Online trading with zero investment

All investments involve risks, including the possible loss of capital.

Top forex bonuses

Fractional shares disclosure

Investing for everyone

Break free from commission fees

Make unlimited commission-free trades in stocks, etfs, and options with robinhood financial, as well as buy and sell cryptocurrencies with robinhood crypto. See our fee schedule to learn more about cost.

Introducing fractional shares

Fractional shares disclosure

Learn as you grow

Our goal is to make investing in financial markets more affordable, more intuitive, and more fun, no matter how much experience you have (or don’t have).

Our products

Earn 0.30% APY* on your uninvested cash and get more flexibility with your brokerage account.

Variable APY and debit card disclosures

Robinhood means robinhood markets and its in-application and web experiences with its family of wholly owned subsidiaries which includes robinhood financial, robinhood securities, and robinhood crypto.

All investments involve risks, including the possible loss of capital.

Securities trading is offered to self-directed customers by robinhood financial. Robinhood financial is a member of the financial industry regulatory authority (FINRA) .

7 best free stock trading platforms

Thanks to the rise of fintech, investors now have the option to buy and sell stocks online or through mobile apps - and often free of charge.

There are dozens of trading apps and platforms that allow investors to invest cash in a variety of securities with minimal to no fees. With the increase in choices, here are the best free stock-trading platforms and how they compare.

7 best free stock trading platforms

Whether you're a beginner investor or have been playing the market since before the last recession, free stock trading platforms and apps provide a great opportunity to maximize your returns and keep trading easy and simple.

These investment platforms are top-notch.

1. E*TRADE

Although E*TRADE (ETFC) - get report accounts aren't always free, there are some promotions and accounts that allow investors to invest for free. Currently, E*TRADE is having a promotion when you open a new account. The promotion offers 60 days of commission-free trading for up to 500 trades with a minimum deposit of $10,000 or more.

The site offers 24/7 customer service, easy mobile trading, data and research information, and has trading vehicles that range from etfs to options. And while E*TRADE's commissions usually hit just under the $7 mark for normal (nonpromotional) trades, the site is still very popular for its ease of use and retirement services.

2. Robinhood

The free stock trading app has seen a meteoric rise in popularity in recent years, accumulating 6 million users in 2019 - and with good reason. Robinhood seems to be the darling of commission-free trading - as a fintech startup founded by baiju bhatt and vlad tenev in 2013 with their free stock trading model.

Although there has been some speculation over how robinhood makes money (given their free trading model), the app is very popular for its easy, free trading and variety of investment vehicles - including options and even cryptocurrency.

To get started, you simply have to submit an application to robinhood and meet a few basic requirements (although if you are planning to participate in options trading, additional requirements are necessary) - with no account minimum. As a bonus, there are no maintenance fees.

As somewhat of a drawback, robinhood doesn't currently allow fractional investing (you can only buy whole shares). But for its cost-efficiency and easily-accessible app format, robinhood is clearly a crowd favorite for a reason.

3. Charles schwab

Ideal for investors looking to get into etfs, charles schwab (SCHW) - get report has an impressive array of 200 etfs to choose from, all commission-free. And, as a bank and stockbroker all-in-one, the schwab app is a great one-stop-shop for investors.

Schwab also has no-transaction-fee mutual funds, with around 4,000 available. Their regular trades will set you back around $5 apiece. There is no minimum balance requirement (although normal accounts typically come with a $1,000 minimum).

Because of their wide selection of the commission-free etfs and mutual funds, schwab is a strong contender for free stock trading.

4. Acorns

If you're a beginner investor looking to make money in stocks, acorns is the perfect introductory stock trading app.

Acorns specializes in micro-investing - that is, investing your spare change in stocks. There is no minimum to create an account, but there is a $5 minimum to start investing.

The app takes the spare change you've got from linked debit or credit cards to invest in commission-free etfs. There are no fees for inactivity.

5. Vanguard

Boasting around 1,800 commission-free etfs (just shy of robinhood's 2,000,) vanguard offers a wide selection of free trading options. The platform offers over 3,000 transaction-free mutual funds to boot - including S&P 500 index funds.

The trading platform doesn't have a minimum account requirement, but they do charge $20 a year for a service fee.

6. TD ameritrade

Much like E*TRADE, TD ameritrade (AMTD) - get report offers a free trading promotional if you open an account. You can get up to 60 days of commission-free trading for options, etfs and other equities, as well as up to $600 if you deposit $3,000 or more.

And even when the 60 days runs out, trades average about $6.95 a trade - on par with several other competitors. But TD ameritrade also offers over 300 commission-free etfs, and hundreds of transaction-fee-free mutual funds to choose from.

As one of the biggest online trading platforms, TD ameritrade offers a variety of top-notch services including research, data, and information on stocks as well as cash management, among others.

7. M1 finance

M1 finance does things a bit differently (think: customization.)

In addition to being completely commission-free and fee-free, M1 finance allows investors to invest in fractional shares as small as one penny. And, what makes M1 finance different is it allows users to create "pies" - that is, pie graphs that are comprised of a variety of etfs, stocks, and bonds. The app also allows users to choose different kinds of pies based on their investment needs and risk tolerance.

Although there is a $100 minimum for investing, the app allows for total customization of your own portfolio, and offers different kinds of "pies" from moderate to "ultra-aggressive" or "market cap 100."

For a completely free, zero-commission stock trading app, M1 finance seems to offer a pretty good deal for the DIY investor.

The bottom line

So, which free stock trading platform is best for you?

While some platforms like TD ameritrade and E*TRADE only offer short-term free stock trading services through promotions or new accounts, they do offer some industry-leading services that may be worth the extra cost you'll incur when your trial run ends.

However, for the investor who wants a truly free stock trading experience, robinhood, acorns and M1 finance offer a formidable range of services and offerings - even including cryptocurrency and options. And, as trading is increasingly becoming mobile, these app-focused companies are optimized to provide a solid, easy-to-use trading experience from the comfort of your ios or android-enabled device.

Still, as always, it is important to examine your personal investment goals and be realistic about how much you are willing to pay for extra services (if you do opt for one of the bigger brokerage names). But thanks to the surge of fintech companies in recent years, there are plenty of investment options that offer free stock trading services that can help grow your returns - all with the touch of a button.

Making money online with ZERO investment

I have created a new and improved version of K money mastery which is called, mastering book publishing!

Want to start making money online with zero investment?

I recently received a question from someone asking me if there's a way to make money online without having to invest any money.

The answer is yes, and I'm going to break down exactly how you can make your first dollar online without spending a penny. The example that I will give is making money with kindle publishing, as that's the primary method of making money online that I specialize in with my mastering book publishing course.

Watch the video below:

Do you want my proven step-by-step system for publishing books on amazon? CLICK HERE to purchase my new and improved mastering book publishing course!

How to make money with kindle without spending money

So you want to make money online, but don't want to invest any money? While this is 100% possible (and I'll show you how below), it isn't recommended (I will explain why later). First, let me share with you exactly how you can make money with kindle publishing without investing any money.

1. Your kindle publishing strategy

The first thing that you require is a method or strategy to be successful at making money with kindle. While investing in a course that can show you HOW to be successful from start to finish is ideal, it is not necessary. There's plenty of people that have battled their ways of making money on kindle by slowly figuring things out on their own and learning from trial and error. There might be some answers you can dig up to things on certain message boards or blogs that can help you along the way, so it can be done.

