Best leverage for $100

Your true leverage is about 90:1 ($40,000 / $440). You’ll be broke faster than mike tyson can chew your ear off.

Top forex bonuses

Low leverage allows new forex traders to survive

As a trader, it is crucial that you understand both the benefits AND the pitfalls of trading with leverage.

Using a ratio of 100:1 as an example means that it is possible to enter into a trade for up to $100 for every $1 in your account.

This gives you the potential to earn profits on the equivalent of a $100,000 trade!

It’s like a super scrawny dude who has a super long forearm entering an arm-wrestling match.

If he knows what he’s doing, it doesn’t matter if his opponent is arnold schwarzenegger, due to the leverage that his forearm can generate, he’ll usually come out on top.

When leverage works, it magnifies your gains substantially. Your head gets BIG and you think you’re the greatest trader that has ever lived.

But leverage can also work against you.

You’ll be broke faster than mike tyson can chew your ear off.

Here’s a chart of how much your account balance changes if prices move depending on your leverage.

| Leverage | % change in currency pair | % change in account |

|---|---|---|

| 100:1 | 1% | 100% |

| 50:1 | 1% | 50% |

| 33:1 | 1% | 33% |

| 20:1 | 1% | 20% |

| 10:1 | 1% | 10% |

| 5:1 | 1% | 5% |

| 3:1 | 1% | 3% |

| 1:1 | 1% | 1% |

Let’s say you bought USD/JPY and it goes up by 1% from 120.00 to 121.20.

If you trade one standard 100k lot, here is how leverage would affect your return:

| Leverage | margin required | % change in account |

|---|---|---|

| 100:1 | $1,000 | +100% |

| 50:1 | $2,000 | +50% |

| 33:1 | $3,000 | +33% |

| 20:1 | $5,000 | +20% |

| 10:1 | $10,000 | +10% |

| 5:1 | $20,000 | +5% |

| 3:1 | $33,000 | +3% |

| 1:1 | $100,000 | +1% |

Let’s say you bought USD/JPY and it goes down by 1% from 120.00 to 118.80.

If you trade one standard 100k lot, here is how leverage would affect your return (or loss):

| Leverage | margin required | % change in account |

|---|---|---|

| 100:1 | $1,000 | -100% |

| 50:1 | $2,000 | -50% |

| 33:1 | $3,000 | -33% |

| 20:1 | $5,000 | -20% |

| 10:1 | $10,000 | -10% |

| 5:1 | $20,000 | -5% |

| 3:1 | $33,000 | -3% |

| 1:1 | $100,000 | -1% |

The more leverage you use, the less “breathing room” you have for the market to move before a margin call.

You’re probably thinking, “I’m a day trader, I don’t need no stinkin’ breathing room. I only use 20-30 pip stop losses.”

Example #1

You open a mini account with $500 which trades 10k mini lots and only requires .5% margin.

You buy 2 mini lots of EUR/USD.

Your true leverage is 40:1 ($20,000 / $500).

You place a 30-pip stop loss and it gets triggered. Your loss is $60 ($1/pip x 2 lots).

You’ve just lost 12% of your account ($60 loss / $500 account).

Your account balance is now $440.

You believe you just had a bad day. The next day, you’re feeling good and want to recoup yesterday losses, so you decide to double up and you buy 4 mini lots of EUR/USD.

Your true leverage is about 90:1 ($40,000 / $440).

You set your usual 30-pip stop loss and your trade losses.

Your loss is $120 ($1/pip x 4 lots).

You’ve just lost 27% of your account ($120 loss/ $440 account).

Your account balance is now $320.

You believe the tide will turn so you trade again.

You buy 2 mini lots of EUR/USD. Your true leverage is about 63:1.

You’ve just lost almost 19% of your account ($60 loss / $320 account). Your account balance is now $260.

You’re getting frustrated. You try to think about what you’re doing wrong. You think you’re setting your stops too tight.

The next day you buy 3 mini lots of EUR/USD.

Your true leverage is 115:1 ($30,000 / $260).

You loosen your stop loss to 50 pips. The trade starts going against you and it looks like you’re about to get stopped out yet again!

But what happens next is even worse!

You get a margin call!

Since you opened 3 lots with a $260 account, your used margin was $150 so your usable margin was a measly $110.

The trade went against you 37 pips and because you had 3 lots opened, you get a margin call. Your position has been liquidated at market price.

The only money you have left in your account is $150, the used margin that was returned to you after the margin call.

After four total trades, your trading account has gone from $500 to $150.

A 70% loss!

Congratulations, it won’t be very long until you lose the rest.

| Trade # | starting account balance | # lots of used | stop loss (pips) | trade result | ending account balance |

|---|---|---|---|---|---|

| 1 | $500 | 2 | 30 | -$60 | $440 |

| 2 | $440 | 4 | 30 | -$120 | $320 |

| 3 | $320 | 2 | 30 | -$60 | $260 |

| 4 | $260 | 3 | 50 | margin call | $150 |

A four-trade losing streak is not uncommon. Experienced traders have similar or even longer streaks.

The reason they’re successful is that they use low leverage.

Most cap their leverage at 5:1 but rarely go that high and stay around 3:1.

The other reason experienced traders succeed is that their accounts are properly capitalized!

While learning technical analysis, fundamental analysis, sentiment analysis, building a system, trading psychology are important, we believe the biggest factor on whether you succeed as a forex trader is making sure you capitalize your account sufficiently and trade that capital with smart leverage.

Your chances of becoming successful are greatly reduced below a minimum starting capital. It becomes impossible to mitigate the effects of leverage on too small an account.

Low leverage with proper capitalization allows you to realize losses that are very small which not only lets you sleep at night, but allows you to trade another day.

Example #2

Bill opens a $5,000 account trading 100k lots. He is trading with 20:1 leverage.

The currency pairs that he normally trades move anywhere from 70 to 200 pips on a daily basis. In order to protect himself, he uses tight 30 pip stops.

If prices go 30 pips against him, he will be stopped out for a loss of $300.00. Bill feels that 30 pips are reasonable but he underestimates how volatile the market is and finds himself being stopped out frequently.

After being stopped out four times, bill has had enough. He decides to give himself a little more room, handle the swings, and increases his stop to 100 pips.

Bill’s leverage is no longer 20:1. His account is down to $3,800 (because of his four losses at $300 each) and he’s still trading one 100k lot.

He decides to tighten his stops to 50 pips. He opens another trade using two lots and two hours later his 50 pip stop loss is hit and he losses $1,000.

He now has $2,800 in his account. His leverage is over 35:1.

He tries again with two lots. This time the market goes up 10 pips. He cashes out with a $200 profit. His account grows slightly to $3,000.

He opens another position with two lots. The market drops 50 points and he gets out. Now he has $2,000 left.

He thinks “what the hell?!” and opens another position!

The market proceeds to drop another 100 pips.

