Forex ranks p150

Before the question arises “how do they earn their money?”, the answer is: imarketslive has developed products that make trades much easier and finances itself.

Top forex bonuses

In addition, you have the possibility to receive the products free of charge if you affiliate 2 other partners.

Imarketslive – forex trading for everyone

60-80% of broker profit + weekly pay

Imarkets live is a sustainable long term investment. You have the chance to learn a lot about forex trading and to earn 30% return per month.

International markets live LTD (iml) is a company that has merged network marketing and trading into one platform.

IML was founded in the USA in 2013 and has enjoyed tremendous growth since then. Through the multi-year experience of the executives and the review by the financial market FDIC, the company has mastered all hurdles with top performance. The founder of imarketslive is one of the most experienced professionals, christopher terry. He has been a full-time trader since 1998 and has been working with the professional trader linda bradford raschke for several years.

Imarketslive and the broker hotforex

IML’s business model allows networkers and traders to use the products of imarketslive to independently learn how to trade, or to build a network and spread the products of imarketslive.

The company is already licensed in over 120 countries.

Before the question arises “how do they earn their money?”, the answer is: imarketslive has developed products that make trades much easier and finances itself.

Income opportunities

There are 2 ways to use imarketslive. Either as a customer or as a networker (IBO)

Customer

As a customer you have the possibility to choose one of two products:

Platinum package for the first time 195 dollar and then 145 dollar monthly.

- Harmonic scanner (https://youtu.Be/0gmic-gocqa) the market is scanned here 24/7 and analyzed in order to recognize a trend and thus to find the best possible trading possibility and thereby to achieve profits.

- IML academy – this is where A-Z explains how the game works and how it is handled (more than 200 videos are subdivided into the individual levels, from the beginner to the professional, everyone can still learn something about it)

- IML TV (here you can watch on working days how the professionals trade, why they do it etc. And you can of course do it all by yourself)

- Daily swing trades (here, the CEO christopher terry of imarketslive offers personal analysis, set ups and insight how he would do this).

Platinum package plus for the first time 235 dollars and then 185 dollars monthly.

Contains the following extras:

- Swipetrades (here you can get traffic signals directly to your mobile phone from the experts of imarketslive – thus without experience you can copy and paste the signals from the professionals)

- Fusion trader (here the auto trade makes up to 30% monthly)

In addition, you have the possibility to receive the products free of charge if you affiliate 2 other partners.

IMPORTANT: imarketslive does not manage the money invested for trading – it is created directly at hot-forex (broker) and thus your money is available at any time.

Networker (IBO)

As a networker (IBO), you have the possibility to build up a network and earn passive money.

- Through the building of a sales structure

- By the trading of your downline

My goal here is to build imarketslive with a 3×3 matrix so as not to lose unnecessarily commissions and to help other partners to earn money through the network.

Here ares the compensation plan of imarketslive:

Here is exactly explained how to get partner commissions.

Example 1:

if you affiliate 3 new partners with your personal link, you will be eligible for platinum 150 and receive $ 37.50 every friday on your paylution account. ($ 150 monthly)

Example 2:

if you affiliate 12 new partners (ie your 3 partners affiliate each 3 partners) you reach the platinum 600 rank and receive $ 150 every friday on your paylution account. ($ 600 monthly)

Example 3:

if you affiliate 30 new partners, you will be eligible for platinum 1000 and receive $ 250 every friday on your paylution account. ($ 1000 monthly)

As you can see, you must not only reach the number of partners, but also the persons you affiliate have to purchase one of the 2 products to count as a partner since the purchased packages are converted into points ($ 145 package brings 145 points)

The commissions here are automatically transferred to your paylution account every friday. No payment requests are necessary.

Income opportunity by trading of your team

Through a special broker deal with hot forex, we benefit from 2 levels of trading volume from our team.

This varies between 60-80% of broker profit depending on the team volume. Imarkets live earns nothing here since it is a pure product network. The capital lies at the broker and is completely independent of imarkets live which gives us again an additional security.

The registration at hot forex is completely independent from imarkets live. If you build your team with a 3×3 construct and you have partners further below you can put these people directly under yourself at hot forex. If someone is already registered at hot forex and trades there, the affiliate ID can be subsequently re-registered, which also gives us enormous advantages.

Profit, duration and costs

- The profit varies up to 30% a month.

- There are no costs for direct deposits to the broker hotforex!

- There is no duration limit, so the investment runs as long as you want. The investment is available at any time.

Deposits and withdrawals

As you’ve already read above, imarketslive’s commission is credited to a paylution account.

As soon as you have registered 3 partners, you will receive a link from imarketslive with the registration link from paylution, where a free registration is necessary to get commissions. The commissions can then be paid out from there.

Paylution is a virtual account where you can pay and transfer money or even withdraw with the prepaid card.

Of course, you can also transfer payments to your bank account. This takes a couple of days.

The payout is made weekly every friday on the paylution account.

The payout to bank account takes 2-3 working days longer.

Video review

Conclusion

Imarkets live is a sustainable long term investment. You have the chance to learn a lot about forex trading and to earn 30% return per month.

A warning about forex

Why are so many now getting into it?

If you’ve been on various social media platforms lately you may have noticed a lot of people posting about how they’ve recently gotten into trading currencies — foreign exchange or forex. Often they are suggesting that others join them on this “path to financial freedom.” personally, a lot of people who I knew starting posting about forex all the time. While it may seem intriguing — an easy way to make money, a “stock market” open seven days a week — it’s best to stay far away.

Forex in and of itself is not a scam. Foreign exchange is simply a way to convert one currency to another. But trading it is extremely risky — more akin to buying options the day they expire than purchasing a stock. Jumping into it without months, if not years of study, will almost certainly result in a loss. With that being said, what you see on social media is very much a scam.

The background

Why are people trading forex all of a sudden? There is an MLM, or pyramid scheme, called imarketslive. Imarketslive is an MLM to provides forex training at an upfront cost of $2,000 a year (institutional investor). In addition to providing training, which makes it an MLM is that you can actually earn income by participating in imarketslive.

There are a number of “tiers” with fancy names of income you can have, all based on the number of people you get to sign up for imarketslive — and all with fancy names. The ranks range from platinum 150, having 3 people signup below you in the pyramid, which affords $1,800 a year in income, all the way up to chairmain 500, getting 30,000 people to sign up below you. Chairman 500 gives a monthly salary of $500,000 (don’t worry, by signing up 30,000 people imarketslive made $60,000,000).

These people are desperate to promote how glamorous forex trading is and how profitable it is because if they don’t get enough people to sign up they are operating at a loss — and that’s before you take into account their forex losses.

The facts

Forex trades, especially binary options, are extremely risky. Most people participating in imarketslive trade what is called a binary option. A binary option is simply an options contract that pays out if the option expires in the money, and all money is lost if it expires out of the money. For example, if I bet that USDGBP trades at above 0.83, and it never goes above, I lose my investment. Similar to stock market options, binary options are extremely risky. Most trades result in a loss. There is no exact number available, but estimates are that more than 60% of forex traders do not take any returns and end up losing money.

The reason binary options are promoted is because of how simple they appear to be. Either you are right in your prediction, and you make money, or you are wrong and you lose all your money.

