBPUSD benchmark fee | $5.0 | $4.3 | $5.6 |

| AUDUSD benchmark fee | $5.0 | $3.4 | $8.8 |

| EURCHF benchmark fee | $4.7 | $2.9 | $3.3 |

| EURGBP benchmark fee | $7.8 | $5.2 | $16.4 |

The low forex fees are mainly due to the low commission tickmill charges. The commission is 2 base currency units (first currency pair) per lot per trade. For example, it's €2 per lot per trade for EURUSD, while £2 per lot per trade for GBPUSD.

CFD fees

CFD fees are average.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.5 | $1.3 | $1.5 |

| europe 50 index CFD fee | $1.2 | $2.3 | $1.6 |

Non-trading fees

Tickmill has low non-trading fees. There is no fee for deposit, withdrawal, or inactivity.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| account fee | no | no | no |

| inactivity fee | no | no | yes |

| deposit fee | $0 | $0 | $0 |

| withdrawal fee | $0 | $0 | $0 |

Tickmill review

account opening

Tickmill has a fast and easy account opening process. Our account was verified within one business day. The minimum deposit is low, $100 for all account types, except VIP accounts.

Can you open an account?

Visit broker

73% of retail CFD accounts lose money

Tickmill accepts clients from all over the world. There are only a few exceptions, e.G. Customers from the US or canada can't open an account.

What is the minimum deposit at tickmill?

The required minimum deposit at tickmill is $100 . For a VIP account, you need to maintain a minimum $50,000 balance.

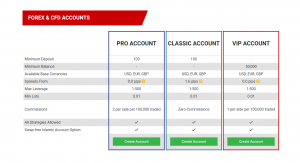

Account types

Tickmill has several account types that differ in pricing, minimum deposit, and minimum account balance.

| pro | classic | VIP | |

|---|---|---|---|

| minimum deposit | $100 | $100 | - |

| minimum account balance | - | - | $50,000 |

| pricing | tight spread plus commission | wide spread, but no commission | tight spread plus commission |

| commission per $100,000 trade | $2 | no commission | $1 |

Retail clients of tickmill ltd can use leverage up to 1:500 while retail clients of tickmill UK ltd and tickmill europe ltd can use maximum leverage of 1:30. If you qualify for a professional trader, you can trade with higher leverage, up to 1:500 (tickmill UK ltd) or up to 1:300 (tickmill europe ltd).

The criteria for professional clients:

- An average frequency of 10 trades per quarter in the previous four quarters

- Size of your financial instrument portfolio exceeds €500k

- You have at least one year experience in a relevant financial position

You can also open corporate and swap-free islamic accounts. The main difference between islamic aand other accounts is that instead of daily swap rates, an administration fee is charged if you hold some exotic currencies for more than 3 nights.

How to open your account

Account opening is fully digital, fast and straightforward. You can fill out the online application form in a matter of minutes. Our account was verified within one day.

To open an account at tickmill, you have to go through these steps:

- 'choose your regulator' will determine whether you sign up for the tickmill site regulated by the UK, cyprus or the seychelles authority. We recommend going for the UK one or the EU one (cyprus) if available in your country

- Fill in your name, country of residence, email address and telephone number

- Add your personal information, such as your date of birth and address

- Select the base currency

- Provide your financial information and answer questions about your financial knowledge

- Select your account type: pro, classic or VIP

- Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency.

Tickmill review 2021

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

🏆 top 5 stock brokers

🏆 top 5 forex brokers

Summary

Recommended for forex traders looking for low fees and prefer metatrader 4 platform

Tickmill is a global forex and CFD broker, established in 2014. The company is regulated by several financial authorities globally, including the top-tier financial conduct authority (FCA) in the united kingdom.

Tickmill is considered safe because it is regulated by the top-tier FCA.

Disclaimer: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill pros and cons

Tickmill has low forex and non-trading fees. The account opening is fast, easy, and fully digital. You can use a lot of options for deposit or withdrawal, and they're free of charge.