Because he has $1,000 locked up as margin deposit, he only has $1,000 margin available, so he receives a margin call and his position is instantly liquidated!

He now has $1,000 left which is not even enough to open a new position.

He lost $4,000 or 80% of his account with a total of 8 trades and the market has only moved 280 pips. 280 pips! The market moves 280 pips pretty darn easy.

Are you starting to see why leverage is the top killer of forex traders?

As a new trader, you should consider limiting your leverage to a maximum of 10:1. Or to be really safe, 1:1. Trading with too high a leverage ratio is one of the most common errors made by new forex traders. Until you become more experienced, we strongly recommend that you trade with a lower ratio.

Best high leverage forex brokers

Dan schmidt

Contributor, benzinga

Want to jump straight to the answer? The best forex broker for most people is definitely FOREX.Com

Currency traders have a few advantages over traders of other types of securities. The market stays open 24 hours a day during the work week and the best forex broker commissions are often a fraction of what online stock brokers charge. But the biggest edge is margin requirements and leverage. You don’t need a big infusion of capital to begin a career as a forex trader, just the right tools and the right broker.

Best high leverage forex brokers:

- Best overall: FOREX.Com – open an account

- HYCM

- Avatrade

- IC markets

- Pepperstone

Best for

Overall rating

Best for

1 minute review

IG is a comprehensive forex broker that offers full access to the currency market and support for over 80 currency pairs. The broker only offers forex trading to its U.S.-based customers, the brokerage does it spectacularly well. Novice traders will love IG’s intuitive mobile and desktop platforms, while advanced traders will revel in the platform’s selection of indicators and charting tools. Though IG could work on its customer service and fees, the broker is an asset to new forex traders and those who prefer a more streamlined interface.

Best for

- New forex traders who are still learning the ropes

- Traders who prefer a simple, clean interface

- Forex traders who trade primarily on a tablet

- Easy-to-navigate platform is easy for beginners to master

- Mobile and tablet platforms offer full functionality of the desktop version

- Margin rates are easy to understand and affordable

- Access to over 80 currency pairs

- U.S. Traders can currently only trade forex

- Customer service options are lacking

- No 2-factor authentication on mobile

Account minimum

Pairs offered

Account minimum

Pairs offered

1 minute review

FOREX.Com is a one-stop shop for forex traders. With a massive range of tradable currencies, low account minimums and an impressive trading platform, FOREX.Com is an excellent choice for brokers searching for a home base for their currency trading. New traders and seasoned veterans alike will love FOREX.Com’s extensive education and research center that provides free, informative forex trading courses at multiple skill levels. While FOREX.Com is impressive, remember that it isn’t a standard broker.

Best for

- Impressive, easy-to-navigate platform

- Wide range of education and research tools

- Access to over 80 currencies to buy and sell

- Leverage available up to 50:1

Account minimum

Pairs offered

Account minimum

Pairs offered

1 minute review

Though australian and british traders might know etoro for its easy stock and mobile trading, the broker is now expanding into the united states with cryptocurrency trading. U.S. Traders can begin buying and selling both major cryptocurrencies (like bitcoin and ethereum) as well as smaller names (like tron coin and stellar lumens).

Etoro offers traders the opportunity to invest their assets into premade portfolios or cryptocurrencies, similar to services offered by robo-advisors through traditional brokers. Though etoro isn’t a one-stop-shop for everything an investor needs, its easy-to-use platform and low spreads is a great way to enter the cryptocurrency market.

Best for

- International forex/CFD traders

- New cryptocurrency traders looking for an easy-to-use platform

- Traders who want to buy and sell cryptocurrencies on-the-go

- Simple platform that is easy to master

- Copytrader feature that allows new traders to copy the same strategies used by professionals

- Virtual dummy account that gives you $100,000 to practice trades

- U.S. Traders currently limited to cryptocurrencies

- Only 15 major coins available to trade

Account minimum

Pairs offered

Account minimum

Pairs offered

1 minute review

HYCM is 1 of the world’s leading forex brokers, offering investors access to over 69 unique currency pairs. However, forex isn’t the only thing the broker offers — HYCM also offers high rates of leverage, stock and ETF trading, commodity investing and much more. Getting started with HYCM is quick and easy, and most investors can open an account in as little as 10 minutes.

HYCM offers a varying fee structure, which allows investors to choose the spread option that’s best for them. A wide range of educational and investing tools are available, which can be equally beneficial to both experienced and novice traders. Though HYCM isn’t currently available in the united states, it can be a great choice for residents of the other 140 countries where it offers service.

Best for

- Investors who want a customizable fee schedule

- Traders comfortable using the metatrader platform

- Islamic traders who need swap-free accounts that don’t build interest

- Wide range of currency pairs available

- Excellent selection of educational tools

- $0 deposit and withdrawal fees

Account minimum

Pairs offered

Account minimum

Pairs offered

1 minute review

A fully regulated broker with a presence in europe, south africa, the middle east, british virgin islands, australia and japan, avatrade deals with mainly forex and cfds on stocks, commodities, indexes, forex, cryptocurrencies, etc. This brokerage is headquartered in dublin, ireland and began offering its services in 2006. It offers multiple trading platforms and earns mainly through spreads.

Best for

- Beginners

- Advanced traders

- Traders looking for a well-diversified portfolio

- Controlled by regulatory agencies of multiple countries

- Choice offered in terms of trading platforms

- Support available in 14 languages and trading platforms in 20 languages

- Practice/demo account available for trying out

- Breadth of trading assets

- Does not accept customers from the U.S. As it isn’t regulated in the U.S.

- Transferring funds to the account may take up to five days; withdrawals could take up to 10 days

What’s leverage and margin in forex trading?

Traditional stock brokers in the united states often offer margin trading to their clients. The broker will lend money to the client for additional stock purchases and then make money in interest when the loan is repaid. Margin rates vary, but most online brokers charge clients between 5% and 9% to borrow money, depending on the amount. Why would clients want to borrow money for the stock market from their brokers?

They want to crank up the leverage on trades.

Leverage refers to how much borrowed money is involved in a trade. In most stock brokerages, investors can get 2:1 leverage, which means they need $50 in their account to trade $100 in capital. Obviously, leverage adds risk to any trade. Since you don’t just lose your capital if it goes bad, you owe your broker money.

Excessive leverage has killed many financial firms, including lehman brothers and long term capital management. But when it’s used properly, you can generate tremendous profits with little upfront capital.

In forex trading, leverage can often be as high as 500:1. Since currencies move incrementally compared to stocks, using leverage doesn’t carry the same risks. When trades are measured in fractions of a penny, 500:1 leverage doesn’t seem excessive. Forex brokers use margin requirements to determine how much leverage currency traders can use per trade. This is expressed as a percentage, such as USD/EUR trades that require a 2% margin.

