Trading without broker

Evaluate your trading results regularly. See what is working or not. Remain disciplined in your trading strategy, but always try to evaluate and improve upon it.

Top forex bonuses

Many years ago, having a broker was essential if you wanted to trade stocks. Only a broker had access to expensive research that the small investor needed. Online trading was not available, so you had to go directly to a broker. With the spread of free information by the internet, and cheap online trading, the small investor now can trade stocks just as easily as a professional trader.

How to trade stocks without a broker

6 tips to save using the most popular food delivery apps

Many years ago, having a broker was essential if you wanted to trade stocks. Only a broker had access to expensive research that the small investor needed. Online trading was not available, so you had to go directly to a broker. With the spread of free information by the internet, and cheap online trading, the small investor now can trade stocks just as easily as a professional trader.

Find an online trading company. There are many online trading companies that you can open an account with. The market is so competitive that the commissions are very low. As a result, you can get very good commission rates when you open an account. Compare the customer service of each trading company to make sure you will get adequate service. Consider what services you will need. You will often get better commission rates the more you trade, so know how much you will be trading when comparing firms.

Research stocks you wish to trade. There is much research on stocks that you can get for free so you will not have to rely on a broker to get information. You can also get financial information online or from the company directly. Also, you may want to try a few paid services if your budget allows it. Form a trading strategy before you start trading.

Practice trading strategies. Many trading companies offer a demo account you can use. A demo account trades like a real account but with no actual money being traded. Use the demo account to test your trading strategy for awhile until you are comfortable with how trading works. Make adjustments with your trading strategy as necessary.

Fund your trading account at the trading company you choose. Deposit at least the minimum amount the account requires before you begin trading. Trade with an amount you are comfortable with, and be careful about using margin or borrowing money to trade. It can escalate your losses very quickly if you are not careful.

Evaluate your trading results regularly. See what is working or not. Remain disciplined in your trading strategy, but always try to evaluate and improve upon it.

Maintain good accounting records. Trading stocks is often fast paced, with many trades being placed very rapidly. Maintaining good records of your trading will not only help track your performance, it will also make it much easier for you when you file your taxes at the end of the year.

Pick stocks or a market to trade in. You can trade any stocks in any markets quite easily, but specialize in just a few areas rather than trading everything. It is better to become an expert trader in a few sectors.

Warnings

It is very easy to make multiple trades very quickly, but be careful that you do not get too emotional and become undisciplined. Stick to your trading strategy, and approach it as a business rather than an emotional decision.

- Pick stocks or a market to trade in. You can trade any stocks in any markets quite easily, but specialize in just a few areas rather than trading everything. It is better to become an expert trader in a few sectors.

- It is very easy to make multiple trades very quickly, but be careful that you do not get too emotional and become undisciplined. Stick to your trading strategy, and approach it as a business rather than an emotional decision.

Allen young is an experienced writer on such subjects such as real estate investing, mortgages, and personal finance. Young has also written on sports, travel, and parenting. Currently he is the president of crestwood capital group.

Buying stocks and mutual funds without a broker

Can you be an online investor without a broker? Sure. Some online investors want to buy stocks but don’t want to bother with a broker. There’s nothing that says you need to have a broker to buy and sell stocks or mutual funds.

Stocks: direct investments

Direct investments are where you buy the stock straight from the company. Many large companies, such as coca-cola, procter & gamble (P&G), and walt disney, allow you to buy and sell your stock with them and avoid a broker. Many direct investment programs are connected with dividend reinvestment plans (drips), where the companies let you use dividend payments to buy, or reinvest, additional shares.

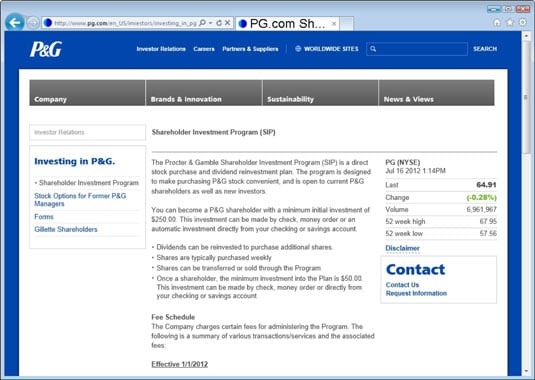

If you’re interested in going with a direct investment program, you can visit the investor-relations section of the company’s web site to see whether it offers one. P&G, for instance, has an elaborate shareholder investment program that lets you buy as little as $250 in stock and will even reinvest the dividends.

The other way to find direct investment programs is through directory services, such as the moneypaper’s directinvesting.Com.

Here are the upsides to direct investing:

Potential commission savings: the fees charged by direct investment programs can be lower than what some brokers charge. P&G, for instance, charges no fee for investments plus a 2-cents-per-share charge if you buy the stock using money from your bank account and just $2.50 plus 2 cents per share if you mail a check.

Dividend reinvestments: dividends can be reinvested for free. If you’re with a broker, you would often need to incur a commission to reinvest a dividend into the company stock.

As you might suspect, direct investing has some downsides:

Not free for all transactions: some companies even charge commissions that exceed what deep discount brokerages charge for certain services. Be sure to check the company’s web site, usually in a document called a direct stock plan prospectus, and understand all the fees that are charged.

Setup fees: although opening a brokerage account is usually free, some direct investment plans charge a fee to get started. Some plans also have minimum initial deposits. P&G, for instance, requires $250 for a new account.

Limited universe: by using direct investment plans, you’re narrowing your universe of possible investments to the hundreds of the largely older, blue-chip companies that offer these programs.

Administrative hassles: with direct investment plans, you need to manage all your separate accounts, which could be a pain if you have ten or more investments.

