Mt4 credit

Торгуйте на финансовых рынках через любой браузер в любой операционной системе купите или арендуйте торгового робота и технический индикатор, чтобы повысить уровень своего трейдинга

Top forex bonuses

Metatrader 4

Metatrader 4 — это торговая платформа для форекса, анализа финансовых рынков и использования торговых советников. Мобильный трейдинг, торговые сигналы и маркет — все это тоже metatrader 4, и все это пригодится вам при работе на рынке форекс.

Миллионы трейдеров с самыми разными потребностями выбирают metatrader 4, чтобы совершать торговые операции на рынке. Независимо от уровня подготовки платформа предлагает трейдерам самые широкие возможности: продвинутый технический анализ, гибкую торговую систему, алгоритмический трейдинг и торговых советников, а также приложения для мобильного трейдинга.

Торговые сигналы и маркет являются дополнительными сервисами и расширяют функционал metatrader 4 до новых горизонтов. Сигналы позволяют автоматически копировать сделки других трейдеров, а в маркете можно купить торговых роботов и технические индикаторы.

Скачайте metatrader 4 и получите самые широкие возможности для торговли на форекс

Торгуйте на рынке при помощи смартфона или планшетного компьютера

Автоматизируйте свою торговлю и пусть советник (expert advisor) анализирует рынки и торгует вместо вас

Торгуйте на финансовых рынках через любой браузер в любой операционной системе

Купите или арендуйте торгового робота и технический индикатор, чтобы повысить уровень своего трейдинга

Подпишитесь на сигналы другого трейдера, чтобы повторять все его торговые операции

Читайте новости и статьи по трейдингу, общайтесь с другими трейдерами, чтобы узнать о форексе что-то новое

Новости

Подключив платформу metatrader 5 к HKEX, форекс-брокеры могут расширить бизнес и начать предлагать фьючерсные инструменты.

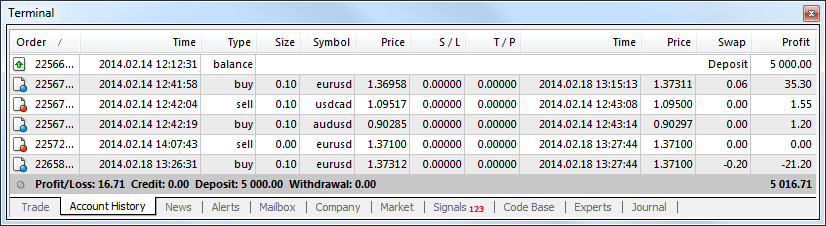

Account history

Information about all trade operations performed is stored in the "account history" tab.

The entire history is displayed as a table with the following fields (from left to right):

- Order – operation ticket number. It is the unique number of a trade operation;

- Time – time of position opening. It is given in YYYY.MM.DD HH:MM (year.Month.Day hour:minute) format. This is the time when the position was opened;

- Type – trade operation type. Only three types of trade operations can be found here: "balance" – entering of funds in the account, "buy" – a long position, and "sell" – a short position;

- Size – amount of lots participated in the operation;

- Symbol – this field shows the name of the security participated in the operation;

- Price – price of position opening. This is the price at which the position was opened;

- S/L – level of the stop loss order placed. If a trade position was closed by this order, its corresponding cell will be colored in red, and "[s/l]" will appear in the field of comments. If no order was placed, zero value will appear in this field. On the other hand, if the an order was placed, but did not trigger, its value will still be shown in this field. At that, the cell will not be colored, and no "[s/l]" will be output in the field of comments. More details about working with orders are given in the corresponding section;

- T/P – level of the take profit order placed. If a trade position was closed by this order, its corresponding cell will be colored in green, and "[t/p]" will appear in the field of comments. If no order was placed, zero value will appear in this field. On the other hand, if the an order was placed, but did not trigger, its value will still be shown in this field. At that, the cell will not be colored, and no "[t/p]" will be output in the field of comments. More details about working with orders are given in the corresponding section;

- Time – time of position closing. It is given in YYYY.MM.DD HH:MM (year.Month.Day hour:minute) format. This is the time when the position was closed;

- Price – price of position closing. This is the price at which the position was closed;

- Commission – commissions charged by the brokerage company at performing trade operations are written in this field;

- Taxes – taxes charged when performing trade operations are written in this field;

- Swap – the swaps charged are stored in this field;

- Profit – the financial result of transaction will be written in this field. Positive number means that the transaction was profitable, and the negative one does vice versa. The profit is shown only in the deposit currency here, unlike it is in the field of the same name in the "trade" tab.