United states limitations

Forex trading is subject to stricter regulations in the united states than most countries in the world. Europe and australia have no aversion to leverage as high as 500:1, but U.S. Law limits forex brokers to 50:1 leverage.

Additionally, many forex brokers offer contracts for difference (cfds) on indices, bonds, commodities and even cryptocurrencies. These products are highly speculative and banned entirely in the U.S., which means metatrader 5 has practically no uptake.

What to look for in A high leverage forex broker

Choosing a forex broker depends not only on your trading preferences but also the country you live in. United states forex traders won’t be able to use the highest available leverage or use popular trading programs like metatrader 5. When you pick a broker, here are a few things to pay attention to:

- Margin requirements: in the united states, margin requirements are limited to 2% (50:1 leverage). Internationally, you can lever trades up to 500:1 on most major currencies. You don’t need to use high leverage on all trades, but make sure to pick a broker with limits that work for you.

- Commissions and fees: forex brokers make money in two ways: from commissions or from the spread. Many brokers have spread-only and commission accounts available, and commission accounts get reduced spreads. Brokers have fee charts on their websites. Make sure you understand all charges before you open an account.

- Support for trading software: many forex brokers have their own proprietary trading software, but also offer popular platforms like metatrader 4 and ctrader. If you like to trade using metatrader 4, make sure the broker you choose supports it!

- Account and trade minimums: capital required to open an account varies by the broker, as does the amount needed to complete a trade. Some brokers may have no account minimum, but all will have trade minimums.

The best high leverage forex brokers

Using the above criteria, benzinga has identified the best high leverage forex brokers on the market today. High leverage in the united states is limited to 50:1, but for international brokers to qualify, they must offer 500:1 leverage for at least a few major pairs.

Thread: what should be the leverage for $100 deposit of beginner label?

Thread: what should be the leverage for $100 deposit of beginner label?

Thread tools

Search thread

Display

What should be the leverage for $100 deposit of beginner label?

Hi, I m new this forex trading market. Before entering this huge market, i heard lots of positive and negative complement. But i believe in patient and thus i want to confirmed about the minimum beginning leverage.

I want to deposit below $100 with 1:1000 leverage. Is it perfect?

Though trading on financial markets entails high risk, still it can generate extra income on condition that you apply the right approach. By choosing a reliable broker such as instaforex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

3 users say thank you to sofeenevu for this useful post.

With 100$ that leverage it ok, it wil give you an opportunity to trade like the pro. But if not careful as a beginner you might loss your capital, just trade 1 pair at a time and make sure you use proper SL and TP

Though trading on financial markets entails high risk, still it can generate extra income on condition that you apply the right approach. By choosing a reliable broker such as instaforex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

2 users say thank you to bigvic28 for this useful post.

Yes, that's ok.

Try using small lot size on your trading since you only beginner

Hi, I m new this forex trading market. Before entering this huge market, i heard lots of positive and negative complement. But i believe in patient and thus i want to confirmed about the minimum beginning leverage.

I want to deposit below $100 with 1:1000 leverage. Is it perfect?

Though trading on financial markets entails high risk, still it can generate extra income on condition that you apply the right approach. By choosing a reliable broker such as instaforex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

Hi, I m new this forex trading market. Before entering this huge market, i heard lots of positive and negative complement. But i believe in patient and thus i want to confirmed about the minimum beginning leverage.

I want to deposit below $100 with 1:1000 leverage. Is it perfect?

I also have less than 100$ deposit. I trade with small lot. I use 1:100 leverage. But I think if new trader start with small lot it's not a matter what leverage he use. We have to keep in mind, that if we trade with big lot, have small deposit but using big leverage then we will lose much for per pip loss and after few pip losses we will get margin call.

Though trading on financial markets entails high risk, still it can generate extra income on condition that you apply the right approach. By choosing a reliable broker such as instaforex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

Hi, I m new this forex trading market. Before entering this huge market, i heard lots of positive and negative complement. But i believe in patient and thus i want to confirmed about the minimum beginning leverage.

I want to deposit below $100 with 1:1000 leverage. Is it perfect?

Using high leverage traders who have small trading capital has so much advantages for the traders. High leverage means we can trade more with our capital. But trader always should try to stay with safe line and not to use high leverage for more trades

100 USD IS a large amount of money;so if you invest you will get large profit.So it is the leverage for under 100 usd deposit at beginner label.Thanks

Though trading on financial markets entails high risk, still it can generate extra income on condition that you apply the right approach. By choosing a reliable broker such as instaforex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

Of course .. Sling finance 1: 1000 is the best for little capital .. Enables you to enter into many transactions at one time. And, of course, but they have some damage , also ..

Though trading on financial markets entails high risk, still it can generate extra income on condition that you apply the right approach. By choosing a reliable broker such as instaforex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

Using a high leverage is not advisable specially if you are a newbie trader, I suggest you use the normal leverage of 1:200 for trading, there is a use for higher leverage.

Though trading on financial markets entails high risk, still it can generate extra income on condition that you apply the right approach. By choosing a reliable broker such as instaforex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

I WILL SAY THAT THE LOT SIZE TO TRADE UNDER $100, SHOULD BE AT MOST 0.03, THAT WILL GIVE YOU SOME RELIABILITY IN THE SMALL CAPITAL, BUT IF YOU WANT TO SCALP, WHY NOT TRY 0.1 LOT SIZE.

Though trading on financial markets entails high risk, still it can generate extra income on condition that you apply the right approach. By choosing a reliable broker such as instaforex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

The following user says thank you to bisifentus for this useful post:

A 1:1000 leverage is very risky I suggest you start with a normal leverage of 1:200 and this is the right way for newbie and experienced trader.

Though trading on financial markets entails high risk, still it can generate extra income on condition that you apply the right approach. By choosing a reliable broker such as instaforex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

The following user says thank you to fxavengers for this useful post:

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

How to choose the right leverage?

How to choose the right forex leverage?

This lesson will cover the following

- What are the risks of high leverage

- How to offset leverage

- What is a common comfort level of leverage

Forex trading does offer high leverage in the sense that for an initial margin requirement, a trader can build up and control a huge amount of money, and high leverage means high risk. Leverage is a “double edged sword”. When you are right on your trade this leverage multiplies your gains. When you are wrong, however, same leverage exacerbates your losses. Far too many traders and investors fall to the temptation, which leverage brings about. Greed takes over when you lose the healthy respect for the market, which is something crucial for success.

Desperation to quickly win back losses that were created by excess leverage in the first place, can ultimately wipe out an account. When one gets complacent and makes that first wrong move the chances to spiral out of control are set in motion. It is crucial to stick to your plan, strategy and realistic goals. Leverage should be used with extreme caution.

Best forex brokers for united states

If the correct money management rules are applied, the amount of leverage can become irrelevant.

The reason for this? Traders base their risk on a percentage of their total account balance. In other words, the total amount risked per trade, even with leverage, is less than 2%.