Mutual funds: straight from the mutual fund company

You can buy mutual funds with no transaction fee if you deal directly with the mutual fund company. This can be a tremendous advantage, especially if you’re making frequent and regular investments into a fund. After you figure out what fund you want to buy, log on to the mutual fund company’s web site, open an account, and buy it. You’ll save yourself some cash.

Buying stocks and mutual funds without a broker

Can you be an online investor without a broker? Sure. Some online investors want to buy stocks but don’t want to bother with a broker. There’s nothing that says you need to have a broker to buy and sell stocks or mutual funds.

Stocks: direct investments

Direct investments are where you buy the stock straight from the company. Many large companies, such as coca-cola, procter & gamble (P&G), and walt disney, allow you to buy and sell your stock with them and avoid a broker. Many direct investment programs are connected with dividend reinvestment plans (drips), where the companies let you use dividend payments to buy, or reinvest, additional shares.

If you’re interested in going with a direct investment program, you can visit the investor-relations section of the company’s web site to see whether it offers one. P&G, for instance, has an elaborate shareholder investment program that lets you buy as little as $250 in stock and will even reinvest the dividends.

The other way to find direct investment programs is through directory services, such as the moneypaper’s directinvesting.Com.

Here are the upsides to direct investing:

Potential commission savings: the fees charged by direct investment programs can be lower than what some brokers charge. P&G, for instance, charges no fee for investments plus a 2-cents-per-share charge if you buy the stock using money from your bank account and just $2.50 plus 2 cents per share if you mail a check.

Dividend reinvestments: dividends can be reinvested for free. If you’re with a broker, you would often need to incur a commission to reinvest a dividend into the company stock.

As you might suspect, direct investing has some downsides:

Not free for all transactions: some companies even charge commissions that exceed what deep discount brokerages charge for certain services. Be sure to check the company’s web site, usually in a document called a direct stock plan prospectus, and understand all the fees that are charged.

Setup fees: although opening a brokerage account is usually free, some direct investment plans charge a fee to get started. Some plans also have minimum initial deposits. P&G, for instance, requires $250 for a new account.

Limited universe: by using direct investment plans, you’re narrowing your universe of possible investments to the hundreds of the largely older, blue-chip companies that offer these programs.

Administrative hassles: with direct investment plans, you need to manage all your separate accounts, which could be a pain if you have ten or more investments.

Mutual funds: straight from the mutual fund company

You can buy mutual funds with no transaction fee if you deal directly with the mutual fund company. This can be a tremendous advantage, especially if you’re making frequent and regular investments into a fund. After you figure out what fund you want to buy, log on to the mutual fund company’s web site, open an account, and buy it. You’ll save yourself some cash.

Can I invest in share market without broker?

Can I invest in share market without broker? ( the beginner’s guide ):

Yes, you are reading the right topic correctly.

You can invest in the share market without a broker also.

And how you can do that we will explain you by this article on “can I invest in share market without broker?”

Mostly, you had purchases the shares through the brokers, right?

And what if you get to know that you can also invest or purchase in the stocks with the involvement of the broker.

Yes, my friend you can invest in the share market without any broker and also you can save some cost like brokerage charges.

Another option of investing in the stock market with any broker is through the direct stock purchase plan (DSPP).

If you have small amount for the investment and you don’t want it to get wiped out by the brokerage charges, then you can consider this option for investing in the share market without broker.

DSPP’s are allowed by the company to directly purchase the shares from the company with the help of the transfer agent.

They are also recognized as the no-loads stocks.

What is direct stock purchase plan (DSPP)?

Direct stock purchase plan (DSPP) is unlike the common, they are the plans that are set-up for investing directly in the company with the help of third party transfer agents that are appointed by the company itself.

This options are largely held with the large and well-established companies where the issuer of the stock can agree for automatically money withdrawals from checking the savings account for purchasing of more stocks.

The third party transfer agent is representative of the company.

They can be any bank, a trust-worthy company or any of the organization.

Some of the companies choose themselves as the transfer agent but mostly they use a third party agent.

Despite, DSPP’s option is a good investment type for the beginner in the investing or trading world but with that you should also aware of the advantages and disadvantages of this option for investing in the share market without any broker.

Let’s talk about the advantages of the DSPP.

Advantages of DSPP

- Direct stock purchase plan helps in saving the heavy brokerage fees and the commissions for purchasing the stocks from the stock brokers.

- This can also consider as good for the passive investment opportunity that is within the hand of the investors as they can also set up an automatic investment plan that can withdrawal the money from the savings account in order to purchase the stocks.

This was about the advantages of the direct stock purchase plan.

Now, move forward to its disadvantages.

Disadvantages of DSPP

- At the start for opting this option, you need to pay the initial set up fee that most companies charge from the investors to open an account. The cost is low but still most of the investors prefers to buy the shares from the brokers.

- Another disadvantage of the DSPP is the automatic investment fees as this charges varies from companies to companies.

- This option of buying the stocks from without broker is unsuitable for the short-term traders. So, this type of traders stick to the low-cost discount brokers.

- DSPP also have another problem is that it have lack of diversification as the investors need to look after more options on other sectors also rather in the same specific company.

- In DSPP, there is multiple of the accounts associated for purchasing the shares and investors prefers only one account and therefore they choose the brokers and stick to their demat account.

These were all the disadvantage of the direct stock purchase plan.

Before making any investment decision for this you need to look after both the pros and cons of the direct stock purchase plan.

Conclusion

Through our article on “can I invest in share market without broker?” and this explains about the second option about purchasing the shares from the share market without involvement of the broker is through the DSPP method. DSPP is direct stock purchase plan and we had explained about the definition, its advantages and disadvantages. You need to get the complete knowledge about this method with making any decision on investment in the share market.

