Which broker is the best for forex

Rewards are generated in forex trading when you take a long or short position in a currency pair that subsequently appreciates in value.

Top forex bonuses

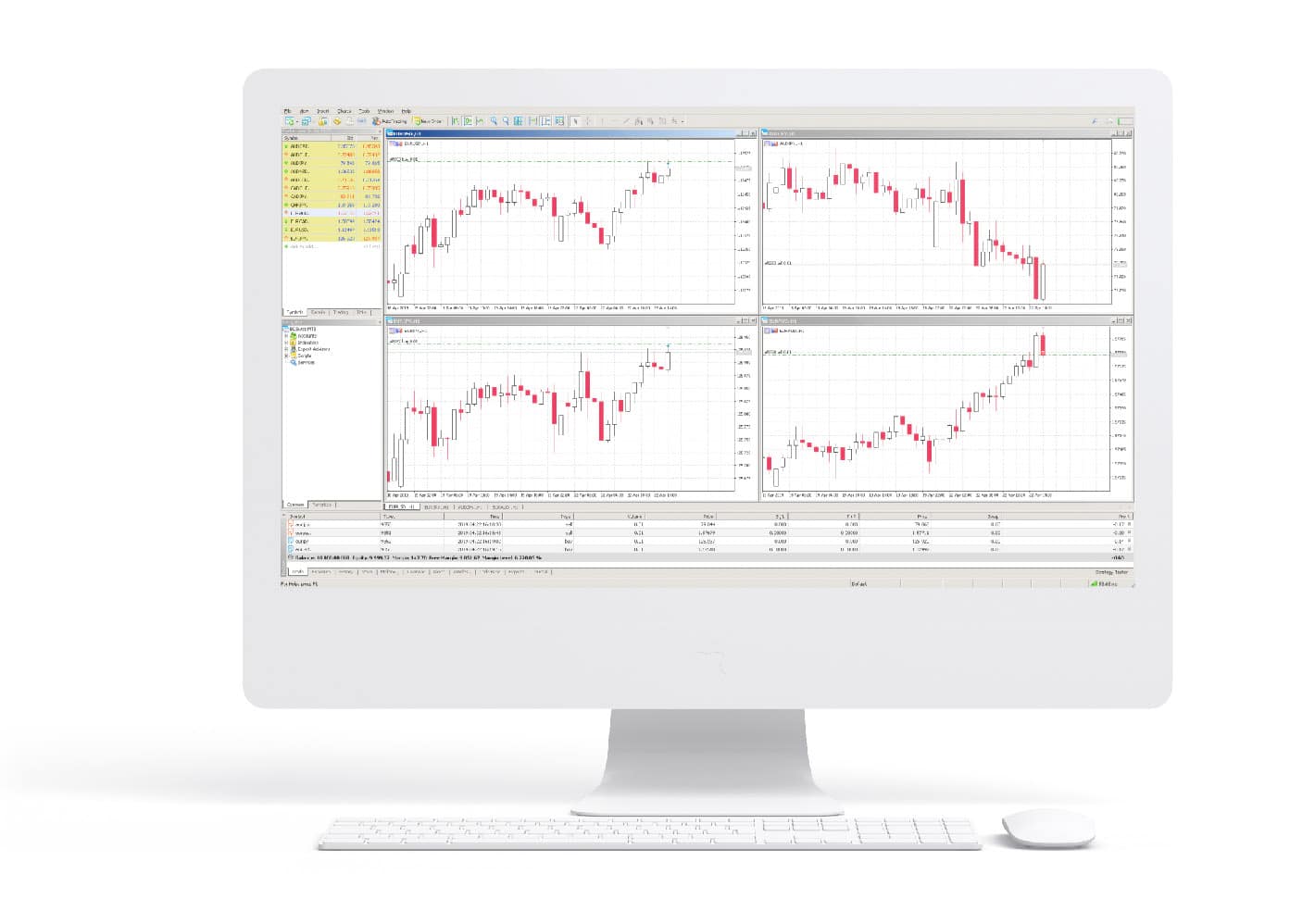

The risk in doing a forex transaction is when the market doesn’t perform as expected once you have done a forex trade. Benzinga’s picks for the best forex brokers in 6 key categories appear below along with details about each broker and a screenshot of their trading platforms.

Best forex brokers

Luke jacobi

Contributor, benzinga

Want to jump straight to the answer? The best forex broker for most people is definitely FOREX.Com

Forex trading is arguably one of the easiest financial markets to begin trading in. To get started, you just need to open and fund an account with a regulated online broker. Choosing the best forex broker to trade forex through does require some initial research to find the one most suitable for your trading needs and experience level.

Best forex brokers right now:

- Best overall forex broker: FOREX.Com

- Best for beginner traders: etoro

- Best for non-US traders: HYCM

- Best for commodities: avatrade

- Best for intermediate traders: pepperstone

- Best for advanced forex traders: interactive brokers

- Best for mobile traders: plus500

- Best forex platform: IG markets

Table of contents [ hide ]

The best forex brokers

Benzinga’s picks for the best forex brokers in 6 key categories appear below along with details about each broker and a screenshot of their trading platforms.

Account minimum

Pairs offered

Minimum trade size

Spread

Commisions

1. Best overall forex broker: FOREX.Com

FOREX.Com is a subsidiary of GAIN capital holdings (NYSE: GCAP) and ranks as the best overall forex broker.

You will only need $50 to open up an account to start trading up to 80 currency pairs on FOREX.Com’s advanced trading platforms, which include metatrader for non-U.S. Residents.

This broker accepts U.S. Clients and is regulated in the U.S. By the commodities futures trading commission (CFTC) and the national futures association (NFA). FOREX.Com also has oversight from regulators in 6 major world jurisdictions through its subsidiaries.

You can check out benzinga’s FOREX.Com review for more information about this excellent broker.

Account minimum

Pairs offered

Minimum trade size

Spread

Commisions

2. Best for beginner traders: etoro

Etoro specializes in social trading, which is ideal for beginners since you can follow the trades of expert traders with a proven track record. In addition to its world-class social trading network, etoro has excellent educational resources for forex beginners. Etoro’s intuitive multi-asset trading and social trading platforms and apps can be used by anyone immediately. Unfortunately, etoro does not support the metatrader 4 and 5 (MT4 and MT5) trading platforms.

The broker lets you trade over 2,000 different assets and has a minimum deposit of $50. Etoro currently accepts clients from most U.S. States where it is registered with the U.S. Financial crimes enforcement network (fincen) as a money services business, instead of with the NFA and CFTC as an online broker. The company is also regulated in australia, the U.K. And cyprus in the EU.

Account minimum

Pairs offered

Minimum trade size

Spread

Commisions

3. Best for non-US traders: HYCM

Highly regulated HYCM offers stocks, forex, indices, cryptocurrencies, commodities and etfs. The company also offers excellent trading conditions and great liquidity.

HYCM uses metatrader 4 to trade the markets and adds in technical analysis, flexible trading systems and expert advisors (eas).

You’ll also encounter low spreads and low-cost trading, which includes 3 spread levels: fixed spreads, variable spreads and raw spreads:

- You can access up to 500:1 leverage through HYCM, depending on where you live and which currency pair you’re trading.

- Account minimums with HYCM may vary depending on your base currency and the type of account you open. You should have at least $100 to $200 ready to go before you open an account.

- You can customize your account levels with varying fee structures to fit your risk tolerance and trade frequency.

- HYCM even offers swap-free accounts that do not accrue interest for each of its fee types to allow islamic investors to trade freely without worrying about being in conflict with religious laws.

You’ll also find a range of education and research tools for endless education opportunities through HYCM.

Account minimum

Pairs offered

Minimum trade size

Spread

Commisions

4. Best for commodities: avatrade

Avatrade, one of the most secure brokers in the industry, carries 7 regulations across 6 continents (europe, australia, japan, british virgin islands, UAE and south africa). You’ll be pleasantly surprised by its asset availability, leading platforms and generous trading conditions (you can leverage your positions up to 400:1).