- Comments – comments on trade operations are stored in this column. A comment can be input only at opening of a position or placing an order. The comment cannot be changed when an order or a position are being modified. Besides, a comment to the trade operation can be input by the brokerage company.

You can easily display the history of performed trades on a chart. To do it, you should just drag the necessary trade on a chart via the mouse. The entering and exiting points of the trade, connected with a line, will be shown with arrows. If you hold the shift button while dragging a trade, the entire history of trades will be placed on the chart.

Context menu

Commands allowing to manage the history range and data performance, as well as commands of history data export are grouped in the context menu:

- All history – show the entire account history. At this command execution, the whole financial history of the account will appear in the screen without any limitations by time;

- Last 3 months – show only the last 3-months history. The history of orders is requested by their close time;

- Last month – show only the last month history. The history of orders is requested by their close time;

- Custom period – show history for the selected period. At this command execution, the window that manages the history range will appear where one can select one of the pre-defined ranges (the "period" field) or specify them manually in the fields of "from" and "to". The history of orders is requested by their close time;

- Save as report – save the account history as a report in the form of the HTML file. At that, a window allowing to select a path for saving of the file will appear;

- Save as detailed report – save the account history as a report in the form of the HTML file. A detailed report differs from a normal one for an additional set of parameters. After this command has been executed, a window allowing to select a path for saving the file will appear;

- Commissions – show/hide the "commissions" column;

- Taxes – show/hide the "taxes" column;

- Comments – show/hide the "comments" column. Comments to trade operations are stored in this column. A comment can only be input at opening of a position or at placing of an order. Besides, the brokerage company can write a comment to the trade operation, as well;

- Auto arrange – automatic arrangement of column sizes at changing of the window size;

- Grid – show/hide grid for separating of columns.

Reports #

The upper part of the report contains general information about the account. Then the trades details are given that are separated into closed trades (closed transactions), open trades (open trades) and pending orders (working orders). The number of the fields displayed depends on the report type chosen (common or detailed).

- Ticket – ticket number of a trading position;

- Open time – time of position opening;

- Type – trade type (sell, buy, s/l, t/p, modify, close at stop, etc.);

- Size – amount of lots traded;

- Item – security traded;

- Price – open price of a trading position;

- S/L – the value of stop loss;

- T/P – the value of take profit;

- Close time – time of position closing;

- Price – price of position closing;

- Commission – commissions charged by the brokerage company at performing the trade operation;

- Taxes – taxes charged at performing trade operation;

- Swap – swaps charged;

- Profit – the financial result of the transaction.

For pending orders, an additional column, "market price", appears. The current market price as of the report generation is specified in it.

The summary about the financial performance of the account is located below (summary):

- Deposit/withdrawal – information about the deposits and withdrawals of the account;

- Credit facility – information about the credit funds on the account;

- Closed trade P/L – total profit/loss by all closed trades of the account;

- Floating P/L – current profit/loss by all opened trades of the account;

- Balance – balance of the account;

- Equity – equity of the account;

- Margin – the account margin for open trades;

- Free margin – the account free margin.

The report also contains the balance diagram and the statistical information about the account:

- Total net profit – financial result of all trades. This index represents a difference between the "gross profit" and "gross loss";

- Gross profit – the sum of all profitable trades in terms of money;

- Gross loss – the sum of all unprofitable trades in terms of money;

- Profit factor – the ratio between gross profit and gross loss in per cents. The one value means that profit equals to loss;

- Expected payoff – the expected payoff. This statistically calculated index represents the average profit/loss factor of a trade. It can also be considered for representing the expected profit/loss factor of the next trade;

- Absolute drawdown – the largest loss is lower than the initial deposit value;

- Maximal drawdown – maximal loss of the local maximum in the deposit currency and in percents of the deposit;

- Relative drawdown – the maximal loss in percents of the maximum balance value and its corresponding money value;

- Total trades – the total amount of trade positions;

- Short positions (won %) – the amount of short positions and percentage of won thereof;

- Long positions (won %) – the amount of long positions and percentage of won thereof;

- Profit trades (% of total) – the amount of profitable trade positions and their percentage in the total trades;

- Loss trades (% of total) – the amount of loss trade positions and their percentage in the total trades;

- Largest profit trade – the largest profit among all profitable positions;

- Largest loss trade – the largest loss among all unprofitable positions;

- Average profit trade – average profit value for a trade (the sum of profits divided by the amount of profitable trades);

- Average loss trade – average loss value for a trade (the sum of losses divided by the amount of unprofitable trades);

- Maximum consecutive wins ($) – the longest series of profitable trade positions and the sum of their wins;

- Maximum consecutive losses ($) – the longest series of unprofitable trade positions and the sum of their losses;

- Maximal consecutive profit (count) – the maximum profit of a series of profitable trades and the amount of profitable trades corresponding with it;

- Maximal consecutive loss (count) – the maximum loss of a series of unprofitable trades and the amount of unprofitable trades corresponding with it;

- Average consecutive wins – the average amount of profitable positions in consecutive profitable series;

- Average consecutive losses – the average amount of unprofitable positions in consecutive unprofitable series.