Example

Lets say for example that a trader who has $2 000 in his live account decides to use a 100:1 leverage. This means that he would have a total amount of $200 000 dollars at his disposal, therefore he can trade two standard lots. As he buys those, each pip movement will earn or cost the trader $20. If we presume that he has placed his protective stop 10 pips away from his entry point, which is relatively tight, a potential triggering of the stop will cost him $200 – 10% of the entire trading account. This is far beyond what a balanced money management method would advise you to risk.

However, if the same trader instead uses a moderate leverage of 10:1, where each pip movement is worth ten times less, or in our case $2, he would end up losing only $20 – just a mere 1% of his trading account. This is a far more acceptable situation.

You should keep in mind that incorporating sound money management and only risking a certain small fraction of your money allows you to safely use leverage. According to those rules, the leveraged amount should be less than 2% of the trading capital, a percentage which most professional traders advise for the inexperienced ones to follow.

Useful advice

As tempting the ability to generate big profits without putting at stake too much of your hard-earned money may be, you should never forget that an excessively high degree of leverage could drain your entire starting capital in a blink of an eye. The following few safety precautions used by experienced traders may prove useful in diminishing the risks of leveraged forex trading:

Use leverage adequate to your comfort level: if you are a cautious or an inexperienced investor or trader, use a lower level of leverage that you feel comfortable with, perhaps 5:1 or 10:1, instead of trying to mimic the professional players choice of 50:1, 100:1 and even higher.

Limit your losses: if you hope to achieve considerable profits somewhere in the future, you must first learn how to cut your losses in order to survive longer on the market and gather experience. Limit your losses to a manageable size to live to trade another day. That is achievable by following a sound money management system and using protective stops.

Don’t make the situation even worse: dont attempt to turn around a losing position by adding more money and averaging down on it. It defies logic to stick to a losing position and risk more and more of your trading capital, hoping for a miracle turnaround. Eventually that losing position will become so large, that your account wont be able to contain it and you will be forced to exit the position at a huge loss which exceeds many times what you would have lost in the first time.

Even if the price action does eventually reverse at some point and you think you should have stuck to it, relax. Such decisions, based solely on emotions and not on solid technical/fundamental analysis are one-time winners and will render you a losing trader in the long-term. Its much better to exit the position, score a minor loss and offset that loss by entering some other, winning position, instead of wasting your time and money on losers.

Fxdailyreport.Com

One of the reasons that many people are attracted to the foreign exchange markets are the high amounts of leverage that many brokers offer. It means that even starting with just a little you can potentially make a whole lot but what is leverage and what are the implications of forex trading with high leverage? In this article we will take a look at exactly what leverage is, consider the benefits of forex trading high leverage and highlight a few of the potential pitfalls.

What is leverage ?

Leverage is a simple concept to understand. It allows you to use your broker’s money in order to trade a position bigger than you would otherwise be able to trade from the amount in your account alone. For example, if your account balance was $1,000 and your broker offered you 100:1 leverage, you would effectively be able to trade with $100,000 worth of capital.

In other words, your broker is loaning you money to trade with based on the amount you have deposited in your account.

Trusted forex brokers with 100:1 leverage

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker |

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $100 spread: starting 0 pips leverage: up to 400:1 regulation: FCA UK, NFA, CFTC, ASIC, IIROC, FSA, CIMA | visit broker | |

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: $200 spread: from 3 pips leverage: 400:1 regulation: NFA, FCA, cysec | visit broker | |

| min deposit: $100 spread: starting 0 pips leverage: up to 500:1 regulation: FCA UK, ASIC australia, MAS singapore | visit broker | ||

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker | |

| min deposit: $250 spread: as low as 0.1 pips leverage: up to 400:1 regulation: ASIC australia and FCA UK | visit broker |

What are the implications of forex trading with high leverage?

To illustrate the implications of forex trading with high leverage, let’s use a simplified example:

Let’s say that you have $1,000 to invest. After some careful analysis, you conclude that the great british pound is looking strong against the dollar and probably set to rise. Your $1,000 buys you approximately £765,

A short time later, your pounds gain in strength and you are able to buy back £1,050 for the same £765, netting you a cool $50 (not including commissions and such like). Welcome to the world of foreign currency exchange!

Now imagine, however, that some nice broker had loaned you $99,000 to go with your existing $1,000 to buy pounds. Instead of buying £765 worth of great british pounds, you were able to buy £76,500 worth of great british pounds. That means that instead of making just $50 profit, you would have made one hundred times that amount of profit, or $5,000! That’s a whopping 400% return on your comparatively small investment of just $1,000.

The flip side, of course, is that leverage amplifies both profits and losses.

Now imagine that when you traded your pounds back to dollars that the dollar had increased in value against the pound, meaning you only got $950 back instead of your original $1,000. Using $1,000 of your own money, you would have simply lost $50 equating to a 5% loss of your original capital. Using 100:1 leverage, however, your losses would have been magnified to $5,000 equating to a 500% loss of capital.

The pros and cons

- Leverage allows you to maximize your potential profits. As seen in the example above, leverage can maximize your returns. It could take months, or even years, to achieve similar returns using only your own capital, even if you took advantage of compounding and reinvested all your returns.

- Leverage can help grow small accounts fast. It could help you double or even treble your account size in a very short space of time as demonstrated in the example above with the 400% return on investment.

- Leverage increases your options. With only a small amount of capital investment opportunities can be limited. Using 100:1 leverage can increase your options and allow you to take positions you would otherwise not be able to take.

- Leverage can be risky. It is easy to forget just how much capital is actually at risk. One mistake a lot of new traders make, for example, is to think in terms of their stop loss as their total capital at risk. In a way it is. However, it is better to always think in terms of the total capital at risk in order to appreciate your full position size and keep perspective on both profits and losses.

- Leverage increases variance. Taking bigger positions means sometimes taking bigger losses, just as it sometimes means getting bigger wins. This variance will inevitably play out in your account balance.

- Leverage can go wrong very quickly. If you are highly leveraged and a position turns against you, it can go wrong rapidly and prove very expensive. This is why whenever you are using leverage it is important to always ensure that you have stop losses in place and appreciate your full position size.

Leverage ratios

What are leverage ratios?