Avatrade offers an exceptionally user-oriented perspective, including a 24-hour multilingual support desk for a broad range of instruments, platforms and services for every level of trader. Instruments include:

- Forex

- Stocks

- Commodities

- Cryptocurrencies

- Indices

You’ll find a range of automated trading platforms, including desktop, tablet, mobile and web-based trading with metatrader 4, metatrader 5, its proprietary webtrader, avaoptions and the award-winning avatradego. Client funds are held in segregated accounts for increased security and fast profits withdrawal.

Avatrade’s innovative technology and cutting-edge trading features also include 1-on-1 training sessions with a dedicated account manager.

Commissions

Account minimum

5. Best for intermediate traders: pepperstone

U.K.-based pepperstone gets our vote for best broker for intermediate traders. It has regulatory oversight in the U.K. And australia, although it does not currently accept U.S. Clients. The broker lets you trade in 61 major, minor and exotic currency pairs and requires a minimum deposit of $200. Pepperstone provides support for the metatrader 4 and 5 and ctrader platforms.

In addition to forex, pepperstone offers trading in cryptocurrencies, energy, metals, commodities and stock index contracts for difference (cfds). Customer balances are maintained in segregated accounts for safety in the australian national bank and barclays U.K.

Pricing

Account minimum

6. Best for advanced forex traders: interactive brokers

Interactive brokers offers some of the lowest costs in the business, including a $0 commission on U.S.-listed stocks and exchange-traded funds (etfs). Because of interactive’s world-class brokerage services in 33 countries that cover 134 markets worldwide, the company has oversight from most of the world’s largest financial regulators, including the U.S. SEC, CFTC and NFA. Interactive also submits to regulatory oversight in the U.K., australia and canada, and it has agencies in japan, hong kong, india and luxembourg.

Interactive brokers offers trading in 23 different currencies and their pairs, and the broker requires a $10,000 minimum margin deposit that is applied to commissions for the first 8 months, followed by a $2,000 minimum starting on the 9th month.

Minimum commissions apply, as well as maintenance fees and charges for inactivity, so interactive brokers would be best for advanced, active and well-funded professional traders. Interactive’s proprietary trading platforms, including its client portal, desktop trader workstation (TWS) and mobile application have been rated as some of the best in the business.

7. Best for mobile traders: plus500

U.K.- based plus500 has oversight from the FCA and is a leading provider of CFD trading on over 1,000 tradable assets including forex currency pairs, stock shares, cryptocurrencies, etfs, options and indices. The company keeps your money in segregated accounts but does not offer services to U.S.-based clients.

Plus500 offers trading in 70 currency pairs featuring competitive spreads on its forex cfds and leverage of up to 300:1. The intuitive interface featured on both the plus500 desktop and mobile trading platforms can be accessed immediately by novices and professionals, which makes plus500 our pick for mobile traders.

Commissions

Account minimum

8. Best forex platform: IG markets

IG markets gives clients access to trade cfds in more than 17,000 different markets including forex, shares, indices, commodities, bonds, etfs, options and short-term interest rate cfds. You can trade up to 80 different currency pairs through IG and the broker requires a $250 minimum deposit.

IG accepts U.S.-based clients due to oversight from the CFTC and NFA. IG holds your money in segregated accounts under trustee arrangements for added security. In addition to its proprietary trading platform, IG offers support for 3rd-party forex platforms such as metatrader 4 and prorealtime. It also allows application programming interface (API) trading.

Forex market explained

In the forex market, traders agree to exchange 1 currency for another to make a transaction in that currency pair at a particular level known as the exchange rate. Like stock prices, this exchange rate fluctuates based on supply and demand factors, as well as on the forex market’s overall expectations of future events.

Forex traders can make money on a currency transaction in 2 ways. First, if they buy or go long a currency and it goes up in value versus the sold currency, then they earn a profit. Second, if they sell or go short a currency and it goes down versus the bought currency, then they also profit.

Many currency pairs quoted in the forex market show substantial volatility or fluctuations, which can result in gains or losses for traders. The daily candlestick chart below shows changes in the exchange rate of the EUR/USD currency pair, which is the european union’s euro quoted in terms of the U.S. Dollar from november 2018 until april 2020.

Risk and reward in forex trading

Rewards are generated in forex trading when you take a long or short position in a currency pair that subsequently appreciates in value. The risk in doing a forex transaction is when the market doesn’t perform as expected once you have done a forex trade.

Many brokers allow traders to magnify the gains or losses they take on a position via the use of leverage. Leverage is typically expressed as the ratio of the size of a position you can control by placing one unit of base currency on deposit as margin. Hence, a 500:1 leverage ratio would mean that you can control a $500 position with a $1 margin deposit.

Furthermore, most successful traders have a minimum risk/reward ratio for a trade before they will consider taking it, such as 1:2 or 1:3. For example, if you think the chances of a trade making 20 pips is around the same as the chances of it losing 10 pips, then your risk/reward ratio of that trade is 1:2. If that meets your risk/reward ratio criteria, then you might consider that trade worthy of executing.

Choose your broker wisely

Since your forex broker will be your primary trading partner, you want to choose one carefully to make sure they are reputable and will fit your requirements as a trader. Open a demo account with an online broker you’re thinking of using to see whether it is a good fit. Demo account trading can also help prevent potentially costly errors that might arise from you being unfamiliar with the broker’s trading platform.

Methodology

These top brokers were chosen for this review for various reasons depending on the specific category in which we felt they excelled. Baseline requirements included the strength of their regulatory environment, their generally good overall reputation with clients earned over an extended period and a substantial number of currency pairs available for trading.

Fxdailyreport.Com

The first and most important factor to consider when choosing a forex broker to trade with is security. Some of the factors to consider to ensure your money is safe includes;

You want your trading capital to be safely deposited and handled with a forex broker that is overseen by a relevant financial authority. In the US, find a broker that is regulated by the national futures association (NFA): the NFA is the main regulatory agency responsible for regulating forex trading. It oversees the regulation and supervision of all fx brokers in the US. The broker should also be registered with the US commodity futures trading commission (CFTC) as a retail foreign exchange dealer and futures commission merchant.

Check the broker’s regulatory body on their website before doing any other thing. Working with a regulated broker also ensures that your withdrawal or deposit request fast and hassle-free.

Recommended US forex brokers regulated by NFA and CFTC

FOREX.Com

Make sure to choose a forex broker whose domicile is in a country with a well-developed financial regulation. This legal structure can help you recover funds if an issue arises. So, ensure that you check the domicile of the company even if the firm looks reputable. Otherwise, choosing an online broker based in a poorly regulated country may not be in your best interest. Trying to exert your legal rights in a foreign jurisdiction can prove a daunting task as there is no regulatory oversight in the background to support your effort.

Always check the broker’s financial security before hiring as you want to choose one with great financial backing. Choose a online forex broker that is well funded or has a trusted owner or parent company. You can find this information on the broker’s official website on tabs like “about us” or “press releases.” you can also check on the regulatory body’s website.

- Transparent and low commission structures

The costs associated with forex trading can be hard to analyze. Also, they can impact a trader’s returns significantly over the long term, especially if your trading strategy calls for frequent trading. Therefore, it is crucial that you deal with an fx trader with a transparent and low commission structure.

However, it is important to note that while a trader with low marginal costs may save you some money in the long term, more expensive traders tend to offer better customer service among other helpful services, including educational materials, trading tools, and market analysis.

- Suitable and reliable trading platform

Another important consideration to make is the trading platform that the potential forex broker works with. This is because the trading platform will be your interface with the market. Therefore, it needs to be intuitive and easy to use. It should also have high speeds to allow for quick execution and enable you to react promptly to any market changes.

Always make sure that your broker offers you a platform that best suits your needs. For instance, if you are always on the move, you should look for a broker whose platform has a mobile app to allow you to manage your trades.

Finally, always choose a broker with top-notch customer service. Since forex trading takes place 24 hours a day, you need to find a broker who offers customer service 24/7. Check to see whether their support is offered as one on one or through automated responses. We highly recommend a broker that offers one on one support as opposed to automated since they may not address your needs adequately.