About us

Trading fuel is our blogging site that focus mainly on the quality and the content of the topic or the blogs. We make sure that the topic describes complete information to the readers. You can also scroll for some of the intraday trading strategies that have been posted in the form of blog in the site and for the traders it will be beneficial if you check them once. Use the days by making yourself learn and read more and practice in the share market for gaining the experiences. Till then, wait for another interesting blogs and happy learning.

Prashant raut is a successful professional stock market trader. He is an expert in understanding and analyzing technical charts. With his 8 years of experience and expertise, he delivers webinars on stock market concepts. He also bags the ‘golden book of world record’ for having the highest number of people attending his webinar on share trading.

How to trade without a broker

In recent years, online trading has become increasingly popular. Many investors are realizing that they can trade on their own without the help, and extra expense, of a traditional stockbroker. Not only are traders becoming empowered by doing their own research and making their own decisions on how to manage their portfolio, but also they are cutting out the middleman, and saving money by trading without having to pay the broker.

When using an online brokerage firm, investors are still trading with a broker. They’re just trading with a less expensive broker who provides less service, support, and advice. When using an online broker, there is still a middleman involved. However, there is a way to eliminate that middleman, too. It’s called direct access trading.

What is direct access trading?

Direct access trading allows investors to trade directly with market makers and specialists, rather than going through a broker. Direct access trading uses software to link directly to the major stock exchanges and electronic communication networks, or ecns. (an ECN is a completely electronic stock exchange.) having this direct access to the exchanges not only saves the trader on commissions, but it also allows for faster executions and immediate trade confirmations. For active traders, and those who need immediate information, this instantaneous action and reaction is a great value.

The other major advantage to direct access trading is it allows the trader to see more of the market. With an online broker, you can see the bid and the ask price for a stock. With direct access, you trade using level II quotes, which allows you to see how many buyers and sellers there are at each price, as well as the size of the lot they are trading. This gives the trader a much better picture of a stock trend, as well as how much support or resistance there is at any given price level. This information, if used properly, will allow you to pinpoint the timing of your entry and exit for maximum profits.

With direct access trading, it is very important to choose the right trading platform. There are many direct access platforms on the market today, but they are not all created equal. They can vary quite a bit in price, features, and even speed. In addition to choosing the right platform, you need to know how to use it properly. Simply having the software on your computer will not make you a more successful trader. You need to have the specific knowledge necessary to use it the same way professional traders do.

Trading without a broker in this fashion is not the best thing for everybody. For a new trader, we would recommend staying away from the complexities of this type of trading until you have a better idea of how the markets work. However, for intermediate and experienced traders, direct access trading will help you maximize your profits.

Forex trading without deposit | no deposit bonus explained

It’s no surprise that one regular lot is equal to 100,000 currency units – forex trading is definitely an expensive endeavor. However, there are still some ways in which you can start trading forex while maintaining some sort of profitability without spending hundreds of thousands of dollars.

No deposit bonus in a glance

In forex trading you can, in fact, start trading with no money of your own or even making a deposit. With free no deposit bonus offered by the top forex brokers, you can start forex trading without deposit with a good boost.

There is no sense in hiding the fact that FX trading is risky, especially if you are trading without proper knowledge and at least minimal experience. In an attempt to prevail over the risk of losing your money and to stay safe, it is undoubtedly better to start trading with a free forex account or no deposit bonus offered by various FX brokers. Especially if such deals are not so rare at this time and even best forex brokers sometimes offer such deals.

It is always better to preview all conditions that offer you an option to trade without money of your own. So, be sure to start forex trading without a deposit now and get yourself a good and reliable deal!

But let’s say that although you’ve learned how to start deposit free forex trading, it’s still too risky for you. Thankfully, there is an alternative. One way to start trading with a broker is by opening a free forex demo account for beginners. A demo account will allow you to try your hand at trading on the real market without ever touching real money. One of the best brokers to try a free demo account with would be FXTM. If you don’t want to be working with FXTM and want access to a reliable forex broker that offers its services around the globe, alpari offers a similar service, including forex trading demo accounts. If you are a US citizen that wants to trade with local brokers, then you should go for forex.Com, who offer their services within the US and are known to be one of the best brokers in the world.

Transparent pricing and fast, reliable trade executions on over 80 currencies

Start trading with the largest forex broker in the US

How to start forex trading without deposit: tips & recommendations

As a matter of fact, a lot of brokers worldwide try to offer their clients those no deposit deals, and we’ve even seen some trading apps without deposit popping up here and there. Do not perceive this as an act of generosity though, those bonuses serve as a sort of protection for them also. But still, this is good for you if you want to start forex trading without a deposit.

Here are some of the main considerations that can help you spot a decent no deposit bonus:

- If you somehow dislike conditions and terms offered by the broker – simply skip the promotion. Let’s investigate the ways that may help you find the best bonus in FX. First of all, bonuses must be easy to understand and transparent in general conditions. If you see non-explicit information presented, avoid the promotion or ask the broker for clarification.

- If you wish to take part in the particular promotion and start forex trading without investment, then do not overlook terms and conditions. Even the smallest detail must be in your sight. A free bonus is actually not always 100% free. Some brokers may ask you to deposit some money in order to collect your profits. Indeed, such promotions are scams.

- Be attentive, because some forex brokers can demonstrate a good opportunity with their no deposit bonus, however it may ask to complete the trading volume requirement. Stay away from the bonus that asks to complete more than 1 lot for $10 to further unlock the profits and balance.

- Bonuses can vary in terms of geographical location requirements. Therefore, ensure that FX bonus accounts of the broker are given in your country as well if you desire to start forex trading without investment. Furthermore, there can be account restrictions. This means that no deposit bonuses may not always be available for every account at a particular broker. Thus, check whether you applied for a correct account.