Yes, it will take you a lot longer by trying to do it by yourself. You will also be more likely to fail, experience more frustrations, and likely make some crucial mistakes that could have been avoided if you invested in a quality course, to begin with. But it CAN be done without investing in a course and there's plenty of people that have proven that.

2. Discover A profitable niche for your kindle book

You will need to discover a profitable niche or category for the kindle book that you want to publish. If you do have an idea for a kindle book, how do you know it's going to sell and be successful?

Being able to identify whether or not there is a MARKET for what you want to create is one of the most important things to master in making money online. You not only have to know whether there's a market but if the book idea you have will be PROFITABLE.

Your kindle book idea may seem profitable, but what about the competition? Is the market or niche too competitive for you? Will you be able to compete with the kindle books out there that have been around for a while and are dominating the space?

These are all important things that you need to know before publishing a kindle book. This can be done on your own (if you have some online marketing experience, then that's plus), or you can use someone else's method of research (in a course), or invest in a software to help with your niche research (AK elite or KDP spy).

Investing in software is also not necessary in order for you to publish a kindle book. I've found many profitable niches without using one, so it can be done on your own (although it does make things much easier and faster).

3. Create your kindle book cover

Once you've discovered the niche for your kindle book, it's next time to come up with a killer title for it, which of course can be done on your own. A great course can help show you how to come up with a title that sells and optimize it for all the best keywords, but it isn't required.

Next is creating your kindle book cover. You can do this if you have your own graphic editing software. While adobe photoshop is the best (it costs money), you can use whatever free softwares that your computer has come with.

Creating your own cover can require some creativity and skill. While I'd typically hire and outsource this for as low as $5, it CAN be done on your own if you choose to spend the time to learn how and go through the process.

4. Write your kindle book

The next step is to write your kindle book.

You CAN write your own kindle book, even if you aren't a writer. I've seen many people do it and have success doing it. Heck, I wrote my first kindle books without any experience writing previously. Writing is a skill that can be learned and developed. There are courses that can help you write your own book and show you how to do it faster than you could do it on your own, but again, it is NOT required.

If you aren't a writer (or hate writing), then the option that I recommend for people is to outsource this step and hire a ghostwriter. There's plenty of writers (and companies that I use) that can write your kindle book for you on ANY topic you want for as low as $55-75 for a 5000-word book. This costs money and it's an option that is available for you. They will typically deliver the book within 7-14 days.

However, you can do it on your own without investing any money. It might take you longer than if you were to outsource it (it took me a year to write my first book – crazy, I know!), but it can be easily done if you want to write your own book.

5. Publish and market your kindle book

Publishing and marketing your kindle book is the final step to have you get started making money. You just need to sign up for a KDP account (kindle direct publishing), which is free. Then you can just easily follow the steps to upload and publish your kindle book which can then be live selling on amazon within 24 hours.

Your kindle book will then be ready to make money for you! Of course, there is a lot you can do to promote and market your kindle book so that it gets selling. This is all stuff that can be learned on your own (just through searching the internet), or can be learned through investing in a course (again, costs money).

It will take you longer and require more effort to learn how to market your book on your own, but it IS possible (if you don't want to invest any money). There you have it… I just broke down 5 simple steps that you can follow to start making money with kindle publishing.

It is absolutely possible to start making money online without investing a penny. But after reading the steps above, my question for you is: why the heck would you? If there is a course or method that will show you how to make money online that is faster, easier, and will save you frustration and failure… then WHY wouldn't you just invest some money and take advantage of it?

Let me show you an easier and faster way…

It doesn't make any sense why someone would attempt to do something on their own and not to invest any money into learning how to do it effectively.

In my opinion, it is just stupid and very unintelligent to attempt to re-invent the wheel.

If you ever want to make money online (or do anything for that matter), the best advice I can give anyone is to invest in a course or program that can teach you how.

By investing in a great course or program, you are compressing time and speeding up your success massively.

Instead of attempting to do things on your own… find people that are already more experienced than you and hire them to do it for you!

This is exactly what I chose to do to grow my online business.

I did this with my kindle e-books by deciding to hire ghostwriters writers to write 99% of my kindle books for me. I also chose to do this by getting my e-covers designed. I have virtual assistants that work every day to promote my kindle books and market them.

In the same way, I hire copywriters, graphics designers, web designers, programmers, and everything else you can imagine for most aspects of my business. This is what allows me to grow faster and make more money online. I attend seminars all the time, read books, and hire coaches/mentors to learn from.

YES… I could learn and do everything on my own, but it doesn't make sense to. My time is more valuable. When you re-write yourself to think in terms of leveraging and outsourcing (learning from others is leveraging your time), then success becomes much faster and easier to attain.

Again, yes, you can do it all on your own… it is possible… but I don't recommend it. Learn to work smarter, not harder. That's the one thing that all successful people do.

Do you want my proven step-by-step system for publishing books on amazon? CLICK HERE to purchase my new and improved mastering book publishing course!

How online brokerages make money charging zero trading fees

Published: 10/04/2020 | updated: 01/15/2021 by financial samurai 36 comments

On october 2, 2019, charles schwab announced that it would no longer charge any trading fees. I remember my father using charles schwab in the 1990s and being charged $50 a trade. This article will discuss how online brokerages make money charging zero trading fees.

Immediately after the announcement, charles schwab stock dropped about 9%, while firms like TD ameritrade and E-trade dropped by even greater percentages. Clearly, investors in these names were not happy that these companies would be losing a significant portion of their revenue.

But when fees are cut, consumers generally win, if the firms can stay in business. Thus, the question is how will online brokerages make up for this lost revenue? Another question is what should investors on the platform do?

How online brokerages make money charging zero trading fees

After charles schwab announced its trading fee elimination, TD ameritrade, the first online brokerage I opened in 1995, followed suit the next day. E*trade has also eliminated trading fees.

So how are online brokerages going to make money or at least make up for their lost revenue? It may surprise you to know that charles schwab has been generating the majority of its revenues (57% in 2018) by acting as a bank.

In other words, charles schwab pays you a lower interest rate on your cash deposits with the firm, and earns a higher interest lending or investing the money elsewhere.

For example, charles schwab could pay you a 0.1% interest rate on your cash and buy a 10-year treasury bond paying 1.5%. This is their net interest margin (NIM) business.

By cutting its trading fees to $0, charles schwab is hoping to attract more customers and their idle cash onto its platform.

In TD ameritrade’s case, it is slightly different because it doesn’t own a bank. It has affiliate partnerships with banks such as TD bank to hold customers’ cash on deposit. The bank partner then pays a portion of its net interest margin to TD ameritrade. Therefore, the net interest margin business profitability is lower.

Further, less than 30% of TD ameritrade’s revenue comes from its net interest margin business. In order to stay competitive, TD ameritrade had no choice but to also cut its trading commissions to zero, even though commissions accounted for a greater percentage of revenue.

Hence the greater percentage fall in its share price. TD ameritrade’s #1 mission has to be to boost its net interest margin business to be its main revenue generator. Thus, I suspect it will be advertising higher cash interest rates in the future.

Besides trying to earn more net interest margin business off customers, online brokerages are hoping to generate more margin trading and options trading business. New customers might even join their money management business that invests money in mutual funds with higher fees than index funds and etfs. For example, schwab has an intelligent portfolio premium business that costs a fixed amount to join and has a monthly fee.