Call the brokers directly to see who will pick your call promptly and the quality of customer service they will offer. If you are dissatisfied with the level of services offered by a particular broker, move on to the next and settle for the one who will offer quality and satisfactory service.

As a trader, it is crucial that you vet as many forex brokers as possible before arriving at a final decision. This will help you choose a broker that offers exceptional services that match your expectations.

Best international forex brokers

Luke jacobi

Contributor, benzinga

Want to jump straight to the answer? The best forex broker for most people is definitely FOREX.Com

You must find a broker that complies with U.S. Laws if you live in the united states and want to trade in the forex market. You’ll have a significantly larger selection of international brokerages if you live outside the united states.

The dodd-frank wall street reform and consumer protection act was signed into U.S. Law on july 21, 2010, to respond to the 2008 global financial crisis, and it affected all U.S. Federal financial regulatory agencies and the entire U.S. Financial services industry, including online forex brokers and the stock market .

Learn more about how you can trade forex with our review of the best international forex brokers.

Best international forex brokers:

Table of contents [ hide ]

Best for

Overall rating

Best for

1 minute review

IG is a comprehensive forex broker that offers full access to the currency market and support for over 80 currency pairs. The broker only offers forex trading to its U.S.-based customers, the brokerage does it spectacularly well. Novice traders will love IG’s intuitive mobile and desktop platforms, while advanced traders will revel in the platform’s selection of indicators and charting tools. Though IG could work on its customer service and fees, the broker is an asset to new forex traders and those who prefer a more streamlined interface.

Best for

- New forex traders who are still learning the ropes

- Traders who prefer a simple, clean interface

- Forex traders who trade primarily on a tablet

- Easy-to-navigate platform is easy for beginners to master

- Mobile and tablet platforms offer full functionality of the desktop version

- Margin rates are easy to understand and affordable

- Access to over 80 currency pairs

- U.S. Traders can currently only trade forex

- Customer service options are lacking

- No 2-factor authentication on mobile

Account minimum

Pairs offered

Account minimum

Pairs offered

1 minute review

FOREX.Com is a one-stop shop for forex traders. With a massive range of tradable currencies, low account minimums and an impressive trading platform, FOREX.Com is an excellent choice for brokers searching for a home base for their currency trading. New traders and seasoned veterans alike will love FOREX.Com’s extensive education and research center that provides free, informative forex trading courses at multiple skill levels. While FOREX.Com is impressive, remember that it isn’t a standard broker.

Best for

- Impressive, easy-to-navigate platform

- Wide range of education and research tools

- Access to over 80 currencies to buy and sell

- Leverage available up to 50:1

Account minimum

Pairs offered

Account minimum

Pairs offered

1 minute review

Though australian and british traders might know etoro for its easy stock and mobile trading, the broker is now expanding into the united states with cryptocurrency trading. U.S. Traders can begin buying and selling both major cryptocurrencies (like bitcoin and ethereum) as well as smaller names (like tron coin and stellar lumens).

Etoro offers traders the opportunity to invest their assets into premade portfolios or cryptocurrencies, similar to services offered by robo-advisors through traditional brokers. Though etoro isn’t a one-stop-shop for everything an investor needs, its easy-to-use platform and low spreads is a great way to enter the cryptocurrency market.

Best for

- International forex/CFD traders

- New cryptocurrency traders looking for an easy-to-use platform

- Traders who want to buy and sell cryptocurrencies on-the-go

- Simple platform that is easy to master

- Copytrader feature that allows new traders to copy the same strategies used by professionals

- Virtual dummy account that gives you $100,000 to practice trades

- U.S. Traders currently limited to cryptocurrencies

- Only 15 major coins available to trade

Account minimum

Pairs offered

Account minimum

Pairs offered

1 minute review

HYCM is 1 of the world’s leading forex brokers, offering investors access to over 69 unique currency pairs. However, forex isn’t the only thing the broker offers — HYCM also offers high rates of leverage, stock and ETF trading, commodity investing and much more. Getting started with HYCM is quick and easy, and most investors can open an account in as little as 10 minutes.

HYCM offers a varying fee structure, which allows investors to choose the spread option that’s best for them. A wide range of educational and investing tools are available, which can be equally beneficial to both experienced and novice traders. Though HYCM isn’t currently available in the united states, it can be a great choice for residents of the other 140 countries where it offers service.

Best for

- Investors who want a customizable fee schedule

- Traders comfortable using the metatrader platform

- Islamic traders who need swap-free accounts that don’t build interest

- Wide range of currency pairs available

- Excellent selection of educational tools

- $0 deposit and withdrawal fees

Account minimum

Pairs offered

Account minimum

Pairs offered

1 minute review

A fully regulated broker with a presence in europe, south africa, the middle east, british virgin islands, australia and japan, avatrade deals with mainly forex and cfds on stocks, commodities, indexes, forex, cryptocurrencies, etc. This brokerage is headquartered in dublin, ireland and began offering its services in 2006. It offers multiple trading platforms and earns mainly through spreads.

Best for

- Beginners

- Advanced traders

- Traders looking for a well-diversified portfolio

- Controlled by regulatory agencies of multiple countries

- Choice offered in terms of trading platforms

- Support available in 14 languages and trading platforms in 20 languages

- Practice/demo account available for trying out

- Breadth of trading assets

- Does not accept customers from the U.S. As it isn’t regulated in the U.S.

- Transferring funds to the account may take up to five days; withdrawals could take up to 10 days

Trading forex internationally

In january 2015, the national futures association (NFA) imposed limits on the leverage allowed on forex positions and other restrictions on U.S.-based forex traders. Many international forex brokers stopped accepting clients from the U.S. Also, due to the new restrictions, international forex brokers increased in popularity relative to american brokers because they typically give traders better terms than U.S.-based forex brokers.

For example, forex brokers in the united states only allow a maximum leverage ratio of 50:1, while some international brokers offer client leverage up to 3,000:1. This high amount of leverage, while extremely profitable when you’re on the right side of the market, could be disastrous if you hold a losing position, especially if you have limited capital.

Another example is the FIFO regulation. FIFO stands for “first in, first out,” and this rule requires you to liquidate positions in the same currency pair in the order that they were established instead of choosing which opposing transaction to liquidate.

The new U.S. Legislation also banned hedging a forex position by taking an opposing position in the same currency pair as 1 already established. Doing this means you effectively hedge the original position and can trade out of both sides individually, which is no longer allowed for U.S.-based forex traders.

Do international forex brokers accept U.S. Clients?

Just because you live in the united states doesn’t mean you can’t trade forex. Many top-tier forex brokers such as IG are based in the united states and also fully comply with the relevant regulations of the NFA and the commodities futures trading commission (CFTC).

Best forex brokers

Luke jacobi

Contributor, benzinga

Want to jump straight to the answer? The best forex broker for most people is definitely FOREX.Com

Forex trading is arguably one of the easiest financial markets to begin trading in. To get started, you just need to open and fund an account with a regulated online broker. Choosing the best forex broker to trade forex through does require some initial research to find the one most suitable for your trading needs and experience level.

Best forex brokers right now:

- Best overall forex broker: FOREX.Com

- Best for beginner traders: etoro

- Best for non-US traders: HYCM

- Best for commodities: avatrade

- Best for intermediate traders: pepperstone

- Best for advanced forex traders: interactive brokers

- Best for mobile traders: plus500

- Best forex platform: IG markets

Table of contents [ hide ]

The best forex brokers

Benzinga’s picks for the best forex brokers in 6 key categories appear below along with details about each broker and a screenshot of their trading platforms.

Account minimum

Pairs offered

Minimum trade size

Spread

Commisions

1. Best overall forex broker: FOREX.Com

FOREX.Com is a subsidiary of GAIN capital holdings (NYSE: GCAP) and ranks as the best overall forex broker.

You will only need $50 to open up an account to start trading up to 80 currency pairs on FOREX.Com’s advanced trading platforms, which include metatrader for non-U.S. Residents.