On the negative side, tickmill has a limited product portfolio as it offers only forex and cfds. Popular asset classes, such as stocks and etfs are missing. Trading platforms are provided by metatrader, and they have outdated designs. Finally, the news feed is basic and not structured.

| Pros | cons |

|---|---|

| • low forex fees | • only forex and cfds |

| • fast and easy account opening | • trading platforms with outdated design |

| • free deposit and withdrawal | • basic news feeds |

| ��️ country of regulation | UK, cyprus, seychelles, south africa, malaysia |

| �� trading fees class | low |

| �� inactivity fee charged | no |

| �� withdrawal fee amount | $0 |

| �� minimum deposit | $100 |

| �� time to open an account | 1 day |

| �� deposit with bank card | available |

| �� depositing with electronic wallet | available |

| �� number of base currencies supported | 4 |

| �� demo account provided | yes |

| ��️ products offered | forex, CFD |

Author of this review

Author of this review

Ádám nasli

Everything you find on brokerchooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Tickmill review

fees

Tickmill has low forex, but average CFD fees. There is no fee for deposit, withdrawal, or inactivity.

| Pros | cons |

|---|---|

| • low forex fees | • average CFD fees |

| • no withdrawal fee | |

| • no inactivity fee |

| assets | fee level | fee terms |

|---|---|---|

| EURUSD | low | pro account pricing: €2 commission per trade per lot plus spread cost. 0.1 pips is the average spread cost during peak trading hours. |

| GBPUSD | low | pro account pricing: £2 commission per trade per lot plus spread cost. 0.3 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | average | the fees are built into the spread, 0.4 points is the average spread cost during peak trading hours. |

| Inactivity fee | low | no inactivity fee |

How we ranked fees

We ranked tickmill's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

To get things rolling, let's go over some lingo related to broker fees. What you need to keep an eye on are trading fees, and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

Below you will find the most relevant fees of tickmill for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

We also compared tickmill's fees with those of two similar brokers we selected, axitrader and FXCM. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of tickmill alternatives.

To have a clear overview of tickmill, let's start with the trading fees.

Tickmill trading fees

Tickmill's trading fees are low. There are different cost structures for different account types. We tested the pro account, which charges a commission but offers tight spreads.

We know it's hard to compare trading fees for forex brokers. So how did we approach the problem of making their fees clear and comparable? We compare brokers by calculating all the fees of a typical trade for selected products.

We have chosen popular instruments in each asset class usually provided by the forex brokers:

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

- Stock index cfds: SPX and EUSTX50

A typical trade means buying a leveraged product, holding it for one week and then selling. For the volume, we chose a $20,000 position for forex and a $2,000 position for stock index and stock CFD transactions. The leverage we used was:

- 30:1 for forex

- 20:1 for stock index cfds

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for tickmill fees.

Forex fees

Tickmill has low forex fees. The forex fees are one of the lowest among the brokers we have reviewed.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| EURUSD benchmark fee | $6.8 | $5.1 | $12.5 |

| GBPUSD benchmark fee | $5.0 | $4.3 | $5.6 |

| AUDUSD benchmark fee | $5.0 | $3.4 | $8.8 |

| EURCHF benchmark fee | $4.7 | $2.9 | $3.3 |

| EURGBP benchmark fee | $7.8 | $5.2 | $16.4 |

The low forex fees are mainly due to the low commission tickmill charges. The commission is 2 base currency units (first currency pair) per lot per trade. For example, it's €2 per lot per trade for EURUSD, while £2 per lot per trade for GBPUSD.

CFD fees

CFD fees are average.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.5 | $1.3 | $1.5 |

| europe 50 index CFD fee | $1.2 | $2.3 | $1.6 |

Non-trading fees

Tickmill has low non-trading fees. There is no fee for deposit, withdrawal, or inactivity.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| account fee | no | no | no |

| inactivity fee | no | no | yes |

| deposit fee | $0 | $0 | $0 |

| withdrawal fee | $0 | $0 | $0 |

Tickmill review

account opening

Tickmill has a fast and easy account opening process. Our account was verified within one business day. The minimum deposit is low, $100 for all account types, except VIP accounts.

Can you open an account?

Open account

73% of retail CFD accounts lose money

Tickmill accepts clients from all over the world. There are only a few exceptions, e.G. Customers from the US or canada can't open an account.

What is the minimum deposit at tickmill?

The required minimum deposit at tickmill is $100 . For a VIP account, you need to maintain a minimum $50,000 balance.

Account types

Tickmill has several account types that differ in pricing, minimum deposit, and minimum account balance.

| pro | classic | VIP | |

|---|---|---|---|

| minimum deposit | $100 | $100 | - |

| minimum account balance | - | - | $50,000 |

| pricing | tight spread plus commission | wide spread, but no commission | tight spread plus commission |

| commission per $100,000 trade | $2 | no commission | $1 |

Retail clients of tickmill ltd can use leverage up to 1:500 while retail clients of tickmill UK ltd and tickmill europe ltd can use maximum leverage of 1:30. If you qualify for a professional trader, you can trade with higher leverage, up to 1:500 (tickmill UK ltd) or up to 1:300 (tickmill europe ltd).