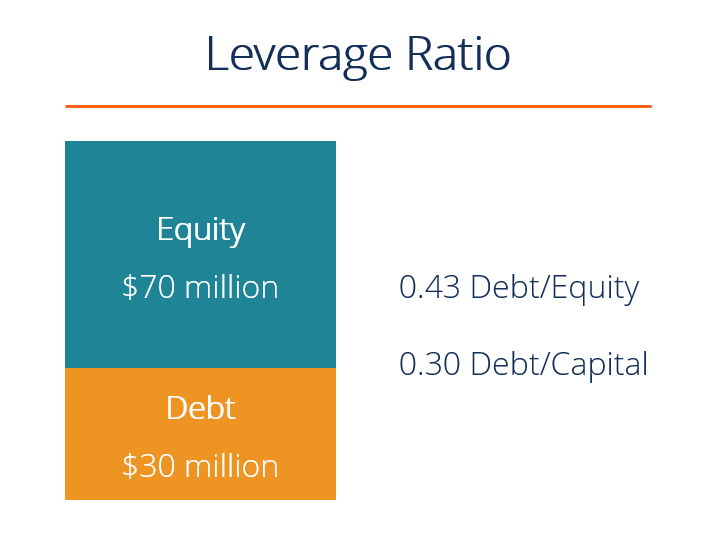

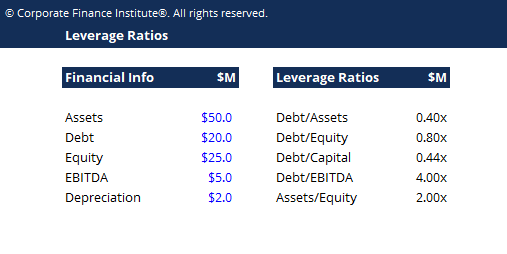

A leverage ratio is any kind of financial ratio financial analysis ratios glossary glossary of terms and definitions for common financial analysis ratios terms. It's important to have an understanding of these important terms. That indicates the level of debt incurred by a business entity against several other accounts in its balance sheet balance sheet the balance sheet is one of the three fundamental financial statements. These statements are key to both financial modeling and accounting , income statement income statement the income statement is one of a company's core financial statements that shows their profit and loss over a period of time. The profit or , or cash flow statement cash flow statement A cash flow statement (officially called the statement of cash flows) contains information on how much cash a company has generated and used during a given period. It contains 3 sections: cash from operations, cash from investing and cash from financing. . These ratios provide an indication of how the company’s assets and business operations are financed (using debt or equity). Below is an illustration of two common leverage ratios: debt/equity and debt/capital.

List of common leverage ratios

There are several different leverage ratios that may be considered by market analysts, investors, or lenders. Some accounts that are considered to have significant comparability to debt are total assets, total equity, operating expenses, and incomes.

Below are 5 of the most commonly used leverage ratios:

- Debt-to-assets ratio = total debt / total assets

- Debt-to-equity ratio = total debt / total equity

- Debt-to-capital ratio = today debt / (total debt + total equity)

- Debt-to-EBITDA ratio = total debt / earnings before interest taxes depreciation & amortization ( EBITDA EBITDA EBITDA or earnings before interest, tax, depreciation, amortization is a company's profits before any of these net deductions are made. EBITDA focuses on the operating decisions of a business because it looks at the business’ profitability from core operations before the impact of capital structure. Formula, examples )

- Asset-to-equity ratio = total assets / total equity

Leverage ratio example #1

Imagine a business with the following financial information:

- $50 million of assets

- $20 million of debt

- $25 million of equity

- $5 million of annual EBITDA

- $2 million of annual depreciation expense

Now calculate each of the 5 ratios outlined above as follows:

- Debt/assets debt to asset ratio the debt to asset ratio, also known as the debt ratio, is a leverage ratio that indicates the percentage of assets that are being financed with debt. = $20 / $50 = 0.40x

- Debt/equity finance CFI's finance articles are designed as self-study guides to learn important finance concepts online at your own pace. Browse hundreds of articles! = $20 / $25 = 0.80x

- Debt/capital = $20 / ($20 + $25) = 0.44x

- Debt/EBITDA debt/EBITDA ratio the net debt to earnings before interest, taxes, depreciation, and amortization (EBITDA) ratio measures financial leverage and a company’s ability to pay off its debt. Essentially, the net debt to EBITDA ratio (debt/EBITDA) gives an indication as to how long a company would need to operate at its current level to pay off all its debt. = $20 / $5 = 4.00x

- Asset/equity = $50 / $25 = 2.00x

Download the free template

Enter your name and email in the form below and download the free template now!

Leverage ratio example #2

If a business has total assets worth $100 million, total debt of $45 million, and total equity of $55 million, then the proportionate amount of borrowed money against total assets is 0.45, or less than half of its total resources. When comparing debt to equity, the ratio for this firm is 0.82, meaning equity makes up a majority of the firm’s assets.

Importance and usage

Leverage ratios represent the extent to which a business is utilizing borrowed money. It also evaluates company solvency and capital structure. Having high leverage in a firm’s capital structure can be risky, but it also provides benefits.

The use of leverage is beneficial during times when the firm is earning profits, as they become amplified. On the other hand, a highly levered firm will have trouble if it experiences a decline in profitability and may be at a higher risk of default than an unlevered or less levered firm in the same situation.

Finally, analyzing the existing level of debt is an important factor that creditors consider when a firm wishes to apply for further borrowing.

Essentially, leverage adds risk but it also creates a reward if things go well.

What are the various types of leverage ratios?

1 operating leverage

An operating leverage ratio refers to the percentage or ratio of fixed costs to variable costs. A company that has high operating leverage bears a large proportion of fixed costs in its operations and is a capital intensive firm. Small changes in sales volume would result in a large change in earnings and return on investment. A negative scenario for this type of company could be when its high fixed costs are not covered by earnings because the market demand for the product decreases. An example of a capital-intensive business is an automobile manufacturing company.

If the ratio of fixed costs to revenue is high (i.E., >50%) the company has significant operating leverage. If the ratio of fixed costs to revenue is low (i.E., property, plant, and equipment PP&E (property, plant and equipment) PP&E (property, plant, and equipment) is one of the core non-current assets found on the balance sheet. PP&E is impacted by capex, (PP&E).

What are the risks of high operating leverage and high financial leverage?

If leverage can multiply earnings, it can also multiply risk. Having both high operating and financial leverage ratios can be very risky for a business. A high operating leverage ratio illustrates that a company is generating few sales, yet has high costs or margins that need to be covered. This may either result in a lower income target or insufficient operating income to cover other expenses and will result in negative earnings for the company. On the other hand, high financial leverage ratios occur when the return on investment (ROI) does not exceed the interest paid on loans. This will significantly decrease the company’s profitability and earnings per share.

Coverage ratios

Besides the ratios mentioned above, we can also use the coverage ratios coverage ratio A coverage ratio is used to measure a company’s ability to pay its financial obligations. A higher ratio indicates a greater ability to meet obligations in conjunction with the leverage ratios to measure a company’s ability to pay its financial obligations debt capacity debt capacity refers to the total amount of debt a business can incur and repay according to the terms of the debt agreement. .