This broker accepts U.S. Clients and is regulated in the U.S. By the commodities futures trading commission (CFTC) and the national futures association (NFA). FOREX.Com also has oversight from regulators in 6 major world jurisdictions through its subsidiaries.

You can check out benzinga’s FOREX.Com review for more information about this excellent broker.

Account minimum

Pairs offered

Minimum trade size

Spread

Commisions

2. Best for beginner traders: etoro

Etoro specializes in social trading, which is ideal for beginners since you can follow the trades of expert traders with a proven track record. In addition to its world-class social trading network, etoro has excellent educational resources for forex beginners. Etoro’s intuitive multi-asset trading and social trading platforms and apps can be used by anyone immediately. Unfortunately, etoro does not support the metatrader 4 and 5 (MT4 and MT5) trading platforms.

The broker lets you trade over 2,000 different assets and has a minimum deposit of $50. Etoro currently accepts clients from most U.S. States where it is registered with the U.S. Financial crimes enforcement network (fincen) as a money services business, instead of with the NFA and CFTC as an online broker. The company is also regulated in australia, the U.K. And cyprus in the EU.

Account minimum

Pairs offered

Minimum trade size

Spread

Commisions

3. Best for non-US traders: HYCM

Highly regulated HYCM offers stocks, forex, indices, cryptocurrencies, commodities and etfs. The company also offers excellent trading conditions and great liquidity.

HYCM uses metatrader 4 to trade the markets and adds in technical analysis, flexible trading systems and expert advisors (eas).

You’ll also encounter low spreads and low-cost trading, which includes 3 spread levels: fixed spreads, variable spreads and raw spreads:

- You can access up to 500:1 leverage through HYCM, depending on where you live and which currency pair you’re trading.

- Account minimums with HYCM may vary depending on your base currency and the type of account you open. You should have at least $100 to $200 ready to go before you open an account.

- You can customize your account levels with varying fee structures to fit your risk tolerance and trade frequency.

- HYCM even offers swap-free accounts that do not accrue interest for each of its fee types to allow islamic investors to trade freely without worrying about being in conflict with religious laws.

You’ll also find a range of education and research tools for endless education opportunities through HYCM.

Account minimum

Pairs offered

Minimum trade size

Spread

Commisions

4. Best for commodities: avatrade

Avatrade, one of the most secure brokers in the industry, carries 7 regulations across 6 continents (europe, australia, japan, british virgin islands, UAE and south africa). You’ll be pleasantly surprised by its asset availability, leading platforms and generous trading conditions (you can leverage your positions up to 400:1).

Avatrade offers an exceptionally user-oriented perspective, including a 24-hour multilingual support desk for a broad range of instruments, platforms and services for every level of trader. Instruments include:

- Forex

- Stocks

- Commodities

- Cryptocurrencies

- Indices

You’ll find a range of automated trading platforms, including desktop, tablet, mobile and web-based trading with metatrader 4, metatrader 5, its proprietary webtrader, avaoptions and the award-winning avatradego. Client funds are held in segregated accounts for increased security and fast profits withdrawal.

Avatrade’s innovative technology and cutting-edge trading features also include 1-on-1 training sessions with a dedicated account manager.

Commissions

Account minimum

5. Best for intermediate traders: pepperstone

U.K.-based pepperstone gets our vote for best broker for intermediate traders. It has regulatory oversight in the U.K. And australia, although it does not currently accept U.S. Clients. The broker lets you trade in 61 major, minor and exotic currency pairs and requires a minimum deposit of $200. Pepperstone provides support for the metatrader 4 and 5 and ctrader platforms.

In addition to forex, pepperstone offers trading in cryptocurrencies, energy, metals, commodities and stock index contracts for difference (cfds). Customer balances are maintained in segregated accounts for safety in the australian national bank and barclays U.K.

Pricing

Account minimum

6. Best for advanced forex traders: interactive brokers

Interactive brokers offers some of the lowest costs in the business, including a $0 commission on U.S.-listed stocks and exchange-traded funds (etfs). Because of interactive’s world-class brokerage services in 33 countries that cover 134 markets worldwide, the company has oversight from most of the world’s largest financial regulators, including the U.S. SEC, CFTC and NFA. Interactive also submits to regulatory oversight in the U.K., australia and canada, and it has agencies in japan, hong kong, india and luxembourg.

Interactive brokers offers trading in 23 different currencies and their pairs, and the broker requires a $10,000 minimum margin deposit that is applied to commissions for the first 8 months, followed by a $2,000 minimum starting on the 9th month.

Minimum commissions apply, as well as maintenance fees and charges for inactivity, so interactive brokers would be best for advanced, active and well-funded professional traders. Interactive’s proprietary trading platforms, including its client portal, desktop trader workstation (TWS) and mobile application have been rated as some of the best in the business.

7. Best for mobile traders: plus500

U.K.- based plus500 has oversight from the FCA and is a leading provider of CFD trading on over 1,000 tradable assets including forex currency pairs, stock shares, cryptocurrencies, etfs, options and indices. The company keeps your money in segregated accounts but does not offer services to U.S.-based clients.

Plus500 offers trading in 70 currency pairs featuring competitive spreads on its forex cfds and leverage of up to 300:1. The intuitive interface featured on both the plus500 desktop and mobile trading platforms can be accessed immediately by novices and professionals, which makes plus500 our pick for mobile traders.

Commissions

Account minimum

8. Best forex platform: IG markets

IG markets gives clients access to trade cfds in more than 17,000 different markets including forex, shares, indices, commodities, bonds, etfs, options and short-term interest rate cfds. You can trade up to 80 different currency pairs through IG and the broker requires a $250 minimum deposit.

IG accepts U.S.-based clients due to oversight from the CFTC and NFA. IG holds your money in segregated accounts under trustee arrangements for added security. In addition to its proprietary trading platform, IG offers support for 3rd-party forex platforms such as metatrader 4 and prorealtime. It also allows application programming interface (API) trading.

Forex market explained

In the forex market, traders agree to exchange 1 currency for another to make a transaction in that currency pair at a particular level known as the exchange rate. Like stock prices, this exchange rate fluctuates based on supply and demand factors, as well as on the forex market’s overall expectations of future events.

Forex traders can make money on a currency transaction in 2 ways. First, if they buy or go long a currency and it goes up in value versus the sold currency, then they earn a profit. Second, if they sell or go short a currency and it goes down versus the bought currency, then they also profit.

Many currency pairs quoted in the forex market show substantial volatility or fluctuations, which can result in gains or losses for traders. The daily candlestick chart below shows changes in the exchange rate of the EUR/USD currency pair, which is the european union’s euro quoted in terms of the U.S. Dollar from november 2018 until april 2020.

Risk and reward in forex trading

Rewards are generated in forex trading when you take a long or short position in a currency pair that subsequently appreciates in value. The risk in doing a forex transaction is when the market doesn’t perform as expected once you have done a forex trade.

Many brokers allow traders to magnify the gains or losses they take on a position via the use of leverage. Leverage is typically expressed as the ratio of the size of a position you can control by placing one unit of base currency on deposit as margin. Hence, a 500:1 leverage ratio would mean that you can control a $500 position with a $1 margin deposit.

Furthermore, most successful traders have a minimum risk/reward ratio for a trade before they will consider taking it, such as 1:2 or 1:3. For example, if you think the chances of a trade making 20 pips is around the same as the chances of it losing 10 pips, then your risk/reward ratio of that trade is 1:2. If that meets your risk/reward ratio criteria, then you might consider that trade worthy of executing.

Choose your broker wisely

Since your forex broker will be your primary trading partner, you want to choose one carefully to make sure they are reputable and will fit your requirements as a trader. Open a demo account with an online broker you’re thinking of using to see whether it is a good fit. Demo account trading can also help prevent potentially costly errors that might arise from you being unfamiliar with the broker’s trading platform.

Methodology

These top brokers were chosen for this review for various reasons depending on the specific category in which we felt they excelled. Baseline requirements included the strength of their regulatory environment, their generally good overall reputation with clients earned over an extended period and a substantial number of currency pairs available for trading.