- In addition, make sure what instruments can be traded to withdraw your profit before you begin trading as sometimes FX bonus accounts are not available for some of them. As for the withdrawal, some forex bonus brokers limit the maximum profit available to withdraw from the account. So, do not miss this field before you start trading on your no deposit FX bonus account.

- Bonuses are frequently represented only in 1 currency equivalent. However, there are many no deposit bonuses that evaluate a similar amount in your local currency, so doing your research in order to figure out how to join forex trading without making any deposits is a good way for ensuring success in the long run.

Not ready for live trading? Try IQ option demo account!

Practice your trading skills with free $10,000 practice account!

How to start forex trading without a deposit?

How to start forex trading without a deposit?

As one of the cases, no deposit bonus may come with SMS verification. It is recommended to make sure that you have the right phone number prior to start applying for the bonus.

One of the last tips that can help you find a trustworthy no deposit bonus, or at least help you get through a scammer, is to save the terms and conditions document as a .Pdf file. Do this even if you deal with the best no deposit forex bonus account. You can use the help of your account manager and ask him to confirm all the statements of the bonus promotion in which you participate.

Start forex trading without deposit: introduction to best no deposit bonuses

Although there are very good no deposit bonuses offered by industry leaders and most proficient brokers, you should understand one fact: FX bonuses without a deposit are most frequently offered by bad brokers. That is the very reason why you should be very careful not to get entangled with a scammer.

All this leads to us stressing how important it is to be attentive at all times, so be attentive to details when researching how to start trading with no deposit bonuses. Fortunately, we have examples of the best brokers/investment firms.

Start forex trading without investment: XM forex broker

To begin with, XM is recognized by the united kingdom-based organization – investors in people for its powerful efforts in developing individuals to realize their entire potential and achieve both individual and corporate goals. We should also admit that this organization provides a huge amount of proven tools and resources specially designed to complement its unique framework with an aim to boost performance and indeed maximize sustainability. XM achieves this standard by showing that it is a driving force in the online trading sector and is committed to the provision of services and products of the best quality. How to start forex trading without money? If you are interested, you can claim the XM 30 USD no deposit bonus!

Get your 30 USD no deposit bonus with XM, and start trading today

Sign up with top tier broker and get the best no deposit deal on the market

*clients registered under the EU regulated entity of the group are not eligible for the bonus

No deposit bonus as an alternative – is it worth it?

So, now that you know what no deposit bonuses are and how they work, one question remains active: is it actually worth it to sign up for one yourself? Will you get any significant benefit from it?

The answer to that question is subjective; some traders can definitely find use in this type of promotion by amassing a small account balance and then turning it into a full-blown trading career. But in order to do so, you need to be very careful not to catch a scammer instead of a legitimate promotion issuer.

As for other traders, they often prefer spending their own money, which gives them more incentive to be more careful in the market – after all, it’s their own money they’re risking.

So, suffice to say no deposit bonuses have their time and place; one just has to seize that exact moment.

Forex trading without leverage

Financial leverage attracts a lot of traders to the forex market. You might see many results on google such as 'best leverage to use in forex'' which make it seem like this is the only option when trading with forex. However, it is not the foolproof tool that some people make it out to be, nor is it the only option in terms of professional forex trading. While leverage can be beneficial, it can also lead to some disastrous outcomes.

This is especially likely in the case of traders with no experience. It's also worth noting that many large financial companies are actually practising currency trading without leverage. So what are the advantages of trading with and without leverage? And what are the pros and cons of forex trading? You can find out the answers to these questions yourself with a free demo account, if you want to jump ahead and start practising now.

However, if you would like to possess a little more knowledge beforehand, we encourage you to read on.

Defining leverage

Perhaps you already know what leverage is? If not, here's a brief summary:

Financial leverage is a credit provided by a broker. Leverage allows traders to place orders that are significantly higher than their actual deposit. It is possible to use leverage to trade stocks and other financial instruments, but it is far more accessible when trading currencies. Leverage potentially helps traders to achieve higher profits in the market. Of course, the same also applies to losses. Traders risk losing their deposit faster when using leverage – so use it cautiously!

(note that the leverage shown in trades 2 and 3 is available for professional clients only. A professional client is a client who possesses the experience, knowledge and expertise to make their own investment decisions and properly assess the risks that these incur. In order to be considered to be professional client, the client must comply with mifid ll 2014/65/EU annex ll requirements.)

A financial leverage example

Image that a trader has a deposit of 10,000 EUR. The trader's broker offers a leverage of 1:100 for a deposit of this size. Knowing these two values, we can easily calculate the largest position available to this trader. We need to multiply the trader's balance by the first value in the leverage ratio (i.E. 10,000 multiplied by 100). Therefore, this trader can open a deal up to 1,000,000 EUR in volume.

Of course, this may sound too optimistic. The position size doesn't mean much if you are not aware of how you're trading. Before you begin trading, you should learn about the positives and negatives of trading, and then try it without leverage.

Forex trading with leverage

Ok, so now you know what leverage is, but what does leverage mean in forex? Let's answer that question by looking at how leverage is used within forex trading:

The biggest advantage of leverage is that it allows traders to boost their trade sizes, even when they don't have substantial capital. Traders usually consider 1,000 USD to be a decent starting sum. However, not all traders can afford this – especially when starting out. And this is where financial leverage comes into play. Even leverage as low as 1:10 allows traders with a 100 USD deposit to open a 0.01 lot position. But this is not a 100% beneficial condition, as you also expose yourself to risk.