These online forex “traders” promote technical analysis as all you need to know to trade. If you’ve ever seen these “traders” posts — they all involve drawing simple trendlines up on a whiteboard or on an online chart and pass it off as an exact science. Technical analysis is anything but an exact science. A meta-analysis of the technical analysis found that most well-researched strategies do not return positive results (the profitability of technical analysis) — much less a few people on the internet drawing two peaks on a whiteboard and calling it a trend.

Should you trade forex?

Probably not. If you try to trade forex on a respectable brokerage like TD ameritrade you have to opt-in an acknowledge the risk associated with it — forex trading is not enabled by default and there's a good reason. It’s extremely risky and TD ameritrade wants to protect your investments.

The best thing to do is to follow the traditional advice. Don’t trade USDCHF in your TD forex account, buy the popular etfs and reits and put your savings in a high-interest account. And make sure not to fall for the quick money trap that online forex traders perpetuate.

This article is for informational purposes only, it should not be considered financial or legal advice. Not all information will be accurate. Consult a financial professional before making any major financial decisions.

Forex ranks p150

You’re wet behind the ears and green in the field. Keep quiet and pay attention!

Just smashed the onboarding level but don’t get too confident you’re still new rookie!

Great! Now you know the rules to survive in this cruel world. Remain compliant and you will overpower any villain, namely your arch nemesis

The regulator!

You just crushed the forex basics level, but you’re no big shot yet! See if you have the mental toughness to face the next level!

Ok you might just have something. Acquiring mind controlling powers is no easy feat! Congrats!

Mind controlling powers is one thing, the ability to keep a journal of strengths and weaknesses is what builds a heroes real character (and account).

Just smashed the tradingview 101 level! Wielding the power to slice and dice the market from your mobile device is no laughing matter.

You have just acquired a very important set of skills. The ability to cut through the market structure like a hot knife cuts through butter. Wield your skills with caution.

You have now mastered the second level and picked up the skill to read the moves behind the moves. No that’s not a riddle.

Having the ability to see through all the markets with your laser vision is the real deal. Now you can read all financial markets not just forex! Wow!

Knowing how to read the news isn’t easy! Congrats on beating the fundamental level and acquiring the skills to perform fundamental analysis!

It might be time to start taking you serious now that you have acquired sensory powers. Now you can read the “feeling” of the market. Don’t take this lightly!

Now you have acquired account savings techniques. Go forth! Be fruitful and multiply. See that no accounts are ever blown on your watch!

Now you can see through the cunning of any broker! You are ready now to pick your sidekick. Who will be handling your money. Pick wisely!

You are officially setup with you MT4 mobile. Go forth and catch all the pips you can!

Picking up the skill to see through multiple timeframes at a time is no small feat! Always remember your rules and don’t compromise for any one!

Candle pattern vision is the 2nd most sought out super power in the world. Good job for obtaining it so swiftly!

You have acquired the valuable tool of the fibonacci, use this carefully as it has the ability to “predict” the future.

You have come a long way pattern wizard, able to recognize patterns in the market will serve you well price action master!

Deciding to specialize is no easy task. Now you have the pick of the litter. Remember though these tools are just an extension of your inner powers!

You are the strongest of all the heroes protect the new up-and-coming heroes. Go forth, catch pips, spread knowledge and always remember to never stop being a STUDENT!

May the be

with you!

Two reward SYSTEMS

Points

Mission points will be given out based the following

- Completing missions (courses).

- Completing go and do’s.

- Attending weekly lives.

- Winning student of the month.

- Commenting on course discussion channels.

Certificates

Certificates show up on your transcript to mark the date and time you were in attendance.

Student of the month!

Badges will given monthly to our student of the month. (founders badges are awarded to founders only).

- Students will be awarded a badge of honor.

- 100 points to go to the all time achievement scoreboard.

- Students will also be showcased on our billboard for all to see.

- Students will be given a monthly news article celebrating their journey at FMI.

To be eligible students MUST complete the go & do’s. Badge and points will be given to the student who is at the top of the leader board for the month AND also completed G&D’s.

ALL GO AND DO’S FOR THAT CURRENT MONTH MUST HAVE BEEN COMPLETED WITHIN THAT SPAN OF TIME. EX. FOR THE MONTH OF SEPTEMBER, GO AND DO’S COMPLETED ONLY DURING THE MONTH OF SEPTEMBER WILL BE VERIFIED.

Example. You could receive the golden top spot, however if you didn’t do the G/ds and someone 2 spaces below you did, you will not be recognized as top student of the month.

Forex trading: A beginner's guide

Forex is a portmanteau of foreign currency and exchange. Foreign exchange is the process of changing one currency into another currency for a variety of reasons, usually for commerce, trading, or tourism. According to a recent triennial report from the bank for international settlements (a global bank for national central banks), the average was more than $5.1 trillion in daily forex trading volume.

Key takeaways

- The foreign exchange (also known as FX or forex) market is a global marketplace for exchanging national currencies against one another.

- Because of the worldwide reach of trade, commerce, and finance, forex markets tend to be the largest and most liquid asset markets in the world.

- Currencies trade against each other as exchange rate pairs. For example, EUR/USD.

- Forex markets exist as spot (cash) markets as well as derivatives markets offering forwards, futures, options, and currency swaps.

- Market participants use forex to hedge against international currency and interest rate risk, to speculate on geopolitical events, and to diversify portfolios, among several other reasons.

What is the forex market?

The foreign exchange market is where currencies are traded. Currencies are important to most people around the world, whether they realize it or not, because currencies need to be exchanged in order to conduct foreign trade and business. If you are living in the U.S. And want to buy cheese from france, either you or the company that you buy the cheese from has to pay the french for the cheese in euros (EUR). This means that the U.S. Importer would have to exchange the equivalent value of U.S. Dollars (USD) into euros. The same goes for traveling. A french tourist in egypt can't pay in euros to see the pyramids because it's not the locally accepted currency. As such, the tourist has to exchange the euros for the local currency, in this case the egyptian pound, at the current exchange rate.

One unique aspect of this international market is that there is no central marketplace for foreign exchange. Rather, currency trading is conducted electronically over-the-counter (OTC), which means that all transactions occur via computer networks between traders around the world, rather than on one centralized exchange. The market is open 24 hours a day, five and a half days a week, and currencies are traded worldwide in the major financial centers of london, new york, tokyo, zurich, frankfurt, hong kong, singapore, paris and sydney—across almost every time zone. This means that when the trading day in the U.S. Ends, the forex market begins anew in tokyo and hong kong. As such, the forex market can be extremely active any time of the day, with price quotes changing constantly.

A brief history of forex

Unlike stock markets, which can trace their roots back centuries, the forex market as we understand it today is a truly new market. Of course, in its most basic sense—that of people converting one currency to another for financial advantage—forex has been around since nations began minting currencies. But the modern forex markets are a modern invention. After the accord at bretton woods in 1971, more major currencies were allowed to float freely against one another. The values of individual currencies vary, which has given rise to the need for foreign exchange services and trading.

Commercial and investment banks conduct most of the trading in the forex markets on behalf of their clients, but there are also speculative opportunities for trading one currency against another for professional and individual investors.