Best international forex brokers

Luke jacobi

Contributor, benzinga

Want to jump straight to the answer? The best forex broker for most people is definitely FOREX.Com

You must find a broker that complies with U.S. Laws if you live in the united states and want to trade in the forex market. You’ll have a significantly larger selection of international brokerages if you live outside the united states.

The dodd-frank wall street reform and consumer protection act was signed into U.S. Law on july 21, 2010, to respond to the 2008 global financial crisis, and it affected all U.S. Federal financial regulatory agencies and the entire U.S. Financial services industry, including online forex brokers and the stock market .

Learn more about how you can trade forex with our review of the best international forex brokers.

Best international forex brokers:

Table of contents [ hide ]

Best for

Overall rating

Best for

1 minute review

IG is a comprehensive forex broker that offers full access to the currency market and support for over 80 currency pairs. The broker only offers forex trading to its U.S.-based customers, the brokerage does it spectacularly well. Novice traders will love IG’s intuitive mobile and desktop platforms, while advanced traders will revel in the platform’s selection of indicators and charting tools. Though IG could work on its customer service and fees, the broker is an asset to new forex traders and those who prefer a more streamlined interface.

Best for

- New forex traders who are still learning the ropes

- Traders who prefer a simple, clean interface

- Forex traders who trade primarily on a tablet

- Easy-to-navigate platform is easy for beginners to master

- Mobile and tablet platforms offer full functionality of the desktop version

- Margin rates are easy to understand and affordable

- Access to over 80 currency pairs

- U.S. Traders can currently only trade forex

- Customer service options are lacking

- No 2-factor authentication on mobile

Account minimum

Pairs offered

Account minimum

Pairs offered

1 minute review

FOREX.Com is a one-stop shop for forex traders. With a massive range of tradable currencies, low account minimums and an impressive trading platform, FOREX.Com is an excellent choice for brokers searching for a home base for their currency trading. New traders and seasoned veterans alike will love FOREX.Com’s extensive education and research center that provides free, informative forex trading courses at multiple skill levels. While FOREX.Com is impressive, remember that it isn’t a standard broker.

Best for

- Impressive, easy-to-navigate platform

- Wide range of education and research tools

- Access to over 80 currencies to buy and sell

- Leverage available up to 50:1

Account minimum

Pairs offered

Account minimum

Pairs offered

1 minute review

Though australian and british traders might know etoro for its easy stock and mobile trading, the broker is now expanding into the united states with cryptocurrency trading. U.S. Traders can begin buying and selling both major cryptocurrencies (like bitcoin and ethereum) as well as smaller names (like tron coin and stellar lumens).

Etoro offers traders the opportunity to invest their assets into premade portfolios or cryptocurrencies, similar to services offered by robo-advisors through traditional brokers. Though etoro isn’t a one-stop-shop for everything an investor needs, its easy-to-use platform and low spreads is a great way to enter the cryptocurrency market.

Best for

- International forex/CFD traders

- New cryptocurrency traders looking for an easy-to-use platform

- Traders who want to buy and sell cryptocurrencies on-the-go

- Simple platform that is easy to master

- Copytrader feature that allows new traders to copy the same strategies used by professionals

- Virtual dummy account that gives you $100,000 to practice trades

- U.S. Traders currently limited to cryptocurrencies

- Only 15 major coins available to trade

Account minimum

Pairs offered

Account minimum

Pairs offered

1 minute review

HYCM is 1 of the world’s leading forex brokers, offering investors access to over 69 unique currency pairs. However, forex isn’t the only thing the broker offers — HYCM also offers high rates of leverage, stock and ETF trading, commodity investing and much more. Getting started with HYCM is quick and easy, and most investors can open an account in as little as 10 minutes.

HYCM offers a varying fee structure, which allows investors to choose the spread option that’s best for them. A wide range of educational and investing tools are available, which can be equally beneficial to both experienced and novice traders. Though HYCM isn’t currently available in the united states, it can be a great choice for residents of the other 140 countries where it offers service.

Best for

- Investors who want a customizable fee schedule

- Traders comfortable using the metatrader platform

- Islamic traders who need swap-free accounts that don’t build interest

- Wide range of currency pairs available

- Excellent selection of educational tools

- $0 deposit and withdrawal fees

Account minimum

Pairs offered

Account minimum

Pairs offered

1 minute review

A fully regulated broker with a presence in europe, south africa, the middle east, british virgin islands, australia and japan, avatrade deals with mainly forex and cfds on stocks, commodities, indexes, forex, cryptocurrencies, etc. This brokerage is headquartered in dublin, ireland and began offering its services in 2006. It offers multiple trading platforms and earns mainly through spreads.

Best for

- Beginners

- Advanced traders

- Traders looking for a well-diversified portfolio

- Controlled by regulatory agencies of multiple countries

- Choice offered in terms of trading platforms

- Support available in 14 languages and trading platforms in 20 languages

- Practice/demo account available for trying out

- Breadth of trading assets

- Does not accept customers from the U.S. As it isn’t regulated in the U.S.

- Transferring funds to the account may take up to five days; withdrawals could take up to 10 days

Trading forex internationally

In january 2015, the national futures association (NFA) imposed limits on the leverage allowed on forex positions and other restrictions on U.S.-based forex traders. Many international forex brokers stopped accepting clients from the U.S. Also, due to the new restrictions, international forex brokers increased in popularity relative to american brokers because they typically give traders better terms than U.S.-based forex brokers.

For example, forex brokers in the united states only allow a maximum leverage ratio of 50:1, while some international brokers offer client leverage up to 3,000:1. This high amount of leverage, while extremely profitable when you’re on the right side of the market, could be disastrous if you hold a losing position, especially if you have limited capital.

Another example is the FIFO regulation. FIFO stands for “first in, first out,” and this rule requires you to liquidate positions in the same currency pair in the order that they were established instead of choosing which opposing transaction to liquidate.

The new U.S. Legislation also banned hedging a forex position by taking an opposing position in the same currency pair as 1 already established. Doing this means you effectively hedge the original position and can trade out of both sides individually, which is no longer allowed for U.S.-based forex traders.

Do international forex brokers accept U.S. Clients?

Just because you live in the united states doesn’t mean you can’t trade forex. Many top-tier forex brokers such as IG are based in the united states and also fully comply with the relevant regulations of the NFA and the commodities futures trading commission (CFTC).

Top 7 of best US forex brokers for 2021

Top rated:

Are you searching for the best US forex brokers?

Luckily, our team of professional forex broker reviewers can take care of your every need.

Let alone the best forex broker in USA, our team realizes it is tough to find any broker which offers a trustworthy, and still value for money proposition when you want to trade forex in the USA. Forex brokers accepting US clients may be few and far between, but we have combined years of experience to narrow your selection down to the top five brokers.

These five are among the best forex brokers USA has to offer.

In fact, they are some of the best forex brokers for residents of any country. These brokers will ensure you feel safe, secure, and still have the ability to prosper in your trading career. They have been selected as the best US forex brokers for a variety of reasons.

Among these reasons are the amount of trading support they offer you, they wide range of markets and instruments that are available for trading, and the very competitive pricing and fee structure offered by these top forex brokers.

Table of contents

Is forex trading legal in the USA?

As a forex trader in the US, one of the most important questions you may be asking yourself from the outset surrounds the legality of forex trading in the US. Well, we are pleased to tell you that yes, forex trading is legal in the US. In fact, the US has several top financial regulators providing the best protection to you as a trader. These bodies are FINRA, the SEC, CFTC, and NFA with the latter two being the main regulators when it comes to forex trading and trading in derivatives such as futures. Remember also that cfds trading in the US is not permitted.

How to trade forex in the USA

The process of getting started with a forex broker in the US is typically similar to that of any other country. With any top broker you will usually be asked for the following information:

- Proof of identity. A passport is typically best for this purpose.

- Proof of residence, usually in the form of a bank statement at your current address.