Glossary

Definition

A foreign exchange line of credit is a type of loan extended by a bank to an individual or a business in order to cover foreign exchange obligations.

| More info | ||

| international payments | payments hub |

FX lines of credit for international businesses

A business often takes out a line of credit with their bank in order to complete payments to foreign suppliers, for example.

The line of credit is often necessary because a business may place an order with a foreign supplier but they may not have the funds necessary to make the payment by the due date. Perhaps the business is dependent on future revenues – profits made from the current supplies order, for instance. For this reason, the business takes out a line of credit to ease its liquidity needs.

Businesses making international transactions often open a line of credit with their bank and also conduct the foreign exchange step with the same bank. However, it is very possible and economically beneficial to separate both steps.

Businesses can save significantly on their foreign exchange costs by benchmarking their bank against the live mid-market rate and considering alternative foreign exchange avenues other than merely staying with their line of credit provider.

Top best crypto broker for mt4 for 2021

We found 11 online brokers that are appropriate for trading best crypto broker for mt4.

Best crypto broker for mt4 guide

Best crypto broker for MT4

The value of bitcoin may not increase consistently like other commodities. Each trend has a limited life, and trading crypto against the dollar may offer some handy benefits.

Remember, physical assets do not back bitcoin; therefore, it is challenging to value through technical analysis.

Certainly, cryptocurrencies have a significant influence on the financial markets of the world. The digital technology offers new dimensions to traders.

Crypto is known for its developments and price volatility thus traders may find it challenging to invest in cryptocurrencies.

Cryptocurrencies are entirely different and decentralized and they depend on blockchain technology for different uses.

For this reason, cryptos are highly unpredictable instruments. Before investing in this currency, it is essential to find out the differences between cryptos cfds and cryptos investments.

Investment in physical cryptocurrencies

Bitcoin is a famous cryptocurrency with different features and benefits. If you want to store and purchase bitcoin, you have to develop a wallet.

It is similar to opening a bank account. To create your wallet, you will need to visit crypto exchanges or firms.

With the help of this wallet, you can receive bitcoins and transfer and store them to others. Several people find it confusing to buy physical bitcoins.

Remember, it is not suitable for margin trading, including cfds or FX market. Selling and buying cryptos on exchanges may not be easy with FX trading platform.

CFD (contracts for difference) trading for cryptocurrency

If a seller and a buyer are ready to pay the price difference in cash, a CFD may be a suitable choice.

This difference is inevitable because of the decrease or increase in the value of cryptocurrency. The contract may not have an actual seller or buyer. You may have to pay the difference to an opposite party.

Remember, trading cfds means there is no real underlying assets in investment. You trade a contract based on the direction of the price.

CFD trading is for experienced traders only as some traders may lose more than there deposited amount due to the leverage on the trades.

With cfds, traders can take profits and avoid losses. This option can be useful as per the volatility of cryptocurrencies.

Trade crypto in MT4

For crypto cfds, MT4 and MT5 are popular trading platforms. Several forex brokers trust both device-complaint and desktop versions for trading.

Traders can easily access USD/BTC and several other crypto pairs with metatrader 4. Several add-ons are available for the latest MT5 version.

Cryptocurrency and metatrader

If you want to get crypto chart in MT4 for analysis, you have to download it from CFD brokers. Search for your preferred currency in the list of assets. Bitcoin brokers may be available under XBT.

You will be able to see a graph for trading and it is not necessary to trade with brokers whose MT4 is useful for you.

In MT4 and MT5, you will get powerful charting tools to make the best trading decisions. Here are some easy steps to start trading on cfds crypto market:

- You will require the best crypto broker for MT4. Several brokers offer cfds cryptocurrency trading. Ensure you find a regulated broker. A live account or demo of your preferred broker will be useful. To download the MT4 platform, a link will be sent to you via email after completing registration.

- Open an MT4 platform and login into the account with the account information for your broker. Now tap “view” and “symbols” from a navigation window or press ctrl+U on the computer. It will highlight cfds crypto listed on this platform.

- Tap on “+” sign to see the available cryptocurrencies. Now hit “crypto” to choose the cryptocurrencies. Now you will have to tap on a “show” button to highlight all options in a market watch window. It is possible to choose every pair of cryptocurrency individually.