Spot market and the forwards & futures markets

There are actually three ways that institutions, corporations and individuals trade forex: the spot market, the forwards market, and the futures market. Forex trading in the spot market has always been the largest market because it is the "underlying" real asset that the forwards and futures markets are based on. In the past, the futures market was the most popular venue for traders because it was available to individual investors for a longer period of time. However, with the advent of electronic trading and numerous forex brokers, the spot market has witnessed a huge surge in activity and now surpasses the futures market as the preferred trading market for individual investors and speculators. When people refer to the forex market, they usually are referring to the spot market. The forwards and futures markets tend to be more popular with companies that need to hedge their foreign exchange risks out to a specific date in the future.

More specifically, the spot market is where currencies are bought and sold according to the current price. That price, determined by supply and demand, is a reflection of many things, including current interest rates, economic performance, sentiment towards ongoing political situations (both locally and internationally), as well as the perception of the future performance of one currency against another. When a deal is finalized, this is known as a "spot deal." it is a bilateral transaction by which one party delivers an agreed-upon currency amount to the counter party and receives a specified amount of another currency at the agreed-upon exchange rate value. After a position is closed, the settlement is in cash. Although the spot market is commonly known as one that deals with transactions in the present (rather than the future), these trades actually take two days for settlement.

Unlike the spot market, the forwards and futures markets do not trade actual currencies. Instead they deal in contracts that represent claims to a certain currency type, a specific price per unit and a future date for settlement.

In the forwards market, contracts are bought and sold OTC between two parties, who determine the terms of the agreement between themselves.

In the futures market, futures contracts are bought and sold based upon a standard size and settlement date on public commodities markets, such as the chicago mercantile exchange. In the U.S., the national futures association regulates the futures market. Futures contracts have specific details, including the number of units being traded, delivery and settlement dates, and minimum price increments that cannot be customized. The exchange acts as a counterpart to the trader, providing clearance and settlement.

Both types of contracts are binding and are typically settled for cash at the exchange in question upon expiry, although contracts can also be bought and sold before they expire. The forwards and futures markets can offer protection against risk when trading currencies. Usually, big international corporations use these markets in order to hedge against future exchange rate fluctuations, but speculators take part in these markets as well.

Note that you'll often see the terms: FX, forex, foreign-exchange market, and currency market. These terms are synonymous and all refer to the forex market.

Forex for hedging

Companies doing business in foreign countries are at risk due to fluctuations in currency values when they buy or sell goods and services outside of their domestic market. Foreign exchange markets provide a way to hedge currency risk by fixing a rate at which the transaction will be completed.

To accomplish this, a trader can buy or sell currencies in the forward or swap markets in advance, which locks in an exchange rate. For example, imagine that a company plans to sell U.S.-made blenders in europe when the exchange rate between the euro and the dollar (EUR/USD) is €1 to $1 at parity.

The blender costs $100 to manufacture, and the U.S. Firm plans to sell it for €150—which is competitive with other blenders that were made in europe. If this plan is successful, the company will make $50 in profit because the EUR/USD exchange rate is even. Unfortunately, the USD begins to rise in value versus the euro until the EUR/USD exchange rate is 0.80, which means it now costs $0.80 to buy €1.00.

The problem the company faces is that while it still costs $100 to make the blender, the company can only sell the product at the competitive price of €150, which when translated back into dollars is only $120 (€150 X 0.80 = $120). A stronger dollar resulted in a much smaller profit than expected.

The blender company could have reduced this risk by shorting the euro and buying the USD when they were at parity. That way, if the dollar rose in value, the profits from the trade would offset the reduced profit from the sale of blenders. If the USD fell in value, the more favorable exchange rate will increase the profit from the sale of blenders, which offsets the losses in the trade.

Hedging of this kind can be done in the currency futures market. The advantage for the trader is that futures contracts are standardized and cleared by a central authority. However, currency futures may be less liquid than the forward markets, which are decentralized and exist within the interbank system throughout the world.

Forex for speculation

Factors like interest rates, trade flows, tourism, economic strength, and geopolitical risk affect supply and demand for currencies, which creates daily volatility in the forex markets. An opportunity exists to profit from changes that may increase or reduce one currency's value compared to another. A forecast that one currency will weaken is essentially the same as assuming that the other currency in the pair will strengthen because currencies are traded as pairs.

Imagine a trader who expects interest rates to rise in the U.S. Compared to australia while the exchange rate between the two currencies (AUD/USD) is 0.71 (it takes $0.71 USD to buy $1.00 AUD). The trader believes higher interest rates in the U.S. Will increase demand for USD, and therefore the AUD/USD exchange rate will fall because it will require fewer, stronger USD to buy an AUD.

Assume that the trader is correct and interest rates rise, which decreases the AUD/USD exchange rate to 0.50. This means that it requires $0.50 USD to buy $1.00 AUD. If the investor had shorted the AUD and went long the USD, he or she would have profited from the change in value.

Currency as an asset class

There are two distinct features to currencies as an asset class:

- You can earn the interest rate differential between two currencies.

- You can profit from changes in the exchange rate.

An investor can profit from the difference between two interest rates in two different economies by buying the currency with the higher interest rate and shorting the currency with the lower interest rate. Prior to the 2008 financial crisis, it was very common to short the japanese yen (JPY) and buy british pounds (GBP) because the interest rate differential was very large. This strategy is sometimes referred to as a "carry trade."

Why we can trade currencies

Currency trading was very difficult for individual investors prior to the internet. Most currency traders were large multinational corporations, hedge funds or high-net-worth individuals because forex trading required a lot of capital. With help from the internet, a retail market aimed at individual traders has emerged, providing easy access to the foreign exchange markets, either through the banks themselves or brokers making a secondary market. Most online brokers or dealers offer very high leverage to individual traders who can control a large trade with a small account balance.

Forex trading: A beginner’s guide

Forex trading risks

Trading currencies can be risky and complex. The interbank market has varying degrees of regulation, and forex instruments are not standardized. In some parts of the world, forex trading is almost completely unregulated.

The interbank market is made up of banks trading with each other around the world. The banks themselves have to determine and accept sovereign risk and credit risk, and they have established internal processes to keep themselves as safe as possible. Regulations like this are industry-imposed for the protection of each participating bank.

Since the market is made by each of the participating banks providing offers and bids for a particular currency, the market pricing mechanism is based on supply and demand. Because there are such large trade flows within the system, it is difficult for rogue traders to influence the price of a currency. This system helps create transparency in the market for investors with access to interbank dealing.

Most small retail traders trade with relatively small and semi-unregulated forex brokers/dealers, which can (and sometimes do) re-quote prices and even trade against their own customers. Depending on where the dealer exists, there may be some government and industry regulation, but those safeguards are inconsistent around the globe.

Most retail investors should spend time investigating a forex dealer to find out whether it is regulated in the U.S. Or the U.K. (dealers in the U.S. And U.K. Have more oversight) or in a country with lax rules and oversight. It is also a good idea to find out what kind of account protections are available in case of a market crisis, or if a dealer becomes insolvent.

Pros and challenges of trading forex

Pro: the forex markets are the largest in terms of daily trading volume in the world and therefore offer the most liquidity. this makes it easy to enter and exit a position in any of the major currencies within a fraction of a second for a small spread in most market conditions.