Once these documents are uploaded and verified, a process that takes most forex brokers just a few minutes, you will be free to get started trading forex.

Top 7 forex brokers in the USA listing for 2021

Here’s our list of the best US forex brokers:

1. Forex.Com

When it comes to US forex brokers, forex.Com has to be an immediate consideration for opening your forex trading account in the USA. They are CFTC licensed and NFA regulated (#0339826) and provide a selection of flexible and accessible account types with low spreads starting from 0.2 pips, including their direct market access account. This offers some of the most unbeatable spreads among any of the forex trading brokers USA. They also provide extensive trading options in all of the top forex currency pairs, metals including gold and silver, as well as futures trading. When it comes to forex brokers accepting US clients, forex.Com certainly offers among the most comprehensive range of services to their US-based traders.

The forex.Com minimum deposits starting form $1000 on standard, and commission accounts, and $25,000 on DMA accounts with demo accounts available. There are also a range of other great benefits such as cash rebates and reduced or no fees for active traders.

2. IG markets

With over 40-years in the industry, IG markets is a true pioneer of the industry, and among the most long standing forex brokers accepting US clients. The broker has evolved continually, keeping the requirements of US-based traders as a top priority. These can be traded on MT4, the mainstay trading platform for top US forex brokers and traders from all around the world as well as being both CFTC licensed, and NFA regulated (#0509630). IG markets offers one type of account to all traders and this has a minimum deposit requirement of $250.

Accessibility with IG is also excellent, you can engage with a number of top professional charting packages using your desktop, phone, or other smart device. Beyond the USA, IG markets also featured in our top 10 largest forex brokers australia. This showcases their global appeal to traders. This appeal is further enhanced by a great cost of trading on more than 90 forex pairs with spreads starting at 0.8 pips.

3. Interactive brokers

You will very often find interactive brokers among our lists of top forex brokers. This is also true when it comes to our choice of top US forex brokers. This is thanks to a number of positive aspects which the longstanding broker uses to attract clients around the world. These include an excellent proprietary trading platform which offers some of the most advanced trading tools available on any market, and a widespread list of products which are available at highly competitive rates. These products include currencies, options, metals, and indices within a list which is ever increasing. IB are a FINRA member and regulated by both the CFTC and NFA (#0392970), as well as the SEC (#8-47257).

They have two account types, you can choose the IBKR lite, or IBKR pro both at no minimum deposit though the pro account has a $10 maintenance fee. As mentioned the product range is excellent as is the trading cost with spreads from 0.1 pips on 105 forex pairs. All of these features make IB a top choice particularly for experienced traders.

4. Oanda

Oanda is also making progress toward becoming the best forex broker in the USA. The industry leader is making progressive inroads in the US market, and now offers trading in more than 70 diverse forex currency pairs. This is more than enough for you to trade successfully. Added to this, you can also benefit from the powerful educational and research infrastructure oanda provides. This includes marketpulse, a selection of news, technical analysis, and research resources which are provided by the in-house oanda team. This can combine perfectly with our own online investment guides and educational content. Oanda are also well-regulated by both the CFTC, and NFA (#325821) offering traders two account types.

The standard account type is attractive thanks to the fact it has no minimum deposit, while the premium account requires a $2,000 minimum deposit but has benefits like lower spreads and other costs. An unlimited oanda demo account is also available. The broker also use the much respected MT4 trading platform for trading in all 70 forex pairs and more at a very competitive spread starting from 0 pips. All traders but particularly newer ones, seem to fit well within oanda.

List of the best 23 forex brokers | trusted reviews

Are you looking for a good and serious forex broker? – then this page is the right place for you. Thanks to the large selection on the internet it is often difficult to make the right decision. With more than 7 years of experience in the financial markets, we present you with the best providers with top service and without hidden costs. Find out in the following texts how to select a secure forex provider and which online broker offers the best conditions.

| Broker: | review: | regulation: | spreads: | assets: | advantages: | open account: |

|---|---|---|---|---|---|---|

1. Bdswiss  | ➜ read the review | cysec, FSC | starting 0.0 pips + $ 2.0 commission per 1 lot | 250+ (50+ currency pairs) | + individual offers + trading signals + raw spreads + leverage up to 1:500 + best education + personal support |

Watch our full video review about the best forex brokers (risk warning: your capital is at risk):

Strict criteria for the forex broker review

In contrast to many other comparison sites, we present you on this website only the safest providers with the best conditions for traders. As experts with many years of experience, we have tested many forex brokers and still use some of them. A good provider should have certain characteristics that guarantee good and safe investing.

It is not uncommon to hear of fraud on the internet. This is to be avoided by this comparison. In addition, one would like to save on charges as a trader because the costs for the trade reduce of course the actual profits. Also, the security of customer’s money is of high priority. A regulation or license, for example, is urgently needed for secure trading with international brokers. All these criteria and many more are included in the test. Therefore we can present you on this page the best forex brokers in a list.

Proven facts for a good forex broker:

- Regulation and license of an official finance authority

- High safety of customer funds

- Fast and reliable market execution

- Small forex trading fees and no hidden fees

- No requotes (high liquidity)

- User-friendly trading platform

- Free and unlimited demo account

- Professional support

- Fast deposit and withdraw methods

How does a forex broker work?

A forex broker is an intermediary between a client (trader) and the interbank market for currencies (wikipedia). In addition, the broker can lend capital to the trader so that he can trade with leverage. The broker’s income is generated by the spread and the cost of financing the leveraged positions.

There are 2 different models of brokers: market maker and ECN/NDD broker

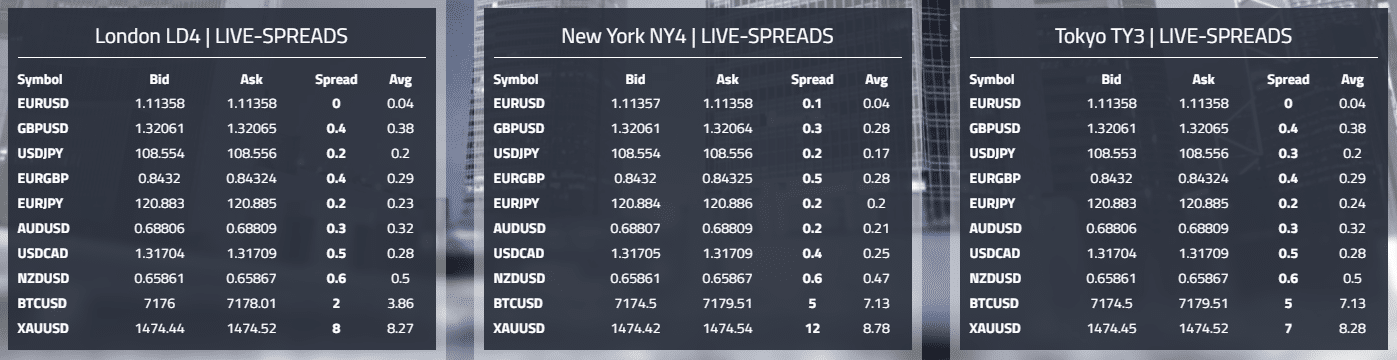

Example of live spreads for forex brokers

Market maker:

This broker does not place the trader’s orders directly into the real interbank or spot market. There is an internal matching system between the positions of the traders. Of course, the broker can hedge himself on the real markets so that there are no distortions in supply and demand. In most cases, this system can be opaque, and only as a broker employee, you know the exact functions. A market maker forex broker is not bad or scam. Nowadays, most providers offer good and exact executions.

ECN/NDD (no dealing desk) broker:

ECN and NDD mean direct access to the interbank market through various liquidity providers. These are large banks or very large forex brokers. The provider places the trader’s orders directly into the real market. So the customers get direct and real market prices for trading. With this model, there is no conflict of interest between trader and broker. Zero (no) spread accounts are offered.