But how does forex leverage work exactly? Let's consider an example of trading with no leverage to answer that question:

Let's say you buy 1000 USD for 800 EUR, and then the price of USD drops by 50%. You would only lose half of your funds (in this particular example, you would lose 400 EUR). However, if you were using 100:1 leverage, and the price changed by less than 1%, you would then lose all of your funds. Always be aware of the risks leverages pose, and try to prepare yourself for them. Preparation can be as simple as practising leveraged and unleveraged trades on a demo account.

If you can't create good returns with low leverage, expect potentially significant loses with over-leverage.

Trading with A demo account

Trader's also have the ability to trade risk-free with a demo trading account. This means that traders can avoid putting their capital at risk, and they can choose when they wish to move to the live markets. For instance, admiral markets' demo trading account enables traders to gain access to the latest real-time market data, the ability to trade with virtual currency, and access to the latest trading insights from expert traders.

To open your FREE demo trading account, click the banner below!

Forex trading without leverage

The main downside of trading forex without leverage is that it is simply not accessible for most traders. Forex trading without leverage means that changes in the price of an asset directly influence the trader's bottom line. The average monthly return a trader can generate is 10%. But in reality, the return is around 3 to 5% a month.

However, this figure already includes marginal trading. With no leverage forex trading you would probably only make between 0.3 to 0.5% a month. It may be enough for some forex traders – but perhaps not for the majority. The need for substantial trading capital is the biggest drawback of trading without leverage. On the other hand, currency trading without leverage gives you less risk exposure.

However, this doesn't mean that there are no risks involved in trading without leverage. Let's proceed with an example of 'no-leverage trading'. Let's say you deposit 10,000 USD and make a monthly return of 5%. You would only get 500 USD each month, and that's before any taxation. You could probably make the same money with a 9-to-5 job, without risking your own capital in the process.

Depicted: EUR/USD wave analysis with a MACD indicator applied - disclaimer: charts for financial instruments in this article are for illustrative purposes and does not constitute trading advice or a solicitation to buy or sell any financial instrument provided by admiral markets (cfds, etfs, shares). Past performance is not necessarily an indication of future performance.

Institutional trading

What is institutional trading? As we've already mentioned, a lot of institutions choose forex trading without leverage. Yet these organisations are still able to achieve large profits. How is this possible? Large banks have access to billions in capital. They can afford to trade large amounts on attractive entry signals. Institutions also often trade long term, so unlike the average trader, institutions can have their position open for months or even years.

Since they don't use leverage, the swap expense tends to be quite low too. In fact, in many cases there is no swap at all. Institutions directly benefit, or suffer from the differences in interest rates. Many of the largest forex market trades have been made by institutions without leverage. These deals have a speculative motivation, and typically use extensive capital in the billions.

Jens klatt, an experienced trader, explains institutional trading in detail, including his top institutional trading strategies, in the webinar below.

To leverage or not to leverage

But unfortunately, there's no definitive answer to it – it depends on the situation. You have to consider your trading strategy, your financial targets, the capital at your disposal, and how much you are willing to lose. Like any financial market, the forex market is generally risky. The higher your leverage is, the riskier your trading gets.

So consider trading with as little leverage as possible, to ultimately get the profit you want. And conversely, keep in mind that the more leverage you use in forex trading, the more profit you can potentially make. In most cases, a beginner trader should consider using leverage between 1:5 to 1:100. The table below illustrates the importance of trading with the right leverage. It displays 10 consecutive losing trades in a row when using high vs low leverage.

Source: example of trading with low leverage vs trading with high leverage

Final thoughts

Hopefully, we've answered some of your questions about forex trading without leverage.

By now, you should understand why leverage is risky, and that high leverage means a higher risk, with the possibility of a higher return and vice versa. So again, practising with leverage on a demo account is a smart initial move. It is important to ensure your trading strategy considers your deposit amount, how much you are willing to lose, and the minimum you are willing to make - before you start leveraged trading. Keep learning, keep educating yourself, and most importantly, keep trying out new things.

Free trading webinars with admiral markets

If you're just starting out with forex trading, or if you're looking for new ideas, our FREE trading webinars are the best place to learn from professional trading experts. Receive step-by-step guides on how to use the best strategies and indicators, and receive expert opinion on the latest developments in the live markets. Click the banner below to register for FREE trading webinars!

About admiral markets

admiral markets is a multi-award winning, globally regulated forex and CFD broker, offering trading on over 8,000 financial instruments via the world's most popular trading platforms: metatrader 4 and metatrader 5. Start trading today!

This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.

Free options trading

Allyson brooks

Contributor, benzinga

“there’s no such thing as a free lunch” is one of the oldest sayings around, and for the most part, it’s completely true. You get what you pay for, especially in the world of finance.

While you might be skeptical of any type of free offer, technology has made finance more efficient and transaction costs have gone down dramatically. In fact, it’s not hard to find a brokerage that will let you trade at least some part of the stock market completely commission-free. Commission-free usually means a trip to the designated ETF list, but some brokers offer everything for free, including options.

Commission-free usually means a trip to the designated ETF list, but some brokers offer everything for free, including options.

Best free options trading brokers:

- Best overall for options and technology: tradestation

- Best for beginners: TD ameritrade

- Best for marginal accounts: interactive brokers

- Best for mobile traders: E*TRADE

- Best derivatives only broker: tastyworks

- Best for social traders: gatsby

- Honorable mention: eoption

Table of contents [ hide ]

Best free options trading brokers

Choosing the best broker requires a little bit of research and not every trader has the same needs. Benzinga has created a list of favorite trading platforms for free paper trading and free or low-cost options trading.

Commissions

Account minimum

Best for

1. Best overall: tradestation

Tradestation is a popular platform for technical analysts and other stock pickers, but its paper trading simulation gives inexperienced traders a way to learn new skills without risking real cash.

Paper money can be traded on desktop and mobile, but only current tradestation brokerage account holders can access the simulation for free.