Challenge: banks, brokers, and dealers in the forex markets allow a high amount of leverage, which means that traders can control large positions with relatively little money of their own. Leverage in the range of 100:1 is a high ratio but not uncommon in forex. A trader must understand the use of leverage and the risks that leverage introduces in an account. Extreme amounts of leverage have led to many dealers becoming insolvent unexpectedly.

Pro: the forex market is traded 24 hours a day, five days a week—starting each day in australia and ending in new york. The major centers are sydney, hong kong, singapore, tokyo, frankfurt, paris, london, and new york.

Challenge: trading currencies productively requires an understanding of economic fundamentals and indicators. A currency trader needs to have a big-picture understanding of the economies of the various countries and their inter-connectedness to grasp the fundamentals that drive currency values.

The bottom line

For traders—especially those with limited funds—day trading or swing trading in small amounts is easier in the forex market than other markets. For those with longer-term horizons and larger funds, long-term fundamentals-based trading or a carry trade can be profitable. A focus on understanding the macroeconomic fundamentals driving currency values and experience with technical analysis may help new forex traders to become more profitable.

Imarketslive review – legit company or just A scam? Find out here…

The reason you are here is because you probably googled imarketslive review and you landed on this page correct?

There has been a TON of buzz about this company lately so I decided to find out what it was all about…

First of all, congratulations on actually doing your diligence because so many people jump into make money opportunities without any logic…

Then they complain about how they got scammed lol.

Well, your different because you are doing your research ��

In this blog post, I am going to walk you through the company, the products and compensation plan so you can make the right decision on imarketlive…

Find out of it’s for you…

Now PAY close attention and read this to the end…

If you don’t, then I can’t help you with your informative decision…

Before we get started, do you want to know how I personally did over 7 figures in the last 12 months using a 3 step system?

You will thank me later ��

Now let’s get into this review shall we?

Imarketslive review – the company

Imarketslive stands for “international markets live” and is run by a professional trader and CEO christopher terry.

The story is after years of struggling in the financial markets, a group of traders came together with a group of marketers to create the ultimate way of real wealth in their lives…

After digging in deeper, looks like terry was involved in MLM in the past and has done well with amway in the 1990’s.

There are some very negative reviews calling chris a forex scam artist, but honestly, he is actually a true professional in the field.

I will just leave it as that…

So now you know what is imarketslive, let’s take a look at the products…

Imarketslive reviews – the products

Like all good network marketing companies, the products have to be good…

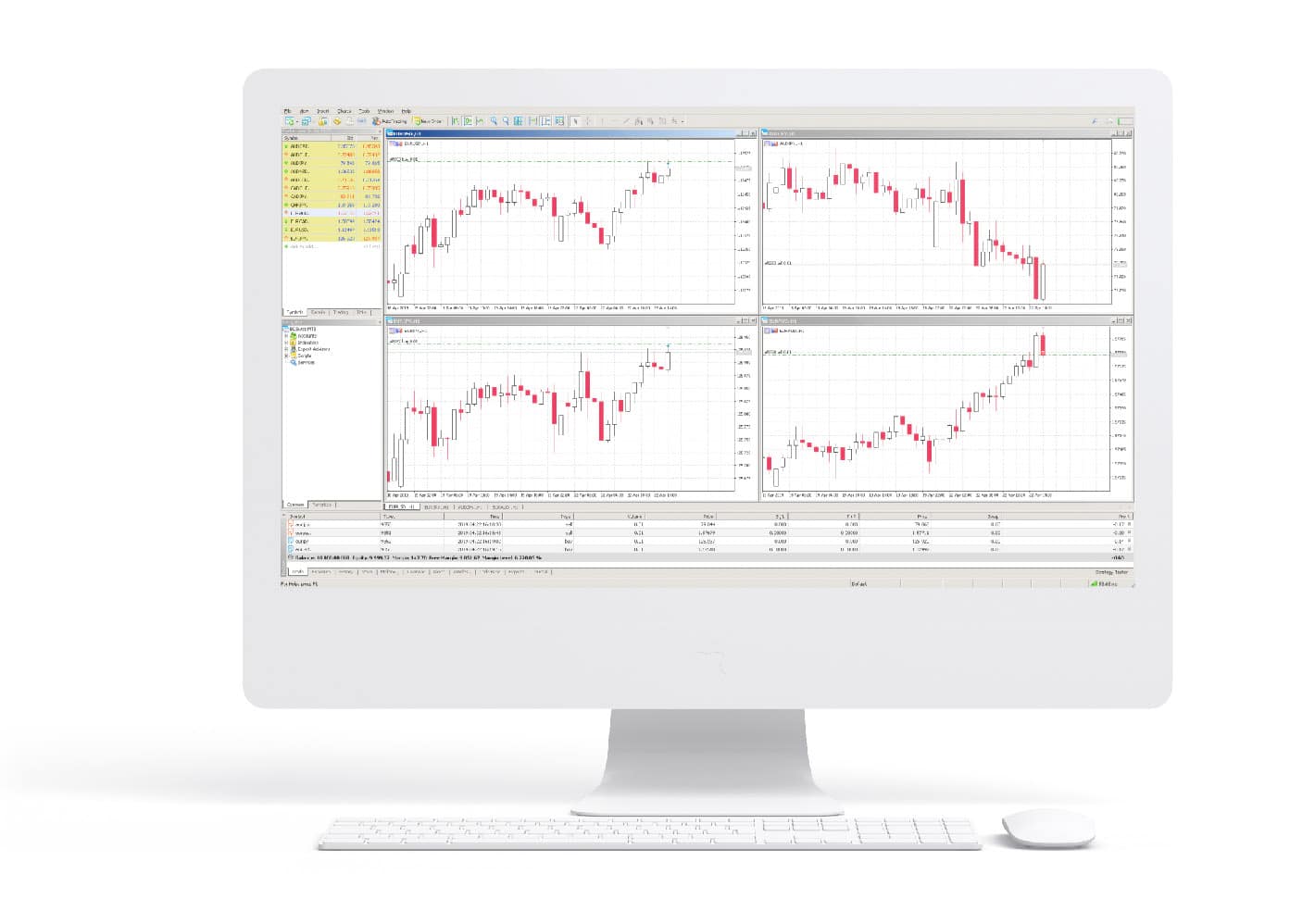

Imarketslive specializes in signal services, live trading and education in the forex world.

This is from their website showing what an imarketslive trading room is:

The ‘live trading & education room’ is hosted daily (monday through friday 8:30 AM to 12 PM EDT.) with our expert traders to see exactly what they are doing each day to win in the markets; what they watch for when trading and areas that provide the best trading opportunities in the financial markets. This is where the real money is made in the markets. Every day the “trading room” provides you a unique opportunity to dive inside the mind of a trader, to learn what sets the successful opportunities from the lease profitable. Imarketslive – live trading & education rooms

Also you get their iml signal service that gives you access to the same buy and sell signals sent by their traders in the live trading room.

I haven’t heard anything negative about these services so if you have anything to say, please leave them in the comments below…

The products here are VERY different than tradional MLM companies like total life changes or mary kay.

Alright, next let’s check out the compensation plan inside of this imarketslive review…

Imarketslive compensation plan

Like all MLM companies, you get paid commissions when you refer someone in the business that buys a membership or product…

Looks like the compensation plan is a unilevel for 1 time fast start bonus and then a 3×8 matrix for residuals.