- When you have finished, you are ready to trade with your desired pairs of cryptocurrency of MT4.

Remember, BTC (bitcoin) is a volatile cryptocurrency. With proper money management, you may be able to take advantage of this volatility.

Nowadays, BTC is famous all around the world. Brokers are always supportive to display graphs of bitcoin along with other currencies. Here are some of the reasons for the bitcoin popularity.

Backtesting

Backtesting is the main benefit of bitcoin in MT4 that refers to testing strategies as per historical data.

This test enables you to find the backward impacts of a business strategy. Trading bitcoin CFD is not any different from any other and you can take advantage of the price action and diversity.

BTC CFD traders must focus on:

- Riding the current trend

- Appropriate management of money

- The concentration of major sessions, such as tokyo, new york and london

It is essential to purchase in a rise and fall with USD/BTC as traders can use this opportunity to become part of the market mainstream.

Trends are always susceptible to change, but USD/BTC may show a strong trend over time. Remember, the success of trading lies in the correct management of money.

We've collected thousands of datapoints and written a guide to help you find the best best crypto broker for mt4 for you. We hope this guide helps you find a reputable broker that matches what you need. We list the what we think are the best best crypto broker for mt4 below. You can go straight to the broker list here.

Reputable crypto broker for mt4 checklist

There are a number of important factors to consider when picking an online best crypto broker for mt4 trading brokerage.

- Check your best crypto broker for mt4 broker has a history of at least 2 years.

- Check your best crypto broker for mt4 broker has a reasonable sized customer support of at least 15.

- Does the best crypto broker for mt4 broker fall under regulation from a jurisdiction that can hold a broker responsible for its misgivings; or at best play an arbitration role in case of bigger disputes.

- Check your best crypto broker for mt4 broker has the ability to get deposits and withdrawals processed within 2 to 3 days. This is important when withdrawing funds.

- Does your best crypto broker for mt4 broker have an international presence in multiple countries. This includes local seminar presentations and training.

- Make sure your best crypto broker for mt4 can hire people from various locations in the world who can better communicate in your local language.

Our team have listed brokers that match your criteria for you below. All brokerage data has been summarised into a comparison table. Scroll down.

Our brokerage comparison table below allows you to compare the below features for brokers offering best crypto broker for mt4.

We compare these features to make it easier for you to make a more informed choice.

- Minimum deposit to open an account.

- Available funding methods for the below best crypto broker for mt4.

- What you are able to trade with each brokerage.

- Trading platforms offered by these brokers.

- Spread type (if applicable) for each brokerage.

- Customer support levels offered.

- We show if each brokerage offers micro, standard, VIP and islamic accounts.

Top 15 best crypto broker for mt4 of 2021 compared

Here are the top best crypto broker for mt4.

Compare best crypto broker for mt4 min deposits, regulation, headquarters, benefits, funding methods and fees side by side.

All brokers below are best crypto broker for mt4. Learn more about what they offer below.

You can scroll left and right on the comparison table below to see more best crypto broker for mt4 that accept best crypto broker for mt4 clients

What can I find in my MT4 trading report?

Metatrader 4 trading statements allow you to evaluate your overall trading performance and examine your individual trades. To access trading reports in MT4:

- Go to the "account history" tab in the lower "terminal" menu.

- Right-click to bring up a drop-down menu.

- Select "save as report" from the drop-down menu.

By right-clicking in the "account history" tab, you can choose to generate a trading report for your entire trading history ("all history"), the "last 3 months" or the "last month". Or you can generate a report for the time period of your choice by selecting "custom period".

Daily trading reports (confirmations) and monthly reports (statements) are sent to your registered email address.

What you'll find in your trading report:

- Deposit/withdrawal: the total result of deposits and withdrawals to / from the account over the reporting period (if no deposits or withdrawals were made, "deposit/withdrawal" will read 0)

- Credit facility: available credit

- Closed trade P/L: total profits or losses from transactions closed during the period

- Floating P/L: total floating profits and losses on all transactions open on a client's account at the time the report is generated

- Margin: total margin for all open transactions at the time the report is generated

- Balance: the total financial result of all completed trading and non-trading transactions (deposits, withdrawals) on the trading account at the time the report is generated

- Equity: the equity level at the moment the statement was generated (balance + credit + floating profit - floating loss)

- Free margin: funds available to open a new position at the time the report is generated (free margin = equity - margin)

In addition to regular trading reports, metatrader 4 allows you to generate a "detailed report," which includes additional information about your trading account, allowing you to analyze your trading performance more thoroughly.

To generate a detailed report:

- In metatrader 4, go to the "account history" tab in the lower "terminal" menu.

- Right-click to bring up a drop-down menu.