The criteria for professional clients:

- An average frequency of 10 trades per quarter in the previous four quarters

- Size of your financial instrument portfolio exceeds €500k

- You have at least one year experience in a relevant financial position

You can also open corporate and swap-free islamic accounts. The main difference between islamic aand other accounts is that instead of daily swap rates, an administration fee is charged if you hold some exotic currencies for more than 3 nights.

How to open your account

Account opening is fully digital, fast and straightforward. You can fill out the online application form in a matter of minutes. Our account was verified within one day.

To open an account at tickmill, you have to go through these steps:

- 'choose your regulator' will determine whether you sign up for the tickmill site regulated by the UK, cyprus or the seychelles authority. We recommend going for the UK one or the EU one (cyprus) if available in your country

- Fill in your name, country of residence, email address and telephone number

- Add your personal information, such as your date of birth and address

- Select the base currency

- Provide your financial information and answer questions about your financial knowledge

- Select your account type: pro, classic or VIP

- Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency.

Tickmill trading fees & costs for traders

What does trading cost with the forex broker tickmill? – the most traders ask this question before they open a new trading account with tickmill. As experienced traders we know the broker for more than 5 years. In the following sections we will give you a exact overview about the trading fees of tickmill.

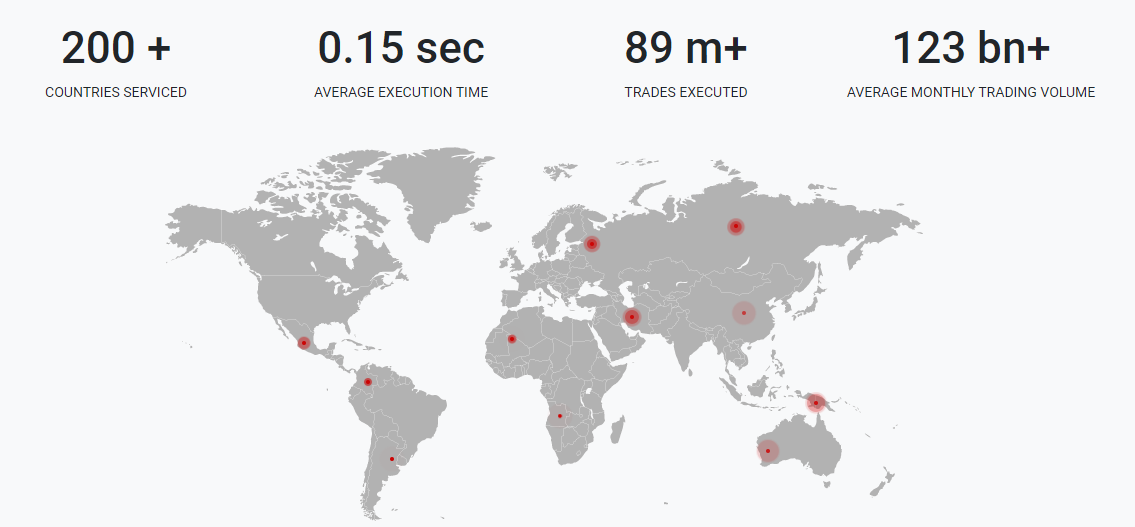

Tickmill international activity

Which fees can occur with tickmill?

By opening an account with a forex broker different trading fees or account fees can occur. This is depending on the policy of the company. From our experience, tickmill is one of the cheapest brokers. There are not any additional fees next to the normal trading fees. In addition, trading fees are very cheap. In the next points, we will show you exactly which fees can occur and which fees do not occur. Later we will go in detail.

Fees which occure by trading with tickmill:

- Spread (direct spread or higher spread in the classic account)

- Trading commission (only by using the VIP or pro account)

The spread in the classic account by 1.2 pips and you will not pay any commissions. By using the pro account you get 0.0 pips spread and pay a commission of $2 per 100.000 (1 lot) traded. For VIP traders the commission is only $1. On this site you can read about the best tickmill account type.

Fees which do not occure by trading with tickmill:

- No deposit or withdrawal fees

- No account maintenance fees

- No inactivity fees

(note: get 5% commission rebate with the codes: IBU13836682 (EU) & IB60353132 (international))

1. Trading fee: market spread

As mentioned before you can choose between two account types. With the classic account, you pay a higher fee on every trade but no commission. In the following, we will discuss and explain the spread. Even in the pro account the spread is starting with 0.0 pips (variable) and is depending on the market situation. The basic account starts with a spread of 1.2 pips.