What online investors should do

Free trading is great. But just as getting fries for free sounds great, if you subsequently also buy a big mac, a 16 oz coke, and baked apple pie, you’ve probably spent too much on an unhealthy meal.

To take full advantage of free online trading, here’s what I think investors should do:

1) review your historical trades.

We know from the data that individual investors are the worst performers. Therefore, instead of immediately increasing your trading frequency because you can for free, review your last several years of trades and see whether you made good decisions or not. Be honest with your results.

Use the $0 trading fees to make incremental adjustments to your portfolio to match your desired risk exposure. In the past, maybe you held back on adjusting your equity exposure from 72% to 70% because it wasn’t worth paying $4.95 – $6.95 per trade. Now, commission fees are no longer a reason not to do so.

2) do not engage in margin trading.

Margin trading is how you can lose all your money in a downturn. Margin trading not only exposes you to total loss, but it also costs an interest fee to trade on margin. Please don’t leverage up at this point in the cycle. The S&P 500 and the NASDAQ are at all-time highs. Valuations are expensive. I’d much rather invest in lagging rental properties instead.

3) do not engage in options trading.

The average investor has no business doing any sort of options trading. If you must dabble, then look to use options to hedge by selling covered calls or buying puts. Even then, I don’t recommend options trading unless you have plenty of time and interest.

4) keep cash to a minimum in the brokerage.

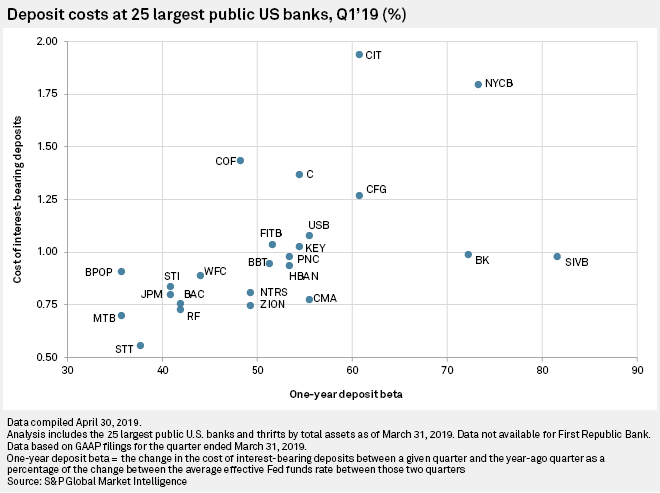

The money in your online brokerage account should be 95% – 100% invested in stocks or bonds or other investments. The vast majority of your cash should be invested in an online bank with a much higher interest rate or in a special cash fund with your online broker that pays a higher interest. The chart below shows how CIT bank has the highest cost of interest-bearing deposits. Savers should take advantage.

Alternatively, your favorite digital wealth advisors such as personal capital and betterment have created new high yield cash products to attract more users and provide more value and synergies as well. But their savings rate will change depending on the conditions.

5) question the fees of their mutual funds.

If you elect to use a digital wealth advisor platform on an online brokerage account, then you should ask them to generate a sample mock portfolio based on your investment goals and risk tolerance.

Then you should analyze the funds they are putting you into by analyzing the composition, the historical returns, and the fees. If the portfolio isn’t made up of index funds and etfs, then the funds will most certainly be more expensive.

6) set up a punt portfolio or a teaching portfolio.

For those of you who have the time and the means, you can now set up a punt portfolio to see if you can actively beat the market. Given there are no fees, your punt portfolio can be as small as $1,000. If you’ve always wanted to be a daytrader, here’s your chance to get it out of your system. I personally have roughly 25% of my public investment portfolio in active funds and individual stocks. I invest in big tech names and other names that I think will outperform.

You can also set up a teaching portfolio for your children or your friends to show them how to buy and sell securities, highlight how difficult it is to time the market, and more.

Because my dad explained to me the stock ticker section of the newspaper in high school, I became interested in a career in finance. My career in finance ended up being quite lucrative, and without it, financial samurai would not exist. Therefore, you never know how far a little education will go with your children.

If you have children, I highly encourage you to put them to work and open up an roth IRA. It’s great to contribute to a roth IRA with earned income at a low or zero percent tax rate. Within 20 years, they could become millionaires if you combine the roth IRA with a custodial trading account and a 529 plan.

Make sure you eat for free

Please stay disciplined when it comes to building your after-tax investment portfolio for passive income. Your taxable investment portfolio is what will generate passive income. And passive income is what is necessary to retire early or live a life of freedom.

Take advantage of $0 trading fees by making minor asset allocation adjustments to your portfolio. But remember, the more often you trade, the higher the likelihood of worse returns.

Finally, don’t forget about the tax consequences of trading. If you hold a security for under 12 months, you will pay short-term capital gains tax. Short-term capital gains tax is equal to your federal marginal income tax rate. The more you trade, the more trade reconciliation you’ll have to do come tax time as well.

Enjoy the race to zero fees. Now if only the real estate industry would hurry up and cut its commission fees to zero. That would be a cataclysmically positive event for the economy!

Investing suggestion. Invest with betterment where they will build a risk-appropriate, passive investment portfolio for you so you can focus on other things in life. It is hard to outperform the market.

Wealth management suggestion

Sign up for personal capital, the web’s #1 free wealth management tool to get a better handle on your finances. In addition to better money oversight, run your investments through their award-winning investment checkup tool to see exactly how much you are paying in fees. I was paying $1,700 a year in fees I had no idea I was paying.

After you link all your accounts, use their retirement planning calculator. It pulls your real data to give you as pure an estimation of your financial future as possible using monte carlo simulation algorithms. Definitely run your numbers to see how you’re doing.

I’ve been using personal capital since 2012 and have seen my net worth skyrocket since. Optimize your finances wisely.

Author bio: sam started financial samurai in 2009 to help people achieve financial freedom sooner, rather than later. Financial samurai is now one of the largest independently run personal finance sites with 1 million visitors a month.

Sam spent 13 years working at two major finance companies. He also earned his BA from william & mary and his MBA from UC berkeley.

He retired in 2012 with the help of his retirement income that now generates roughly $250,000 passively. He enjoys being a stay-at-home dad to his two young children.

Here are his current recommendations:

1) take advantage of record-low mortgage rates by refinancing with credible. Credible is a top mortgage marketplace where qualified lenders compete for your business. Get free refinance or purchase quotes in minutes.

2) for more stable investment returns and potential outperformance of volatile stocks, take a look at fundrise, a top real estate crowdfunding platform for non-accredited investors. It’s free to sign up and explore.

3) if you have dependents and/or debt, it’s good to get term life insurance to protect your loved ones. The pandemic has reminded us that tomorrow is not guaranteed. Policygenius is the easiest way to find free affordable life insurance in minutes. My wife was able to double her life insurance coverage for less with policygenius in 2020.

4) finally, stay on top of your wealth and sign up for personal capital’s free financial tools. With personal capital, you can track your cash flow, x-ray your investments for excessive fees, and make sure your retirement plans are on track.

18 ways to earn money online from home without investment

Are you looking for the ways to earn money online?

Did you try to make money online before but did not get success? Then no need to worry anymore!