The most common coverage ratios are:

- Interest coverage ratio interest coverage ratio interest coverage ratio (ICR) is a financial ratio that is used to determine the ability of a company to pay the interest on its outstanding debt. : the ability of a company to pay the interest expense interest expense interest expense arises out of a company that finances through debt or capital leases. Interest is found in the income statement, but can also (only) on its debt

- Debt service coverage ratio: the ability of a company to pay all debt obligations, including repayment of principal and interest

- Cash coverage ratio: the ability of a company to pay interest expense with its cash balance

- Asset coverage ratio: the ability of a company to repay its debt obligations with its assets

Additional resources

This leverage ratio guide has introduced the main ratios, debt/equity, debt/capital, debt/EBITDA, etc. Below are additional relevant CFI resources to help you advance your career.

- Coverage ratios coverage ratio A coverage ratio is used to measure a company’s ability to pay its financial obligations. A higher ratio indicates a greater ability to meet obligations

- Valuation multiples multiples analysis multiples analysis involves valuing a company with the use of a multiple. It compares the company’s multiple with that of a peer company.

- EV/EBITDA EV/EBITDA EV/EBITDA is used in valuation to compare the value of similar businesses by evaluating their enterprise value (EV) to EBITDA multiple relative to an average. In this guide, we will break down the EV/EBTIDA multiple into its various components, and walk you through how to calculate it step by step

- Financial modeling guide free financial modeling guide this financial modeling guide covers excel tips and best practices on assumptions, drivers, forecasting, linking the three statements, DCF analysis, more

Financial analyst training

Get world-class financial training with CFI’s online certified financial analyst training program FMVA® certification join 350,600+ students who work for companies like amazon, J.P. Morgan, and ferrari

Gain the confidence you need to move up the ladder in a high powered corporate finance career path.

Learn financial modeling and valuation in excel the easy way, with step-by-step training.

Leverage in forex trading

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/foreign-currency-804917648-5ae5ef29ff1b780036736d7c.jpg)

Leverage is the ability to use something small to control something big. Specific to foreign exchange (forex or FX) trading, it means you can have a small amount of capital in your account, controlling a larger amount in the market.

Stock traders will call this trading on margin. In forex trading, there is no interest charged on the margin used, and it doesn't matter what kind of trader you are or what kind of credit you have. If you have an account and the broker offers margin, you can trade on it.

The apparent advantage of using leverage is that you can make a considerable amount of money with only a limited amount of capital. The problem is that you can also lose a considerable amount of money trading with leverage. It all depends on how wisely you use it and how conservative your risk management is.

You have more control than you think

Leverage makes a rather boring market incredibly exciting. But when your money is on the line, exciting is not always good, and that is what leverage has brought to FX.

Without leverage, traders would be surprised to see a 10% move in their account in one year. However, a trader using leverage can easily see a 10% move in one day.

But typical amounts of leverage tend to be too high, and it is important for you to know that much of the volatility you experience when trading is due more to the leverage on your trade than the move in the underlying asset.

Leverage amounts

Leverage is usually given in a fixed amount that can vary with different brokers. Each broker gives out leverage based on their rules and regulations. The amounts are typically 50:1, 100:1, 200:1, and 400:1.

- 50:1: fifty-to-one leverage means that for every $1 you have in your account, you can place a trade worth up to $50. As an example, if you deposited $500, you would be able to trade amounts up to $25,000 on the market.

- 100:1: one-hundred-to-one leverage means that for every $1 you have in your account, you can place a trade worth up to $100. This ratio is a typical amount of leverage offered on a standard lot account. The typical $2,000 minimum deposit for a standard account would give you the ability to control $200,000.

- 200:1: two-hundred-to-one leverage means that for every $1 you have in your account, you can place a trade worth up to $200. The 200:1 ratio is a typical amount of leverage offered on a mini lot account. The typical minimum deposit on such an account is around $300, with which you can trade up to $60,000.

- 400:1: four-hundred-to-one leverage means that for every $1 you have in your account, you can place a trade worth $400. Some brokers offer 400:1 on mini lot accounts but beware of any broker who offers this type of leverage for a small account. Anyone making a $300 deposit into a forex account and trying to trade with 400:1 leverage could be wiped out in a matter of minutes.

Professional traders and leverage

Professional traders usually trade with very low leverage. Keeping your leverage lower protects your capital when you make trading mistakes and keeps your returns consistent.

Many professionals will use leverage amounts like 10:1 or 20:1. It's possible to trade with that type of leverage regardless of what the broker offers you. You have to deposit more money and make fewer trades.

No matter what your style, remember that just because the leverage is, there does not mean you have to use it. In general, the less leverage you use, the better. It takes the experience to really know when to use leverage and when not to. Staying cautious will keep you in the game for the long run.

The balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk, including the possible loss of principal.

Leverage 1:200 forex brokers

Leverage is available when trading with different asset classes, including currency pairs, commodities, stocks, indices, and cryptocurrencies. Options and futures can also be traded with leverage. With that in mind, traders also need to be aware of the fact that leverage can have adverse consequences for their balance.

Best forex brokers for united states

It has the potential to significantly boost their profits but the same applies to the losses they could suffer from unsuccessful trades. Leveraging your positions is not necessarily a guarantee for trading success. Due to this, one should exercise great caution when using excessive leverage ratios like 200:1. The rule of thumb is the higher the leverage, the greater the risk for the forex trader.

What is leverage?

There are two types of leverage, operating and financial. Operating leverage is used to measure to what extent a company can grow its operating earnings by increasing its revenue. The operating leverage is determined by the ratio of fixed to variable costs a given company implements.

A company uses higher operating leverage when it has more fixed than variable costs. And vice versa, when the variable costs exceed the fixed costs, the company is said to utilize lower operating leverage.

There is also financial leverage, which refers to using debt to purchase assets. If an investment is said to be highly leveraged, this means it has less equity than debt. In the context of trading, leverage enables investors to increase their purchasing power by controlling bigger amounts in a given market with less capital.

This practice is called trading on margin and is available to both retail and professional investors. Trading on margin is interest-free in foreign exchange trading. One obvious benefit of financial leverage is that it allows you to realize significant earnings from a relatively small investment.

It also gives traders more exposure to the financial markets. Using a leverage ratio of 200:1, for example, gives a trader the ability to enter a trade of $200 for every dollar they have available in their live account’s balance.

In short, you can trade with 200 times more money than what you have. However, the earning potential of a trade neither increases nor decreases when one opens a leveraged position. Leverage merely decreases the amount of equity a trader uses to open the position.

Since leverage is a capital you borrow from your forex broker, you can incur substantial debts if you lose a position. Many traders describe leverage as a double-edge sword because it can greatly magnify your losses as well as your profits. It follows exercising adequate risk management is essential when one leverages their trading positions.

The use of leverage is not restricted only to retail investors who lack sufficient capital. On the contrary, professional investors also trade on margin but would normally utilize low leverage ratios such as 20:1 or 10:1. This helps them maintain consistent profits and protects their capital from trading mistakes and unexpected market movements in an unfavorable direction.