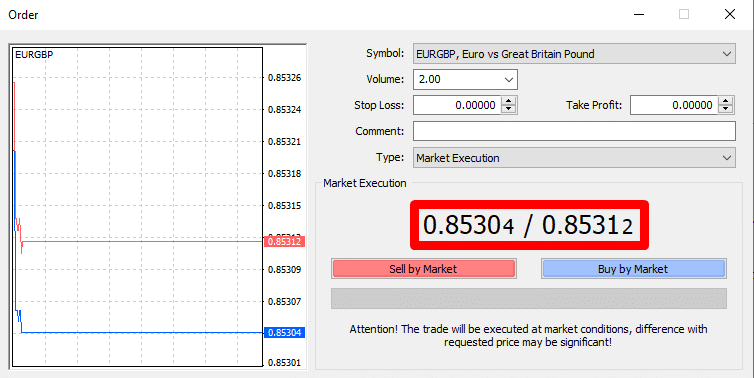

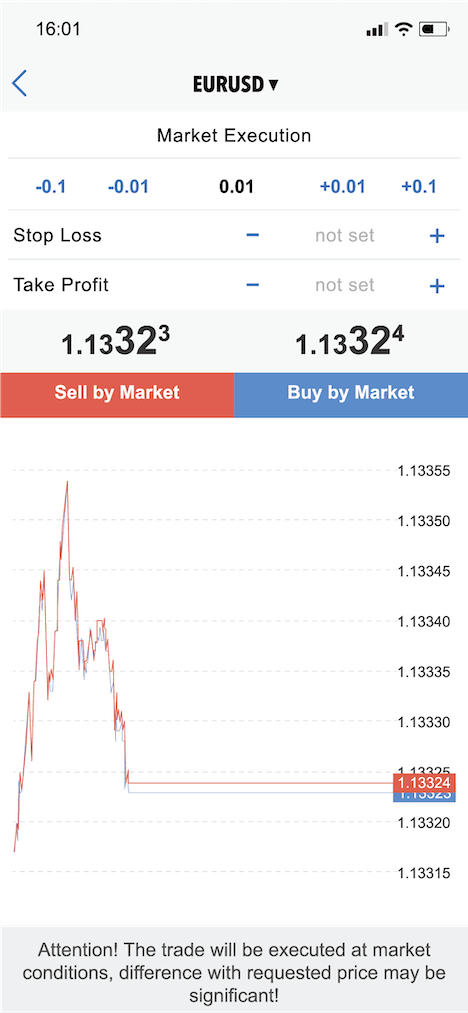

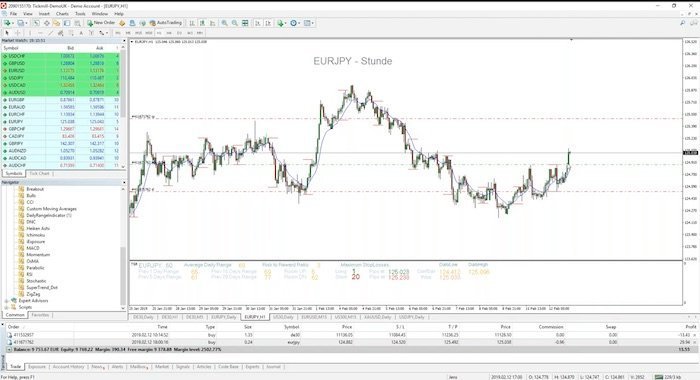

Tickmill trading fee: market spread

In the picture above you see the order mask with the spread (red box). The spread is the difference between the bid (buy liquidity) and ask (sell liquidity) price. The broker adds an additional spread to the normal market condition to earn money. If you open or close a position you pay the trading fee because of the additional spread.

Example of spread fee calculation:

For example, you want to trade the EUR/USD with one lot (value 100.000). The average spread on the classic account is 1.2 pips on the EUR/USD asset.

To calculate the pip value we use the formula: pip value = one pip / exchange rate * 100,000

At the moment the pip value on the price 1,08962 is $10.00. That means you pay a trading fee 0f $12 by trading 1 lot EUR/USD.

2. Trading fee: commission

By using the pro account you trade the original spreads of the liquidity providers with no markup. The spreads are starting at 0.0 pips but sometimes they can be higher depending on the market situation. Tickmill does not earn money by the spread but with an additional commission each trade. By trading 1 lot you will pay $2 commission by opening or closing a trade. Overall it is a $4 fee in this example. If you are using the VIP account you pay fewer fees because the commission is only $1 per 1 lot trade.