Tradestation has a tilt toward active traders, so new traders can find plenty of research material and charting tools to test new strategies. Tradestation is a trusted name and its simulator is one of the best.

If you’re new to trading, you’ll love tradestation’s simulated trading tool. Its simulated trading tool allows you to practice entering buy and sell orders, using tradestation’s suite of charting and analysis tools and using your trading strategy without risking any of your own money.

Commissions

Account minimum

Best for

2. Best for beginners: thinkorswim by TD ameritrade

Thinkorswim is the gold standard for advanced trading features and using their paper money accounts is a great way to teach yourself technical analysis.

TD ameritrade account holders will get $100,000 in fake money to trade stocks, bonds, futures, commodities and options. You’ll find over 100 technical tools on thinkorswim and unlike many brokers, commission costs are factored in with your paper trading portfolio. This makes for a more realistic trading experience.

Paper trading is only worthwhile if the simulation is near perfect. Thinkorswim passes all the tests.

TD ameritrade recently completed an acquisition of scottrade, which will provide options traders with another level of flexibility as well. Right now, TD ameritrade charges $0 fin options based fess and $0.65 for options per contract.

Pricing

Account minimum

Best for

- Access to foreign markets

- Detailed mobile app that makes trading simple

- Wide range of available account types and tradable assets

- Comprehensive, quick desktop platform

- Mobile app mirrors full capabilities of desktop version

- Access to massive range of tradable assets

- Low margin rates

- Easy-to-use and enhanced screening options are better than ever

3. Best for marginal accounts: interactive brokers

The interactive brokers trader workstation provides a comprehensive list of options trading features and has been compared to the look and feel of a commercial airline cockpit. The workstation includes integrated tools such as IB risk navigator, options analytics and model navigator. It has a configurable format, quick-click order entry capabilities, and is extremely customizable.

The optiontrader combo tab allows traders to monitor price variations, view all available chains or filter for specific contracts and configure columns to view calculated model prices, implied volatilities open interest and greeks.

Interactive brokers also helps active traders minimize commissions and fees as well. Interactive brokers charges nothing in options based fees but charges $0.65 per contract fee for options.

Commissions

Account minimum

Best for

- Sophisticated trading platforms

- Wide range of tradable assets

- Exceptional customer service

4. Best for mobile traders: E*TRADE

E*TRADE’s power E*TRADE platform and mobile app are the gold standards of option trading platforms. Power E*TRADE currently offers traders premium-quality tools without the premium price tag.

According to a customer service rep, the long-term plan is to have the power E*TRADE platform replace E*TRADE pro as the premium service, but for now, it is free for all E*TRADE users.

Power E*TRADE is the perfect combination of speed, quality, tools, and navigation capabilities. The platform offers virtual trading for testing strategies. The option chain screen provides access to customizable real-time streaming option chains with up to 30 columns. The tradelab snapshot analysis breaks down risk/reward in an easy-to-understand way, indicating pros and cons as well as key events to watch for and a profit and loss chart. The strategyseek tool allows users to scan market data and identify potential trading strategies.

For all E*TRADE’s advances option trading features, the broker charges $0 in options based fees and $0.65 for options per contract.

Commissions

Account minimum

Best for

- Powerful platform inspired by thinkorswim

- Multiple order types and strategies

- Cheap options commissions

5. Best derivatives only broker: tastyworks

Tastyworks allows opening of an individual, entity/trust or joint account, and the account type held with the brokerage can be margin, cash or retirement. In margin trading, you are allowed to trade with borrowed capital, facilitating the use of all trading strategies available with the broker, while a cash account requires that you fully fund transactions, and also restricts usage of some trading strategies such as spread and uncovered options.

The web-based trading platform allows access from any computer and gives all functionalities as the downloadable version. Some of the features in the browser version is the follow page, where you can follow the firm’s curated experts’ trade, trade curve, which allows visualization of trades easily and the trade history option, which helps you analyze your trades.

Though opening an account is fairly easy, a prospective client is required to register with tastyworks ahead of time with an email address, username, and password, as well as:

- Address and phone numbers,

- Citizenship status,

- Personal information such as social security number and employment information,

- Bank details and

- Copies of identity and address proofs.

Once an account is registered, it normally takes one to three days to be approved.

Commissions

Account minimum

Best for

- Retail investors

- Traders new to options

- Social traders

- Millennial traders

6. Best for social traders: gatsby

Gatsby and robinhood a bit in common. Like robinhood, gatsby had a soft launch and the only way to access the platform is to get on the waiting list. Also like robinhood, all trading on gatsby is commission-free. Gatsby’s founders seek to “democratize the world of options” by simplifying the language and making it easier for newbies to understand.

You’ll be asked a series of simple questions on gatsby’s platform. If you think a certain stock will fall, you’ll be directed to the put options (and call options if you think the stock price will rise). You’ll then choose a strike price and expiration date and initiate your trade, all done in 4 quick phone swipes. Gatsby and robinhood are the only truly commission-free brokers for options trading.

Commissions

Account minimum

Best for

- Options traders looking for low-cost options contracts

- Beginner and advanced traders looking for options education

- Advanced traders who don’t need a lot of platform guidance

7. Honorable mention: eoption

Eoption isn’t a commission-free brokerage, but the transactions costs here are among the lowest in the industry. For options trades, you’ll only pay $3 per trade plus $0.15 per contract.

Many legacy brokers charge upward of $0.60 to $0.75 cents per contract, so this is a great deal. You’ll also get plenty of bang for your buck, thanks to eoption’s bells and whistles. You can set up an automated strategy using its auto trading feature and even get direct market access through the sterling pro trader.

Eoption has a $500 minimum to open an account and offers traditional, roth, SEP and coverdell iras.

Can you really trade options for free?