Recruitment commissions payout

Imarketslive pays 4 levels in their fast start bonus through a 4 level unilevel and looks like this…

- Level 1: 30% (personally sponsored members)

- Level 2: 10%

- Level 3: 5%

- Level 4: 5%

Residual income commissions

Residuals are paid through their 3×8 matrix system.

With a full matrix, you will have 9840 positions in your downline.

There are two membership levels, $195 then $145 per month and $200 then $150 per month.

The company pays 8% in commissions per spot.

So at the $150 per month level, you will get $12 per spot.

You have to unlock the levels in the matrix by recruiting more people.

- Sponsor 2 affiliates – earn on levels 1 to 4 of the matrix

- Sponsor 6 affiliates – earn on levels 5 and 6 of the matrix

- Sponsor 9 affiliates – earn on level 7 of the matrix

- Sponsor 12 affiliates – earn on all 8 levels of the matrix

Cost to join imarketslive

Platinum package ($195 one-time then $145 per month) and includes the following:

- AUTOTRADER

- LIVE TRADING ROOM

- HARMONIC SCANNER

- TRADING EDUCATION

IBO platinum package ($200 one-time then $150 per month) and includes the following:

- AUTOTRADER

- LIVE TRADING ROOM

- HARMONIC SCANNER

- TRADING EDUCATION

- IBO KIT

- COMPENSATION PLAN

Imarketslive scam – the verdict

Overall, imarketslive scam is false…

I am not sure why some bloggers are calling it some kind of pyramid scheme…

It has product/services they market and have an affiliate program attached.

You get a signal service and live trading rooms…

So if your just interested in the trading aspect, give it a shot and see how it goes…

Just remember like any forex trading, there are risks involved and be ready to lose money as well…

You just have to do it over the long haul and see what kind of return you get…

If you have the gambling mentality then this business is NOT for you…

You definitely needs patience and know when to stop trading.

Personally, it’s a risky business and I recommend something much less risky when you are first starting out.

I personally have made a 7 figure business through a 3 step system in the last 12 months and TON of my students have been crushing it…

I hope you enjoyed my imarketslive review and if you have any question please leave them in the comments below…

PAY CLOSE ATTENTION to what I am going to say next because this could be the day where you LIFE completely changes…

My personal recommendation (totally optional of course)…

I have been in the network marketing field for three and a half years and have made multiple 7 figures in that time frame…

Picking a company that provides value and the right training is KEY to your success.

Anyway, after reviewing hundreds of companies and systems out there…

It’s the only system out there where you will learn step by step on how to build a business online with the right training’s, tools and one one one coaching to help you start up, setup and scale this business.

Take a look at my recent results below where I had a $12K+ day!

Now I know that was my results, now you are wondering if it can be duplicated which is very important right?

Take a look at my team members below and see how they are crushing it.

In other words, my members are winning here ��

You will thank me later ��

Follow me on social media below:

A warning about forex

Why are so many now getting into it?

If you’ve been on various social media platforms lately you may have noticed a lot of people posting about how they’ve recently gotten into trading currencies — foreign exchange or forex. Often they are suggesting that others join them on this “path to financial freedom.” personally, a lot of people who I knew starting posting about forex all the time. While it may seem intriguing — an easy way to make money, a “stock market” open seven days a week — it’s best to stay far away.

Forex in and of itself is not a scam. Foreign exchange is simply a way to convert one currency to another. But trading it is extremely risky — more akin to buying options the day they expire than purchasing a stock. Jumping into it without months, if not years of study, will almost certainly result in a loss. With that being said, what you see on social media is very much a scam.

The background

Why are people trading forex all of a sudden? There is an MLM, or pyramid scheme, called imarketslive. Imarketslive is an MLM to provides forex training at an upfront cost of $2,000 a year (institutional investor). In addition to providing training, which makes it an MLM is that you can actually earn income by participating in imarketslive.

There are a number of “tiers” with fancy names of income you can have, all based on the number of people you get to sign up for imarketslive — and all with fancy names. The ranks range from platinum 150, having 3 people signup below you in the pyramid, which affords $1,800 a year in income, all the way up to chairmain 500, getting 30,000 people to sign up below you. Chairman 500 gives a monthly salary of $500,000 (don’t worry, by signing up 30,000 people imarketslive made $60,000,000).

These people are desperate to promote how glamorous forex trading is and how profitable it is because if they don’t get enough people to sign up they are operating at a loss — and that’s before you take into account their forex losses.

The facts

Forex trades, especially binary options, are extremely risky. Most people participating in imarketslive trade what is called a binary option. A binary option is simply an options contract that pays out if the option expires in the money, and all money is lost if it expires out of the money. For example, if I bet that USDGBP trades at above 0.83, and it never goes above, I lose my investment. Similar to stock market options, binary options are extremely risky. Most trades result in a loss. There is no exact number available, but estimates are that more than 60% of forex traders do not take any returns and end up losing money.

The reason binary options are promoted is because of how simple they appear to be. Either you are right in your prediction, and you make money, or you are wrong and you lose all your money.

These online forex “traders” promote technical analysis as all you need to know to trade. If you’ve ever seen these “traders” posts — they all involve drawing simple trendlines up on a whiteboard or on an online chart and pass it off as an exact science. Technical analysis is anything but an exact science. A meta-analysis of the technical analysis found that most well-researched strategies do not return positive results (the profitability of technical analysis) — much less a few people on the internet drawing two peaks on a whiteboard and calling it a trend.

Should you trade forex?

Probably not. If you try to trade forex on a respectable brokerage like TD ameritrade you have to opt-in an acknowledge the risk associated with it — forex trading is not enabled by default and there's a good reason. It’s extremely risky and TD ameritrade wants to protect your investments.

The best thing to do is to follow the traditional advice. Don’t trade USDCHF in your TD forex account, buy the popular etfs and reits and put your savings in a high-interest account. And make sure not to fall for the quick money trap that online forex traders perpetuate.

This article is for informational purposes only, it should not be considered financial or legal advice. Not all information will be accurate. Consult a financial professional before making any major financial decisions.

List of the best 23 forex brokers | trusted reviews

Are you looking for a good and serious forex broker? – then this page is the right place for you. Thanks to the large selection on the internet it is often difficult to make the right decision. With more than 7 years of experience in the financial markets, we present you with the best providers with top service and without hidden costs. Find out in the following texts how to select a secure forex provider and which online broker offers the best conditions.

| Broker: | review: | regulation: | spreads: | assets: | advantages: | open account: |

|---|---|---|---|---|---|---|

1. Bdswiss  | ➜ read the review | cysec, FSC | starting 0.0 pips + $ 2.0 commission per 1 lot | 250+ (50+ currency pairs) | + individual offers + trading signals + raw spreads + leverage up to 1:500 + best education + personal support |

Watch our full video review about the best forex brokers (risk warning: your capital is at risk):

Strict criteria for the forex broker review

In contrast to many other comparison sites, we present you on this website only the safest providers with the best conditions for traders. As experts with many years of experience, we have tested many forex brokers and still use some of them. A good provider should have certain characteristics that guarantee good and safe investing.