Because we have already trained more than 7,00,000 people across the world & they are successfully making $300 to $2000 (INR 20,000+) per month.

We are showing you below some of the best ways to earn money online. You can also download our training package which will help you to grow your income very fast.

And yes, everything in this website is absolutely free & without investment.

18 ways to earn money online

Check some of the best ways below & start immediately-

1. Make money with online surveys

Here you can make money by completing small surveys which takes 5 minutes to 20 minutes depending on the requirement of a particular company.

You need to write your feedback & opinion in a survey. You just have to select your choice from the question & there is no need to write anything.

You can make $1 to $20 depending on the length of the survey, your profile & the country you are living in. You can find more about paid surveys and join 20 best survey sites.

2. Earn money with blogging

I have been making money with blogging from the last 7-8 years. I have made more than 1 million dollar (almost rs. 7 crore+) with blogging. I was so confused when I started blogging.

I had absolutely no idea about blogging when I started in 2010. I worked very hard but made no money with blogging for almost 1 year.

But I never gave up! I was doing my research on topics like, ‘how to create a blog', ‘how to write on your blog' and ‘how to promote your blog'.

And things started in my favor after 1 year. I made my first $100 from blogging in 2011. Then there was no looking back. Today I am earning $25,000 (rs 15 lacs+) per month from blogging.

You can know more about my blogging journey, my income proofs and a complete guide on how to start a blog for FREE.

3. Become a captcha solver

If you have more free time (2 hours a day) then you can add further income in your pocket by working as a captcha solver.

This is one of the easiest way to earn money online. As a captcha solver, you need to read the captcha images & type the exact characters.

You need to be very fast in order to earn better income. You can get paid up to $2 for every 1000 captchas you solve.

If you are interested in this then you can check this list of 10 best captcha work sites.

4. Earn with affiliate marketing

If you are serious about earning money online & you are a hard working guy who wants to make big income then affiliate marketing is for you.

There is more scope for affiliate marketing than before because of the high growth of online shopping.

There are hundreds of online merchants like amazon, flipkart, ebay, clickbank, CJ etc. Where you can signup & promote their products.

In affiliate marketing, you are simply helping customers to buy the right product by creating a simple website & in return you can earn 4% to 20% commission.

You can signup for free training so that we can send you one of the best guide on affiliate marketing that can help you to earn great income.

5. Become a freelancer

Freelancing is another popular way to make money after blogging & affiliate marketing. As a freelancer, you can work with small or big companies on a temporary basis & provide them your services.

Freelancers can make $500 to $2000+ per month depending on the type of freelance jobs you will do for your client.

You can work as a content writer, web designer, graphics designer or provide services like SEO, data entry, video testimonials, digital marketing etc.

There are dozens of popular websites like upwork, freelancer.In , worknhire , and many more freelance sites that can give you the ready platform with ready clients.

6. Virtual assistant

A virtual assistant is like a personal assistant who can earn money by working online for someone without being physically present.

He can do variety of tasks like taking care of websites, counseling, writing & proofreading, publishing content, marketing, coding, website & app development, research etc.

There are dozens of companies like hiremymom , mytasker , zirtual , uassistme , 123employee where you can signup for virtual assistant work.

7. Writing job

Writing is another better way to earn money on internet through writing different types of content.

You can write for blogs, companies, institutions, individual people etc. Different types of writers get paid differently.

Normally people get paid $5 to $20+ for writing 500 words content.

If you don’t have writing skills then you can read this post and become a freelance writer.

You can go to the sites like upwork, iwriter, writerbay, freelancewriting, textbroker, expresswriters.Com, freelancewritinggigs.Com to find the content writing jobs.

8. Micro-working

There are more ways that can help you to make extra income by working in part time. You can easily make $200-$300 per month by doing simple tasks on different sites.

Here you can work on variety of different tasks like identifying an object, rating & commenting on different sites, visiting some websites, finding contact details, doing small research, writing small articles etc.

There are many websites like mturk, microworker, seoclerk, clickworker, gigwalk where you can work as a micro worker & earn extra income. After signup, we will show you how to work as micro-worker and make money.

9. Become a youtuber

Youtube is one of the hottest trend in earning money online. You can start your youtube channel, upload some quality videos and then become a youtube partner to make money online on youtube.

You can create different kind of videos like prank videos, comedy videos, kitchen recipes, how-to-do videos, travel tips, or anything you think, is useful for people.

Once you get the videos views and subscribers for your channel then you can apply for youtube partner program.

Once you get the approval, people will see the ads along with ads in your videos. You will make money for each views your video receive.

You can shoot videos from your smartphone or any DSLR camera.

10. Become an online seller

Online selling is not like traditional selling. You don’t have much scope of selling your items outside your local market but in online selling, you can sell your product all over the country.

There are 2 ways to sell anything online.

Either, you can create your own website and sell your products from your website OR become a seller on any famous shopping portal like amazon, flipkart, ebay, snapdeal etc.

Second option is much better you will get existing customers of these popular portals.

Now you must be thinking that what can I sell when I don’t have any product?

I have seen many amazon and flipkart sellers who don’t have any product but still they are selling number of products on these sites.

What you can do is, roam around your city & check for the best products you can sell on these sites. You can find the wholesalers and distributors who can sell you these products at a highly discounted rates.

You can list these products on amazon, ebay etc. And make money by selling at a higher price.

You need to try the best products that you can sell at lower than market price. Trust me, its easier than your thought. Only thing you need to do is take action.

11. Domain trader

Domain trading is another high profit business you can do online. But here you need some investment for buying the domain.’

You must be an expert OR you should get detailed knowledge before you start this business.

You can buy domains from godaddy or other domain registrar for less than $10 & sell in future to the needy person for hundreds of dollars. Your skill here is to identify great domains that are not booked yet & companies in future can try to buy that domain.

When companies don’t find the domain of their choice, they contact the domain owner for the deal & it’s in your control to fix the price. You can even put your domains on auction so that people can buy directly at your desired price.

12. Website flipping

Like domain trading, website flipping is also a hot business to earn money online. Here you don’t deal with domains but websites.

You have to create a website, work on it for 3-6 months or more so that you can start making money from the websites.

After earning for 2-3 months, you can put that site on auction on flippa , empireflippers etc. You can easily get 15-20 times price of your monthly earning from that website.

It’s much easier to grow an old sites than creating a new site and the grow this new site.

Many experienced people buy websites from flippa, work for 3-4 months on these sites and make double or triple income.

13. Provide training & consultancy

There is a big scope of earning money online if you have some good skills that people need. Like you can provide training on spoken english, computer courses, any technical course, feng shui, medical treatment and any other things.

You can promote your business through a website or a facebook business page.

You need to promote your website or facebook page in order to get the potential leads.

You can get many customers through a good follow ups.

14. Stock & forex trading

Stock trading & forex trading is a very lucrative way to make money for those who has good idea of the market.

There are number of free or paid courses available on internet that can train you for online trading.

You can even read newspaper like economic times or watch TV channels like CNBC to become more expert in the field. Its risky to enter into this market without sufficient knowledge.

15. Earn money from your smartphone

There are various smartphone apps that can pay you some extra income by completing some simple tasks on your smartphone.

There are at least 20 money making apps that if you install in your smartphone, can give an extra income of $200-$300.

You have to take simple surveys, complete offers by signup on other websites, play games, watch videos etc.