How does tickmill earn money?

Tickmill is a real NDD (no dealing desk broker) who provides high liquidity to its clients. The broker only earns money from the trader’s trading volume. If a trader starts trading he pays the trading spread fee or the trading commission. Tickmill does not hedge or trade against clients like other unpopular brokers.

Tickmill earns only money with:

- Additional spread on the market

- Trading commissions

Pay less trading fees with our IB codes

By using our IB codes (below the buttons on this page) you get a 5% rebate of all trading commission made with the pro account. We negotiated this rebate with tickmill to give our clients and readers an advantage. Just open a new trading account and type in the code. You will pay less trading fees. First off all 5% rebate sounds like nothing but if you do a calculation over a year you can save a lot of money.

Conclusion: the tickmill trading fees are very small

From our experience, tickmill is the cheapest forex broker. The trading conditions are very good for trading international markets. The broker earns only money by the spread or commissions. There are no hidden fees and the broker does not require deposit, withdrawal, or inactivity fees.

Overall, tickmill is a highly recommended broker. You will save a lot of money because compared to other companies the trading costs are very low. Moreover, you will get personal support in multi-languages and you can start with a $100 deposit.

We compared more than 50 different brokers and tickmill is the cheapest one.

Tickmill IB\partner program - up to 10$ per lot

Tichmill marketing tools

Tichmill IB withdrawal

methods

Tichmill IB rebate \ commission

Tichmill marketing tools is available in english language

:: tickmill processes ibs withdrawals within few hours once it is submitted

Tichmill advantages for your clients\referrals

Tichmill IB commission calculation (example)

Tichmill IB limitations

Tichmill provides personal account manager for ibs

Tichmill minimum payout for ibs is 100 USD

Commissions can be withdrawn on a weekly basis

Tichmill's cookie life duration for IB link is ? Days

Tichmill partner support

IB commission calculation examples Trader 1# opens 1 lot position IB will get 2$ round turn on ECN and VIP account. 10$ on classic account. Trader 2# opens 2 lot position IB will get 4$ round turn on ECN and VIP account. 20$ on classic account.             We introduced our IB program less than a year ago and now almost 50% of our clients are coming through IB- s. Our IB program great and easy tool for introducing brokers (IB) to maximize their income. IB program doesn’t require any experience and there are no hidden fees nor special conditions. We are offering highest IB commission among high grade ECN brokers.   © 2015 - 2021 www.Bestforexib.Com all rights reserved.        General risk warning: trading forex carries a high level of risk and is not suitable for all investors. All contents on this website are for informational purposes only. Tickmill rebates – 5% commission discount for ECN PRO accountsTickmill rebates and commission discounts  We offer the following tickmill rebates and commission discounts: 1. Login to the tickmill client area   Your spreads remain exactly the same – there is no spread mark up to provide you this service. The tickmill account is useful if you are news trading, or scalping, as tickmill has one of the best spreads versus other forex brokers and good execution speeds Frequently asked questions

Questions about tickmill rebates?Sign up instructions and existing accounts To open a tickmill ECN pro account with the above commission discount, please click here .

Existing account holders – login to the tickmill client area, open a new trading account, select new introducing broker in the dropdown and enter IB80466563 into the IB code field. What to expect: once you click the link above, it will send you to tickmill’s webpage. Go ahead and open your account there. Select seychelles as your regulator. Fill out your personal details, and when asked to enter IB number, enter IB80466563 . Then submit your proof of identity (scanned passport page) and proof of address (scanned utility bill) and wait 12-48 hours for your account to be opened. Once your account is opened, the 5% commission discount will automatically be applied to your account What to expect (if you have an existing account): login to the tickmill client area, open a new trading account, select new introducing broker in the dropdown and enter IB80466563 into the IB code field. The 5% discount is automatically applied to your account once your account is opened.

Don’t wait! The faster you sign up, the more you save! Leave us a review in the comments section below if you have benefited from this rebate! More information about tickmillTickmill spread comparison with other brokers Stop level, leverage and min trade size They have zero stop level and offer 500:1 leverage with min 0.01 lot trade size Trade server location & execution speed from VPS Tickmill’s MT4 servers are located at LD4/5 (london) and a co-location is possible from a london based VPS from CNS (commercial network services) or beeks . Both are located 2ms* away from tickmill’s trade servers. *ping latency is 2ms to tickmill’s servers: latency chart Tickmill group licenses |

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.