Warning: only trade with regulated and licensed forex brokers

Security has the highest priority in online trading. When it comes to trading leveraged financial products, you have to be able to trust the forex broker. It is not uncommon for large sums of money to be used to generate a large profit. For example, brokers in europe must have regulations or licenses if they want to offer their services. The regulation can be in any european country. The same or almost the same requirements apply to brokers everywhere. In order to avoid fraud, it is important to look for such a license.

Licenses are only issued under certain conditions and criteria. If a broker violates these conditions, the license may be withdrawn immediately. All tested companies of mine are always concerned to keep the highest criteria and to guarantee a safe trade. Many brokers, for example, are regulated in cyprus. This has tax advantages. Nevertheless, there are also forex brokers with more than one regulation. The various regulatory authorities can be seen in the table above.

Facts of reliable and secure companies:

- Regulation and license

- Separated customer funds

- Regulated deposit and withdrawal methods

- Using well-known banks

- Large liquidity providers

Another important point for serious trading is the security of customer funds. Payouts of winnings or the deposited amount should work smoothly. It was not uncommon for some brokers to speculate on customer funds themselves. In the end, withdrawals were refused or delays occurred.

How risky is forex trading?

Forex trading is managed by leveraged financial products. That means you are able to trade a bigger contract size than the amount of money in your account. Some brokers offer the leverage up to 1:3000. Many traders are afraid of the obligation to make margin calls and this is not without reason as the past has shown. Account balances could slip into the negative balance. This is possible due to extreme market situations and too large a position size in relation to the account balance.

The providers shown above all have no obligation to make additional contributions (except IC markets and vantage FX). With the providers in the upper table, you are therefore protected against such a scenario. In our experience, this can only happen if the account is too heavily leveraged. You should always beware of sensible risk management.

Beginners should always start with the free demo account to practice forex trading.

A demo account is essential for successful trading. The trading column form and conditions can be tested extensively with this account. It is a virtual credit account that simulates real money trading. It can be traded without risk. This means that new strategies can be developed or new markets tested. The demo accounts of the compared providers are completely free and unlimited. This account is best suited for entry into forex trading.

How to deposit and withdrawal money:

For most traders, the first deposit into their account is very exciting. It should work smoothly and be highly secure. Forex brokers offer well-known and proven payment methods. Capitalize the trading account with electronic methods (credit card, e-wallet, paypal, crypto) or with the classic way of bank transfer. Electronic methods work in real-time and the money is credited directly to the trading account. Trading can be started immediately. The minimum deposit at the compared brokers is very low. For example, you can open an account from as little as 1$. If this is worth it, you have to decide for yourself. There are no fees for deposits.

Example of payment methods of a forex broker

The payout is also very uncomplicated. With a few clicks, you can request a withdrawal on the menu. This is then released in 1-3 working days. However, most brokers payout customer money in less than 24 hours. All presented brokers passed this test. The fees can be high for small payouts. With payments over 200$, the most forex brokers take over the fees but some brokers do not charge any commissions.

Facts about the payments:

- Instant deposit of money

- Fast withdrawal within 1 – 3 working days

- Electronic methods (skrill, neteller, paypal, and more)

- Cryptocurrencies

- Bank wire

Not every country is available for forex trading

Not every country is available for forex brokers and trading. This is because there are some restrictions and special regulations. For example, in some countries, an international broker needs a special license for that specific country. So it is too much afford for some companies to get the license and they stop taking clients from these countries. You can clearly see on the homepage which clients they accept. Not many brokers accept clients of the united states of amerika.

From my experience, the fastest-growing countries are in africa and asia. Because of the development of mobile internet, more people get connected to the forex market. India, nigeria, philippines, malaysia, and china are at the moment the fastest-growing countries.

Is forex trading legal?

Forex trading is fully legal if there is not any ban from the government. Forex trading is just changing money into another currency. This is not an illegal practice. The brokers on my review got official regulations so they act fully legal.

Review conclusion: start trading with a reliable forex broker

On this page, we have presented you with our current list of the top 23 forex brokers in comparison. Now you have a selection of good and reputable companies in front of you. It was particularly important to us that we only present providers here, which we have tested by ourselves with real money. This is not the case with most comparisons.

Profit now from the most favorable fees and the best conditions by my experience of many years. With these providers, you are 100% safe and can take your forex trading to the next level.

We hope you could learn something in this comparison and act now with better providers through my recommendations. If you can’t make up your mind, please also read the reviews.

Successful forex trading requires a good and reliable broker. In this review, we showed you the top 23 secure forex brokers. Now you can choose your professional trading partner.

Best US forex brokers 2021

The foreign exchange market is more active than any other financial market in the world, with over $5 trillion swapping hands every day. This guide is focused on assisting US traders in finding the best forex broker for their style of trading.

We break down the best us forex brokers for commissions & spreads, trading platforms, execution, and overall quality. All of the top forex brokers we cover are regulated and licensed in the US by the national futures association (NFA) and meet a strict set of criteria, ensuring protection from forex scams.

For a more in-depth comparison of top US brokers, or if you are trading outside of the US, visit our sister site forexbrokers.Com. Our annual FX broker review covers the top brokers for 2020, with over 50,000 words of research and 5,000+ data points spanning 30 firms.

Best US forex brokers 2021

- IG - best overall

- TD ameritrade - currency trading with thinkorswim

- Forex.Com - best for ease of use

- Interactive brokers - best for professionals

As an early pioneer in offering contracts for difference (cfds) and spread betting, IG was founded in 1974 and has grown to be a global leader in the online trading industry. IG is a london-based public company listed on the london stock exchange’s FTSE 250 (LON: IGG). Read full review

- Total forex pairs offered: 91

- Likes: comprehensive research tools and real-time exchange data; broad range of markets, currency pairs, and multi asset cfds (including cryptocurrencies); licensed in major regulatory jurisdictions; competitive commission-based pricing and spreads on forex.

- Dislikes: web platform trading windows must be resized manually to keep the layout organized; forex direct only available to professional traders within EU.

- Bottom line: forex and CFD traders looking to trade a large number of instruments across multiple asset classes, including exchange-traded securities on international exchanges, will find IG offers an extensive range of tradable products on its platforms.

- Visit site

TD ameritrade's desktop trading platform, thinkorswim, offers an impressive combination of both design and functionality. The platform has virtually anything you could want, including live CNBC tv, trade alerts, real-time scanning, and practically every technical indicator under the sun for charting. Read full review

- Total forex pairs offered: 75

- Likes: powerful desktop charting that syncs with mobile; wide array of premium research and trading tools through thinkorswim platform; futures and options trading on forex and bitcoin futures.

- Dislikes: forex only available to US residents; no web-based platform offered for forex; platform complexity may deter beginners.

- Bottom line: for US-based investors and traders, TD ameritrade’s thinkorswim platform is a sophisticated multi-asset desktop experience optimized for securities trading, including off-exchange spot forex and exchange-traded options and futures (including bitcoin).

- Visit site

Forex.Com (gain capital) is known for providing forex traders a well-rounded offering. Like TD ameritrade and interactive brokers, it is also publicly traded and offers fx traders a large variety of trading tools. Beyond offering its own propertiary trading platform, forex.Com also offers metatrader4 (MT4) to customers, making it an ideal choice for investors of all experience levels. Read full review

- Total forex pairs offered: 84

- Likes: licensed in highly regulated jurisdictions; advanced charting capabilities in both desktop and web platforms; platforms feature numerous channels of research content and trading ideas; offers cryptocurrency cfds in the UK, and bitcoin futures in the US.

- Dislikes: MT5 not yet rolled out; ceased business of regulated activities in hong kong.

- Bottom line: FOREX.Com has plenty of options for forex and CFD traders across its regulated offerings globally. With full-feature platforms, diverse trading tools, and comprehensive research, FOREX.Com caters to traders of all experience levels.

- Visit site

Professional currency traders should consider interactive brokers. Interactive brokers is well-known in the US stock and options industry as an active trading broker. IMPORTANT: to trade forex with interactive brokers in the united states, you must be classified as an ECP, "an eligible contract participant is generally an individual or organization with assets of over $10 MM (or $5 MM if trades are hedging)." read full review

- Total forex pairs offered:115

- Likes: regulated in major jurisdictions and publicly traded; extensive range of global markets and asset classes; bitcoin futures trading supported; competitive fees and discounts for high-volume traders.