It is not uncommon to hear of fraud on the internet. This is to be avoided by this comparison. In addition, one would like to save on charges as a trader because the costs for the trade reduce of course the actual profits. Also, the security of customer’s money is of high priority. A regulation or license, for example, is urgently needed for secure trading with international brokers. All these criteria and many more are included in the test. Therefore we can present you on this page the best forex brokers in a list.

Proven facts for a good forex broker:

- Regulation and license of an official finance authority

- High safety of customer funds

- Fast and reliable market execution

- Small forex trading fees and no hidden fees

- No requotes (high liquidity)

- User-friendly trading platform

- Free and unlimited demo account

- Professional support

- Fast deposit and withdraw methods

How does a forex broker work?

A forex broker is an intermediary between a client (trader) and the interbank market for currencies (wikipedia). In addition, the broker can lend capital to the trader so that he can trade with leverage. The broker’s income is generated by the spread and the cost of financing the leveraged positions.

There are 2 different models of brokers: market maker and ECN/NDD broker

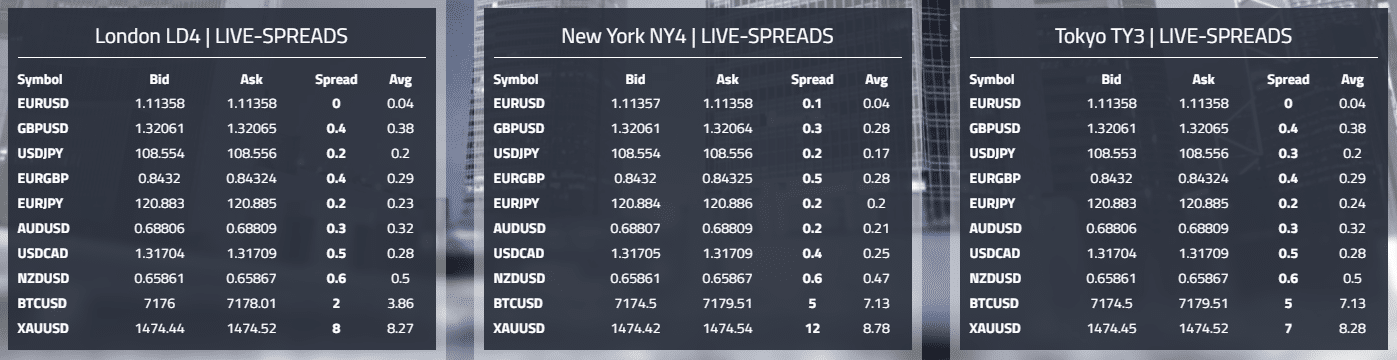

Example of live spreads for forex brokers

Market maker:

This broker does not place the trader’s orders directly into the real interbank or spot market. There is an internal matching system between the positions of the traders. Of course, the broker can hedge himself on the real markets so that there are no distortions in supply and demand. In most cases, this system can be opaque, and only as a broker employee, you know the exact functions. A market maker forex broker is not bad or scam. Nowadays, most providers offer good and exact executions.

ECN/NDD (no dealing desk) broker:

ECN and NDD mean direct access to the interbank market through various liquidity providers. These are large banks or very large forex brokers. The provider places the trader’s orders directly into the real market. So the customers get direct and real market prices for trading. With this model, there is no conflict of interest between trader and broker. Zero (no) spread accounts are offered.

Warning: only trade with regulated and licensed forex brokers

Security has the highest priority in online trading. When it comes to trading leveraged financial products, you have to be able to trust the forex broker. It is not uncommon for large sums of money to be used to generate a large profit. For example, brokers in europe must have regulations or licenses if they want to offer their services. The regulation can be in any european country. The same or almost the same requirements apply to brokers everywhere. In order to avoid fraud, it is important to look for such a license.

Licenses are only issued under certain conditions and criteria. If a broker violates these conditions, the license may be withdrawn immediately. All tested companies of mine are always concerned to keep the highest criteria and to guarantee a safe trade. Many brokers, for example, are regulated in cyprus. This has tax advantages. Nevertheless, there are also forex brokers with more than one regulation. The various regulatory authorities can be seen in the table above.

Facts of reliable and secure companies:

- Regulation and license

- Separated customer funds

- Regulated deposit and withdrawal methods

- Using well-known banks

- Large liquidity providers

Another important point for serious trading is the security of customer funds. Payouts of winnings or the deposited amount should work smoothly. It was not uncommon for some brokers to speculate on customer funds themselves. In the end, withdrawals were refused or delays occurred.

How risky is forex trading?

Forex trading is managed by leveraged financial products. That means you are able to trade a bigger contract size than the amount of money in your account. Some brokers offer the leverage up to 1:3000. Many traders are afraid of the obligation to make margin calls and this is not without reason as the past has shown. Account balances could slip into the negative balance. This is possible due to extreme market situations and too large a position size in relation to the account balance.

The providers shown above all have no obligation to make additional contributions (except IC markets and vantage FX). With the providers in the upper table, you are therefore protected against such a scenario. In our experience, this can only happen if the account is too heavily leveraged. You should always beware of sensible risk management.

Beginners should always start with the free demo account to practice forex trading.

A demo account is essential for successful trading. The trading column form and conditions can be tested extensively with this account. It is a virtual credit account that simulates real money trading. It can be traded without risk. This means that new strategies can be developed or new markets tested. The demo accounts of the compared providers are completely free and unlimited. This account is best suited for entry into forex trading.

How to deposit and withdrawal money:

For most traders, the first deposit into their account is very exciting. It should work smoothly and be highly secure. Forex brokers offer well-known and proven payment methods. Capitalize the trading account with electronic methods (credit card, e-wallet, paypal, crypto) or with the classic way of bank transfer. Electronic methods work in real-time and the money is credited directly to the trading account. Trading can be started immediately. The minimum deposit at the compared brokers is very low. For example, you can open an account from as little as 1$. If this is worth it, you have to decide for yourself. There are no fees for deposits.

Example of payment methods of a forex broker

The payout is also very uncomplicated. With a few clicks, you can request a withdrawal on the menu. This is then released in 1-3 working days. However, most brokers payout customer money in less than 24 hours. All presented brokers passed this test. The fees can be high for small payouts. With payments over 200$, the most forex brokers take over the fees but some brokers do not charge any commissions.

Facts about the payments:

- Instant deposit of money

- Fast withdrawal within 1 – 3 working days

- Electronic methods (skrill, neteller, paypal, and more)

- Cryptocurrencies

- Bank wire

Not every country is available for forex trading

Not every country is available for forex brokers and trading. This is because there are some restrictions and special regulations. For example, in some countries, an international broker needs a special license for that specific country. So it is too much afford for some companies to get the license and they stop taking clients from these countries. You can clearly see on the homepage which clients they accept. Not many brokers accept clients of the united states of amerika.

From my experience, the fastest-growing countries are in africa and asia. Because of the development of mobile internet, more people get connected to the forex market. India, nigeria, philippines, malaysia, and china are at the moment the fastest-growing countries.

Is forex trading legal?

Forex trading is fully legal if there is not any ban from the government. Forex trading is just changing money into another currency. This is not an illegal practice. The brokers on my review got official regulations so they act fully legal.

Review conclusion: start trading with a reliable forex broker

On this page, we have presented you with our current list of the top 23 forex brokers in comparison. Now you have a selection of good and reputable companies in front of you. It was particularly important to us that we only present providers here, which we have tested by ourselves with real money. This is not the case with most comparisons.