Leverage and margin

Margin reflects the funds you need to actually have in your live balance to open a leveraged position with a broker. The brokerage uses margin to maintain your open position. Margin is typically presented in the form of percentages that represent the full amount of a trade, such as 2%, 1%, 0.5%, 0.25% or 5%.

The required margin is based on the size of the trader’s position and the financial instrument they invest in. The relationship between margin and leverage is inversely proportional as is reflected by the following two formulas:

- 1 / margin = leverage. If the margin required by a broker is 0.02 or 2%, it follows the maximum leverage in this case will be equal to 1 / 0.02 = 50, or 50:1.

- 1 / leverage = margin. Respectively, a leverage ratio of 200:1 would yield a margin of 1 / 200 = 0.005, which when expressed in the form of a percentage amounts to 0.5%.

Used margin is another important concept forex traders must familiarize themselves with. It reflects the amount of funds the broker must lock up in your trading account to maintain the positions you currently have. There is also usable margin which represents the overall available amount you have in your balance to open new positions.

The funds are practically still yours while the position remains open. However, it is impossible for you to withdraw them from your balance until your brokerage “unlocks” them from your account. This happens either when you close the leveraged position or when the broker sends you a margin call, something we shall tackle in the next section.

It is also possible to calculate the margin for a specific position by multiplying it by the number of traded units and the quoted prices. For example, you want to open a long position for the EUR/USD pair and purchase 10,000 units of the EUR currency. The brokerage firm requires a margin of 0.5%, which is commonly the case for leverage ratios of 200:1.

The price for this pair quoted by the broker is 1.09, which is to say you must pay $1.09 for each EUR you purchase. Therefore, the required margin will be equal to 10,000 EUR x 1.09 x 0.5 = $5,450. Suppose you had $6,000 in your available balance before you opened this position. If so, your remaining equity would amount to $6,000 – $5,450 = $550.

Margin calls – why and when do they occur?

By sending you a margin call, the broker demands you to transfer extra money to your balance so that your account can return to the minimum maintenance margin. If you fail to do this, the broker will close your open positions to prevent your balance from dropping even further.

It is important to point out a trader’s usable margin is determined by their remaining equity rather than their balance. As long as the trader’s equity exceeds their used margin, the broker will not send them a margin call. A margin call occurs as soon as the trader’s equity equals or drops below their used margin.

How leverage works in forex trading

This borrowed capital in the form of leverage is provided to traders by the brokers that handle their live accounts. To use leverage when trading currency pairs, the trader must first sign up for a margin account, preferably with a reliable and regulated brokerage firm.

Most brokers typically offer higher leverage ratios for major currency pairs and lower ratios for exotics and minors. Some of the most common ratios for majors are 30:1, 50:1, 100:1, and 200:1. The ratios depend on where the broker is regulated as well as on the size of the trader’s position.

From a regulatory perspective, leverage is often proportionate to market volatility. The more volatile a given market is, the lower the leverage the broker will offer. It is for this reason cryptocurrency positions can usually be leveraged at a ratio of no more than 2:1 or 5:1 as opposed to the 100:1 and 200:1 leverages offered for major currency pairs in some cases. Trading indices is rarely available with leverage of more than 20:1.

Forex traders love to leverage their positions because this enables them to increase both the size of their trades and their potential earnings. Suppose a person has deposited $1,000 into their forex account but wants to open a position that exceeds this amount.

If their broker supplies leverage of 200:1, this would allow the trader to open a position as a big as 2 lots, with one standard lot amounting to $100,000. The trader will extend their initial investment from $1,000 to $200,000 for this position with a leverage of 200:1, or two standard lots of $100,000 each. This way, the person can trade up to $200 for every dollar of equity they have available in their account.

A leverage ratio of 200:1 is often offered to traders with mini accounts where mini lots are traded. One mini lot is equal to 10,000 units of the base currency, or USD in this case. Sometimes leverage can depend on your account’s deposit level. For instance, some trading sites may offer a 500:1 leverage for deposits under $1,000 and a ratio of 200:1 for deposits ranging from $1,000 to $5,000.

Is 200:1 leverage suitable for you?

The leverage ratio you use should be proportionate to your risk tolerance. The trading strategy you implement also plays a role in what leverage works best for you. The rule of thumb is to use lower leverage if you intend to hold your positions open for a longer period.

By contrast, when you have a short-term position that would remain open for minutes or seconds only, you are looking to extract maximum earnings from it within a very short time. In this case, you will want to use as much leverage as possible to ensure you generate high profits from minuscule market fluctuations.

It is for this reason that high leverage ratios like 200:1 are usually used by scalpers and traders who rely on price breakouts. Position traders, on the other hand, usually utilize low leverage (with the ratios ranging between 5:1 and 20:1) or use no leverage at all. By means of comparison, scalpers typically employ leverage from 50:1 to 500:1.

Maximum leverage restrictions vary wildly between different jurisdictions. In some countries like belgium, trading on margin and leveraging your positions is prohibited by law. The belgian financial services and markets authority (FSMA) outlawed the distribution of leveraged OTC derivatives to local retail customers in 2016.

Also important is to mention that trading with leverage of 200:1 would be impossible if you are based in a member state of the european union, at least if you want to trade with an EU-regulated brokerage.

The european securities and markets authority (ESMA) has proposed the following leverage ratios – 30:1 for major forex pairs, 20:1 for minor/exotic pairs, major indices, and gold, 10:1 for other commodities and equity indices, 5:1 for individual equities, and 2:1 for cryptocurrency positions. Most EU member states have already adopted the recommended ratios.

Meanwhile, the maximum allowed leverage for retail customers in the united states is 50:1 while that in japan is restricted to 25:1. If you live in any of these countries but want to trade with a 200:1 leverage, you will have no other option but to register with a foreign broker, licensed in another jurisdiction that allows for higher leverage caps.

Advantages and disadvantages of using 200:1 leverage

With a leverage of 200:1, you can increase your investment 200 times. The same goes for the profits you generate from successful trades, which also get magnified thanks to leverage. Leverage gives you access to significant capital you can use to trade forex currency pairs.

You can generate additional earnings from assets you would not be able to afford without this financial injection. Leverage multiplies the value of each dollar of your own capital you invest in the forex markets.

With that in mind, there are inevitably two sides to every story and using leverage is not an exception. Leverage allows you to control significant capital you practically do not own. It amplifies your profits but the same goes for your losses.

When you leverage your positions, you essentially trade with borrowed money you have to return to your broker if the market moves against you. The reality is the majority of retail investors who trade on margin lose their money, with the percentage of leverage victims ranging between 60% and 90% across different brokerages.

To prevent incurring huge debts, you should always ensure the broker you trade with offers negative balance protection. This will safeguard you in case your balance goes in the red after a stop out, preventing you from losing more than you have deposited. Your account will be automatically reset to zero in one such scenario when negative balance protection is in place.

4 of the best stocks to buy with $100 for 2021

It doesn't take a fortune to make one on wall street.