- Select "save as detailed report" from the drop-down menu.

What you'll find in your detailed report (in addition to the information found in regular trading reports):

- Gross profit: the total amount of profits earned on profit-earning positions over the reporting period

- Gross loss: the total losses on loss-making positions over the reporting period

- Total net profit: the difference between "gross profit" and "gross loss"

- Profit factor: A measure of your return; a coefficient showing the ratio of "gross profit" to "gross loss"

- Expected payoff: your "total net profit" divided by the number of transactions made

- Absolute drawdown: drawdown from the initial account balance; how much the balance has decreased in relation to the initial deposit

- Maximal drawdown: the largest drop from a peak to a trough during a certain time period (expressed as a monetary value). It may be higher than the "absolute drawdown" and show a loss even during a profit-earning period.

- Relative drawdown: shows the "maximum drawdown" expressed as a percentage of initial deposit

- Total trades: the total number of trades placed on the trading account

- Short positions (win%): the number of short positions closed during the period (the percentage of short positions which earned a profit is shown in parentheses)

- Long positions (win%): the number of long positions closed during the period (the percentage of long positions which earned a profit is shown in parentheses)

- Profit trades (% of total): the total number of profit-earning trades during the period (the percentage out of the total number of trades is shown in parentheses)

- Loss trades (% of total): the total number of loss-making trades during the period (the percentage out of the total number of trades is shown in parentheses)

- Largest profit trade: the most earned on a single trade

- Largest loss trade: the most lost on a single trade

- Average profit trade: the average amount earned on transactions which earned a profit (gross profit / profit trades)

- Average loss trade: the average amount lost on transactions which made a loss (gross loss / loss trades)

- Maximum consecutive wins ($): the longest streak of consecutive profit-earning trades (the total profits earned on these trades is shown in parentheses)

- Maximum consecutive losses ($): the longest streak of consecutive loss-making trades (the total losses earned on these trades is shown in parentheses)

- Maximal consecutive profit (count): the most earned on a trade during the streak of consecutive profit-earning trades (the number of trades in the streak is shown in parentheses)

- Maximal consecutive loss (count): the most lost on a trade during the streak of consecutive loss-making trades (the number of trades in the streak is shown in parentheses)

- Average consecutive wins: the average number of consecutive profit-earning trades

- Average consecutive losses: the average number of consecutive loss-making transactions

Mt4 credit

XM MT4 review was conducted by the team of our professional forex experts for those who want to invest with XM.Com broker.Formerly founded in 2009 as trading point of financial instruments ltd, it is a regulated forex broker in the republic of cyprus. The company was originally established by a group of interbank traders who required to recover the level of services in the forex trading communal. Through XM, traders now have access to the cfds, commodities and forex marketplaces.

Featured site

One of the foremost advantages of trade with XM is the information that the company is founded in cyprus, a member nation of the eurozone. This mean it meets the lowest fiduciary standard essential of a financial service provider working in the eurozone. By the way, it is also registered with the UK’s financial services authority (FSA) and federal financial supervisory authority of germany (bafin) thus giving extra protection to traders.

XM forex trading platforms

Maximum forex brokers offer an industry-leading platform such as MT4 and combine this with a good mobile app. It provides 9 platforms, five of which are keen to desktop computers and 4 that are keen to mobile traders. They really do not leftover any chance to live up to the right of “valuing trading competence” and provide for traders of all levels and necessities. These stages are below defined in brief detail.

XM MT4 download

This is XM’s version of the commerce-leading mt4 platform. It is extremely configurable and effortlessly suited to both novice and expert traders alike. It provides a live news feed and a wide technical analysis abilities. The MT4 platform also joins one click trading along with their manual trading feature, and even permits you to setup eas to mechanically place trades for you. Actually, there are a sum of add-ons and applications that will assistance you trade and progress your approaches. Trade cfds, futures and forex with no requotes and no refusals on this platform.

MT4 multiterminal

The multiterminal platform is mainly intended for money managers or traders who use manifold accounts and perform multiple order types instantaneously. Several of the features of MT4 are presented, but eas are not permissible as the terminal is planned for managing numerous accounts simply. Multiterminal doesn’t offer tech study either, but it does provide financial news and system signals in real-time, accompanied by numerous execution models intended to meet the necessities of those who essential to manage numerous accounts.

Mac MT4

This is a mac friendly version of the extremely popular metatrader4 platform. This version of the platform comprises all of the functionality and features defined above, but permits traders to usage the platform on apple computers without the essential to run a parallel windows emulator or windows desktop.