You don’t need to take any extra time to earn from this as you can make money on the go.

16. Sell photos online

This is another use of your smartphone. You can take high quality images of nature, places, people, things, dishes, homes etc. & sell them online.

There are number of big sites like shutterstock, fotolia, , istockphoto, photobucket where you can submit your photos. Whenever some customer wants to purchase your photos, you will get paid as per the price you fix.

You can get paid multiple time for the same photos. Read this moneyconnexion post for more details.

17. Sell old stuff on OLX or quikr

I am sure there may be number of things in your home that are lying unused for months & if you take little efforts, you can earn some good money.

You just need to do 2 things, i.E. Find out all the items that you are no longer using, take high quality photos of these items from different angles & list these items on OLX & quikr for sale.

Not only this, you can also ask your friends & relatives for selling their old stuff. You can help them selling these items & make some commission.

So these 18 ways can provide a perfect answer for your query ‘how to earn money online” & yes, you can shoot an email to us in case of assistance.

Let me help you overshoot your financial goals in the right ways

Our services

Do you want to improve your grip and acquire the mastery

in personal finance, stock market, and other essential skills

for the growth of your hard-earned money?

Online stock trading full training program

Our zero to hero program is the best in the industry at bringing any level of trader to profitability through a combination of educational modules and hands-on experience over a five months period.

Trading journal and advanced analytics

One-on-one coaching and mentoring

Trading masters

Our zero to hero program is the best in the industry at bringing any level of trader to profitability through a combination of educational modules and hands-on experience over a five-month period. It is suited for the following students:

Promising traders

Someone who has zero to little knowledge in stocks but who's willing to do the work until you could pursue a trading career with a process driven approach

Stock market investors

Someone who has an experienced in the stock market as an investor but still wants to learn systematic trading strategy in order to boost investment portfolio.

Seasoned traders

Someone who has an experienced in trading but is still looking for new and powerful trading setups to add in one's arsenal.

Trading edge

AOL signature exclusive set-ups

Use our 6 trading edge (AOL signature setup) so you could adapt any market environment

SAVE framework

An active investing strategy which will protect your capital and could offer good (if not great) ROI by only trading stalwart companies.

Big bang set-up

Catch big moves after an explosive breakout while momentum is in your favor with good RRR. (trading breakout)

Burst set-up

Provides an opportunity to profit by entering a trade during temporary price reversal before the continuation of the larger trend. (trading pullback)

STTF pro set-up

A hybrid setup of momentum and swing trading which stands for short term trend following.

One day reversal (ODR)

Attempt to profit from a short-term correction or "bounce" off of the identified support once the price falls toward an important level of support after parabolic moves.

Bottom picking 2.0

Bottom picking trading strategy

Course content's outline

Our training program, zero to hero guide full training course, has been so in-demand to the point that we decided to make a brand new image and take trading to a higher level! Trading masters trading course is designed to help even absolute beginners learn how to trade. The training course is absolutely 100% online. Each lesson will feature an online live training video conferencing with written infographic notes, student homework, virtual and/or live practical trading.

A guide to master one skillset in less than 180 days.

Introduction to stock market.

In our technical analysis module it is not just a study of price but the study of when & how to enter, when to hold, and when to exit.

By mastering the 4 concepts of technical analysis:

candlesticks, support and resistance, role reversal, and trend will give an edge to maximize the full potential on how to make money on stocks through market timing.

The module will discuss also on how to use properly the different indicators and oscillators such as moving average, RSI, stochastics, MACD, ADX to use in your trading edge advantage.

Know yourself so you can align your strategy to your profile by checking the optimal balance between fit and preference to find which trading profile such momentum trading, swing trading, position trading, or value investing that fits you.

Trading psychology is essentially one’s thought process OR proper mindset when it comes to trading.

Journal your trades by using our signature AOL trading journal and analytics and then improve trading performance by identifying your strength and weaknesses through top trading kpis.

Build your right trading habits and discipline thru 90 days trading challenge.

7 best free stock trading platforms

Thanks to the rise of fintech, investors now have the option to buy and sell stocks online or through mobile apps - and often free of charge.

There are dozens of trading apps and platforms that allow investors to invest cash in a variety of securities with minimal to no fees. With the increase in choices, here are the best free stock-trading platforms and how they compare.

7 best free stock trading platforms

Whether you're a beginner investor or have been playing the market since before the last recession, free stock trading platforms and apps provide a great opportunity to maximize your returns and keep trading easy and simple.

These investment platforms are top-notch.

1. E*TRADE

Although E*TRADE (ETFC) - get report accounts aren't always free, there are some promotions and accounts that allow investors to invest for free. Currently, E*TRADE is having a promotion when you open a new account. The promotion offers 60 days of commission-free trading for up to 500 trades with a minimum deposit of $10,000 or more.

The site offers 24/7 customer service, easy mobile trading, data and research information, and has trading vehicles that range from etfs to options. And while E*TRADE's commissions usually hit just under the $7 mark for normal (nonpromotional) trades, the site is still very popular for its ease of use and retirement services.

2. Robinhood

The free stock trading app has seen a meteoric rise in popularity in recent years, accumulating 6 million users in 2019 - and with good reason. Robinhood seems to be the darling of commission-free trading - as a fintech startup founded by baiju bhatt and vlad tenev in 2013 with their free stock trading model.

Although there has been some speculation over how robinhood makes money (given their free trading model), the app is very popular for its easy, free trading and variety of investment vehicles - including options and even cryptocurrency.

To get started, you simply have to submit an application to robinhood and meet a few basic requirements (although if you are planning to participate in options trading, additional requirements are necessary) - with no account minimum. As a bonus, there are no maintenance fees.

As somewhat of a drawback, robinhood doesn't currently allow fractional investing (you can only buy whole shares). But for its cost-efficiency and easily-accessible app format, robinhood is clearly a crowd favorite for a reason.

3. Charles schwab

Ideal for investors looking to get into etfs, charles schwab (SCHW) - get report has an impressive array of 200 etfs to choose from, all commission-free. And, as a bank and stockbroker all-in-one, the schwab app is a great one-stop-shop for investors.

Schwab also has no-transaction-fee mutual funds, with around 4,000 available. Their regular trades will set you back around $5 apiece. There is no minimum balance requirement (although normal accounts typically come with a $1,000 minimum).

Because of their wide selection of the commission-free etfs and mutual funds, schwab is a strong contender for free stock trading.

4. Acorns

If you're a beginner investor looking to make money in stocks, acorns is the perfect introductory stock trading app.

Acorns specializes in micro-investing - that is, investing your spare change in stocks. There is no minimum to create an account, but there is a $5 minimum to start investing.

The app takes the spare change you've got from linked debit or credit cards to invest in commission-free etfs. There are no fees for inactivity.

5. Vanguard

Boasting around 1,800 commission-free etfs (just shy of robinhood's 2,000,) vanguard offers a wide selection of free trading options. The platform offers over 3,000 transaction-free mutual funds to boot - including S&P 500 index funds.

The trading platform doesn't have a minimum account requirement, but they do charge $20 a year for a service fee.

6. TD ameritrade

Much like E*TRADE, TD ameritrade (AMTD) - get report offers a free trading promotional if you open an account. You can get up to 60 days of commission-free trading for options, etfs and other equities, as well as up to $600 if you deposit $3,000 or more.