- Dislikes: retail spot forex only offered to non-U.S. Clients; desktop platform too complex for inexperienced traders; web platform lacks forex charts; monthly minimum activity charges.

- Bottom line: professional traders and highly experienced investors looking for a complete multi-asset forex broker will find interactive brokers offers a comprehensive platform with competitive fees across multiple global financial markets.

- Visit site

Compare US forex brokers at forexbrokers.Com

Compare IG vs TD ameritrade vs forex.Com vs interactive brokers side by side and view an industry-leading comparison based on over 100 different data points.

Read next

Explore our other online trading guides:

Advertiser disclosure: stockbrokers.Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. How do we make money? Our partners compensate us through paid advertising. While partners may pay to provide offers or be featured, e.G. Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data. Here is a list of our partners.

Disclaimer: it is our organization's primary mission to provide reviews, commentary, and analysis that are unbiased and objective. While stockbrokers.Com has all data verified by industry participants, it can vary from time to time. Operating as an online business, this site may be compensated through third party advertisers. Our receipt of such compensation shall not be construed as an endorsement or recommendation by stockbrokers.Com, nor shall it bias our reviews, analysis, and opinions. Please see our general disclaimers for more information.

© 2021 reink media group LLC.

All rights reserved.

Best online forex trading classes

Learn the basics or sharpen your skills with the best forex trading classes

We publish unbiased product reviews; our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

With its low capital requirements, ease of entry, and 24/7 accessibility, forex trading has a strong appeal for anyone with a laptop looking to increase their income—as a part-time gig or as a full-time trader. While there is money to be made in forex trading, it requires specialized knowledge and a lot of discipline, neither of which is easy to obtain. The good news is aspiring forex traders can access dozens of online forex trading classes, promising a learning path to profitable trading. The bad news is that forex trading is not regulated in the way stock trading is, so it attracts many scammers.

A good forex trading class is developed with successful traders' knowledge and experience and is typically offered as part of membership into their trading forum. Courses are typically self-paced and often include online videos, webinars, trading simulators, chat rooms, and access to mentors. When students feel ready, they can begin putting their knowledge into action through real trading.

In this roundup, we reviewed 15 of the top forex trading classes, screening first for reputation to eliminate possible scam operations. We then took a closer look to compare such factors as costs, support, course features, and access to mentors to arrive at the best forex trading classes in six different categories.

The 6 best online forex trading classes of 2021

- Best overall:forexsignals.Com

- Best for newbies:udemy—forex trading from A-Z

- Best value:traders academy club

- Best comprehensive course offering:asia forex mentor—one core program

- Best free option:daily forex FX academy

- Best crash course:six figure capital

Investopedia offers its own stock trading class as part of the investopedia academy, but to maintain objectivity, we opted to exclude it from this roundup. If you are interested in this course, please visit the investopedia academy.

Best overall : forexsignals.Com

" data-caption="" data-expand="300" data-tracking-container="true" />

Forexsignals.Com is a fully comprehensive offering that includes an in-depth educational course, access to professional trading tools, and ongoing professional guidance, topped with a seven-day refund period if you're not satisfied for any reason. That makes forexsignals.Com our pick for the best overall forex trading class.

In-depth educational courses

Access to mentors, proprietary trading tools, and live trading room

Substantial membership discount for annual payment

Free seven-day trial and seven-day refund period

Mostly aimed at beginning or intermediate traders

Monthly membership payment plan twice as expensive as annual plan

Forexsignals.Com was founded in 2012 by nick mcdonald, a leading independent trader and financial educator with a global following. At its core, forexsignals is a hub for knowledge and learning in the forex industry. Besides providing standout courses, it relies heavily on best-in-class trading tools, a close-knit trading community, and mentoring by top trading pros to round out what we believe to be the best overall forex trading class.

The goal of forexsignals.Com is to teach its students how to trade using their methods for identifying trends and generating signals. That knowledge and training are reinforced by the professional traders who trade on the same information they are teaching. The formula appears to be working. In just eight years, the community trading room has grown to 83,000 members, and its youtube channel has 253,000 subscribers.

The first stop for new traders is the trading academy educational courses delivered by highly experienced professional forex traders. The two courses are broken down into six modules, each featuring 136 one-hour videos. The content starts with the basics and gradually advances to the technical aspects of trading.

To reinforce their learning, students have access to the trading room, which functions as a chat room to share ideas and showcase trading strategies. Also, students are able to follow live-streamed trading sessions of the professional traders. Membership also includes access to several proprietary trading tools, including the profit simulator.

The apprentice membership is a monthly plan costing $97 a month and includes trading room access, access to the pro trading video academy, daily live trading sessions, live interactive workshops, and access to pro trading tools. The annual package goes for $297, charged every six months. It adds personal feedback and a one-on-one session with professional forex trader andrew lockwood. For $567 annually, there's also a professional package that adds a direct line to mentors. All packages offer a free seven-day trial, and the company offers a no-questions-asked refund for a period of seven days after payment.

Best for newbies : udemy—forex trading from A-Z

" data-caption="" data-expand="300" data-tracking-container="true" />

so, let's see, what we have: if you’d like to trade forex or are thinking of switching brokers, read this article for benzinga’s picks for the best forex brokers. At which broker is the best for forex

Contents of the article

- Top forex bonuses

- Best forex brokers

- Best forex brokers right now:

- The best forex brokers

- Account minimum

- Pairs offered

- Minimum trade size

- Spread

- Commisions

- 1. Best overall forex broker: FOREX.Com

- 2. Best for beginner traders: etoro

- 3. Best for non-US traders: HYCM

- 4. Best for commodities: avatrade

- 5. Best for intermediate traders: pepperstone

- 6. Best for advanced forex traders: interactive...

- 7. Best for mobile traders: plus500

- 8. Best forex platform: IG markets

- Forex market explained

- Risk and reward in forex trading

- Choose your broker wisely

- Methodology

- Fxdailyreport.Com

- Recommended US forex brokers regulated by NFA and...

- Best international forex brokers

- Best international forex brokers:

- Table of contents [ hide ]

- Best for

- Overall rating

- Best for

- 1 minute review

- 1 minute review

- 1 minute review

- 1 minute review

- 1 minute review

- Trading forex internationally

- Do international forex brokers accept U.S....

- Best forex brokers

- Best forex brokers right now:

- The best forex brokers

- Account minimum

- Pairs offered

- Minimum trade size

- Spread

- Commisions

- 1. Best overall forex broker: FOREX.Com

- 2. Best for beginner traders: etoro

- 3. Best for non-US traders: HYCM

- 4. Best for commodities: avatrade

- 5. Best for intermediate traders: pepperstone

- 6. Best for advanced forex traders: interactive...

- 7. Best for mobile traders: plus500

- 8. Best forex platform: IG markets

- Forex market explained

- Risk and reward in forex trading

- Choose your broker wisely

- Methodology

- Best international forex brokers

- Best international forex brokers:

- Table of contents [ hide ]

- Best for

- Overall rating

- Best for

- 1 minute review

- 1 minute review

- 1 minute review

- 1 minute review

- 1 minute review

- Trading forex internationally

- Do international forex brokers accept U.S....

- Top 7 of best US forex brokers for 2021

- Is forex trading legal in the USA?

- How to trade forex in the USA

- Top 7 forex brokers in the USA listing for 2021

- List of the best 23 forex brokers | trusted...

- Strict criteria for the forex broker review

- How does a forex broker work?

- Warning: only trade with regulated and...

- How risky is forex trading?

- How to deposit and withdrawal money:

- Not every country is available for forex trading

- Review conclusion: start trading with a reliable...

- Best US forex brokers 2021

- Best US forex brokers 2021

- Compare US forex brokers at forexbrokers.Com

- Read next

- Best online forex trading classes

- Learn the basics or sharpen your skills with the...

- The 6 best online forex trading classes of 2021

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.