One of the wildest years on record for equities is nearly over. Yet when the curtain closes on 2020, the benchmark S&P 500 will probably have ended the year higher by a double-digit percentage. This isn't too shabby, considering that we've been navigating our way through the worst recession in the U.S. In decades.

The good news for investors is that a new year breeds new opportunity. A focus on fiscal stimulus and an incredibly dovish federal reserve offers hope that we could see a roaring bull market for years to come.

Best of all, investors don't need to have a cash pile the size of fort knox to build wealth in the stock market. If you have $100 that can be put to work right now, here are four of the best stocks you can buy for 2021.

Image source: getty images.

Walgreens boots alliance

Forget about investing in highly volatile coronavirus disease 2019 (COVID-19) vaccine developers. Instead, I'd suggest putting $100 to work in the ancillary players that'll find new life during the administration of these vaccines. Pharmacy-chain walgreens boots alliance (NASDAQ:WBA) is a great example that comes to mind.

The biggest challenge for walgreens is competing in an increasingly digital world. But with over 200 million american adults likely eligible for a COVID-19 vaccine in 2021, qualified physicians, nurses, and pharmacists will be needed to administer these vaccines. The COVID-19 inoculation campaign could drive an incredible amount of traffic to walgreens' locations and give the company an opportunity to latch onto customers at the grassroots level.

Beyond the coronavirus, investors should also be pleased with walgreens' ongoing transformation. The company is on track to cut at least $2 billion in annual spending by 2022, all while reinvesting heavily in digitization. Though it represents a small percentage of total sales, direct-to-consumer sales should remain a double-digit growth opportunity.

Further, walgreens has partnered up with villagemd to create full-service clinics in up to 700 of its locations. This would effectively make walgreens a one-stop shop for a person's medical needs.

Image source: getty images.

Trulieve cannabis

Buying shares of U.S. Marijuana stock trulieve cannabis (OTC:TCNNF) would be another smart way to put $100 to work.

To be crystal clear, I'm not expecting any major changes in how cannabis is scheduled at the federal level with president-elect joe biden in office. Biden has called for the decriminalization and rescheduling of marijuana, which isn't the same as legalizing the drug. Nevertheless, state-level legalizations and organic growth have provided plenty of opportunity for U.S. Pot stocks.

What makes trulieve cannabis so special is the company's focus on the florida market. Rather than spreading itself thin like other multistate operators, trulieve has opened 69 of its 74 dispensaries in the medical marijuana-legal sunshine state. By saturating the florida market, trulieve has done an excellent job of building up its brand without having to spend a fortune on marketing. It controls an estimated 50% of florida's medical cannabis market.

Trulieve cannabis also happens to be the most nominally profitable marijuana stock on the planet. It's been profitable on a recurring basis for quite some time, which is the reason it deserves a healthy premium.

Image source: getty images.

Annaly capital management

Mortgage real estate investment trusts (reits) have been a truly unexciting industry to park your money in for the past eight years. However, that's about to change, which is why $100 invested in annaly capital management (NYSE:NLY) could be a genius move.

With coronavirus vaccines beginning to make their way to the public, we're likely to see a resurgence in U.S. Economic activity in the months and years to come. Historically, when emerging from a recession, the yield curve tends to steepen. Put another way, the gap between long-term and short-term yields widens.

Mortgage reits like annaly borrow at short-term rates and, using leverage, acquire assets with higher long-term yields. This gap between higher long-term yields and lower short-term borrowing rates is known as net interest margin (NIT). Over the coming years, annaly should see its NIT rocket higher, which would propel its profits and robust dividend payout.

Also of note, a majority of annaly capital management's assets are agency-only mortgage-backed securities (MBS). Agency means these assets are backed by the federal government in the event of default. Though the yields on agency mbss are lower than non-agency assets, it allows for leverage to be used to boost profits.

Image source: getty images.

Yamana gold

The next couple of years should also be highly favorable for gold stocks like yamana gold (NYSE:AUY) . On the macro side of the equation, the nation's central bank is choosing to keep interest rates at or near historic lows. At the same time, it's also buying bonds and flooding the market with new money. This combination of exceptionally low bond yields and a pressured U.S. Dollar should be a big-time positive for the price of gold.

More specific to yamana, it'll see its gold equivalent ounce (GEO) production surge, once again, in 2021. After upping its GEO forecast by 25,000 ounces to 915,000 ounces following its third-quarter performance, yamana foresees north of 1 million GEO in 2021 and 2022. Production growth at the flagship canadian malartic mine, as well as mainstay jacobina, may deliver record cash flow next year.

Best of all, growing cash flow has allowed yamana to pay down its debt. As of Q3 2020, net debt stood at $619.1 million, which is down from around $1.7 billion in the mid-2010s. It's possible yamana achieves its goal of being net-cash positive by the end of 2021.

So, let's see, what we have: low leverage allows new forex traders to survive as a trader, it is crucial that you understand both the benefits AND the pitfalls of trading with leverage. Using a ratio of 100:1 as an at best leverage for $100

Contents of the article

- Top forex bonuses

- Low leverage allows new forex traders to survive

- Example #1

- Example #2

- Best high leverage forex brokers

- Best high leverage forex brokers:

- Best for

- Overall rating

- Best for

- 1 minute review

- 1 minute review

- 1 minute review

- 1 minute review

- 1 minute review

- What’s leverage and margin in forex trading?

- United states limitations

- What to look for in A high leverage forex broker

- The best high leverage forex brokers

- What should be the leverage for $100 deposit of...

- 3 users say thank you to sofeenevu for this...

- 2 users say thank you to bigvic28 for this useful...

- The following user says thank you to bisifentus...

- The following user says thank you to fxavengers...

- Lorem ipsum dolor sit amet, consectetur...

- Lorem ipsum dolor sit amet, consectetur...

- Lorem ipsum dolor sit amet, consectetur...

- How to choose the right leverage?

- How to choose the right forex leverage?

- Best forex brokers for united states

- Useful advice

- Fxdailyreport.Com

- Trusted forex brokers with 100:1 leverage

- Leverage ratios

- What are leverage ratios?

- List of common leverage ratios

- Leverage ratio example #1

- Download the free template

- Leverage ratio example #2

- Importance and usage

- What are the various types of leverage ratios?

- What are the risks of high operating leverage and...

- Coverage ratios

- Leverage in forex trading

- You have more control than you think

- Leverage amounts

- Professional traders and leverage

- Leverage 1:200 forex brokers

- Best forex brokers for united states

- What is leverage?

- How leverage works in forex trading

- Is 200:1 leverage suitable for you?

- Advantages and disadvantages of using 200:1...

- 4 of the best stocks to buy with $100 for 2021

- It doesn't take a fortune to make one on wall...

- Walgreens boots alliance

- Trulieve cannabis

- Annaly capital management

- Yamana gold

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.