And even when the 60 days runs out, trades average about $6.95 a trade - on par with several other competitors. But TD ameritrade also offers over 300 commission-free etfs, and hundreds of transaction-fee-free mutual funds to choose from.

As one of the biggest online trading platforms, TD ameritrade offers a variety of top-notch services including research, data, and information on stocks as well as cash management, among others.

7. M1 finance

M1 finance does things a bit differently (think: customization.)

In addition to being completely commission-free and fee-free, M1 finance allows investors to invest in fractional shares as small as one penny. And, what makes M1 finance different is it allows users to create "pies" - that is, pie graphs that are comprised of a variety of etfs, stocks, and bonds. The app also allows users to choose different kinds of pies based on their investment needs and risk tolerance.

Although there is a $100 minimum for investing, the app allows for total customization of your own portfolio, and offers different kinds of "pies" from moderate to "ultra-aggressive" or "market cap 100."

For a completely free, zero-commission stock trading app, M1 finance seems to offer a pretty good deal for the DIY investor.

The bottom line

So, which free stock trading platform is best for you?

While some platforms like TD ameritrade and E*TRADE only offer short-term free stock trading services through promotions or new accounts, they do offer some industry-leading services that may be worth the extra cost you'll incur when your trial run ends.

However, for the investor who wants a truly free stock trading experience, robinhood, acorns and M1 finance offer a formidable range of services and offerings - even including cryptocurrency and options. And, as trading is increasingly becoming mobile, these app-focused companies are optimized to provide a solid, easy-to-use trading experience from the comfort of your ios or android-enabled device.

Still, as always, it is important to examine your personal investment goals and be realistic about how much you are willing to pay for extra services (if you do opt for one of the bigger brokerage names). But thanks to the surge of fintech companies in recent years, there are plenty of investment options that offer free stock trading services that can help grow your returns - all with the touch of a button.

Investing for everyone

Break free from commission fees

Make unlimited commission-free trades in stocks, etfs, and options with robinhood financial, as well as buy and sell cryptocurrencies with robinhood crypto. See our fee schedule to learn more about cost.

Introducing fractional shares

Fractional shares disclosure

Learn as you grow

Our goal is to make investing in financial markets more affordable, more intuitive, and more fun, no matter how much experience you have (or don’t have).

Our products

Earn 0.30% APY* on your uninvested cash and get more flexibility with your brokerage account.

Variable APY and debit card disclosures

Robinhood means robinhood markets and its in-application and web experiences with its family of wholly owned subsidiaries which includes robinhood financial, robinhood securities, and robinhood crypto.

All investments involve risks, including the possible loss of capital.

Securities trading is offered to self-directed customers by robinhood financial. Robinhood financial is a member of the financial industry regulatory authority (FINRA) .

8 best exchanges to trade crypto with no fees (zero commission)

Best no-fee exchange for

Best no-fee exchange for

Best no-fee exchange for

Did you know the most popular cryptocurrency trading platforms in the world such as coinbase, binance and etoro take a small amount of your account balance each time you make a trade?

This is where zero-fee fee crypto exchanges can allow traders to buy, trade and sell bitcoin and cryptocurrencies assets without paying any fees. For active investors, it could be the difference between a profitable and losing trader in the long run. In this article, we will share the best places to trade cryptocurrency without fees.

How to trade cryptocurrency without fees

To trade cryptocurrency without fees or commissions, follow these simple steps:

- Register a new account with phemex that offers no-fee crypto trading

- Click the 'products' link and select 'spot trading (zero fees)'

- Search for bitcoin or another cryptocurrency you want to buy, trade or sell

- Enter the amount of crypto to buy or sell against another coin

- Click on the 'buy' or 'sell' button to complete the trade without fees

Before getting started, some exchanges require you to own a bitcoin hardware wallet such as the ledger nano X. If you don't have a wallet, read our guide on the best cryptocurrency hardware wallets.

Platforms to trade bitcoin with no fees

Here is our list of the best crypto exchanges to trade bitcoin without fees (with our commentary):

- Phemex (lightning-fast trade execution speed and features a demo trading account)

- Crypto.Com (global digital asset service that offers a wide range of products)

- Kucoin (trusted by 1 out of every 4 crypto holders in the world)

- Digitex (suitable for crypto day traders, uses native exchange token as collateral)

- Amplify (trade over 14 crypto pairs against fiat, BTC, ETH or native token)

- Shapeshift (instantly swap crypto with zero fees and commissions)

- BLADE (exchange is backed by coinbase and other world-class and trusted investors)

- Lykke (an innovative digital exchange that offers forex, crypto and crypto index trading)

Overall rating

Our review

Website

Phemex

Phemex is a cryptocurrency trading exchange that offers spot, derivatives and simulated trading all on a single unified platform. The trading platform offers it's premium users the ability to trade crypto with zero-fees on its spot exchange for the major cryptocurrency assets such as bitcoin, ethereum, XRP and link.

Founded in 2019 by a group of 8 former morgan stanley executives, the team is focused on creating a trustworthy digital platform and become a leading financial services provider in the cryptocurrency industry. Phemex supports traders all over the world such as the united states, australia and the UK.

Phemex exchange is packed with features such as:

- Trade crypto without fees on its spot-trading exchange (for premium users)

- Derivatives trading up to 100x leverage with BTC & USD contract settlement

- Competitive trading fees on margin trading platform

- Advanced order types to manage risk

- Cryptocurrency demo account for beginners to practise

- 300k transactions per second (TPS)

- Cold wallet storage to keep funds safe on the exchange

- Fast and responsive mobile trading app

- Traditional financial assets (coming soon)

Users that create an account with phemex receive free access to the premium membership for 7 days. This can be extended to 30 days by referring a friend to the exchange. Once the trial ends, users on the exchange will need to purchase the premium membership which starts at $0.19USD per day to continue to trade bitcoin with zero fees.

While it might seem add to pay a subscription for no fee crypto trading, for high volume investors and crypto day traders, this is a very small price to pay to buy, trade and sell crypto without paying fees or commissions.

Crypto.Com

Crypto.Com is a digital asset platform that offers several cryptocurrency products and services. The exchange has seen massive growth in recent years and has over 1 million users on its platform and is a supported cryptocurrency exchange in the US. Crypto.Com is a popular platform that offers a powerful alternative to traditional financial services, making it easier for everyone to buy, trade and sell cryptocurrencies.

Get $50 FREE when you download the app and stake CRO for a MCO visa card using our referral code 45h3ct59tv. Get your debit card now!

With its growing list of features and crypto services, we expect crypto.Com to be one of the best cryptocurrency companies in the world within the next few years to rival the likes of binance and coinbase.

Crypto.Com is continually innovating and developing new crypto services and products for its users to accelerate the adoption of blockchain technology and improving the user experience of using cryptocurrencies. The exchange offers the following limited-time promotional offers:

- 0% trading fee for the first 90 days for new users

- Up to 50% trading fee reduction on all trades for existing users of the exchange

- 2% bonus deposit interest rate for all deposits made by new users in the first 30 days

- Send crypto to crypto.Com app users instantly without fees

- Buy bitcoin with 0% credit card fees

The digital currency provider offers a suite of crypto services and features at your fingertips which let's you buy, sell, trade, spend, store, earn interest on crypto, loan cash and even pay bills with cryptocurrency. Crypto.Com have also announced the future launch of margin and derivatives trading to compete with bybit and FTX.