Profit now from the most favorable fees and the best conditions by my experience of many years. With these providers, you are 100% safe and can take your forex trading to the next level.

We hope you could learn something in this comparison and act now with better providers through my recommendations. If you can’t make up your mind, please also read the reviews.

Successful forex trading requires a good and reliable broker. In this review, we showed you the top 23 secure forex brokers. Now you can choose your professional trading partner.

Best forex brokers 2021

US brokers

Canadian brokers

UK brokers

Australian brokers

Brokers from around the world

*leverage depends on the entity of the group and the financial instrument traded.

- Demo accounts

- FX brokers by regulatory bodies

- Islamic forex accounts

- FX brokers for beginners

- FX trading tips

- Social trading & copy trade

- Forex trading platform for beginners

- What is CFD trading

- How to avoid ESMA regulations

- ESMA guide

2021 top 5 forex broker reviews

- AVATRADE review

- XM review

- FX choice review

- IC markets review

- Blackbull markets review

Forex trading is not only for professional traders. Anyone can try their hand at it and be successful, with the proper training of course.

Are you new to forex trading?

If you are already experienced with online trading, you will find our website useful in discovering top rated brokers who can bring you more success and a better broker experience.

Legit forex trading sites

There are hundreds of forex brokers out there, some better than the rest.

If you want to succeed and make money on the foreign exchange market, it is essential to make the correct choice right from the beginning.

- Our aim is to rank foreign exchange brokers , evaluate them and compare the brokers for you, so you don’t have to mine through hundreds of forex trading sites and thousands of reviews.

- We believe that less is more when it comes to the choices that we show you and recommend.

- We are always on the lookout for the best brokers.

- We handpick the best forex brokers who have proved to be reliable and respectable, and carefully vet them before we bring them to you on our ranked lists.

- We list ONLY legitimate forex trading sites.

Forex articles

6 forex millionaires you never heard of

6 forex millionaires you never heard of forex trading has been recognized as one of the fastest ways to accumulate financial wealth in a short

How to choose the right forex broker

Choosing the right forex broker as of today, there are hundreds of forex brokers around the world claiming to be the best among the rest. But we all

Why do forex traders fail

Why do forex traders fail? The failure rate of new forex traders has been estimated to be as high as 95%. Why is this rate

Best forex trading platform for beginners

Best forex trading platform for beginners choosing the best forex trading platform can be a challenging task for beginners. Selecting the most suitable, easy to use,

6 basics of forex risk management

Forex risk management to succeed in the forex market as a trader, you need to develop suitable forex risk management strategies. Even if your trading

10 forex trading tips for beginners

10 forex trading tips for beginners. The careers of many forex traders have gotten off to a rough start without the right tips and forex

Beginners guide to CFD trading

Beginners guide to cfds trading if you are a forex trader who is searching for information on how to broaden your trading skills to include

Forex trading vs stock trading

Forex trading vs stock trading – why forex ticks well. Forex vs stocks. Risk tolerance, convenience and account size are the major factors that influence

Forex regulation

Regulation in forex trading top 5 fx regulators the risky forex trading market, which involves trading currency pairs needs proper forex regulation. The forex industry

We investigate brokers before listing

Our process of ranking the best FX brokers is a thorough process where we carefully filter contenders.

We investigate every broker and their claims before listing them.

We choose our top picks based on trading conditions, trading platforms, trade execution speed, account types, deposit methods and regulated bodies.

Since we care about your confidence in us, we also look particularly at customer service and the overall reputation of the brokers we recommend. The safety of your funds is key.

You will find that all of our recommended brokers have received good reviews from traders for their security and customer service.

We want our customers to have full confidence in every broker on our website. So we only look for the most trustworthy forex trading brokers to include.

You may already be familiar with some of these forex brokers but may have passed them by without a closer look.

But with our guidance, we promise you will find the most legitimate forex trading sites.

What is forex?

Let us consider a situation where your friend is asking you to invest in forex, and you are wondering what is forex?

The foreign exchange market or forex, FX and currency market is a global market for the trading of the worlds currencies, or simply when one country trades with another, there is a need to exchange currency. The FX market determines the foreign exchange rate. It includes all aspects of buying, selling and exchanging currencies at current or determined prices.

The very basis of getting started with fx trading is to understand what you will need to get started. You should start off with a reliable forex education program. A forex education program is a great way to start. It is very important to have a reasonable understanding of forex concepts to get started. The key to winning in forex is to picking the right strategy, which as well requires lots of training. Here at forex rank we want you to be fully confident when starting to trading in the foreign exchange market.

Right strategy is about minimizing risks

When anyone is talking investment, you will automatically be prompted to think about returns and risks. Learning to control risks is the key to understanding forex. The best way to understand what is forex is to learn by doing. This experience is invaluable. With little strategic training, you can get started on the right path. Getting started on the right path involves choosing the right strategy.

Work with a forex trading plan

When you choose to work with a particular forex trading plan, start off with a clear understanding of the strength, weakness, opportunities, and threats in the strategy. A plan need not be too complicated. A plan can be very simple, yet effective.

Start with a simple plan

If you are a beginner to trading who is just beginning to understand what is forex, you should start off with a simple plan. Creating a plan is not at all a tedious process. There are different levels of trading plans. When you trade with a strategy, you are actually trying to come up with a set of rules that can be used to trade forex profitably. Every plan is about controlling the risks and increasing the profits. The degree of risk and the amount in profits you are willing to make will decide the kind of strategy you should choose?

Develop the skill

For those who are trying to buy commercially developed forex strategies, a crucial skill in need is to evaluate the strength of strategy. If you are going to buy a trading system you should be sure of what it is going to do for you. It does not make sense in to buying something that will not do you any good. You will not understand a strategy unless you know the ins and outs of forex trading.

Focus on the performance

When you choose a forex strategy, you should choose it by the performance. The design of a complex strategy can sometimes be deceiving, while a simple strategy will perform robustly than you imagined. At the same time it is important to know that trading strategies are not a one size fit for all. A strategy that worked miracle for someone will not suit you in any way. Whereas, a strategy that did not work for someone might bring you lot of profit.

Anybody can hit on a sudden luck and make a big profit, but what matters is to make profits in a consistent manner. Luck will come and go, but skill and strategy is what you will need for consistency in profit making.

Forex rank was created with the trader in mind, be it, a newbie, intermediate or expert traders. We want to see you succeed and at the same time have fun! Forexrank.Co lists only the best forex brokers and up-to-date content on the foreign exchange market.

Our services

To help you make headway in the foreign exchange market and achieve success, we offer the following services:

- Forex broker ranking and reviews:we rank brokers based on client fund safety, reputation, customer service and overall scores besides offering an overall list of top-ranked brokers in the world. You will also find reviews that will tell you about the experiences of other traders on these platforms.

- Forex trading news and calendar:you need to follow forex economic news to be able to trade successfully in the market. You may know that news is what moves the market. You can find all the latest news and events right at our economic news calendar.

- Broker lists: we have compiled a list of forex brokers from across the world. The best forex broker list on the web.

- Forex broker bonus: A list of the brokers who offer free deposits or sign up bonuses to try them out can be useful, to test the waters. You will only find the best reliable forex brokers offering bonuses on our website.