XM.Com MAM

As revealed previous, it look like to be the “one broker for all” as they offer a huge number of explanations. If you are an account or portfolio manager, or you are attentive in managing numerous accounts with the comprehensive features of metatrader4, this is the platform for you. Unlike MT4 multiterminal, XM MAM permits automated trading with eas and offer the technical analysis and charts you’d expect from metatrader4. There is so much more to this platform as it even permits numerous account pockets to manage numerous MT4 trading accounts through one main account. If this sounds right to your necessities, we endorse you speak with the support team to completely understand the functionality and features available here.

Webtrader

This is online trading platform. It is well-matched with mac, PC and any other apparatus accomplished of running a browser. No download is essential. Just open the platform from XM.Com in your browser and increase complete access to your trading accounts instantly. Traders can take benefit of a number of tools to increase their trading skills and trade with no rejections and no requotes. Like the metatrader4 platform, the webtrader 4 platform offers one-click trading, market analysis, an economic calendar and streaming news. It’s influential, capable and flexible. It comes extremely optional.

Ipad trader

XM brings MT4 to all ipad users by their ipad trader platform. It offers admittance to your metatrader4 account and presents actual interactive charts with scroll and zoom functionality. It also delivers real-time estimates of financial instruments, a complete set of trading tools and a comprehensive trading history, confirming that traders can examine their progress precisely. Unlike certain apps, this is far from an extra and really does provide an imaginary remote trading knowledge.

Iphone trader (IOS), mobile trader (windows mobile), droid trader (android) – mobile operators are not left imperfect as XM provide a mobile solution for all main smartphones. Their mobile platforms provide exceptional trading suppleness by bringing you a mounted down version of MT4 to your fingertips. They all provide direct access to your account and offer actual quotes of financial tools. The platforms also offer a complete set of trade orders comprising pending orders, 30 technical indicators, trade history, and the aptitude to trade straight from charts.

Mt4 credit

The gold standard

of FX platforms

The most popular trading platform

for currencies & cfds

Extensive analysis

& charting suite

Unrestricted automated

trading capabilities

Complimentary plug-ins

for clients

Smart features

Automated trading

_

Automate your trading with robots or copy trading.

• use the built-in editor to develop and back-test your own strategies.

• thousands of expert advisors (algorithmic trading robots) available free or for a small fee.

• view the profiles of hundreds of successful traders and copy their deals automatically.

Analysis & charting

_

Detect trends and forecast price direction with MT4 technical analysis tools.

• create your own indicators or choose between 30 built-in indicators, over 2000 free custom indicators and 700 paid ones.

• 24 analytical objects: lines channels, gann and fibonacci tools, shapes and arrows.

• customizable charts with 9 timeframes. Combine indicators and graphical objects on various periods of a single symbol.

Trading & orders

_

Buy or sell securities at the next available bid/ask price.

Market orders do not guarantee a price, but they do guarantee your trade is executed as soon as possible.

In liquid markets, the price is at or near the posted bid/ask price.

You can set stop loss and/or take profit levels to specify the maximum/minimum price at which your trade is closed out for a profit/loss.

Set the maximum or minimum price at which you are willing to buy or sell securities.

Your order will only be triggered for execution if the price reaches the pre-defined level.

If your order is triggered, you can set stop loss and/or take profit levels to specify the maximum/minimum price at which your trade is closed out for a profit/loss.

Buy limit

set your desired ask price at a level below the current price (you expect the price to fall to a certain level, from which it will rise again).

Buy stop

set your desired ask price at a level above the current price (you expect the price to keep rising after reaching a certain level).

Sell limit

set your desired bid price at a level above the current price (you expect the price to rise to a certain level, from which it will fall again).

Sell stop

set your desired bid price at a level below the current price (you expect the price to keep falling after reaching a certain level).

Plug-ins

_

The famous market scanner providing automated trade alerts, volatility analysis and more.

Metatrader master edition

A suite of advanced tools and indicators to save time and improve your performance.

Identify opportunities in real time and make decisions based on expert analytics.

Enjoy full mobility

Download the desktop version or switch to the mobile or web version while on the move.

Web platform

_

• trade from any browser and OS (windows, mac, and linux).

• no software installation required.

• all transmitted data is securely encrypted.

Mobile

_

• available for all ios and android devices.

• includes the full set of trading orders and the most popular tools.

• interactive quote charts, one-click trading, account monitoring.

Ready to get started?

How to become a client?

Account documentation

Keep up with the markets

Want to join our teams?

Want to refer clients?