The short answer is: absolutely! Brokers continually undercut each other on commissions and that’s great news for retail traders.

Online brokers rarely have commissions higher than $5 to $7 these days and disruptors like robinhood and gatsby options have gone even lower than that. Both offer $0 commissions on all options trades.

Another way to trade options for free is through paper trading. With a paper trading account, you’ll be given monopoly money in a simulated brokerage account and can actively trade the market with your fake cash. Paper trading is a great way to hone your skills, practice new strategies and figure out how to trade.

But which should you choose, free trading or paper trading? When it comes to options brokers, all it depends on your bankroll and experience level as a trader.

Getting started

Before choosing an options broker, you need to determine your own investing goals. Do you simply want to make the most possible money? Do you have a specific savings target in mind? Or do just want to increase your knowledge of the options market and explore how different strategies work?

If you’re inexperienced with options or want to try out a few new strategies, paper trading might be your best bet. However, if you’re a veteran trader and you want to cut your transaction costs, take a look at some of our favorite free or low-cost options brokers.

Paper trading

Practice makes perfect and that’s why paper trading is so popular, especially among new traders. With paper trading, you aren’t putting any real capital at risk, but you can simulate live action in the markets or even go back in time and trade through previous periods. Many brokers have a free paper trading account available to anyone with a real brokerage account.

However, know that paper trading has drawbacks. Fake money means no skin in the game. All the emotion is taken out of trading, which is something that will never happen in the real market. Expertise in paper trading does not automatically translate to success in the real world.

Using a free or low-cost broker

If paper trading doesn’t appeal to you, finding a free or low-cost broker should be your alternative goal. Free trading is still a relatively new concept, but brokers like robinhood and gatsby options have totally removed commissions.

Even traditional legacy brokers are getting into the race to zero (for example, fidelity now has zero-expense etfs). Finding a free or low-cost broker to trade options is no longer like looking for a needle in a haystack.

Zero-commission trading: what you need to know

The ascent is reader-supported: we may earn a commission from offers on this page. It’s how we make money. But our editorial integrity ensures our experts’ opinions aren’t influenced by compensation.

Most major online brokers have eliminated commissions for online stock trades. Here’s what investors like you need to know.

In a rather sudden move, major online brokerages including TD ameritrade, E*TRADE, and schwab have eliminated commissions for standard online-initiated stock trading. Depending on the broker, it used to cost $4.95 to $6.95 every time a stock position was bought or sold, which could amount to hundreds or even thousands in investment returns over time.

With that in mind, there are quite a few questions that you might have as an investor. For example, why did all of the brokers suddenly decide that they didn’t want to make commission revenue on stock trades? What does this mean to you as an investor? And are there any downsides to zero-commission stock trading?

Image source: getty images

Let’s take a closer look at zero-commission trading and what you should know about it.

When it comes to trading commissions, zero is the new normal

When robinhood pioneered the idea of commission-free stock trading a few years ago, it seemed like a disruptive trend, but not necessarily one that would permeate throughout the entire investment industry. After all, robinhood has a relatively no-frills platform, and many investors find value in educational tools, stock research, and access to specialized types of brokerage accounts like iras and college savings accounts.

The ascent's picks for the best online stock brokers

Find the best stock broker for you among these top picks. Whether you're looking for a special sign-up offer, outstanding customer support, $0 commissions, intuitive mobile apps, or more, you'll find a stock broker to fit your trading needs.

The same could be said when interactive brokers announced commission-free trading. Interactive brokers has historically catered to experienced investors who make frequent trades, not the mass market.

However, when schwab announced that it would be eliminating commissions (which were previously $4.95) for all stock trades on its platform, it caught many investors and industry experts by surprise. In the days and weeks that followed, most other major online stock brokers announced that they would be eliminating trading commissions for online stock trades as well. As of late october 2019, TD ameritrade, E*TRADE, fidelity, and bank of america have all eliminated traditional commissions -- at least to some degree.

At this point it’s fair to say that zero is the new normal when it comes to stock trading commissions.

How can brokers afford to do this?

There are two basic parts to the answer to this question. First, once schwab eliminated commissions, the move to zero commissions became more of a defensive strategy that was necessary in order to prevent a loss of clients. And second, brokers have other ways of making money.

In fact, there isn’t a single major broker that derives the bulk of its revenue from trading commissions. For example, TD ameritrade is one of the more commission-dependent brokers and trading commissions made up just over 25% of the company’s revenue in the most recent quarter. Other major sources of revenue come from interest income from things like margin loans, bank deposit account fees, and fee revenue from the company’s proprietary investment products like its robo-advisory service.

Directly related to trading, TD ameritrade (and most other brokers) makes money for routing orders to certain market makers. Market makers are the party to a trade that actually executes the transaction and makes money from the spread between the bid and ask prices, or the price they can buy the stock for and the price at which they sell it to investors. These spreads are typically pennies, so they make their money from volume -- and are willing to give brokers a cut of their profits in exchange for order flow.

It’s also worth noting that in many cases, commissions won’t entirely drop to zero. Some brokers are still charging commissions for options trades, and for services like broker-assisted and phone-initiated trades.

Buying your first stocks: do it the smart way

Once you’ve chosen one of our top-rated brokers, you need to make sure you’re buying the right stocks. We think there’s no better place to start than with stock advisor, the flagship stock-picking service of our company, the motley fool. You’ll get two new stock picks every month from legendary investors and motley fool co-founders tom and david gardner, plus 10 starter stocks and best buys now. Over the past 17 years, stock advisor’s average stock pick has seen a 569% return — more than 4.5x that of the S&P 500! (as of 1/15/2021). Learn more and get started today with a special new member discount.