- Information for beginners:successful FX trading depends on trading strategies. Forex trading beginners must study up on forex trading before they jump into the market, to avoid disappointments. We bring information and tips on trading, trading platforms, and types of brokers to get you started.

- Forex articles: here you will find articles related to forex trading, brokers, platforms, currencies, strategies and so on! We keep adding new content on forex every week!

A portion of the sign up links to brokers websites are affiliate links. We may receive a commission with no charge to you. This enables us to keep creating helpful forex trading content for our readers for free.

S&P 600 index

S&P smallcap 600 ($IQY)

The information below reflects the ETF components for S&P smallcap 600 SPDR (SLY).

Percentage of S&P 600 stocks above moving average

Summary of S&P 600 stocks with new highs and lows

| (597 total components) | 5-day | 1-month | 3-month | 6-month | 52-week | year-to-date |

|---|---|---|---|---|---|---|

| today's new highs (% of total) | 107 (18%) | 71 (12%) | 61 (10%) | 57 (10%) | 37 (6%) | 74 (12%) |

| today's new lows (% of total) | 270 (45%) | 33 (6%) | 3 (1%) | 2 (0%) | 1 (0%) | 48 (8%) |

| difference | -163 | 38 | 58 | 55 | 36 | 26 |

S&P 600 components

Stocks: 15 20 minute delay (cboe BZX is real-time), ET. Volume reflects consolidated markets. Futures and forex: 10 or 15 minute delay, CT. Market data powered by barchart solutions. Fundamental data provided by zacks and morningstar.

© 2021 barchart.Com, inc. All rights reserved.

This page provides details for the index you are viewing. At the top, you'll find a histogram containing today's high and low price. The histogram shows where the open and last price fall within that range. Below is a histogram showing the 52-week high and low. A chart also shows you today's activity.

Available only with a premier membership, you can base a stock screener off the symbols currently on the page. This lets you add additional filters to further narrow down the list of candidates.

- Click "screen" on the page and the stock screener opens, pulling in the symbols from the components page.

- Add additional criteria in the screener, such as "20-day moving average is greater than the last price", or "trendspotter opinion is buy".

- View the results and save them to a watchlist, or save the screener to run again at a later date.

- Running a saved screener at a later date will always present a new list of results. Your saved screener will always start with the most current set of symbols found on the components page before applying your custom filters and displaying new results.

Percentage of stocks above moving average

For the major indices on the site, this widget shows the percentage of stocks contained in the index that are above their 20-day, 50-day, 100-day, 150-day, and 200-day moving averages.

In theory, the direction of the moving average (higher, lower or flat) indicates the trend of the market. Its slope indicates the strength of the trend. Longer averages are used to identify longer-term trends. Shorter averages are used to identify shorter-term trends. Many trading systems utilize moving averages as independent variables and market analysts frequently use moving averages to confirm technical breakouts.

When prices are rising they are usually above the average. This is to be expected since the average includes data from the previous, lower priced days. As long as prices remain above the average there is strength in the market.

Components table

The components table shows you the stocks that comprise the index.

Barchart data table

Data tables on barchart follow a familiar format to view and access extensive information for the symbols in the table.

Pages are initially sorted in a specific order (depending on the data presented). You can re-sort the page by clicking on any of the column headings in the table.

Views

Most data tables contain multiple standard "views", and each view contains "links" to each symbol's quote overview, chart, barchart opinion, and technical analysis page. A view simply presents the same symbols with different columns. Site members can also display the data using any custom view. (simply create a free account, log in, then create and save custom views to be used on any data table.) standard views on the index page include:

Main view: symbol, name, last price, change, percent change, high, low, and time of last trade.

Technical view: symbol, name, last price, today's opinion, 20-day relative strength, 20-day historic volatility, 20-day average volume, 52-week high and 52-week low.

Performance view: symbol, name, last price, weighted alpha, YTD percent change, 1-month, 3-month and 1-year percent change.

Data table expand

Unique to barchart.Com, data tables contain an "expand" option. Click the "+" icon in the first column (on the left) to "expand" the table for the selected symbol. Scroll through widgets of the different content available for the symbol. Click on any of the widgets to go to the full page.

Horizontal scroll on wide tables

Especially when using a custom view, you may find that the number of columns chosen exceeds the available space to show all the data. In this case, the table must be horizontally scrolled (left to right) to view all of the information. To do this, you can either scroll to the bottom of the table and use the table's scrollbar, or you can scroll the table using your browser's built-in scroll:

- Left-click with your mouse anywhere on the table.

- Use your keyboard's left and right arrows to scroll the table.

- Repeat this anywhere as you move through the table to enable horizontal scrolling.

Flipcharts

Also unique to barchart, this feature allows you to scroll through all the symbols on the table in a chart view. Flipcharts are a free tool available to site members.

Download

This tool will download a .Csv file (compatible with many spreadsheet programs) for the view being displayed. Download is also a free tool available to site members.

So, let's see, what we have: imarketslive – forex trading for everyone 60-80% of broker profit + weekly pay imarkets live is a sustainable long term investment. You have the chance to learn a lot about forex at forex ranks p150

Contents of the article

- Top forex bonuses

- Imarketslive – forex trading for everyone

- Imarketslive and the broker hotforex

- Income opportunities

- Profit, duration and costs

- Deposits and withdrawals

- Video review

- Conclusion

- A warning about forex

- Why are so many now getting into it?

- The background

- The facts

- Should you trade forex?

- Forex ranks p150

- Two reward SYSTEMS

- Points

- Certificates

- Student of the month!

- Forex trading: A beginner's guide

- What is the forex market?

- A brief history of forex

- Spot market and the forwards & futures markets

- Forex for hedging

- Forex for speculation

- Currency as an asset class

- Why we can trade currencies

- Forex trading risks

- Pros and challenges of trading forex

- The bottom line

- Imarketslive review – legit company or just A...

- Imarketslive review – the company

- Imarketslive reviews – the products

- Imarketslive compensation plan

- Cost to join imarketslive

- Imarketslive scam – the verdict

- My personal recommendation (totally optional of...

- A warning about forex

- Why are so many now getting into it?

- The background

- The facts

- Should you trade forex?

- List of the best 23 forex brokers | trusted...

- Strict criteria for the forex broker review

- How does a forex broker work?

- Warning: only trade with regulated and...

- How risky is forex trading?

- How to deposit and withdrawal money:

- Not every country is available for forex trading

- Review conclusion: start trading with a reliable...

- Best forex brokers 2021

- 2021 top 5 forex broker reviews

- Legit forex trading sites

- Forex articles

- 6 forex millionaires you never heard of

- How to choose the right forex broker

- Why do forex traders fail

- Best forex trading platform for beginners

- 6 basics of forex risk management

- 10 forex trading tips for beginners

- Beginners guide to CFD trading

- Forex trading vs stock trading

- Forex regulation

- What is forex?

- S&P 600 index

- S&P smallcap 600 ($IQY)

- Percentage of S&P 600 stocks above moving average

- Summary of S&P 600 stocks with new highs and lows

- S&P 600 components

- Percentage of stocks above moving average

- Components table

- Barchart data table

- Views

- Data table expand

- Horizontal scroll on wide tables

- Flipcharts

- Download

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.