Discover our mobile apps

Follow us on social media

Contacting us is easy! Customer care switzerland, phone: 0848 25 88 88. From abroad, phone: +41 44 825 88 88

Trading foreign exchange, spot precious metals and any other product on the forex platform involves significant risk of loss and may not be suitable for all investors. Prior to opening an account with swissquote, consider your level of experience, investment objectives, assets, income and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not speculate, invest or hedge with capital you cannot afford to lose, that is borrowed or urgently needed or necessary for personal or family subsistence. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts. The content of this website represents advertising material and has not been submitted to nor approved by any supervisory authority.

Fxdailyreport.Com

- Proper regulation

In an industry that requires a lot of trust, regulation is key. Proper regulation will ensure that the broker is capitalized in case of trading losses, keeps your money in safe, secure as well as segregated accounts and sticks to fair dealing practices to make sure your trades are always done at the current market prices. The MT4 forex broker you choose should have a strong regulatory record.

Most countries have taken the initiative of regulating forex trading. However, the fine print of the regulations may vary from country to country. Brokers who operate in different countries need to be registered and licensed. When making your choice, ask the broker which regulator has licensed them, and if possible, request to be provided with the registration number for verification.

Best metatrader 4 forex brokers fully regulated in 2021

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker |

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $100 spread: starting 0 pips leverage: up to 400:1 regulation: FCA UK, NFA, CFTC, ASIC, IIROC, FSA, CIMA | visit broker | |

| min deposit: $300 spread: floating, from 0 pips leverage: 500:1 regulation: FCA UK reference number 579202 | visit broker | ||

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: no minimum deposit spread: 1.2 pips leverage: 50:1 regulation: CFTC, NFA, FCA, MAS, ASIC, IIROC | visit broker | |

| min deposit: $100 spread: starting 0 pips leverage: up to 500:1 regulation: FCA UK, ASIC australia, MAS singapore | visit broker | ||

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker |

- Data security

When you are opening an account with your broker, you’ll provide lots of personal and financial information. Usually, you’ll be requested to provide copies of your passport, bank account information, utility bills, and credit card number.

Having poor internet security protocols puts your data at risk of theft. It could also disrupt your trading activities and even lead to identity theft. Before committing to any forex broker, ensure they have great internet security. The internet security could include SSL, a 2-factor authentication and a privacy policy.

To ensure that you always get the best rates at the required times, you should choose a broker with exceptional trade execution methods/practices. Essentially, forex brokers can be classified into two: market makers (those dealing desks) and STP brokers (those that pass your directives to interbank markets).

With market makers, any loss you make registers as a loss on their end and vice versa. But this doesn’t mean that they are working against you. The idea is to spread the bid when clients enter as well as exit the trades. They offset the risk of the trade with other trades from their clients and with their current liquidity provider.

On the flip side, STP brokers route all your directives to financial institutions like hedge funds, mutual funds, and banks. They see a good quote in the interbank market and then add some fractional pips as compensation before they route the order to liquidity providers.

- Product coverage

Today, you can trade several currencies with a broker. A good broker will grant you access to several capital market areas via one forex account. It’s therefore important to note that broad coverage doesn’t always mean deep coverage. If your goal is to trade a lot more than forex, then the number of products that your broker covers is imperative.

Now that you know how to pick an MT4 forex broker, let’s look at the benefits you stand to gain using the MT4 platform.

- Exemplary user experience

The MT4 interface is user-friendly. This enables forex trading newbies to navigate the volatile and complex market with great comfort and ease. Moreover, MT4 has a mobile app which allows access to the platform anytime and anywhere.

MT4 supports lots of languages all over the world. This means that you can use the platform in your native language.

Charts

in addition to its user-friendliness, MT4 provides advanced chart features, which help traders to analyze the technical aspects of their market. Also, you can change the style and color of the charts and use different templates that you like.

Communication

the platform has advanced tools of communication which enable the brokers to communicate with traders in real time. This gets rid of long email threads which can be a pain to follow. It makes trading and collaboration easier and simpler.

As you prepare to venture into the forex trading, be patient and a good communicator. Hopefully, you don’t think it is a get rich quick scheme, but you will undoubtedly enjoy great returns if you do it right.

Forex ECN account, MT4/MT5

The most seamless access to the world’s markets.

The future of forex trading has arrived

With alpari international’s ECN account, you will experience a more flexible, more transparent and more efficient trading experience than ever before. This is next level stuff, an account that offers you the best ask and bid prices from liquidity providers.

The electronic communication network (ECN) is an automated system providing a direct connection with banks, brokerages and other liquidity providers for buyers and sellers to execute trades. Regarded as a major development in forex, ECN gives the trader direct access to liquidity providers and is designed to match buy and sell orders.

The multiple benefits it brings has made ECN one of the most popular forms of trading around the world.

Why should I trade with an ECN account?