Kucoin

Kucoin is a cryptocurrency exchange that was built to cater to individuals around the globe by providing an easy to use platform for investors to exchange digital assets and cryptocurrencies. Established in late 2017, kucoin is one of the most popular crypto trading exchanges in the world with over 5 million users globally.

PROMOTION: we have partnered with kucoin to offer a special promotion of zero-trading fees for 7 days when you create a new account using our link below.

Kucoin offers innovative crypto services and products including a spot exchange, futures markets, margin trading, staking rewards, lending service to earn interest on crypto assets and even the ability to purchase cryptocurrencies using a credit/debit card.

The well-known trading platform has recently launched an 'instant exchange' to provide access to the best available crypto exchange rate in the global market. Users can purchase cryptocurrencies such as bitcoin, ethereum, litecoin and XRP with zero-trading fees or commissions.

Kucoin instant exchange is a one-click crypto exchange service that was co-developed by kucoin and a top high frequency trading firm in wall street. The integration through the instant exchange allows a quick purchase of the supported cryptocurrencies, with zero-trading fees and the best available prices.

Digitex

Digitex futures exchange (DFE) is a zero-fee, peer-to-peer crypto futures exchange that allows users to trade bitcoin perpetual swap futures contract with leverage up to 100x. The trading exchange is built on ethereum’s blockchain technology to provide a cutting-edge crypto futures exchange with zero trading fees.

The exchange model is based on users having a balance of its own native coin, the DGTX token to be eligible for zero-commission trading. Each user that places a trade increases the demand for the DGTX token.

The platform is able to offer zero-fee bitcoin trading by selling DGTX tokens to earn money. This means, you can trade crypto with high frequency without having to worry about exchange commissions and taker fees eroding your profits.

Overall, we were quite impressive with digitex and the direction the exchange is headed. However, we would like to see improvements to the user interface, which appears dated in terms of functionality and lacks advanced trade order types. This is an important aspect to trading as this is where most of your time will be spent analyzing the charts.

Amplify

Amplify exchange was launched in 2019 to solve issues in the crypto world that inhibit the broader crypto adoption and common frustrations experienced by crypto traders.

The crypto exchange offers customers all over the globe (apart from US and canada) to buy and sell cryptocurrency without paying trading fees. This means there are no additional fees above spot crypto pricing.

Furthermore, there are no prerequisites to be eligible for zero-trading fees such as financial status, degree of trading expertise and/or amount of investment making it suitable for everyone.

Amplify exchange has over 14 crypto pairs such as:

- Bitcoin

- Ethereum

- Litecoin

- Ripple

- Bitcoin cash

- Stellar lumens

- Dash

- Cardano

- NEO

- Ethereum classic

- Basic attention token

- ZRX

- EOS

- Amplify loyalty token (AMPX)

Each crypto pair can be traded against fiat currency, BTC, ETH and the platform's native coin, AMPX token with zero-fees and commissions. When you log in for the first time, you might be a little surprised at the interface. It's not like other margin crypto exchanges. While it is very simplistic and suited to beginners.

Shapeshift

Shapeshift is a digital marketplace that was established in 2014 by erik voorhees that provides a crypto services to users all around the world. The online exchange offers the ability to quickly swap between assets in a seamless, safe, and secure environment.

In a matter of minutes, you can instantly exchange bitcoin to another altcoin and vice versa without any hassle. The team behind shapeshift have recently launched a new platform to buy bitcoin with no fees in an effort to compete with other cryptocurrency exchanges.

To be eligible for commission free, zero spread and zero trading fees on shapeshift, users need to hold their native FOX tokens. When you create an account, shapeshift deposit 100 FOX tokens for free in your account.

The new shapeshift platform allows you to:

- Create a new wallet or connect your keepkey, trezor or portis wallet

- Visualize your portfolio performance through a powerful dashboard

- Trade crypto instantly and for free with over a thousand asset pairs by holding FOX tokens

- Buy crypto with your bank account

- Send, receive, and HODL your digital assets on your hardware wallet

Zero-commission trading: what you need to know

The ascent is reader-supported: we may earn a commission from offers on this page. It’s how we make money. But our editorial integrity ensures our experts’ opinions aren’t influenced by compensation.

Most major online brokers have eliminated commissions for online stock trades. Here’s what investors like you need to know.

In a rather sudden move, major online brokerages including TD ameritrade, E*TRADE, and schwab have eliminated commissions for standard online-initiated stock trading. Depending on the broker, it used to cost $4.95 to $6.95 every time a stock position was bought or sold, which could amount to hundreds or even thousands in investment returns over time.

With that in mind, there are quite a few questions that you might have as an investor. For example, why did all of the brokers suddenly decide that they didn’t want to make commission revenue on stock trades? What does this mean to you as an investor? And are there any downsides to zero-commission stock trading?

Image source: getty images

Let’s take a closer look at zero-commission trading and what you should know about it.

When it comes to trading commissions, zero is the new normal

When robinhood pioneered the idea of commission-free stock trading a few years ago, it seemed like a disruptive trend, but not necessarily one that would permeate throughout the entire investment industry. After all, robinhood has a relatively no-frills platform, and many investors find value in educational tools, stock research, and access to specialized types of brokerage accounts like iras and college savings accounts.

The ascent's picks for the best online stock brokers

Find the best stock broker for you among these top picks. Whether you're looking for a special sign-up offer, outstanding customer support, $0 commissions, intuitive mobile apps, or more, you'll find a stock broker to fit your trading needs.

The same could be said when interactive brokers announced commission-free trading. Interactive brokers has historically catered to experienced investors who make frequent trades, not the mass market.

However, when schwab announced that it would be eliminating commissions (which were previously $4.95) for all stock trades on its platform, it caught many investors and industry experts by surprise. In the days and weeks that followed, most other major online stock brokers announced that they would be eliminating trading commissions for online stock trades as well. As of late october 2019, TD ameritrade, E*TRADE, fidelity, and bank of america have all eliminated traditional commissions -- at least to some degree.

At this point it’s fair to say that zero is the new normal when it comes to stock trading commissions.

How can brokers afford to do this?

There are two basic parts to the answer to this question. First, once schwab eliminated commissions, the move to zero commissions became more of a defensive strategy that was necessary in order to prevent a loss of clients. And second, brokers have other ways of making money.

In fact, there isn’t a single major broker that derives the bulk of its revenue from trading commissions. For example, TD ameritrade is one of the more commission-dependent brokers and trading commissions made up just over 25% of the company’s revenue in the most recent quarter. Other major sources of revenue come from interest income from things like margin loans, bank deposit account fees, and fee revenue from the company’s proprietary investment products like its robo-advisory service.

Directly related to trading, TD ameritrade (and most other brokers) makes money for routing orders to certain market makers. Market makers are the party to a trade that actually executes the transaction and makes money from the spread between the bid and ask prices, or the price they can buy the stock for and the price at which they sell it to investors. These spreads are typically pennies, so they make their money from volume -- and are willing to give brokers a cut of their profits in exchange for order flow.

It’s also worth noting that in many cases, commissions won’t entirely drop to zero. Some brokers are still charging commissions for options trades, and for services like broker-assisted and phone-initiated trades.