In fact, dropping commissions could end up being a net positive in the long run for some of these brokers. Now that investors can access to feature-packed brokers like TD ameritrade, E*TRADE, and schwab for the same price as no-frills robinhood, they may potentially see an influx of assets.

What it means to you as an investor

The emergence of zero-commission stock trading is certainly a win for investors, especially beginner investors with limited capital.

For one thing, this makes it practical to buy small amounts -- even one share -- of a single stock. For example, let’s say that apple is trading for $200 per share. With a $6.95 trading commission, you would essentially pay a 3.5% premium to buy one share, making it rather impractical from a cost standpoint. Or, if you received a $50 dividend from a stock you own, it wouldn’t be practical to pay a commission to invest that money – you would either have to enroll in a dividend reinvestment plan (DRIP), which would automatically reinvest dividends in the same stock that paid them, or let your cash build up in order to invest your dividends in a cost-efficient manner. Now, that’s far less of a concern.

On a similar note, it also makes diversification much easier for new investors. If you’re starting with say, $1,000, you can invest your money in a portfolio of five or more stocks rather easily when you don’t have to worry about commissions taking a $35 (or more) bite out of your capital.

An example of why zero-commission stock trading is such a big win for investors

Here’s a quick example of how this could affect you. Let’s say that you want to invest $1,000 every year for the foreseeable future, and that you want to split your money among five stocks. We’ll also say that you were previously paying a $6.95 trading commission (so about $35 per investment round), and that your investments will earn a 10% annualized return over time.

If you’re paying commissions, that means you’re effectively investing $965 each time, not the full $1,000. Based on our assumptions, you could expect to have a portfolio worth roughly $15,400 after 10 years, $55,300 after 20 years, and $158,700 after 30 years. Not bad, right?

However, if you’re not paying commissions, that means you’re able to put the entire $1,000 to work each time. Although $6.95 commissions may not sound like much, you might be surprised by the difference it makes. After 10 years, commission-free investing would result in an additional $560 in your portfolio. After 20 years, you’d have an extra $2,000, and after 30 years, you’d have nearly $5,800 in additional wealth that you wouldn’t have had had you been paying commissions. That’s why zero-commission stock trading is such a big win for investors.

Could fractional shares become the next trend in the investing world?

Fees in the investment world have been gravitating toward zero for some time now, so although it may surprise you that major brokers eliminated commissions so suddenly, it was a long time in the making. After all, it wasn’t that long ago that $50 commissions were common when buying stocks. Mutual fund expense ratios and other forms of investment fees have also been steadily getting lower, so where can brokers go from here to stay competitive?

One potential move that brokers might make is to offer fractional shares. For example, if a stock is trading for $100 per share and you have $150, you’d normally only be able to buy one. With fractional shares, you could use all $150 to buy 1.5 shares.

This wouldn’t be much of a stretch for most of the major brokers. Investors can generally already buy fractional shares by enrolling their stocks in a DRIP, although not as a totally separate trade. Schwab has already announced the addition of this capability to its platform, and it wouldn’t be surprising to see others follow suit.

A word of caution

Although the emergence of zero-commission trading is generally a win for investors, there’s one potential downside -- the temptation to over-trade. In other words, it could be more tempting to move in and out of stock positions more frequently because it doesn’t cost anything to do it.

Don’t make this mistake. Although there are certainly some good reasons to sell stocks, the lack of trading commissions isn’t one of them. Keep a long-term focus and enjoy the long-term compounding benefits of commission-free stock trading.

Using the wrong broker could cost you serious money

Over the long term, there's been no better way to grow your wealth than investing in the stock market. But using the wrong broker could make a big dent in your investing returns. Our experts have ranked and reviewed the top online stock brokers - simply click here to see the results and learn how to take advantage of the free trades and cash bonuses that our top-rated brokers are offering.

About the author

Matt is a certified financial planner® and investment advisor based in columbia, south carolina. He writes personal finance and investment advice, and in 2017 he received the SABEW best in business award.

So, let's see, what we have: how to trade stocks without a broker 6 tips to save using the most popular food delivery apps many years ago, having a broker was essential if you wanted to trade stocks. Only a broker had at trading without broker

Contents of the article

- Top forex bonuses

- How to trade stocks without a broker

- Buying stocks and mutual funds without a broker

- Stocks: direct investments

- Mutual funds: straight from the mutual fund...

- Buying stocks and mutual funds without a broker

- Stocks: direct investments

- Mutual funds: straight from the mutual fund...

- Can I invest in share market without broker?

- What is direct stock purchase plan (DSPP)?

- Advantages of DSPP

- Disadvantages of DSPP

- How to trade without a broker

- Forex trading without deposit | no deposit bonus...

- No deposit bonus in a glance

- How to start forex trading without deposit: tips...

- Start forex trading without deposit: introduction...

- No deposit bonus as an alternative – is it worth...

- Forex trading without leverage

- Defining leverage

- A financial leverage example

- Forex trading with leverage

- Forex trading without leverage

- Institutional trading

- To leverage or not to leverage

- Final thoughts

- Free options trading

- Best free options trading brokers:

- Best free options trading brokers

- Commissions

- Account minimum

- Best for

- 1. Best overall: tradestation

- 2. Best for beginners: thinkorswim by TD...

- 3. Best for marginal accounts: interactive brokers

- 4. Best for mobile traders: E*TRADE

- 5. Best derivatives only broker: tastyworks

- 6. Best for social traders: gatsby

- 7. Honorable mention: eoption

- Can you really trade options for free?

- Getting started

- Zero-commission trading: what you need to know

- When it comes to trading commissions, zero is the...

- How can brokers afford to do this?

- What it means to you as an investor

- An example of why zero-commission stock trading...

- Could fractional shares become the next trend in...

- A word of caution

- Using the wrong broker could cost you serious...

- About the author

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.