With so many benefits to ECN trading, its popularity is not surprising. When you trade with an ECN account, you experience:

- Total transparency, as your order goes straight to other market participants

- Rock bottom – and even zero – spreads during high market volatility

- No re-quotes, thanks to no deal desk technology

- The best possible bid and ask prices from a range of market participants

- Flexibility and trade continuity outside normal market hours and other breaks

- Enhanced execution through direct trading

Account specifications

| Parameter | value |

|---|---|

| account currency | USD / EUR / GBP / NGN |

| leverage / margin req. | Floating from 1:1000 |

| maximum deposit | X |

| minimum deposit | $/€/£ 500, ₦20 000 |

| commission | 1.5$/lot per side |

| order execution | market execution |

| spread | from 0.4 |

| margin call | 100% |

| stop out | 80% |

| swap-free | MT4: V MT5: X |

| limit & stop levels | N/A |

| pricing | MT4: 5 decimals for FX (3 on JPY pairs), 2 decimals for spot metals MT5: 5 decimals for FX (3 on JPY pairs), 3 decimals for spot metals |

| trading instruments | MT4: majors, minors, exotics, RUB - 56 spot metals - 3 spot cfds - 14 crypto-currencies - 4 |

Notes:

1 NGN accounts are only available to clients in nigeria.

2 please bear in mind that the company may at its sole discretion change, within the hour before the close of the trading session on every friday, the stop out and margin call levels from 80% to 100% and from 100% to 130% respectively, for all ECN MT4/MT5 accounts. Moreover, kindly note that the company may extend these amendments for as long as it deems necessary after the market opening, by providing the client with prior written notice.

3 spreads are floating and they may increase during specific periods of the day depending on the market conditions.

4 exotic pairs are not available for swap-free accounts.

5 alpari applies dividend adjustments on spot indices when positions remain open on the ex-dividend date. If a client is holding buy positions his/her account will be credited with the fixed dividend amount. If a client is holding sell positions then the dividend amount will be debited from his/her account.

6 for spot indices and spot commodities on ECN MT4 account the maximum volume per trade is 5 lots.

7 for spot indices and spot commodities on ECN MT4 account: the maximum volume of all orders for spot indices is 15 lots and 50 lots for spot commodities.

8 commission on ECN MT4/MT5 is fixed per lot and is taken only when a position is opened accounting for both the opening and the closing of the order. Commission depends on the account's currency - forex/metals: 3 USD/lot, 2.6 EUR/lot, 2.35 GBP/lot or 1,095NGN/lot, indices: 7 USD/lot, 6 EUR/lot, 5.5 GBP/lot or 2,555 NGN/lot, commodities: 4 USD/lot, 3.5 EUR/lot, 3.15 GBP/lot or 1,460 NGN/lot, cryptocurrencies: 15 USD/lot, 12.5 EUR/lot, 11.5 GBP/lot or 5,400 NGN/lot.

9 please note that margin requirements may vary between symbols and servers. For further information please refer to the leverage and margin requirements section.

10 please note that for clients who reside in iran, there is a minimum deposit requirement of $/€/£50 for standard accounts, $/€/£250 for ECN accounts.

So, let's see, what we have: metatrader 4 — это бесплатная торговая платформа, предназначенная для торговли на рынке форекс. Широкие аналитические возможности, гибкая торговая система, алгоритмический и мобильный трейдинг, маркет торговых роботов и технических индикаторов, встроенный виртуальный хостинг и торговые сигналы — вот что предлагает metatrader 4 каждому трейдеру! At mt4 credit

Contents of the article

- Top forex bonuses

- Metatrader 4

- Account history

- Context menu

- Reports #

- Glossary

- Definition

- Top best crypto broker for mt4 for 2021

- Best crypto broker for mt4 guide

- Best crypto broker for MT4

- Investment in physical cryptocurrencies

- CFD (contracts for difference) trading for...

- Trade crypto in MT4

- Cryptocurrency and metatrader

- Backtesting

- Reputable crypto broker for mt4 checklist

- Top 15 best crypto broker for mt4 of 2021 compared

- What can I find in my MT4 trading report?

- Mt4 credit

- Featured site

- XM forex trading platforms

- XM MT4 download

- XM.Com MAM

- Webtrader

- Mt4 credit

- The most popular trading platform for...

- Smart features

- Enjoy full mobility

- Web platform _

- Mobile _

- Ready to get started?

- How to become a client?

- Account documentation

- Keep up with the markets

- Want to join our teams?

- Want to refer clients?

- Discover our mobile apps

- Follow us on social media

- Fxdailyreport.Com

- Best metatrader 4 forex brokers fully regulated...

- Forex ECN account, MT4/MT5

- Account specifications

- Notes:

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.