Buying your first stocks: do it the smart way

Once you’ve chosen one of our top-rated brokers, you need to make sure you’re buying the right stocks. We think there’s no better place to start than with stock advisor, the flagship stock-picking service of our company, the motley fool. You’ll get two new stock picks every month from legendary investors and motley fool co-founders tom and david gardner, plus 10 starter stocks and best buys now. Over the past 17 years, stock advisor’s average stock pick has seen a 569% return — more than 4.5x that of the S&P 500! (as of 1/15/2021). Learn more and get started today with a special new member discount.

In fact, dropping commissions could end up being a net positive in the long run for some of these brokers. Now that investors can access to feature-packed brokers like TD ameritrade, E*TRADE, and schwab for the same price as no-frills robinhood, they may potentially see an influx of assets.

What it means to you as an investor

The emergence of zero-commission stock trading is certainly a win for investors, especially beginner investors with limited capital.

For one thing, this makes it practical to buy small amounts -- even one share -- of a single stock. For example, let’s say that apple is trading for $200 per share. With a $6.95 trading commission, you would essentially pay a 3.5% premium to buy one share, making it rather impractical from a cost standpoint. Or, if you received a $50 dividend from a stock you own, it wouldn’t be practical to pay a commission to invest that money – you would either have to enroll in a dividend reinvestment plan (DRIP), which would automatically reinvest dividends in the same stock that paid them, or let your cash build up in order to invest your dividends in a cost-efficient manner. Now, that’s far less of a concern.

On a similar note, it also makes diversification much easier for new investors. If you’re starting with say, $1,000, you can invest your money in a portfolio of five or more stocks rather easily when you don’t have to worry about commissions taking a $35 (or more) bite out of your capital.

An example of why zero-commission stock trading is such a big win for investors

Here’s a quick example of how this could affect you. Let’s say that you want to invest $1,000 every year for the foreseeable future, and that you want to split your money among five stocks. We’ll also say that you were previously paying a $6.95 trading commission (so about $35 per investment round), and that your investments will earn a 10% annualized return over time.

If you’re paying commissions, that means you’re effectively investing $965 each time, not the full $1,000. Based on our assumptions, you could expect to have a portfolio worth roughly $15,400 after 10 years, $55,300 after 20 years, and $158,700 after 30 years. Not bad, right?

However, if you’re not paying commissions, that means you’re able to put the entire $1,000 to work each time. Although $6.95 commissions may not sound like much, you might be surprised by the difference it makes. After 10 years, commission-free investing would result in an additional $560 in your portfolio. After 20 years, you’d have an extra $2,000, and after 30 years, you’d have nearly $5,800 in additional wealth that you wouldn’t have had had you been paying commissions. That’s why zero-commission stock trading is such a big win for investors.

Could fractional shares become the next trend in the investing world?

Fees in the investment world have been gravitating toward zero for some time now, so although it may surprise you that major brokers eliminated commissions so suddenly, it was a long time in the making. After all, it wasn’t that long ago that $50 commissions were common when buying stocks. Mutual fund expense ratios and other forms of investment fees have also been steadily getting lower, so where can brokers go from here to stay competitive?

One potential move that brokers might make is to offer fractional shares. For example, if a stock is trading for $100 per share and you have $150, you’d normally only be able to buy one. With fractional shares, you could use all $150 to buy 1.5 shares.

This wouldn’t be much of a stretch for most of the major brokers. Investors can generally already buy fractional shares by enrolling their stocks in a DRIP, although not as a totally separate trade. Schwab has already announced the addition of this capability to its platform, and it wouldn’t be surprising to see others follow suit.

A word of caution

Although the emergence of zero-commission trading is generally a win for investors, there’s one potential downside -- the temptation to over-trade. In other words, it could be more tempting to move in and out of stock positions more frequently because it doesn’t cost anything to do it.

Don’t make this mistake. Although there are certainly some good reasons to sell stocks, the lack of trading commissions isn’t one of them. Keep a long-term focus and enjoy the long-term compounding benefits of commission-free stock trading.

Using the wrong broker could cost you serious money

Over the long term, there's been no better way to grow your wealth than investing in the stock market. But using the wrong broker could make a big dent in your investing returns. Our experts have ranked and reviewed the top online stock brokers - simply click here to see the results and learn how to take advantage of the free trades and cash bonuses that our top-rated brokers are offering.

About the author

Matt is a certified financial planner® and investment advisor based in columbia, south carolina. He writes personal finance and investment advice, and in 2017 he received the SABEW best in business award.

So, let's see, what we have: commission-free investing, plus the tools you need to put your money in motion. Sign up and get your first stock for free. Certain limitations and fees may apply. View robinhood financial’s fee schedule at rbnhd.Co/fees to learn more. At online trading with zero investment

Contents of the article

- Top forex bonuses

- Investing for everyone

- Break free from commission fees

- Introducing fractional shares

- Learn as you grow

- Our products

- 7 best free stock trading platforms

- 7 best free stock trading platforms

- The bottom line

- Making money online with ZERO investment

- How to make money with kindle without...

- 1. Your kindle publishing...

- 2. Discover A profitable niche for your...

- 3. Create your kindle book cover

- 4. Write your kindle book

- 5. Publish and market your kindle...

- Let me show you an easier and faster...

- How online brokerages make money charging zero...

- How online brokerages make money charging zero...

- What online investors should do

- 1) review your historical trades.

- 2) do not engage in margin trading.

- 3) do not engage in options trading.

- 4) keep cash to a minimum in the brokerage.

- 5) question the fees of their mutual funds.

- 6) set up a punt portfolio or a teaching...

- Make sure you eat for free

- Wealth management suggestion

- 18 ways to earn money online from home without...

- 18 ways to earn money online

- 1. Make money with online surveys

- 2. Earn money with blogging

- 3. Become a captcha solver

- 4. Earn with affiliate marketing

- 5. Become a freelancer

- 6. Virtual assistant

- 7. Writing job

- 8. Micro-working

- 9. Become a youtuber

- 10. Become an online seller

- 11. Domain trader

- 12. Website flipping

- 13. Provide training & consultancy

- 14. Stock & forex trading

- 15. Earn money from your smartphone

- 16. Sell photos online

- 17. Sell old stuff on OLX or quikr

- Let me help you overshoot your financial goals in...

- Our services

- Do you want to improve your grip and acquire the...

- Online stock trading full training program

- Trading journal and advanced analytics

- One-on-one coaching and mentoring

- Trading masters

- Our zero to hero program is the best in the...

- Trading edge

- AOL signature exclusive set-ups

- Use our 6 trading edge (AOL signature setup) so...

- SAVE framework

- Big bang set-up

- Burst set-up

- STTF pro set-up

- One day reversal (ODR)

- Bottom picking 2.0

- Course content's outline

- 7 best free stock trading platforms

- 7 best free stock trading platforms

- The bottom line

- Investing for everyone

- Break free from commission fees

- Introducing fractional shares

- Learn as you grow

- Our products

- 8 best exchanges to trade crypto with no fees...

- How to trade cryptocurrency without fees

- Platforms to trade bitcoin with no fees

- Zero-commission trading: what you need to know

- When it comes to trading commissions, zero is the...

- How can brokers afford to do this?

- What it means to you as an investor

- An example of why zero-commission stock trading...

- Could fractional shares become the next trend in...

- A word of caution

- Using the wrong broker could cost you serious...

- About the author

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.